Learning Inside:

This Post would enable you to understand:

- Purchases Book #

- Purchases Return Book #

- Sales Book #

- Sales Return Book #

- Bills Receivable Book #

- Bills Payable Book #

- Journal Proper; its Role and Importance in Practical System of Book Keeping #

- Distinction between Special Journal and General Journal #

- QUESTION-ANSWER #

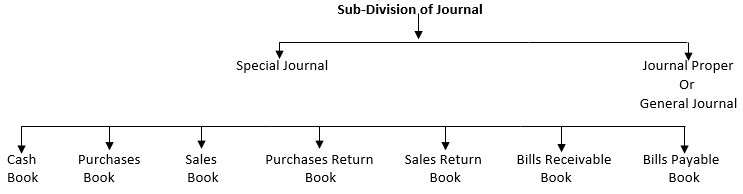

Journal is sub-divided into: (i) Cash Book; (ii) Purchases Book; (iii) Sales Book; (iv) Purchases Return Book; (v) Sales Return Book; (vi) Bills Receivable Book; (vii) Bills Payable Book and (viii) Journal Proper.

The above Day Books are also called the Special Journal or the Books of Original Entry.

We have already discussed Cash Book in the previous Post. In this post, we shall discuss the remaining books of accounts.

PURCHASES BOOK OR PURCHASES JOURNAL

Credit purchases of goods dealt in or of materials and stores used in the factory are recorded on the basis of the invoices in the Purchases Book or the Purchases Journal. It means cash purchases and purchases of goods other than goods dealt in are not recorded in the Purchases Journal.

Features of Purchases Book

1. Credit purchases of goods traded in or material used for production are recorded in the Purchases Book. Credit purchases of goods or materials not dealt in, such as office furniture or computers for office use are not recorded in the Purchases Book. They are journalised.

2. Cash purchases are not recorded in the Purchases Book since they are recorded in the Cash Book.

3. The entries in the Purchases Book are made on the basis of invoices received from the suppliers with the net amount after Trade Discount.

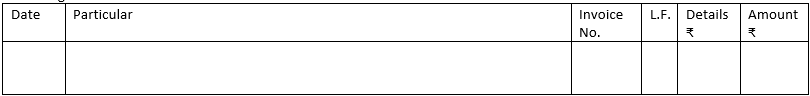

The ruling of a Purchases Book is as follows:

The Purchases Book has six columns:

(i) Date: In the first column, the transaction date is written.

(ii) Particulars: In this column, the name of the supplier, name of the articles and quantities purchased are written.

(iii) Invoice No.: Invoice number of the goods purchased is written.

(iv) L.F.: When the Purchases Book is posted to the Ledger, the page number of the Ledger is written.

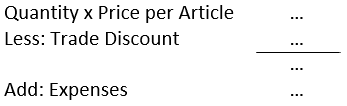

(v) Details: The amount in respect of each article is written in this column. If the seller has allowed a Trade Discount it is also deducted in this column itself. It is shown as follows:

(vi) The net amount of the invoice is recorded in the extreme right-hand column. The total in this column will show the total credit purchases made in a period.

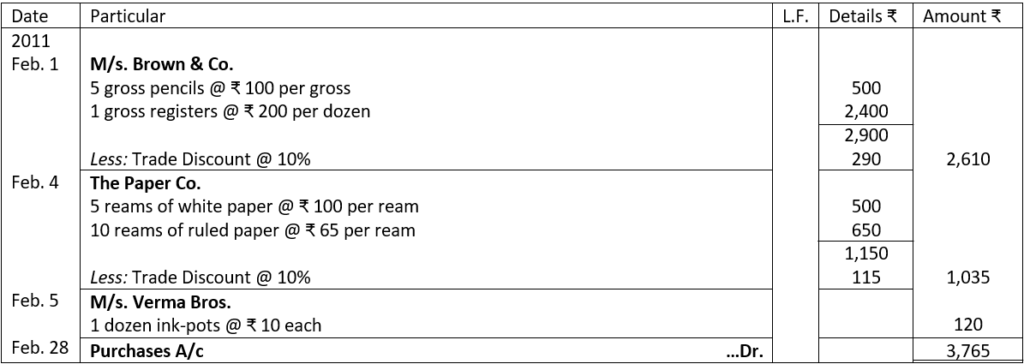

Let us use an illustration to clarify how a purchase transaction is recorded.

Illustration 1. The Rough Book of M/S. Narain & Co. contains the following:

| 2011 | |

| February 1 | Purchased from M/s. Brown & Co. on credit: 5 gross pencils @ ₹ 100 per gross 1 gross registers @ ₹ 200 per dozen Less: Trade Discount @ 10% |

| February 2 | Purchased for cash from the Stationery Mart: 10 gross exercise books @ ₹ 60 per dozen |

| February 3 | Purchased computer printer for office use from M/s. Office Goods Co. on credit for ₹ 4,000 |

| February 4 | Purchased on credit from The Paper Co.: 5 reams of white paper @ ₹ 100 per ream 10 reams of ruled paper @ ₹ 65 per ream Less: Trade Discount @ 10% |

| February 5 | Purchased 1 dozen ink-pots @ ₹ 10 each from M/s. Verma Bros. on credit. |

Solution:

Some Important Items

1. Central Sales Tax: Central Sales Tax is a tax levied on the inter-state sales affected at the rates prescribed by the Government. It is charged by the seller from the customers on the net sale value, i.e., sale value less trade discount. The seller is duty-bound to charge Central Sales Tax on inter-state sales from the customer and deposit it in the Government Account. For the purchaser of goods, it is a part of purchase cost hence, is not shown in the Purchases Book in a separate column.

2. Value Added Tax (VAT): Local Sales Tax has been replaced by Value Added Tax (VAT). The difference between the two taxes is that while Central Sales Tax is levied on inter-state sales and the amount so collected is deposited in the Government Account. VAT is charged by the seller of goods on all local (within the state) sales. VAT paid on purchases is set-off against VAT collected on sales and balance in the VAT Collected Account is deposited in the Government Account. It is therefore, necessary that a column be provided in the Purchases Book for VAT paid. The total of the VAT paid column is posted to the VAT Account.

3. Freight or Cartage: At the time of sending goods, supplier may include freight charges in the invoice. In the Purchases Book, a separate column is maintained to record such freight. The total invoice price is divided between cost and freight. The total of cost column is debited to Purchases Account and total of freight column is debited to Freight Account. Total of invoice price is credited to Supplier’s Account.

4. Packing and Forwarding Expenses: Like freight, supplier may include packing and forwarding expenses in the invoice. In the Purchases Book, a separate column is maintained to record such packing and forwarding expenses. The total invoice price is divided among cost, packing and forwarding expenses. The total of cost column is debited to Purchases Account and total of packing and forwarding expenses are debited to Packing and Forwarding Account. Total of invoice price is credited to Supplier’s Account.

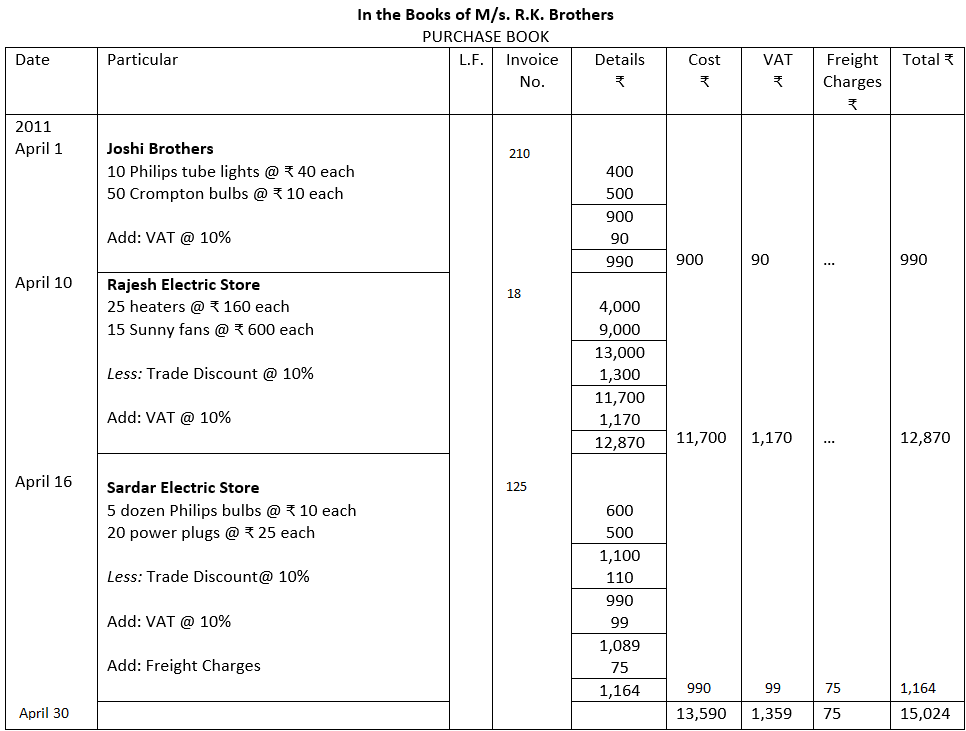

Illustration 2. Enter the following transactions in Purchases Book of M/S. R.K. Brothers and pass the Journal entry:

| 2011 | |

| April 1 | Purchased goods from Joshi Brothers on credit vide Invoice No. 210: 10 Philips tube lights @ ₹ 40 each, paid VAT @ 10% 50 Crompton bulbs @ ₹ 10 each, paid VAT @ 10% |

| April 10 | Purchased goods from Rajesh Electric Store vide Invoice No. 18: 25 heaters @ ₹ 160 each, paid VAT @ 10% 15 Sunny fans @ ₹ 600 each paid VAT @ 10%, 10% Trade Discount, |

| April 16 | Purchased goods from Sardar Electric Store vide Invoice No. 125: 5 dozen Philips bulbs @ ₹ 10 each, paid VAT @ 10% 20 power plugs @ ₹ 25 each, paid VAT @ 10% The Trade Discount is 10% and Freight Charges are ₹ 75. |

Solution:

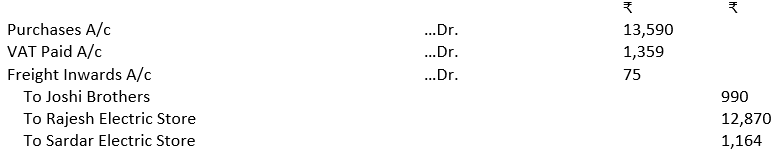

Note: At the time of posting into the Ledger, Purchases Account will be debited with ₹ 13,590; VAT Paid Account with ₹ 1,359; Freight Inwards Account will be debited with ₹ 75 and creditors will be credited with ₹ 15,024.

Distinction between Purchases Book and Purchases Account

| Basis | Purchases Book | Purchases Account |

|---|---|---|

| 1. Part | It is a part of a Journal. | It is a part of a Ledger. |

| 2. Format | Like Ledger Account, it does not have debit and credit columns. | It has debit and credit columns. |

| 3. Contents | Only credit purchases of goods dealt in or consumed for production are recorded. | Credit as well as cash purchases of goods dealt in or consumed for production are recorded. |

| 4. Amount | Total of Purchases Book is posted to the Purchases Account. | Balance in the account is transferred to the Trading Account. |

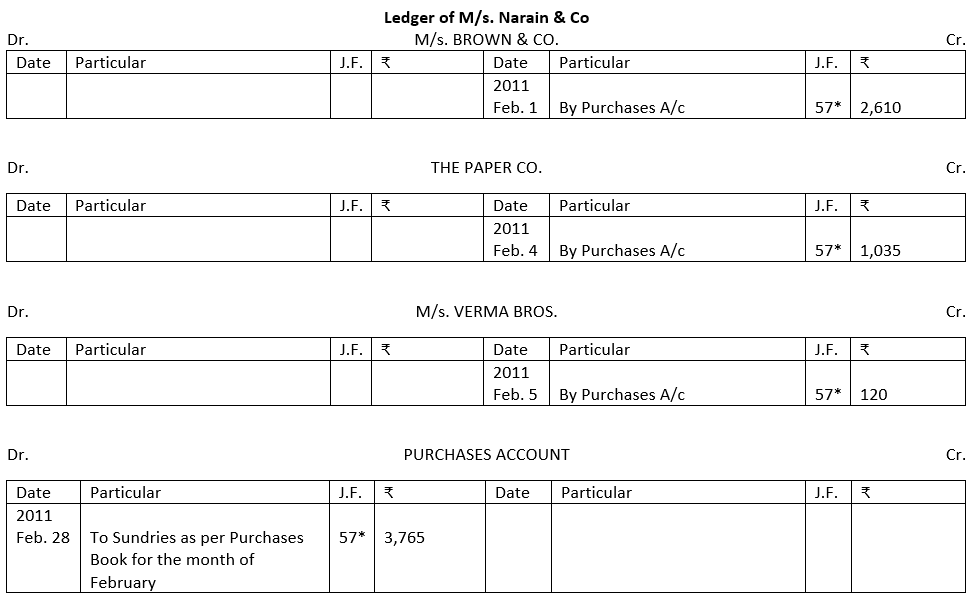

Ledger Posting of Purchases Book: The book shows the names of the parties from whom goods have been purchased on credit. These parties are now, in accounting terminology, creditors of the firm. Their accounts have to be credited for the respective amounts shown in the Purchases Book. The total of the amounts column shows the total credit purchases made in a period. The total amount is debited to the Purchases Account by writing ‘To Sundries as per Purchases Book’ in the Particulars Column. In Illustration 1 given, the Purchases Account will be debited by ₹ 3,765; M/s. Brown & Co. will be credited by ₹ 2,610, The Paper Co. by ₹ 1,035 and M/s. Verma Bros. by ₹ 120. The total of the amount put on the credit side equals the debit side. Thus, double entry is completed.

Continuing Illustration 1, we will study how it is posted in the Ledger Accounts.

SALES BOOK OR SALES JOURNAL

Credit sales of goods dealt in by the firm are recorded in a separate register called the Sales Book or Sales Journal. Cash sales are entered in the Cash Book and not in the Sales Book. Credit sales of items other than goods dealt in by the firm are not entered in the Sales Book, they are journalised. Entries in the Sales Book are on the basis of invoices issued to the customers with the net amount after trade discount.

Features of Sales Book

1. Credit sales of goods dealt in are recorded in the Sales Book. Sale of assets is not recorded in the Sales Book.

2. Credit sales of goods other than goods dealt in are not recorded in the Sales Book. They are journalised.

3. Cash sales are not recorded in Sales Book since these are recorded in the Cash Book.

4. Entries are recorded on the basis of invoices.

The ruling for the Sales Book is as shown below:

Entries in the Sales Book are also recorded in the same manner as in the Purchases Book. For example, the Particulars column will record the name of the customers to whom credit sales have been made together with particulars and quantities of the goods sold. For each item the amount is recorded in the details column; after totalling the amounts for one sale, charges for packing, etc., are added and the Trade Discount, if any, is deducted. The net amount is extended to the outer column. The total of this column will show the total credit sales for a period.

Distinction between Sales Book and Sales Account

| Basis | Sales Book | Sales Account |

| 1. Part | It is a part of a Journal Book. | It is a part of a Ledger. |

| 2. Format | Like a Ledger Account, it does not have debit and credit columns. | It has debit and credit columns. |

| 3. Contents | Only credit sales of goods are recorded. | Credit as well as cash sales of goods are recorded. |

| 4. Amount | Total amount of Sales Book is posted to the Sales Account periodically. | Balance in the account is transferred to the Trading Account. |

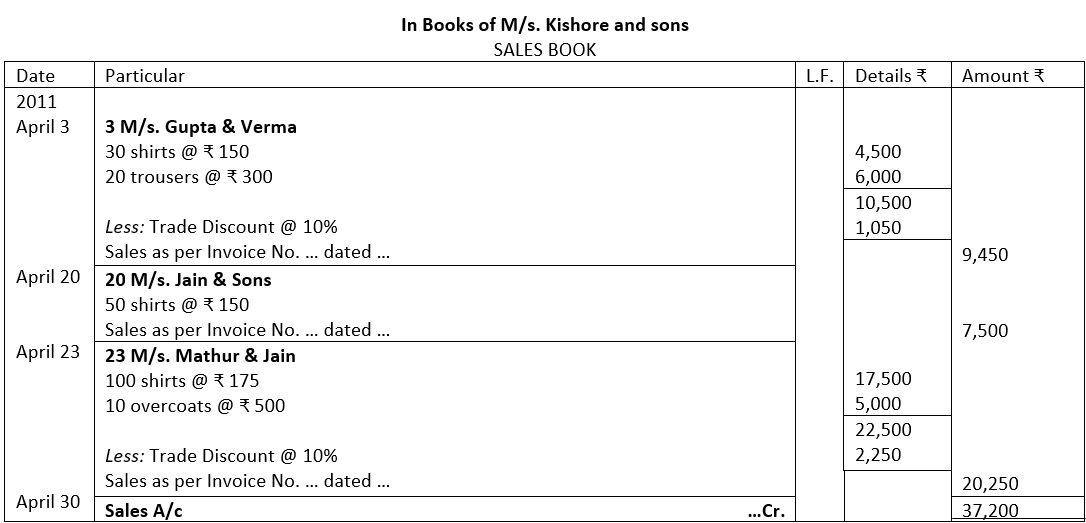

Illustration 3. Following transactions are of M/s. Kishore & Sons for the month of April, 2011. Prepare their Sales Book:

| April 3 | Sold to M/s. Gupta & Verma on credit: 30 shirts @ ₹ 150 each 20 trousers @ ₹ 300 each Less: Trade Discount @ 10% |

| April 10 | Sold old furniture to M/s. Sehgal & Co. on credit ₹ 800. |

| April 20 | Sold 50 shirts on credit to M/S. Jain & Sons @ ₹ 150 each. |

| April 23 | Sold on credit to M/S. Mathur & Jain: 100 shirts @ ₹ 175 each 10 overcoats @ ₹ 500 each Less: Trade Discount @ 10% |

Solution:

Note: Sale of furniture is not recorded in the Sales Book as the firm does not deal in furniture.

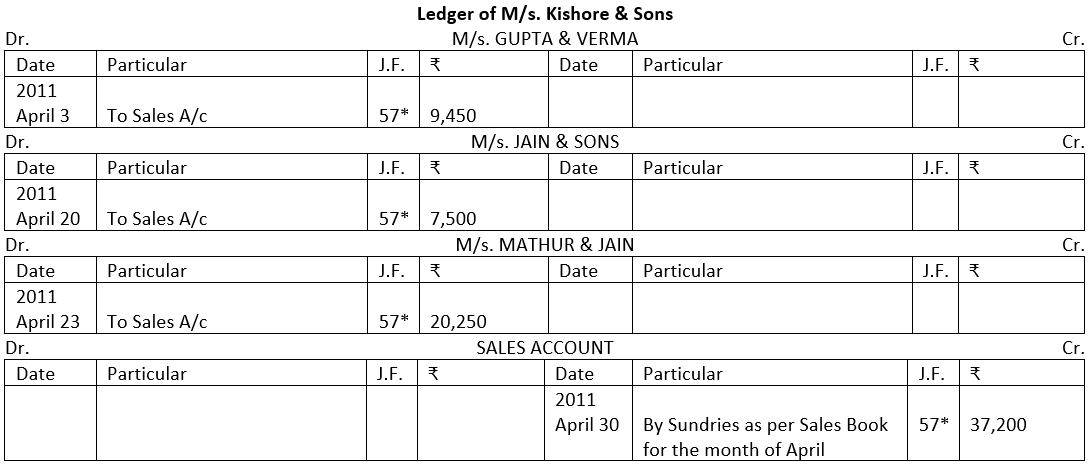

Ledger Posting of Sales Book: Names appearing in the Sales Book are of those parties who have purchased the goods on credit. The accounts of the parties have to be debited with their respective amounts. The total of the Sales Book shows the credit sales made during the period. The amount is credited to the Sales Account. In the Illustration given above, ₹ 37,200 will be credited to the Sales Account, ₹ 9,450 will be debited to M/S. Gupta & Verma, ₹ 7,500 to M/S. Jain & Sons and ₹ 20,250 to M/S. Mathur & Jain. The amount put on the credit side is equal to the total of the amounts put on the debit side. Thus, the double-entry principle is followed correctly. Continuing Illustration 3, we will study how it is posted in the Ledger.

Some Important Items

1. Central Sales Tax: Central Sales Tax is charged on inter-state sales from the customers on the net sale value, i.e., sale value less Trade Discount. Since, it is a liability of seller to deposit sales tax in the Government Account, a separate column is provided in the Sales Book to record the sales tax charged. Periodically, the total of the column for sales tax is credited to the Sales Tax Account. The balance in the account at the end of the year is shown as a liability in the Balance Sheet.

2. Value Added Tax (VAT): VAT is the tax charged on local (within the state) sales. The VAT paid on purchases is set-off against VAT collected on sales and balance in the VAT Collected Account is deposited in the Government Account. Since, it is a liability of seller to deposit VAT in the Government Account, a separate column is provided in the Sales Book to record the VAT charged. Periodically, the total of the column for VAT is credited to the VAT Account. The balance in the account at the end of the year is shown as a liability in the Balance Sheet.

3. Freight and Packing Charges: Sometimes, Freight and Packing Charges are charged from the customer along with the cost of goods sold in the sale invoice itself. In the Sales Book, a separate column is maintained to record such recoveries. They are recorded in a separate column because it is not a part of sales proceeds and thus, are shown separately in the final accounts. Monthly total of the freight and packing charges column is credited to Freight and Packing Charges Recovered Account while the customer is debited with the cost of goods (sales value) plus VAT and Freight and Packing Charges.

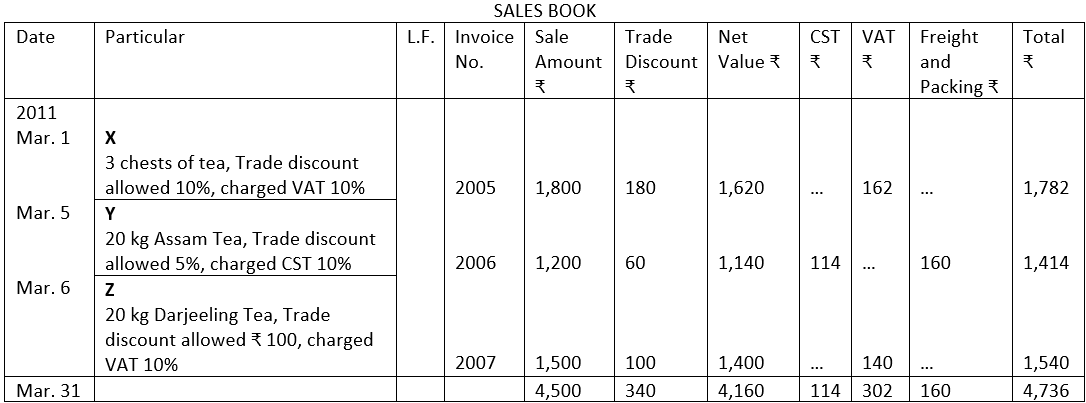

Illustration 4. From the following transactions, prepare the Sales Book:

| 2011 March 1 | Sold to ‘X’, vide Invoice No. 2005, 3 chests of tea for ₹ 1,800 less Trade Discount @ 10%, and VAT is charged @ 10%. |

| March 4 | Sold to Mohan & Sons vide Cash Memo No. 5785, 20 kg butter @ ₹ 150 per kg, less Trade Discount @ 5% and VAT is charged @ 10%. |

| March 5 | Sold to ‘Y’ vide Invoice No. 2006, 20 kg Assam Tea @ ₹ 60 per kg less Trade Discount @ 5%, charged CST @ 10%. Freight and Packing charges were separately charged in the invoice at ₹ 160. |

| March 6 | Sold to ‘Z’ vide Invoice No. 2007, 20 packs (1 kg) of Darjeeling Tea @ ₹ 75 per kg less Trade Discount ₹ 100, charged VAT @ 10%. |

Solution:

Notes:

1. Goods are sold to M/s. Mohan & Sons in cash. Therefore, it is not recorded in the Sales Book.

2. VAT is calculated on the net price after deducting Trade Discount.

3. A column each may be provided for Central Sales Tax and VAT collected. These columns will be use full because Central Sales Tax is a liability towards Government and VAT collected is to be offset against VAT paid.

4. Net value = Sales value – Trade Discount.

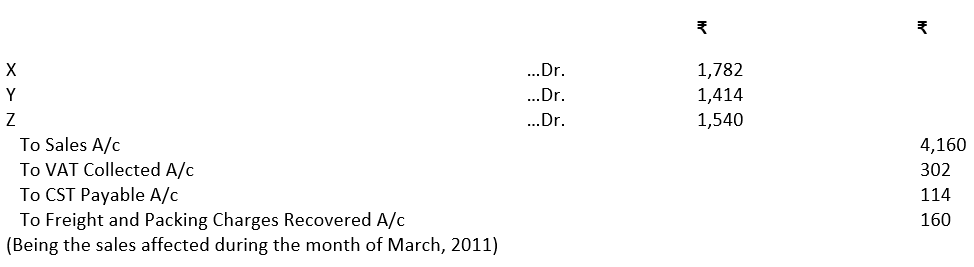

Journal Entry

Always Remember

1. Purchases Book is used for recording credit purchases and Sales Book is used for recording credit sales of goods.

2. Cash purchases are not recorded in the Purchases Book. Similarly, cash sales are not recorded in the Sales Book. Both of them are recorded in the Cash Book.

PURCHASES RETURN OR RETURNS OUTWARD BOOK

Purchases Return or Returns Outward Book is maintained to record the goods or materials returned to the suppliers that have been purchased on credit. This book is maintained if the return of goods is frequent otherwise it can be recorded in the Journal. Goods may be returned because of any of the following reasons:

- 1. Goods are not as per sample.

- 2. Goods are defective.

- 3. Goods are not as per order.

- 4. Goods have been delivered late and the customer has refused to accept them.

In all these cases the purchaser prepares a ‘Debit Note’ and sends it to the supplier. A Debit Note is prepared when goods are returned by the purchaser due to some reason. It is called a Debit Note because the party’s account is debited with the amount written in this note. This ‘Debit Note’ is the basis for writing in the Purchases Return or Return Outwards Book.

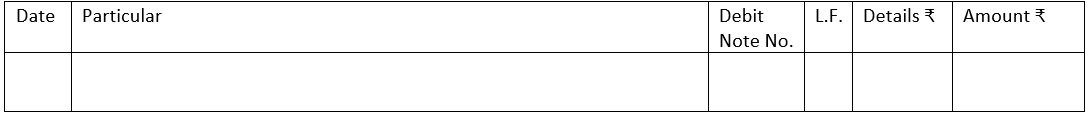

Ruling of a Purchases Return Book

Ruling of a Purchases Return Book is similar to the Purchases Book ruling except that instead of a column for ‘Invoice No.’ it has a column for ‘Debit Note No.’

Casting or Totalling a Purchases Return Book

Purchases Return Book is totalled at the month end and in the Particulars column ‘Purchases Return Account … Cr.’ is written and the book is closed for the month.

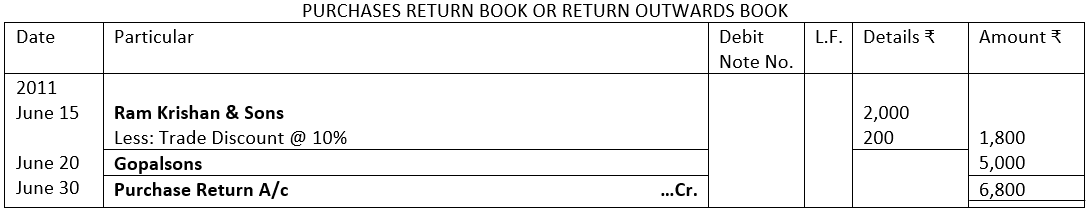

Illustration 5. Enter the following transactions in the Purchases Return Book of Shri Govind Ram:

2011

June 15 – Returned goods to Ram Krishan & Sons for ₹ 2,000. Trade Discount @ 10%.

June 20 – Returned goods to Gopalsons for ₹ 5,000, as the goods were not as per sample.

Solution:

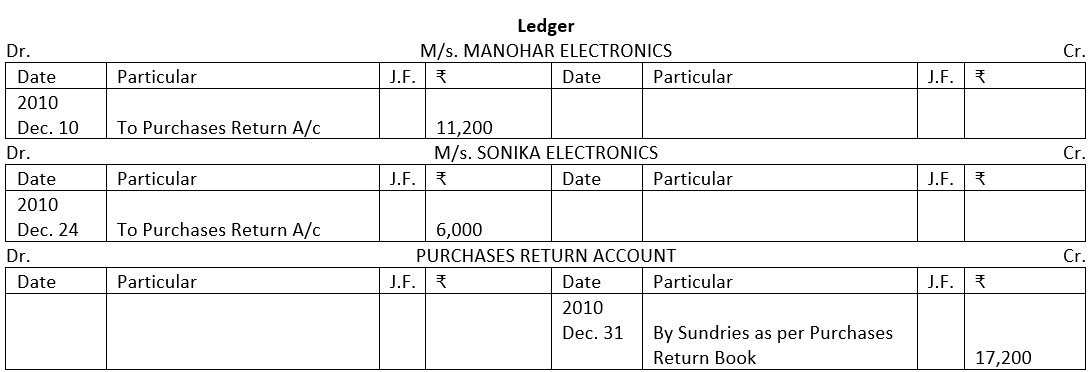

Ledger Posting from Purchases Return Book

The amount of the goods returned is debited to the account of the supplier and credited to the Purchases Return Account. The Supplier’s Account is debited by writing ‘To Purchases Return Account’ and the total of Purchases Return is posted to the Purchases Return Account by writing ‘By Sundries as per Purchases Return Book’.

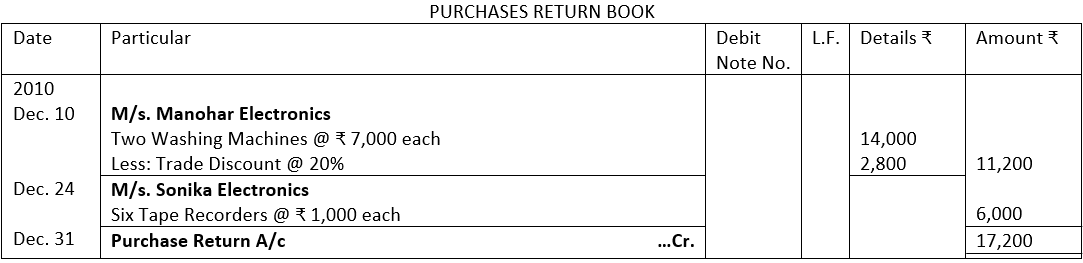

Illustration 6. Record the following in Purchases Return Book and post them in a ledger book:

2010

Dec. 10 – Returned two washing machines purchased from M/s. Manohar Electronics at the list price of ₹ 7,000 per machine, less trade discount @ 20%,

Dec. 24 – Returned six tape recorders to M/s. Sonika Electronics purchased @ ₹ 1,000 per tape recorder.

Solution:

SALES RETURN OR RETURNS INWARD BOOK

Sales Return or Returns Inward Book is maintained to record the goods or materials returned by the purchaser (customers) that had been sold on credit. This book is maintained if the return of goods is frequent otherwise it can be recorded in the Journal. When goods are returned by the customer, a document is prepared called Credit Note and sent to the customer to intimate that his account has been credited. The original copy is sent to the customer while the second copy is retained -for record and

entry is recorded in the book on its basis.

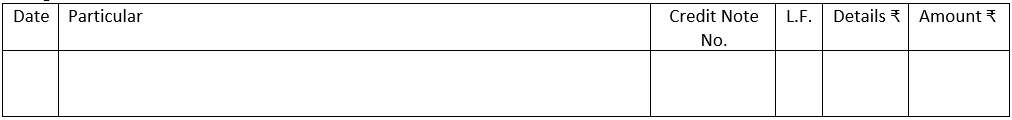

Ruling of Sales Return Book

Ruling of Sales Return Book is as follows:

Casting or Totalling of Sales Return Book

A Sales Return Book is totalled at the month end and in the Particulars column ‘Sales Return Account …Dr.’ is written and the book for the month is closed.

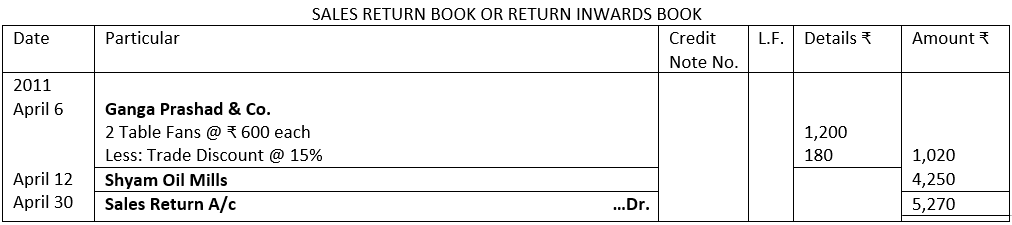

Illustration 7. Prepare the Sales Return Book in the books of Ram Lal & Co. from the following transactions:

2011

April 6 – Goods returned by Ganga Prashad & Co.:

2 Table Fans @ ₹ 600 each

Less: Trade Discount @ 15%

April 12 – Shyam Oil Mills returned defective goods valued ₹ 4,250.

Solution:

Ledger Posting from Sales Return Book

The amount of the goods received is credited to the Debtor’s (customer) Account and debited to the Sales Return Account. The Debtor’s Account is credited by writing ‘By Sales Return Account’ in the Particulars column and Sales Return Account is debited by writing ‘To Sundries as per Sales Return Book’.

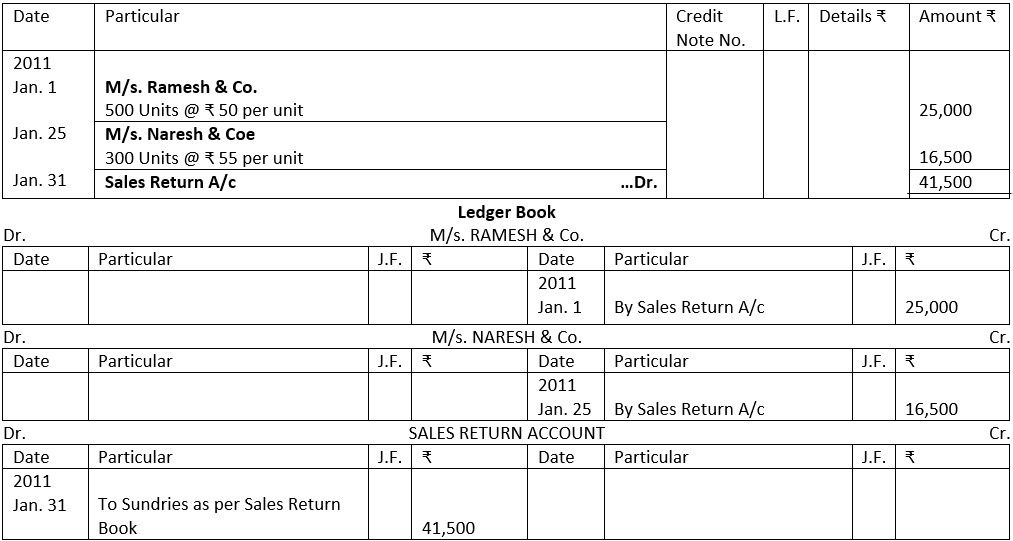

Illustration 8. Record the following in the Returns Inward Book and post these transactions into the ledger accounts:

2011

January 1 – M/S. Ramesh & Co. returned 500 units

Sold @ ₹ 50 per unit.

January 25 – M/S. Naresh & Co. returned 300 units

Sold @ ₹ 55 per unit.

Solution:

Look at the next Illustration and study how the transactions are recorded in various subsidiary books and how these books are closed.

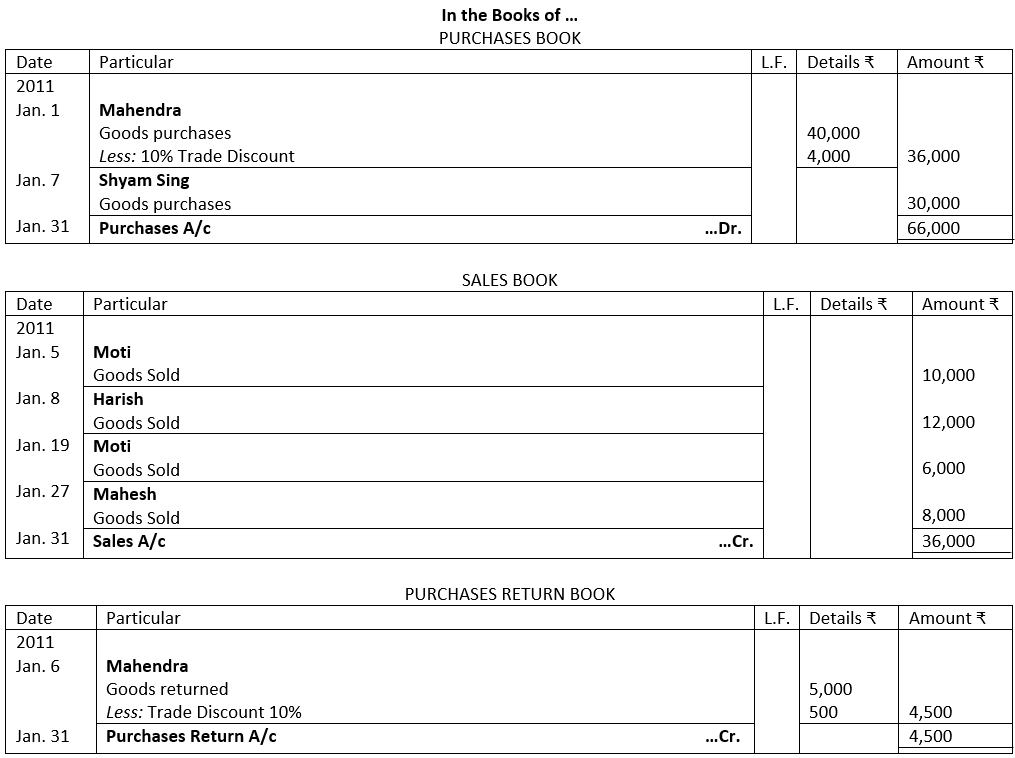

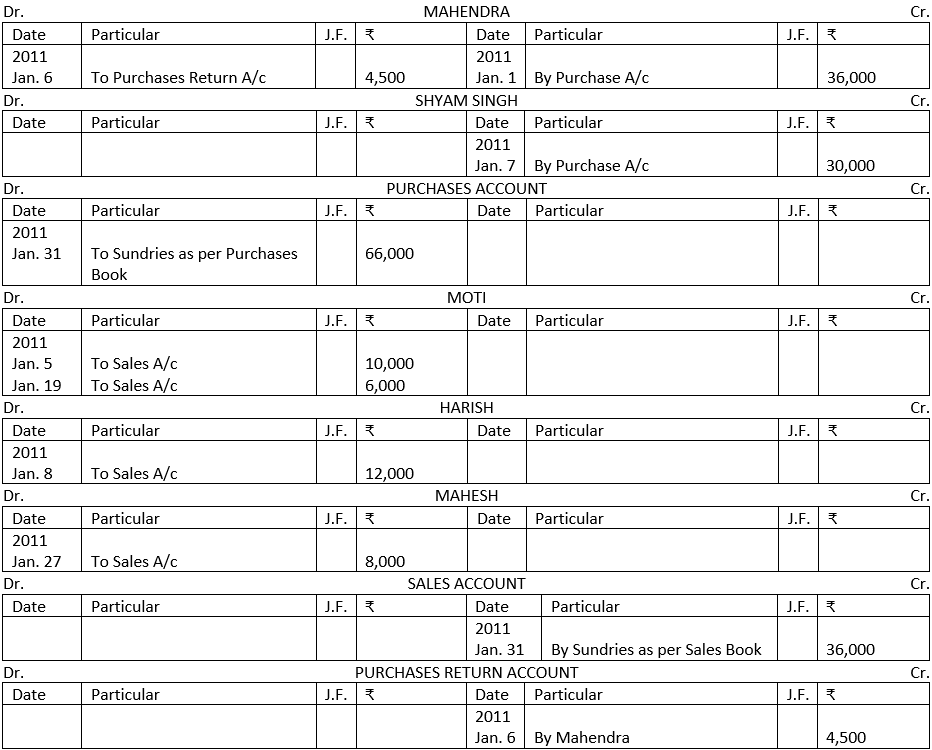

Illustration 9. Record the following transactions into proper subsidiary books, then close Che subsidiary books on 31st January, and post them into a Ledger:

| 2011 | |

|---|---|

| Jan. 1 | Purchased goods from Mahendra of the list price of ₹ 40,000 jess 10% Trade Discount |

| Jan. 5 | Sold goods to Moti for ₹ 10,000. |

| Jan. 6 | Returned goods to Mahendra list price of ₹ 5,000. |

| Jan. 7 | Shyam Singh sent goods for ₹ 30,000. |

| Jan. 8 | Sold goods to Harish for ₹ 12,000. |

| Jan. 19 | Sold goods to Moti for ₹ 6,000. |

| Jan. 27 | Sold goods to Mahesh for ₹ 8,000. |

Solution:

Posting into Ledger

Difference between Debit Note and Credit Note

| Debit Note | Credit Note |

| 1. Debit Note is prepared by the customer on the supplier. | Credit Note is prepared by the supplier. |

| 2. Debit Note is an intimation for debit made in the account of supplier containing the reasons for it. | Credit Note is an intimation of credit made in the account of the customer containing the reasons for it. |

| 3. In case of return of goods, it is the basis of recording entry in Purchases Return Book or Purchases Journal Book. | In case of return of goods, it is the basis of recording entry in Sales Return Book or Sales Return Journal Book. |

BILLS RECEIVABLE BOOK

Now-a-days it has become a common practice to purchase and sell goods on credit. The seller of goods usually desires to have a written commitment from his debtors as to the date of payment. He also likes to have such a document which he can get discounted from a bank, in case of need. The written commitment can be in the form of Bill of Exchange or Promissory Note. A Bill of Exchange is prepared by the seller of goods and accepted by the purchaser. On the other hand, a Promissory Note is prepared by the purchaser of goods.

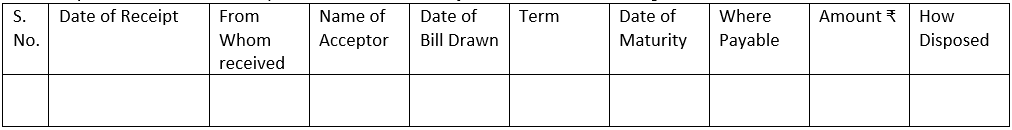

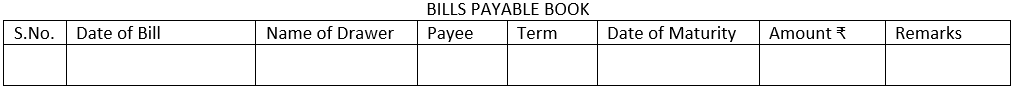

Bill of Exchange or Promissory Note received are recorded in a separate book called the Bills Receivable Book. The entries are made only at the time of the receipt of bill. Usual Format of Bills Receivable Book is given below:

Bills Receivable Book

It is to be noted that on receipt of payment of a Bill of Exchange, it is recorded in the Cash Book. Any other transaction is recorded in the Journal.

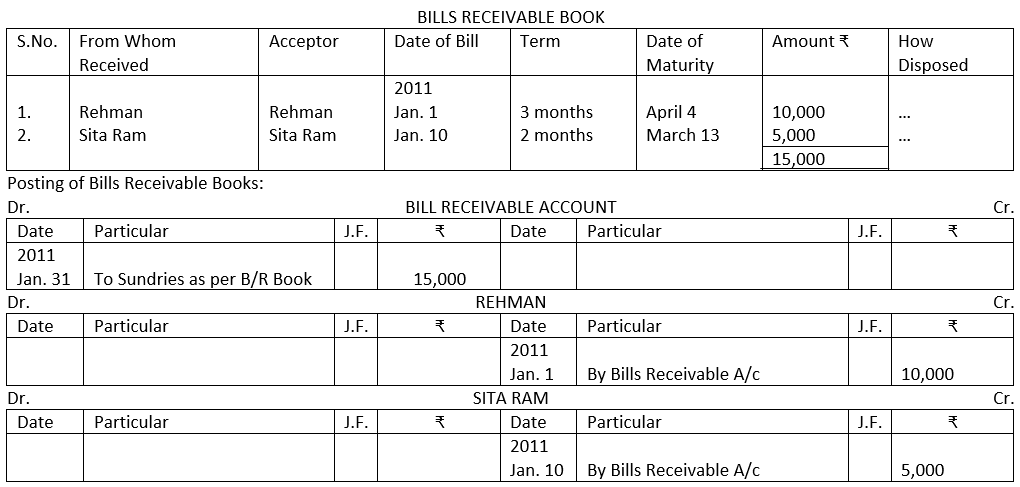

Ledger Posting of Bills Receivable Book

1. Total amount of Bills Receivable Book at the month end is debited to the Bills Receivable Account by writing ‘To Sundries as per the Bills Receivable Book’.

2. The Drawee’s Account, i.e., the debtor’s or customer’s account is credited by writing ‘By Bills Receivable Account’.

Illustration 10. A received the following Bills of Exchange. Record them in Bill Receivable Book and post them into the Ledger:

2011

Jan. 1 Drawn on Rehman a Bill of Exchange at 3 months which was accepted and returned by him on 1st January, 2011. The amount of the bill is ₹ 10,000.

Jan. 10 Drawn on Sita Ram a Bill of Exchange for ₹ 5,000 at 2 months, which was accepted on the same day. The bill is payable at Punjab National Bank.

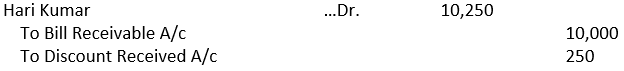

Jan. 12 Rehman’s acceptance endorsed in favour of Hari Kumar in full settlement of a debt of ₹ 10,250.

Solution:

Note: On 12th January, following entry will be passed for endorsement of Rehman’s acceptance in favour of Hari Kumar:

BILLS PAYABLE BOOK

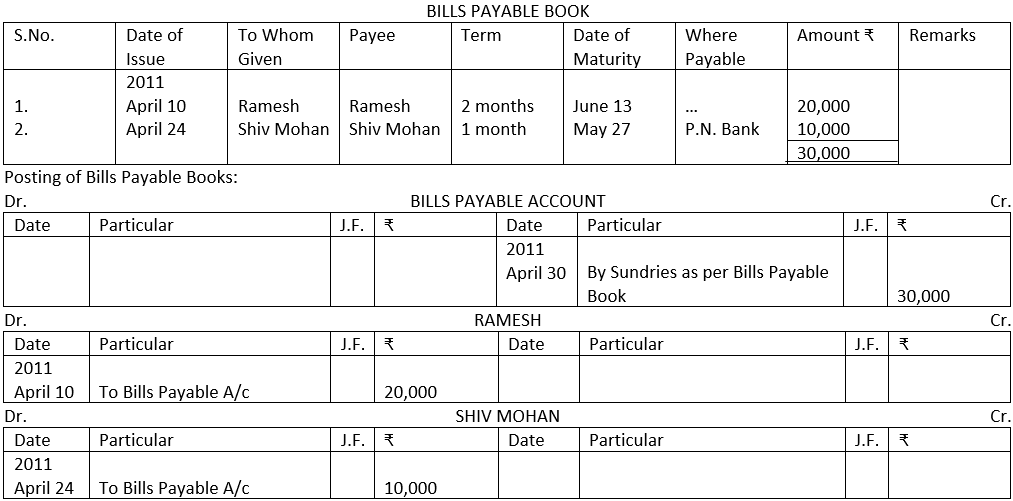

The purchaser of goods gives his acceptance to the seller. The acceptance so given is the Bill Payable for him. Similarly, a Promissory Note made by him is also a Bill Payable. Bills Payable are recorded in a book called the Bills Payable Book. Usual Format of Bills Payable Book is given below:

It is to be noted that the payment of a bill payable on the due date is recorded in the Cash Book. Dishonour or renewal of bills are recorded in the Journal.

Ledger Posting of Bills Payable Book

1. The amount column of the Bills Payable Book is totalled and the total is posted to the credit of Bills Payable Account by writing ‘By Sundries as per Bills Payable Book’.

2. Drawer’s Account (i.e., the party who has written the bill) is debited by writing ‘To Bills Payable Account’.

Illustration 11. An accepted the following bills. Enter them in Bills Payable Book and post them into the Ledger:

2011

April 10 Accepted Ramesh’s bill for ₹ 20,000 due at 2 months.

April 24 Accepted the bill drawn by Shiv Mohan for ₹ 10,000 at 1 month payable at Punjab National Bank.

Solution:

JOURNAL PROPER OR GENERAL JOURNAL

We have discussed above that transactions of a particular nature are recorded in a special journal maintained for the purpose.

1. Cash transactions are recorded in the Cash Book.

2. Credit purchases of goods or materials dealt in are recorded in the Purchases Book.

3. Credit sales of goods are recorded in the Sales Book.

4. Returns to suppliers are entered in the Purchases Return Book.

5. Returns from customers are recorded in the Sales Return Book.

6. Bill transactions are entered in a separate book called the Bills Receivable Book or the Bills Payable Book, if these are maintained by the firm.

Apart from the above transactions, there are other transactions which have to be recorded. For them, the proper place is the Journal Proper. The role of the Journal Proper is, thus, usually restricted to the following types of entries:

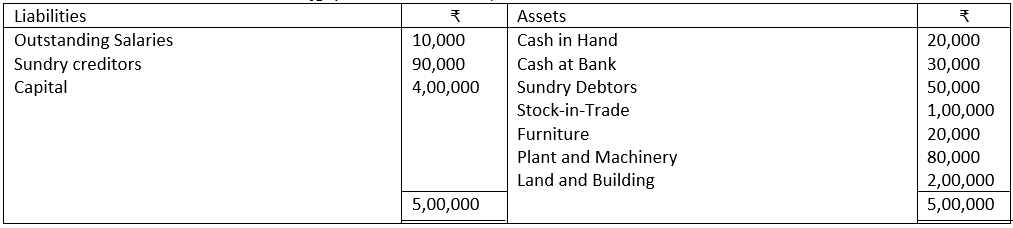

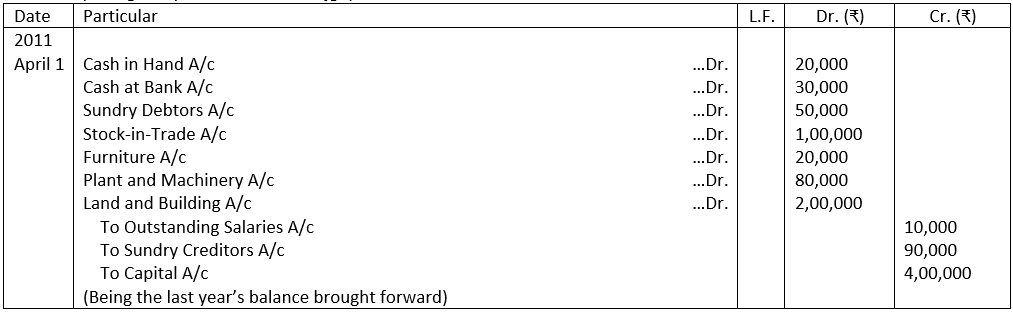

1. Opening Entry: Opening Entry is recorded in the beginning of a financial year to open the books by debiting assets and crediting liabilities and the capital appearing in the Balance Sheet of the previous year.

Illustration 12. The Balance Sheet of Rajgopal as at 31st March, 2011 is as under:

Pass the opening entry in the books of Rajgopal.

Solution:

Opening entry is not actually posted in the ledger, but the accounts are merely opened or incorporated in the new books of accounts with the word ‘To balance b/d’ on the debit side for all assets accounts (asset accounts have debit balance), and with the words ‘By Balance b/d’ on credit side for all liabilities and capital accounts. (All liabilities have credit balances.)

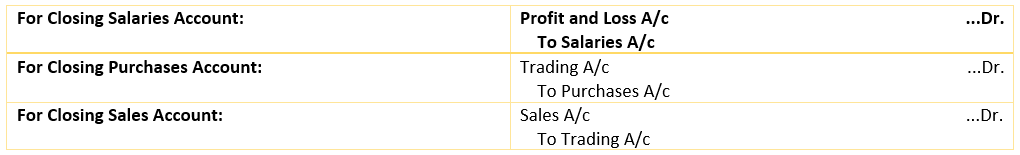

2. Closing Entries: Closing entries are passed at the end of the year to close the accounts relating to expenses and revenues by transferring them to the Trading Account and Profit and Loss Account. For example, the Salary Account is closed by

transferring its balance to the Profit and Loss Account, the Purchases Account is closed by transferring its balance to the Trading Account and so on.

Accounting Entries

All nominal accounts relating to expenses and gains or incomes must be closed at the end of the year. In order to close them, they are transferred either to trading account or profit and loss account.

Note: Closing entries have been discussed in detail in the Chapter on Final Accounts.

3. Rectification Entries: Entries to rectify the errors in the books of original entries or of a Ledger are recorded in the Journal Proper.

4. Transfer Entries: If an amount is to be transferred from one account to another, such a transfer is also made through a Journal entry only.

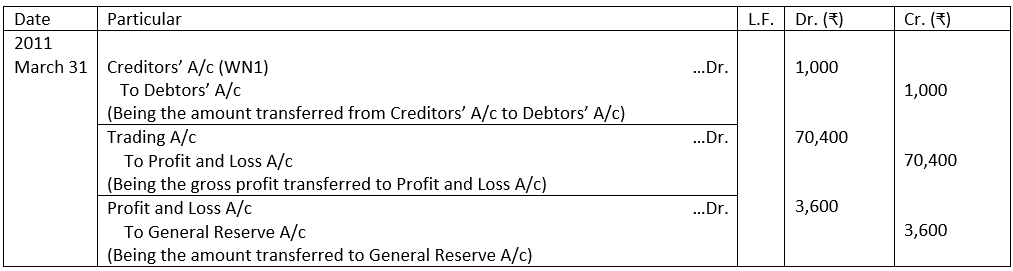

Illustration 13. On the closing date of an accounting period of Mr. Singh, i.e., on 31st March, 2011, make the following transfer entries:

(i) Debtors include ₹ 2,000 due from A, whereas creditors include ₹ 1,000 due to A;

(ii) Gross profit ₹ 70,400; and

(iii) Net profit ₹ 36,000, out of which 10% is to be transferred to General Reserve.

Solution:

Working Notes:

1. Amount due from A is ₹ 2,000 and amount due to A is ₹ 1,000. Therefore, ₹ 1,000 is to be deducted from the Debtors’ balance as well as from the Creditors’ balance.

2. Adjustment entries are passed before they are transferred to the Trading and Profit and Loss Account and the Balance Sheet. This is because adjustment entries always have a dual effect. They affect either the Trading Account or the Profit and Loss Account but definitely the Balance Sheet.

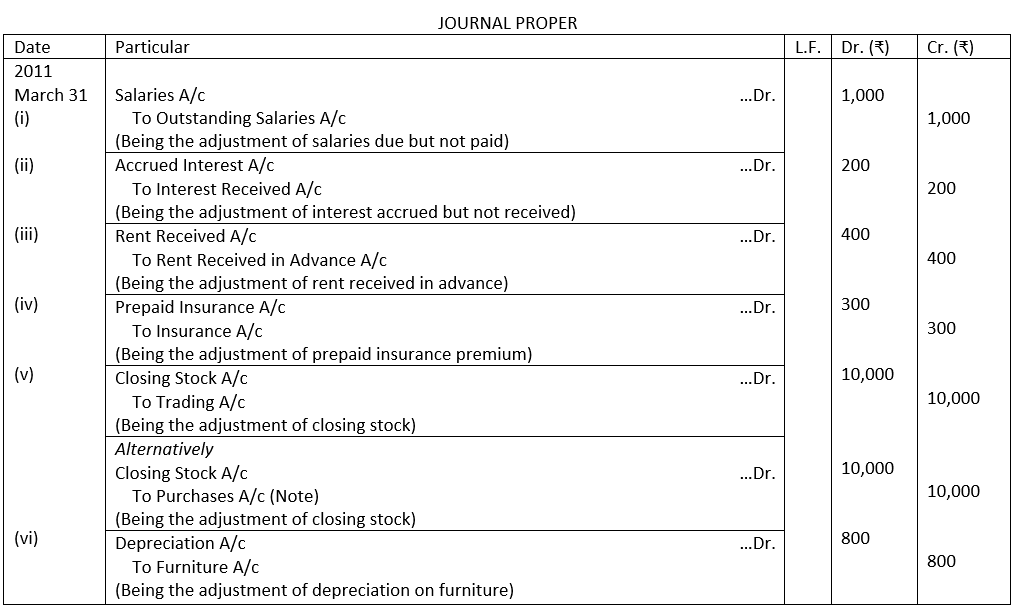

5. Adjusting Entries: At the end of the year, the amount of expenses or incomes may have to be adjusted for amounts paid or received in advance or for amounts not yet settled in cash. Such an adjustment is also made through Journal entries only. Usually the adjustment entries may pertain to the following:

(a) Outstanding expenses, i.e., expenses incurred but not yet paid.

(b) Prepaid expenses, i.e., expenses already paid in advance for some period in the future.

(c) Income received in advance.

(d) Accrued Income, i.e., income earned but not received.

(e) Interest on capital, i.e., the interest which the proprietor thinks proper to all his investment.

(f) Depreciation, i.e., fall in the value of the assets used on account of wear and tear over a period.

Note: Adjusting entries have been discussed in detail in Post on Final Accounts.

Illustration 14. Pass the necessary adjustment entries for the following in the books of Shri R. Banerjee at the end of accounting year which closes on 31st March, 2011:

(i) Salary of ₹ 1,000 for March, 2011 is outstanding.

(ii) Interest accrued on investment ₹ 200.

(iii) Rent received in advance ₹ 400.

(iv) Insurance prepaid ₹ 300.

(v) Closing stock ₹ 10,000.

(vi) Depreciate furniture by ₹ 800.

Solution:

Note: Closing Stock represents a part of the goods purchased but not yet sold. Therefore, it should be adjusted against purchases. Alternatively, it’ can be transferred to the credit side of the Trading Account.

6. Entries for Dishonour of Bills: If someone who accepted a Bill of Exchange or issued a Promissory Note, is not able to pay it on its due date, a Journal entry is necessary to record the non-payment or dishonour.

7. Miscellaneous Entries: Besides the above, the following entries also require journalising:

(a) Credit purchase of goods other than goods dealt in or materials required for production of goods, e.g., credit purchase of furniture or machinery will be journalised.

(b) Discount Allowed and Discount Received.

(c) An allowance to be given to customers or a charge to be made to them after the issue of the invoice.

(d) On an amount becoming irrecoverable, say, because of the customer becoming insolvent.

(e) Effects of accidents such as loss of property by fire.

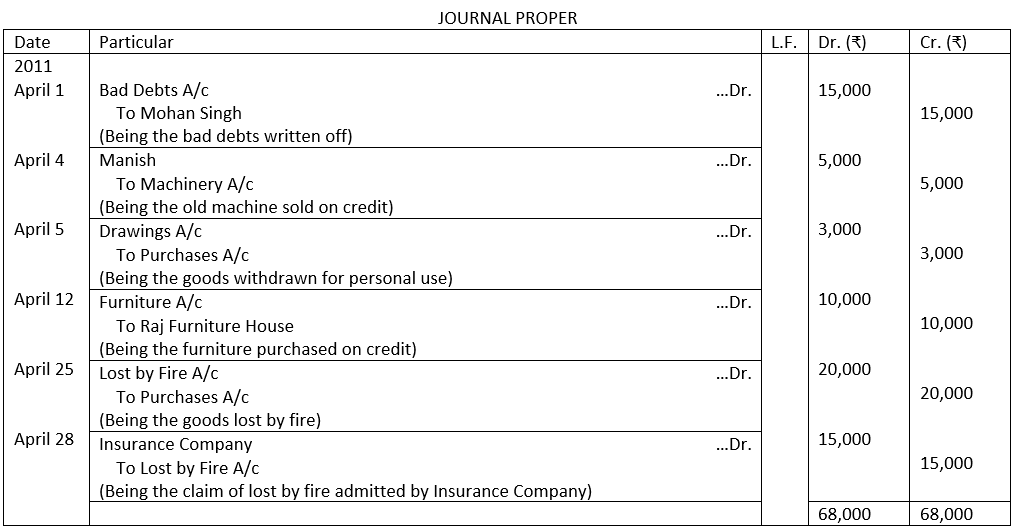

Illustration 15. Enter the following transactions in the appropriate books of original entry:

2011

April 1- Mohan Singh was declared insolvent and a sum of ₹ 15,000 could not be received.

April 4 – An old machinery was sold to Manish for ₹ 5,000.

April 5 – Goods withdrawn from business for personal use of ₹ 3,000.

April 12 – Purchased furniture on credit from Raj Furniture House for shop for ₹ 10,000.

April 25 – Goods worth ₹ 20,000 lost by fire.

April 28 – Insurance company accepted a fire insurance claim of ₹ 15,000.

Solution:

Distinction between Special Journal and General Journal

| Basis | Special Journal (Subsidiary Books) | Genera/ Journal (Journal Proper) |

| 1. Nature of Transactions Recorded | It records transactions of similar nature, e.g., Purchases Book records only credit purchases. | It does not record transactions of a similar nature. |

| 2. Format | It is in the form of a statement. | It is in the form of a Journal. |

| 3. Need | A business unit may not have a Special Journal. | A business unit must have a Journal Proper. |

| 4. Posting | Each transaction is not recorded in the Ledger separately. | Each transaction is recorded in the Ledger separately. |

| 5. Rectification | A mistake in the Journal Proper is not rectified by a Special Journal. | A mistake in a Special Journal is rectified by the Journal Proper. |

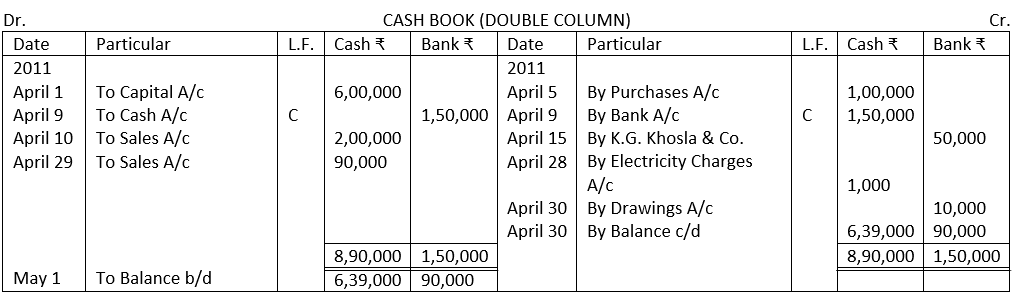

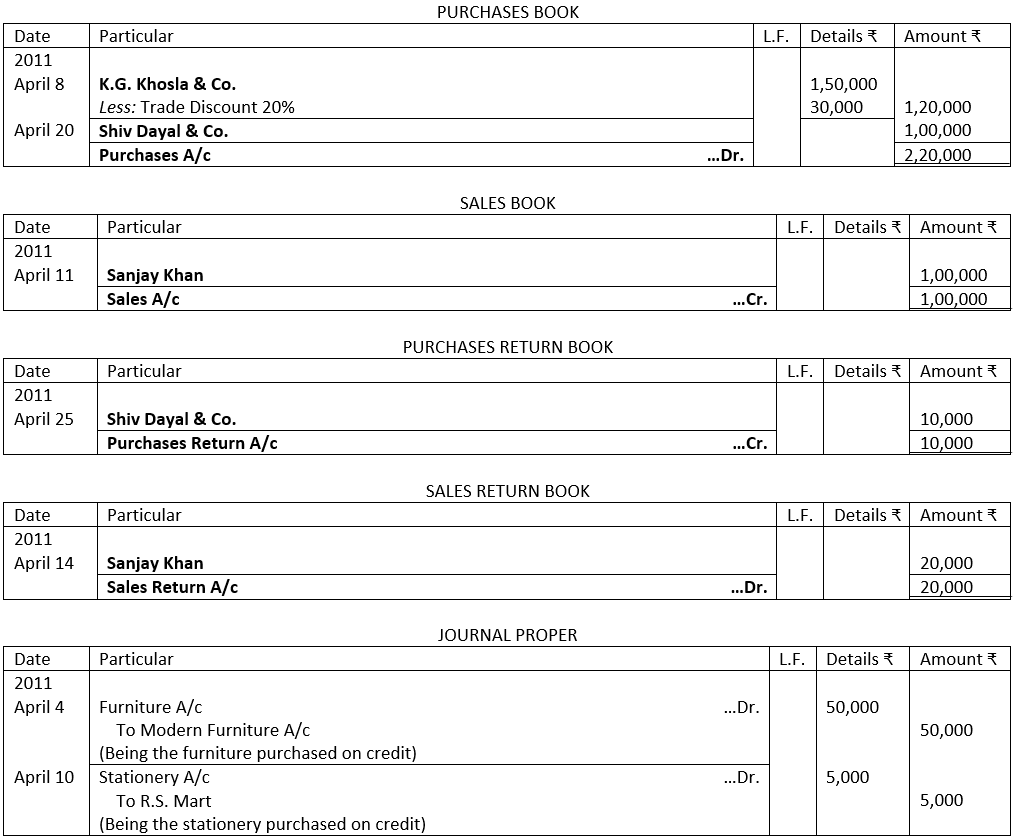

Illustration 16. Enter the following transactions in the subsidiary books and post them into the Ledger and prepare a Trial Balance:

2011

April 1 Mr. Raj started a business with – ₹ 60,000

April 4 Furniture purchased from Modern Furniture worth – ₹ 50,000

April 5 Purchased goods for cash – ₹ 1,00,000

April 8 Purchased goods from K.G. Khosla & Co. for ₹ 1,50,000, trade discount 20%

April 9 Opened a bank account by depositing – ₹ 1,50,000

April 10 Sold goods for cash – ₹ 2,00,000

April 10 Purchased stationery worth ₹ 5,000 from R.S. Mart

April 11 Sold goods to Sanjay Khan worth – ₹ 1,00,000

April 14 Goods returned by Sanjay Khan worth – ₹ 20,000

April 15 Payment to K.G. Khosla & Co. by cheque – ₹ 50,000

April 20 Goods purchased on credit from Shiv Dayal & Co. worth – ₹ 1,00,000

April 25 Goods returned to Shiv Dayal & Co. worth – ₹ 10,000

April 28 Paid electricity bill – ₹ 1,000

April 29 Cash sales – ₹ 90,000

April 30 Withdrew ₹ 10,000 for private use from bank

Solution:

Note: One can draw the following conclusions:

In the Simple Cash Book only the cash receipts and cash payments are recorded. Credit transactions are not recorded.

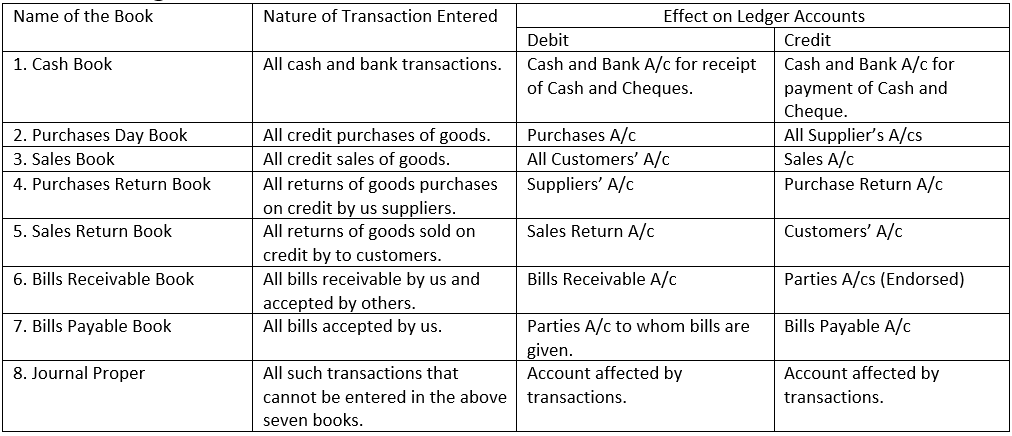

Chapter summary

Table showing the Nature of Transactions Recorded in Subsidiary Books and their Effect on Ledger Accounts

Purchases Book is a book of primary entry, used for recording credit purchases.

Cash purchases are not recorded in the Purchases Book. They are recorded in the Cash Book.

Sales Book is used for the purposes of recording the sale of merchandise on credit.

Purchases Return Book (also known as Return Outwards Book) is used for recording all returns of goods purchased on credit.

Sales Return Book (also known as Return Inwards Book) is used for the purposes of recording the return of goods sold on credit.

Bills Receivable Book and Bills Payable Book: For any organisation, where a number of bills are drawn and/or accepted, these are recorded in special subsidiary books particulars of all bills receivable in the Bills Receivable Book and particulars of the bills payable in the Bills Payable Book.

Journal Proper is used for making the original record of those transactions which do not find a place in any other subsidiary book. Entries recorded in the Journal Proper are:

(i) Opening Entry; (ii) Closing Entry; (iii) Transfer Entries; (vi) Credit Purchase of Assets; (v) Rectifying Entries; (iv) Adjusting Entries; (vii) Credit Sale of Worn-out or Obsolete Assets.

The End!

- Unit 4 Business Finance PYQ’s 14th Oct 2022 Shift 1

- Unit 4 Business Finance PYQ’s 29th Sep 2022 Shift 2

- Unit 4 Business Finance PYQ’s 29th Sep 2022 Shift 1

- Unit 4 Business Finance PYQ’s 4th March 2023 Shift 1

- Unit 4 Business Finance PYQ’s 4th March 2023 Shift 2