Learning Inside:

- Introduction #

- Objective of IASB #

- Meaning of IFRS #

- Table of Accounting standards issued by the IASC #

- Table of IFRS Issued by the IASB #

- Assumptions in IFRS #

- IFRS Based Financial Statement #

- Measurement of Elements of IFRS Based Financial Statement #

- Benefit of IFRS #

- Different between IFRS and Indian GAAP or Accounting Standards #

- Indian and IFRS #

- Table of Indian Accounting Standards (Ins-AS) #

Introduction

Globalisation integrates the national economies into the international economy through the trade, foreign direct investments, capital flow etc. In this age of globalisation and technology, enterprises are carrying on businesses worldwide. We also understand that accounting is the language of business. Thus, business enterprises around the world should not be speaking different languages while sharing financial information. Therefore, there is a need of single set of accounting standards that can unify the accounting practice worldwide. It is difficult to understand and compare worldwide financial information without a common set of accounting and financial reporting standards. The use of a single set of high-quality accounting standards would facilitate investment and other economic decision across borders, increase market efficiency, and reduce the cost of capital. Thus, International Accounting Standards (IAS) were developed, which are being withdrawn or superseded by International Financial Reporting Standards (IFRS).

The International Accounting Standards Committee (IASC) was established in 1973 through an agreement by professional accountancy bodies from Australia, Canada, France, Germany Japan, Mexico, the Netherlands, the United Kingdom and Ireland, and the United State. The objective behind setting up the IASC was to develop accounting standards that would be acceptable worldwide to produce and make available financial information prepared by following similar accounting standards. Thus, it is the process to improve financial reporting internationally.

IASC was replaced by International Accounting Standards Board (IASB) in the year 2001 which now issue International Financial reporting standards (IFRS). IASB initially adopted the accounting standards issued by IASC to be replaced by IFRS upon their issuance.

Objectives of IASB

The objectives of IASB are:

- To develop, in the public interest, a single set of high-quality, understandable, and enforceable global accounting standards that require high-quality, transparent, and comparable information in financial statements and other financial reporting to help participants in the various capital markets of the world and other users of the information to make economic decisions;

- To promote the use and rigorous application of those standards; and

- In fulfilling the objectives associated with (i) and (ii), to take account of, as appropriate, the special needs of small and medium-sized entities and emerging economies; and

- To bring about convergence of national accounting standards and Intentional Financial Reporting Standards to high-quality solutions.

Meaning

IFRS are a set of accounting standards developed by the international Accounting Standards Board (IASB), the international accounting standard setting body. IASB places emphasis on developing standards based on sound and clearly stated principles, from which interpretation is necessary. Therefore, IFRS are referred to as principles-based accounting standards. This contrasts with sets of standards, like Indian Accounting Standards, which contain significantly more application guidance. These standards are often referred to as rule-based accounting standards.

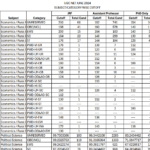

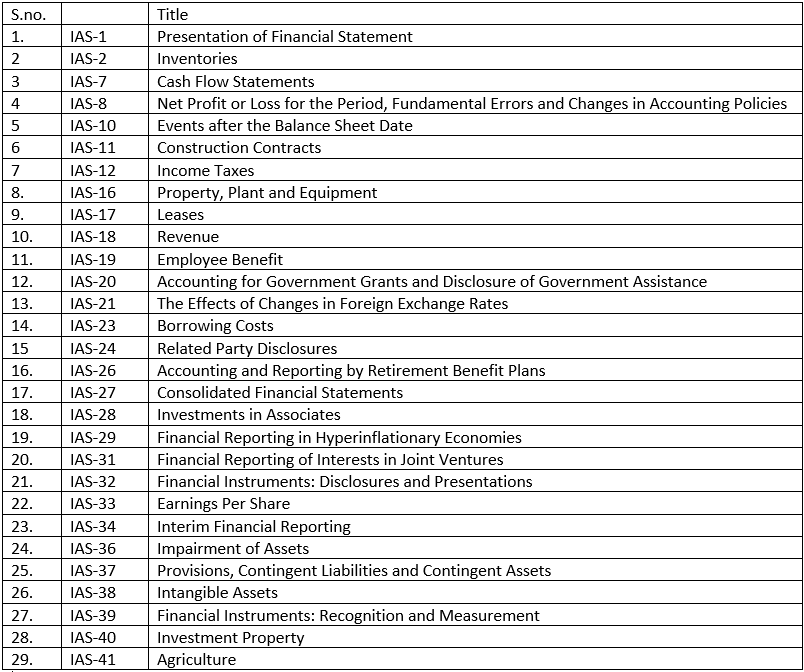

Accounting Standards Issued by the IASC and Standing Interpretation Committee (SIC)

IASC had issued 41 accounting standards, known as the International Accounting Standards (IAS), and a Framework for the Preparation and Presentation of Financial Statements, out of which 12 IASs have been superseded and a large number of them have been revised. Standing Interpretation Committee (SIC) was the interpretive body of the IASC. The interpretation of IAS issued by the SIC are described as SIC-1, SIC-2, etc. The IASs presently in force are as follows:

IASB had adopted all outstanding IAS and SIC issued by the IASC as its own standards. Those IAS and SIC continue to be in force to the extent they are not amended or withdrawn by the IASB. New standards issued by the IASB are known as IFRS. New interpretations issued by the International Financial Reporting Interpretations Committee (IFRIC) are known as IFRIC Interpretations. When referring collectively to IFRS, that term includes IAS, SIC, IFRS, AND IFRIC Interpretations.

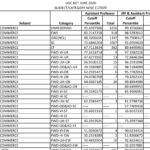

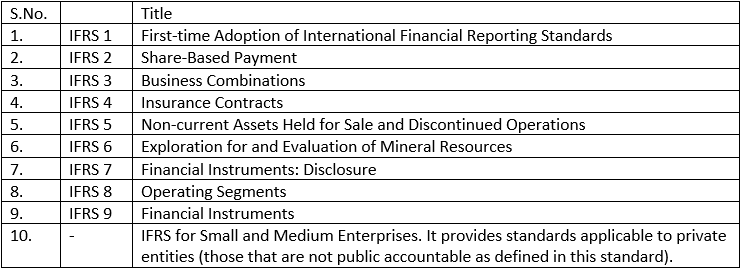

IFRS Issued by the IASB

Assumptions in IFRS

The underlying assumptions in IFRS are:

- Accrual Assumption: The transactions are recorded in the books of accounts on accrual basis i.e., as and when they occur and not when the settlement of transaction take place.

- Going Concern Assumption: It is assumed that the life of the business is infinite i.e., the entity will continue its operations for an indefinite period.

- Measuring Unit Assumption: Measuring unit for valuation of capital if the current purchasing power. It means assets should be reflected at current i.e., fair value.

- Constant Purchasing Power Assumption: Constant Purchasing Power means value of capital be adjusted to inflation in the economy at the of the financial year.

IFRS Based Financial Statements

The financial statements produced under IFRS are:

- Statement of Financial Position: The elements or contents of the statement are:

- Assets: Assets are the resources controlled by the enterprise as a result of past events and operations from which the future economic benefits shall flow to the enterprise.

- Liability: Liabilities are the obligations of the enterprise from the past events and operations, which shall result in outflow of resources, i.e., assets.

- Equity: Equity is the residual interest in the assets of the enterprise after deducting liabilities. It is the real value of shareholders’ equity.

- Statement of Comprehensive Income: A statement of Comprehensive Income includes two separate statements. i.e., Income statement and a statement of Comprehensive Income are prepared. The Statement of Comprehensive Income reconciles the income or loss as per Income Statement with total comprehensive income. The elements or contents of the statement are:

- Revenue: It increases the economic benefit during the accounting period as a result of business operations or increase in value of assets or decrease in liabilities. it results in increase in the value of shareholders’ equity.

- Expense: It is a decrease in economic benefits in the form of outflows during the accounting period as a result of business operations or decrease in value of assets or increase in liabilities. It results in decrease in the value of shareholders’ equity.

- Statement of Changes in Equity.

- Statement of Cash Flow.

- Notes and Significant Accounting Policies.

Measurement of Elements of IFRS Based Financial Statements

- Historical Cost: Assets are recorded at the amount of cash or cash equivalents paid or the fair value of the consideration paid to acquire them at the time of their acquisition. Liabilities are recorded at the amount of proceeds received in exchange for the obligation.

- Current Cost: Assets are carried in the Balance Sheet at the amount of cash or cash equivalents that would have to be paid if the same or an equivalent asset has been acquired currently. Liabilities are carried at undiscounted value that would be required to settle the obligation.

- Realisable (Settlement) Value: Assets are carried at the amount of cash or cash equivalents that could be realised by selling the asset in an orderly disposal. Assets are carried at the present discounted value of future net cash inflows that asset is expected to generate in the normal course of business. Liabilities are carried at the present discounted value of the future net cash outflows that are expected to be required to settle the liabilities in the normal course of business.

Benefit of IFRS

IFRS are important for entities that have businesses, investor and lenders located worldwide. A single accounting standard provides all stakeholders a cohesive view of finances. Globally Accepted Accounting Standards will improve the credibility of financial statements that are IFRS compliant since such financial statements shall be prepared following common accounting standards and reporting language. IFRS shall be helpful to the economy at large, investors, industry, and accounting professionals.

Investors: Investors are more concerned about the relevant, reliable, timely and comparable information. Financial statements prepared using common set of accounting standards (say IFRS) shall be better understood in comparison to financial statements prepared under the country specific accounting standards. The investors shall be in a better position to make investment decisions.

Industry: Investment in businesses is generally large and thus entities have to look for cost effective funds from investors within and outside the country. Raising cost effective funds from outside the country becomes easier if their financial statements comply with Globally Accepted Accounting Standards. Financial statements using a common set of accounting standards help better understanding of the investment opportunities as compared to financial statement prepared under a different set of accounting standards.

Entities having operations in different countries and preparing the financial statement according to accounting standards of that country face problem of consolidation and producing a single set of financial statements. The burden is lessened with adoption of IFRS or convergence of accounting standards.

Accounting Professionals are in a position to render their services in countries adopting IFRS.

Difference between IFRS and Indian GAAP or Accounting Standards

The principal difference between IFRS and Indian GAAP are as follows:

IFRS are Principle based while Indian GAAP or Accounting Standards are Rule based. Unlike Indian Accounting Standards, IFRS do not prescribe any form for preparing the financial statements. For example, under the Indian laws, Balance Sheet is prepared according to Schedule VI of the Companies Act, 1956 or in the form as near thereto. It means, a Balance Sheet item should be depicted under the prescribed head. In contrast to this, IFRS do not prescribe any form for the Balance Sheet. They prescribe that item may be shown in the Balance Sheetin accordance with the principle associated with them. For example, Redeemable Preference Shares are shown under the main head “Share Capital” under Schedule VI of the Indian Companies Act, 1956. But, in the real sense, Preference Share Capital is not a capital but loan because it carries a fixed rate of dividend and also must be redeemed in accordance with the terms of issue but not later than 25 years from the date of issue. IFRS require that since it is in the nature of load, it should be depicted under the main head “Loans”.

IFRS are based on Fair Value Concept while Indain GAAP or Accounting Standards are based on Historical Cost Concept. Unlike Indian GAAP or Accounting Standards, IFRS require that the assets and liabilities of the company should be shown at the fair value as the date of Balance Sheet. Thus, in effect, depreciation is not charged on the cost of the asset but it is valued as on that date and the difference in opening and closing valuation id debited or credited to Profit and Loss Account. It means every asset and also liability will have to be valued or discounted every to be shown in the Balance Sheet.

However, besides the above two principal differences there are differences in a number of areas and are hereunder:

Revenue Recognition

Inventory Valuation in Service Sector

Accounting for Taxes on Income

Useful life of Intangible Assets

Current and Non-current Classification

Prior Period Items

Extra-ordinary Items

Regrouping/Reclassification

Impact on Fixed Assets

Business Combinations

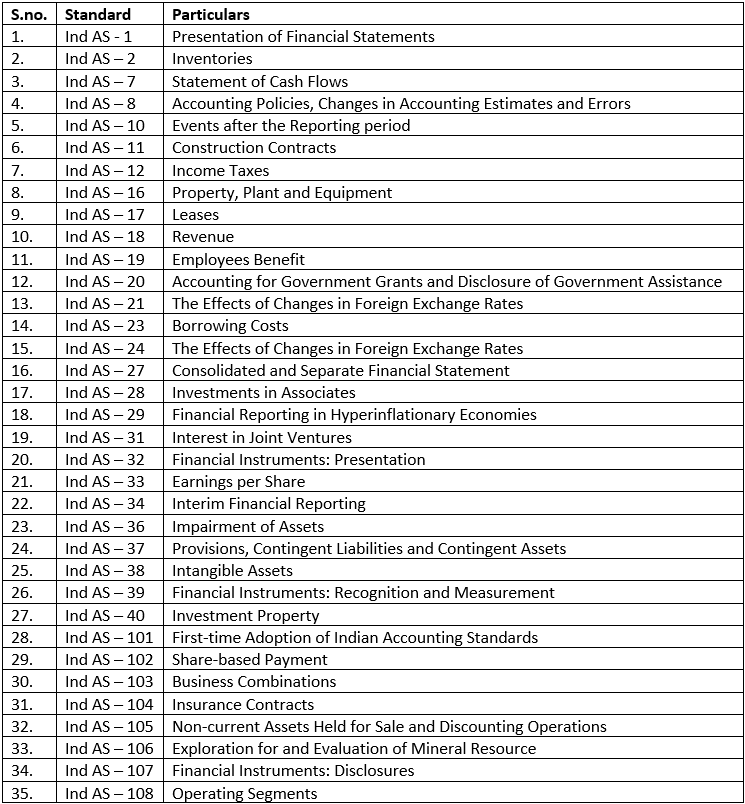

Indian and IFRS

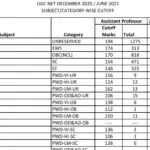

Indian had two options, i.e., either to adopt IFRS as they are or converge the Indian Accounting Standards in line with the IFRS. It decided to converge its existing accounting standards with IFRS. The converged accounting standards title Ind – AS have been issued and notified. The Ind – AS issued and notified are:

Indian Accounting Standards (Ind-AS)

It should be understood that the existing Indian Accounting Standard shall not cease to be applicable standards. They will continue to apply on entities that are not required to migrate to Ind – AS. However, if the entities that are not required to migrate to Ind – AS, may adopt them voluntarily.

Currently, over 100 countries permit or require IFRS compliant financial statements by public companies. Indian has committed to be IFRS Compliant Country from the year ended March 31, 2011 and has prepared a roadmap for its adoption as follows:

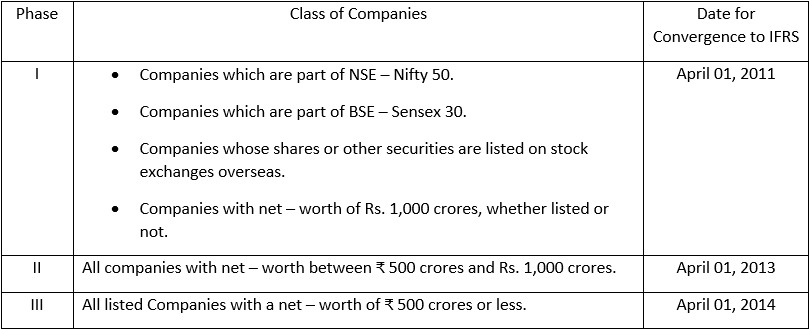

For Companies other than Insurance, Banking and Non-banking Financial Companies (NBFC)

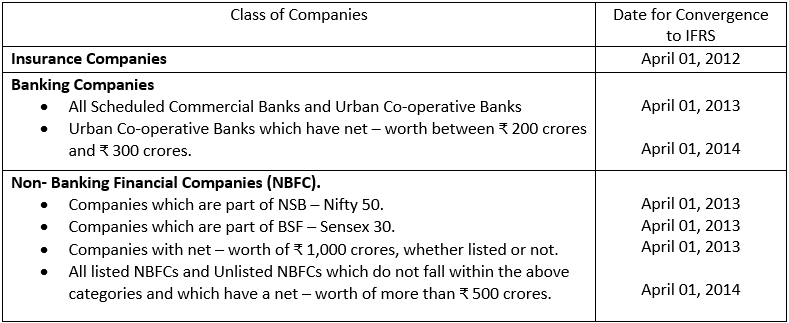

For Insurance, Banking and Non-banking Financial Companies (NBFC)

The End