Abstract

- A Trial Balance is a statement of accounts appearing in the Ledger. It may be prepared either by taking the balance of each account or the total amounts of debit and credit items.

- The agreement of Trial Balance ensures arithmetical accuracy and not accounting accuracy.

- Functions of a Trial Balance are to

- (i) ascertain arithmetical accuracy.

- (ii) facilitate preparation of Financial Statements.

- (iii) provide summary of Ledger Accounts.

- (iv) help to locate errors.

- Methods of Preparing a Trial Balance:

- (1) Balance Method

- (2) Totals Method.

Meaning of a Trial Balance

A Trial Balance is a statement of accounts which appears in the Ledger showing either balances or the total amounts of debit and credit items.

“A Trial Balance is a statement, prepared with the debit and credit balance of the Ledger Accounts to test the arithmetical accuracy of the books. ” -J.R. Batliboi

“A Trial Balance is the list of debit and credit balances, taken out from the Ledger. It also includes the balances of cash and bank taken from the Cash Book”. —Carter

A Trial Balance is prepared after having posted the Journal entries into the Ledger and balancing the accounts.

The balance of an account is the difference between the total of the debit side and the total of the credit side.

If the debit side total is greater, it is called a Debit Balance. Likewise, if the credit side total is greater, it is called a Credit Balance.

All Ledger Accounts showing debit balances are posted in one column and those showing credit balances are posted in the other.

We already know that under the Double Entry System, for every debit there is an equal and corresponding credit. Therefore, the total of debit balances in different accounts in the Ledger must be equal to the total of credit balances in different accounts, i.e., the totals of the two columns should agree.

If they agree, it means that both the aspects of each transaction have been correctly recorded in the Ledger.

Characteristics or Features of a Trial Balance

- 1. It is a list of balances of Ledger Accounts and Cash Book.

- 2. It is not a part of the Double Entry System of Book Keeping. It is a result of Double Entry System of Book Keeping. It is only a working paper.

- 3. It can be prepared on any date.

- 4. It verifies the arithmetical accuracy of posting of entries from the Journal to the Ledger.

- 5. It is not a conclusive proof of the accuracy of the books of accounts since some errors are not disclosed by the Trial Balance, for example, error of principle.

Objectives or Functions of a Trial Balance

(i) To Ascertain the Arithmetical Accuracy of Ledger Accounts: The Trial Balance enables one to establish whether posting and other accounting processes have been carried out without committing arithmetical errors.

(ii) To Help Prepare the Final Accounts: Financial Statements are prepared from the Trial Balance. Preparation of Financial Statements, therefore, is the second objective of preparing a Trial Balance.

(iii) Summary of Each Account: The Trial Balance offers a summary of the Ledger. The Ledger may have to be referred to only when more detail is required in respect of an account.

(iv) To Help in Locating Errors: The Trial Balance helps in locating errors in Book Keeping work. It should, however, be borne in mind that it does not disclose all the errors in Book Keeping but only the arithmetical inaccuracies.

Limitations of Trial Balance

Trial Balance is not a conclusive proof of accuracy. There are many errors which may remain undetected even if the Trial Balance agrees. These are:

- (i) Errors of complete omission;

- (ii) Errors of Principles;

- (iii) Compensating errors;

- (iv) Incorrect amount entered in Journal,

- (v) Posting to the wrong account and

- (vi) An entry posted twice in the Ledger.

All these errors are discussed in detail in next POST.

Methods of Preparing a Trial Balance

A Trial Balance may be prepared by following either the Balance Method or the Totals Method.

(i) Balance Method: In this method, only the debit or credit balances are entered separately in the two columns. This is known as the Net Trial Balances. This is the commonly used method of preparing a Trial Balance because it facilitates the preparation of the final accounts.

(ii) Totals Method: In this method, the total of each side of the account is entered respectively in the debit and credit columns of the Trial Balance. Such a Trial Balance is known as the Gross Trial Balance.

A specimen of Trial Balance follows:

TRIAL BALANCE

as on…

While preparing a Trial Balance, the following points should be borne in mind:

- (i) It is prepared on a particular date which should be written on the top.

- (ii) In the first column, the name of the account is written.

- (iii) In the second column, Ledger Folio, i.e., the page number of the Ledger where the balance appears, is written.

- (iv) In the third column, the total of the debit side of the account concerned or the debit balance, if any, is entered.

- (v) In the fourth column, the total of the credit side or the credit balance is written.

- (vi) The two columns are totalled at the end.

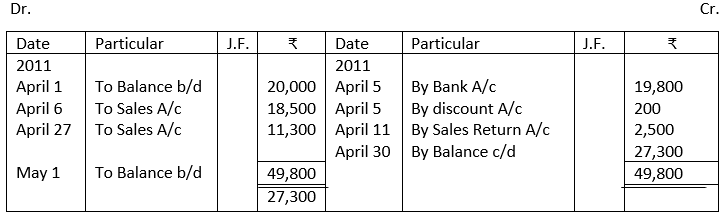

Consider the following Ledger account:

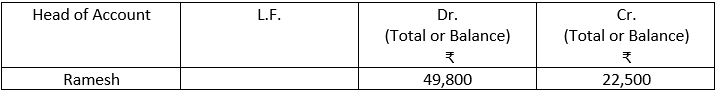

If we prepare a Trial Balance by the Total Amount Method, the account will appear as follows:

On the other hand, if we prepare a Trial Balance by the Total Amount Method, the account will appear as follows:

A Trial Balance is generally prepared using the Balance Method.

Difference between a Trial Balance by Balance Method and a Trial Balance by Totals Method

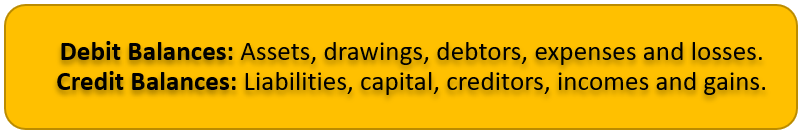

Hints for Preparing a Trial Balance

1. A Trial Balance is prepared with the help of Ledger and Cash Book.

2. While preparing a Trial Balance all the Personal, Real and Nominal Accounts are considered.

3. In addition to these, the cash balance and bank accounts are considered.

4. If an account does not show any balance, it is ignored.

5. The Ledger Accounts showing debit balances are shown in the debit column of a Trial Balance and the Ledger Accounts showing credit balances are shown in the credit column of a Trial Balance.

6. The Purchases Account always shows a debit balance which is shown in the debit column of a Trial Balance.

7. The Sales Account always shows a credit balance which is shown in the credit column of a Trial Balance.

8. The Return Inwards Account or Sales Return Account always shows a debit balance and hence is shown in the debit column of a Trial Balance.

9. The Return Outwards Account or Purchases Return Account always shows a credit balance and hence is shown in the credit column of a Trial Balance.

10. The Opening Stock Account shows a debit balance which is shown in the debit column of a Trial Balance.

11. Generally, the closing stock does not appear in the Trial Balance. It is usually given as an additional information or adjustment outside the Trial Balance. It represents the balance of goods unsold out of opening stock and purchases. To incorporate the closing stock in the book, Closing Stock Account is debited and the Trading Account is credited by the amount of unsold stock at the end. Closing stock appears as an asset on the assets side of the Balance Sheet.

If the closing stock appears in the Trial Balance, it means that it has already been adjusted through purchases by debiting the closing stock and crediting the Purchases Account. In this case closing stock will not be shown on the credit side of the Trading Account and it will be shown as an asset on the assets side of the Balance Sheet.

12. Accounts of assets such as Plant and Machinery, Furniture and Fixtures, Land and Building, Motor Car, Bills Receivable, Goodwill, Trade Marks, Patents and Copy Right, Cash in Hand, Cash at Bank, etc., show a debit balance and are shown in the debit column of a Trial Balance.

13. Accounts of incomes and gains show credit balances and are shown in the credit column of a Trial Balance.

14. Accounts of expenses and losses show debit balances and are shown in the debit column of a Trial Balance.

Illustration 1.

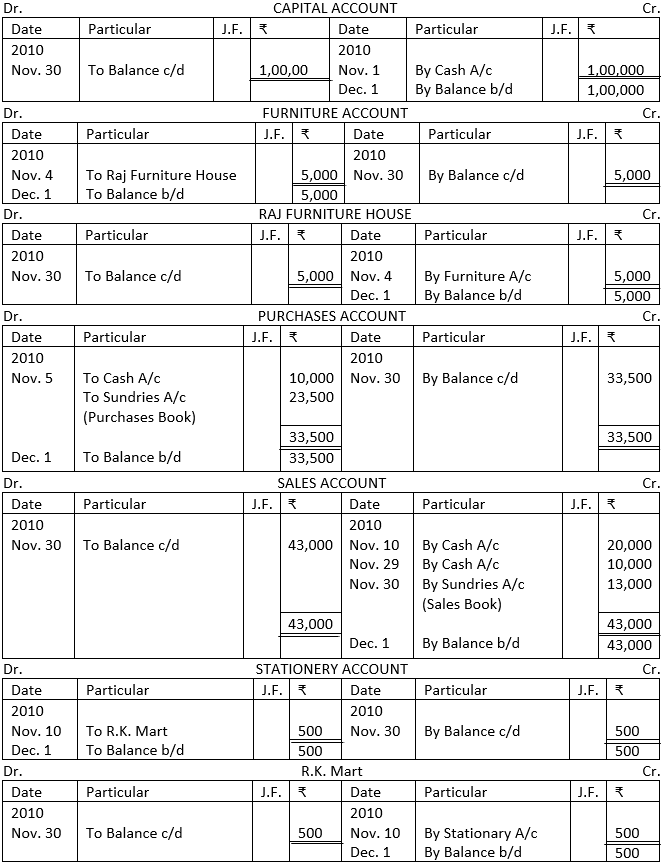

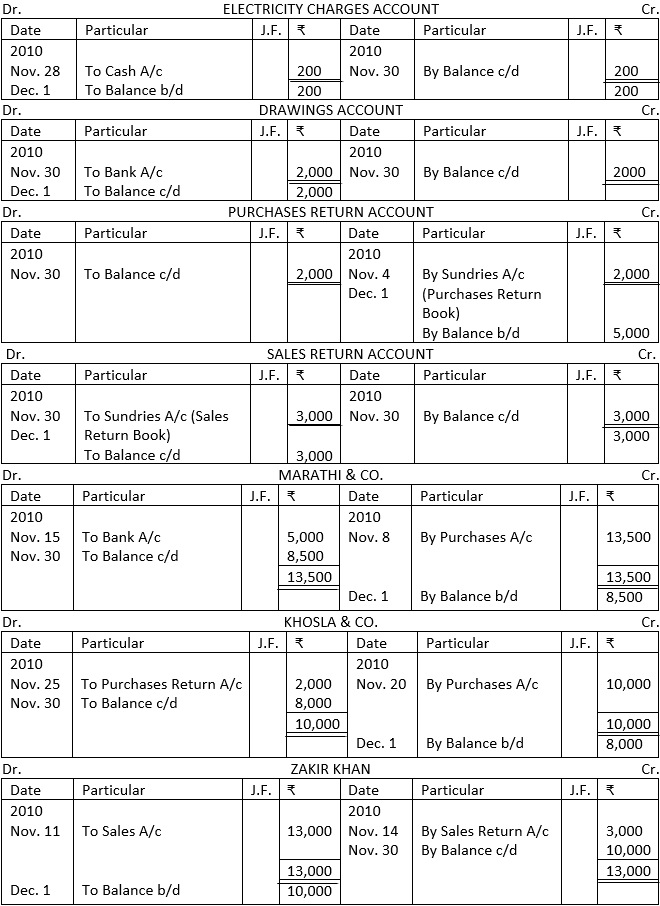

Enter the following transactions in the subsidiary books, post them into the Ledger and prepare a Trial Balance:

Solution:

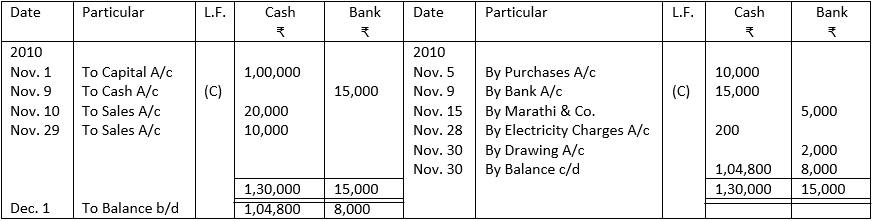

CASH BOOK (DOUBLE COLUMN)

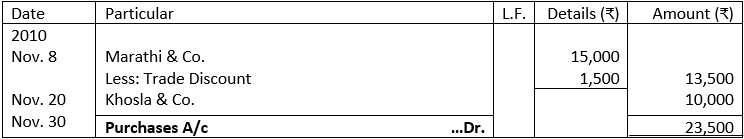

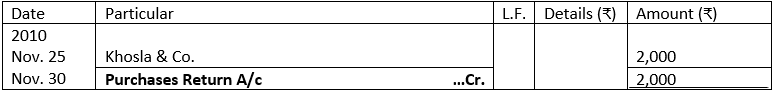

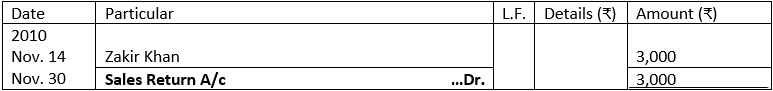

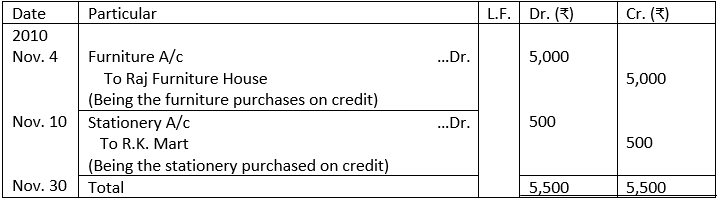

PURCHASES BOOK

SALES BOOK

PURCHASES RETURN BOOK

SALES RETURN BOOK

JOURNAL PROPER

Ledger

TRIAL BALANCE

As on 30th November, 2010

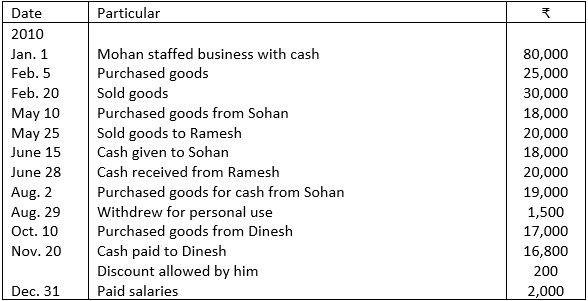

Illustration 2.

From the following transactions, pass the necessary Journal entries in the books of Mohan & Co., post them into their Ledger and prepare a Trial Balance using the Balance and Total Methods:

Solution:

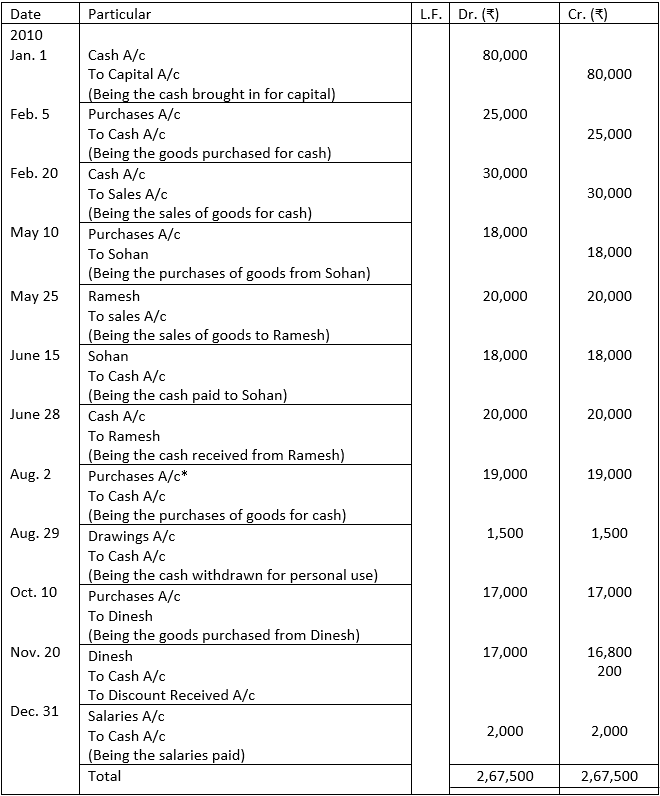

JOURNAL

*As it is a cash transaction) hence name of Sohan has not been recorded.

TRIAL BALANCE (BALANCE METHOD)

as on 31st December, 2010

Working note:

1. At the end of the year balance of Purchases Account Will be transferred to the debit of Trading Account and balance of Sales Account will be transferred to the credit of Trading Account.

2. Balance of salary Account will be transferred to the debit of Profit and Loss Account and balance of Discount Received Account will be transferred to the credit of Profit and Loss Account.

Nominal Accounts are not balanced but are closed by transferring their balances to Trading and Profit and loss Account.

TRIAL BALANCE (TOTAL METHOD)

as on 31st December, 2010

Working Notes:

1. The amount ₹ 82,300 is the total of the credit side of the Cash Account.

2. In this method, the total of the debit and credit sides of the Trial Balance is the same as the total of the debit and credit sides of the Journal on the basis of which the Trial Balance has been prepared.

Illustration 3.

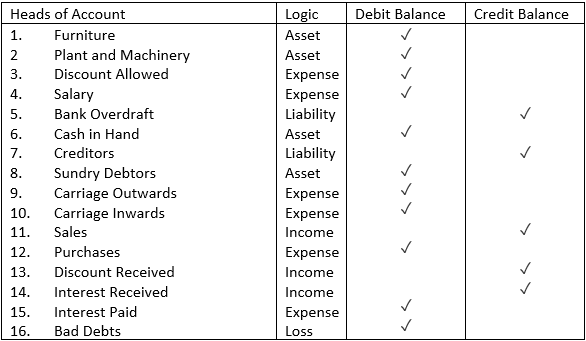

State whether the balances of the following accounts should be placed in the debit or the -credit columns of the Trial Balance:

Solution:

TRIAL BALANCE

as on …

Illustration 4.

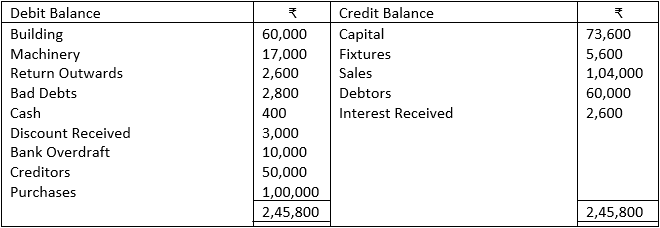

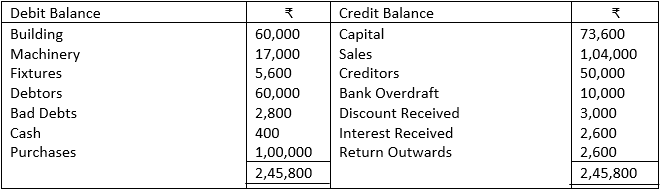

The following Trial Balance is drawn from the books of Brown Traders:

TRIAL BALANCE

as on…

You are required to comment on whether it is correct or not. If this Trial Balance is not correct, draw the correct one.

Solution:

Even though the debit and credit sides agree, the Trial Balance is incorrect. Assets, i.e., Fixtures and Debtors are wrongly shown on the credit side and Return Outwards, Bank Overdraft and Creditors on the debit side. The redrafted Trial Balance will be as follows:

REDRAFTED TRIAL BALANCE OF

BROWN TRADERS

as on…

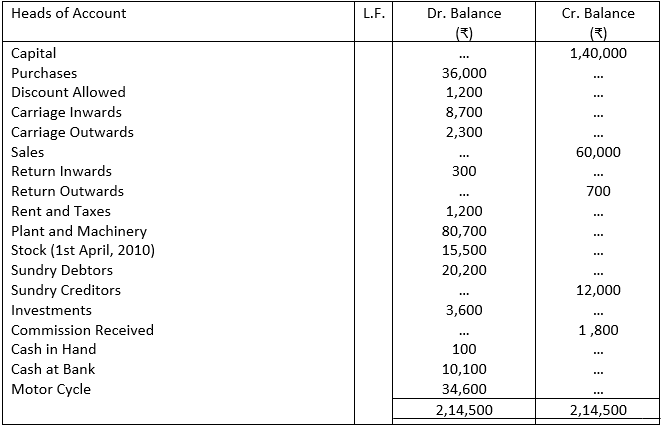

Illustration 5.

From the following information, draw up a Trial Balance in the books of Shri Haridas Chaki as on 31st March, 2011:

Capital ₹ 1,40,000; Purchases ₹ 36,000; Discount Allowed ₹ 1,200; Carriage Inwards ₹ 8,700; Carriage Outwards ₹ 2,300; Sales ₹ 60,000; Return Inwards ₹ 300; Return Outwards ₹ 700; Rent and Taxes ₹ 1,200; Plant and Machinery ₹ 80,700; Stock on 1st April, 2010 ₹ 15,500; Sundry Debtors ₹ 20,200; Sundry Creditors ₹ 12,000; Investments ₹ 3,600; Commission Received ₹ 1,800; Cash in Hand ₹ 100; Cash at Bank ₹ 10,100; Motor Cycle ₹ 34,600 and Stock on 31st March, 2011 (not adjusted) ₹ 20,500.

Solution:

TRIAL BALANCE

as on 31st, March 2011

Note: Closing Stock will not be taken in the Trial Balance because it represents a part of the goods purchased but not yet sold. As the total purchases have been included in the Trial Balance, there is no need of including Closing Stock again. If Closing Stock is adjusted against purchases, then only Closing Stock is shown in the Trial Balance.

Illustration 6.

Following balances were extracted from the books of Shri S. Pal on 31st March, 2011. You are required to prepare a Trial Balance. The amount required to balance should be entered as capital.

Solution:

TRIAL BALANCE

as on 31st March, 2011

Illustration 7:

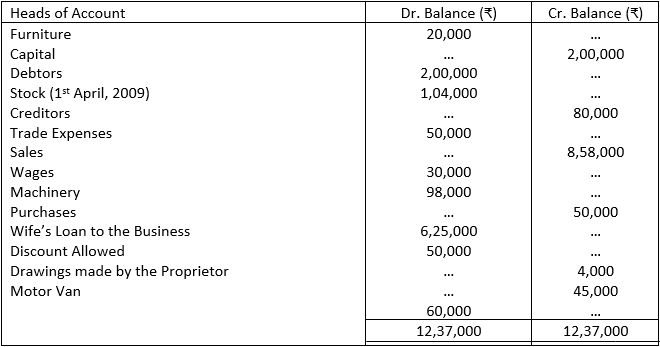

A bookkeeper extracted the following Trial Balance as on 31st March, 2010:

You are required to:

(i) State the errors giving reasons

(ii) Redraft the Trial Balance correctly.

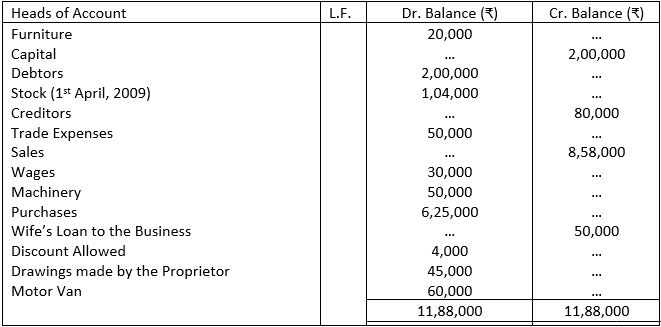

Solution:

(i) (a) Stock on 31st March, 2010, will not appear in the Trial Balance because it represents a part of the goods purchased but not yet sold. As the total purchases have been included in the Trial Balance, there is no need of including the Closing Stock again.

(b) Machinery is an asset and thus will appear in the debit column.

(c) Wife’s loan to the business is a liability. It will appear in the credit column.

(d) Discount allowed, being an expense, will appear in the debit column.

(e) Drawings made by the proprietor is a decrease of capital (i.e., decrease of proprietor’s claim from the business). It will appear in the debit column.

(ii)

Trial Balance

As on 31st March, 2010

Thank You! 🙏

Well done exploration.

Explation