Bases of Accounting

For recording financial transactions, there can be two broad approaches to accounting. These are:

1. Cash Basis and

2. Accrual Basis.

Cash Basis of Accounting: A system in which accounting entries are made only when cash is received or paid.

Accrual Basis of Accounting: A system in which income is recorded when it is earned, whether received or not. Similarly, expense is recorded when incurred, whether paid or not.

Let us Understand Bases of Accounting in Details

The most significant function of accounting is to determine profit earned or loss incurred by a business during an accounting period.

Profit earned or loss incurred by the business can be determined by 1. Cash Bases of Accounting or 2. Accrual or Mercantile Basis of Accounting.

1. Cash Basis of Accounting:

Cash basis of accounting is a system in which transactions are recorded only when cash is received or paid, i.e., entry is not recorded when a payment or receipt is merely due.

It means revenue is recognised only on receipt of cash. Likewise, expenses are recorded as incurred only when they have been paid.

The difference between the total incomes and total expenses represents Profit or Loss of a concern for a particular accounting period. Thus, when Cash Basis of Accounting is followed, outstanding and prepaid expenses and income received in advance or accrued incomes are not considered.

Receipts and Payments Account prepared in case of Not-For-Profit Organisations, such as charitable institutions, clubs and schools, is an example of accounting on cash basis.

- Outstanding Expenses are those expenses which have become due during the accounting period but which have not yet been paid.

- Prepaid Expenses are those expenses which have been paid in advances.

- Accrued Income is an income which has been earned during the accounting period but has not yet become due and, therefore, has not been received.

- Income Received in Advance is an income which has been received before it has been earned, i.e., goods have been sold or services have been rendered.

Advantages: Advantages of Cash Basis of Accounting are:

(i) It is very simple as adjustment entries are not required.

(ii) This approach is more objective as very few estimates and judgments are required.

(iii) This basis of accounting is suitable for those enterprises where most of the transactions are on cash basis.

Disadvantages: Disadvantages of Cash Basis of Accounting are:

(i) It does not give a true and fair view of the profit or loss and the financial position of an enterprise because it ignores outstanding and prepaid expenses and accrued income received in advance.

(ii) It does not follow the matching principle of accounting.

(iii) This system does not distinguish between capital and revenue items and, as a result, there is no consistency in the profits of the two years.

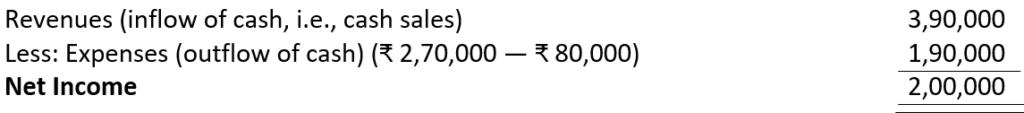

Illustration 1. During the financial year 2010—11, Ashok had cash sales of ₹ 3,90,000 and credit sales of ₹ 1,60,000. His expenses for the year were ₹ 2,70,000 out of which ₹ 80,000 is still to be paid. Find out Ashok’s income for 2010—11 following the Cash Basis of Accounting.

Solution:

Note: Credit sales and outstanding expenses will not be considered under Cash Basis of Accounting.

2. Accrual Basis of Accounting:

Under the Accrual Basis of Accounting, unlike under the Cash Basis of Accounting, income is recorded as income when it is earned or accrued.

For example, credit sale is recognised as sale irrespective of the fact whether cash has been received or not.

Similarly, if an expense has been incurred but payment has not been made, it will be recorded as an expense. For example, rent for the month of March, 2010 has not been paid. It will still be recorded as an expense because it had become due.

Accrual Basis of Accounting is based on the concept of realisation and expiration and follows two basic accounting principles, i.e., revenue recognition and matching principle.

Thus, under the Accrual Basis of Accounting, outstanding and prepaid expenses are adjusted, Similarly, accrued income and income received in advance are recognised for ascertaining correct profit or loss for the accounting period.

Thus, under the Accrual Basis of Accounting, net income for the period is the result of matching revenue realised in the period and cost incurred, whether paid or not.

The difference between total income and total expense incurred is the profit or loss for the period.

Advantages: The advantages of Accrual Basis of Accounting are:

(i) It is more scientific compared to Cash Basis of Accounting and hence is preferred by accountants.

(ii) This basis of accounting shows a complete picture of financial transactions of the

business as it takes into account the effect of all transactions relating to a period as well as adjustments like outstanding expenses, prepaid expenses, accrued income and income received in advance.

(iii) This basis discloses correct profit or loss for a particular period and also exhibits true financial position of the business on a particular day.

(iv) It reflects true profit or loss. during the accounting period and, therefore, has wide acceptability.

This system is followed by most of the industrial and commercial firms.

Disadvantages: The disadvantages of Accrual Basis of Accounting are:

(i) This system is not as simple as Cash Basis of Accounting.

(ii) The accounting process is too elaborate.

(iii) A quick appraisal of the profit/loss is not possible because many adjustments are

required to ascertain the true financial position of the business.

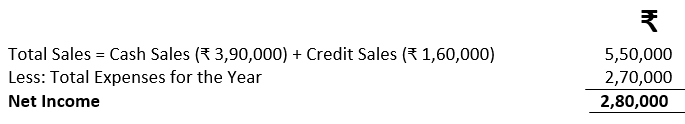

Illustration 2. Taking the figures given in Illustration 1, find out the net income according to Accrual Basis of Accounting.

Solution:

Note: ₹ 80,000 expenses still to be paid belong to this year and hence are to be charged to the revenue of this year. Similarly, credit sales of ₹ 1,60,000 are taken in the year in which sales transaction is done.

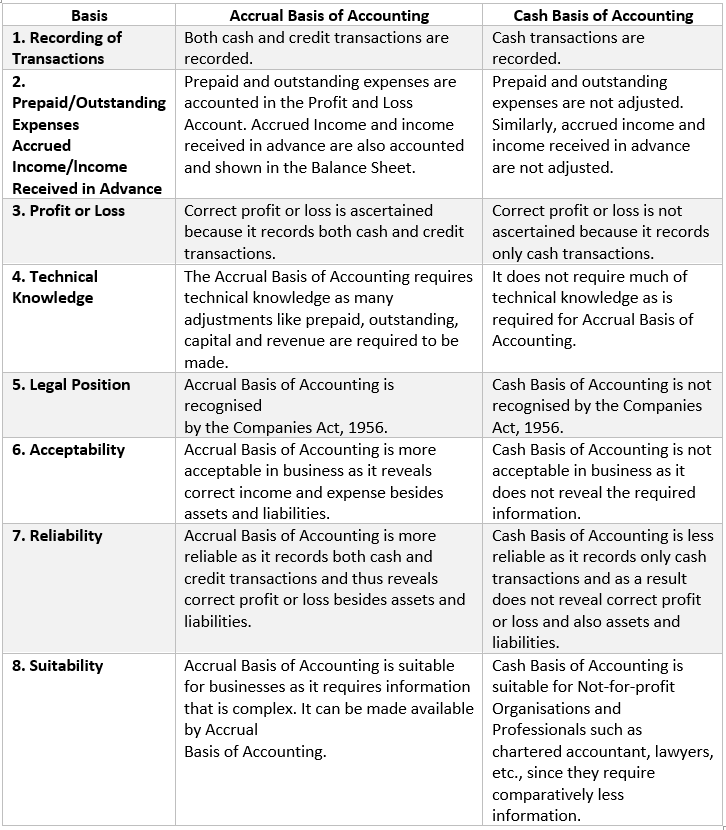

Difference between Accrual Bases of Accounting and Cash Basis of Accounting

The End