Entries of some Specific Transactions

1. Bad debts: In a business, if an amount is not realised or is partially realised, then the amount not realised is a loss and is termed as Bad Debts. The following Journal entries are passed in such a case:

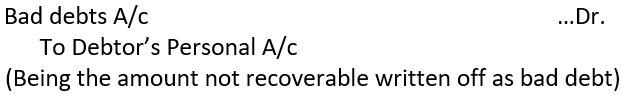

(i) When the amount is irrecoverable:

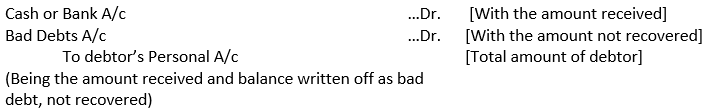

(ii) When a part of the debt is recoverable. When a debtor becomes bankrupt, i.e., he is unable to pay his total debt, the unrealised amount is a loss to the business, i.e., a bad Debt. The Journal entry passed is:

2. Bad Debts Recovered: Sometimes a debtor whose account had been earlier written off as a Bad Debt pays some account. The amount so received is a gain to the business because the amount was earlier written off as a loss, i.e., bad debt. The entry of bad debts recovered is:

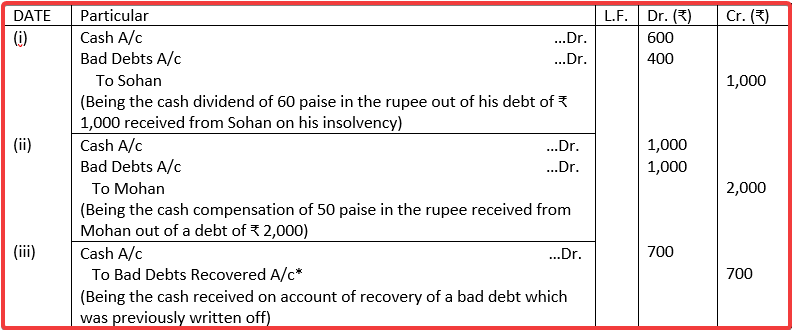

Illustration 4 (Insolvency and Bad Debts). Journalise the following transactions:

(i) Sohan is declared insolvent. Received from his Official Receiver a first and final dividend of 60 paise in the rupee on a debt of ₹ 1,000.

(ii) Mohan who owed ₹ 2,000 has become insolvent. He pays a compensation of 50 paise in the rupee.

(iii) Received cash for a bad debt written off last year ₹ 700

Solution:

In the Books of …

JOURNAL

*Recovery of bad debts written off last year is a gain, therefore, it is credited to the Bad Debts Recovered Account.

This is very good website for getting the Right Knowledge at one place in the filed of commerce specialized in Account.