Casting (Totalling) and Carry Forward

Usually, the number of transactions in a business are large and requires a number of pages of a Journal. Amounts of the debit and credit columns on each page are totalled (casted) and carried forward to the next page. In the Particulars column, against the total, the words ‘Total c/f’ (carried forward) are written. It indicates that the total has been carried forward to the next page. In the next page, in the Particulars column, against the amount brought forward, the word ‘Total b/f’(brought forward) are written. It indicates that the total has been brought forward from the previous page. Further, transaction are recorded and amounts in the two columns are totalled again. This process is followed till the recording of the last transaction. Each page of the Journal is casted to ensure no mistake has been committed in recording the amounts. Remember, under the dual aspect concept, every debit has a corresponding credit of equal amount. It means amounts debited in a transaction should be equal to the amounts credited. Thus. Totals of debit column and credit column should agree.

Important Considerations

1. If a transaction relates to sales or purchases of goods and the name of the seller or purchaser is given and it is not stated as a cash transaction, it is considered to be a credit transaction. For example, ‘Goods sold to Mohan’ means that it is a credit transaction. Accordingly, Mohan’s Account will be debited and the Sales Account credited.

2. If a transaction relates to sales or purchases and name of seller or purchaser is given along with cash, it is taken as cash transaction. For example, ‘Goods sold to Mohan for cash’, it is sales of goods in cash. Accordingly, Cash Account will be debited and Sales Account credited.

3. If a transaction relates to sales or purchases and the name of the seller or purchaser is not giver, it is considered as a cash transaction. For example, good sold for ₹ 10,000.

4. In Nominal Account, even if the name of the party receiving or making payment is given, it is still treated as a cash transaction. Personal Account will not be opened. For example, if a salary of ₹ 5,000 is paid to Ranjan, the transaction will not be recorded in the account of Ranjan, instead the Salary Account and Cash Account will be affected.

5. Introduction of funds in the business by the proprietor known as capital is credited to his Capital Account whereas withdrawal in cash or by way of goods for his personal use is debited to Drawings Account.

Recording of Journal: Transactions are recorded in the Journal on the basis of source documents following the rules of debit and credit. Let us take few examples to understand how a transaction is recorded.

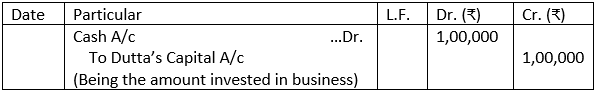

Example 1: Shri Dutta started a business and introduced capital in cash ₹ 1,00,000. The transaction is recorded by passing the following Journal entry:

Reason for Debit and credit:

(i) Cash Account is debited because it is received by the firm. It being a Real Account, the rule ‘Debit what comes in and Credit what goes out’ is applied.

(ii) Dutta’s Capital Account is credited because the firm has assumed a liability towards Dutta. It being a Personal Account, the rule ‘Debit the receiver and Credit the giver’ is applied.

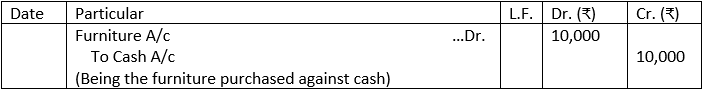

Example 2: Purchased furniture from Raj Furniture for ₹ 10,000, paid in cash. The transaction is recorded by passing the following Journal entry:

Reason for Debit and Credit:

(i) Furniture Account is debited because the firm has purchased, i.e., received it. It being a Real Account, the rule ‘Debit what comes in and Credit what goes out’ is applied.

(ii) Cash Account is credited because the firm has paid cash for purchase of furniture. It being a Real Account, the rule ‘Debit what comes in and Credit what goes out’ is applied.

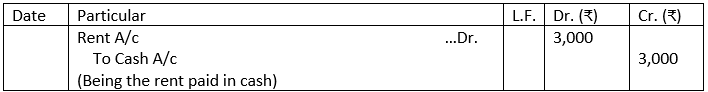

Example 3: Paid rent ₹ 3,000 in cash. The transaction is recorded by passing the following Journal entry:

Reason for Debit and Credit:

(i) Rent Account is debited because it is an expense. It being a Nominal Account, the rule ‘Debit all expenses and losses and Credit all incomes and gains’ is applied.

(ii) Cash Account is credited because the firm has paid cash towards the expenses. It being a Real Account, the rule ‘Debit what comes in and Credit what goes out’ is applied.

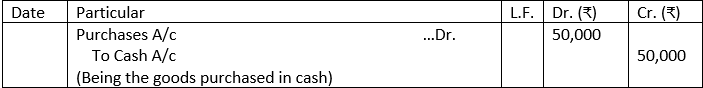

Example 4: Purchased goods for ₹ 50,000 for cash. The transaction is recorded by passing the following Journal entry:

Reason for Debit and Credit:

(i) Purchases Account is debited because the firm has purchased goods for the purposes of sale. It being a Nominal Account, the rule ‘Debit all expenses and losses and Credit all incomes and gains’ is applied.

(ii) Cash Account is credited because the firm has paid cash for purchases of goods. It being a Real Account, the rule ‘Debit what comes in and Credit what goes out’ is applied.

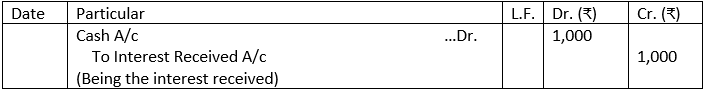

Example 5: Interest received ₹ 1,000 in cash. The Journal entry passed is:

Reason for Debit and Credit:

(i) Cash Account is debited because the firm has received cash. It being a Real Account, the rule ‘Debit what comes in and Credit what goes out’ is applied.

(ii) Interest Received Account is Credited because the firm has received an income. It being a Nominal Account, the rule ‘Debit all expenses and losses; Credit all incomes and gains’ is applied.

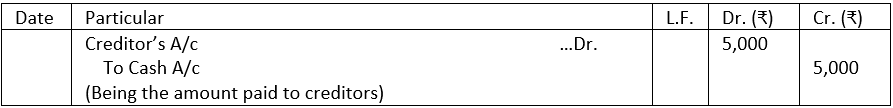

Example 6: Paid a creditor ₹ 5,000. The Journal entry passed is:

Reason for Debit and Credit:

(i) Creditor’s Account is debited because the firm has paid the liability towards a creditor. It being a Personal Account, the rule ‘Debit the receiver and Credit the giver’ is applied.

(ii) Cash Account is credited because the firm has paid cash to a creditor. It being a Real Account the rule ‘Debit what comes in and Credit what goes out’ is applied.

A transaction entered into by the business can be recorded by applying the rules of debit and credit to each aspect of it. Let us take illustrations for even better understanding.

This is very good website for getting the Right Knowledge at one place in the filed of commerce specialized in Account.