BALANCING OF ACCOUNTS

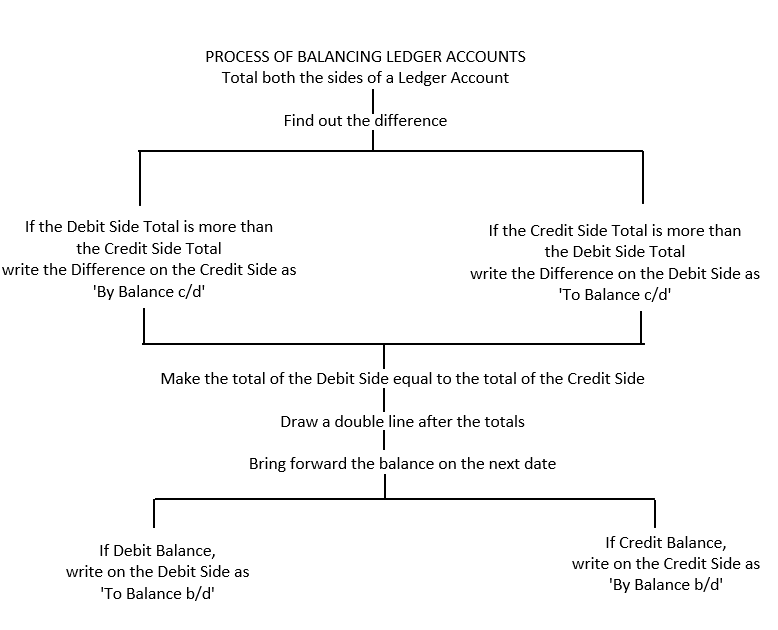

Balance of an account is the difference between the debit and credit totals of an account. After posting all transactions, accounts are balanced every year or after a certain period to ascertain the net effect of entries in the accounts. Balancing an account means that the two sides of an account are totalled and the difference in total of the two sides is written on the side whose total is short. For example, if the total of credit side is more than the debit side of any account, the difference of amount will be recorded as Balance c/d on the debit side and vice versa on the credit side. If the total of the debit side of any account is greater, that account will reveal a debit balance and if total of credit side of any account is greater it will show a credit balance. The debit balance is then written on the debit side as ‘To balance brought down’ or ‘To Balance b/d’, which is the opening balance for the new period. The credit balance is then written on the credit side as ‘By Balance brought down’, or ‘By Balance b/d’. This is the opening balance for the new period. The total of the debit and credit sides of some accounts may be equal, those accounts will not show any balance. The concept of balancing is illustrated in the following diagram:

Thus, balance can be of two types:

(i) Opening Balance: There can be opening debit balance or credit balance. The rule for showing these balances is: Show debit balance on the debit side and credit balance on the credit side.

(ii) Closing Balance: There can be closing debit balance or credit balance. The rule for showing them in the account is: Show debit balance on the credit side and credit balance on the debit side.

Types of Accounts that are Balanced: Normally, Personal Accounts and Real Accounts are balanced. Nominal Accounts are not balanced but are closed by transferring to Trading or Profit and Loss Account at the end of the accounting year.

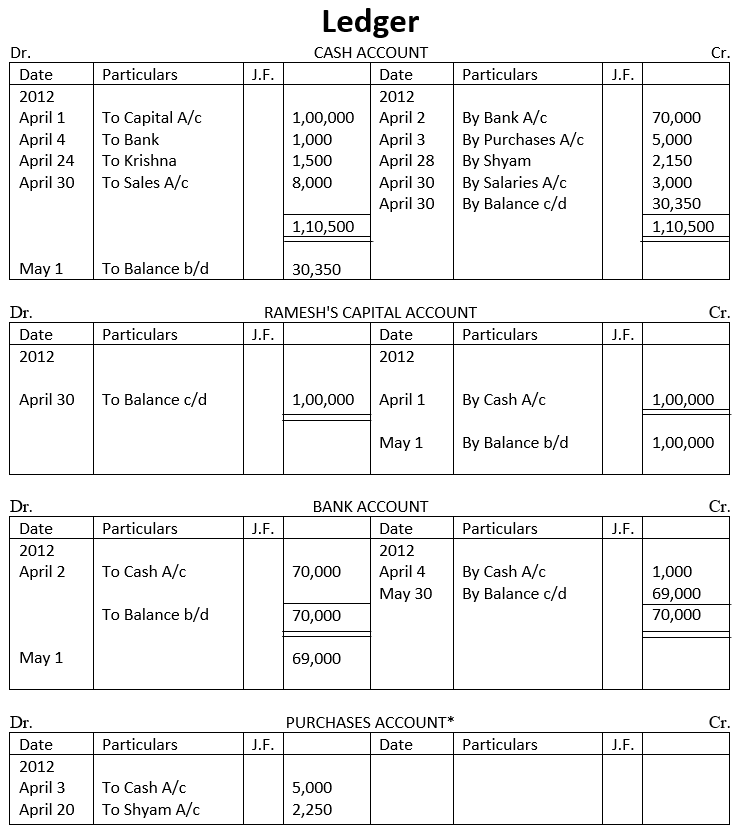

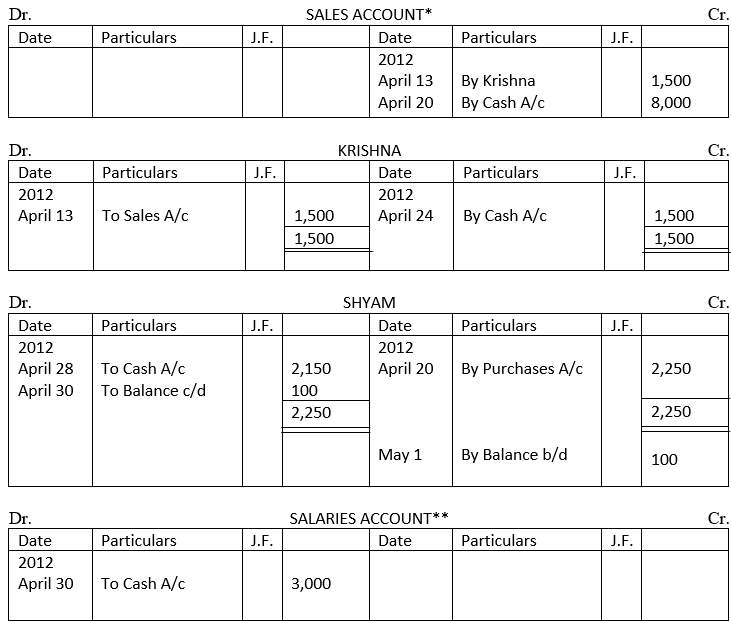

The Ledger accounts based on Journal entries in Illustration 1 will be opened as follows:

Note: At the end of an accounting period, accounts marked* will be closed by transferring to the ‘Trading Account’ and accounts marked** will be closed by transferring to the ‘Profit and Loss Account’. In other words, balance of accounts related to Goods Account, (e.g., Purchases Account, Sales Account, Purchases Return Account and Sales Return Account) and Direct Expenses Accounts are transferred to the Trading Account and accounts related to indirect expenses or incomes are transferred to the Profit and Loss Account. Such accounts are balanced only for Trial Balance purpose. Account balances in the nature of assets and liabilities appear in the Balance Sheet which are not closed but carried forward to the next accounting period.

This is very good website for getting the Right Knowledge at one place in the filed of commerce specialized in Account.