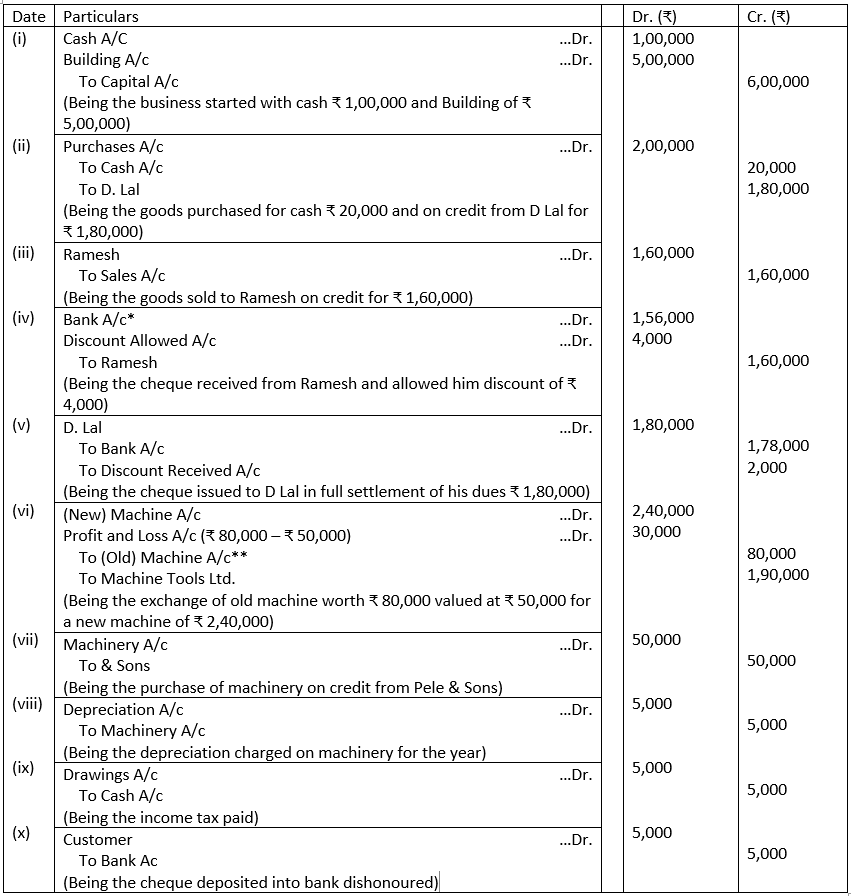

Illustration 15 (Comprehensive). Journalise the following transactions:

(i) Mr. Peter started business with cash ₹ 1,00,000 and a building valued at ₹ 5,00,000.

(ii) Purchased goods amounting to ₹ 2,00,000 out of which goods of 1,80,000 were purchased on credit from D. Lal.

(iii) Sold goods on credit to Ramesh ₹ 1,60,000.

(iv) Received cheque for ₹ 1,56,000 from Ramesh in full settlement of his account.

(v) Paid ₹ 1,78,000 to D. Lal in full settlement of ₹ 1,80,000 due to him by cheque.

(vi) An old machine with the book value of ₹ 80,000 is exchanged for a new machine of ₹ 2,40,000. The old machine is valued at ₹ 50,000 for exchange purposes by Machine Tools Ltd.

(vii) Purchased a machinery from Pele & Sons for ₹ 50,000 on credit.

(viii) Depreciation of ₹ 5,000 was provided on the machinery at the end of the year.

(ix) Paid income tax ₹ 5,000.

(x) A cheque from a customer amounted to 5,000 deposited in the bank was returned dishonoured.

Solution:

In the Books of Mr. Peter

JOURNAL

* It is assumed the cheque was deposited into bank on the same day.

**The old machine should be credited with the book value and not the exchange value in order to cancel the Old Machine Account.

This is very good website for getting the Right Knowledge at one place in the filed of commerce specialized in Account.