Central Sales Tax (CST): It is charged by the seller on inter-state sale, i.e., sale made outside the state. For example, sale made by a dealer (seller) in Rajasthan to a dealer (purchaser) in Delhi, it is a case of inter-state sale.

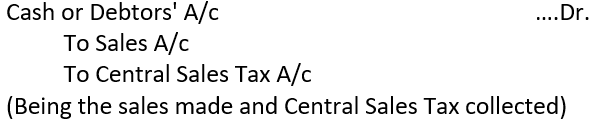

CST Collected on Sales: Sales Tax collected on sales is a liability as it is collected on behalf of the Government. It must be deposited in the Government Account on the due date. The entries passed are:

(i)

(ii) At the time of depositing Sales Tax in the Government Account, the entry passed is:

CST paid on Purchases: CST paid on purchases is a cost, it being not recoverable. Therefore, it is debited to Purchases Account.

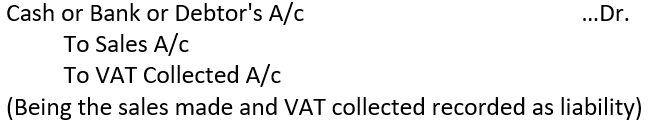

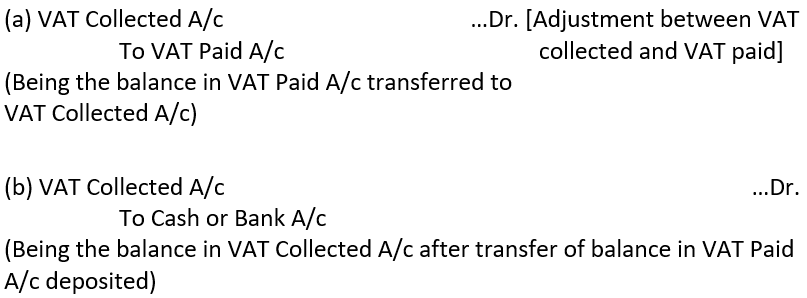

Value Added Tax (VAT): VAT is the tax levied on sale made within the state. VAT paid on purchases is adjustable against VAT collected on sale. Thus, VAT paid is an asset while VAT collected is a liability of the business. VAT paid is adjusted against VAT collected. If the balance in VAT Collected Account is more than the balance in VAT Paid Account, the difference is deposited in the Government Account. In case the balance in VAT Paid Account is more than the balance in VAT Collected Account, it is carried forward to the next year as recoverable.

(i) When VAT is paid at the time of purchases:

(ii) When VAT is collected at the time of sales:

(iii) When VAT is paid to the Government:

Illustration 12. Journalise the following transactions in the books of Rajan:

(i) Purchased goods for ₹ 50,000 in cash and paid Central Sales Tax @ 8%.

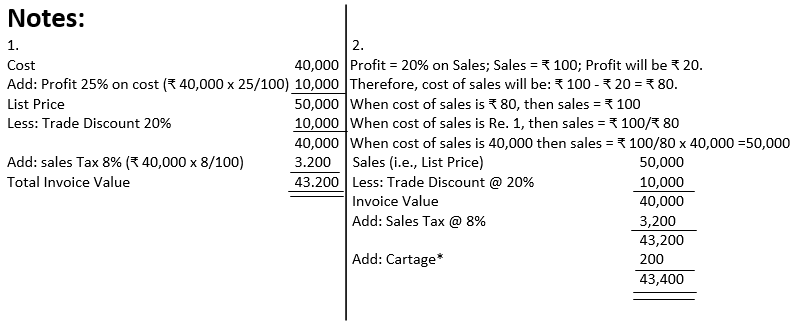

(ii) Sold goods costing ₹ 40,000 to Ashok for cash at a profit of 25% on cost less 20% Trade Discount and charged 8% Central Sales Tax and paid cartage ₹ 200 (not to be charged from the customer).

(iii) Sold goods costing ₹ 40,000 to Mohan at a profit of 20% on sales less 20% Trade Discount and charged 8% Central Sales Tax and paid cartage ₹ 200 (to be charged from the customer).

(iv) Goods were distributed costing 2,500 as free sample, as part of an advertising campaign.

(v) Anjan, a customer, returned goods invoiced at ₹ 2,000, they being defective.

(vi) Central Sales Tax deposited in the Government Account.

Solution:

In the Books of Rajan

JOURNAL

*Cartage paid on buyer’s behalf should be debited to Buyer’s Personal Account and not to Cartage Account.

Illustration 13. Journalise the following transactions:

(i) Purchased goods from Rahul ₹ 25,000 less Trade Discount of 20% plus VAT @ 10%.

(ii) Sold goods costing 6,000 to Nikhil for 7,500 plus VAT @ 10%.

(iii) Sold the balance goods for ₹ 20,000 and charged VAT @ 10% against cheque.

(iv) VAT was deposited into Government Account on the due date.

Solution:

JOURNAL

Alternatively: Net VAT deposited into Government Account can be ascertained by VAT Collected Account:

VAT COLLECTED ACCOUNT

This is very good website for getting the Right Knowledge at one place in the filed of commerce specialized in Account.