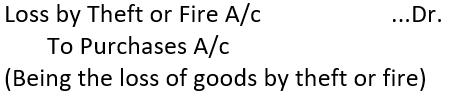

Loss by Theft or Fire: In both the cases, it is loss of goods and loss to business. The entry passed is:

Note: Loss by Theft or Fire Account is debited because the loss is a nominal account and the Purchase Account is credited because the purchases decrease. The loss will be treated in accounts as follows:

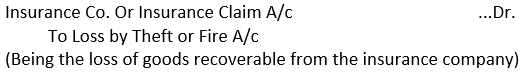

(i) When goods (stock) are fully insured, loss is to be borne by the Insurance Company. The entry passed is:

Insurance claim is an asset and will be shown as an asset in the Balance Sheet until actually received in cash.

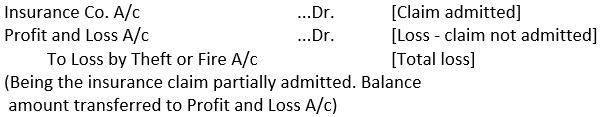

(ii) When the goods are partly insured:

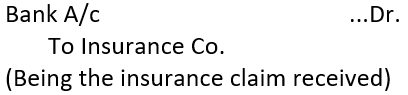

(iii) When the claim is received from the Insurance Company:

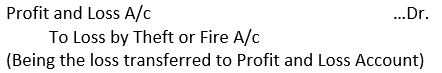

(iv) When the stock is not insured, whole of the loss will be borne by the firm. At the end of the year balance in loss by Theft or Fire Account is transferred to Profit and Loss Account.

This is very good website for getting the Right Knowledge at one place in the filed of commerce specialized in Account.