Discount: A reduction in amount, whether to encourage more purchase or prompt payment is called a Discount. A discount may be classified into: (i) Trade Discount and (ii) Cash Discount.

(i) Trade Discount: Trade Discount is allowed when the goods are sold to the purchaser for resale to the ultimate consumer or when the goods are purchased in large quantity. Trade Discount is allowed as a deduction from the sale value and the sale is recorded in the books of accounts at net amount, i.e., sale value less trade discount. The purchaser records it in the Purchases Book at the net purchase value.

(ii) Cash Discount: Cash Discount is an allowance or deduction allowed when amount is received promptly of before its due date. It is usually allowed as a percent (say 2%) of the amount received.

Cash Discount, received or allowed, is recorded separately in the books. Obviously, a Cash Discount is allowed when payment is received and Cash Discount is received when a payment is made. The Cash Discount allowed is debited to Discount Allowed Account and the discount received is credited to the Discount Received Account.

If both Trade Discount and Cash Discount are allowed, first Trade Discount is allowed and therefore, Cash Discount is allowed. In other words, Cash Discount is calculated on the net amount.

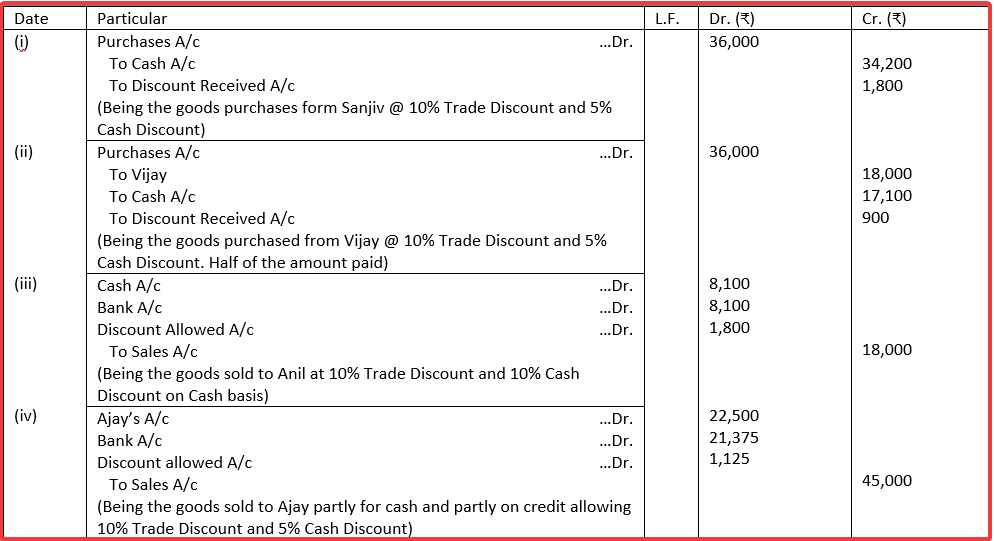

Illustration 6. Pass the Journal entries of the following transactions:

(i) Purchased goods from Sanjiv of ₹ 40,000 at terms 10% Trade Discounts and 5% Cash Discount. Paid amount at the time of purchase itself.

(ii) Purchased goods from Vijay of ₹ 40,000 on 10% Trade Discount and 5% Cash Discount. Half of the amount was paid at the time of purchase.

(iii) Sold goods to Anil for ₹ 20,000, allowed him 10% Trade Discount and 10% Cash Discount. Received half of the amount by cash and balance half by cheque within specified time.

(iv) Sold goods to Ajay for ₹ 50,000 allowing 5% Cash Discount and 10% Trade Discount. Half of the amount was received by cheque within specified time.

Solution:

JOURNAL

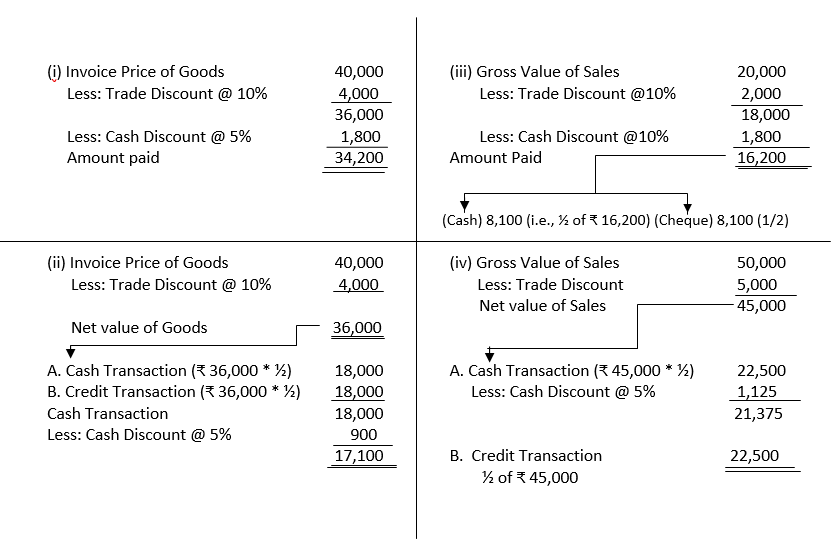

Working Notes:

Calculation of Trade Discount and Cash Discount:

Illustration 7 (Payments on Account and Payments in Full Settlement). Journalise the following transactions in the books of K.G. Gupta:

(i) Received ₹ 9,750 from Hari Ram in full settlement of his account for ₹ 10,000.

(ii) Received ₹ 9,750 from Shyam on his account for ₹ 10,000.

(iii) Received first and final dividend of 60 paisa in the rupee from the Official Receiver of Mr. Ashok who owed ₹ 10,000.

(iv) Paid ₹ 4,800 to Sohan in full settlement of his account for ₹ 5,000.

(v) Paid ₹ 4,800 to Mohan on his account for ₹ 5,000.

Solution:

JOURNAL

DISTINCTION BETWEEN TRADE DISCOUNT AND CASH DISCOUNT

| Basis | Trade Discount | Cash Discount |

| 1. Nature | It is allowed upon purchases made in large quantity. | It is allowed on payment being made promptly on or before an agreed date. |

| 2. Recording | Trade Discount is not recorded separately in the books of accounts. | Cash Discount is recorded separately in the books of accounts. |

| 3. Deduction from Invoice | The amount of the Trade Discount is deducted from the invoice. | It is not deducted from the invoice. |

| 4. Nature of Transaction | It is allowed on both credit and cash transactions. | It is allowed only on payment. |

| 5. Consideration | The consideration for allowance is purchases. | The consideration for allowance is payment. |

| 6. Relation | It is related to sales and purchases of goods. | It is related to payment. |

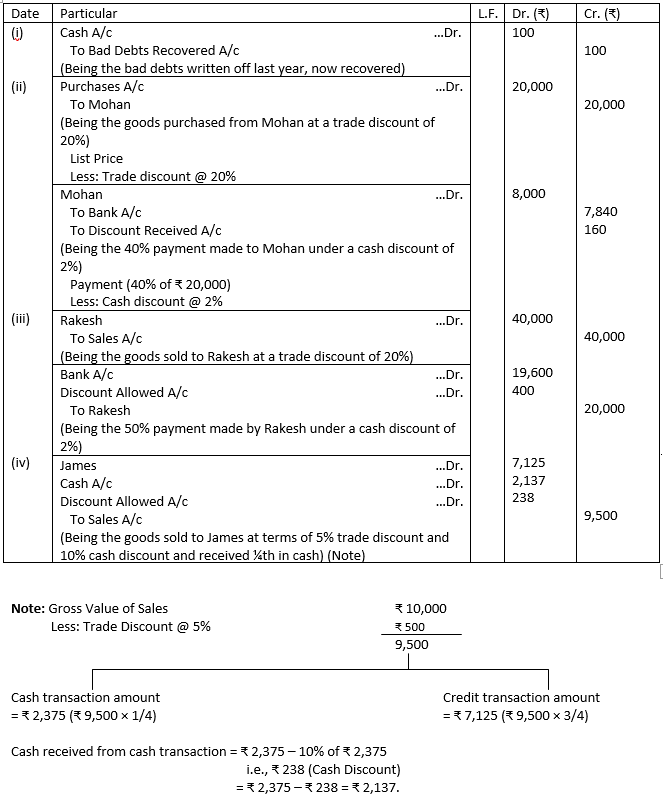

Illustration 8. Record the following transactions in a Journal:

(i) Received cash from Ram for a bad debt written off last year ₹ 100.

(ii) Bought goods at the list price of ₹ 25,000 from Mohan less 20% trade discount and 2% cash discount and paid 40% by cheque.

(iii) Sold goods to Rakesh at the list price of ₹ 50,000 less 20% trade discount and 2% cash discount and paid 50% by cheque.

(iv) Sold goods to James for ₹ 10,000 allowing him a trade discount of 5% and a cash discount of 10%. He paid 1/4th of the amount in cash at the time of purchase.

Solution:

In the Books of …

JOURNAL

This is very good website for getting the Right Knowledge at one place in the filed of commerce specialized in Account.