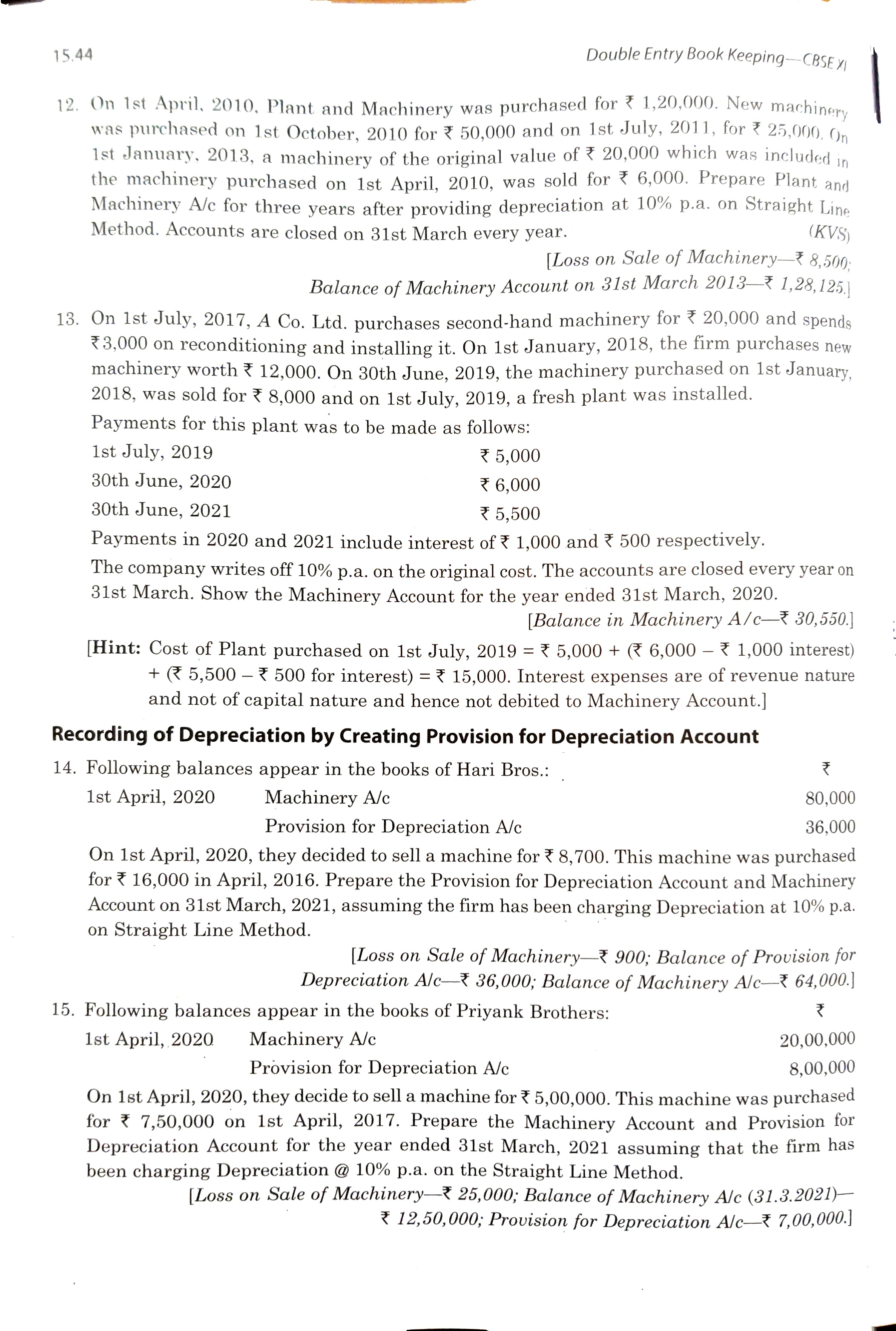

SOLUTIONS/ANSWERS:

Solutions of Question no.1 of Depreciation

| 1 | |||||||

|---|---|---|---|---|---|---|---|

| Case | Purchase Price of Machinery | Installation Charges | Estimated Scrap Value | Estimated Useful Life (in Years) | Total Cost of Asset | Amount of Annual Depreciation | Rate of Depreciation |

| a | b | c | d | e = a+b | f = e - c / d | g = f x 100 / e | |

| a | 180000 | 20000 | 10000 | 5 | 200000 | 38000 | 19 |

| b | 475000 | 25000 | 50000 | 5 | 500000 | 90000 | 18 |

| c | 90000 | 10000 | 20000 | 10 | 100000 | 8000 | 8 |

| d | 340000 | 60000 | 40000 | 10 | 400000 | 36000 | 9 |

| e | 90000 | 10000 | 20000 | 4 | 100000 | 20000 | 20 |

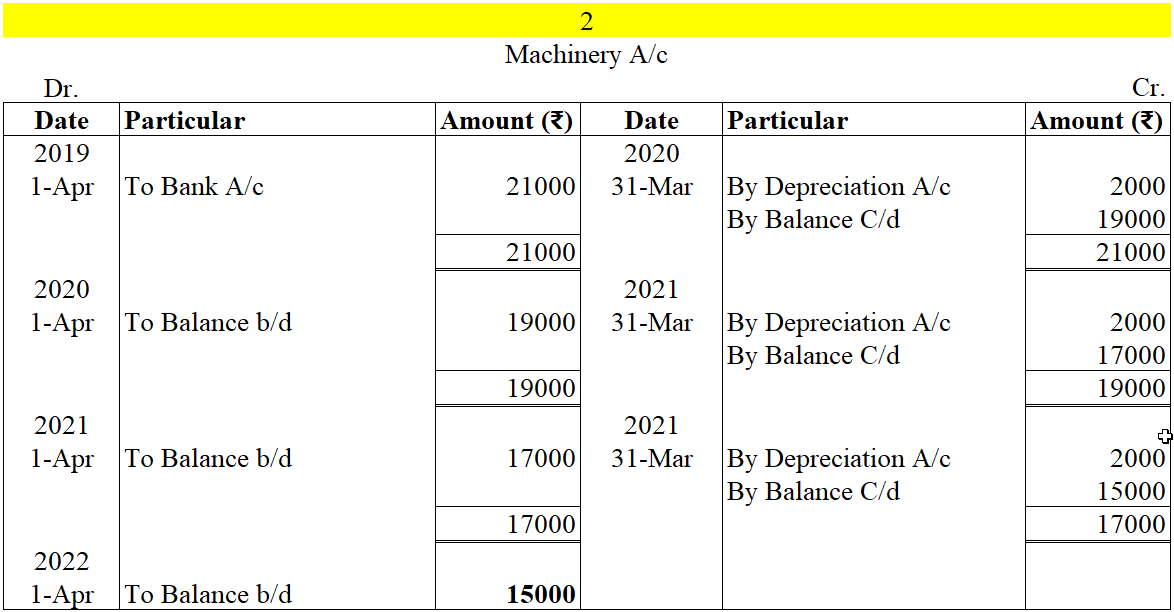

3

Amount Spend on Purchase of Second-Hand Machinery = 96000 + 24000 = 120000 ₹

Estimated Residual Value = 72000 ₹

= 120000 – 72000 = 48000

Annual Depreciation: Total Cost – Resideul Value / No. of Useful life of Machinery

= 120000 – 72000 / 4

Rate of Depreciation = Annual Depreciation x 100 / Total of Cost

=12000*100/120000