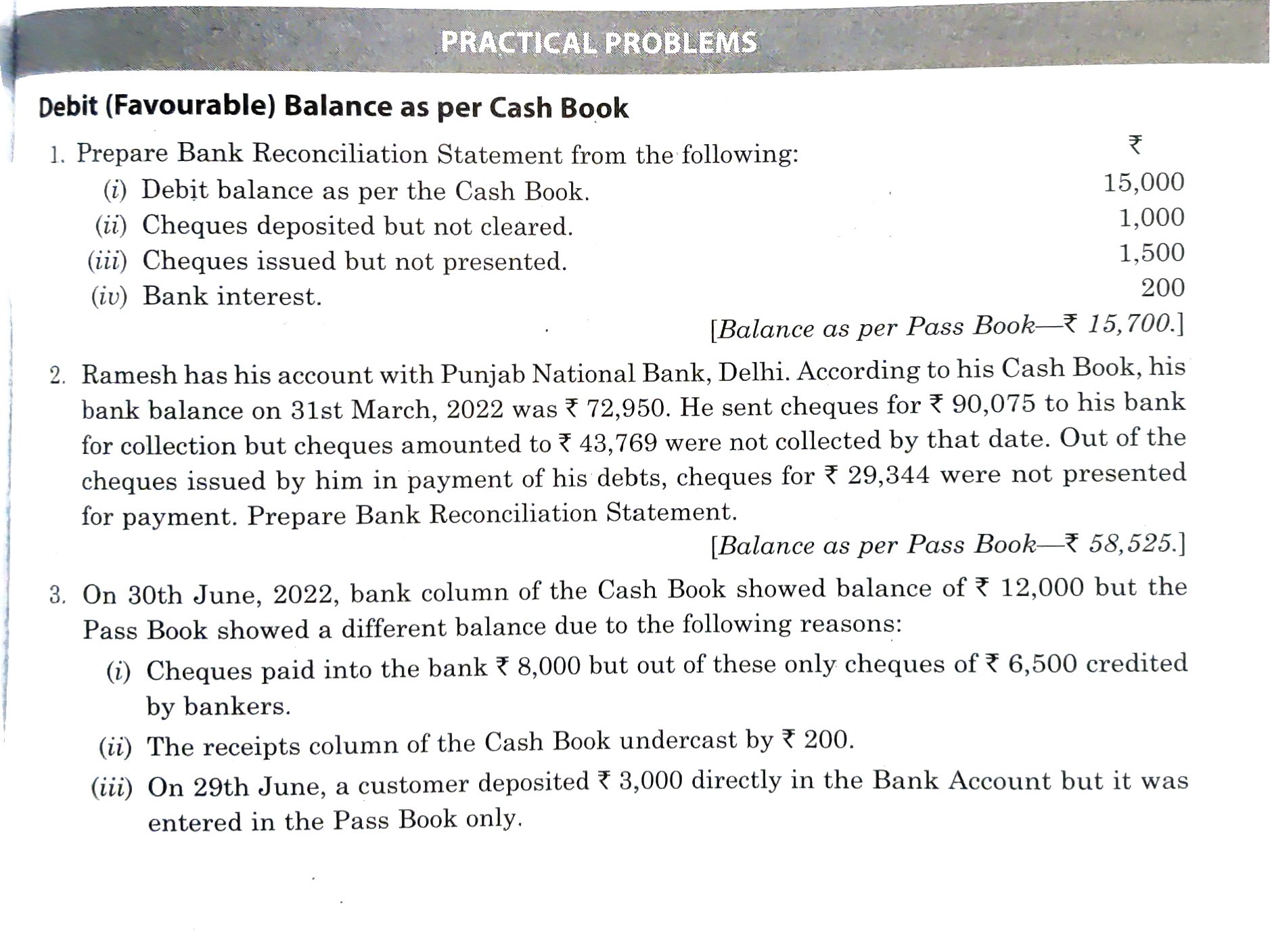

| 1 | | |

| BANK RECONCILIATION STATEMENT as on 31 march, … | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Cash Book (Dr.) | 15000 | |

| Cheque deposite but not cleared | | 1000 |

| Cheque issued but not presented | 1500 | |

| Bank Interest (Received) | 200 | |

| Balance as per Pass Book (Cr.) | | 15700 |

| 16700 | 16700 |

| | |

| 2 | | |

| BANK RECONCILIATION STATEMENT as on 31 march, … | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Cash Book (Dr.) | 72950 | |

| Send Cheque to his bank for collection | | 43769 |

| Cheque issued by him in payment of debts | 29344 | |

| Balance as per Pass Book (Cr.) | | 58525 |

| 102294 | 102294 |

| | |

| 3 | | |

| BANK RECONCILIATION STATEMENT as on 30 June, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Cash Book (Dr.) | 12000 | |

| Cheque paid into the bank | | 1500 |

| Undercast | 200 | |

| Directly deposited in the Bank a/c | 3000 | |

| Cheque issued | 2200 | |

| Interest Received | 330 | |

| Interest Charges | | 60 |

| Balance as per Pass Book (Cr.) | | 16170 |

| 17730 | 17730 |

| | |

| 4 | | |

| BANK RECONCILIATION STATEMENT as on 31 march, … | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Cash Book (Dr.) | 12500 | |

| Cheque issued but not yet presented for payment | 6000 | |

| Cheque deposited in the bank but not collected | | 9000 |

| Bank paid insurance premium | | 5000 |

| Bank Charges | | 300 |

| Directly deposited by a customer | 8000 | |

| Interest on Investment collected by bank | 2000 | |

| Cash discount | | 200 |

| Balance as per Pass Book (Cr.) | | 14000 |

| 28500 | 28500 |

| | |

| 5 | | |

| BANK RECONCILIATION STATEMENT as on 31 December, 2008 | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Cash Book (Dr.) | 10000 | |

| Cheque issued in favour of Karan but not presented | 500 | |

| Bill retired by Bank | 20 | |

| Cheque deposited in bank but dishonoured | | 295 |

| 800 ₹ Deposite in bank has been credited as ₹ 80 in pass book | | 720 |

| Payment side of the Cash book has been undercasted | | 200 |

| Bill Receivable dishonoured | | 1000 |

| Balance as per Pass Book (Cr.) | | 8305 |

| 10520 | 10520 |

| | |

| 6 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Cash Book (Dr.) | 36000 | |

| Cheque has been issued for 30000 out of which cheques of 24000 were presented for payment | 6000 | |

| Cheque Deposited in bank | | 8400 |

| Cheque entered in cash book on 30th march, 2022 was banked on 3rd April | | 3000 |

| Cheque from Suresh was deposited | | 2400 |

| Pass Book showed Bank Charges | | 120 |

| Debtors deposited in the bank account of the firm | 3000 | |

| Balance as per Pass Book (Cr.) | | 31080 |

| 45000 | 45000 |

| | |

| 7 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Cash Book (Dr.) | 23650 | |

| Not credited by the bank until the following date | | 2860 |

| Bank Charges | | 70 |

| Bill Discounted with bank but charges omitted | | 270 |

| Cheques issued by the company but note presented at the bank for payment | 16720 | |

| Debtors paid into the Company's Bank | 1000 | |

| Dishonour of Bill | | 550 |

| Balance as per Pass Book (Cr.) | | 37620 |

| 41370 | 41370 |

| | |

| 8 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Bank had wrongly debited the account | | 25000 |

| Receipts side of the cash book was overcasted | | 100 |

| Payment side of the Cash Book was overcasted | 1000 | |

| Receipts side of the cash book was Undercasted | 1000 | |

| Payment side of the Cash Book was Undercasted | | 10000 |

| Cheque issued but was not recorded | | 10000 |

| Bills of Exchange | 5000 | |

| | |

| 9 | | |

| BANK RECONCILIATION STATEMENT as on 31 July, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Pass Book (Cr.) | 50000 | |

| Three Cheques issued were presented for payment aug 2022 | | 11462 |

| Two Cheques sent to the bank for collection | 1150 | |

| Bank Charges | 460 | |

| Allowed Interest | | 100 |

| Balance as per Cash Book (Dr.) | | 40048 |

| 51610 | 51610 |

| | |

| 10 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Pass Book (Cr.) | 6000 | |

| Issued Cheques to 1500 of which cheques of 900 have been presented for payment | | 600 |

| Cheque paid by you into the bank | 800 | |

| Interest Credit | | 85 |

| Cheque received by you and was paid into bank | | 510 |

| Balance as per Cash Book (Dr.) | | 5605 |

| 6800 | 6800 |

| | |

| 11 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Pass Book (Cr.) | 62000 | |

| Cheques were paid into the bank | | |

| P | 3500 | |

| Q | 2500 | |

| R | 2000 | |

| Cheques Issued in March 2022 | | |

| X | | 4000 |

| Q | | 4500 |

| Cheques received from a customer | 1000 | |

| Bank Charges | 1000 | |

| Interest Credit | | 2000 |

| Interest on Investment | | 2500 |

| Balance as per Cash Book (Dr.) | | 59000 |

| 72000 | 72000 |

| | |

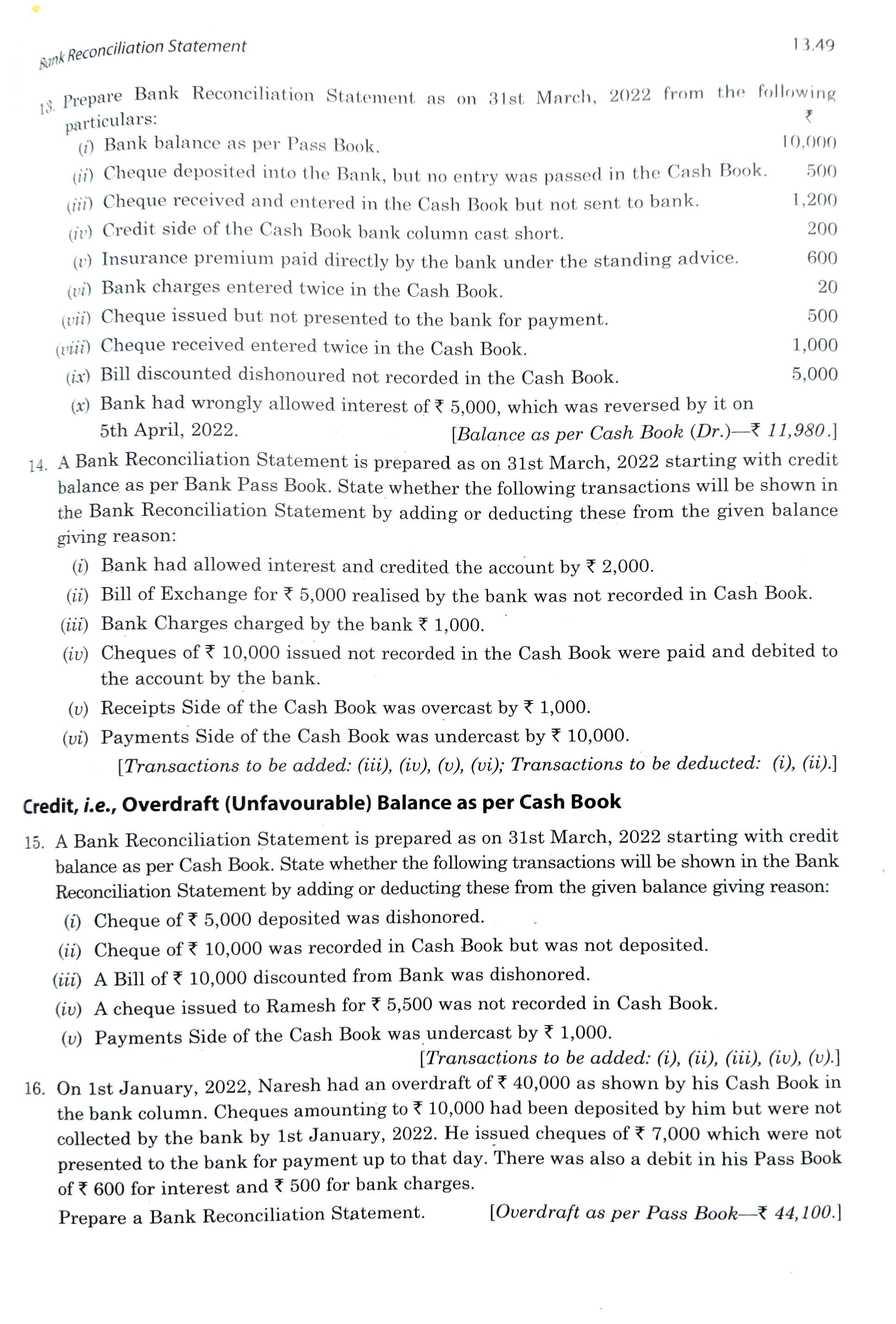

| 13 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Balance Statement as per Pass Book (Cr.) | 10000 | |

| Cheque deposited into the Bank, but no entry was passed in the Cash Book | | 500 |

| Cheque received and entered in the Cash Book but not sent to bank. | 1200 | |

| Credit side of the Cash Book bank column cast short. | 200 | |

| Insurance premium paid directly by the bank under the standing advice. | 600 | |

| Bank charges entered twice in the Cash Book | | 20 |

| Cheque issued but not presented to the bank for payment. | | 500 |

| Cheque received entered twice in the Cash Book | 1000 | |

| Bill discounted dishonoured not recorded in the Cash book | 5000 | |

| Bank had wrongly allowed interest of 5000, which was reversed | | 5000 |

| Balance as per Cash Book (Dr.) | | 11980 |

| 18000 | 18000 |

| | |

| 14 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Bank had allowed interest and credited the account | | 2000 |

| Bill of Exchangerealised by the bank was not recorded in Cash Book | | 5000 |

| Bank Charges charged by the bank | 1000 | |

| Cheques of issued not recorded in the Cash Book were paid and debited to the account by the bank | 10000 | |

| Receipt Side of the Cash Book was overcast | 1000 | |

| Payments side of the Cash Book was undercast | 10000 | |

| | |

| 15 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Cheque deposited was dishonored | 5000 | |

| Cheque was recorded in Cash Book but was not deposited | 10000 | |

| A bill of discounted from Bank was Dishonoured | 10000 | |

| A Cheque issued to Ramesh was not recorded in Cash Book | 5500 | |

| Payment side of the Cash book was undercast | 1000 | |

| | |

| 16 | | |

| BANK RECONCILIATION STATEMENT as on 1 Jan, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Cash Book (Cr.) | | 40000 |

| Cheque had been deposited by him but were not collected by the bank | | 10000 |

| He issued cheques which were not presented to the bank for payment | 7000 | |

| Interest Charges | | 600 |

| Bank Charges | | 500 |

| Overdraft Balance as per Pass Book (Dr.) | 44100 | |

| 51100 | 51100 |

| | |

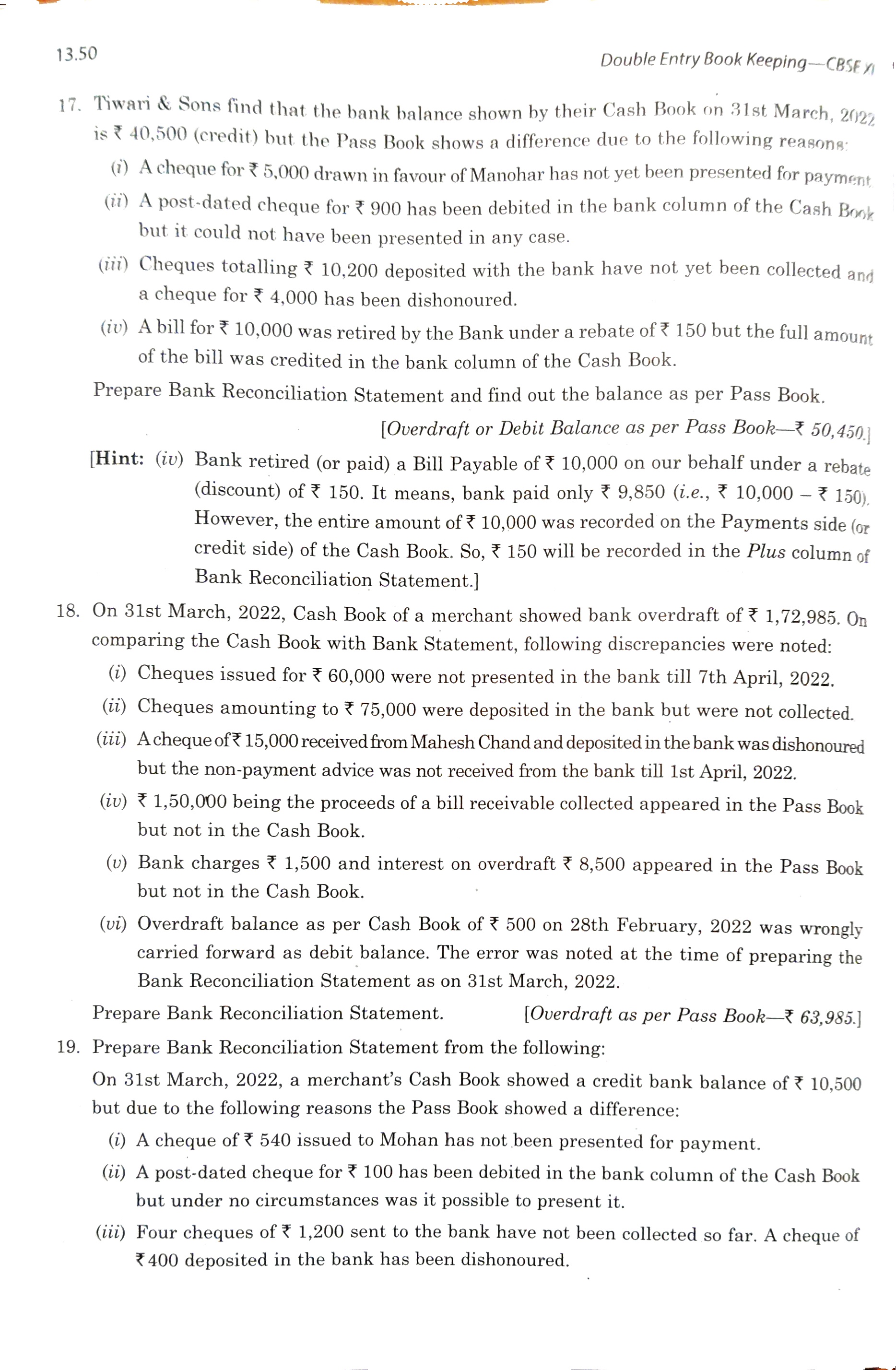

| 17 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Cash Book (Cr.) | | 40500 |

| Cheque drawn in favour of Manohar has not yet been presented | 5000 | |

| Post-dated cheque has been debited in the bank column of the cash book but it not have been presented | | 900 |

| Cheque deposited with the bank have not yet been collected | | 10200 |

| Cheque has been dishonoured | | 4000 |

| Bank Rebate | 150 | |

| Overdraft Balance as per Pass Book (Dr.) | 50450 | |

| 55600 | 55600 |

| | |

| 18 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Cash Book (Cr.) | | 172985 |

| Cheques issued were not presented in the bank | 60000 | |

| Cheques were deposited in the bank but were not collected | | 75000 |

| Cheque received from Mahesh Chand and deposited in the bank was dishonoured but the non-payment advice was not received from the bank 1st april, 2022 | | 15000 |

| Bill receivable collected appeared in the pass book but not in the Cash Book | 150000 | |

| Bank Charges | | 1500 |

| Interest on overdraft | | 8500 |

| Overdraft balance as per cash book was wrongly carried forward as debit balance (500+500) | | 1000 |

| Overdraft Balance as per Pass Book (Dr.) | 63985 | |

| 273985 | 273985 |

| | |

| | |

| 19 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Cash Book (Cr.) | | 10500 |

| Cheque issued to Mohan has not been presented for payment | 540 | |

| Post-dated cheque has been debited in the bank column of the Cash Book but it not present | | 100 |

| Cheque sent to the bank have not been collected | | 1200 |

| Cheque deposite in the bank has been dishonoured | | 400 |

| Bank paid Fire Insurance premium | | 50 |

| Bank Charges | | 15 |

| Interest on Current Account | 25 | |

| Overdraft Balance as per Pass Book (Dr.) | 11700 | |

| 12265 | 12265 |

| | |

| 20 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Cash Book (Cr.) | | 45000 |

| Bill receivable discounted with the bank had been dishonoured | | 5000 |

| Interest on investment collected by the bank | 1500 | |

| Cheques deposited into bank but not yet collected | | 7500 |

| Interest charged by the ank on overdraft balance | | 1850 |

| Cheques issued but not yet presented for payment | 11350 | |

| Receivable a payment directly from a customer | 12500 | |

| Cheques recorded in the cash book but not sent to the bank | | 17500 |

| Bank Charges debited as per Pass Book | | 500 |

| Overdraft Balance as per Pass Book (Dr.) | 52000 | |

| 77350 | 77350 |

| | |

| 21 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Cash Book (Cr.) | | 52100 |

| Deposite into the bank | | 11160 |

| Cheques drawn in favour of creditors of them creditor for ₹ 38580 encashed his cheque on 7th April whereas another for ₹ 4320 have not yet been encashed | 42900 | |

| Paid out to a creditor but by mistake the same has not been entered in the Cash Book | | 10500 |

| A debtor deposited directly into the bank but the same has not been recorded in the Cash Book | 9000 | |

| Bank without any intimation, debited his account bank charges | | 120 |

| Credited for interest | 180 | |

| Overdraft Balance as per Pass Book (Dr.) | 21800 | |

| 73880 | 73880 |

| | |

| 22 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 36000 |

| Cheque issued but not presented for payment | | 19700 |

| Cheque deposited with bank but not collected | 25000 | |

| Cheque entered in Cash Book but not banked | 9000 | |

| Directly deposited to bank by a customer | | 11000 |

| Overdraft Balance as per Cash Book (Cr.) | 32700 | |

| 66700 | 66700 |

| | |

| 23 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 2500 |

| Cheque issued but only 3000 could be cleared (5000-3000) | | 2000 |

| Cheques issued but omitted to be recorded in the Cash Book | 1000 | |

| Cheques deposited but Cheques for 500 werer collected on 4th april, 2022 | 500 | |

| Discounted Bill of Exchange dishonoured | 1000 | |

| Cheque debited in cash book but omitted to be banked | 500 | |

| Interest allowed but no entry was passed in the Cash Book | | 200 |

| Overdraft Balance as per Cash Book (Cr.) | 1700 | |

| 4700 | 4700 |

| | |

| 24 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 10000 |

| Point No. (i) | | 5000 |

| Point No. (ii) (5000-2200) | 2800 | |

| Point No. (iii) | 25 | |

| Point No. (iii) | | 350 |

| Point No. (iv) | 600 | |

| Point No. (v) | | 5000 |

| Overdraft Balance as per Cash Book (Cr.) | 16925 | |

| 20350 | 20350 |

| | |

| 25 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 5220 |

| Point No. (i) | 6000 | |

| Point No. (ii) | 800 | |

| Point No. (iii) | 50 | |

| Point No. (iv) | | 200 |

| Point No. (v) | | 900 |

| Point No. (vi) | | 400 |

| Balance as per Cash Book (Dr.) | | 130 |

| 6850 | 6850 |

| | |

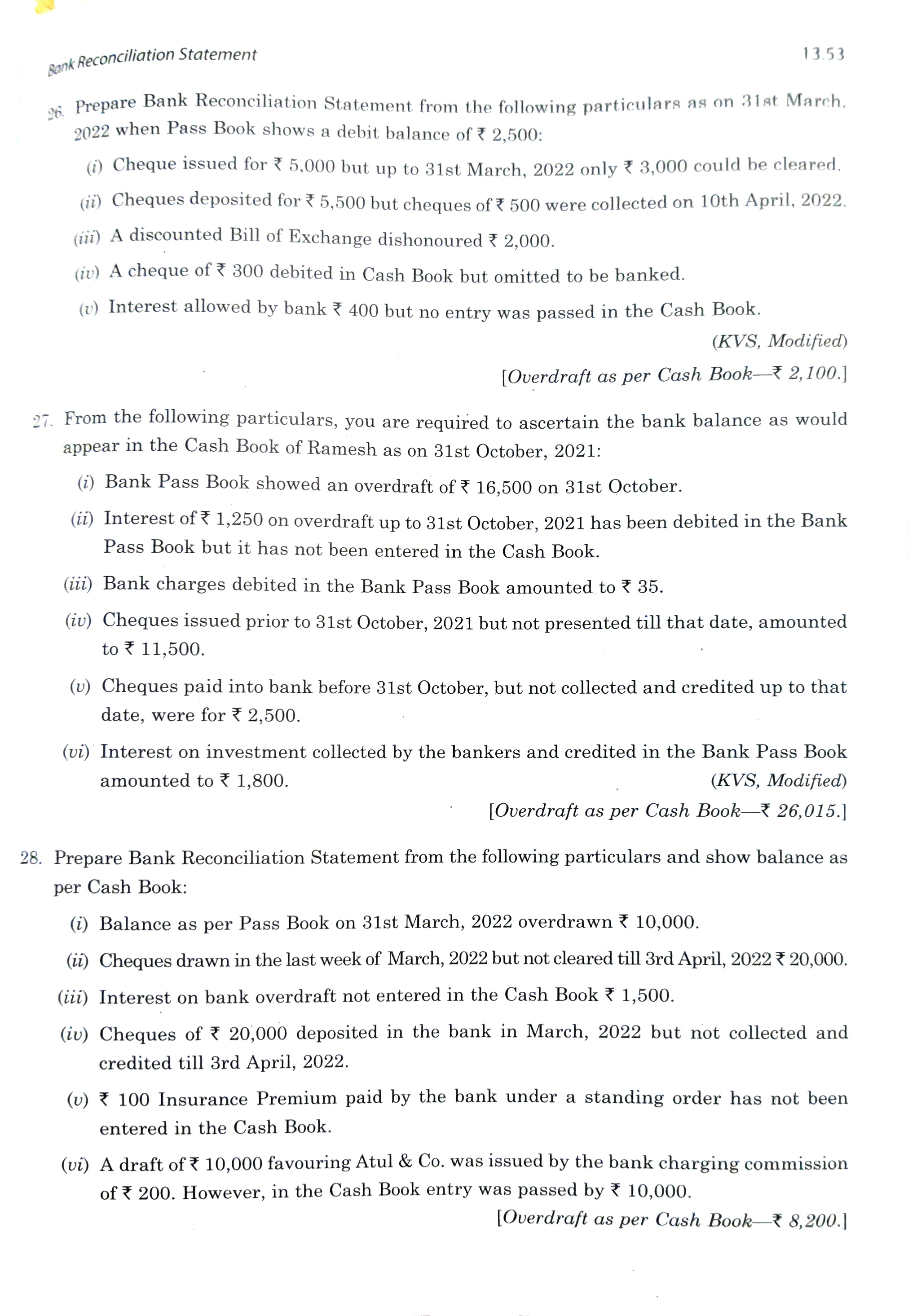

| 26 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 2500 |

| Point No. (i) | | 2000 |

| Point No. (ii) | 500 | |

| Point No. (iii) | 2000 | |

| Point No. (iv) | 300 | |

| Point No. (v) | | 400 |

| Overdraft Balance as per Cash Book (Cr.) | 2100 | |

| 4900 | 4900 |

| | |

| 27 | | |

| BANK RECONCILIATION STATEMENT as on 31 October, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 16500 |

| Point No. (ii) | 1250 | |

| Point No. (iii) | 35 | |

| Point No. (iv) | | 11500 |

| Point No. (v) | 2500 | |

| Point No. (vi) | | 1800 |

| Overdraft Balance as per Cash Book (Cr.) | 26015 | |

| 29800 | 29800 |

| | |

| 28 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 10000 |

| Point No. (ii) | | 20000 |

| Point No. (iii) | 1500 | |

| Point No. (iv) | 20000 | |

| Point No. (v) | 100 | |

| Point No. (vi) | 200 | |

| Overdraft Balance as per Cash Book (Cr.) | 8200 | |

| 30000 | 30000 |

| | |

| 29 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 12000 |

| Point No. (ii) (70000-3000) | | 67000 |

| Point No. (iii) (3500-500) | 3000 | |

| Point No. (iv) | 500 | |

| Point No. (v) (400+600) | | 1000 |

| Point No. (vi) | 200 | |

| Overdraft Balance as per Cash Book (Cr.) | 76300 | |

| 80000 | 80000 |

| | |

| 30 | | |

| BANK RECONCILIATION STATEMENT as on 31 March, 2022 | | |

| Particulars | Plus Items | Minus Items |

| Overdraft Balance as per Pass Book (Dr.) | | 16500 |

| Point No. (ii) | | 8750 |

| Point No. (iii) | 10500 | |

| Point No. (iv) | 2000 | |

| Point No. (v) | | 3500 |

| Point No. (vi) | 200 | |

| Point No. (vii) | 1980 | |

| Point No. (viii) (3000+100) | 3100 | |

| Overdraft Balance as per Cash Book (Cr.) | 10970 | |

| 28750 | 28750 |