Transaction are recorded in the books of accounts on the basis of evidences, i.e., source documents, such as bill of purchases, invoices for sales, debit and credit notes, etc. Rules of debit and credit are applied to each transaction and recorded in the books of original entry, i.e., Journal and Special Purpose Books in a chronological order. The transactions recorded in the books of accounts are transferred (posted) to the specific account maintain in the Ledger. At this stage, it is appropriate to define and understand the term ‘account’.

Table of Contents

ACCOUNT

An account is a summarised record of transactions at one place relating to a particular head. It records not only the amount of transactions but also their effect and direction.

An account is dividend into two parts, i.e., debit and credit. It is usually in a “T” form and the commonly used layout of an account is as follows:

NAME OF THE ACCOUNT, e.g., WAGES ACCOUNT

Note the following points about the layout of this account:

- The name of the account is written at the top.

- The account is divided into two identical halves, separated by a thick vertical line.

- The left-hand side is called the debit side (‘debit’ is abbreviated as ‘Dr.’).

- The right-hand side is called the credit side (‘credit’ is abbreviated as ‘Cr.’).

- The date, i.e., the date of the transaction is entered in the ‘Date’ column.

- In the ‘Particular’ column, the name of the other account involved in the transaction is entered.

- The ‘folio’ or Journal Folio (J.F.) column is used as a referencing system where the original entry was recorded in the Journal Book.

- In the last column, the amount transacted is written:

This is illustrated below by taking imaginary amounts:

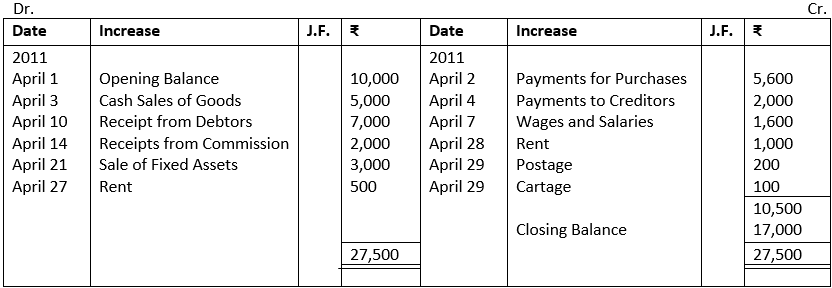

CASH ACCOUNT

What we have to do is to place the increases in cash on the left-hand side and the decreases on the right-hand side. It can also be said that the receiving account is debited and the giving account is credited. The closing balance has been ascertained by deducting the total of payments, ₹ 10,500 from the total of the left-hand side, ₹ 27,500.

MEANING OF DEBIT AND CREDIT

In simple words, debit refers to the left side of an account and credit refers to the right side of an account.

In the abbreviated form Dr. Stands for debit and Cr. Stands for credit.

An item recorded on the debit side of an account is said to be debited to the signifies that value has flowed to the named account, e.g., payment to a creditor signifies that payment has been made for the goods purchased from him Thus, his account is debited.

An item recorded on the credit side of an account is said to be credited to the account and the balance resting on this side is side to be a credit balance.

A credit entry signifies that value has flown from the source indicated by the name of the account, e.g., receipt of cash from a debtor signifies that debtor has made payment for the goods. Purchase by him. Thus, his account is credited. Debit and Credit are simply additions to or subtractions form of accounts.

RULES OF DEBIT AND CRDIT

Under Double Entry System of book keeping each transaction has two aspects.

One aspect is the receiving or incoming aspect. This is also known as the debit aspect.

Another aspect is giving or outgoing aspect. This is also known as the credit aspect.

Debit and credit aspects of a transaction form the basis of Double Entry System.

Debit and Credit are simple addition to or subtractions from an account.

We have discussed that by deducting the total of liabilities from the total of assets, the capital can be ascertained, as indicated by the Accounting Equation:

Assets = Liabilities + Capital

Or

Assets – Liabilities = Capital

We have also discussed that if there is any change on one side of the equation, there will be a similar change on the other side of the equation or among items comprised in it.

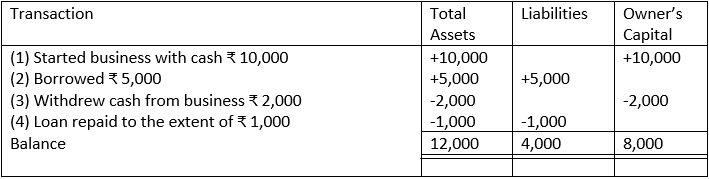

This is due to the dual aspect effect of the transaction. It will become clear from the following illustration:

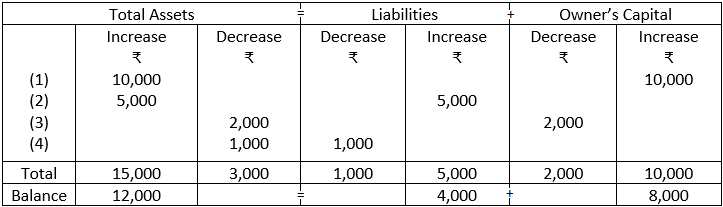

The above method is suitable only if the number of transactions is small. But if the number is large, a different procedure – of putting increases and decreases in a different columns – will be useful and this will also yield significant information. The transactions given above are shown below according to this method:

In accounting, the tradition followed is as follows:

- Increases in assets are recorded on the left-hand side and decrease on the right-hand side.

- In the cash of liabilities and capital, increases are recorded on the right-hand side and decrease on the left-hand side.

From the above example, the following rules can be derived:

- When there is an increase in the amount of an asset, its account is debited; the account is credited if there is a reduction in the amount of the asset: Let us take an example to clarify this, Suppose, furniture worth ₹ 800 is purchased, the Furniture Account will be debited by ₹ 800 since the asset has increased by this amount. Later, if furniture worth ₹ 300 is old, the reduction will be recorded by crediting the Furniture Account by ₹ 300.

- When there is an increase in the amount of liability, the account is credited; the account is debited if ther is a reduction in the amount of liability: Suppose, a firm borrows ₹ 5,000 from Mohan. Mohan’s Account will be credited since ₹ 5,000 is now owed to him. If later the loan is repaid, Mohan’s Account will be debited since the liability no longer exists.

- When there is an increase in the proprietor’s capital, the account is credited; the account is debited if the amount is withdrawn by the proprietor: Suppose, the proprietor introduces additional capital, the Capital Account is credited. If the owner withdrawn some money, the Capital Account is debited.

- Profit leads to increases and loss to a reduction in the capital: According to the rule maintained in (iii) above, profit, i.e., revenue may be directly credited to the Capital Account and expenses and losses may be similarly debited.

However, it is more useful to record all incomes, gains, expenses and losses separately. By doing so, very useful information becomes available regarding the factors which have contributed to the year’s profits or losses. Later, the net result of all these is ascertained and adjusted in the Capital Account.

Since incomes and gains increase capital, the rule is to credit all gains and incomes and since expenses and losses decrease capital, the rule is to debit all expenses and losses in the concerned accounts. Of, course, if there is a reduction in any income or gain, the concerned account will be debited; similarly for any reduction in an expense or loss, the concerned account will be credited.

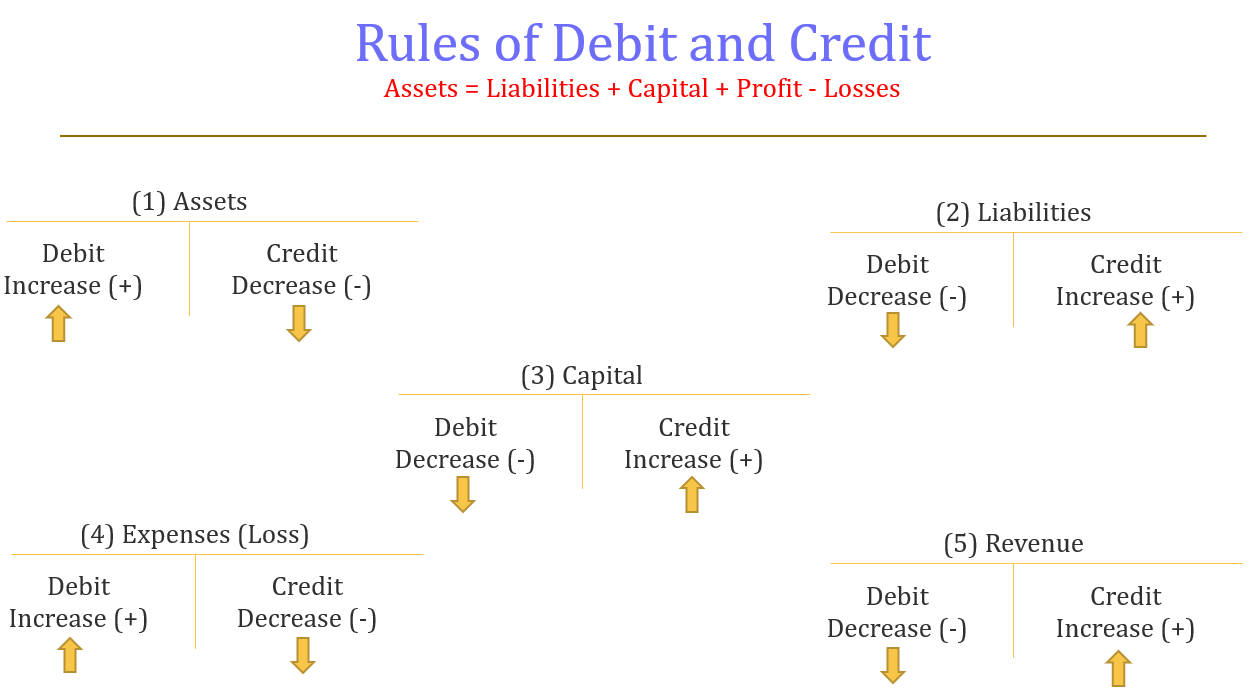

The rules given above can be summarised as:

- Increases in assets are debits; decreases are credits.

- Increases in liabilities are credits; decreases are debits.

- Increases in the owner’s capital are credits; decreases are debits.

- Increases in expenses are debits; decreases are credits.

- Increases in revenues or incomes are credits; decreases are debits.

It should be noted that an increase in assets is something favourable to the firm but an increase in expenses is not so, even though in both the cases, the fact remains that the increase will be recorded on the debit side, Similarly increases in liabilities is, of course, not favourable but an increase in revenue is favourable. Nonetheless, both will be recorded on the credit side. Thus, the terms ‘debit’ and ‘credit’ should not be taken to mean respectively favourable and unfavourable things – they merely describe the two sides of an account. In other words, both debit and credit may represent either increase or decrease depending upon the nature of an account.

One way to understand rules of debit and credit may be as follows:

Illustration 1.

On which side will the increase in the following accounts be recorded? Also, mention the nature of the account.

1. Machinery A/c 2. Creditor’s A/c 3. Mohan (Proprietor) 4. Sales A/c 5. Carriage Outwards A/c 6. Cash A/c 7. Debtor’s A/c 8. Rent A/c 9. Interest Payable A/c 10. Bills Payable A/c

Solution:

1. Debit – Asset 2. Credit – Liability 3. Credit – Capital 4. Credit – Revenue 5. Debit – expense 6. Debit – Asset 7. Debit – Asset 8. Debit – Expense 9. Credit – Liability 10. Credit – Liability

Illustration 2.

On which side the decrease in the following accounts be recorded? Also, mention the nature of the account.

1. Mohan (Proprietor) 2. Freight A/c 3. Cartage A/c 4. Bank A/c 5. Furniture A/c 6. Machinery A/c 7. Bills Payable A/c 8. Salary Outstanding A/c 9. Ram (Supplier) 10. Sohan (Customer)

Solution:

1. Debit – Capital 2. Credit – Expense 3. Credit – Expense 4. Credit – Asset 5. Credit – Asset 6. Credit – Asset 7. Debit – Liability 8. Debit – Liability 9. Debit – Liability 10. Credit – Asset

These rules can be explained in another manner:

(i) Suppose, Ram and Mohan go to see a cricket match and Ram purchases tickets for himself and for Mohan. Ram has thus placed Mohan under a debt and can be said to have done a creditable thing. Next time, Mohan purchases tickets for Ram and himself; forgetting for a moment the earlier incident, Mohan earns a credit and Ram suffers a debit. From this, one rule of accounting can be developed—one who receives should be debited and one who gives, credited. So, Debit the receiver and Credit the giver.

(ii) Let us consider transactions relating to things like cash, goods, etc. In any business, receipts and payments are entrusted to the cashier. If the above rule is followed, he will be debited on every transaction (when cash is received) and credited (when cash is paid). But he is receiving and paying cash for the firm. Therefore, it will be more appropriate to title the account as Cash Account. Likewise, transactions relating to goods received (purchases) should be debited to the Purchases Account and goods out (sales) should be credited to the Sales Account. From this, the second rule can be developed Debit what comes in and Credit what goes out.

(iii) There are other transactions in a business that relate to Nominal Accounts. Suppose, a clerk works for a month and receives his salary. According to rule (i), the Clerk’s Personal Account should be debited since he has received cash. If we do so, the account will indicate that he owes us money whereas it is not so—he is not going to return this money since he has already rendered the requisite service. It would be better to recognise this from the very beginning and style the account as Salary Account to show that so much money has been paid out on account of salary. Whenever money is paid because of an expense, the debit should be to an account showing the nature of the expense and not to the Personal Account of the receiver.

Suppose, we place some money in a fixed deposit in a bank and later receive interest. According to rule (i), the bank should be credited since it has paid cash. Interest received is an income for the business, therefore, it would be better to credit the amount to an account (Interest Received Account) showing that it is an income. When cash is received on account of an income or gain, the credit should be to an account indicating the fact. This leads to the rule: Debit all expenses and losses and Credit all gains and profits.

The three rules now can be put as follows:

(i) Debit the receiver and credit the giver.

(ii) Debit what comes in and credit what goes out,

(iii) Debit all expenses and losses and credit all gains and Profit.

These three rules are not different from those five given on Page 6.4. These merely state the position in a different manner. One should note that when a transaction takes place, two rules may simultaneously apply; to try to record the transaction by applying only one rule may lead to misleading results. Suppose, a firm buys a computer on

credit. The Supplier’s Account has to be credited because he has given the computer [Rule (i)]; the Computer Account has to be debited since a computer has been received [Rule (ii)]. If we take the rules given on Page 6.4, the first two rules will apply—the stock of computers increases and, therefore, the Computer Account has to be debited; a liability to the supplier has arisen, therefore, his account has to be credited.

CLASSIFICATION OF ACCOUNTS

Accounts can be classified in two ways:

1. Traditional Classification

2. Modern Classification

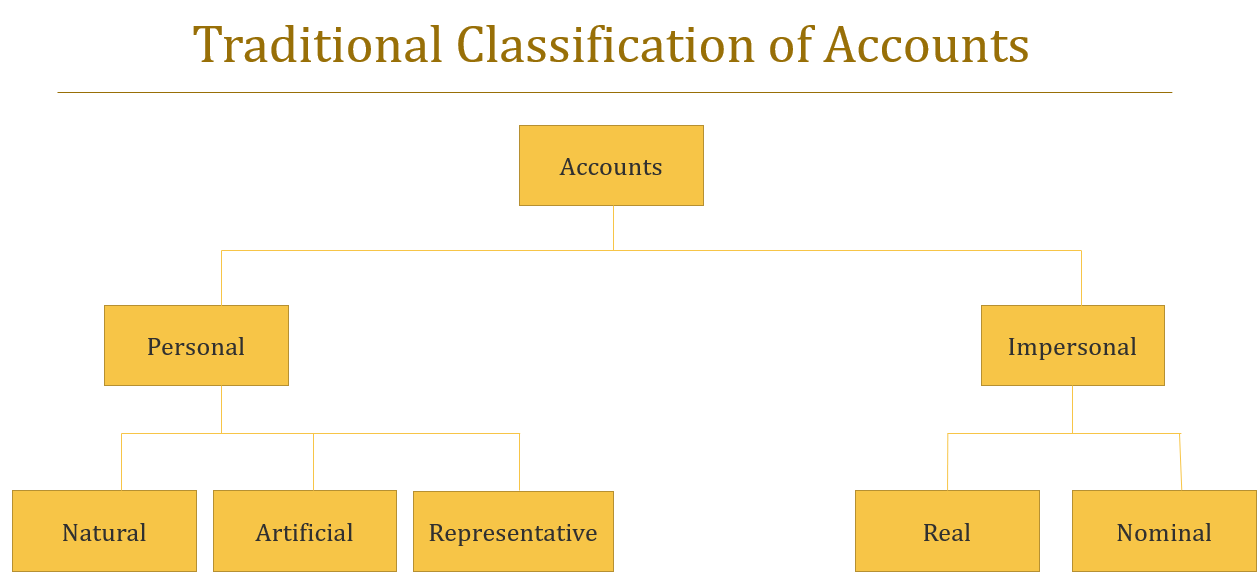

Traditional Classification of Accounts

This is a very old system of classifying accounts. Under this system, accounts are classified into two groups as shown below:

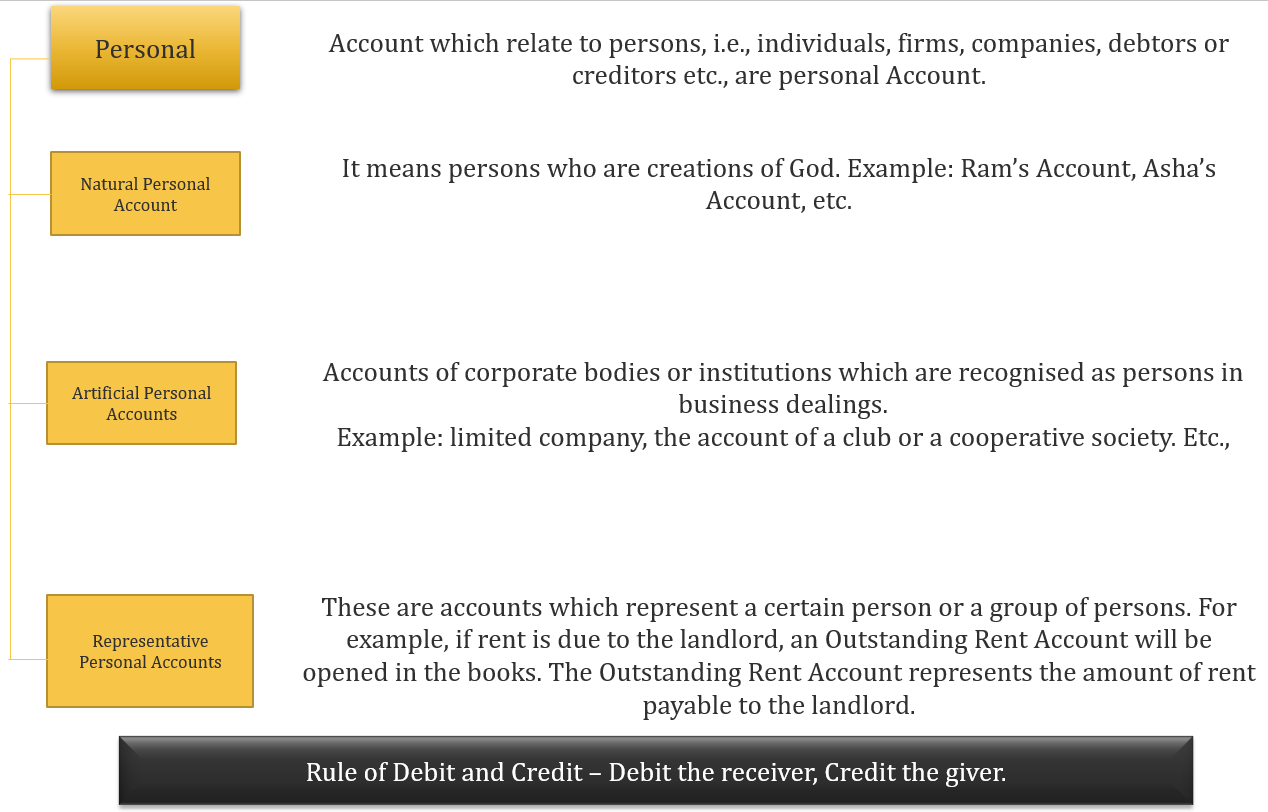

Personal Account:

Accounts which relate to persons, i.e., individuals, firms, companies, debtors or creditors etc., are Personal Account. Example of Personal Accounts are the account of Ram & Co., a credit customer, or the account of Jhaveri & Co., a supplier of goods. A Capital Account is the account of the proprietor and, therefore, is also personal but adjustments on account of profits and losses are made in it. Similarly, a Drawings Account is also a Personal Account. The main purpose of preparing a Personal Account is to ascertain the balance due to or due from persons or organisation.

Personal Accounts can be classified into three categories:

(i) Natural Personal Accounts:

The term ‘Natural Personal’ means persons who are creations of God. For example, Ram’s Account, Asha’s Account, etc.

(ii) Artificial Personal Accounts:

These accounts include accounts of corporate bodies or institutions which are recognised as persons in business dealings. For example, the account of a limited company, the account of a club or a cooperative society, etc.

(iii) Representative Personal Accounts:

These are accounts which represent a certain person or a group of persons. For example, if rent is due to the landlord, an outstanding rent account will be opened in the books. The Outstanding Rent Account represents the amount of rent payable to the landlord.

Rule of Debit and Credit – Debit the receiver, Credit the giver.

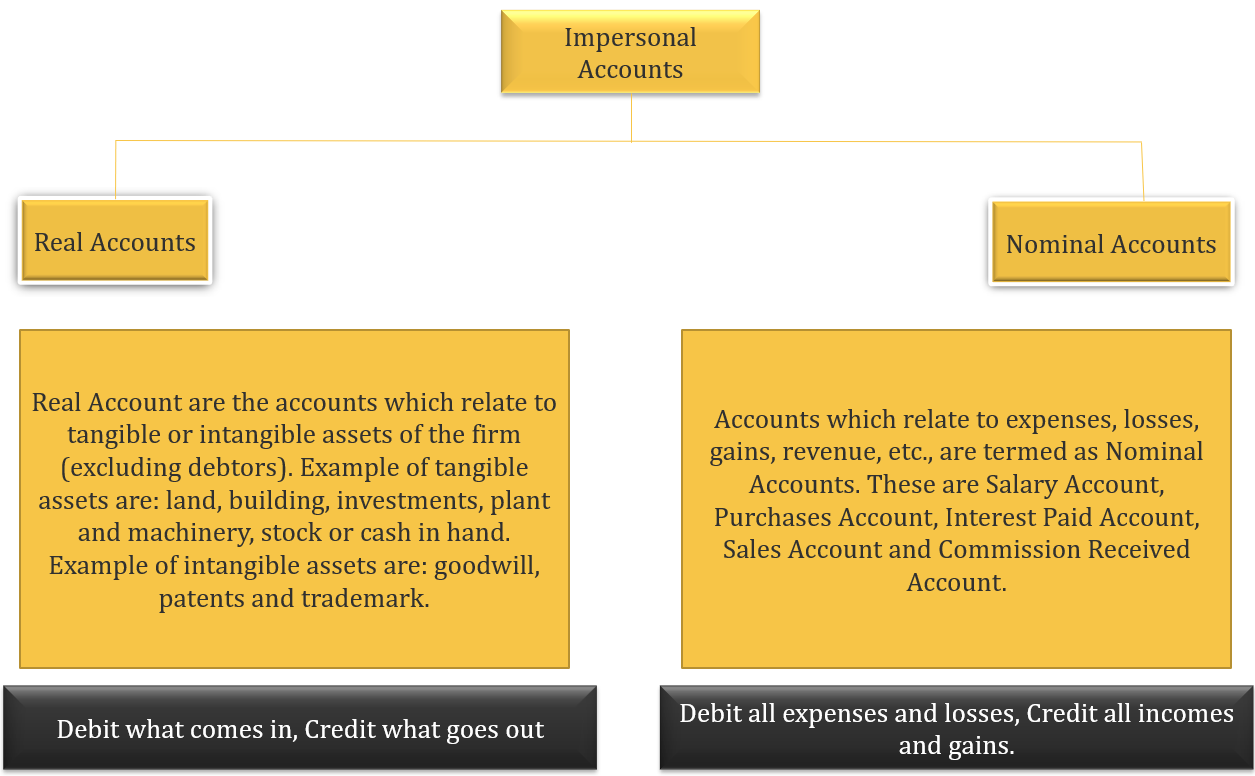

Impersonal Accounts:

Accounts which are not personal such as Machinery Account, Cash Account, Rent Account, etc., are termed as ‘Impersonal Accounts’. These can be further subdivided into two accounts:

Real Accounts:

Real Account are the accounts which relate to tangible or intangible assets of the firm (excluding debtors). Examples of tangible assets are: land, building, investments, plant and machinery, stock or cash in hand. Example of intangible assets are: goodwill, patents and trademark.

Rule of Debit and Credit – Debit what comes in, Credit what goes out.

Nominal (Revenue or Expense) Accounts:

Accounts which relate to expenses, losses, gains, revenue, etc., are termed as Nominal Accounts. These are Salary Account, Purchases Account, Interest Paid Account, Sales Account and Commission Received Account. The net result of all the Nominal Accounts is profit or loss which is transferred to the Capital Account.

Rule of Debit and Credit – Debit all expenses and losses, credit all income and gains.

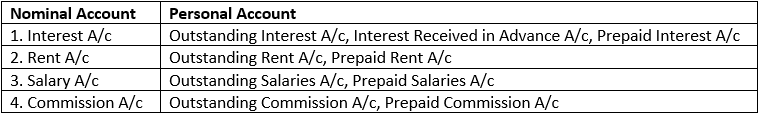

Note: When some prefix or suffix is added to a Nominal Account, it become a Personal Account. The table given below explains the above rule:

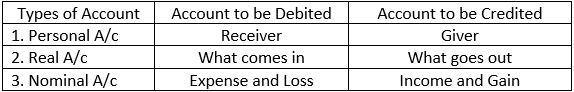

Rules of Debit and Credit (Traditional) at a Glance

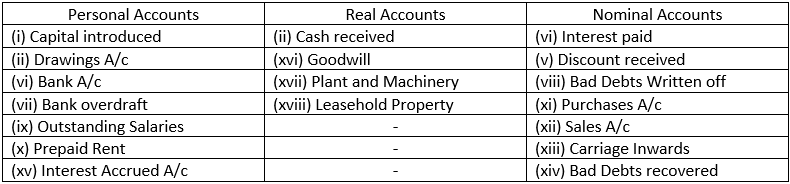

Illustration 3.

Classify the following under Personal, Real and Nominal accounts:

- Capital Introduced

- Drawing A/c

- Cash received

- Interest paid

- Discount received

- Bank A/c

- Bank overdraft

- Bad Debts Written off

- Outstanding Salaries

- Prepaid Rent

- Purchases A/c

- Sales A/c

- Carriage Inwards

- Bad Debts recovered

- Interest Accrued A/c

- Goodwill

- Plant and Machinery

- Leasehold Property

Solution:

Each transaction involves two or more accounts. After ascertaining the accounts involved, our next problem is to decide which account should be debited and which account should be credited.

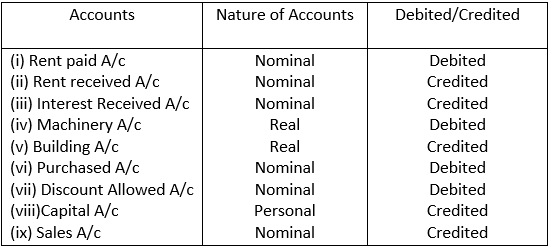

Illustration 4:

State the nature of account (Personal, Real, or Nominal) and show which will be debited and which will be credited:

- Rent paid

- Rent received

- Interest received

- Machinery purchased

- Building sold

- Goods purchased

- Discount allowed

- Capital introduced

- Goods sold

Solutions:

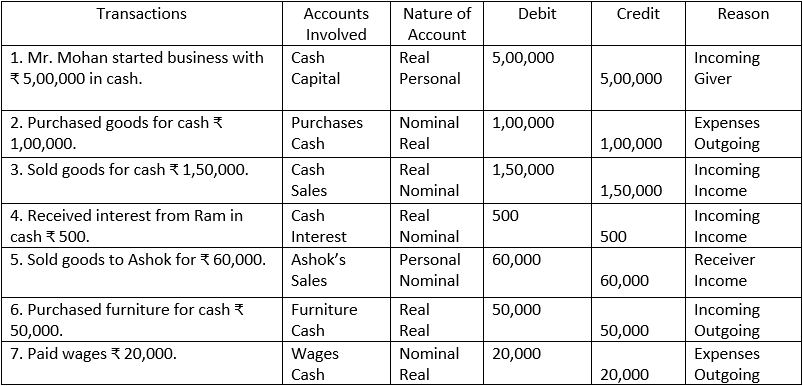

Illustration 5.

From the following transactions, state the nature of accounts and state which account will be debited and which account will be credited:

1. Mr. Mohan started business with ₹ 5,00,000 in cash.

2. Purchased goods for cash ₹ 1,00,000.

3. Sold goods for cash ₹ 1,50,000.

4. Received interest from Ram in cash ₹ 500.

5. Sold goods to Ashok for ₹ 60,000.

6. Purchased furniture for cash ₹ 50,000.

7. Paid wages ₹ 20,000.

Solution:

2. Modern Classification of Accounts

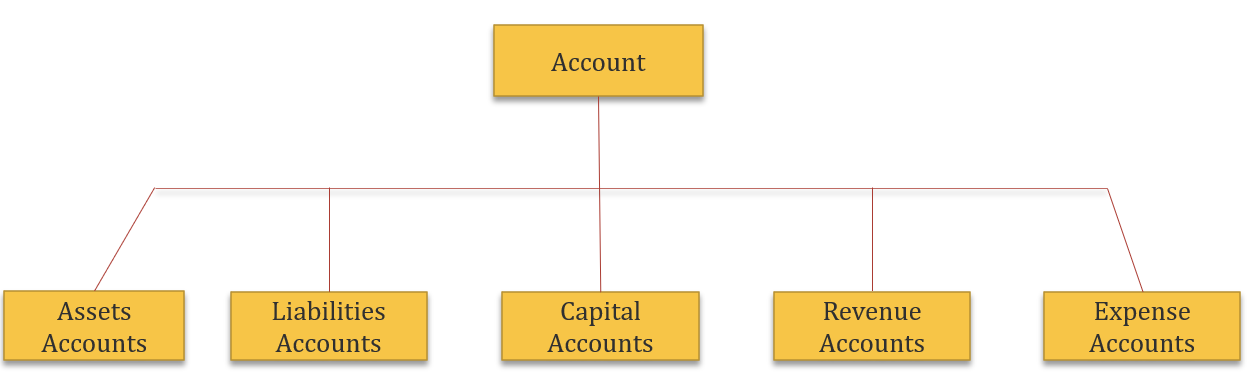

The modern approach classifies account into five categories as shown below:

- Assets Accounts: These accounts are accounts of assets and properties such as land and building, plant and machinery, furniture, patents, inventory, etc.

- Liabilities Accounts: These accounts are accounts of lenders, creditors for goods, creditors for expenses, etc.

- Capital Accounts: They refer to the accounts of the proprietor/partner who invested money in the business.

- Revenue Account: These are accounts of incomes and gains. Examples are: sales, interest, received, etc.

- Expense Account: These are accounts which shown the amount spent or even lost in carrying on business operations. Examples are: purchases, wages paid, depreciation, rent, etc.

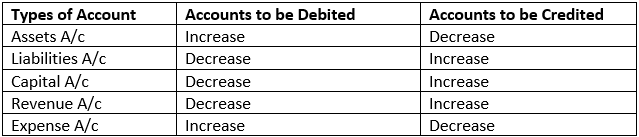

Rules of Debit and Credit

Illustration 6.

On which side will the increase in the following accounts be recorded? Also, mention the nature of the account on the basis of Modern Classification of Accounts:

1. Building A/c 2. Creditor’s A/c 3. Abhishek (Proprietor) 4. Purchases A/c 5. Carriage Inwards A/c 6. Cash A/c 7. Creditors A/c 8. Rent Received A/c 9. Interest Payable A/c 10. Bills Payable A/c

Solution:

1. Debit – Asset 2. Credit – Liability 3. Creditor – Capital 4. Debit – Expenses 5. Debit – Expense 6. Debit – Asset 7. Credit – Liability 8. Credit – Revenue 9. Credit – Liability 10. Credit – Liability

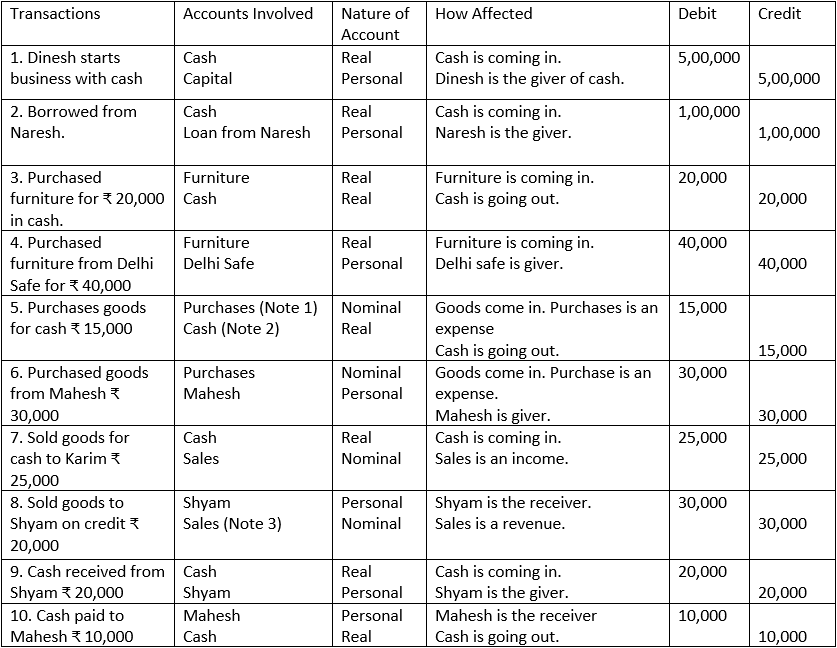

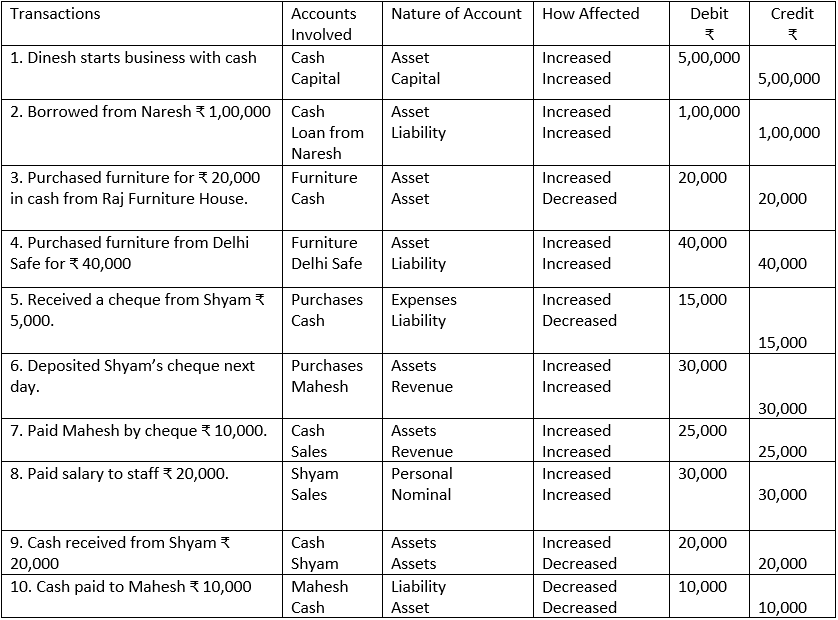

Illustration 7.

Analyse the following transactions, state the nature of accounts and state which account will be debited and which account will be credited according to the traditional approach.

- Dinesh started business with cash ₹ 5,00,000.

- Borrowed from Naresh ₹ 1,00,000.

- Purchased furniture for ₹ 20,000 in cash from Raj Furniture House.

- Purchased furniture from Delhi Safe for ₹ 40,000.

- Purchased goods for cash ₹ 15,000.

- Purchased goods from Mahesh ₹ 30,000.

- Sold goods for cash to Karim ₹ 25,000.

- Sold goods for Shyam on credit ₹ 30,000.

- Cash received from Shyam ₹ 20,000.

- Cash paid to Mahesh ₹ 10,000.

Solution:

ANALYSIS OF TRANSACTIONS

Notes:

1. Purchases: It refers to purchases of goods for resale, and not the purchase of assets.

2. In cash purchases, the seller’s name is not considered. Similarly in cash sales, the purchaser’s name is not considered.

3. Sales: It refers to the sales of goods which firms a part of the Stock-in-Trade of the business firm. The sale of assets are not ‘sales’ in accounting.

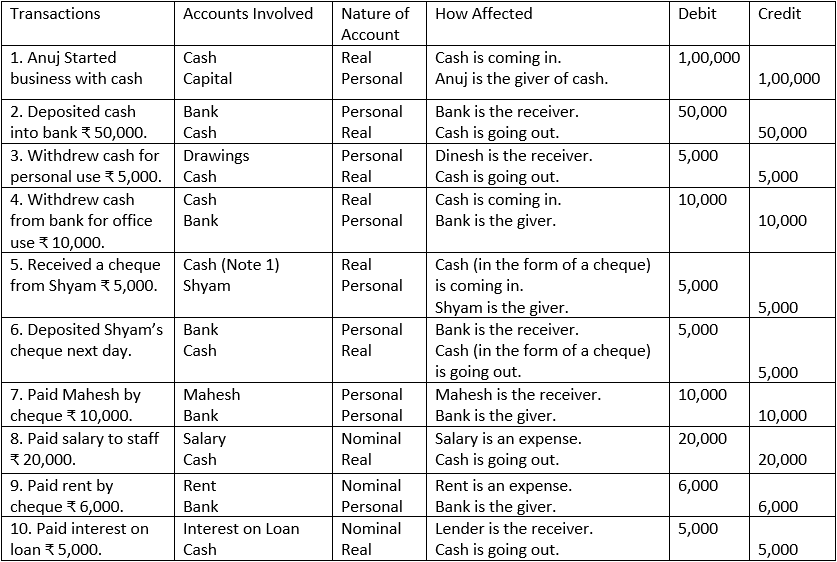

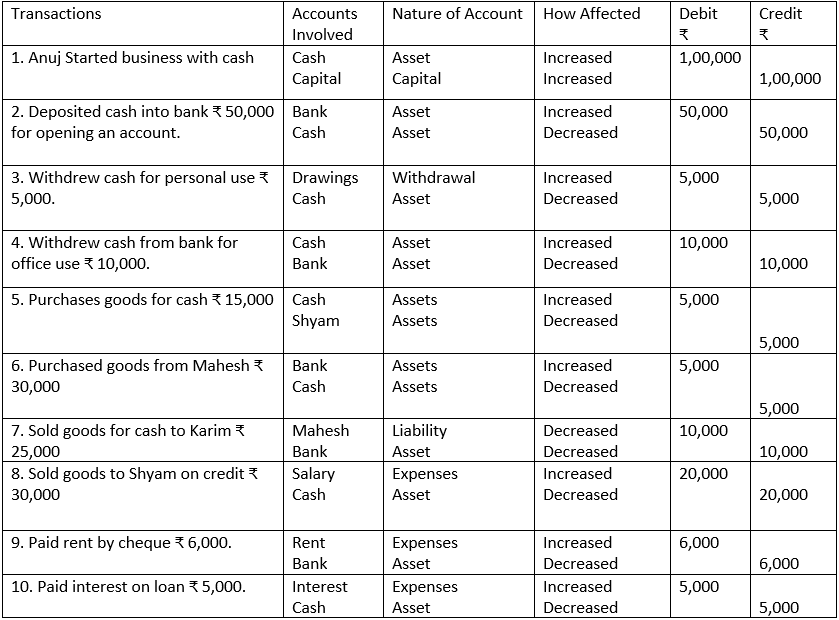

Illustration 8:

Analyse the following transactions, state the nature of accounts and state which account will be debited and which account will be credited according to the Traditional approach:

1. Anuj Started business with cash ₹ 1,00,000.

2. Deposited cash into bank ₹ 50,000.

3. Withdrew cash for personal use ₹ 5,000.

4. Withdrew cash from bank for office use ₹ 10,000.

5. Received a cheque from Shyam ₹ 5,000.

6. Deposited Shyam’s cheque next day.

7. Paid Mahesh by cheque ₹ 10,000.

8. Paid salary to staff ₹ 20,000.

9. Paid rent by cheque ₹ 6,000.

10. Paid interest on loan ₹ 5,000.

Solution:

ANALYSIS OF TRANSACTIONS

Note: When a cheque is received from a customer but is not deposited into the bank on the same date, the cheque is first treated as cash received. Afterwards, when the cheque is deposited into the bank, it is recorded as cash deposited into bank, that is, the Bank Account is debited and the Cash Account is credited. When a cheque received from a customer is deposited on the same date, the Bank Account is debited directly and the Customer’s Account is credited.

Illustration 9:

Analyse the transaction given in Illustration 7 using the Modern Approach for Classification of Accounts.

Solution:

ANALYSIS OF TRANSACTION

Illustration 10:

Analyse the transaction given in Illustration 8 using the Modern Approach for Classification of Accounts.

Solution:

ANALYSIS OF TRANSACTION

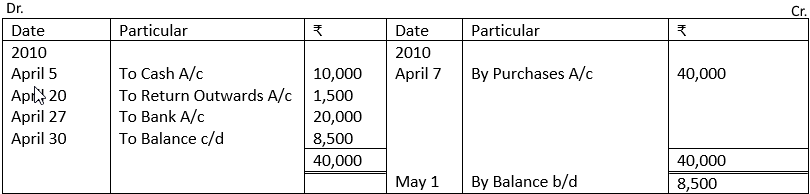

BALANCING AN ACCOUNT

At the end of each month or year or in fact on any day, it may be necessary to determine the balance in an account. The process of balancing is as follows:

(i) Total the two sides (i.e., Debit and Credit) of the account.

(ii) Strike the difference in totals of the two sides. The difference is the balance.

(iii) Enter the difference in the side with shorter total. Now the total of two sides will match.

If the credit side is shorter, then the amount is entered in the credit side writing ‘By Balance c/d’ in the Particular column. It is carried forward by writing in the debit side is shorter, then the amount is entered in the debit side writing ‘To Balance c/d’ in the Particular column. It is carried forward by writing in the credit side ‘By Balance b/d’, it being a credit balance.

As an illustration, following account is given with imaginary amounts:

Ranjan’s Account

The account shows that the firm has a liability towards Ranjan for 8,500.

It is to be noted that Nominal Accounts are not balanced, they are totalled and transferred to the Profit and Loss Account. Balances in Real and Personal Accounts are transferred to the Balance Sheet.

SIGNIFICANCE OF DEBIT AND CREDIT IN ACCOUNTS

1. Personal Accounts: Debit in Personal Accounts means that the person whose account is being debited becomes a debtor or that he owes a certain sum to the business. In case of credit sales, the account of customer is debited because he becomes the debtor of the business. If the account of the customer is already in existence, debit implies that the amount due from him has further increased.

If the account of a creditor is debited, the debit implies that the amount due to that person has decreased, e.g., on payment.

Credit in Personal Accounts means that the person whose account is being credited becomes a creditor of the business or that the business owes a certain sum to him. In case of credit purchases, the account of the supplier is credited. If the amount of a debtor is credited, it implies decrease in the amounts due from customers.

2 Real Accounts: Debit in Real Account implies purchase of an asset. Any further debit in Real Account means acquisition of more assets.

A credit in Real Account indicates that some part or whole of the asset has been sold. It reduces amount in Assets Account.

3. Nominal Accounts: Debit in Nominal Accounts implies that an expense has been incurred or some loss has taken place or some income has diminished by the amount of debit. Any expense on account of rent, salary, commission, interest is incurred, these accounts should be debited.

Credit in Nominal Account indicates that income or profit has been earned or some expenditure or loss has decreased by the amount of credit.

SIGNIFICANCE OF VARIOUS BALANCES

Some accounts show debit balances and some credit. These balances have special importance as follows:

1. Credit balance of the Capital Account is the amount due to the owner of the business. In other words, the amount invested in the business by the owner.

2. Debit balance of Cash Account shows the cash in hand.

3. Credit balance of Discount Received Account shows discount received.

4. Debit balance of Discount Allowed Account shows discount allowed by the business Debit balances of other expenses show the expenses incurred, e.g., salary, rent, etc.

So, we can briefly say that:

(a) A debit balance is either an asset (cash, bank, etc.) or an expense (salary, rent, etc.); and

(b) A credit balance shows the income earned or liability or the amount invested by the proprietor.

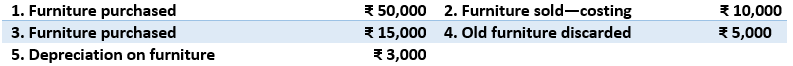

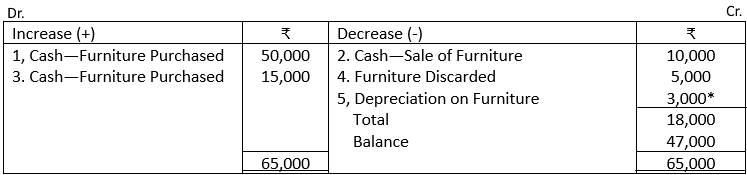

Illustration 11.

Open a ‘T’ shape account for furniture and write the following transactions on the proper side:

Solution:

*Depreciation is a permanent and continuous decrease in the book value of fixed assets due to use, effluxion of time, obsolescence etc.

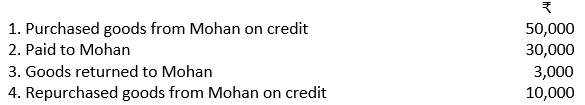

Illustration 12.

Open a ‘T’ shape account of a creditor, Mohan, and write the following transactions on the proper side:

Solution:

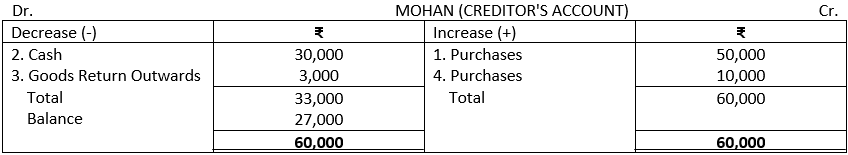

Illustration 13.

Write the following transaction in Debtor’s Account, Creditor’s Account and Cash Account:

Illustration 14.

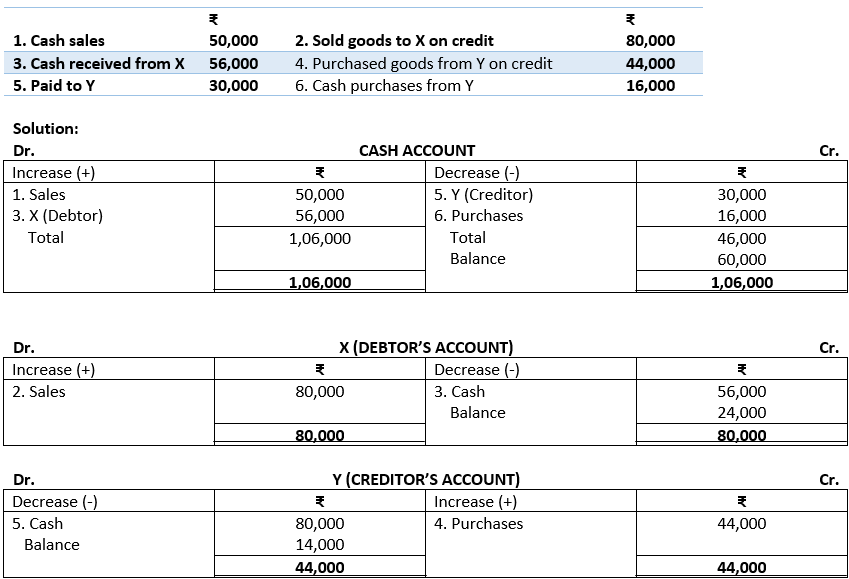

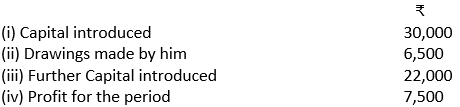

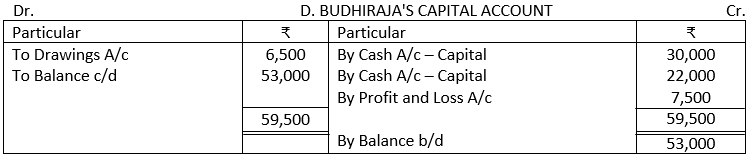

From the following particulars, prepare the account of D. Budhiraja, the proprietor of a business:

Balance the same and explain what the closing balance indicates.

Solution:

Note: Proprietor’s Capital Account has a credit balance of ₹ 53,000 which indicates that the business owes him this amount.

Please check your solved ans images they are not matching. Illustration 10 image which you stated ans of illustration 8 but transaction in images are different and it’s circulating on Google as it is which is wrong

Where is wrong pls elaborate your query?