We are discussing “INTRODUCTION Of ACCOUNTING in Full Detail”. Let’s dive into it:-

Learning Inside:-

- Meaning and Definition of Accounting #

- Attributes of Accounting #

- Accounting Process #

- Branches of Accounting #

- Book Keeping, Accounting and Accountancy #

- Objective of Accounting #

- Function of Accounting #

- Advantages of Accounting #

- Limitations of Accounting #

- Accounting Information #

- Users of Accounting Information #

- Qualitative Characteristics of Accounting Information #

- Systems of Accounting #

MEANING OF ACCOUNTING

Accounting is primarily concerned with recording of financial transactions, summarizing them and communicating the financial information to users, i.e., the proprietors, creditors, investors, government agencies, employees, etc. It is because of these characteristics that accounting is called the language of business.

[simple_icon name=”pinboard”]

“Accounting is the art of recording, classifying and summarising in a significant manner and in terms of money; transactions and events which are, in part at least, of a financial character, and interpreting the results thereof.”

-American Institute of Certified Public Accountants

[simple_icon name=”pinboard”]

“Accounting is the science of recording and classifying business transactions and events, primarily of a financial character, and the art fo making significant communicating the results to persons who must make decisions or form judgment.”

-Smith and Ashburne

[simple_icon name=”pinboard”]

“Accounting is the process of identifying, measuring and communicating economic information to permit informed judgements and decision by users of the information.”

-American Accounting Association

In simple words, accounting is the process of collecting, recording, summarising and communicating financial information. Accounting is an information system that provides accounting information to the users for correct decision-making.

Also Read:

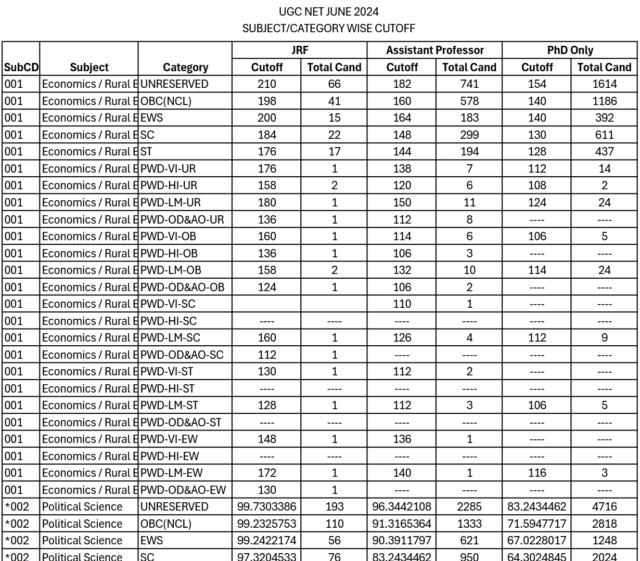

- UGC-NET June 2025 Cut-off marks & Final Answer Key

The National Testing Agency (NTA) has announced the UGC NET…

The National Testing Agency (NTA) has announced the UGC NET… - UGC-NET December 2024 Cut-off marks

UGC NET EXAMINATION DECEMBER 2024 SUBJECT/CATEGORY WISE CUTOFF MARKS

UGC NET EXAMINATION DECEMBER 2024 SUBJECT/CATEGORY WISE CUTOFF MARKS - UGC-NET December 2024 Final Answer Key

The final answer key for the UGC NET December 2024 session has been released by the National Testing Agency (NTA). You can download it from the official website here. The results for the December 2024 session have also been announced, and you can check your scorecard and cut-off marks here.

The final answer key for the UGC NET December 2024 session has been released by the National Testing Agency (NTA). You can download it from the official website here. The results for the December 2024 session have also been announced, and you can check your scorecard and cut-off marks here. - UGC NET Official Paper 1: 19 June 2023 Shift 1

UGC NET Official Paper 1: 19 June 2023 Shift 1 with explanation…

UGC NET Official Paper 1: 19 June 2023 Shift 1 with explanation… - UGC NET JUNE (Re-NET) 2024 Cut Off

UGC NET JUNE (Re-NET) 2024 Cut Off PDF Download

UGC NET JUNE (Re-NET) 2024 Cut Off PDF Download

ATTRIBUTES (CHARACTERISTICS) OF ACCOUNTING

The definitions of accounting bring to light the following attributes of accounting.

Identification of Financial Transactions and Events: Accounting records only those transactions and events which are of financial character. It is concerned with those financial transactions and events that bring about a change in the resources of a firm. This involves identifying transactions that are considered apart of economic activity. For example, purchase of raw material or sale fo finished goods by a firm. Such transactions are identified with the help of bills and receipts as evidence of the transactions.

Measuring the Identified Transactions: Accounting measure the transactions in terms of a common measurement unit (that is the currency of a country). In other words, financial transactions and events are measured in terms of money.

Recording: Accounting is an art of recording business transactions in the book of accounts. The recording is the process of entering business transactions fo financial character in the book of original entry, i.e., Journal. This book is further sub-divided into various subsidiary books such as Cash Journal or Cash Book (for recording cash transactions), Purchases Jornal or Purchases Book (for recording credit purchases of goods), Sales Book (for recording credit sales), etc.

Classifying: Accounting is an art of classifying business transactions. Classification is the process fo grouping transactions or entries of one nature at one place. The transactions recorded in the ‘Journal’ or the subsidiary books are classified or posted to the main book of account known as the Ledger. This book contains individual account heads under which all financial transactions of a similar nature are collected. For example, in Rahul’s account in the Ledger, all business transactions connected with Rahul are posted so that what is ultimately due to Rahul or due from Rahul can be ascertained.

Summarising: Accounting is an art of summarising financial transactions. This involves presenting the classified data in a manner which is understandable and useful to internal as well as external users of accounting statements. This process leads to the preparation of the following statements: (i) Trial Balance, (ii) Trading and Profit and Loss Account or statements of Profit and Loss, and (iii) Balance sheet.

Trading Account, Profit and Loss Account or Statement of Profit and Loss and Balance Sheet are collectively known as Final Accounts or Financial Statements.

Analysis and Interpretation: Analysis and interpretation of the financial data is carried out so that the users of financial data can make a meaningful judgment of the profitability and financial position fo the business. This helps in planning for the future in a better way.

Communicating: Finally, the accounting function involves communicating the financial data, i.e., financial statements to its users. The accounting information must be provided in time and presented to the users so that the appropriate decisions may be taken at the right time.

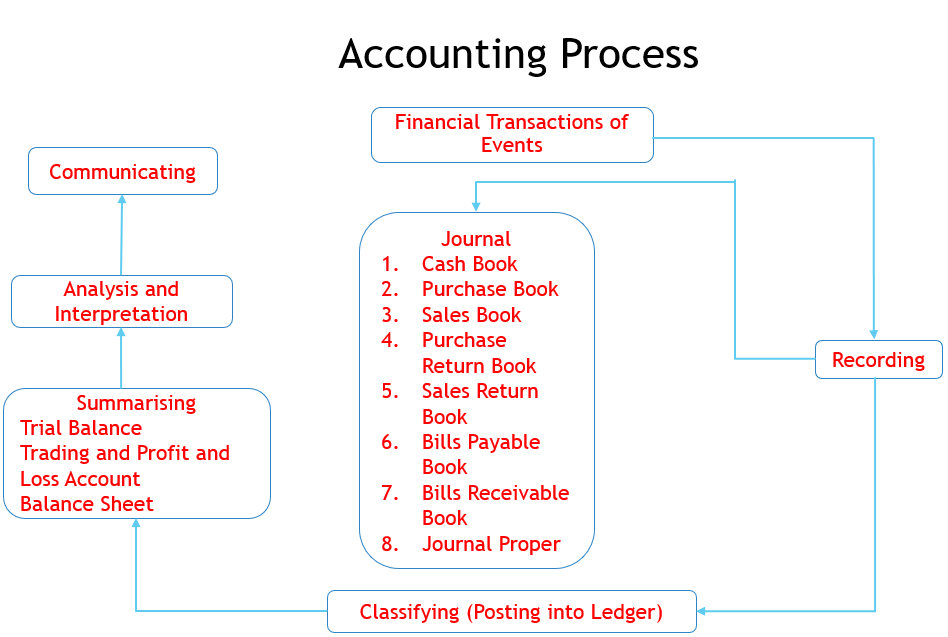

ACCOUNTING PROCESS

Based on the main attributes of accounting, we may list the steps of accounting process as follows:

- Financial Transactions,

- Recording,

- Classifying,

- Summarising,

- Analysing and Interpreting and

- Communicating.

We have discussed the above steps in detail. We may now explain the accounting process with the help of a diagram.

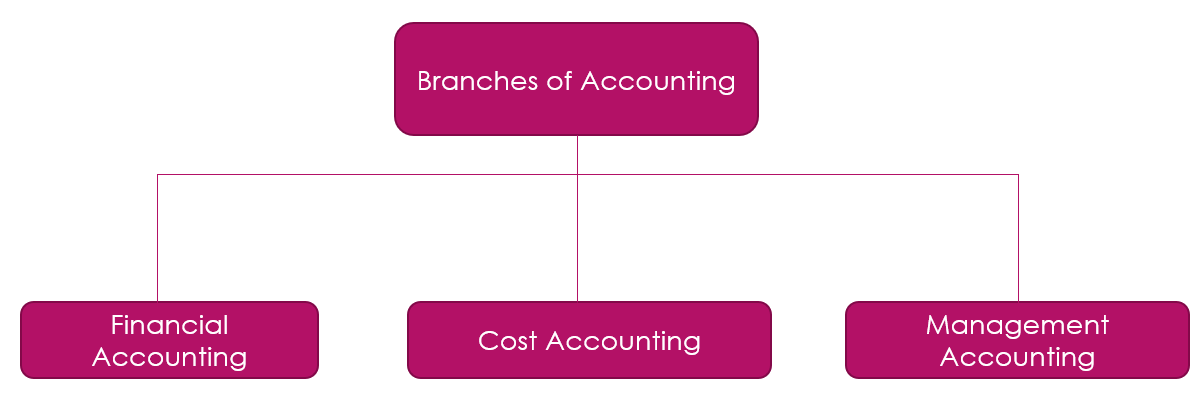

BRACHES OF ACCOUNTING

The changing business scenario through centuries has given rise to specialised branches of accounting which could cater to the changing requirements. These branches are:

Financial Accounting

Financial Accounting is that branch of accounting, while records financial transactions and events, summarises and interprets them and communicates the results to the users. It ascertains profit earned or loss incurred during an accounting period (usually a year) and the financial position on the date when the accounting period ends.

The end-product of Financial Accounting is the Profit and Loss Account for the period ended (which shows the profit earned or loss incurred) and the Balance Sheet as on the last day of the accounting period (which shows the financial position). In short, Financial Accounting is mainly confined to the preparation of financial statements, i.e., the Profit and Loss Account and the Balance Sheet, for the users of accounting information.

COST ACCOUNTING

The limitation of Financial Accounting in respect of information relating to the cost of products or services led to the development of a specialised branch, i.e., Cost Accounting. It ascertains the cost of product manufactured or services rendered and helps the management in decision making (say price fixation) and exercising controls.

MANAGEMENT ACCOUNTING

Management Accounting is the most recently developed branch of accounting. It is concerned with generating accounting information relating to funds, costs, profit, etc, as it enables the management in decision making. We may say that Management Accounting addresses the needs of a single user group, i.e., the management.

DIFFERENCE BETWEEN BOOKKEEPING, ACCOUNTING AND ACCOUNTANCY

Meaning of Book Keeping

Bookkeeping is a part of accounting that is concerned with the recording of financial transactions and events in the books of accounts. It is the process by which a record of financial transactions is maintained. Thus, Book Keeping is concerned with:

1.Identifying Financial transactions and events.

2. Measuring them in terms of money.

3. Recording the financial transactions and events so identified in the books of accounts, and

4. Classifying recorded transactions and events, i.e., posting them into Ledger account.

Definitions of Book Keeping

“Book Keeping is an art of recording in the books of accounts the monetary aspect of commercial and financial transactions.”

–NORTHCOTT

“Book Keeping is an art of recording business dealings in a set of books.”

–J.R. Batliboi

“Book Keeping is the science and art of recording correctly in the books of accounts all those business transactions that result in the transfer of money or money’s worth.”

– R.N. Carter

“Book Keeping is the art of recording business transactions in a systematic manner.”

–A.N. Rosen Kampff

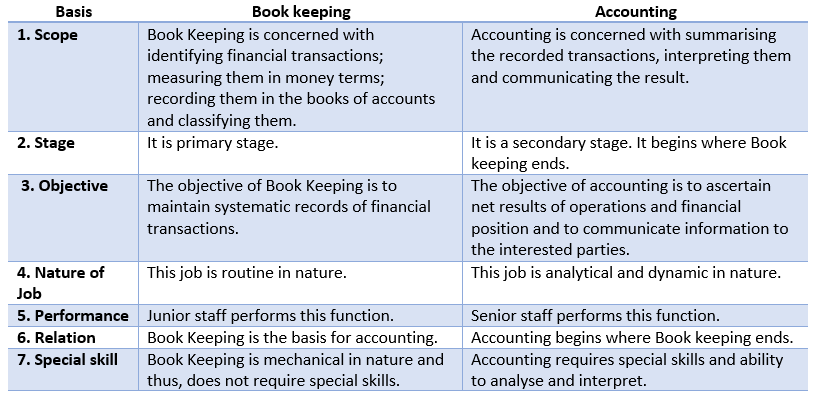

ACCOUNTING

Accounting is an art of recording, classifying and summarising the financial data and interpreting the results thereof. Accounting is a wider concept than Book Keeping. It starts where Book Keeping ends. In other words, Book Keeping is a part of accounting.

Difference between Book Keeping and Accounting

ACCOUNTING

Accountancy refers to a systematic knowledge of accounting. It explains how to deal with various aspects of accounting. It educates us why and how to maintain the books of accounts and how to summarise the accounting information and communicate it to the users. In the words of Kohler, accountancy refers to the entire body of the theory and practice of accounting.

Accounting and Accountancy

Some persons are of the opinion that the terms accounting and accountancy are synonymous while some others make a distinction between the two.

Accountancy is an area of knowledge whereas accounting is the action or process used in this area. Accounting depends on the rules and principles framed by the Accountancy but Accountancy does not depend on Accounting. It may be said that Accountancy is the whole thing while Accounting is the application part of accountancy.

OBJECTIVE OF ACCOUNTING

The objectives or functions of accounting are:

- Maintaining Systematic Records of Transactions:- The objective of accounting is to record financial transactions and events of the organisation in the books of accounts in a systematic manner, classifying the recorder data under appropriate accounts and summarising them into financial statements, i.e., Income Statement and Position Statement.

- Ascertaining Profit or Loss: Another objective of accounting is to ascertain the net result of day-to-day transactions for a period. In other words, to ascertain whether during the accounting period, the firm earned a profit or incurred a loss. For this purpose, a statement called an Income Statement or the Trading and Profit and Loss Account is prepared. In this account, the revenue resulting from the transactions of the accounting period and the expenses incurred are recorded. A comparison of the two shows whether the business earned a profit or incurred a loss.

- Ascertaining Financial Position: For a businessman, it is not adequate to only ascertain the profit or loss; it is also necessary to know the financial position of the organisation. For this purpose, a statement of assets, liabilities and the owner’s capital is prepared. Such a statement is called a Balance Sheet.

- Assisting the Management: The management often requires financial information for decision-making, effective control, budgeting and forecasting, Accounting provides financial information to assist the management in discharging this function.

- Communicating Accounting Information to Users: Another objective of accounting is to provide accounting information to users who analyse them as per their individual requirements.

FUNCTION OF ACCOUNTING

The main functions of accounting are:

- Maintaining Systematic Records: To maintain the systematic records of business transactions, post them to the ledger and ultimately to prepare the final accounts is the primary function of accounting.

- Communicating the Financial Results: Accounting is used to communicate financial information in respect of net profit/net loss, assets, liabilities, etc., to the interested parties.

- Meeting Legal Requirements: The accounting system must be able to comply with legal requirements. Under the provisions of various laws such as Companies Act, Income Tax and Sales Tax Acts require the submission of statements or returns, i.t., annual accounts, income tax return, sales tax return, etc.

- Protecting Business Assets: Accounting maintains proper records of various assets of the business which enable the management to exercise proper control over them.

- Assistance to Management: Accounting assists the management in the task of planning, controlling and coordination of business activities.

- Stewardship: In case of companies, the management is entrusted with the resources of the enterprise. The directors are expected to act as true trustee of the funds and accounting, helps to achieve the same.

ADVANTAGES AND LIMITATIONS OF ACCOUNTING

There are some advantages and some limitations have in accounting as follows:

ADVANTAGES OF ACCOUNTING

- Financial Information about Business: Financial performance during the accounting period, i.e., profit or loss and also the financial position at the end of the accounting period is known through accounting.

- Assistance to Management: The management makes business plans, takes decisions and exercises control over affairs on the basis of accounting information.

- Replaces Memory: A systematic and timely recording of transactions obviates the necessity to remember the transactions. The accounting record provides the necessary information.

- Facilitates Comparative Study: A systematic record enables a businessman to compare one year’s results with those of other years and locate significant factors leading to the change if any.

- Facilitates Settlement of Tax Liabilities: A systematic accounting record immensely helps settlement of income tax, sales tax, VAT and excise duty liabilities since it is a good evidence of the correctness of transactions.

- Facilitates Loans: Loan is granted by the banks and financial institutions on the basis of growth potential which is supported by the performance. Accounting makes available information with respect to performance.

- Evidence in Court: Systematic record of transactions is often accepted by the Courts as good evidence.

- Facilitates Sale of Business: If someone desire to sell his business, the accounts maintained by him will enable the ascertainment of the proper purchase price.

- Assistance in the event of Insolvency: Insolvency proceeding involves explaining many transactions that have taken place in the past. Systematic accounting records assist a great deal in such a situation.

- Helpful in Partnership Accounts: At the time of admission of a partner, retirement or death of a partner and dissolution of the firm, accounting record is of vital importance and use. It is so because it provides the basis to reach a settlement.

LIMITATIONS OF ACCOUNTING

- Accounting is not Fully Exact: Although most of the transactions are recorded on the basis of evidence such as sale or purchase or receipt of cash, yet some estimates are also made for ascertaining profit or loss. Examples of this are providing depreciation on the basis of estimated useful life of an asset, possible bad debts, the probable market price of the stock of goods, etc.

- Accounting does not Indicate the Realisable Value: The Balance Sheet does not show the amount of cash which the firm may realise by the sale of all the assets. This is because many assets are not meant to be sold; they are meant for use and are shown at cost less depreciation that may have been written off.

- Accounting Ignores the Qualitative Elements: Since accounting is confined to monetary matters only, qualitative elements like quality of staff, industrial relations and public relations are ignored.

- Accounting Ignores the Effect of Price Level Changes: Accounting statements are prepared at historical cost. Money, as a measurement unit, changes in value. It does not remain stable. Unless price level changes are considered whiel preparing financial statements, accounting information will not show true financial results.

- Accounting may Lead to Window Dressing: The term window dressing means manipulation of accounts in a way so as to conceal vital facts and present the financial statements in a way to show better position than what it is actually. In this situation, income statement (i.e., Profit and Loss Account) fails to provide a true and fair view of the result of operations and the Balance Sheet fails to provide a true and fair view of the financial position of the enterprise.

WHAT IS ACCOUNTING INFORMATION?

“Accounting is a service activity. Its function is to provide qualitative information, primarily financial in nature, about economic entities that is intended to be useful in making economic decision.” -Accounting Principles Board

As an information system, accounting collects financial data, records it in the books of accounts, classifies and summarises it to produce financial information that is communicated to its users. Accounting begins with the identification of transactions of financial nature and ends with the preparation of financial statements (i.e., Income Statement and Balance Sheet). Each step in the process of accounting generates information. Generation of information is not an end in itself, it is a way to facilitate the communication of information to users of accounting information.

Types of Accounting Information

Accounting information refers to the financial statements generated through the process of Book Keeping, use of which enables the users to arrive at the correct decision, the financial statements so generated are the Income Statement, i.e., Profit and Loss Account and the Position Statement, i.e., Balance Sheet. The information made available by these statements can be categories into the following:

- Information Relating to Profit or Surplus;

- Information Relating to Financial Position; and

- Information about Cash Flow.

Let us now discuss these in detail.

Information Relating to Profit and Surplus: The Income Statement, i.e., Profit and Loss Account makes available the accounting information about the profit earned or loss incurred as a result of business operations or otherwise during an accounting period. Trading Account, a part of the Profit and Loss Account provides information about Gross Profit and Profit and Loss Account provides information about the Net Profit.

A Not-for-Profit Organisation prepares Income and Expenditure Account instead of Profit and Loss Account because it carries on welfare or charitable activities and not business. The excess of income over expenditure is termed as ‘Surplus’ while excess of expenditure over income is termed as ‘Deficit’.

Information Relating to Financial Position: The Position Statement, i.e., the Balance Sheet makes available the information about the financial position of the entity. The Position Statement provides information about the assets owned by the entity, amounts receivable and the cash and bank balance held by it. These are represented in the liabilities by the amounts owed by the entity towards loans, creditors and amount payable. The difference between the two is represented by capital, i.e., amount due to owners. In the case of Not-for-Profit Organisation, difference between assets and liabilities is termed as ‘General Fund’.

Information about Cash Flow: Cash Flow Statement is a statement that shows flow, both inflow and outflow, of cash during a specific period. It is of immense use as many decisions such as payment of liabilities, payment of dividend and expansion of business, etc., are based on availability of cash.

USERS OF ACCOUNTING INFORMATION

Users of Accounting Information may be categorised into Internal Users and External Users.

Internal Users

- Owners: Owners contribute capital in the business and thus are exposed to maximum risk. Naturally, they are interested in knowing the profit earned or loss suffered by the business besides the safety of their capital. The financial statements give the information about profit or loss and financial position of the business.

- Management: The management makes extensive use of accounting information to arrive at informed decisions such as determination of selling price. Cost controls and reduction, investment into new projects, etc.

- Employees and Workers: Employees and workers are entitled to bonus at the year-end, which is linked to the profit earned by an enterprise. Therefore, the employees and workers are interested in financial statements. Besides, the financial statements also reflect whether the enterprise has deposited its dues into the provident fund and employees state insurance, etc., or not.

External Users

- Banks and Financial Institutions: Banks and financial institutions are an essential part of any business as they provide loans to the businesses. Naturally, they watch the performance of the business to know, whether it is making progress as projected to ensure the safety and recovery of the loan advanced. They assess it by analysing the accounting information.

- Investors and Potential Investors: Investment involves risk and also the investors do not have direct control over the business affairs. Therefore, they rely on the accounting information available to them and seek answer to the questions such as what is the earning capacity of the enterprise and how safe is their investment?

- Creditors: Creditors are those parties who supply goods or services on credit. It is a common business practice that a large number of suppliers remains invested in credit sales. Before granting credit, creditors satisfy themselves about the credit-worthiness of the business. The financial statement help them immensely in making such an assessment.

- Government and its Authorities: The government makes use of financial statements to compile national income accounts and other information. The information available to it enables them to take the policy decision.

- Government levies varied taxes such as Excise Duty, VAT, Service Tax and Income Tax. These government authorities assess the correct tax dues from an analysis of financial statement.

- Researchers: Researchers use accounting information in their research work.

- Consumers: Consumers require accounting information for establishing good accounting control so that cost of production may be reduced with the resultant reduction of the prices of products they buy. Sometimes, prices of some products are fixed by the government, so it needs accounting information to fix fair price so that consumers and producers are not exploited.

- Public: They want to see the business running since it makes substantial contribution to the economy in many ways, e.g., employment of people, patronage to suppliers, etc. Thus, financial accounting provides useful financial information to various user groups for decision-making.

QUALITATIVE CHARACTERISTICS OF ACCOUNTING INFORMATION

Two fundamental characteristics of financial statements are their truth and fairness. An auditor of the enterprise has to make a statement in the audit report whether, in his opinion, the financial statements give a true and fair view. Besides the above two fundamental characteristics, there are other qualitative characteristics (attributes) of accounting information which are:

- Reliability: Accounting information must be reliable. The reliability of information means it is verifiable, free from material error and bias. It depends on:

- Neutrality

- Prudence

- Completeness

- Substance Over Form

- Relevance: The accounting information, besides disclosing statutorily required information, should disclose other information, after judging its relevance to the decision-making need of its users.

- Understandability: Understandability means that the information provided through the financial statement be presented in a manner that the users are able to understand it in the manner it should be.

- Comparability: Comparability means that the users should be able to compare the accounting information of an enterprise of the period either with that of other periods, known as an intra-firm comparison or with the accounting information of other enterprises, known as an inter-firm comparison.

SYSTEMS OF ACCOUNTING

The systems of recording transactions in the books of accounts are two namely:

- Double Entry System.

- Single Entry System.

Double Entry System

The Double Entry System of accounting was developed int the 15th Century in Italy by Lucas Pacioli. Under the system, every transaction has two aspects-Debit and Credit and at the time of recording a transaction, it is recorded once on the debit side and again on the credit side. For example, at the time of cash purchases, goods are acquired and in return cash is paid. In the transaction, two aspects are involved i.e., receiving goods and paying cash and under the Double Entry System, both these aspects are recorded. One part i.e., the receipt of goods is debited and the second part, i.e., payment of cash is credited. In other words, if only two accounts are affected (as in the purchase of building for cash), one account, Building is debited and the other account, Cash is credited for the same amount. If more than two accounts are affected by a transaction, the sum of the debit entries must be equal to the sum of the credit entries. Thus, on any day, total amount debited is equal to the total amount credited.

Thus, we can define Double Entry System as: “The system which recognises and records both aspects of a transaction. The Double Entry System has proved to be a scientific and complete system of accounting followed by every enterprise and organisation”.

Features of the Double Entry System

- It maintains a complete record of each transaction.

- It recognises the two-fold aspect of every transaction, viz., the aspect of receiving (value in) and the aspect of giving (value out).

- In this system, one aspect is debited and other aspect is credited following the rules of debit and credit.

- Since, one aspect of a transaction is debited and the other is credited, the total of all debits is always equal to total of all credits. It helps in establishing arithmetical accuracy by preparing the Trial Balance.

Stages of Double Entry System

The following are the three different stages of a complete system of a double-entry bookkeeping:

- Recording the transaction in the Journal.

- Classifying the transaction in the Journal by posting them to the appropriate ledger accounts and then preparing the Trial Balance.

- Closing the books and preparing the final accounts.

All these stages shall be discussed one by one in succeeding chapters.

Advantages of the Double Entry System

The main advantages of Double Entry System are:

- Scientific System: Double Entry System is the only scientific system of recording business transactions as compared to other systems of Book Keeping. It helps attain the objectives of accounting.

- Complete Record of Transactions: Under the system both side of a transaction are recorded. It is a complete record as it results in depicting correct income or loss, assets and liabilities.

- A Check on the Accuracy of Accounts: By the use of this system the accuracy of the accounting work can be established through the Trial Balance.

- Ascertainment of Profit or Loss: The Profit earned or loss incurred during a period can be ascertained by preparing the Profit and Loss Account.

- Knowledge of Financial Position: The financial position of the firm or the institution can be ascertained at the end of each period by preparing the Balance Sheet.

- Full Details for Purposes of Control: The system permits accounts to be maintained in as much detail as necessary and, therefore, provides significant information for purposes of control, etc.

- Comparative Study in Possible: Results of one year may be compared with those of previous years and reasons for the change may be ascertained.

- Helps Management in Decision-Making: The management may be able to obtain good information for its work, specially in making decisions.

- No Scope of Fraud: The firm is saved from frauds and misappropriations since full information about all assets and liabilities is available.

It is because of these advantages that the Double Entry System has been used extensively in all countries.

Single Entry System

Single Entry System of recording transactions in the books of accounts may be defined to be an incomplete Double Entry System. In this system, all transactions are not recorded on the double-entry basis. As regards some transactions, both aspects of the transactions are recorded, as regards others, either one aspect is recorded or not recorded at all.

Instead of maintaining all the accounts, only Personal Accounts and Cash Book are maintained under this system. The accounts maintained under this system are incomplete and unsystematic and therefore, not reliable. The Single-Entry System is also known as Accounts from Incomplete Records.

Since all transactions are not recorded under double-entry principle, it is not possible to prepare a Trial Balance. As a result, the Profit and Loss Account and the Balance Sheet cannot be prepared.

The end!