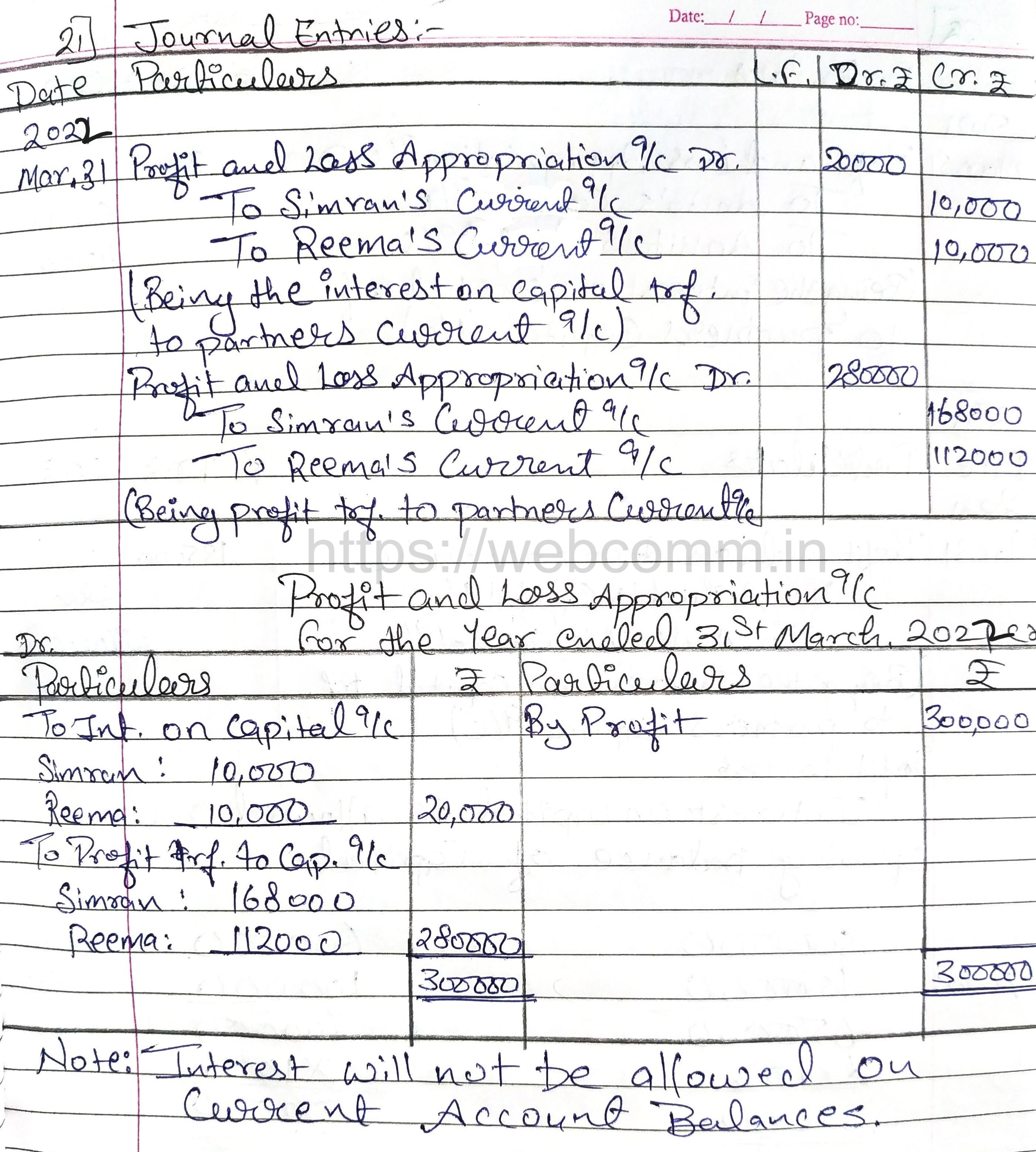

QUESTION: 21

Simran and Reema are partners sharing profits in the ratio of 3:2. Their capitals as on 31st March, 2021 were ₹ 2,00,000 each whereas Current Accounts had balances of ₹ 50,000 and ₹ 25,000 respectively. Interest on capital is to be allowed @ 5% p.a.. The firm earned net profit of ₹ 3,00,000 for the year ended 31st March, 2022.

Pass the Journal entries for interest on capital and distribution of profit. Also prepare Profit and Loss Appropriation Account for the year.

Answer:

Hey! Would you mind providing video solutions? Thanks.

may be in forthcoming months but not with confirmation.