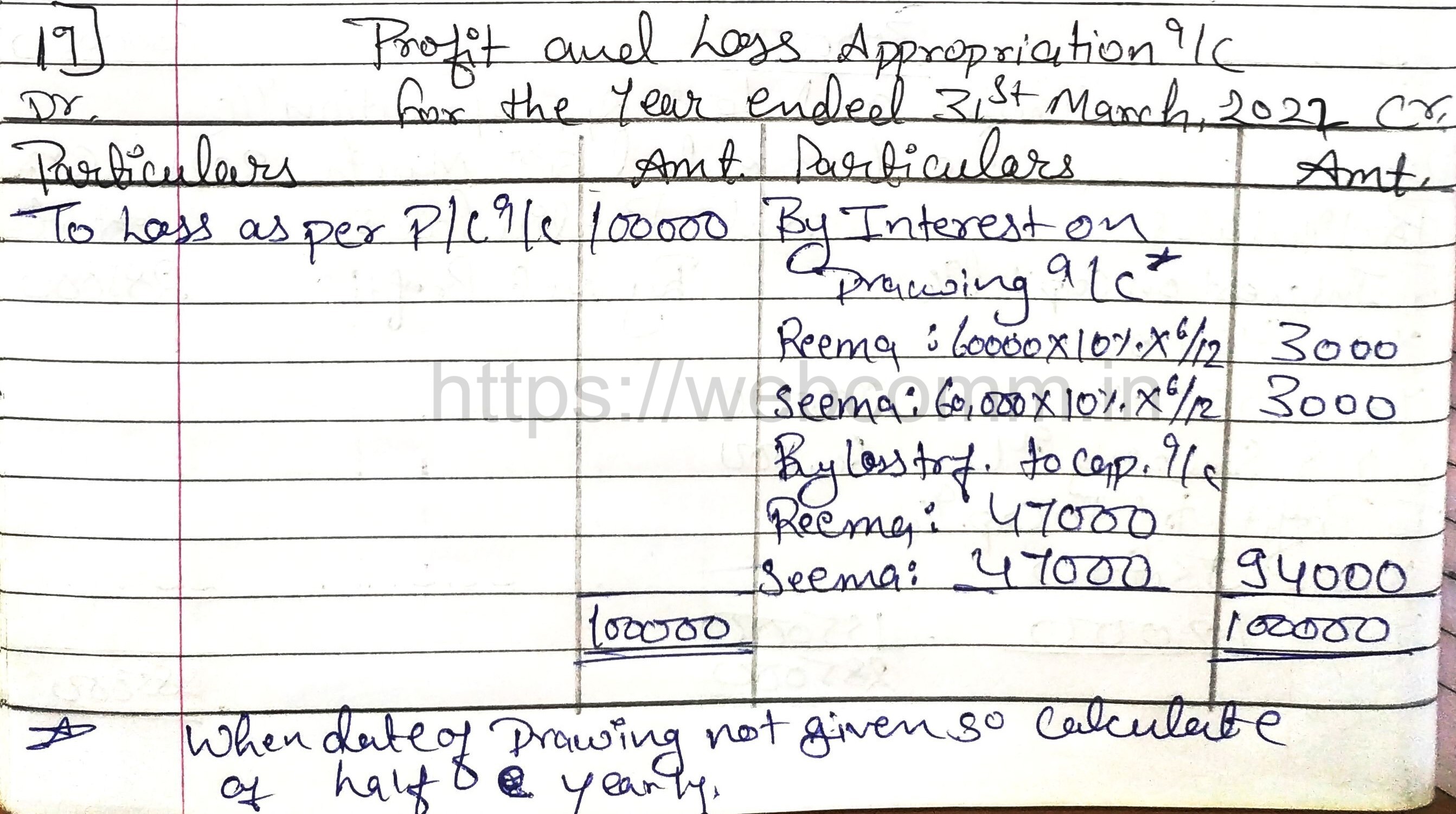

QUESTION: 17

Reema and Seema are partners sharing profits equally. The partnership Deed provides that both Reema and Seema will get monthly salary of ₹ 15,000 each, Interest on capital will be allowed @ 5% p.a. and Interest on Drawings will be charged @ 10% p.a. Their capitals were ₹ 5,00,000 each and drawings during the year were ₹ 60,000 each.

The firm incurred net loss of ₹ 1,00,000 during the year ended 31st March, 2022.

Prepare Profit and Loss Appropriation Account for the year ended 31st March, 2022.

Answer:

Hey! Would you mind providing video solutions? Thanks.

may be in forthcoming months but not with confirmation.