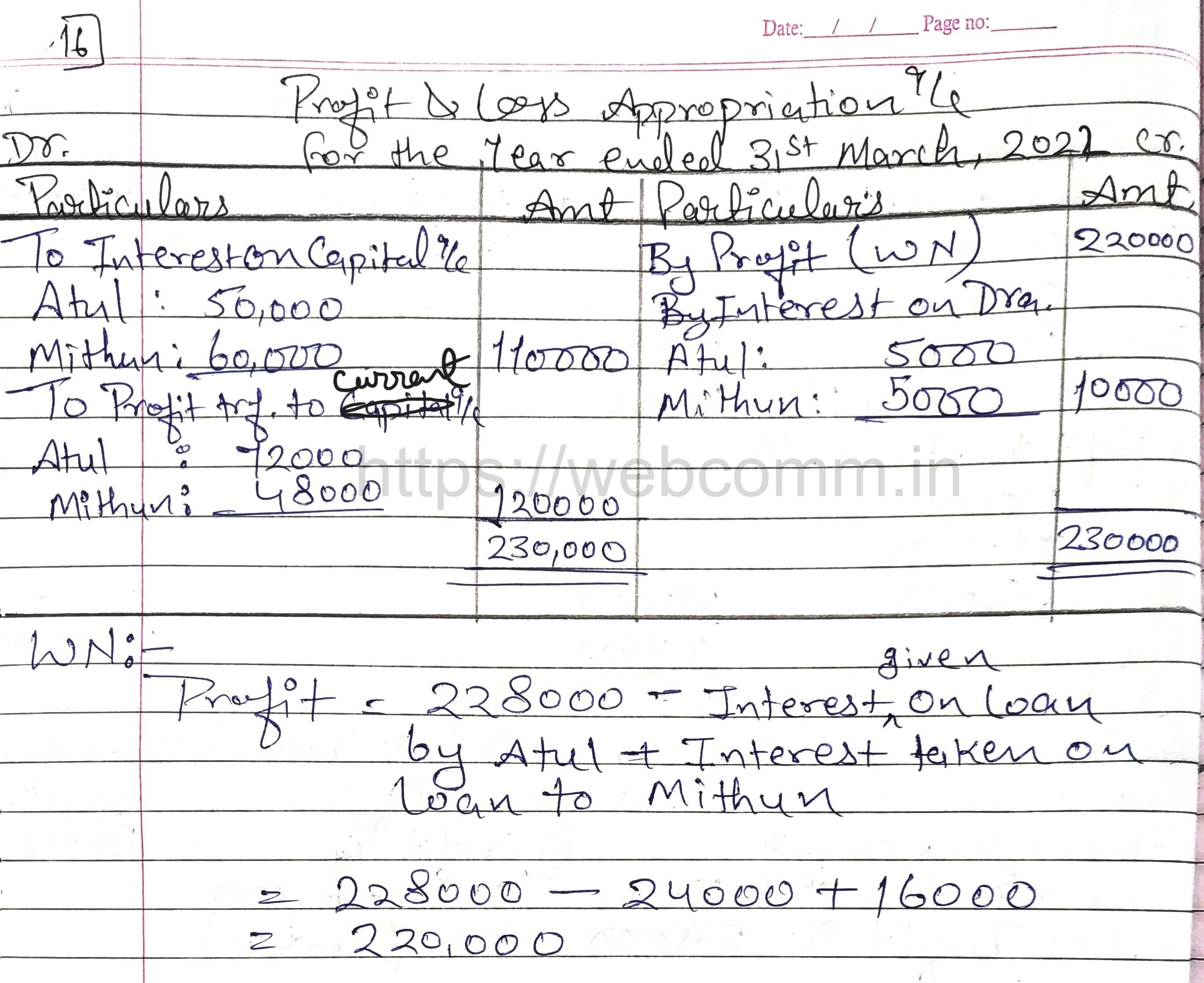

QUESTION: 16

Atul and Mithun are partners sharing profits in the ratio of 3:2.

Balances as on 1st April, 2021 were as follows:

Capital Account (Fixed): Atul – ₹ 5,00,000 and Mithun – ₹ 6,00,000.

Loan Accounts: Atul – ₹3,00,000 (Cr.) and Mithun – ₹ 2,00,000 (Dr.)

It was agreed to allow and charge interest @ 8% p.a. Partnership Deed Provided to allow interest on capital @ 10% p.a. Interest on Drawings was charged ₹ 5,000 each.

Profit before giving effect to above was ₹ 2,28,000 for the year ended 31st March, 2022. Prepare Profit and Loss Appropriation Account.

Answer:

Hey! Would you mind providing video solutions? Thanks.

may be in forthcoming months but not with confirmation.