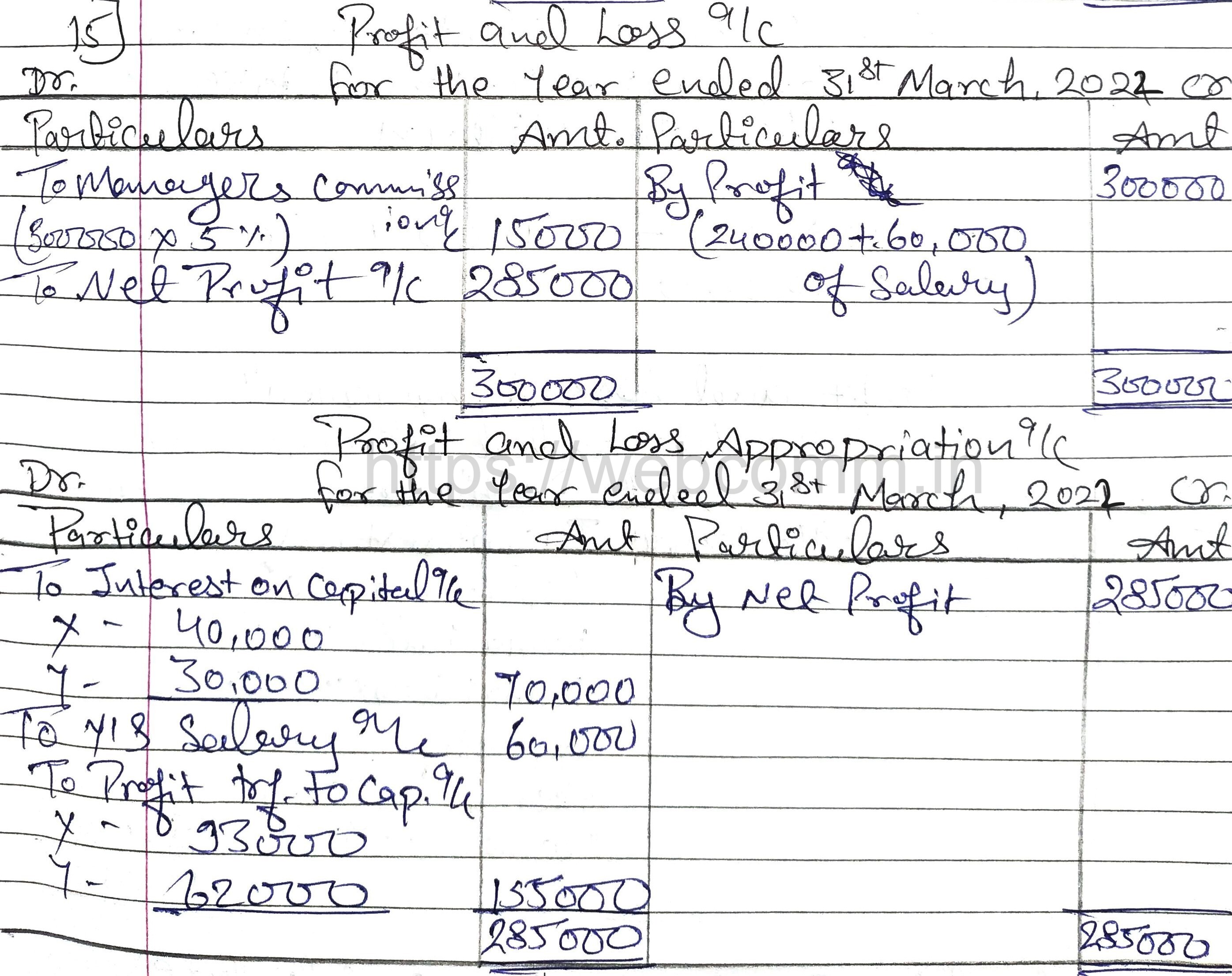

QUESTION: 15

X and Y are partners sharing profits in the ratio of 3:2 with capitals of ₹ 8,00,000 and ₹ 6,00,000 respectively. Interest on capital is agreed @ 5% p.a. Y is to be allowed an annual salary of ₹ 60,000 which has not been withdrawn. Profit for the year ended 31st March 2022 before interest on capital but after charging Y’s salary was ₹ 2,40,000.

A provision of 5% of the net profit is to be made in respect of commission to the Manager. Prepare a Profit and Loss Appropriation Account showing the allocation of profits.

Answer:

Hey! Would you mind providing video solutions? Thanks.

may be in forthcoming months but not with confirmation.