59

Working Notes:

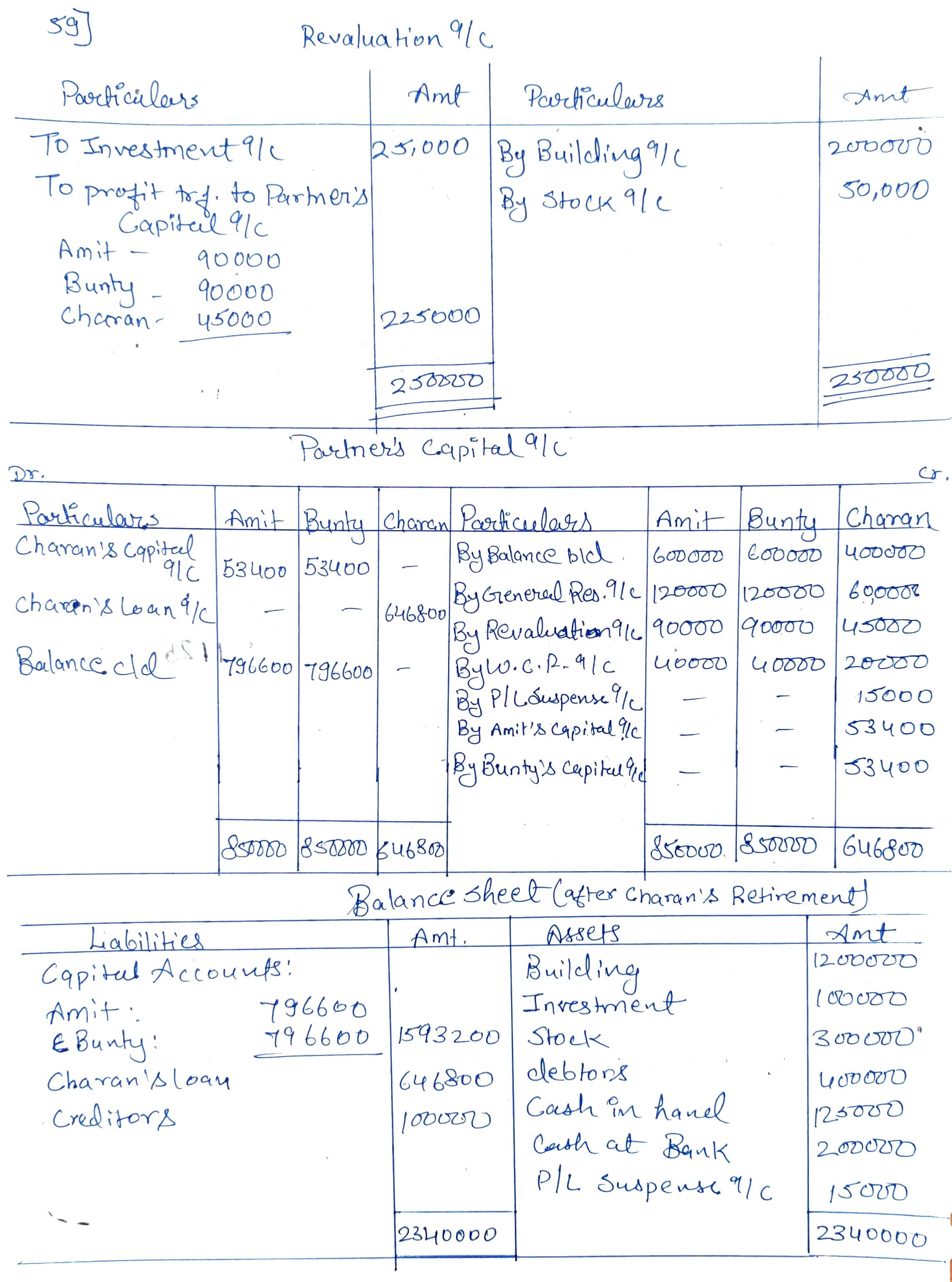

W.N.- 1: Distribution of employee’s’ Compensation Reserve

A = 1,00,000×2/5=40,000

B = 1,00,000×2/5=40,000

C = 1,00,000×1/5=20,000

W.N.- 2: Distribution of General Reserve

A = 3,00,000×2/5 = 1,20,000

B = 3,00,000×2/5 = 1,20,000

C = 3,00,000×1/5 = 60,000

W.N.- 3: Valuation of goodwill

Average Profit = 2,00,000+2,35,000+3,00,000+2,75,000+3,25,000/5=2,67,000

Goodwill =2,67,000×2= 5,34,000

Chetan’s share of Goodwill= 5,34,000×1/5=1,06,800

Chetan will be compensated by Amit and Bunty in 2:2 or 1:1 as follow

Amount of compensation = 1,06,800×1/2=53,400

W.N.- 3: Calculation of Share of Profit till the date of retirement on the basis of past three year profits

Average Profit = 3,00,000 + 2,75,000 + 3,25,000/3=3,00,000

Profit share of Charan = 3,00,000 ×1/5×3/12= 15,000

As someone still navigating this field, I find your posts really helpful.