Abstract

Cash Book: Cash Book records cash transactions. Even banking transactions can be recorded in the Cash Book. When a Cash Book is maintained there is no need of opening a separate Cash Account in the Ledger as the purpose of opening a Cash Account is served by maintenance of a Cash Book. Thus, the Cash Book plays a dual role as a Journal as well as a Ledger.

Contra Entries: Contra entries mean entries that are made on both sides of the Cash Book.

Petty Cash Book: This book is maintained for recording petty payments or expenses in cash.

Imprest System of Petty Cash: Under this system, the Petty Cashier is given a certain amount of cash for a particular period (say for a week, a fortnight or a month) to meet various petty expenses for the period. At the end of the period, the amount actually spent by the Petty Cashier is reimbursed to him by the Chief Cashier.

And many more have in detail Post ⬇

Comprehensive about CASH BOOK – Special Purpose Books

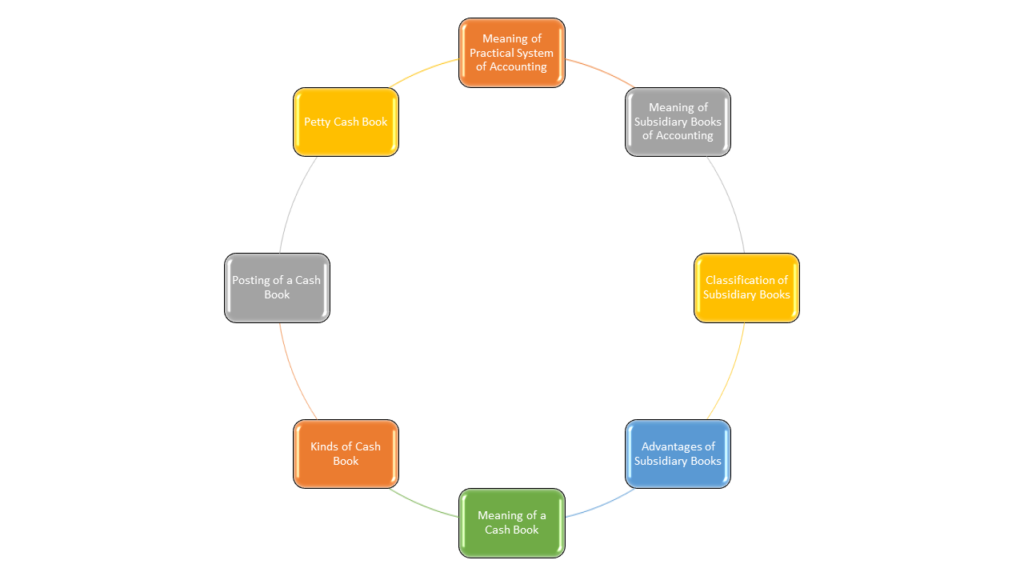

Learning Objectives

This Post would enable you to understand:

Business transactions are generally large in number and it becomes difficult, if not impossible, to record all of them in one book of prime entry, i.e., Journal Book. For example, in a business, most of the transactions may relate to receipt and payment of cash, sale of goods and their purchase. It is convenient to maintain a separate book for each such class of transactions—one for receipts and payments of cash, one for purchase of goods and one for sale of goods. A book of this type is called a book of original entry or prime entry—it is a special form of a Journal, a sub-division of it.

For transactions recorded in such books, there will be no Journal entry. The system by which transactions of a class are first recorded in a book, specially meant for it, and then posted into a Ledger is called the Practical System of Accounting.

Meaning of Subsidiary Book

These books of original or prime entry are also called a Special Journal or Subsidiary Books since Ledger Accounts are prepared on their basis and without this process of Ledger posting, a Trial Balance cannot be drawn. The Ledger is thus called the Principal Book.

SUBSIDIARY BOOKS OR SUB-DIVISION OF JOURNAL

We had discussed earlier that it is practically difficult to record all the transactions in only one book of prime entry. For convenience, the Journal is divided into a number of Subsidiary Books. These are:

1. Cash Book: To record receipts and payments of cash, including receipts into and payments out of the bank.

2. Purchases Book: To record credit purchases of goods dealt in by the firm. All credit purchases of goods are recorded in this book.

3. Sales Book: To record the credit sales of goods dealt in by the firm.

4. Purchases Return Book: To record the return of goods previously purchased on credit.

5. Sales Return Book: To record the return of credit sales made by customers.

6. Bills Receivable Book: To record the receipts of promissory notes or bill drawn by firm and accepted by debtors.

7. Bills Payable Book: To record the issue of promissory notes or bills accepted by the firm.

8. Journal Proper: To record the transactions which cannot be recorded in any of the seven books mentioned above.

It may be noted that in all the above cases the word ‘Journal’ may be used for the word ‘book’.

Advantages of Subsidiary Books

The use of subsidiary books has the following advantages:

(i) Division of Work: Since in the place of one Journal there are many subsidiary books, accounting work can be divided among a number of persons.

(ii) Specialisation and Efficiency: When the same work is handled by a particular person for a considerable time, he acquires expertise in it and becomes efficient in handling it. Thus, accounting is done more efficiently.

(iii) Saving of Time: Various accounting processes can be undertaken simultaneously because of the use of number of books. Thus, it leads to saving of time.

(iv) Availability of Information: Since a separate book is maintained for each class of transactions, information relating to each class is available at one place.

(v) Facility in Checking: When the Trial Balance does not agree, location of error or errors is facilitated by the existence of separate books. Since the number of transactions will be considerably less as compared to only one Journal, it would become easy to locate the errors.

(vi) Responsibility: Division of work results in assigning a particular job to a particular person. If an error is committed in recording, responsibility can be easily fixed.

In this post, we shall discuss Cash Book while other Subsidiary Books shall be discussed in the next Post.

- UGC-NET June 2025 Cut-off marks & Final Answer Key

- UGC-NET December 2024 Cut-off marks

- UGC-NET December 2024 Final Answer Key

- UGC NET Official Paper 1: 19 June 2023 Shift 1

- UGC NET JUNE (Re-NET) 2024 Cut Off

CASH BOOK

Cash Book is a book of prime entry in which cash and bank transactions are recorded in a chronological order, i.e., as they occur. Cash receipts are recorded on the debit side of the Cash Book and cash payments on the credit side. A balance is struck by deducting the total cash payments from the total cash receipts to know the cash in hand, a necessary and useful information. The number of cash transactions in a firm is generally large, therefore, it is convenient to have a separate Cash Book to record such transactions.

Features of Cash Book

1. Only cash transactions are recorded in the Cash Book.

2. Cash and cheque receipts are recorded on the debit side while cash and cheque payments are recorded on the credit side.

3. It records only one aspect of the transaction, i.e., cash.

4. Cash and bank transactions are recorded in the Cash Book in a chronological order, i.e., in order they take place.

5. It performs the function of both Journal and the Ledger at the same time.

Cash Book—A Subsidiary Book and a Principal Book

Cash transactions are recorded in the Cash Book and on the basis of such record, Ledger Accounts are prepared. Therefore, the Cash Book is a Subsidiary Book. At the same time, Cash Book by itself is the Cash Account and the Bank Account. As a matter of fact, the balances are entered in the Trial Balance directly. The Cash Book, therefore, is a part of the Ledger also. Hence, it is also a Principal Book. The Cash Book is, thus, both a Subsidiary Book and a Principal Book.

Kinds of Cash Books

There are three types of Cash Books:

(i) Simple Cash Book or Single Column Cash Book: For recording cash transactions only.

(ii) Two-Column Cash Book (Cash Book with cash and bank column): For recording cash and bank transactions.

(iii) Three-Column Cash Book (Cash Book with cash, bank and discount columns): In this cash book there are three columns of amount on both the sides. The first for discount, the second for cash and the third for bank transactions. Discount allowed is recorded on the debit side, while discount received is recorded on the credit side.

In addition to the main Cash Book, firms sometimes also maintain a Petty Cash Book.

(1) Simple Cash Book or Single Column Cash Book

A Simple Cash Book looks like an account, with one account column on each side. Left-hand side records receipts of cash and the right-hand side records payments. The ruling is as follows:

In the column for:

(i) Date: Date of transaction is written.

(ii) Particulars: The name of the account under which cash has been received or payment has been made is written. In an existing business, Cash Book starts with the Opening Balance of cash written on the receipts side as ‘To Balance b/d’. A new business will not have an opening balance.

(iii) Voucher No. (V. No.): The document supporting a transaction is called a Voucher. There are two types of cash vouchers: (1) Receipt Voucher and (2) Payment Voucher. Generally, a Voucher has a serial number which is written in this column.

(iv) Ledger Folio (L.E.): It records the page number in the Ledger where the amount has been posted in the account.

(v) Amount: The amounts received are written on the Debit side and amounts paid are written on the Credit side.

Balancing of Single Column Cash Book: A Cash Book is balanced like any other account. The receipts column is always bigger than the payments column. The difference is written on the credit side as ‘By Balance c/d’. The totals are then entered in the two columns opposite one another and then on the debit side, the balance is written as ‘To Balance b/d’ to show the cash balance in hand in the beginning of the next period.

Simple Cash Book or Single Column Cash Book—Some Observations

1. When a Cash Book is maintained, a Cash Account is not opened in the Ledger.

2. Cash Book is balanced just like any other account.

3. It does not record (a) non-cash transactions, (b) cheques received or given and (c) cash discount allowed and received.

4. When an entry is recorded in a Simple Cash Book, a corresponding entry is recorded in the Ledger. For instance, if Ram pays ₹ 5,000, the receipt (or debit) entry is passed in the Cash Book and Ram’s Account is credited in the Ledger.

5. Cash Book always shows a debit balance, i.e., Cash in Hand, because cash paid cannot exceed Cash in Hand.

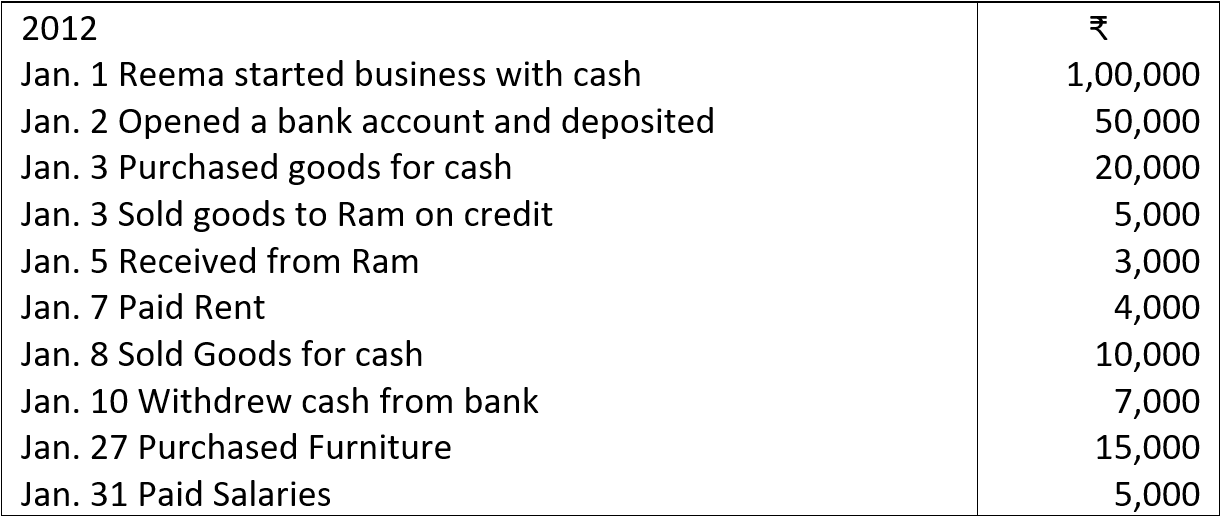

Illustration 1. Enter the following transactions in a Simple Cash Book:

Solution:

In the Books of …

Notes: One can draw the following conclusions:

1. In the Single Column Cash Book only the cash receipts and cash payments are recorded.

2. Credit transactions (Jan. 3, sold goods to Ram on credit ₹ 5,000) are not recorded.

3. The debit side will always be bigger or equal to the credit side since the payment cannot exceed the available cash.

4. It is like an ordinary account.

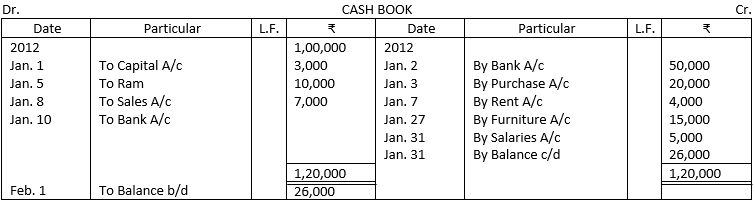

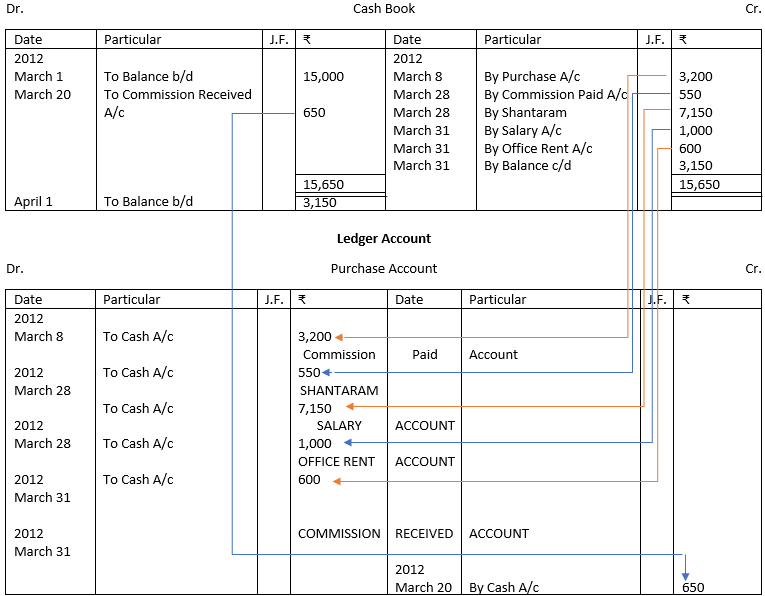

Illustration 2. Enter the following in Shri Shambunath’s Cash Book and show the balance:

2012

March 1 Balance of Cash in Hand ₹ 15,000

March 8 Purchases goods for cash from X for ₹ 3,200

March 15 Sold goods for ₹ 4,800 to Y

March 20 Received commission ₹ 650

March 20 Paid commission ₹ 550

March 28 Paid to Shantaram on account ₹ 7,150

March 31 Paid salary to the office clerk ₹ 1,000 and office rent ₹ 600

Solution:

In the Books of Shri Shambunath

Note: Credit transactions are not recorded in the Cash Book. (See transaction of 15th March, 2012, i.e., a credit sale is not recorded in the Cash Book.)

Illustration 3. Enter the following transactions in a Single Column Cash Book:

Solution:

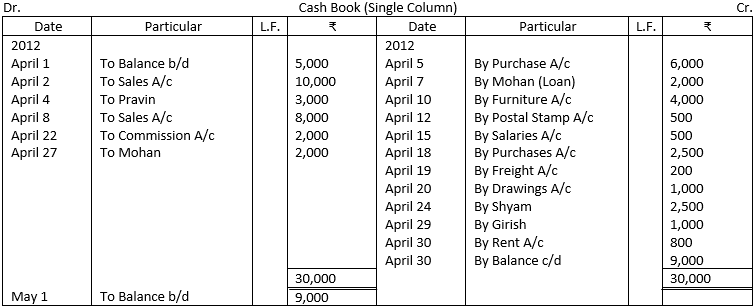

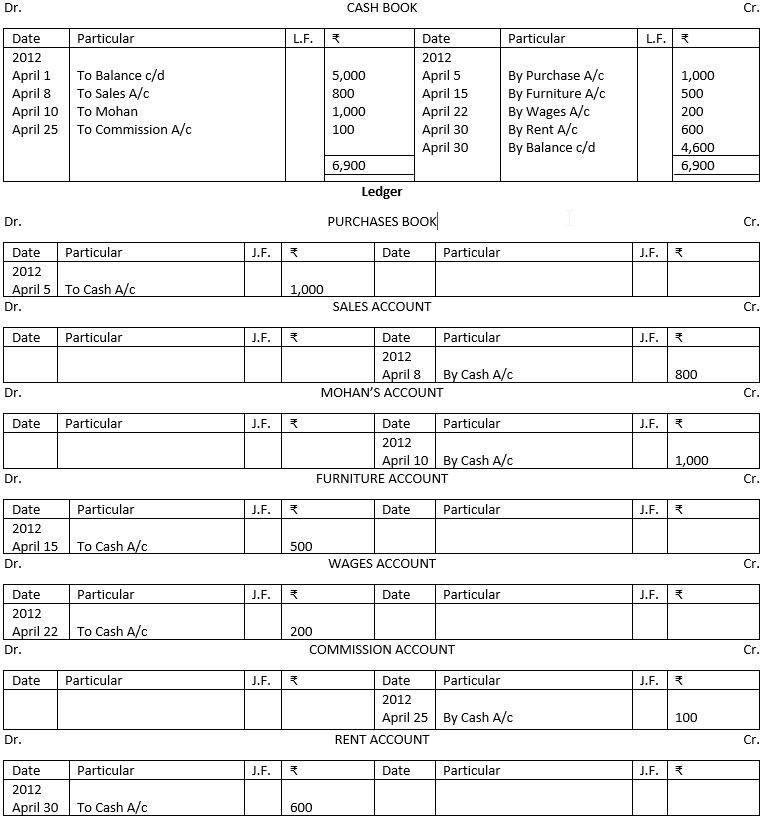

Illustration 4. Write-up Single Column Cash Book for the month of April 2012 of Rahul a trader from the following particulars:

Rule-off and balance the Cash Book on 30th April, 2012.

Solution:

In the Books of Rahul

Notes:

1. Credit purchases are not recorded in the Cash Book since the Cash Book is maintained to record only cash transactions.

2. Cheque issued to creditors ₹ 49,900 on 3rd April, is not recorded in Single Column Cash Book.

3. Cash is deposited into bank.

4. Discount allowed to Mahesh ₹ 2,500 shall be recorded through Journal entry.

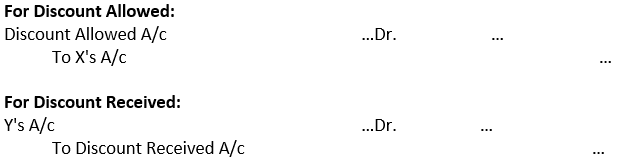

Discount allowed and discount received are accounted by passing the Journal entries.

In the above illustration entries for discount shall be as follows:

Cash Book cannot have a Credit Balance

Cash Column in the Cash Book cannot show a credit balance because cash payments cannot exceed cash receipts. At best, it can show nil balance when total cash receipts are equal to total payments.

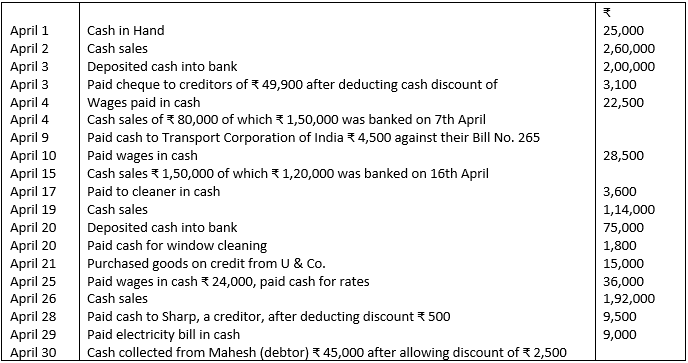

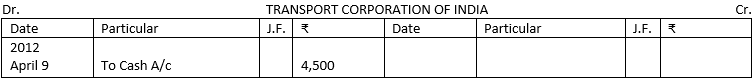

Ledger Posting from Single Column Cash Book: The posting of the debit and credit sides of Cash Book is carried out as follows:

Posting of Debit Side of Cash Book: The receipts are recorded on the debit side of the Cash Book and to complete the process of dual aspect concept they are posted to the credit side of the respective Ledger account by writing ‘By Cash’. For example, the entry for cash received from Mahesh (See Illustration 4) on 30th April, is posted to Mahesh’s Account from the debit side of Cash Book as follows:

Posting of Credit Side of Cash Book: The payments are recorded on the credit side of the Cash Book and to complete the process of dual aspect concept they are posted to the debit side of the Ledger accounts by entering ‘To Cash’. For example, the entry for payment to Transport Corporation of India (TCI) 4,500 (See Illustration 4) on 9th April is posted to the Account of TCI from the credit side of Cash Book as follows:

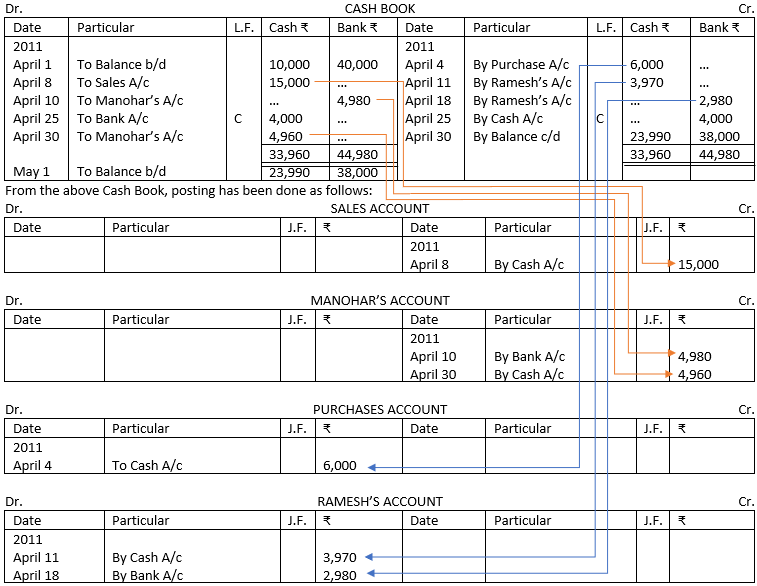

Let us take Cash Book from Illustration 2 and study the posting into Ledger.

In the Books of Shri Shambunath

Note: Opening Balance shown on the debit side of Simple Cash Book is not posted in the Ledger account. In the same manner closing balance is also not posted. It is shown on the assets side of the Balance Sheet.

Illustration 5. Enter the following transactions in a Single Column Cash Book and post them into the Ledger:

Solution:

(2) Two-Column or Double Column Cash Book (Cash Book with Cash and Bank Column)

A Two-column cash Book or Double Column cash Book is a cash Book with two columns on each side; one column for recording cash transactions and the other column for recording bank transactions, i.e., deposit of cheques or cash, issue of cheques and withdrawal of cash, etc. We can say that a Two-Column Cash Book represents two accounts, i.e., Cash Account and Bank Account.

A Bank Account is a Personal Account and while recording transactions in the bank column oft [he Cash Book, the golden rule of Debit and Credit applicable to Personal Account, i.e., ‘Debit the receiver and Credit the giver’ is followed. Thus, for cash deposited into the bank-the bank is the receiver and therefore is debited in the bank column of the Cash Book. Since cash has been deposited, i.e., cash has gone out, cash column is credited in the Cash Book. Similarly, for cash withdrawn or cheque issued—the bank would be the giver therefore, it would be credited in the bank column of the Cash Book.

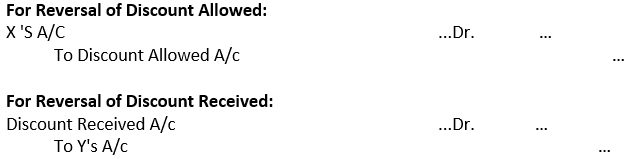

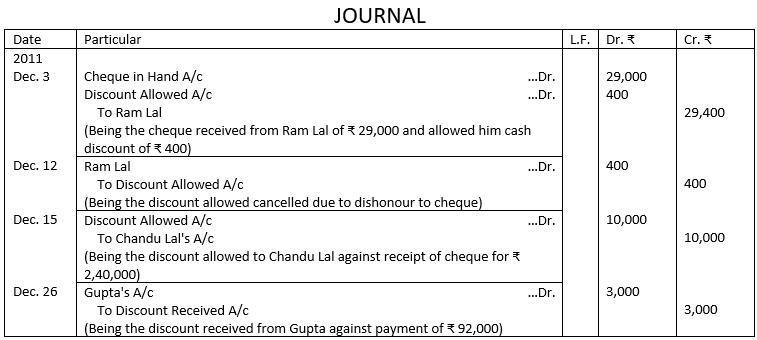

Cash discount may be received when payment is made by cheque/cash and similarly it may be allowed when payment is received by cheque/cash. Cash discount allowed or received is recorded by means of a Journal entry as follows:

In case, cheque is dishonoured discount received or allowed is also written back by passing a Journal entry in the Journal Proper as follows:

The ruling of a Two-Column Cash Book is as follows:

Two-Column or Double Column Cash Book—Some Observations

While maintaining a Two-Column Cash Book, the following points should be noted:

(i) While commencing a new business, capital is introduced in the business. The amount is written in the cash column (in Receipts Side or Debit Side) if cash is introduced and in the bank column if it is directly put into the bank with the explanation ‘To Capital Account’. If a new Cash Book is started for an existing business, the opening balance is written as: ‘To Balance b/d’.

(ii) All receipts are written on the receipts side, cash in the cash column and cheques in the bank column. In the particulars column, the name of the account under which the payment has been received is written.

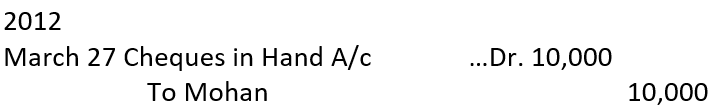

If a cheque or a draft is deposited in the bank on the same day, the amount is entered in the bank column on the debit side. But, if cheques and drafts received are not deposited in the bank on the same day, they are recorded in the books of accounts through a Journal entry as follows:

Cheques in Hand A/c …Dr.

To Ashutosh (say)

When the cheque received is deposited, it is recorded through the cash book by entering in the bank column on the receipts side as follows:

To Cheques in Hand A/c

In this manner the balance in Cheques in Hand A/c will become nil.

Example: On 27th March, 2012 a cheque is received from Mohan for ₹ 10,000.

However, the cheque is deposited into the bank on 31st March, 2012. The Journal entry passed shall be as follows:

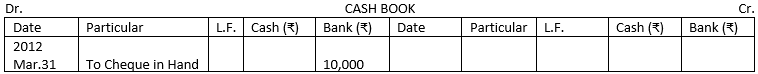

On deposit of cheque from Mohan in the bank on 31st March, 201 2, it will be recorded in the cash book as follows:

Alternative Treatment. When a cheque is received but it is not deposited in the bank on the same day, the cheque is first entered in the Cash Column on the debit side of the Cash Book. Subsequently, when the cheque is deposited in the bank, it is recorded as if cash is deposited into the bank; Bank Account is debited (by writing on the debit side in Bank Column) and Cash Account is credited (by writing in the Cash Column on the credit side).

If there is no information as to the deposit date of the cheque, it may be assumed that the cheque has been deposited on the same date.

(iii) All payments are written on the payments side, i.e., cash payments in the cash column and payments by cheques in the bank column.

In fact, if by a transaction the bank balance increases, the bank column is debited and if the balance decreases, the bank column is credited.

(iv) Contra Entry: Some transactions are recorded in a Two-Column Cash Book which relate to both cash and bank, i.e., balance of one will decrease and the other will increase due to such transactions. Such transactions are entered on both sides of the Cash Book. Such entries are known as Contra Entries. Let us take an example to understand it better.

- (a) Cash deposited into the Bank ₹ 20,000: In this transaction, Bank Account is to be debited and Cash Account is to be credited. Debit aspect is recorded on the debit side of the Bank Column and credit aspect is recorded on the credit side of Cash Column.

- (b) Cash withdrawn from Bank for Office Use 10,000: In this transaction, Cash Account is to be debited and Bank Account is credited. Debit aspect is recorded on the debit side of the Double Column Cash Book in the Cash Column and credit aspect is recorded on the credit side of the Double Column Cash Book in the Bank Column.

- Against such entries, the letter ‘C’ is written in the L.F. column to indicate that these are contra transactions and are not posted into the Ledger Account.

(v) If a cheque sent to the bank is dishonoured, i.e., the bank does not collect the amount, the uncollected amount is entered in the bank column on the credit side with the name of the cheque issuing party in the particulars column, In other words, when a cheque is received from a customer and deposited into the bank for collection but ultimately returned dishonoured, the Customer’s Account is debited and the Bank Account credited.

(vi) On the contrary, if any cheque issued by the firm is not paid on presentation, it is entered in the bank column on the debit side with the name of the party to whom the cheque was issued.

(vii) A cheque received may be given to some other party to whom payment is to be made, i.e., endorsed to a third party. The receipt and endorsement of cheque is recorded through a Journal entry. It is recorded through a Journal entry because cheque is not routed through the bank account. For example, cheque for 25,000 received from Tarun is endorsed in favour of Charnesh, the Journal entry will be as follows:

(viii) Cheques or drafts deposited by customers directly into the bank are entered in the bank column on the debit side.

(ix) Whenever the firm avails a bank service, it has to pay a charge for the service called Bank Charges. It is written on the credit side of the Cash Book and the amount is entered in the bank column.

(x) Cash Discount allowed or received are recorded by way of a Journal entry.

(xi) Discount may be allowed when the payment is received by cheque. If the cheque is dishonoured the discount is written back by passing an entry in the Journal proper. However, the entry for bank is passed in the Cash Book. Similarly, cash discount may be received when payment is made by cheque. If the cheque is dishonoured, the discount is written back by passing an entry in the Journal proper for discount. Entry for bank is recorded in the Cash Book.

Balancing of Double Column Cash Book

Cash columns are balanced in the same manner as in the case of a Simple Cash Book. The process is similar for balancing the bank column. It is possible, however, that the bank may allow the firm to withdraw more than the amount deposited. If the bank allows the firm to withdraw more than the balance, it is called an Overdraft. In such a case, the total of the bank column on the credit side will be bigger than the one on the debit side. The difference is written on the debit side as ‘To Balance c/d’. Then the totals are written on the two sides opposite one another. The balance is then entered on the credit side mentioning ‘By Balance b/d’.

Always remember, bank column may have either debit or credit balance. Debit balance in bank column shows bank balance, while credit balance in bank column shows bank overdraft. But cash book will always either have a debit balance or nil balance.

If a firm maintains cash book with bank column, there is no need to open cash and bank accounts in the Ledger.

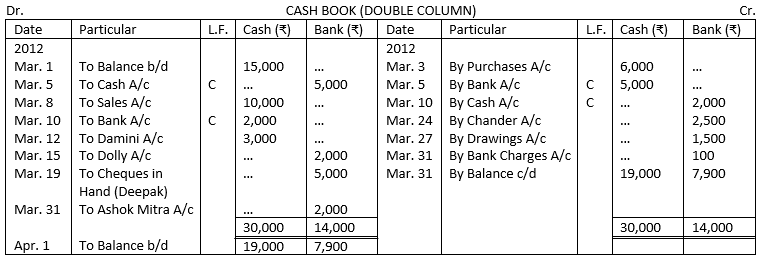

Illustration 6. Write a Double Column Cash Book with cash and bank columns from the following transactions:

2012

March

1. cash in Hand ₹ 15,000.

3. Purchase goods for cash ₹ 6,000.

5. Deposited in bank ₹ 5,000.

8. cash sales ₹ 10,000.

10. Cash withdrawn from bank for office use ₹ 2,000.

12. Received cash from Damini ₹ 3,000.

15. Received cheque from Dolly ₹ 2,000 and deposited in the bank on the same day.

18. Received cheque from Deepak for ₹ 5,000 (not banked).

19. Cheque received from Deepak deposited in bank.

24. Paid to Chander by cheque ₹ 2,500.

27. Withdrew from bank for personal use ₹ 1,500.

28. Sold goods on credit to Ashok Mitra ₹ 4,000.

30. Purchased goods on credit from Chander ₹ 5,000.

31. Received cheque from Ashok Mitra ₹ 2,000 and deposited in bank.

31. Bank charges for the month 100.

Solution:

Notes: 1. Cheque received from Deepak for ₹ 5,000 on 18th March, 2012 will be recorded in the Journal proper.

When the above cheque is deposited into bank (19th March, 2012) it will be recorded in the debit column of Bank.

2. Transactions of the 28th March and 30th March, 2012 are not recorded being credit transactions.

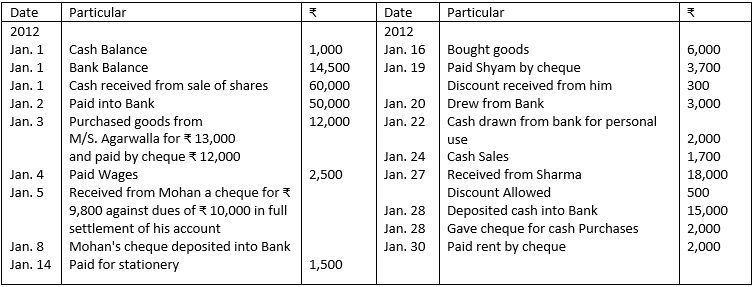

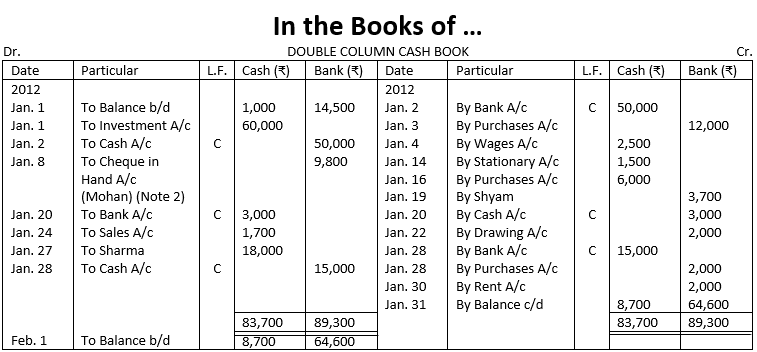

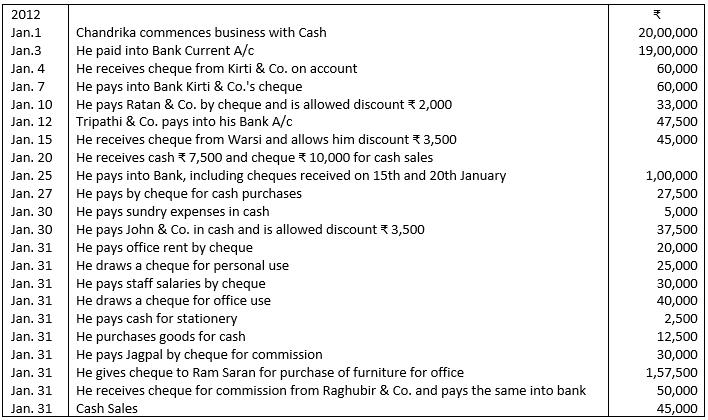

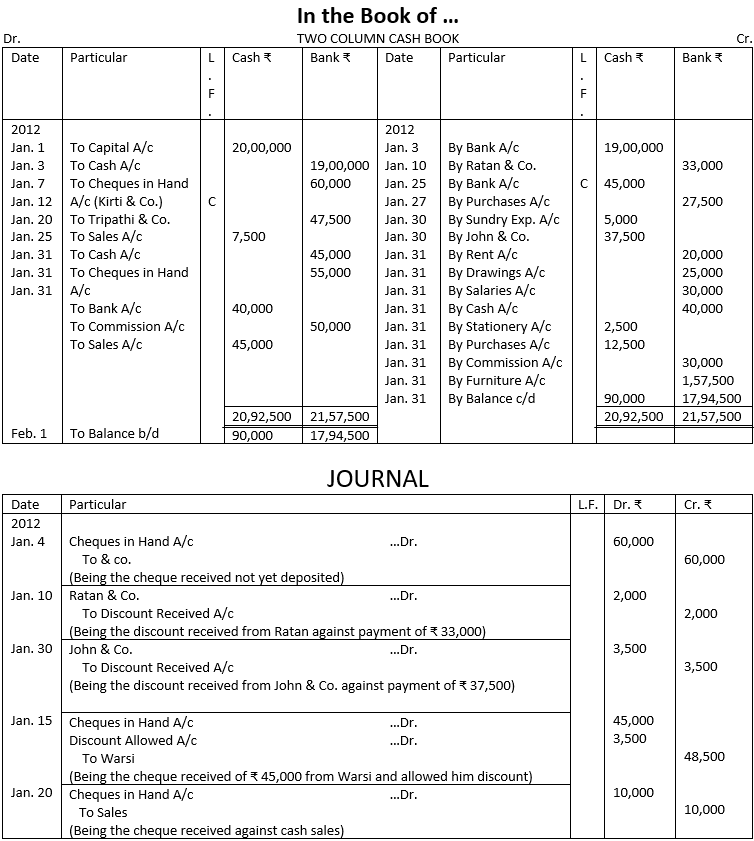

Illustration 7. Record the following transactions in a Double Column Cash Book (Cash and Bank) and balance the book on 31st January, 2012:

Solution:

Notes:

1. Discount allowed ₹ 200 to Mohan, ₹ 500 to Sharma and discount received ₹ 300 from Shyam shall be posted in the respective Ledger accounts through Journal entries.

2. Cheque received from Mohan ₹ 9,800 on 5th January, 2012 will be recorded through Journal entry: Dr. Cheque in Hand A/c and Cr. Mohan by ₹ 9,800. When it is deposited (8th January, 2012) into bank, it will be recorded in the bank column of Two Column Cash Book.

Bank Overdraft

Many a times, a firm enjoys overdraft facility from a bank. It means the firm can overdraw from its bank up to the limit allowed by the bank. Amount withdrawn in excess of its own money in the bank is known as a bank overdraft. A bank overdraft is shown as a credit balance meaning thereby that the business has to pay that amount to the bank. If a business has a credit bank balance (i.e., overdraft) in the beginning of a period, it is recorded on the credit side of the Cash Book as ‘By Balance b/d’. At the end of the period, at the time of balancing the bank column, if it is found that the debit side total is short (i.e., overdraft), the bank column is balanced by entering ‘To Balance c/d’ in the bank column on the debit side of the Cash Book. In the beginning of the following year, it is entered on the credit side of the Cash Book as ‘By Balance c/d’.

Remember the cash column will always have a ‘debit balance’ which will be shown on the assets side of the Balance Sheet or nil balance. But the bank column may have either debit or credit balance which will be shown on the assets or liabilities side of the Balance Sheet respectively.

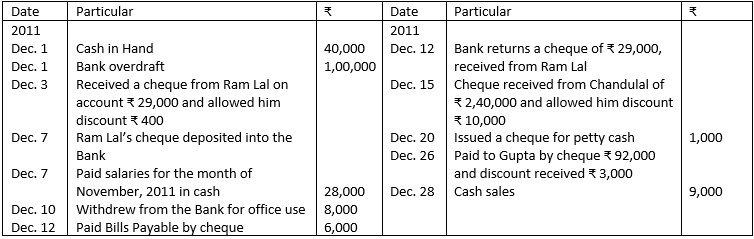

Illustration 8. Record the following in the appropriate book of original entry.

2009

Jan. 1 Cash in Hand ₹ 12,400

Jan. 1 Bank Overdraft ₹ 1,400

Jan. 3 Deposited into Bank ₹ 3,000

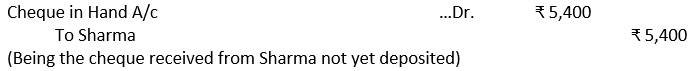

Jan. 5 Received Cheque from Sharma ₹ 5,400

Jan. 6 Deposited Sharma’s Cheque into Bank

Jan. 31 Bank Charges ₹ 65

Solution:

Note: Cheque received from Sharma on 5th January, 2009 will be recorded in the Journal proper:

When the above cheque is deposited into bank (6th January, 2009) it will be recorded in the debit column of Bank.

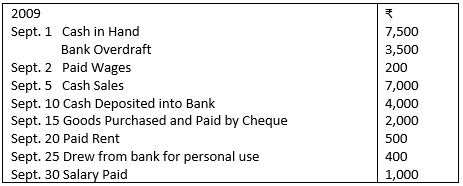

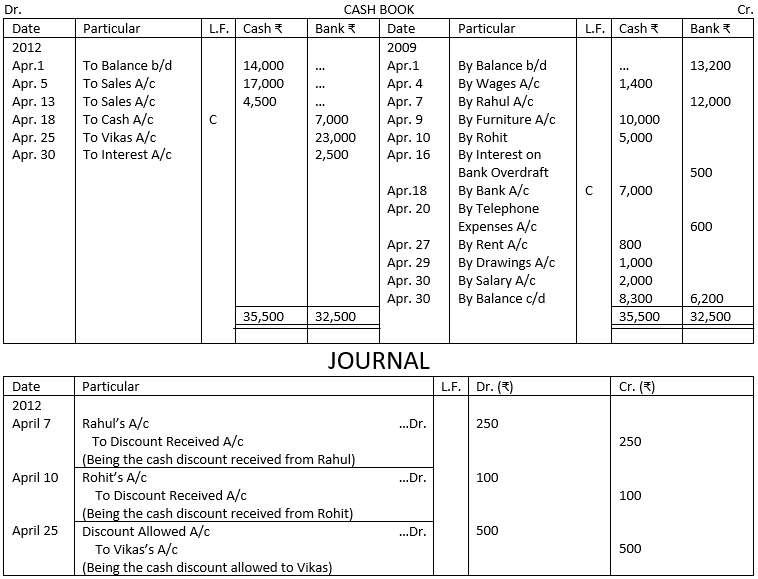

Illustration 9. Prepare a Double Column Cash Book with Cash and Bank Columns from the following information:

Solution:

Illustration 10. From the following cash and bank transactions of Mr. Gupta, owner of Gupta Stationery House, prepare a suitable Cash Book and strike the balances at the end of the month:

Solution:

Working Notes:

1. Trade Discount is not recorded separately in the books of accounts. Net amount ₹ 1,600 – ₹ 80 = ₹ 1,520 is credited to the Cash Account and debited to the Purchases Account.

2. In this case, there is no information as to the date of deposit of the cheque. Therefore, it has been assumed that the cheque has been deposited on the same date.

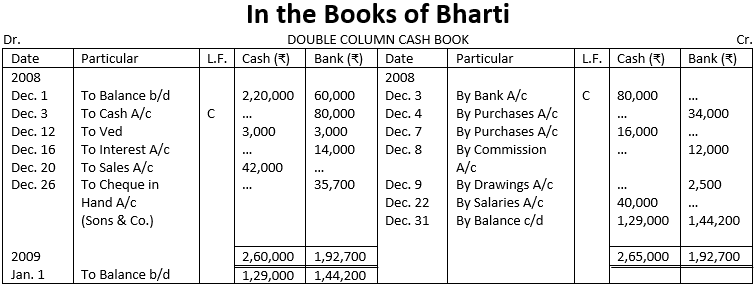

Illustration 11. Prepare the Cash Book with Bank Column of Bharti from the following transactions:

Solution:

Notes:

1. Goods sold to Sona & Co. on 22nd December, 2008 is not recorded in Cash Book since it being a credit sales.

2. Cheque received from Sona & Co. for ₹ 35,700 on 23rd December, 2008 will be recorded in the Journal Proper:

When the cheque is deposited into bank (26th December, 2008) it will be recorded in the debit column of Bank.

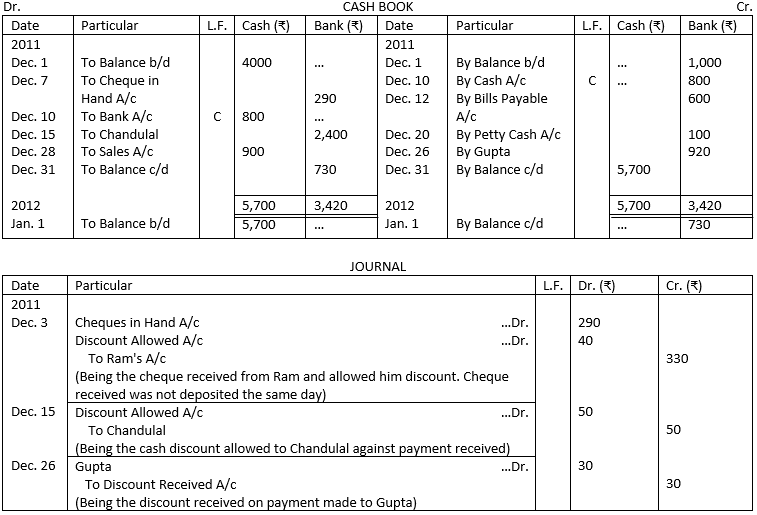

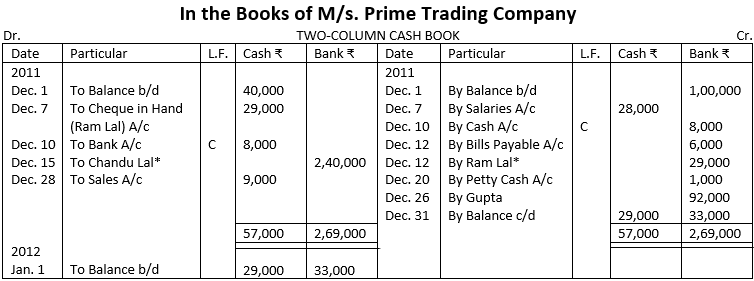

Illustration 12. Enter the following transactions of M/S. Premier Trading Company in Cash Book with Double Columns and balance the cash book as on 31st December, 2011. Also pass the Journal entries where necessary.

Solution:

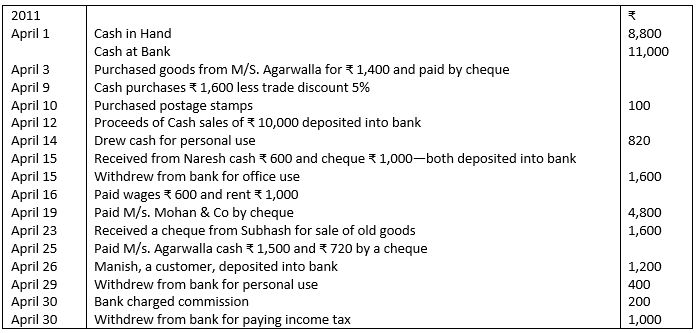

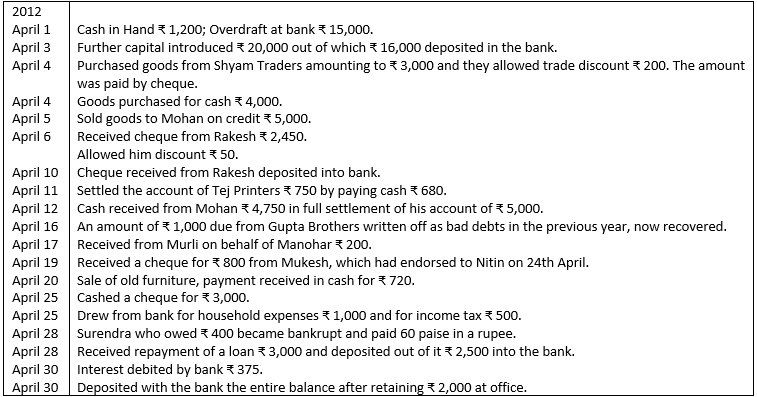

Illustration 13. Prepare a Double Column Cash Book (Cash and Bank) from the following transactions:

Solution:

Notes:

1 Goods sold to Mohan on 5th April, shall not be recorded in the Cash Book it being credit sale.

2. When a cheque is received but endorsed in favour of a creditor, the transaction is recorded through a Journal entry. It is recorded through the Journal and not Cash because cheque has neither been deposited in the bank nor has been issued to the third party. In this case we shall pass two entries one for reeving cheque from Mukesh on 19th April, 2012 and later for endorsing the cheque in favour of Nitin on 24th April, 2012.

3. On 25th April, a cheque encashed for ₹ 3,000 is treated as cash withdrawn from bank for business.

4. ₹ 45,610 – (₹ 4,000 + ₹ 680 + ₹ 2,000) = ₹ 8,930.

5. ₹ 8,930 is deposited into bank after retaining ₹ 2,000 at office on 30th April, 2012.

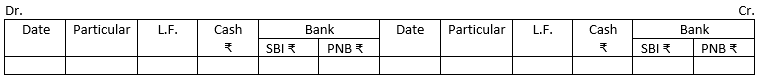

More than one Bank Account: If a firm has more than one bank account, the bank column is suitably divided to record bank transactions through different banks separately. For example. if a business enterprise has two bank accounts, one with the State Bank of India (SBI) and another with the Punjab National Bank (PNB), the bank columns on debit side as well as credit side can be divided as follows:

Illustration 14. From the following particulars, prepare a Cash Book with suitable columns:

Solution:

Ledger Posting of Two-Column Cash Book: In order to complete the double entry of transactions that have been recorded in the Two-Column Cash Book, the transactions are posted into the respective Ledger Accounts.

Posting of the Receipts Side: Transactions written on the debit side of the Cash Book are posted to the credit side in the Ledger Accounts. In the ‘Particulars Column’ of the Ledger, ‘By Cash Account’ is written for cash transactions and ‘By Bank Account’ for bank transactions. Amount of the transaction is written in the ‘Amounts Column’.

Posting of the Payment Side: Transactions written on the credit side of the Cash Book are posted to the debit side in the Ledger Accounts. In the ‘Particulars Column’ of the Ledger, ‘To Cash Account’ is written for cash transactions and ‘To Bank Account’ for bank transactions. Amount of the transaction is written in the ‘Amounts Column’. ‘Contra entries’ are not posted into a Ledger.

‘Contra entries’, i.e., the transaction between cash and bank are not posted into the Ledger.

Illustration 15. Prepare the Cash Book from the following transaction of M/s. Advance Technology Zone for the month of April, 2012 and post them to the related Ledger Accounts.

Solution:

In the Books of M/s. Advance Technology Zone

Illustration 16. Enter the following transactions of M/S. Prime Trading Company in Cash Book with Bank Column. Balance the Cash Book as on 31st December, 2011:

Solution:

*In this case, there is no information as to the date of deposit of the cheque. Therefore, it has been assumed that the cheques has been deposited on the same day.

*Entry for written back ₹ 400 discount will be passed in the Journal Proper.

Illustration: 17 Enter the following transactions in Two-Column Cash Book with Cash and Bank Columns.

Solution:

PETTY CASH BOOK

Petty Cash Book is the book which is used for the purpose of recording expenses involving petty amounts. Besides petty expenses, receipts from main cash are recorded. Petty Cash Book is prepared by Petty Cashier and acts as the Petty Cash Account.

In a business besides large payments, a number of small payments, such as for conveyance, stationery, cartage, etc., have to be made. If all these payments are recorded in the Cash Book, it will become unwieldy. Also, the main cashier will be overburdened with work. Therefore, it is usual for firms to appoint a person as ‘Petty Cashier’ and to

entrust the task of making small payments, say, below ₹ 250, to him. Of course, he is reimbursed for the payments made. The respective accounts are debited.

Recording of Petty Cash

Petty cash given to the Petty Cashier for small payments is recorded on the credit side of the Cash Book as ‘By Petty Cash Account’ and is posted to the debit side of the Petty Cash Account in the Ledger.

SYSTEM OF PETTY CASH

Petty Cash Book may be maintained by ordinary system or by imprest system.

In case of Ordinary System of Petty Cash, Petty Cashier is given a certain amount of cash and after spending the whole of that amount, he submits the account to the Head Cashier.

Imprest System of Petty Cash

Under this system, an estimate is made of amount required for petty expenses for a certain period (say for a week, a fortnight or a month). The amount so ascertained is given to the petty cashier in the beginning of a period and is reimbursed the amount paid by him during the period. Thus, he will again have the fixed amount in the beginning of the new period. This amount is called imprest money. This system of paying advance in the beginning and reimbursing the amount spent from time to time is called imprest system.

Advantages of Imprest System of Petty Cash

(i) Control Over Mistakes: The Petty Cash Book is checked by the cashier at regular intervals so that a mistake, if committed, is soon rectified.

(ii) Control Over Petty Expenses: Petty expenses are kept within the limits of imprest since the petty cashier can never spend more than the available petty cash.

(iii) Control Over Fraud: Under this system defalcation of cash can be minimised since the Petty Cashier is not allowed to draw cash as and when he desires.

Types of Petty Cash Books

Following are the two types of Petty Cash Books:

1. Simple Petty Cash Book

2, Analytical Petty Cash Book.

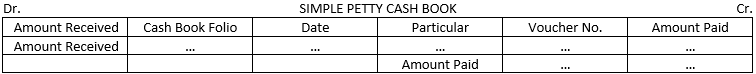

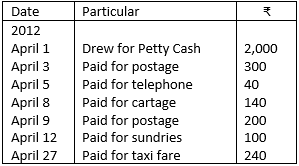

Simple Petty Cash Book: A Simple Petty Cash Book is identical with a Cash

Book. Any cash which the Petty Cashier receives will be recorded on the left-hand side cash column (debit column) and any cash which he pays out will be recorded on the right hand side payment column. The date and particulars of every transaction will be written in the same date and particulars column.

A specimen form of a Simple Petty Cash Book is given below:

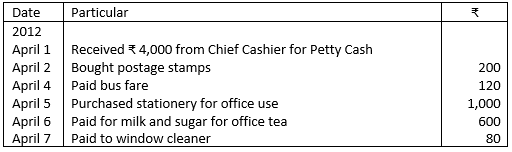

Illustration 18. From the following information, write up a Simple Petty Cash Book for the 1st week of April, 2012:

Solution:

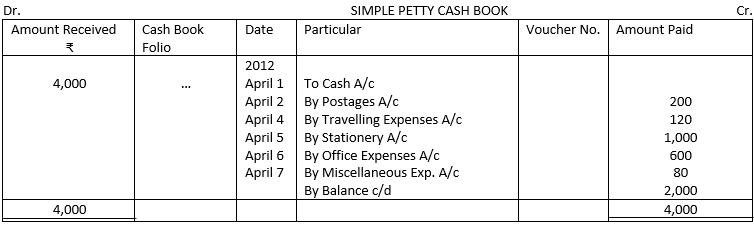

Illustration 19: From the following particulars, prepare a Petty Cash Book for the month of April, 2012:

If the imprest amount is ₹ 2,000, show what amount the Petty Cashier would be entitled to draw in the beginning of the next month.

Solution:

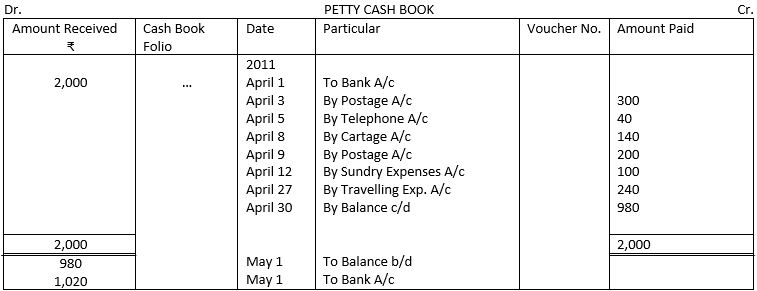

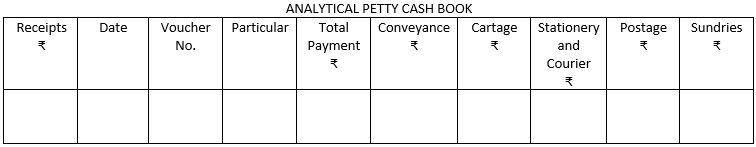

2. Analytical Petty Cash Book: An Analytical Petty Cash Book has two sides, the left-hand side is used for recording receipts of cash (which will be only from the main cashier) and right-hand side, which is used for recording payments. In the Analytical Petty Cash Book, a separate column is provided for recording a particular item of expenditure, i.e., postage, stationery, traveling, advertisement, etc. A column is usually provided for ‘sundries’ to record infrequent payments. When a petty expense is recorded on the right-hand total payment column, the same amount is immediately recorded in the appropriate expense column. At the end of a particular period, all the analysis (expenses) columns are added and posted to the debit side of the respective accounts.

A specimen form of Analytical Petty Cash Book is given below:

In an Analytical Petty Cash Book, petty expenses are classified into different heads of expenses. Each head of expenses under different head; can be conveniently transferred to appropriate account head in the ledger. Thus, posting from Petty Cash Book becomes easy.

While maintaining a Petty Cash Book, the following points should be noted:

(i) The amount fixed for petty cash should be sufficient for the likely small payments for a relatively short period, say, for a week, a fortnight or a month.

(ii) Reimbursement should be made only when the Petty Cashier prepares a statement showing total payments supported by vouchers, i.e., documentary evidence and should be limited to the amount of actual disbursements.

(iii) The vouchers should be filed in order.

(iv) No payment should be made without proper authorisation. Also, payments above a certain specified limit should be made only by the main cashier or with his consent only.

(v) The Petty Cashier should be allowed to receive only the reimbursement.

Balancing the Petty Cash Book

A Petty Cash Book is balanced at the end of the month or a specified period. The columns for payments and expenses are totalled and the total equals the total in the ‘Total Payment Column’. Thereafter, the Petty Cash Book is balanced. The method of balancing the Petty Cash Book is the same as that of a Simple Cash Book.

DIFFERENCE BETWEEN SIMPLE AND ANALYTICAL PETTY CASH BOOK

| Simple Petty Cash Book | Analytical Petty Cash Book |

|---|---|

| 1. Separate record of each kind of petty expenses is not maintained. | The analysis columns are used for each commonly occurring item of expenses such as stationery, postage and traveling, etc. |

| 2. It is written just like a Cash Book. The pages are divided down the centre. | The pages are not divided down the centre, major space is provided for credit side. |

| 3. At the end of the period, total expenses under different heads cannot be determined easily. | At the end of the period, total expenses under different heads can be determined easily. |

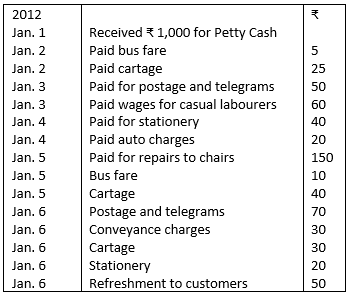

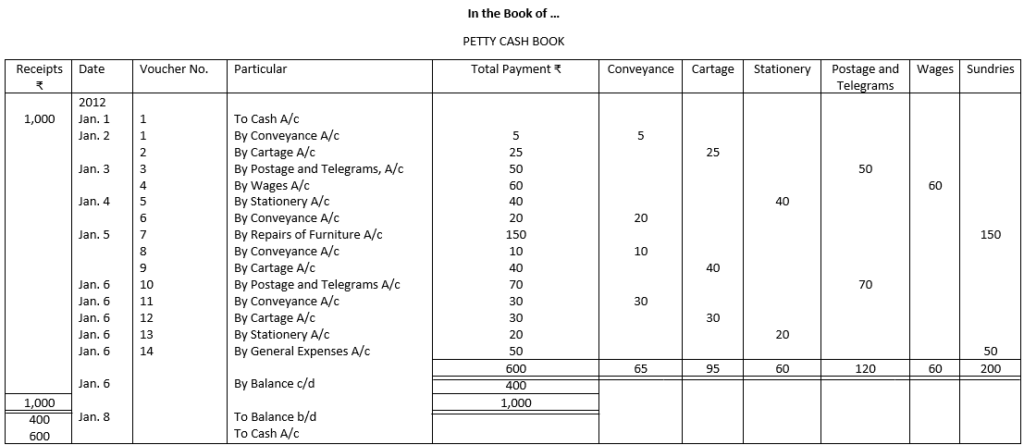

Illustration 20: Prepare an Analytical Petty Cash Book on the Imprest System from the following:

Solution:

Note: Expense occurring casually are entered into the sundries column and thereafter into the correct account. On 8th January, the Petty Cashier will get ₹ 600 so that his cash balance is ₹ 1,000 again.

Posting the Petty Cash Book

Posting in the Ledger from the Petty Cash Book is done at the end of the period, i.e., month or quarter as the case may be. Petty Cash Book is considered as a memorandum book. The petty expenses are not directly posted to ledger accounts. A petty cash account is maintained in the ledger.

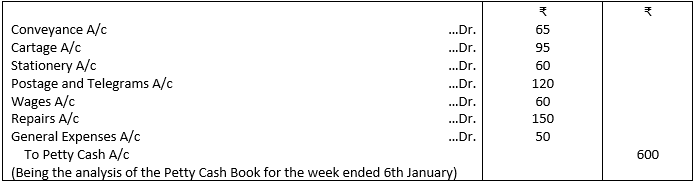

When Petty Cash is advanced to the petty cashier, the chief cashier will record it on the credit side of Cash Book as “By Petty Cash A/c”. At the end of specified period (say a week. a fortnight or a month), for the total expenses paid a Journal entry shall be passed by debiting to individual petty expenses and crediting to Petty Cash Account. All the accounts relating to petty expenses shall be maintained in the ledger individually. Posting will be made on the debit side of these accounts by writing “To Petty Cash A/c” in the Particulars Column.

(a) When money is advanced to the Petty Cashier:

Petty Cash A/c …Dr.

To Cash A/c

(b) On submission of accounts by the Petty Cashier:

Expenses A/c …Dr.

To Petty Cash A/c

(Each expense is to be debited separately with the expenditure incurred the period as shown by the Petty Cash Book.)

Thus, in the Ledger, there is a Petty Cash Account as well as separate Expenses Accounts for each of the expenses.

In Illustration 20, the Journal entry and the relevant accounts will be as follows:

Journal entry (if required) for cash handed over to the Petty Cashier will be passed as follows:

In the Books of…

Ledger

Advantages of Petty Cash Book

The advantages of maintaining a Petty Cash Book are:

(i) Time Saving: Saves the Chief Cashier’s time.

(ii) Labour Saving: Saving of labour in writing up the Cash Book and posting into the Ledger.

(iii) Control: It provides control over small payments.

(iv) Convenience in Preparing Ledger Accounts: The totals are only taken to post them into the Ledger. No unnecessary details are to be given. Hence, it is convenient to post these directly into the Ledger.

The end

- UGC-NET June 2025 Cut-off marks & Final Answer Key

- UGC-NET December 2024 Cut-off marks

- UGC-NET December 2024 Final Answer Key

- UGC NET Official Paper 1: 19 June 2023 Shift 1

- UGC NET JUNE (Re-NET) 2024 Cut Off