Learning Objectives

This Post would enable you to understand:

- Meaning of a Bank Reconciliation Statement

- Need and Importance of a Bank Reconciliation Statement

- Reasons of Difference between Cash Book and Pass Book Balances

- Methods of Preparing a Bank Reconciliation Statement

- Presentation of a Bank Reconciliation Statement

- Preparation of a Bank Reconciliation Statement from Corrected Cash Book Balance

Table of Contents

MEANING OF A BANK RECONCILIATION STATEMENT

Crystal Clear Definition: A Bank Reconciliation Statement is a statement prepared on a particular date to reconcile the bank balance as per the Cash Book with the balance as per the Bank Pass Book or Bank Statement by showing reasons for differences between the two.

Amount deposited into a bank is recorded in the Bank Column of a Two-Column Cash Book on the debit side while withdrawals are recorded on the credit side.

The bank also maintains an account of the customer in its books of accounts.

Deposits made by the customer are recorded on the credit side of the Customer’s Account and withdrawals on the debit side.

A copy of it is given to the customer for his knowledge in the form of a Pass Book or a Statement of Account.

Debit entries in the Cash Book are reflected on the credit side of the Bank Statement or Bank Pass Book, while credit entries in the Cash Book are reflected on the debit side of the Bank Statement or Bank Pass Book.

As the transactions relating to deposits and withdrawals made during a period are recorded in both Cash Book and the Pass Book, the balances shown by the two records at the end of a period should normally agree.

But, sometimes the two balances differ. If the two balances differ, it becomes necessary to know the reasons for the difference.

A statement showing the reasons or causes of differences is prepared. This statement is known as a Bank Reconciliation Statement.

NEED AND IMPORTANCE OF A BANK RECONCILIATION STATEMENT

A Bank Reconciliation Statement is required and is important because of the following reasons:

1. It brings out any error that may have been committed either in the Cash Book or in the Pass Book.

2. Any undue delay in the clearance of cheques is highlighted by the reconciliation.

3. Regular reconciliation discourages embezzlements.

4. Reconciliation helps the management to check the accuracy of entries recorded in the Cash Book and keep track of cheques, etc., which may have been sent to the bank for collection.

5. It reflects actual bank balance.

REASONS OF DIFFERENCE BETWEEN CASH BOOK AND PASS BOOK BALANCES

Balances as per books of accounts and Pass Book may differ under some situations. We can broadly classify these situations into three categories:

1. Difference Due to Timing: There is always a time gap between recording a transaction in the books of accounts and it being recorded by the bank for example, a cheque issued is recorded in the books of accounts immediately but the bank will record it when it is presented for payment.

Similarly, a cheque deposited is recorded in the books of accounts immediately whereas the bank grants credit on the clearing of the cheque. Thus, there is always a time gap between the two. So, if a Bank Reconciliation Statement is prepared in between the two dates, differences will exist.

2. Transactions Recorded by the Bank: Sometimes transactions are recorded by the bank, which are not known to the account holder. For example. interest charged or allowed, bank charges, transfer of balance from one account to another.

The account holder comes to know about it after receiving the Bank Statement. Such transactions in the Bank Statement lead to a difference between the Cash Book and the Bank Statement balance.

3. Errors: Errors may be committed by the bank or the account holder and these errors lead to difference in the balances of Cash Book and Bank Statement. For example, wrong balance may be carried forward, a transaction may not have been recorded in the Cash Book or a transaction may have been wrongly recorded in another account.

Let us elaborate on the reasons of differences.

1. Difference Due to Timing

(i) Cheques Issued but not yet Presented for Payment: When a cheque is issued for payment, an entry in the Cash Book is recorded immediately. But the entry is recorded by the bank only when the cheque is presented for payment. There will, thus, be a gap of few days between the entry in the Cash Book and in the Pass Book.

If the Bank Reconciliation Statement is prepared on a date between the issue of cheque and its presentation to the bank for payment, a difference will arise.

Let us take an example for better understanding. Suppose, a cheque of ₹ 2,000 is issued on 27th December, 2009 which is presented to the bank on 2nd January, 2010. The issue of cheque will be recorded in the Cash Book on 27th December, 2009 whereas the bank will record it in the Pass Book on 2nd January, 2010. On 31st December, 2009, the Cash Book balance will be less by ₹ 2,000 due to this reason.

(ii) Cheques Paid into the Bank but not yet Cleared: Cheques sent to the bank are recorded in the bank column on the debit side of the Cash Book. But banks credit the customer’s account when they have received the payment from the other bank— in other words, when the cheques have been cleared.

Again, there will be a gap of few days between the deposit of the cheques and the credit given by the bank. Therefore, a difference will arise on a particular date in the bank balance as per the books and the bank.

For example, a cheque of ₹ 1,000 is deposited into the bank on 30th March, 2010 which is collected by the bank on 4th April, 2010. Now, if the balances on 31st March, 2010 are compared, the Cash Book balance will be higher by ₹ 1,000.

2. Transactions Recorded by Bank

(iii) Interest Credited by the Bank but not Recorded in the Cash Book: If the bank allows interest to a customer, it credits the customer’s account and his balance would increase.

But the customer will make the corresponding entry in the Cash Book at the end of the month or when he comes to know about this. Until then, the balance as per the Pass Book would be more than the balance as per the Cash Book.

(iv) Bank Charges and Interest Charged by Bank but not Entered in the Cash Book: Bank renders certain services to its customers for which it charges an amount known as Bank Charges.

Similarly, bank provides overdraft facilities for which it charges interest. As soon as these charges are made, the bank debits the customer’s account in its books and thus reduces the bank balance. But the customer comes to know about them only when he receives the Bank Statement or Pass Book and then he credits the Bank Account in his Cash Book. Until then, the balance as per the Pass Book would be less than the balance as per the Cash Book.

(v) Interest and Dividends Collected by the Bank: Sometimes investments are left in the safe custody of the bank. The bank collects interest or dividend on the due dates and credits them to the customer’s account. The bank then sends the necessary information to this effect to the customer. Naturally, the customers record it in their Cash Books either on receiving such information from the bank or noticing it from their pass Book. The entries in the Pass Book and in the Cash Book may thus be on different dates. Until then, the balance as per the Pass Book would be more than the balance as per the Cash Book.

(vi) Direct Payments by the Bank: The bank may be given standing instructions for certain payments such as for insurance premiums. When the bank makes such payments, it immediately debits the customer’s account. In this case, also the customer may come to know of the payment only on perusing the Pass Book. Entries in the Pass Book and in the Cash Book will thus be on different dates.

(vii) Direct Payment into the Bank by a Customer: If a payment is received by the bank directly, it will be recorded in the customer’s account and also in the Pass Book. The account holder may come to know of the amount on a later date only when he peruses the Pass Book.

(viii) Dishonour of a Bill Discounted with the Bank: If the bank is not able to receive payment on Promissory Notes discounted by it, it will debit the customer’s account together with any charges that it may have incurred. The customer will naturally record the entry only when he peruses the Pass Book. But till such entry is recorded, the balances shown by Cash Book and Pass Book will differ.

(ix) Bills Collected by the Bank on Behalf of the Customer: If goods are sold, the documents may be sent through the bank. If the bank is able to collect the amount, it will credit the customer’s account. The customer may make the entry only on receiving the Pass Book on a later date.

3. Errors

(x) Errors and Omissions: Errors and Omissions either in the Cash Book or in the Pass Book would cause disagreement between the balance as per the Cash Book and the balance as per the Pass Book. It may be possible that while recording the transactions in the Cash Book, a cheque of ₹ 1,000 deposited into the bank is recorded as ₹ 10,000. Similarly, the bank may also commit a mistake while recording the transactions in the Pass Book. For example, a cheque collected on behalf of Mohan is entered in the account of Mahesh. Such errors would also lead to differences in the balances between the Cash Book and the Pass Book.

Ascertaining the Reasons or Causes of the Difference in the Balance:

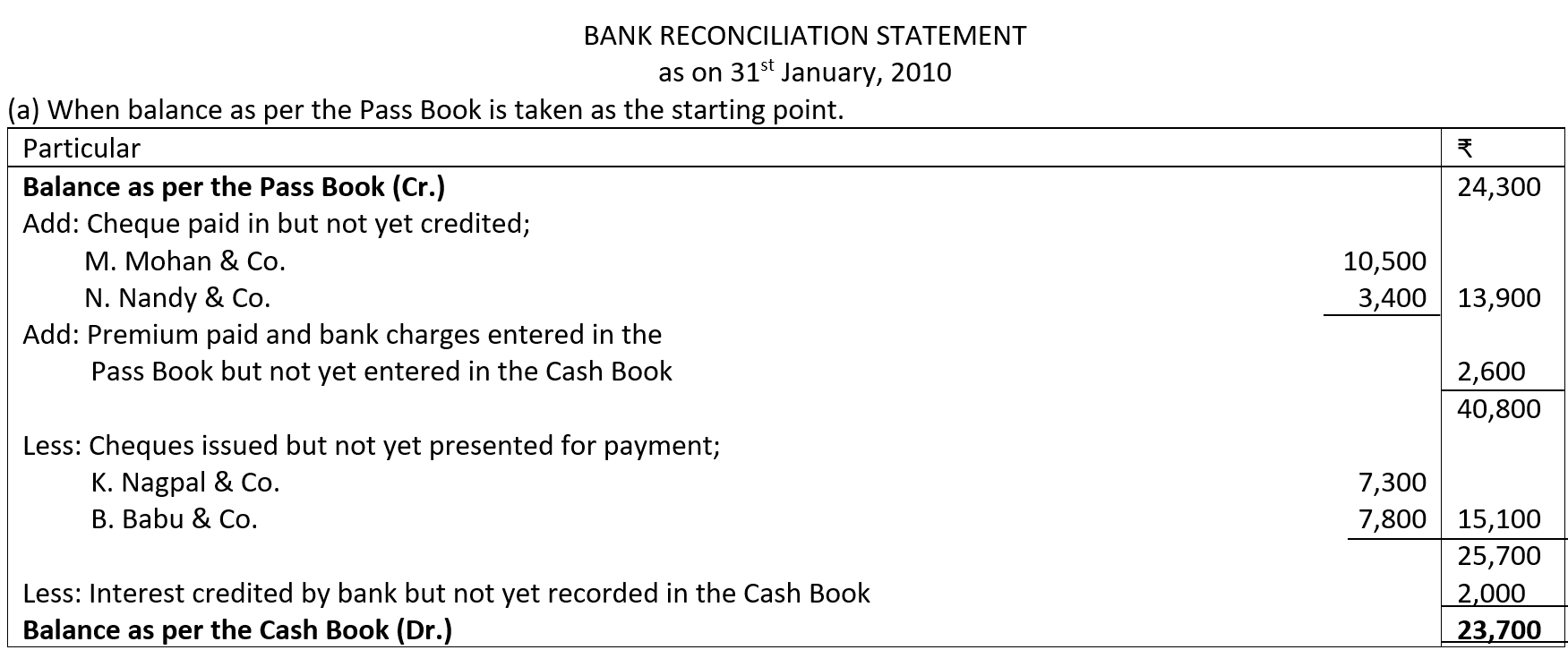

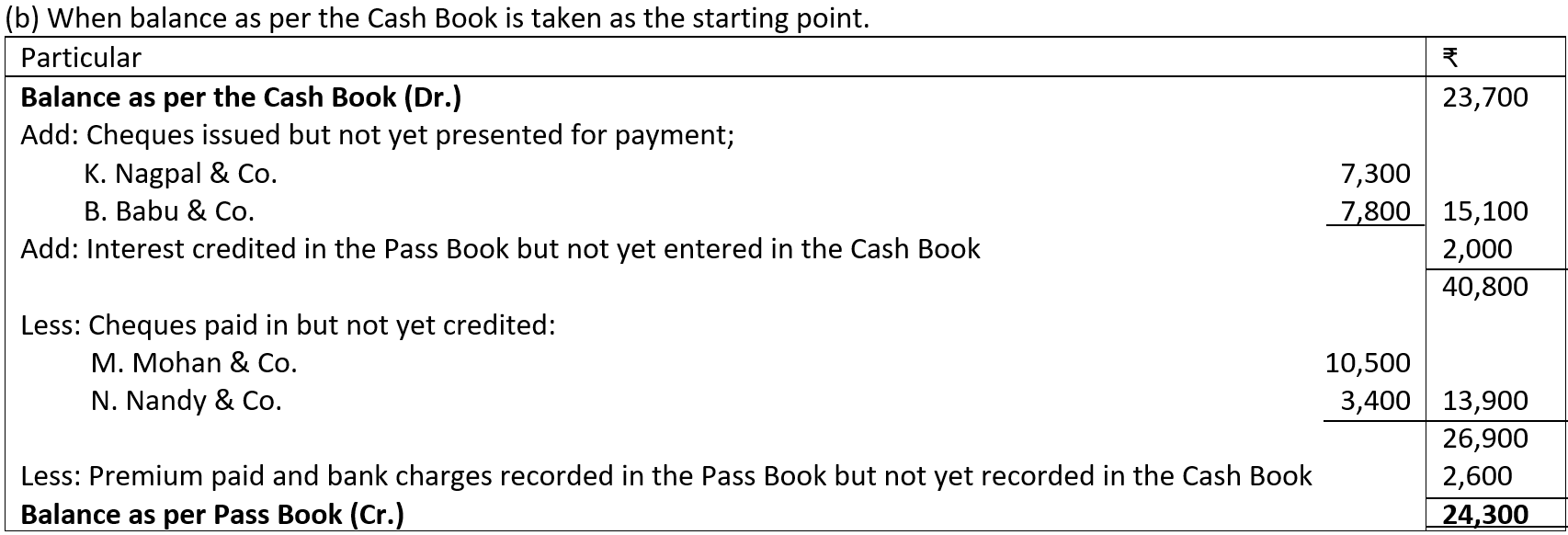

The causes of the difference are ascertained when items in the Pass Book and in the Cash Book are compared. To illustrate this, we give below an extract from a Pass Book and the bank columns in the Cash Book.

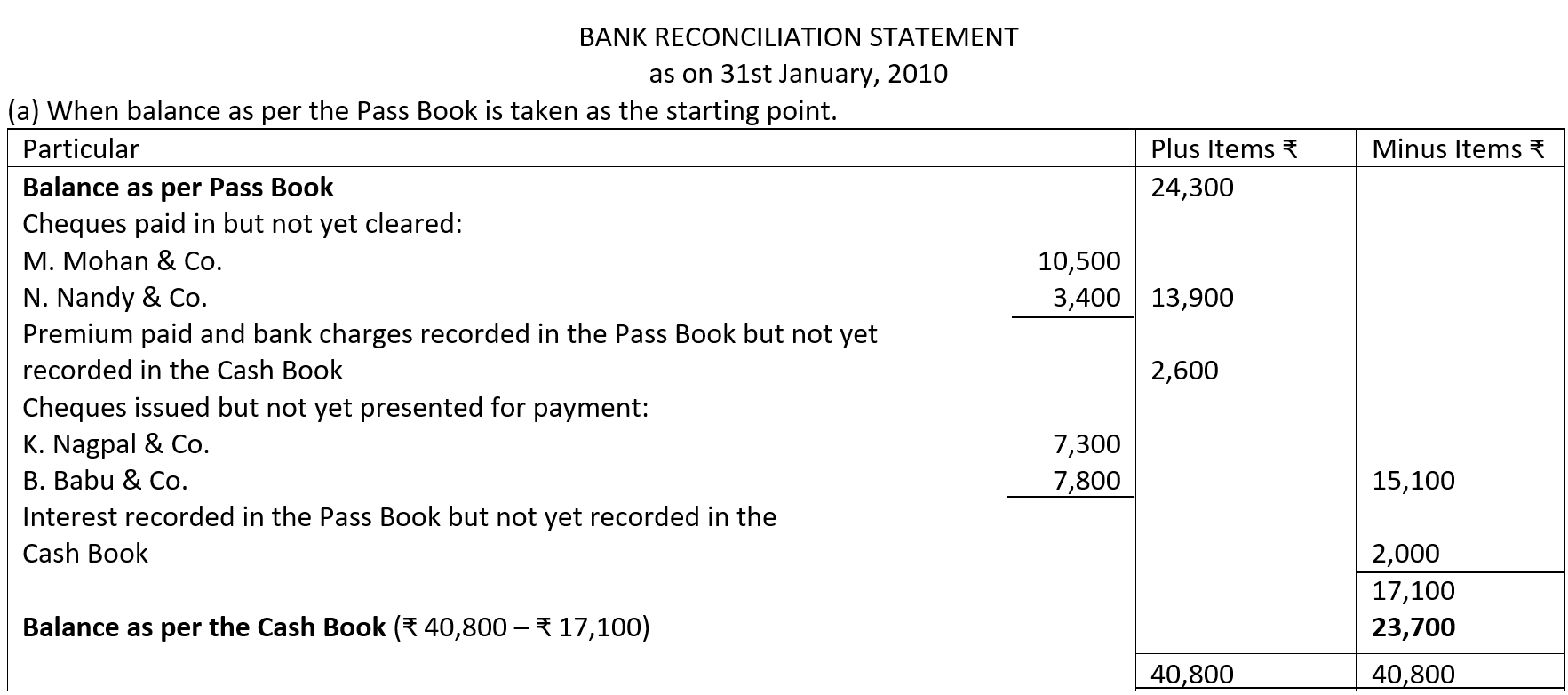

It will be seen that whereas the Pass Book shows a balance of ₹ 24,300, the Cash Book shows a balance of ₹ 23,700. Let us try to compare the two balances to establish the causes for the difference.

If we compare the debit side of the Cash Book with the deposits column of the Pass Book, we will find that the following cheques have been sent to the bank but have not been credited by the bank:

M. Mohan & Co. ₹ 10,500

Total ₹ 13,900

N. Nandy & Sons ₹ 3,400

Had these two accounts been recorded in the deposits column of the Pass Book also, the Pass Book balance would have been ₹ 38,200, i.e., ₹ 24,300 + ₹ 13,900. Looking at the withdrawals column of the Pass Book and the credit side of the Cash Book, we find that the following two cheques have not yet been paid by the bank:

K. Nagpal & co. ₹ 7,300

Total ₹ 15,100

B. Babu & co. ₹ 7,800

Had these cheques been presented and paid, the balance at the bank would have been ₹ 23,100, i.e., ₹ 38,200 – ₹ 15,100.

In addition to the above, two accounts appear in the withdrawals column of the pass Book but not on the credit side of the Cash Book. These two accounts are 2,500 premium and 100 bank charges. Had these amounts also been omitted from the withdrawals column, the balance at the bank would have been ₹ 25,700, i.e., ₹ 23,100 + ₹ 2,600.

There is one amount of ₹ 2,000, i.e., interest collected, which has been entered in the deposits column of the Pass Book but not on the debit side of the Cash Book. Omission of this amount from the Pass Book also would reduce the balance to ₹ 23,700, i.e.,

₹ 25,700 — ₹ 2,000. This agrees with the Cash Book balance. Thus, this process shows that the difference between the two balances arises only because there are some entries which have been recorded in the Cash Book but not in the pass Book or vice versa. A comparison of the two books shows up such entries and then, on that basis, the reconciliation is prepared. To illustrate it again, let us proceed from the Cash Book balance of ₹ 23,700. Since cheques totalling ₹ 13,900 have not been entered in the Pass Book, let us assume that they are also omitted from the Cash Book. This will thus reduce the Cash Book balance to ₹ 9,800. Cheques totalling ₹ 15,100 have been entered on the credit side of the Cash Book but not in the Pass Book. Their omission from the Cash Book will increase the Cash Book balance to ₹ 24,900. Amounts totalling ₹ 2,600 have been entered in the withdrawals and its recording in the Cash Book will reduce the balance to ₹ 22,300. The deposits column of the Pass Book shows an entry of ₹ 2,000 which is not found on the debit side of the Cash Book. An entry made in the Cash Book will increase the balance to ₹ 24,300, as shown in the Pass Book. Thus, the two balances stand reconciled.

METHODS OF PREPARING A BANK RECONCILIATION STATEMENT

A Bank Reconciliation Statement is prepared by starting with one of the balances— the Cash Book balance or the Pass Book balance. Then the causes that lead to the difference are ascertained. The starting balance is then adjusted by noting how the balance would have changed if the same entries were made in the two books.

Note: Any transaction which has been correctly recorded in both the Cash Book as well as in the Pass Book within the date of preparing the Bank Reconciliation Statement is not considered while preparing the Bank Reconciliation Statement. The items which have been entered in the Cash Book and not in the Pass Book or have been entered in the Pass Book and not in the Cash Book are considered.

Starting with Cash Book Balance

✔If we start Bank Reconciliation Statement with favourable balance (Dr. Balance) as per the Cash Book, we determine the items that have led to the difference in the balances of Cash Book and Pass Book. Thereafter, each item of difference is analysed to ascertain whether each item has led to increase or decrease in the Cash Book balance.

Items of differences which have led to decreased Cash Book balance (e.g., cheques issued but not presented for payment, interest credited by the bank but not recorded in the Cash Book, etc.) are added to the Cash Book balance.

Similarly, items of differences which have led to increased Cash Book balance (e.g., cheques deposited but not credited by bank, bank charges charged by the bank, etc.) are deducted from the Cash Book balance.

The addition and deduction of above amounts lead us to the balance as per the Pass Book.

✔If we start Bank Reconciliation Statement with unfavourable or bank overdraft (Cr. Balance) as per the Cash Book, then we ascertain whether each item causing difference has led to increase or decrease in the overdraft Cash Book balance.

Items of differences which have led to increased overdraft Cash Book balance (e.g., cheques issued but not presented for payment, interest credited by the bank; etc.) are deducted from overdraft Cash Book balance.

Similarly, items of differences which have led to decreased overdraft Cash Book balance (e.g., cheques deposited but not credited by bank, bank charges charged by the bank, etc.) are added to the overdraft Cash Book balance.

The deduction and addition of above amounts, lead us to the balance as per the Pass Book.

Starting with Bank Pass Book Balance

✔ If we start Bank Reconciliation Statement with favourable balance (Cr. Balance) as per the Pass Book, we determine the items that have led to the differences in the two balances. Thereafter, each item causing difference is analysed whether it has led to increase or decrease in the balance as per the Pass Book.

Items of differences which have led to increased Pass Book balance (e.g., cheques issued but not presented for payment, interest credited by bank, etc.) are deducted from the Pass Book balance.

Similarly, items of differences which have led to the decreased Pass Book balance (e.g., cheques deposited but not credited, bank charges charged by bank, etc.) are added to the Pass Book balance.

The adjustments of above amounts lead us to the balance as per the Cash Book.

✔If we start Bank Reconciliation Statement with unfavourable balance or bank overdraft (Dr. Balance) as per the Pass Book, we determine the items that have led to the differences in the two balances. Thereafter, each item causing difference is analysed whether it has led to increase or decrease in balance as per the Pass Book.

Items of differences which have led to increased overdraft Pass Book balance (e.g., cheques deposited but not credited, bank charges charged by bank, etc.) are deducted from the overdraft Pass Book balance.

Similarly, items of differences which have led to decreased overdraft Pass Book balance (e.g., cheques issued but not presented for payment, interest credited by bank, etc.) are added to the overdraft Pass Book balance.

The adjustments of above amounts lead us to the balance as per the Cash Book.

Apart from the above, the following points should also be borne in mind, while preparing this statement:

(i) Date: The date on which the Bank Reconciliation Statement is prepared.

(ii) Balance: Which balance is the basis of bank reconciliation. In this regard it should also be remembered that:

- (a) balance as per the Cash Book means the balance as per the bank column of the Cash Book,

- (b) a debit balance or favourable balance in the Cash Book means that the amount is lying deposited in the bank,

- (c) a credit balance in the Cash Book means overdraft, i.e., there is an excessive withdrawal of that amount,

- (d) a credit balance or favourable balance as per the Pass Book means that the amount is lying deposited in the bank, and

- (e) a debit balance as per the Pass Book means an overdraft has been made by the customer. In other words, the customer is a debtor to the bank for the amount equal to the debit balance of the Pass Book.

Besides this, the following facts should also be remembered:

- (a) Debiting any item in the Cash Book increases the Cash Book balance and crediting decreases it.

- (b) Debiting any item in the Pass Book decreases the Pass Book balance or increases the overdraft balance and crediting increases the balance or decreases the overdraft balance.

(iii) Preparation of Statement: After deciding which entries are to be added to the balance of the concerned book and which entries are to be subtracted, we should prepare the Bank Reconciliation Statement in a statement form.

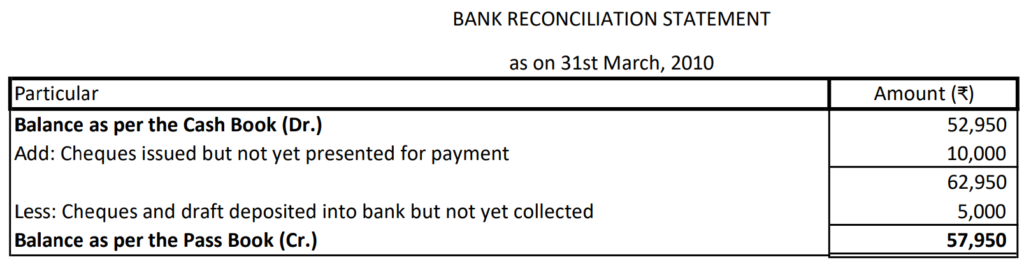

Continuing with our previous example, the Bank Reconciliation Statement can be prepared by (a) taking the balance as per the Pass Book as the starting point or (b) taking the balance as per the Cash Book as the starting point.

or

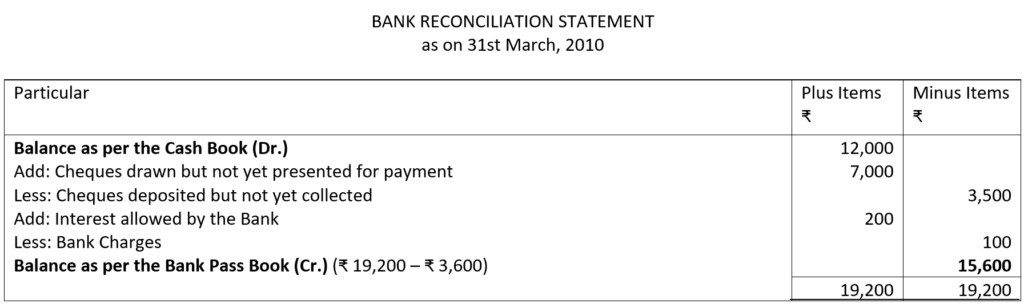

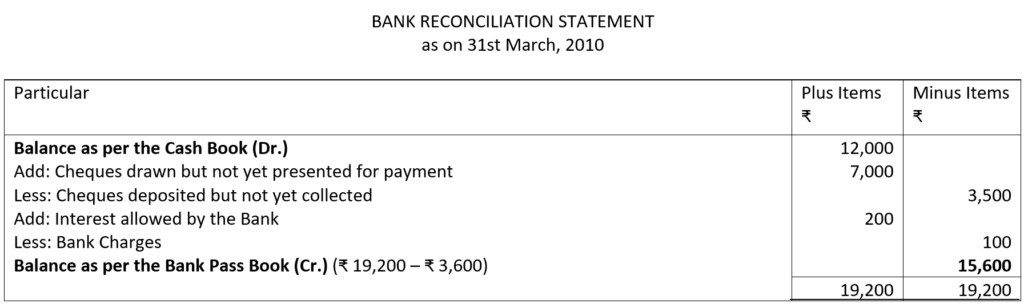

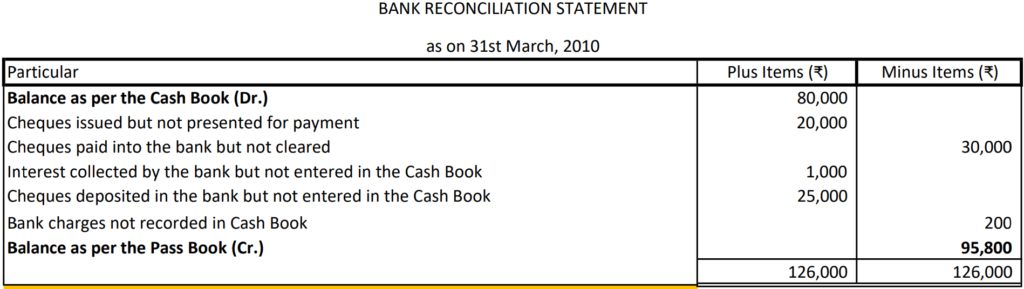

Alternative Presentation

An alternative presentation of a Bank Reconciliation Statement is also possible. Two columns are given, one to record items that increase the balance (plus column) and the other to record items that reduce the balance (minus column). Balances as per the Cash Book or Pass Book are written as the starting balance as follows:

1. Debit balance of the Cash Book is written in the ‘plus’ column.

2. Credit balance of the Cash Book is written in the ‘minus’ column.

3. Debit balance of the Pass book is written in the ‘minus’ column.

4. Credit balance of the Pass Book is written in the ‘plus’ column.

Having written the amounts for causes of difference, the two columns are totalled and the difference is ascertained. The difference is written in the column having the shorter total. The difference is the balance as per the Cash Book, if balance as per the Pass Book is taken as the starting balance and it is balance as per the Pass Book, if balance as per the Cash Book is taken as the starting balance. The statement given above is redrawn below:

or

Let us discuss how a Bank Reconciliation Statement is prepared under each of the above situations.

CASE 1. WHERE FAVOURABLE BALANCE AS PER THE CASH BOOK IS GIVEN.

A favourable balance as per the Cash Book means a debit balance in the books of account, i.e., balances lying deposited in the bank. When the balance (favourable) as per the Cash Book is taken as a basis to arrive at the balance as per the Pass Book, adjustments are made for the differences as have been discussed above. Let us discuss individual items of differences and the basis why these items are added to or deducted from the Cash Book balance.

Items of Differences | Reasoning |

| Added to Cash Book Balance (i) Cheques issued but not presented for payment | The amount is added to the balance because it had been earlier deducted from the Cash Book balance at the time of its recording but has not been deducted by the bank because they have not been presented for payment. |

| (ii) Cheque deposited by a debtor directly into the bank | It is added because the balance as per the bank already stands increased but it has not been added to the Cash Book balance because the deposit is not recorded in the Cash Book. Adding the amount will bring it at par with balance as per the Pass Book. |

| (iii) Interest allowed by the bank | It is added because the balance as per the bank already stands increased but it has not been added to the Cash Book balance because the deposit is not recorded in the Cash Book. Adding the amount will bring it at par with balance as per the Pass Book. |

| (iv) Dividend collected | It is added because the balance as per the bank already stands increased but it has not been added to the Cash Book balance because the deposit is not recorded in the Cash Book. Adding the amount will bring it at par with the balance as per the Pass Book. |

| (v) Bills of exchange realised Or Cash directly deposited into the bank but not recorded in the Cash Book | It is added because the balance as per the bank already stands increased but it has not been added to the Cash Book balance because the deposit is not recorded in the Cash Book. Adding the amount will bring it at par with the balance as per the Pass Book. |

| (vi) Wrong credit granted by the bank | It is added because the balance as per bank already stands increased but is not added to the Cash Book balance. Adding the amount will bring it at par with the balance as per the Pass Book. But remember, that entry is not recorded in the books of accounts for wrong credit granted by the bank. |

| (vii) Cheque deposited but not recorded | It is added because bank balance stands increased but Cash Book balance does not. Adding the amount to the Cash Book balance will bring it at par with balance as per the Pass Book. |

| Deducted from Cash Book Balance (viii) Cheque deposited but not collected (Credited) by the bank | The amount is deducted because the Cash Book balance stands increased but the bank has not given credit because it has not collected it. Deducting the amount will bring the balance at par with the Pass Book balance. |

| (ix) Cheque or Bill of Exchange dishonoured | It is deducted because the Cash Book balance stands increased but the balance as per the bank has not increased because the cheque or Bill of Exchange deposited has not been collected. |

| (x) Bank charges charged | The Bank has debited the account by the charges. thus, the balance as per the bank stands reduced. So, reduce the amount of bank charges from the Cash Book balances. |

| (xi) Interest charged | The Bank has debited the account by the interest charges, thus, the balance as per the bank stands reduced. So, reduce the amount of interest charged from the Cash Book. |

| (xii) Direct payment by the bank as per standing order, e.g., life insurance premium paid | It is deducted because the balance as per the bank is reduced. Had it also been recorded in the Cash Book; the Cash Book balance would also have been reduced. |

| (xiii) Wrong debit by the bank | It is deducted because the balance as per the bank is reduced on recording. Deduc ting the amount from the balance as per the Cash Book will bring the balance at par with the balance as per the bank. But remember that entry is not recorded in the books of accounts for wrong debit made by the bank. |

| (xiv) Cheques recorded but not deposited | It is deducted because the Cash Book balance stands increased with the amou nt. But the bank will increase the balance upon receipt of the cheque and its clearance. Deducting th e amount will bring the balances at par. |

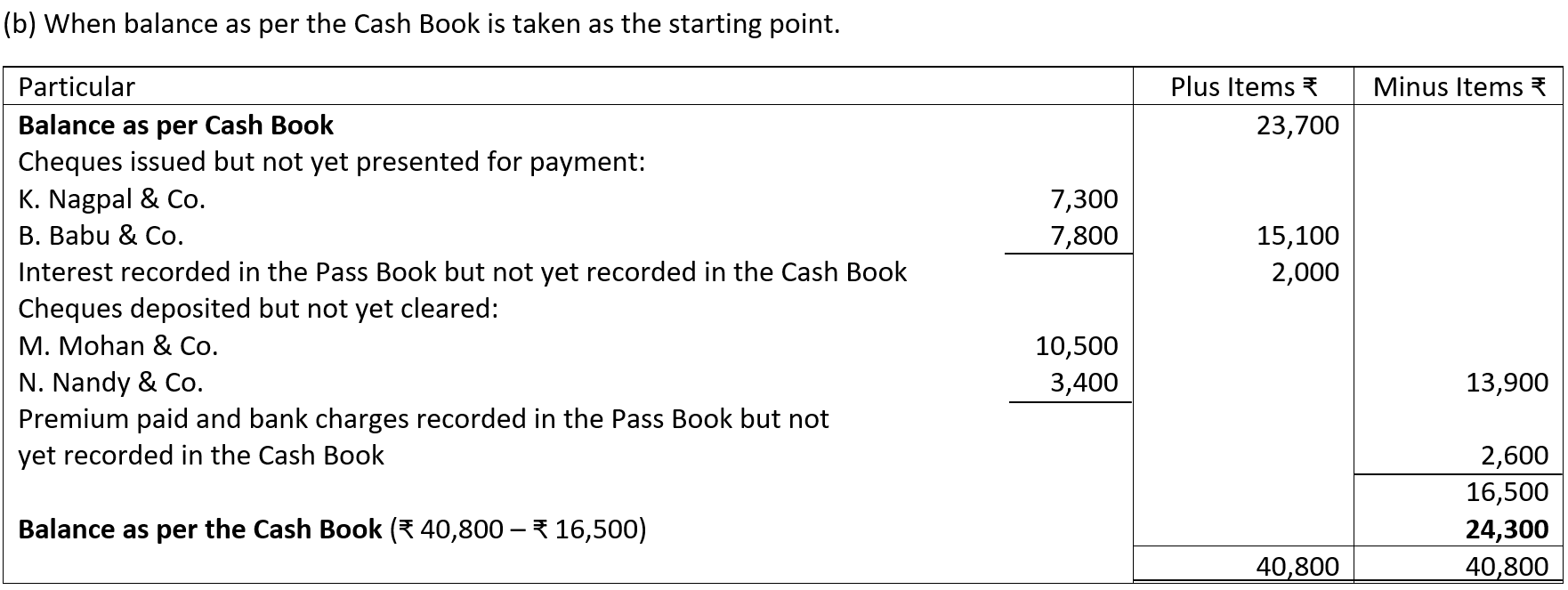

Illustration 1. The bank column of a Cash Book showed a debit balance of ₹ 49,000 on 30th June, 2010. Entries in the Cash Book and the Pass Book were compared and the following differences were noticed:

(i) Cheques of Shyam ₹ 9,000 and of Mohan ₹ 15,000 were deposited but were not collected up to 30th June, 2010.

(ii) Ramesh, a debtor, deposited a cheque of ₹ 8,000 directly into the bank.

(iii) Bank allowed an interest of ₹ 500.

(iv) Cheque for ₹ 10,000 issued to Radhey Shyam was not presented for payment.

(v) Bank debited the account by ₹ 6,000, being insurance premium.

(vi) Bank debited the account by ₹ 100, being bank charges.

You are required to prepare a Bank Reconciliation Statement as on 30th June, 2010.

Solution:

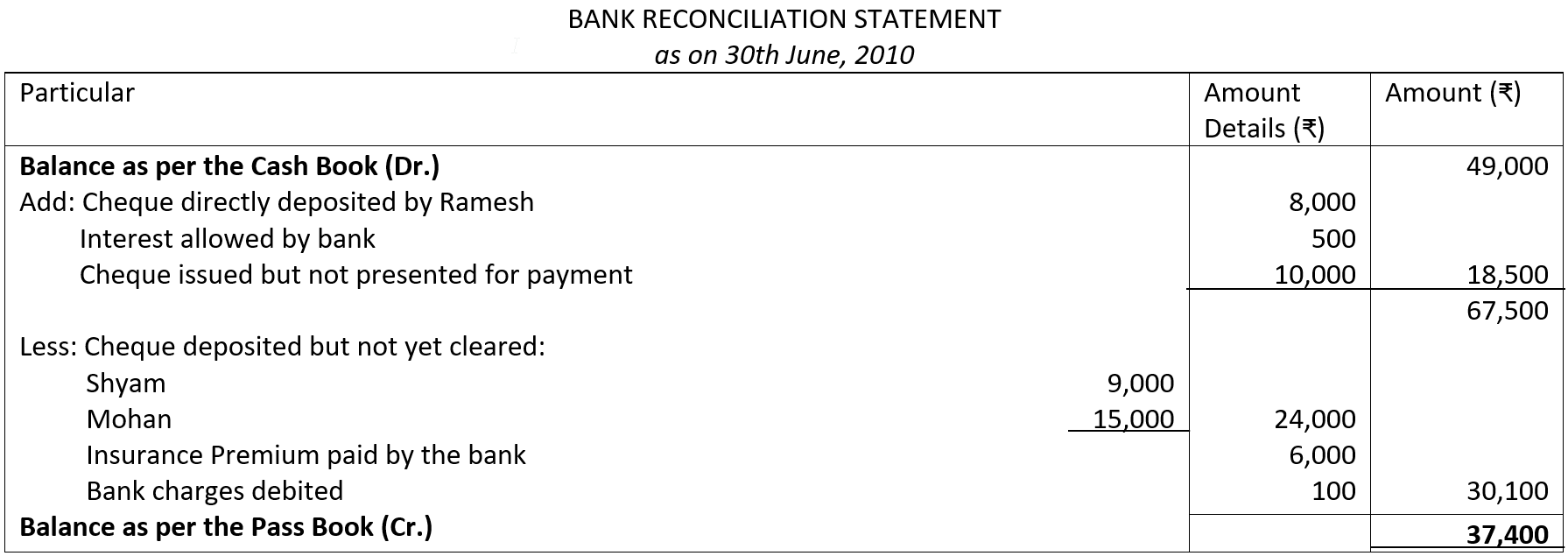

Illustration 2. From the following particulars, prepare a Bank Reconciliation Statement showing balance as per the Bank Pass Book on 31st March, 2010:

The cheques from Shri Morarji Dalal ₹ 2,500, Shri Dinkar Tapase ₹ 3,000 and Shri Baliram Gidwani ₹ 2,400 were deposited into account in March 2010 but were credited by the bank in April, 2010.

The cheques issued to Shri M. Kher ₹ 3,000, Shri Natverlal Mehta ₹ 5,000 and Shri Dayabhai Desai ₹ 3,000 in March, 2010 and were presented for payment in April, 2010.

A cheque for ₹ 1,000 which was received from a customer was entered in the bank column of the Cash Book in March, 2010 but the same was paid into bank in April, 2010.

The Pass Book shows a credit of ₹ 2,500 for interest and -a debit of ₹ 500 for bank charges. The balance (Dr.) as per the Cash Book was whereas the Pass Book showed a credit balance of ₹ 1,84,100.

Solution:

Illustration 3. From the following particulars, ascertain the Bank Balance that would appear in the Bank Pass Book:

(i) Balance as per Cash Book as on 31st March, 2010 ₹ 12,000.

(ii) Out of the total cheques amounted to ₹ 10,000 drawn, cheques aggregating ₹ 3,000 were encashed in March, 2010, cheques aggregating ₹ 4,000 were encashed in April, 2010 and the rest have not been presented at all.

(iii) Out of the total cheques amounted to ₹ 5,000 deposited, cheques aggregating ₹ 1,500 were credited in March, 2010, cheques aggregating ₹ 2,000 were credited in April, 2010 and the rest have not been collected at all.

(iv) The bank has debited ₹ 100 as bank charges and has credited ₹ 200 on account of interest.

Solution:

Illustration 4. State any six reasons when the Cash Book balance will be higher than the Pass Book balance.

(Delhi 2007)

Solution: Cash Book balance will be higher than the Pass Book balance in the following situations:

(i) Cheques sent for collection but not collected by the bank.

(ii) Cheque recorded in the Cash Book but not deposited in Bank.

(iii) Overcasting of debit side of the Cash Book.

(it)) Wrong entry on the debit side of the Cash Book.

(v) Undercasting of payment side of the Cash Book.

(vi) Payment through cheque but not credited in the Cash Book.

CASE 2. WHEN FAVOURABLE BALANCE AS PER THE PASS BOOK IS GIVEN.

Favourable balance as per the Pass Book means a credit balance in the Pass Book, i.e., balance lying deposited in the bank. When the balance (favourable) as per the pass Book is taken as the basis to arrive at the balance as per the Cash Book, adjustments are made for the differences as have been discussed above. Let us discuss individual items of differences and the basis why these items are added to or deducted from the Pass Book balance.

| Items of Differences | Reasoning |

| Added to Pass Book Balance (i) Cheques deposited but not collected (Credited) by the bank | The amount is added because the Cash Book balance already stands increased. By adding the amount, the balance will come at par with the Cash Book balance. |

| (ii) Deposited cheques or Bills Receivable dishonoured | The amount is added because the amount of deposit already stands added to the balance of the Cash Book but on dishonour, the amount is not deducted from the Cash Book balance. By adding the amount, the balance will come at par with the Cash Book balance. |

| (iii) Bank charges charged by the bank but not recorded in the Cash Book | The amount is added because the balance of the bank is reduced but the Cash Book balance is not as it is not recorded. By adding the amount, the balance will come at par with the Cash Book balance. |

| (iv) Interest charged by the bank not recorded in the Cash Book | The amount is added because the balance of the bank stands reduced but the Cash Book balance is not as it is not recorded. By adding the amount, the balance will come at par with the Cash Book balance. |

| (v) Direct payment by the bank as per standing instruction, say for insurance premium | The amount is added because the balance of the bank is reduced but the Cash Book balance is not as it is not recorded. By adding the amount, the balance will come at par with the Cash Book balance. |

| (vi) Bill Payable paid by the bank but not recorded in the Cash Book | The amount is added because the Pass Book balance stands reduced but Cash Book balance is not reduced. By adding the amount, the two balances will come at par. |

| (vii) Wrong debit by bank | The amount is added because the balance of the bank is reduced but the Cash Book balance is not as it is not recorded. By adding the amount, the balance will come at par with the Cash Book balance. |

| (viii) Cheques recorded in the Cash Book but not deposited | The amount is added because, if the cheque had been deposited, the balance of the bank would have been equal to that of the Cash Book. |

| Deducted from the Pass Book Balance (ix) Cheques issued but not presented for payment | The amount is deducted because if the cheques had been presented for payment, the balance would have been reduced and the two balances would have been the same. |

| (x) Cheques deposited directly into the bank by a debtor | The amount is deducted because the entry is not recorded in the Cash Book, the Cash Book balance would have increased, i.e., had it been recorded, the two balances would have matched. |

| (xi) Interest allowed by the bank but not recorded in the Cash Book | The amount is deducted because the entry is not recorded in the Cash Book, the Cash Book balance would have increase. i.e., had it been recorded, the two balances would have matched. |

| (xii) Dividend collected | The amount is deducted because the entry is not recorded in the Cash Book, the Cash Book balance would have increased i.e., had it been recorded, the two balances would have matched. |

| (xiii) Bill of exchange realised | The amount is deducted because the entry is not recorded in the Cash Book, the Cash Book balance would have increased, i.e., had it been recorded, the two balances would have matched. |

| (xiv) Wrong credit granted by the bank | The amount is deducted because the entry is not recorded in the Cash Book, the Cash Book balance would have increased i.e., had it been recorded, the two balances would have matched. |

| (xv) Cheques deposited into bank but not recorded in the Cash Book | It is deducted because it has not been recorded in the Cash Book. It means Cash Book balance is lower by that amount. |

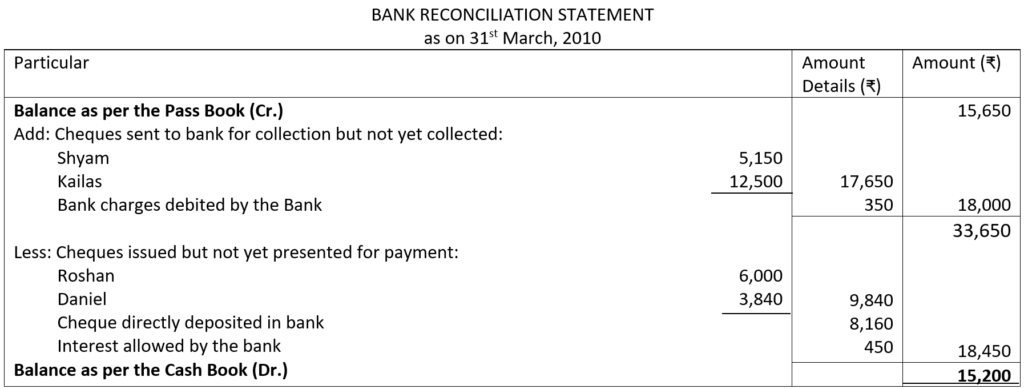

Illustration 5. On 31st March, 2010 the Pass Book of a trader showed a credit balance of ₹ 15,650 whereas the Cash Book showed a debit balance of ₹ 15,200. The reasons for the differences were:

(i) Cheques issued to Roshan for ₹ 6,000 and to Daniel for ₹ 3,840 were not presented for payment.

(ii) Bank charged ₹ 350 for bank charges.

(iii) Nitesh directly deposited ₹ 8,160 into the Bank Account of the trader which was not entered in the Cash Book.

(iv) Two cheques one from Shyam for ₹ 5,150 and another from Kailash for ₹ 12,500 were collected by bank in the first week of April, 2010 although they were banked on 25th March, 2010.

(v) Interest allowed by bank ₹ 450.

Prepare a Bank Reconciliation Statement as on 31st March, 2010.

Solution:

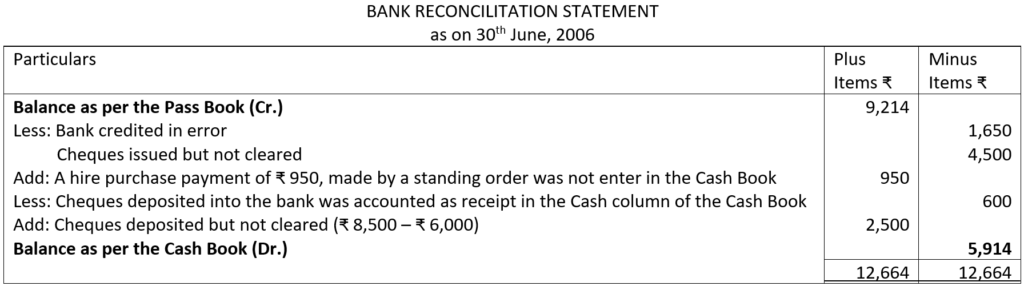

Illustration 6. Prepare a Bank Reconciliation Statement from the following particulars on 30th June, 2006:

Bank statement showed a favourable balance of ₹ 9,214.

(i) On 29th June, 2006 the bank credited the sum of ₹ 1,650 in error.

(ii) Certain cheques, valued at ₹ 4,500 issued before 29th June, 2006 were not cleared.

(iii) A hire purchase payment of ₹ 950, made by a standing order was not entered in the Cash Book.

(iv) A cheque of ₹ 600 received, deposited and credited by bank, was accounted as a receipt in the cash column of the Cash Book.

(v) Other cheques for ₹ 8,500 were deposited in June but cheques for ₹ 6,000 only were cleared by the bankers.

Solution:

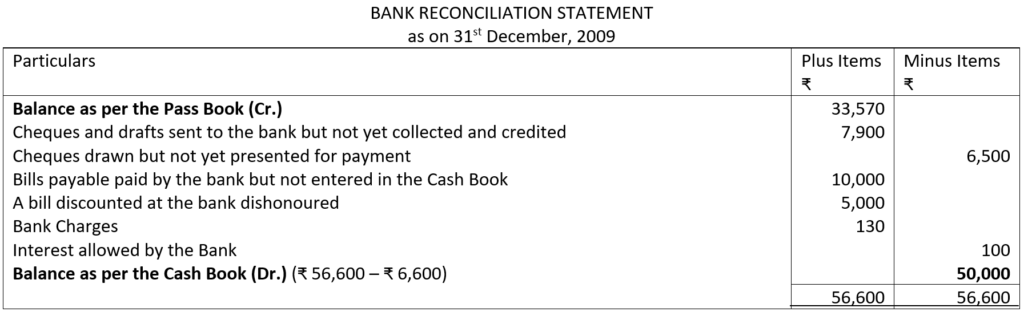

Illustration 7. On 31st December, 2009, the Pass Book of a merchant shows a credit balance of ₹ 33,570 whereas the Cash Book showed a debit balance of ₹ 50,000.

It was observed that the differences were because of the following:

The cheques and drafts sent to the bank but not collected and credited, amounted to ₹ 7,900 and three cheques drawn for ₹ 3,000, ₹ 1,500 and ₹ 2,000 respectively were not presented for payment till 31st January next year.

The bank has paid a bill payable amounted to ₹ 10,000 but it has not been entered in the Cash Book and a bill receivable of ₹ 5,000 which was discounted with the bank was dishonoured by the drawer on the due date.

The bank has charged ₹ 130 as its commission for collecting outstation cheques and has allowed an interest of ₹ 100 on the trader’s balance.

Prepare a Bank Reconciliation Statement as on 31st December, 2009.

Solution:

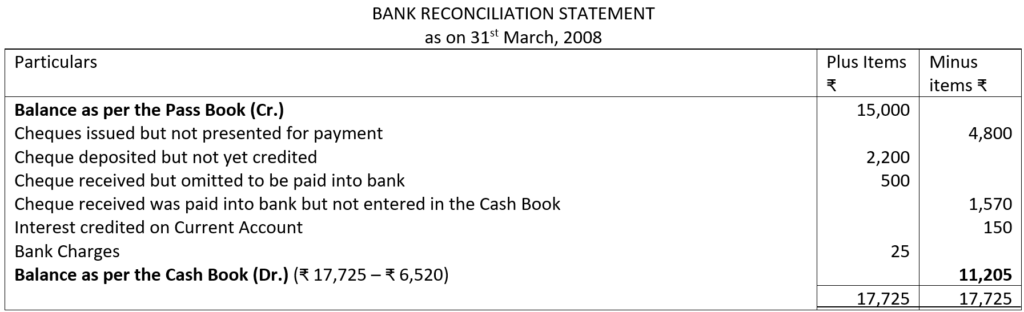

Illustration 8.

(i) On 31st March, 2008 the Bank Pass Book of Radha showed a balance of ₹ 15,000 to her credit.

(ii) Before that date, she had issued cheques amounting to ₹ 8,000 of which Cheques amounting to ₹ 3,200 have so far been presented for payment.

(iii) A cheque of ₹ 2,200 deposited by her into the bank on 26th March, 2008 is not yet credited in the Pass Book.

(iv) She had also received a cheque of ₹ 500 which although entered by her in the bank column of Cash Book, was omitted to be paid into the bank.

(v) On 30th March, 2008 a cheque of ₹ 1,570 received by her was paid into the bank but the same was omitted to be entered in the Cash Book.

(vi) There was a credit of ₹ 150 for interest on current account and a debit of ₹ 25 for bank charges.

Draw up a Bank Reconciliation Statement.

Solution:

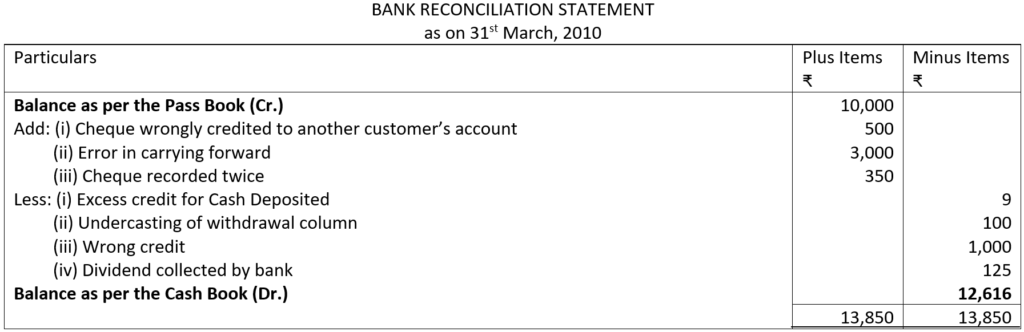

Illustration 9. Prepare a Bank Reconciliation Statement of Shri Krishna as on 31st March, 2010 from the following information:

(i) Balance as per the Pass Book is ₹ 10,000.

(ii) Bank collected a cheque of ₹ 500 on behalf of Shri Krishan but wrongly credited it to Shri Kishan’s Account (another customer),

(iii) Bank recorded a cash deposit of ₹ 2,589 as ₹ 2,598.

(iv) Withdrawal column of the Pass Book undercast by ₹ 100.

(v) The credit balance of ₹ 1,500 as on Page 10 of the Pass Book was recorded on Page 11 as a debit balance.

(vi) The payment of a cheque of ₹ 350 was recorded twice in the Pass Book.

(vii)The Pass Book showed a credit for a cheque of ₹ 1,000 deposited by Shri Kishan (another customer of the Bank).

(viii) Dividend directly collected by bank ₹ 125.

Solution:

CASE 3. WHEN OVERDRAFT (UNFAVOURABLE) BALANCE AS PER THE CASH BOOK IS GIVEN.

Overdraft (unfavourable) balance as per the Cash Book means credit balance in the Cash Book, i.e., an amount has been overdrawn and is payable to the bank. When the balance (unfavourable) as per the Cash Book is taken as the basis to arrive at the balance as per the Pass Book, adjustments are made for the differences as have been discussed in the foregoing paragraphs. Let us discuss individual items of differences and the basis ‘why these items are added to or deducted from the unfavourable Cash Book balance:

| Items of Differences | Reasoning |

| Added to the Cash Book Balance (i) Cheques deposited but not collected (Credited) by the bank | The amount is added to the overdraft amount because the bank has not credited the amount to the account. Thus, the Cash Book shows a lower overdraft balance compared to the overdraft balance of the bank. |

| (ii) Cheques recorded in the Cash Book but not sent to bank | The amount is added to the amount of overdraft because the cheques have not been deposited although they have been recorded in the Cash Book. In effect, the overdraft Cash Book balance is lower than the overdraft balance of the bank because the bank has not credited the account. |

| (iii) Bank charges charged by the bank not recorded in the Cash Book | The amount is added to the overdraft balance because the bank has debited the account and in effect increased the overdraft balance. If the amount had been recorded in the Cash Book, the overdraft balance of the Cash Book would have increased. |

| (iv) Interest charged by the bank is not recorded in the Cash Book | The amount is added to the overdraft balance because the bank has debited the account and in effect increased the overdraft balance. If the amount had been recorded in the Cash Book, the overdraft balance of the Cash Book would have increased. |

| (v) Direct payment by the bank as per standing instruction, say payment of insurance premium | The amount is added to the overdraft balance because the bank has debited the account and in effect increased the overdraft balance. If the amount had been recorded in the Cash Book, the overdraft balance of the Cash Book would have increased. |

| (vi) Wrong debit by the bank | The amount is added to the overdraft balance because the bank has debited the account and in effect increased the overdraft balance. Adding the amount will bring the overdraft balance of the Cash Book at par with the bank. |

| (vii) Cheques issued but not recorded in the Cash Book | The amount is added to the overdraft balance because the unrecorded cheque presented to the bank has increased the overdraft balance as per the bank. Had it been recorded in the Cash Book, the overdraft balance as per the Cash Book would have increased. |

| (viii) Deposited cheques or Bills Receivable dishonoured | The amount is added to overdraft balance because at the time of deposit overdraft balance was reduced. Overdraft balance will increase and therefore, will come at par with balance as per the bank. |

| Deducted from the Cash Book Balance (ix) Cheques issued but not presented for payment | The amount is deducted from the overdraft Cash Book balance because the issue of cheques is recorded in the Cash Book, in effect the overdraft Cash Book balance stands increased. The cheques so issued are not presented for payment, meaning, the bank has not debited the amount. Thus, the overdraft balance of the bank is lower or the credit balance the bank is higher. |

| (x) Cheques deposited directly into the bank by a debtor | The amount is deducted because the amount is credited the bank, in effect the overdraft balance in the bank stands decreased. Since the cheques directly deposited are not recorded in the Cash Book, the overdraft Cash Book balance is higher than the bank balance. |

| (xi) Interest allowed by the bank not recorded in the Cash Book | The amount is deducted because the amount is credited by the bank, in effect the overdraft balance stands decreased. The Cash Book shows higher overdraft balance because the credit for interest is not recorded. |

| (xii) Dividend collected | The amount is deducted because the amount is credited by the bank, in effect the overdraft balance stands decreased. Cash Book shows a higher overdraft balance because the credit for interest is not recorded. |

| (xiii) Wrong credit granted by the bank | The amount is deducted because the amount is credited by the bank, in effect the overdraft balance stands decreased. The Cash Book shows a higher overdraft balance because the credit is not recorded. |

| (xiv) Cheques deposited but not recorded in the Cash Book | The amount is deducted because the amount is credited by the bank, in effect, the overdraft balance stands decreased, The Cash Book shows a higher overdraft balance because the cheques deposited are not recorded, i.e., the overdraft balance is not decreased. |

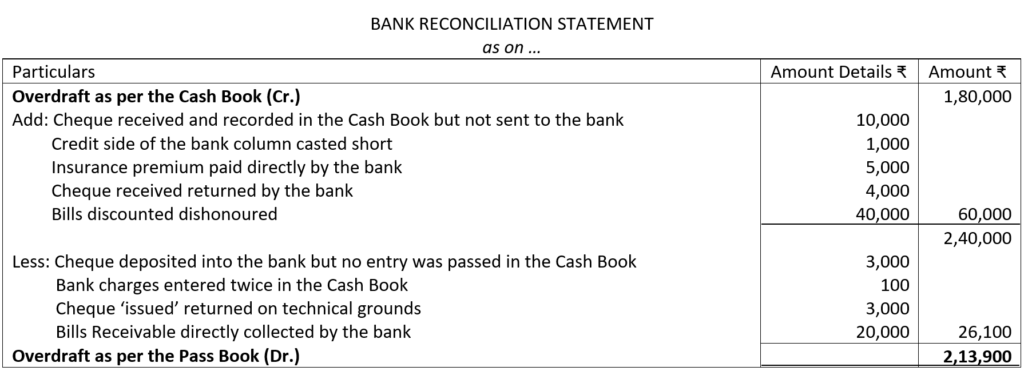

Illustration 10. Prepare a Bank Reconciliation Statement from the following particulars:

(i) Overdraft as per the Cash Book. – ₹ 1,80,000

(ii) Overdraft as per the Pass Book. – ₹ 2,13,900

(iii) Cheque deposited into the bank but no entry passed in the Cash Book. – ₹ 3,000

(iv) Cheque received and entered into the Cash Book but not sent to the bank. – ₹ 10,000

(v) Credit side of the bank column casted short. – ₹ 1,000

(vi) Insurance premium paid directly by the bank understanding order. – ₹ 5,000

(vii) Bank charges entered in the Cash Book twice. – ₹ 100

(viii) Cheque ‘received’ returned by the bank but no entry passed. – ₹ 4,000

(ix) Cheque ‘issued’ returned on technical grounds. – ₹ 3,000

(x) Bill discounted dishonoured. – ₹ 40,000

(xi) Bills receivable directly collected by the bank. – ₹ 20,000 Solution:

Solution:

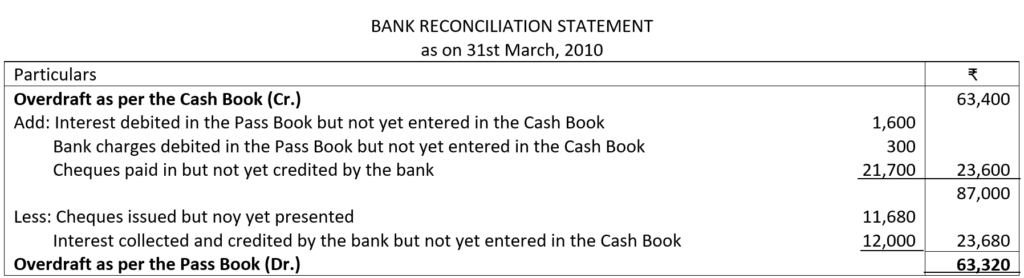

Illustration 11. From the following particulars ascertain the balance that would appear in the Bank Pass Book of A on 31st March, 2010:

(i) The bank overdraft as per the Cash Book on 31st March, 2010 ₹ 63,400.

(ii) Interest on overdraft for 6 months ended 31st March, 2010, ₹ 1,600 entered in the Pass Book.

(iii) Bank charges of ₹ 300 for the above period are debited in the Pass Book.

(iv) Cheques issued but not cashed prior to 31st March, 2010, amounted to ₹ 11,680.

(v) Cheques paid into the bank but not cleared before 31st March, 2010 were for ₹ 21,700.

(vi) Interest on investments collected by the bank and credited in the Pass Book, ₹ 12,000.

Note: In this illustration, the point to be noted is that the opening balance is an overdraft. Hence, items which increase the balance at bank will be deducted from the overdraft since money deposited will reduce the overdraft. Similarly, items which reduce the balance at bank will be added to the overdraft.

Solution:

The above illustration can also be presented with the two column using the ‘Plus’ and ‘Minus’ method.

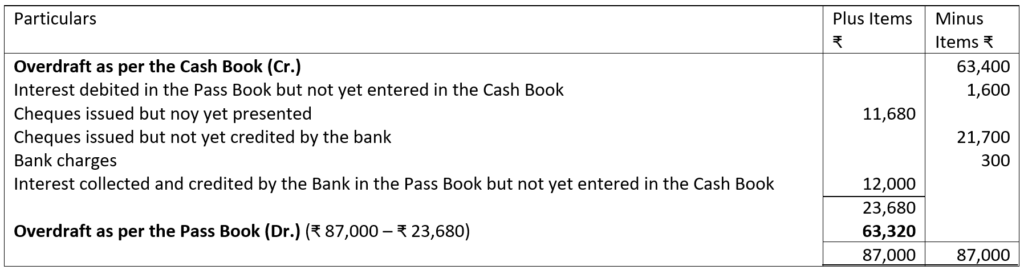

Illustration 12 (Overdraft as per Cash Book). Prepare a Bank Reconciliation Statement as on 30th June, 2010 for Jyoti Sales Private Limited from the information given below:

(i) Bank overdraft as per the Cash Book on 30th June, 2010. – ₹ 1,10,450

(ii) Cheques issued on 20th June, 2010 but not yet presented. – ₹ 15,000

(iii) Cheques deposited but not yet credited by the bank. – ₹ 22,750

(iv) Bills for collection not advised by the bank but credited to the account. – ₹ 47,200

(v) Interest debited by the bank on 27th June, 2010 but no advice received. – ₹ 12,115

(vi) Subsidy received from the authorities by the bank on our behalf, credited to the account. – ₹ 22,000

(vii) Amount wrongly debited by the bank. – ₹ 2,400

(viii) Amount wrongly credited by the bank. – ₹ 5,000

Solution:

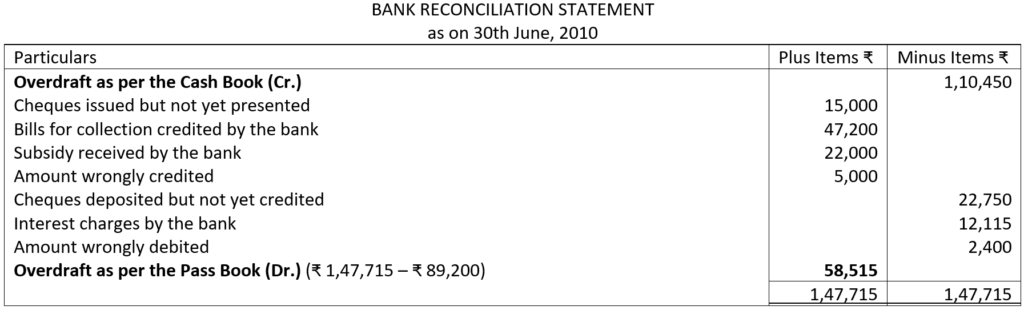

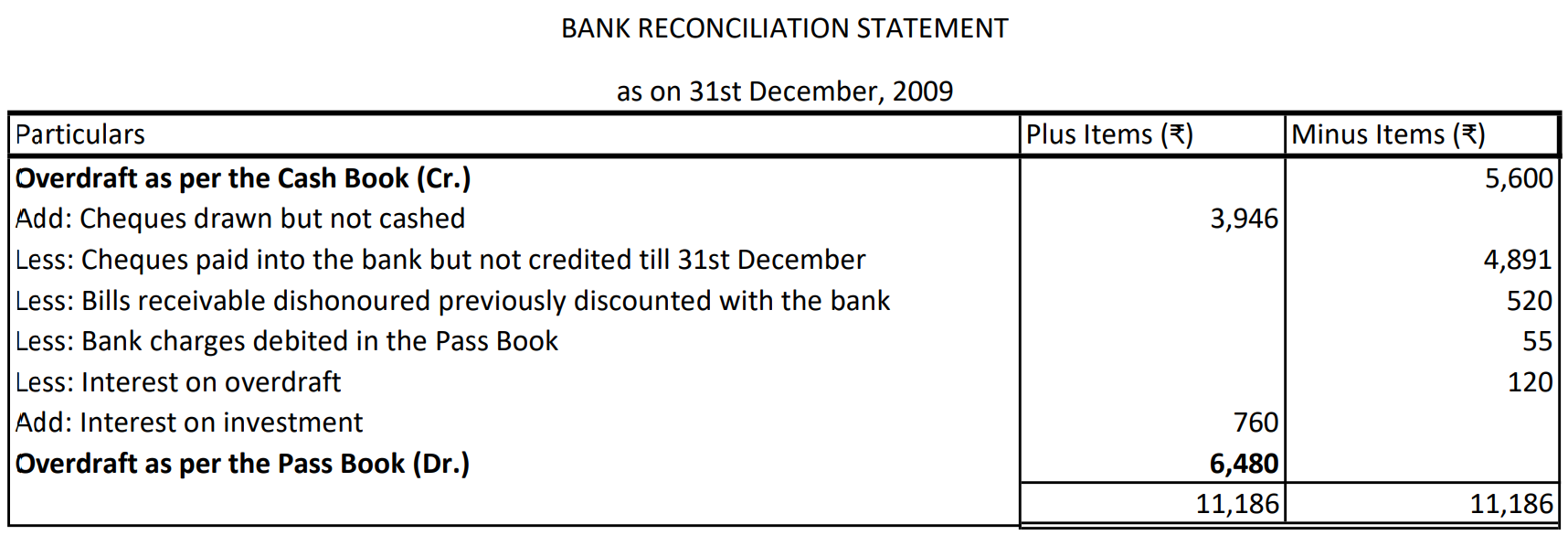

Illustration 13. On 31st December, 2009, the Cash Book of Rohan showed an overdraft of ₹ 5,600. From the following particulars make out a Bank Reconciliation Statement:

(i) Cheques drawn but not cashed before 31st December 2009 amounted to ₹ 3,946.

(ii) Cheques paid into the bank but not credited before 31st December, 2009 amounted to ₹ 4,891.

(iii) A Bill Receivable for ₹ 520 previously discounted with the bank had been dishonoured and bank charges debited in the Pass Book amounted to ₹ 55.

(iv) Debit is made in the Pass Book for ₹ 120 on account of interest on overdraft.

(v) The bank has collected interest on investment and credited ₹ 760 in the Pass Book.

Solution:

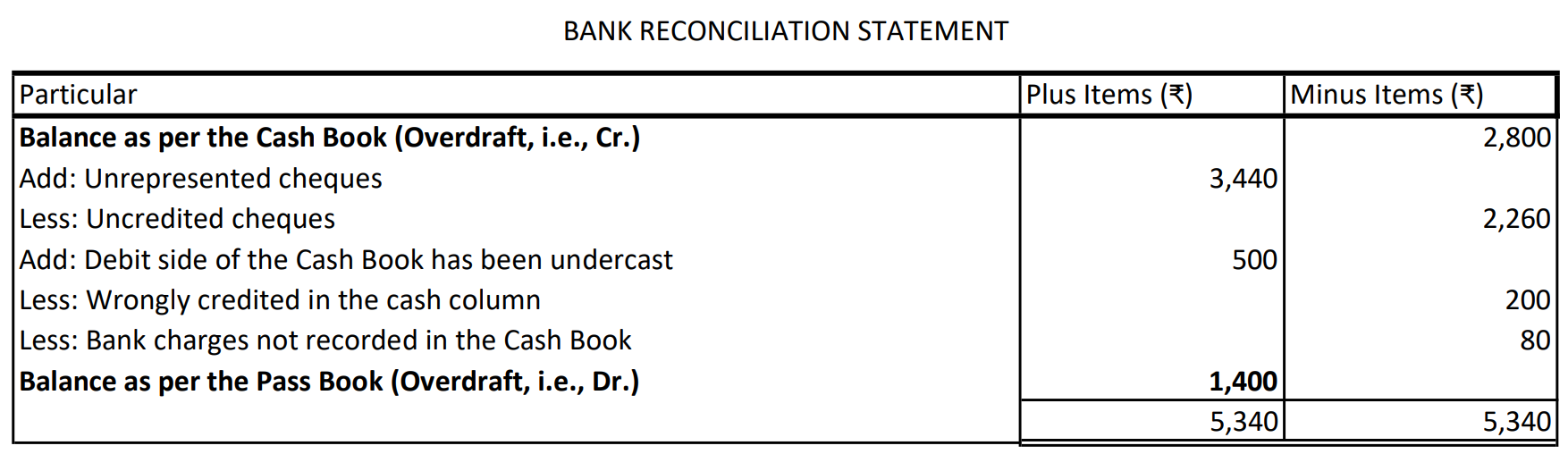

Illustration 14. The following facts relate to the business of Roshan who requires you to reconcile his Cash Book with the Pass Book balance:

Balance as per the Cash Book (Cr.) ₹ 2,800

Unpresented cheques ₹ 3 440

Uncredited cheques ₹ 2,260

Additional Information:

(a) The debit side of the Cash Book (bank column) has been undercast by ₹ 500.

(b) A cheque of ₹ 200 paid to a creditor has been entered by mistake in the Cash Column.

(c) Bank charges ₹ 80 have not been entered in the Cash Book.

Solution:

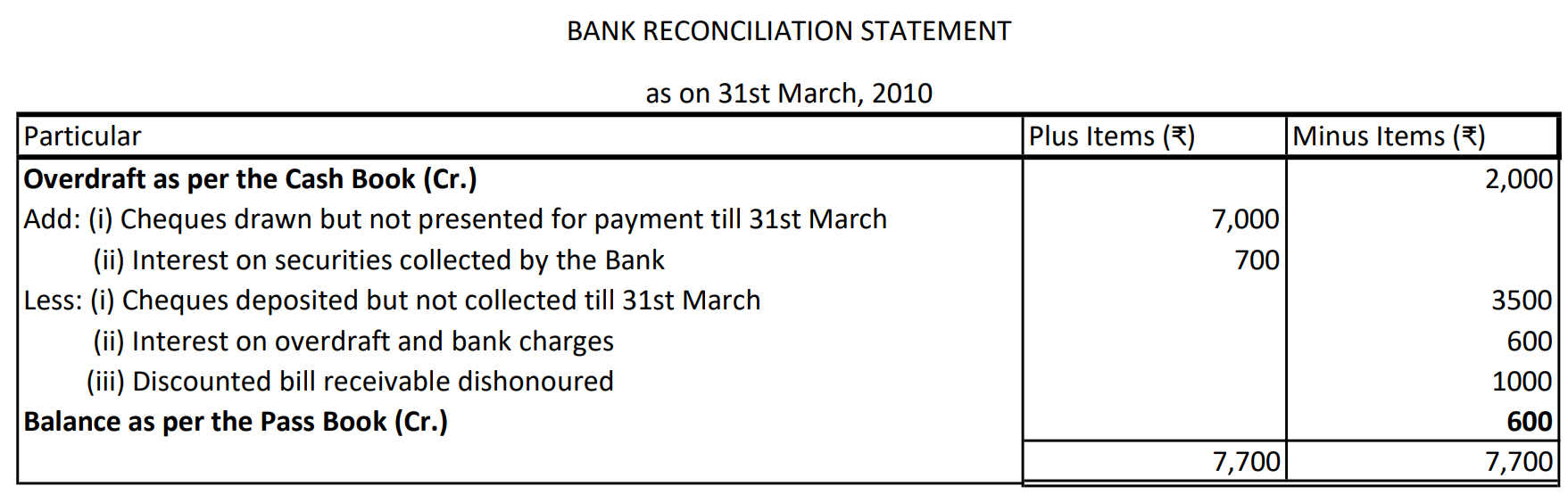

Illustration 15. Prepare a Bank Reconciliation Statement from the following particulars:

(i) On 31st March, 2010, the Cash Book showed a credit bank balance (i.e., bank overdraft) of ₹ 2,000.

(ii) Out of the total cheques amounting to ₹ 10,000 drawn, cheques aggregating ₹ 3,000 were encashed in March, cheques aggregating ₹ 4,000 were encashed in April and the rest have not been presented at all.

(iii) Out of the total cheques amounting to ₹ 5,000 deposited, cheques aggregating ₹ 1,500 were credited in March, cheques aggregating ₹ 2,000 were credited in April, and the rest have not been collected at all.

(iv) The bank has debited ₹ 500 on account of interest on overdraft and ₹ 100 as bank charges.

(v) The bank has credited ₹ 700 on account of interest collected on securities.

(vi) A Bill Receivable of ₹ 1,000 (discounted with the bank in January) dishonoured on 31st March (but not yet recorded in the Cash Book).

Solution:

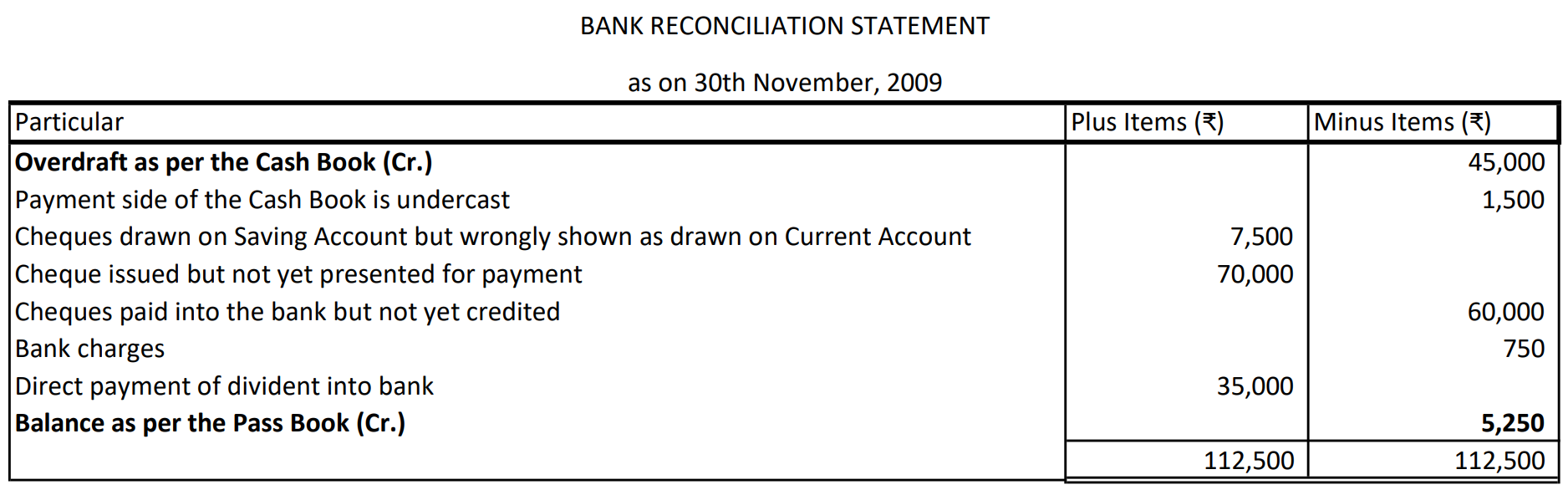

Illustration 16. Comparing Ram’s Cash Book with the Bank Statement of his overdraft account for the month of November, 2009, find the following:

(i) Cash Book showed an overdraft of ₹ 45,000.

(ii) The payment side of the Cash Book had been undercast by ₹ 1,500.

(iii) A cheque for ₹ 7,500 drawn on his Savings Account has been shown as drawn on his Current Account.

(iv) Cheques amounting to ₹ 70,000 drawn and entered in the Cash Book have not been presented.

(v) Cheques amounting to ₹ 60,000 sent to the bank for collection, which though entered in the Cash Book have not been credited by the bank.

(vi) Bank charges of ₹ 750 as per Bank Statement have not been recorded in the Cash Book.

(vii) Dividends amounting to ₹ 35,000 have been paid directly into the bank and not entered in the Cash Book.

You are required to prepare a Bank Reconciliation Statement on 30th November, 2009.

Solution:

CASE 4. WHERE OVERDRAFT BALANCE AS PER THE PASS BOOK IS GIVEN.

Overdraft (Unfavourable) balance as per the Pass Book means debit balance in the bank, i.e., amount overdrawn or payable to the bank. When an overdraft balance (unfavourable) as per the Pass Book is taken as the basis of arriving at the balance as per the Cash Book, adjustments are made for the differences as have been discussed in the foregoing paragraphs. Let us discuss individual items of differences and the basis why these items are added to or deducted from the unfavourable Pass Book balance:

| Items | Reasoning |

| Added to the Pass Book Balance (i) Cheques issued but not presented for payment | The amount is added to the balance because if the cheques had been presented for payment, the overdraft balance as per the bank would have increased. |

| (ii) Cheques deposited directly in the bank by a debtor | The amount is added because the bank has credited the account and in effect the overdraft balance stands reduced. Since the deposit is not recorded in the Cash Book, higher overdraft balance in the Cash Book is shown. |

| (iii) Interest allowed by the bank but not recorded in the Cash Book | The amount is added because the bank has credited the account and in effect the overdraft balance stands reduced. Since the deposit is not recorded in the Cash BOOK higher overdraft balance in the Cash Book is shown. |

| (iv) Dividend collected | The amount is added because the bank has credited the account and in effect the overdraft balance stands reduced. Since the deposit is not recorded in the Cash Book, higher overdraft balance in the Cash Book is shown. |

| (v) Bill of Exchange realised | The amount is added because the bank has credited the account and in effect the overdraft balance stands reduced. Since the deposit is not recorded in the Cash Book, higher overdraft balance in the Cash Book is shown. |

| (vi) Wrong credit granted by the bank | The amount is added because the bank shows a lower overdraft balance due to wrong credit, Adding the amount will increase the overdraft balance as per the bank. |

| (vii) Cheques paid into the bank but not recorded in Cash Book | The amount is added because the bank shows a lower overdraft balance due to this credit. Adding the amount will increase the overdraft balance as per the bank. |

| Deducted from the Pass Book Balance (viii) Cheques deposited but not collected | The amount is deducted from the overdraft balance because if the cheques had been collected and credited to account by the bank, it would have reflected a lower overdraft balance. |

| (ix) Cheque recorded in the Cash Book but not sent for collection | The amount is deducted from the overdraft balance because if the cheques had been collected and credited to account by the bank, it would have reflected a lower overdraft balance. |

| (x) Cheque or Bill of Exchange dishonoured | The amount is deducted from the overdraft balance because the amount not realised by the bank is debited to the account, thus in effect, reflecting a higher overdraft balance, At the same time, the amount has not been recorded in the Cash Book, thus reflecting a lower overdraft balance. |

| (xi) Bank charges charged | The amount is deducted from the overdraft balance because the amount has been debited to the account resulting in a higher overdraft balance. At the same time, the amount is not recorded in the Cash Book thus, reflecting a lower overdraft balance. |

| (xii) Interest charged | The amount is deducted from the overdraft balance because the amount has been debited to the account resulting in a higher overdraft balance. At the same time, the amount is not recorded in the Cash Book thus, reflecting a lower overdraft balance. |

| (xiii) Direct payment by the bank as per standing instruction e.g., insurance premium paid | The amount is deducted from the overdraft balance because the amount has been debited to the account resulting in a higher overdraft balance. At the same time, the amount is not recorded in the Cash Book thus, reflecting a lower overdraft balance. |

| (xiv) Wrong debit by the bank | The amount is deducted from the overdraft balance because the amount has been debited to the account resulting in a higher overdraft balance. At the same time, the amount is not recorded in the Cash Book thus, reflecting a lower overdraft balance. |

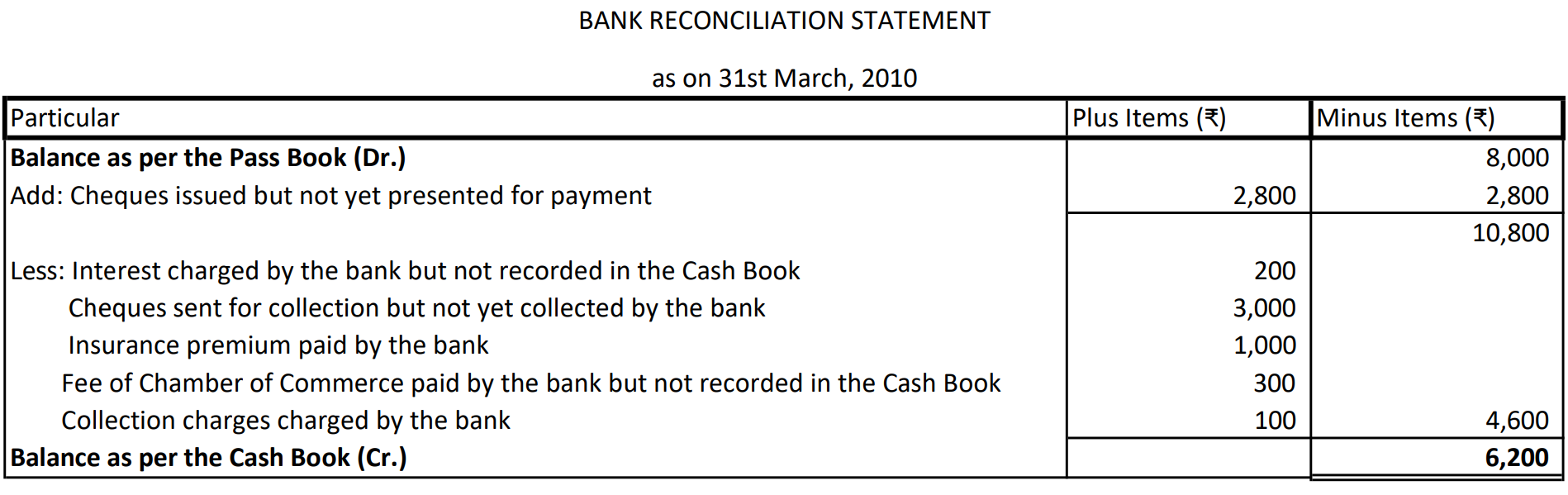

Illustration 17. From the following particulars, prepare a Bank Reconciliation Statement as on 31st March, 2010:

(i) Balance as per the Pass Book on 31st March, 2010 overdrawn ₹ 8,000.

(ii) Cheques drawn on 25th March, 2010 but not collected till April 2010 ₹ 1,500, ₹ 500 and ₹ 800.

(iii) Interest on bank overdraft not entered in the Cash Book ₹ 200.

(iv) Outstation cheque ₹ 3,000 deposited into the bank but collected in April 2010.

(v) ₹ 1,000 Insurance premium paid by the bank as per the trader’s standing order has not been entered in the Cash Book.

(vi) Chamber of Commerce fee ₹ 300 paid by the bank for traders but not recorded in the Cash Book.

(vii) Collection charges of ₹ 100 charged by the bank but not entered in the Cash Book.

Solution:

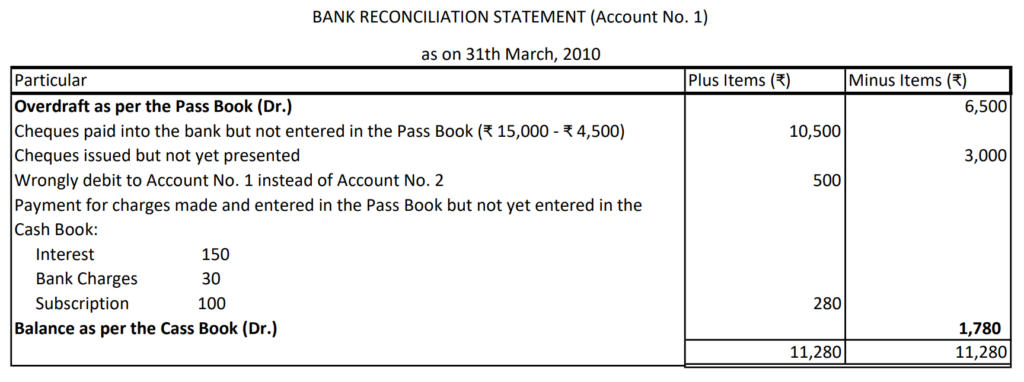

Illustration 18. My bank Pass Book for Account No. 1 shows an overdraft of ₹ 6,500 on 31st March, 2010. This does not agree with the Cash Book balance. From the following particulars, ascertain the Cash Book balance:

Cheques amounting to ₹ 15,000 were paid into the bank in March out of which, it appears, only cheques amounting to ₹ 4,500 were credited by the bank. Cheques issued during March amounted in all to ₹ 11,000. Out of these cheques for ₹ 3,000 were unpaid on 31st March, 2010. The bank has wrongly debited Account No. 1 with ₹ 500 in respect of a cheque drawn on Account No. 2. The Account stands debited with ₹ 150 for interest and with ₹ 30 for bank charges. The bank has paid the annual subscription of ₹ 100 to my club according to my instructions. The entries for interest, bank charges and subscription have not yet been made in the Cash Book.

Solution:

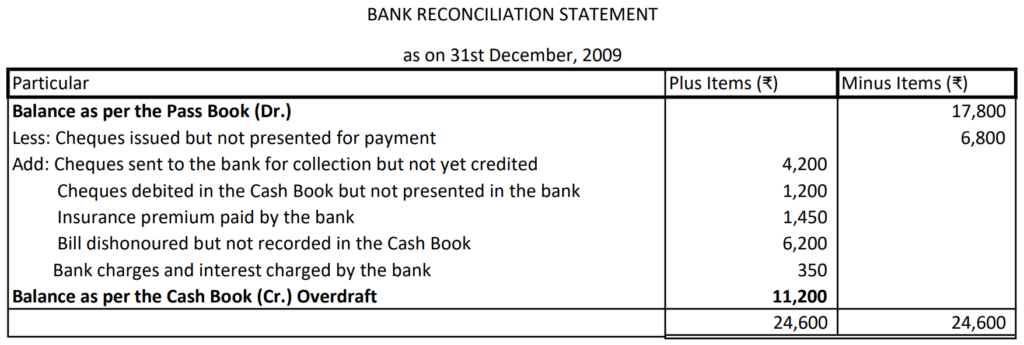

Illustration 19. Following information has been given by Rajendra. Prepare a Bank Reconciliation Statement as on 31st December, 2009, showing balance as per the Cash Book.

(i) Debit balance shown by the Pass Book ₹ 17,800.

(ii) Cheques of ₹ 21,600 were issued in the last week of December but only cheques of ₹ 14,800 were presented for payment.

(iii) Cheques of ₹ 10,750 were presented to the bank. Out of them. a cheque of ₹ 4,200 was credited in the first week of January 2010.

(iv) A cheque of ₹ 1,200 was debited in the Cash Book but was not presented in the bank.

(v) Insurance premium paid by the bank ₹ 1,450.

(vi) A Bill of Exchange of ₹ 6,200 which discounted with the bank was returned dishonoured but no entry was made in the Cash Book.

(vii) Bank charges and interest charged by the bank are ₹ 350. (Delhi 2004, Adapted)

Solution:

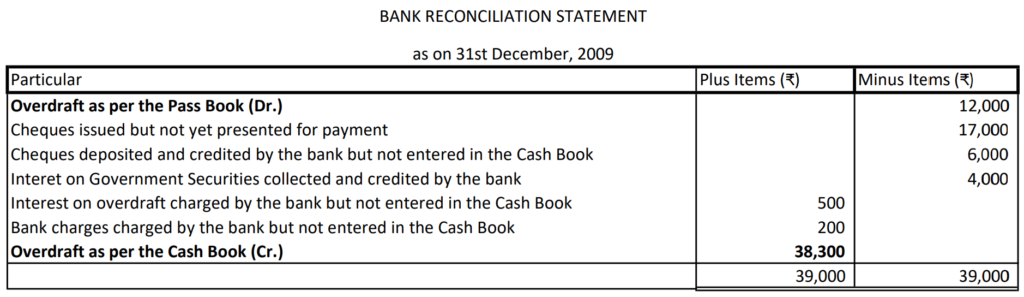

Illustration 20. Prepare a Bank Reconciliation Statement from the details given below and ascertain the balance as per Mr. Gami’s Cash Book as on 31st December, 2009:

(i) Bank overdraft balance as per the Pass Book ₹ 12,000.

(ii) Cheques issued to creditors amounting to ₹ 20,000 in the month of December, 2009 of which cheques worth ₹ 3,000 were presented to the bank up to 31st December, 2009.

(iii) A cheque of ₹ 6,000 received from Mr. Raj was deposited in the Bank Account on 26th December, 2009 but no entry was passed in the Cash Book. The same was collected and credited to Mr. Gami’s Account on 29th December, 2009.

(iv) A cheque of ₹ 2,000 received from Mr. Baria on 20th December, 2009 was recorded in the discount column of the Cash Book but was not banked.

(v) The Pass Book showed that the bank had collected ₹ 4,000 as interest on Government Securities. The bank had charged interest ₹ 500 and bank charges ₹ 200. There was no entry in the Cash Book for the same.

Solution:

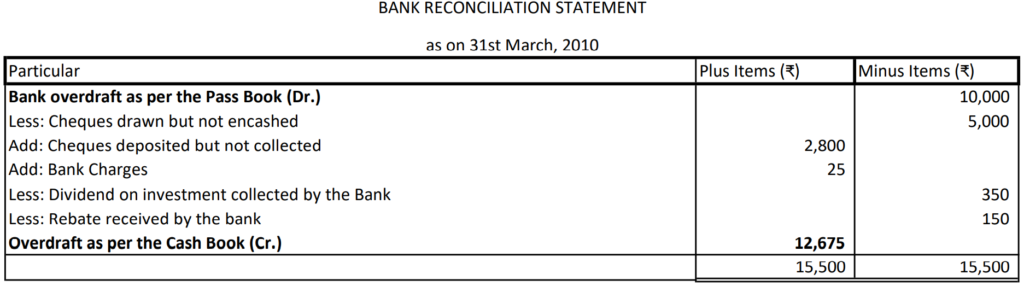

Illustration 21. On 31st March, 2010, Pass Book of Shri Rajendra shows a debit of ₹ 10,000. From the following, prepare a Bank Reconciliation Statement:

(i) Cheques amounting to ₹ 8,000 drawn on 25th March, 2010 of which cheques of ₹ 5,000 were encashed on 2nd April, 2010.

(ii) Cheques paid into the bank for collection ₹ 5,000 but cheques of ₹ 2,200 could only be collected in March, 2010.

(iii) Bank charges ₹ 25 and dividend of ₹ 350 on investments collected by the bank could not be shown in the Cash Book.

(iv) A bill of ₹ 10,000 was retired by the bank under rebate of ₹ 150 but the full amount was credited in the Cash Book.

Solution:

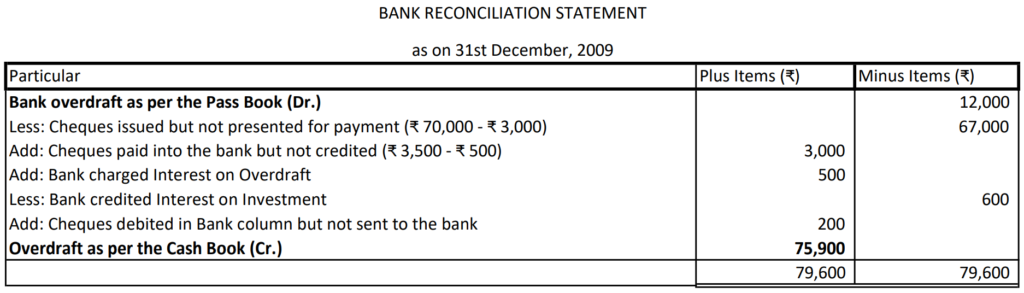

Illustration 22. Prepare a Bank Reconciliation Statement on 31st December, 2009 from the following transactions:

(i) A’s Overdraft as per Pass Book ₹ 12,000 as on 31st December.

(ii) On 30th December, cheques had been issued for ₹ 70,000 of which cheques worth ₹ 3,000 only had been encashed up to 31st December.

(iii) Cheques amounted to ₹ 3,500 had been paid into the bank for collection but out of these only ₹ 500 had been credited in the Pass Book.

(iv) The bank has charged ₹ 500 as interest on overdraft and the intimation of which has been received on 2nd January, 2010.

(v) Bank has collected ₹ 600 directly in respect of interest on A’s investment. A has no knowledge of it.

(vi) A cheque for ₹ 200 has been debited in bank column of Cash Book by A, but it was not sent to bank at all.

Solution:

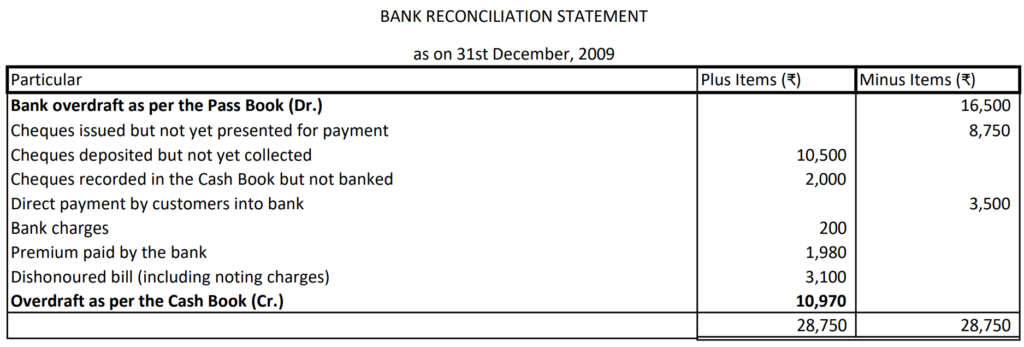

Illustration 23. From the following information supplied by Gokul, prepare his Bank Reconciliation Statement as on 31st December, 2009:

(i) Bank overdraft as per the Pass Book. – ₹ 16,500

(ii) Cheques issued but not presented for payment. – ₹ 8,750

(iii) Cheques deposited with the bank but not collected. – ₹ 10,500

(iv) Cheques recorded in the Cash Book but not sent to the bank for collection. – ₹ 2,000

(v) Payments received from customers directly by the bank. – ₹ 3,500

(vi) Bank charges debited in the Pass Book. – ₹ 200

(vii) Premium on life policy of Gokul paid by the bank on standing advice. – ₹ 1,980

(viii) A bill for ₹ 3,000 (discounted with the bank in November) dishonoured on 31st December, 2009 and noting charges paid by the bank. – ₹ 100

Solution:

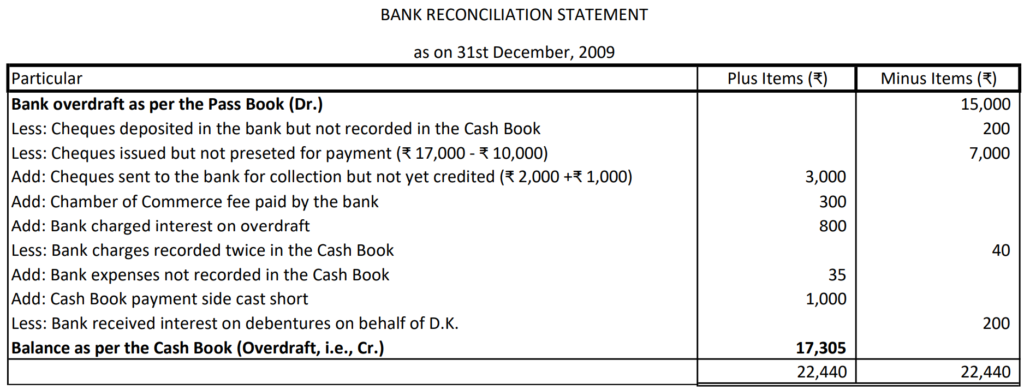

Illustration 24. From the following particulars, make out a Bank Reconciliation Statement and ascertain the balance as per the Cash Book on 31st December, 2009 in the books of D.K.:

(i) Pass Book showed an overdraft of ₹ 15,000 on 31st December, 2009.

(ii) A cheque of ₹ 200 was deposited in the bank but not recorded in the Cash Book

(iii) Cheques of ₹ 17,000 were issued but cheques worth only ₹ 10,000 were presented for payment up to 31st December, 2009.

(iv) Cheques of ₹ 10,000 were sent to the bank for collection. Out of these, cheques of ₹ 2,000 and of ₹ 1,000 were credited respectively on 7th January and 9th January 2010 and remaining cheques were credited before 31st December, 2009.

(v) Bank paid ₹ 300 as Chamber of Commerce fee on behalf of D.K. which was not recorded in the Cash Book.

(vi) Bank charged interest on overdraft ₹ 800.

(vii) ₹ 40 for bank charges were recorded two times in the Cash Book and bank expenses of ₹ 35 were not at all recorded in the Cash Book.

(viii) Payment side of the Cash Book was ₹ 1,000 short.

(ix) Bank received ₹ 200 as interest on debentures on behalf of D.K.

Solution:

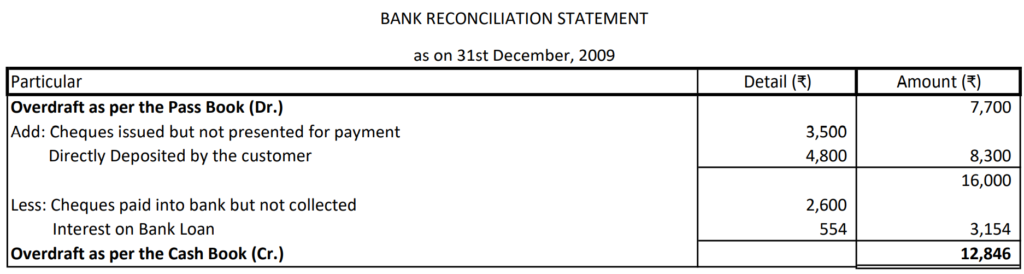

Illustration 25. On 31st December, 2009, the Bank Pass Book of Taneja & Co. showed an overdraft of ₹ 7,700. On the basis of the following particulars prepare a Bank Reconciliation Statement:

(i) Cheques issued before 31st December, 2009 but not yet presented for payment amounted to ₹ 3,500.

(ii) Cheques paid into the Bank but a cheque amounting to ₹ 2,600, has not been collected yet.

(iii) Interest on Loan amounting to ₹ 554, directly debited by the Bank did not appear in the Cash Book.

(iv) ₹ 4,800 directly deposited by the customer entered in the Pass Book but not in the Cash Book.

Solution:

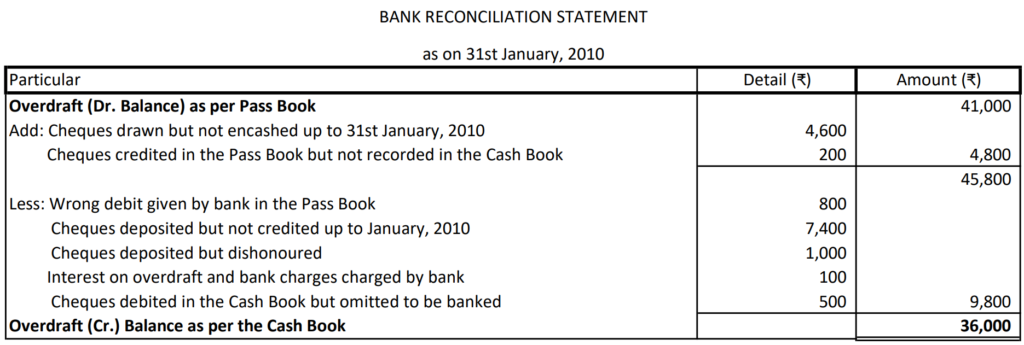

Illustration 26. On 31st January, 2010 the Pass Book of Shri. M.L. Gupta shows a debit balance of e 41,000. Prepare a Bank Reconciliation Statement from the following particulars:

(i) Cheques amounting to ₹ 15,600 were drawn on 27th January, 2010. Out of which cheques for ₹ 11,000 were encashed up to 31st January, 2010.

(ii) A wrong debit of ₹ 800 has been given by the bank in the Pass Book.

(iii) A cheque for ₹ 200 was credited in the Pass Book but was not recorded in the Cash Book.

(iv) Cheques amounting to ₹ 21,000 were deposited for collection. But out of these cheques for ₹ 7,400 have been credited in the Pass Book on 5th February, 2010.

(v) A cheque for ₹ 1,000 was returned dishonoured by the bank and was debited in the Pass Book only.

(vi) Interest on overdraft and bank charges amounted to ₹ 100 were not entered in the Cash Book.

(vii) A cheque of ₹ 500 debited in the Cash Book was omitted to be banked.

Solution:

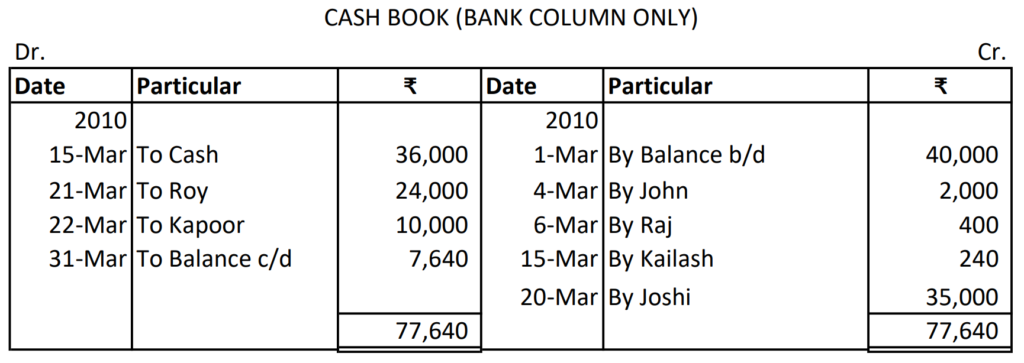

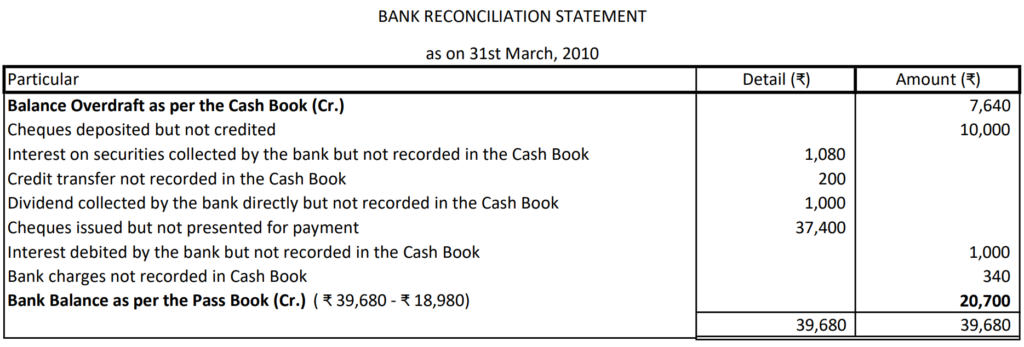

Illustration 27. Following are the entries recorded in the bank column of the Cash Book of Mr. V. K. Gupta for the month ended 31st March, 2010:

On 31st March, 2010 Mr. V.K. Gupta received his Bank Statement. On perusal of the statement, Mr. V.K. Gupta ascertained the following information:

(i) Cheques deposited but not credited by the bank ₹ 10,000.

(ii) Interest on securities collected by the bank but not recorded in the Cash Book ₹ 1,080.

(iii) Credit transfer not recorded in the Cash Book ₹ 200.

(iv) Dividend collected by the bank directly but not recorded in the Cash Book ₹ 1,000.

(v) Cheques issued but not presented for payment ₹ 37,400.

(vi) Interest debited by the bank but not recorded in the Cash Book ₹ 1,000.

(vii) Bank charges not recorded in the Cash Book ₹ 340.

From the above information, you are asked to prepare a Bank Reconciliation Statement to ascertain the balance as per the Bank Statement.

Solution:

BANK RECONCILIATION STATEMENT WITH CORRECTED (ADJUSTED) CASH BOOK BALANCE

Bank Reconciliation Statement is prepared generally without correcting the Cash Book during the different months of the financial year. At the end of the financial Year, the Cash Book must be corrected for the entries that should have been incorporated but have not been incorporated, before preparing the Bank Reconciliation Statement. It is so because, otherwise correct balances (including cash balance) will not be reflected in the Balance Sheet. Following procedure is to be followed for ascertaining the corrected (adjusted) Cash Book Balance.

Step 1: Draw up a Cash Book with having Bank column only. If favourable balance (Dr. balance) as per the Cash Book is given, write down the balance on the debit side of the Cash Book. If unfavourable balance or overdraft as per the Cash Book is given, write down the balance on the credit side of the Cash Book.

Step 2: Pass entries in the Cash Book in respect of the following items:

(a) Amount recorded in the Pass Book but not yet recorded in the Cash Book, i.e., omission in the Cash Book, e.g., bank charges, interest charged on overdraft, interest allowed by bank, dividend/interest/bills receivable directly collected by the bank, direct payment by the bank understanding instructions from the customers.

(b) Rectifying entries in respect of errors committed in the Cash Book, e.g., cheques issued but recorded in cash or discount column, cheques issued recorded in bank column for wrong amount, over or under cast of bank column, error in balancing the bank column, errors in carry forward or brought forward bank balance.

At this point, one arrives at the Adjusted Cash Book Balance.

Step 3: The adjusted balance of the Cash Book is taken as starting point. A Bank Reconciliation Statement is prepared listing the causes of differences and arriving at the balance as per the Pass Book. It is prepared as has been discussed earlier in the Chapter. In other words, add to Cash Book balance if there is more in the Pass Book and deduct from the Cash Book balance if there is less in the Pass Book.

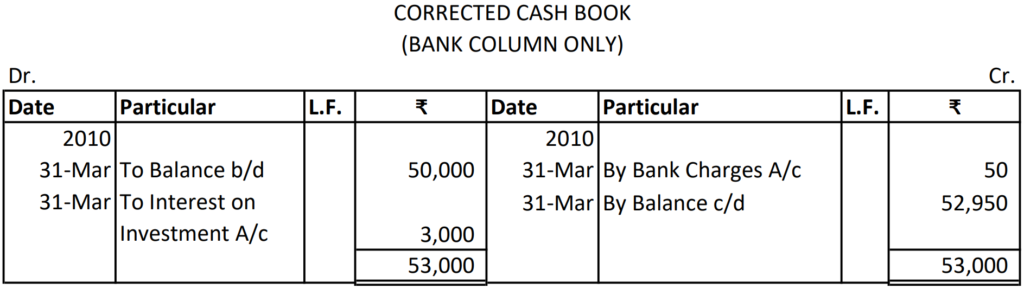

Illustration 28. You are given the following particulars:

(i) Debit balance in the bank column as per the Cash Book on 31st March, 2010 was ₹ 50,000.

(ii) Cheques and drafts deposited into the bank but not collected ₹ 5,000.

(iii) Cheques of ₹ 10,000 were issued but not presented for payment.

(iv) Bank charges of ₹ 50 for expenses which were not yet entered in the Cash Book.

(v) Interest on investment ₹ 3,000 was collected by the bank but not entered in the Cash Book.

Pass the necessary entries in the Cash Book and then prepare a Bank Reconciliation Statement on 31st March, 2010.

Solution:

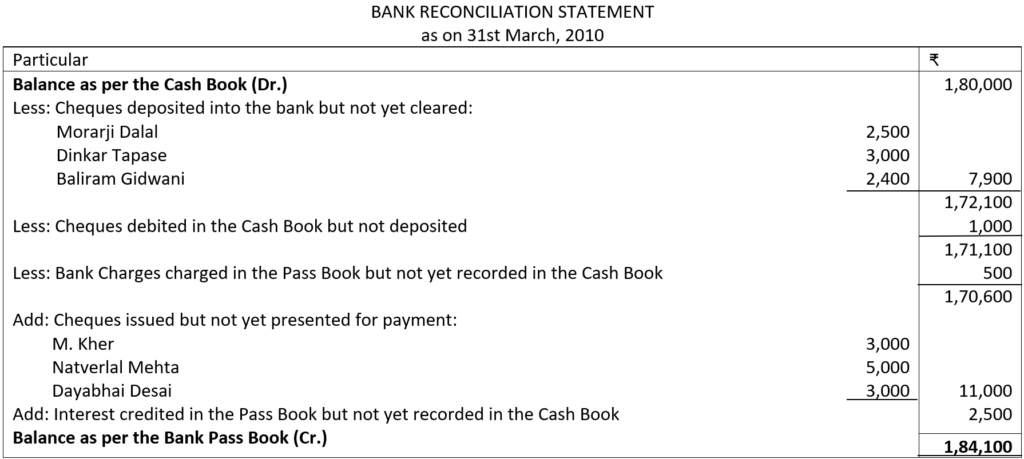

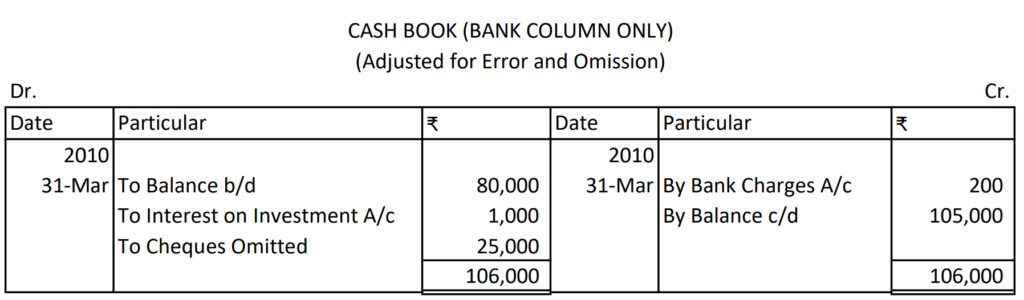

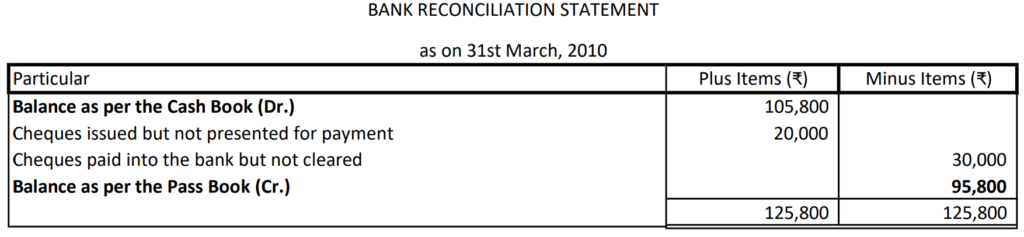

Illustration 29. From the following particulars, ascertain the Bank balance as per the pass Book as on 31st March, 2010 (a) without adjusting the Cash Book balance and (b) after adjusting the Cash Book balance:

(i) Bank balance as per the Cash Book on 31st March, 2010 ₹ 80,000.

(ii) Cheques issued but not encashed up to 31st March, 2010 to ₹ 20,000.

(iii) Cheques paid into the bank but not cleared up to 31st March, 2010 amounted to ₹ 30,000.

(iv) Interest on investments collected by the bank but not entered in the Cash Book ₹ 1,000.

(v) Cheques deposited in the bank but not entered in the Cash Book ₹ 25,000.

(vi) Bank charges debited in the Pass Book but not entered in the Cash Book ₹ 200.

Solution:

(a) Preparation of Bank Reconciliation Statement without adjusting the Cash Book balance:

(b) Preparation of Bank Reconciliation Statement after adjusting the Cash Book balance:

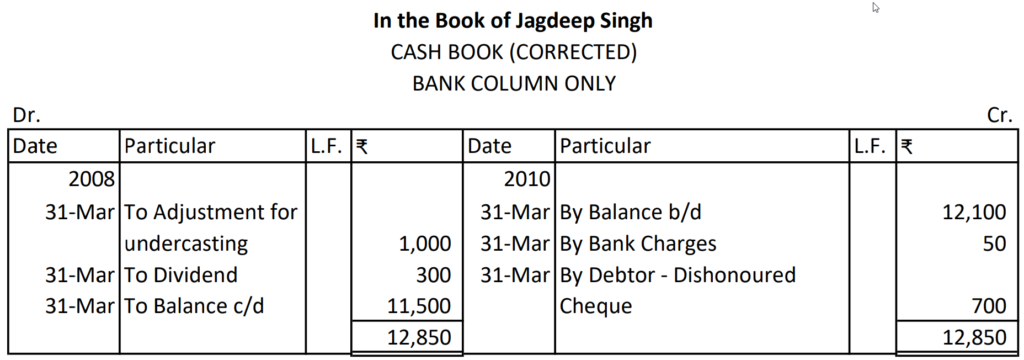

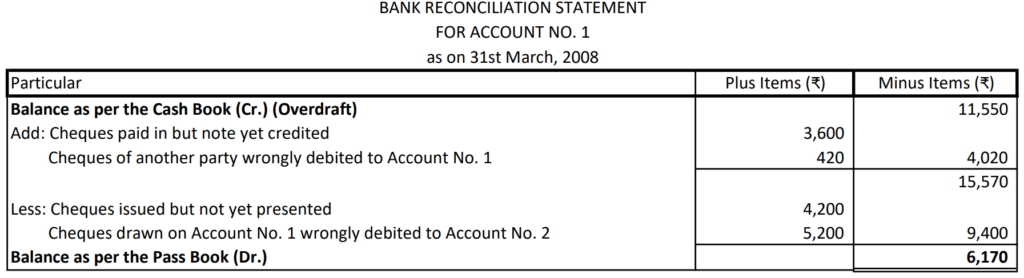

Illustration 30. Jagdeep Singh’s Cash Book on 31st March, 2008 showed an overdraft balance of e 12,100 on his Account No. 1 at the bank.

On investigation it is found that:

(i) Cheque drawn amounting to ₹ 4,200 had not been presented to the bank for payment.

(ii) Cheque for ₹ 3,600 entered in the Cash Book and paid into the bank had not been credited by the bank.

(iii) The receipts side of the Cash Book had been undercast by ₹ 1,000.

(iv) Bank charges of ₹ 50 entered in the Bank Statement had not been entered in the Cash Book.

(v) A cheque for ₹ 5,200 drawn on the Account No. 1 had been charged by the bank erroneously to Account No. 2.

(vi) A dividend of ₹ 300 paid directly to the bank had not been entered in the Cash Book.

(vii) A cheque for ₹ 700 received from a debtor paid into the bank, dishonoured and shown as such by the bank but no entry of dishonour had been made in the Cash Book.

(viii) A cheque for ₹ 420, drawn by another customer of the bank bearing the same name had been charged to Jagdeep Singh’s Bank Account by error.

You are required to:

(a) show the necessary adjustments to be made in the Cash Book; and

(b) prepare a Bank Reconciliation Statement for Account No. 1 as on 31st March. 2008

Solution: