TS Grewal Double Entry Book Keeping Class 12 Solutions Volume1: Accounting for Partnership Firms

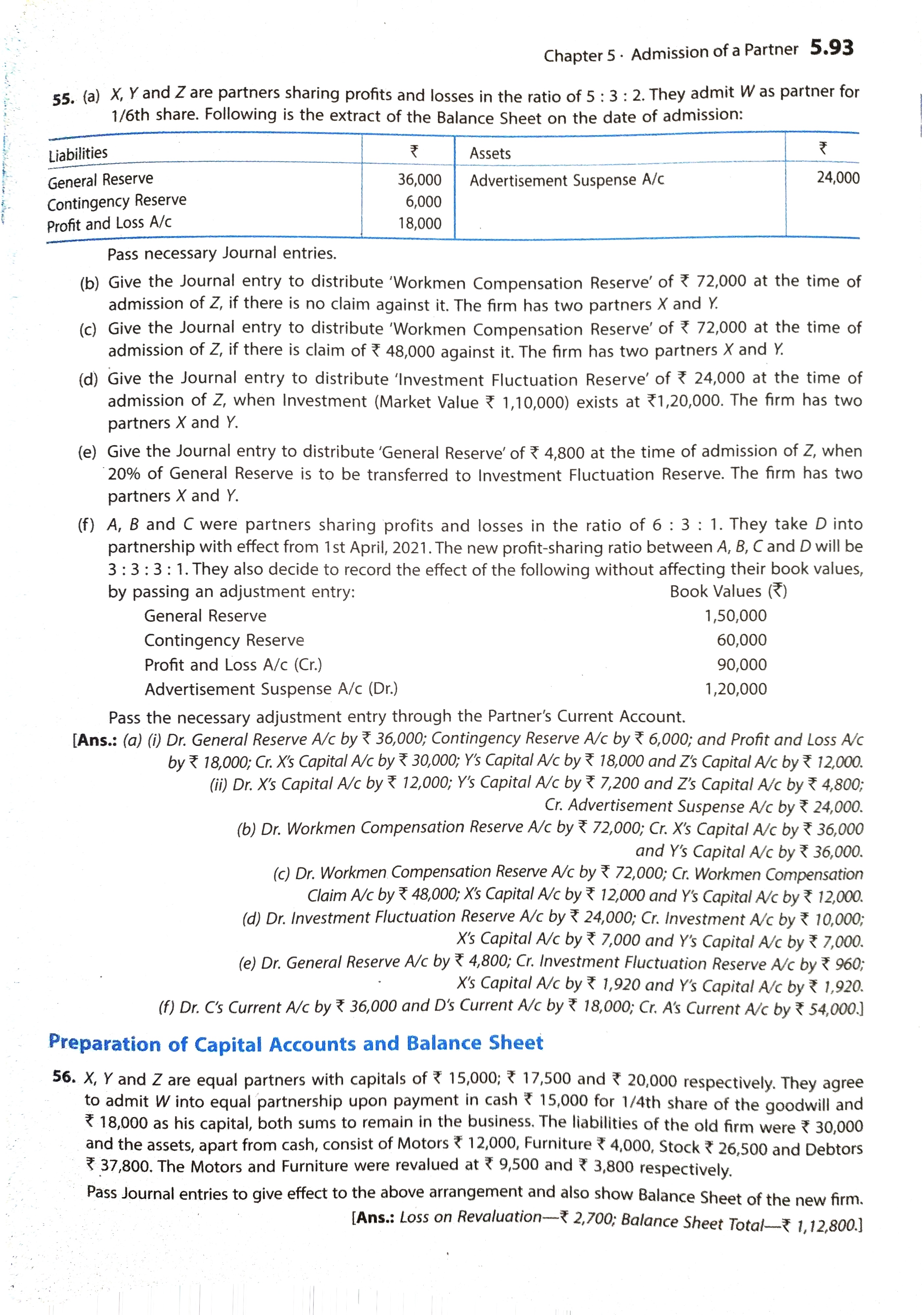

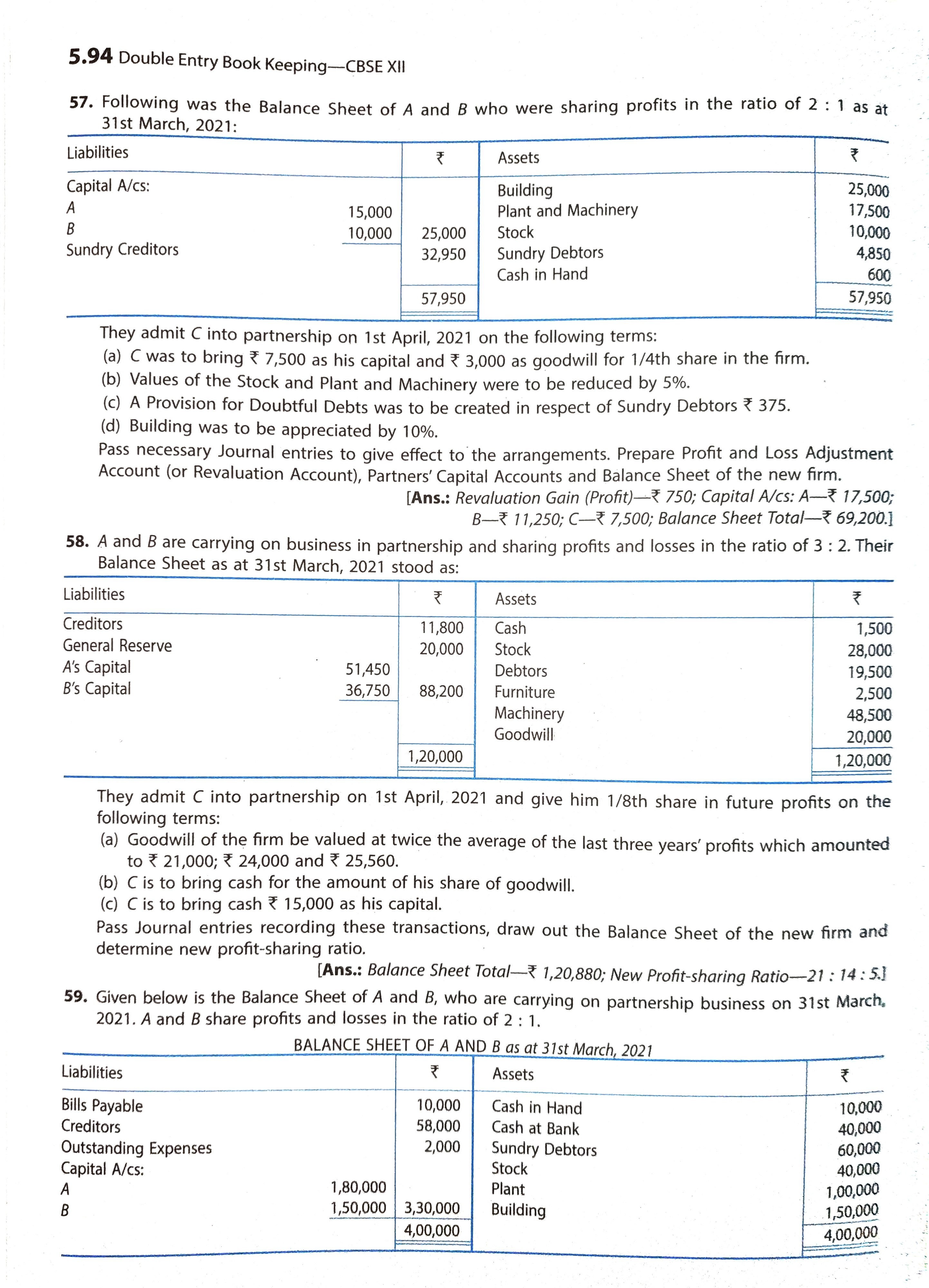

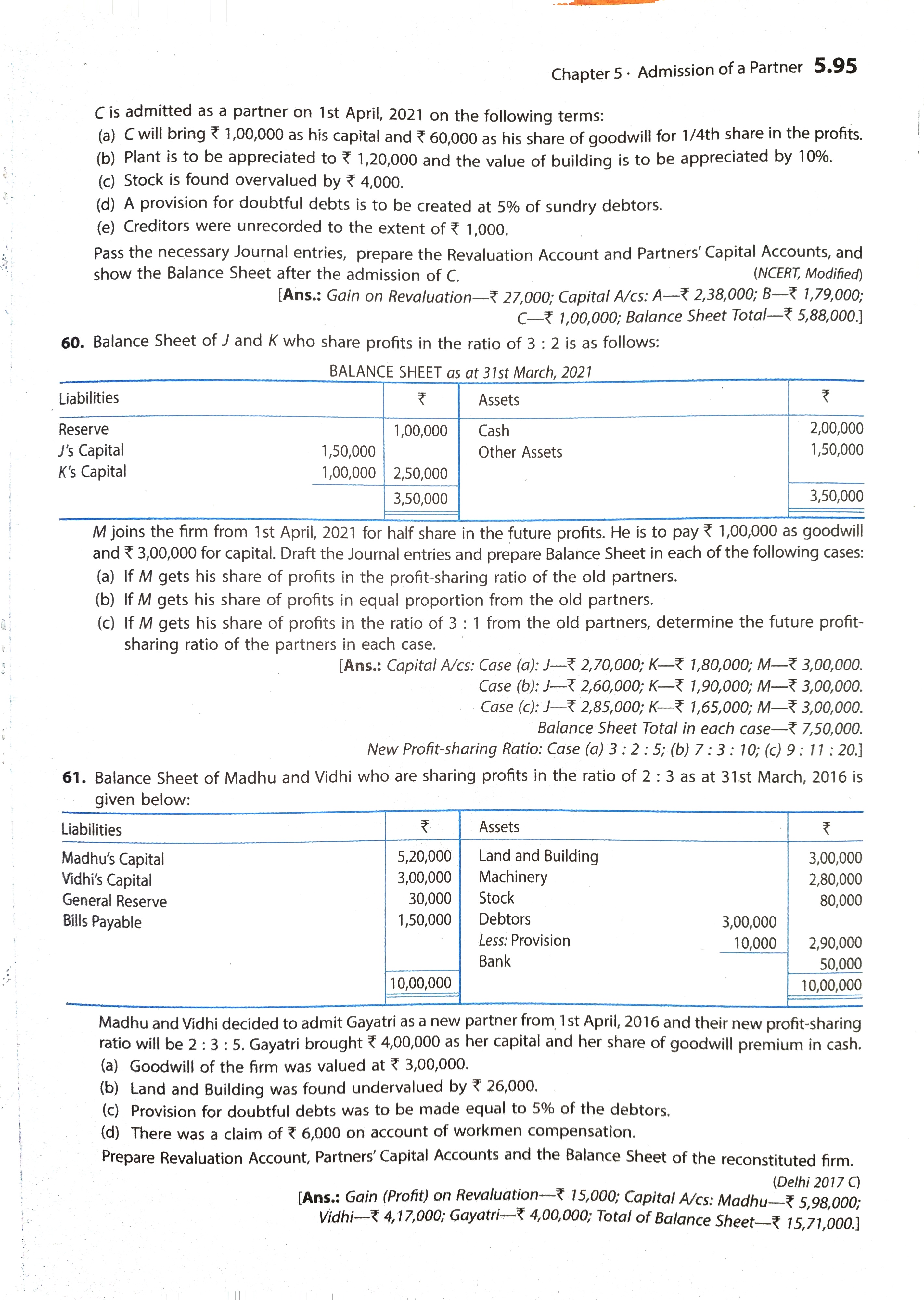

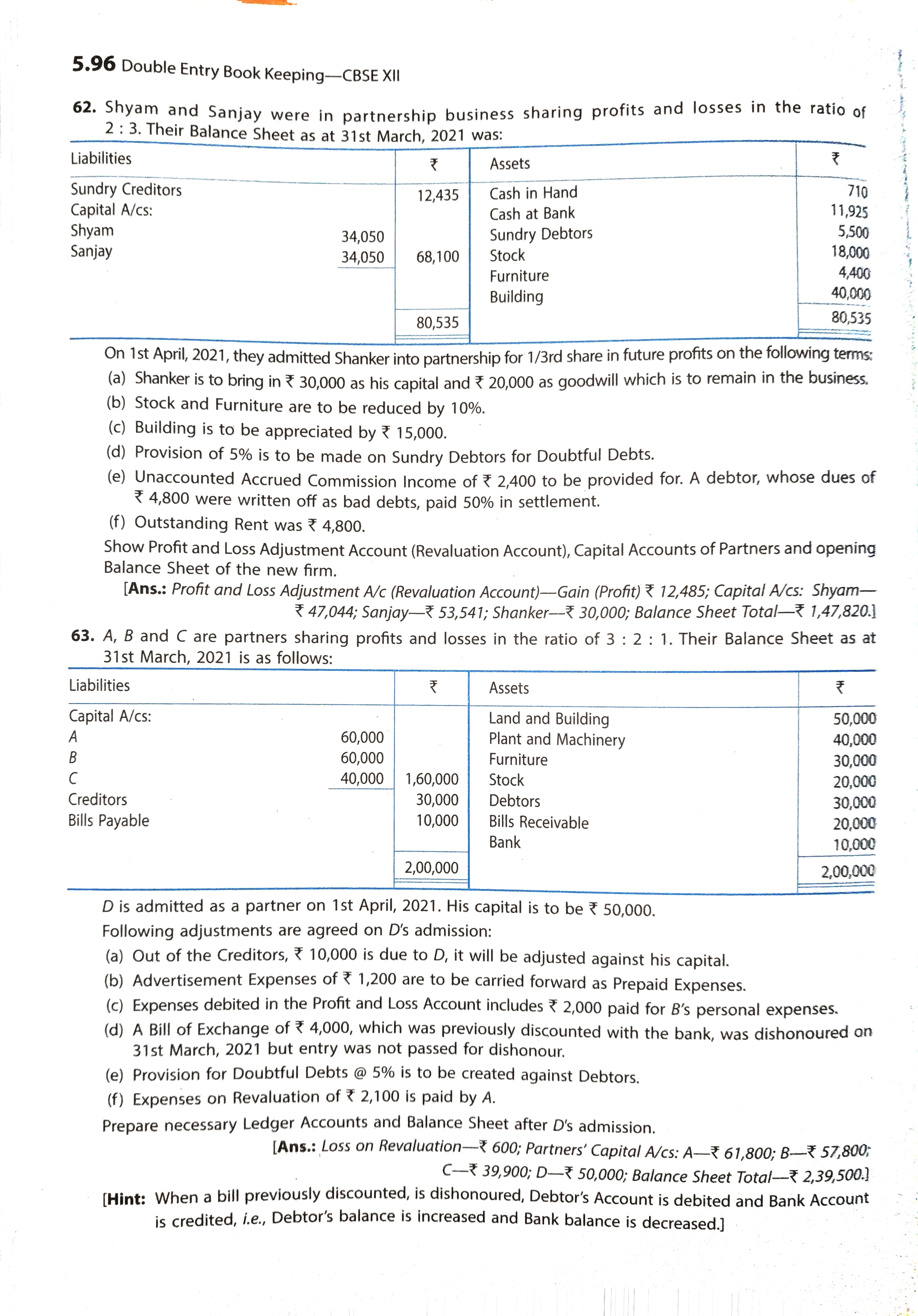

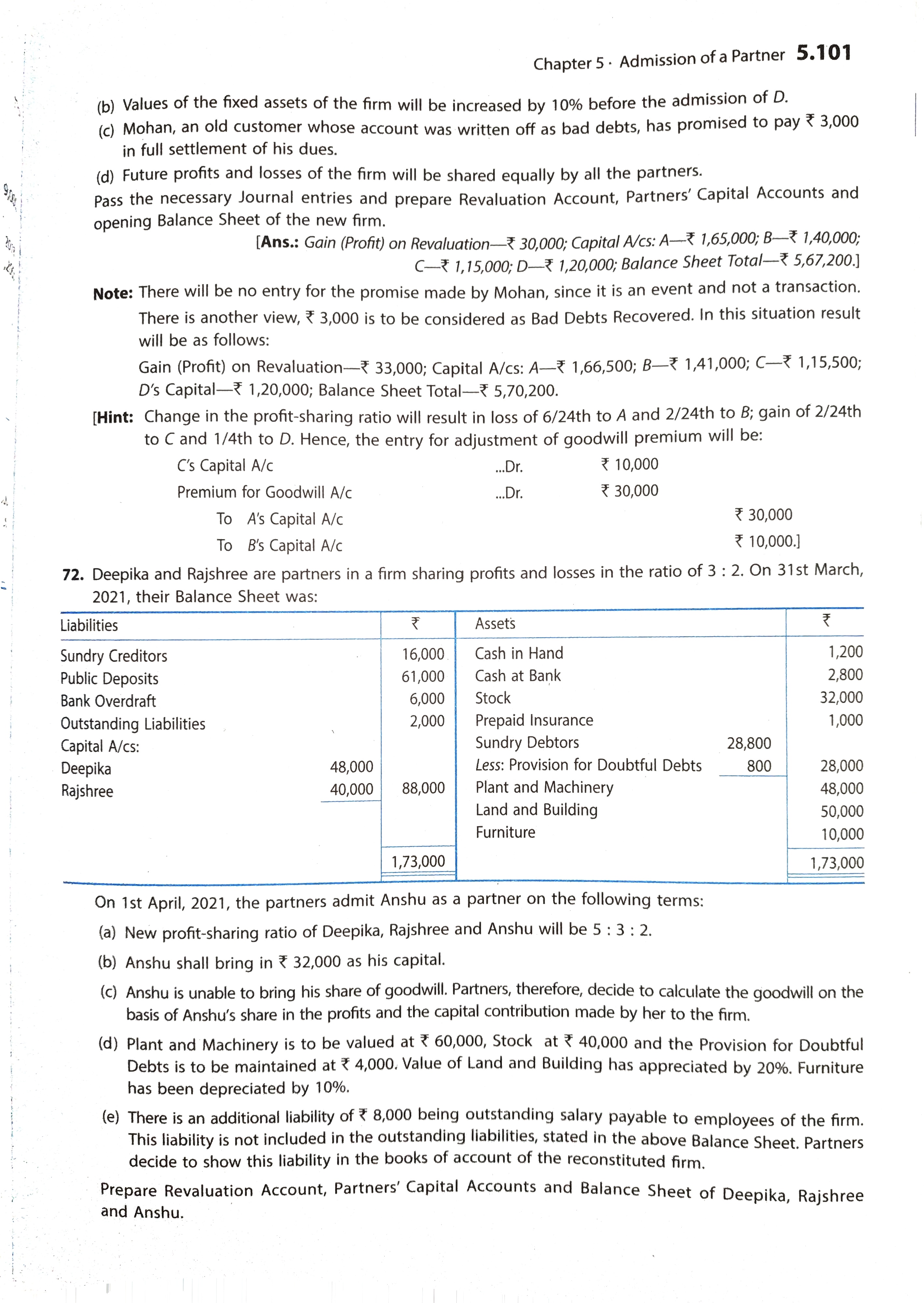

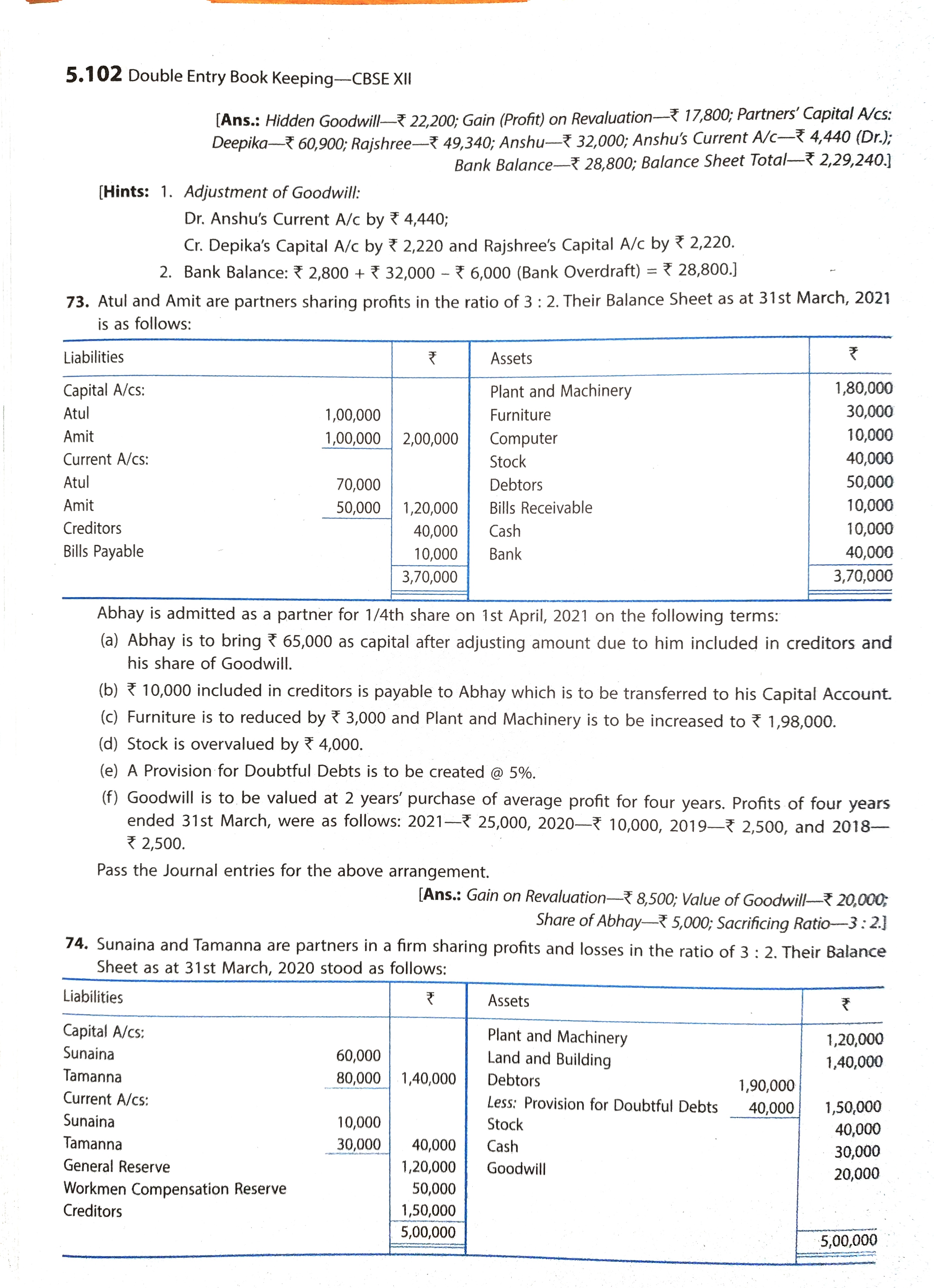

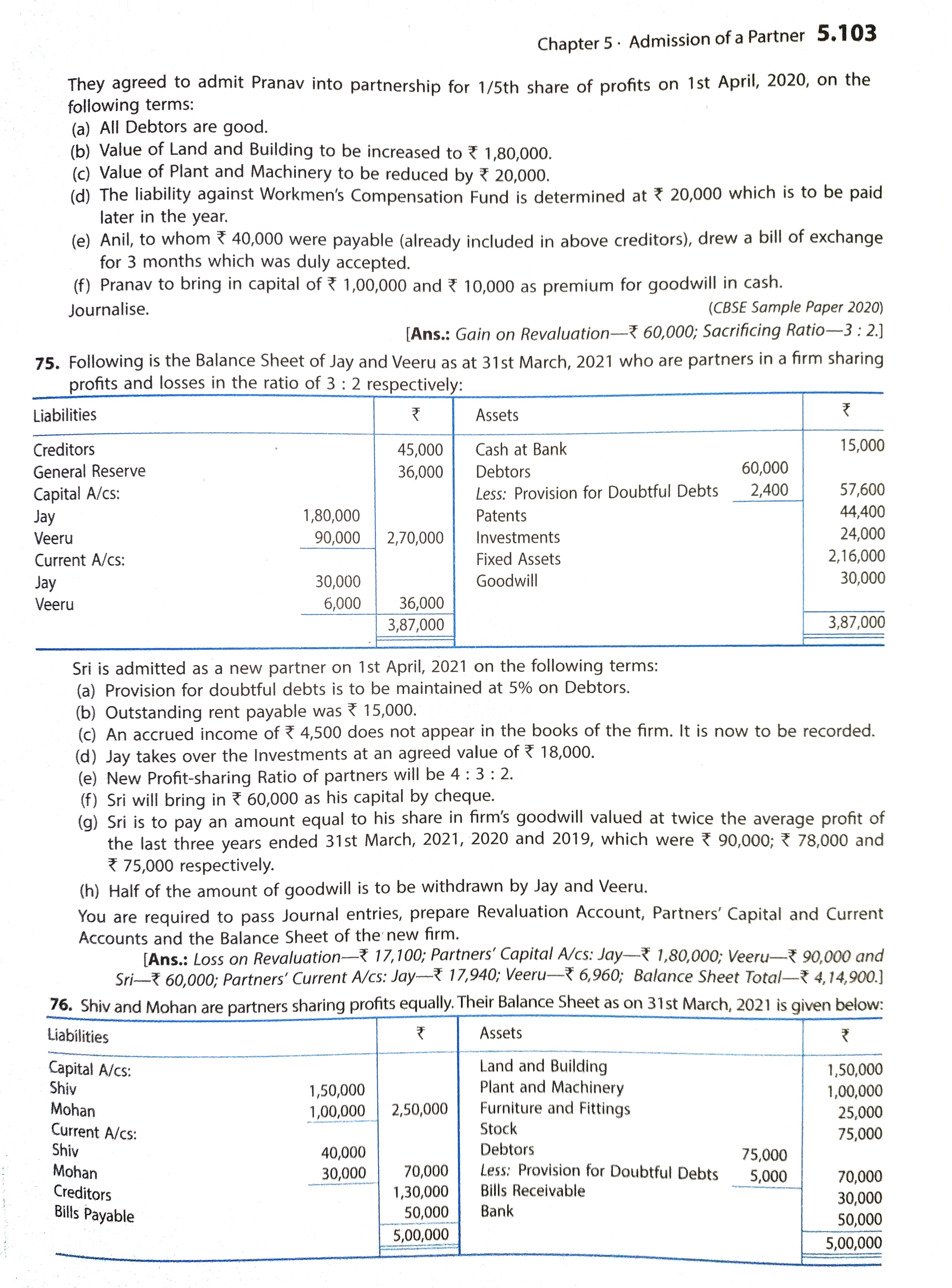

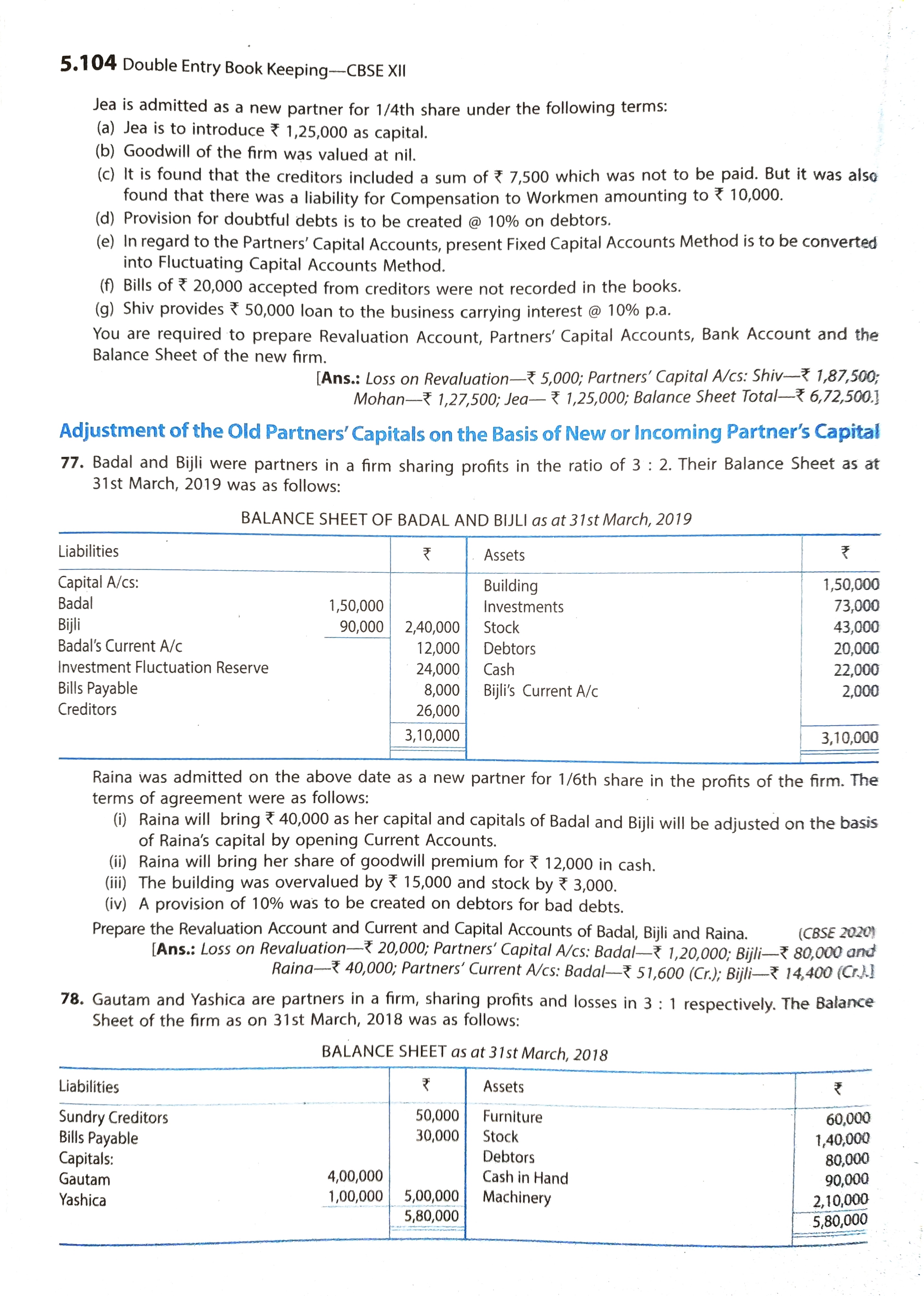

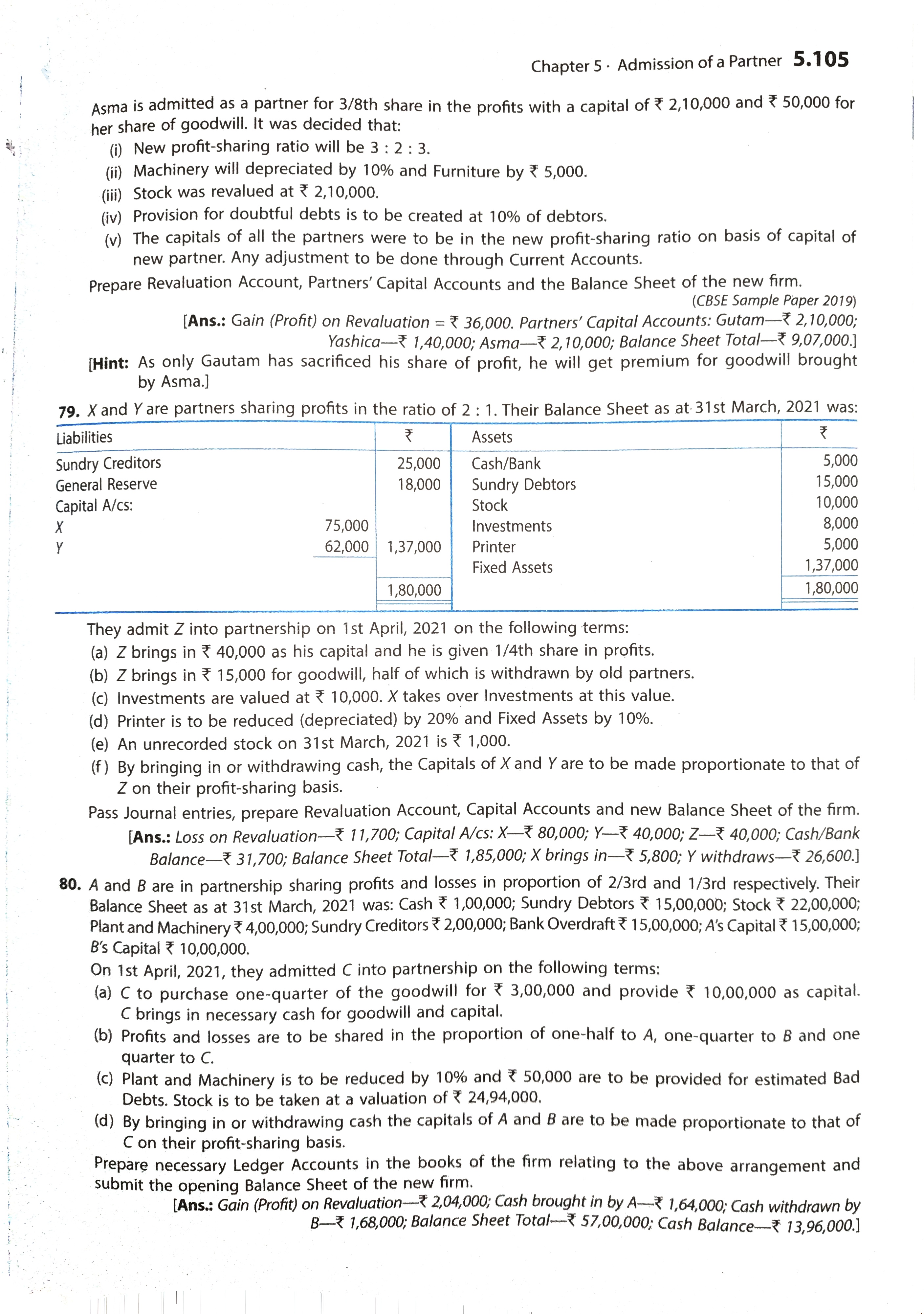

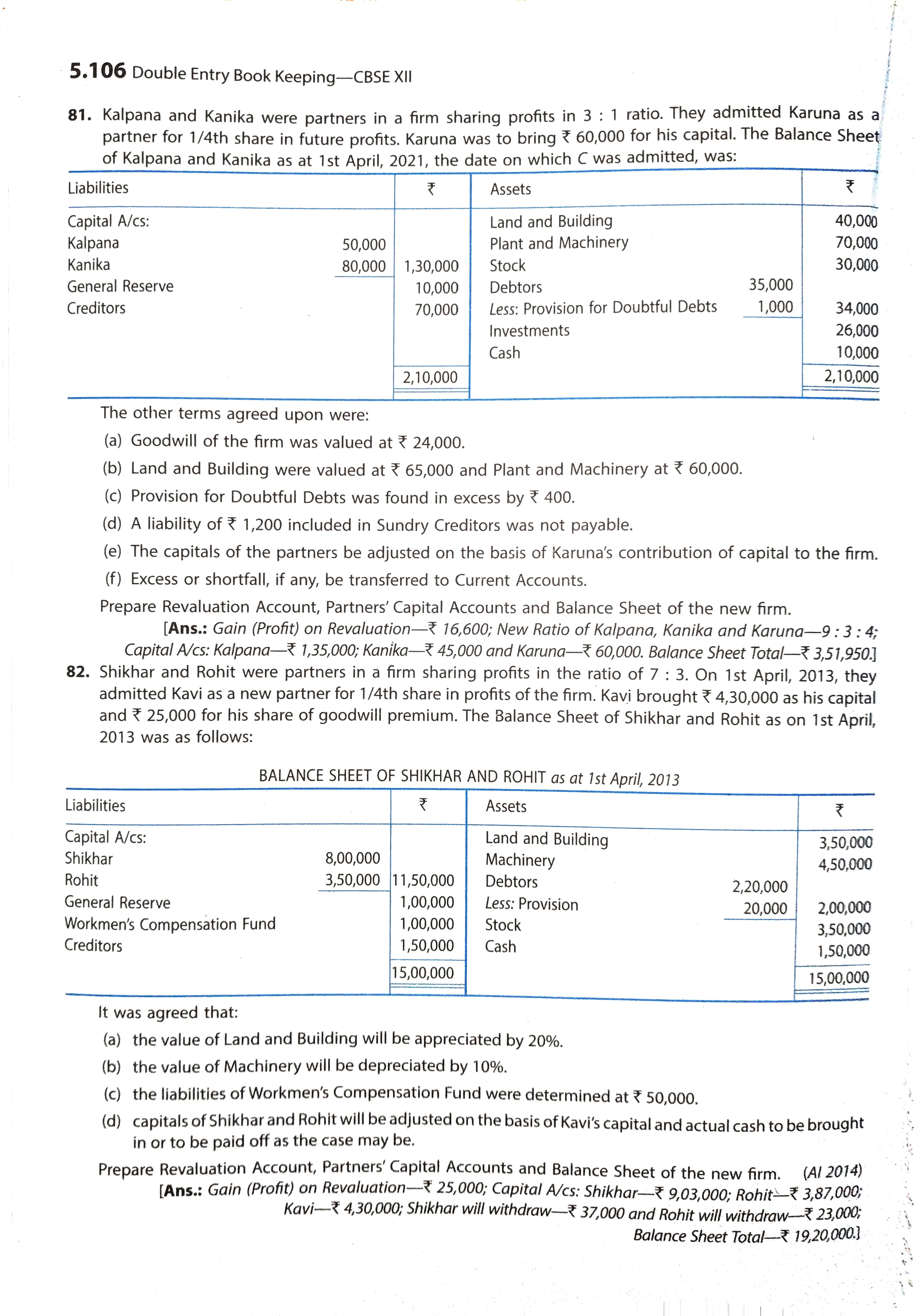

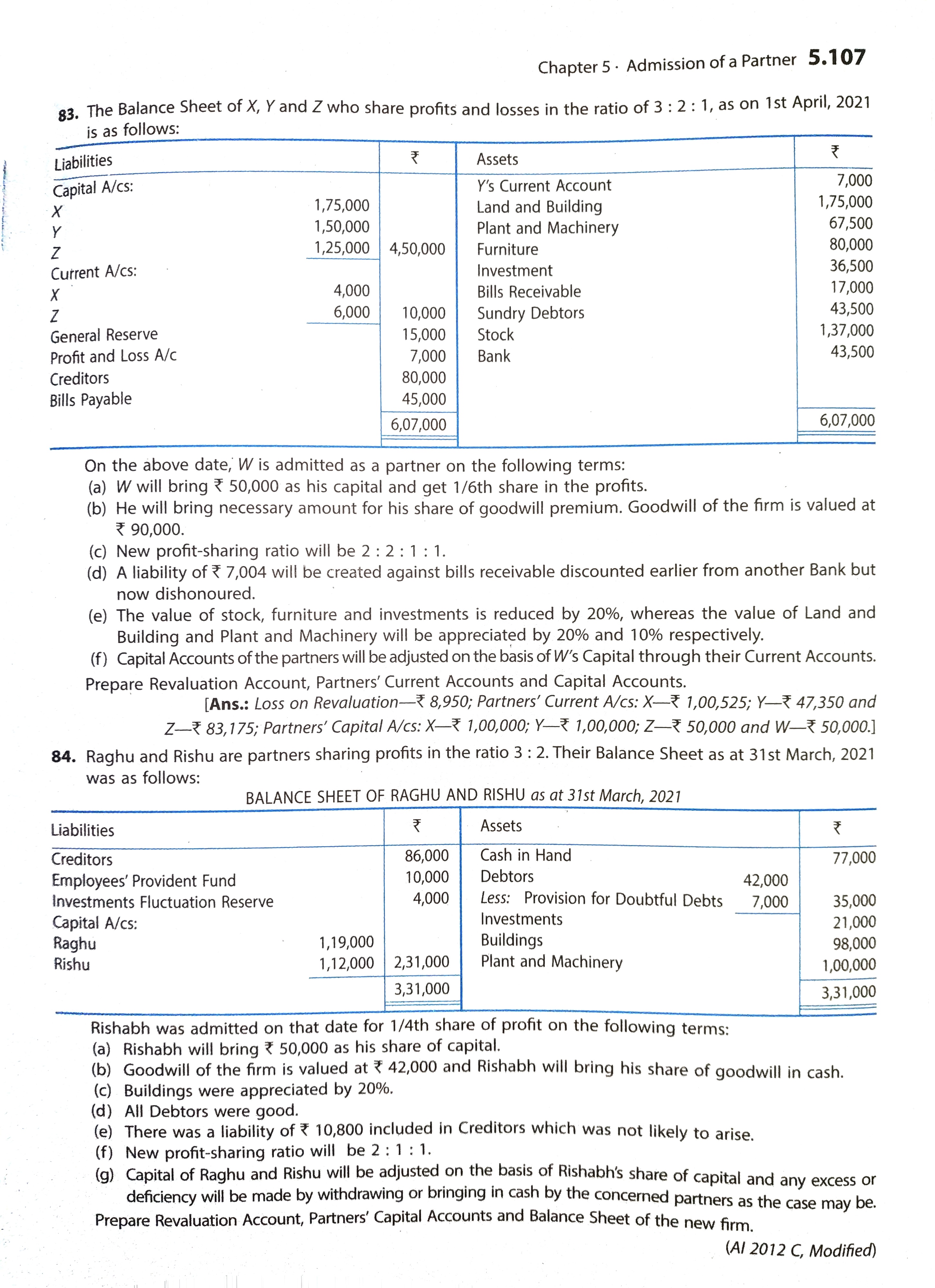

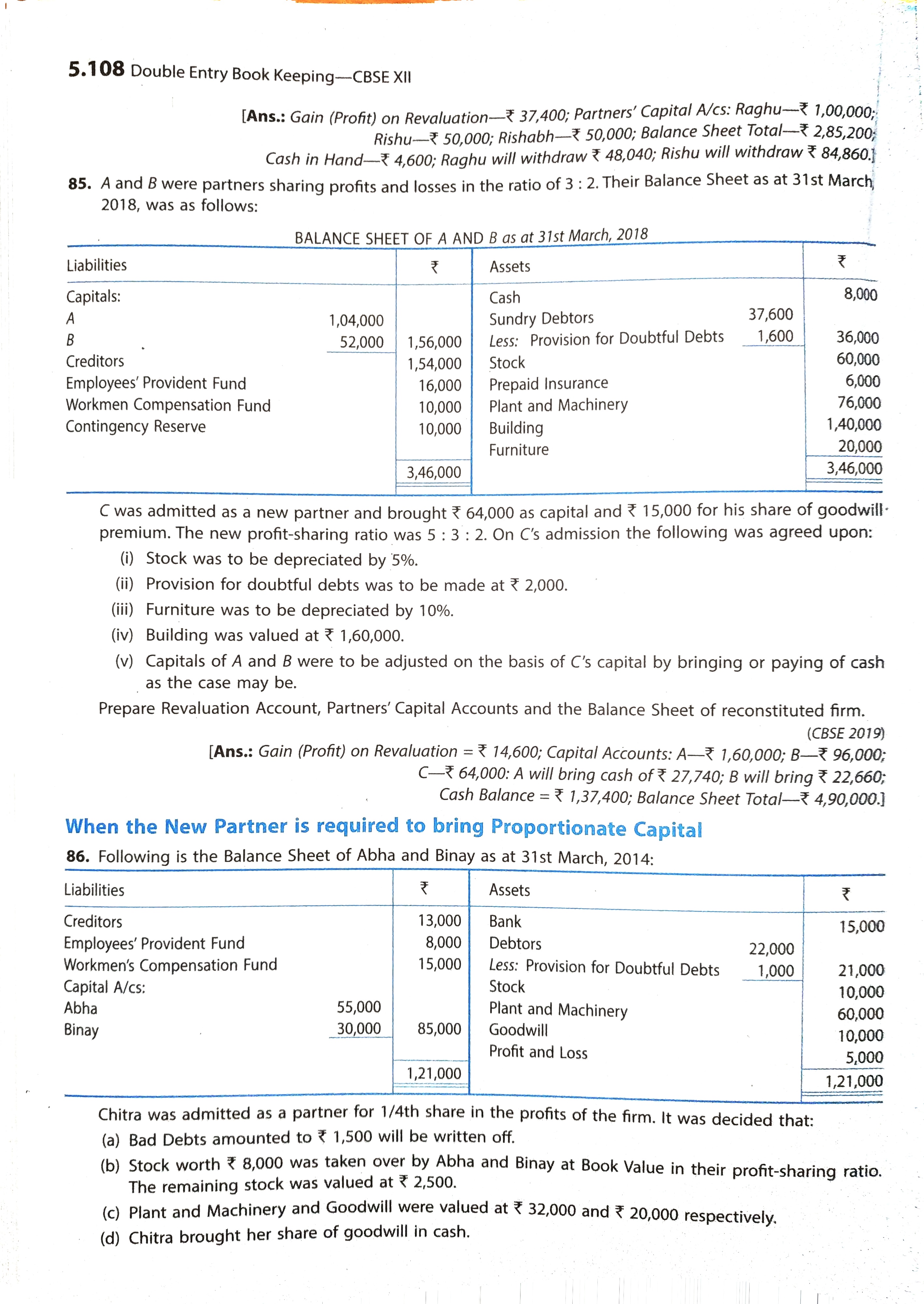

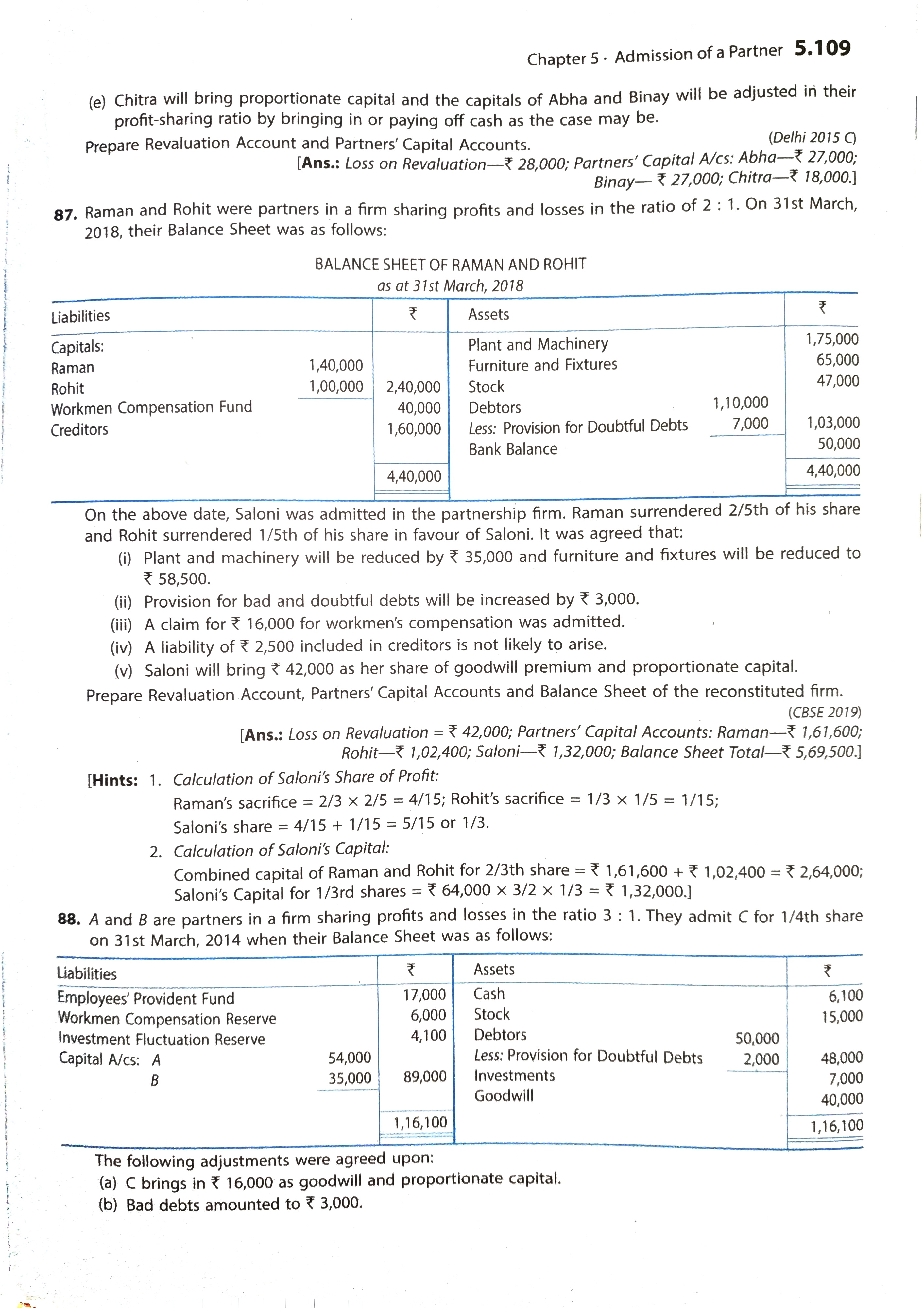

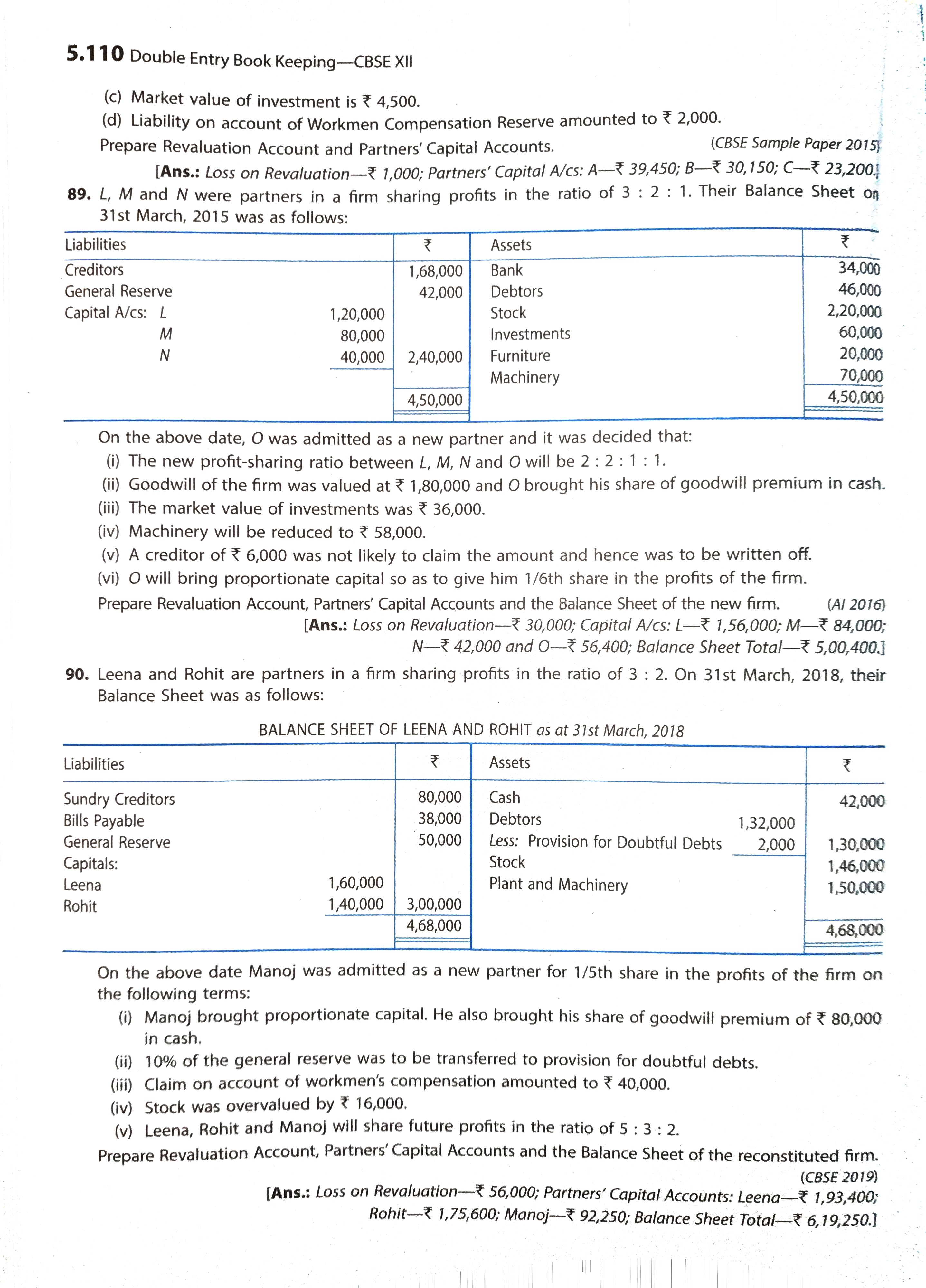

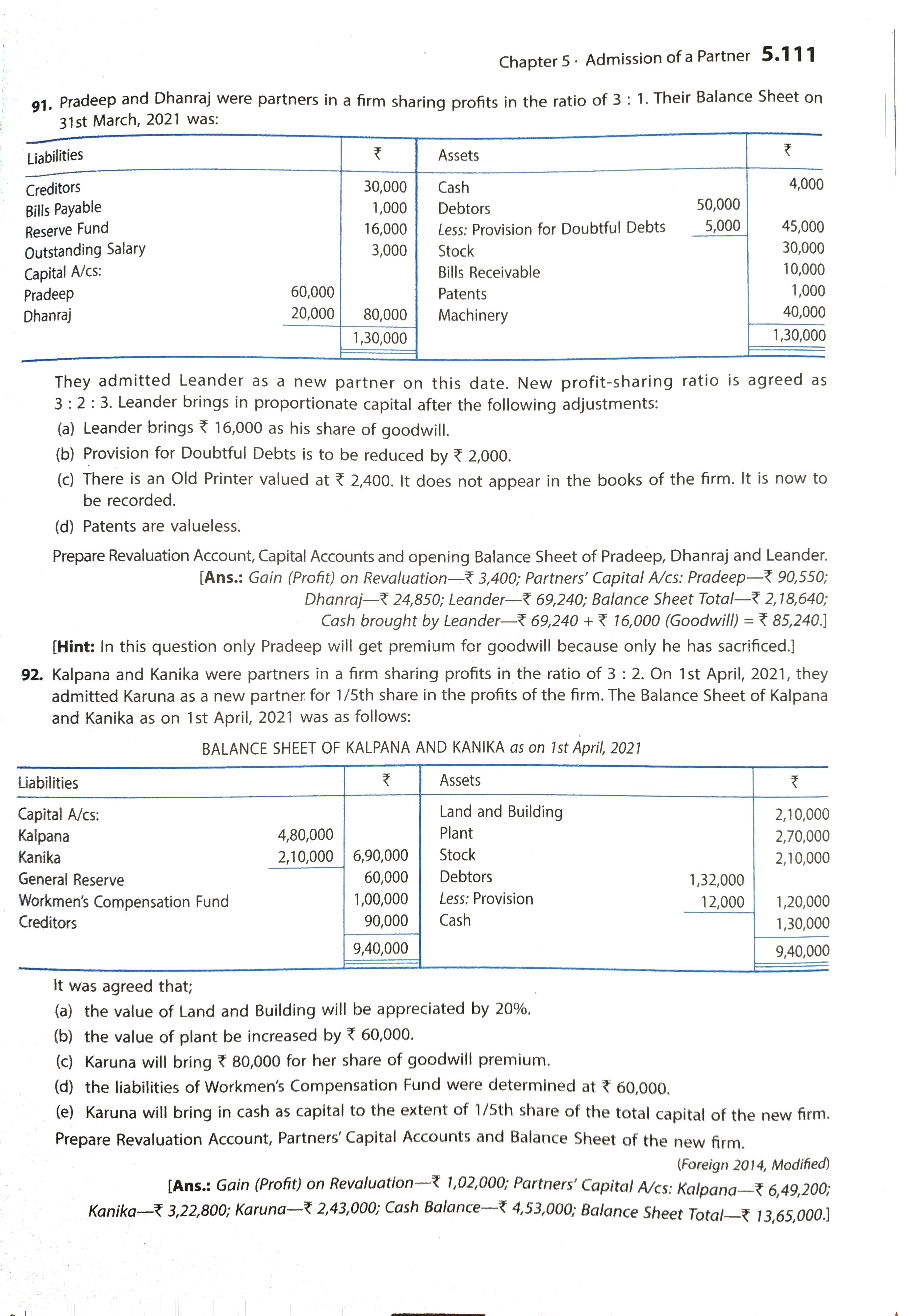

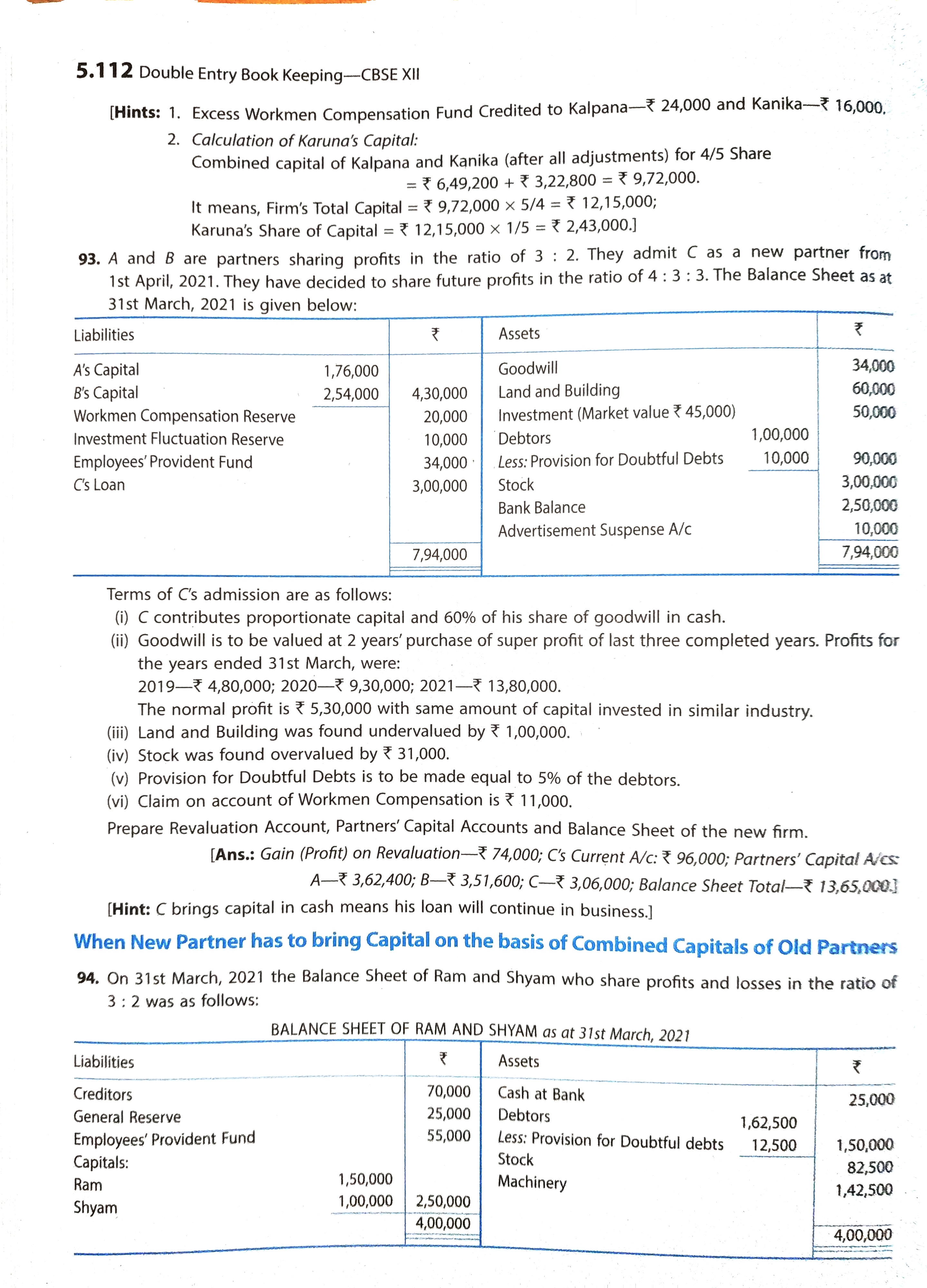

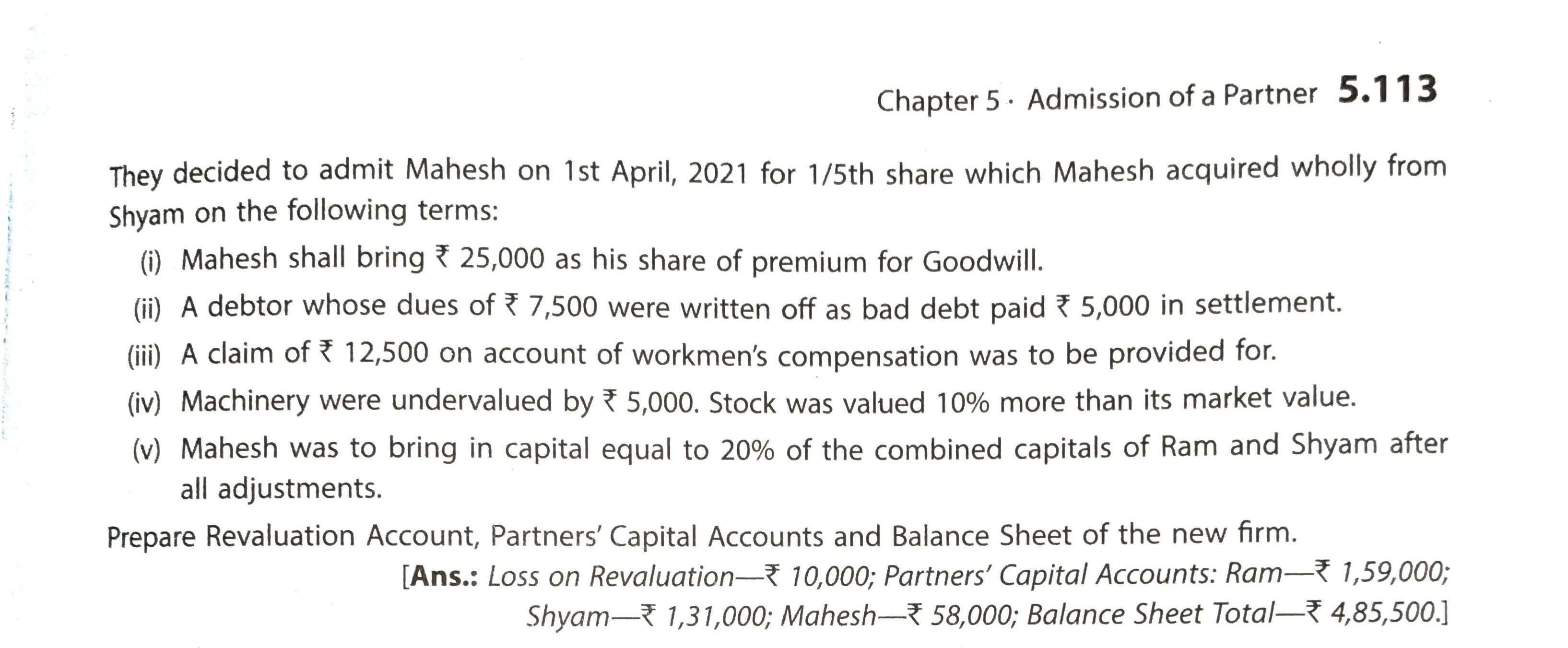

T.S. Grewal Accountancy Class 12th Solutions Chapter 5th – Admission of a Partner is part of TS Grewal Accountancy Class 12 Solutions.

Here we have given TS Grewal Accountancy Class 12 Solutions Chapter – 5th of Accounting for Partnership Firms – Fundamentals Book Edition 2021.

| Board | CBSE |

| Textbook | NCERT |

| Book | Accounting for Partnership Firms |

| Volume | I |

| Class | 12th |

| Subject | Accountancy |

| Chapter | 5 |

| Chapter Name | Admission of a Partner |

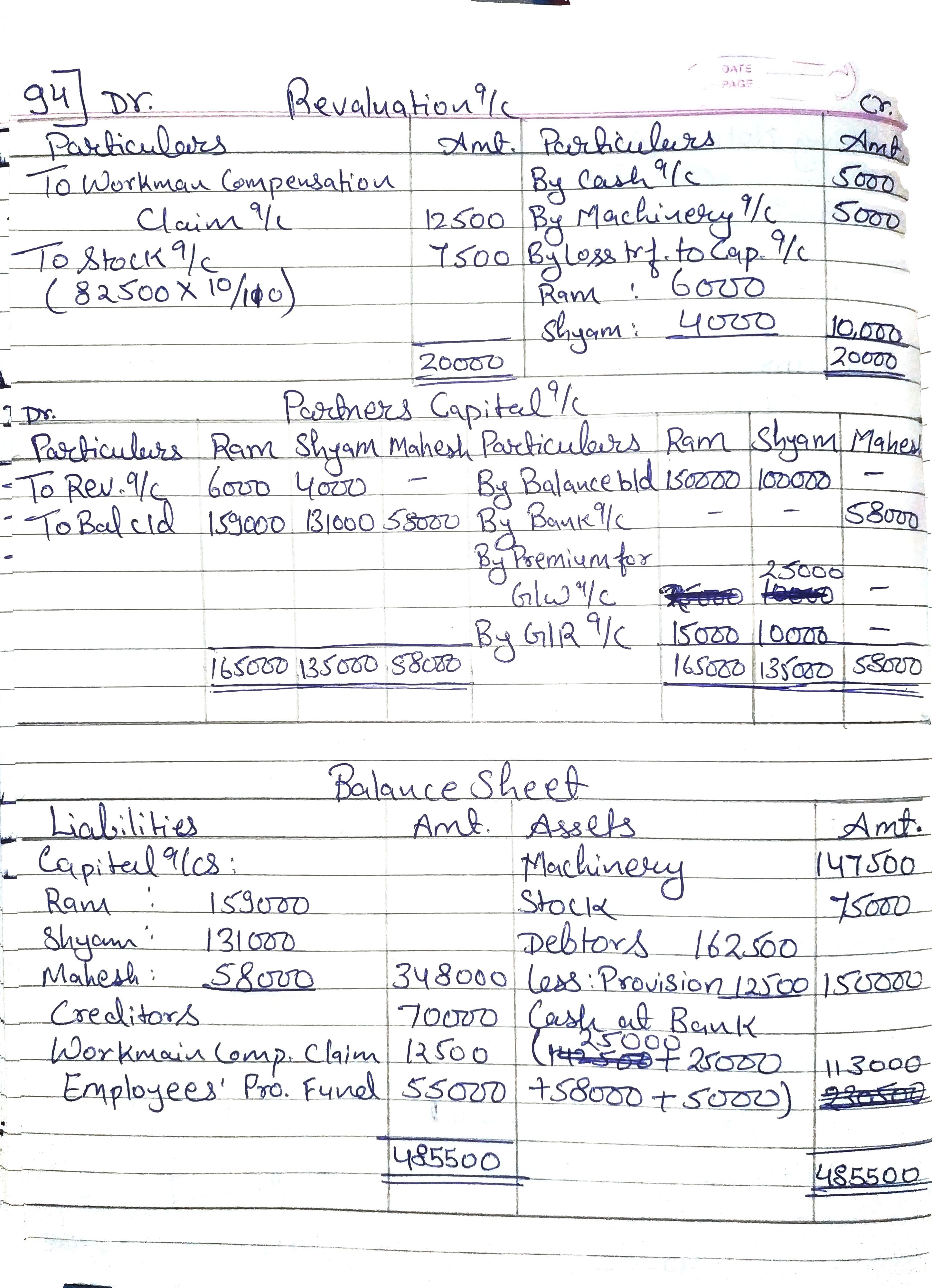

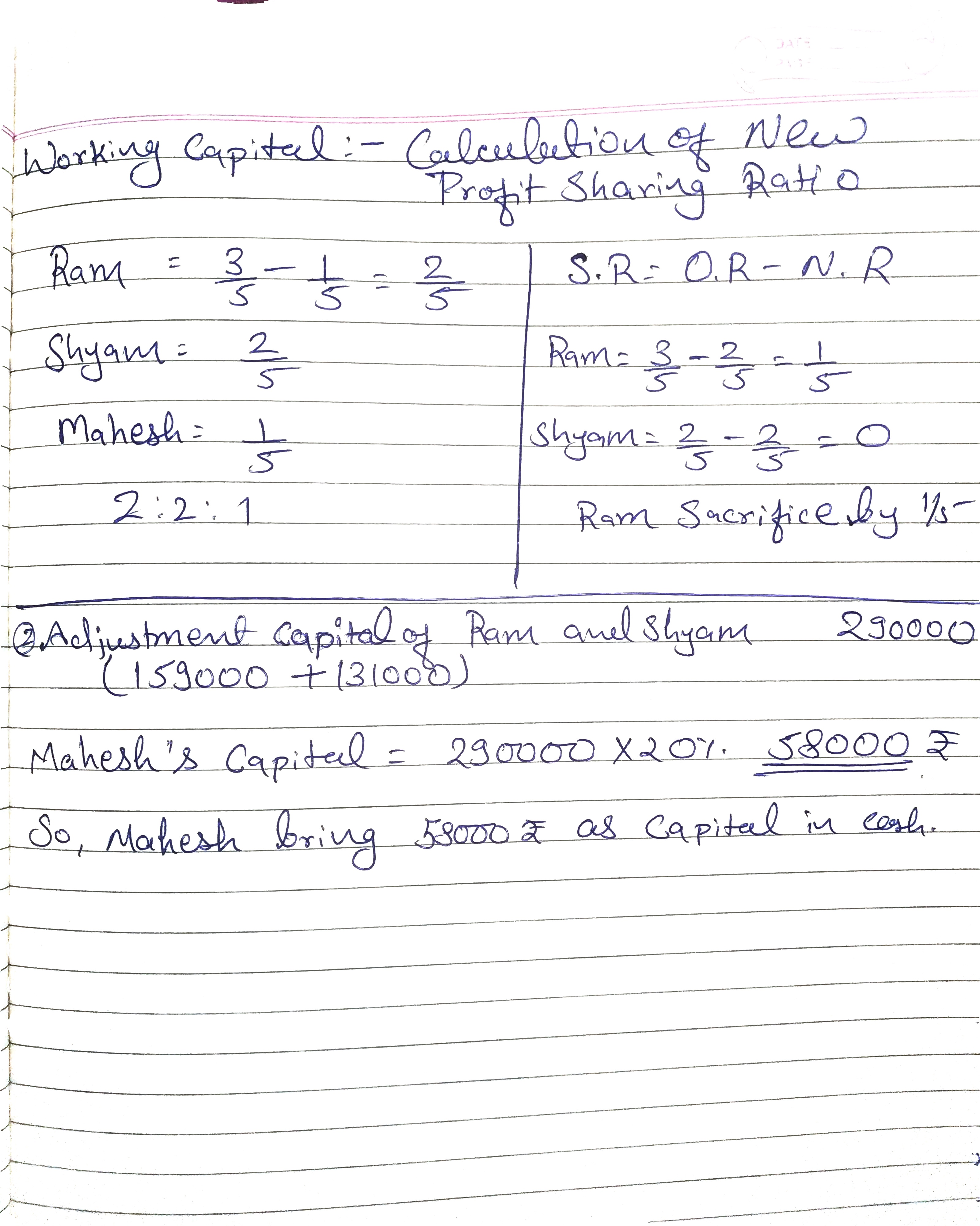

| Number of Questions (Solved) | 94 |

| Category | TS Grewal’s Solutions |

MCQ’S

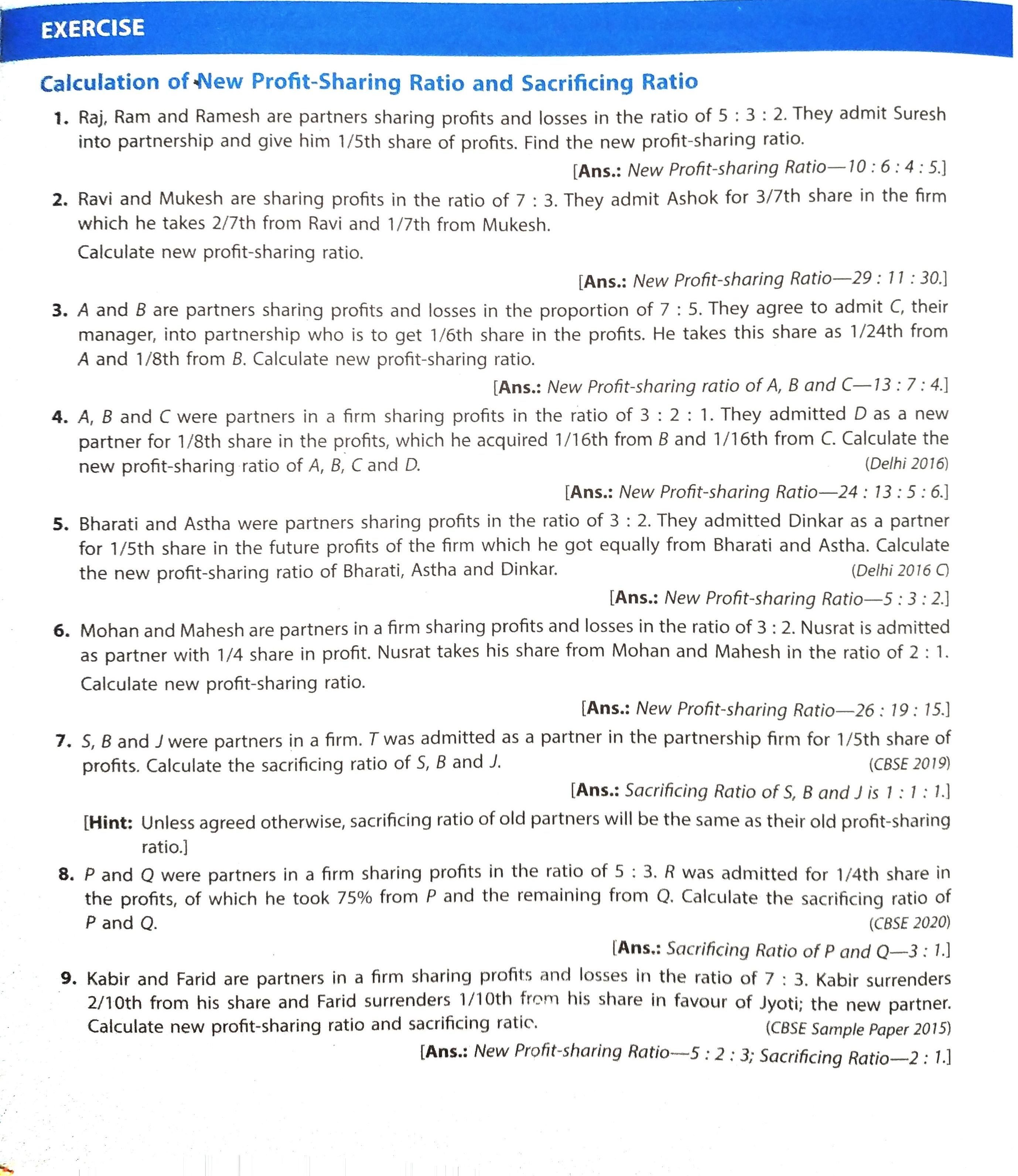

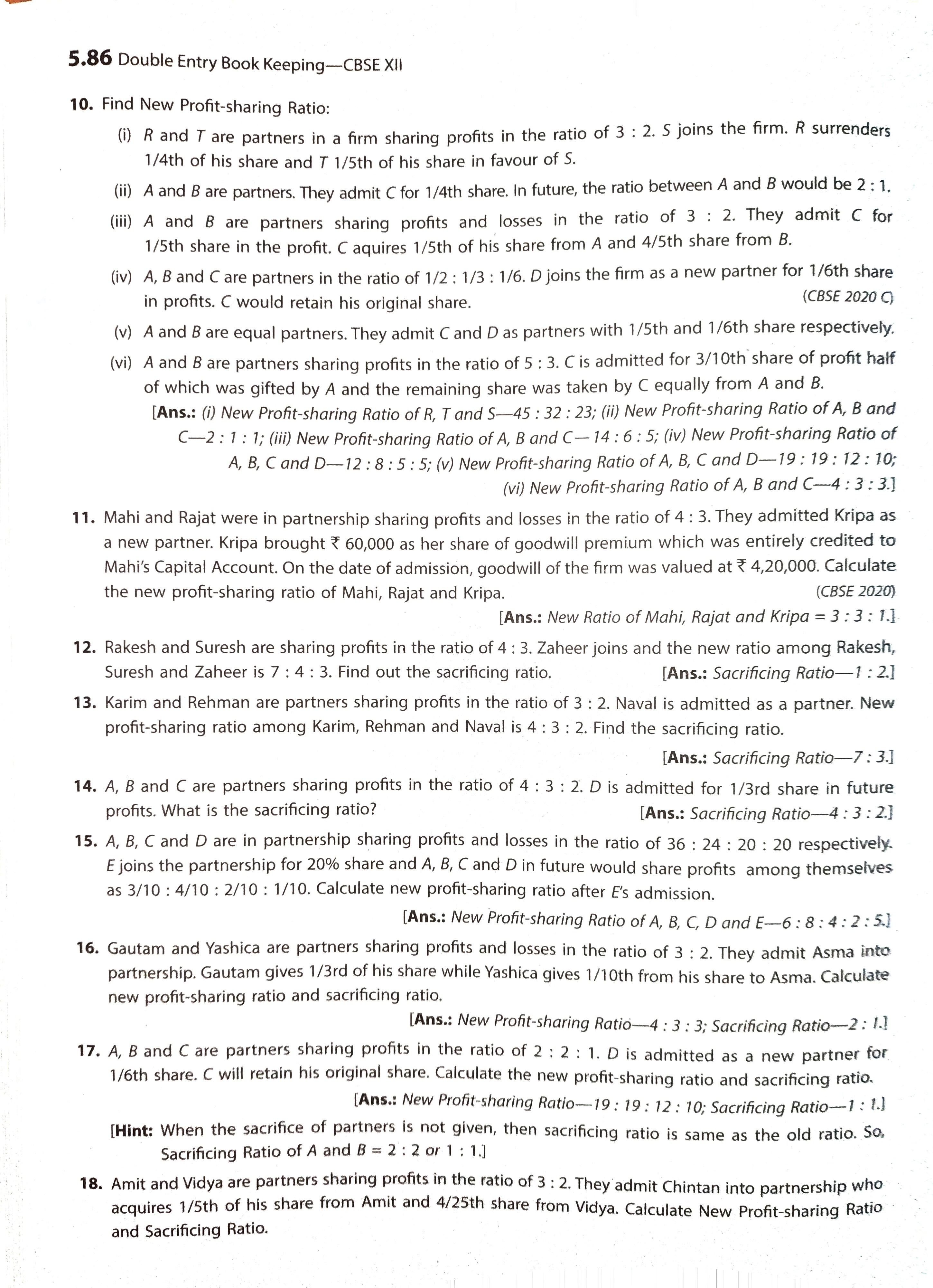

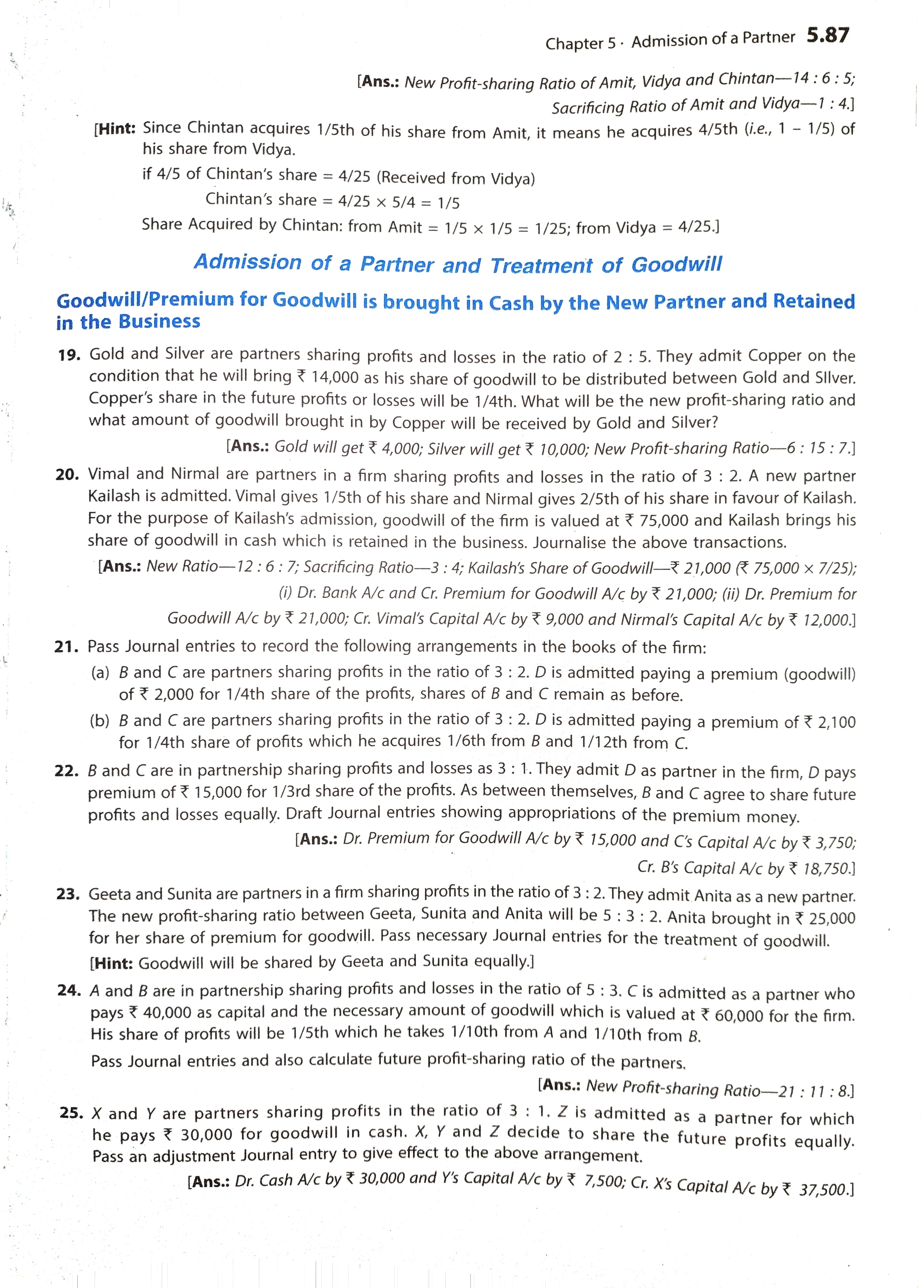

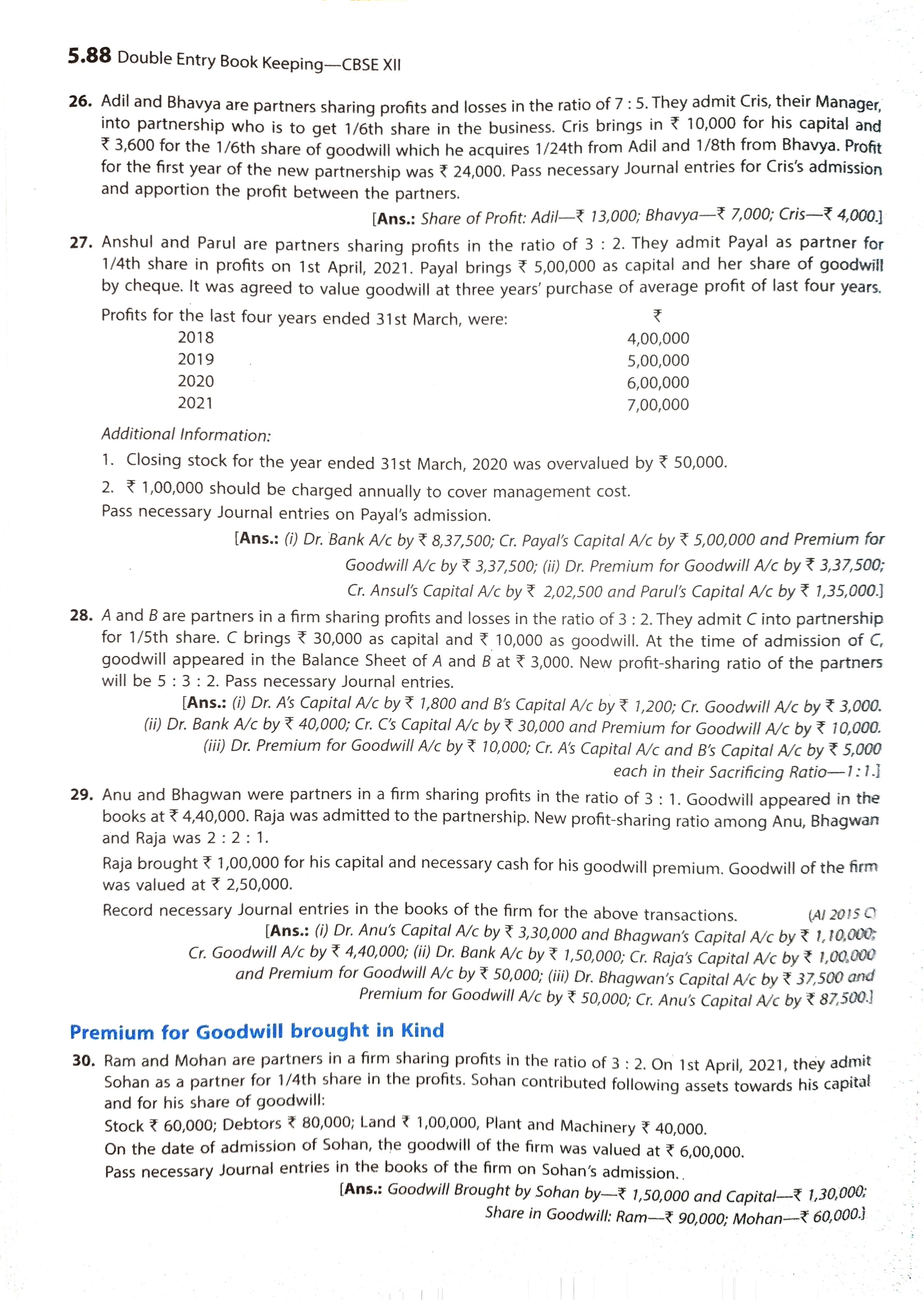

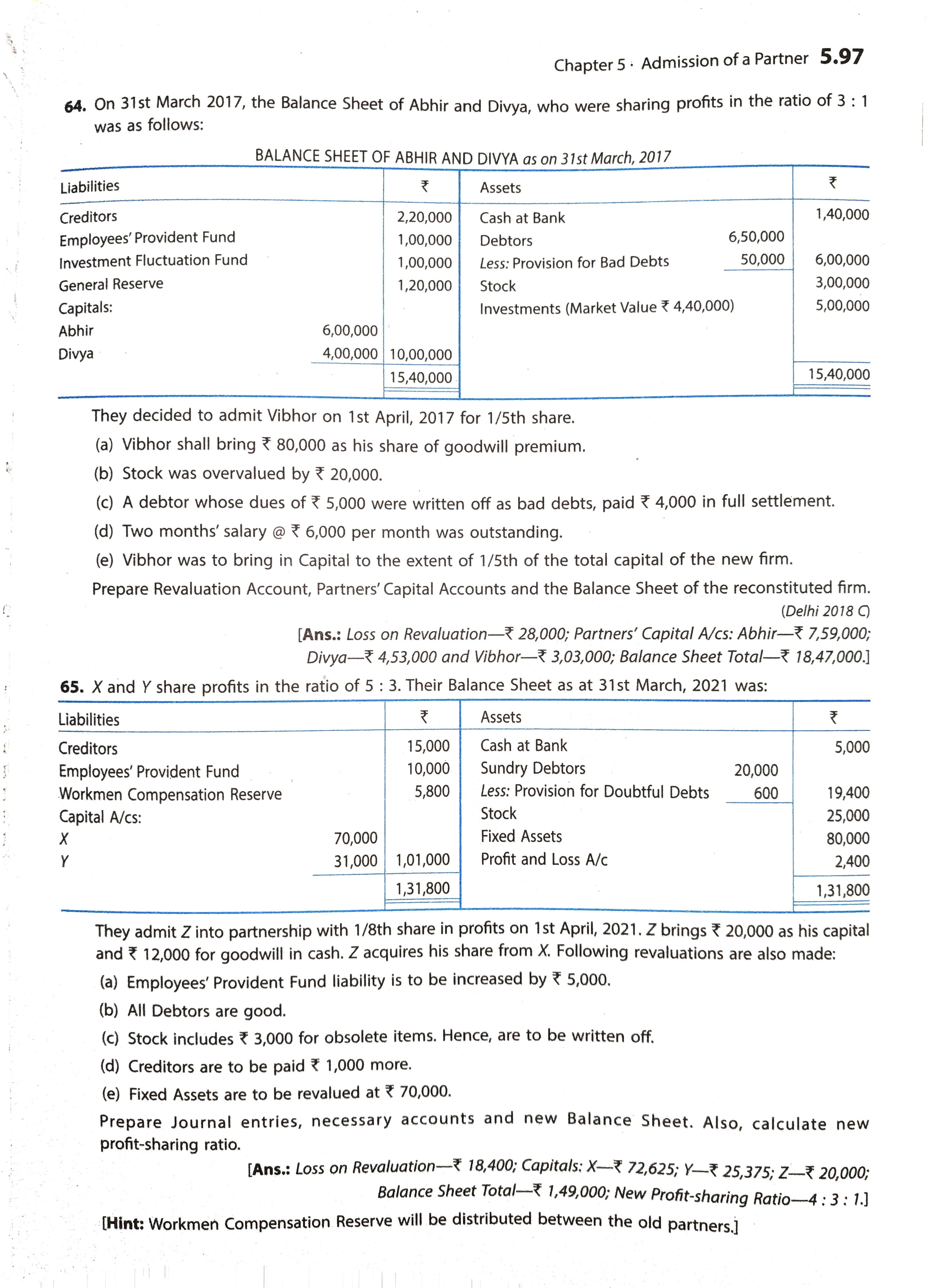

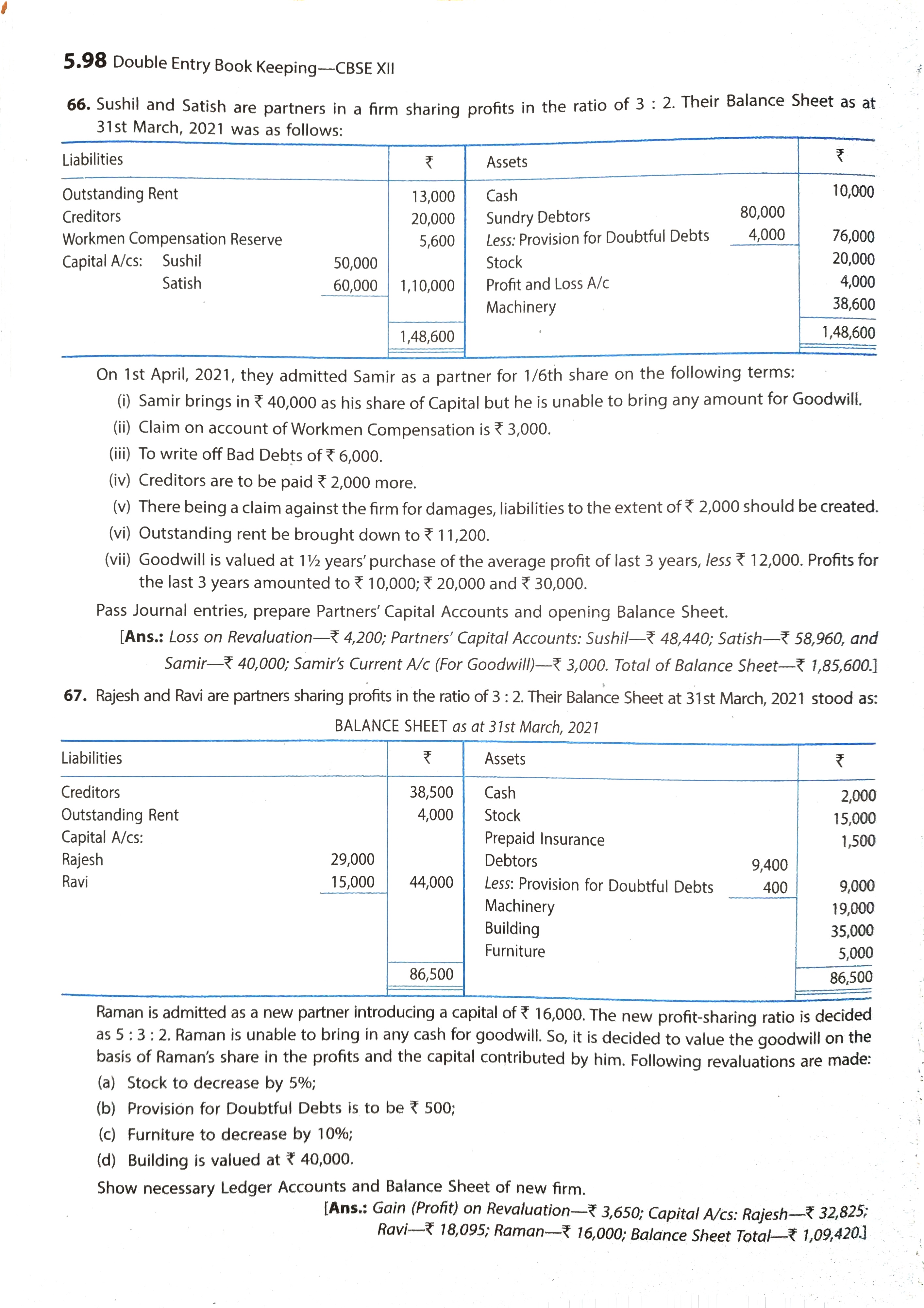

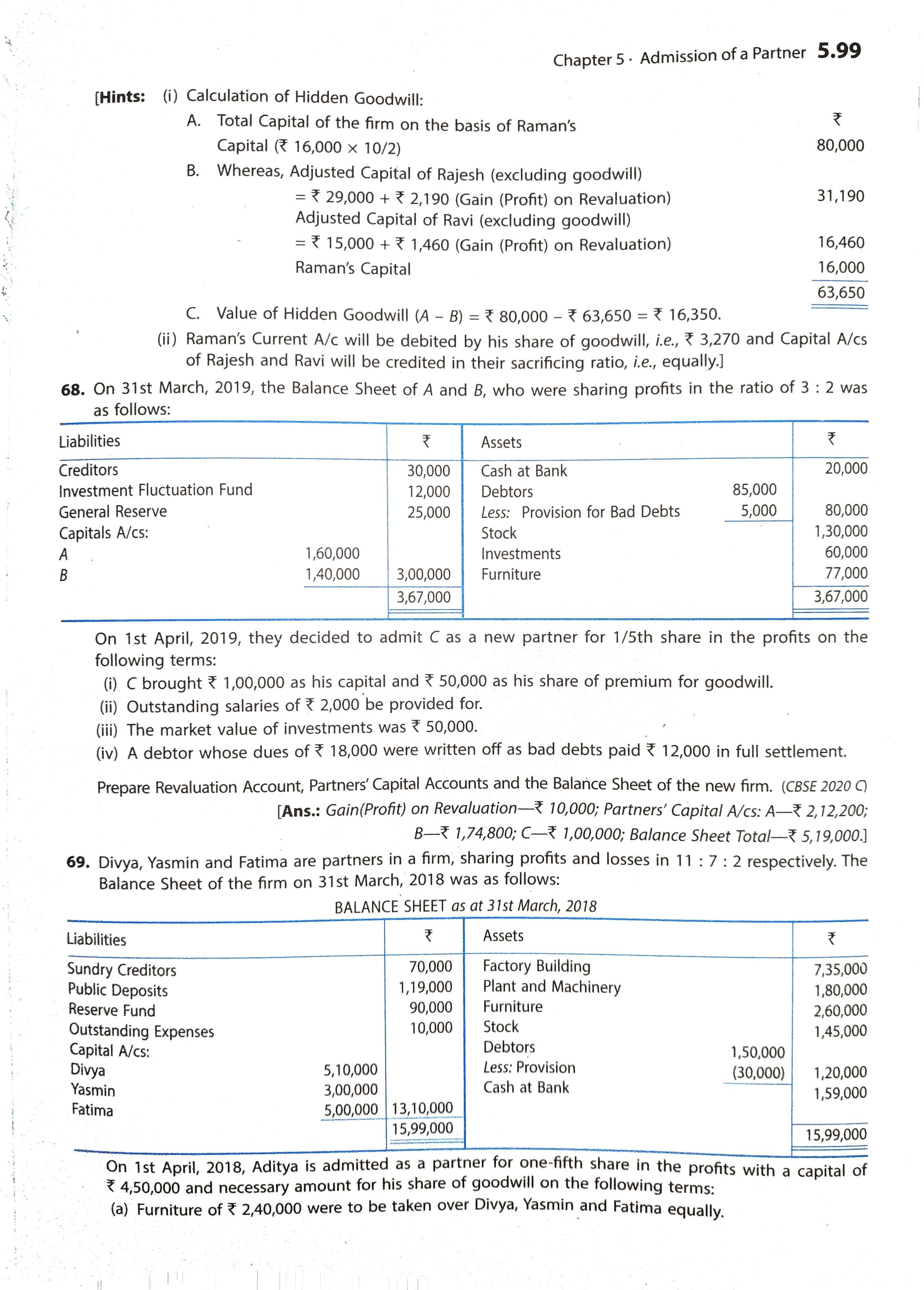

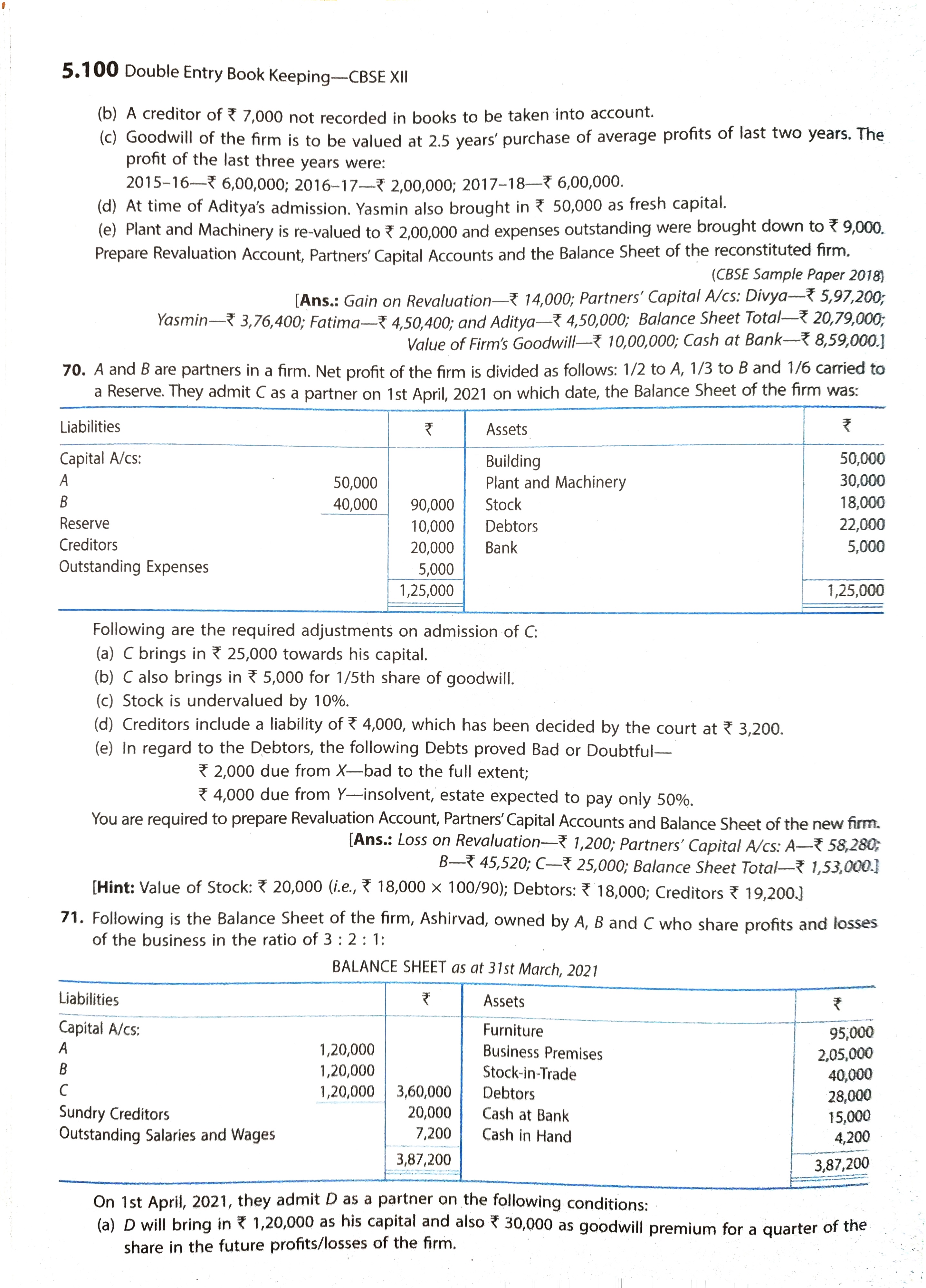

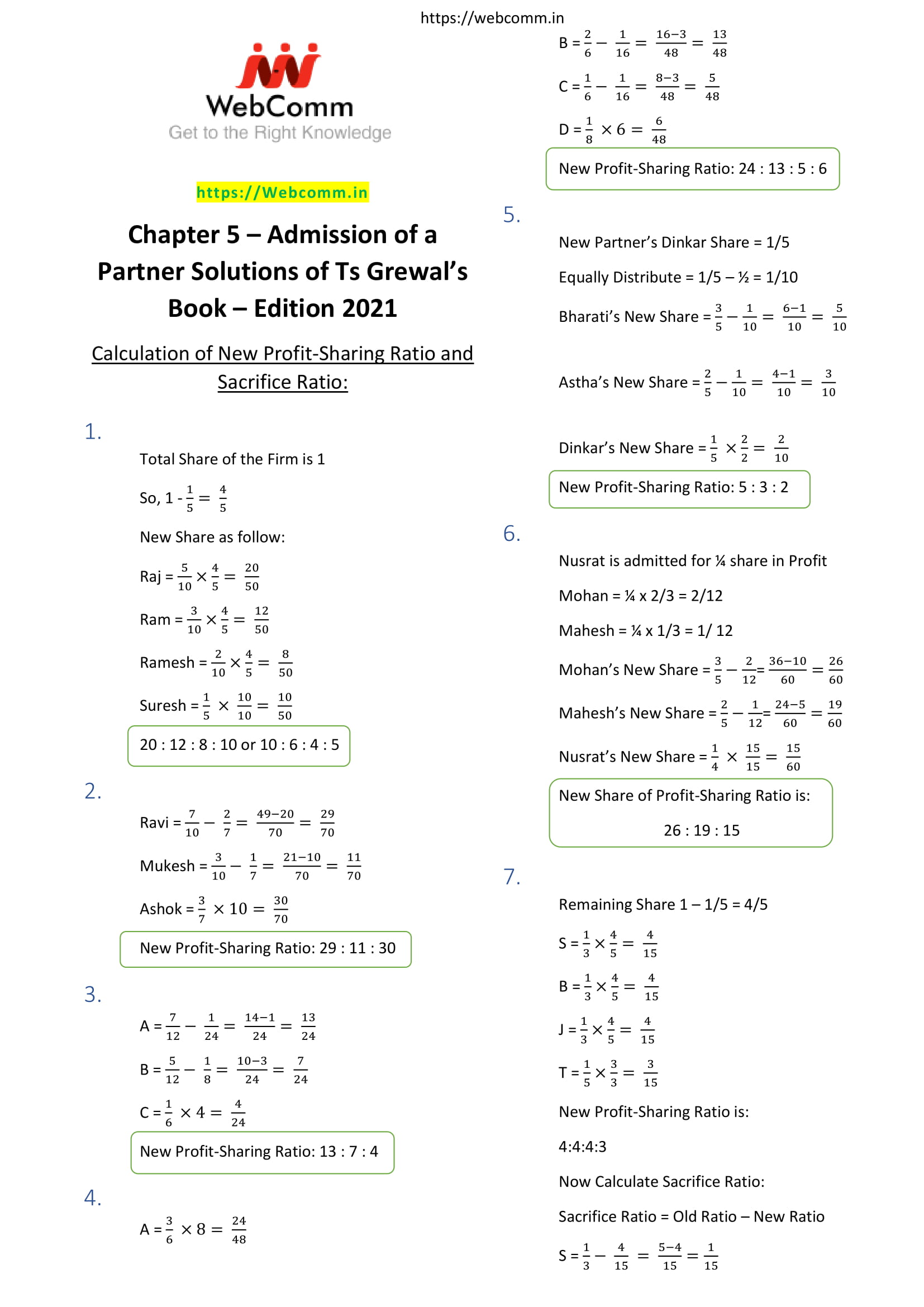

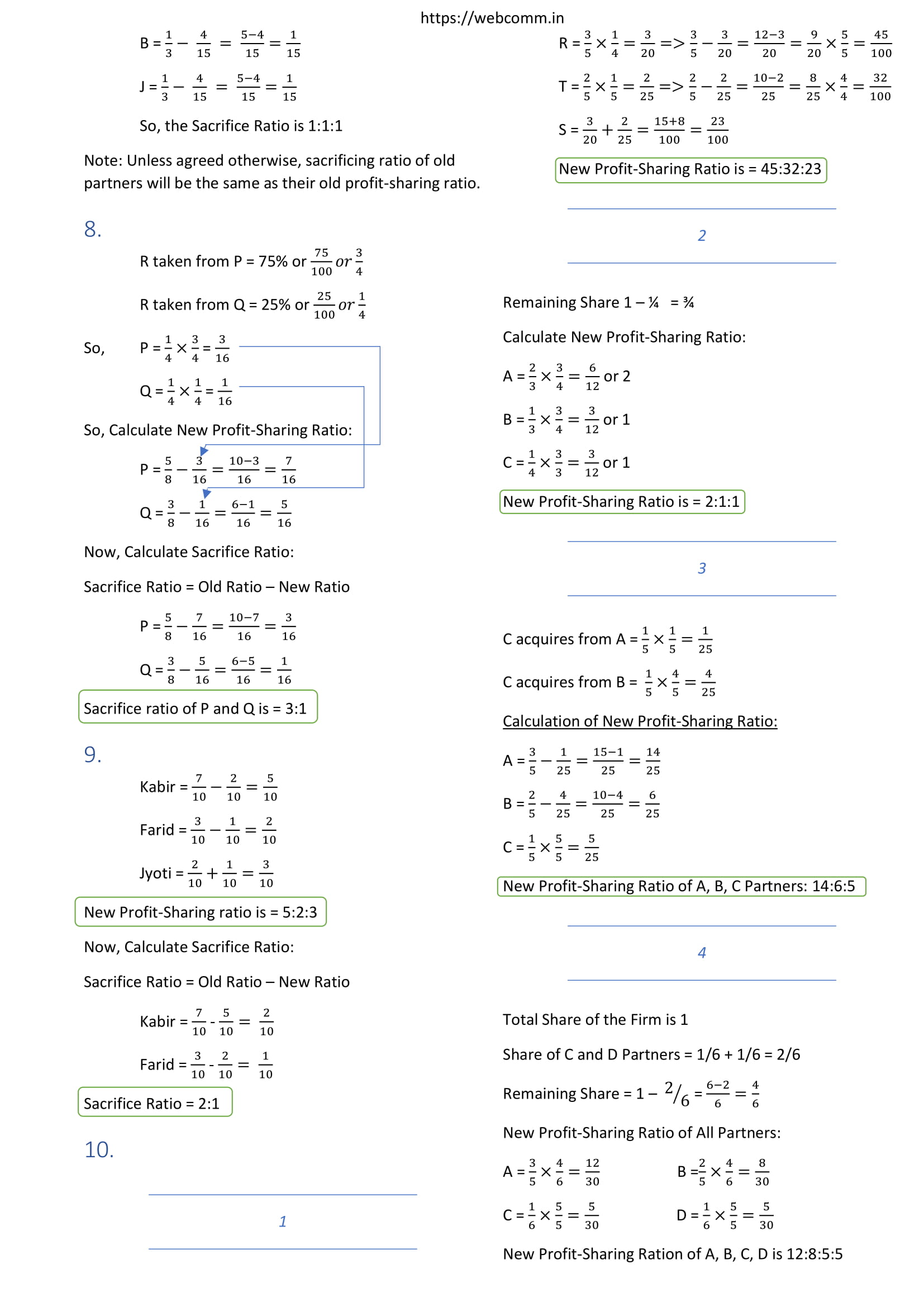

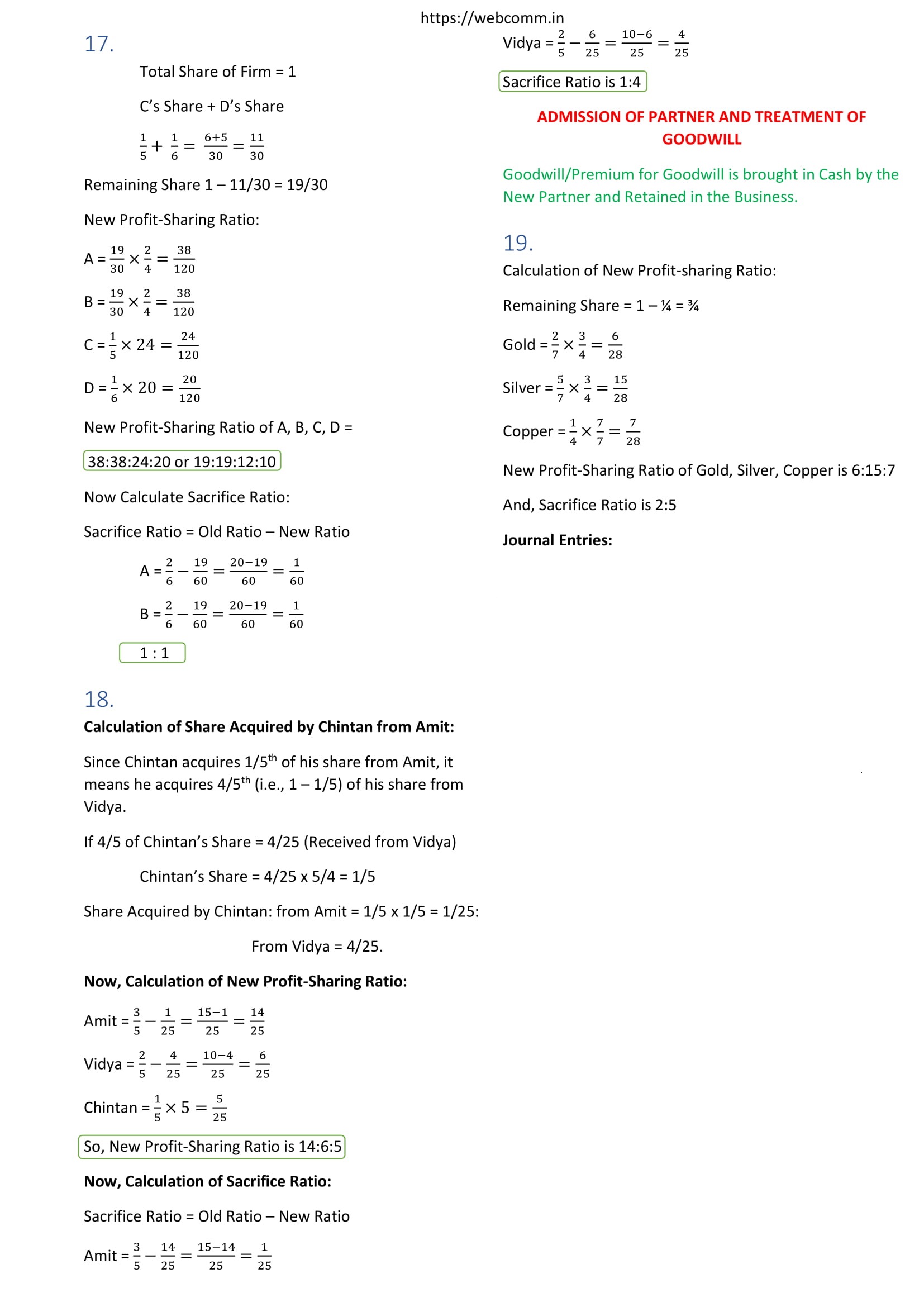

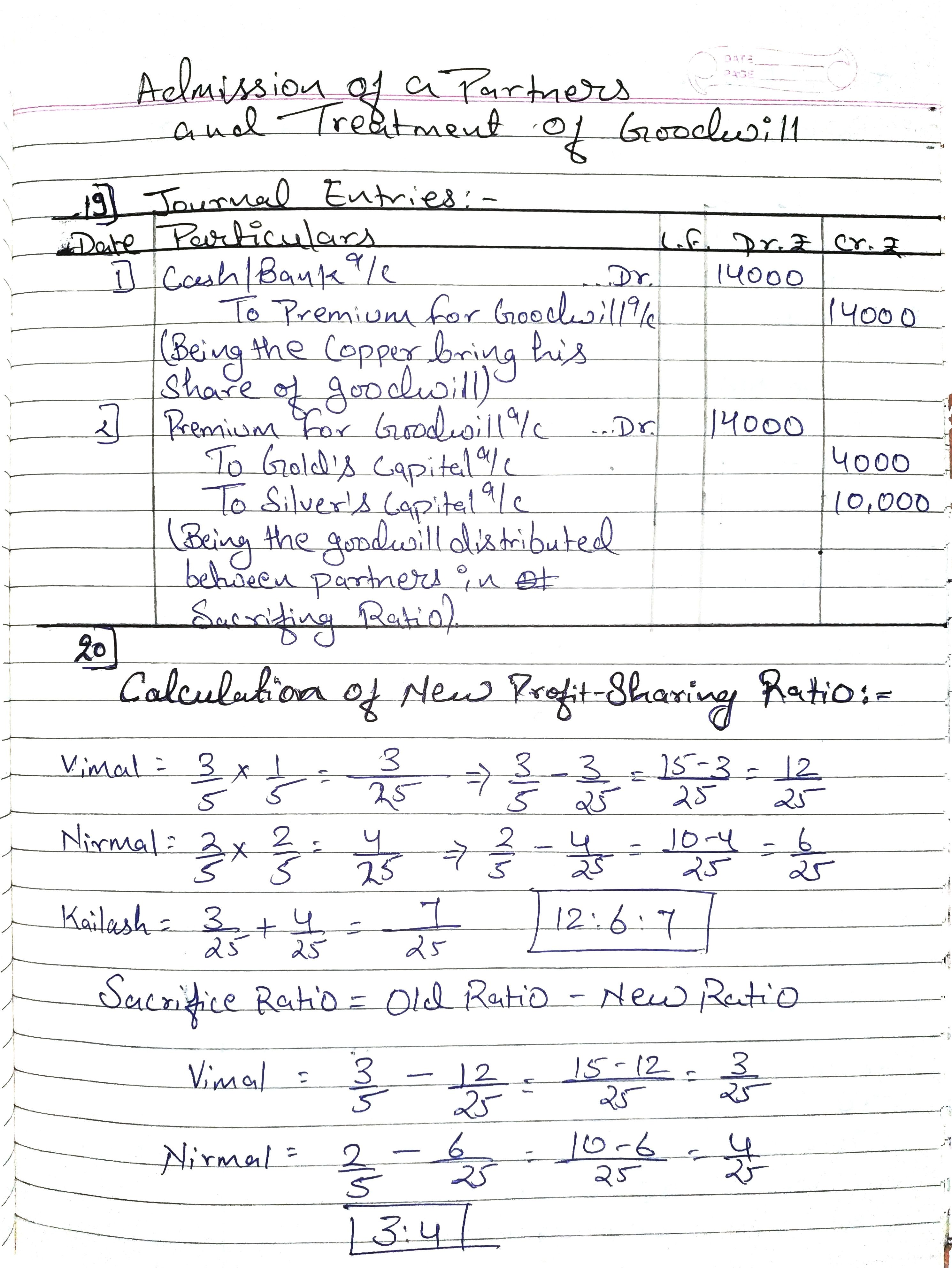

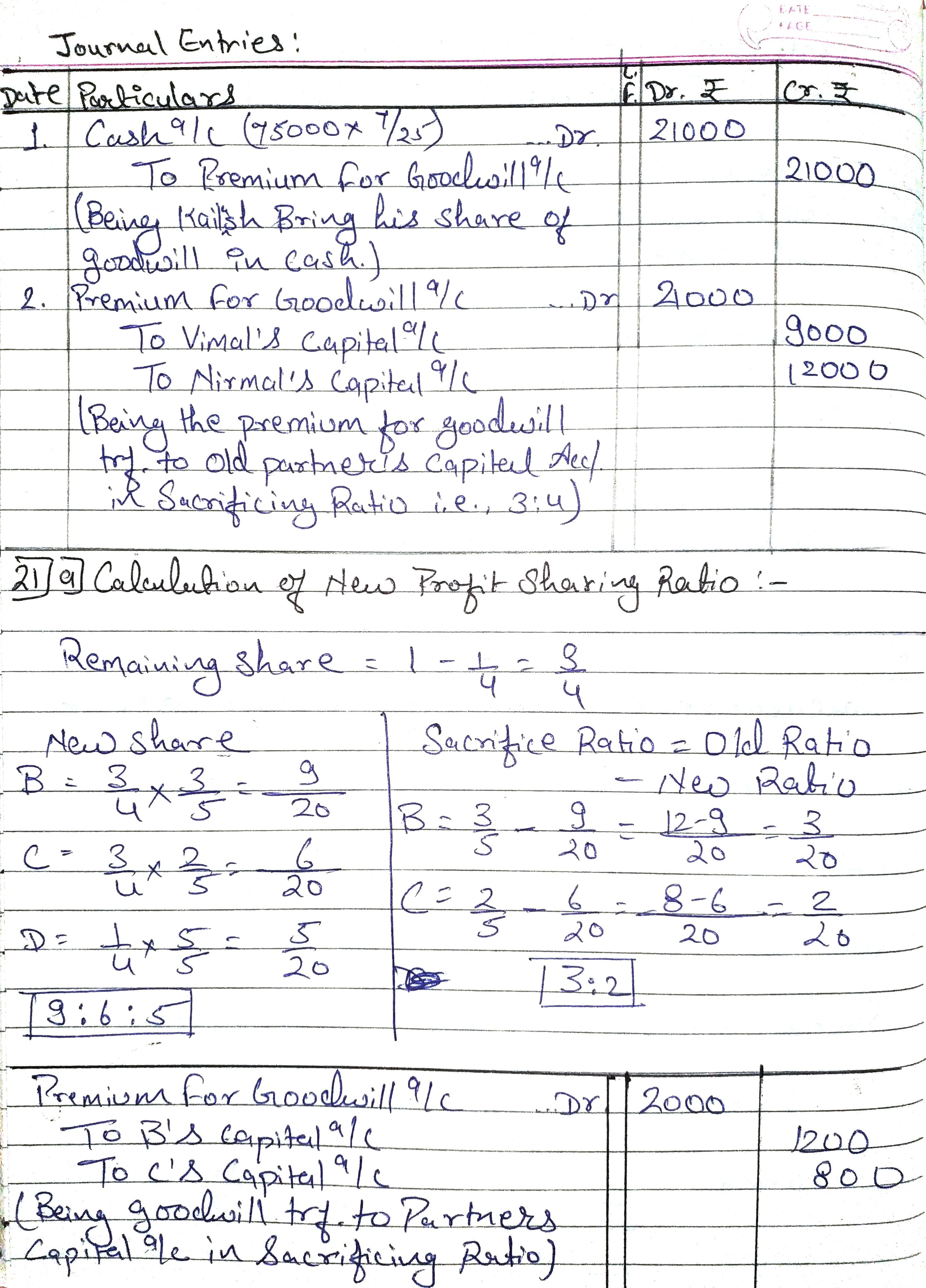

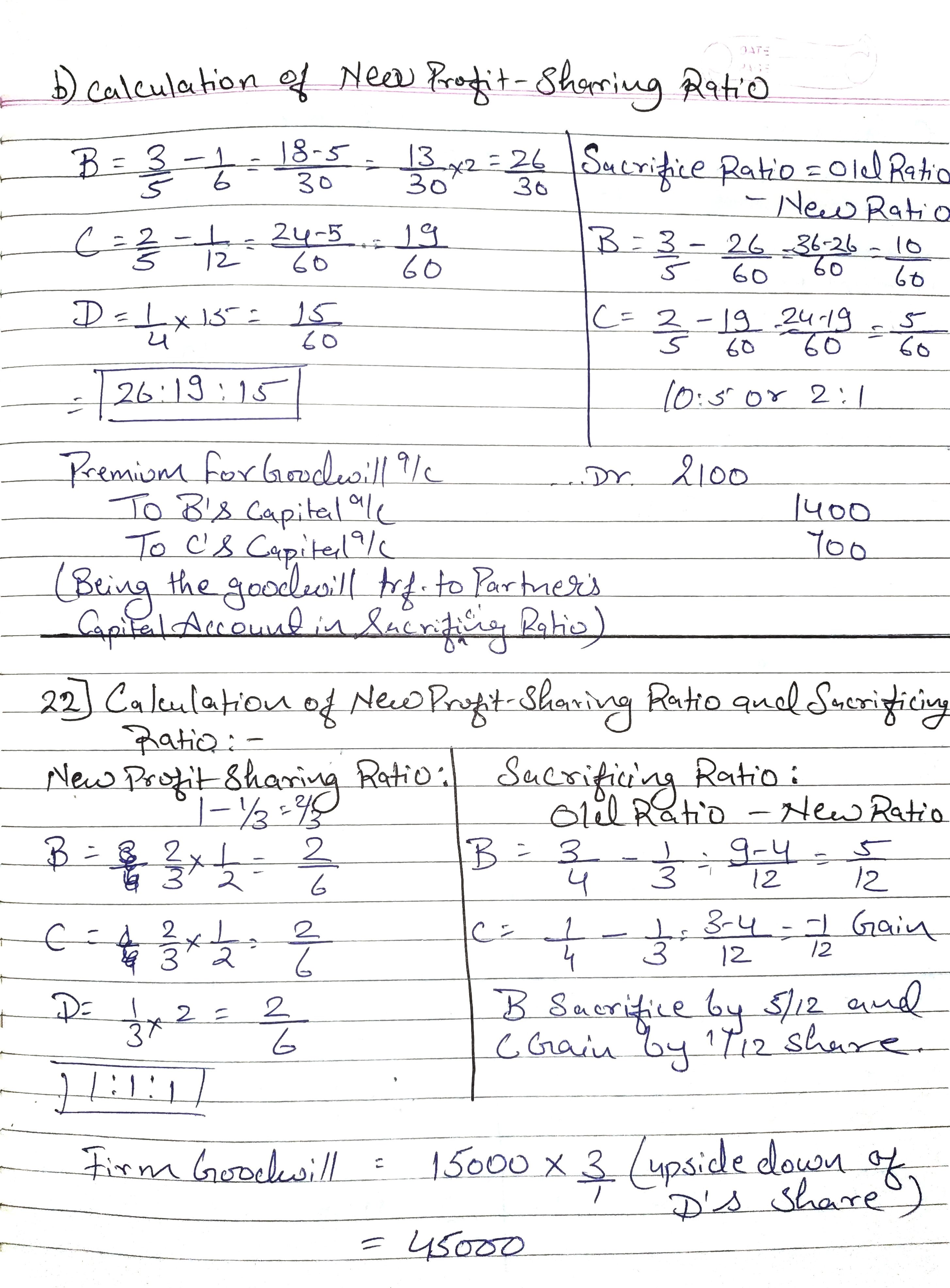

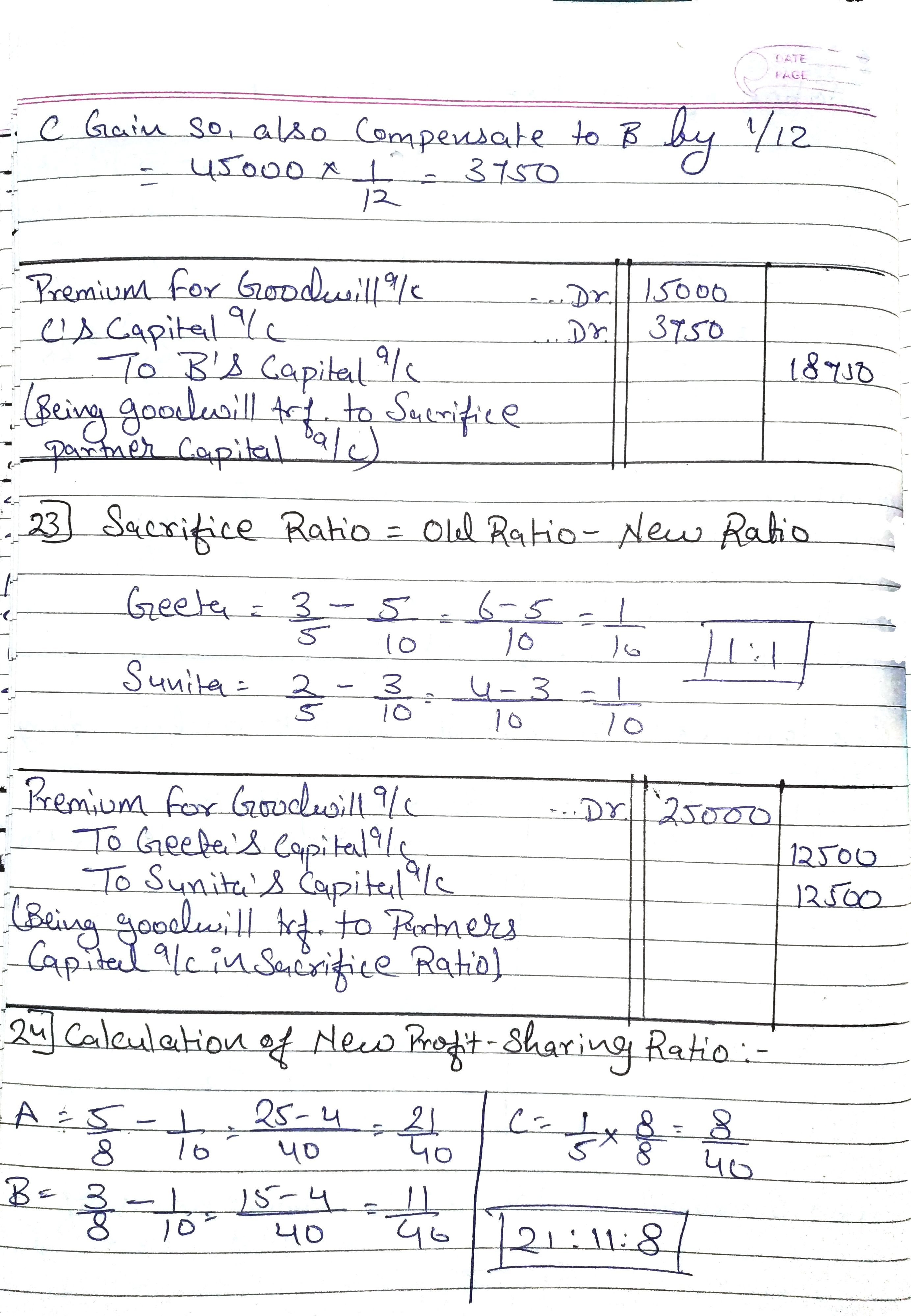

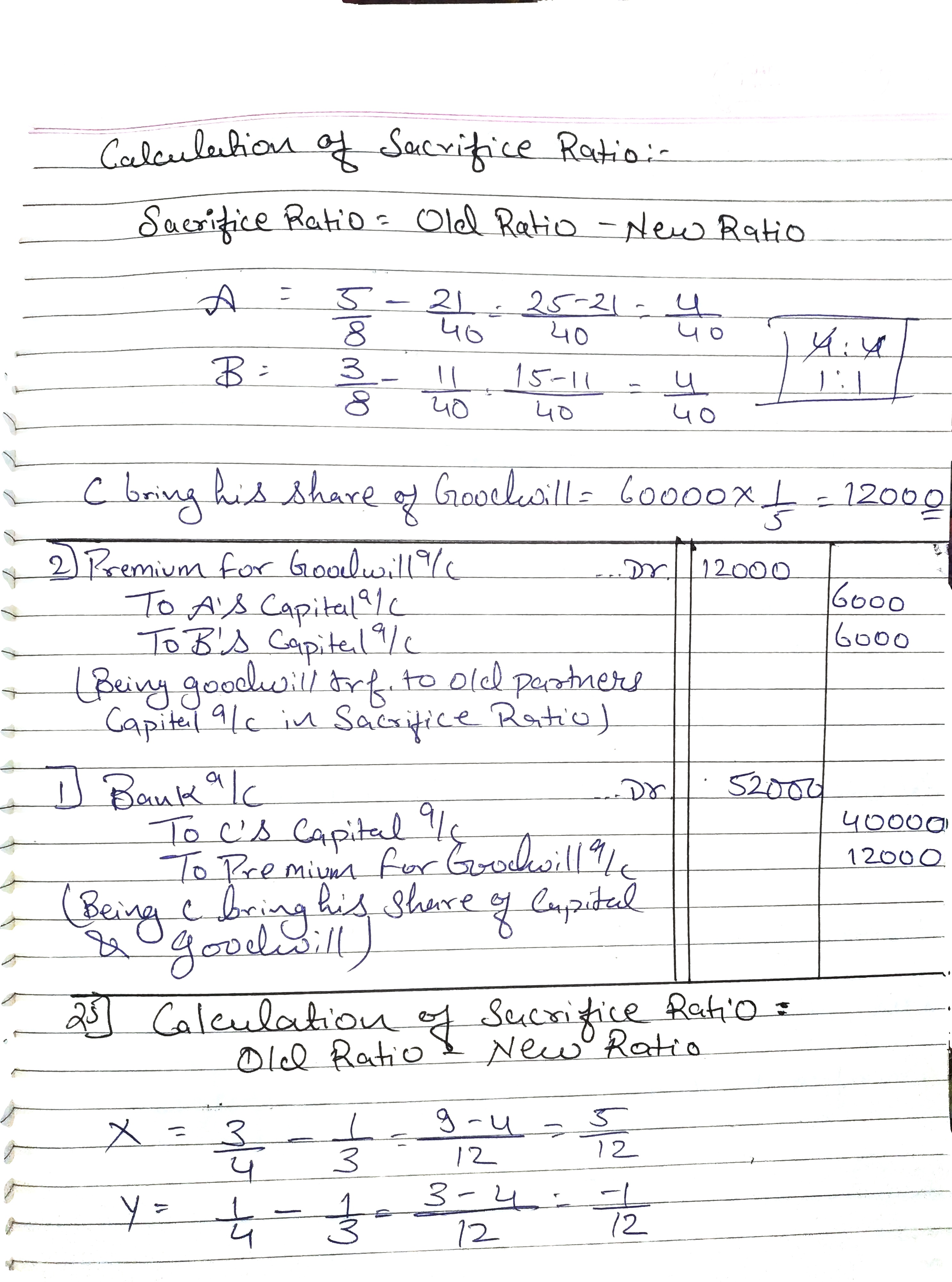

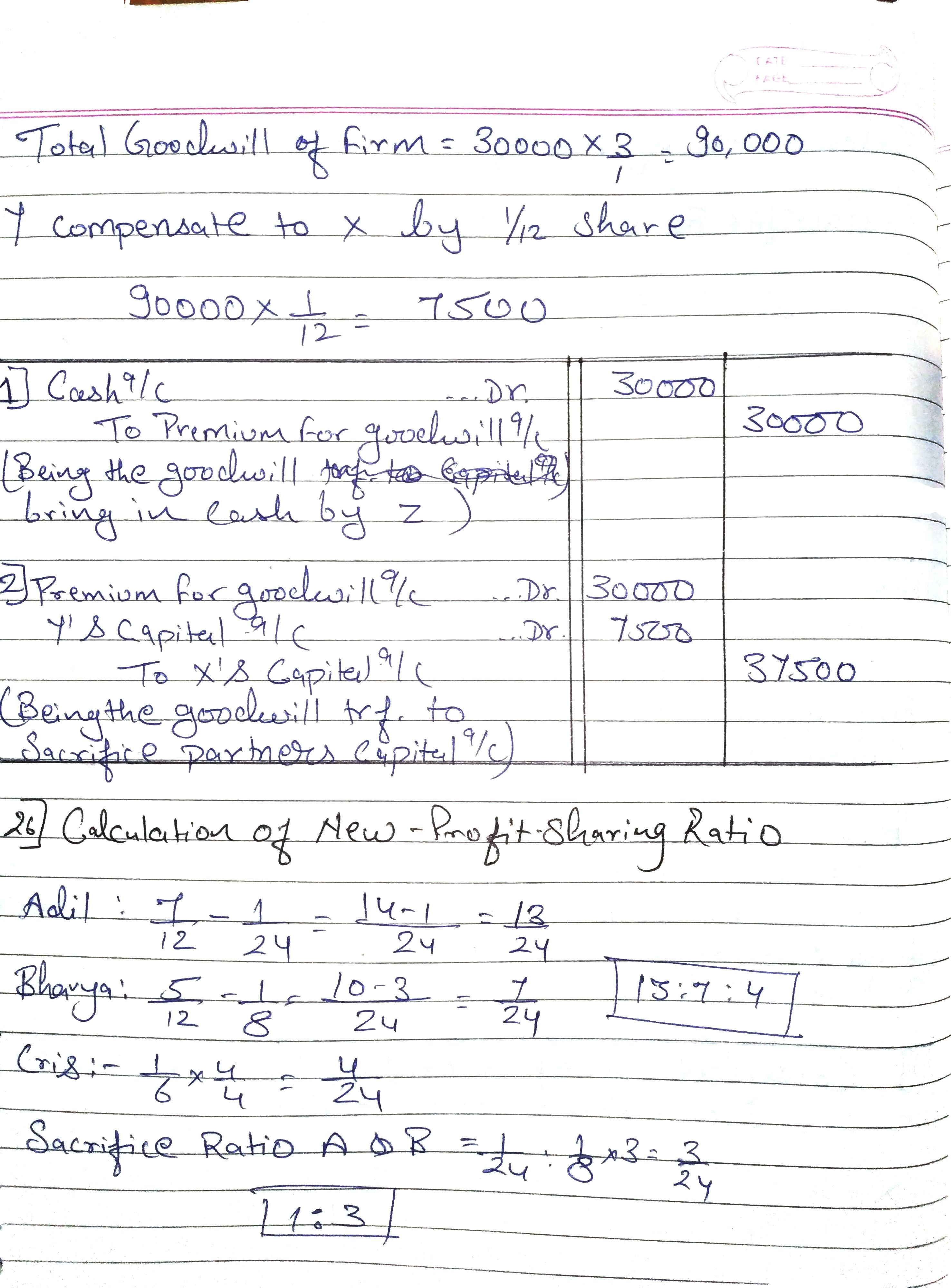

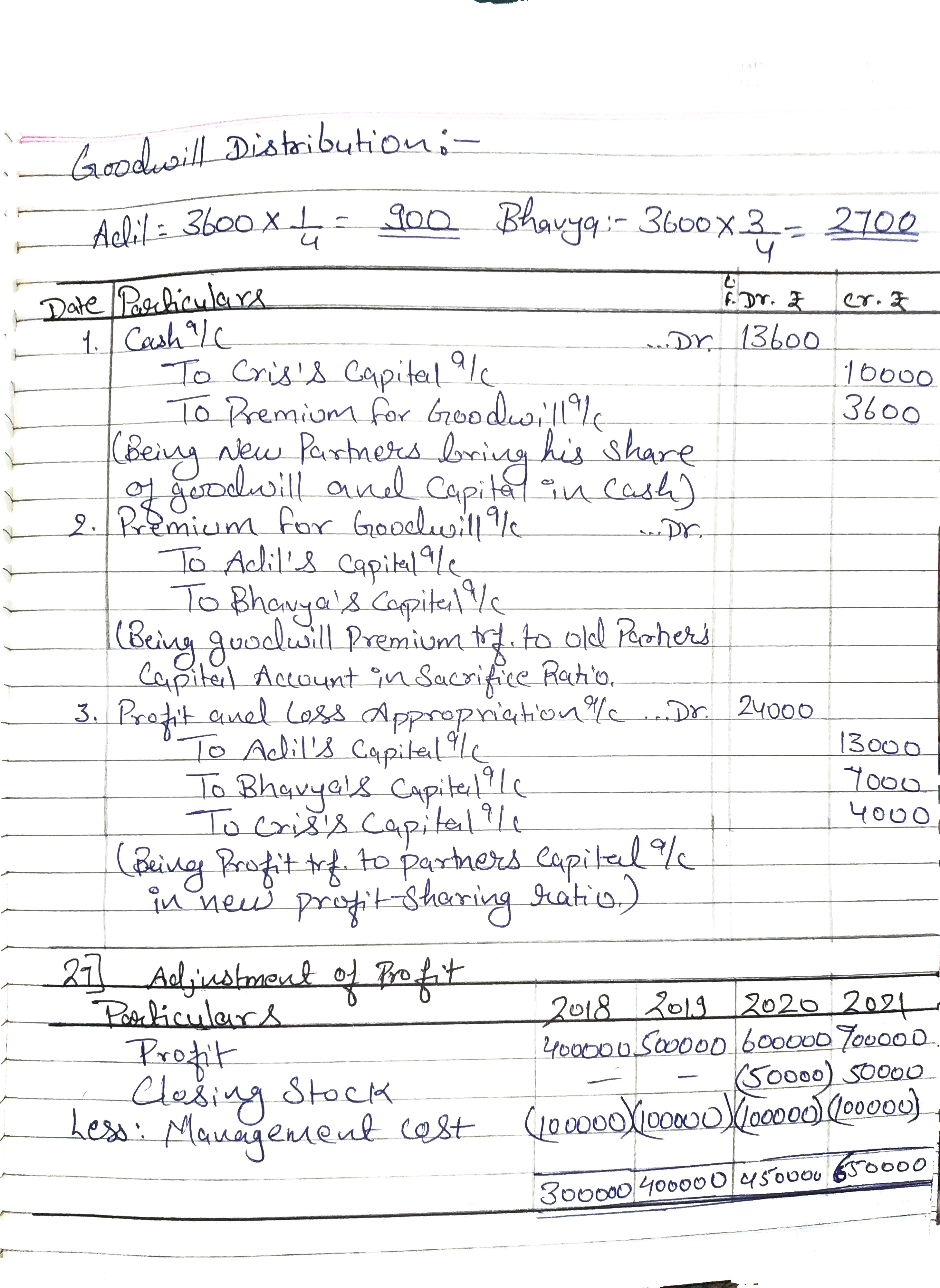

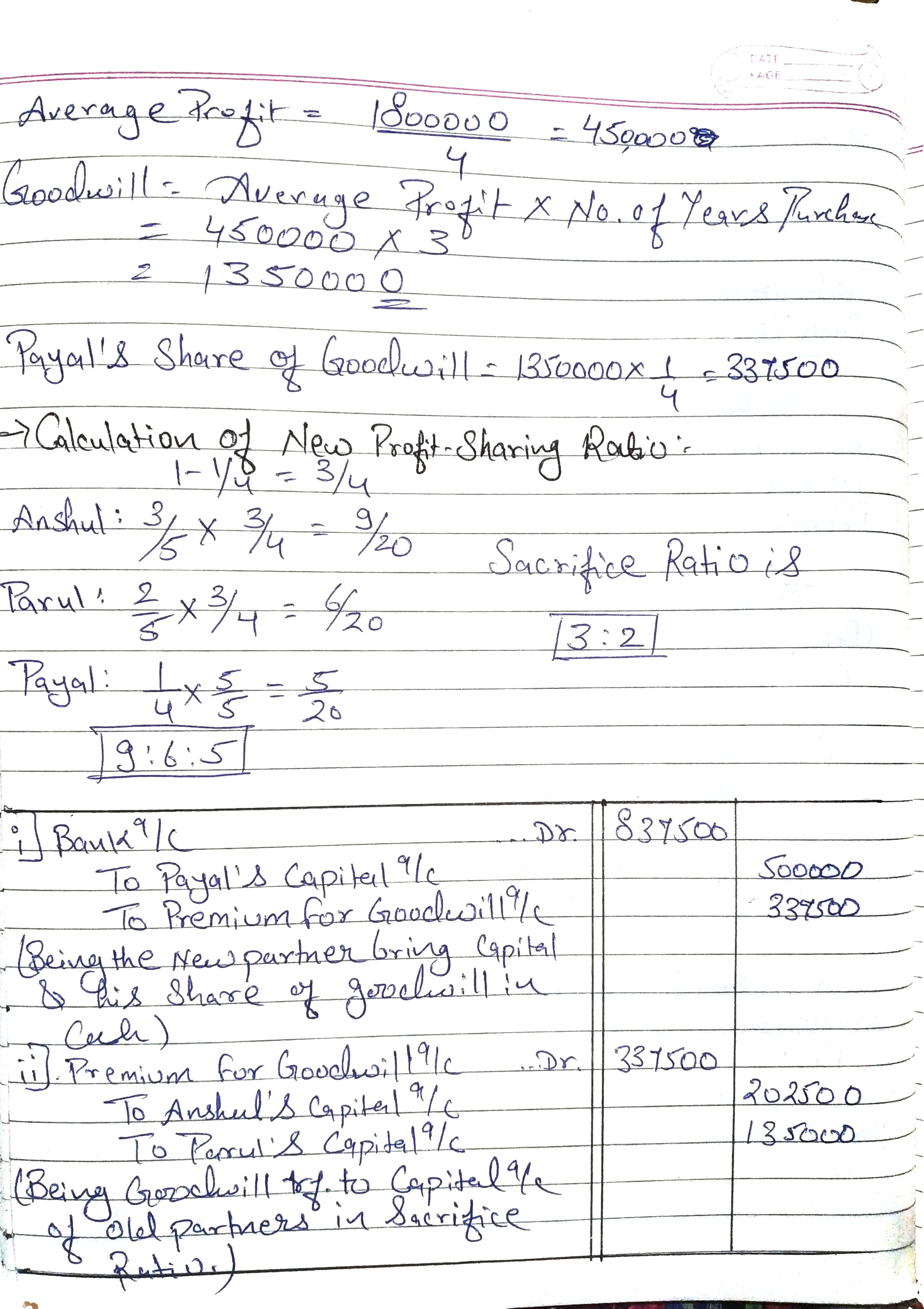

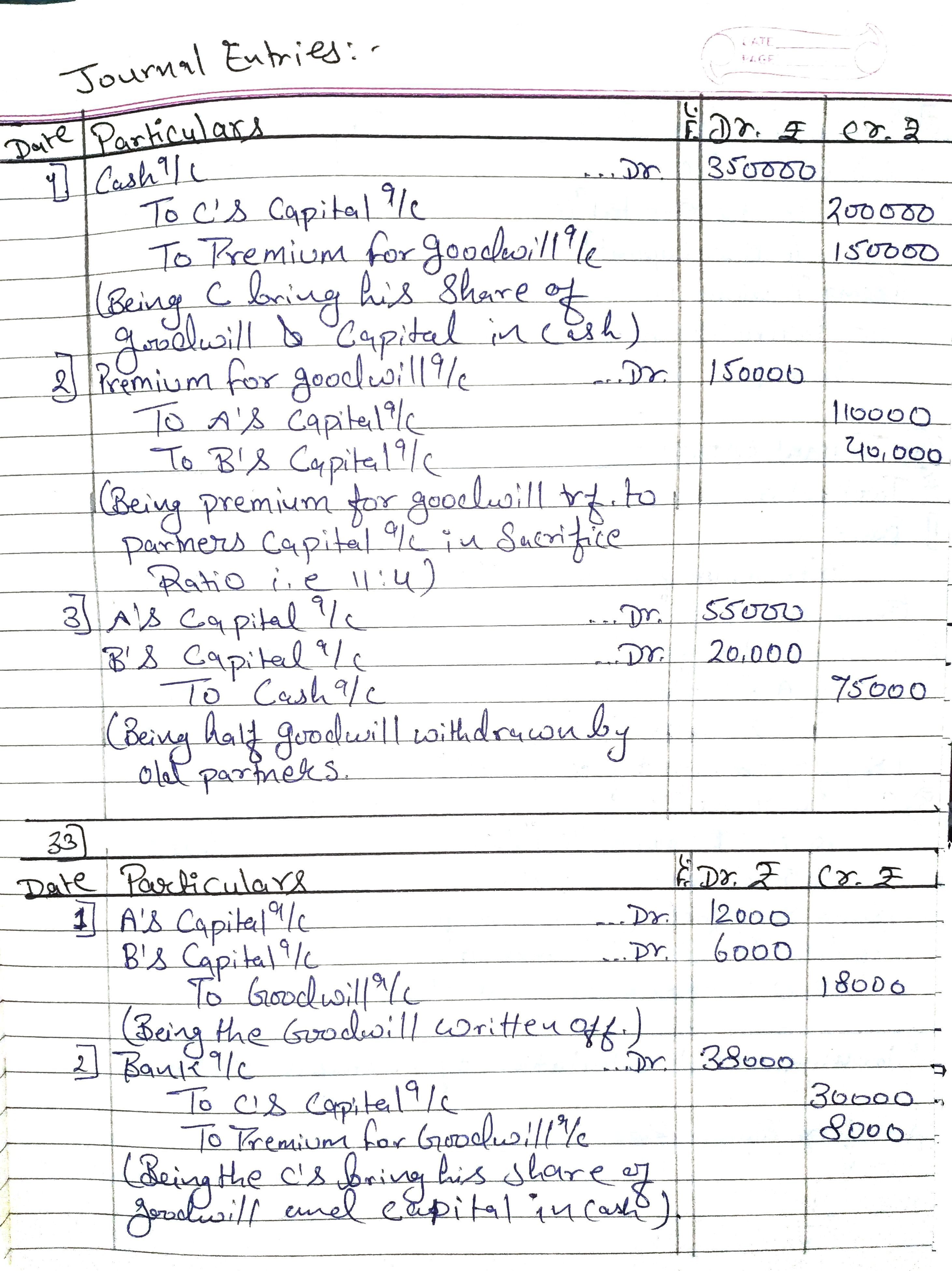

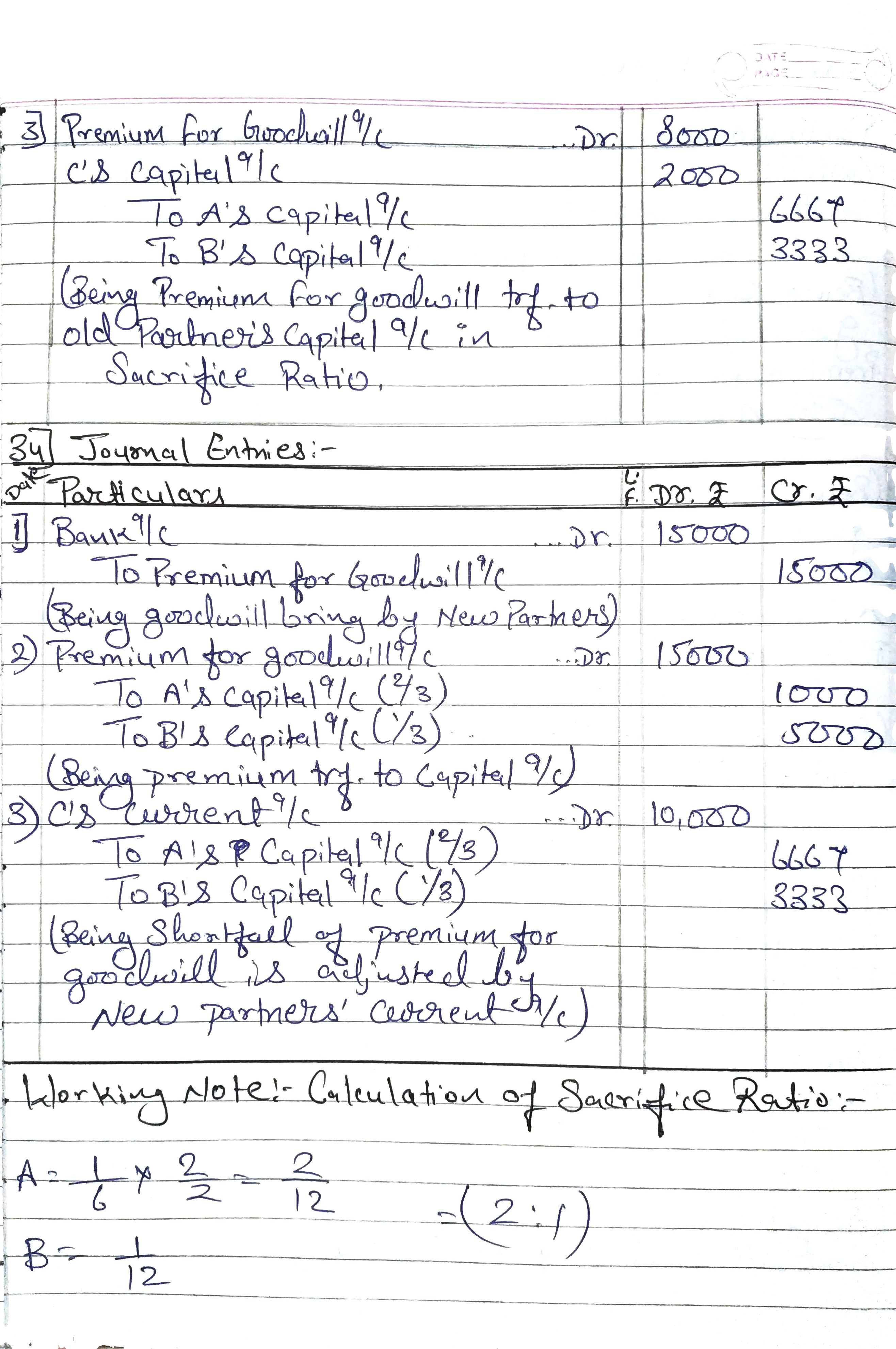

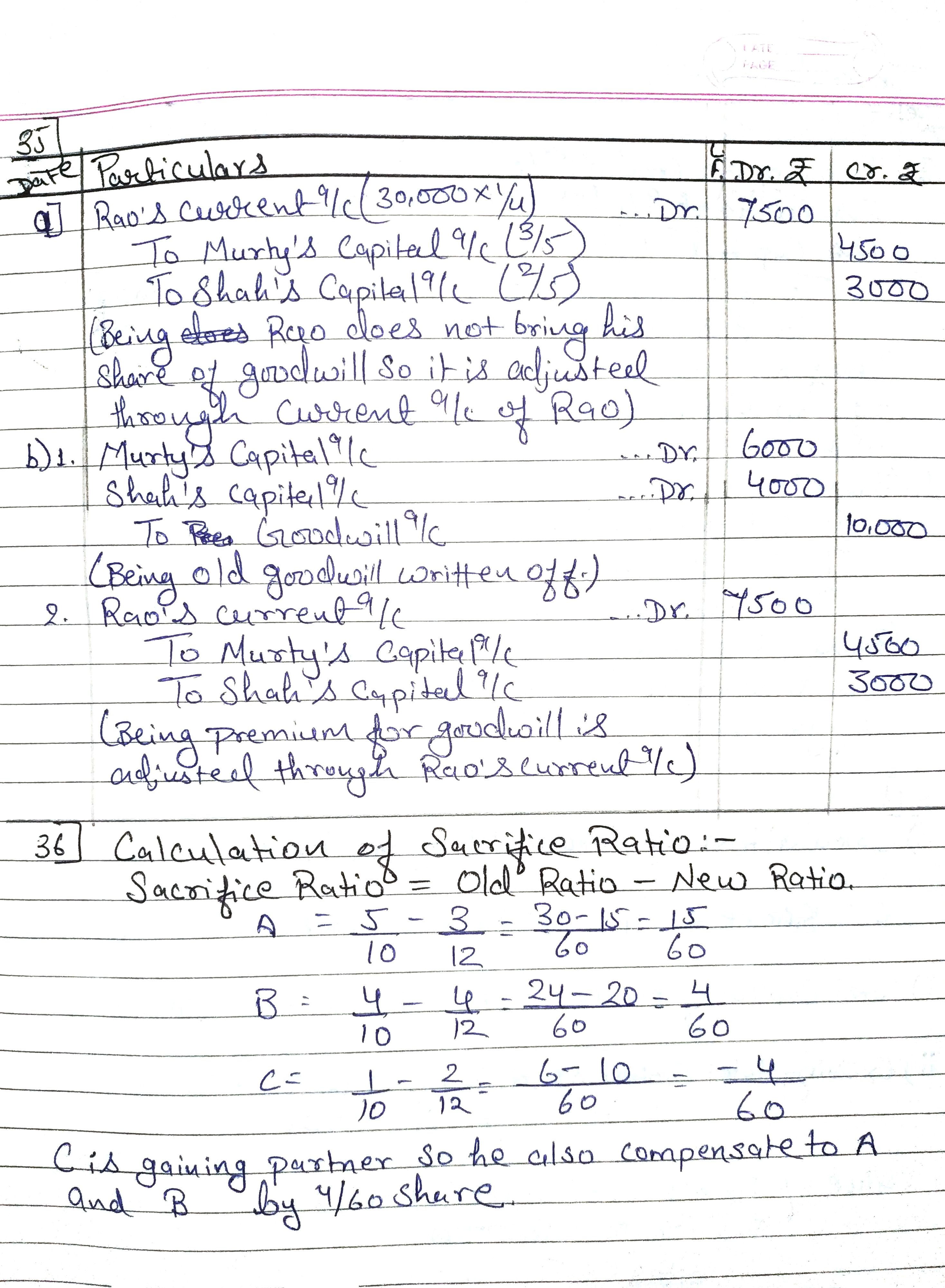

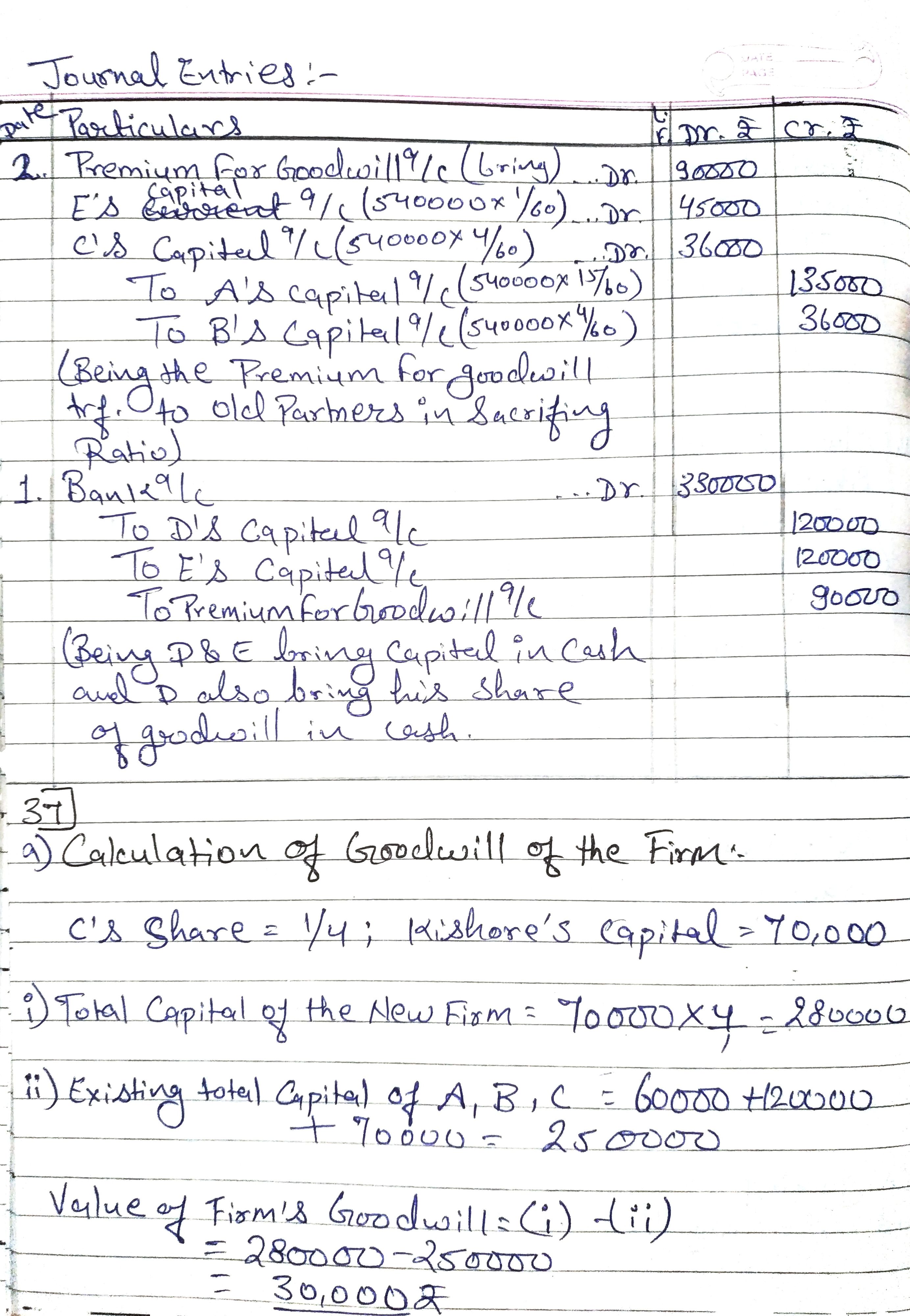

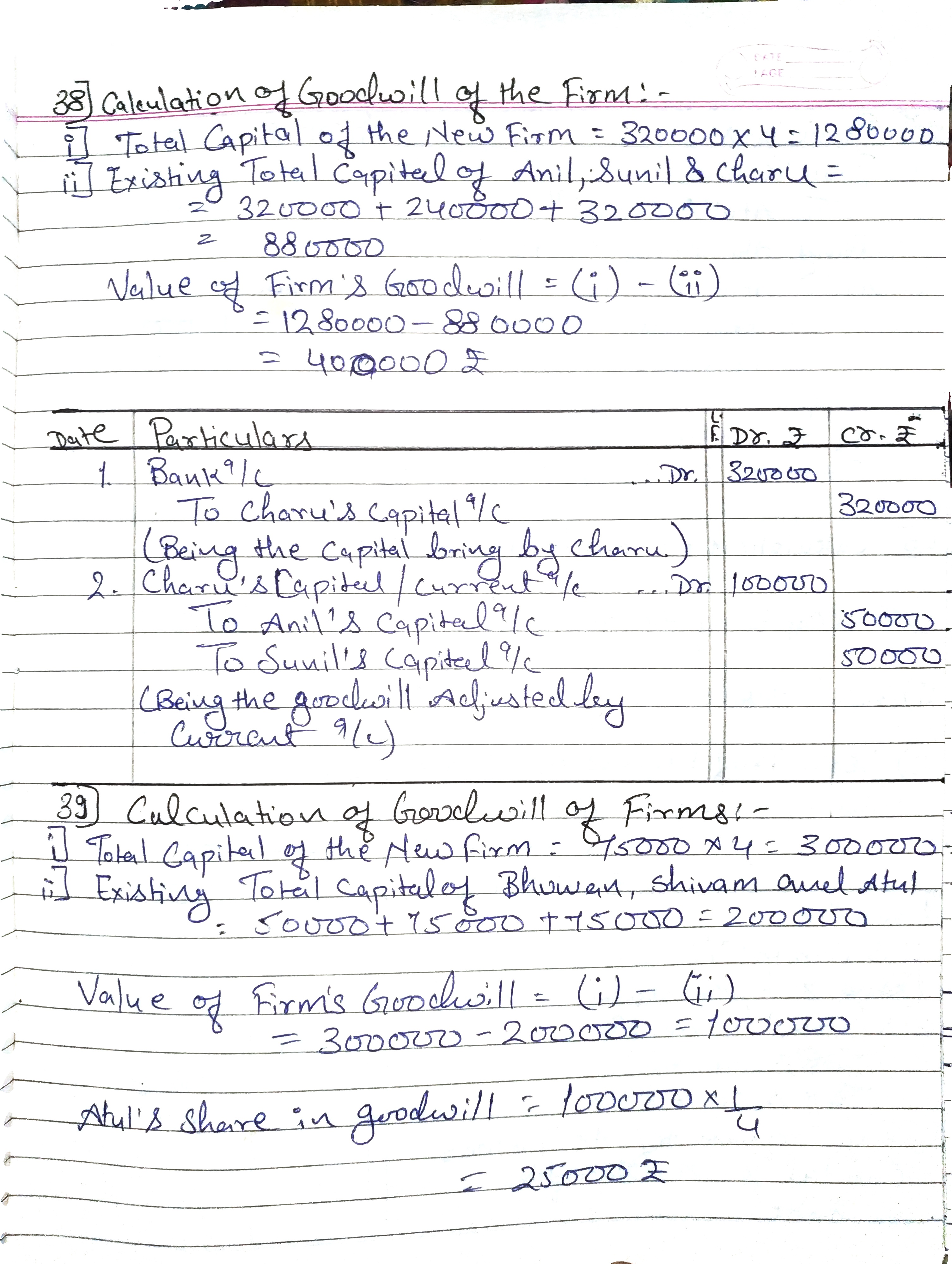

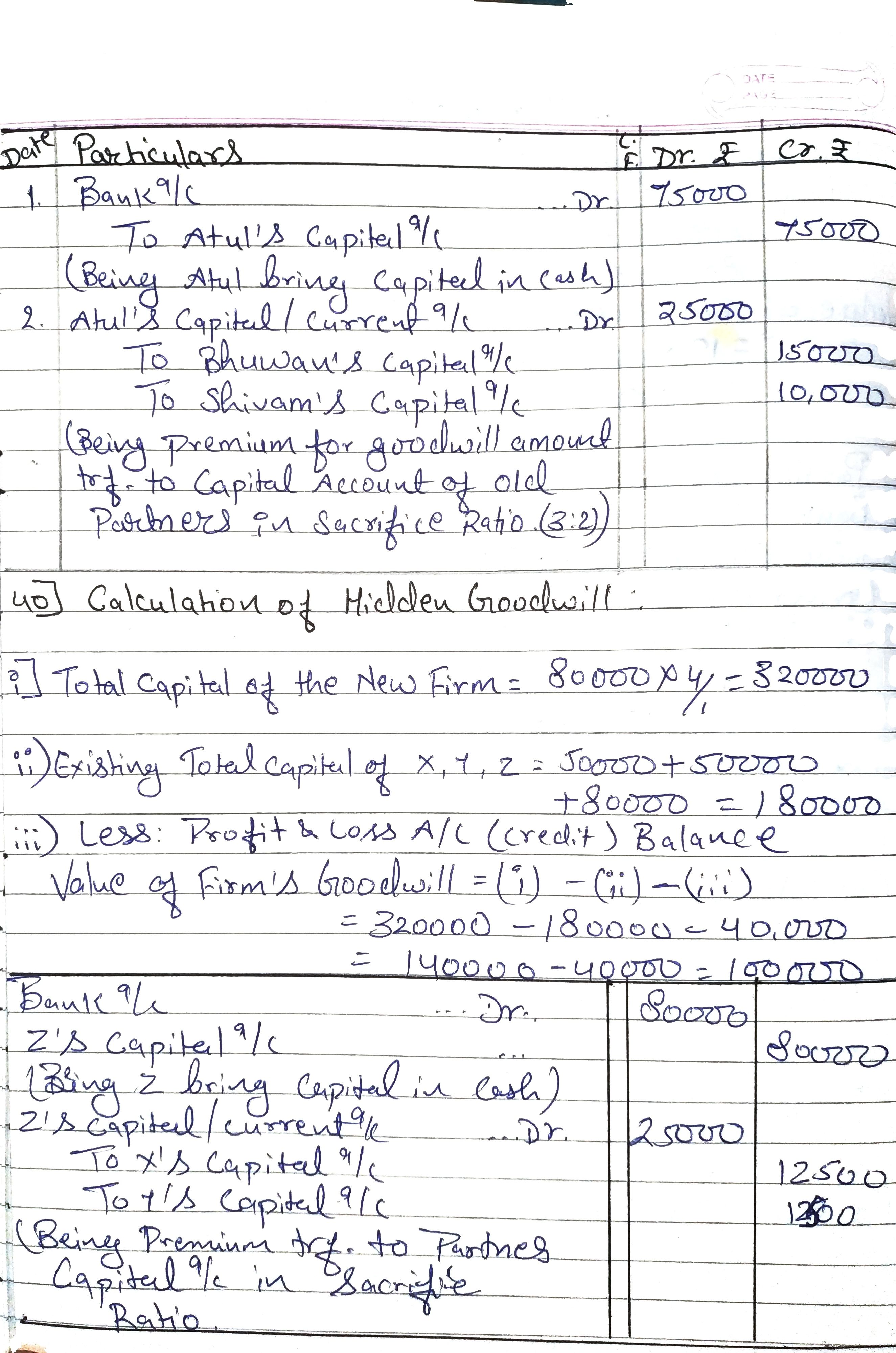

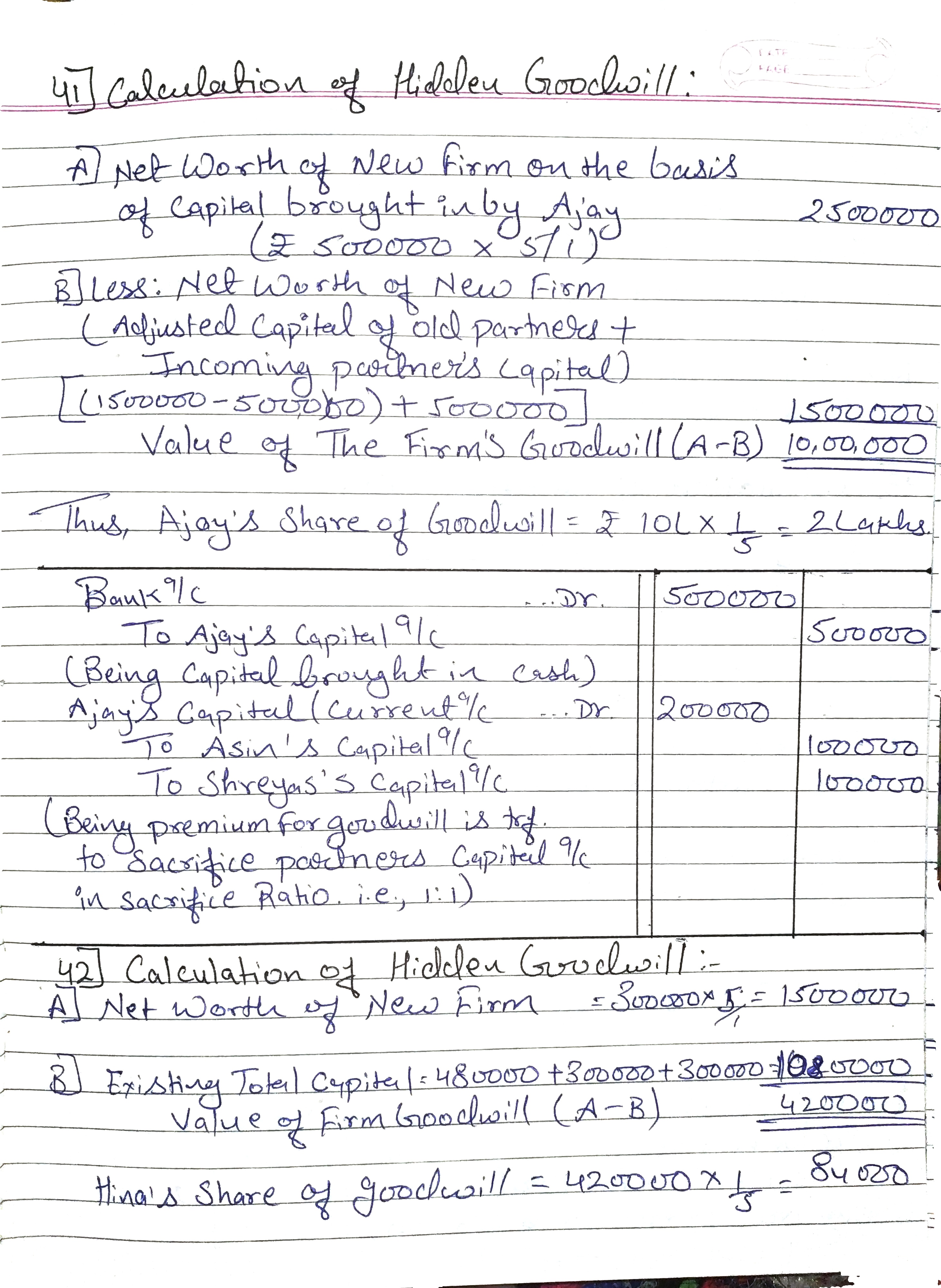

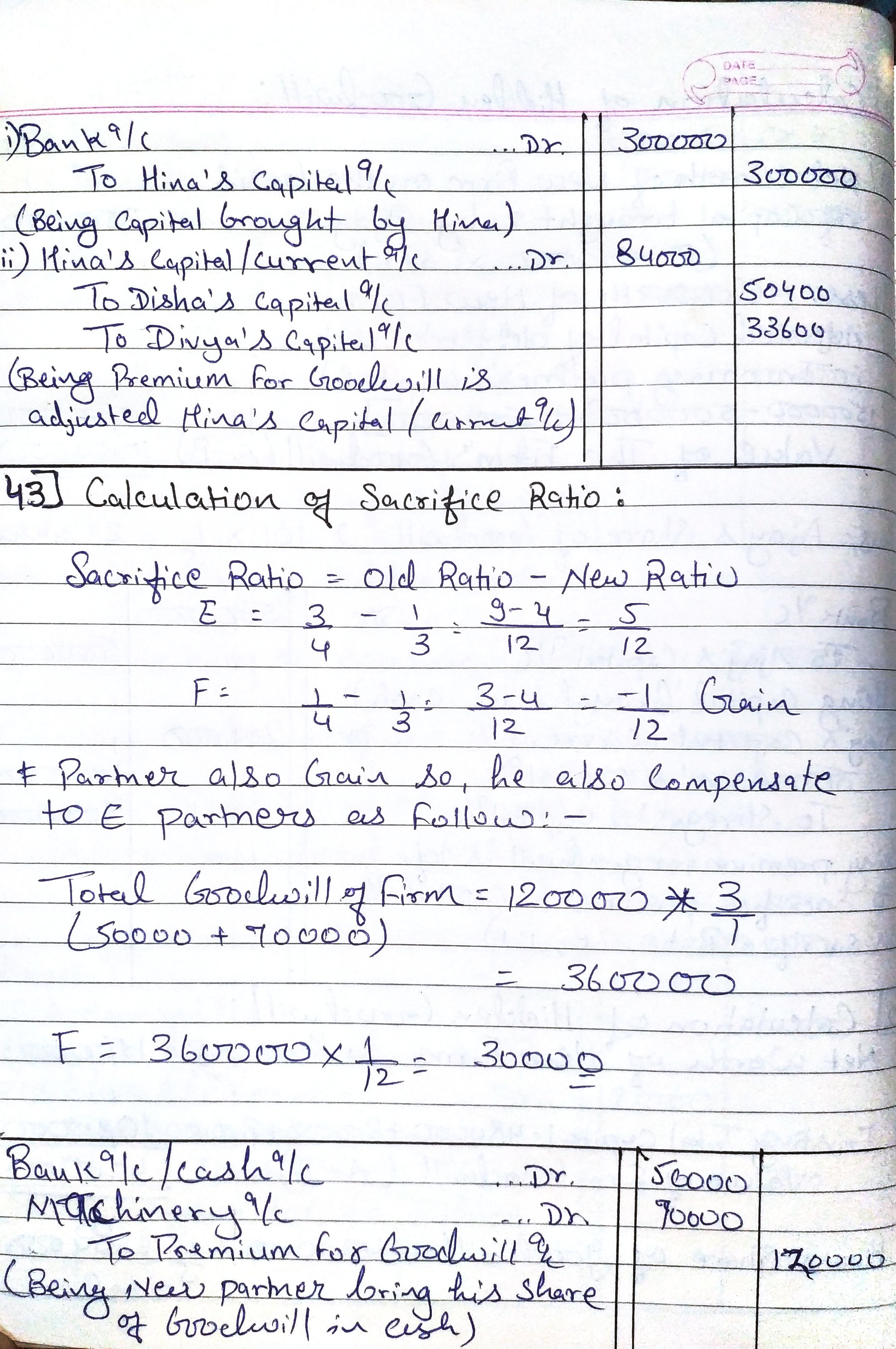

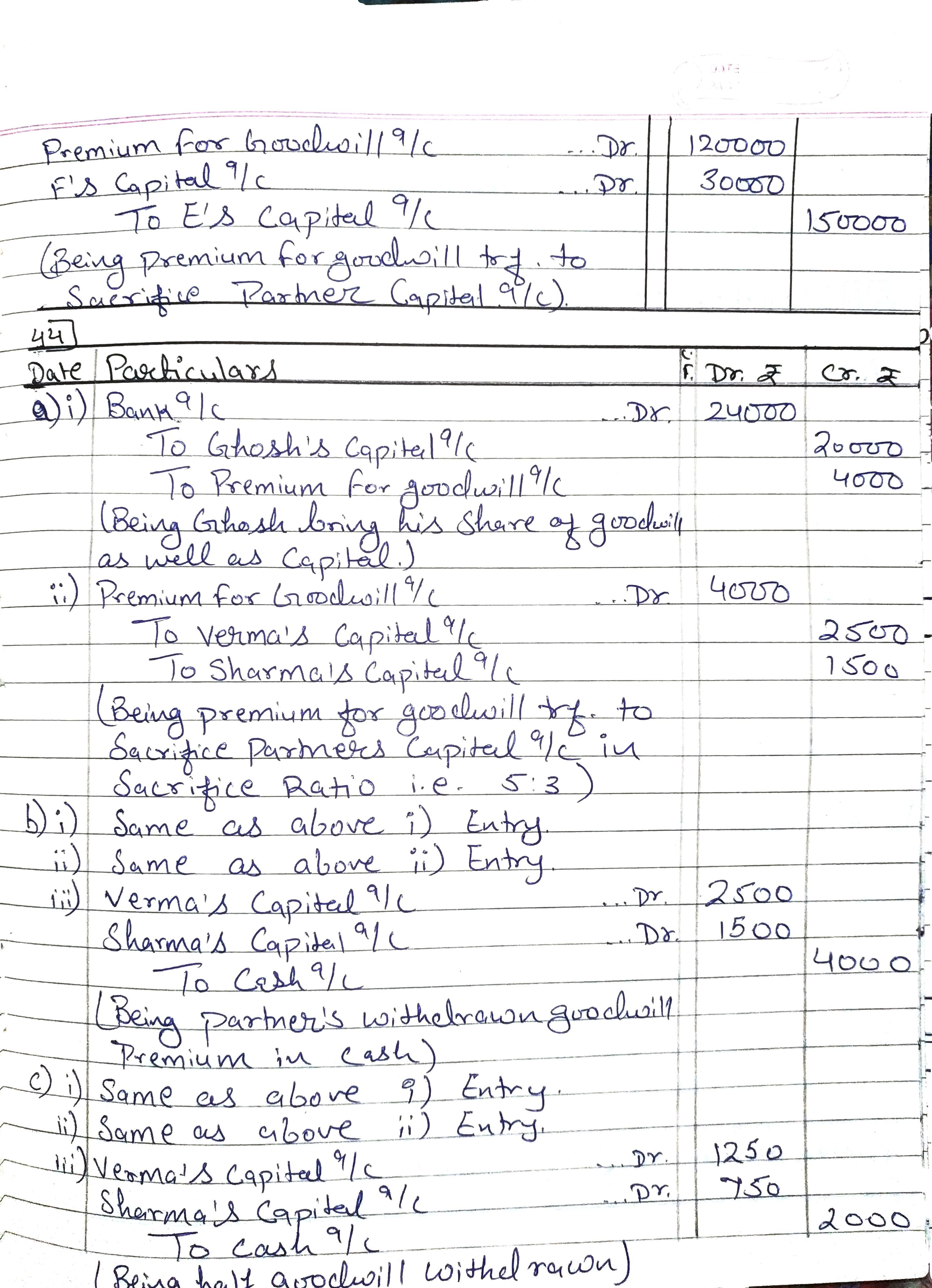

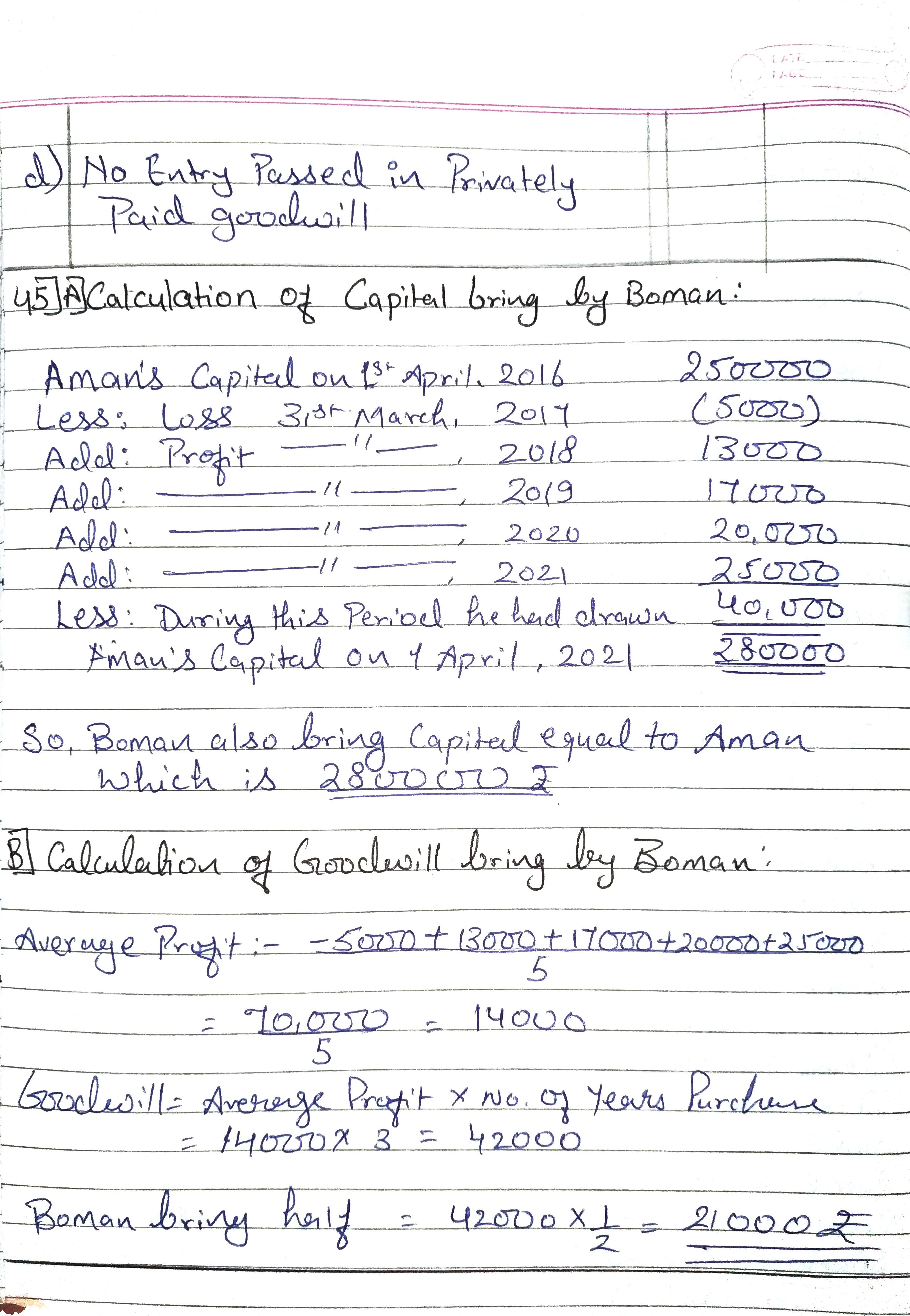

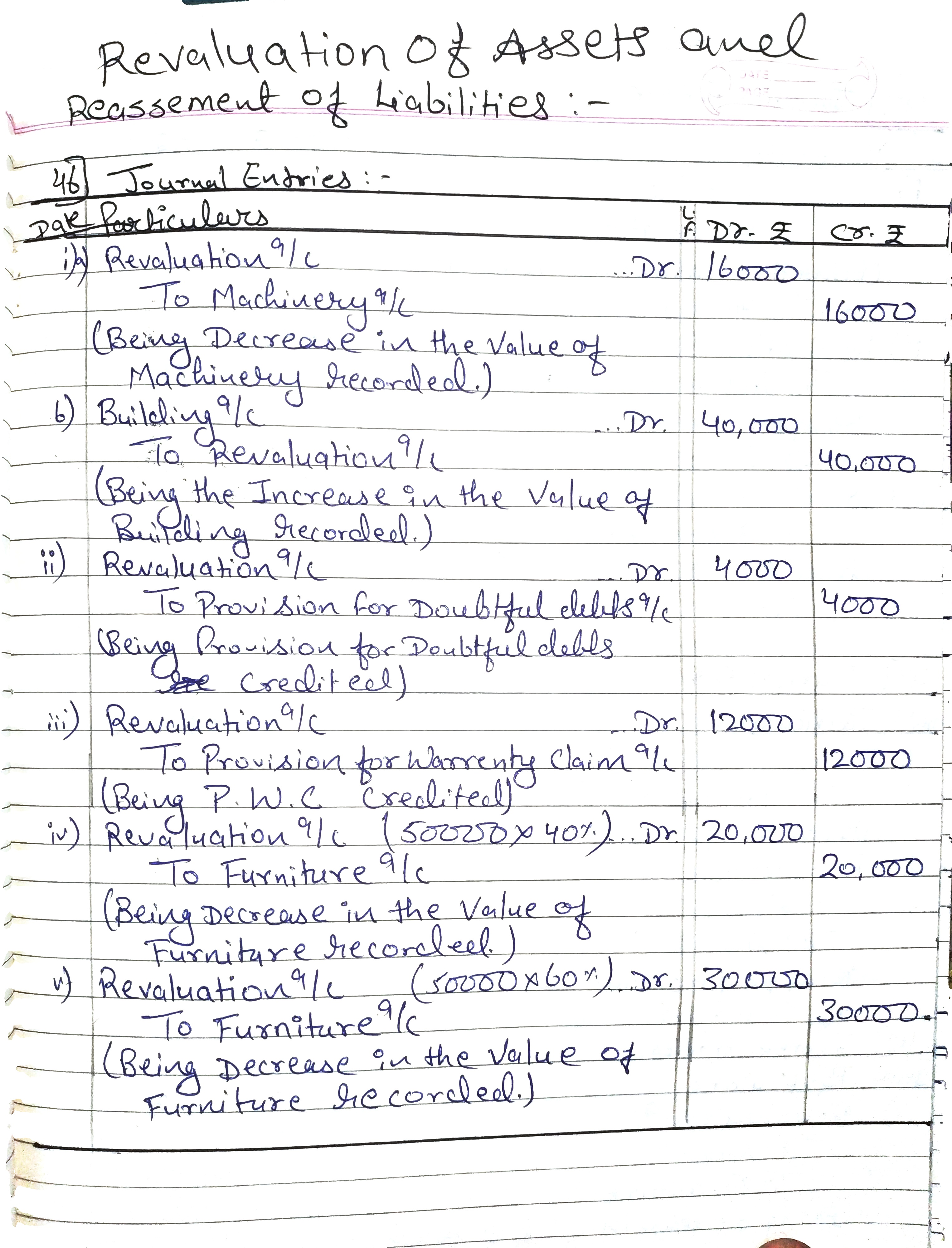

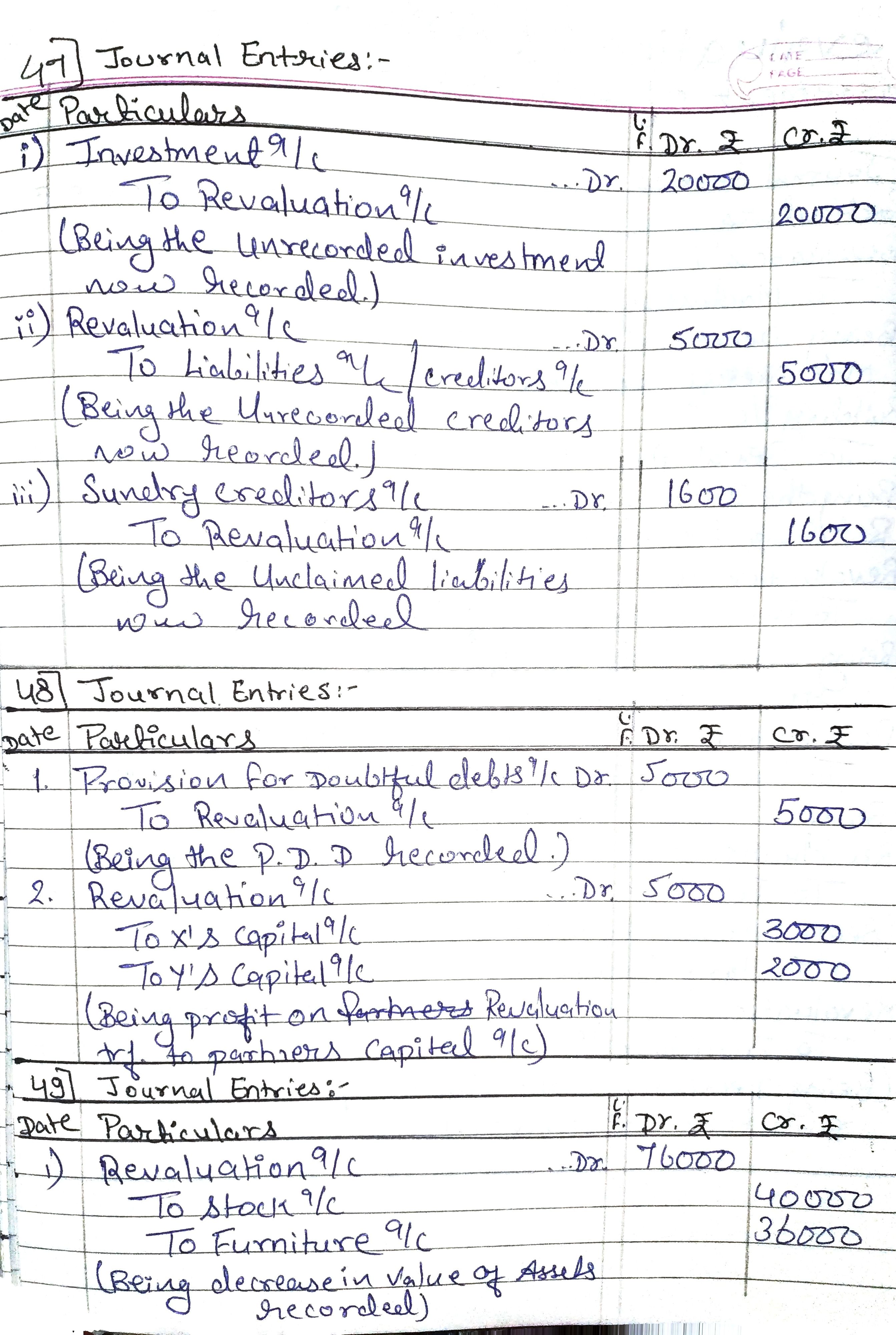

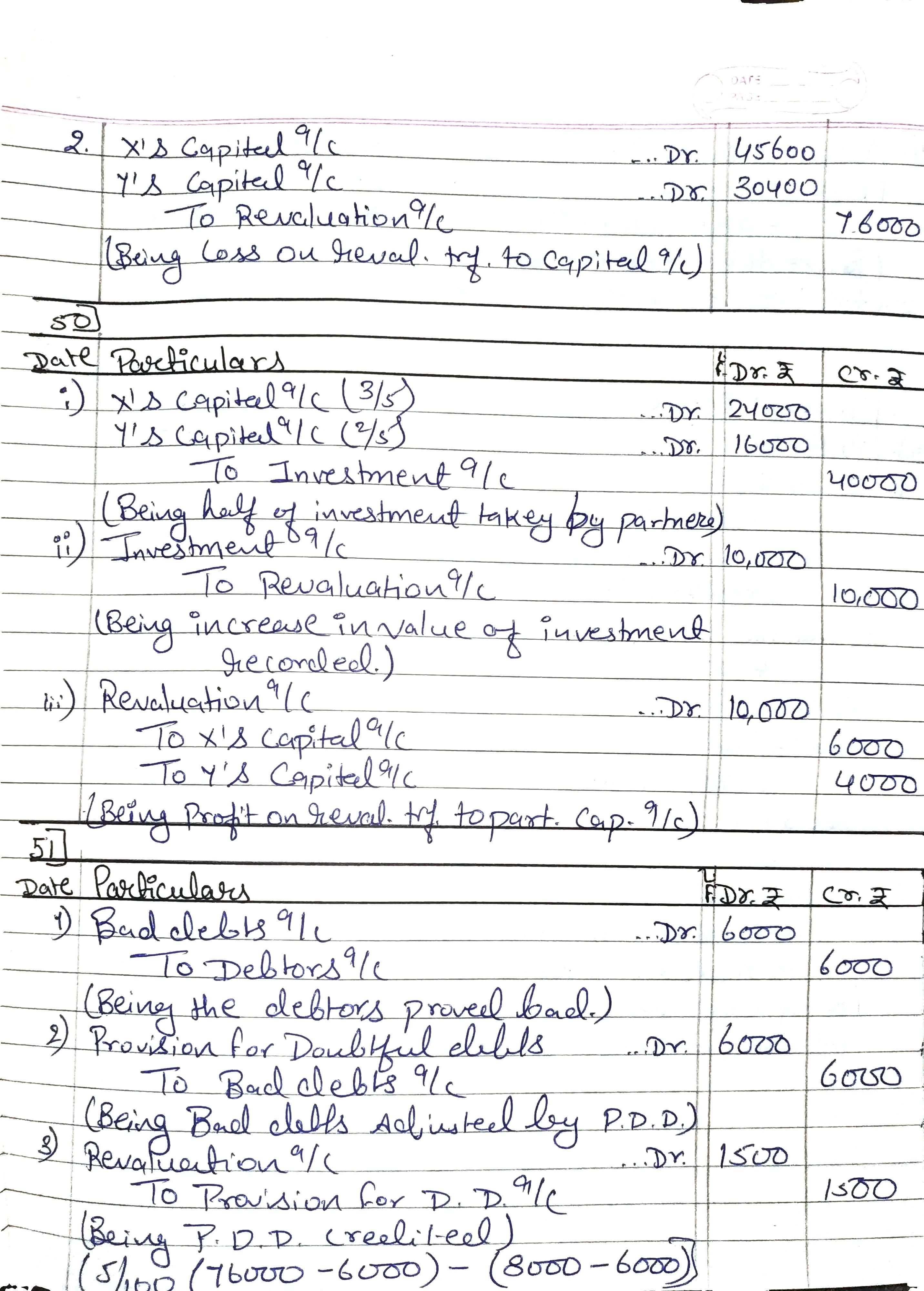

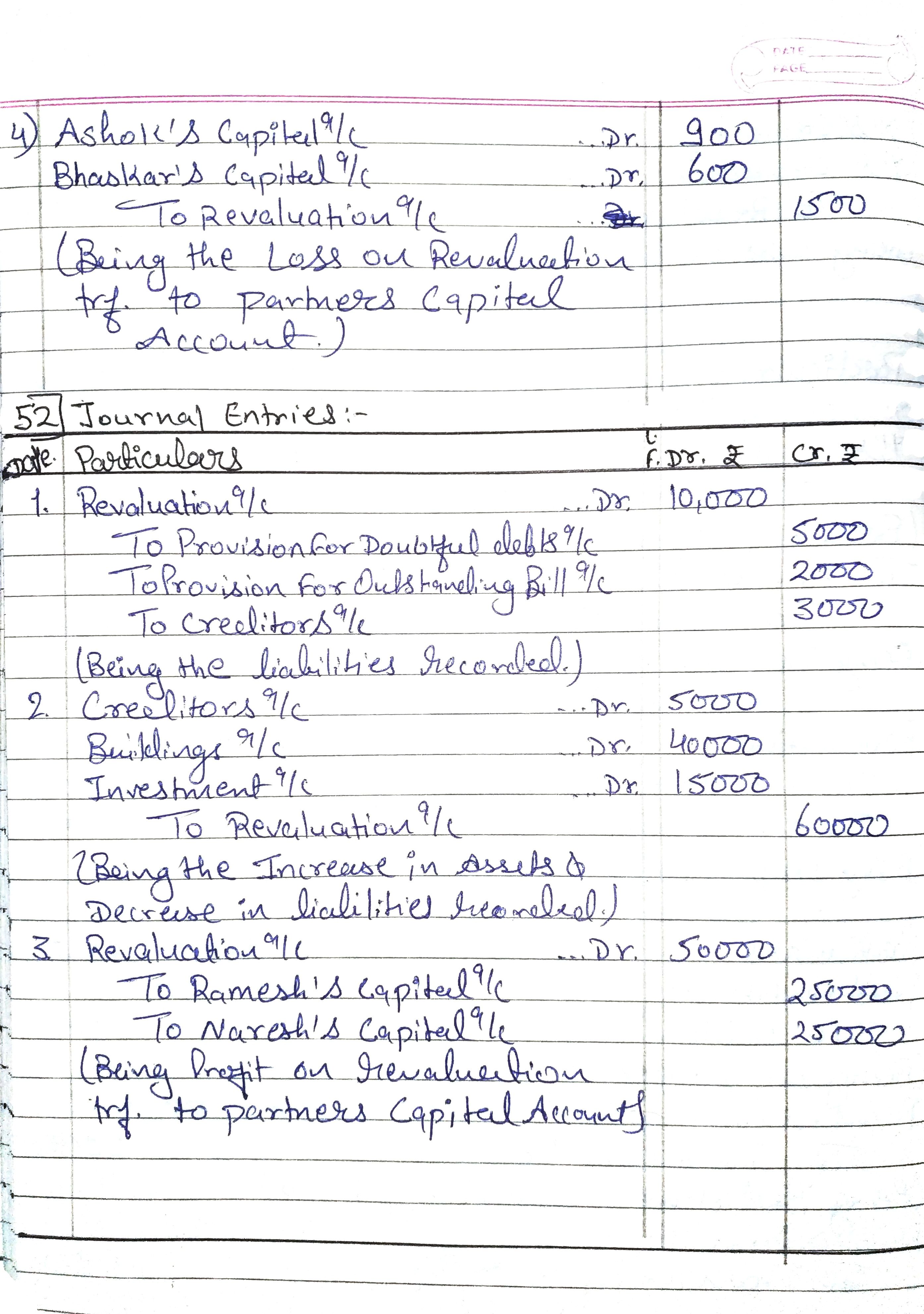

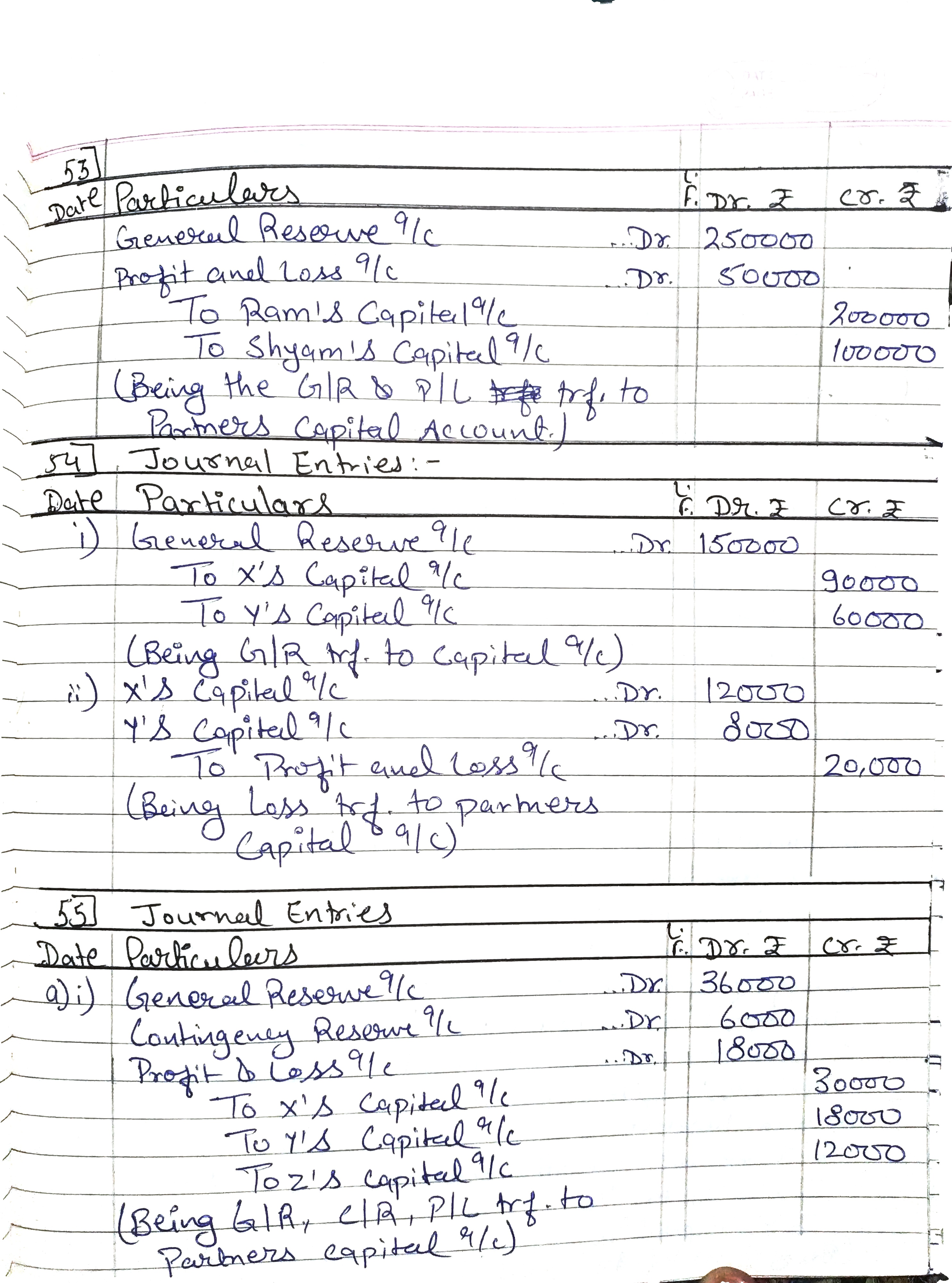

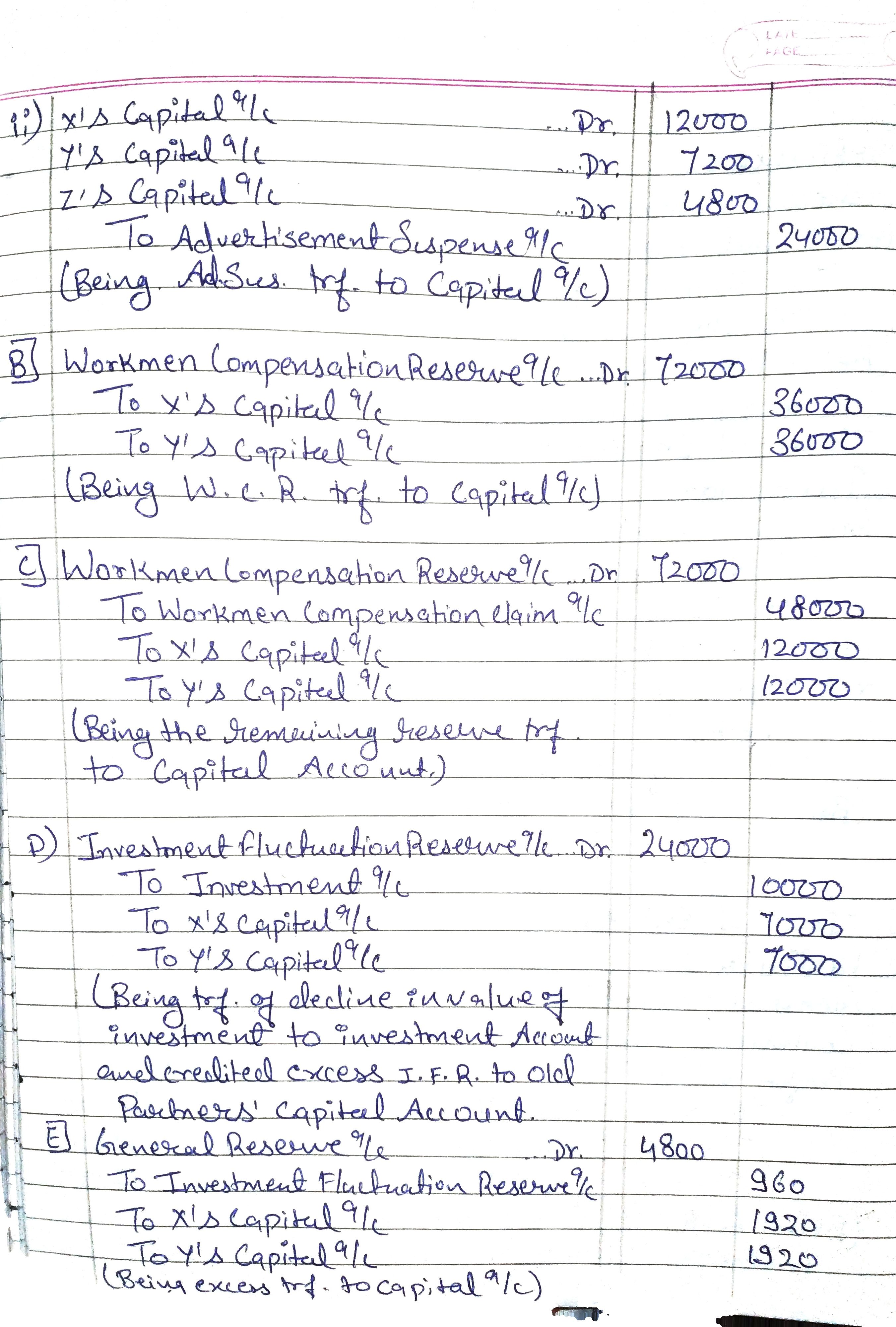

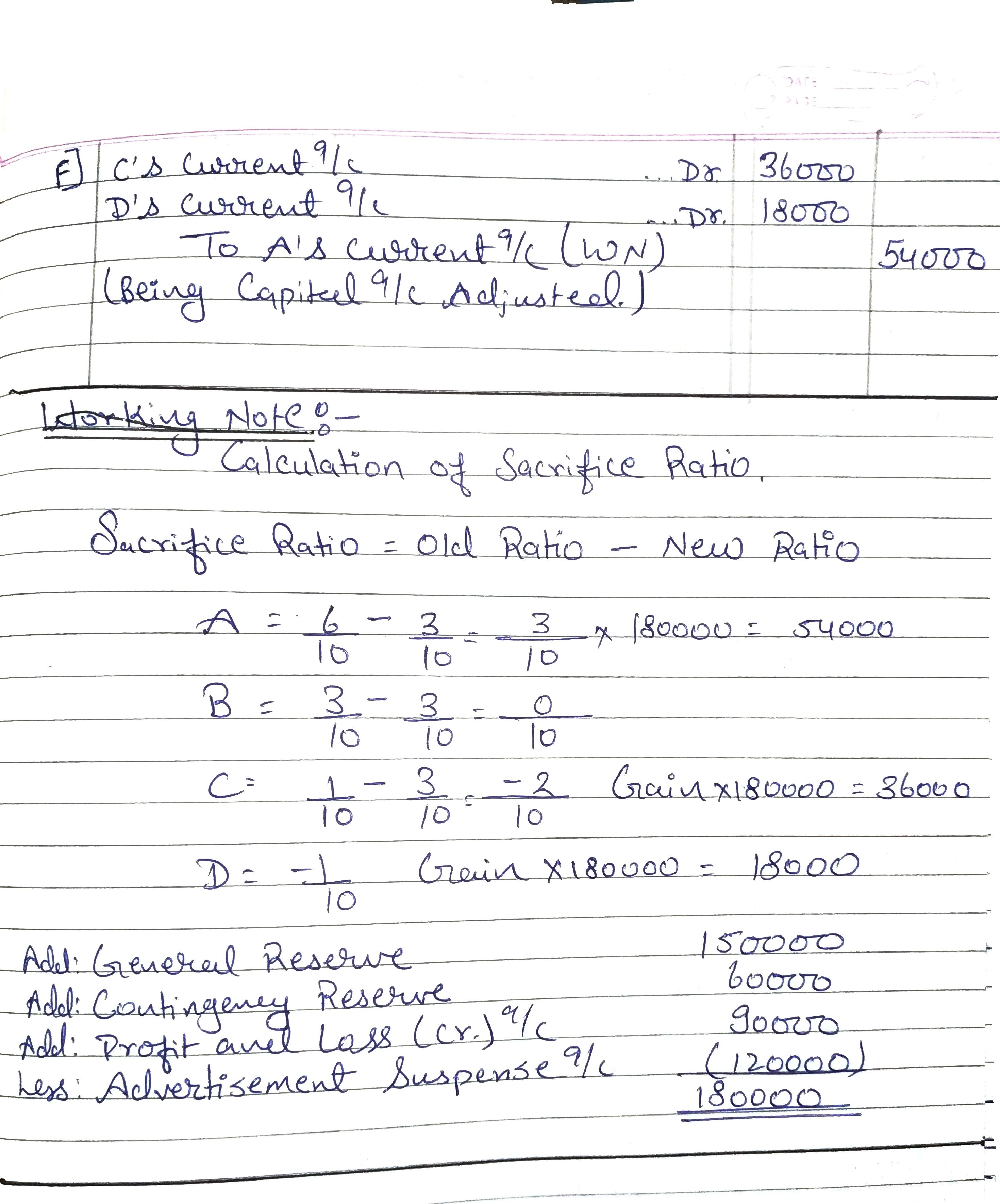

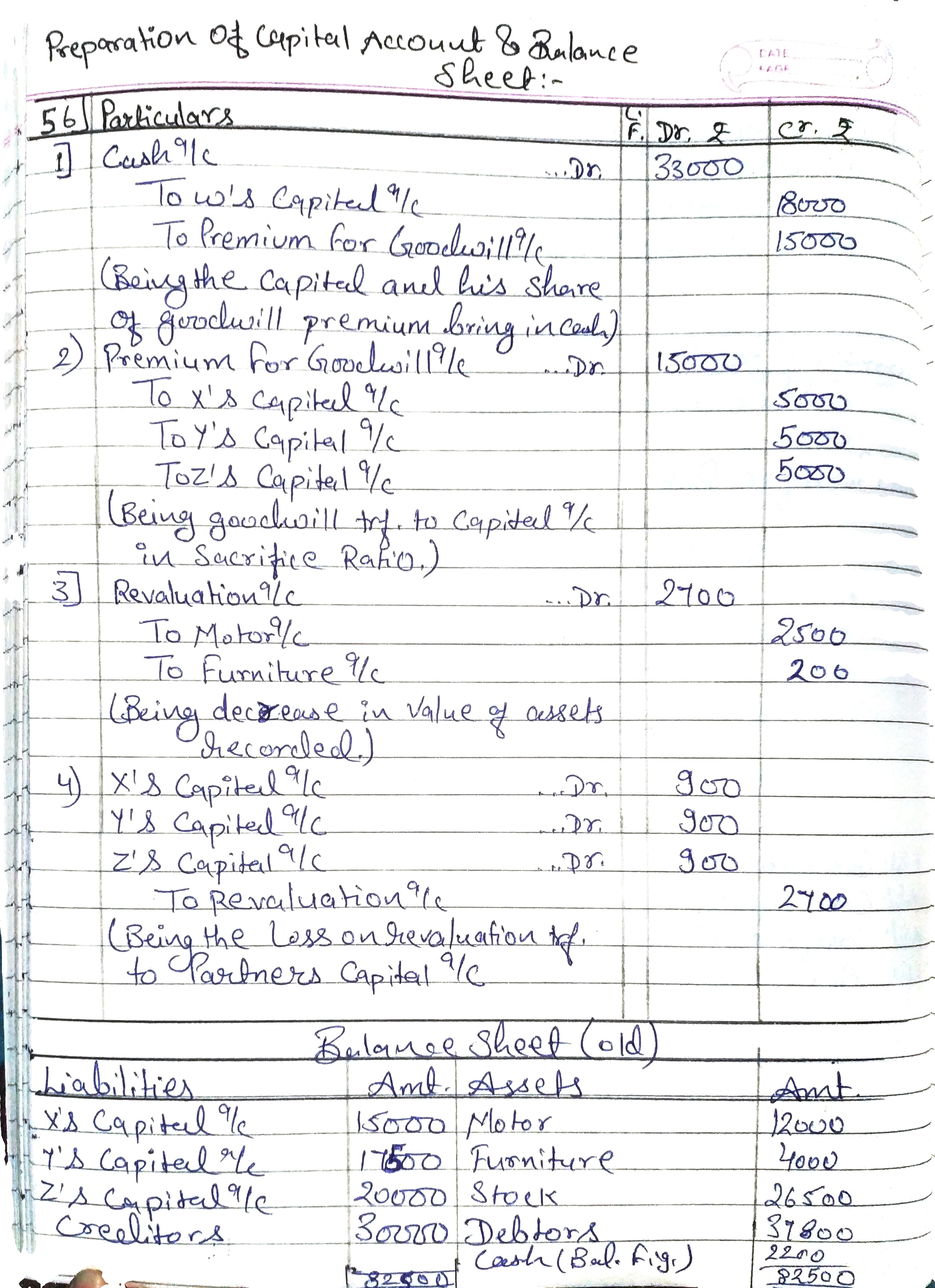

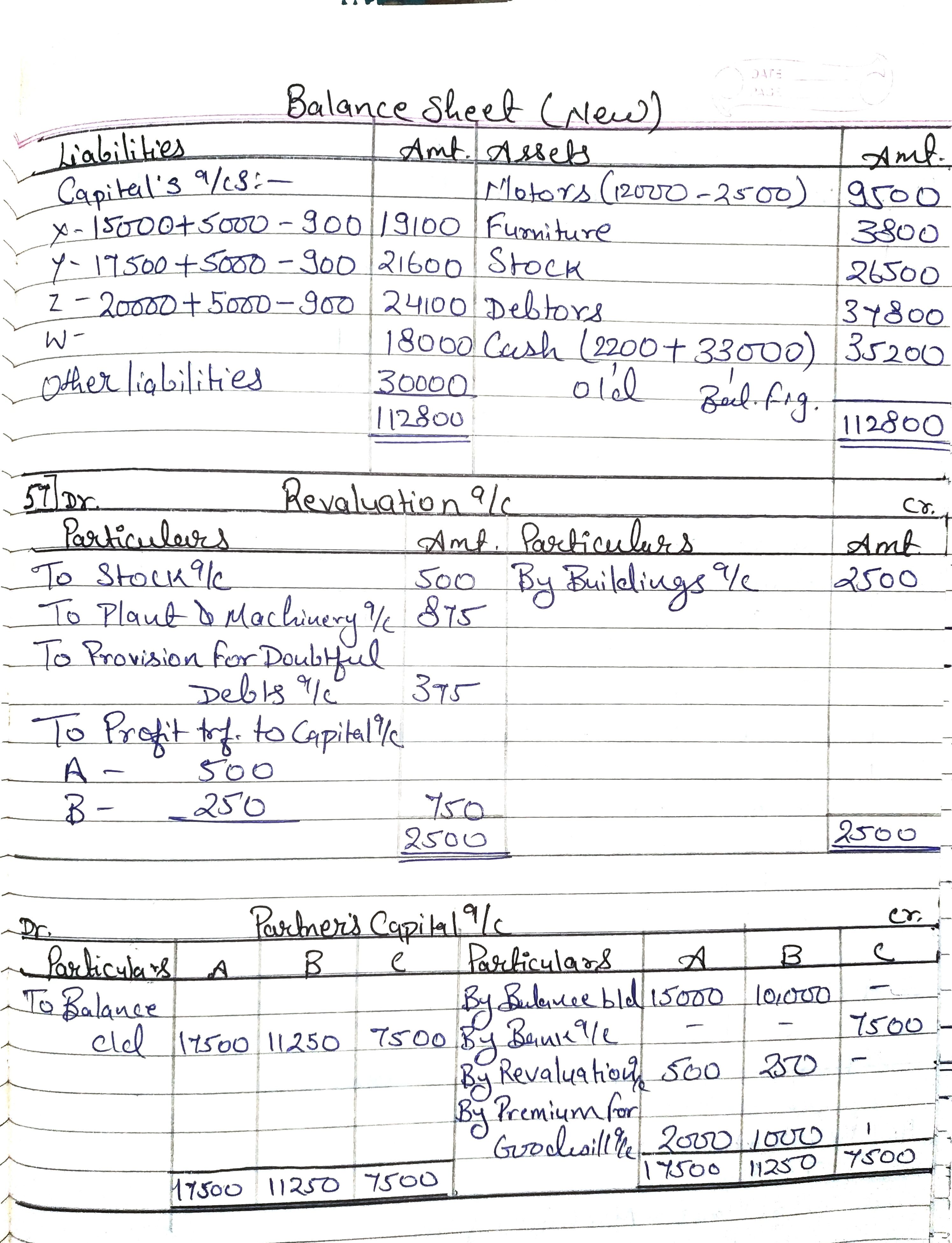

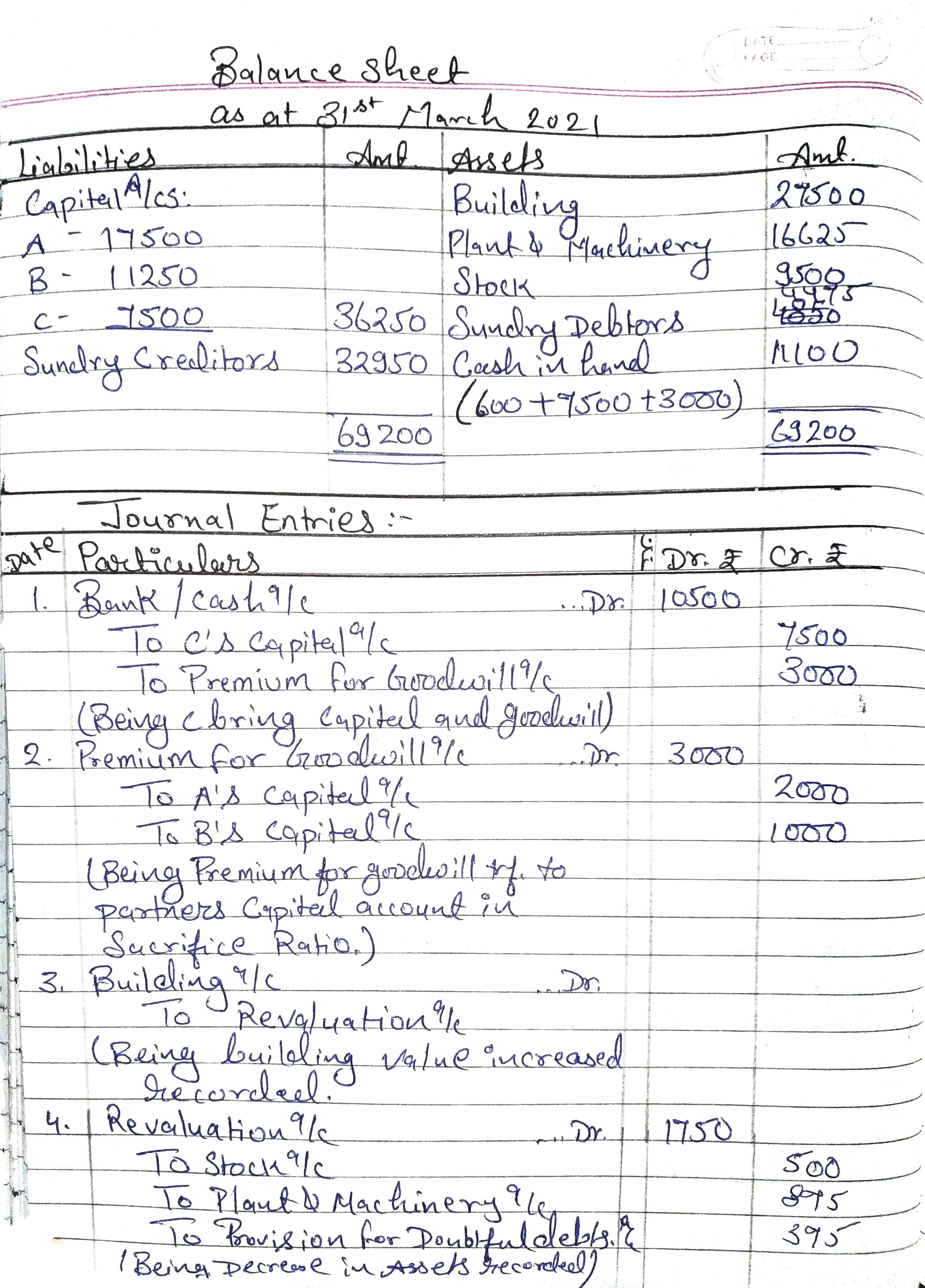

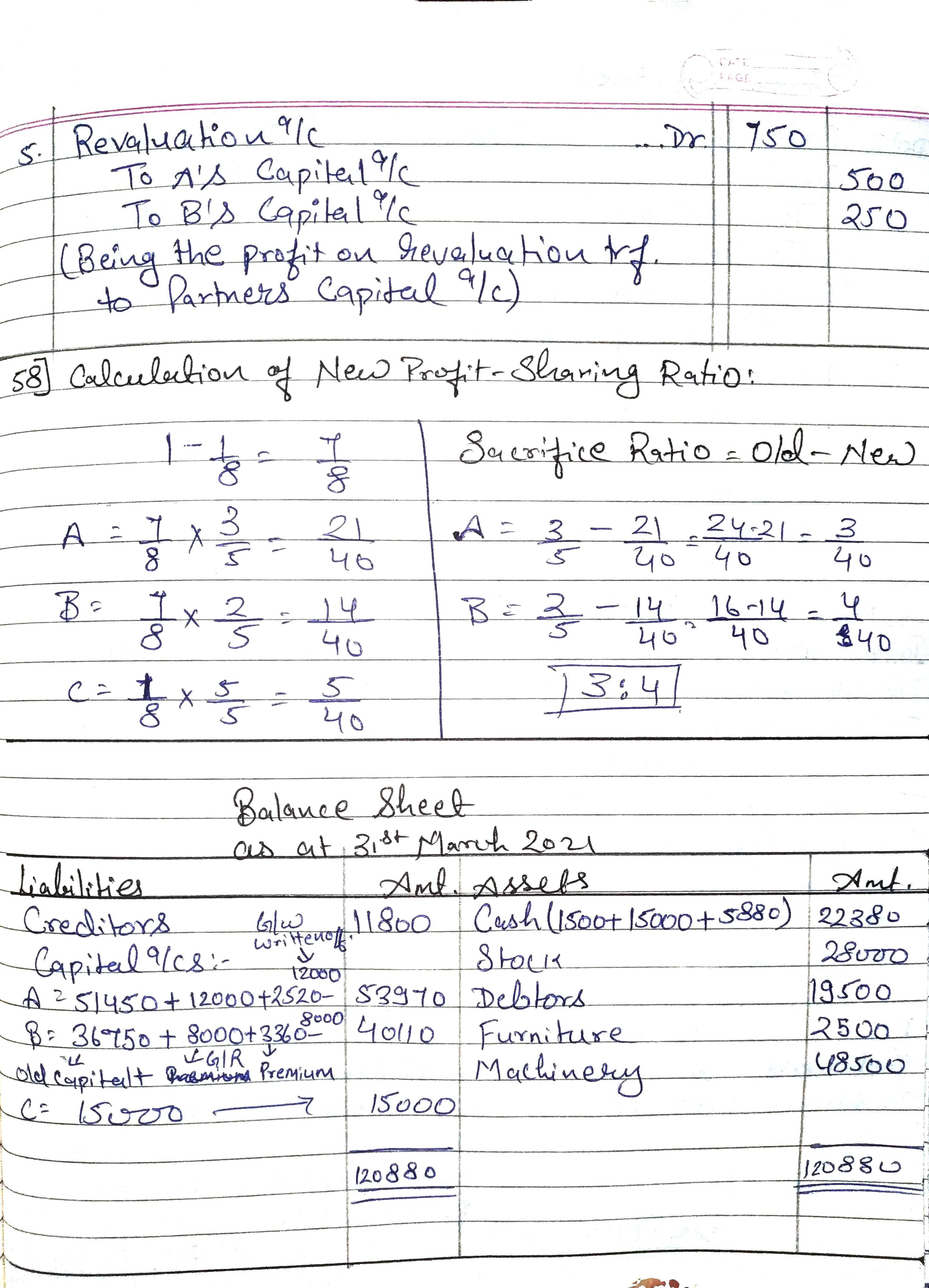

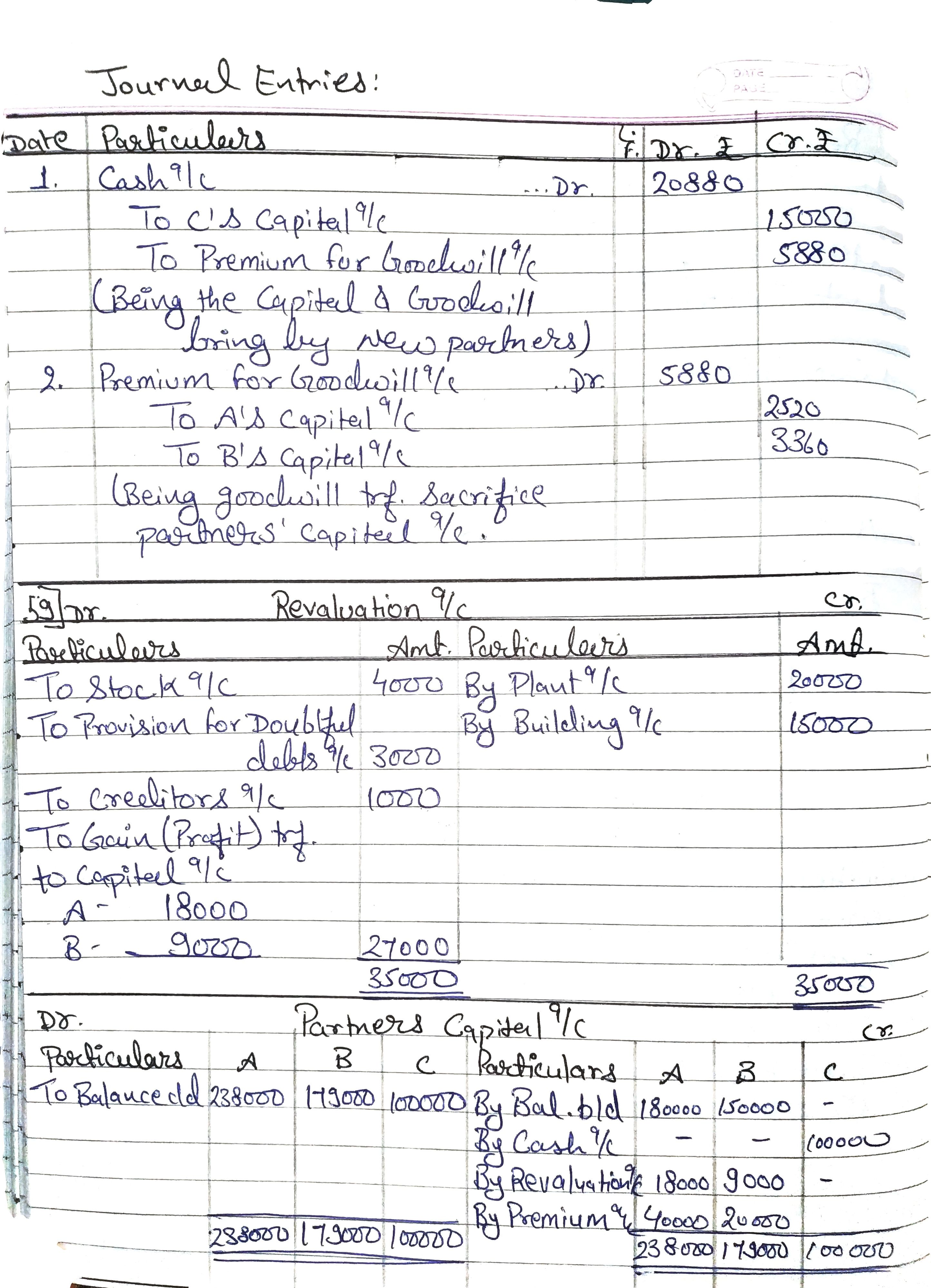

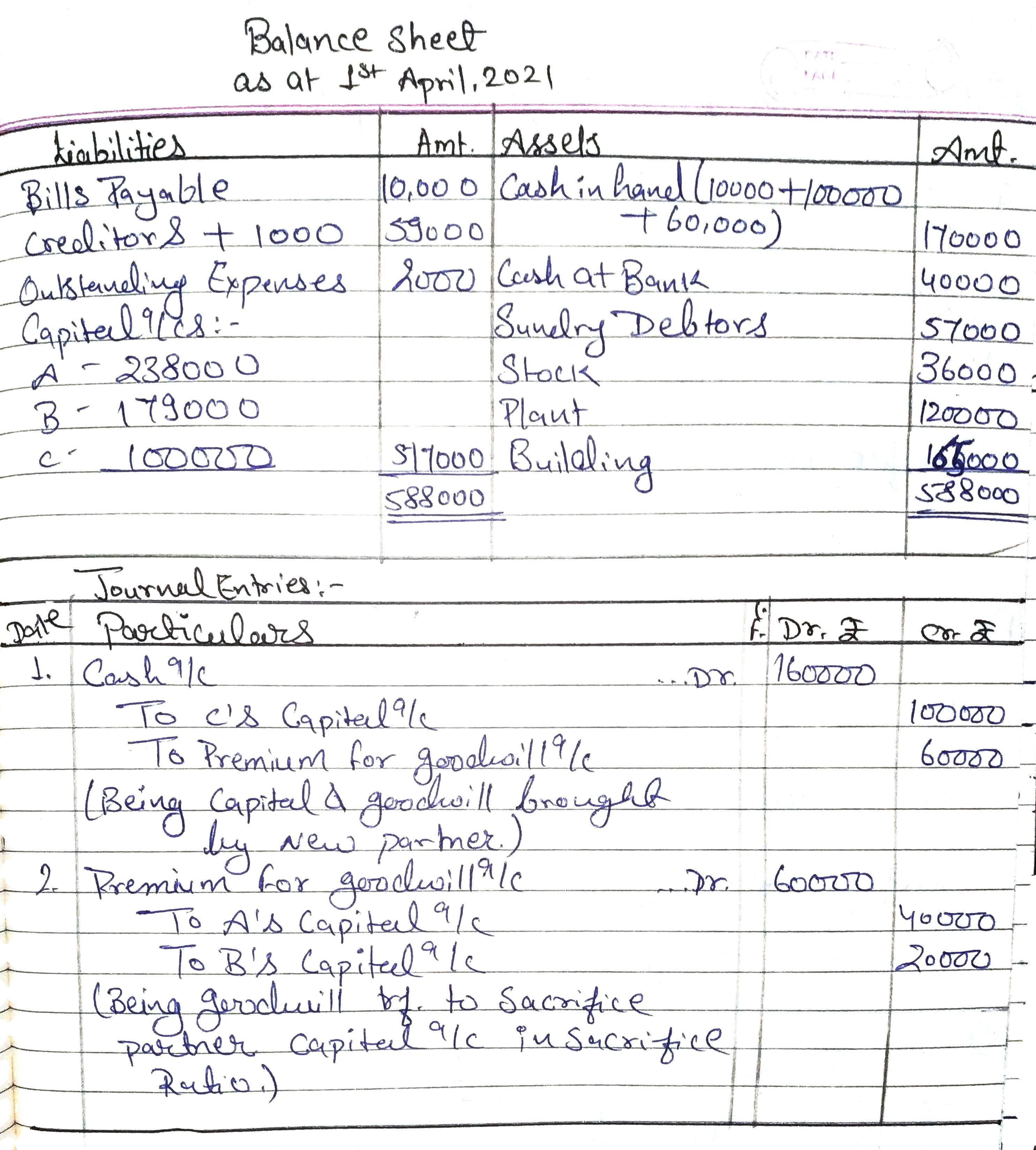

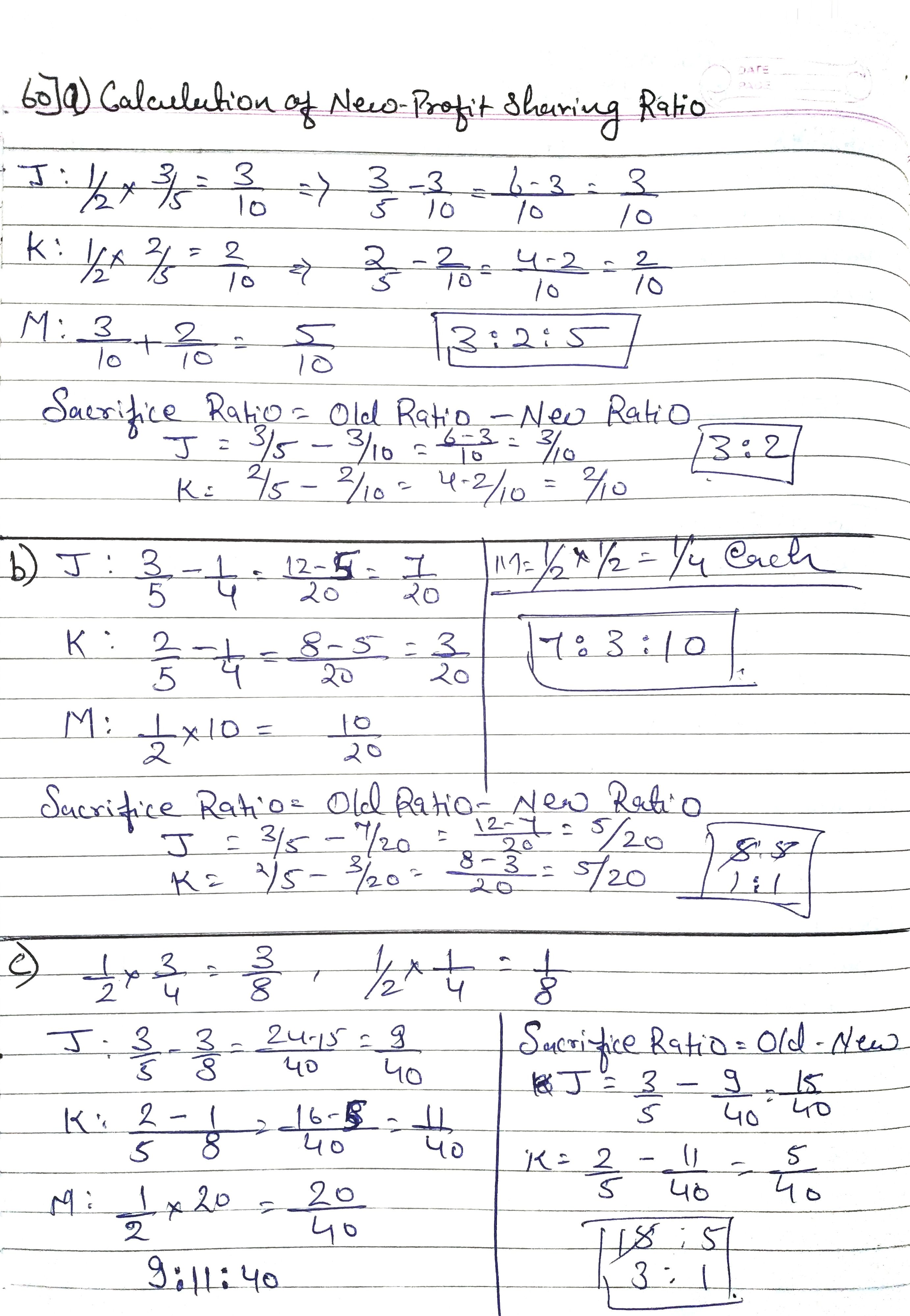

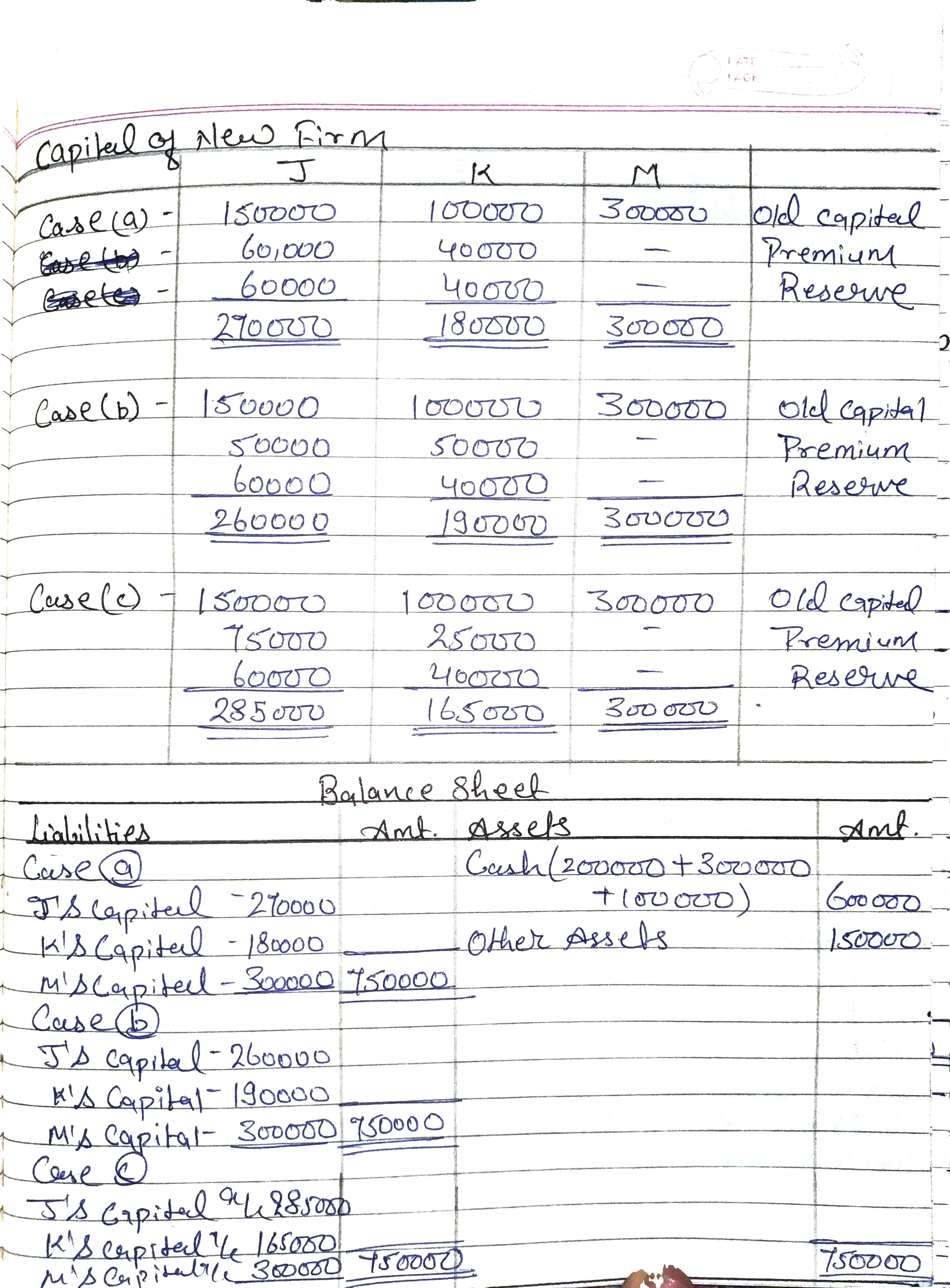

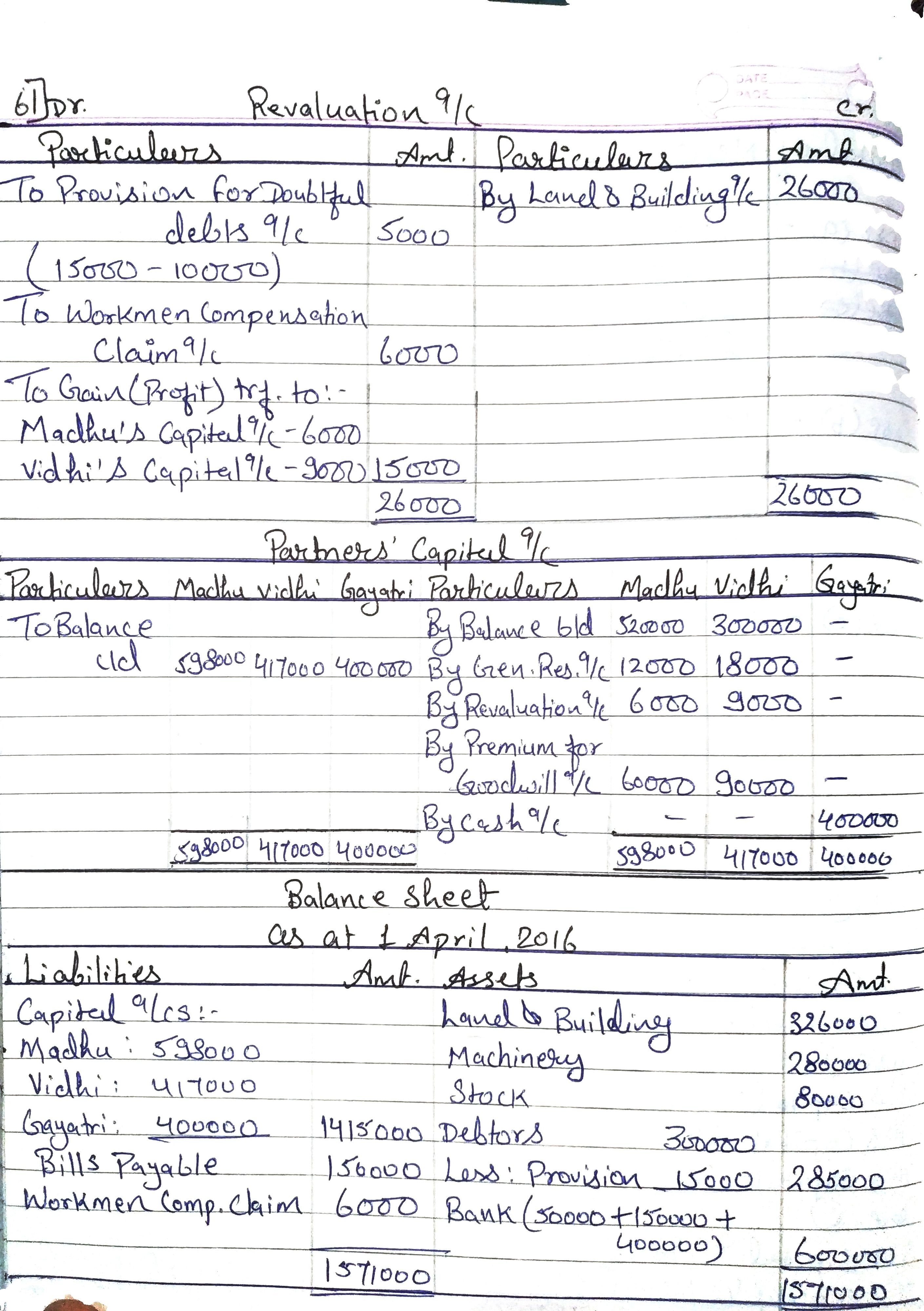

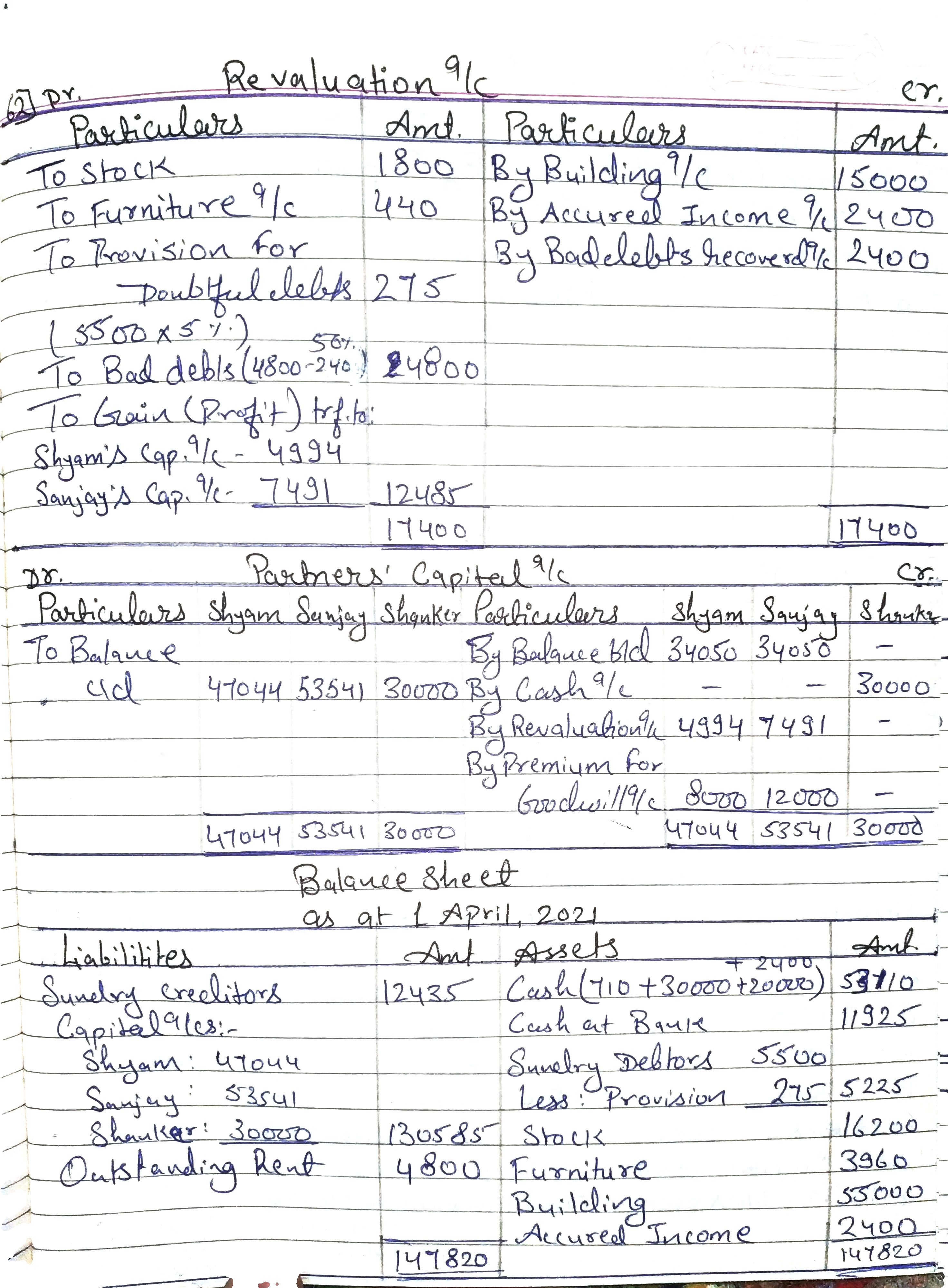

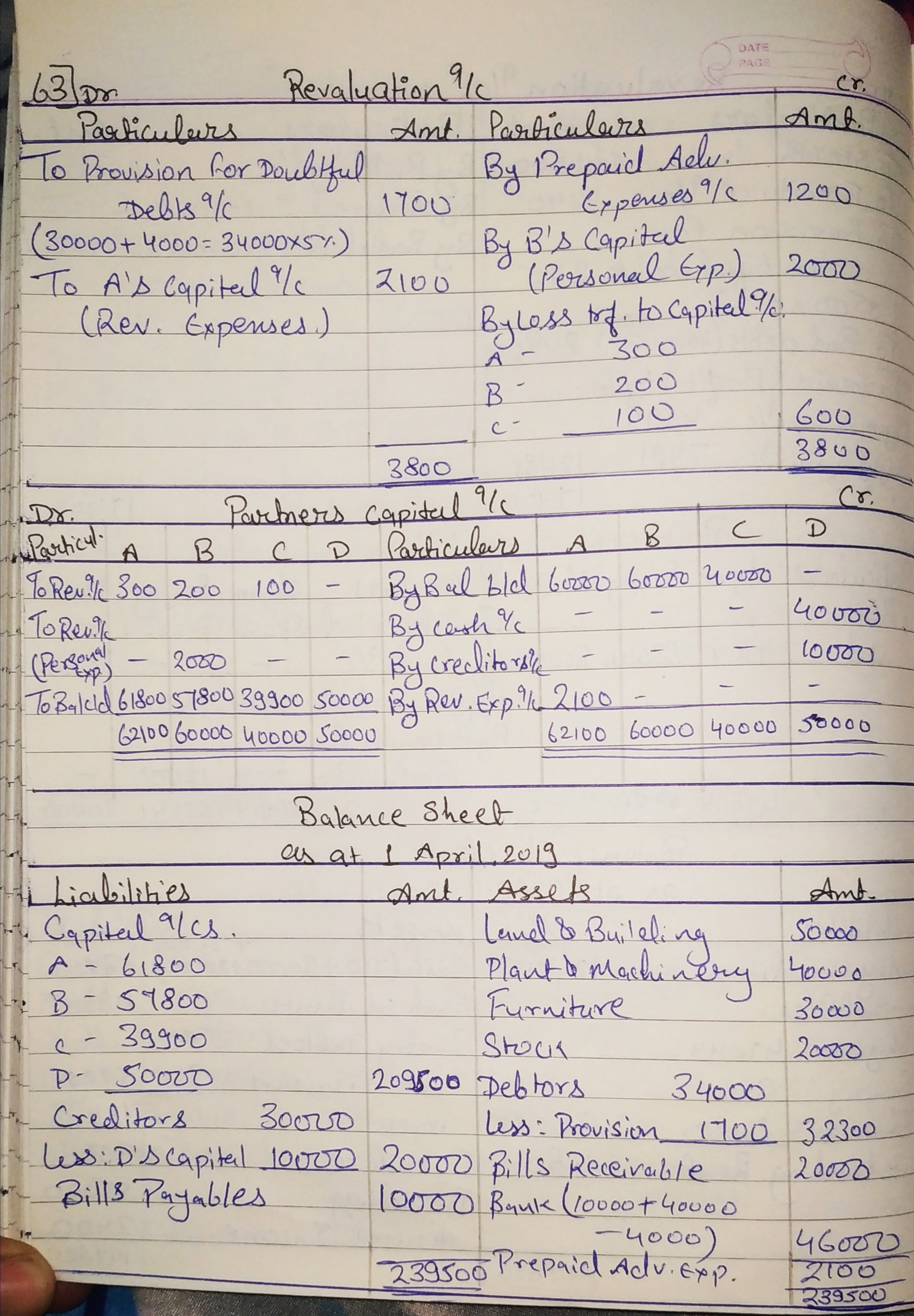

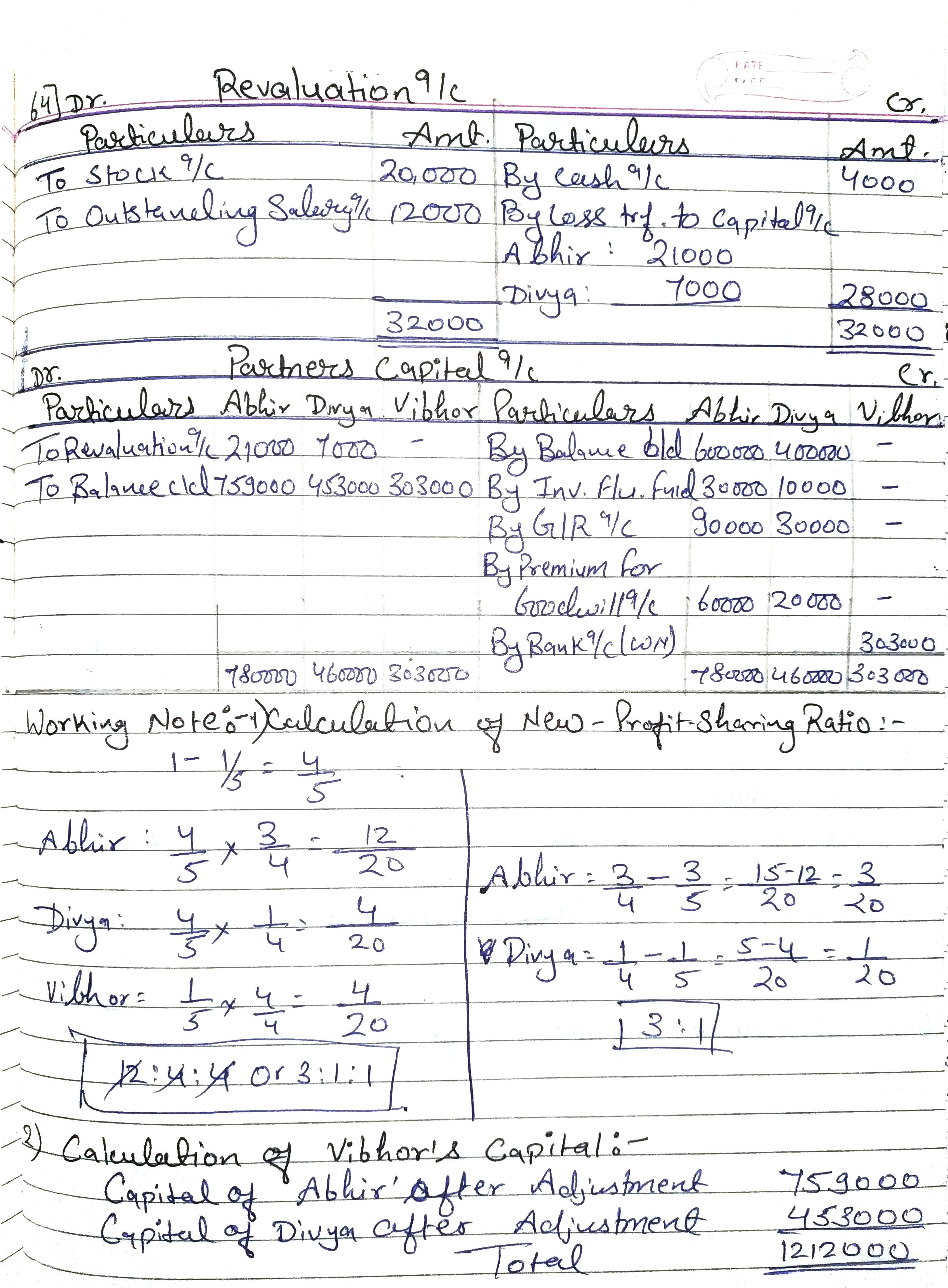

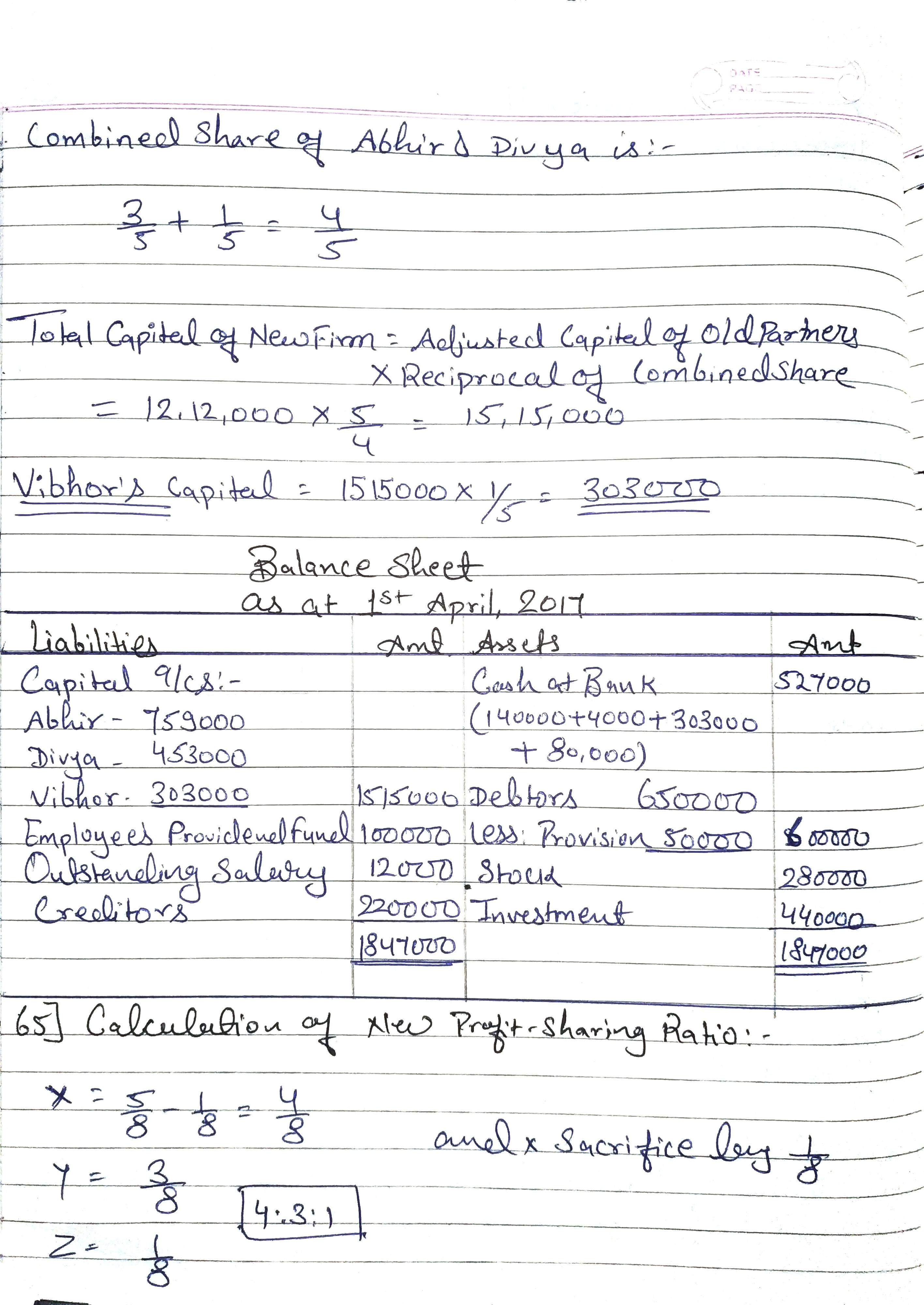

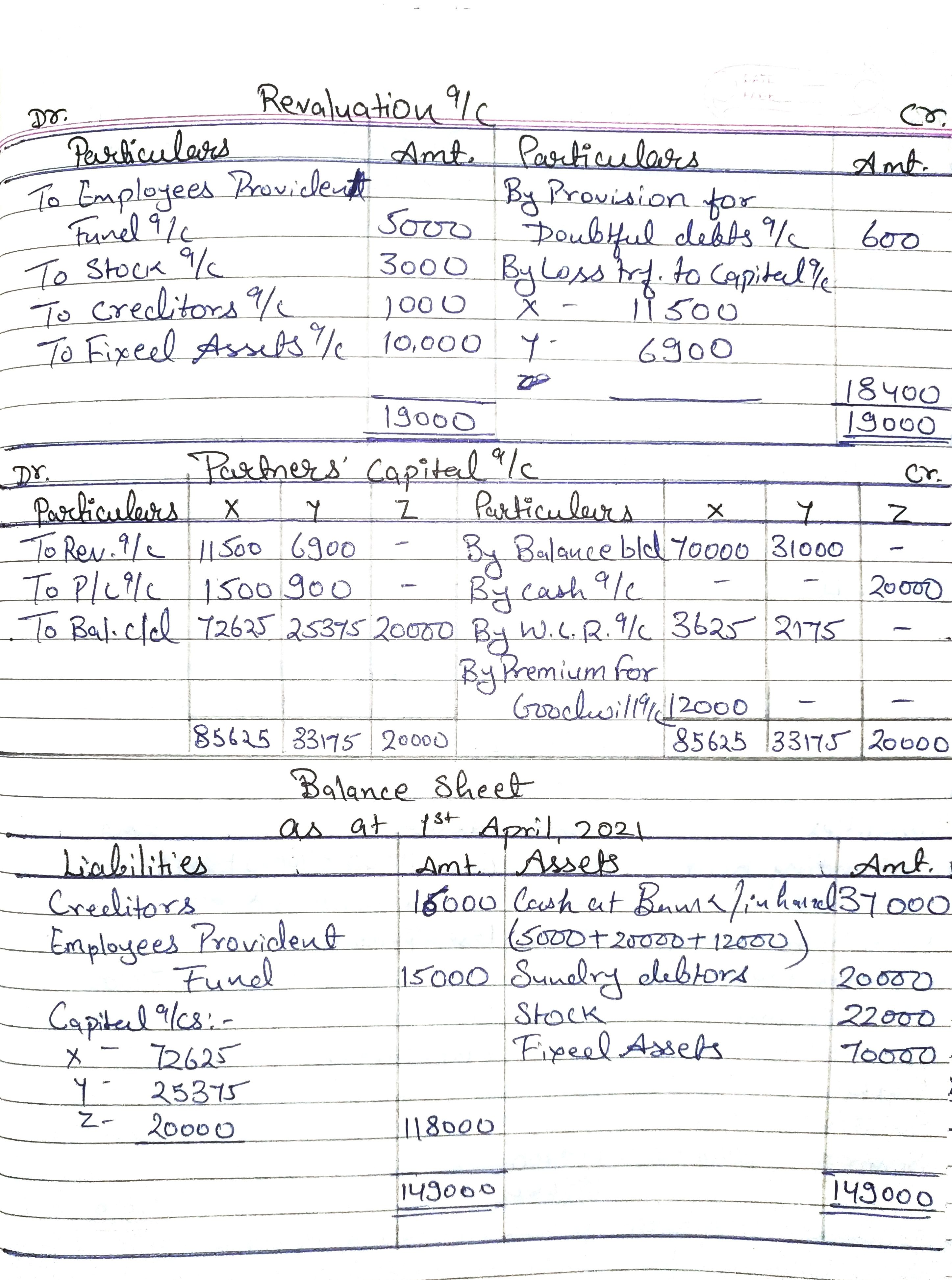

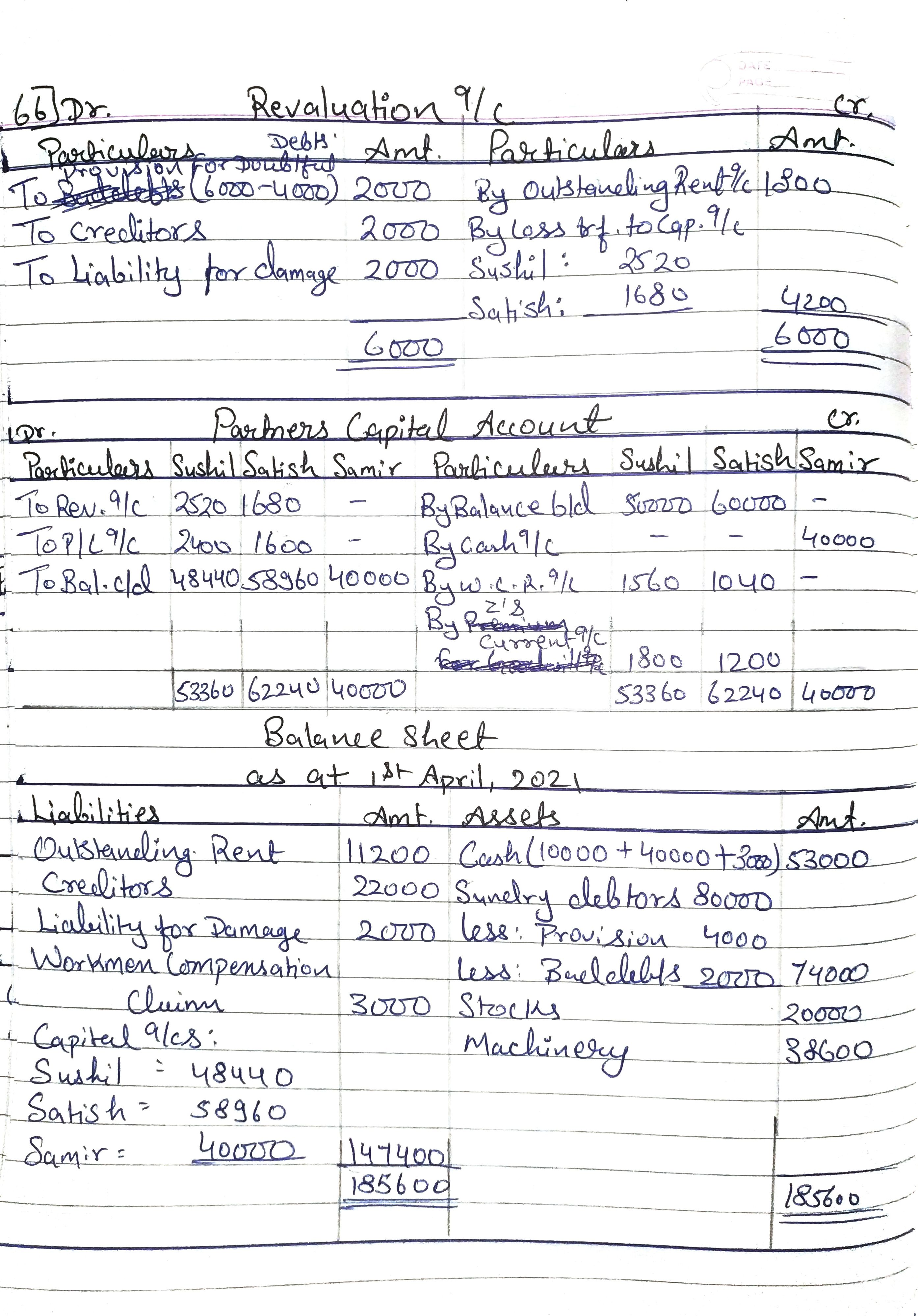

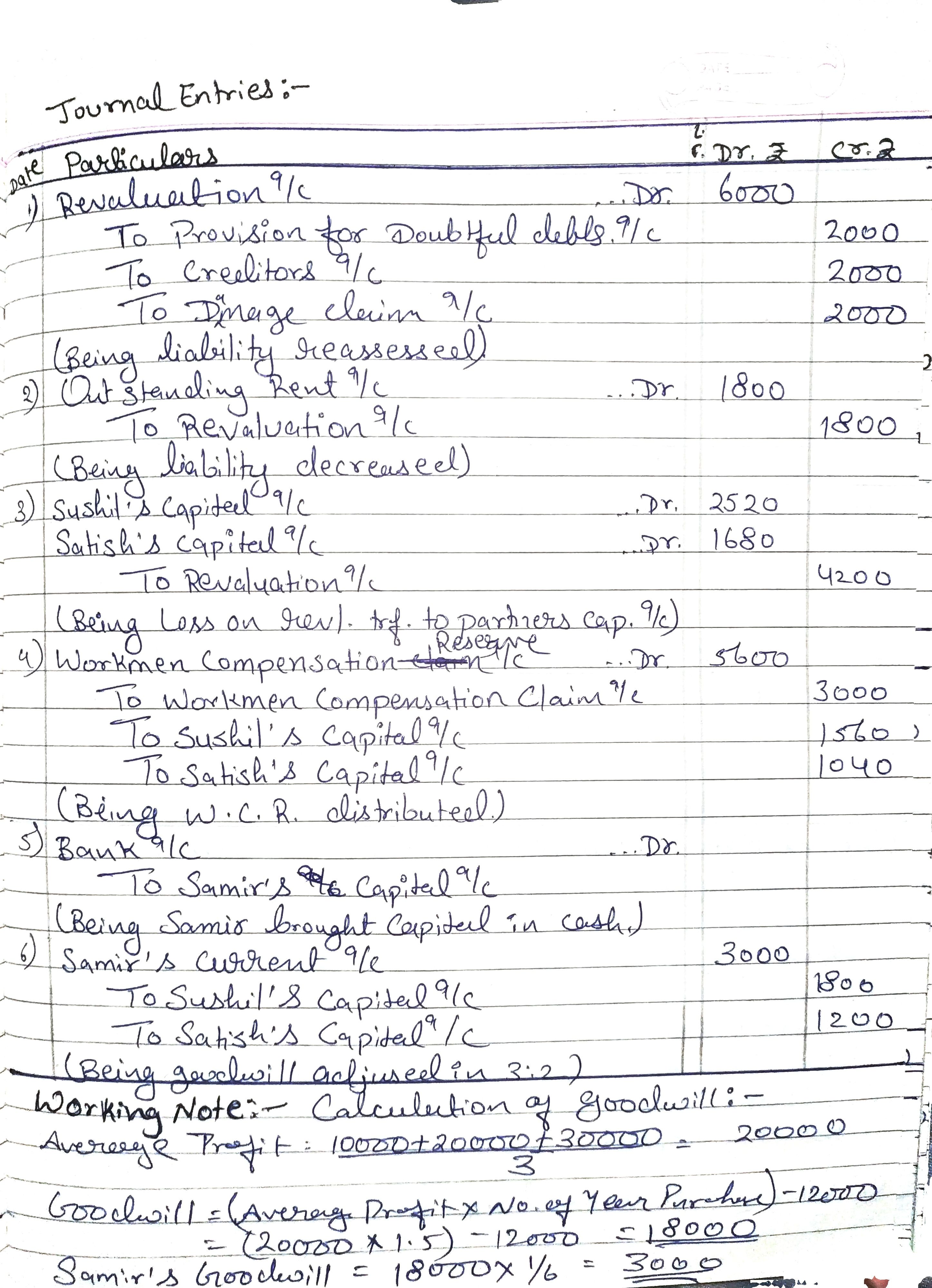

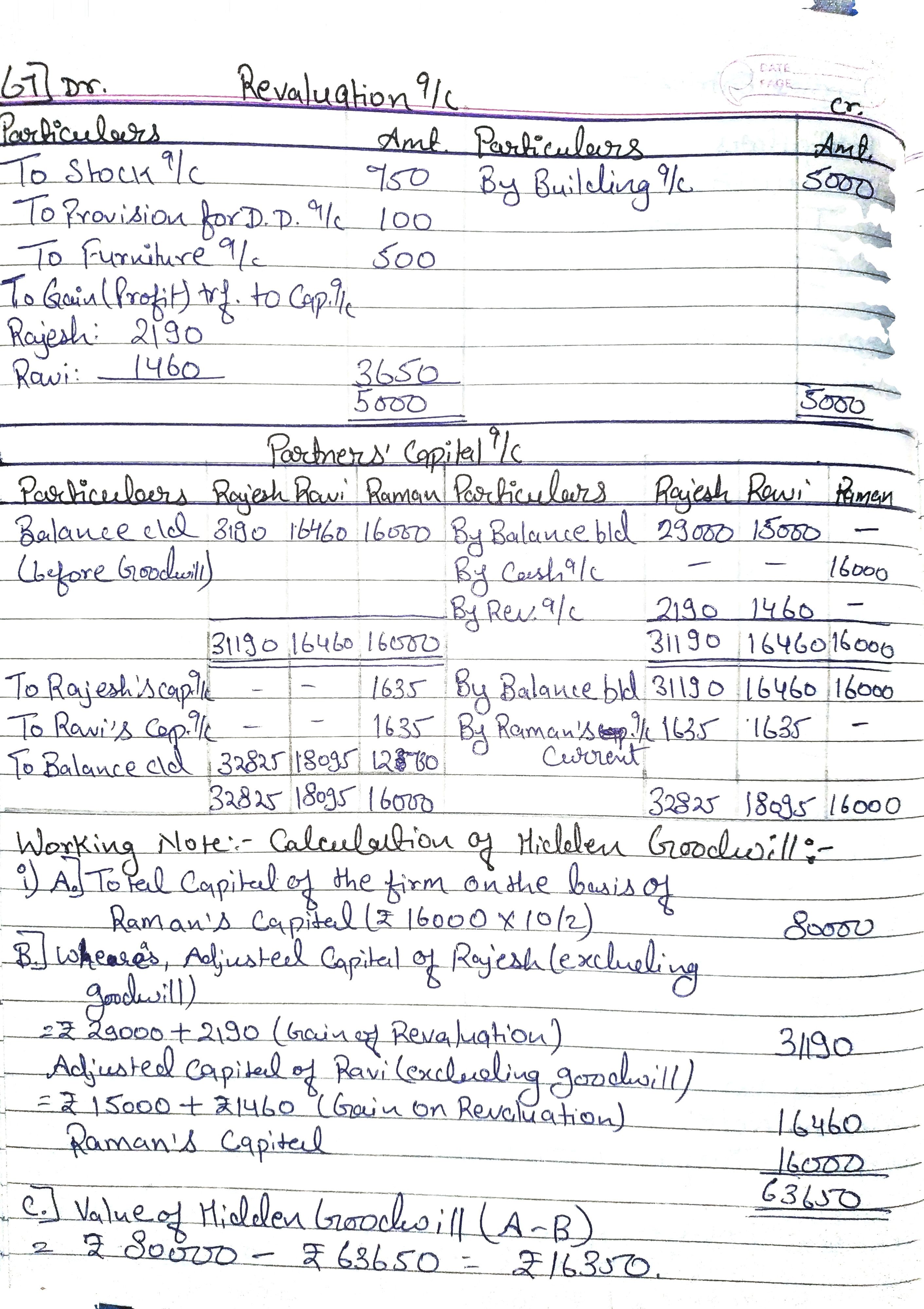

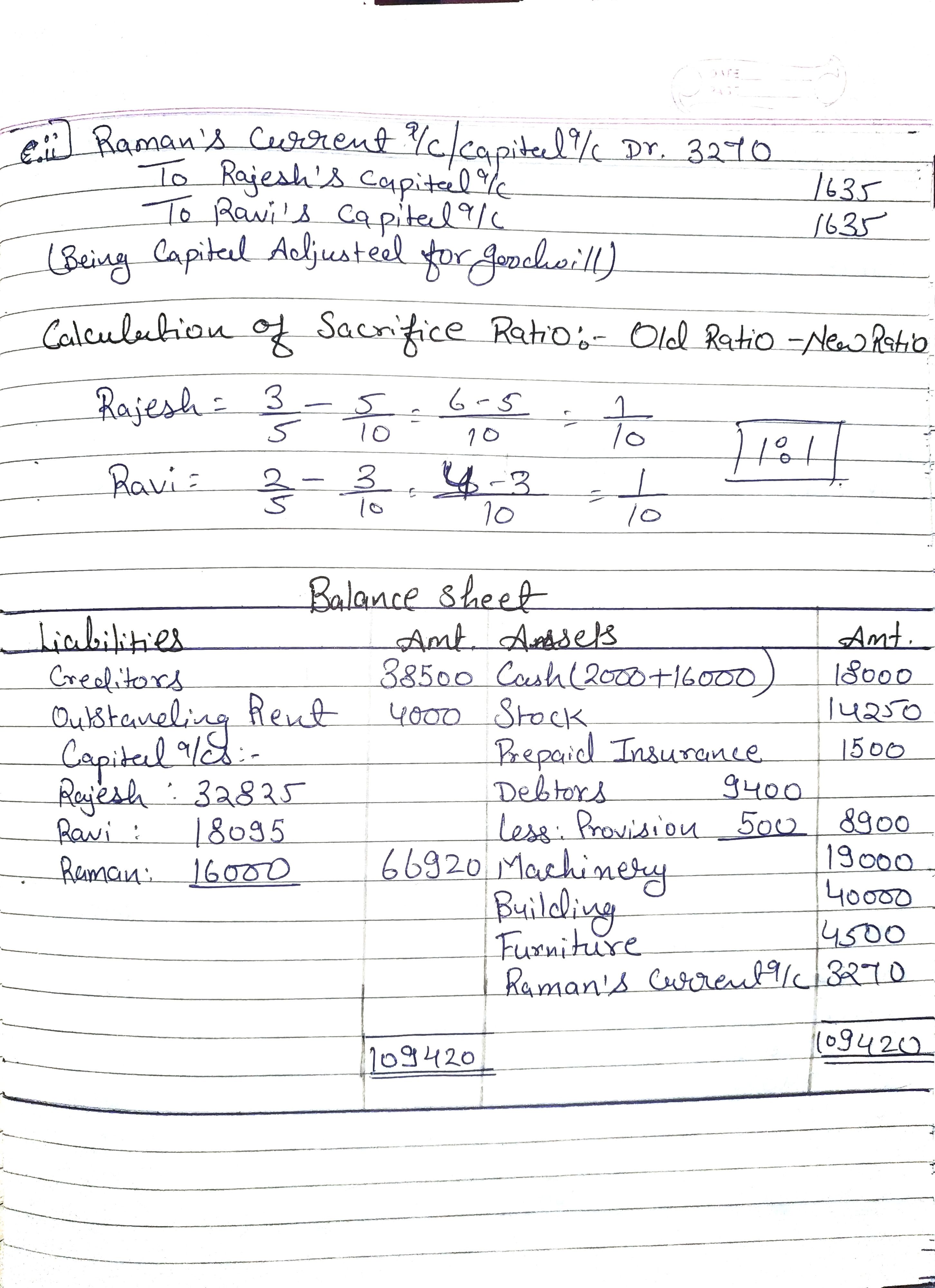

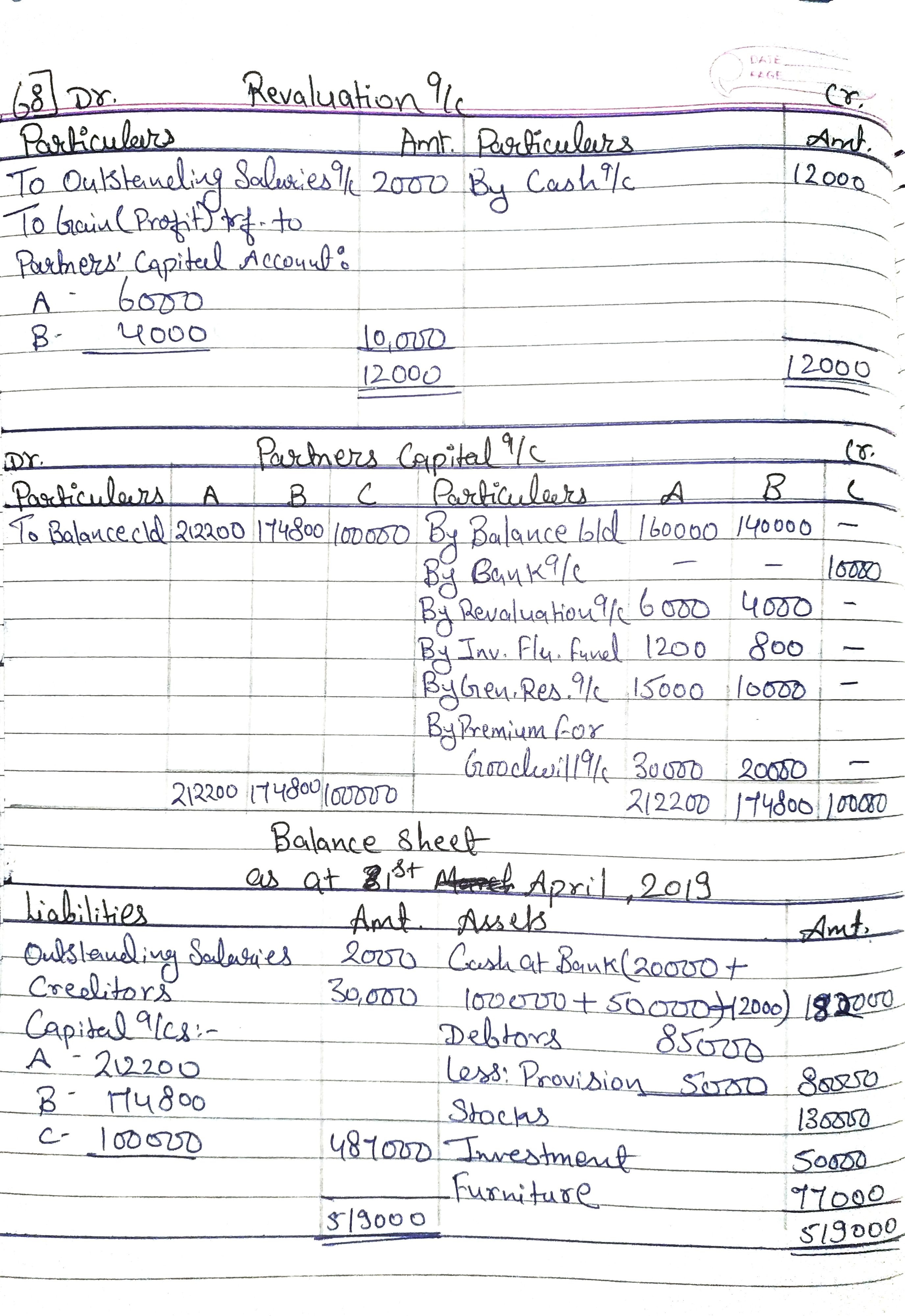

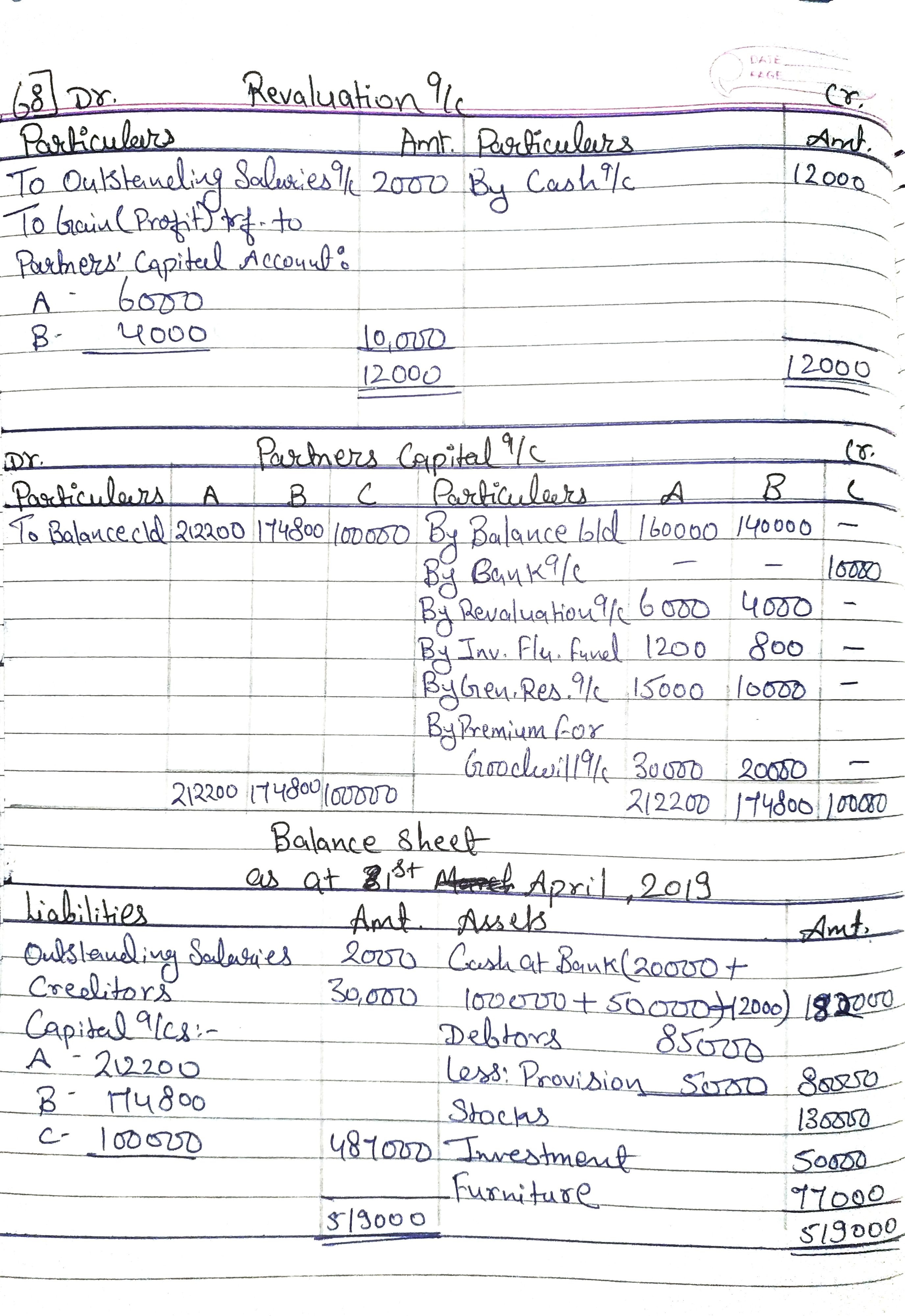

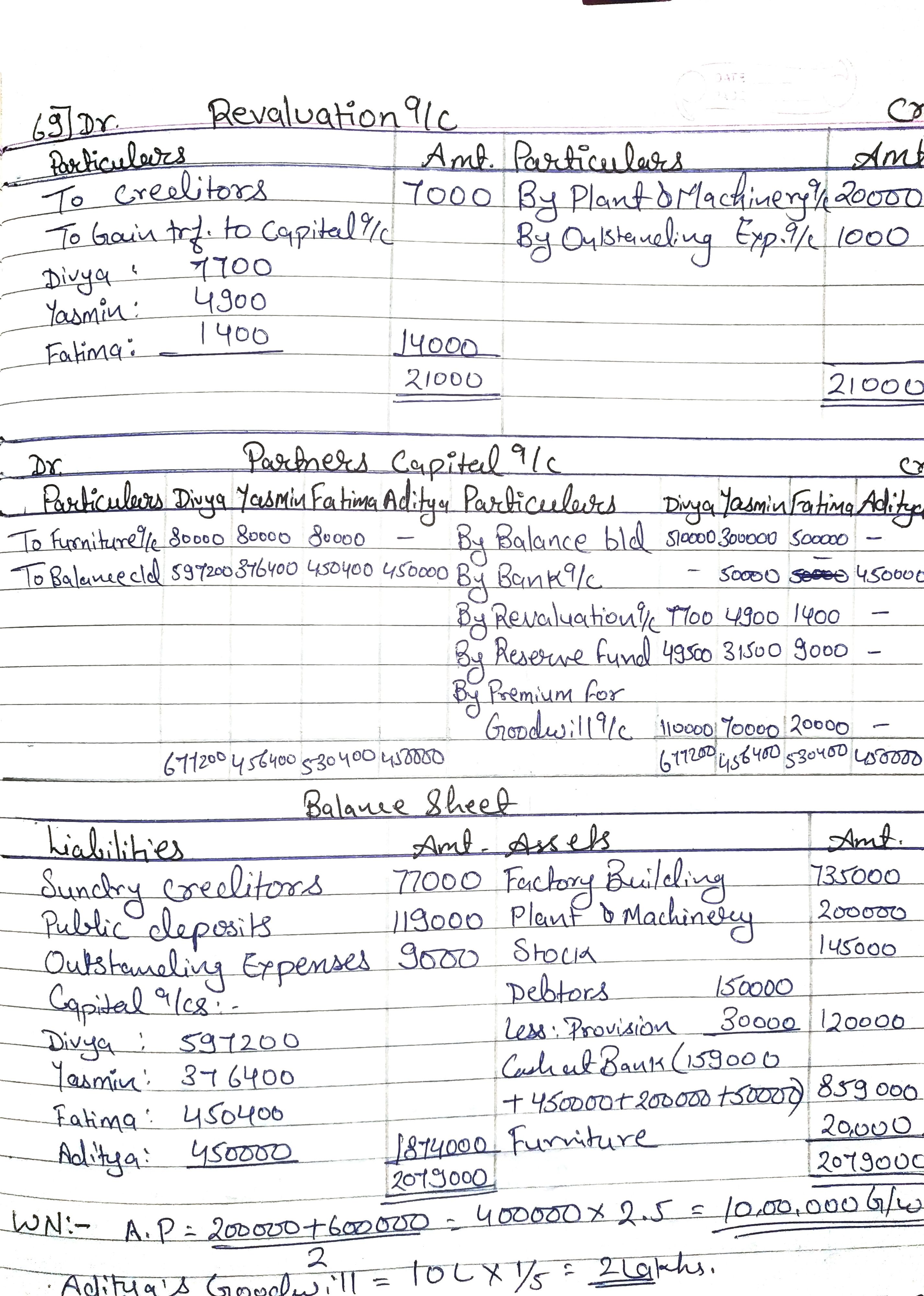

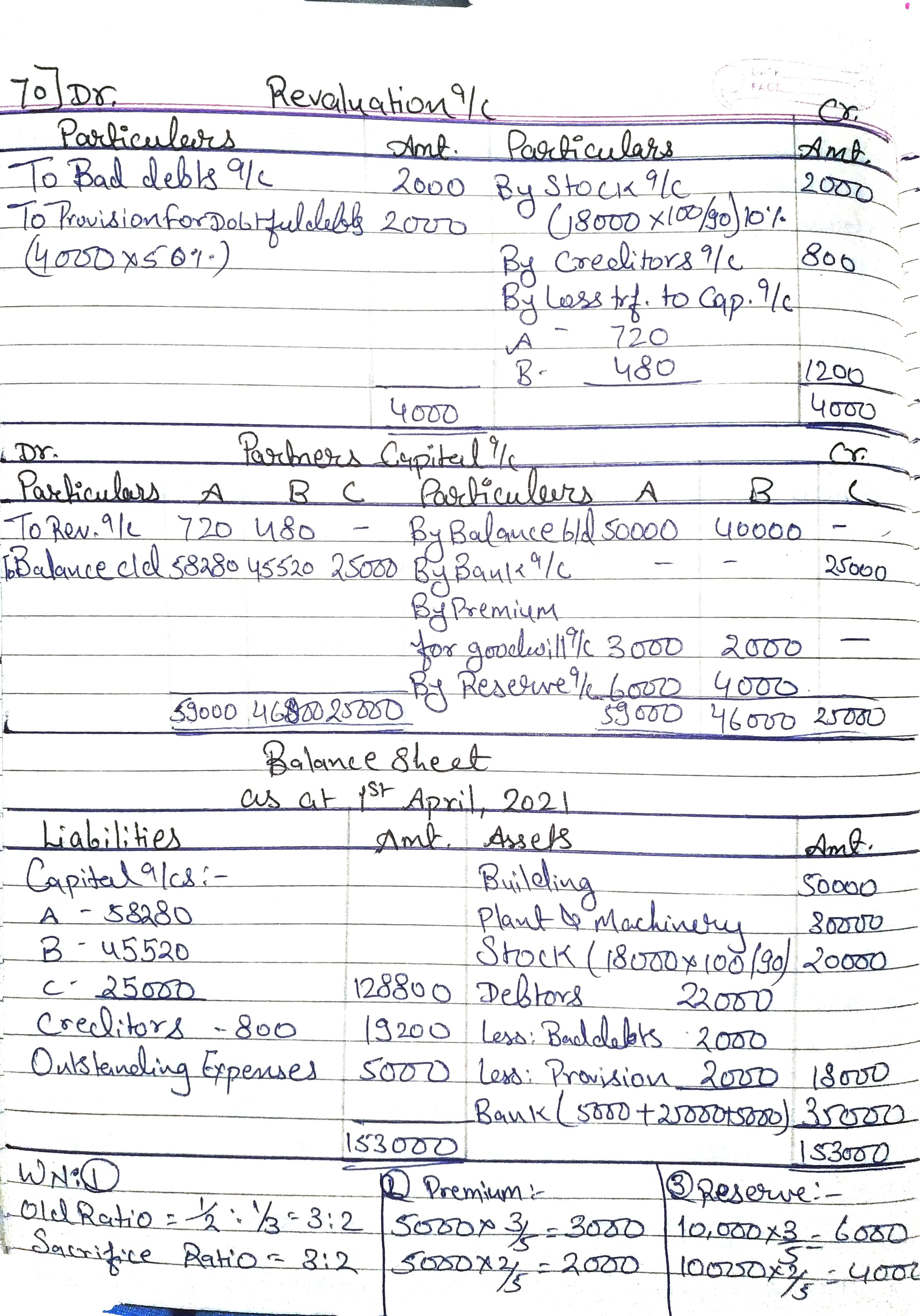

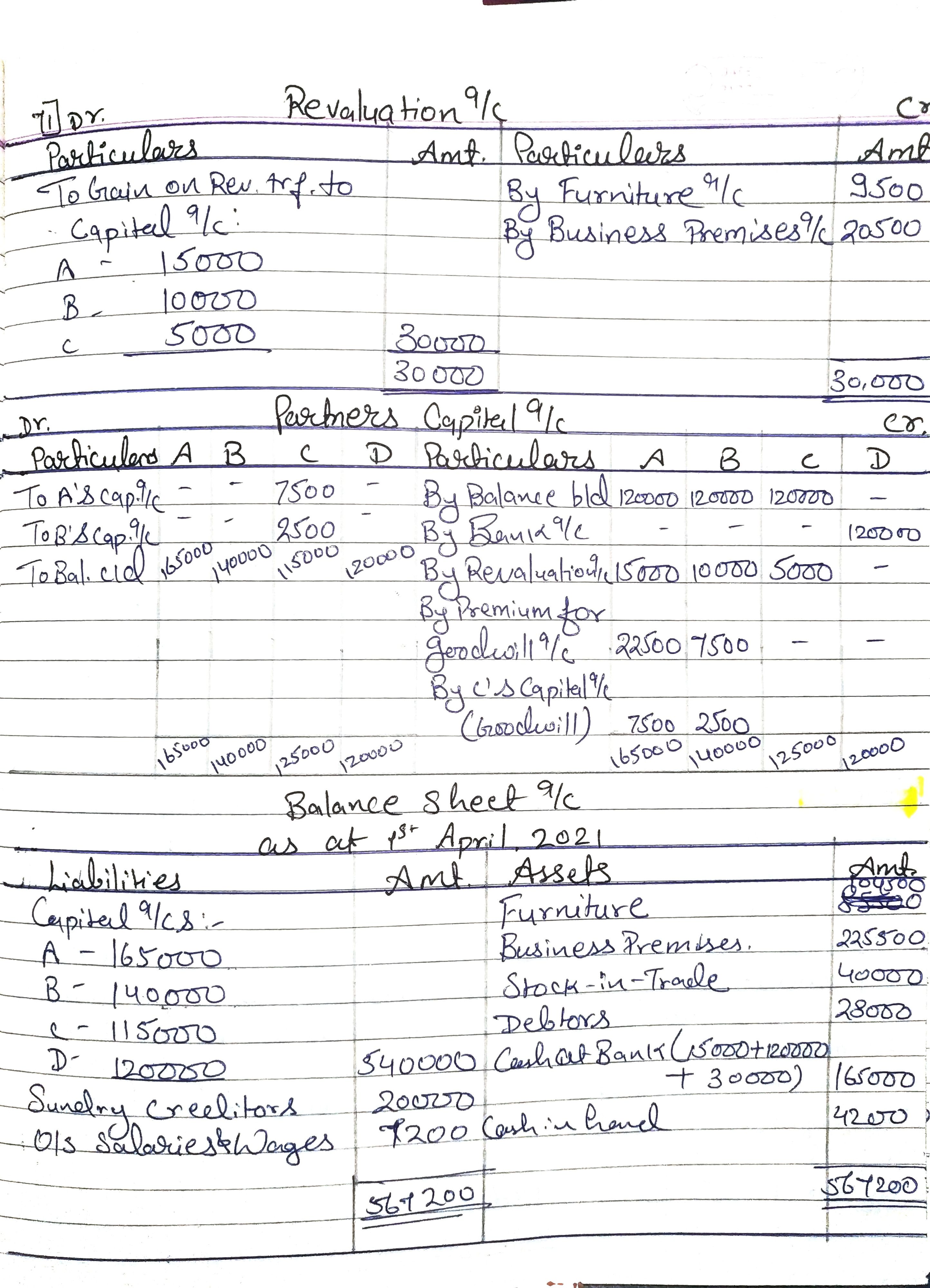

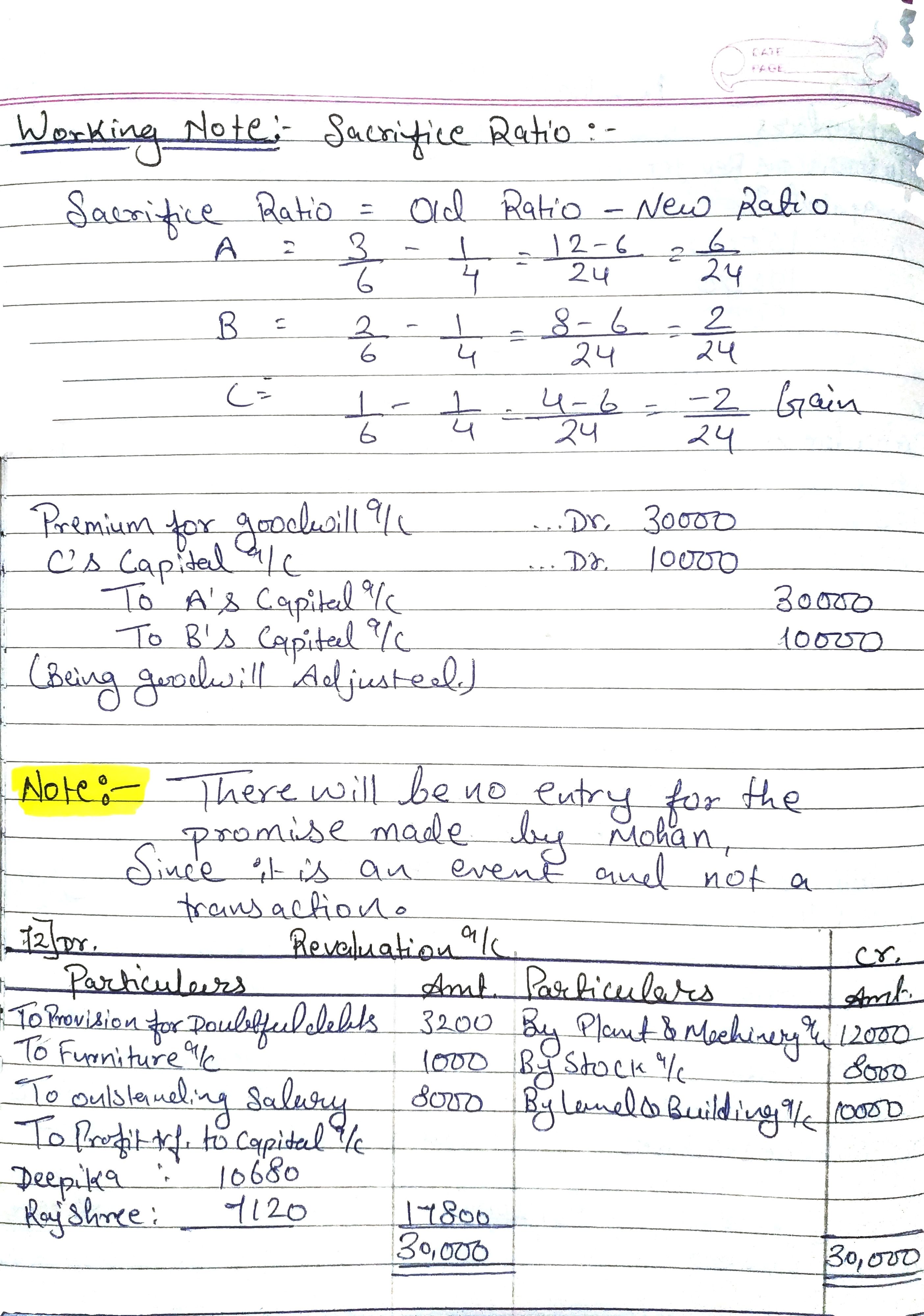

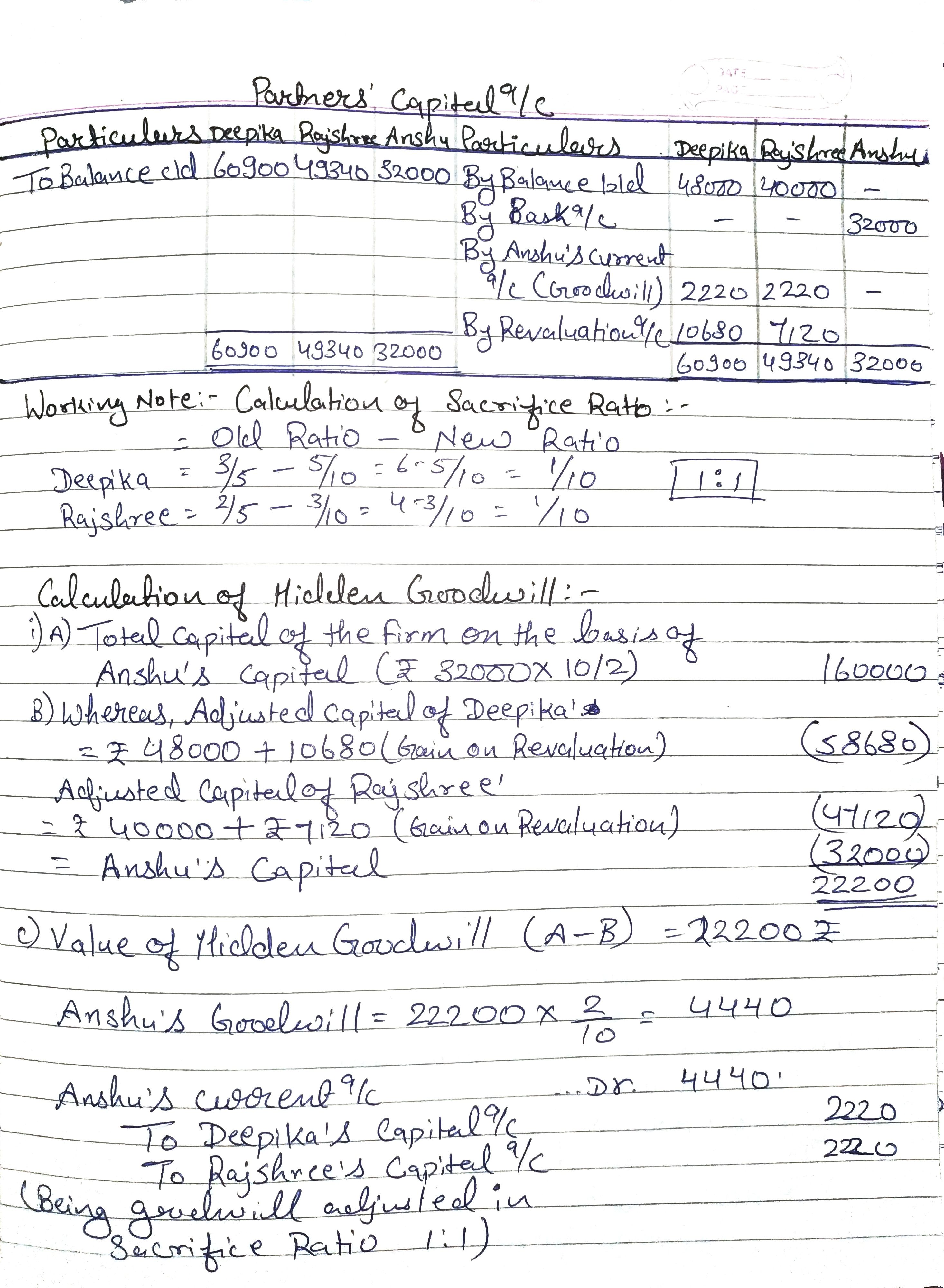

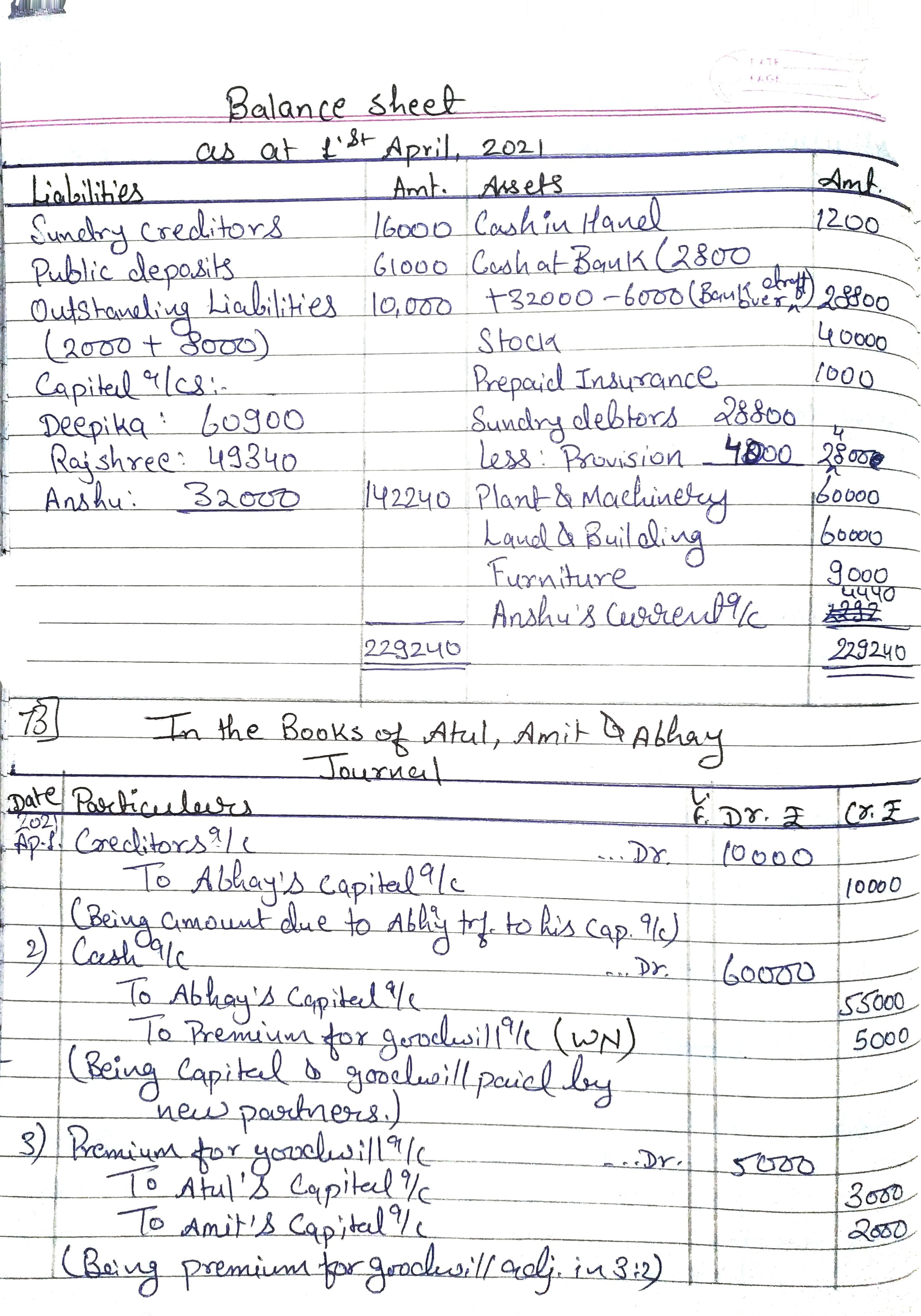

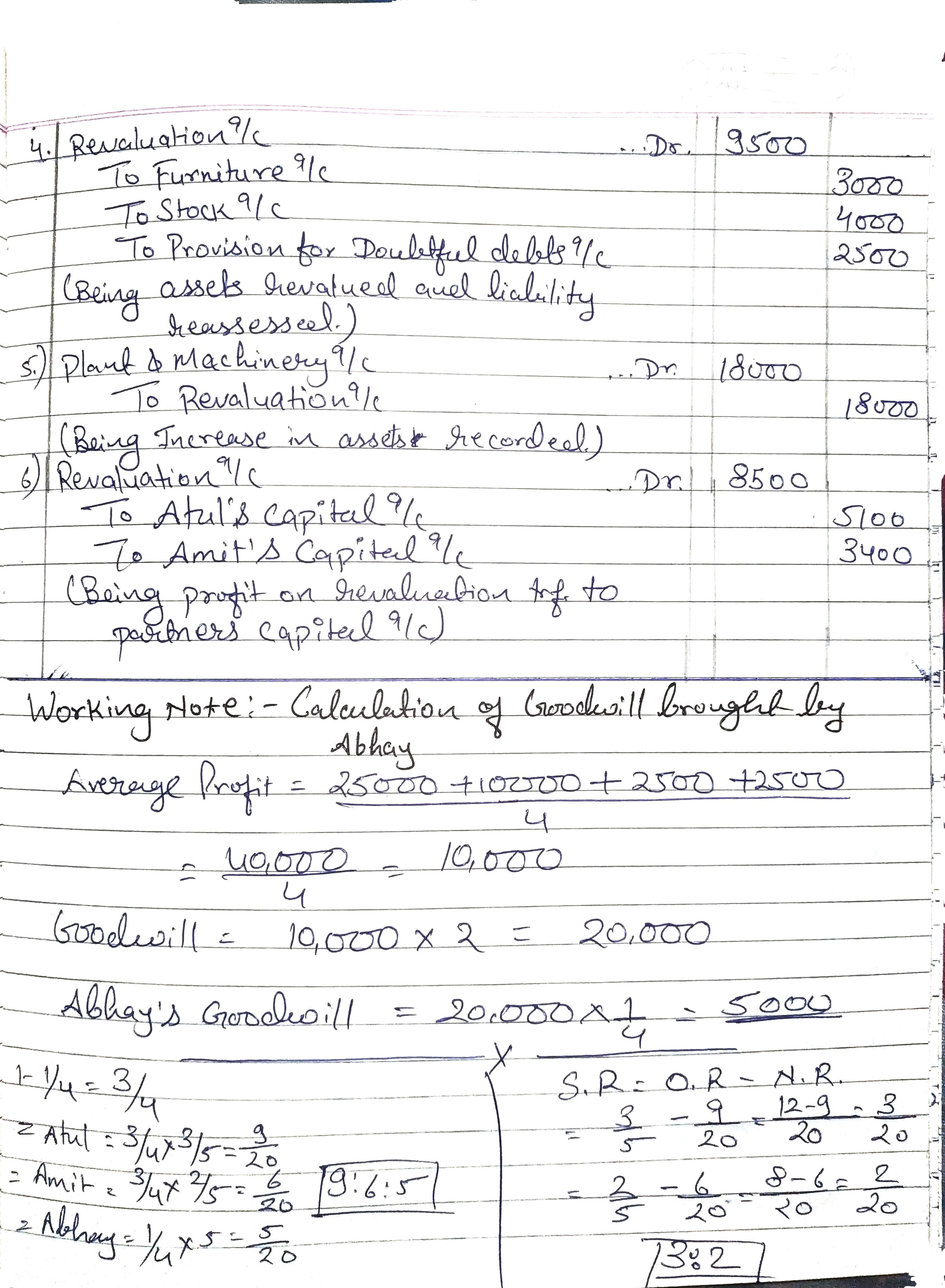

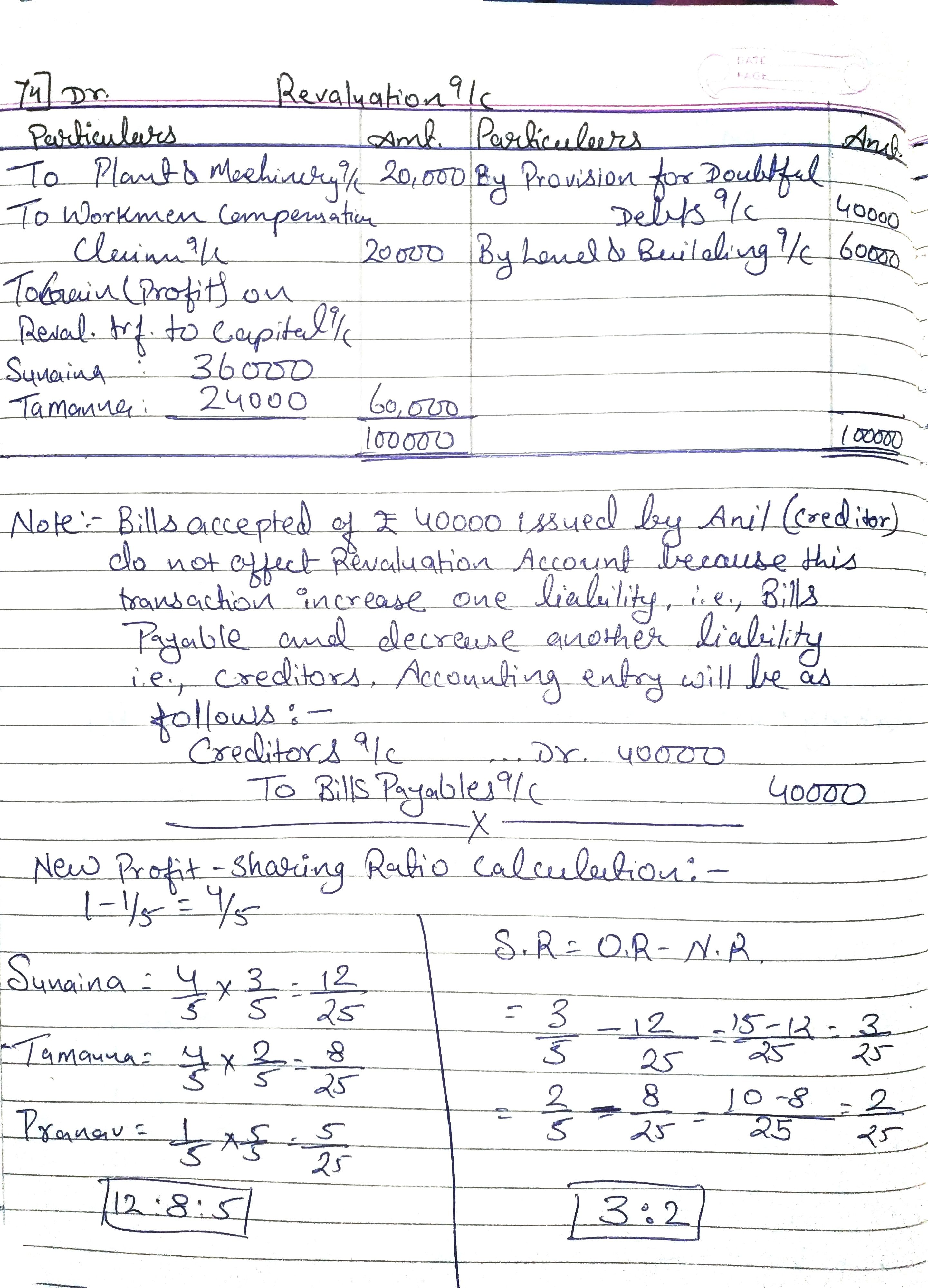

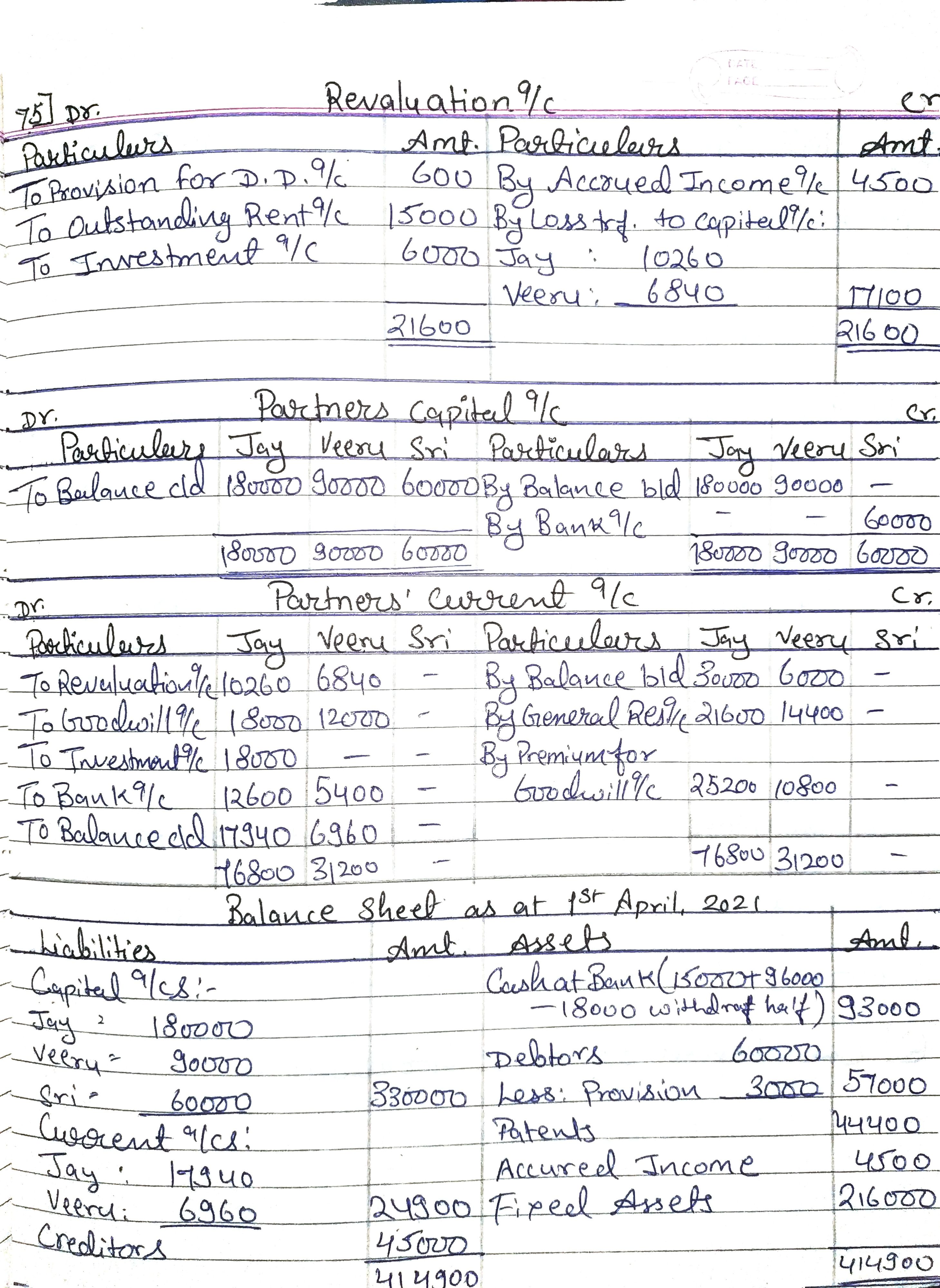

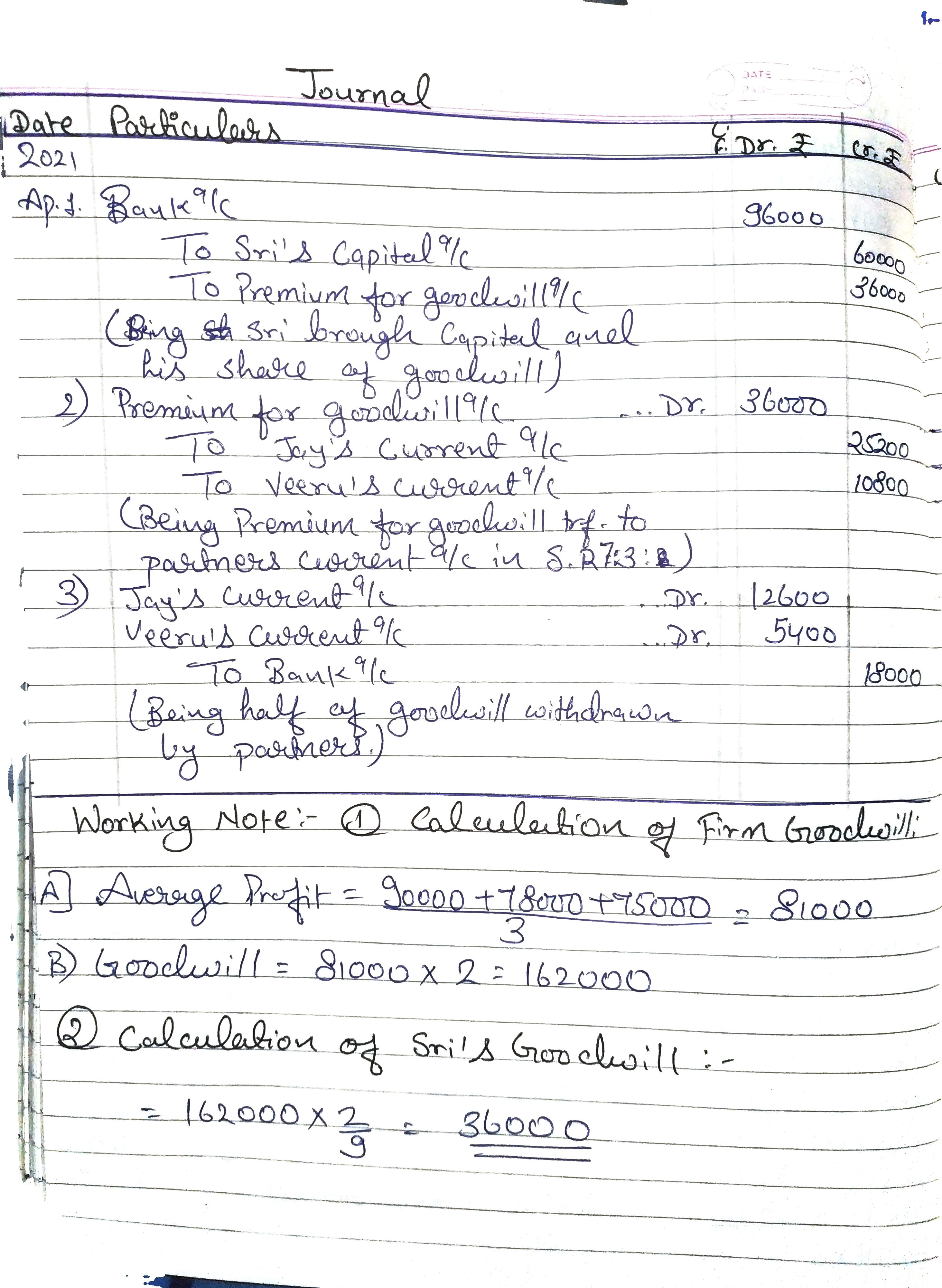

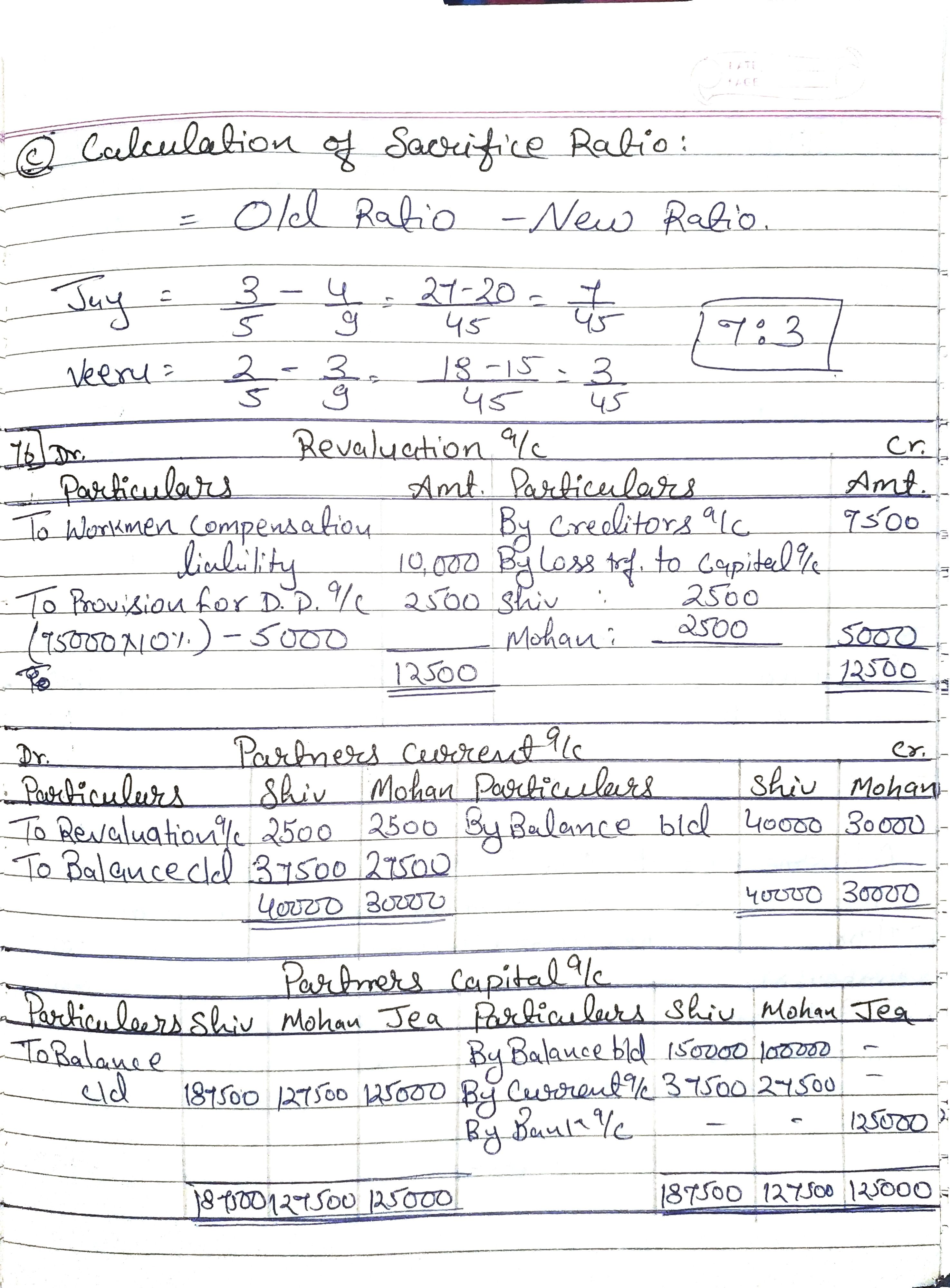

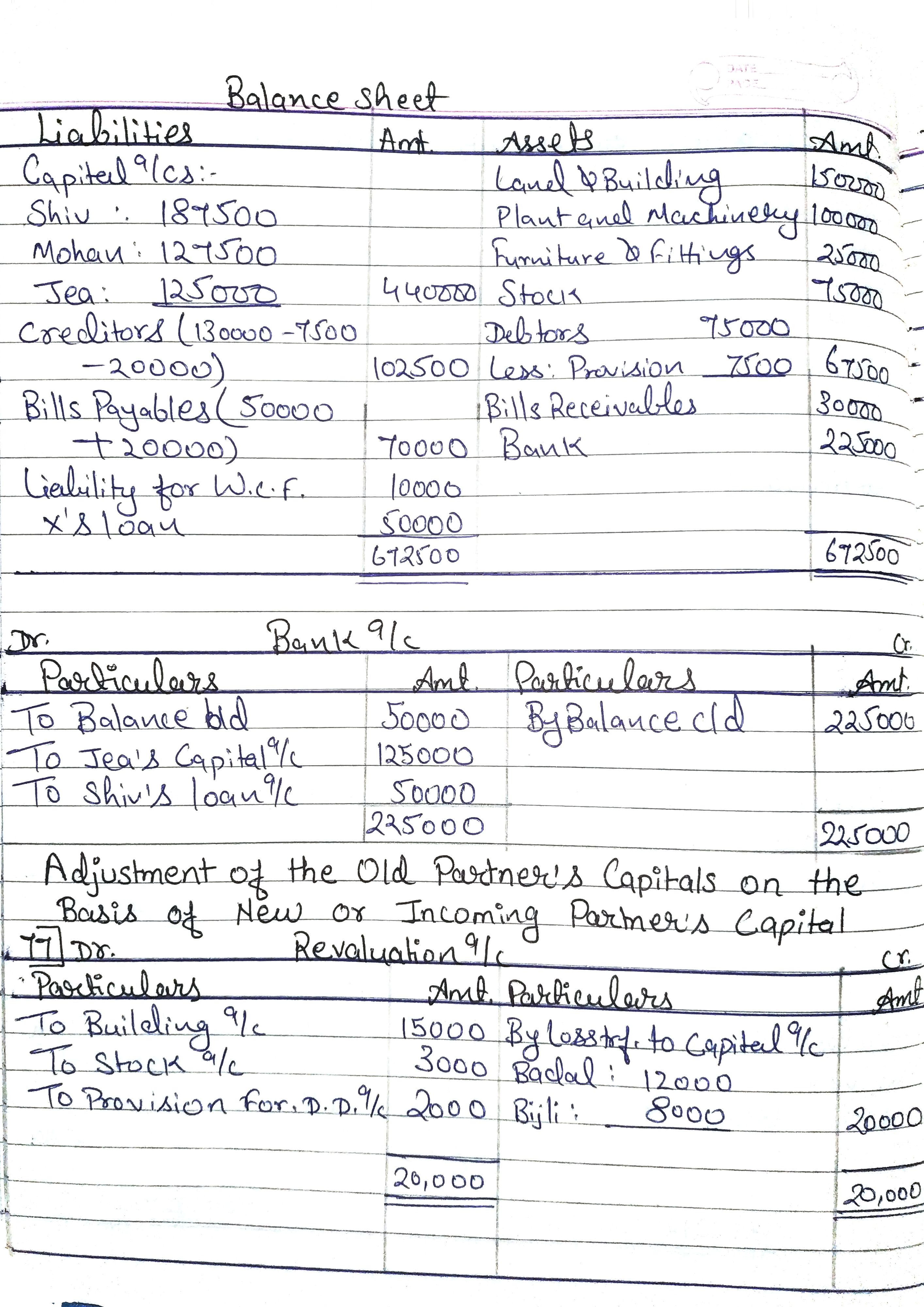

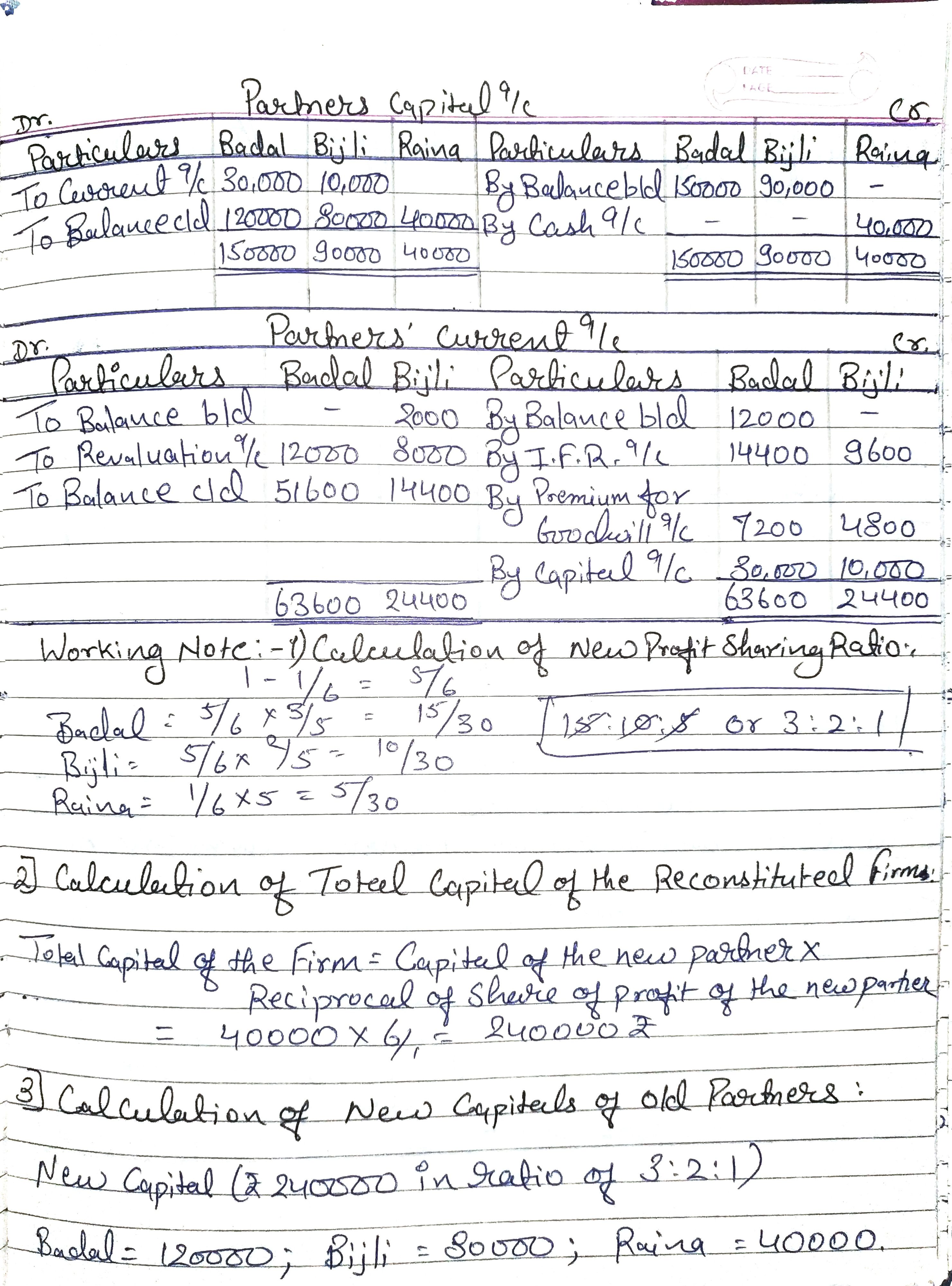

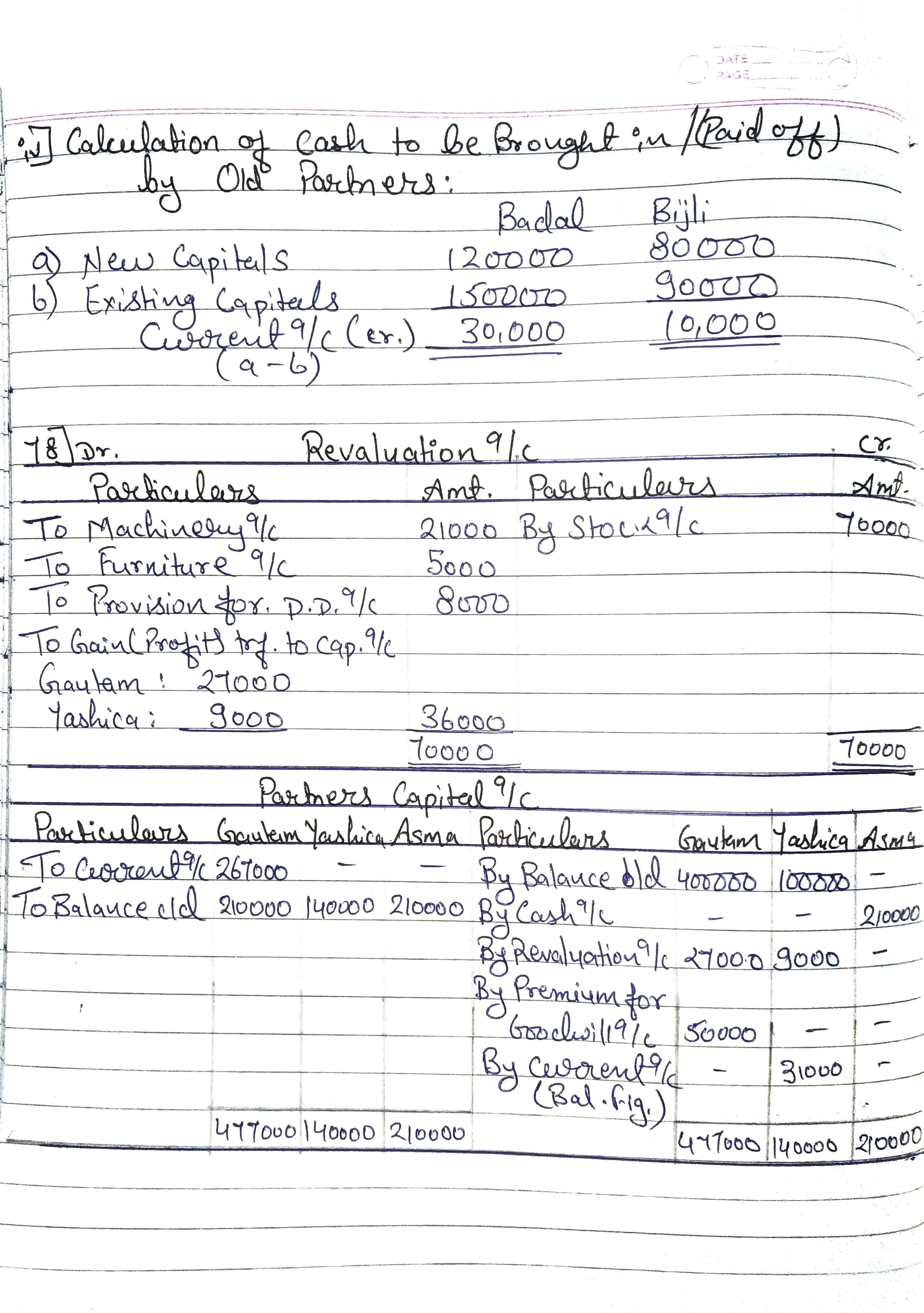

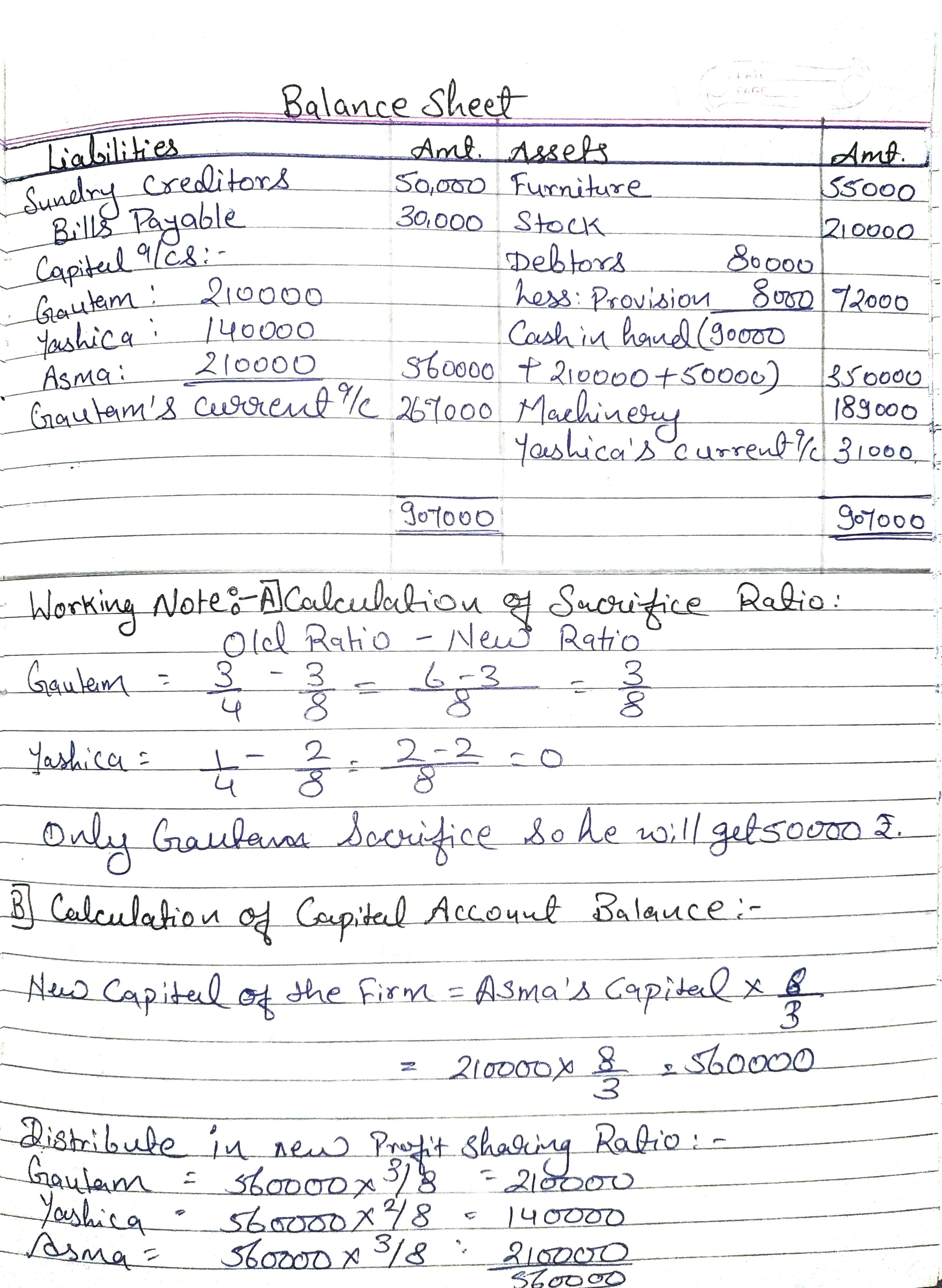

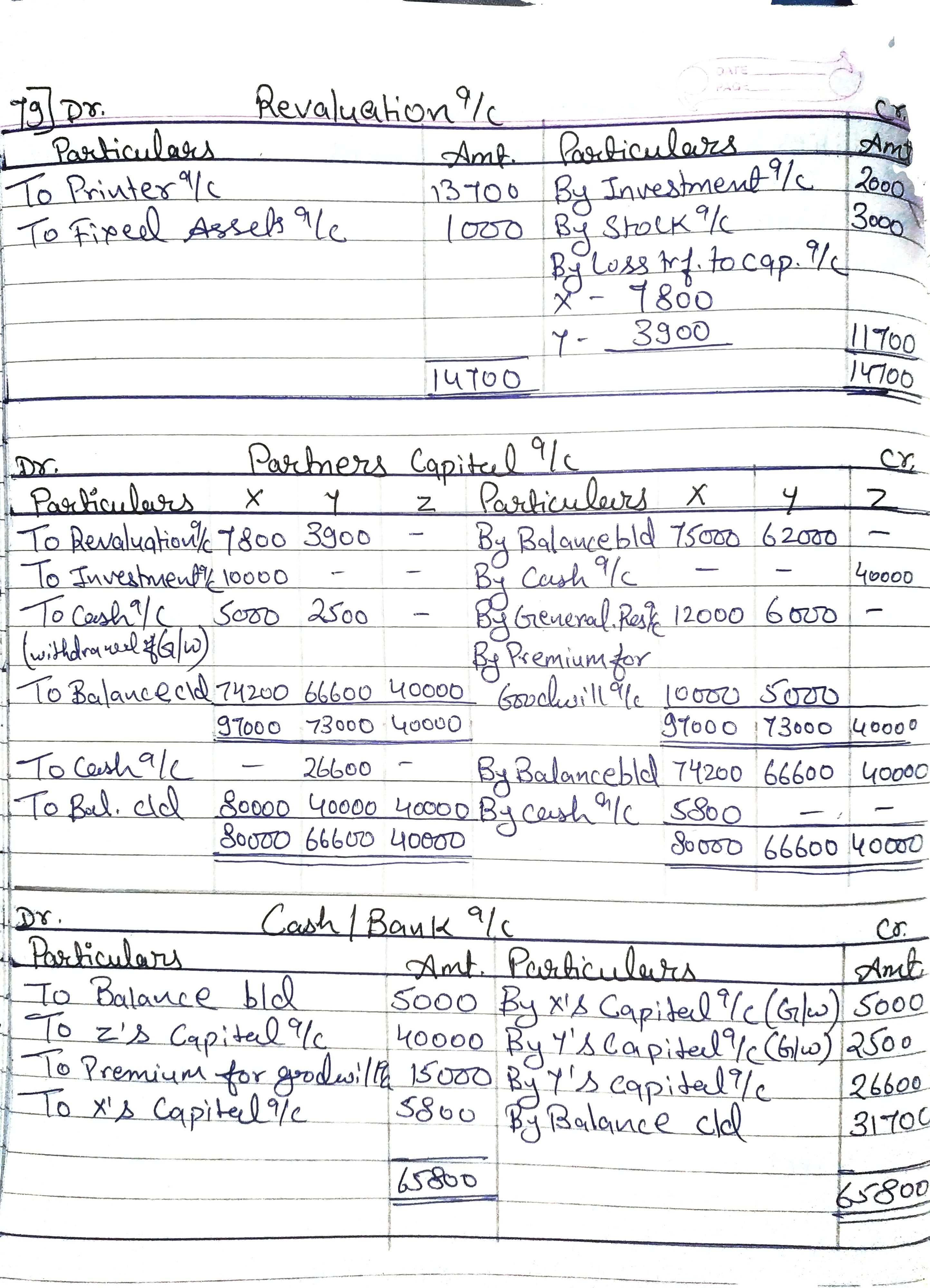

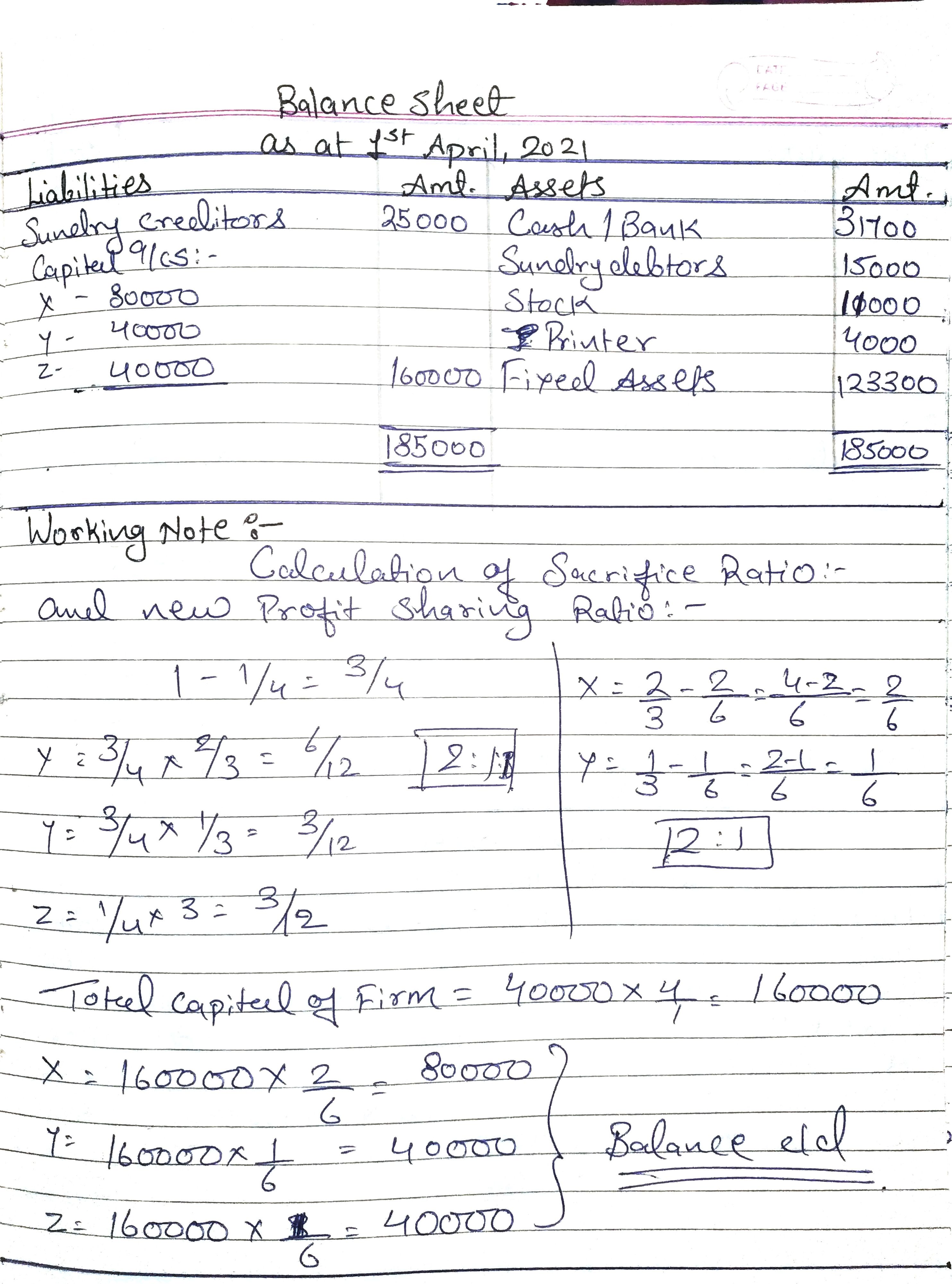

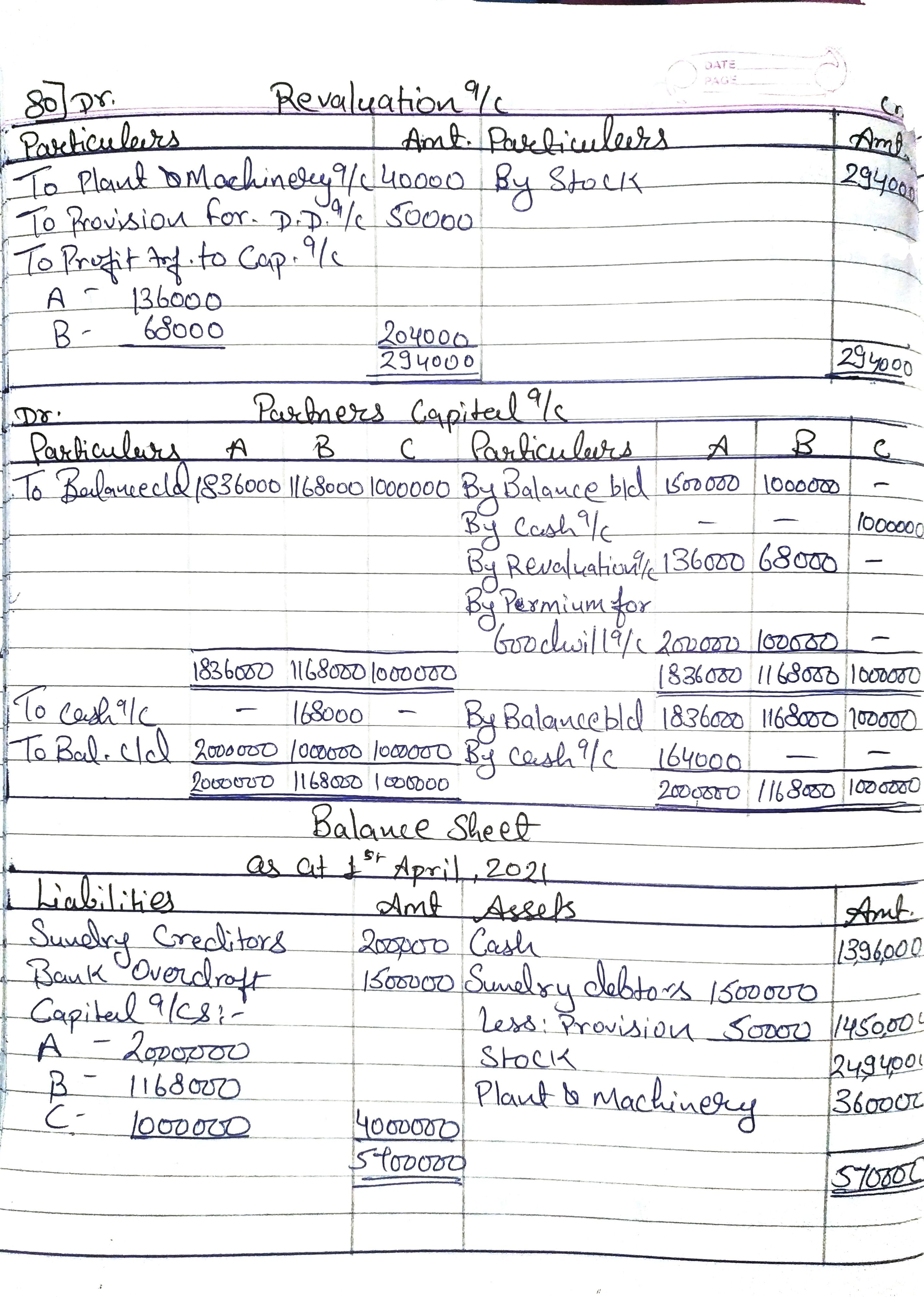

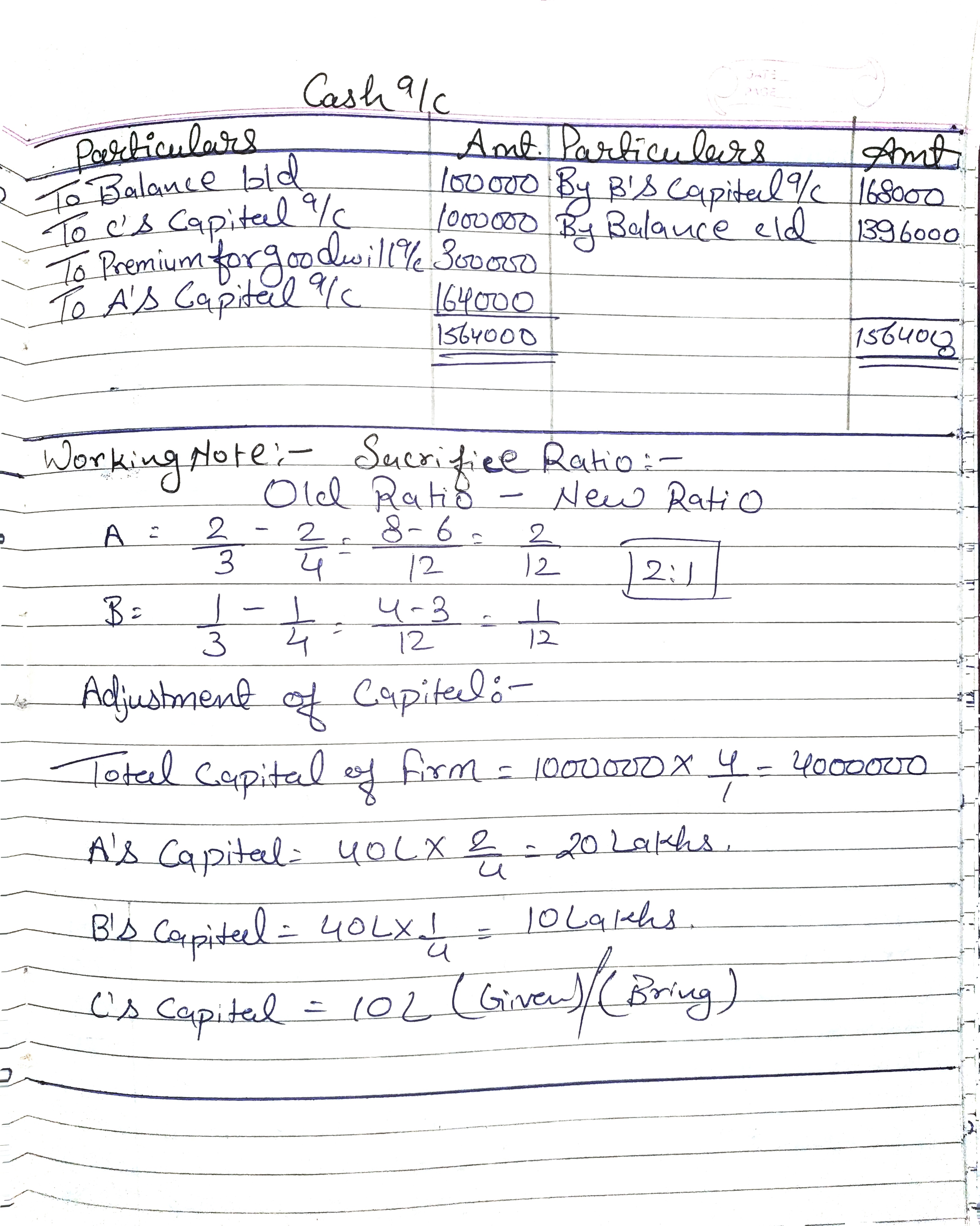

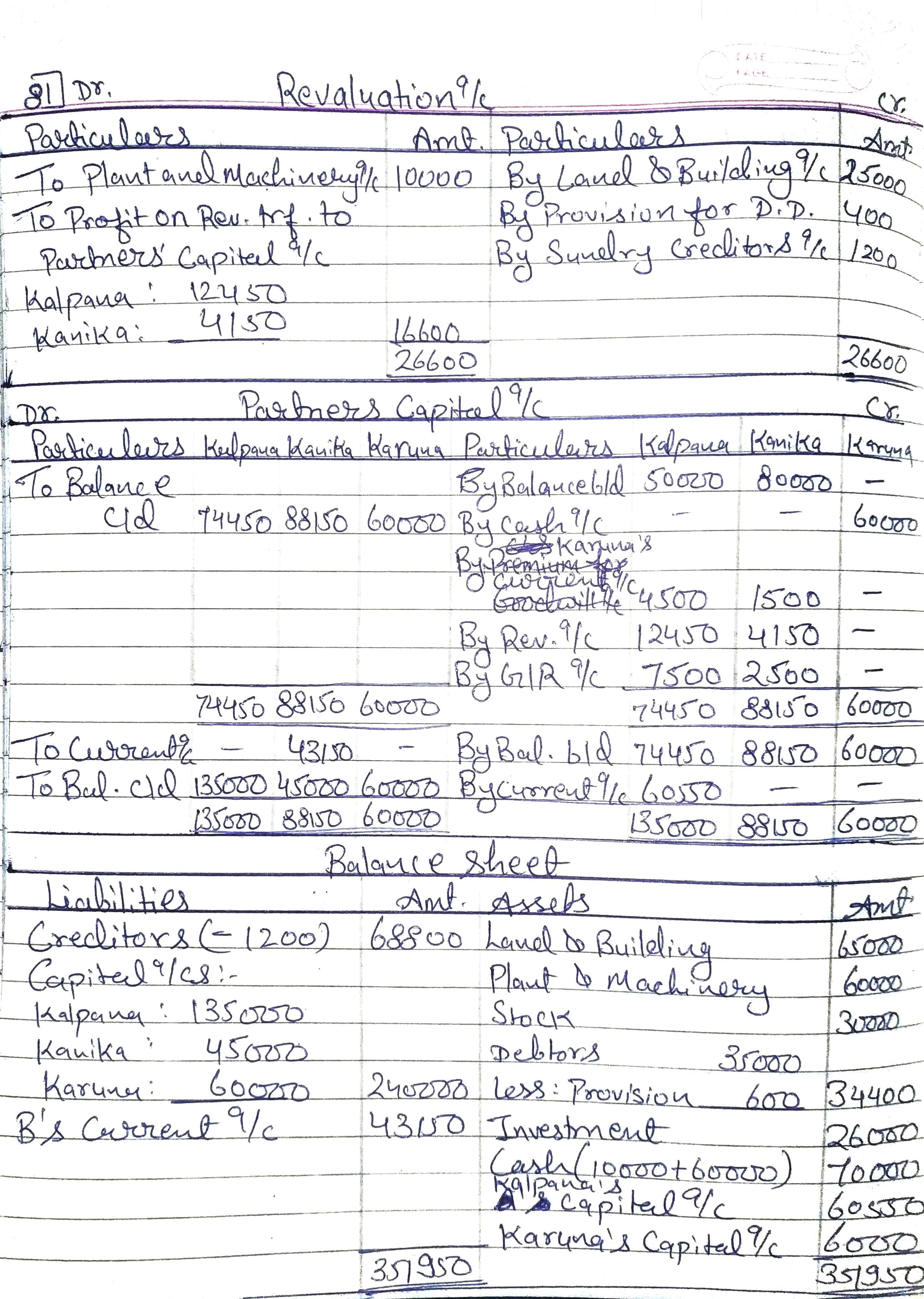

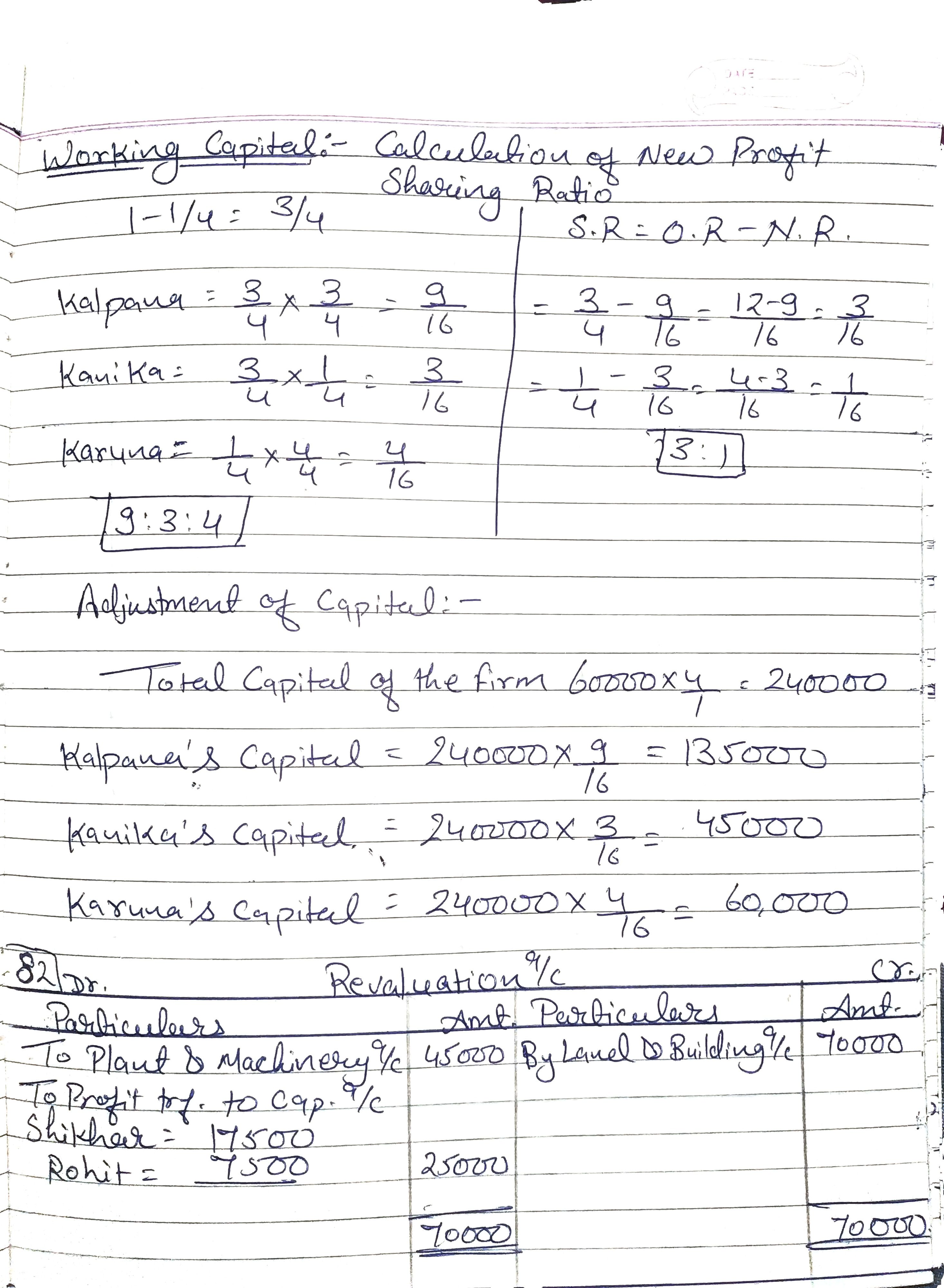

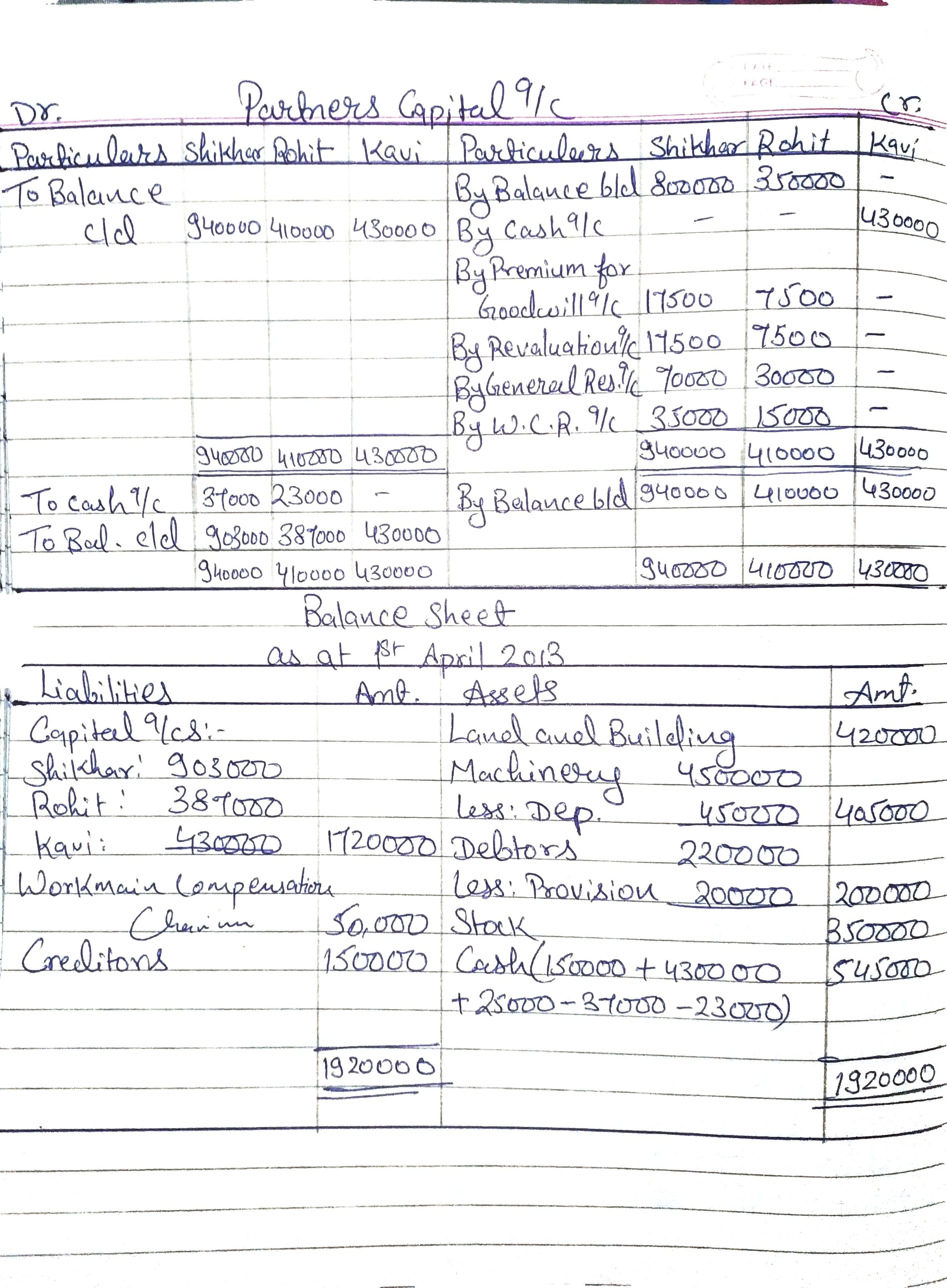

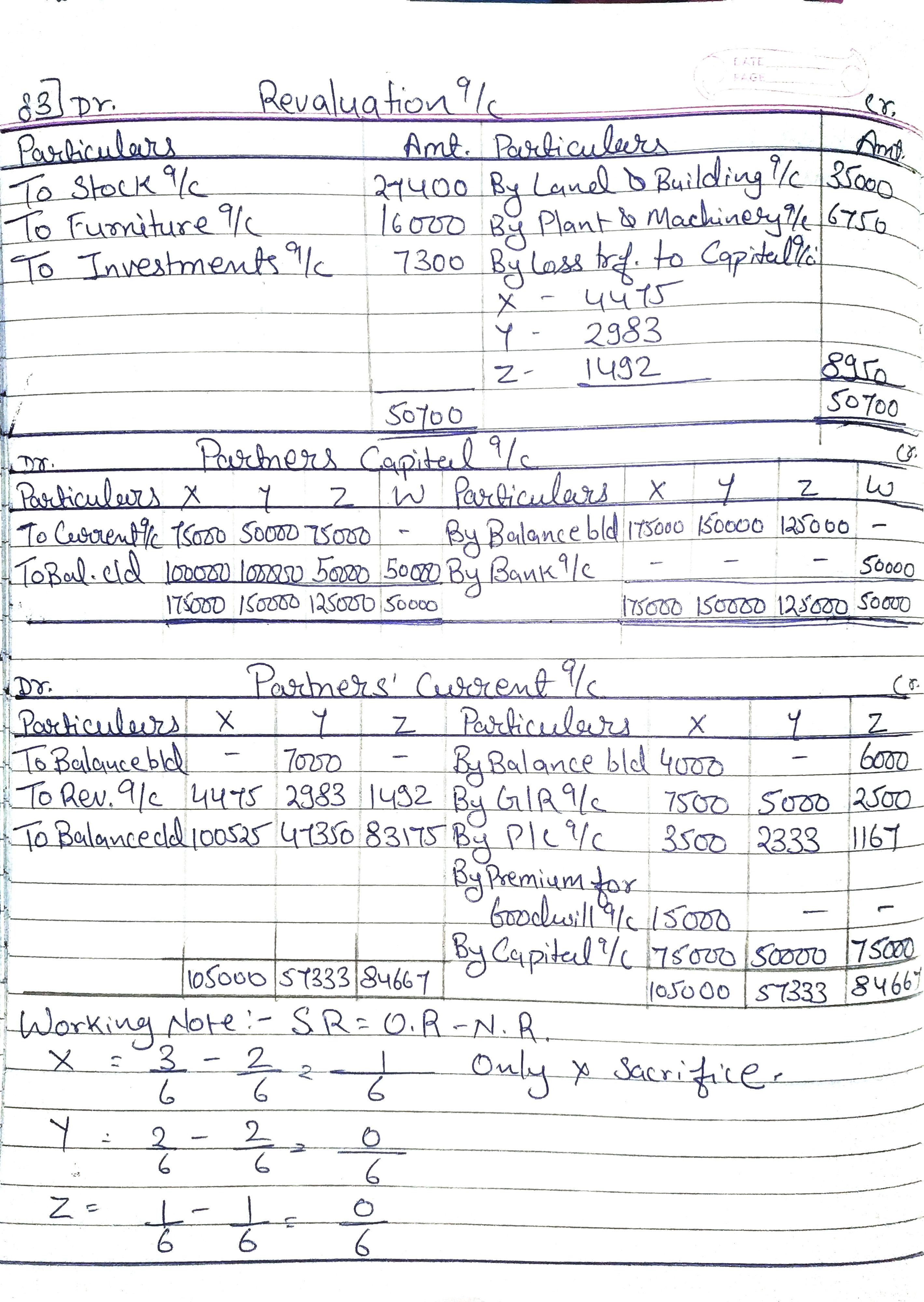

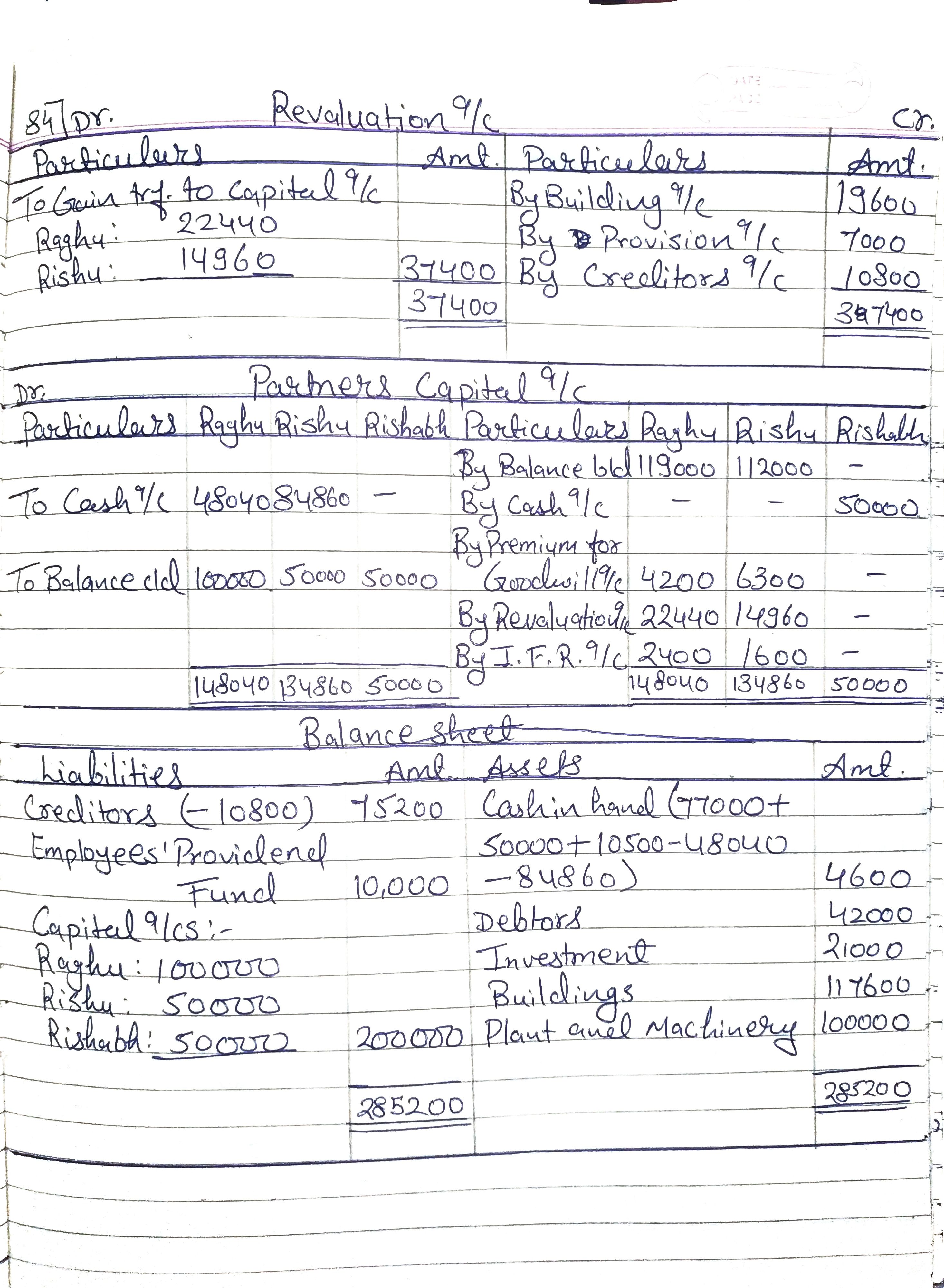

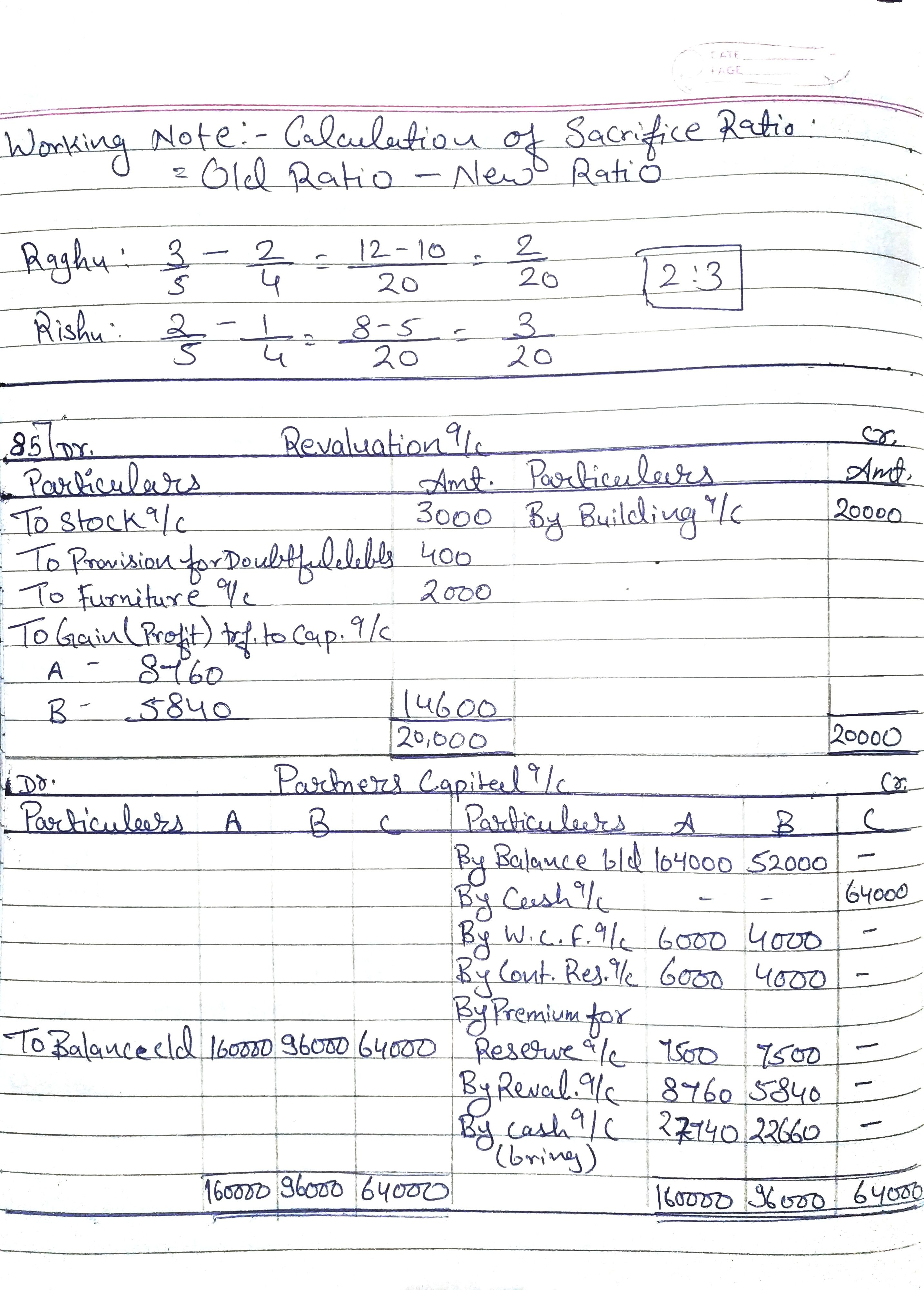

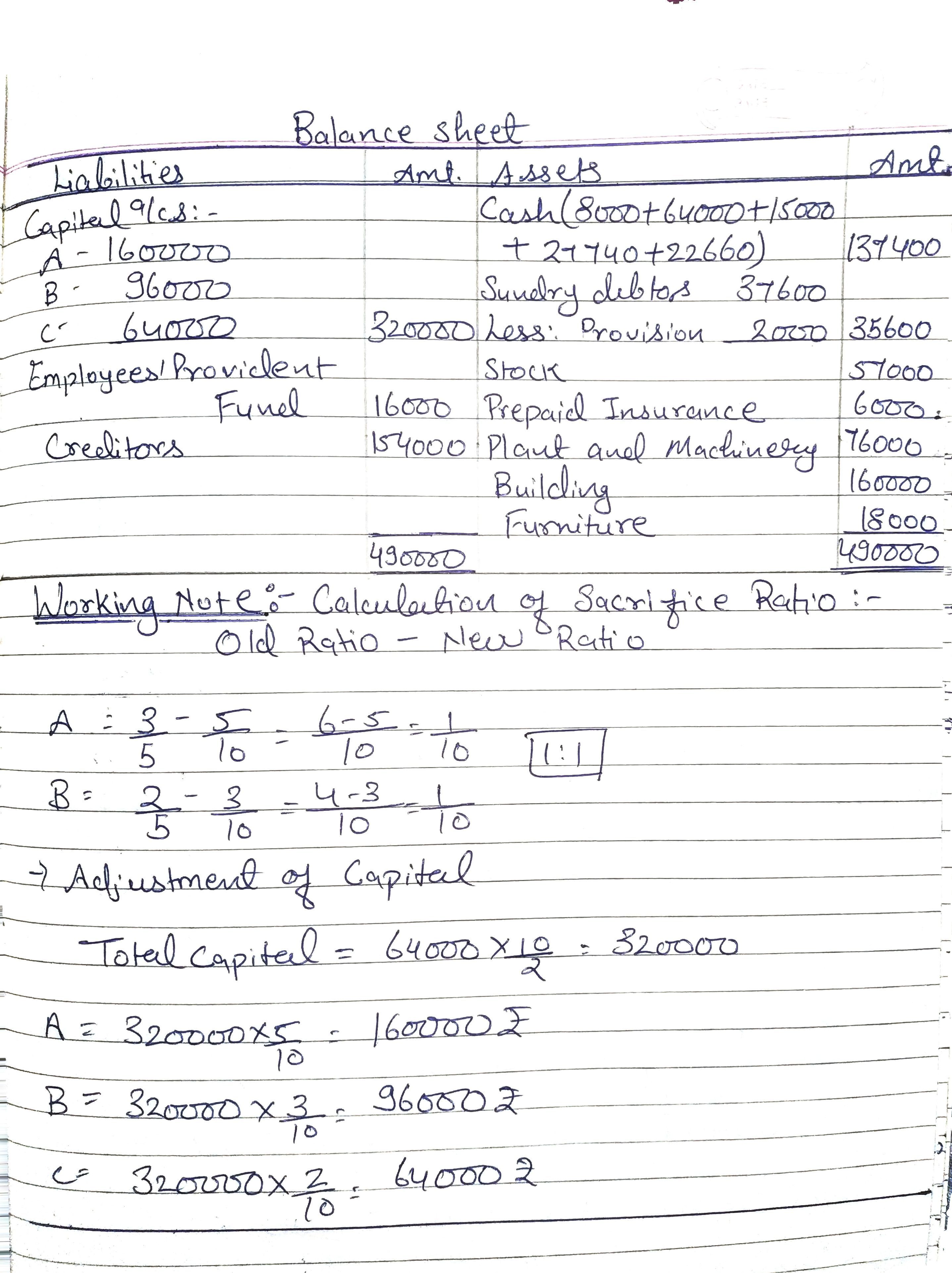

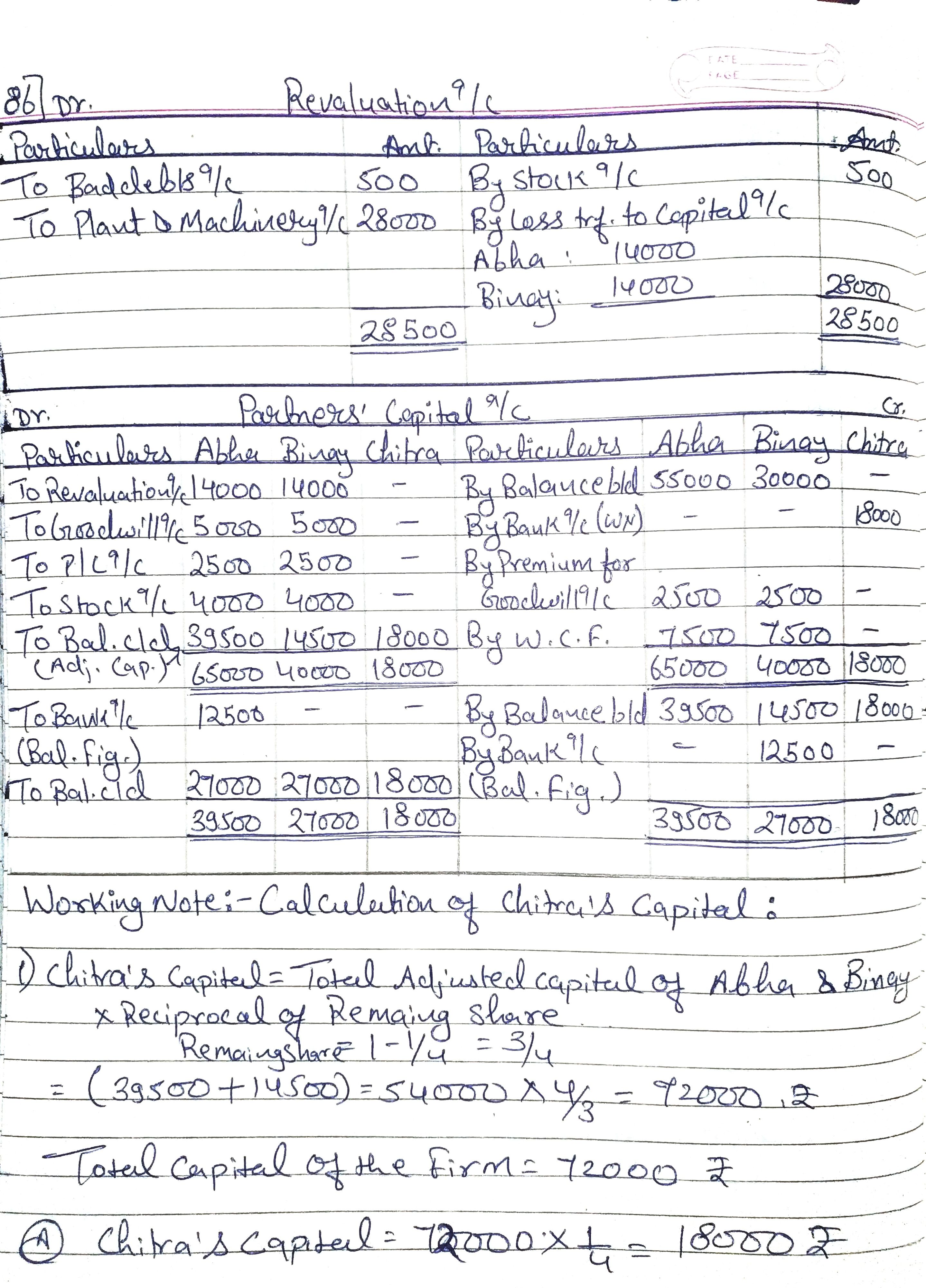

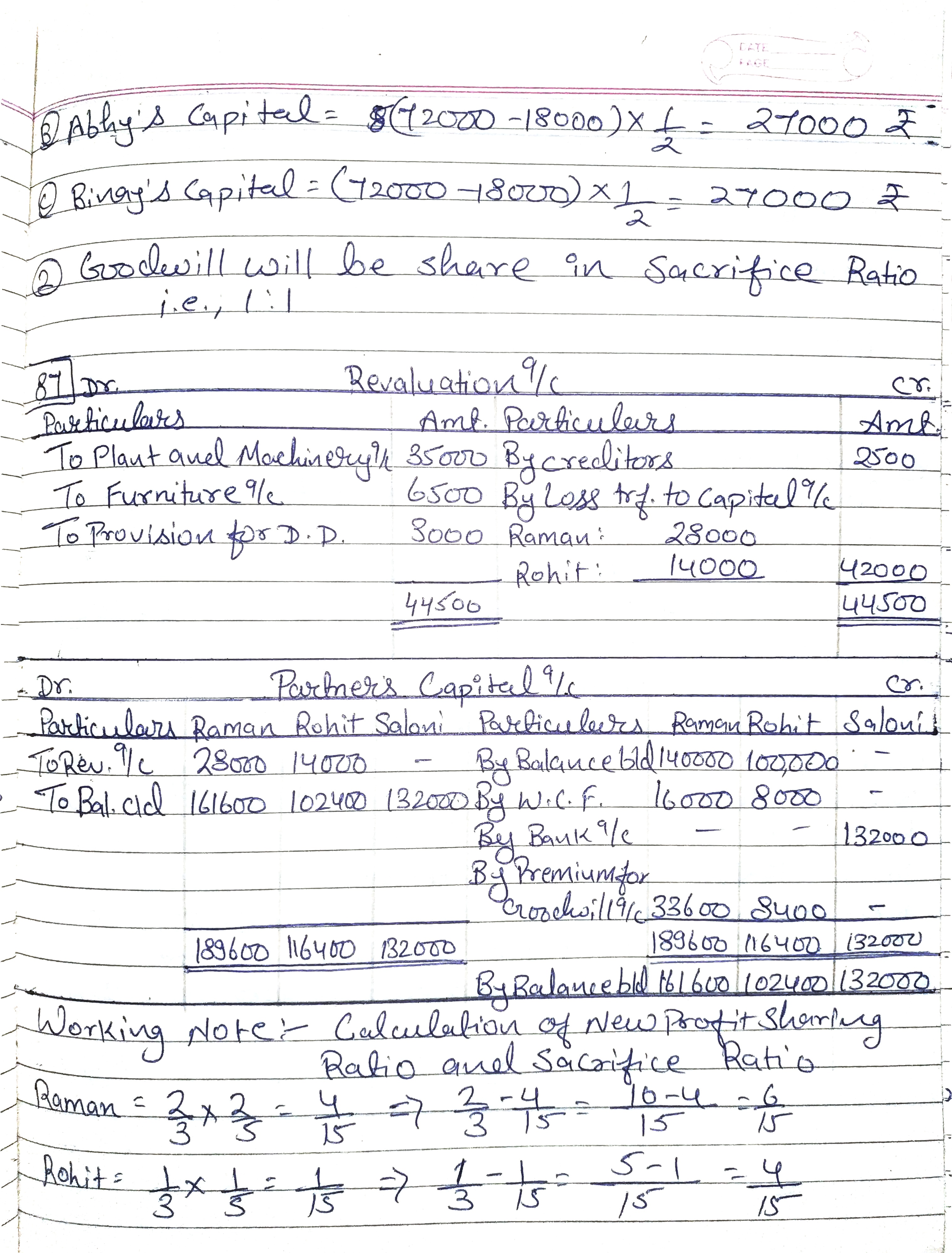

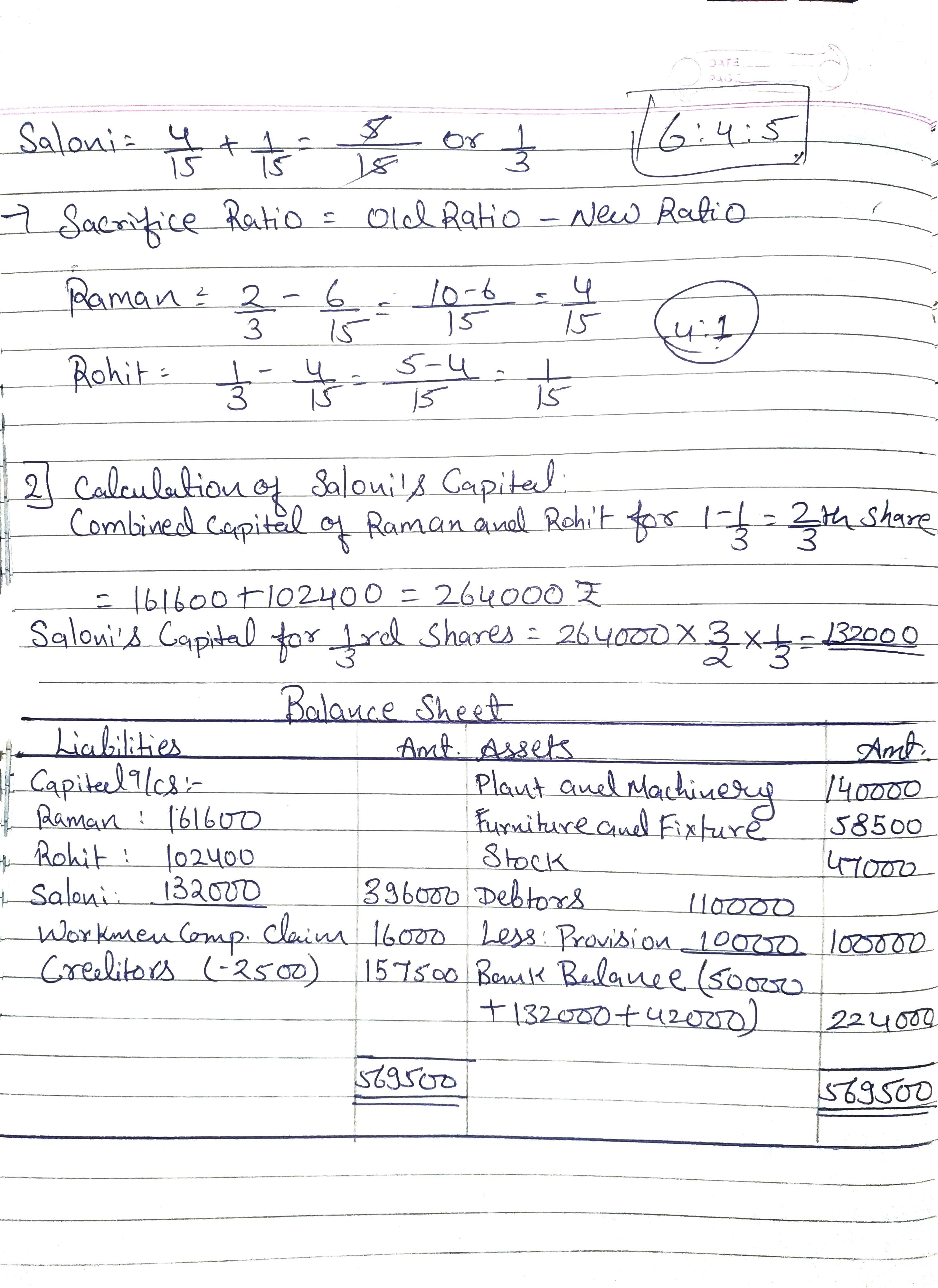

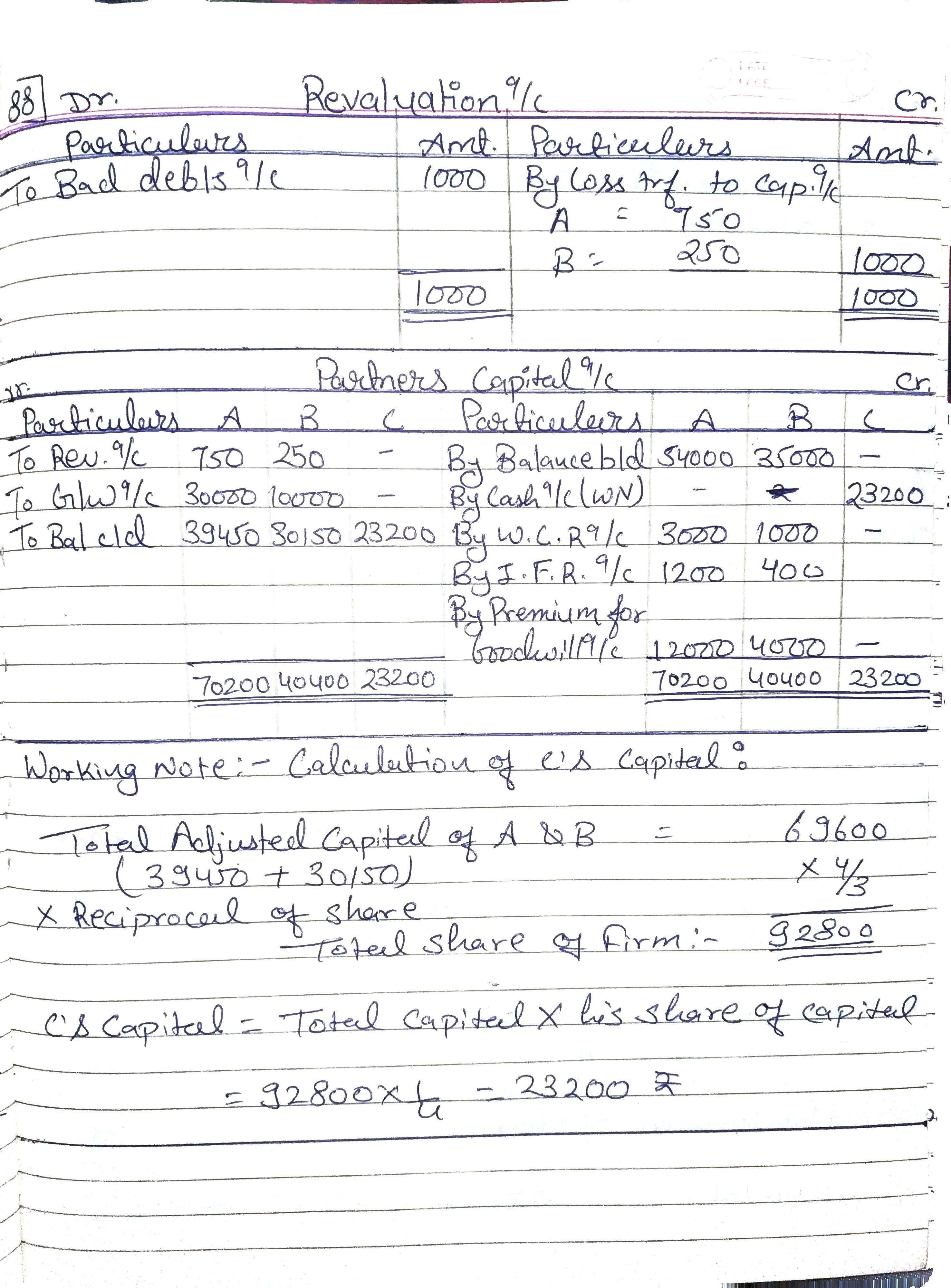

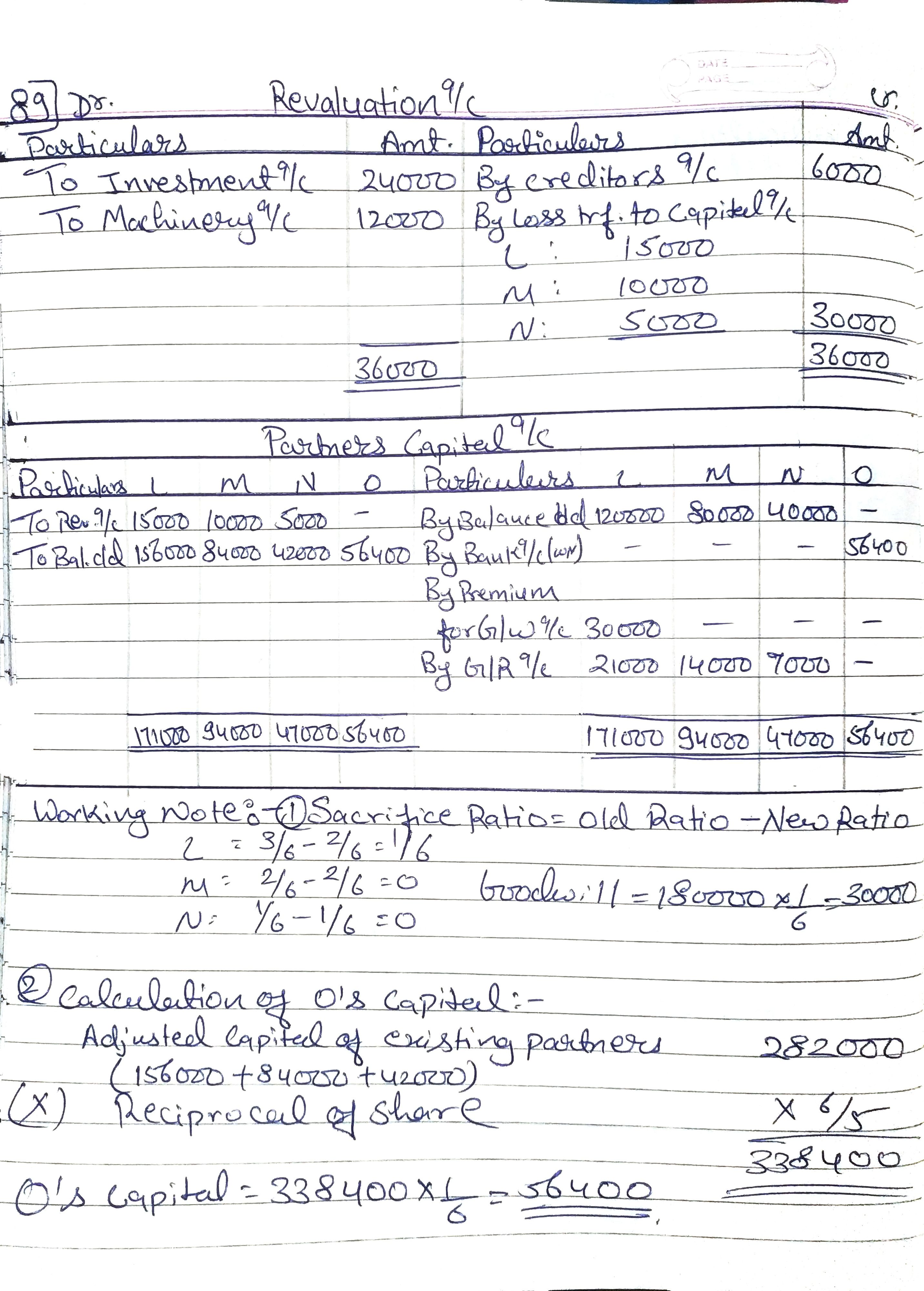

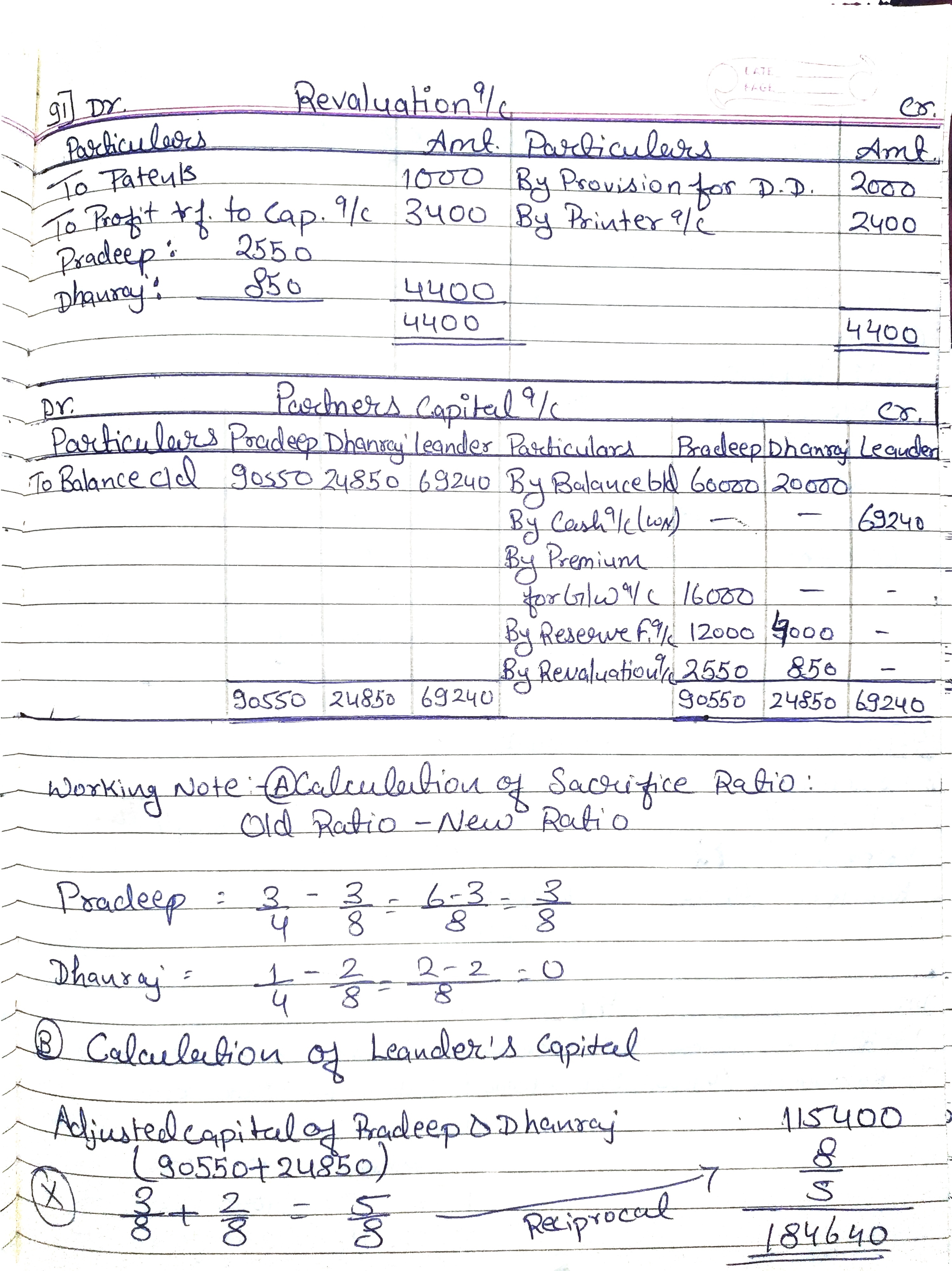

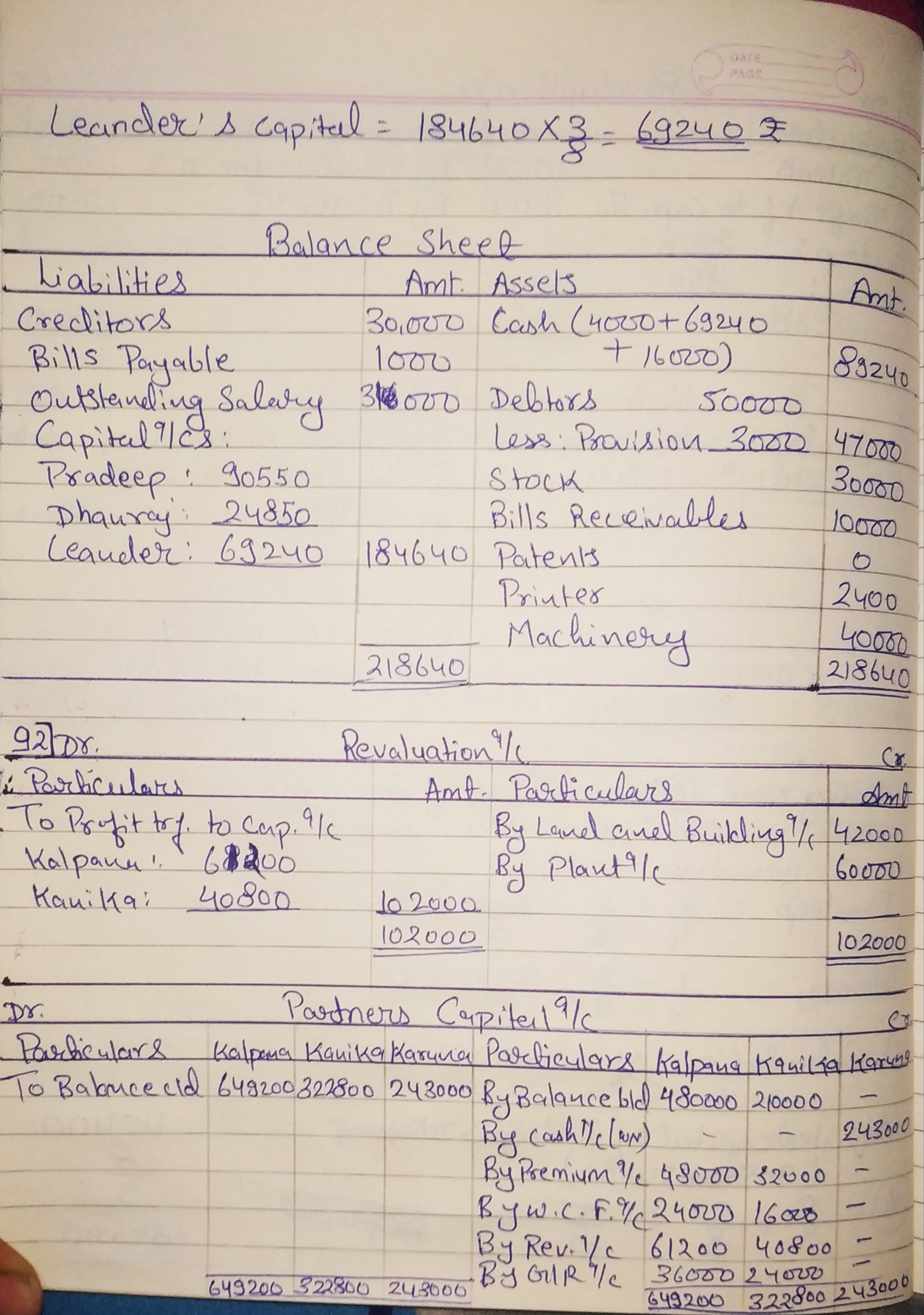

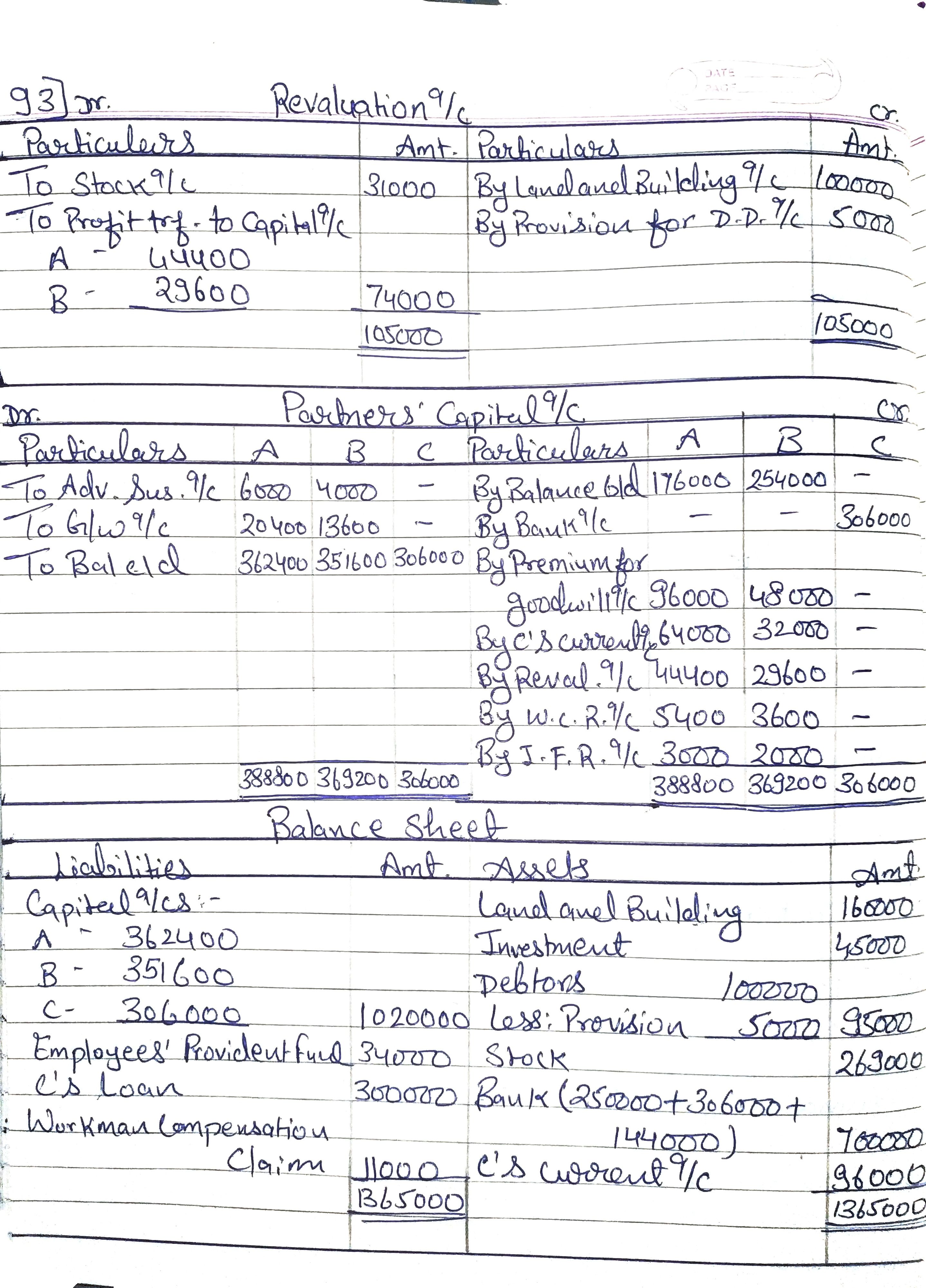

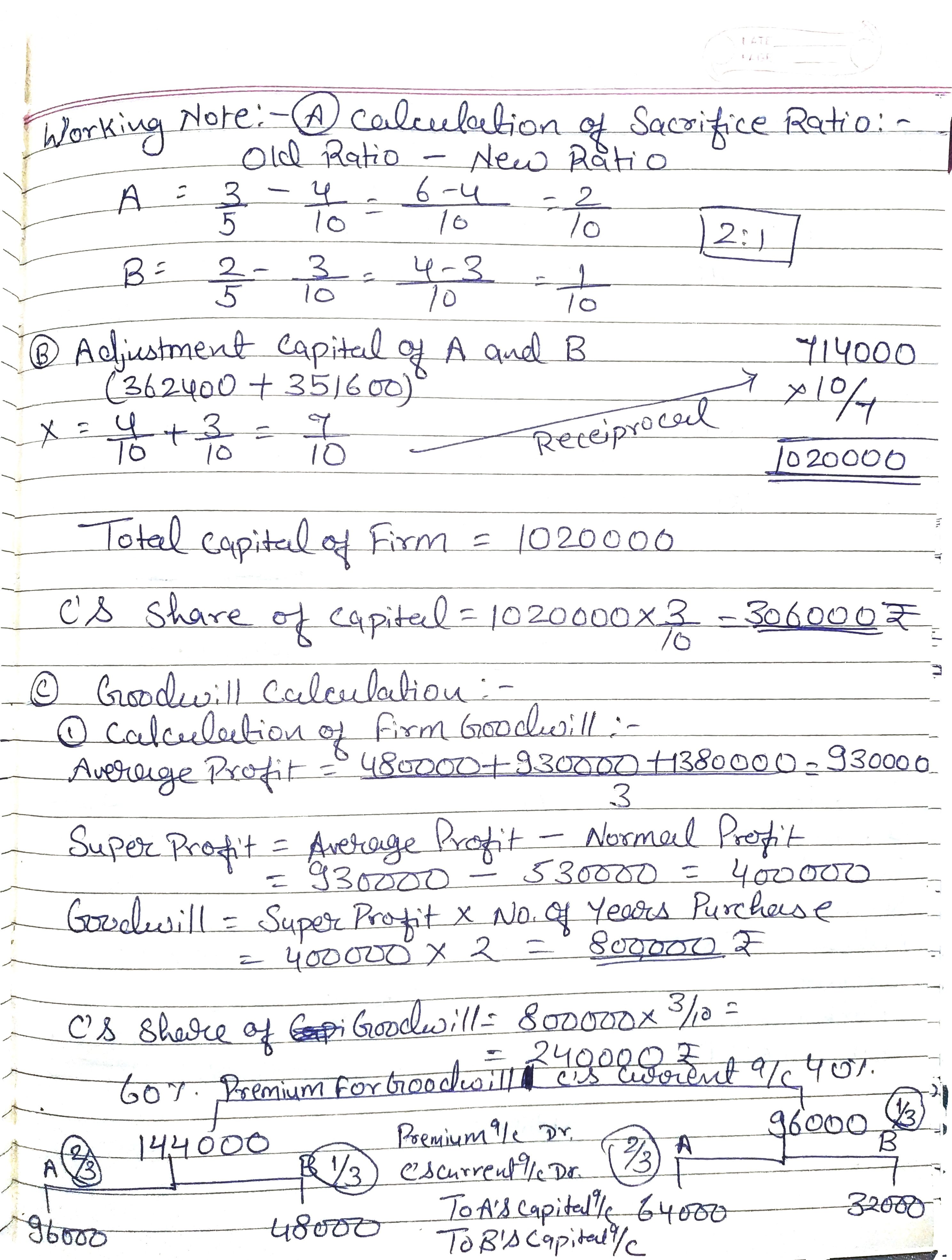

TS Grewal Accountancy Class 12 Solutions – Chapter 5th Admission of a Partner

QUESTIONS:

Solutions:

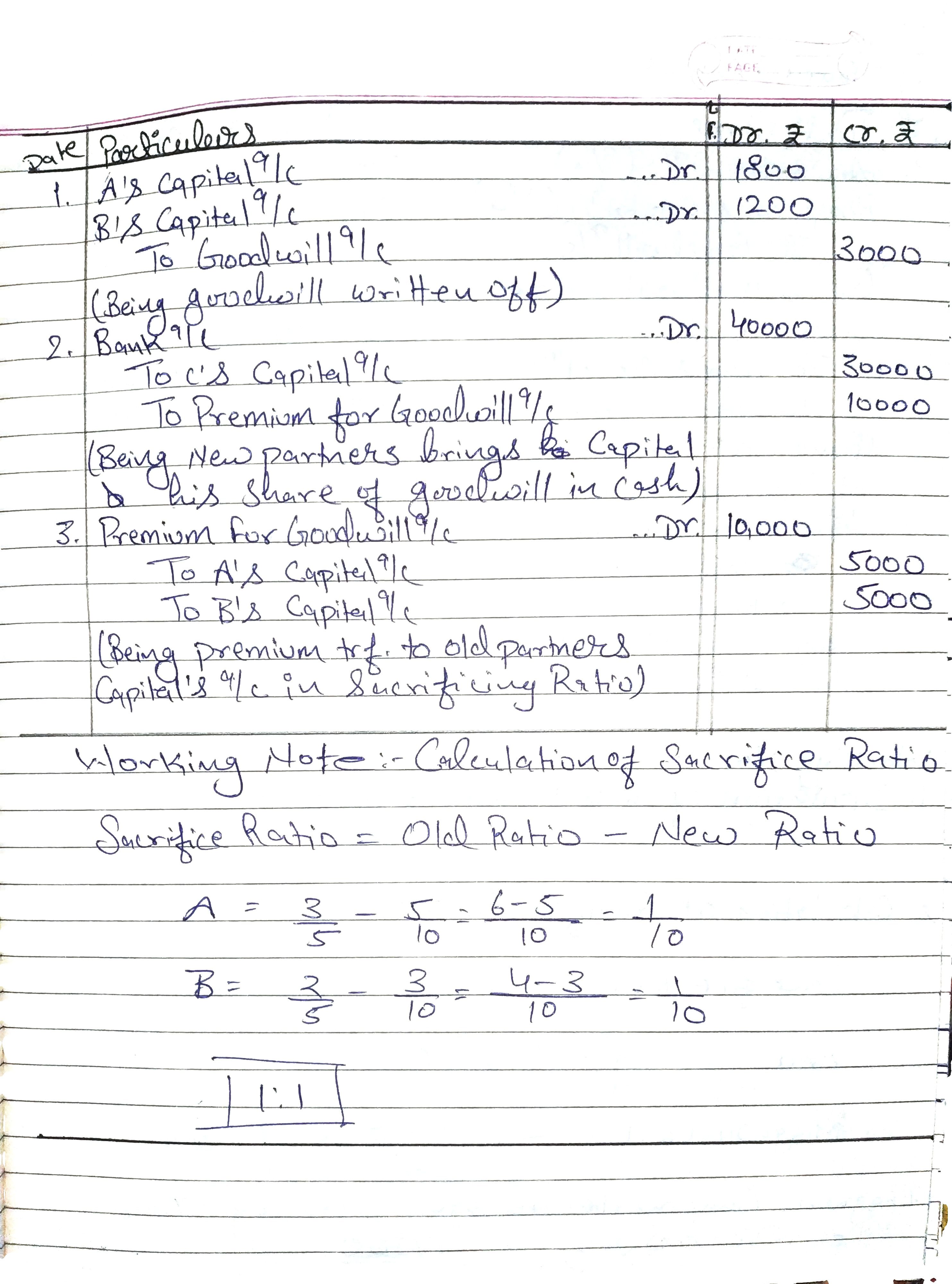

28:

IF YOU HAVE ANY QUERY

COMMENT

DOWN

BELOW

!!!

Pdf me mil jayega mujhe ye please

Sorry, due to piracy webcomm.in not provide solutions in pdf.

please explain ques 73 first entry