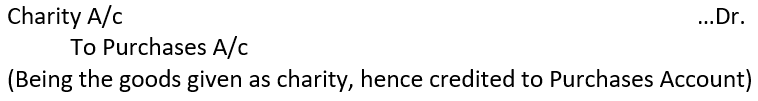

Goods Given as Charity: The amount of purchases is reduced with the value of goods (purchase cost) given as charity. It is so because if goods are used for the purpose other than sales, the amount of such goods is reduced from purchases, i.e., credited to the Purchases Account. The entry passed is:

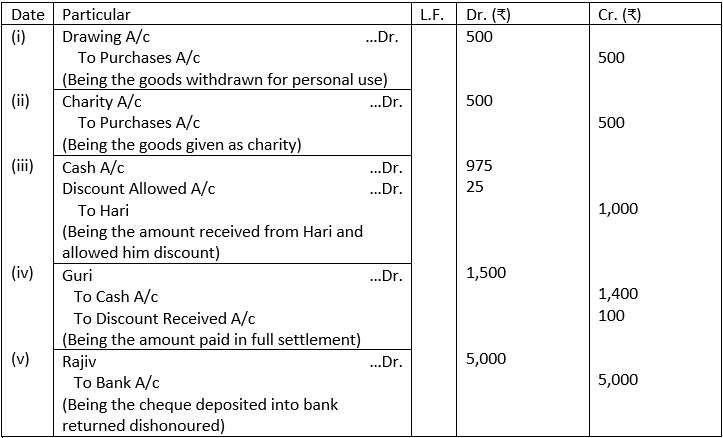

Illustration 9. Record the following transaction in a Journal:

(i) Withdrawn goods for personal use (Cost ₹ 500, Sales Price ₹ 700).

(ii) Goods costing ₹ 500 given as charity.

(iii) Received ₹ 975 from Hari in full settlement of his account for ₹ 1,000.

(iv) Paid ₹ 1,400 to Guri in cash in full settlement of his account for ₹ 1,500.

(v) A cheque for ₹ 5,000 received from Rajiv deposited into bank was returned dishonoured.

Solution:

In the Books of …

JOURNAL

Distribution of Goods as Free Samples: Goods may be distributed as free samples to increase sales. It is in the nature of advertisement expense. Hence, it is debited to the Advertisement Account or Samples Account and deducted from purchases:

This is very good website for getting the Right Knowledge at one place in the filed of commerce specialized in Account.