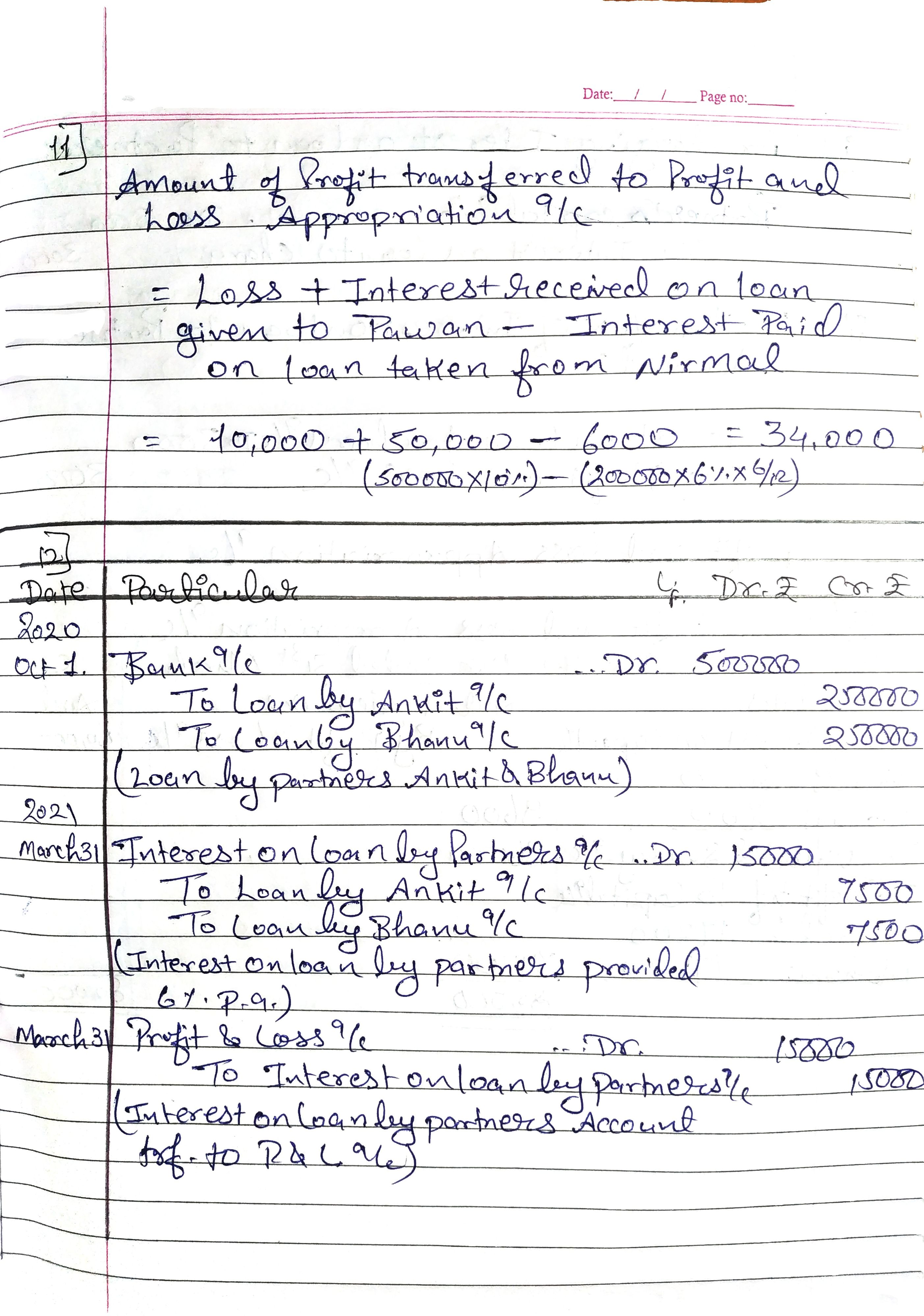

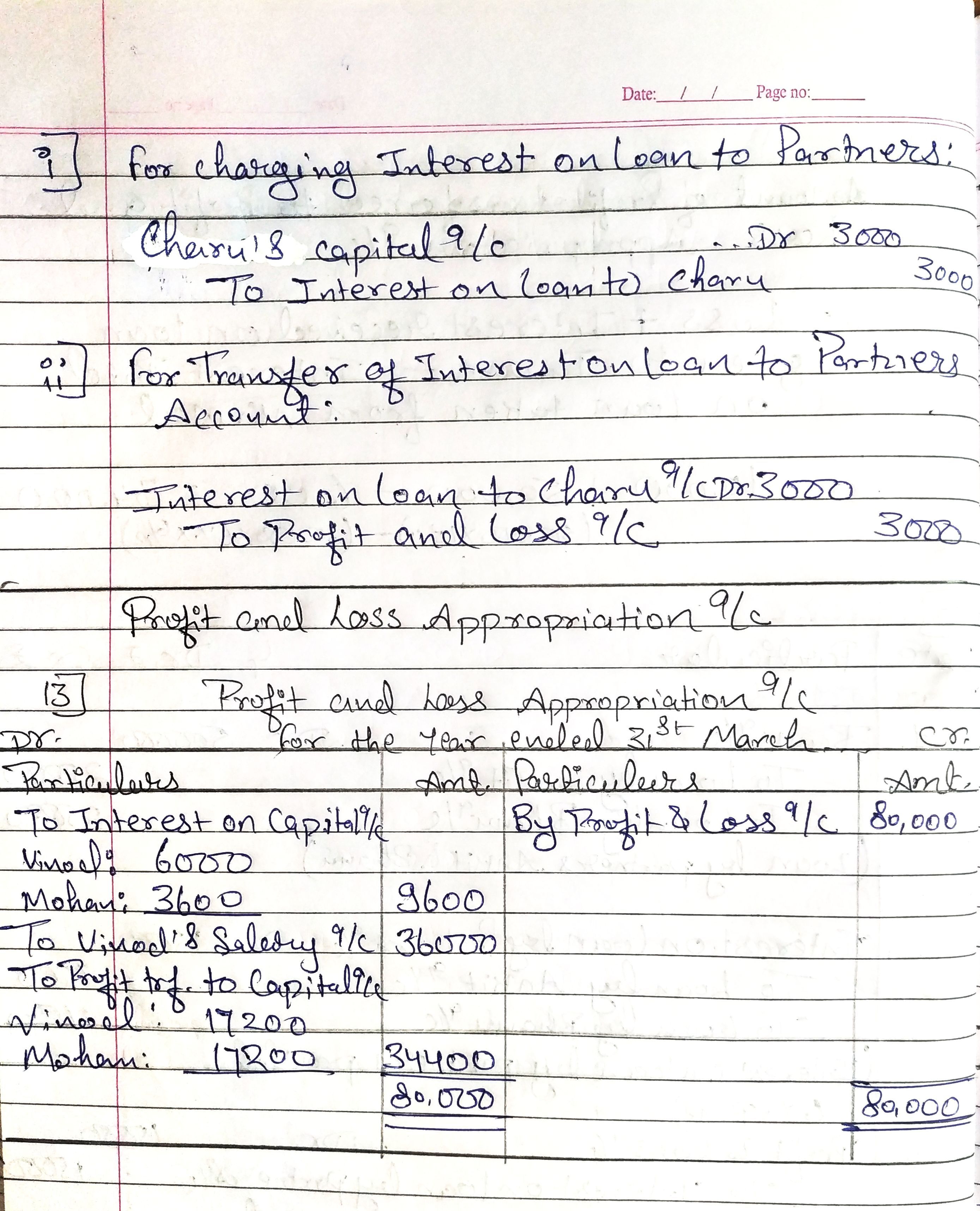

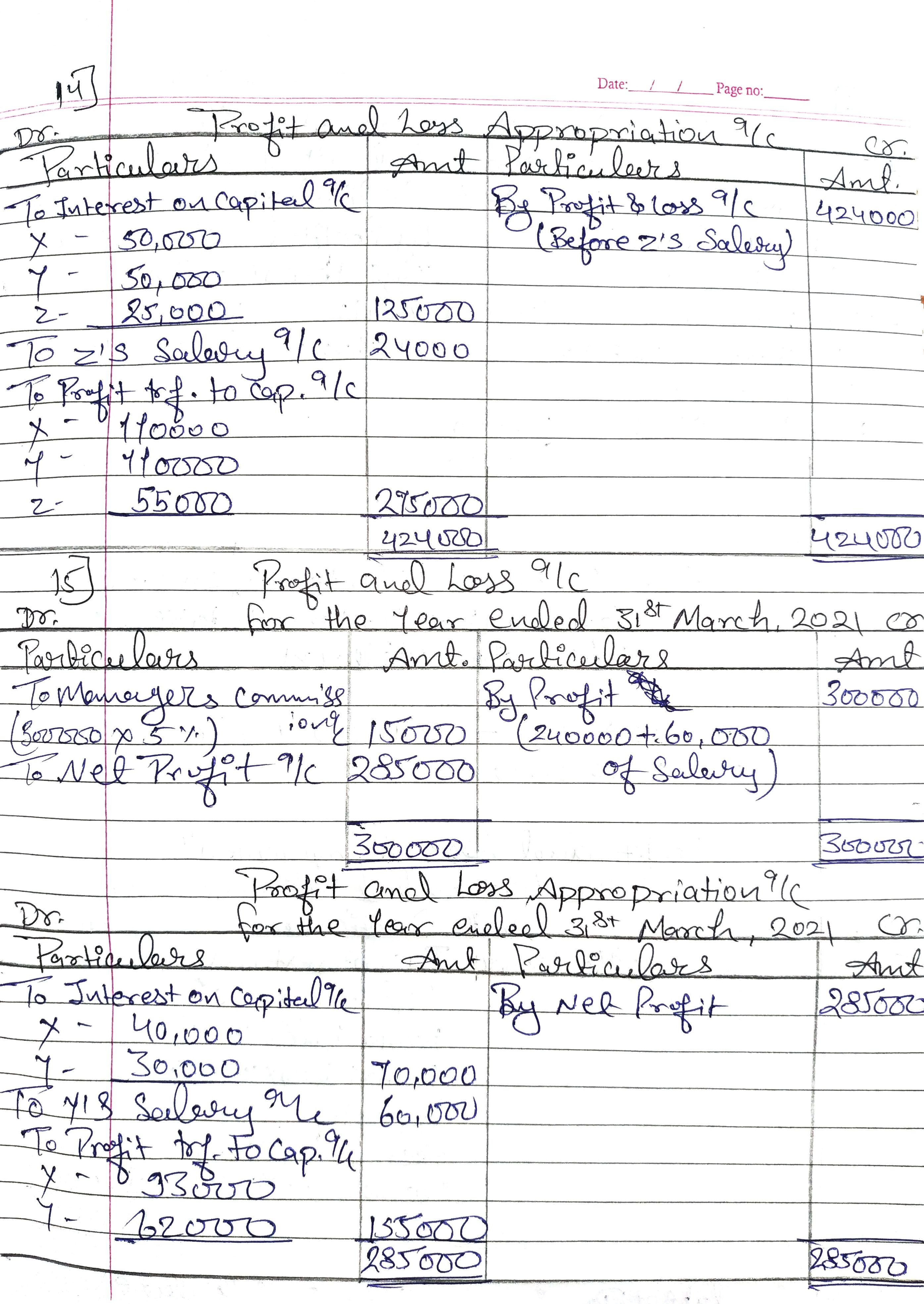

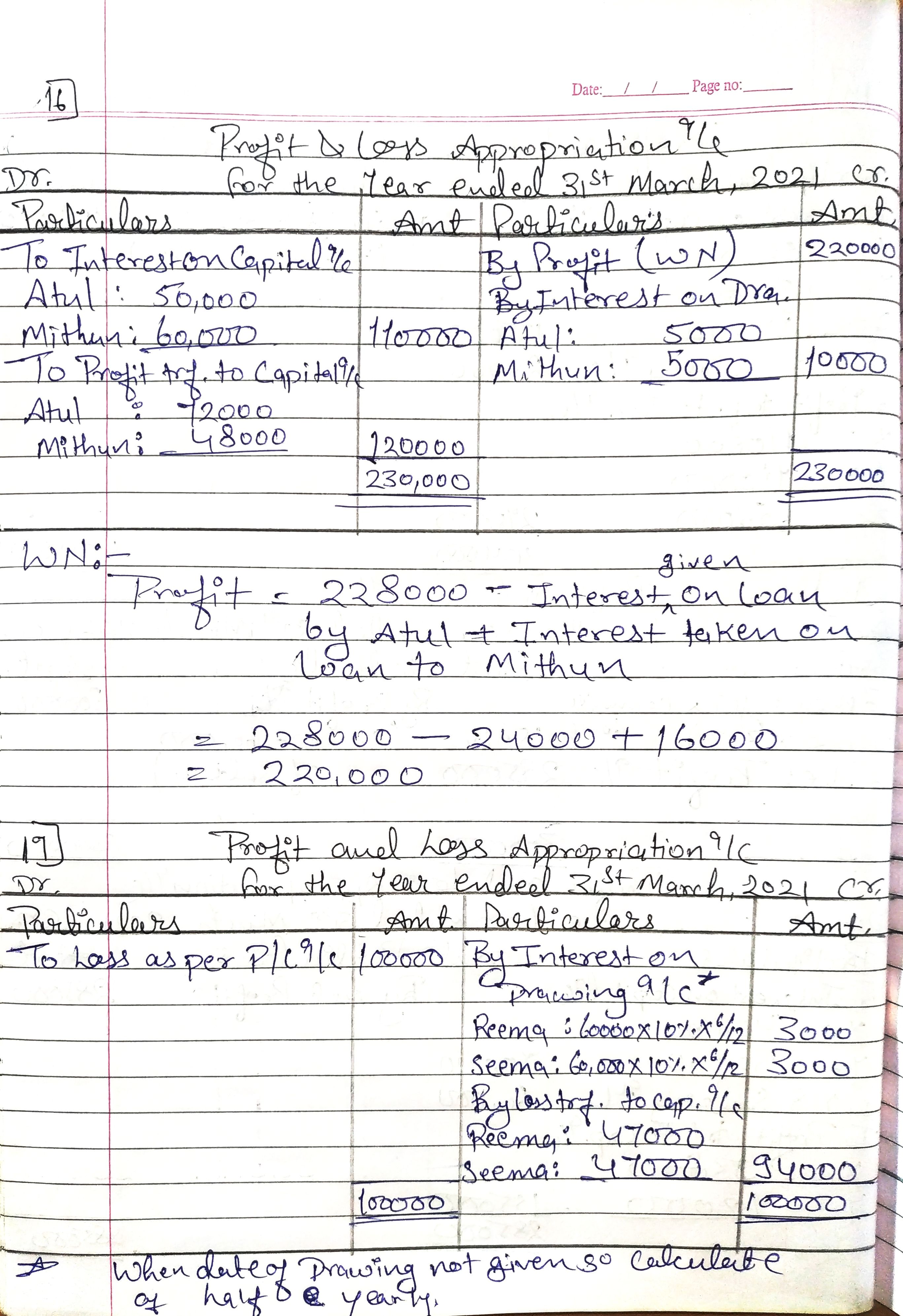

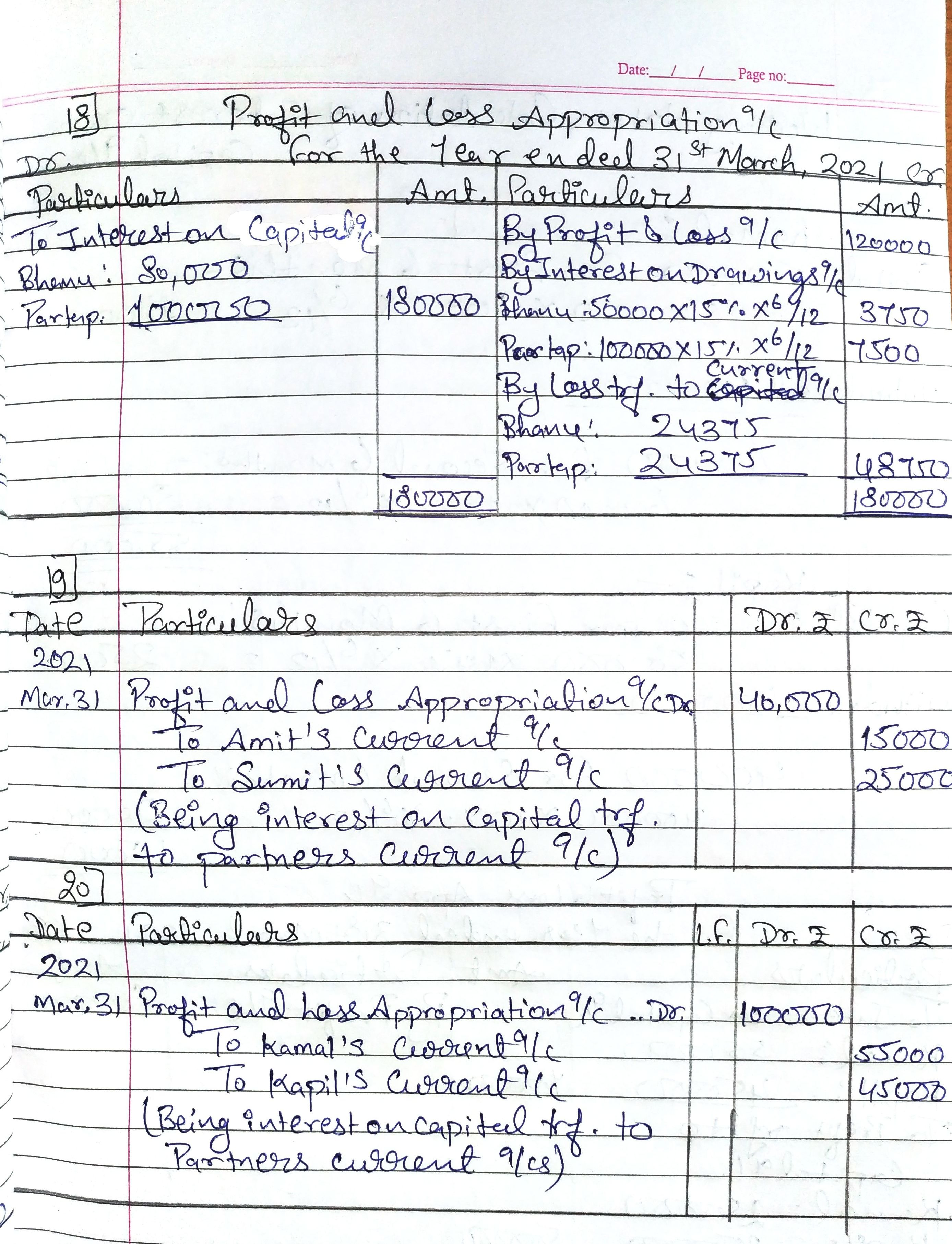

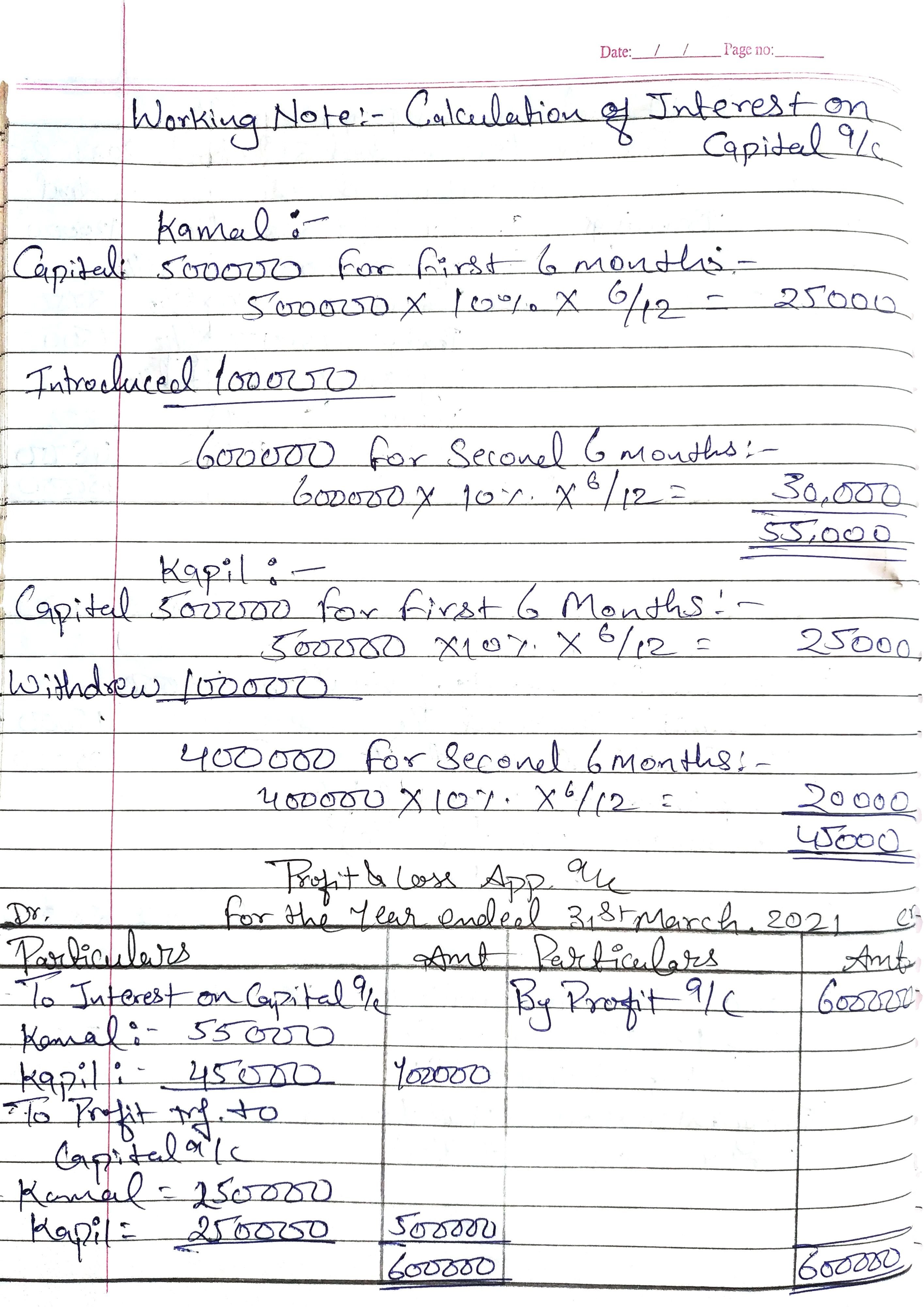

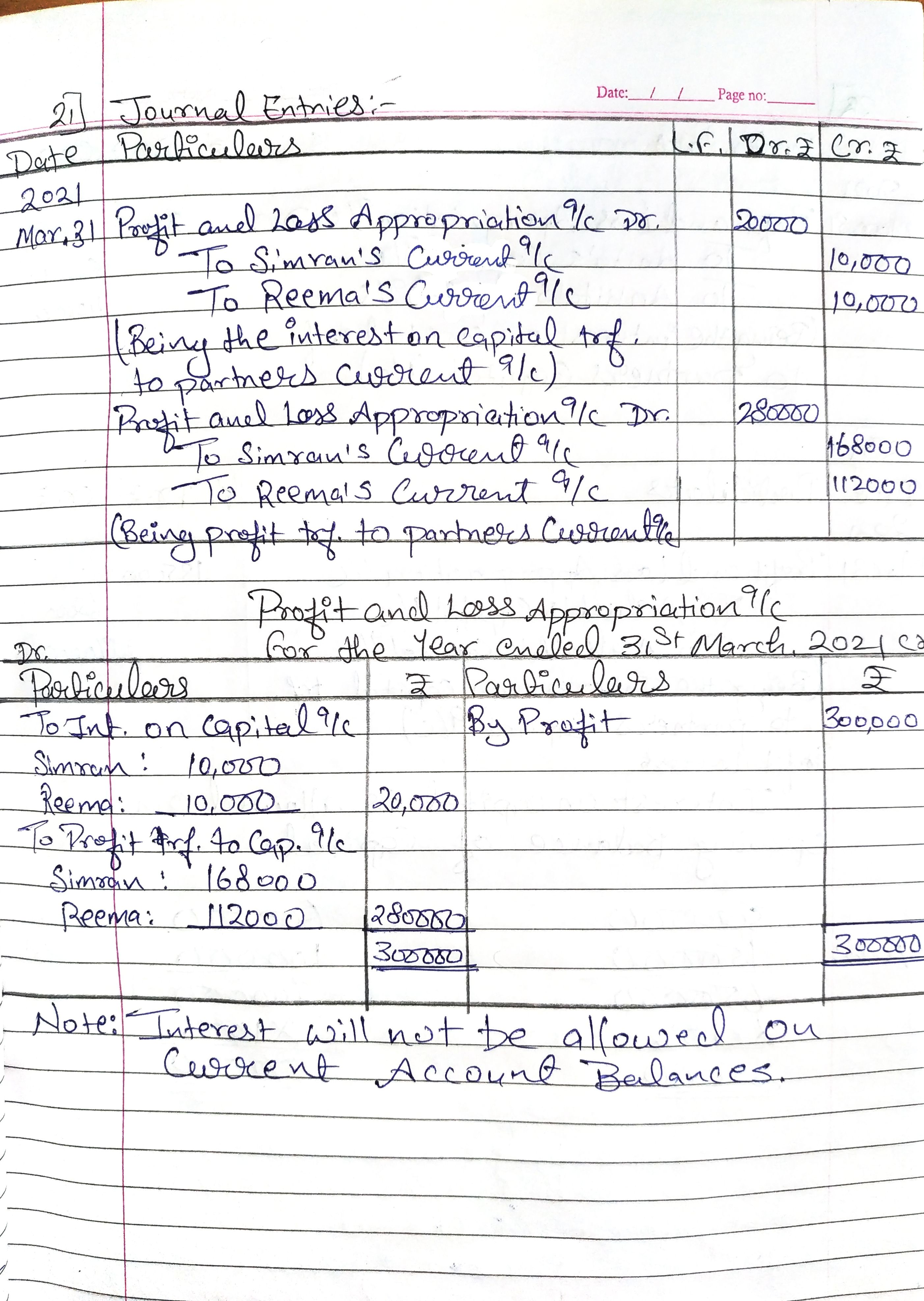

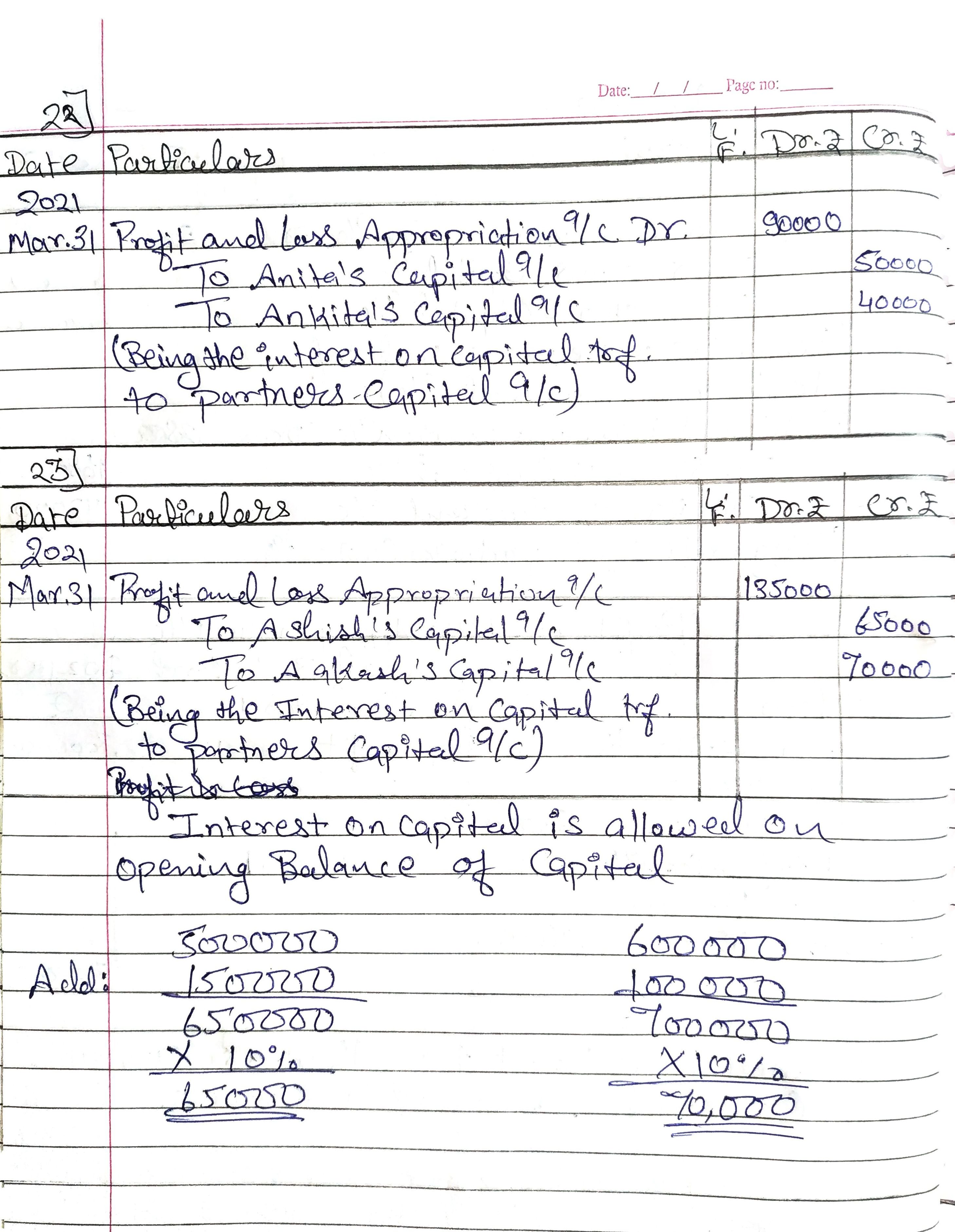

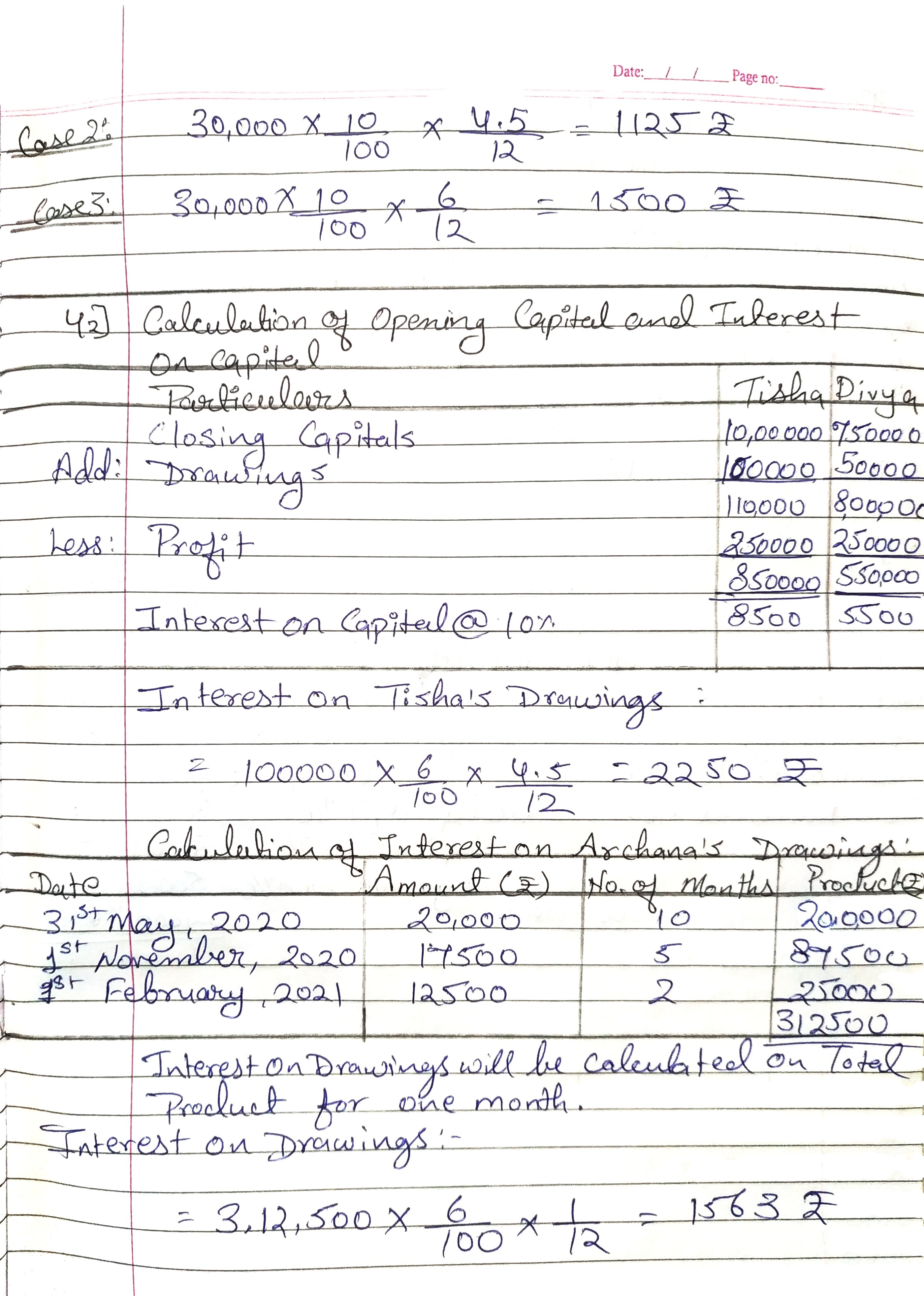

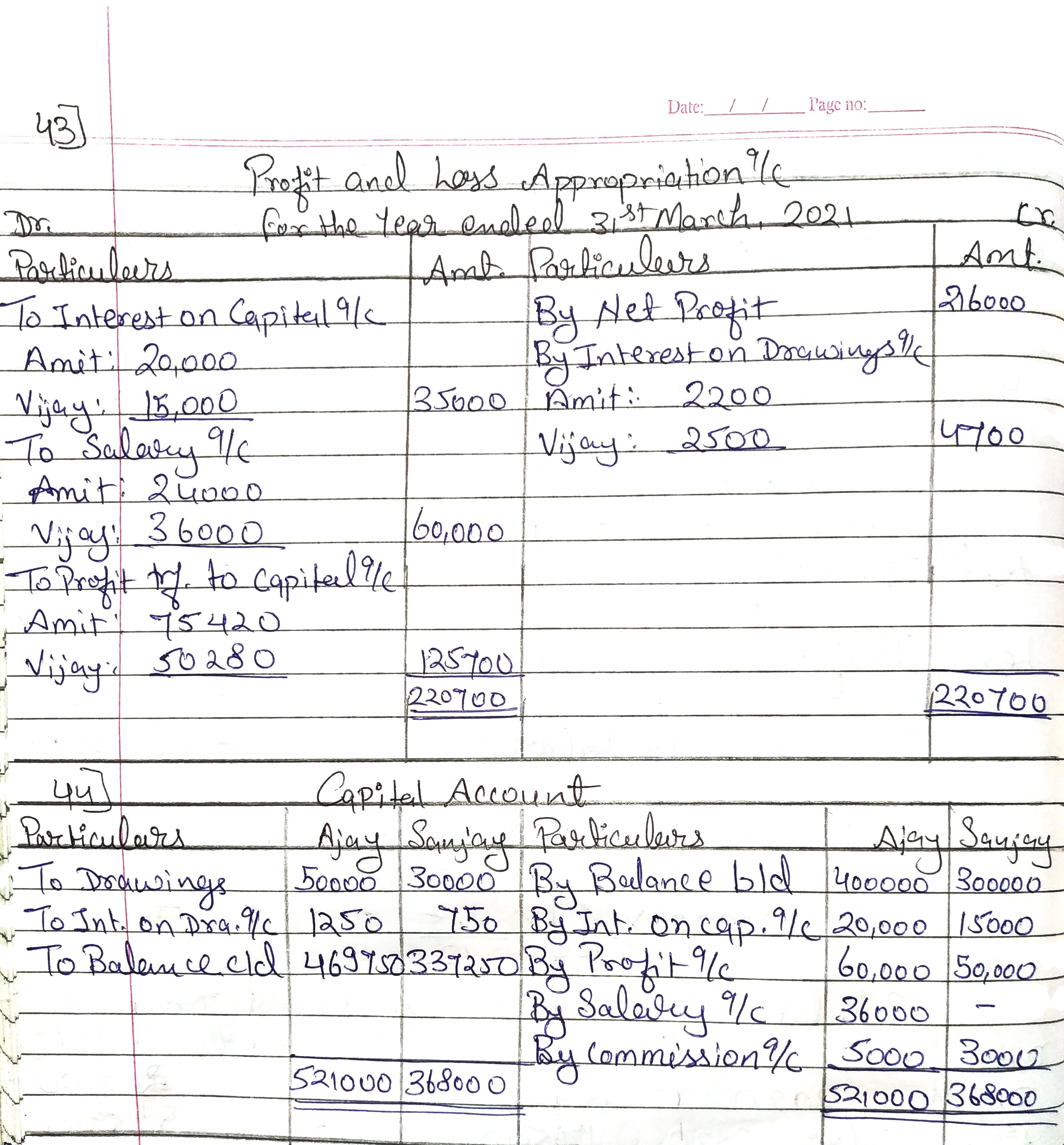

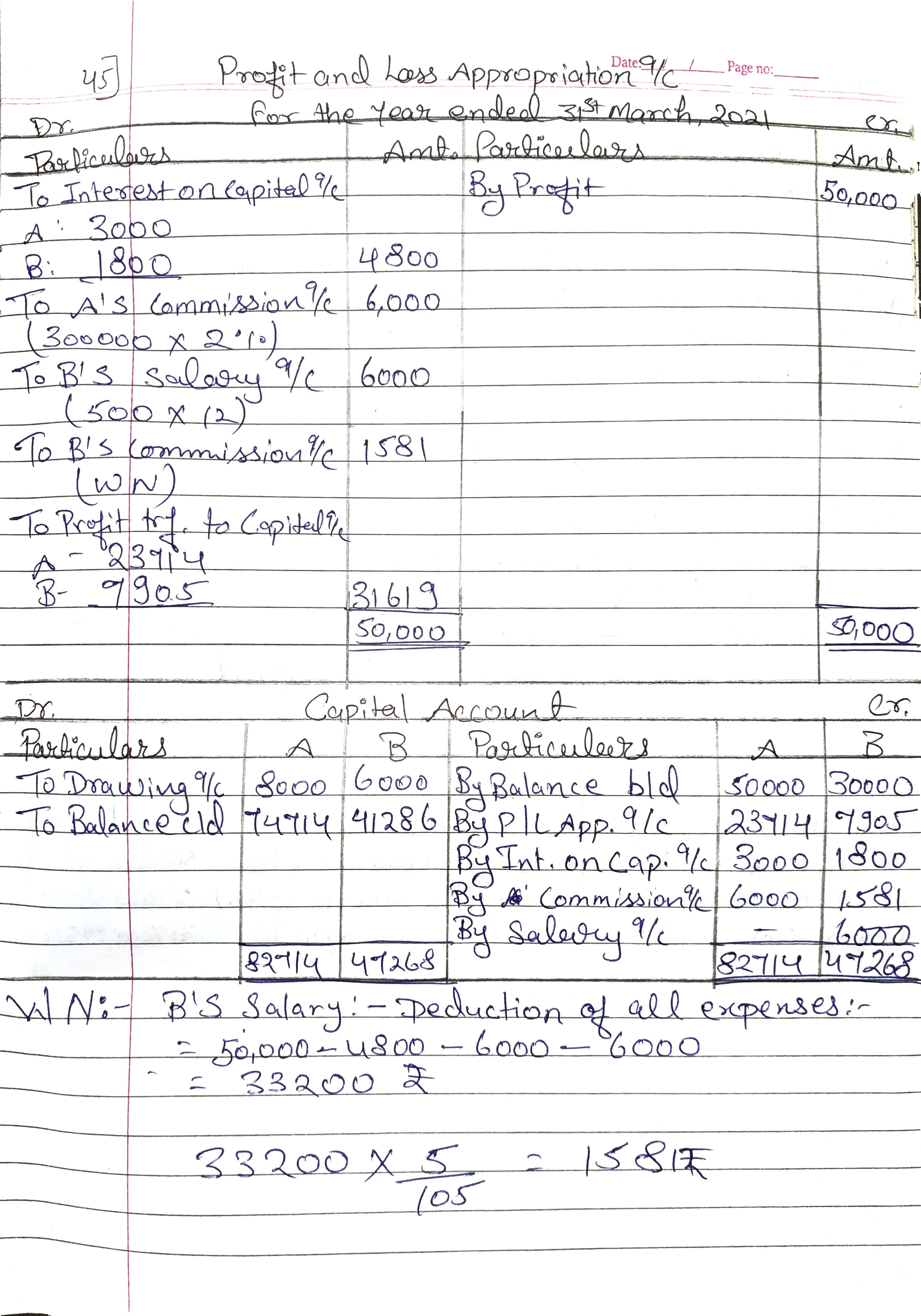

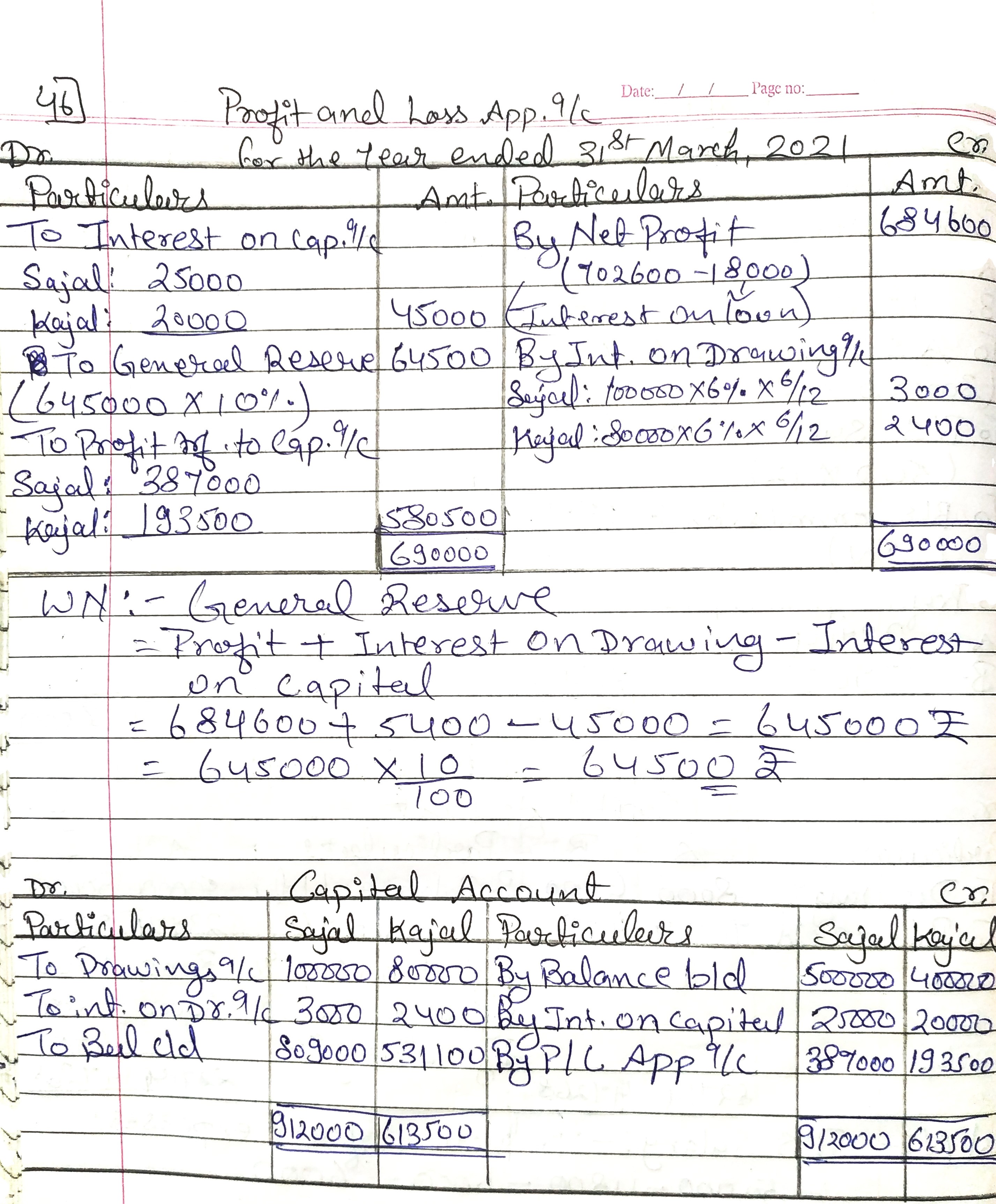

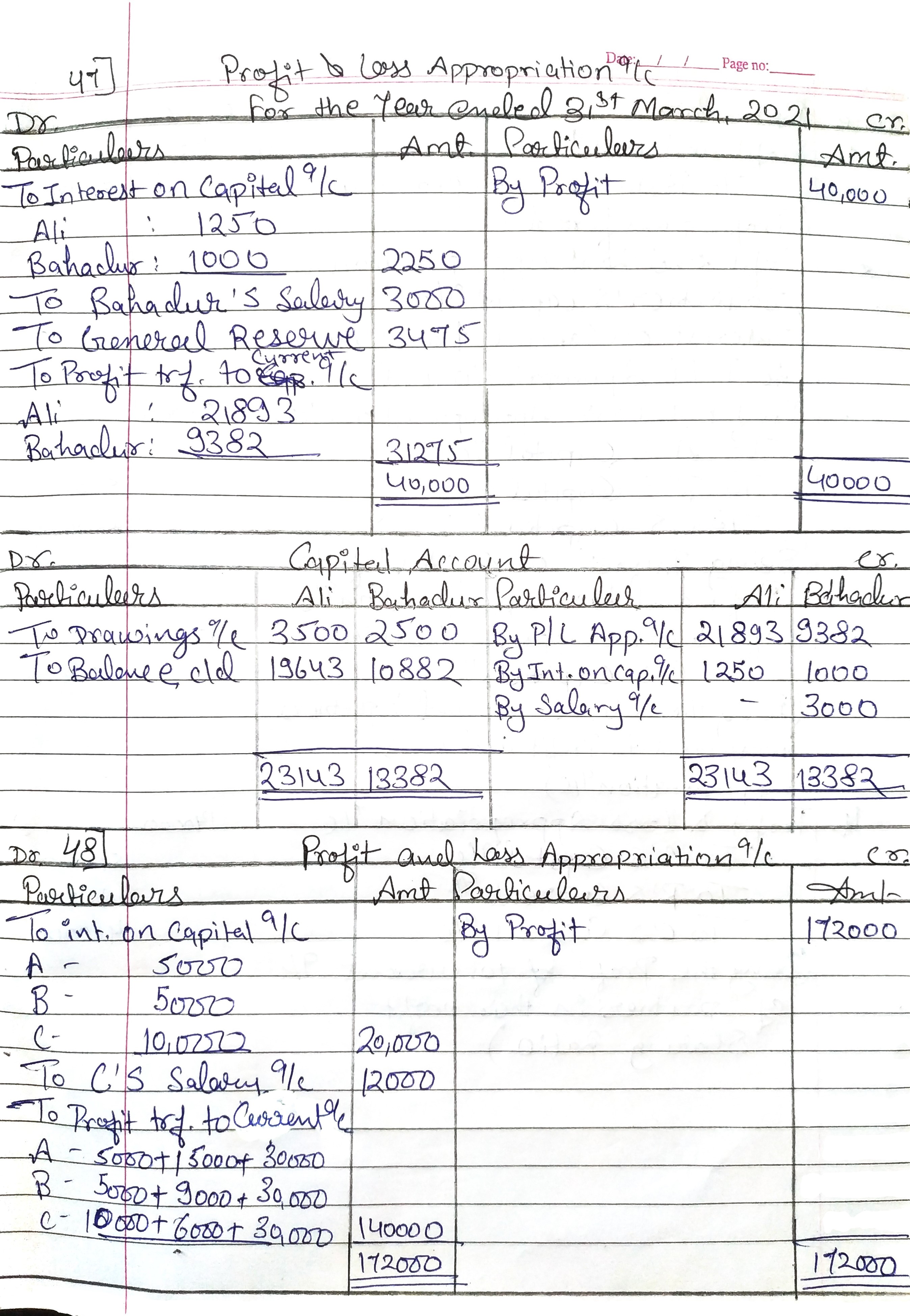

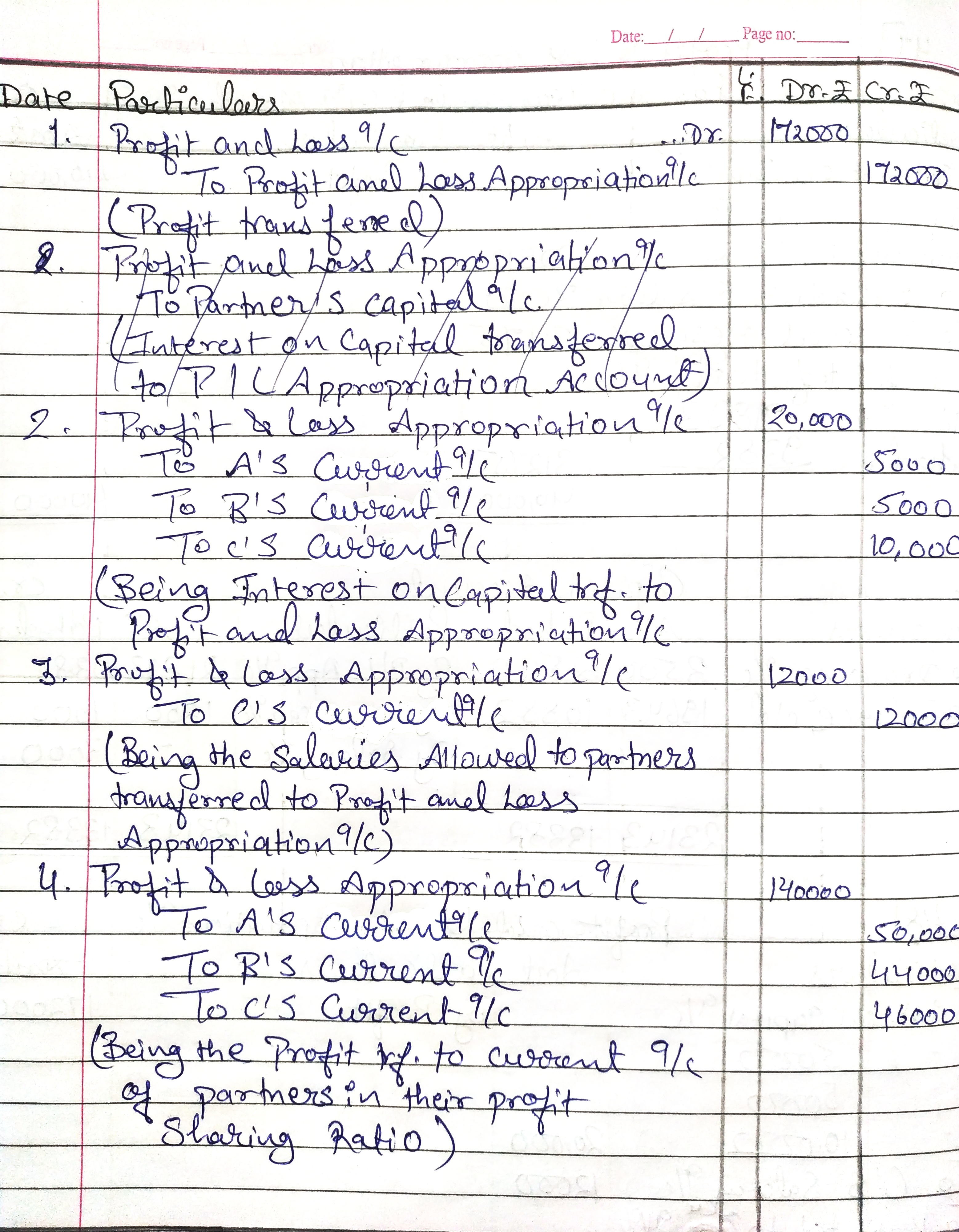

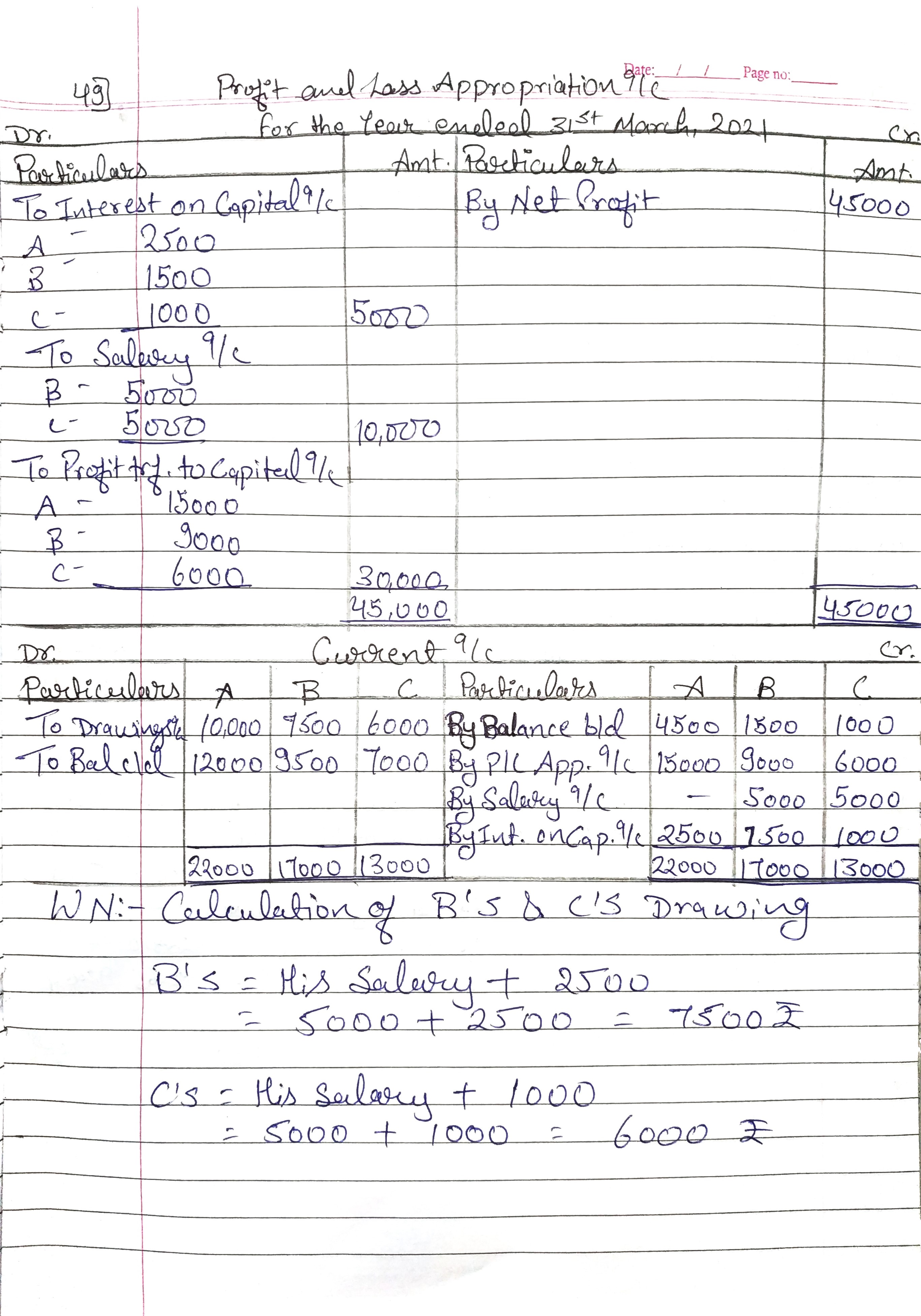

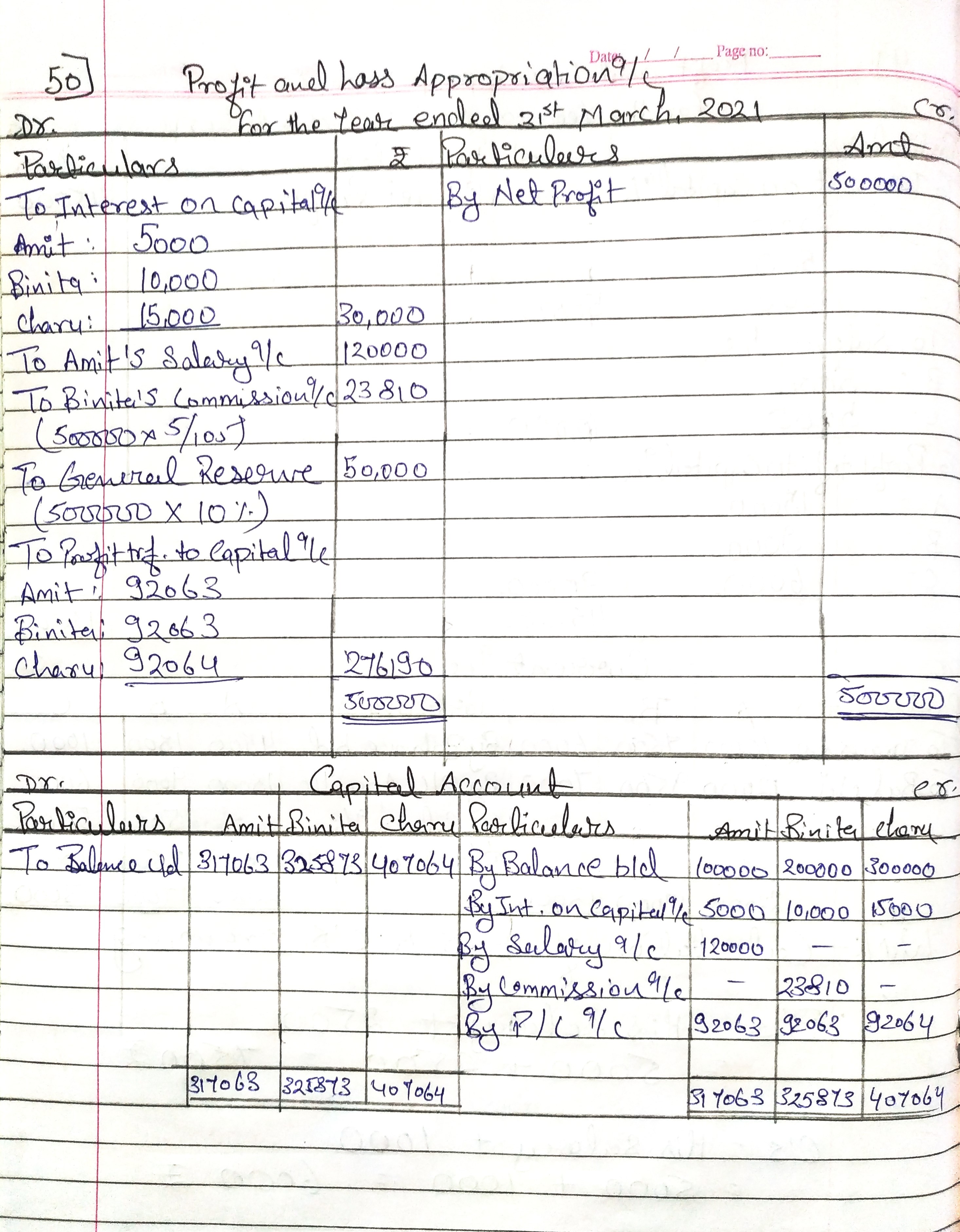

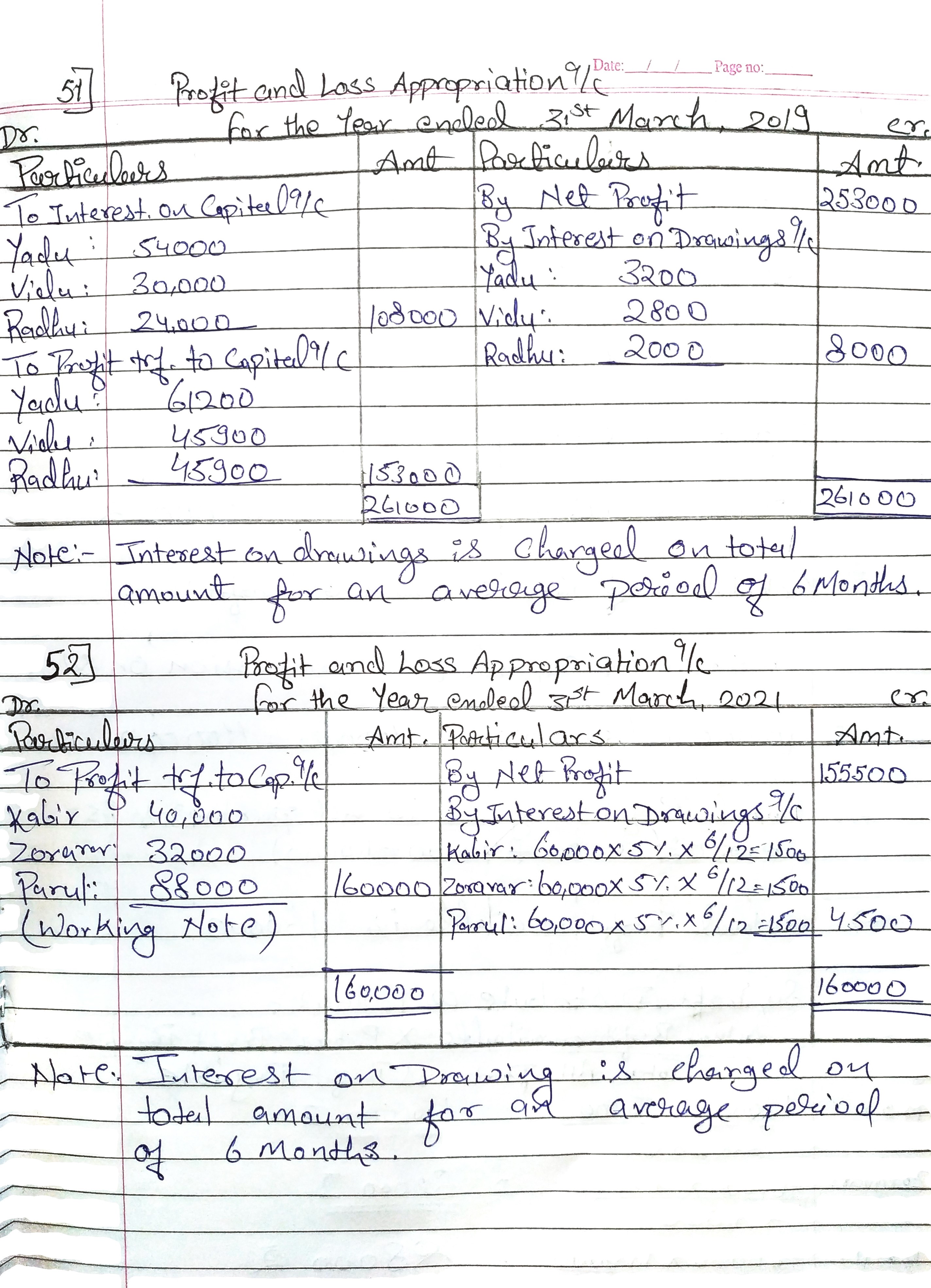

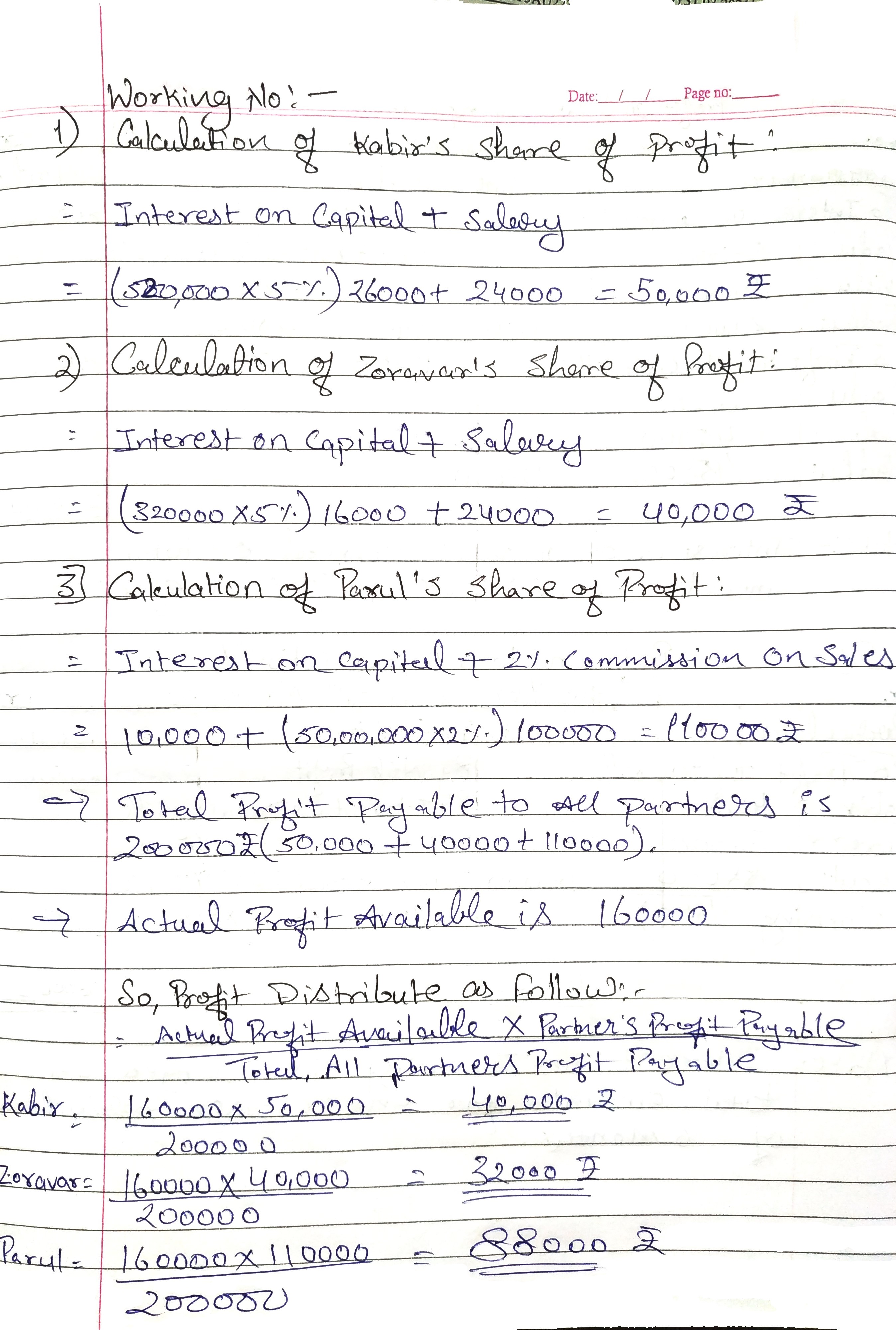

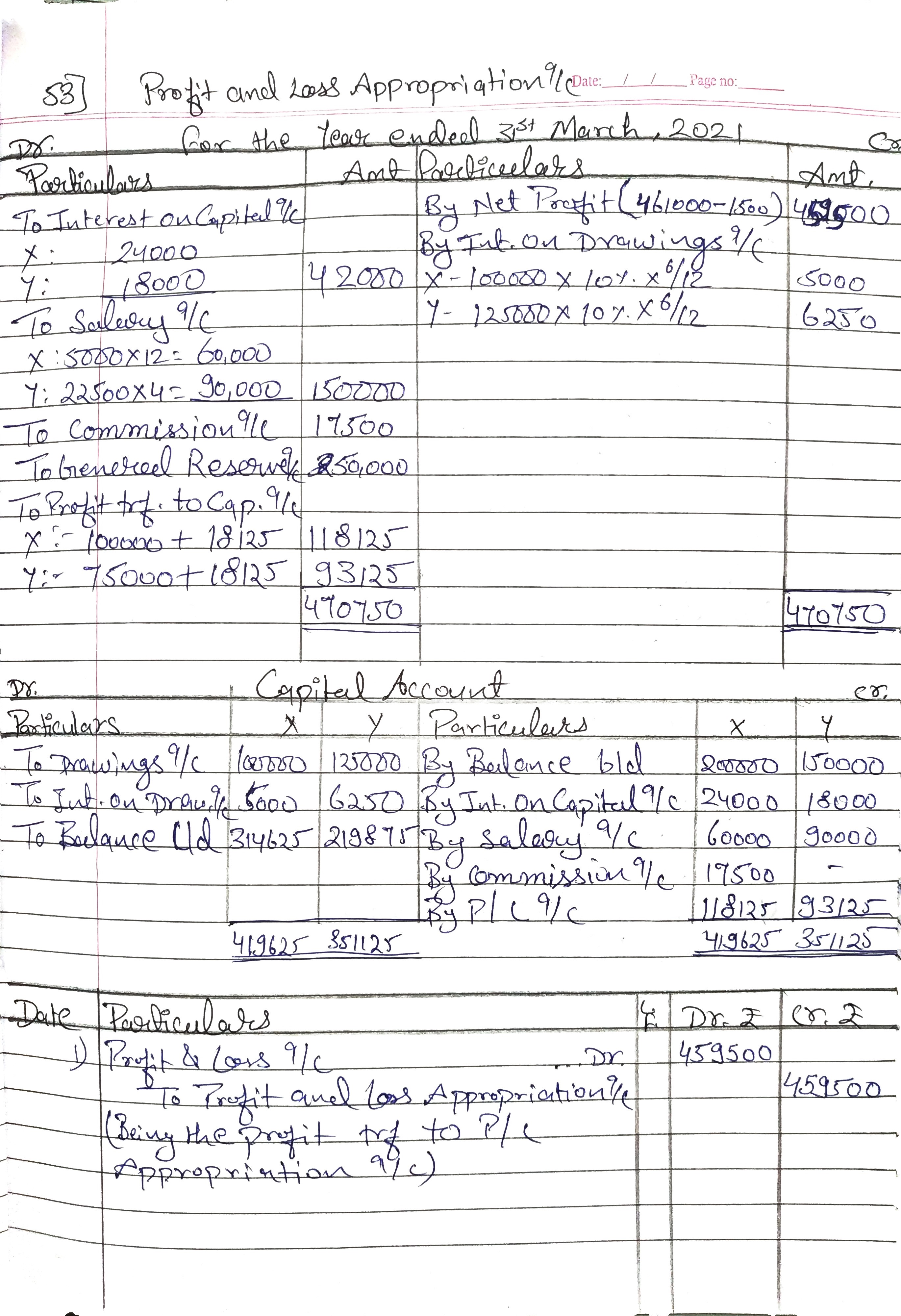

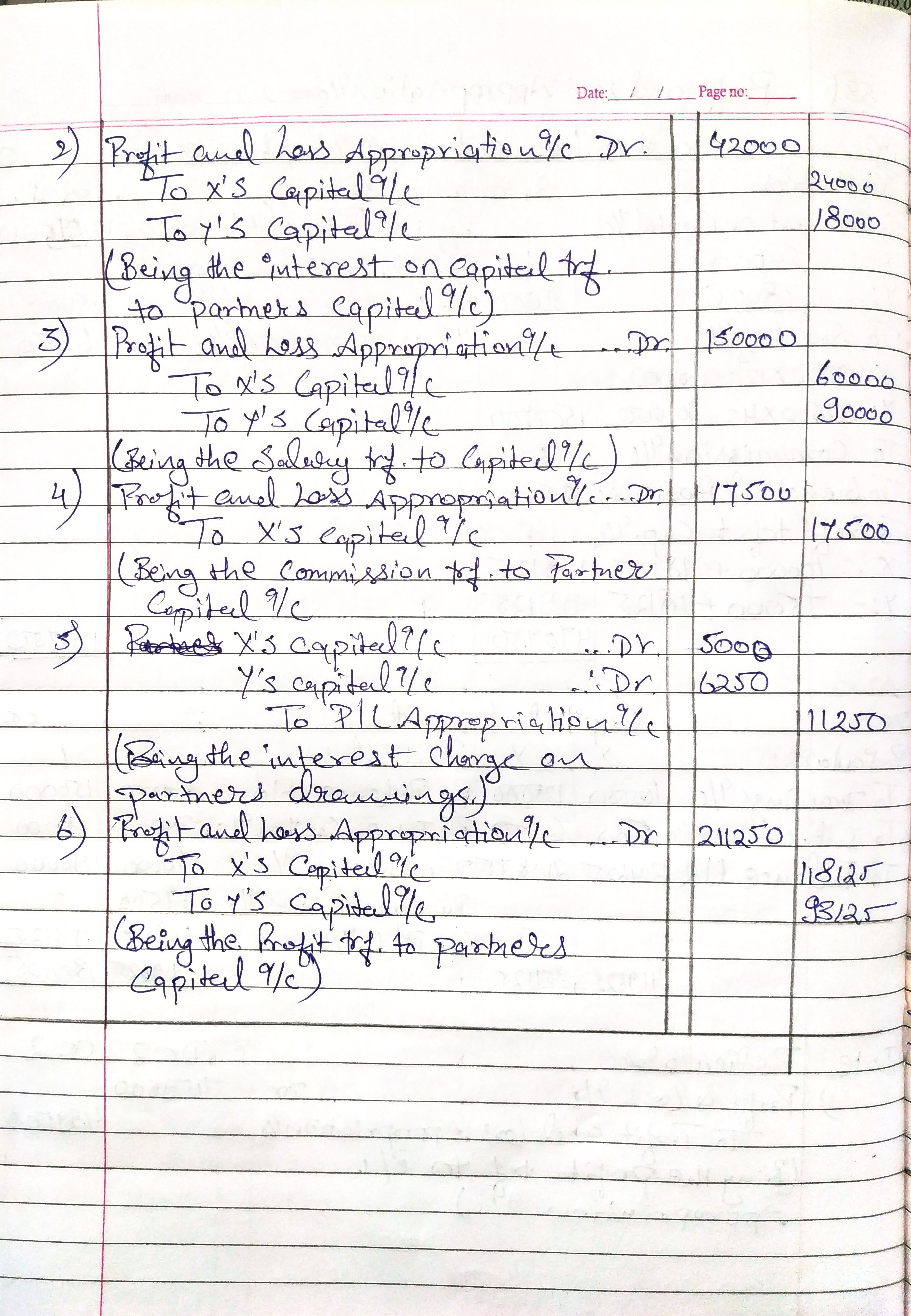

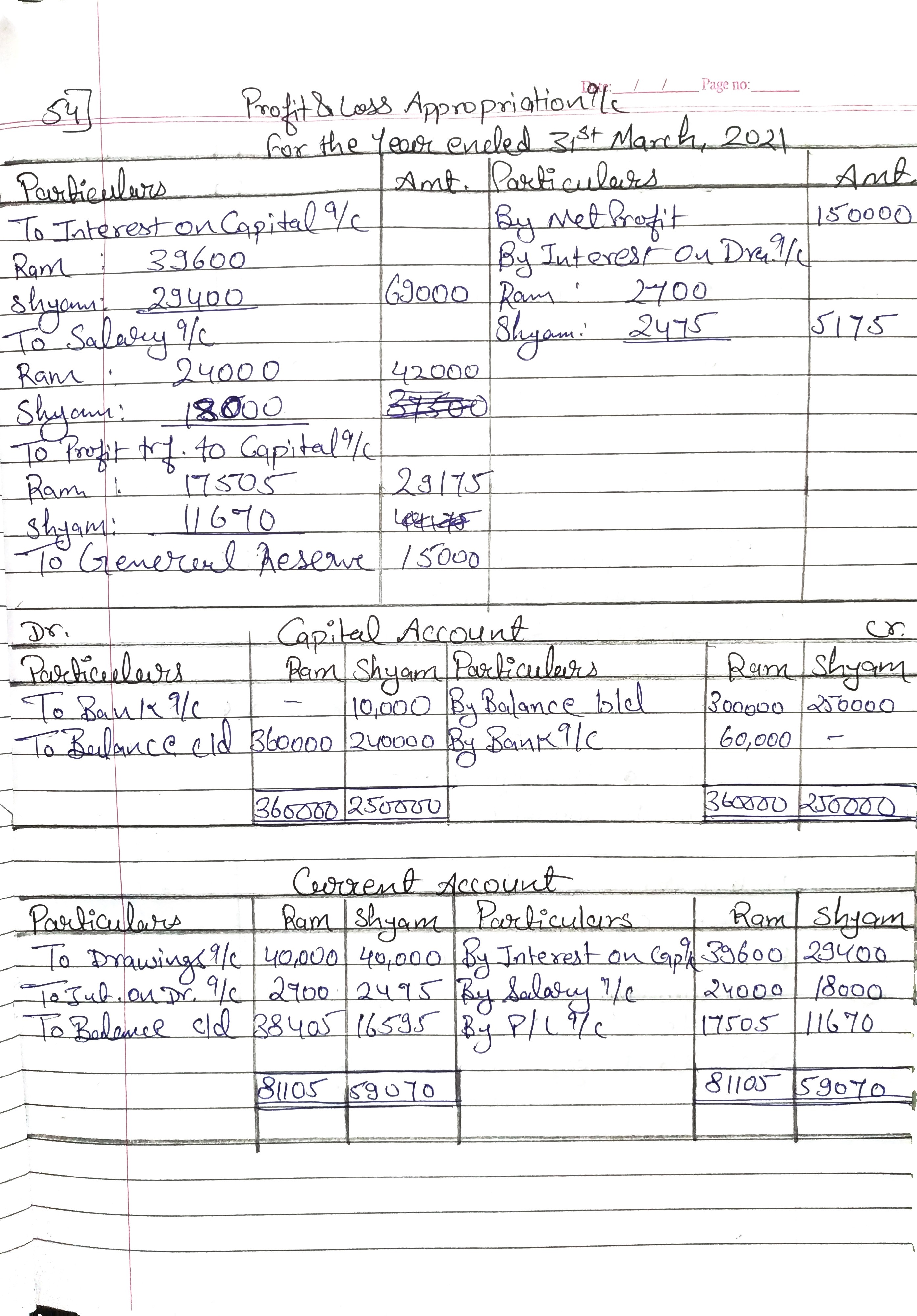

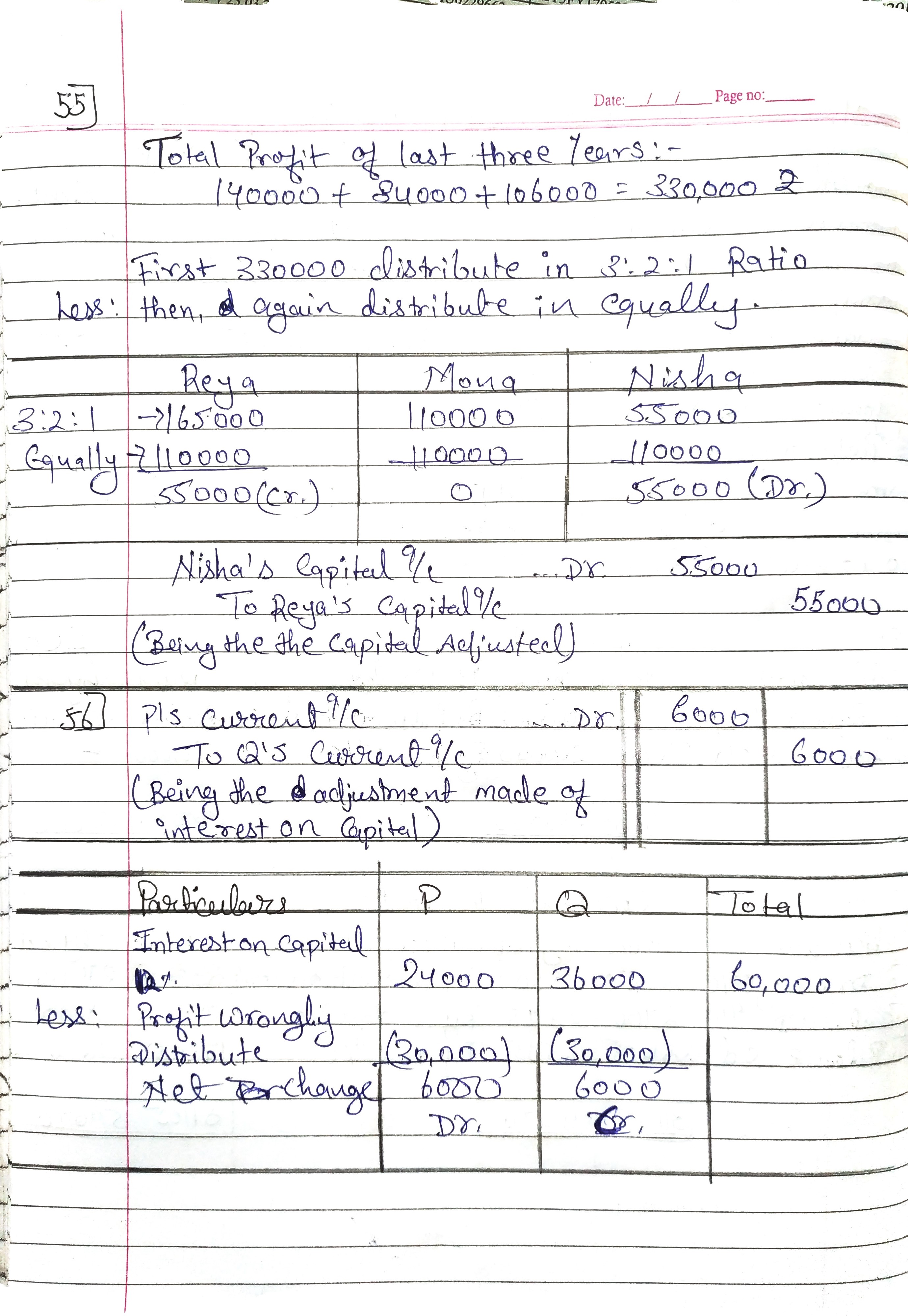

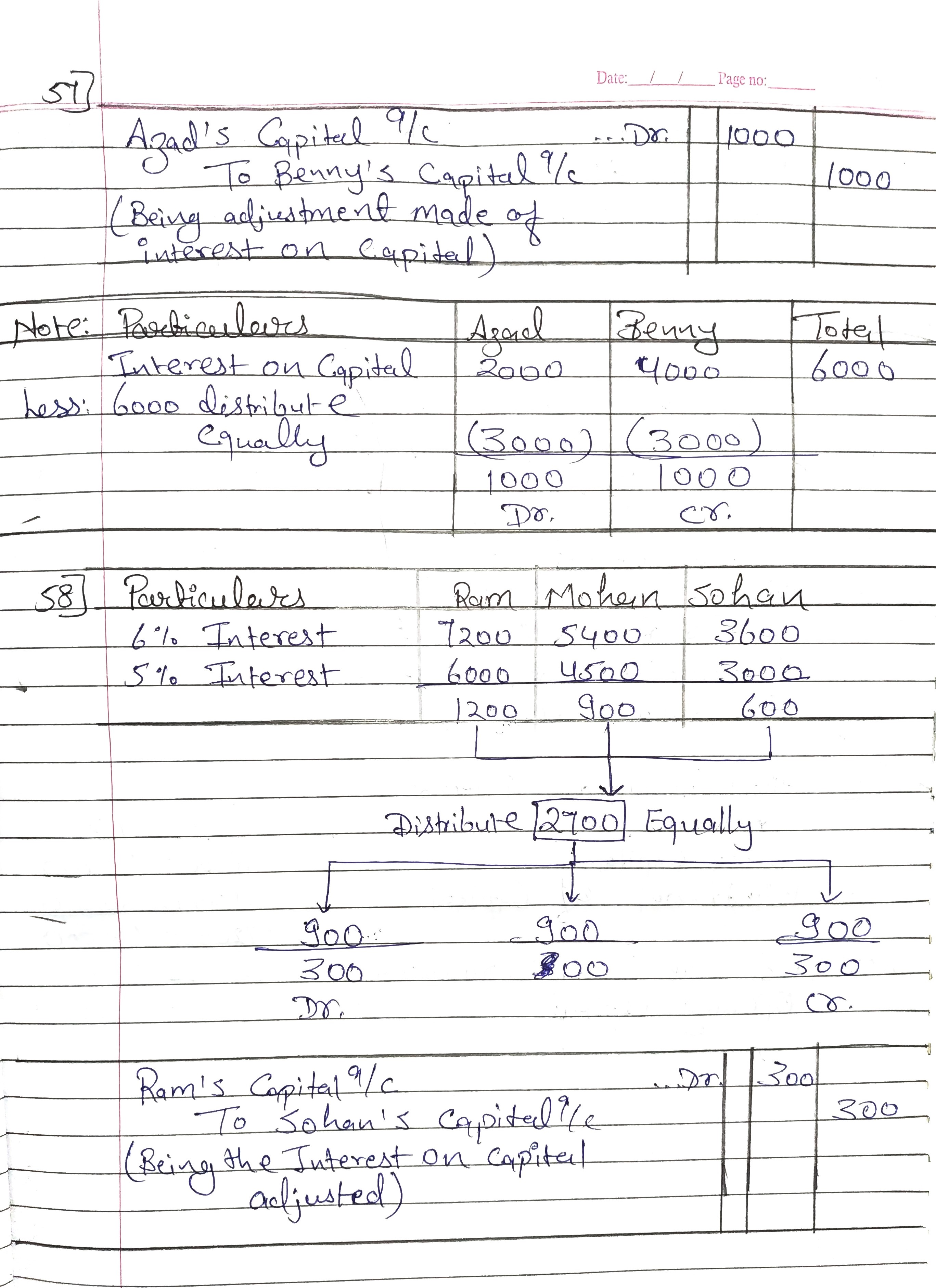

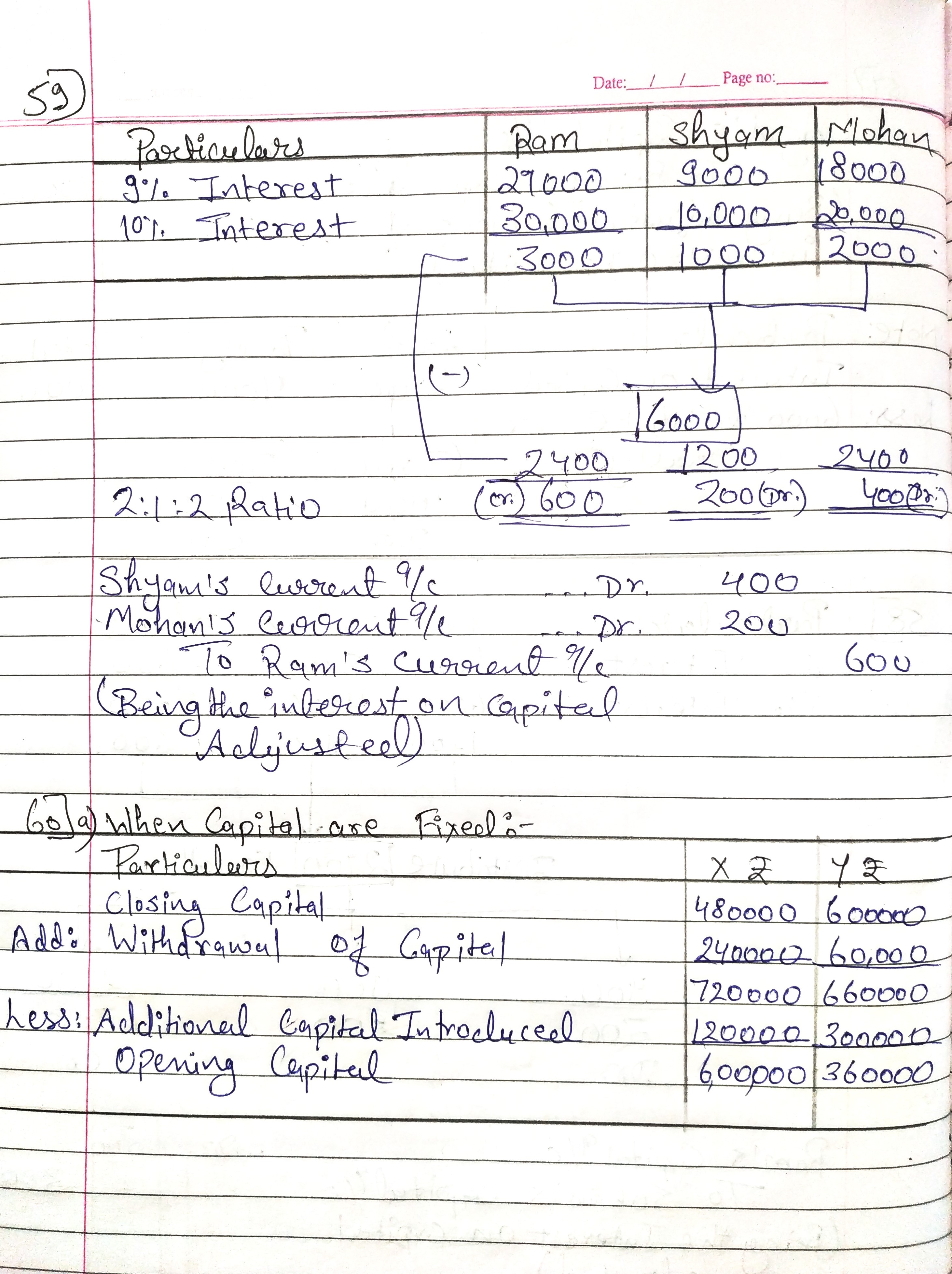

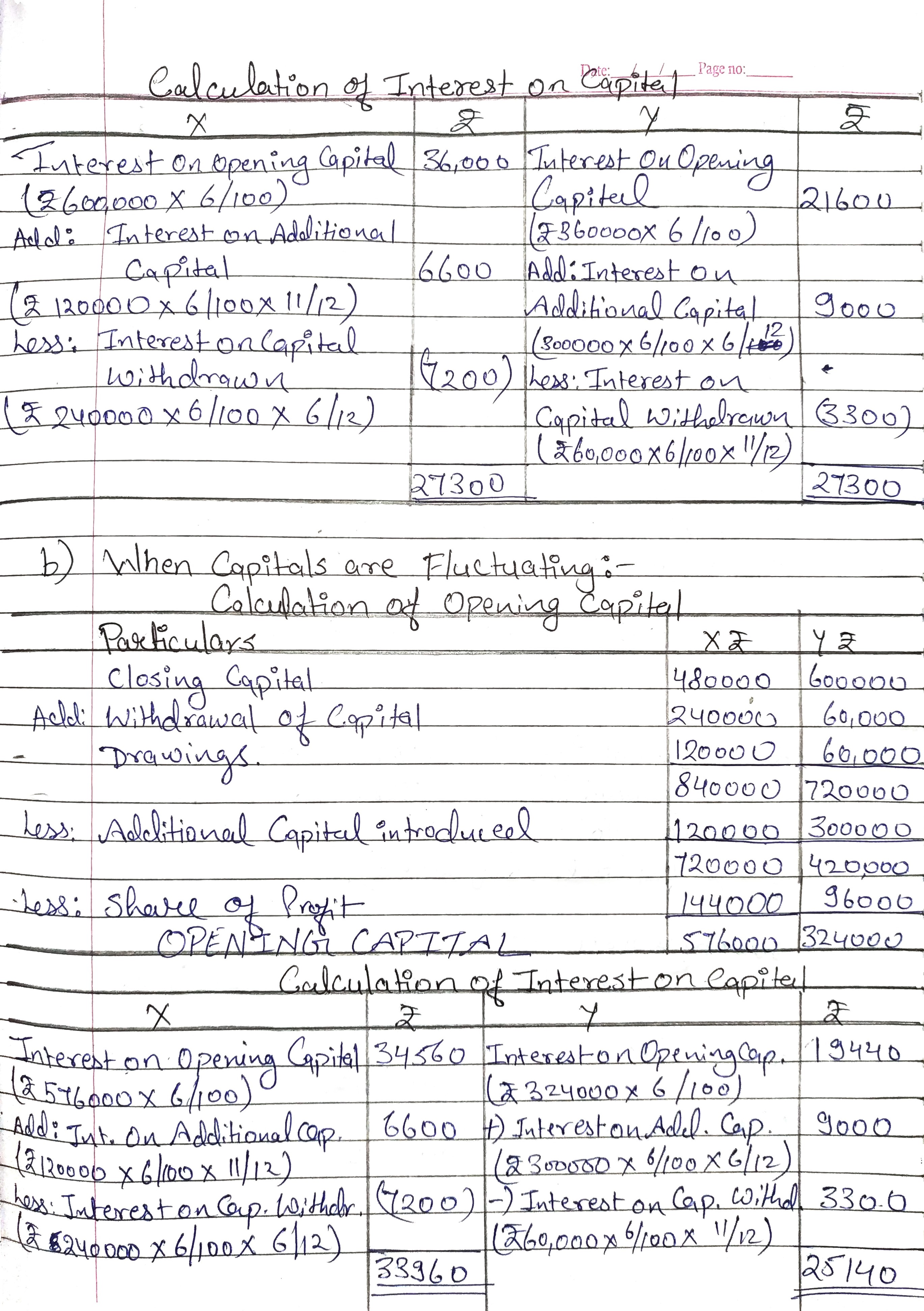

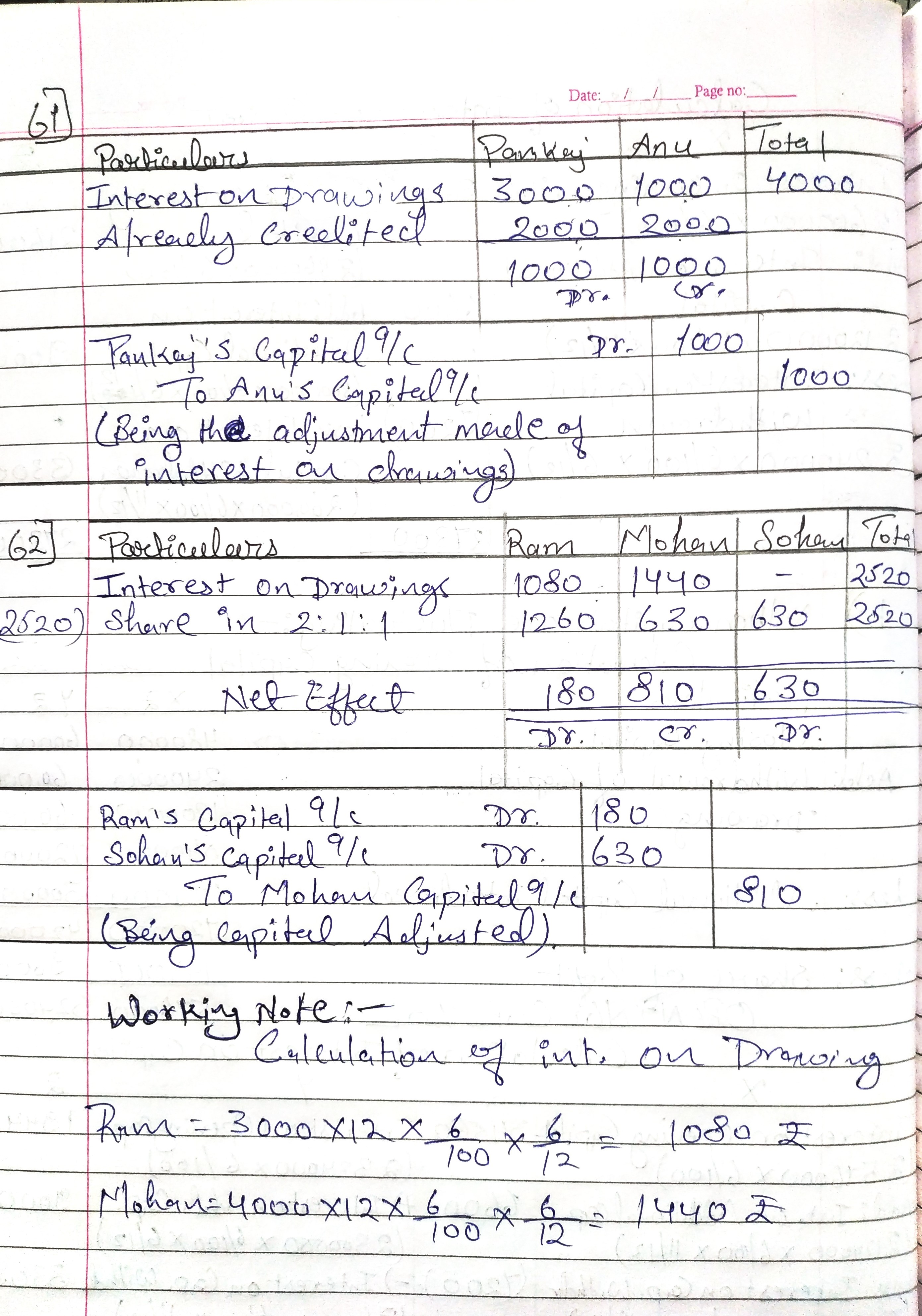

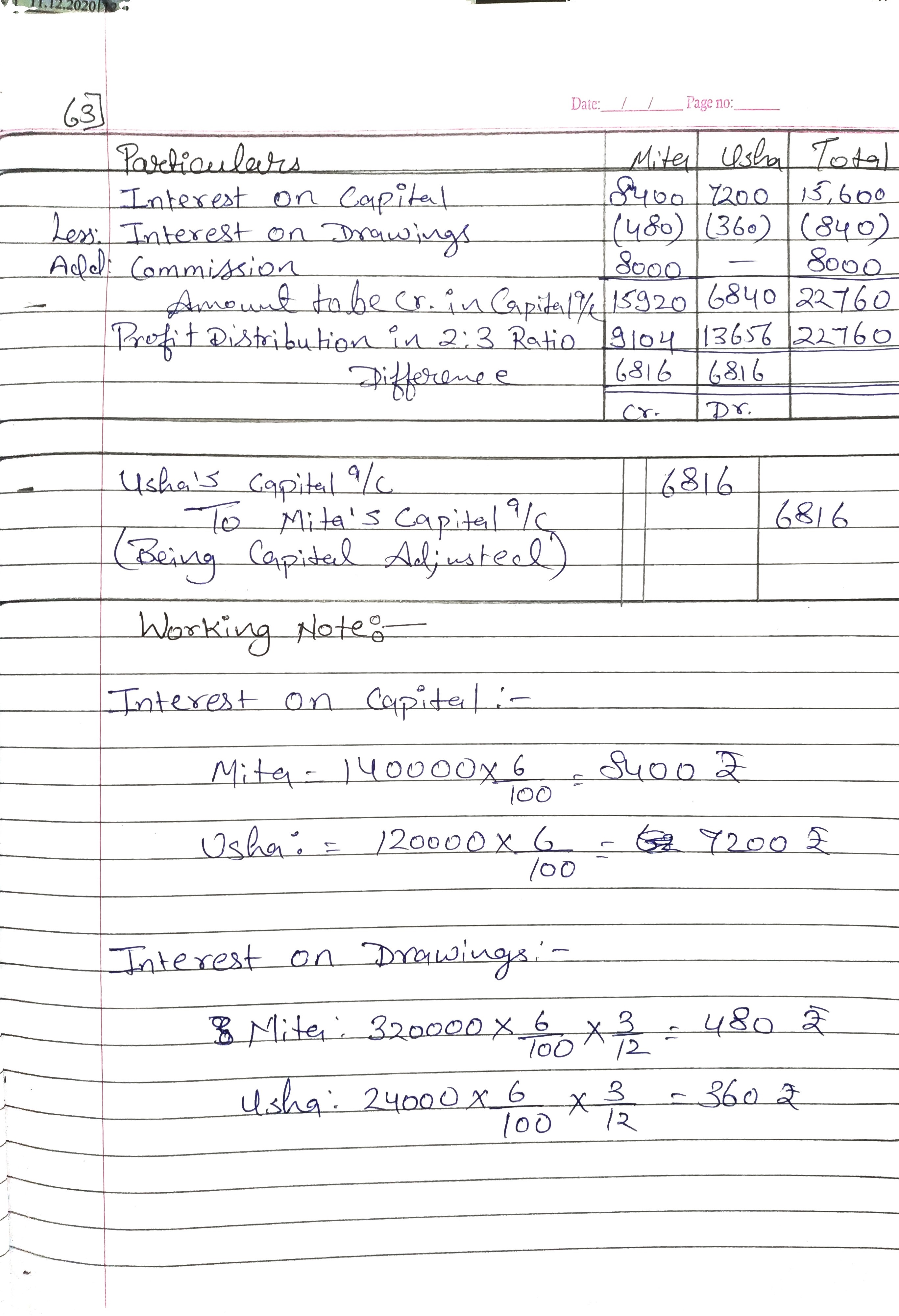

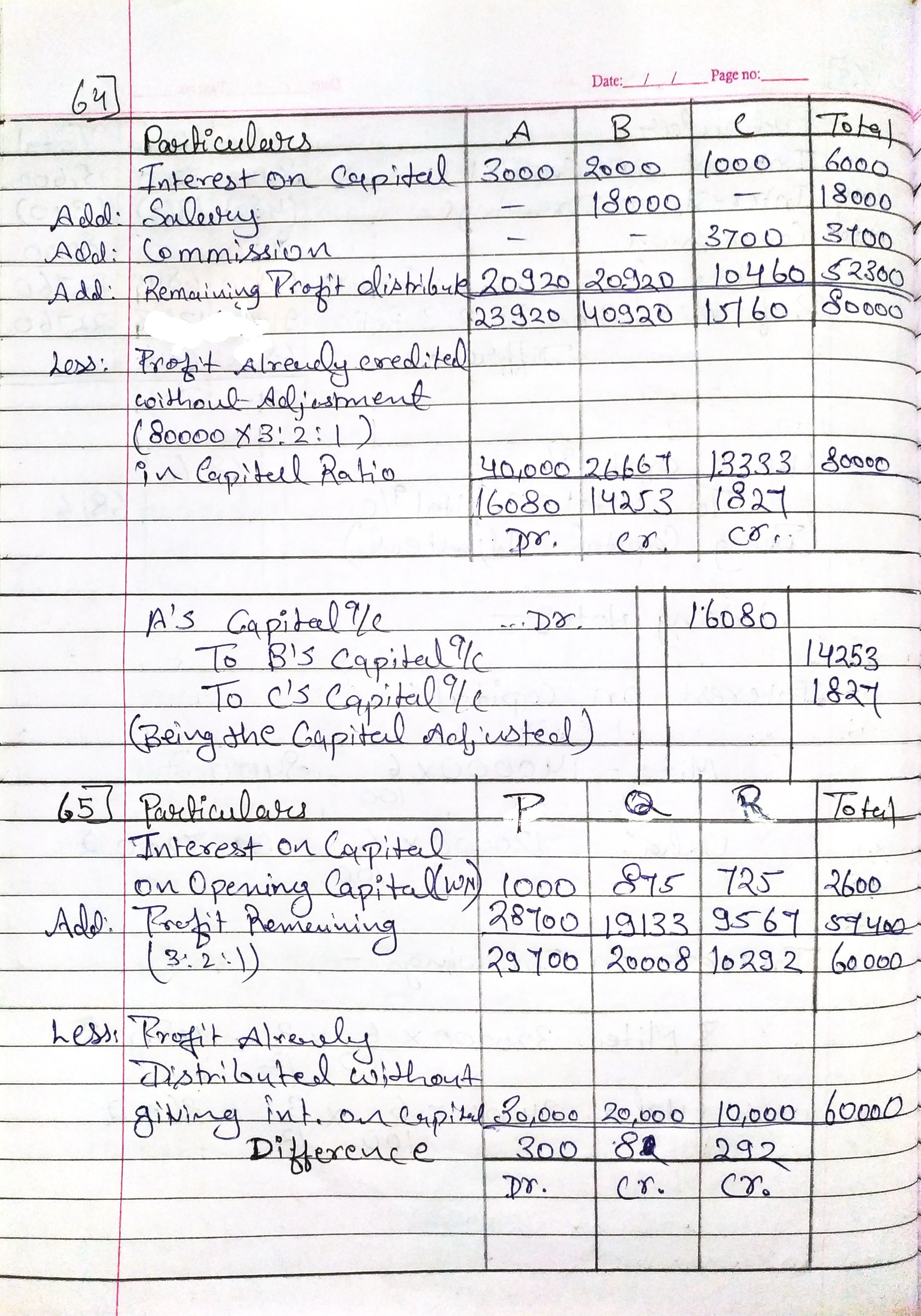

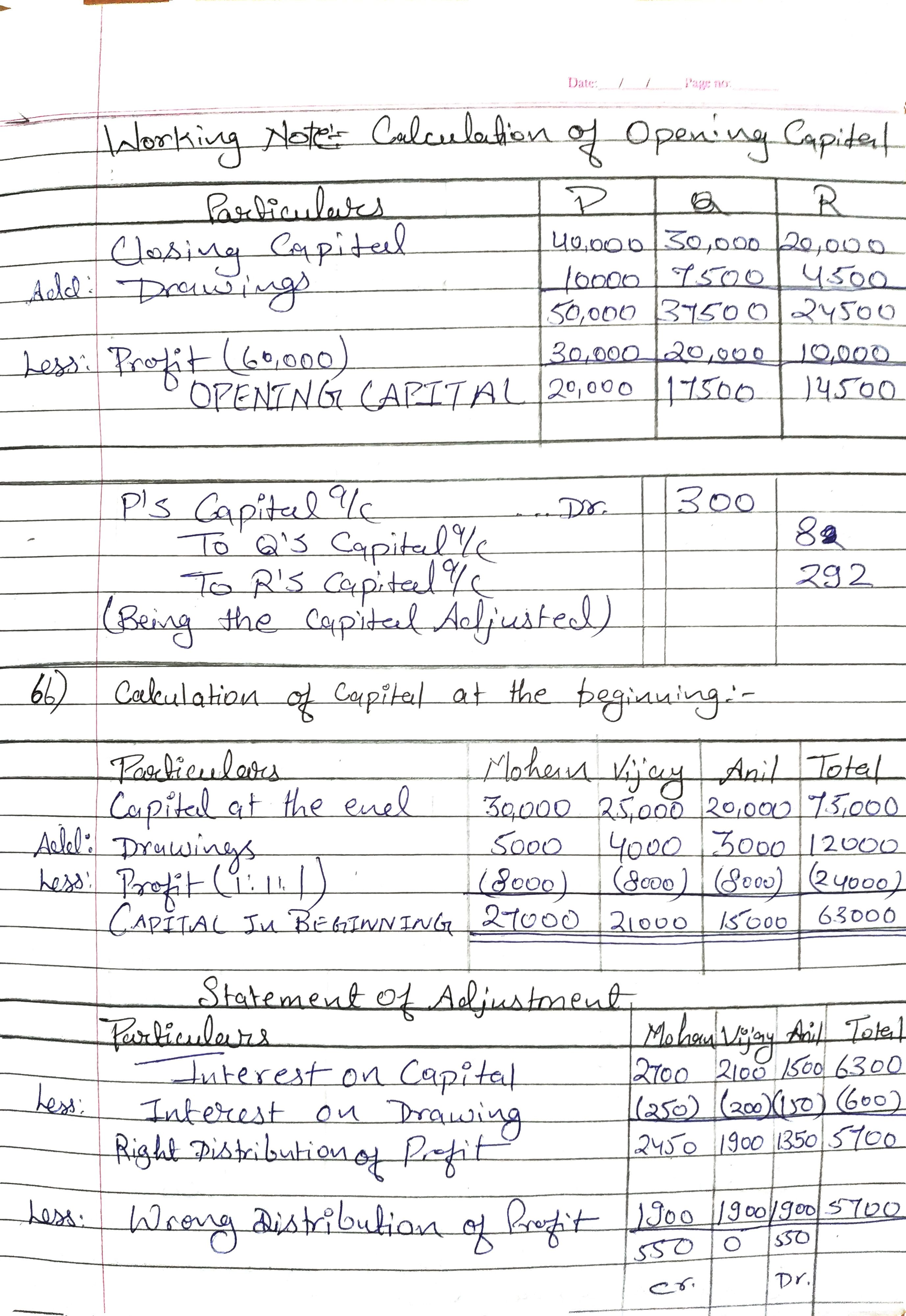

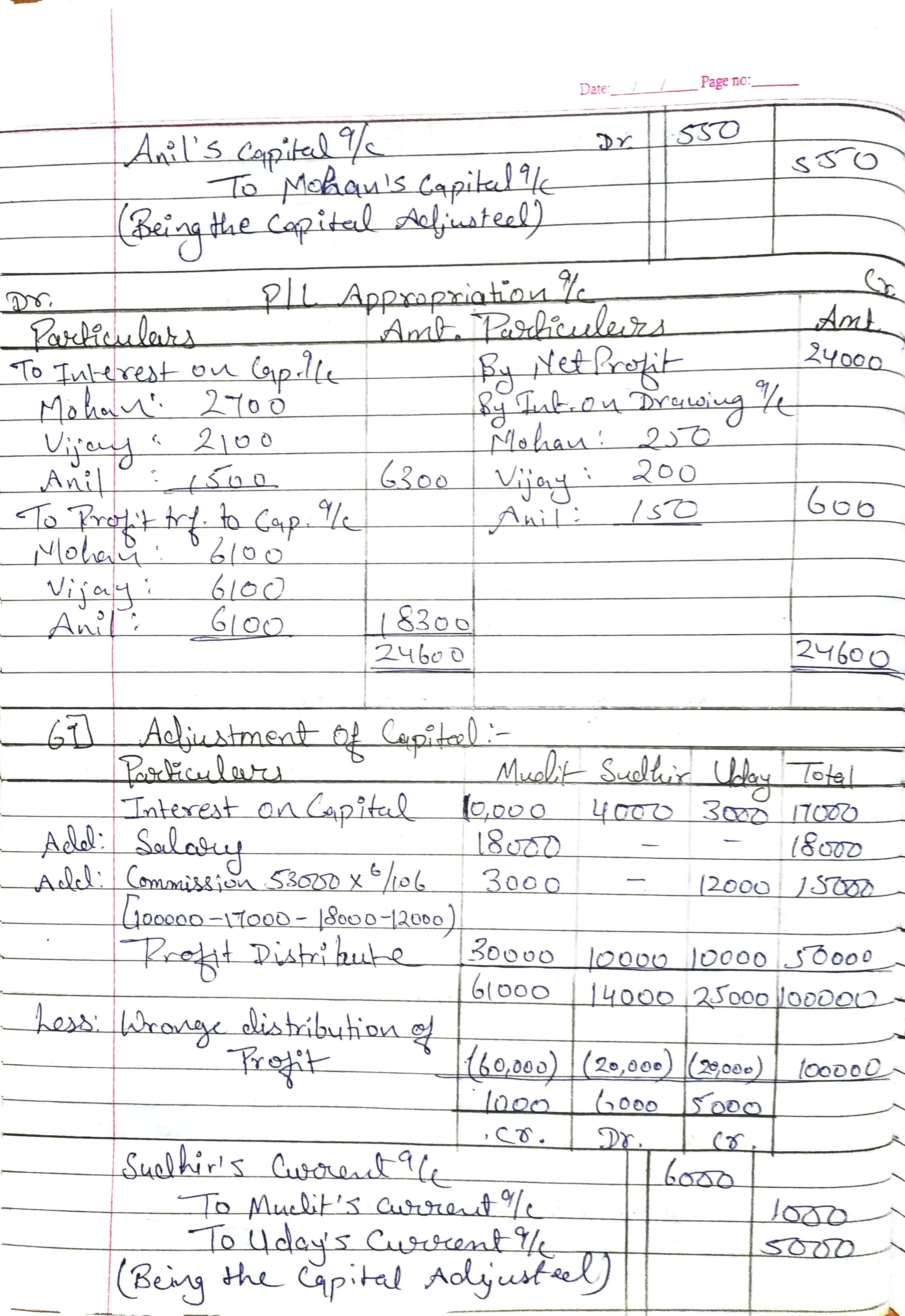

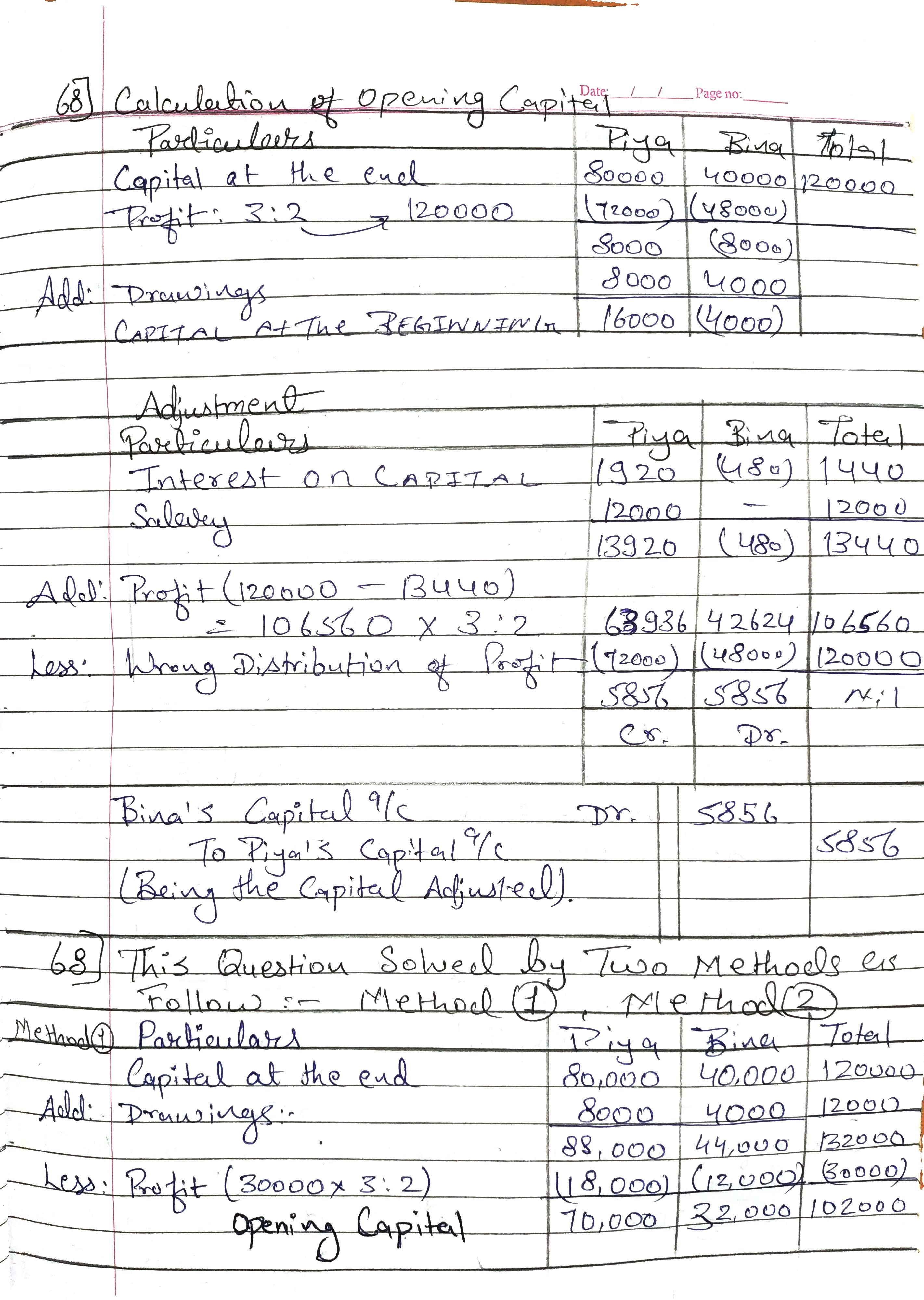

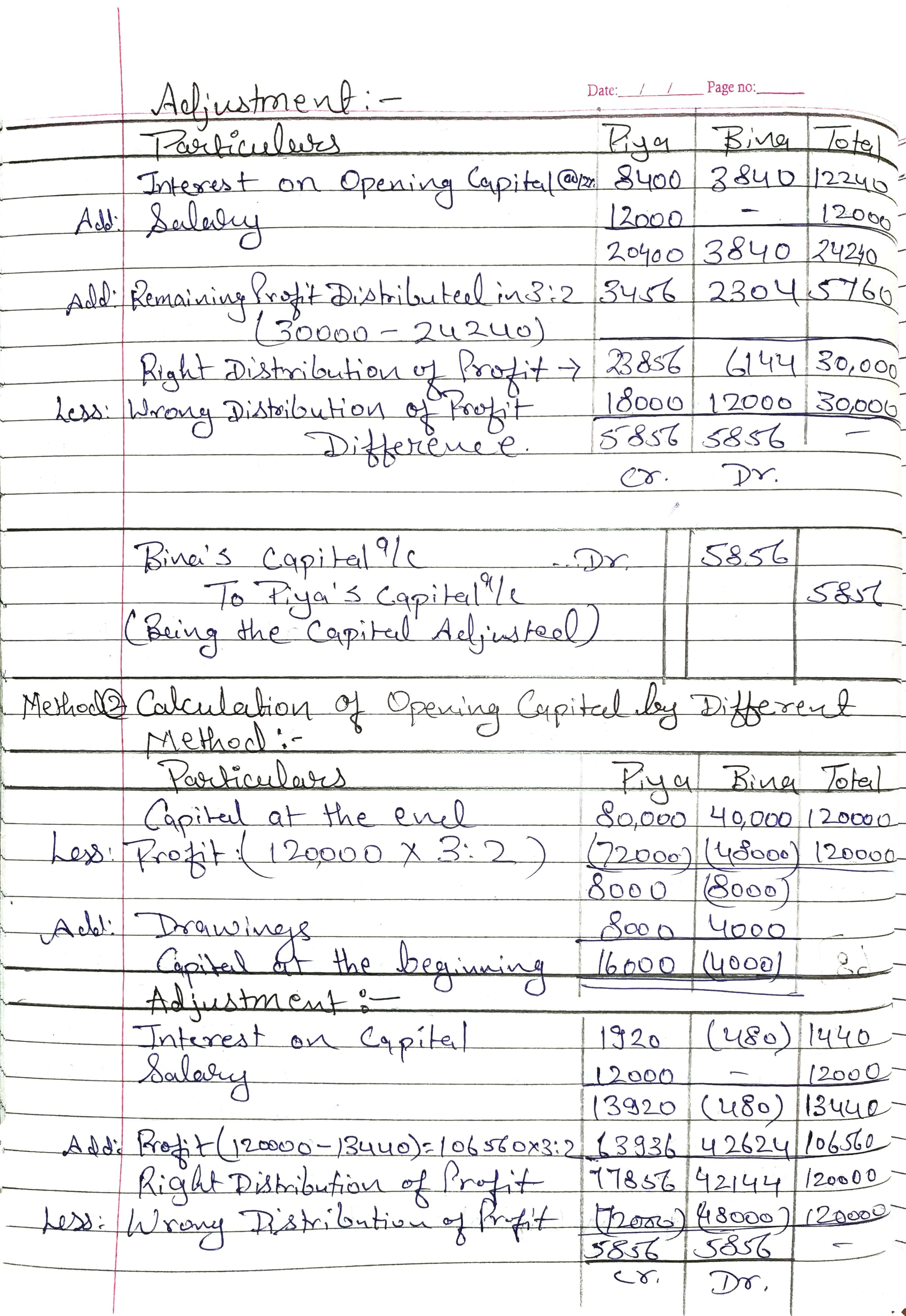

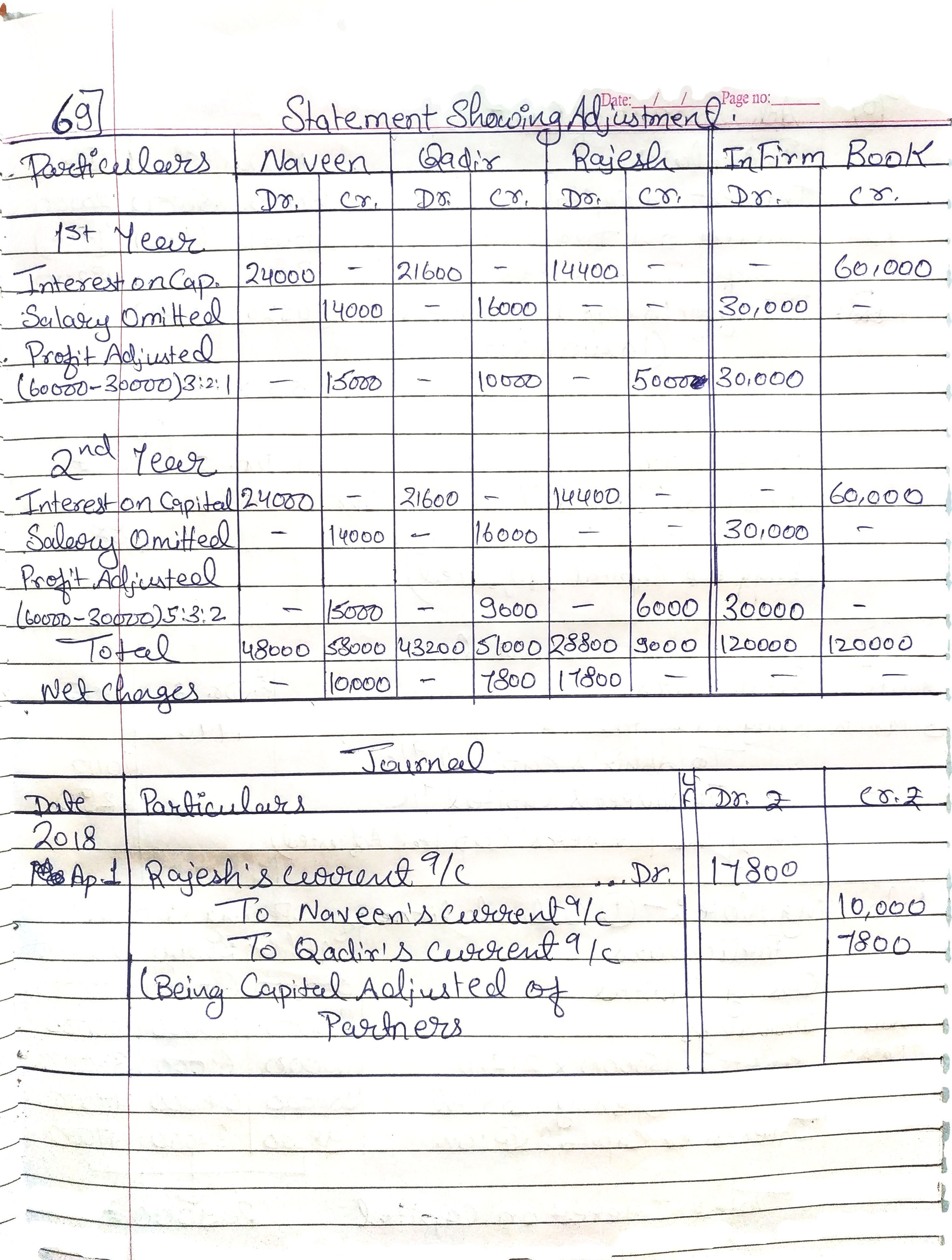

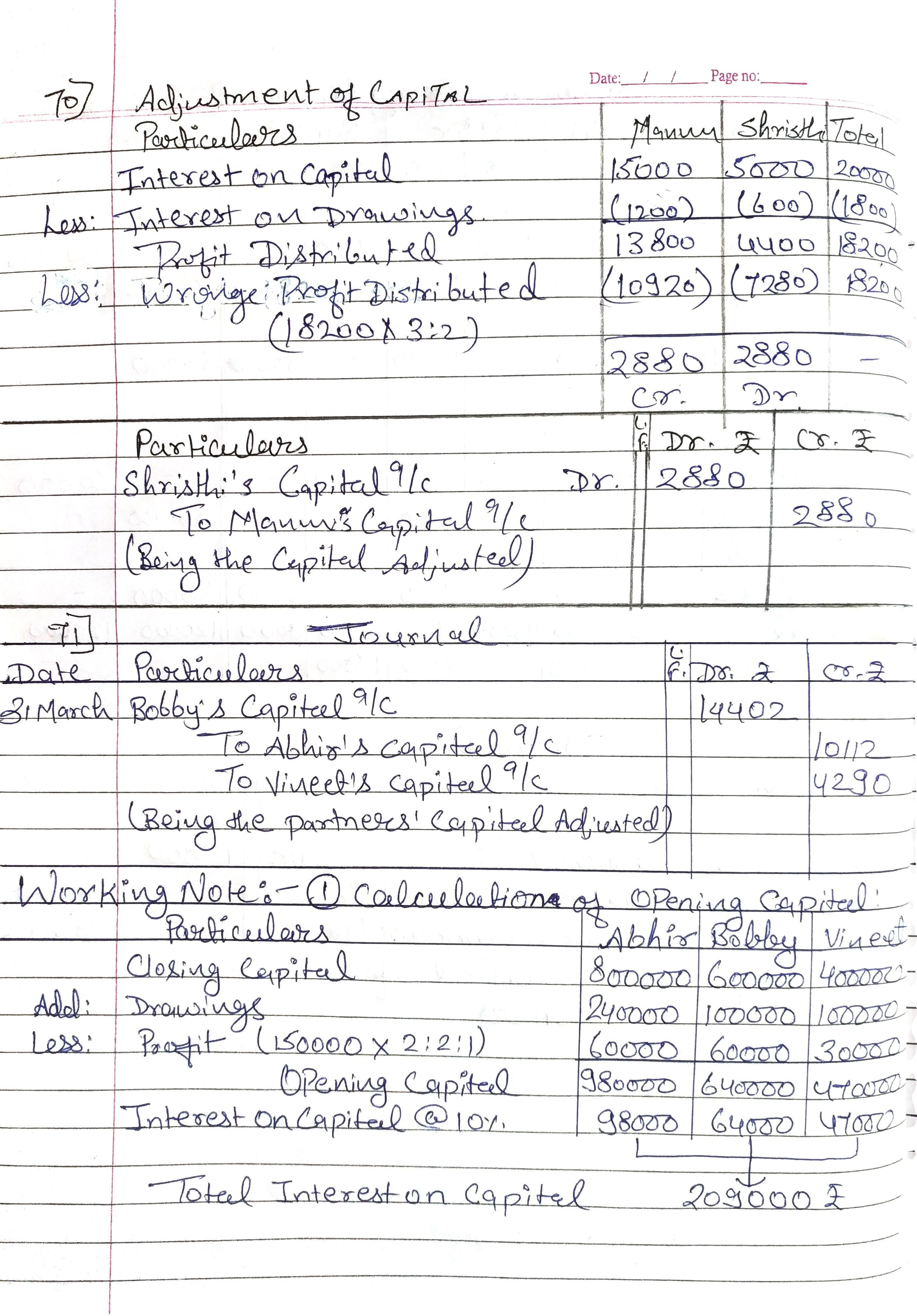

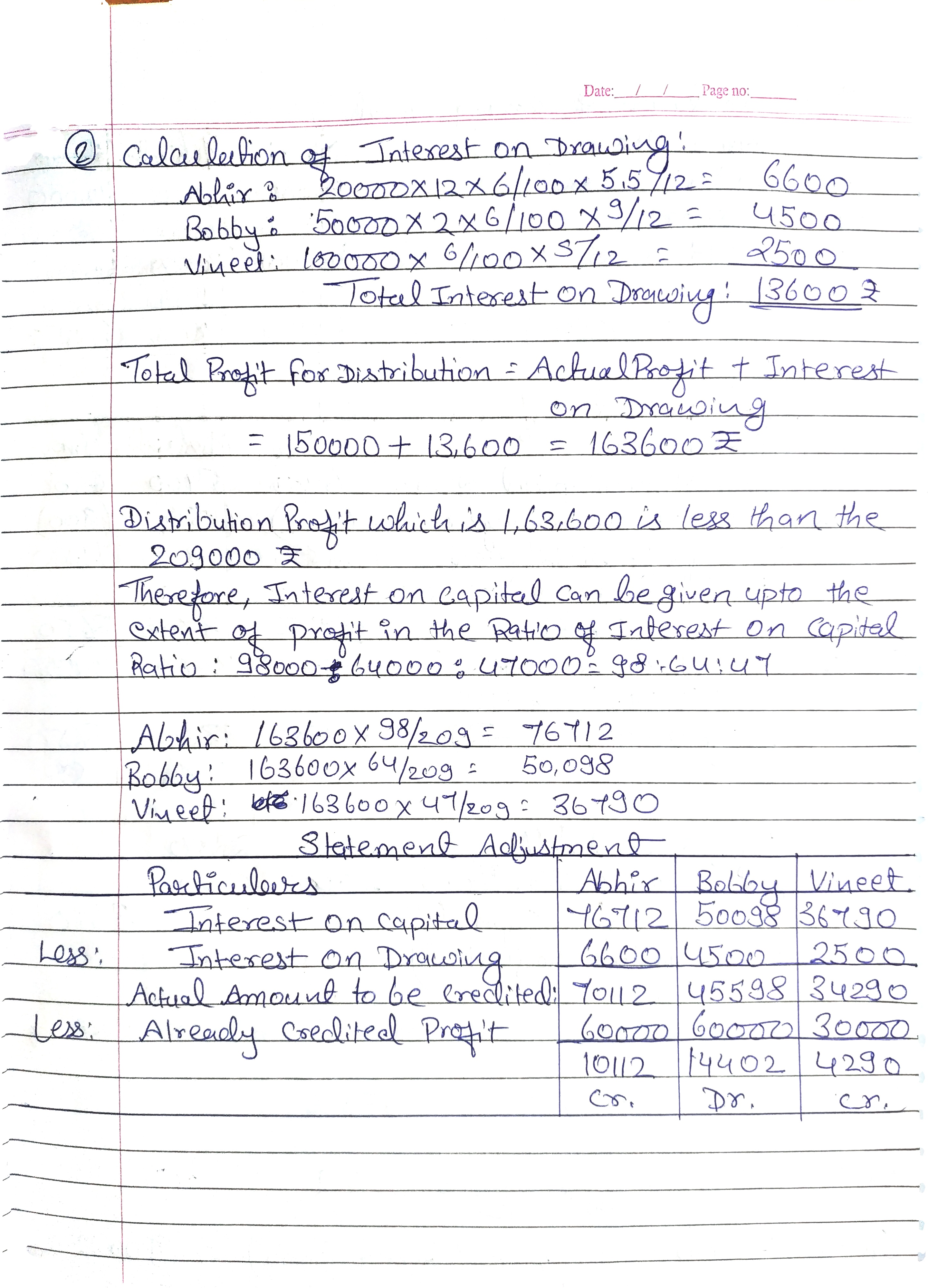

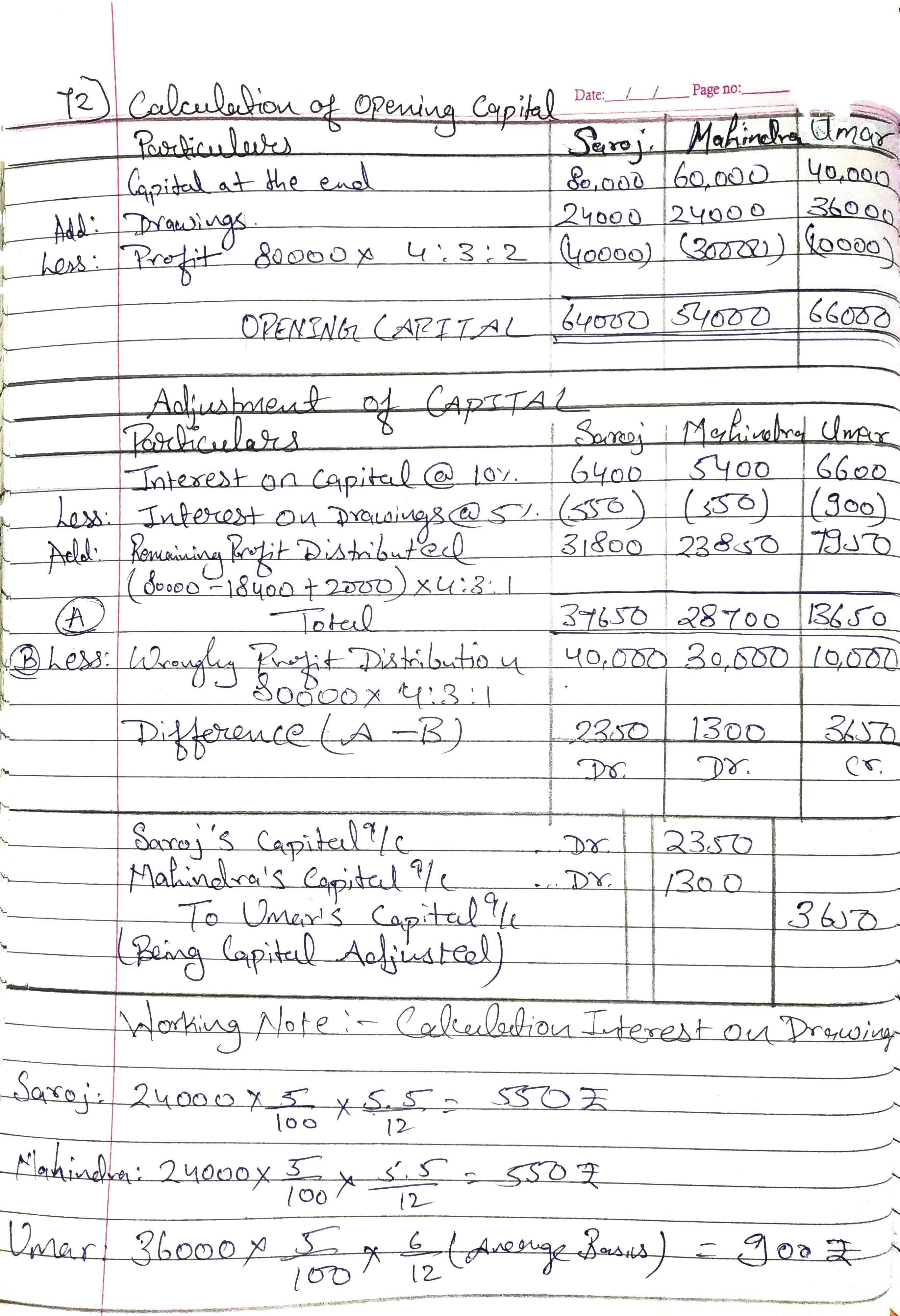

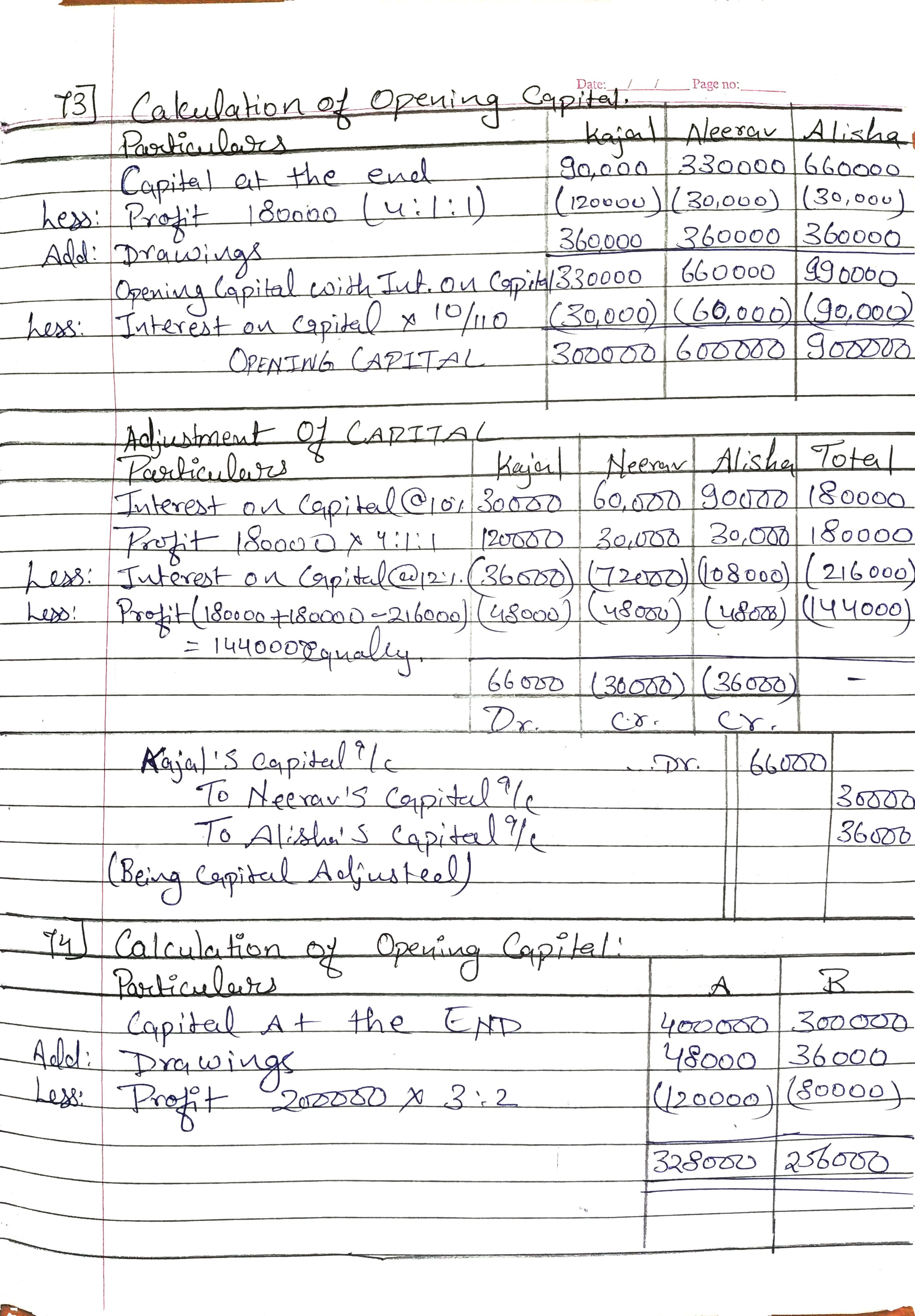

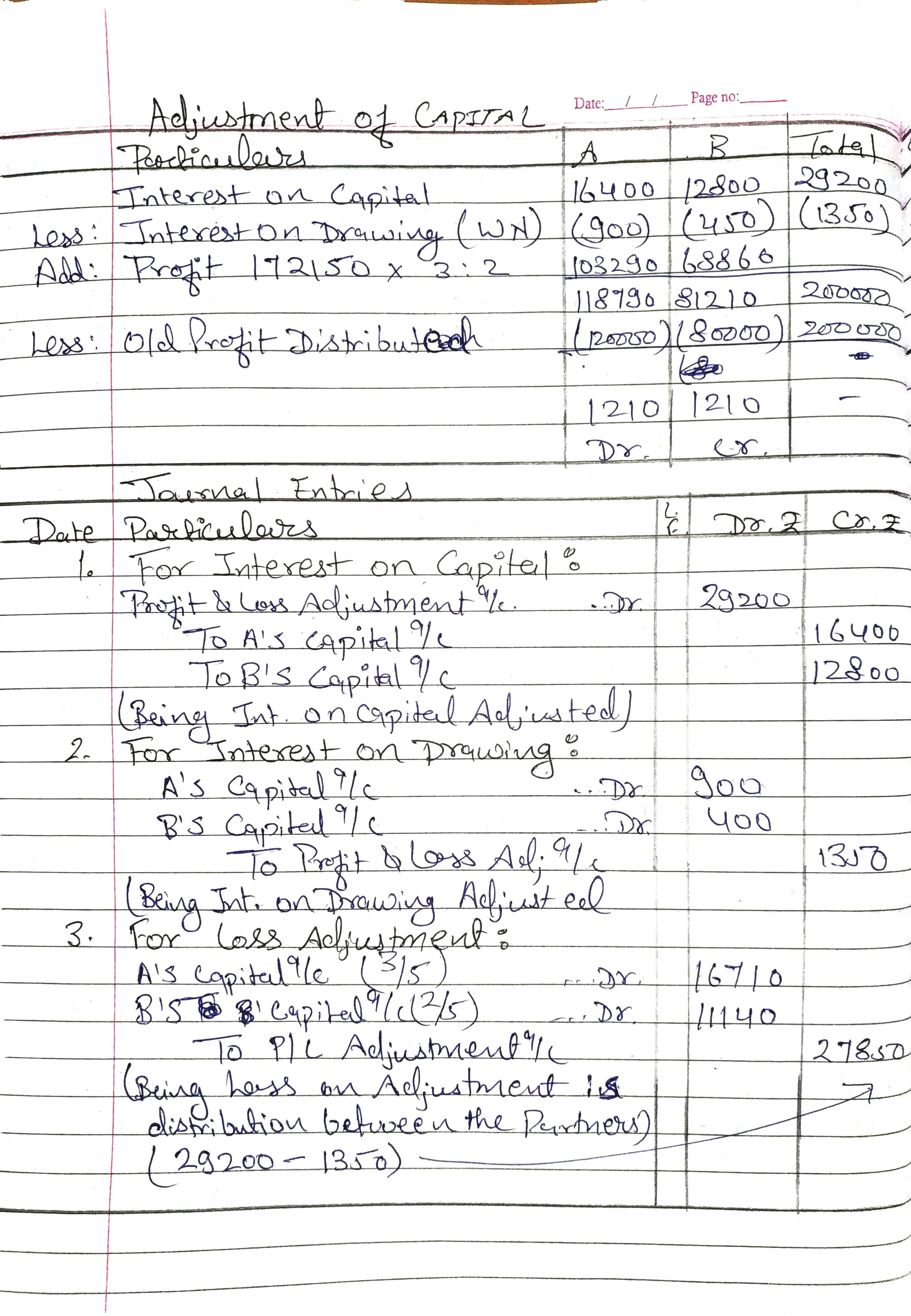

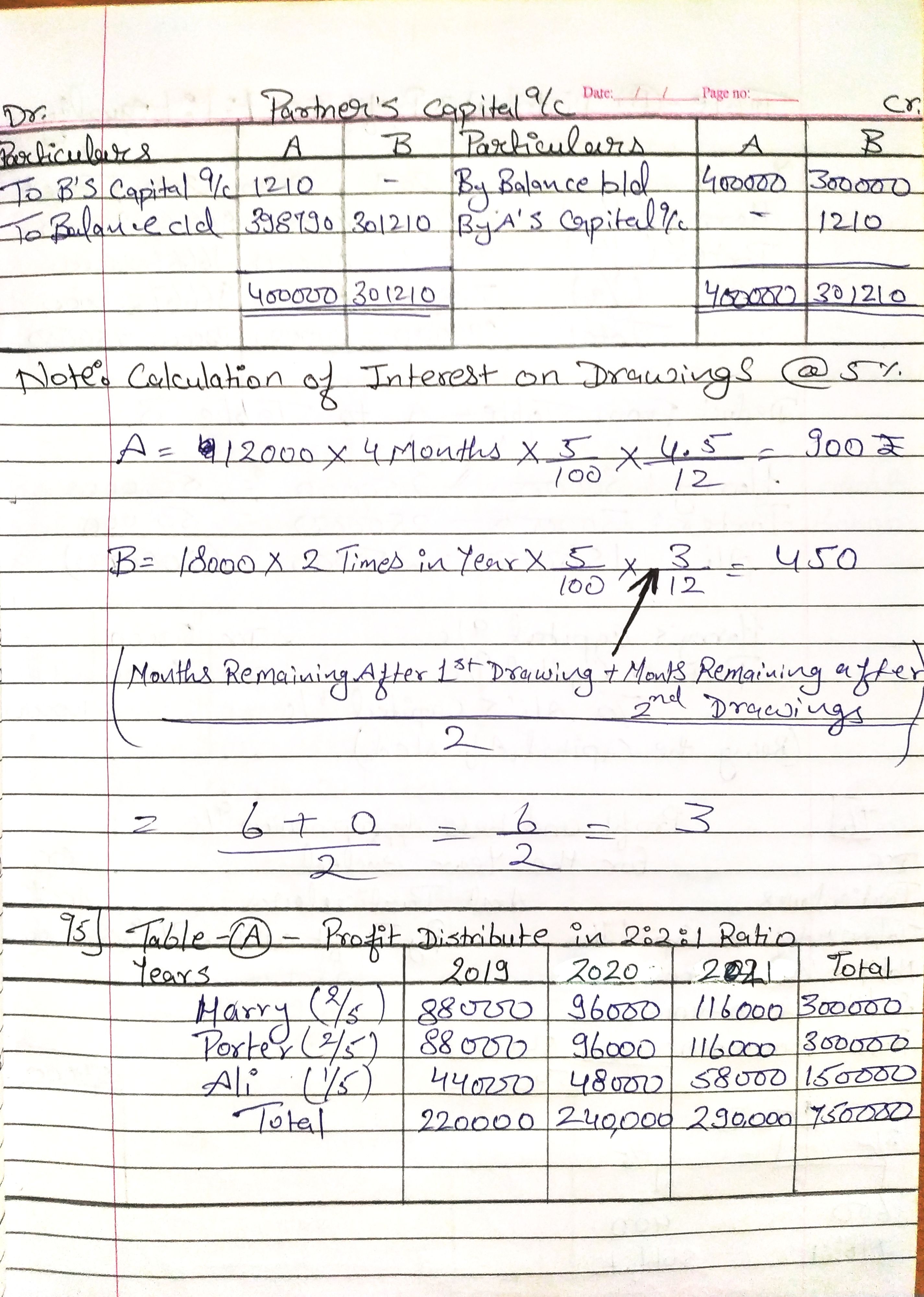

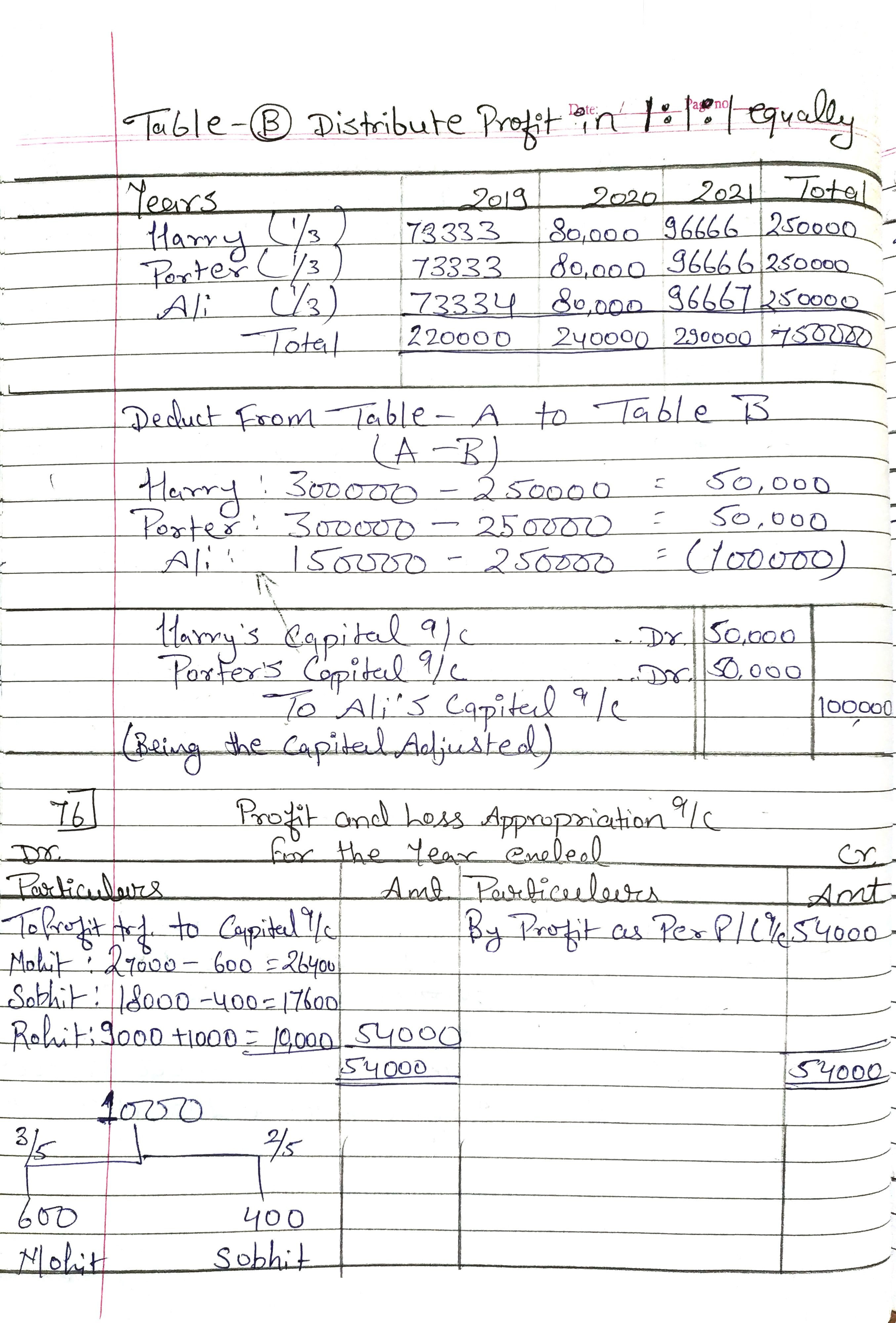

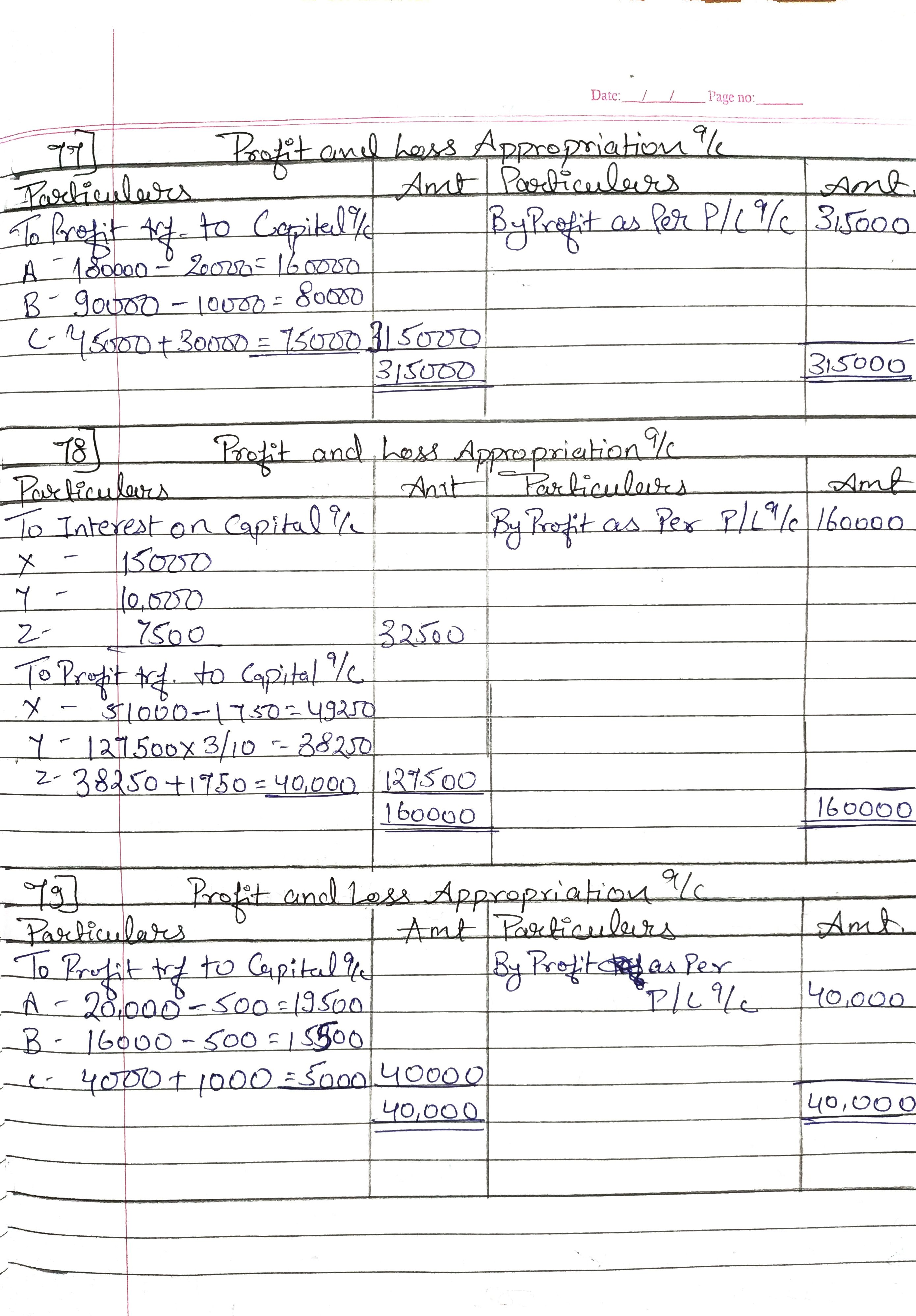

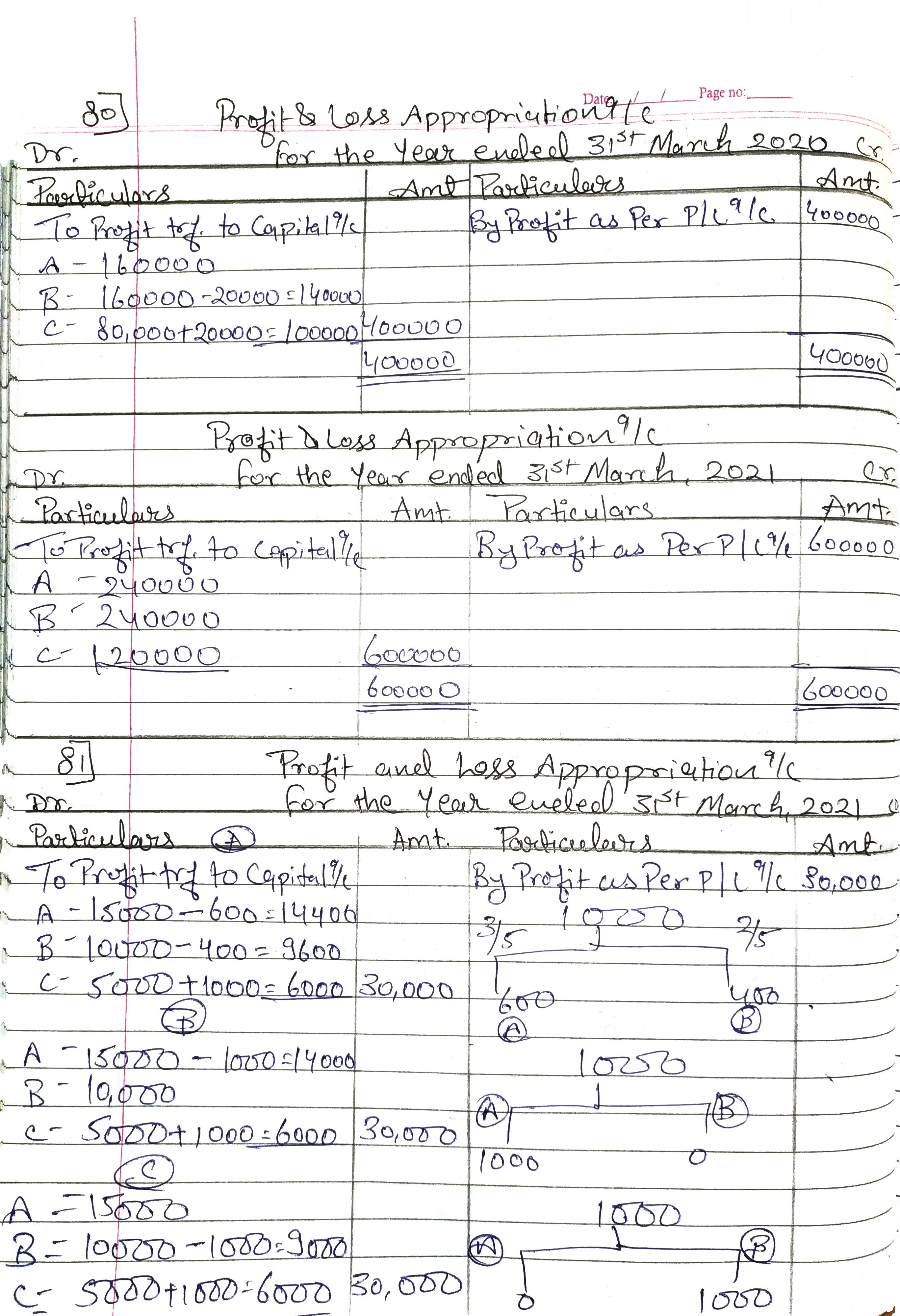

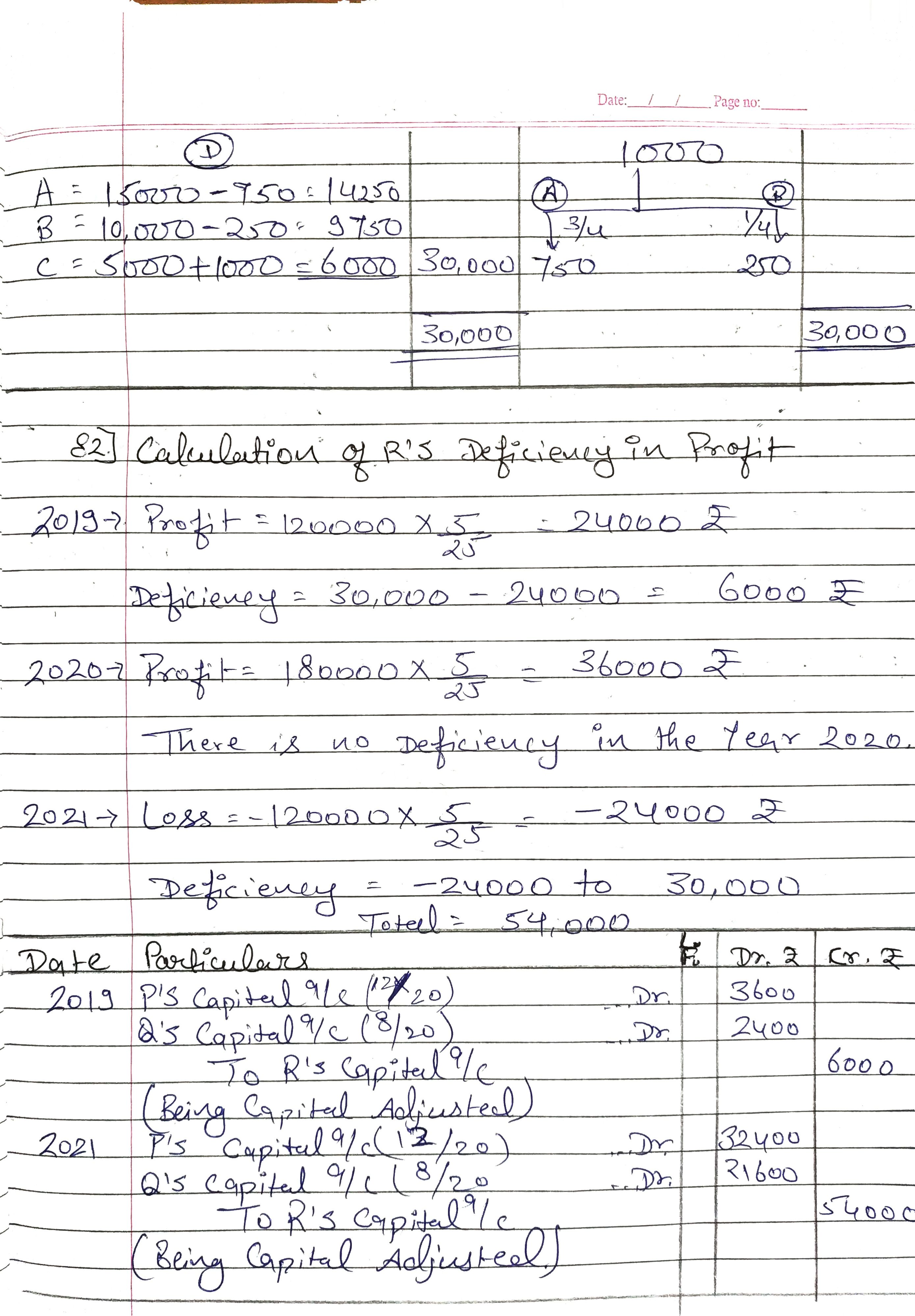

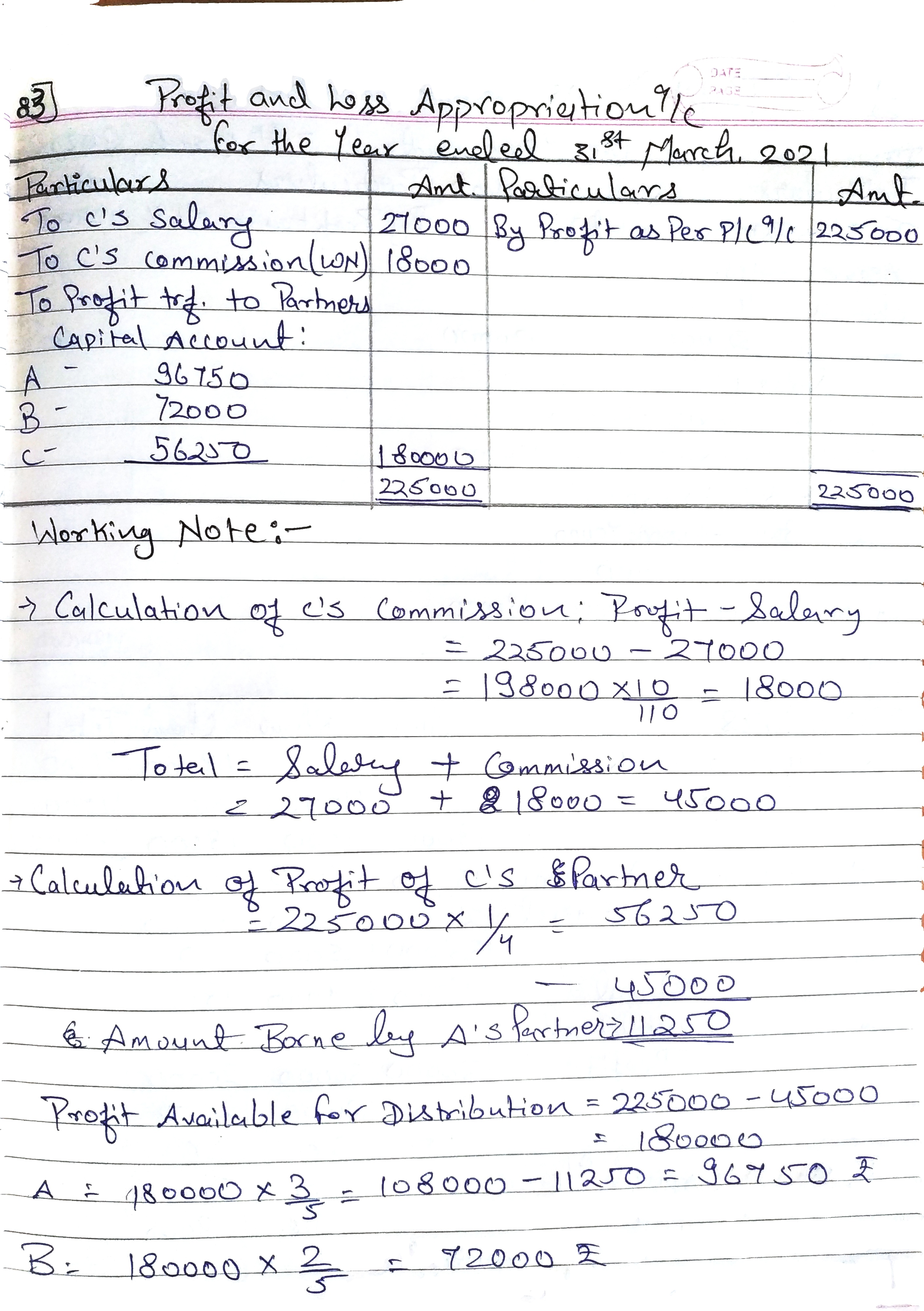

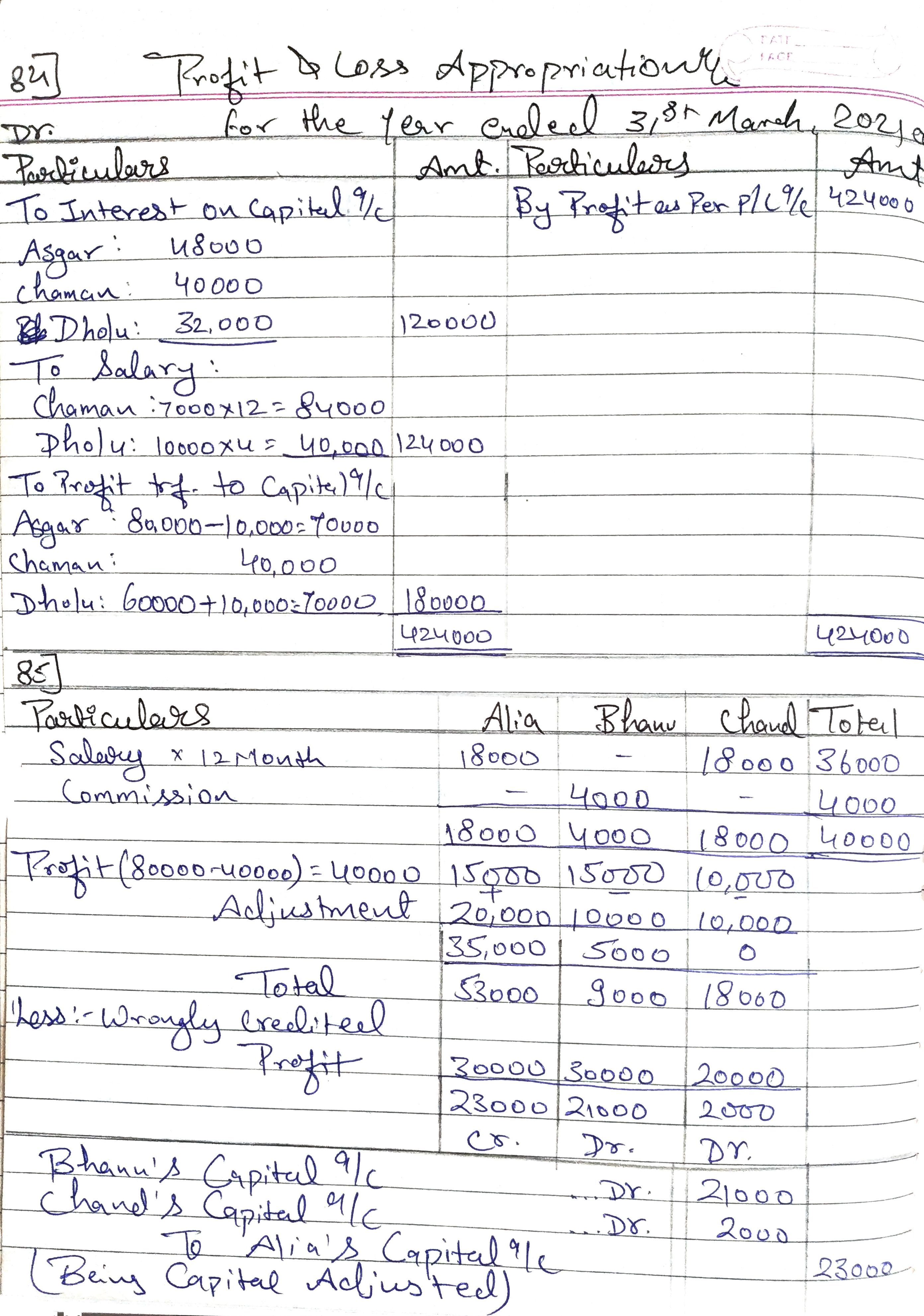

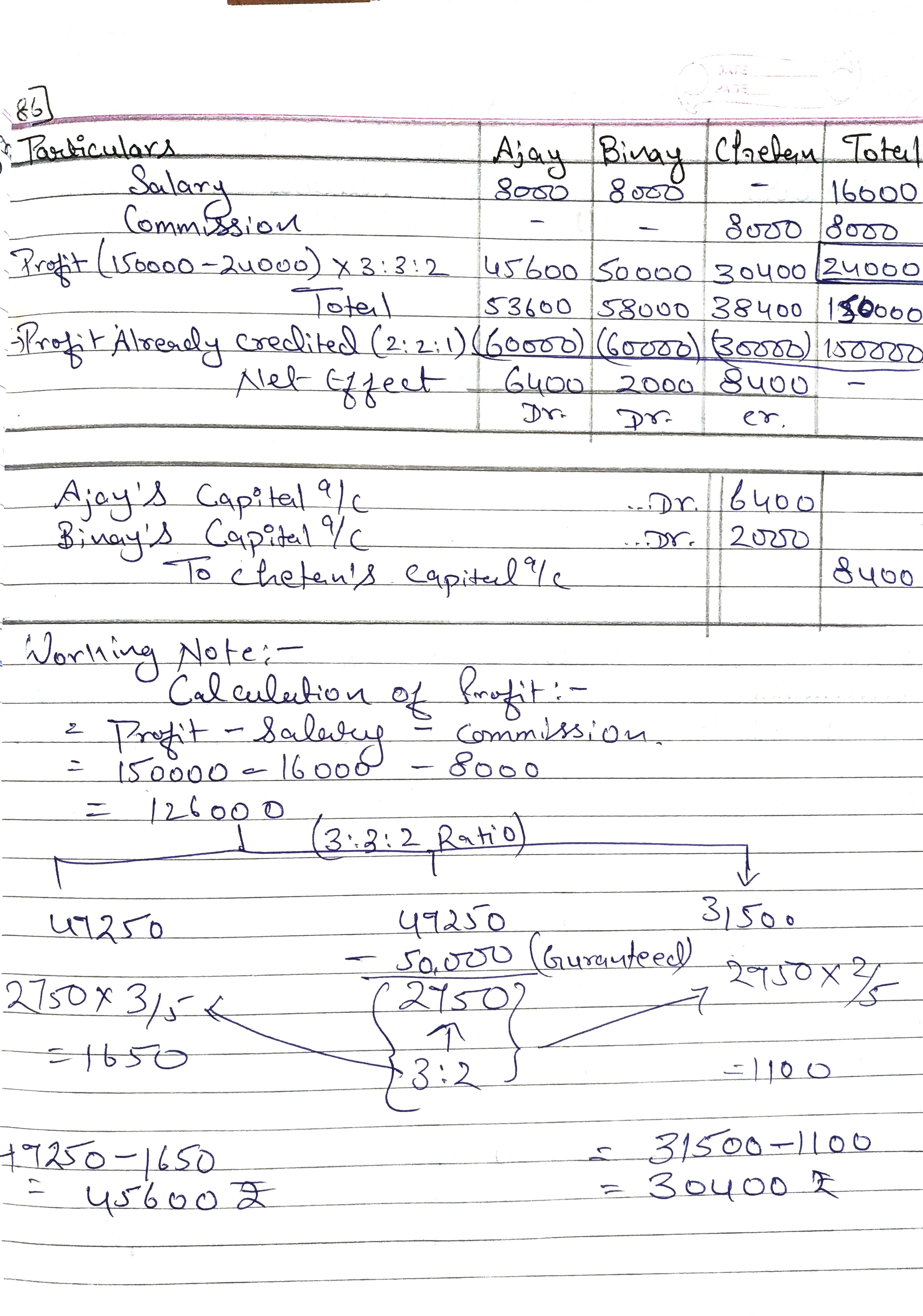

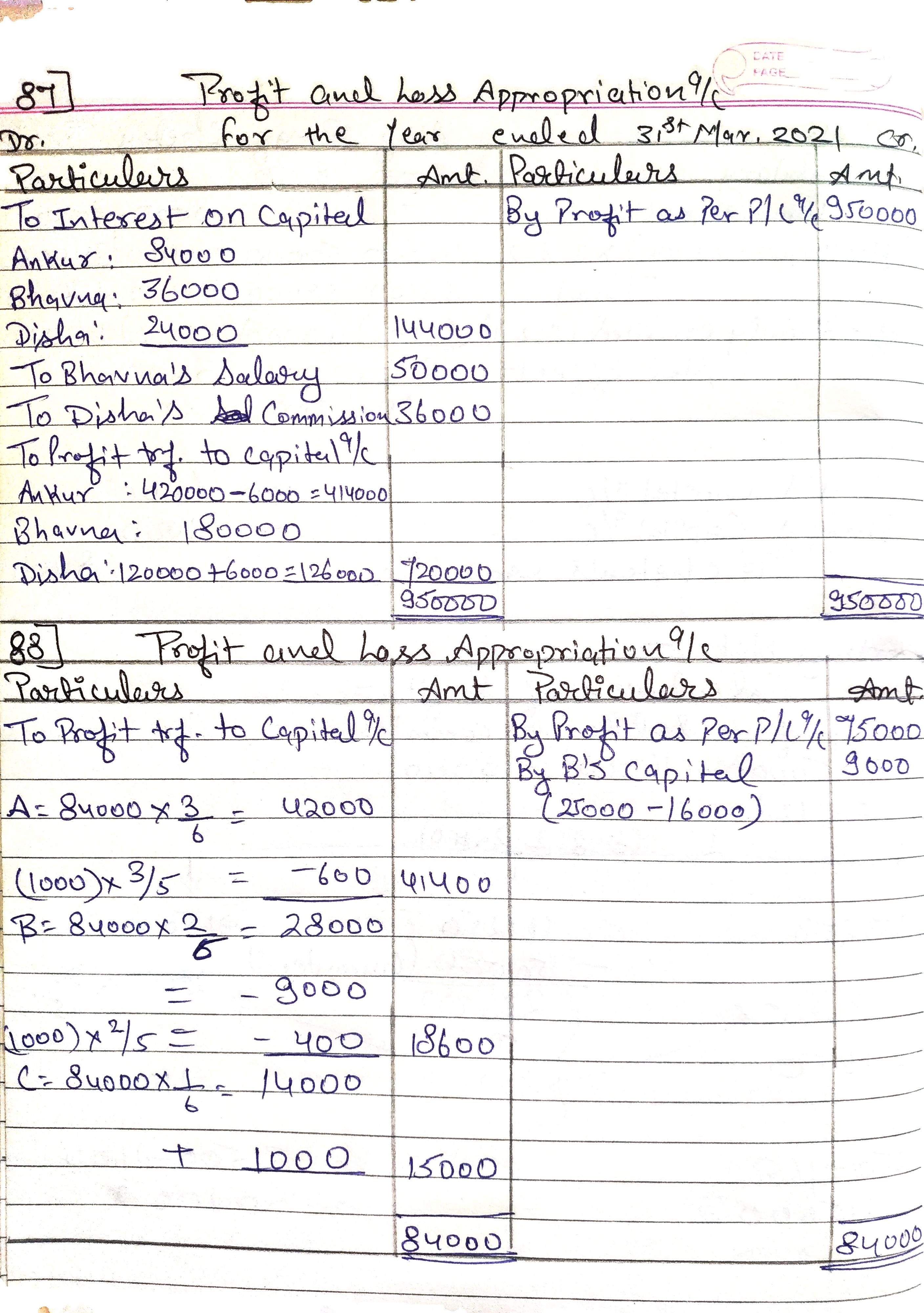

TS Grewal Double Entry Book Keeping Class 12 Solutions Volume1: Accounting for Partnership Firms

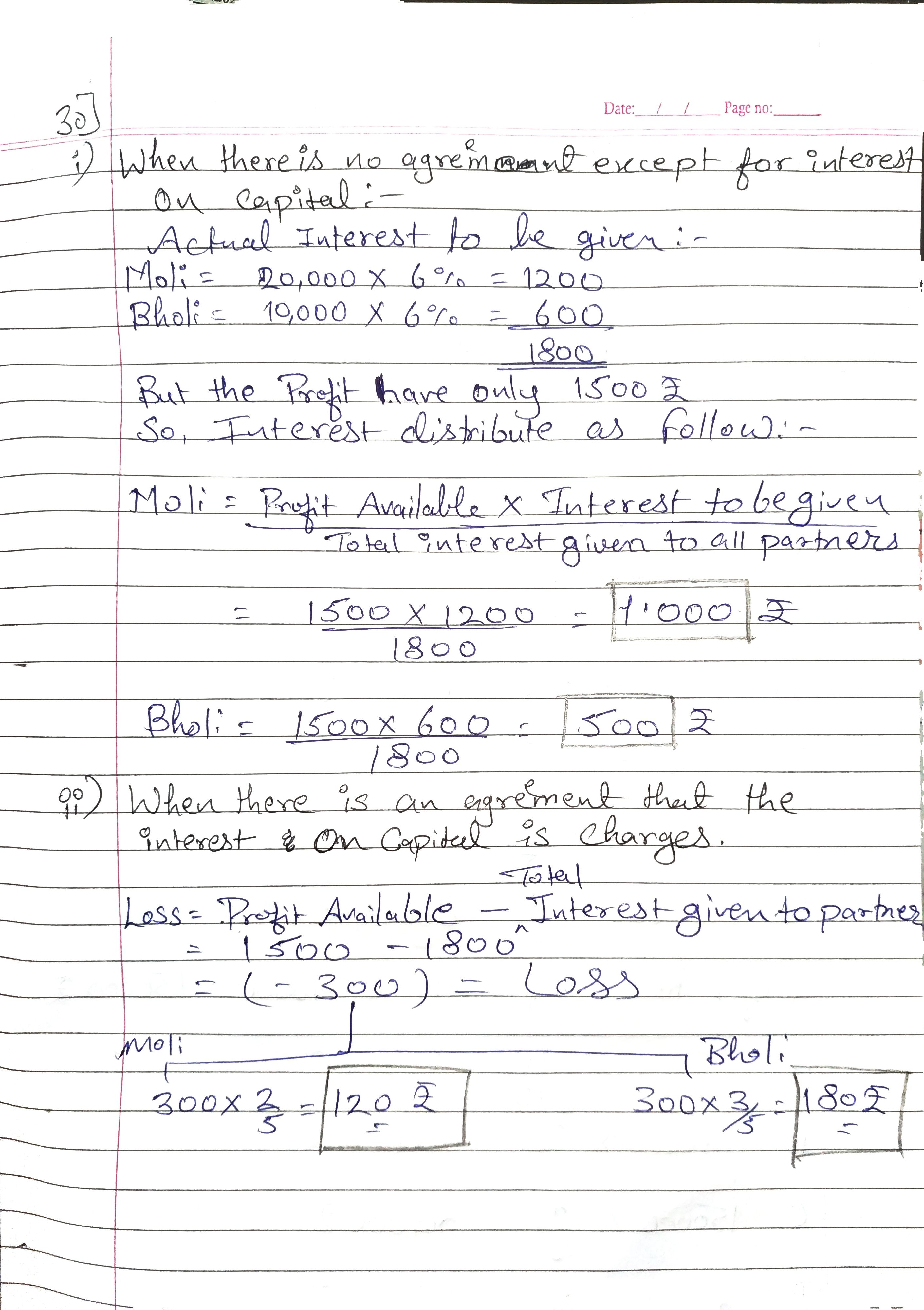

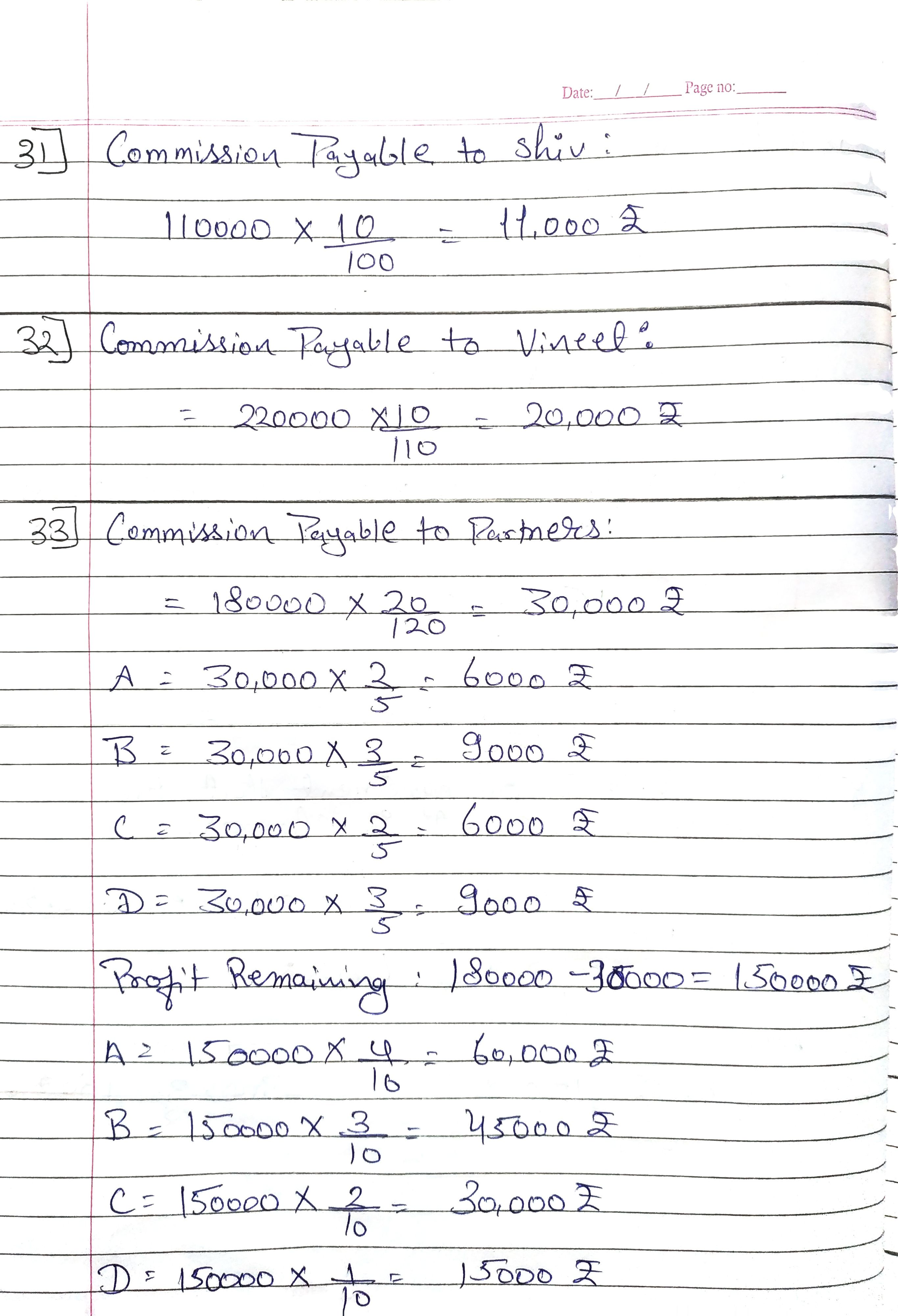

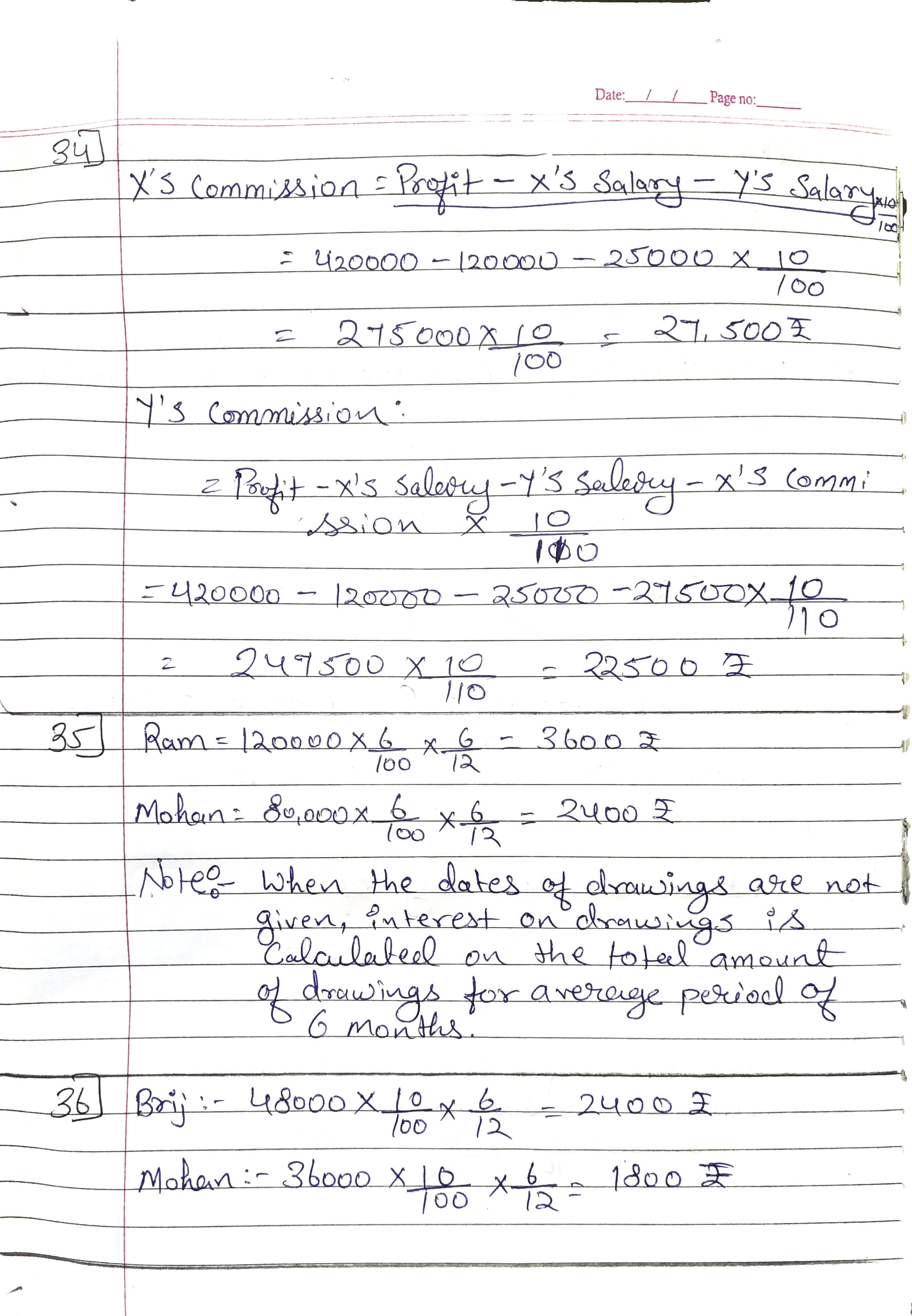

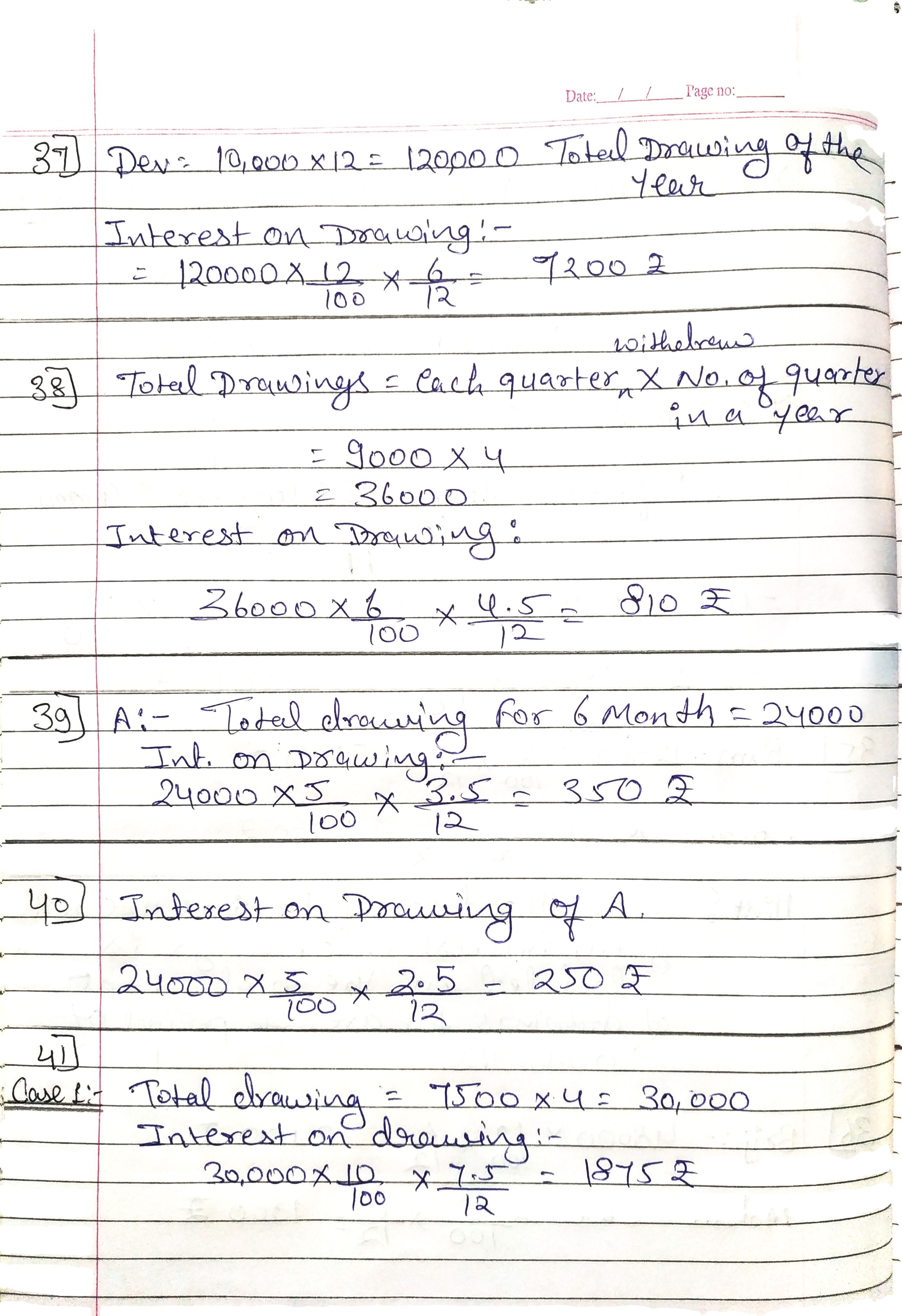

TS Grewal Accountancy Class 12 Solutions Chapter 2 Accounting for Partnership Firms – Fundamentals are part of TS Grewal Accountancy Class 12 Solutions.

Here we have given TS Grewal Accountancy Class 12 Solutions Chapter 2 Accounting for Partnership Firms – Fundamentals.

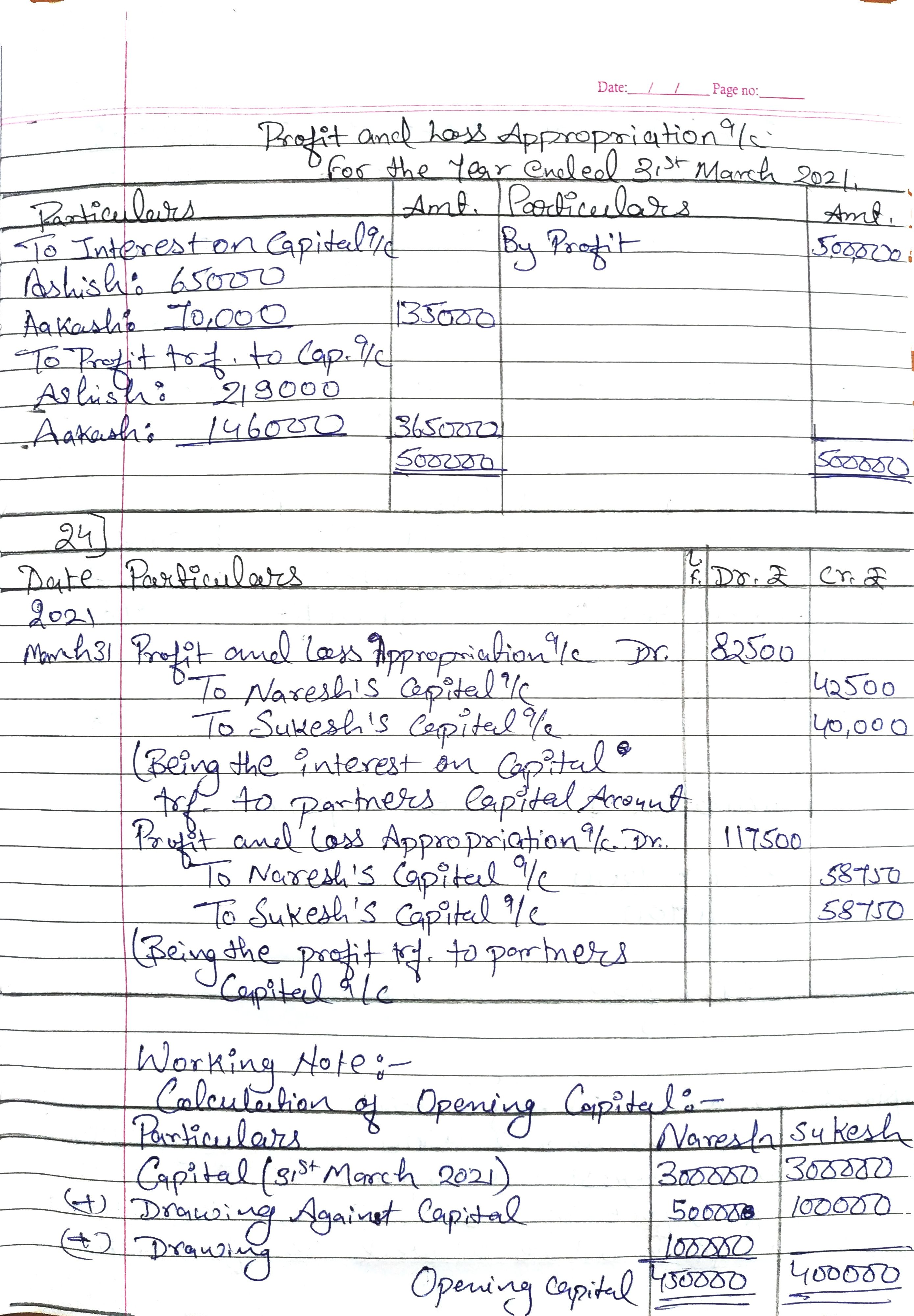

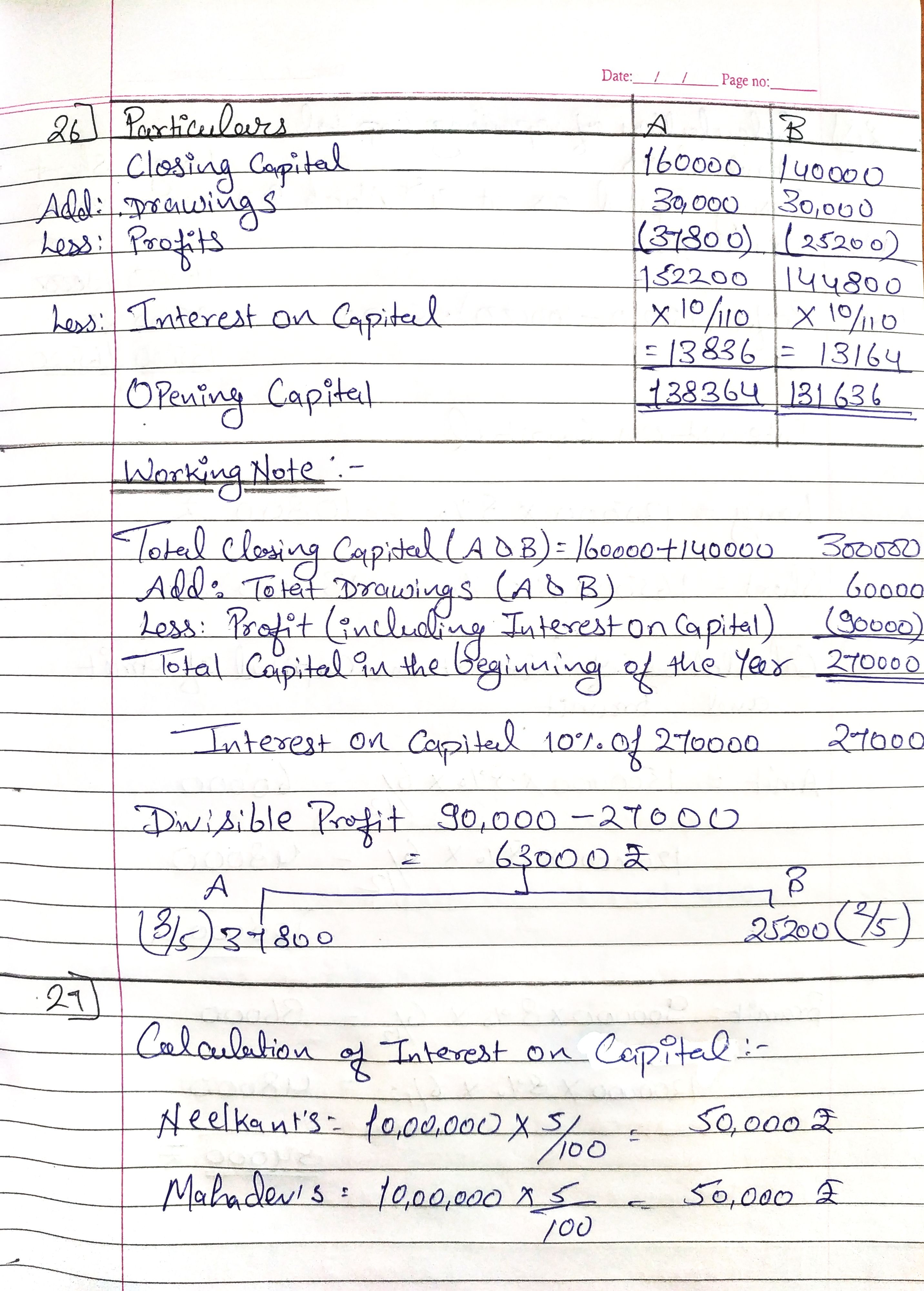

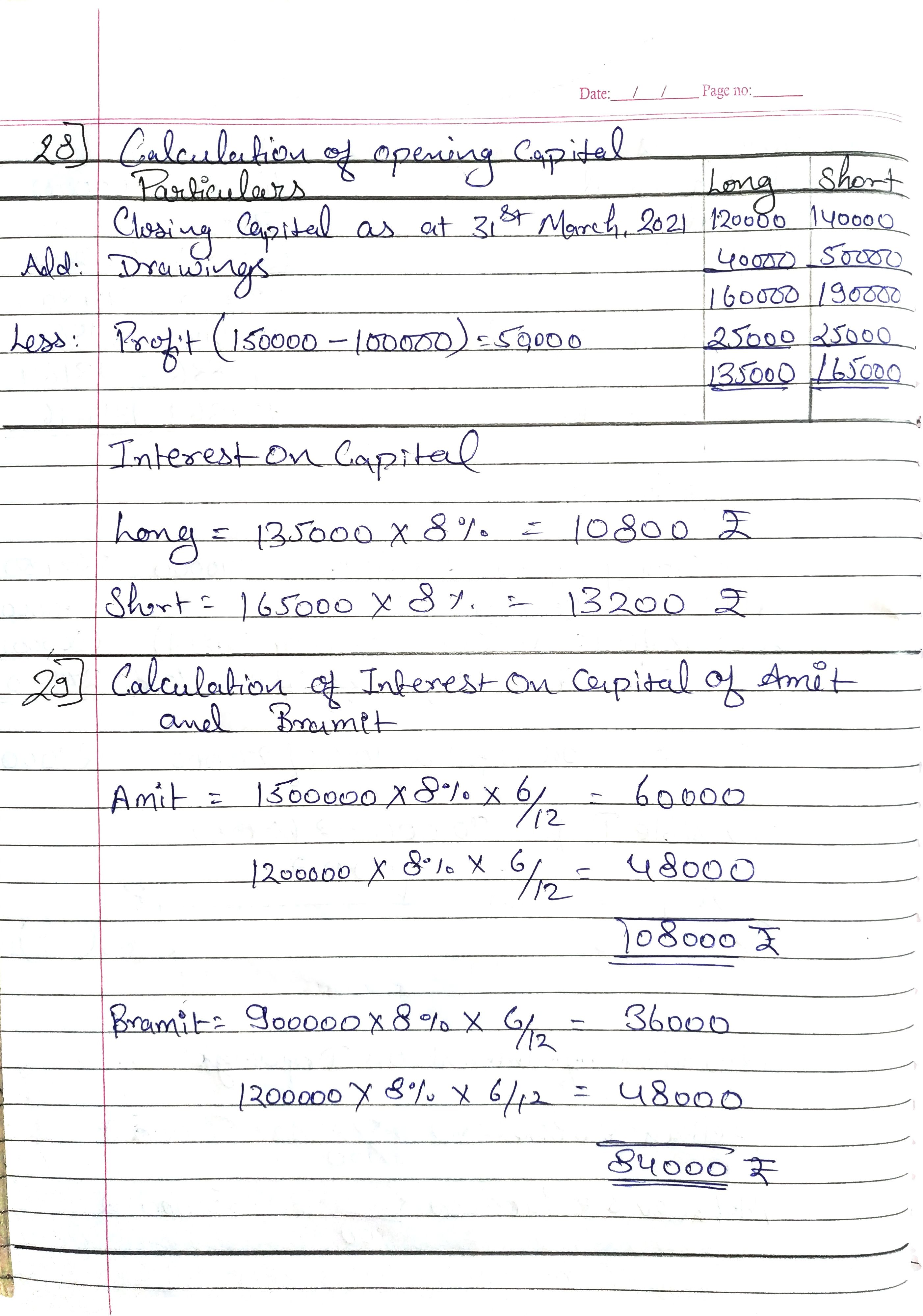

TS Grewal Accountancy Class 12 Solutions – Chapter 2th Accounting for Partnership Firms – Fundamentals Edition 2021

If not Loading Wait at least 10 Sec. or refresh page.

Questions:

ExternalLink_Question20of20Chapter20220-20Accounting20of20Partnership20Firms20-20FundamentalsAnswers:

IF YOU HAVE ANY QUERY

COMMENT

DOWN

BELOW

!!!

If you have any query comment down below. If you have any feedback regarding this page comment down below.

Thank u so much for penning down all the answers. Please post the answers of volume 2 and 3 of TS grewal 2021 edition as well.

Follow the main page where you can see the update of Chapter wise solutions.

page link: https://webcomm.in/ts-grewal-accountancy-solutions-12th-class/

Hlo sir, I want scanner of volume 1 ( edition 21-22 ) , please send in my email id please sir

NO, it is not possible to do that. Why you do not use this page for solutions?

Thnk u soo much sir

For giving us solutions

❤️❤️

It is my pleasure!

can you provide the pdf files for solutions

Check on telegram page to see instructions how to download all chapter’s solutions in pdf.

Sir in q. 25 the drawings against capital is added why?

Mention correct ques. no. which you arise problem

Sir i figured it out myself .

Thankyou

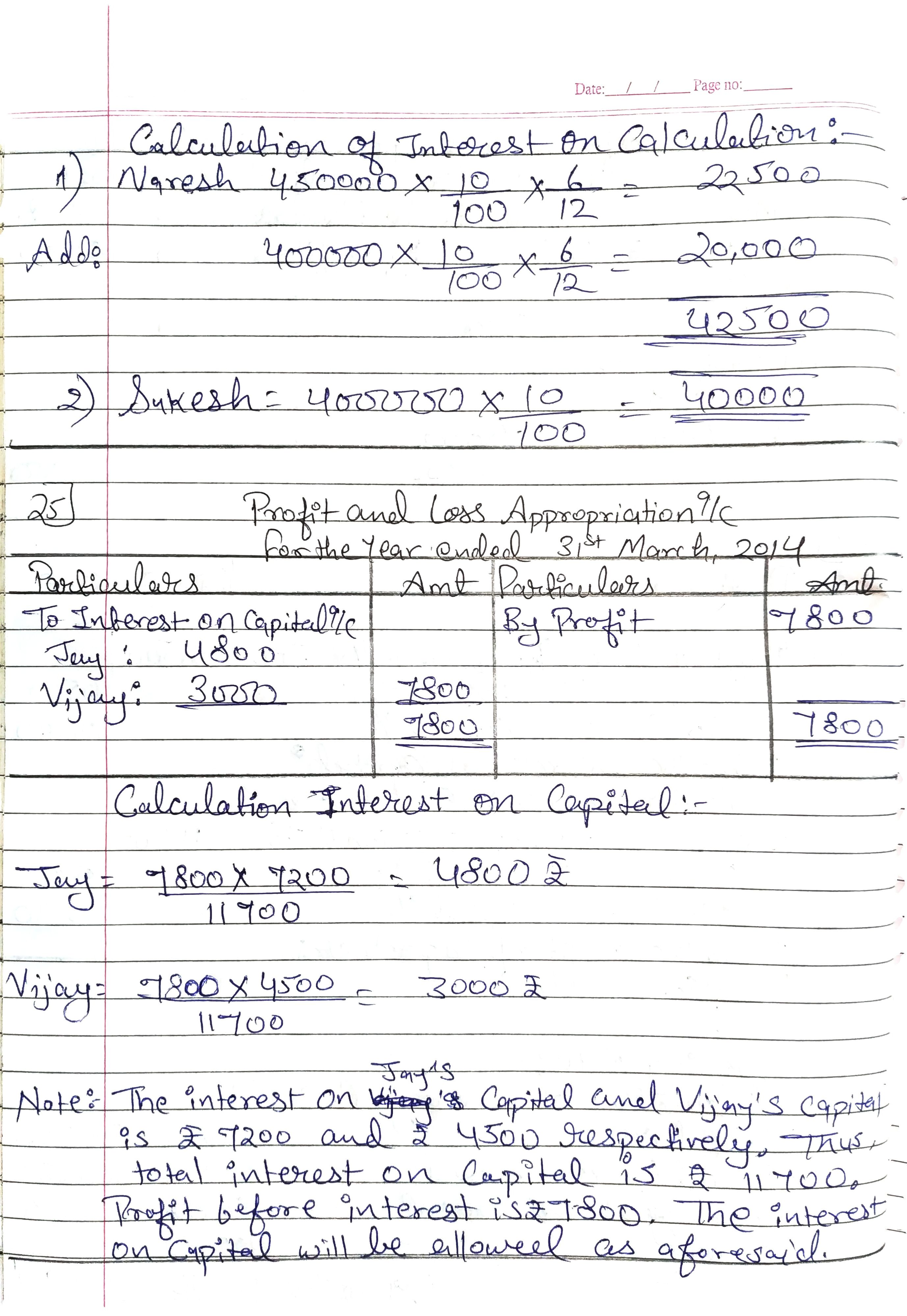

In question number 25 the interest on Capital is charged on opening capital