Here you can see Practical Problems of Journal and Ledger for improving your Practice and expertise in Journal and Ledger.

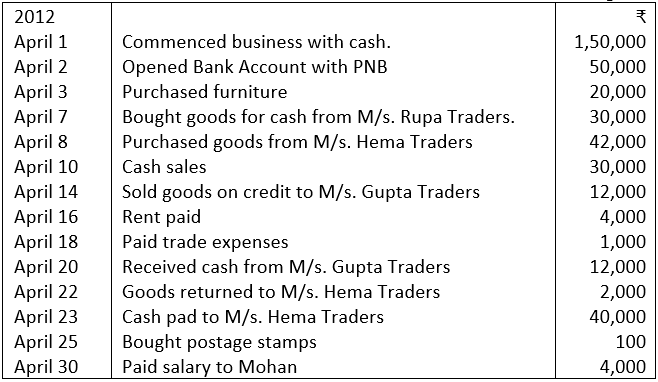

1. Journalise the following transactions:

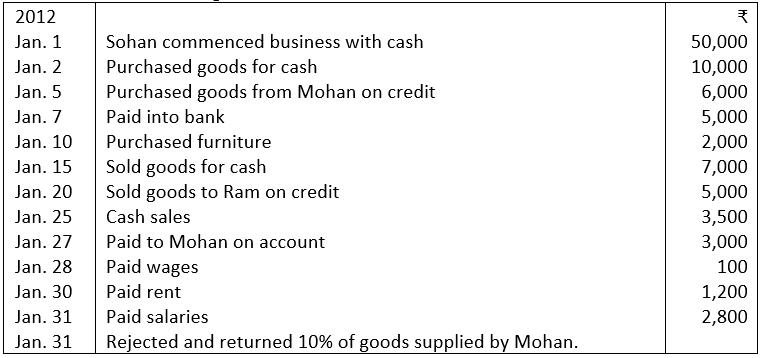

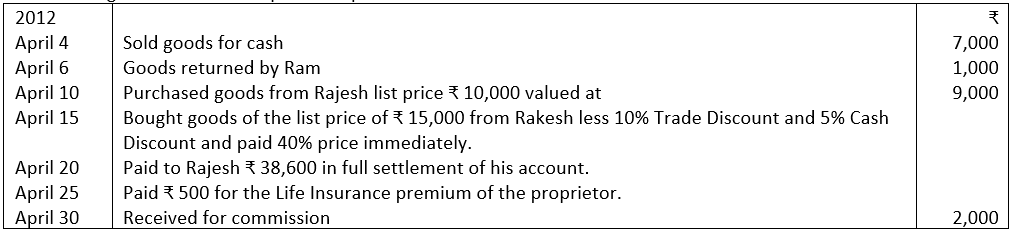

2. Journalise the following transactions in the books of Mr. Sohan:

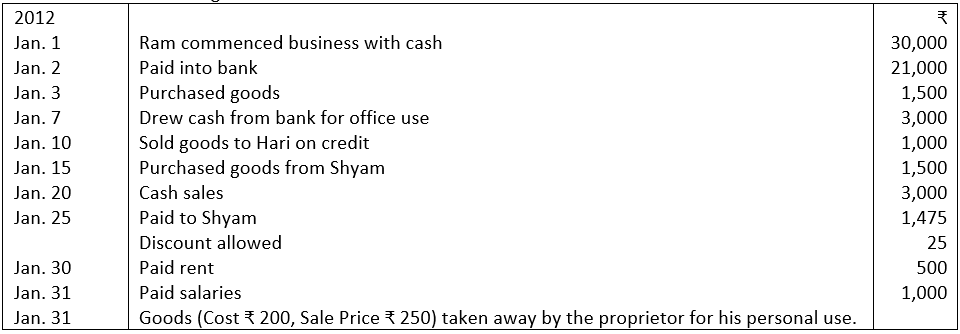

3. Journalise the following transactions:

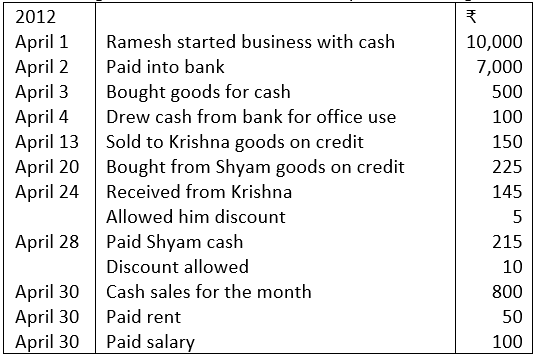

4. Following transactions of Ramesh for April, 2012 are given below. Journalise them:

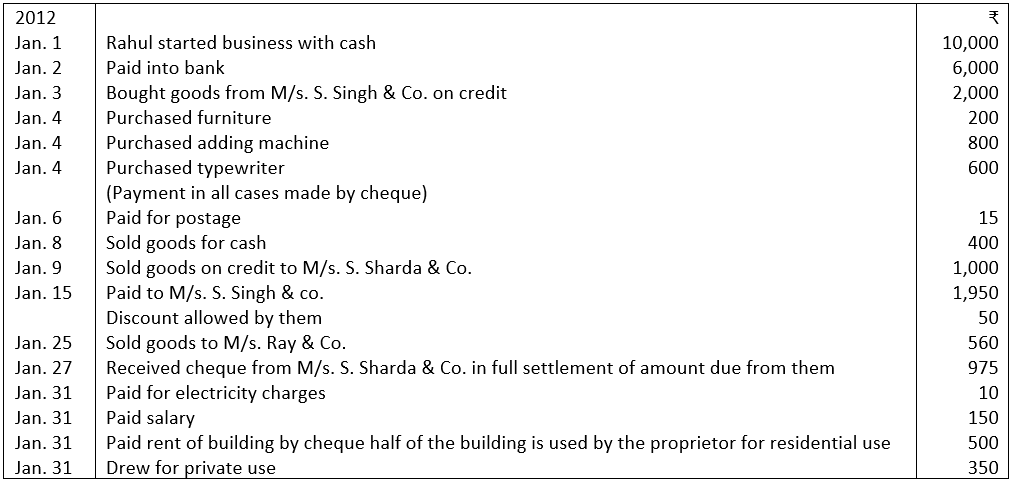

5. Journalise the following transactions of Mr. Rahul:

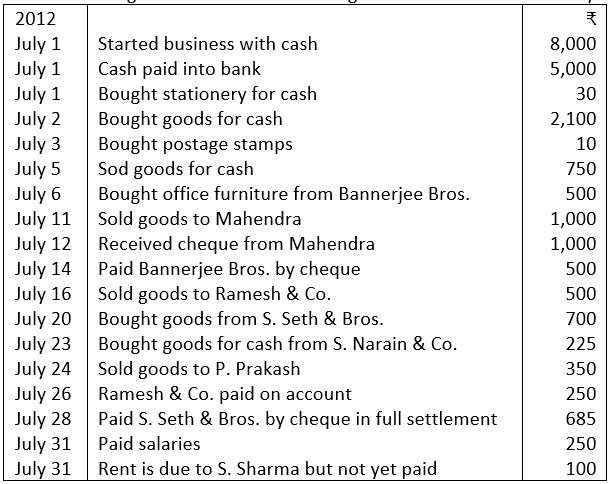

6. The following the transactions of R. Singh & co. for the month of July. You are required to journalise them:

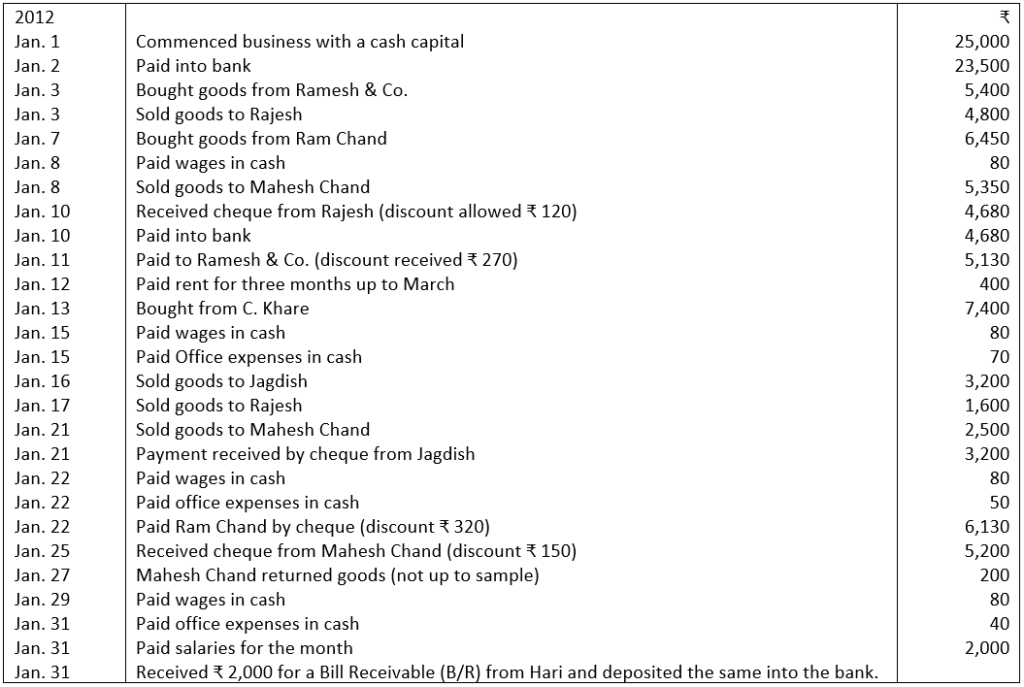

7. D. Chadha commenced business on 1st January, 2012. His transactions for the month are given below. Journalise them:

8. Enter the following transactions in the Journal of Suresh who trades in readymade garments:

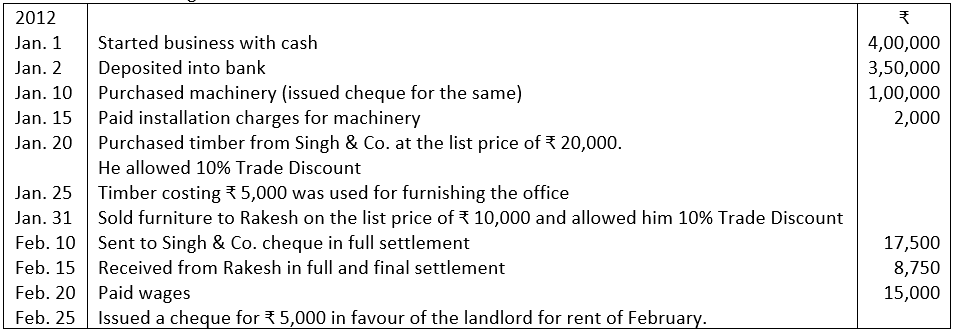

9. Record the following transactions in the Journal of Ashoka Furniture Traders:

10. Journalise the following transactions:

- (i) Paid ₹ 2,000 in cash as wages on installation of a machine.

- (ii) Sold goods to Manohar, list price ₹ 4,000, Trade Discount 10% and Cash Discount 5%. He paid the amount on the same day and availed the cash discount.

- (iii) Received an order from Shyam for supply of goods of the list price of ₹ 1,00,000 with an advance of 10% of list price.

- (iv) Received commission ₹ 5,000 half of which is in advance.

- (v) Rajani Kant is declared insolvent. A final compensation of 25 paise in the rupee in received from his estate out of ₹ 5,000.

- (vi) Cash embezzled by an employee ₹ 1,000.

11. Journalise the following:

- (i) Isha invested ₹ 2,00,000 in business.

- (ii) Opened a Current Account in bank ₹ 1,20,000.

- (iii) Purchased goods for ₹ 60,000 and paid ₹ 2,000 for carriage.

- (iv) Purchased goods for ₹ 1,00,000 from Rashmi.

12. Journalise the following transactions in the book of Akash.

- (i) Goods given as charity ₹ 5,000.

- (ii) Salary for the month is outstanding ₹ 2,000.

- (iii) Goods sold for a list price of ₹ 50,000; trade discount allowed 10%, cash discount allowed 10%.

13. Give Journal entries for the following transactions giving in each case the nature of account (whether personal, real or nominal), the rule applicable, and the point of view of business:

- (i) Ajit started business by investing cash ₹ 50,00,000. He bought goods of ₹ 4,00,000 and furniture of ₹ 5,00,000.

- (ii) Purchased building for ₹10,00,000

- (iii) Purchased goods for cash ₹3,00,000.

- (iv) Purchased goods on credit 25,000.

- (v) Paid cartage ₹ 2,000.

- (vi) Sold goods for cash ₹ 2,55,000.

- (vii) Sold goods for cash to Avtar ₹ 24,000.

- (viii) Sold goods to Mahendra on credit ₹ 46,500.

- (ix) Paid freight ₹ 1,200.

- (x) Deposited cash into bank ₹ 80,000.

- (xi) Paid salary ₹ 46,000.

- (xii) Withdrew from the bank ₹ 50,000 for office use.

- (xiii) Withdrew from the bank ₹ 30,000 for private use.

- (xiv) Charged interest on capital ₹ 1,25,000.

- (xv) Mahendra became insolvent. Only ₹ 30,000 could be realised from him.

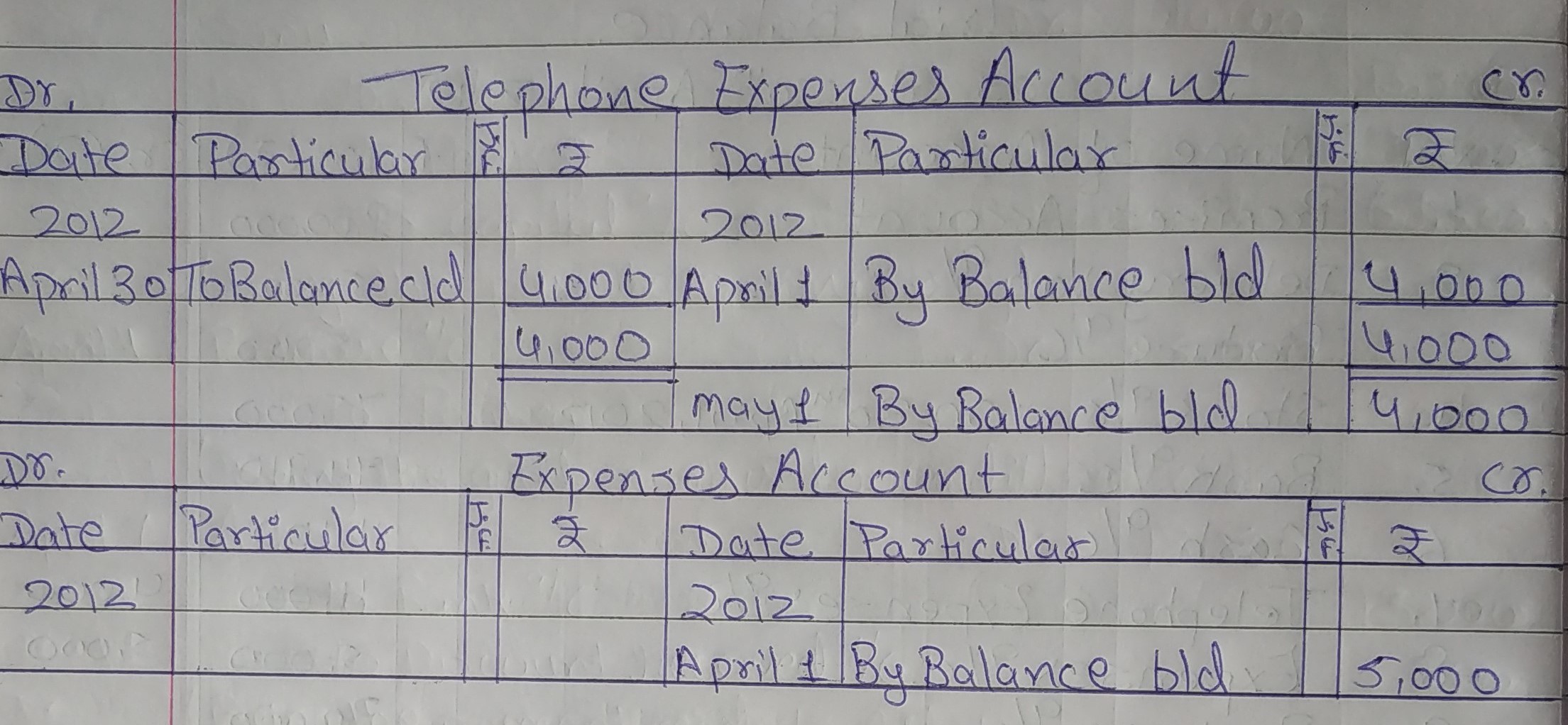

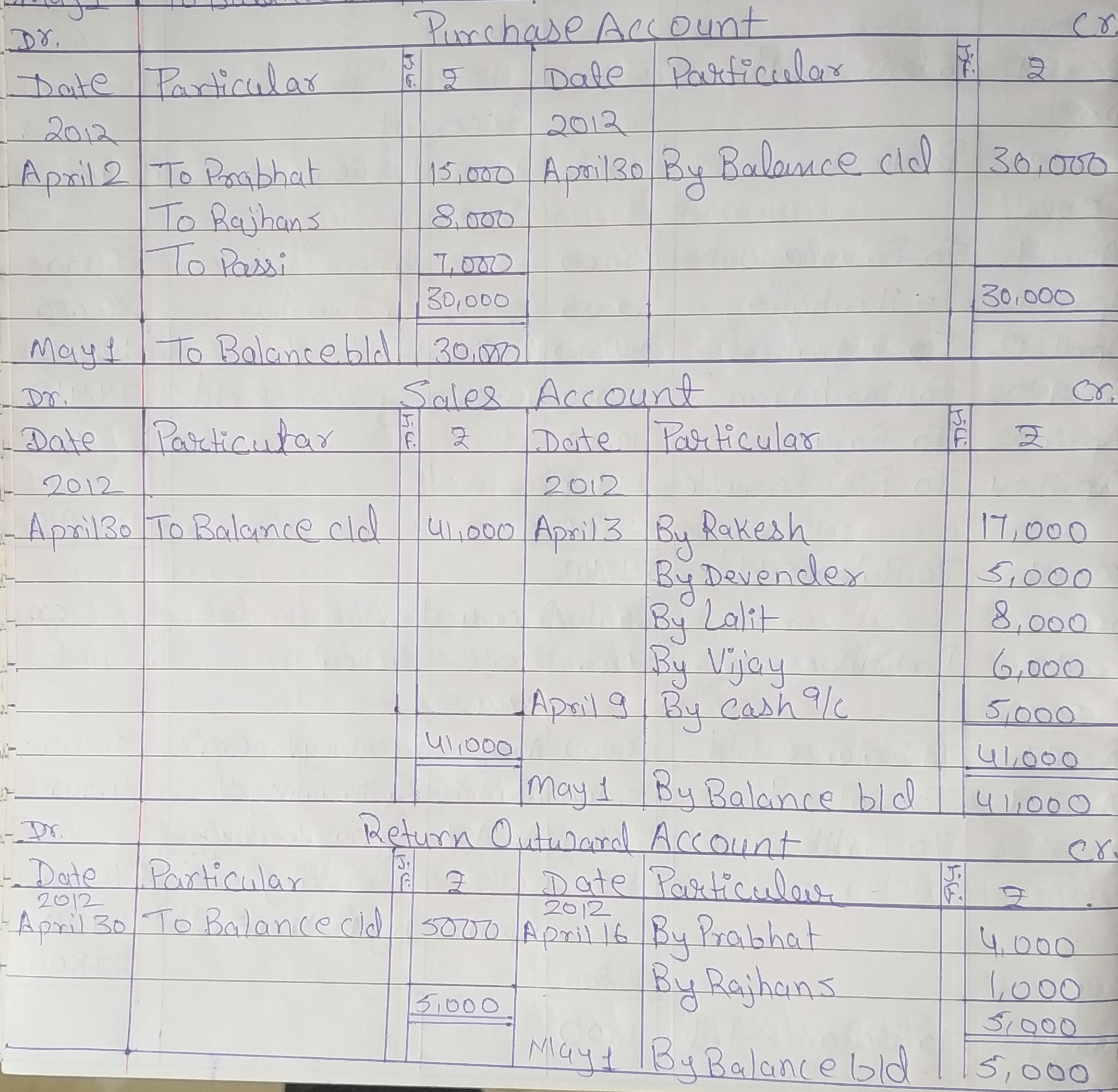

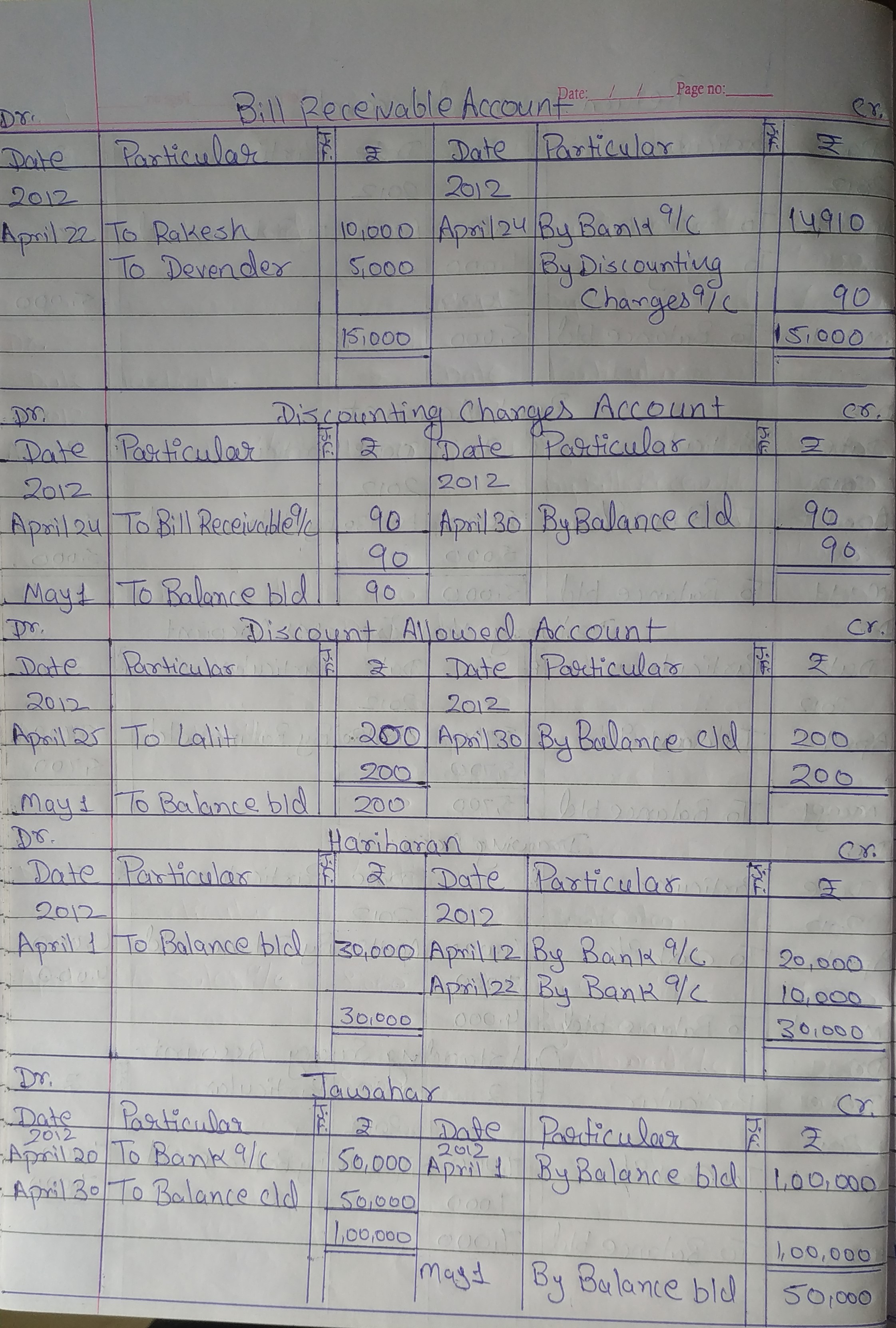

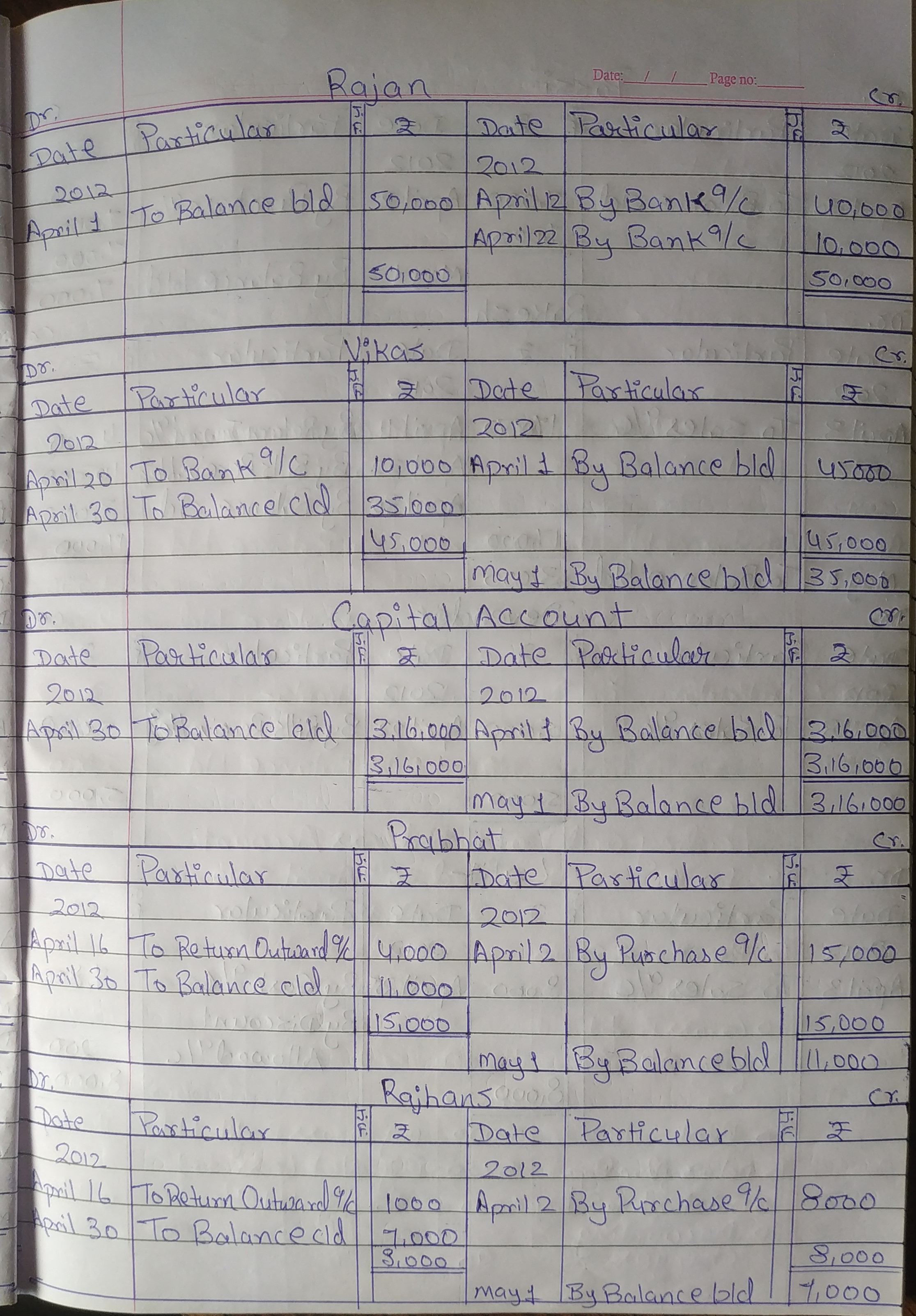

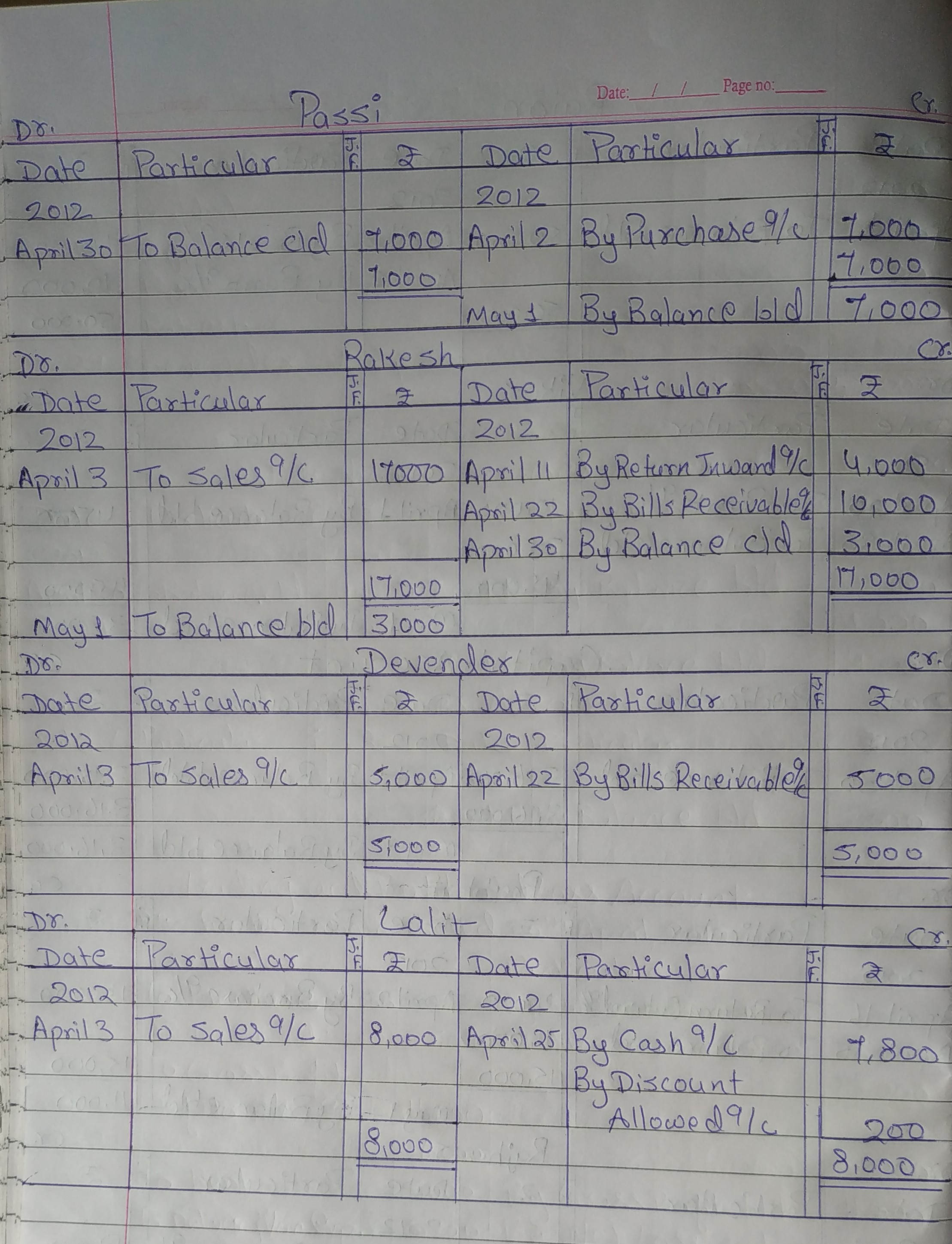

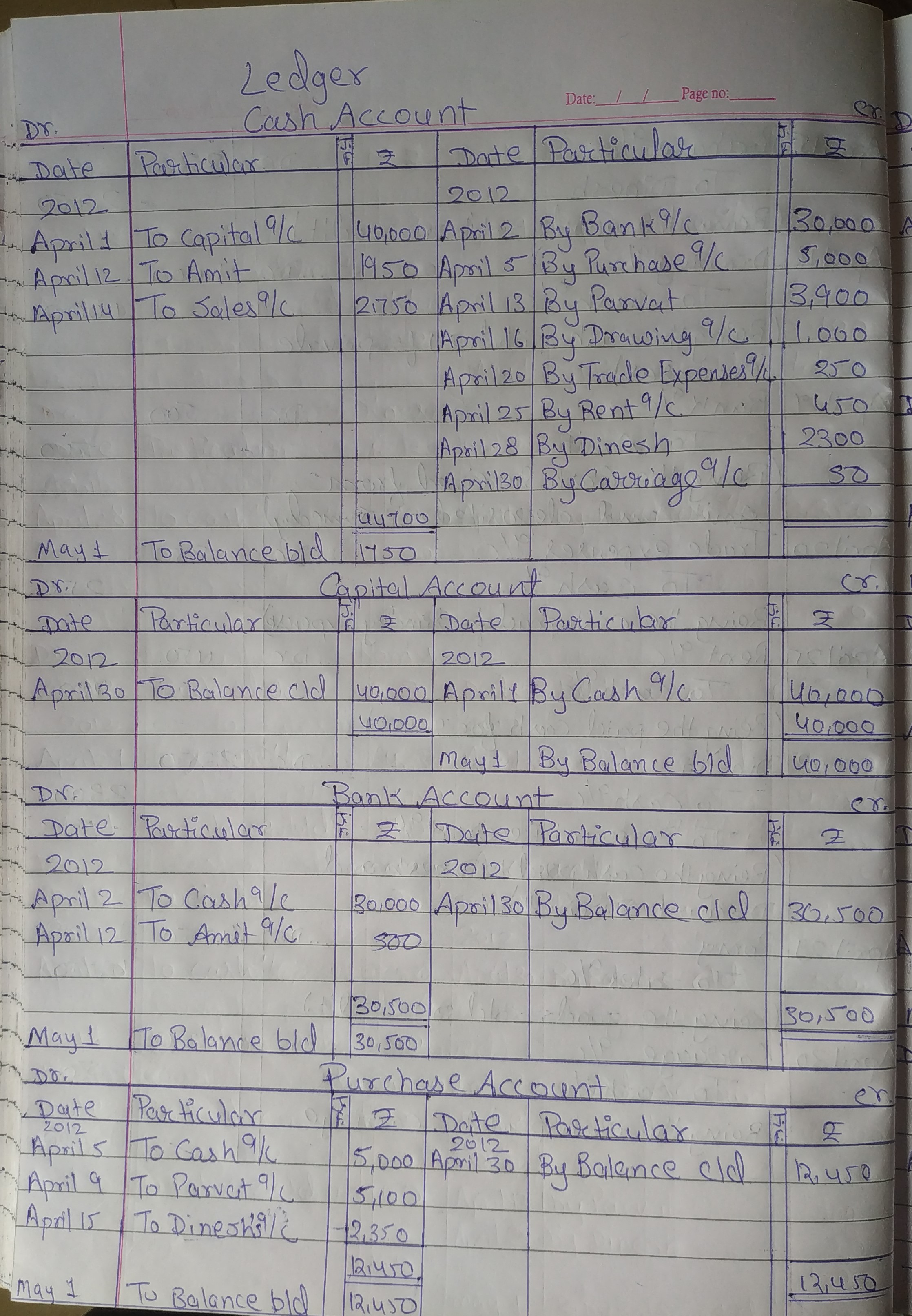

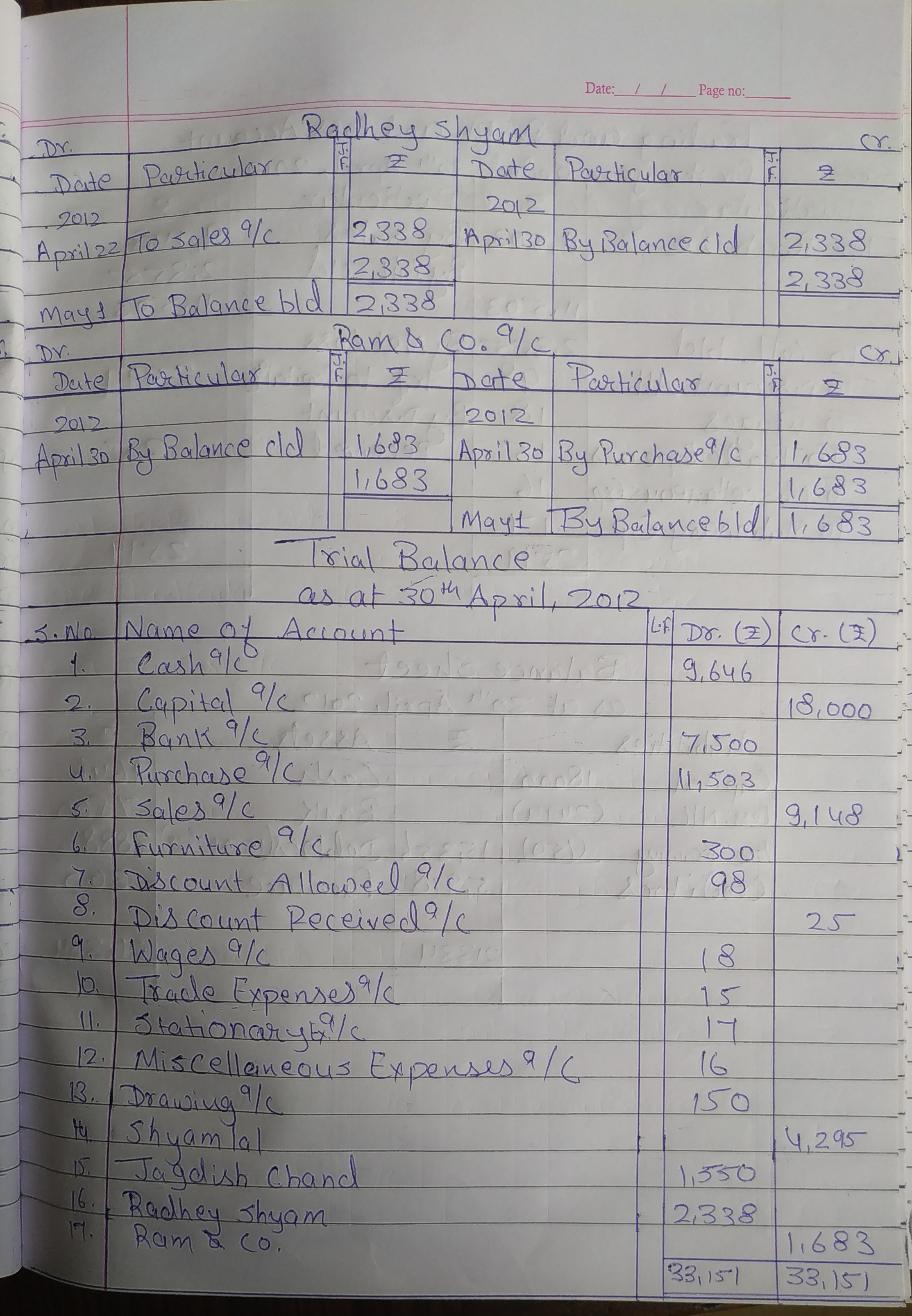

Ledger and Trial Balance

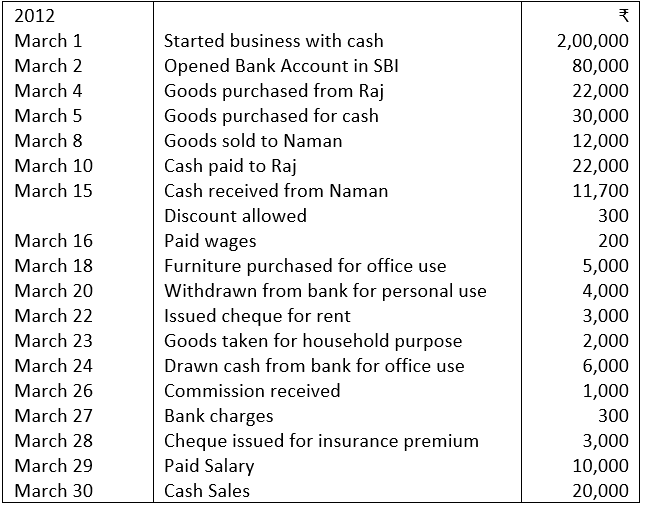

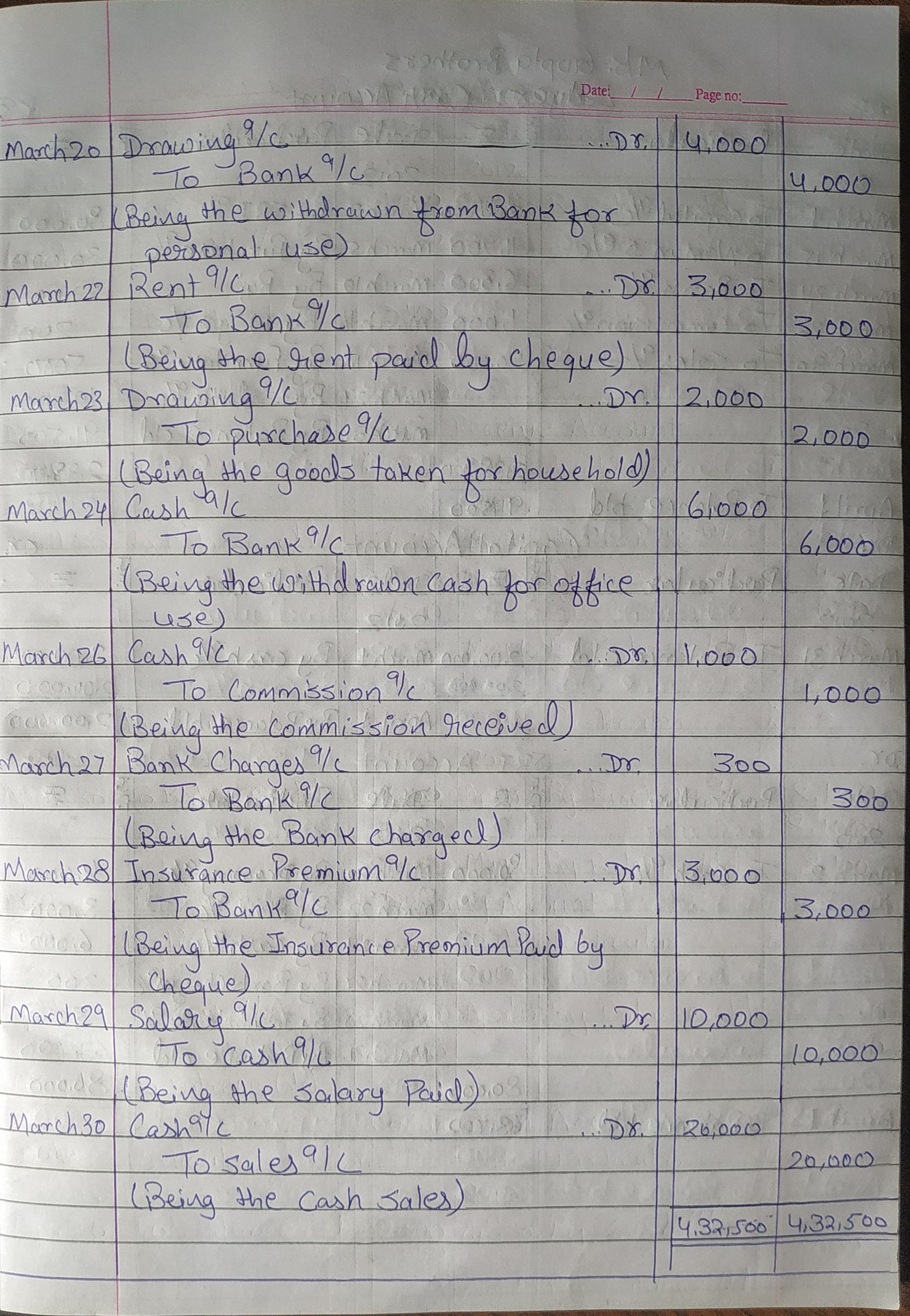

14. Pass the Journal entries of M/S. Bhanu Traders. Post them to the Ledger from the following transactions:

15. The following balances appeared in the books of Ashok on 1st April, 2012:

Assets: Cash ₹ 50,000; Stock ₹ 30,000; Debtors ₹ 50,000; Machinery ₹ 60,000.

Liabilities: Creditors—Rajesh ₹ 30,000.

The following transactions took place in April 2012:

Pass the Journal entries for the above transactions and post them into the Ledger and balance the Leader accounts.

[Hint: Capital = Assets — Liabilities = ₹ 1,60,000]

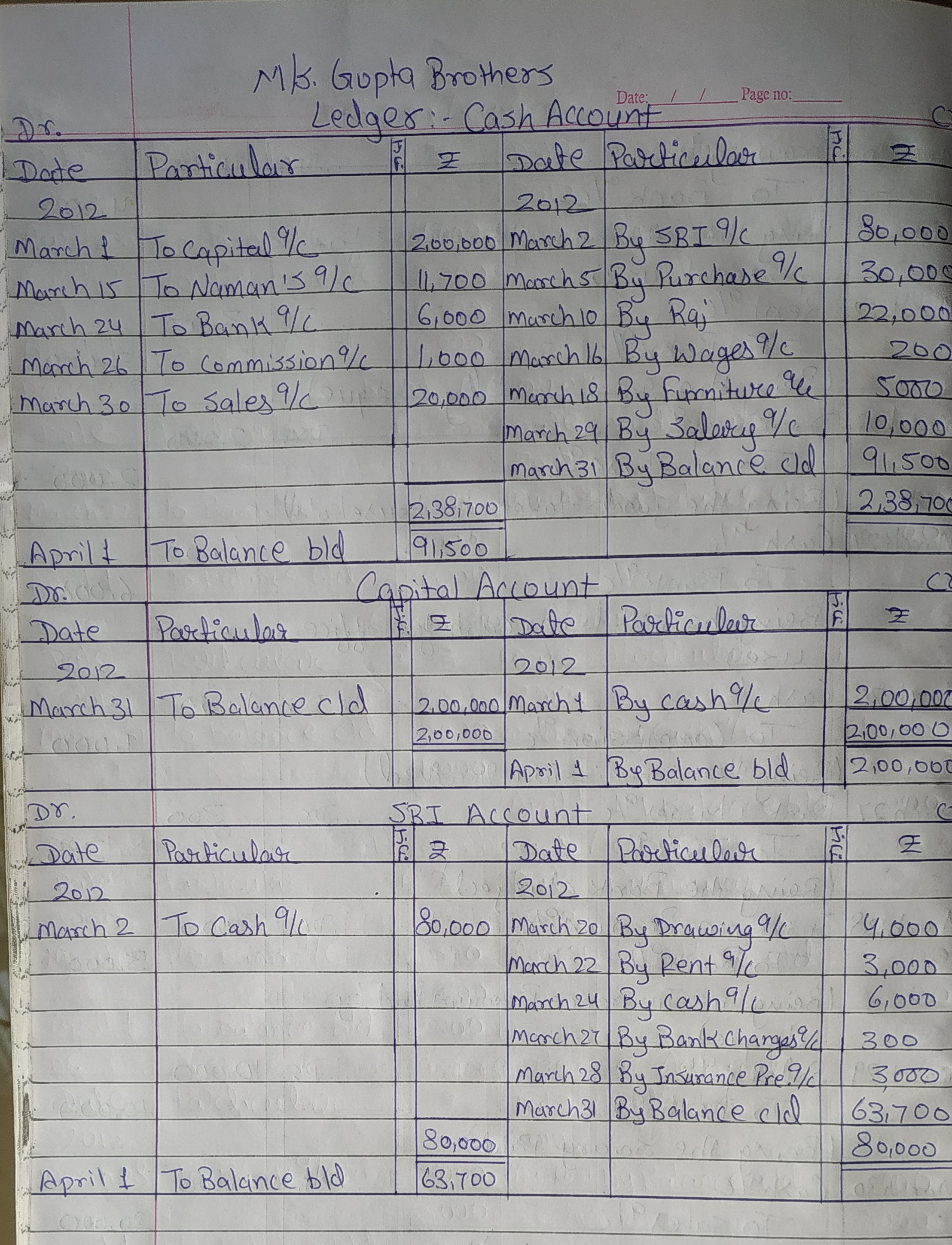

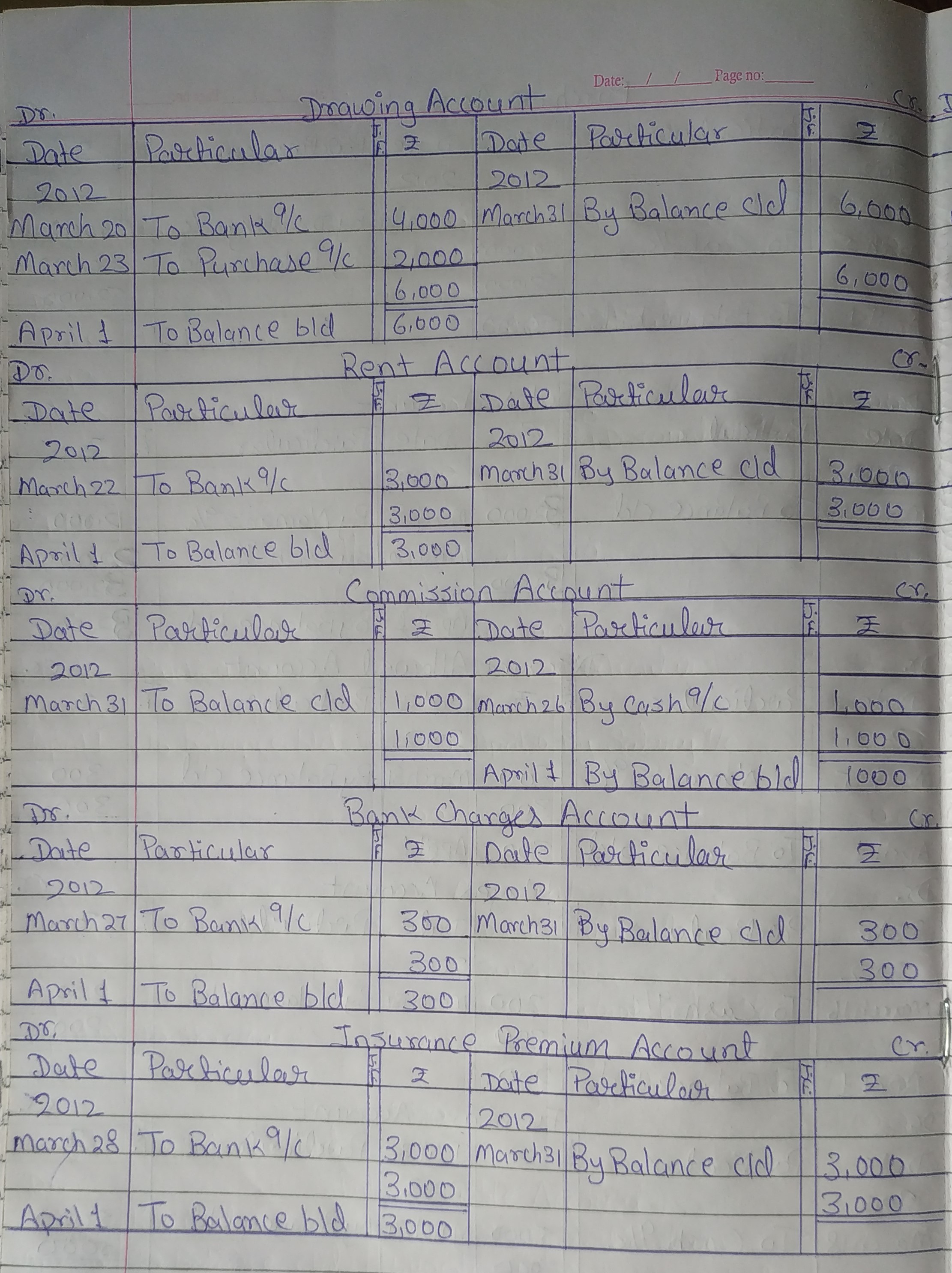

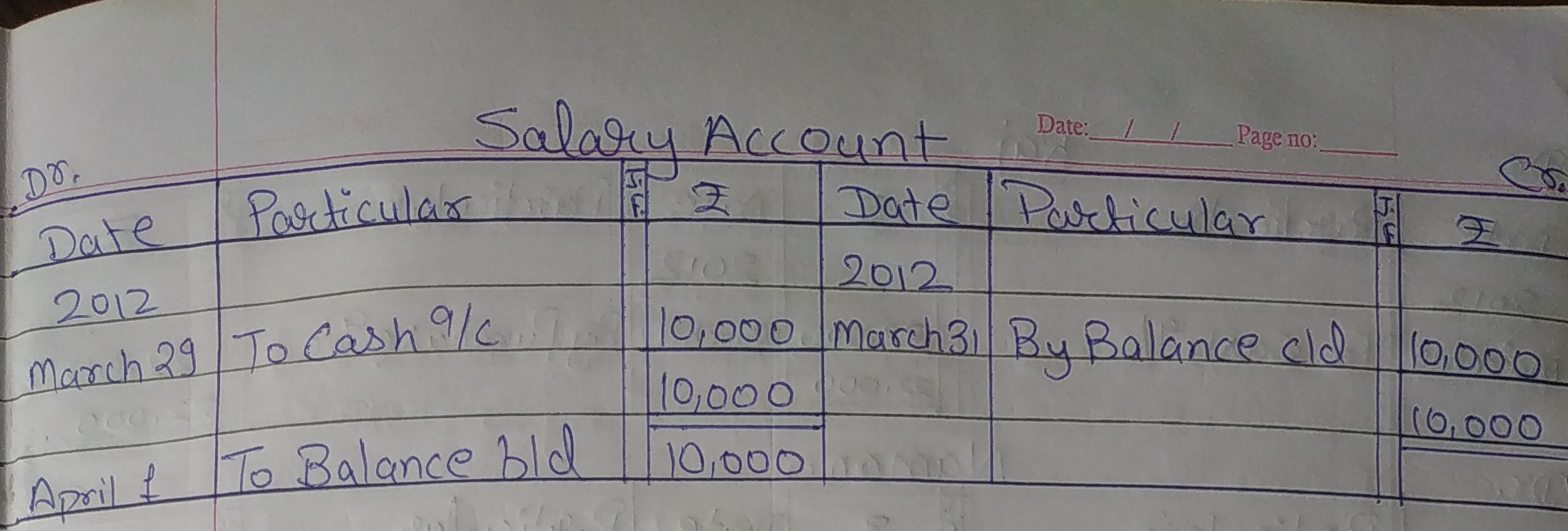

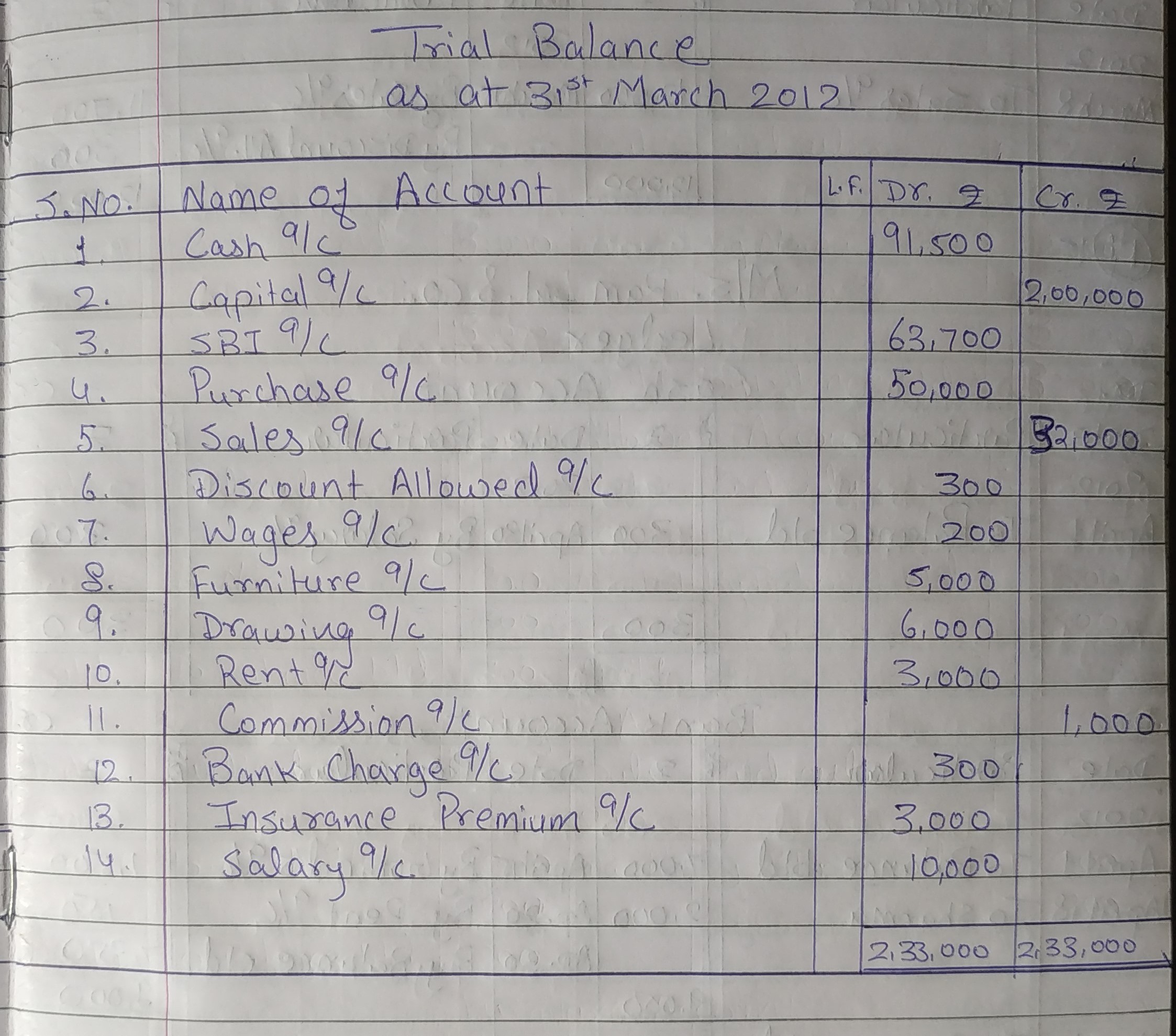

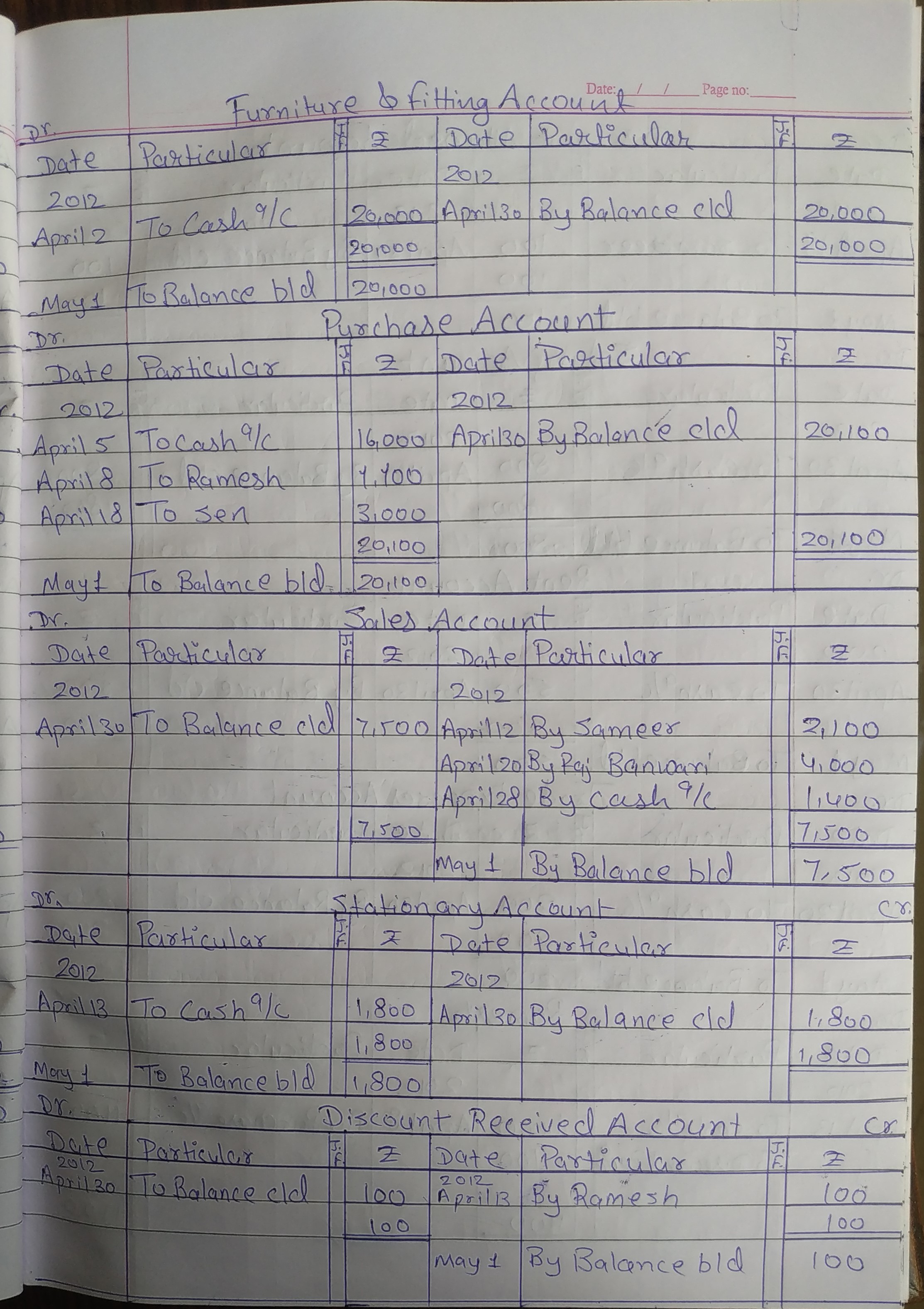

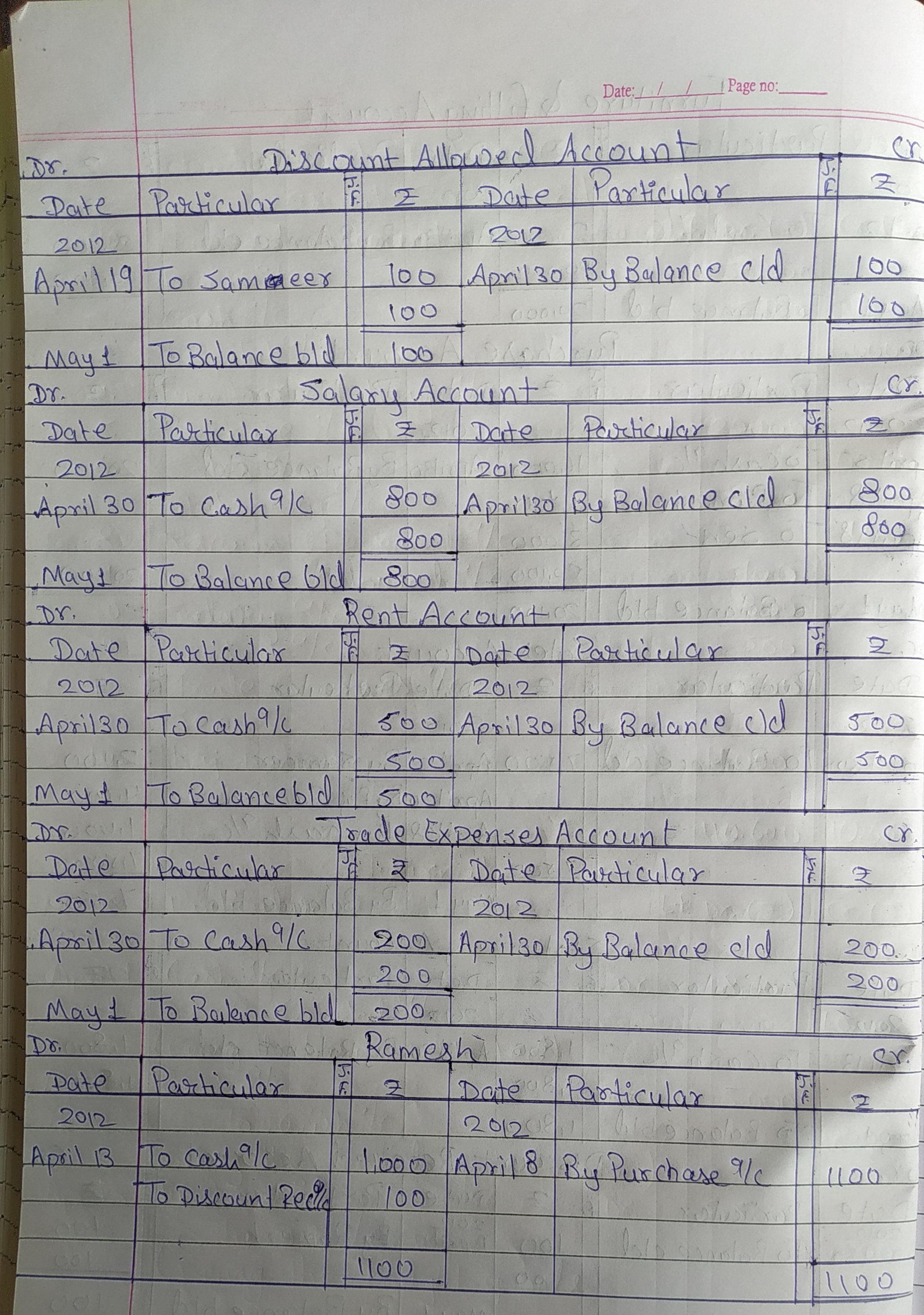

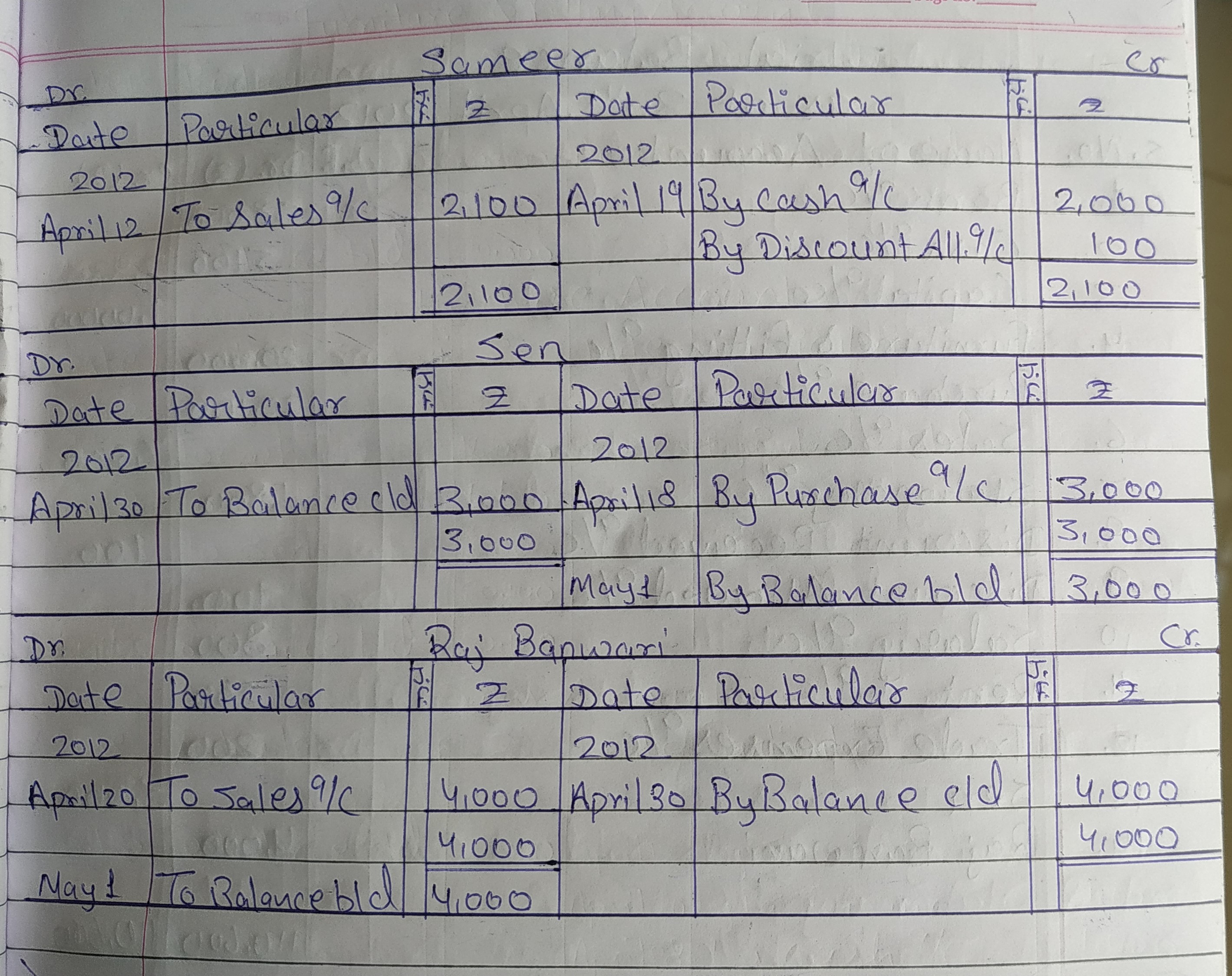

16. Journalise the following transactions in the Journal of M/s. Gupta Brothers and post them to the Ledger:

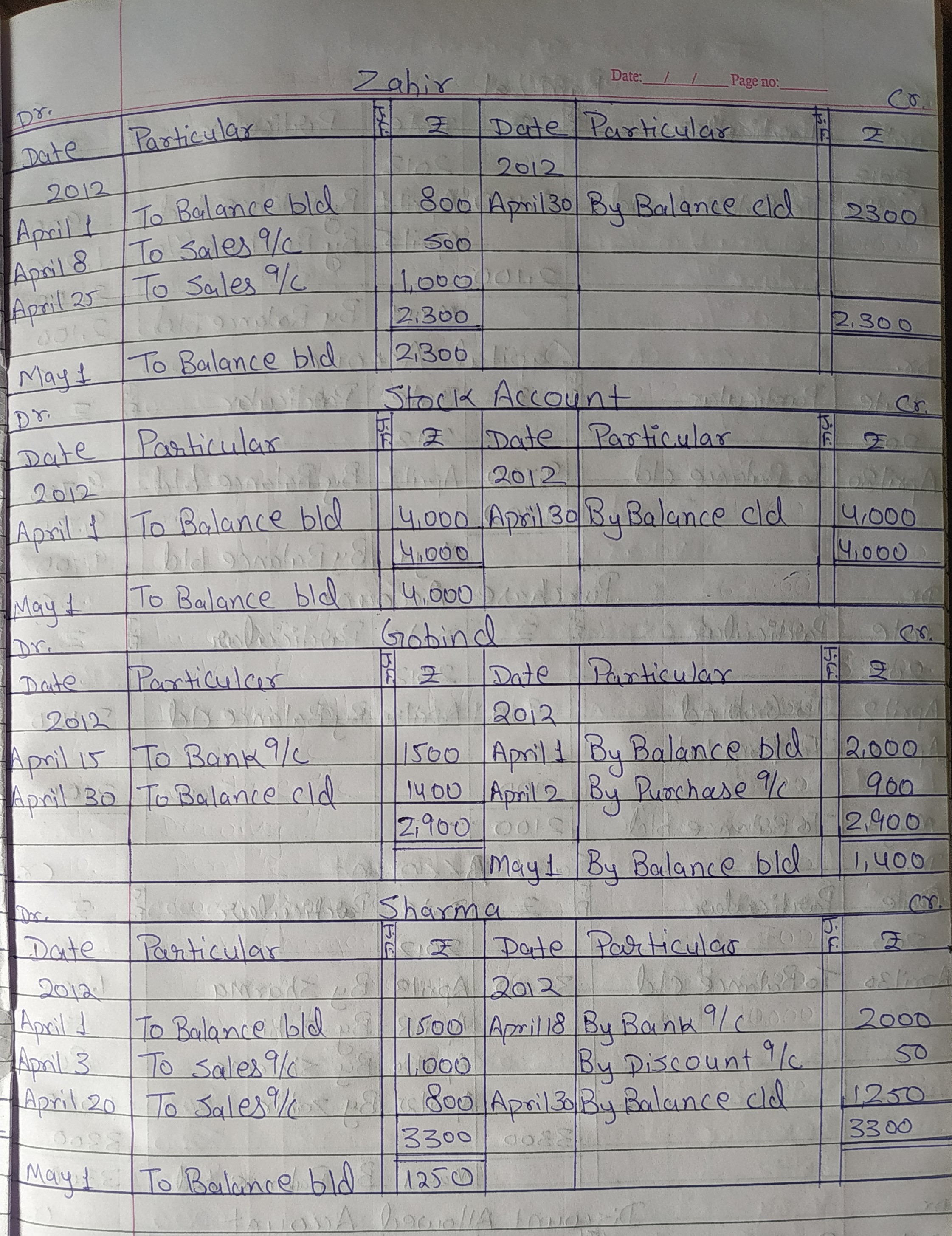

17. On 1st April, 2012, the following were Ledger balances of M/S. Ram Lal & Co.:

Cash in Hand ₹ 300; Cash at Bank ₹ 7,000; Bills Payable ₹ 1,000; Zahir (Dr.) ₹ 800; Stock ₹ 4,000; Gobind (Cr.) ₹ 2,000; Sharma (Dr.) ₹ 1,500; Ram Lal (Cr.) ₹ 900; Capital ₹ 9,700.

Transactions during the month were:

Post the above transactions to the Ledger and take out a Trial Balance on 30th April, 2012.

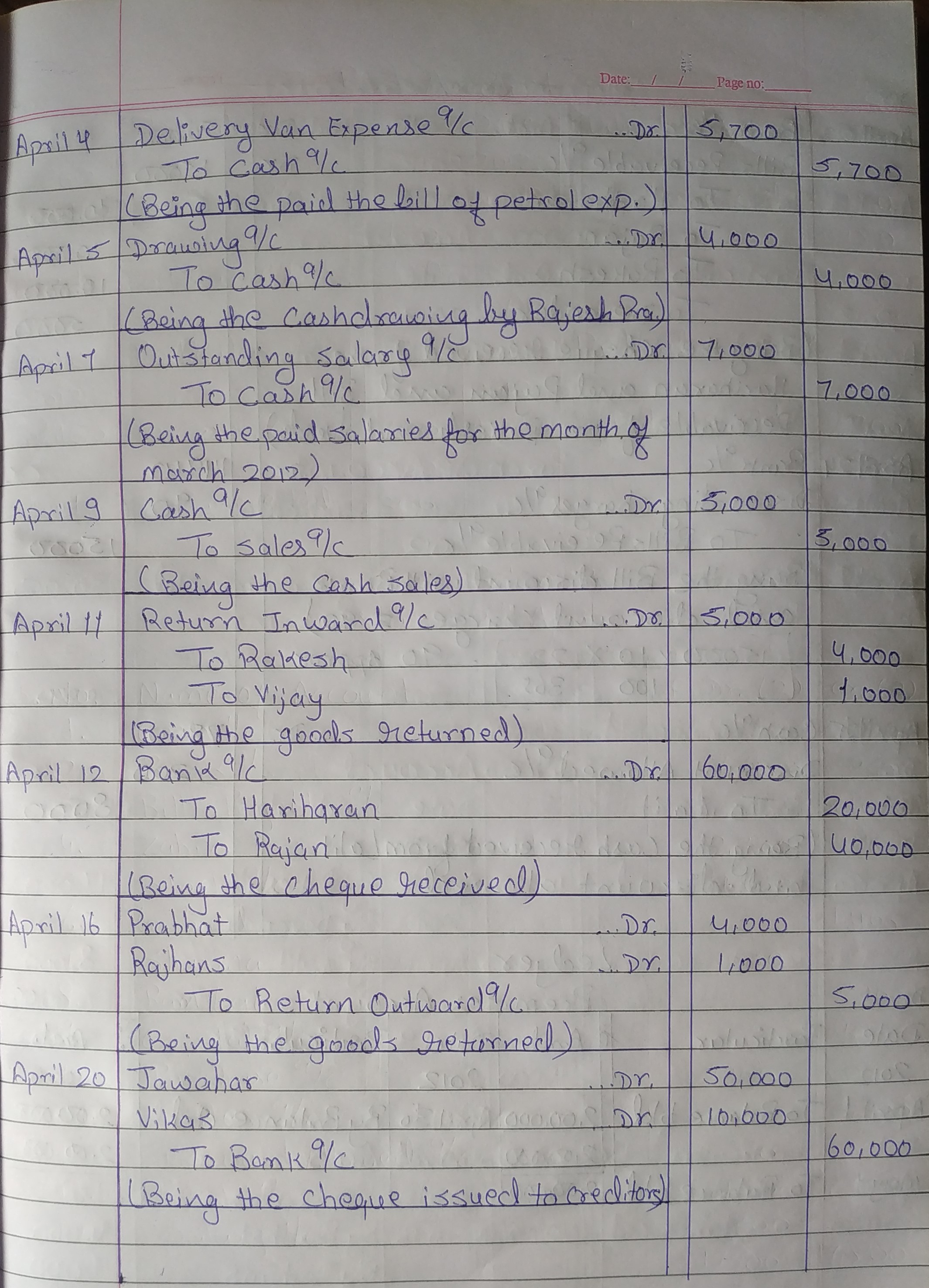

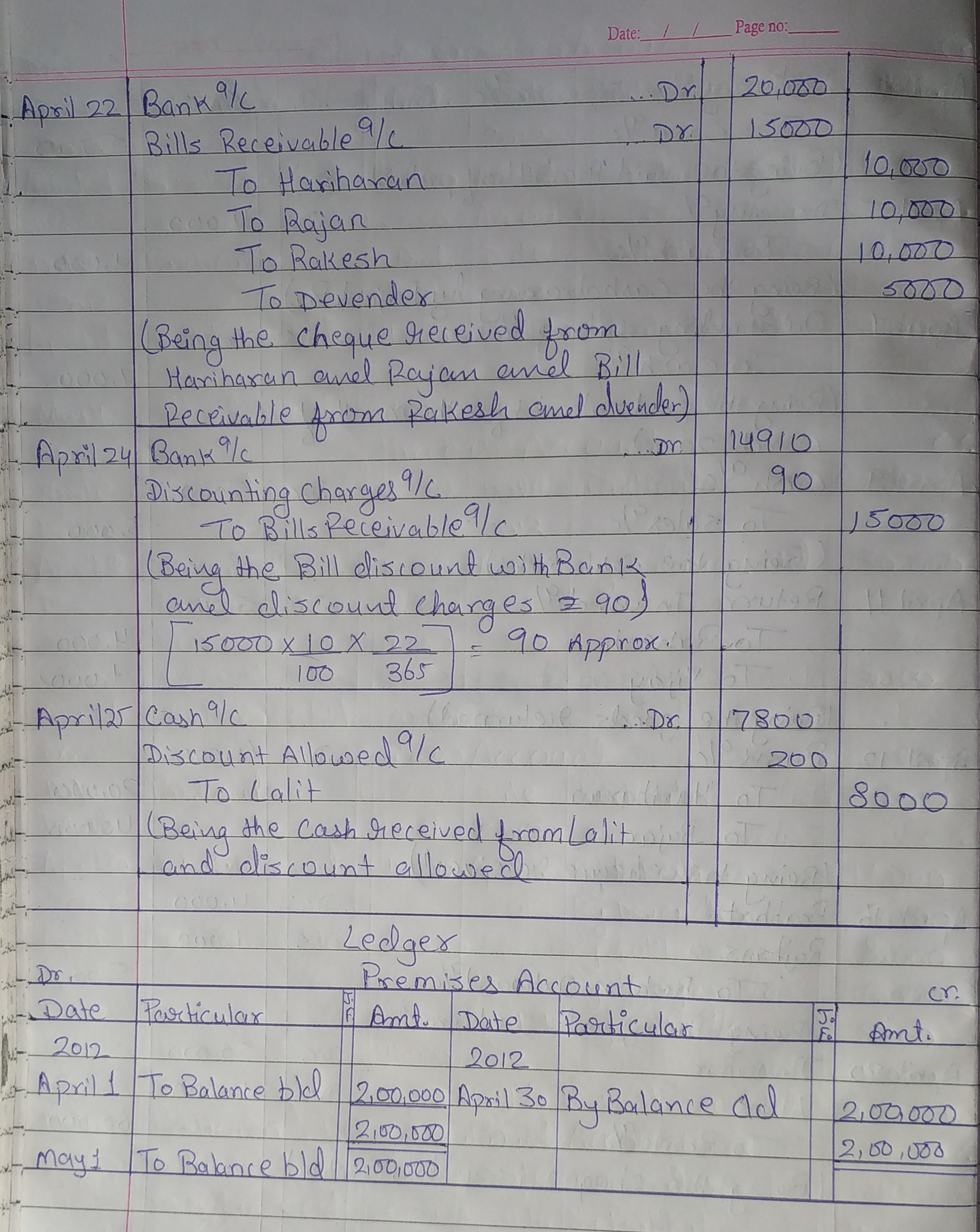

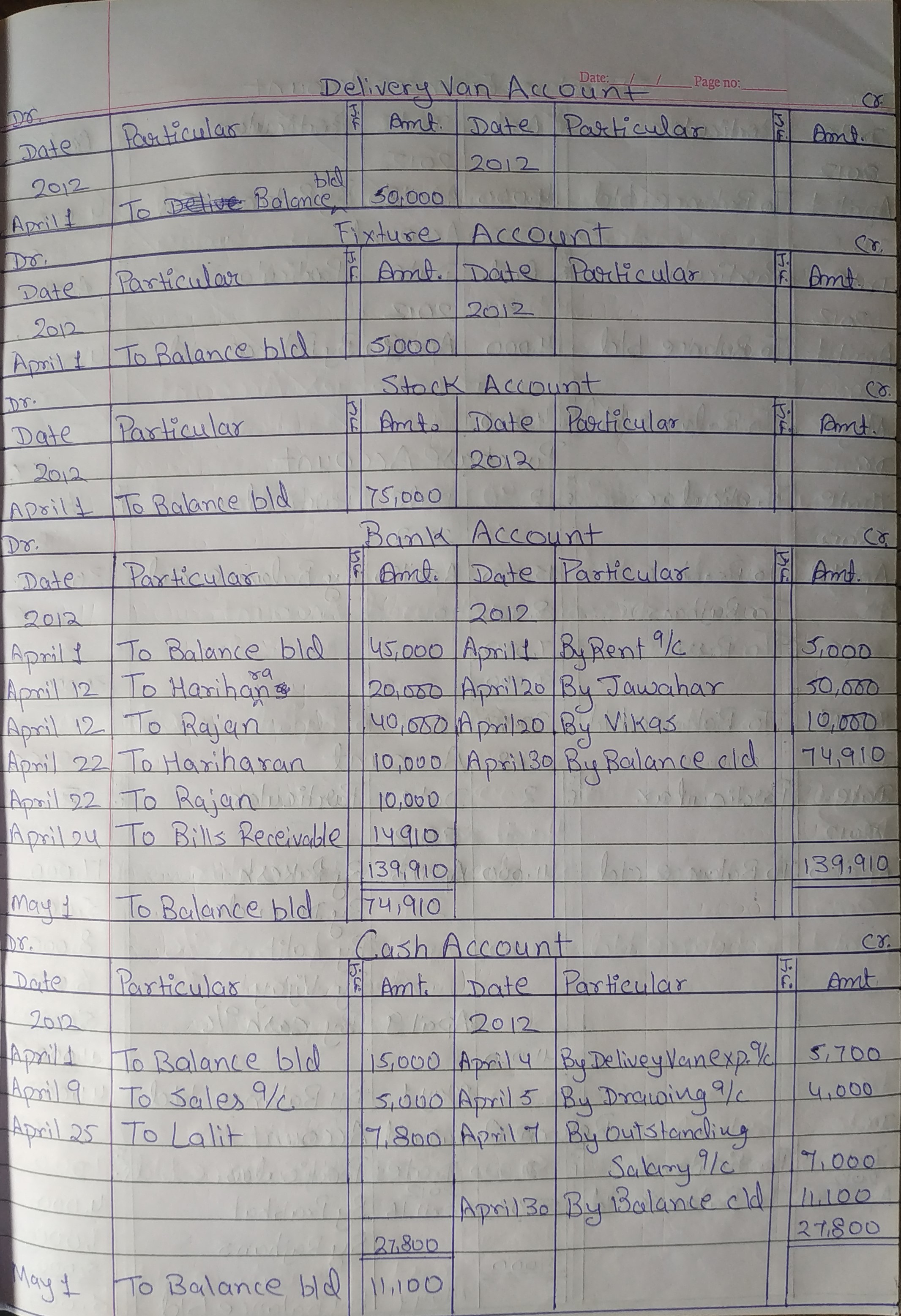

18. You are to open the books of Rajesh Prabhu, a trader through the Journal to record the assets and liabilities and then to record the daily transactions for the month of April, 2012.

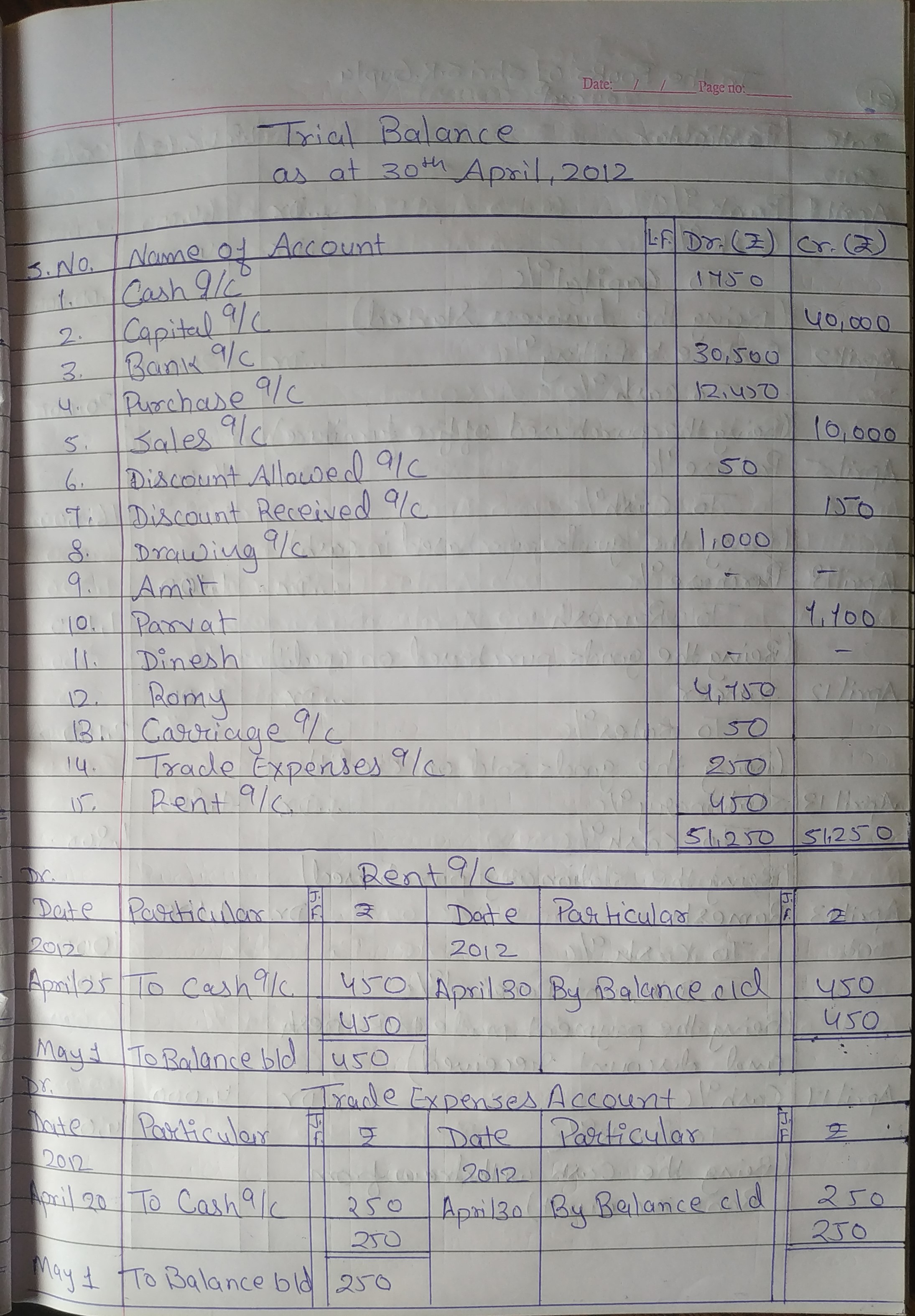

A Trial Balance is to be extracted as on 30th April, 2012:

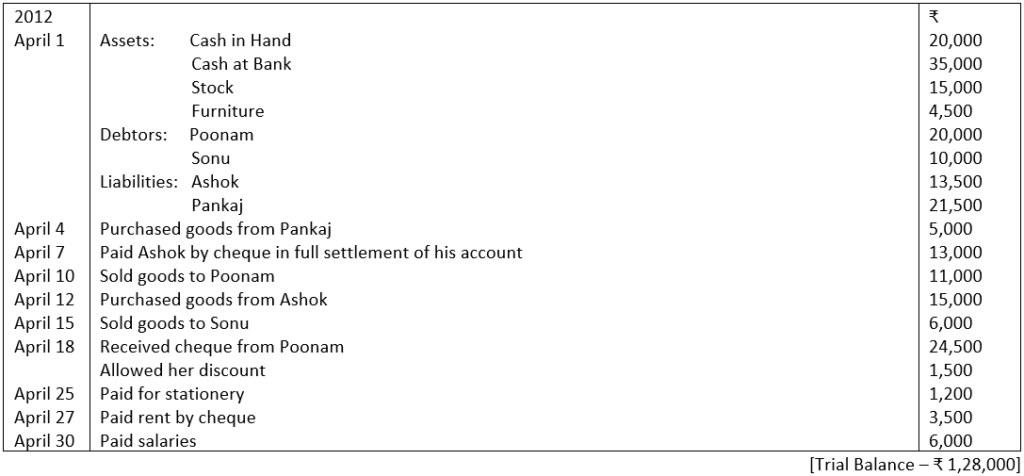

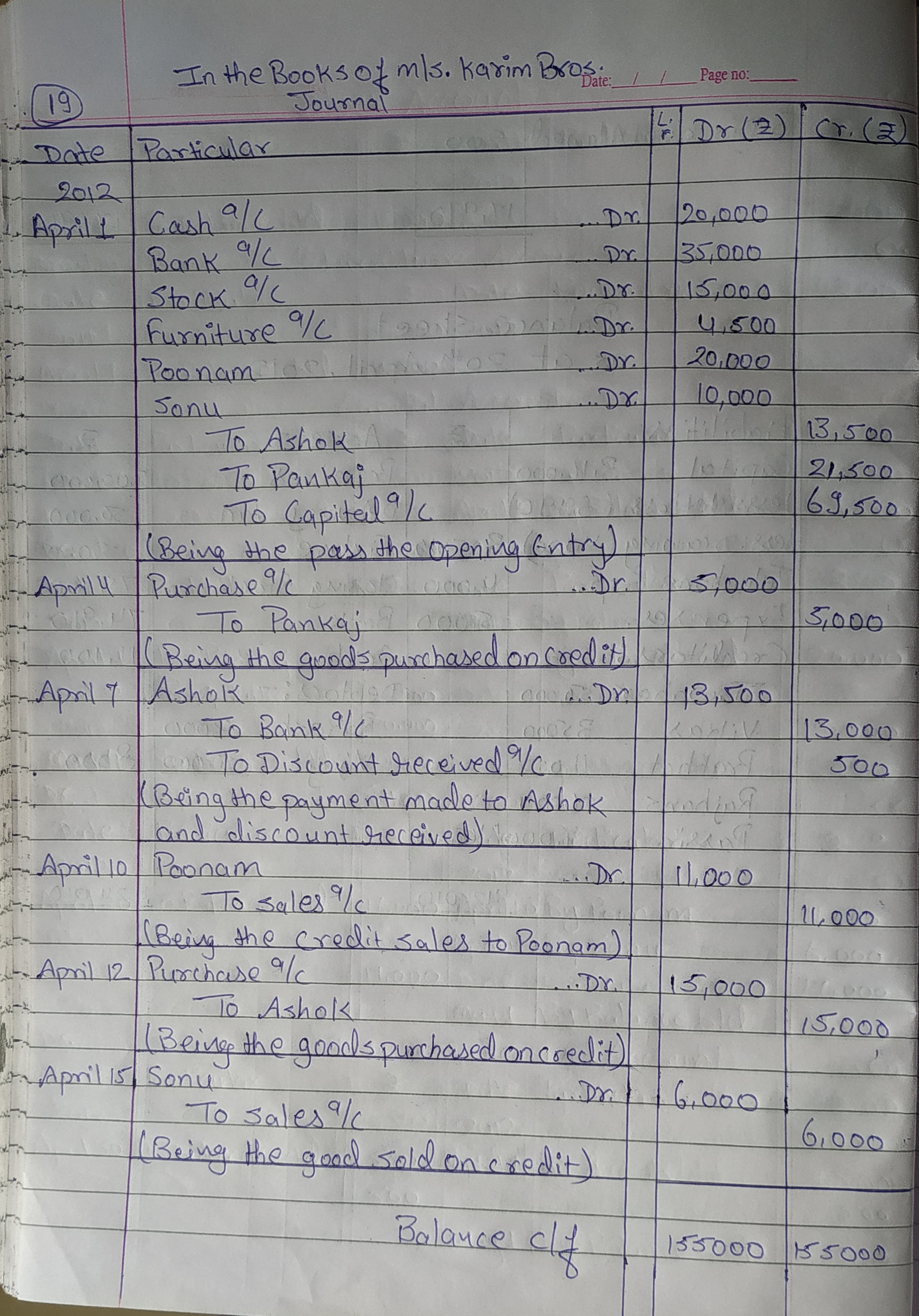

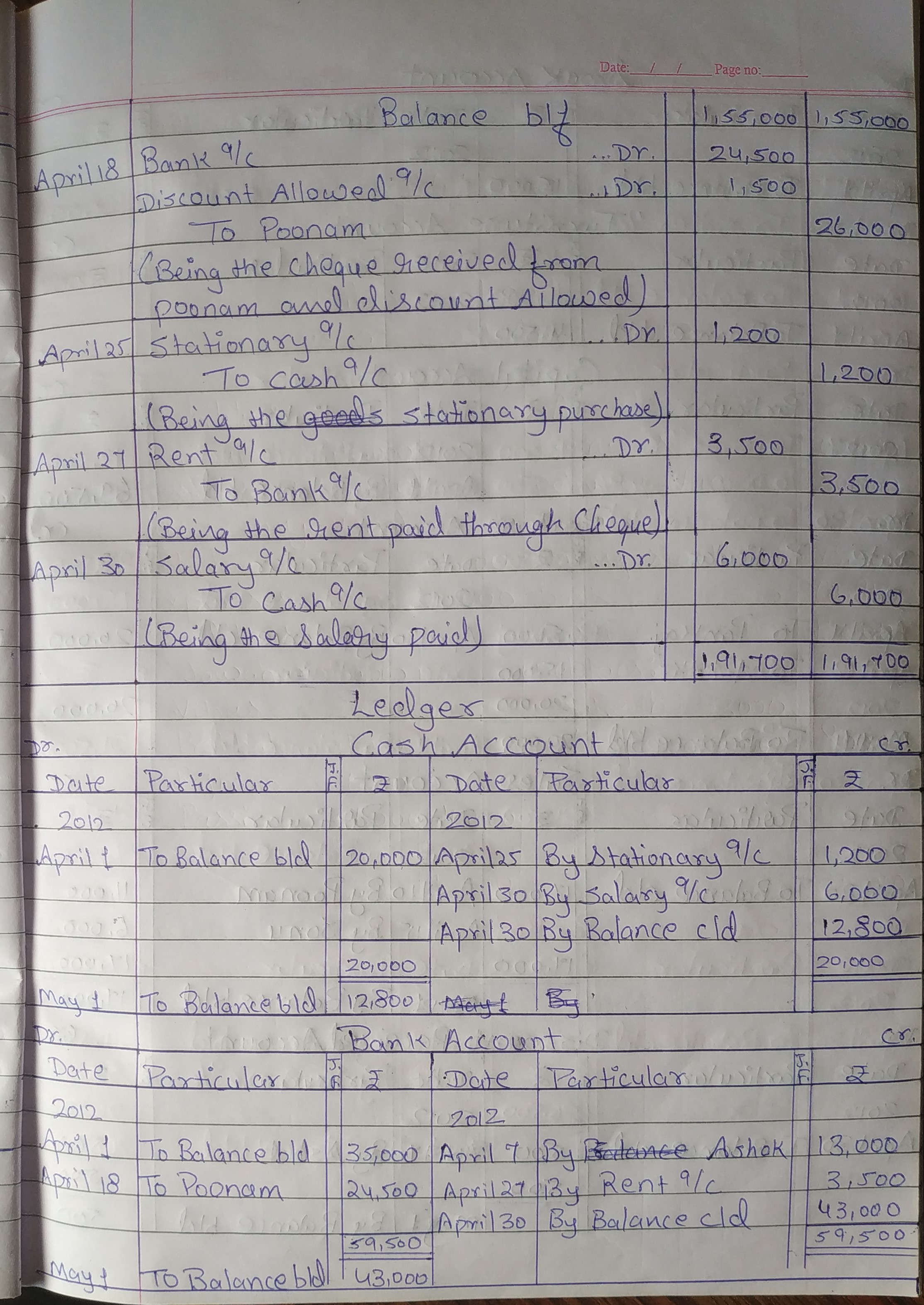

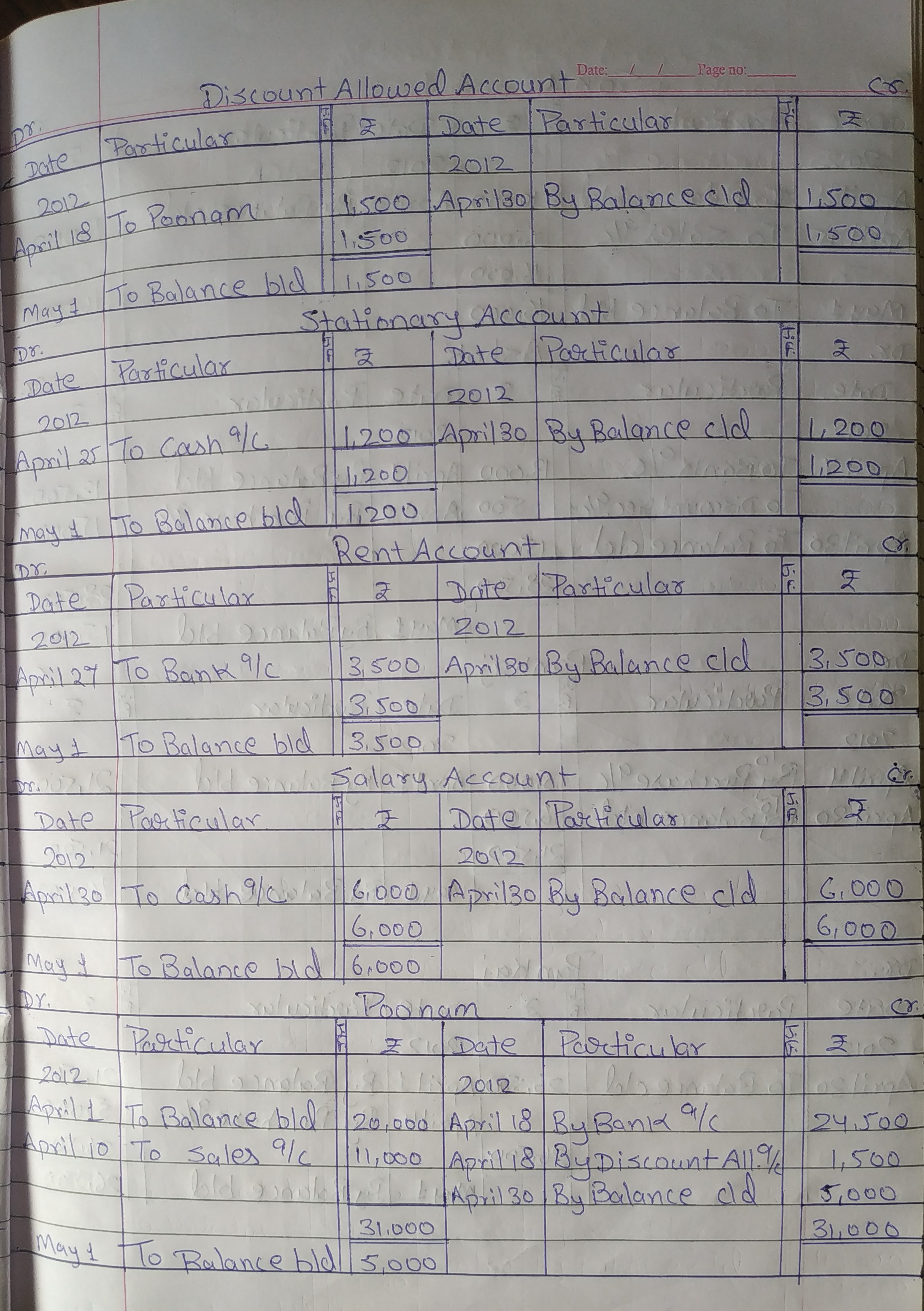

19. Enter the following transactions in the Journal of M/S. Karim Bros., post to the Ledger and prepare a Trial Balance:

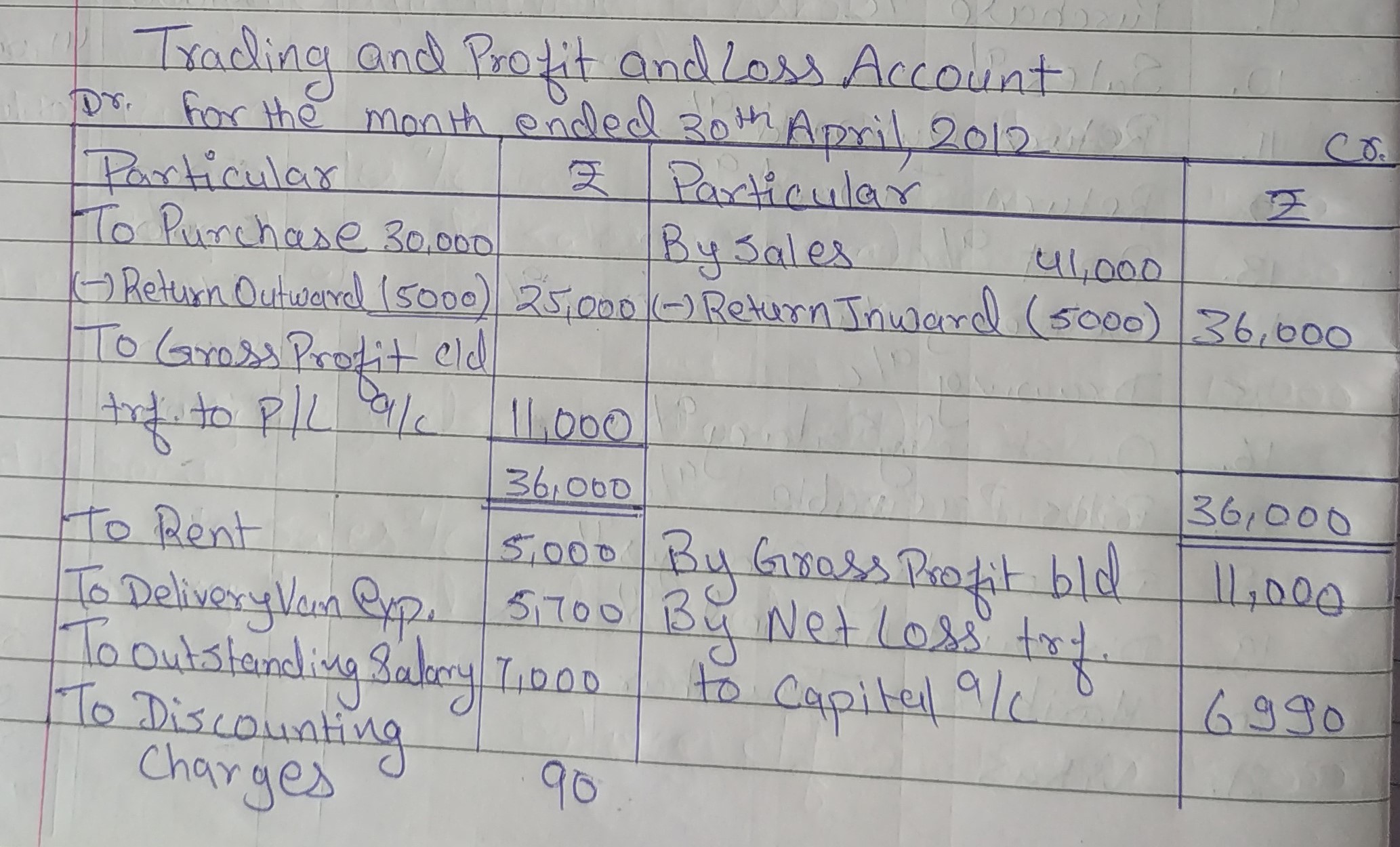

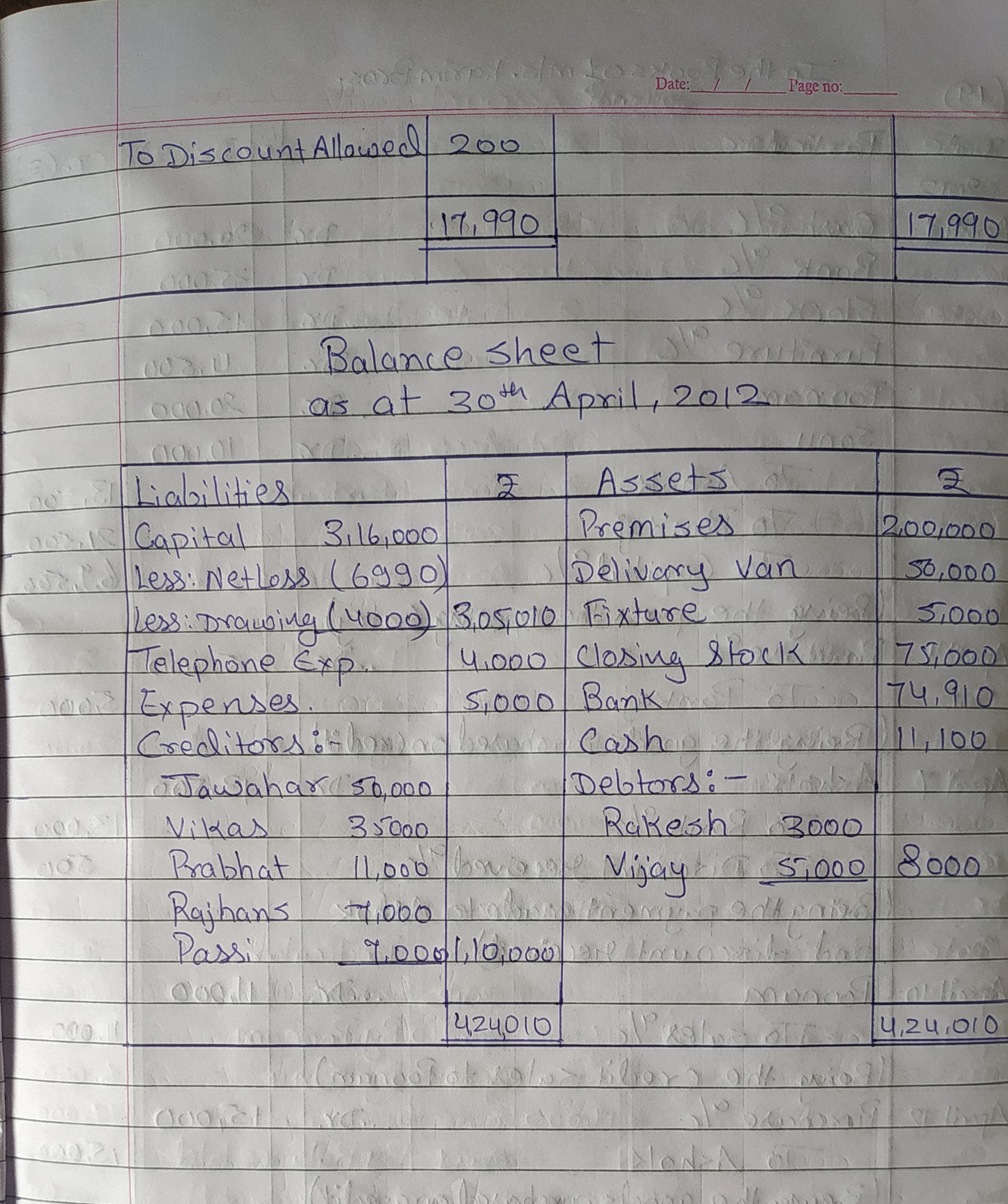

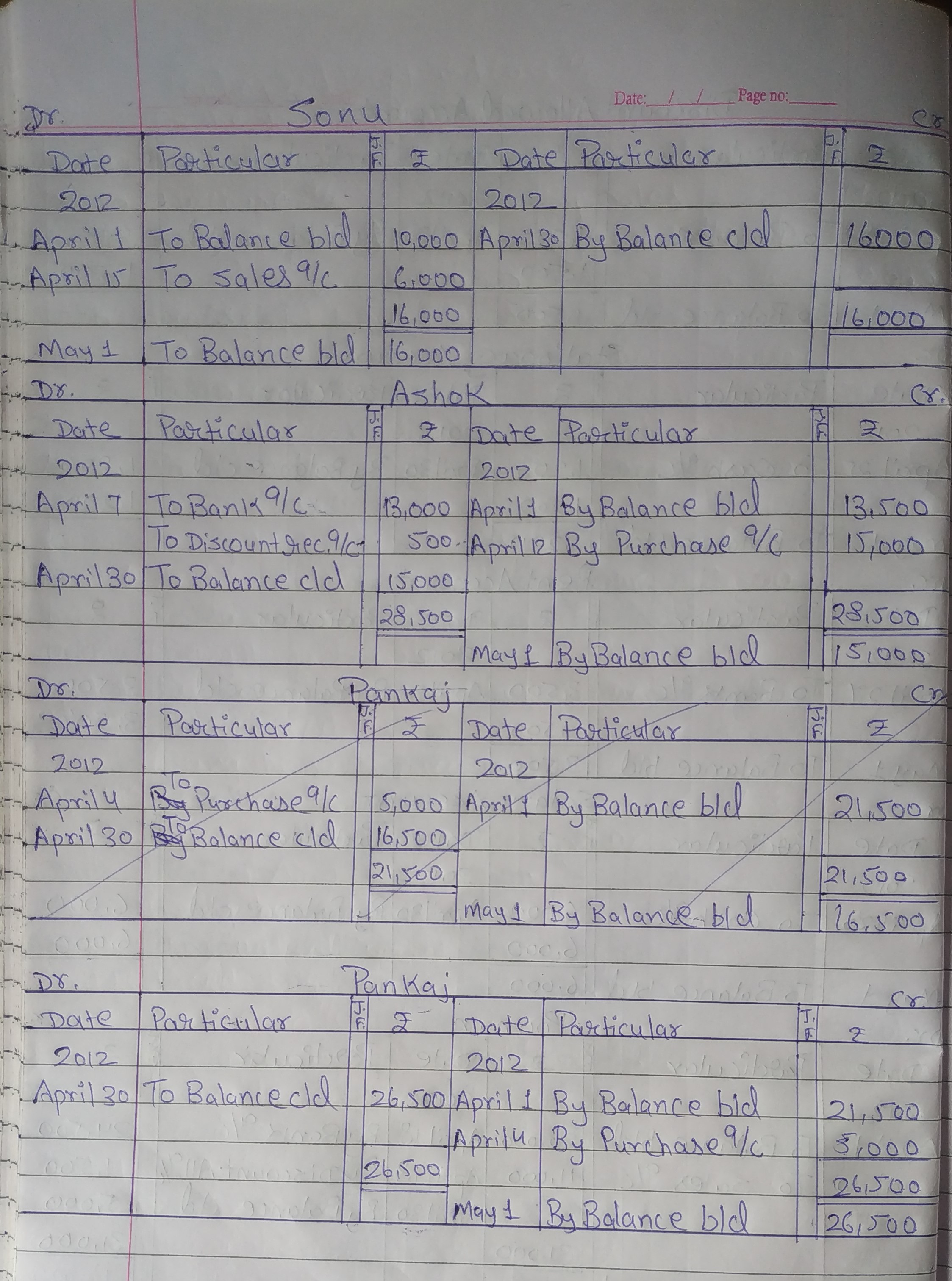

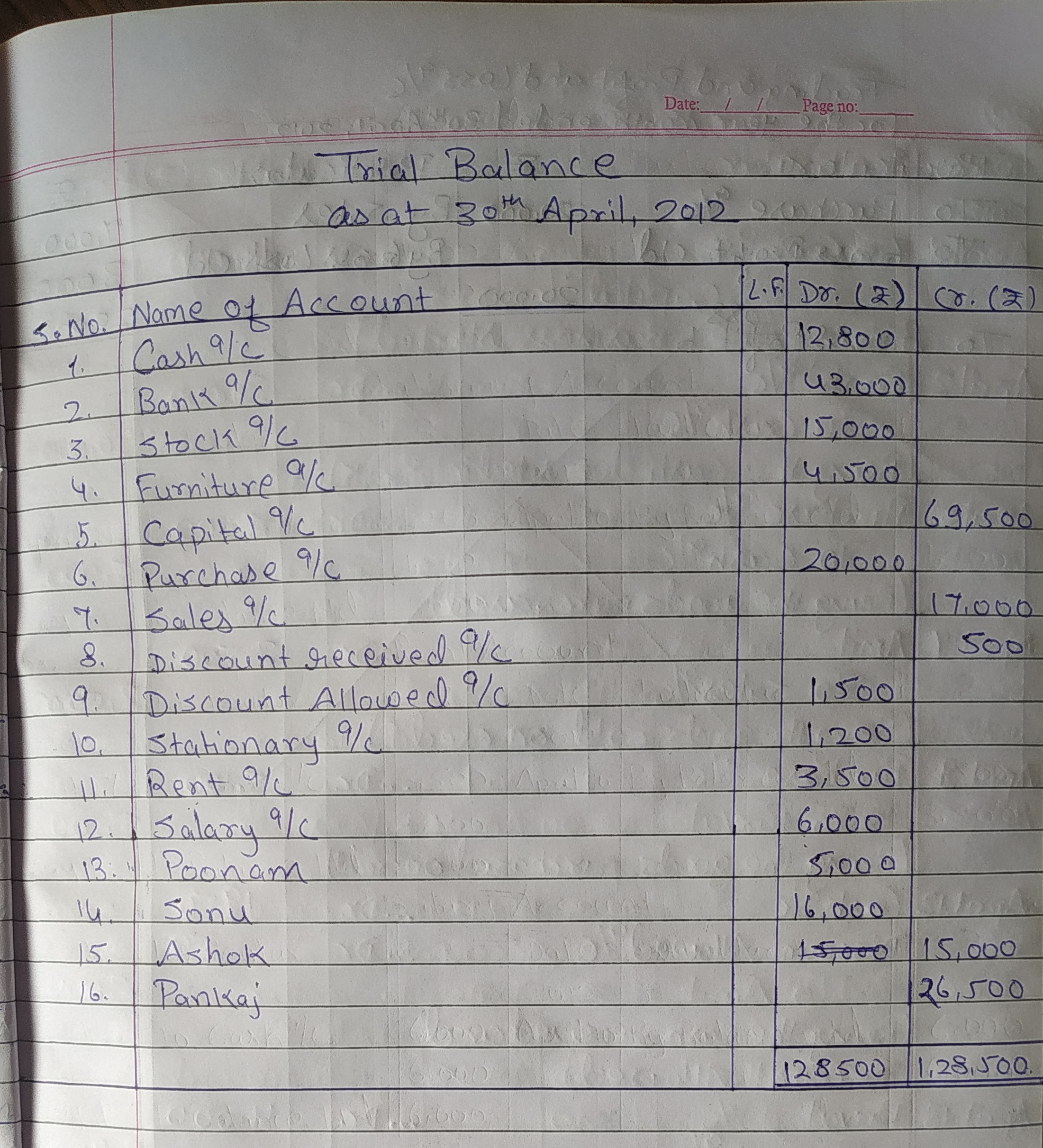

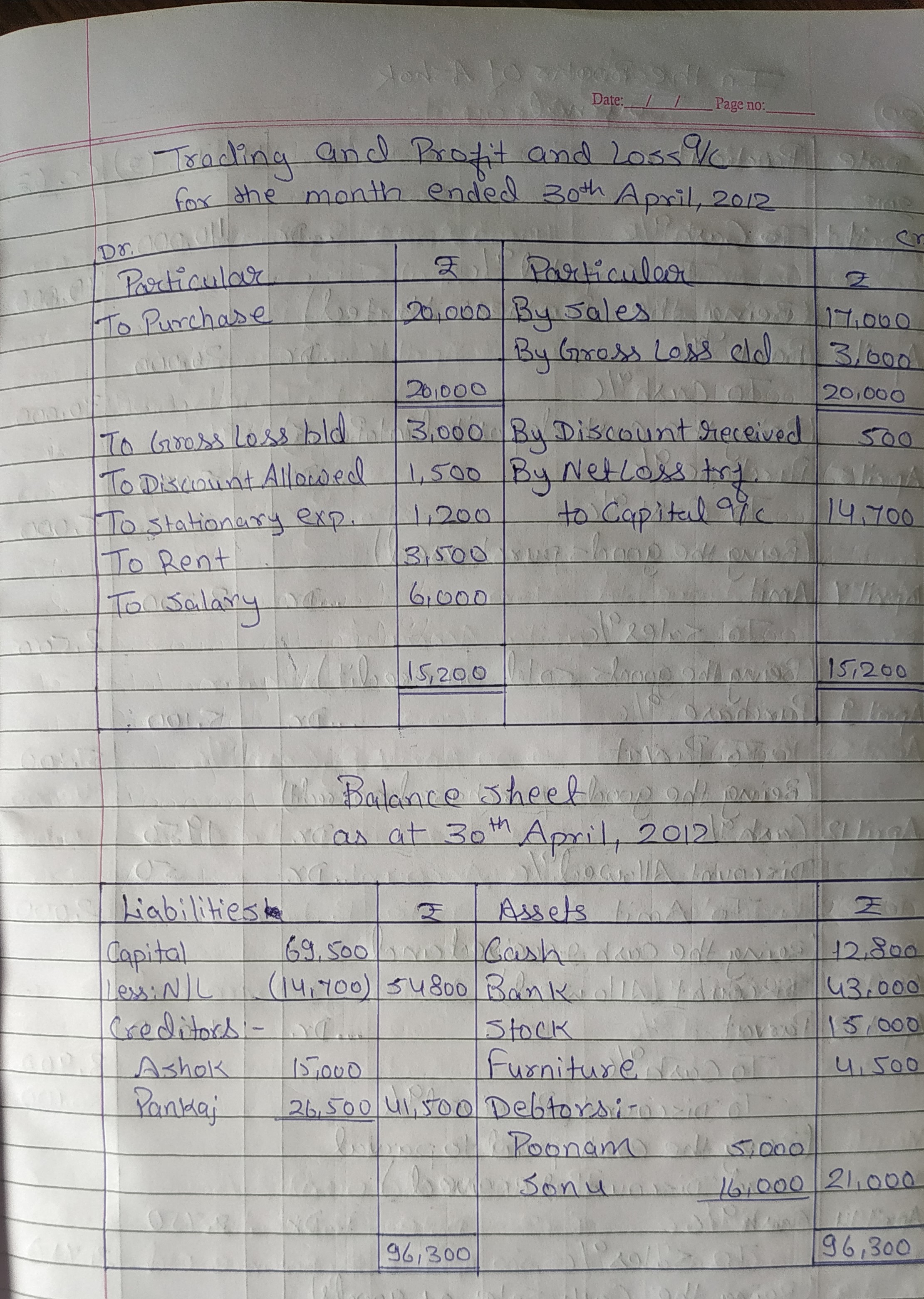

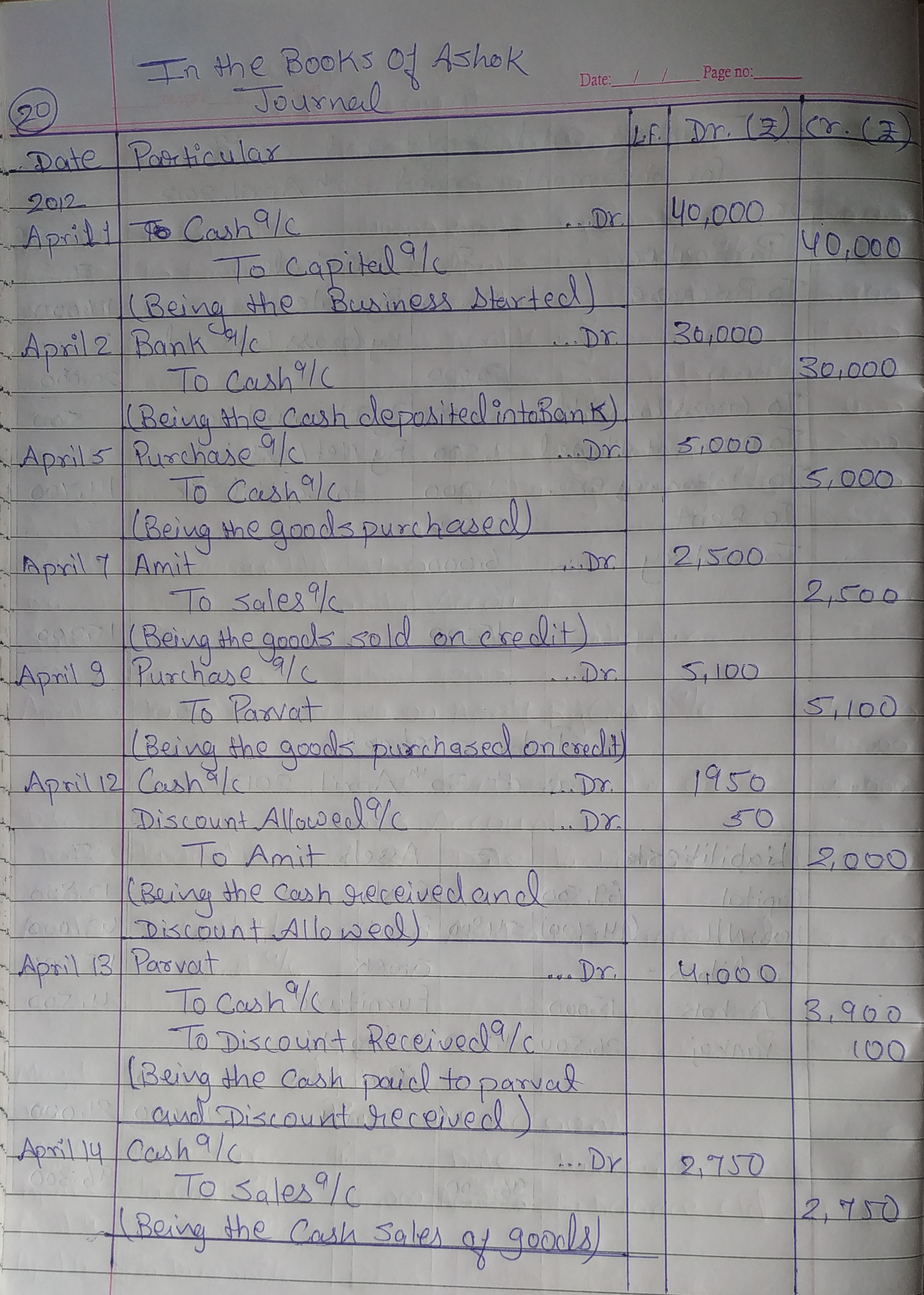

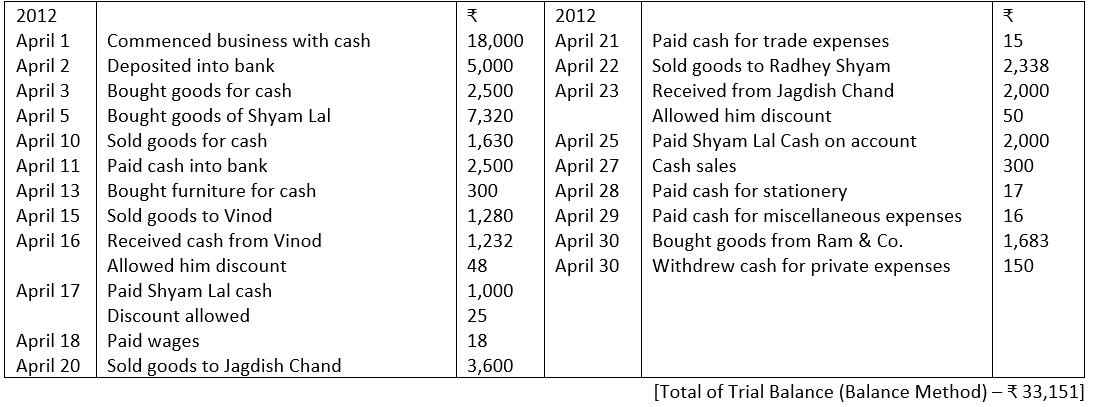

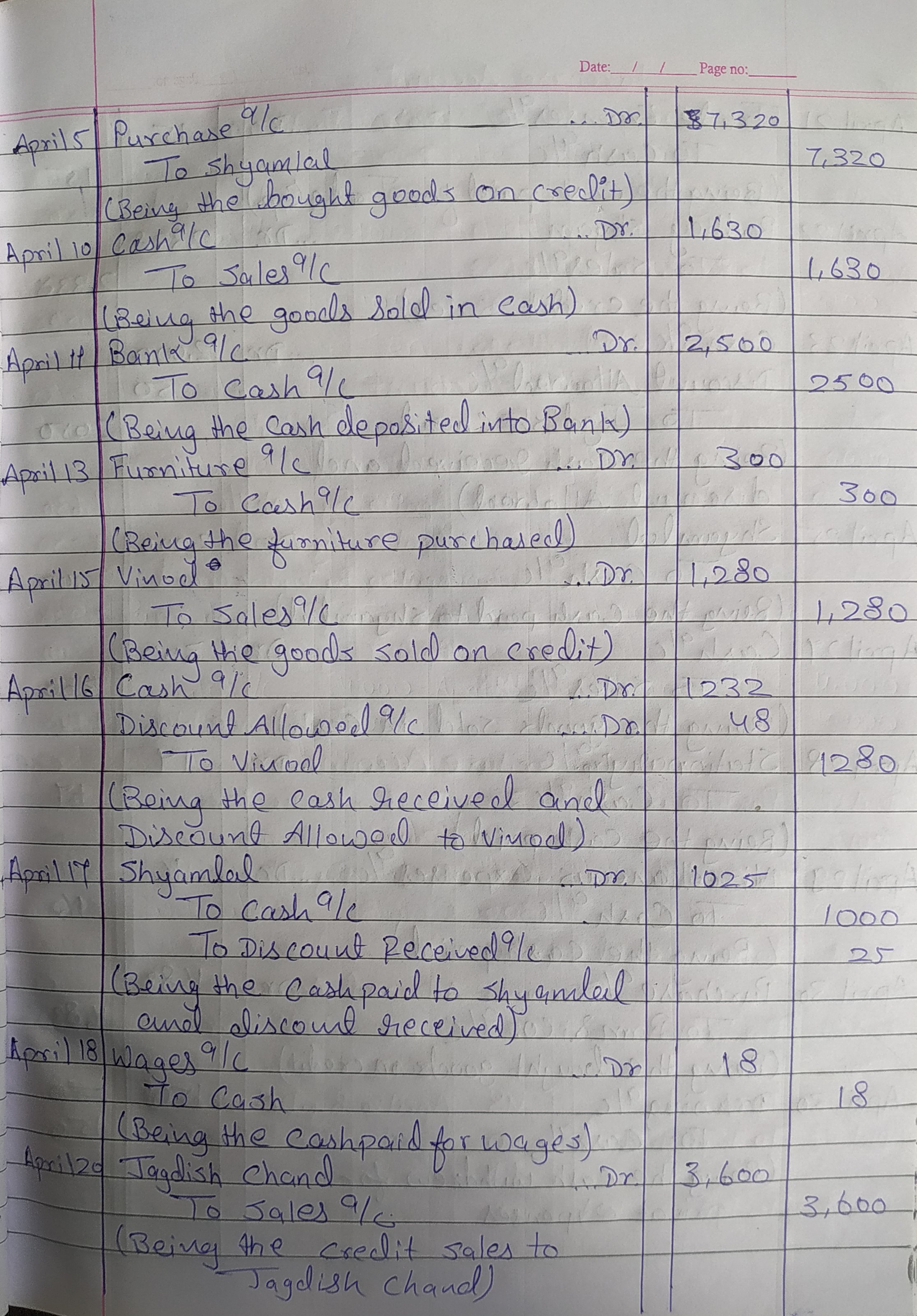

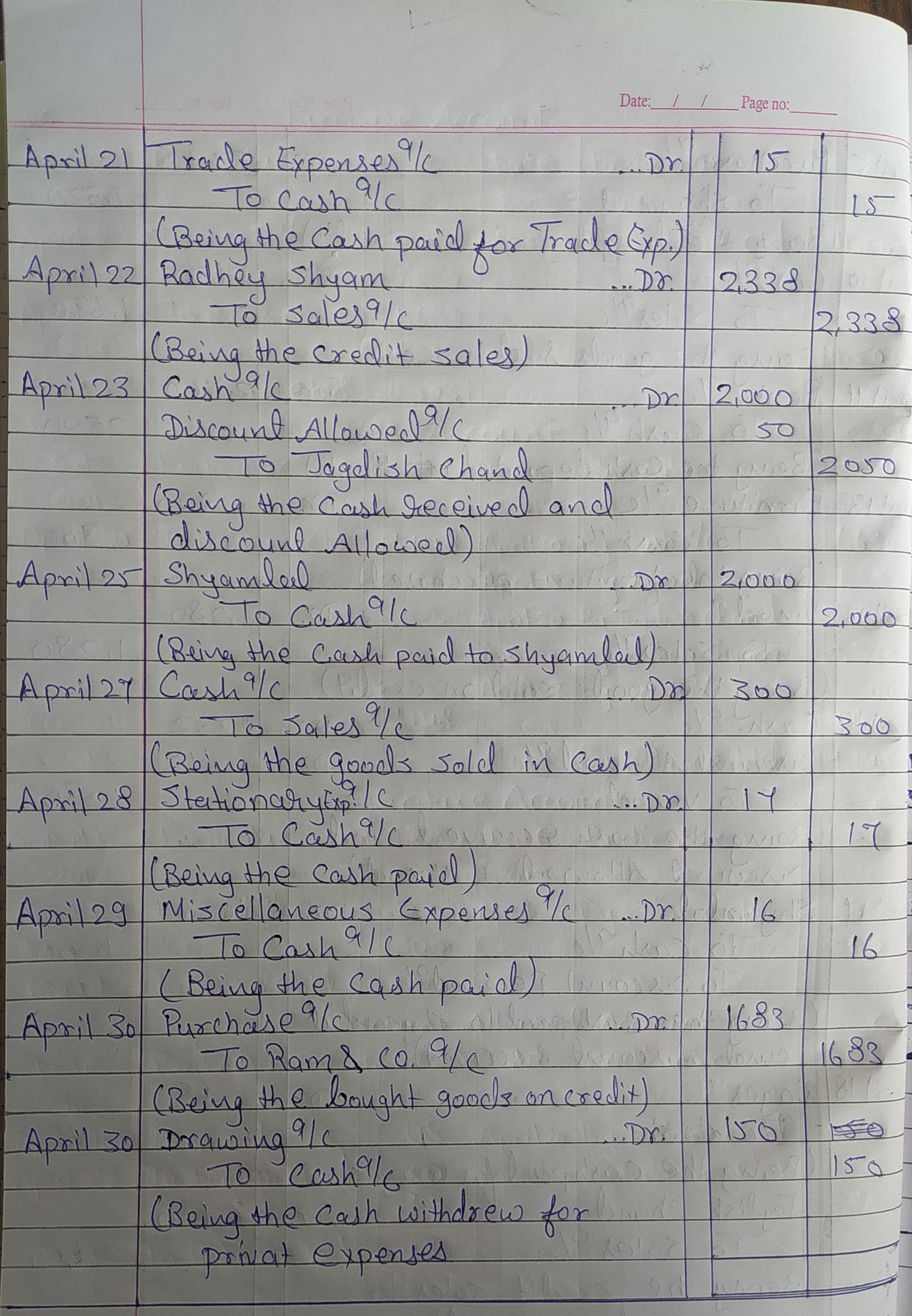

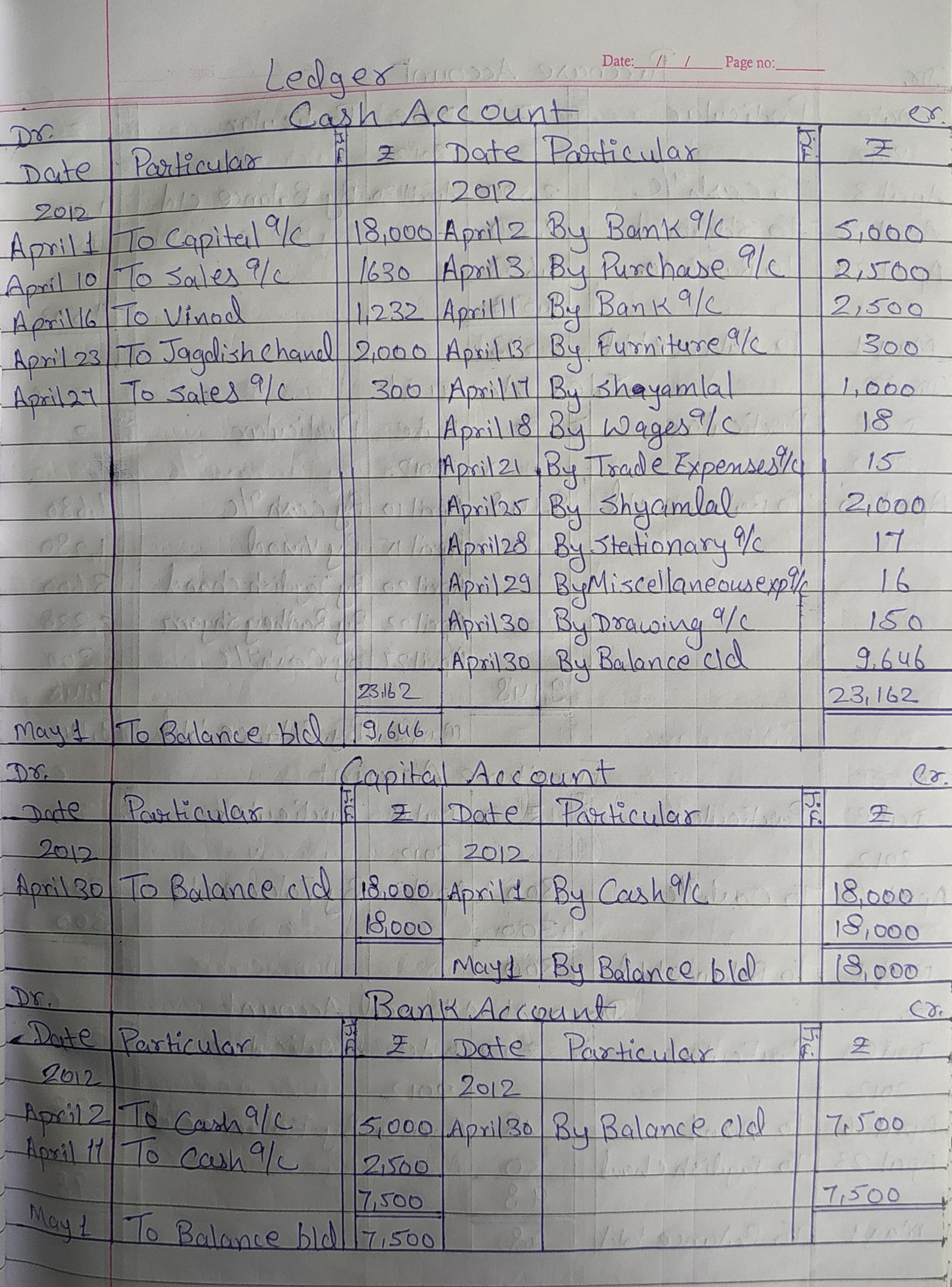

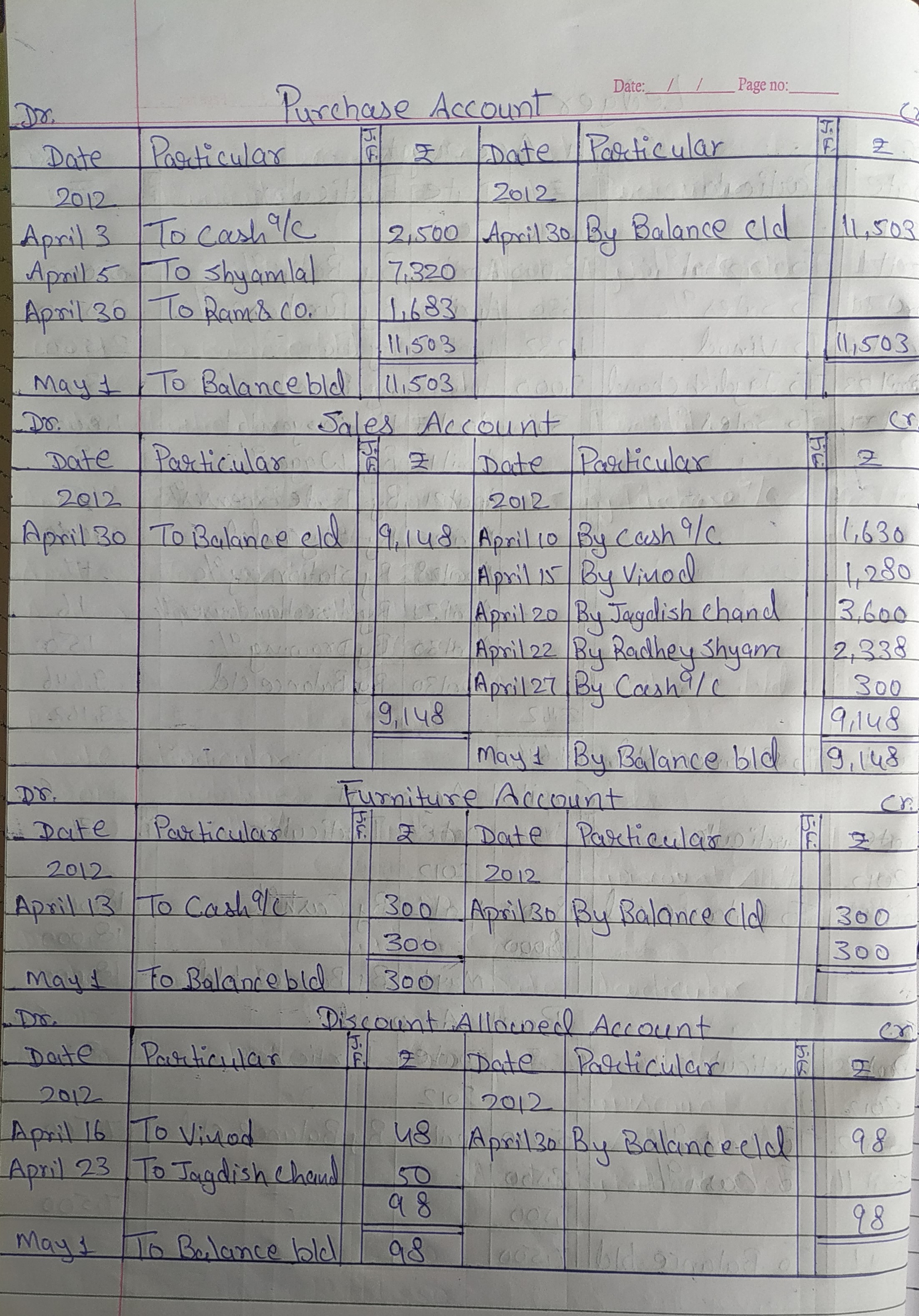

20. write up the following transactions in the Journal of Ashok and post them to the Ledger for April, 2011. Also, prepare a Trial Balance as on 30th April, 2012.

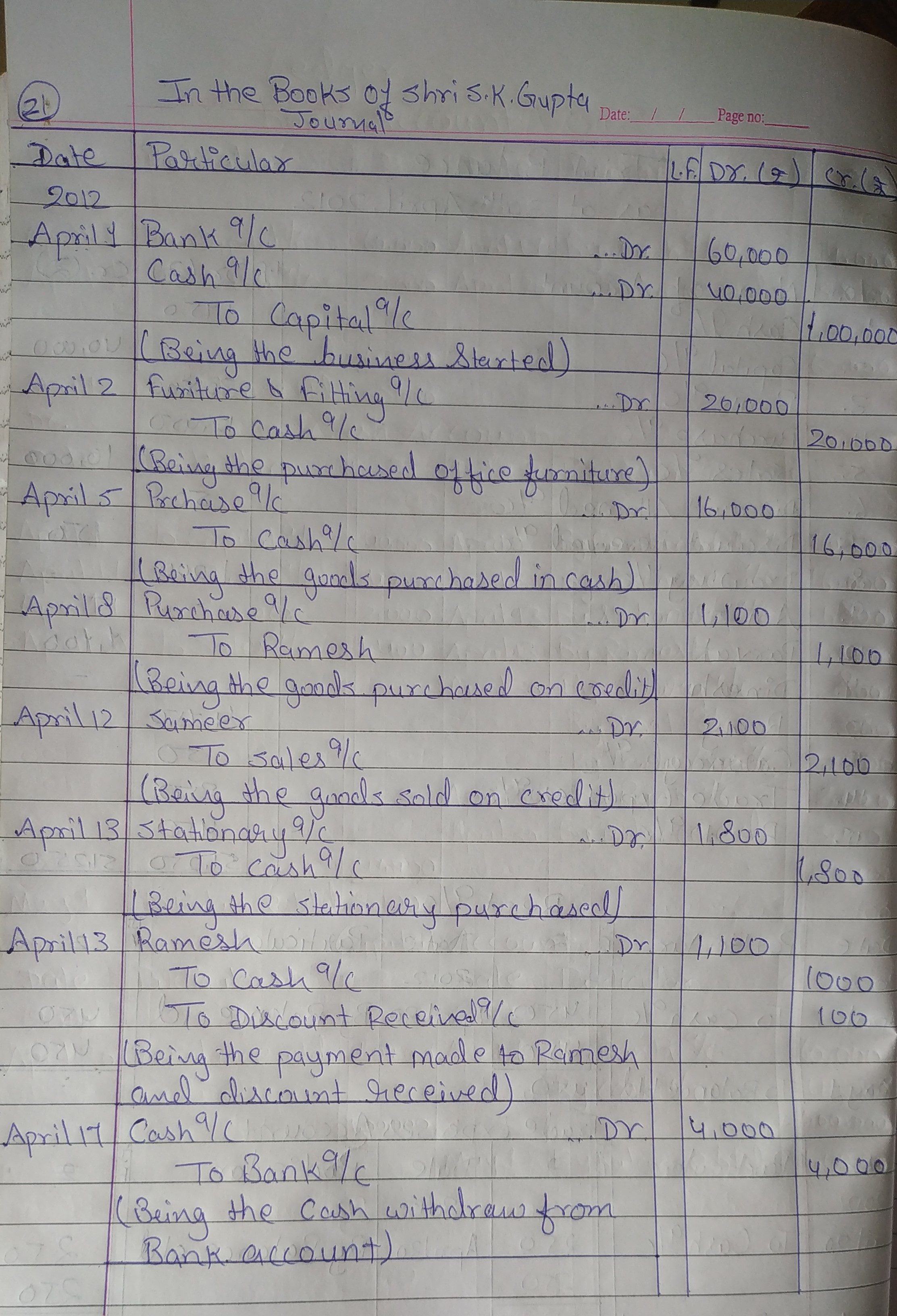

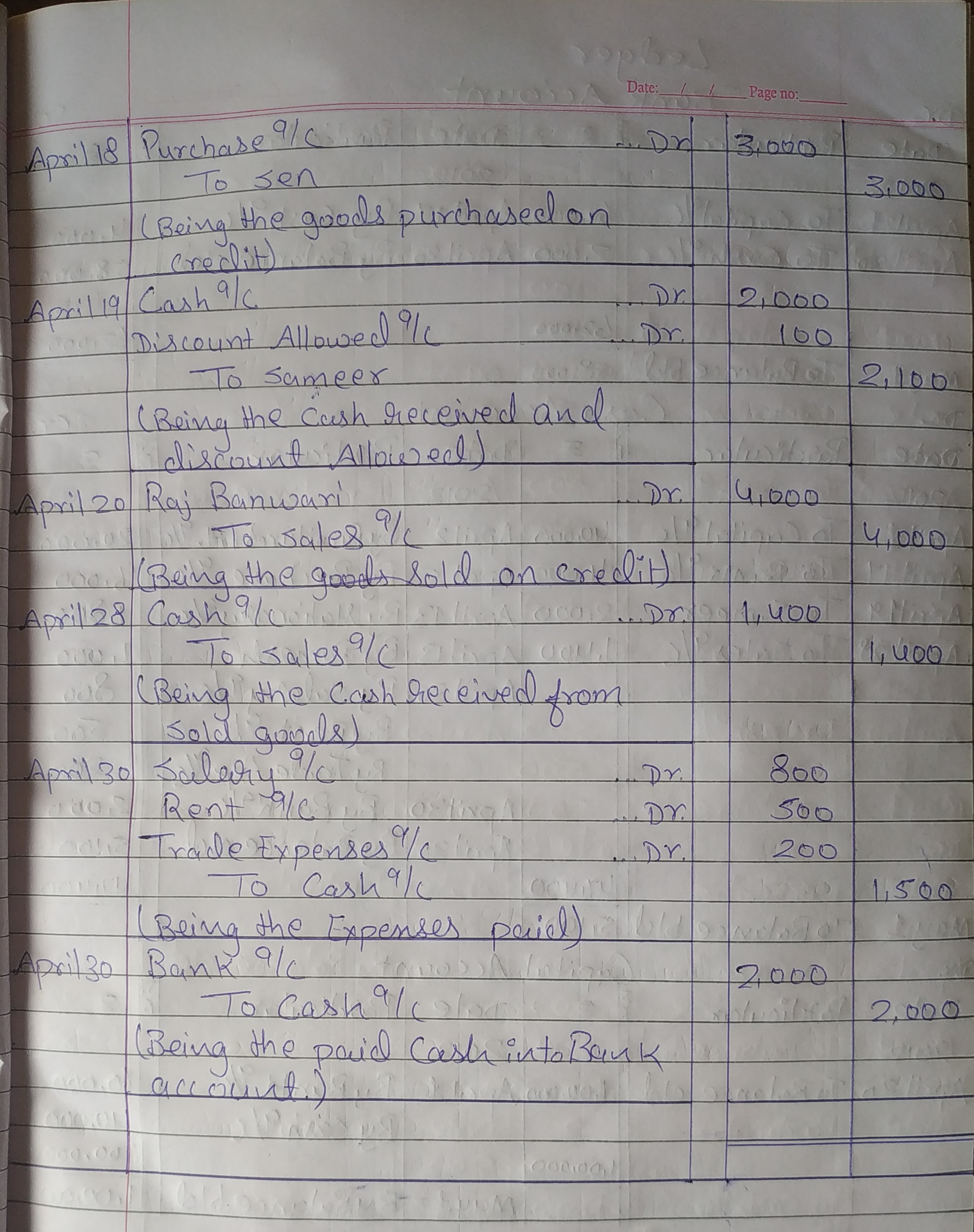

21. Shri S.K. Gupta commenced business on 1st April, 2012 with a capital ₹ 1,00,000 of which ₹ 60,000 was paid into his Bank Account and ₹ 40,000 retained as cash. His other transactions during the month were as follows:

Journalise the above transactions and post them to the Ledger.

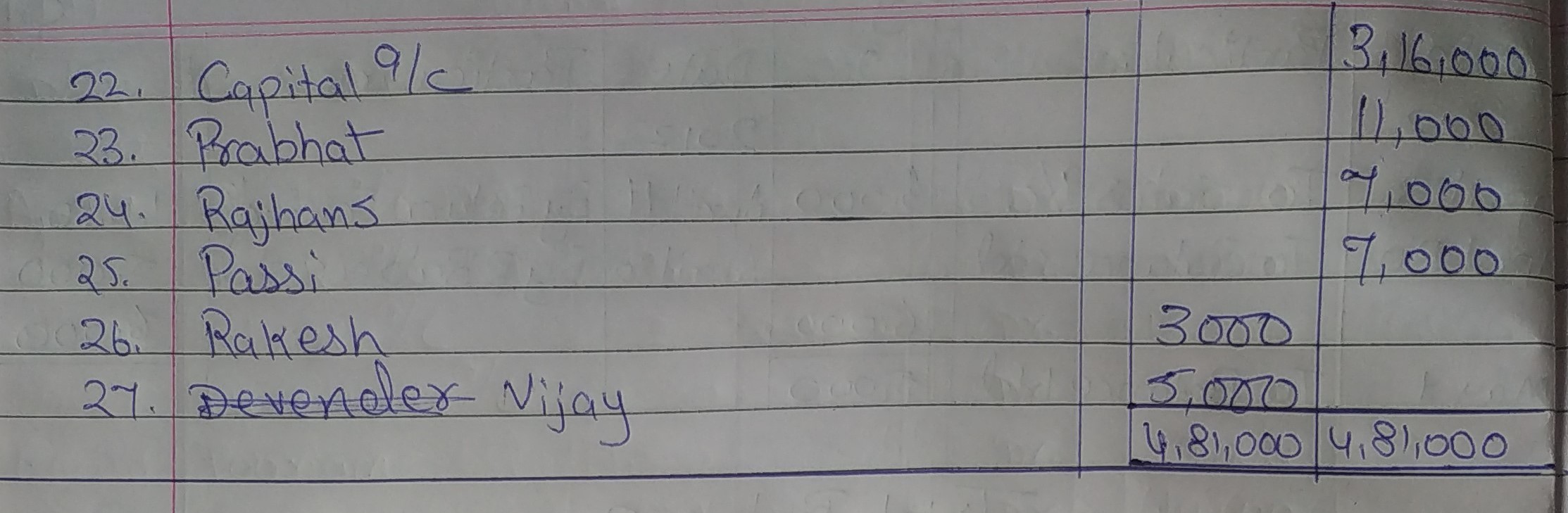

22. Journalise the following transactions, post to the Ledger and prepare a Trial Balance to check its arithmetical accuracy:

If you have any doubt in above Question-Answer Please drop you COMMENT down below!!!