Here we have given TS Grewal Accountancy Class 12 Solutions Chapter 3 Goodwill: Nature and Valuation are part of TS Grewal Accountancy Class 12 Solutions.

| Board | CBSE |

| TextBook | NCERT |

| Class | 12th |

| Book | Accounting for Partnership Firms |

| Volume | I |

| Subject | Accountancy |

| Chapter | 3 |

| Chapter Name | Goodwill: Nature and Valuation |

| Number of Question (Solved) | 48 |

| Category | TS Grewal’s Solutions |

TS Grewal Accountancy Class 12 Solutions – Chapter 3rd Goodwill: Nature and Valuation – EDITION 2019

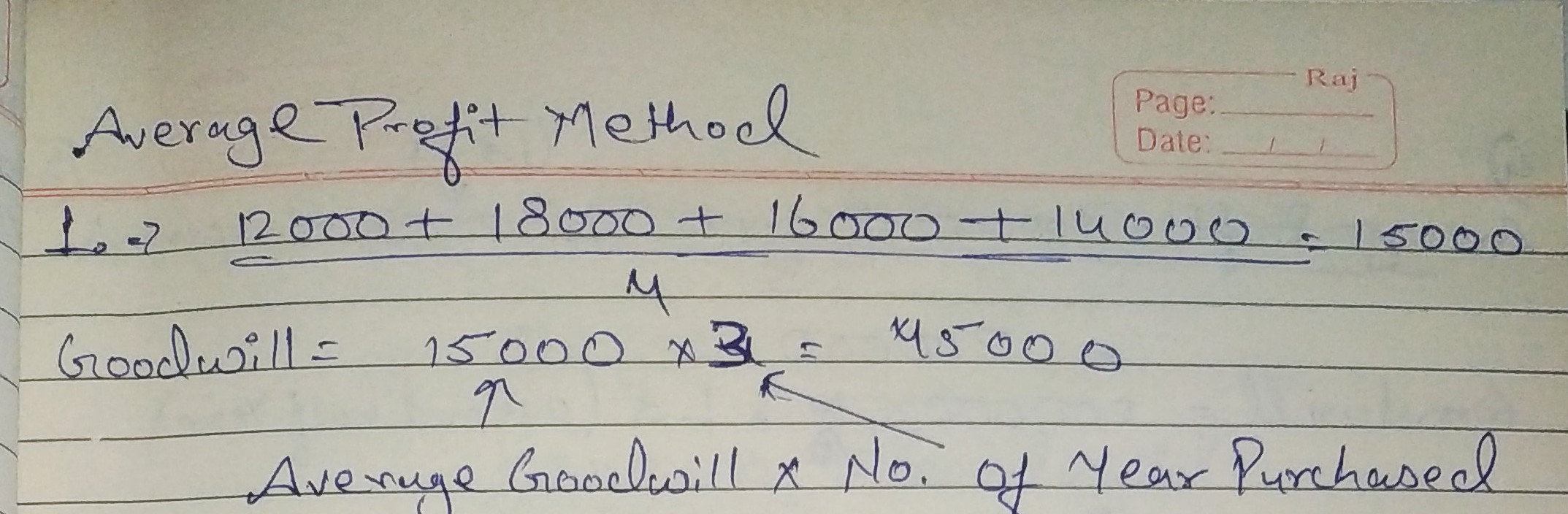

Average Profit Method

Question 1:

Goodwill is to be valued at three years’ purchase of four years’ average profit. Profits for last four years ending on 31st March of the firm were:

2016 − ₹ 12,000; 2017 − ₹ 18,000; 2018 − ₹ 16,000; 2019 − ₹ 14,000.

Calculate amount of Goodwill.

ANSWER:

Question 2:

Profits for the five years ending on 31st March, are as follows:

Year 2015 − ₹ 4,00,000; Year 2016 − ₹ 3,98,000; Year 2017 − ₹ 4,50,000; Year 2018 − ₹ 4,45,000 and Year 2019 − ₹ 5,00,000.

Calculate goodwill of the firm on the basis of 4 years’ purchase of 5 years’ average profit.

ANSWER:

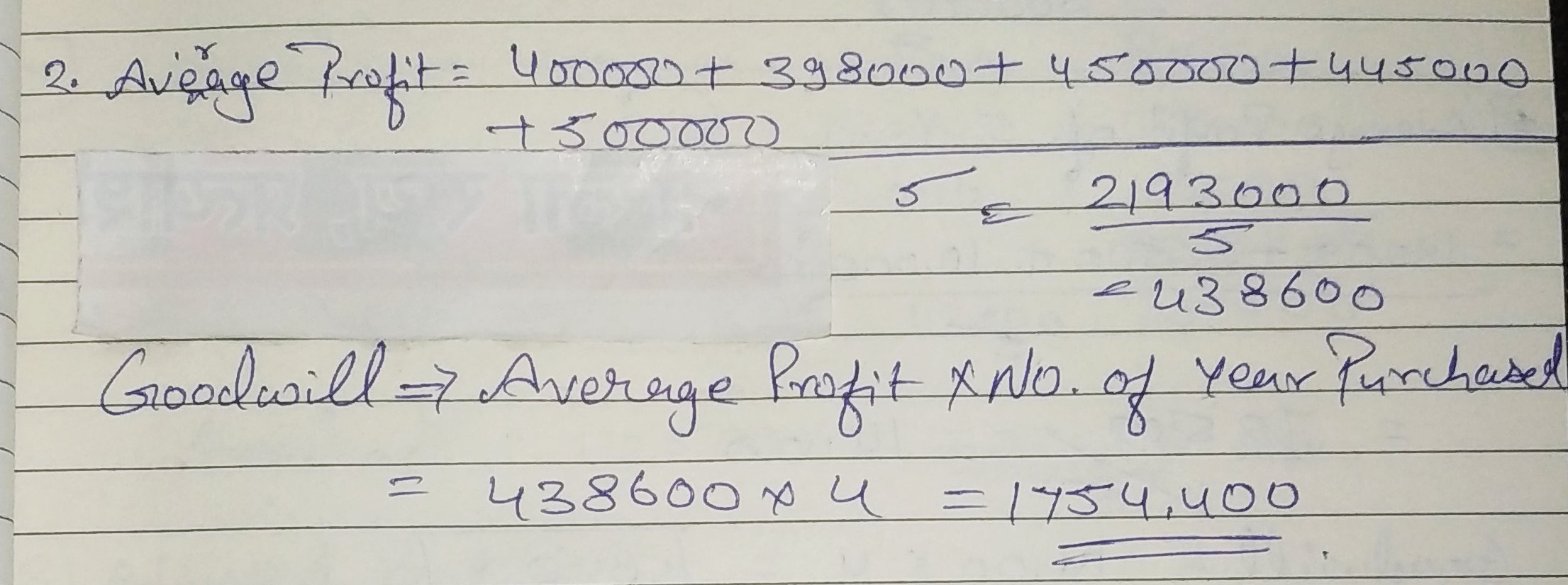

Question 3:

Calculate value of goodwill on the basis of three years’ purchase of average profit of the preceding five years which were as follows:

| Year | 2018-19 | 2017-18 | 2016-17 | 2015-16 | 2014-15 |

| Profits (₹) | 8,00,000 | 15,00,000 | 18,00,000 | 4,00,000 (Loss) | 13,00,000 |

ANSWER:

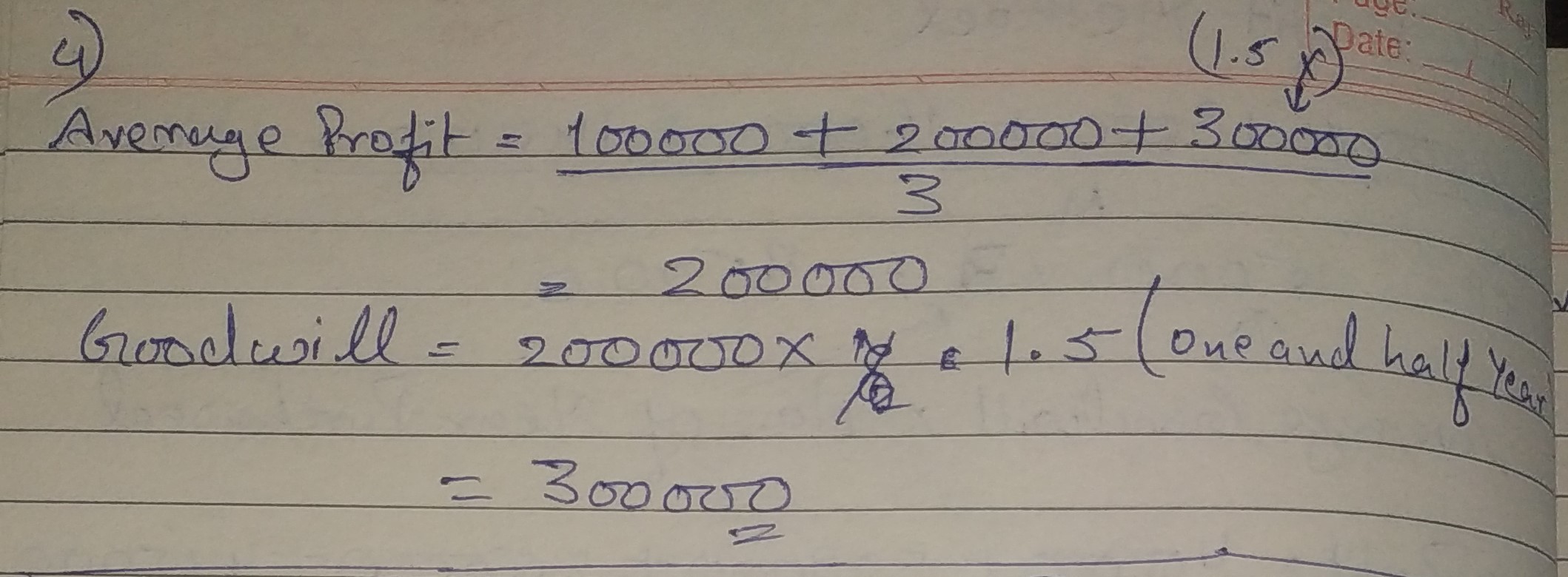

Question 4:

Calculate the value of firm’s goodwill on the basis of one and half years’ purchase of the average profit of the last three years. The profit for first year was ₹ 1,00,000, profit for the second year was twice the profit of the first year and for the third year profit was one and half times of the profit of the second year.

ANSWER:

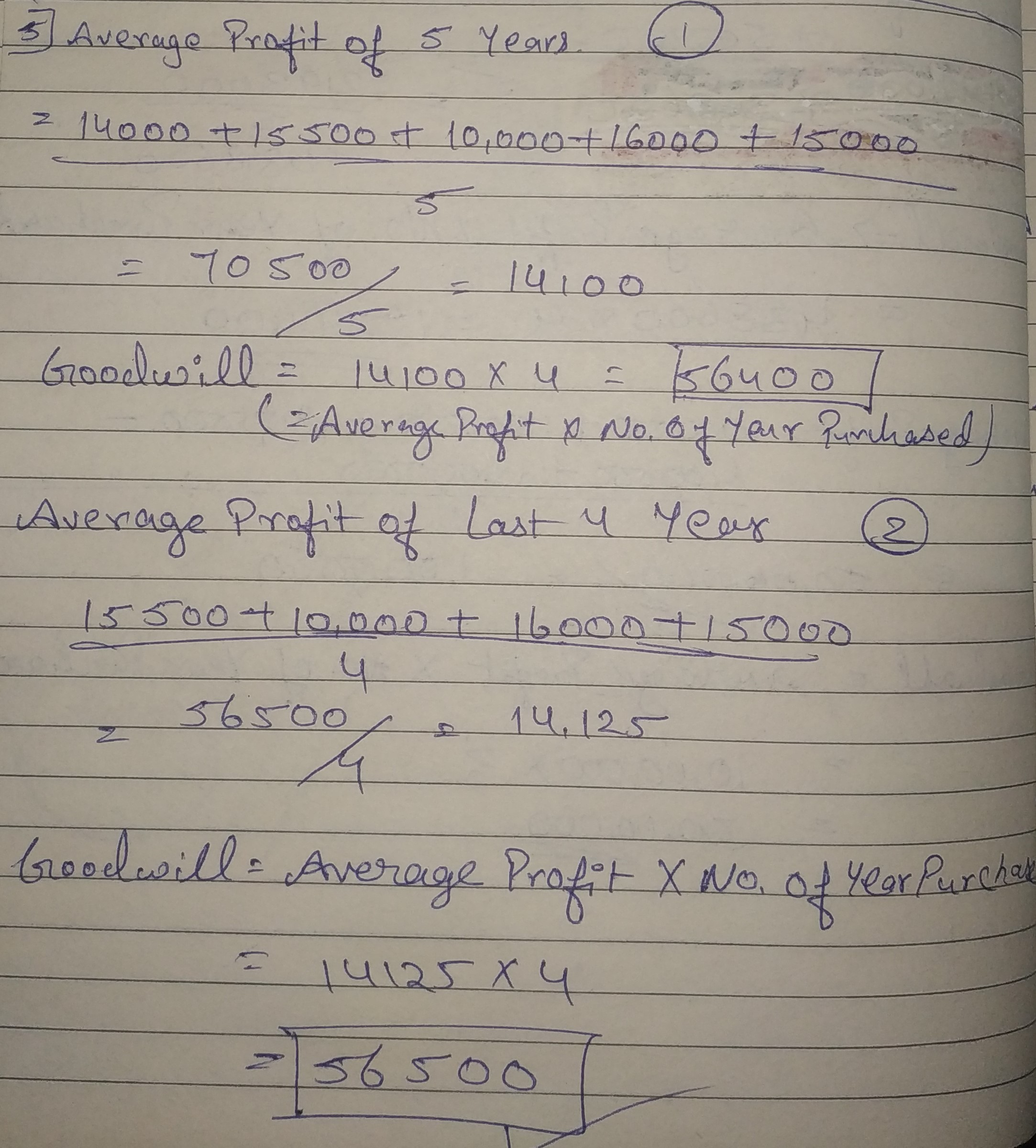

Question 5:

Purav and Purvi are partners in a firm sharing profits and losses in the ratio of 2 : 1. They decide to take Parv into partnership for 1/4th share on 1st April, 2019. For this purpose, goodwill is to be valued at four times the average annual profit of the previous four or five years, whichever is higher. The agreed profits for goodwill purpose of the past five years are:

| Year | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| Profits (₹) | 14,000 | 15,500 | 10,000 | 16,000 | 15,000 |

Calculate the value of goodwill.

ANSWER:

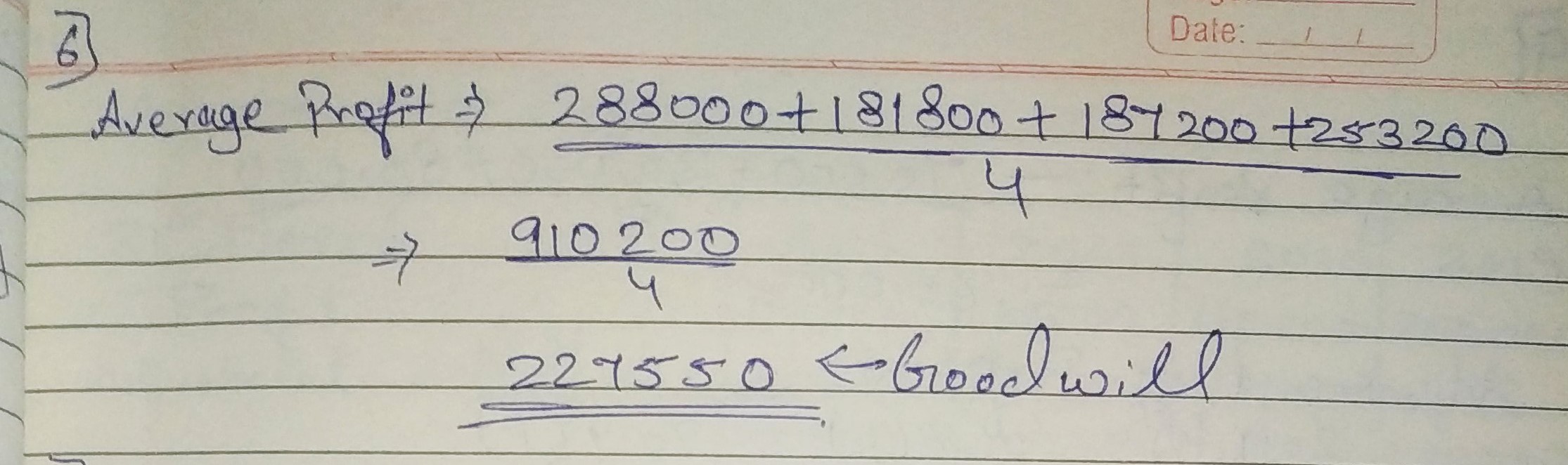

Question 6:

Annu, Baby and Chetan are partners in a firm sharing profits and losses equally. They decide to take Deep into partnership from 1st April, 2019 for 1/5th share in the future profits. For this purpose, goodwill is to be valued at 100% of the average annual profits of the previous three or four years, whichever is higher. The annual profits for the purpose of goodwill for the past four years were:

| Year Ended | Profit (₹) |

| 31st March, 2019 | 2,88,000; |

| 31st March, 2018 | 1,81,800; |

| 31st March, 2017 | 1,87,200; |

| 31st March, 2016 | 2,53,200. |

Calculate the value of goodwill.

ANSWER:

Average Profit Method when Past Adjustment are Made

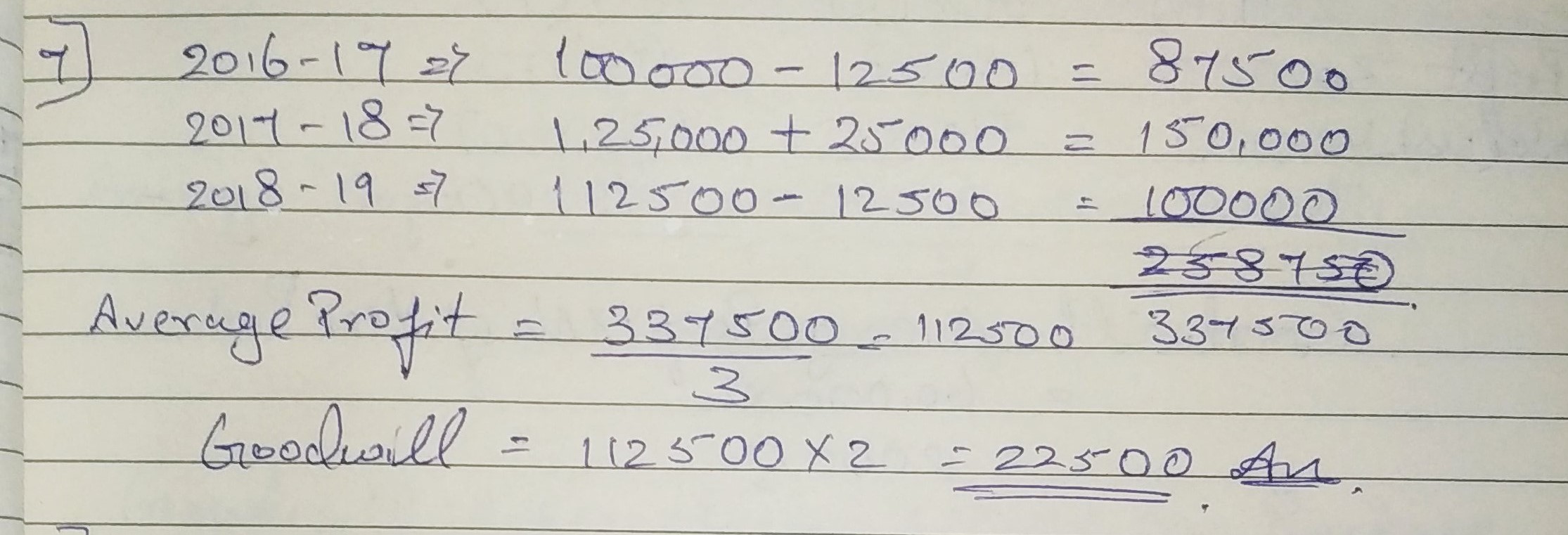

Question 7:

Divya purchased Jyoti’s business with effect from 1st April, 2019. Profits shown by Jyoti’s business for the last three financial years were:

| 2016-17 | : | ₹ 1,00,000 (including an abnormal gain of ₹ 12,500). |

| 2017-18 | : | ₹ 1,25,000 (after charging an abnormal loss of ₹ 25,000). |

| 2018-19 | : | ₹ 1,12,500 (excluding ₹ 12,500 as insurance premium on firm’s property- now to be insured). |

Calculate the value of firm’s goodwill on the basis of two year’s purchase of the average profit of the last three years.

ANSWER:

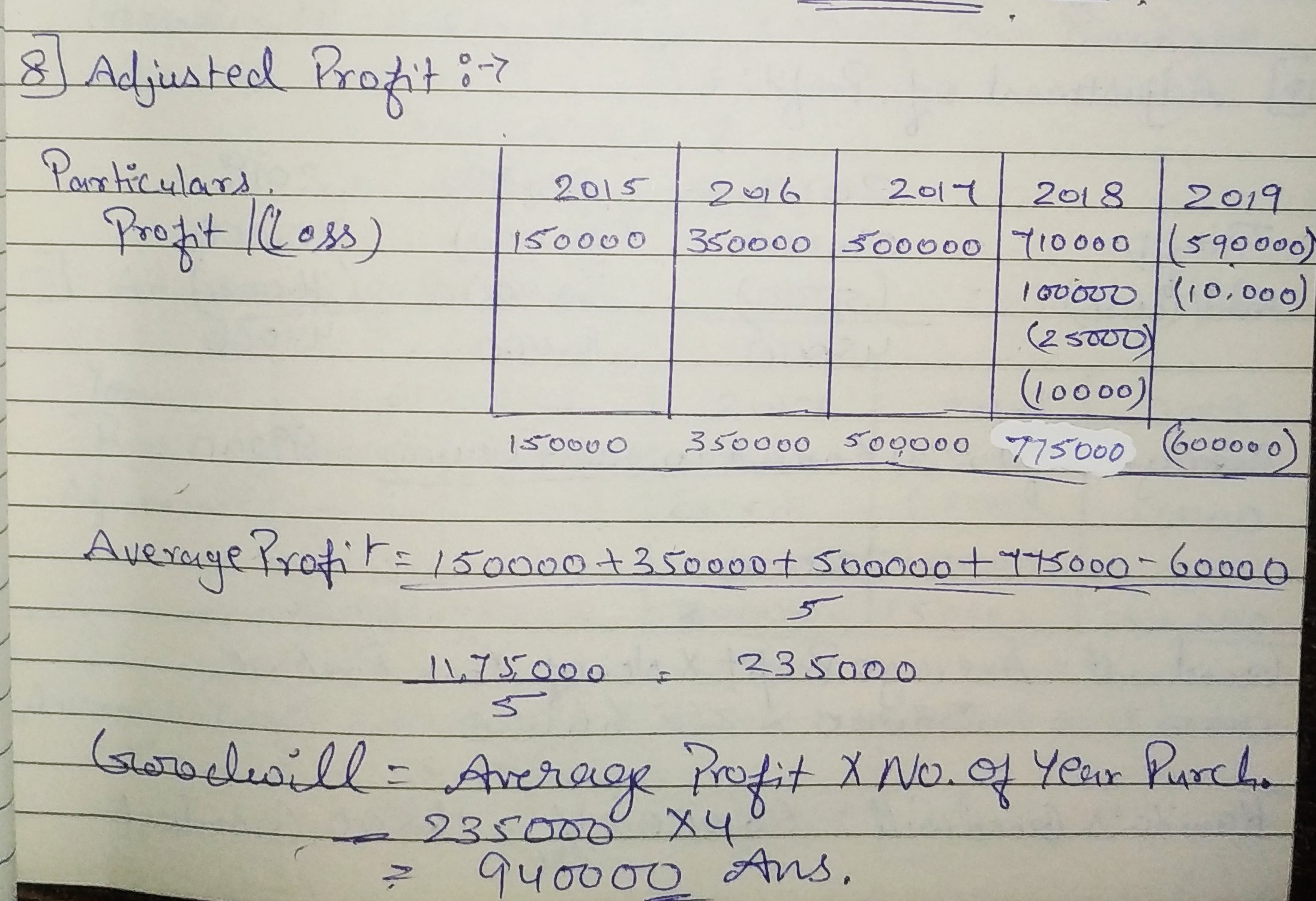

Question 8:

Abhay, Babu and Charu are partners sharing profits and losses equally. They agree to admit Daman for equal share of profit. For this purpose, the value of goodwill is to be calculated on the basis of four years’ purchase of average profit of last five years. These profits for the year ended 31st March, were:

| Year | 2015 | 2016 | 2017 | 2018 | 2019 |

| Profit/(Loss) (₹) | 1,50,000 | 3,50,000 | 5,00,000 | 7,10,000 | (5,90,000) |

On 1st April, 2018, a car costing ₹ 1,00,000 was purchased and debited to Travelling Expenses Account, on which depreciation is to be charged @ 25%. Interest of ₹ 10,000 on Non-trade Investments is credit to income for the year ended 31st March, 2018 and 2019.

Calculate the value of goodwill after adjusting the above.

ANSWER:

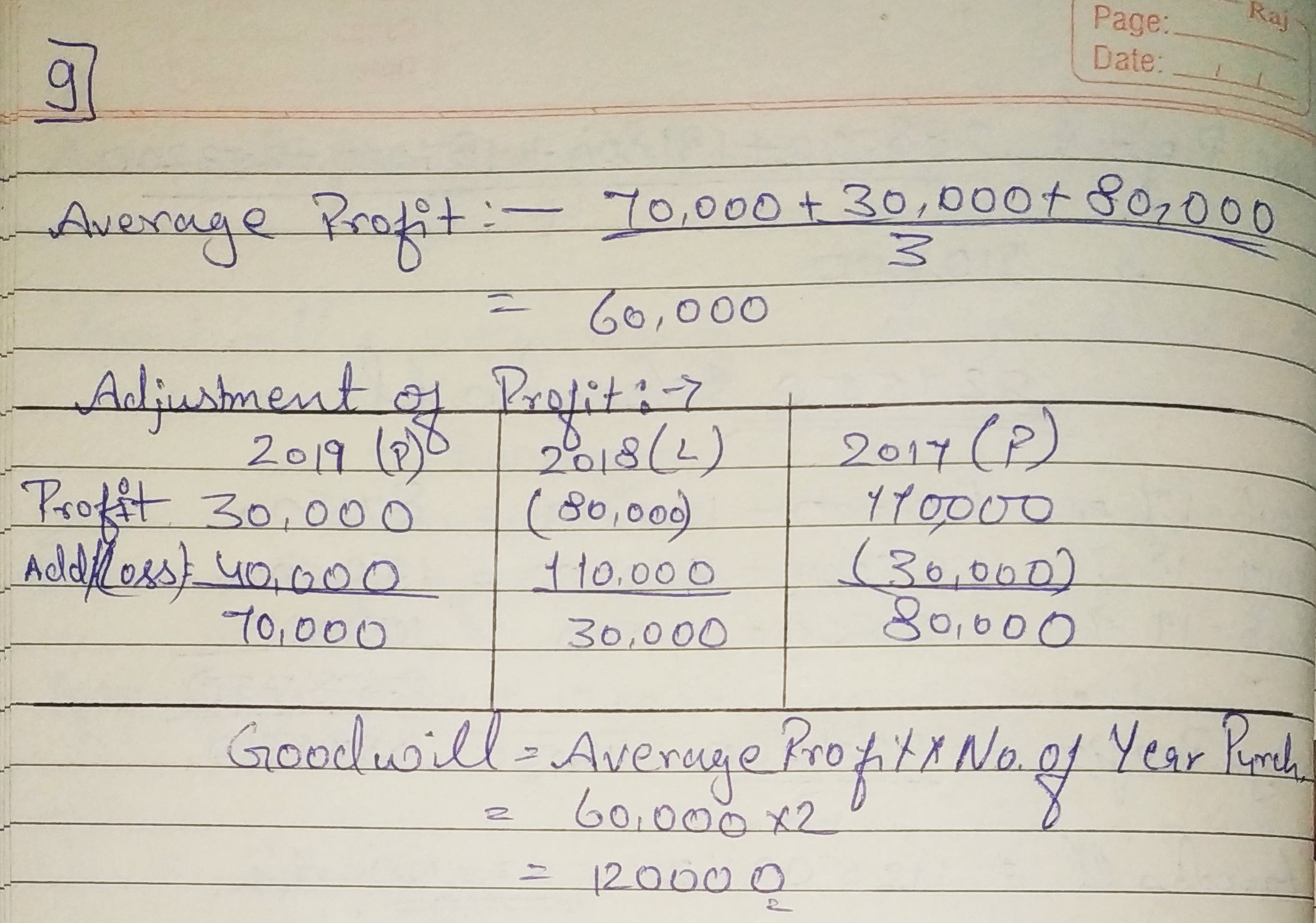

Question 9:

Bharat and Bhushan are partners sharing profits in the ratio of 3 : 2. They decided to admit Manu as a partner from 1st April, 2019 on the following terms:

(i) Manu will be given 2/5th share of the profit.

(ii) Goodwill of the firm will be valued at two years’ purchase of three years’ normal average profit of the firm.

Profits of the previous three years ended 31st March, were:

2019 – Profit ₹ 30,000 (after debiting loss of stock by fire ₹ 40,000).

2018 – Loss ₹ 80,000 (includes voluntary retirement compensation paid ₹ 1,10,000).

2017 – Profit ₹ 1,10,000 (including a gain (profit) of ₹ 30,000 on the sale of fixed assets).

Calculate the value of goodwill.

ANSWER:

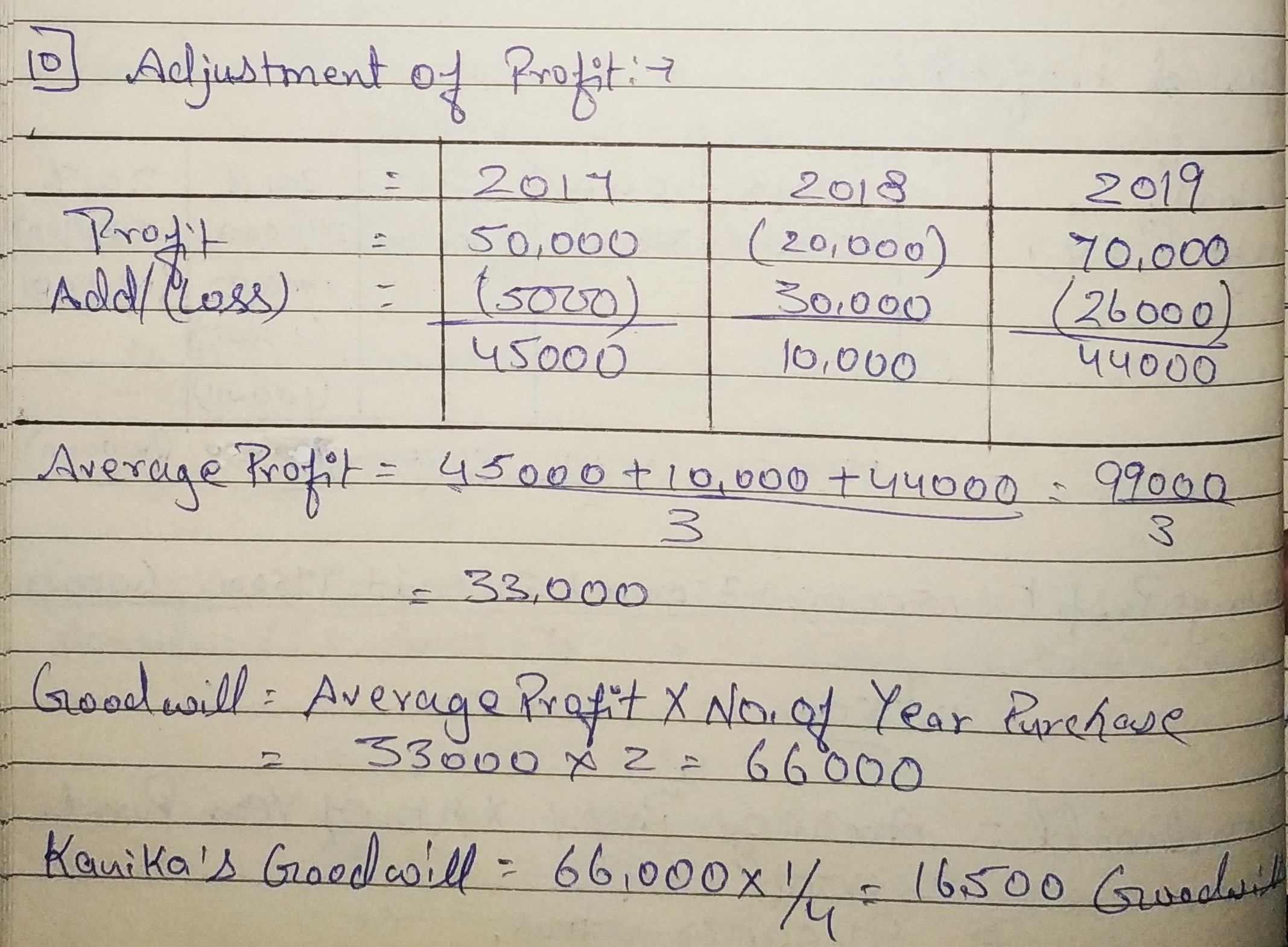

Question 10:

Bhaskar and Pillai are partners sharing profits and losses in the ratio of 3 : 2. They admit Kanika into partnership for 1/4th share in profit. Kanika brings in her share of goodwill in cash. Goodwill for this purpose is to be calculated at two years’ purchase of the average normal profit of past three years. Profits of the last three years ended 31st March, were:

2017 – Profit ₹ 50,000 (including profit on sale of assets ₹ 5,000).

2018 – Loss ₹ 20,000 (including loss by fire ₹ 30,000).

2019 – Profit ₹ 70,000 (including insurance claim received ₹ 18,000 and interest on investments and Dividend received ₹ 8,000).

Calculate the value of goodwill. Also, calculate goodwill brought in by Kanika.

ANSWER:

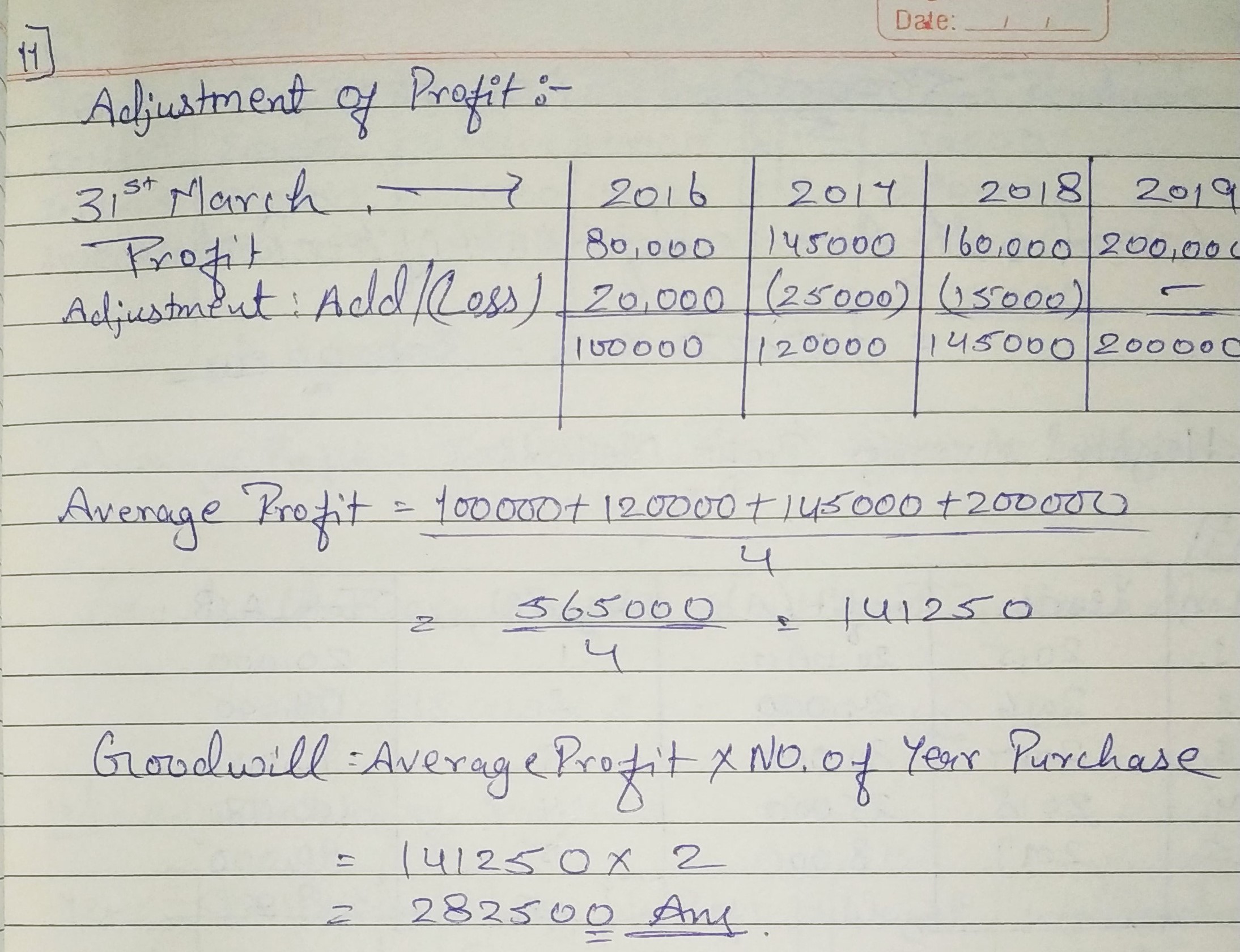

Question 11:

Sumit purchased Amit’s business on 1st April, 2019. Goodwill was decided to be valued at two years’ purchase of average normal profit of last four years. The profits for the past four years were:

| Year Ended | 31st March, 2016 | 31st March, 2017 | 31st March, 2018 | 31st March, 2019 |

| Profits (₹) | 80,000 | 1,45,000 | 1,60,000 | 2,00,000 |

Books of Account revealed that:

(i) Abnormal loss of ₹ 20,000 was debited to Profit and Loss Account for the year ended 31st March, 2016.

(ii) A fixed asset was sold in the year ended 31st March, 2017 and gain (profit) of ₹ 25,000 was credited to Profit and Loss Account.

(iii) In the year ended 31st March, 2018 assets of the firm were not insured due to oversight. Insurance premium not paid was ₹ 15,000.

Calculate the value of goodwill.

ANSWER:

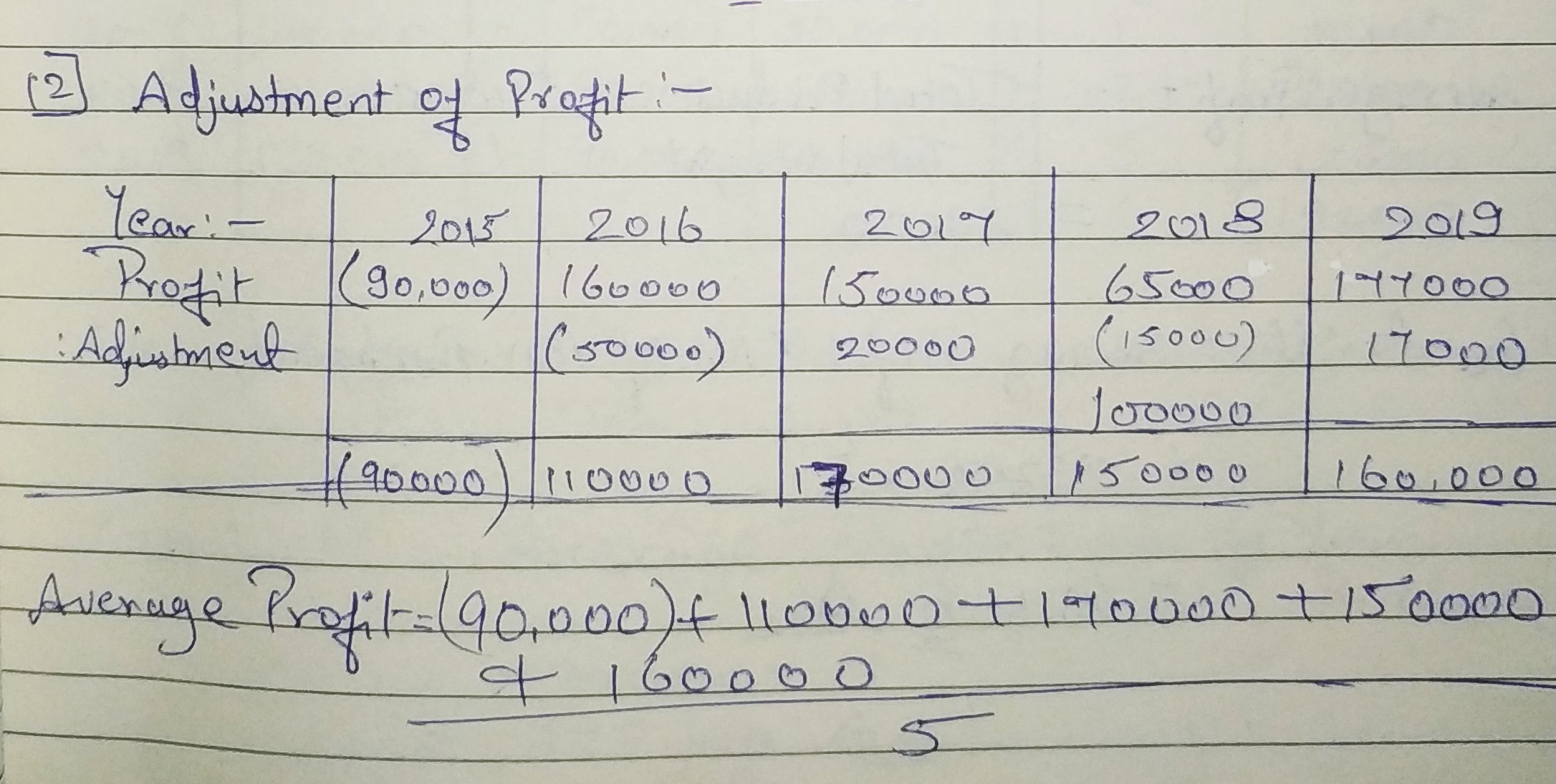

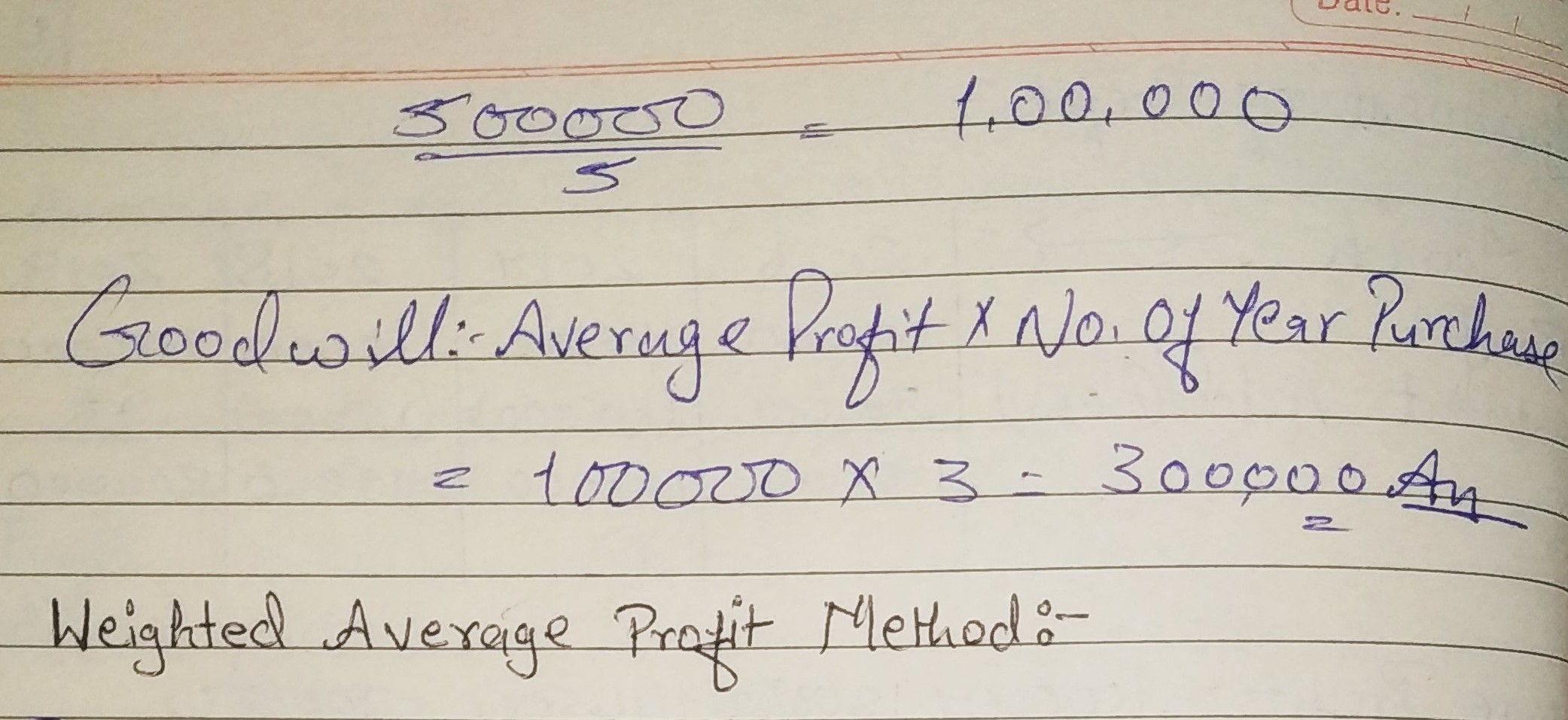

Question 12:

Geet and Meet are partners in a firm. They admit Jeet into partnership for equal share. It was agreed that goodwill will be valued at three years’ purchase of average profit of last five years. Profits for the last five years were:

| Year Ended | 31st March, 2015 | 31st March, 2016 | 31st March, 2017 | 31st March, 2018 | 31st March, 2019 |

| Profits (₹) | 90,000 (Loss) | 1,60,000 | 1,50,000 | 65,000 | 1,77,000 |

Books of Account of the firm revealed that:

(i) The firm had gain (profit) of ₹ 50,000 from sale of machinery sold in the year ended 31st March, 2016. The gain (profit) was credited in Profit and Loss Account.

(ii) There was an abnormal loss of ₹ 20,000 incurred in the year ended 31st March, 2017 because of a machine becoming obsolete in accident.

(iii) Overhauling cost of second hand machinery purchased on 1st July, 2017 amounting to ₹ 1,00,000 was debited to Repairs Account. Depreciation is charged @ 20% p.a. on Written Down Value Method.

Calculate the value of goodwill.

ANSWER:

Weighted Average Profit Method

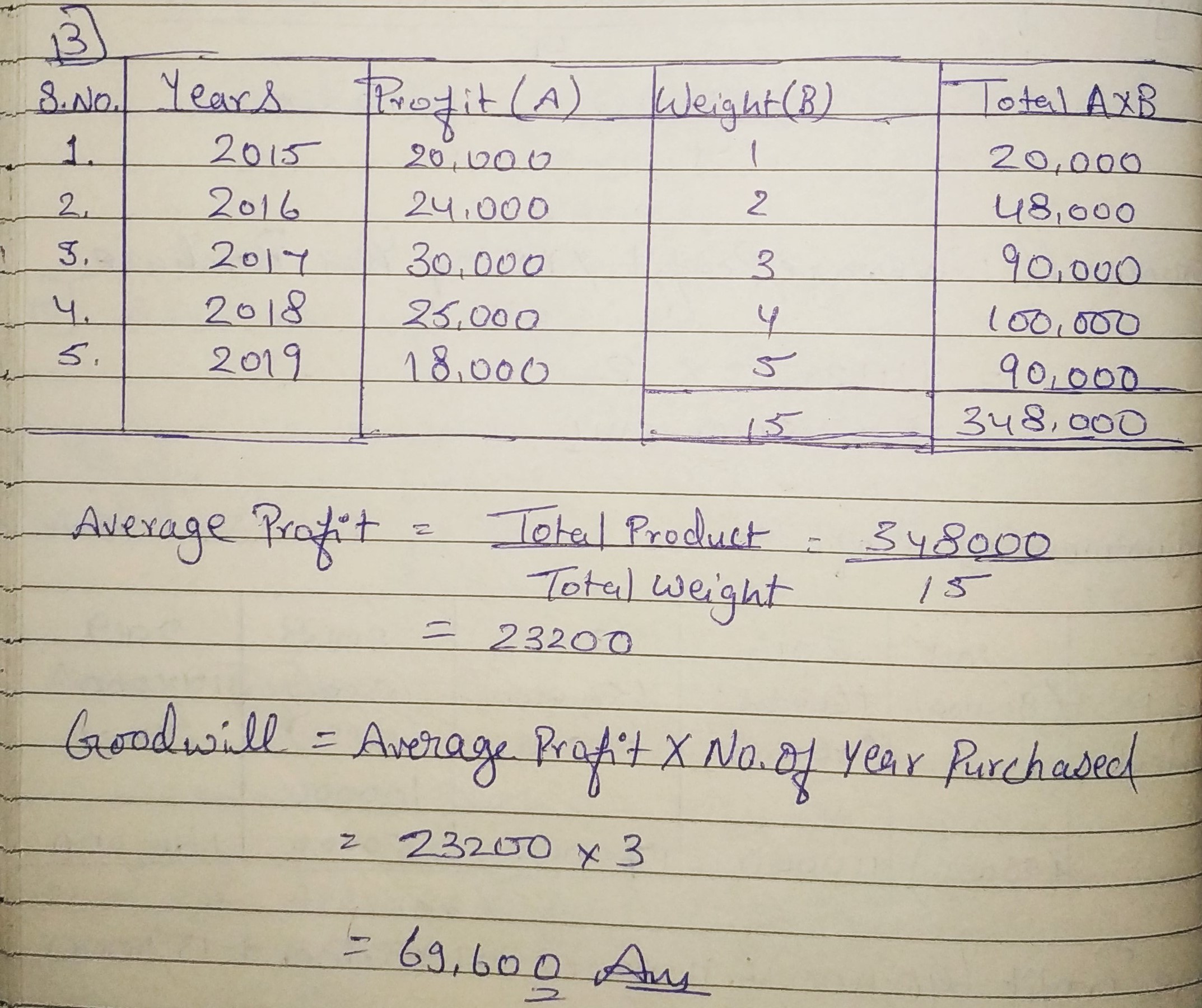

Question 13:

Profits of a firm for the year ended 31st March for the last five years were:

| Year Ended | 31st March, 2015 | 31st March, 2016 | 31st March, 2017 | 31st March, 2018 | 31st March, 2019 |

| Profits (₹) | 20,000 | 24,000 | 30,000 | 25,000 | 18,000 |

Calculate value of goodwill on the basis of three years’ purchase of Weighted Average Profit after assigning weights 1, 2, 3, 4 and 5 respectively to the profits for years ended 31st March, 2015, 2016, 2017, 2018 and 2019.

ANSWER:

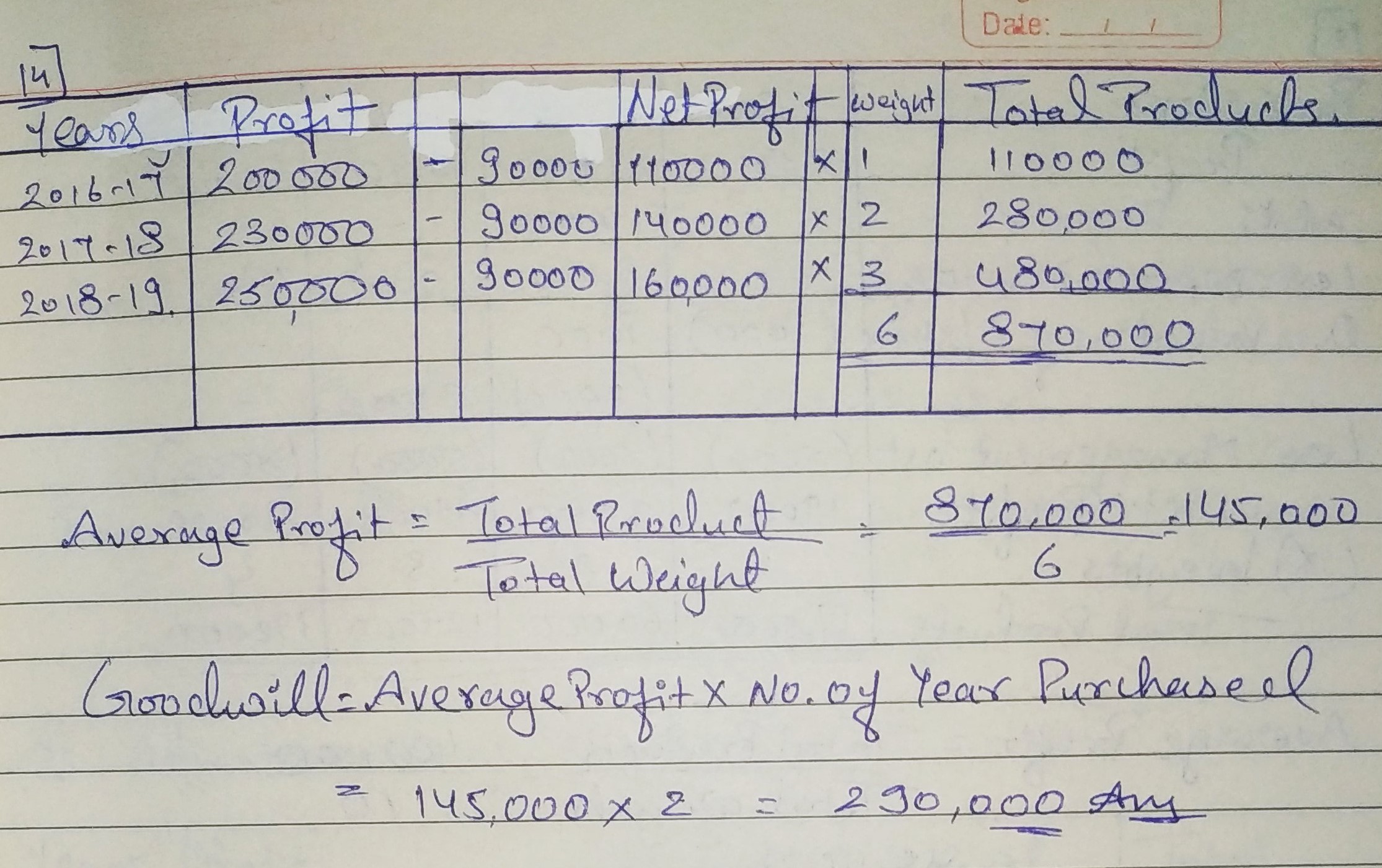

Question 14:

A and B are partners sharing profits and losses in the ratio of 5 : 3. On 1st April, 2019, C is admitted to the partnership for 1/4th share of profits. For this purpose, goodwill is to be valued at two years’ purchase of last three years’ profits (after allowing partners’ remuneration). Profits to be weighted 1 : 2 : 3, the greatest weight being given to last year. Net profit before partners’ remuneration were: 2016-17 : ₹ 2,00,000; 2017-18 : ₹ 2,30,000; 2018-19 : ₹ 2,50,000. The remuneration of the partners is estimated to be ₹ 90,000 p.a. Calculate amount of goodwill.

ANSWER:

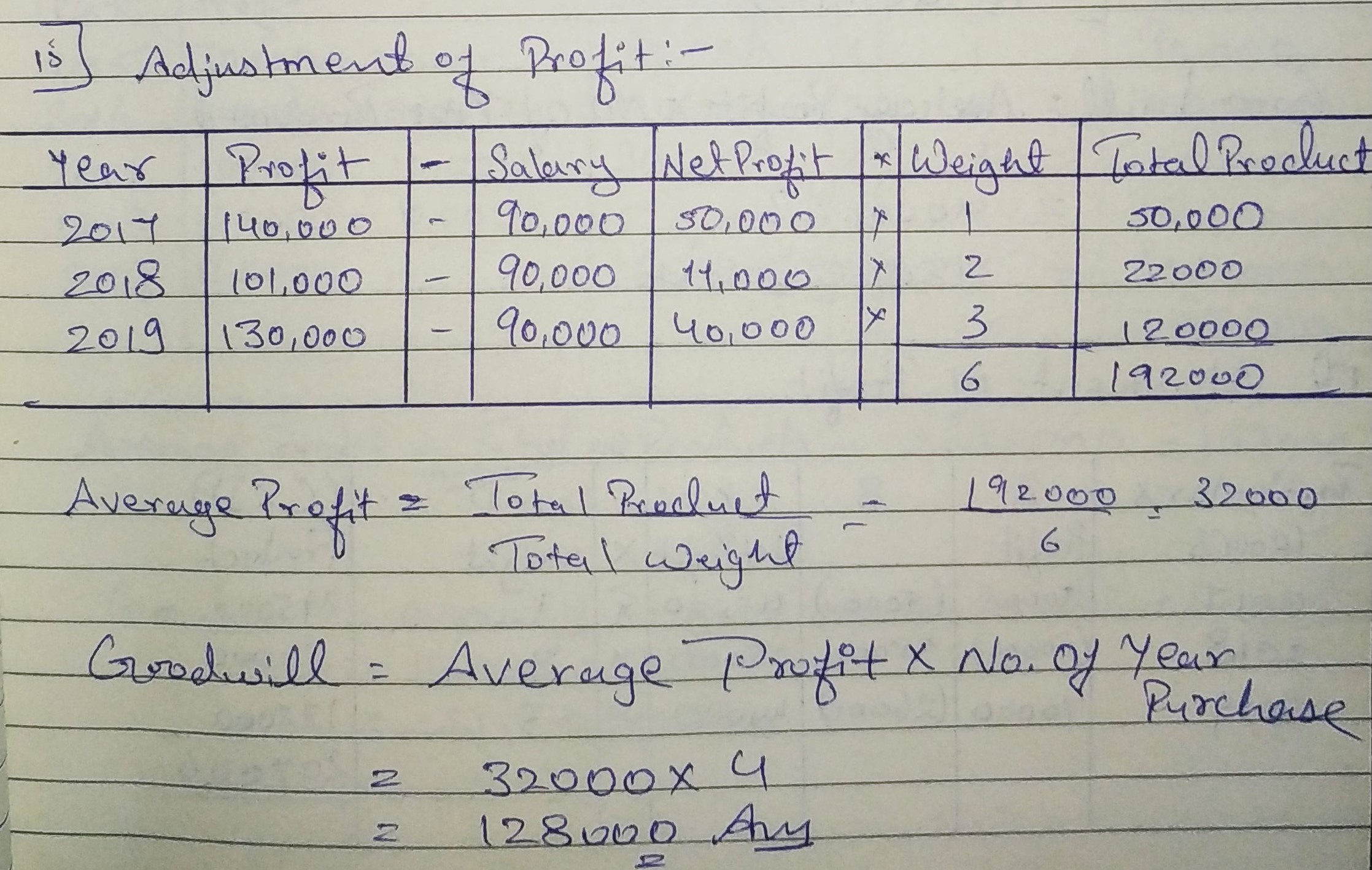

Question 15:

Raman and Daman are partners sharing profits in the ratio of 60 : 40 and for the last four years they have been getting annual salaries of ₹ 50,000 and ₹ 40,000 respectively. The annual accounts have shown the following net profit before charging partners’ salaries:

Year ended 31st March, 2017 − ₹ 1,40,000; 2018 − ₹ 1,01,000 and 2019 − ₹ 1,30,000.

On 1st April, 2019, Zeenu is admitted to the partnership for 1/4th share in profit (without any salary). Goodwill is to be valued at four years’ purchase of weighted average profit of last three years (after partners’ salaries); Profits to be weighted as 1 : 2 : 3, the greatest weight being given to the last year. Calculate the value of Goodwill.

ANSWER:

Weighted Average Profit Method when Adjustment are Made

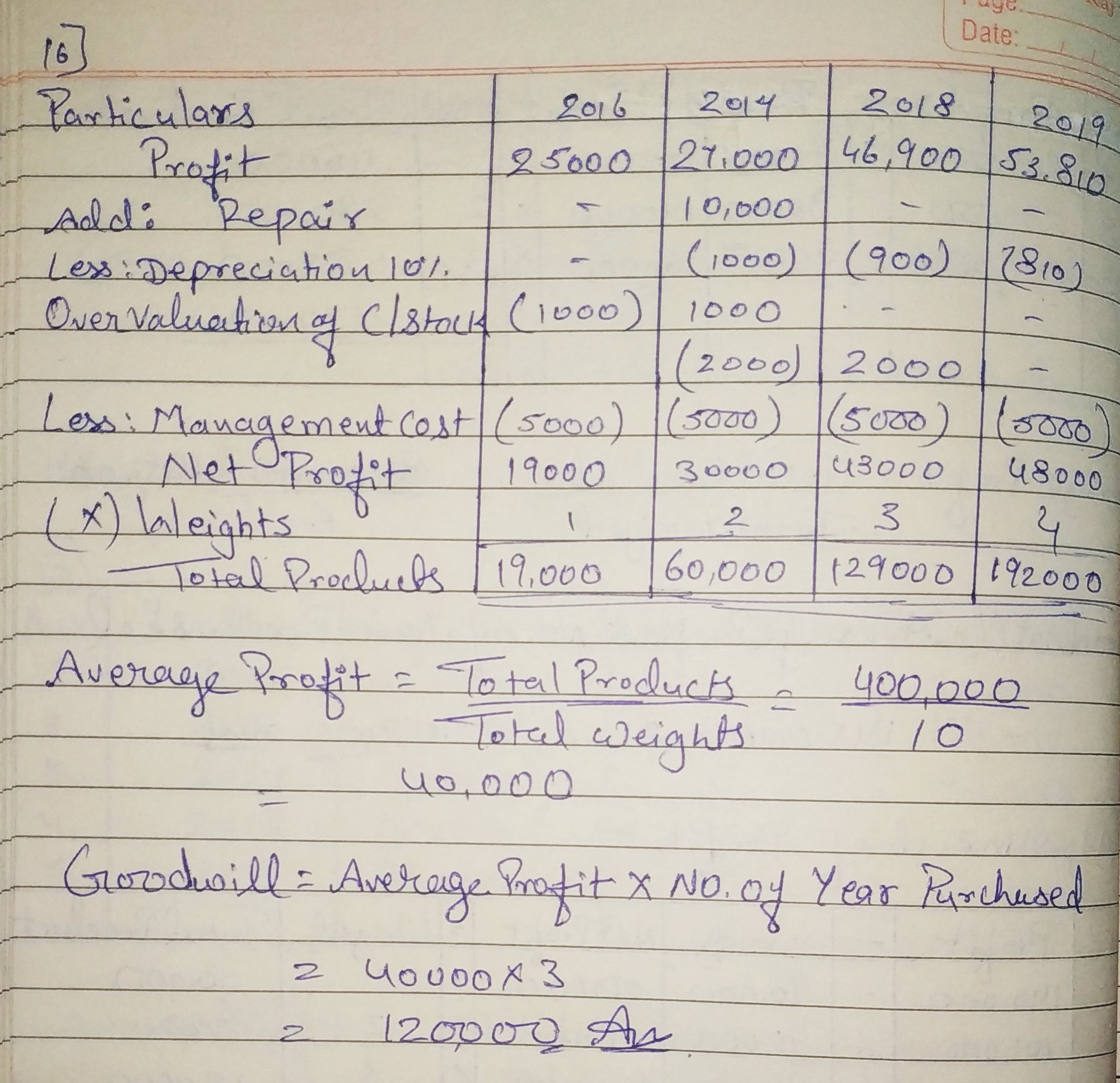

Question 16:

Calculate goodwill of a firm on the basis of three years’ purchase of the Weighted Average Profit of the last four years. The profits of the last four financial years ended 31st March, were: 2016 − ₹ 25,000; 2017 − ₹ 27,000; 2018 − ₹ 46,900 and 2019 − ₹ 53,810. The weights assigned to each year are: 2016 − 1; 2017 − 2; 2018 − 3; 2019 − 4. You are supplied the following information:

(i) On 1st April, 2016, a major plant repair was undertaken for ₹ 10,000 which was charged to revenue. The said sum is to be capitalised for goodwill calculation subject to adjustment of depreciation of 10% on Reducing Balance Method.

(ii) The Closing Stock for the years ended 31st March, 2017 and 2018 were overvalued by ₹ 1,000 and ₹ 2,000 respectively.

(iii) To cover management cost an annual charge of ₹ 5,000 should be made for the purpose of goodwill valuation.

ANSWER:

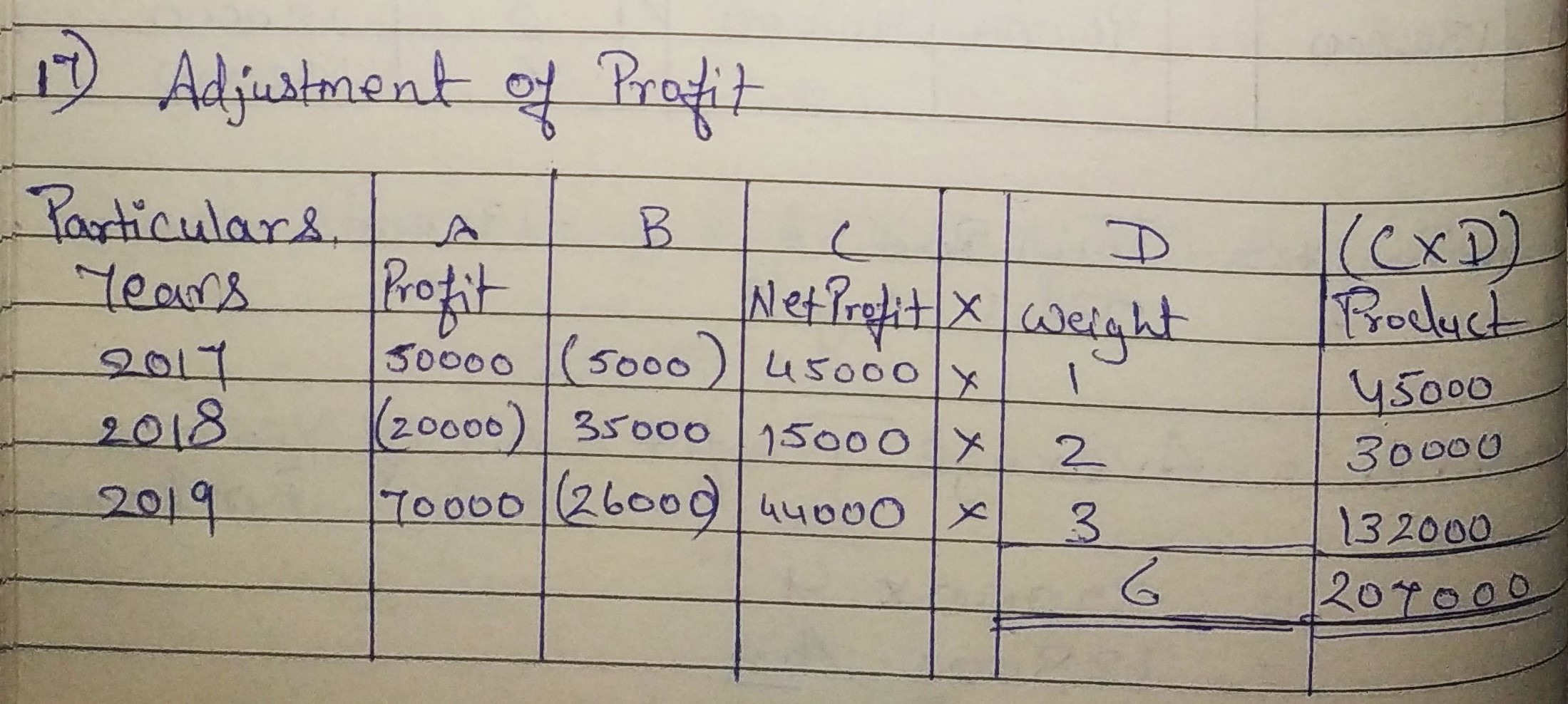

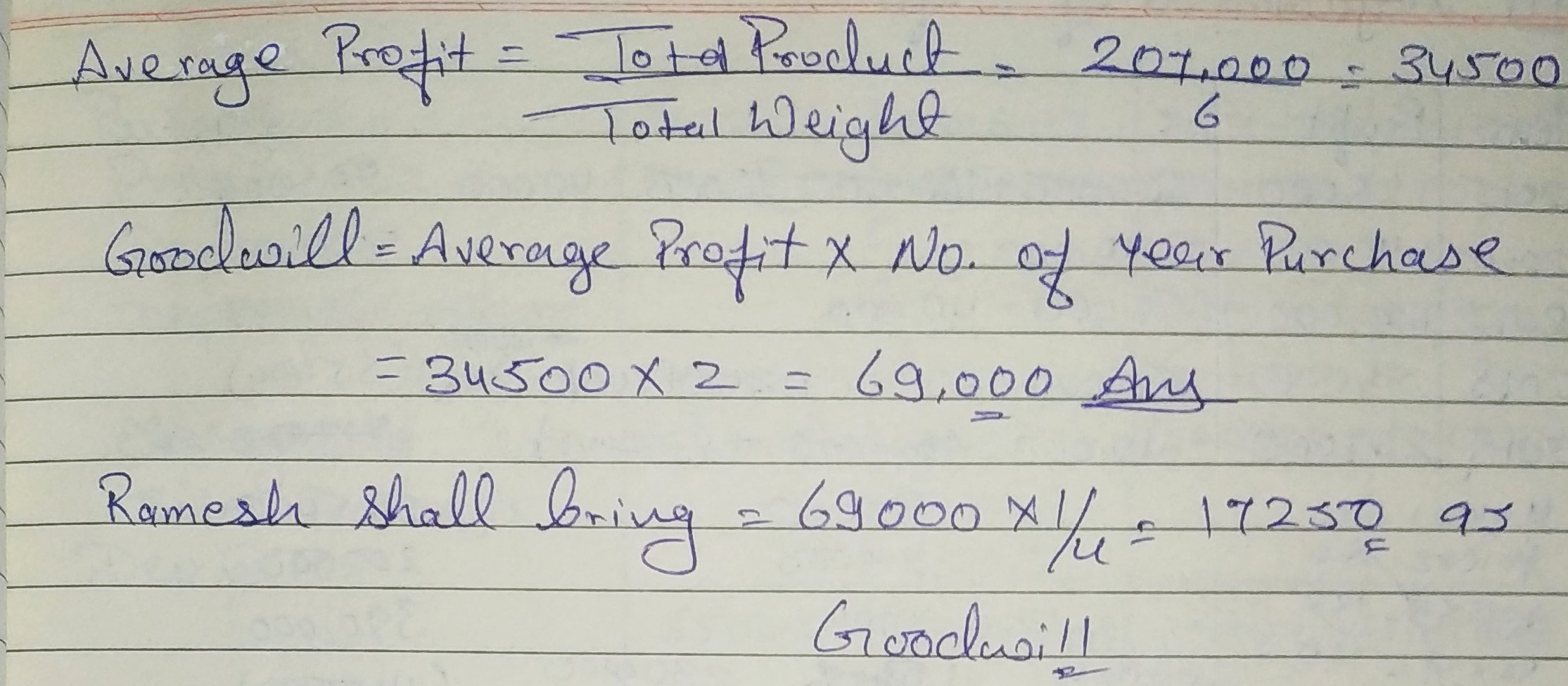

Question 17:

Dinesh and Mahesh are partners sharing profits and losses in the ratio of 3 : 2. They admit Ramesh into partnership for 1/4th share in profits. Ramesh brings in his share of goodwill in cash. Goodwill for this purpose shall be calculated at two years’ purchase of the weighted average normal profit of past three years. Weights being assigned to each year 2017−1; 2018−2 and 2019−3. Profits of the last three years were:

2017 − Profit ₹ 50,000 (including profits on sale of assets ₹ 5,000).

2018 − Loss ₹ 20,000 (including loss by fire ₹ 35,000).

2019 − Profit ₹ 70,000 (including insurance claim received ₹ 18,000 and interest on investments and dividend received ₹ 8,000).

Calculate the value of goodwill. Also, calculate the goodwill brought in by Ramesh.

ANSWER:

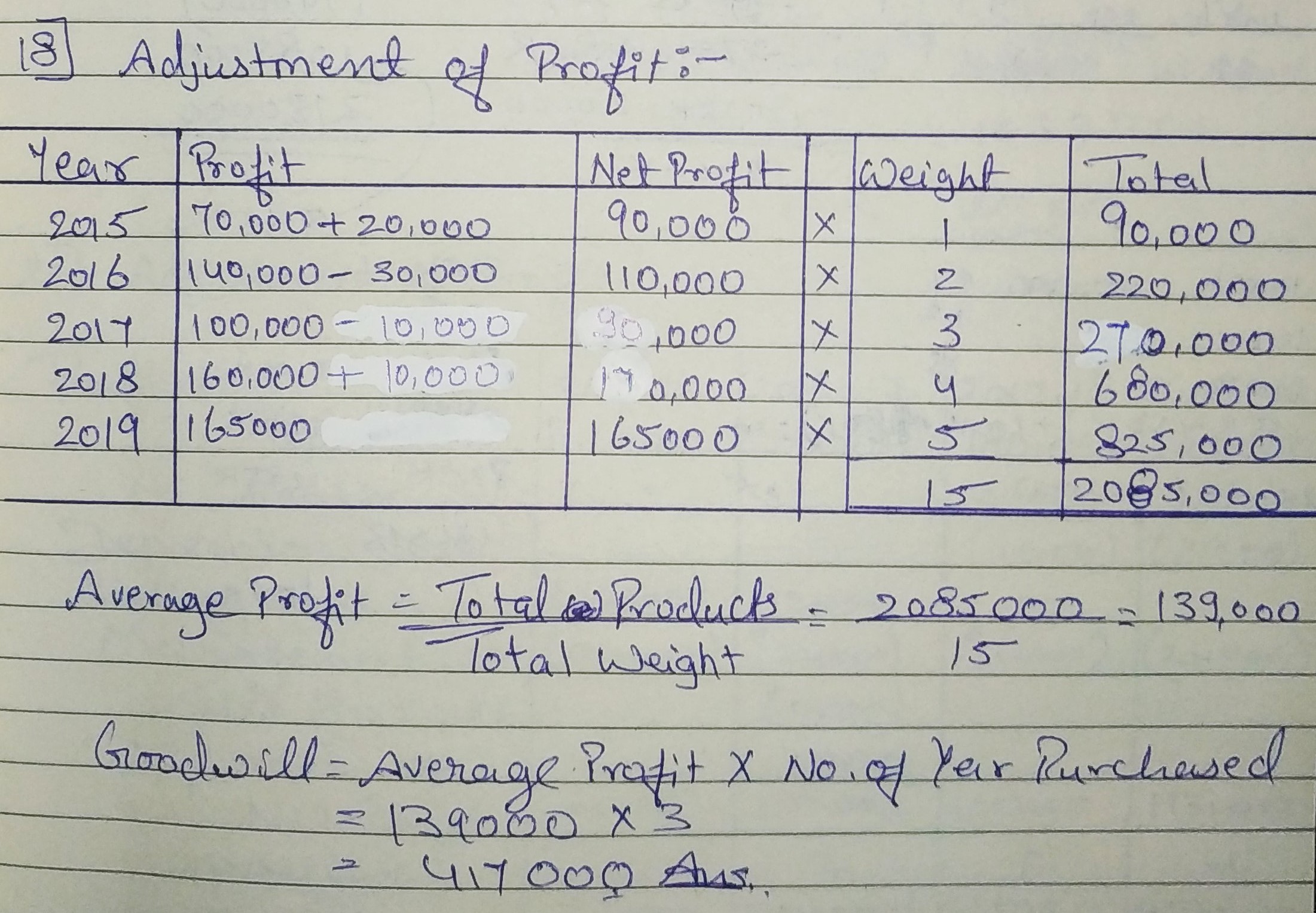

Question 18:

Manbir and Nimrat are partners and they admit Anahat into partnership. It was agreed to value goodwill at three years’ purchase on Weighted Average Profit Method taking profits of last five years. Weights assigned to each year as 1, 2, 3, 4 and 5 respectively to profits for the year ended 31st March, 2015 to 2019. The profits for these years were: ₹ 70,000, ₹ 1,40,000, ₹ 1,00,000, ₹ 1,60,000 and ₹ 1,65,000 respectively.

Scrutiny of books of account revealed following information:

(i) There was an abnormal loss of ₹ 20,000 in the year ended 31st March, 2015.

(ii) There was an abnormal gain (profit) of ₹ 30,000 in the year ended 31st March, 2016.

(iii) Closing Stock as on 31st March, 2018 was overvalued by ₹ 10,000.

Calculate the value of goodwill.

ANSWER:

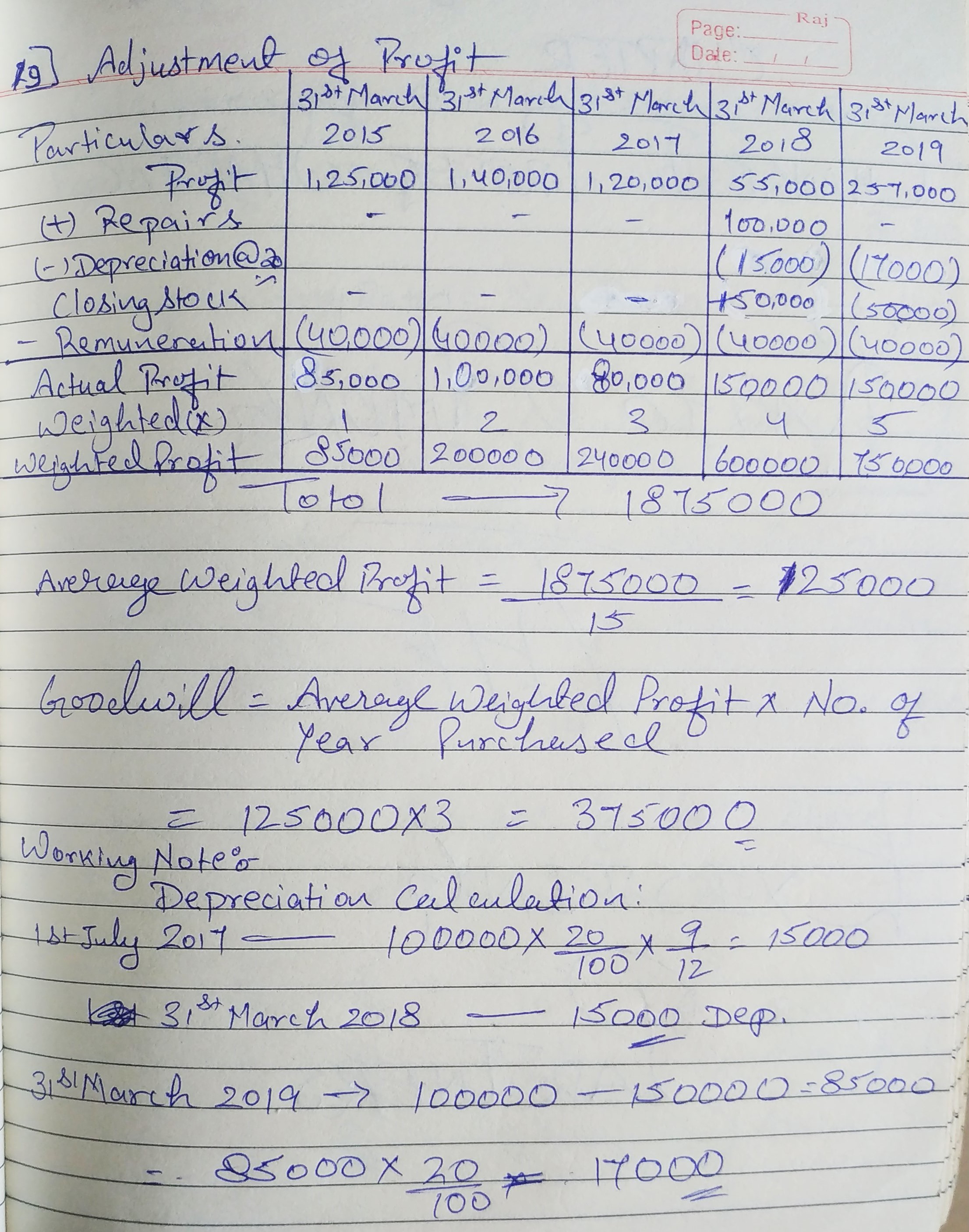

Question 19:

Mahesh and Suresh are partners and they admit Naresh into partnership. They agreed to value goodwill at three years’ purchase on Weighted Average Profit Method taking profits for the last five years. They assigned weights from 1 to 5 beginning from the earliest year and onwards. The profits for the last five years were as follows:

| Year Ended | 31st March, 2015 | 31st March, 2016 | 31st March, 2017 | 31st March, 2018 | 31st March, 2019 |

| Profits (₹) | 1,25,000 | 1,40,000 | 1,20,000 | 55,000 | 2,57,000 |

Scrutiny of books of account revealed the following:

(i) A second-hand machine was purchased for ₹ 5,00,000 on 1st July, 2017 and ₹ 1,00,000 were spent to make it operational. ₹ 1,00,000 were wrongly debited to Repairs Account. Machinery is depreciated @ 20% p.a. on Written Down Value Method.

(ii) Closing Stock as on 31st March, 2018 was undervalued by ₹ 50,000.

(iii) Remuneration to partners was to be considered as charge against profit and remuneration of ₹ 20,000 p.a. for each partner was considered appropriate.

Calculate the value of goodwill.

ANSWER:

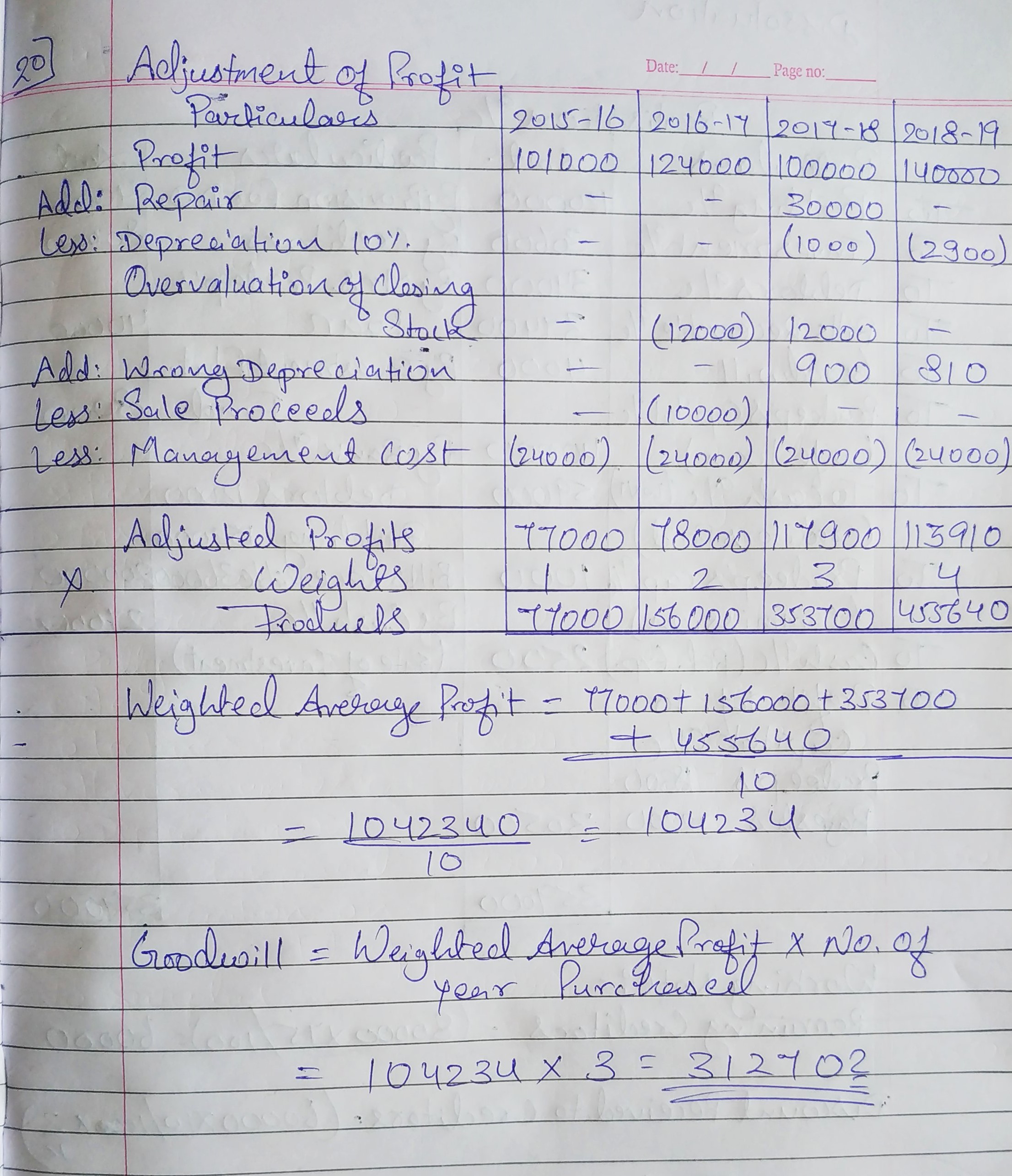

Question 20:

Calculate the goodwill of a firm on the basis of three years’ purchase of the weighted average profit of the last four years. The appropriate weights to be used and profits are:

| Year | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| Profits (₹) | 1,01,000 | 1,24,000 | 1,00,000 | 1,40,000 |

| Weights | 1 | 2 | 3 | 4 |

On a scrutiny of the accounts, the following matters are revealed:

(i) On 1st December, 2017, a major repair was made in respect of the plant incurring ₹ 30,000 which was charged to revenue. The said sum is agreed to be capitalised for goodwill calculation subject to adjustment of depreciation of 10% p.a. on Reducing Balance Method.

(ii) The closing stock for the year 2016-17 was overvalued by ₹ 12,000.

(iii) To cover management cost, an annual charge of ₹ 24,000 should be made for the purpose of goodwill valuation.

(iv) On 1st April, 2016, a machine having a book value of ₹ 10,000 was sold for ₹ 11,000 but the proceeds were wrongly credited to Profit and Loss Account. No effect has been given to rectify the same. Depreciation is charged on machine @ 10% p.a. on reducing balance method.

ANSWER:

Super Profit Method

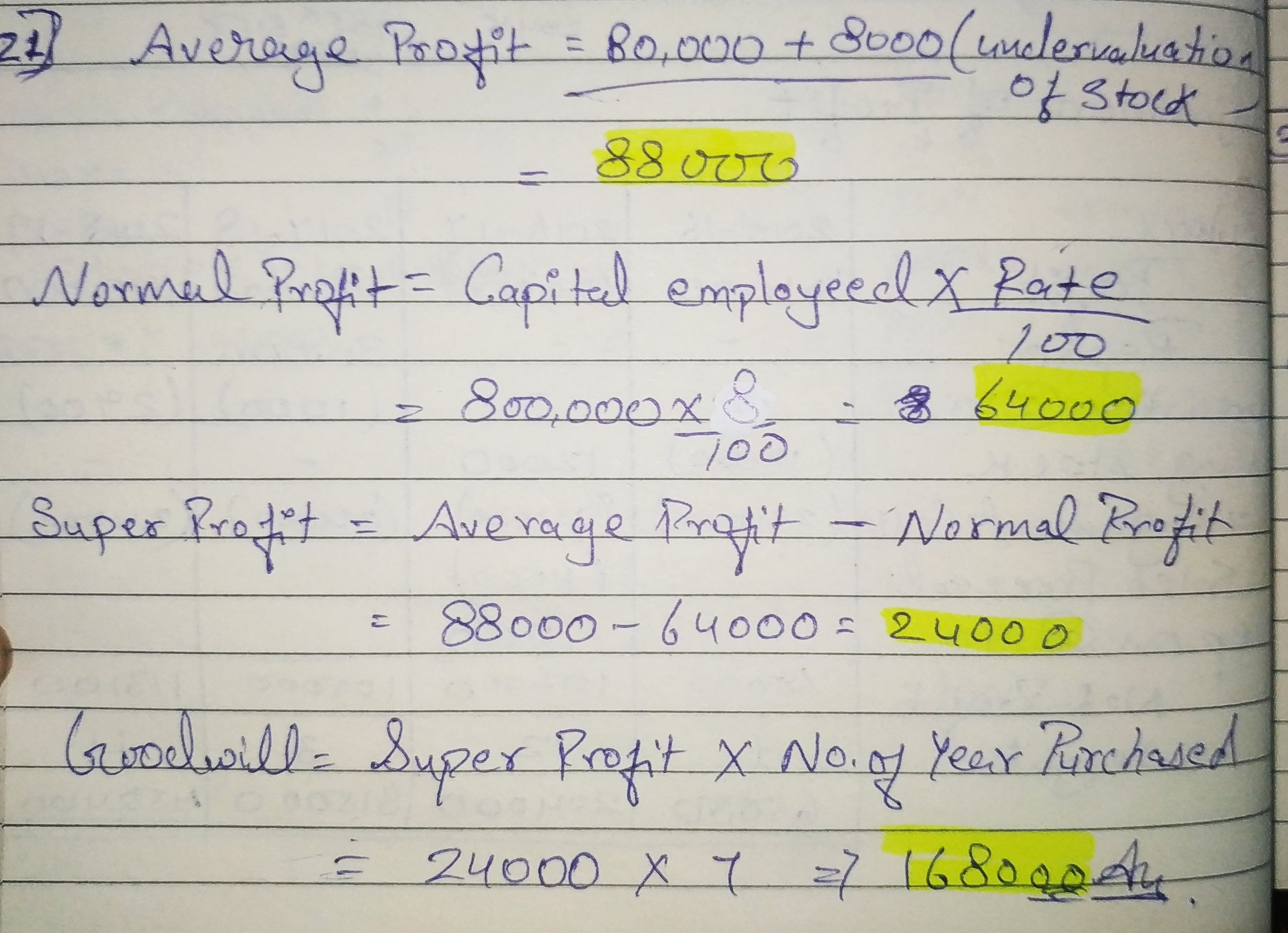

Question 21:

Average profit earned by a firm is ₹ 80,000 which includes undervaluation of stock of ₹ 8,000 on an average basis. The capital invested in the business is ₹ 8,00,000 and the normal rate of return is 8%. Calculate goodwill of the firm on the basis of 7 times the super profit.

ANSWER:

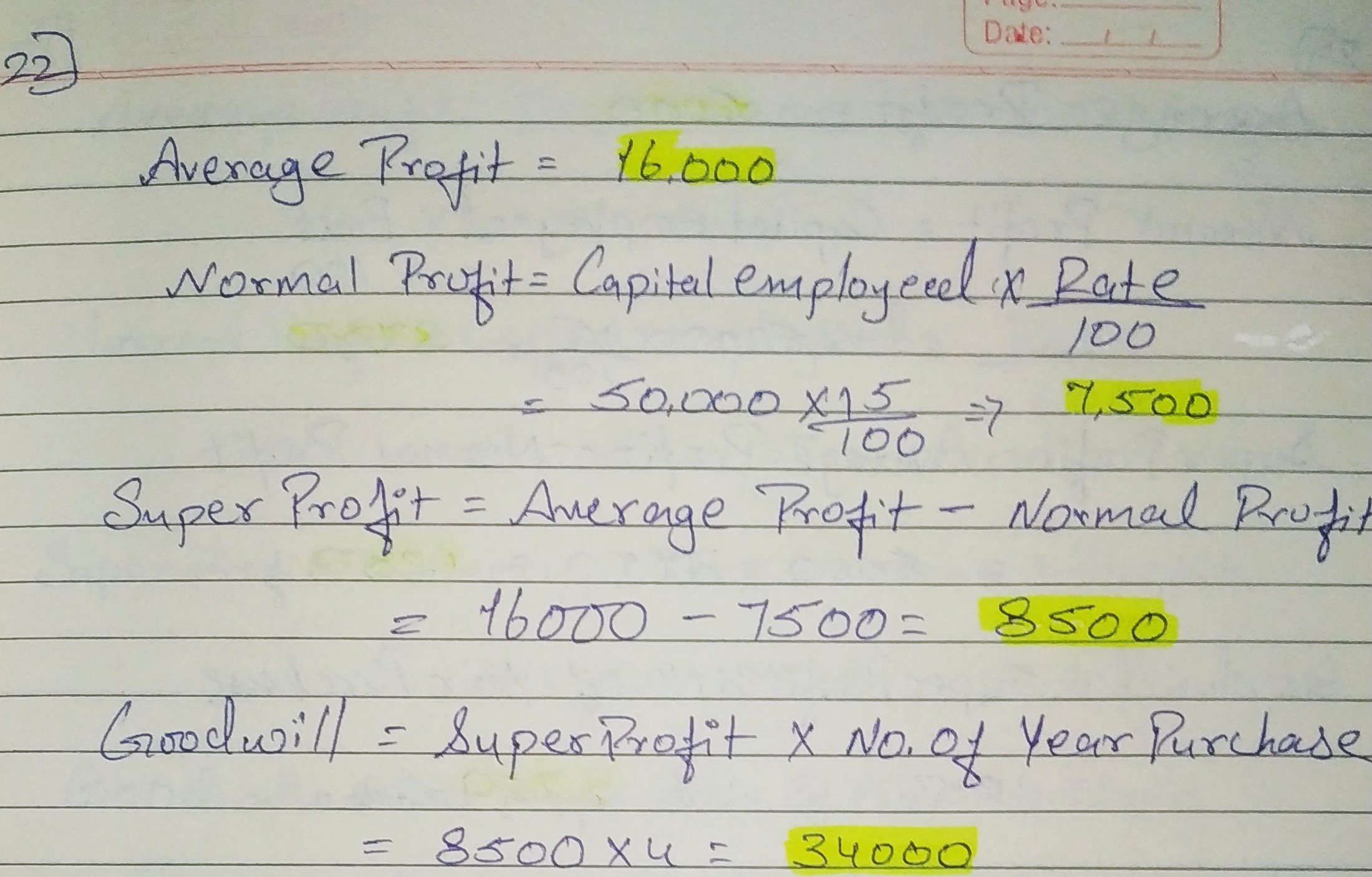

Question 22:

Gupta and Bose had a firm in which they had invested ₹ 50,000. On an average, the profits were ₹ 16,000. The normal rate of return in the industry is 15%. Goodwill is to be valued at four years’ purchase of profits in excess of profits @ 15% on the money invested. Calculate the value goodwill.

ANSWER:

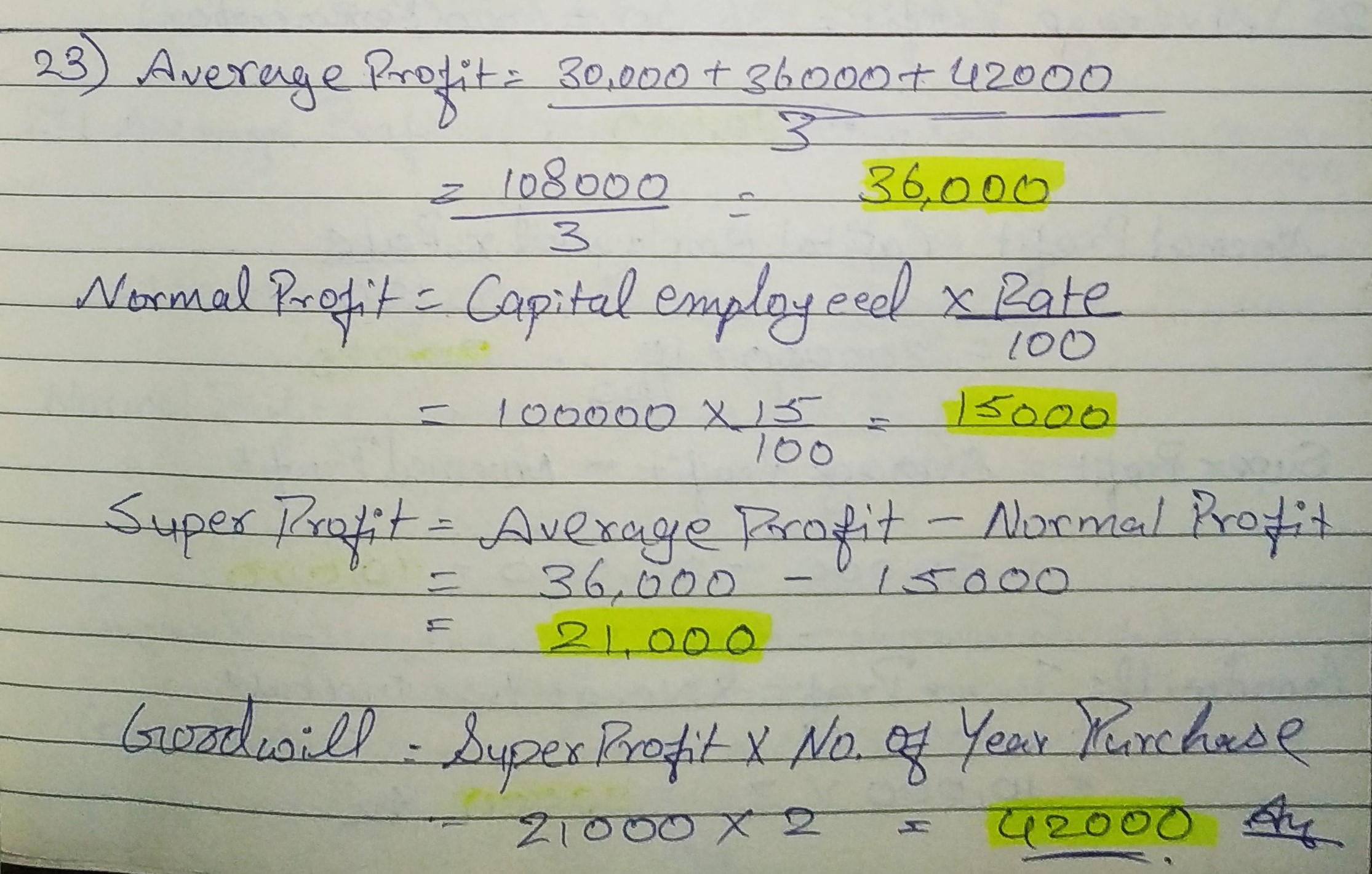

Question 23:

The total capital of the firm of Sakshi, Mehak and Megha is ₹ 1,00,000 and the market rate of interest is 15%. The net profits for the last 3 years were ₹ 30,000; ₹ 36,000 and ₹ 42,000. Goodwill is to be valued at 2 years’ purchase of the last 3 years’ super profits. Calculate the goodwill of the firm.

ANSWER:

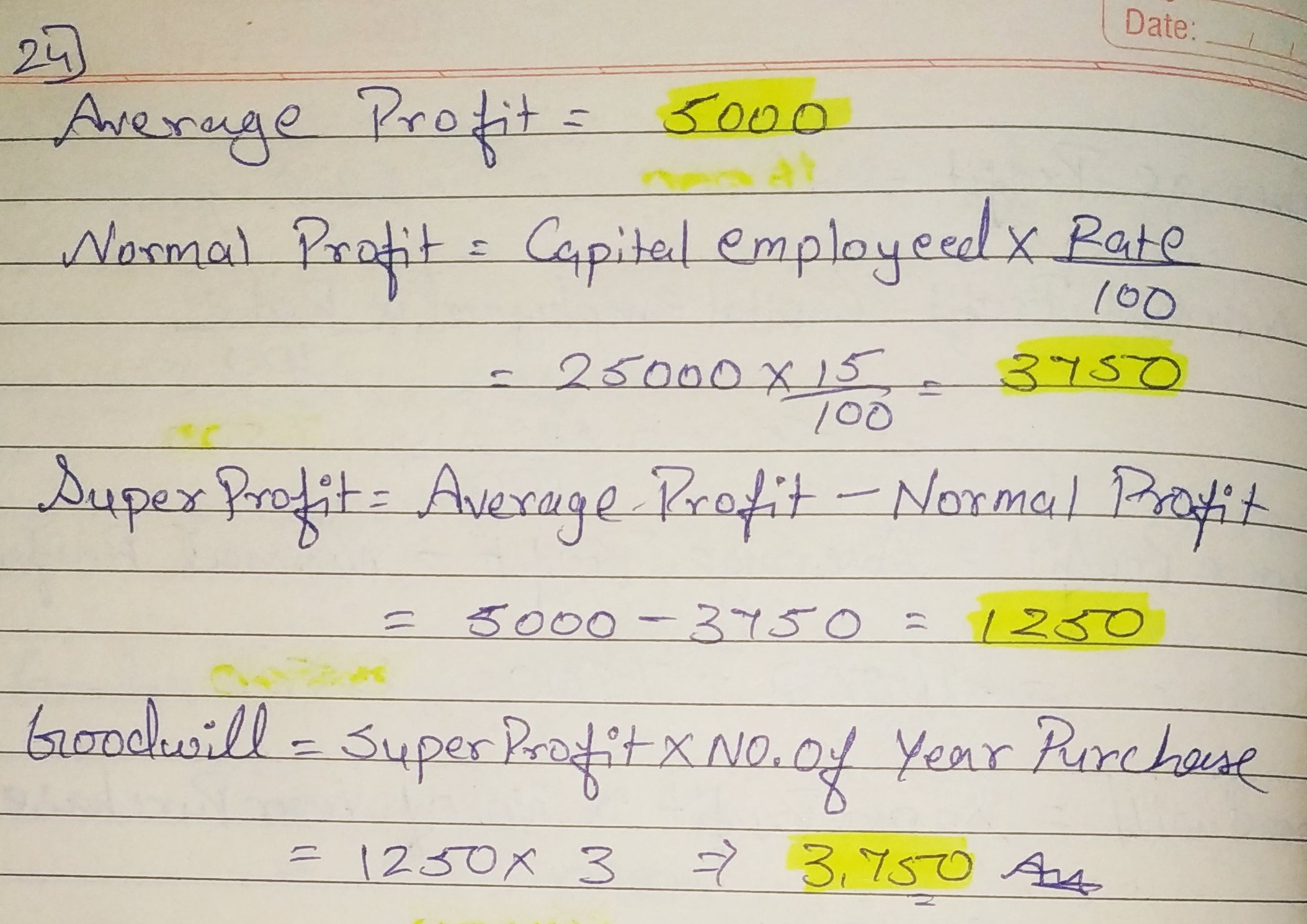

Question 24:

Rakesh and Ashok earned a profit of ₹ 5,000. They employed capital of ₹ 25,000 in the firm. It is expected that the normal rate of return is 15% of the capital. Calculate amount of goodwill if goodwill is valued at three years’ purchase of super profit.

ANSWER:

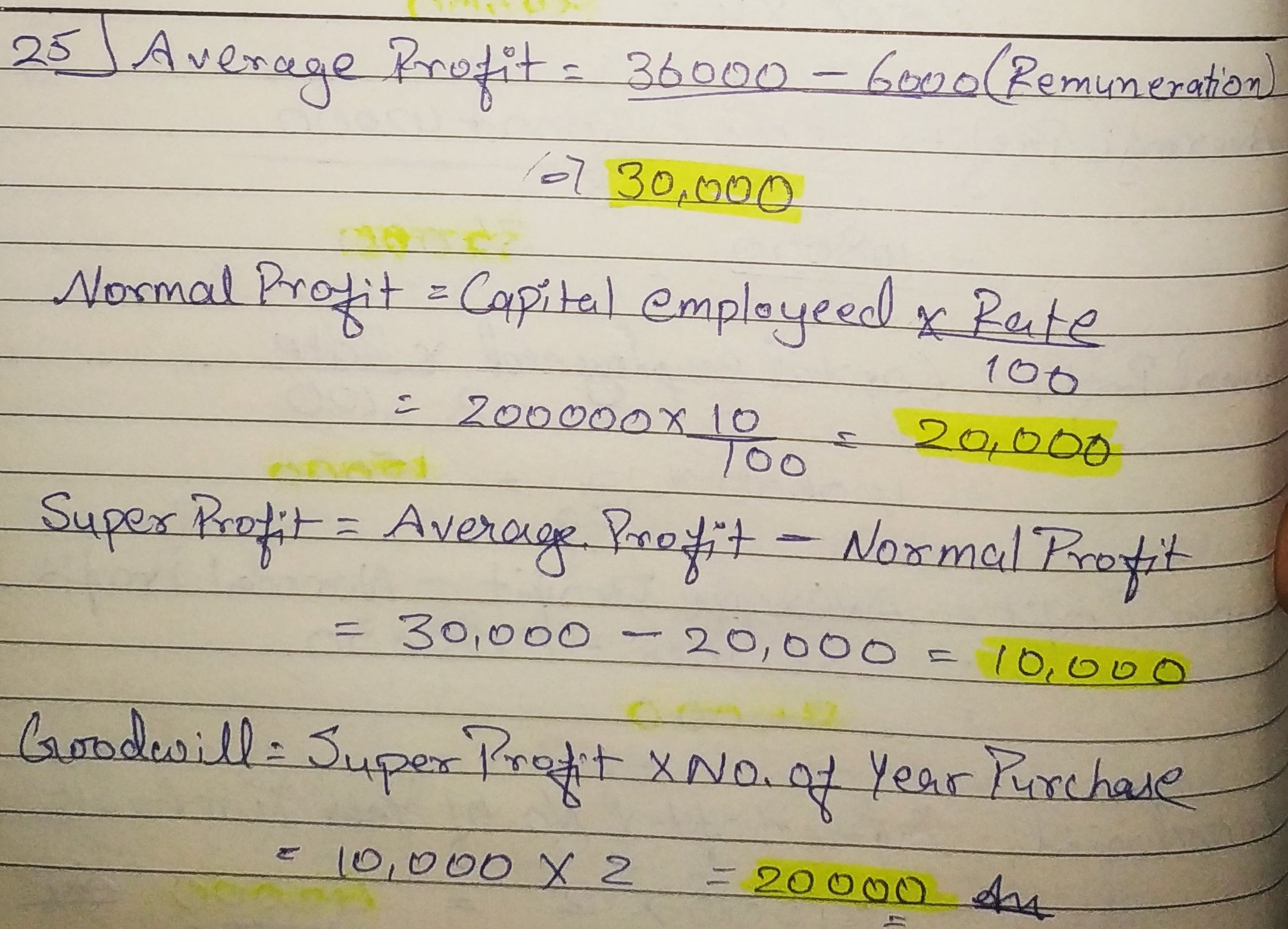

Question 25:

Average net profit expected in future by XYZ firm is ₹ 36,000 per year. Average capital employed in the business by the firm is ₹ 2,00,000. The normal rate of return from capital invested in this class of business is 10%. Remuneration of the partners is estimated to be ₹ 6,000 p.a. Calculate the value of goodwill on the basis of two years’ purchase of super profit.

ANSWER:

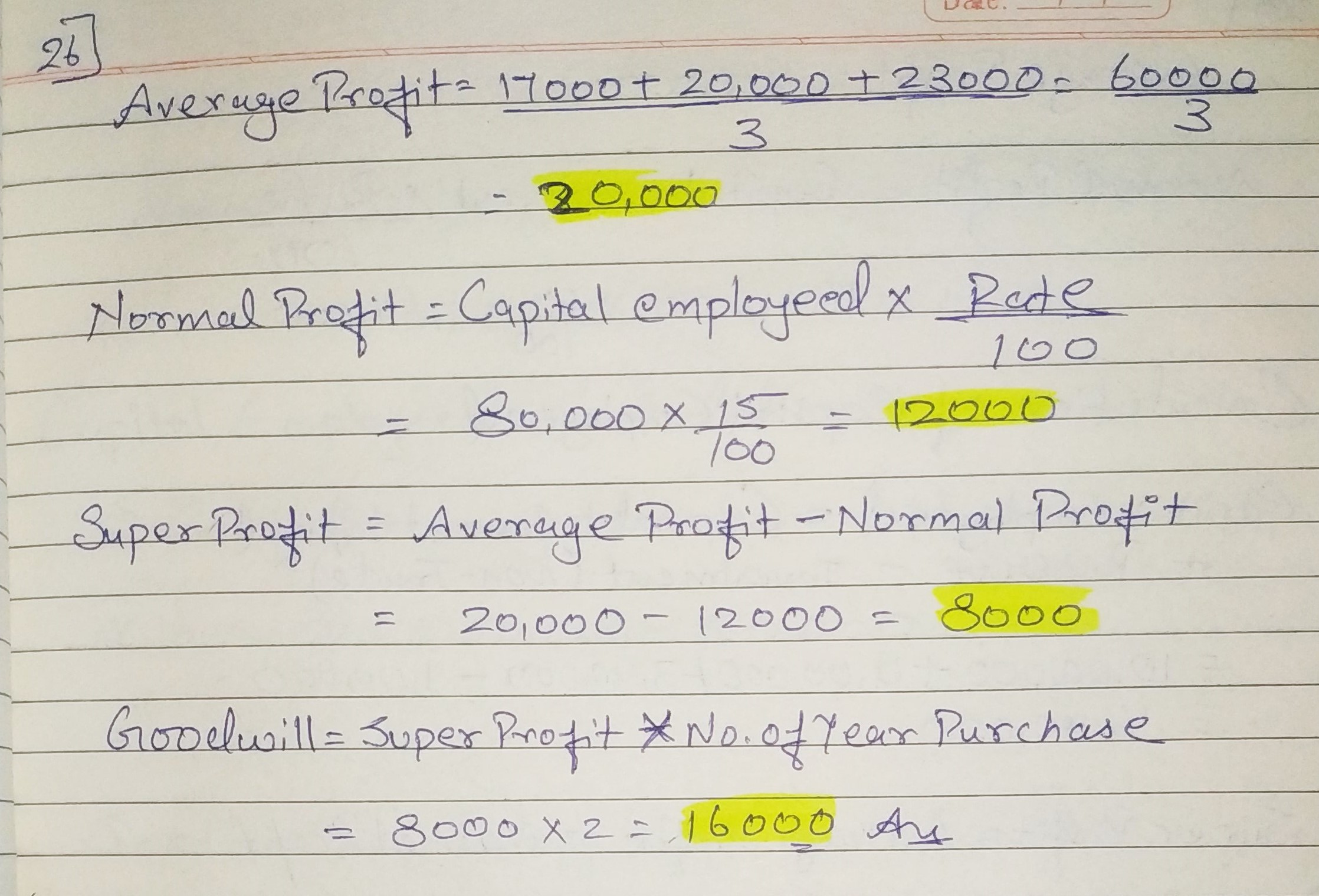

Question 26:

A partnership firm earned net profits during the last three years ended 31st March, as follows: 2017 − ₹ 17,000; 2018 − ₹ 20,000; 2019 − ₹ 23,000.

The capital investment in the firm throughout the above-mentioned period has been ₹ 80,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. Calculate value of goodwill on the basis of two years’ purchase of average super profit earned during the above-mentioned three years.

ANSWER:

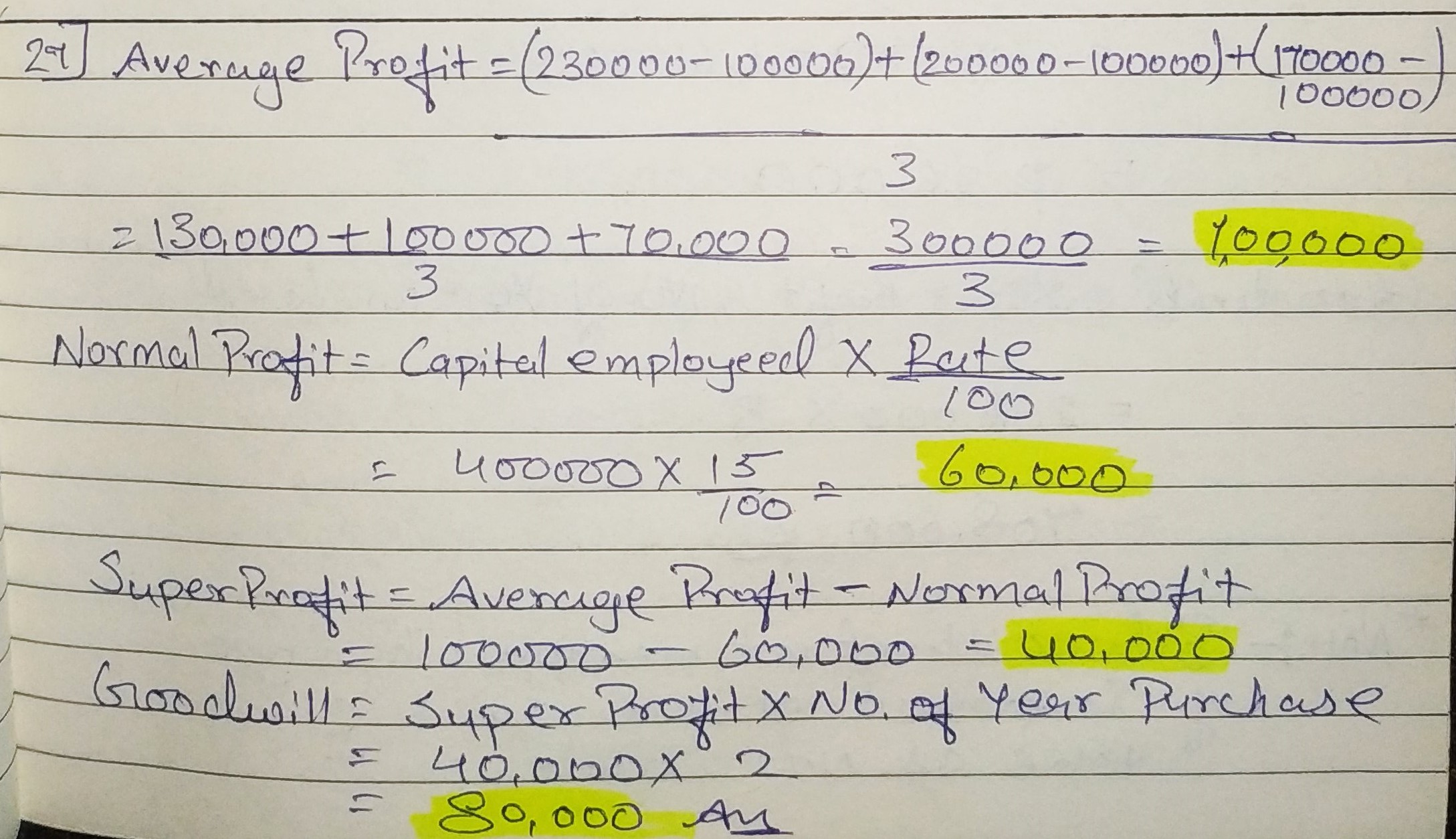

Question 27:

A partnership firm earned net profits during the past three years as follows:

| Year ended | 31st March, 2019 | 31st March, 2018 | 31st March, 2017 |

| Net Profit (₹) | 2,30,000 | 2,00,000 | 1,70,000 |

Capital investment in the firm throughout the above-mentioned period has been ₹ 4,00,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. The remuneration of the partners during this period is estimated to be ₹ 1,00,000 p.a.

Calculate value of goodwill on the basis of two years’ purchase of average super profit earned during the above-mentioned three years.

ANSWER:

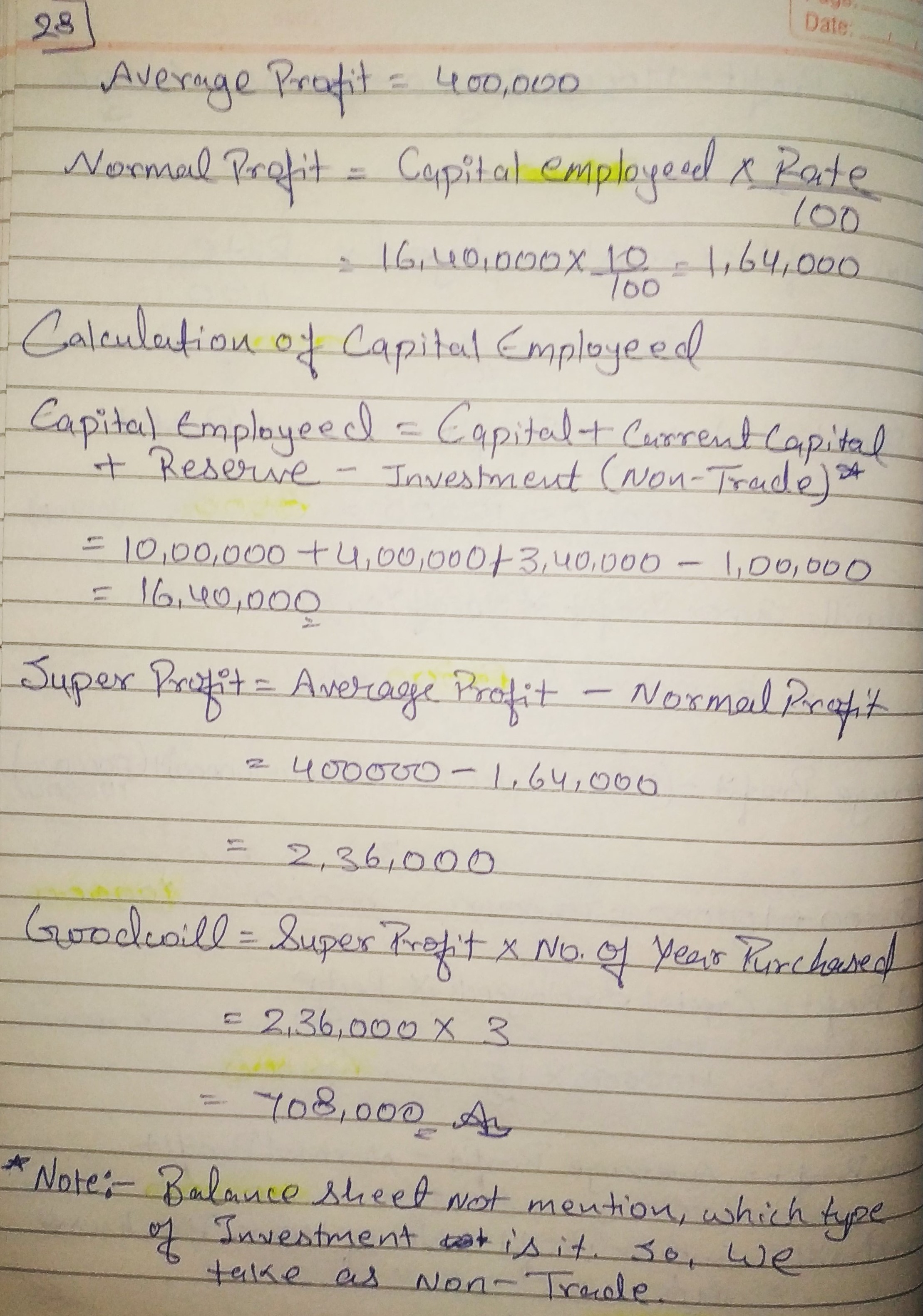

Question 28:

Ideal Marketing earned an average profit of ₹ 4,00,000 during the last five years. Normal rate of return on capital employed is 10%. Balance Sheet of the firm as at 31st March, 2019 was as follows:

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Capital A/cs: | Land and Building | 10,00,000 | ||

| Shyam | 5,00,000 | Furniture | 2,00,000 | |

| Sunder | 5,00,000 | 10,00,000 | Investments | 1,00,000 |

| Current A/cs: | Sundry Debtors | 5,00,000 | ||

| Shyam | 2,00,000 | Bills Receivable | 50,000 | |

| Sunder | 2,00,000 | 4,00,000 | Closing Stock | 3,00,000 |

| Reserves | 3,40,000 | Cash in Hand | 50,000 | |

| Sundry Creditors | 4,00,000 | Cash at Bank | 1,00,000 | |

| Bills Payable | 1,00,000 | |||

| Outstanding Expenses | 60,000 | |||

| 23,00,000 | | 23,00,000 | ||

Calculate the value of goodwill, if it is valued at three years’ purchase of Super Profits.

ANSWER:

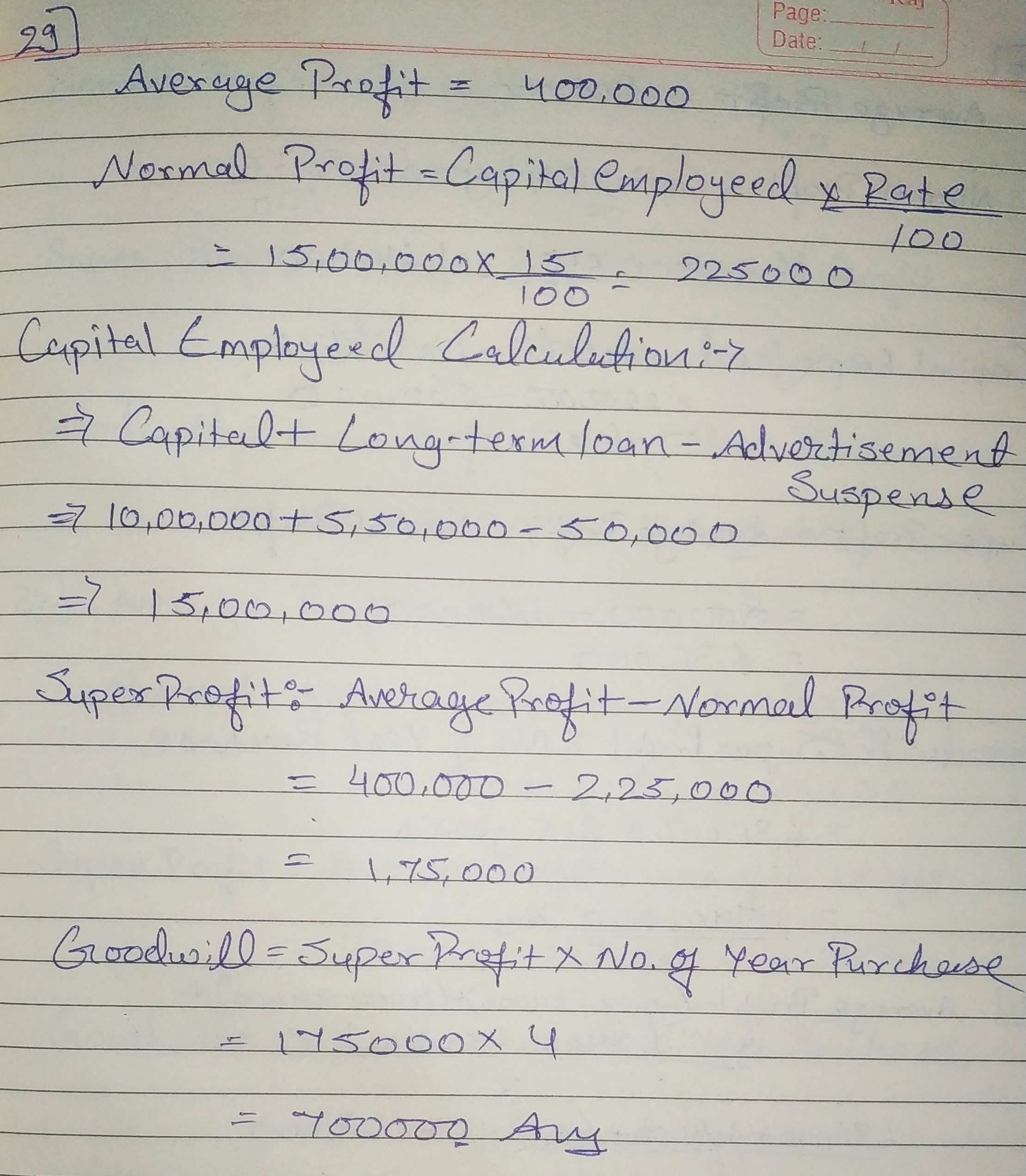

Question 29:

Varuna and Karuna are partners for equal shares. They admit Lata into partnership for 1/4th share. It was agreed to value goodwill of the firm at 4 years’ purchase of super profit. Normal rate of return is 15% of the capital employed. Average profit of the firm is ₹ 4,00,000. Balance Sheet of the firm as at 31st March, 2019 was as follows:

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Capital A/cs: | Furniture | 4,00,000 | ||

| Varuna | 5,00,000 | Computers | 3,00,000 | |

| Karuna | 5,00,000 | 10,00,000 | Electrical Fittings | 1,00,000 |

| Long-term Loan | 5,50,000 | Investments (Trade) | 2,00,000 | |

| Sundry Creditors | 2,00,000 | Stock | 3,00,000 | |

| Outstanding Expenses | 50,000 | Sundry Debtors | 3,00,000 | |

| Advances from Customers | 1,50,000 | Bills Receivable | 50,000 | |

| Cash in Hand | 50,000 | |||

| Cash at Bank | 2,00,000 | |||

| Deferred Revenue Expenditure: | ||||

| Advertisement Suspense | 50,000 | |||

| 19,50,000 | 19,50,000 | |||

Calculate the value of goodwill.

ANSWER:

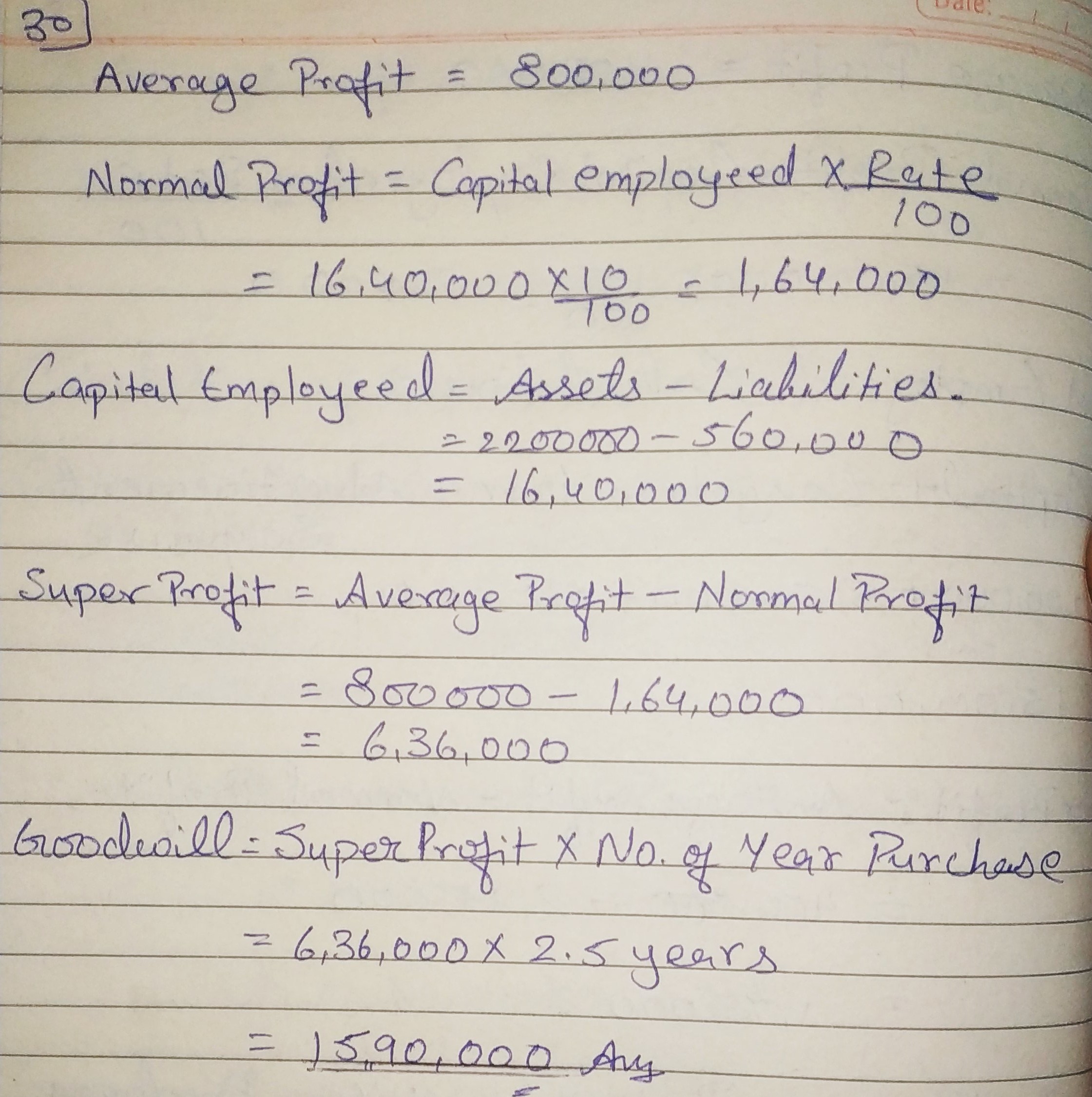

Question 30:

A business earned an average profit of ₹ 8,00,000 during the last few years. The normal rate of profit in the similar type of business is 10%. The total value of assets and liabilities of the business were ₹ 22,00,000 and ₹ 5,60,000 respectively. Calculate the value of goodwill of the firm by super profit method if it is valued at 212/212 years’ purchase of super profits.

ANSWER:

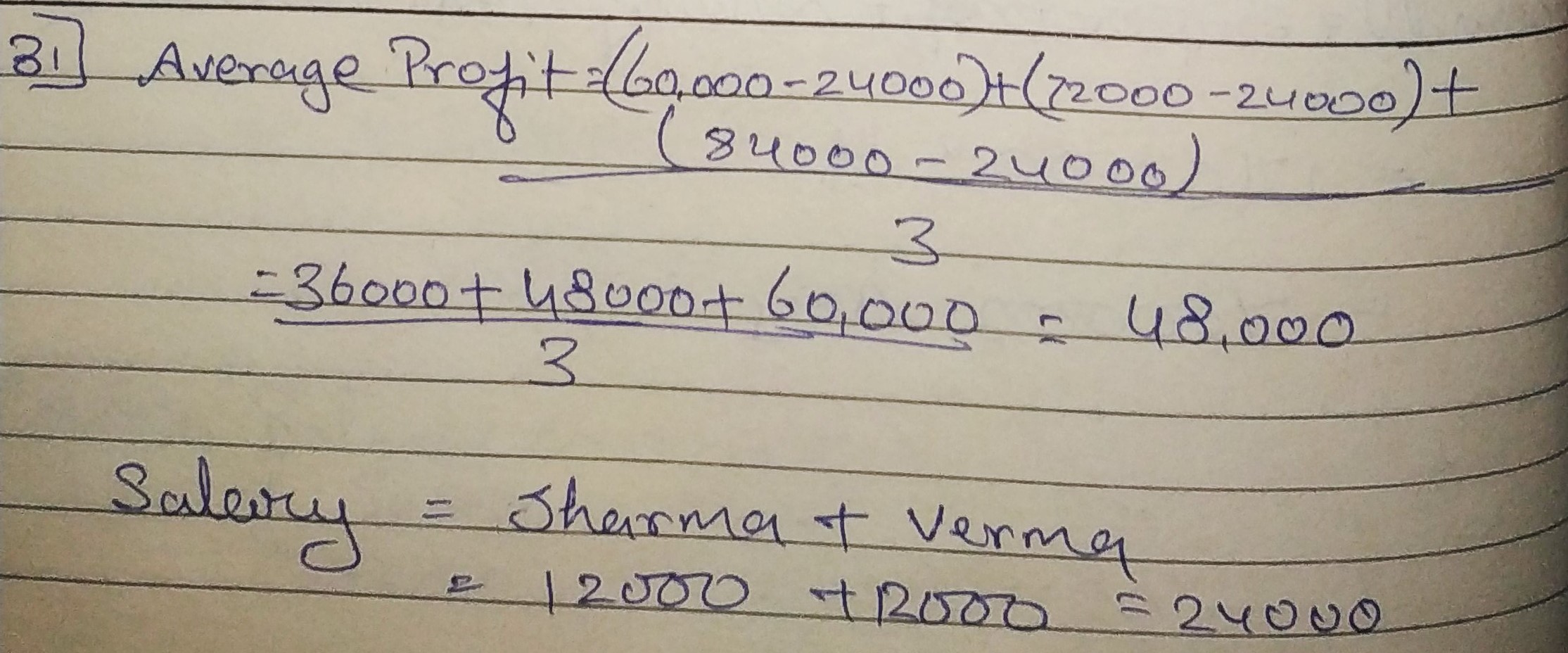

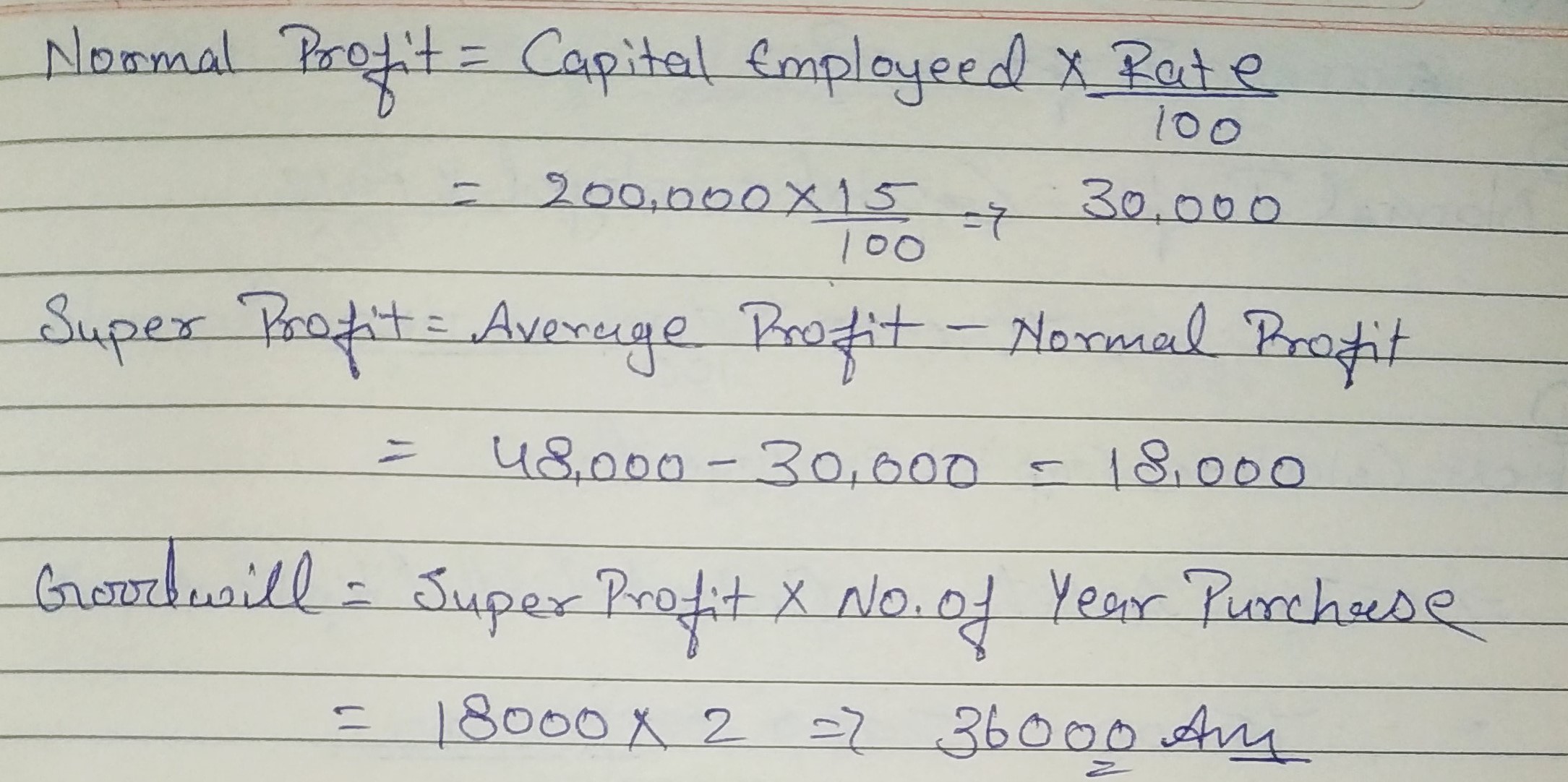

Question 31:

Capital of the firm of Sharma and Verma is ₹ 2,00,000 and the market rate of interest is 15%. Annual salary to partners is ₹ 12,000 each. The profits for the last three years were ₹ 60,000; ₹ 72,000 and ₹ 84,000. Goodwill is to be valued at 2 years’ purchase of last 3 years’ average super profit.

Calculate goodwill of the firm.

ANSWER:

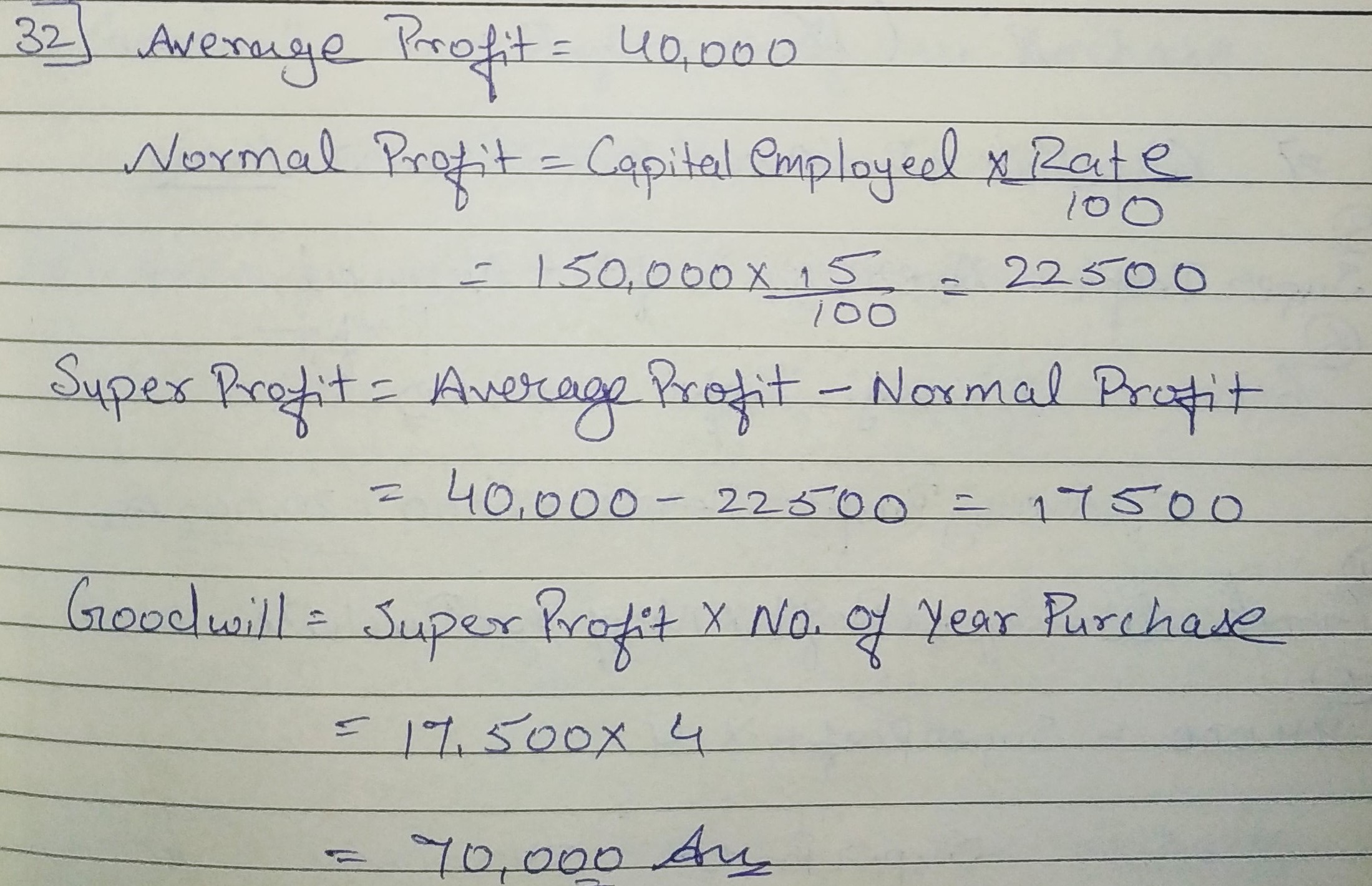

Question 32:

Supreet and Shubham are equal partners. They decide to admit Akriti for 1/3rd share. For the purpose of admission of Akriti, goodwill of the firm is to be valued at four years’ purchase of super profit. Average capital employed in the firm is ₹ 1,50,000. Normal rate of return may be taken as 15% p.a. Average profit of the firm is ₹ 40,000. Calculate value of goodwill.

ANSWER:

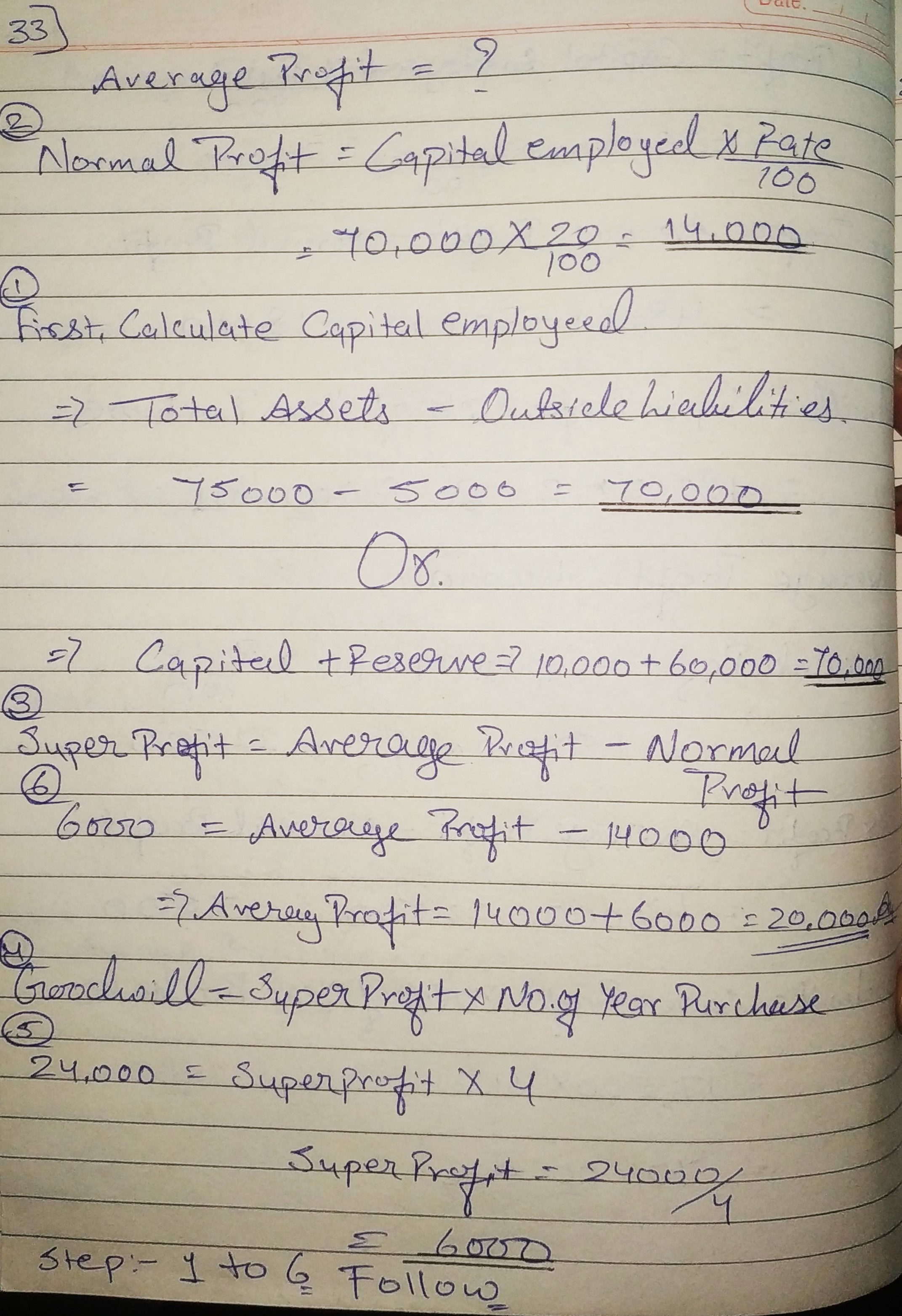

Question 33:

On 1st April, 2019, an existing firm had assets of ₹ 75,000 including cash of ₹ 5,000. Its creditors amounted to ₹ 5,000 on that date. The firm had a Reserve of ₹ 10,000 while Partners’ Capital Accounts showed a balance of ₹ 60,000. If Normal Rate of Return is 20% and goodwill of the firm is valued at ₹ 24,000 at four years’ purchase of super profit, find average profit per year of the existing firm.

ANSWER:

Super Profit Method when Past Adjustments are Made

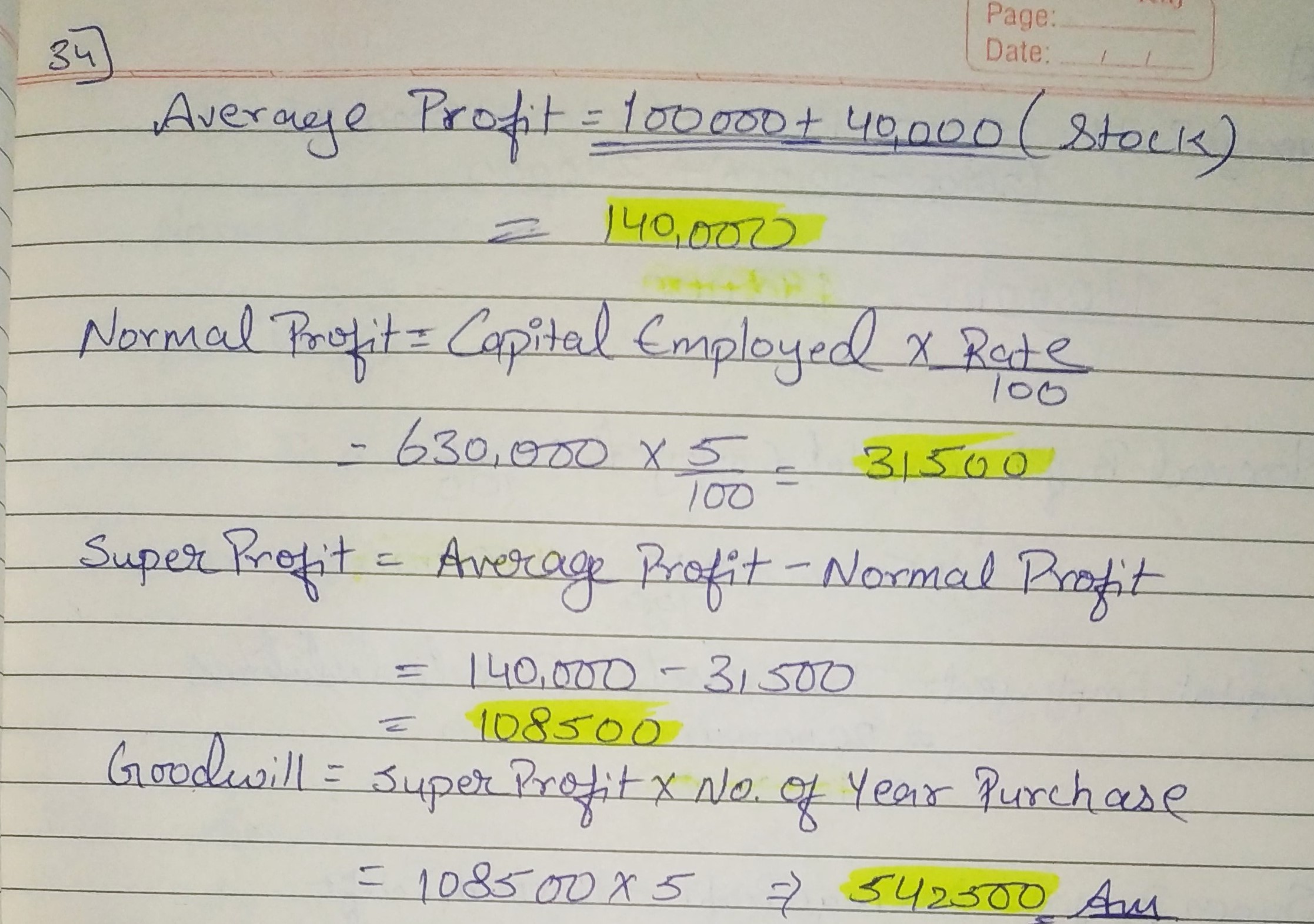

Question 34:

Average profit earned by a firm is ₹ 1,00,000 which includes undervaluation of stock of ₹ 40,000 on an average basis. The capital invested in the business is ₹ 6,30,000 and the normal rate of return is 5%. Calculate goodwill of the firm on the basis of 5 times the super profit.

ANSWER:

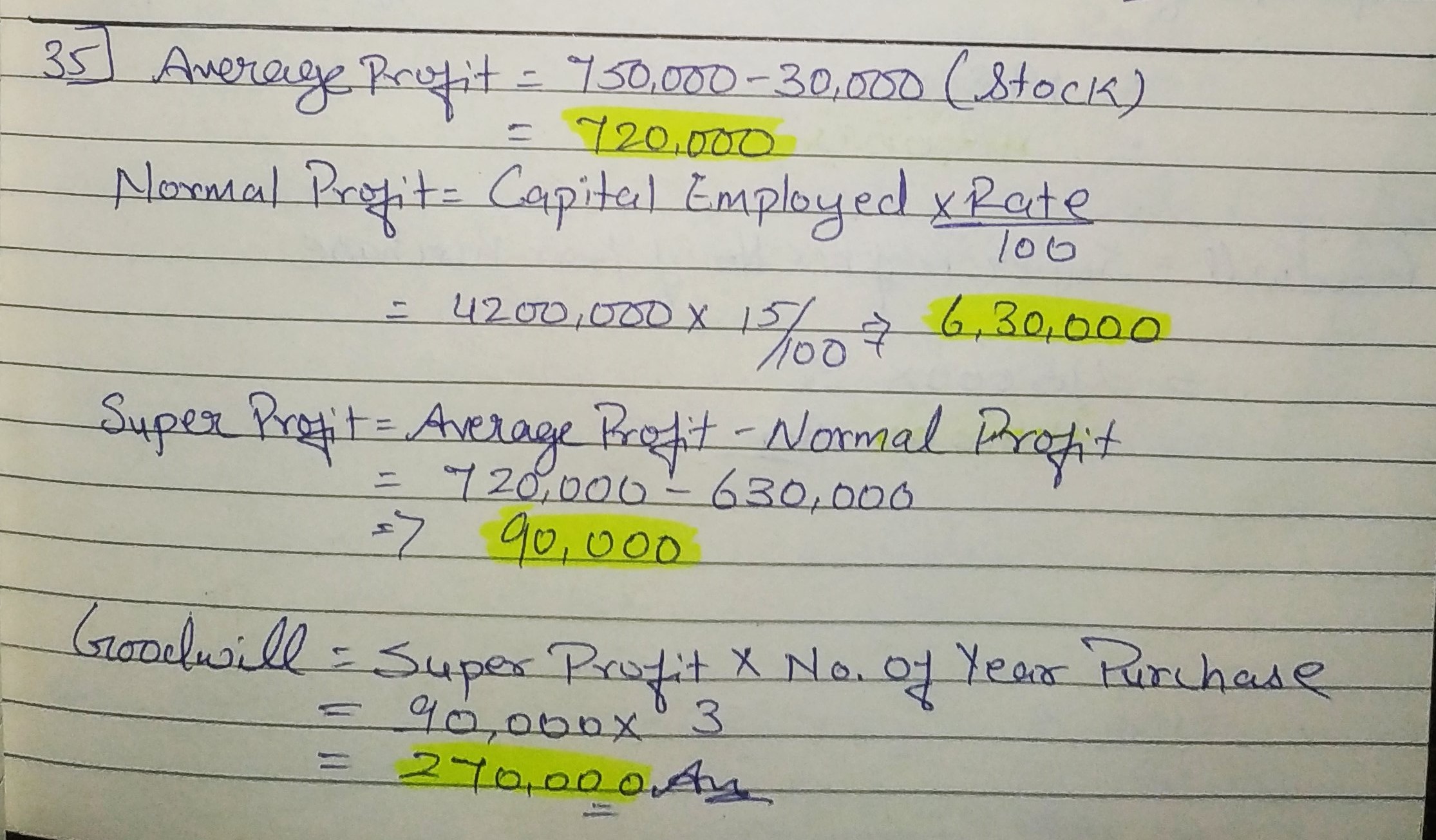

Question 35:

Average profit earned by a firm is ₹ 7,50,000 which includes overvaluation of stock of ₹ 30,000 on an average basis. The capital invested in the business is ₹ 42,00,000 and the normal tare of return is 15%. Calculate goodwill of the firm on the basis of 3 time the super profit.

ANSWER:

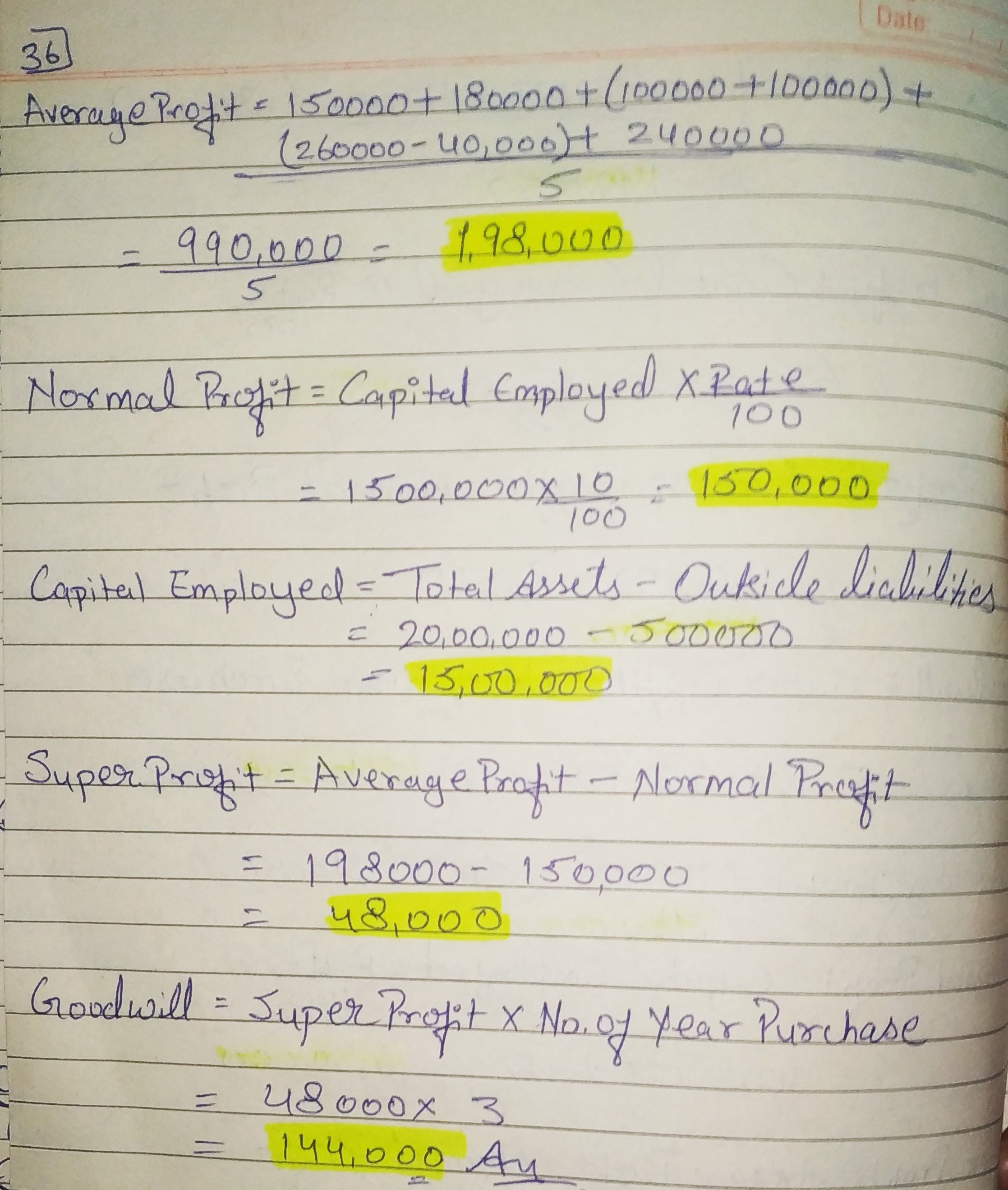

Question 36:

Ayub and Amit are partners in a firm and they admit Jaspal into partnership w.e.f. 1st April, 2019. They agreed to value goodwill at 3 years’ purchase of Super Profit Method for which they decided to average profit of last 5 years. The profits for the last 5 years were:

| Year Ended | Net Profit (₹) | |

| 31st March, 2015 | 1,50,000 | |

| 31st March, 2016 | 1,80,000 | |

| 31st March, 2017 | 1,00,000 | (Including abnormal loss of ₹ 1,00,000) |

| 31st March, 2018 | 2,60,000 | (Including abnormal gain (profit) of ₹ 40,000) |

| 31st March, 2019 | 2,40,000 |

The firm has total assets of ₹ 20,00,000 and Outside Liabilities of ₹ 5,00,000 as on that date. Normal Rate of Return in similar business is 10%.

Calculate value of goodwill.

ANSWER:

Capitalisation Method

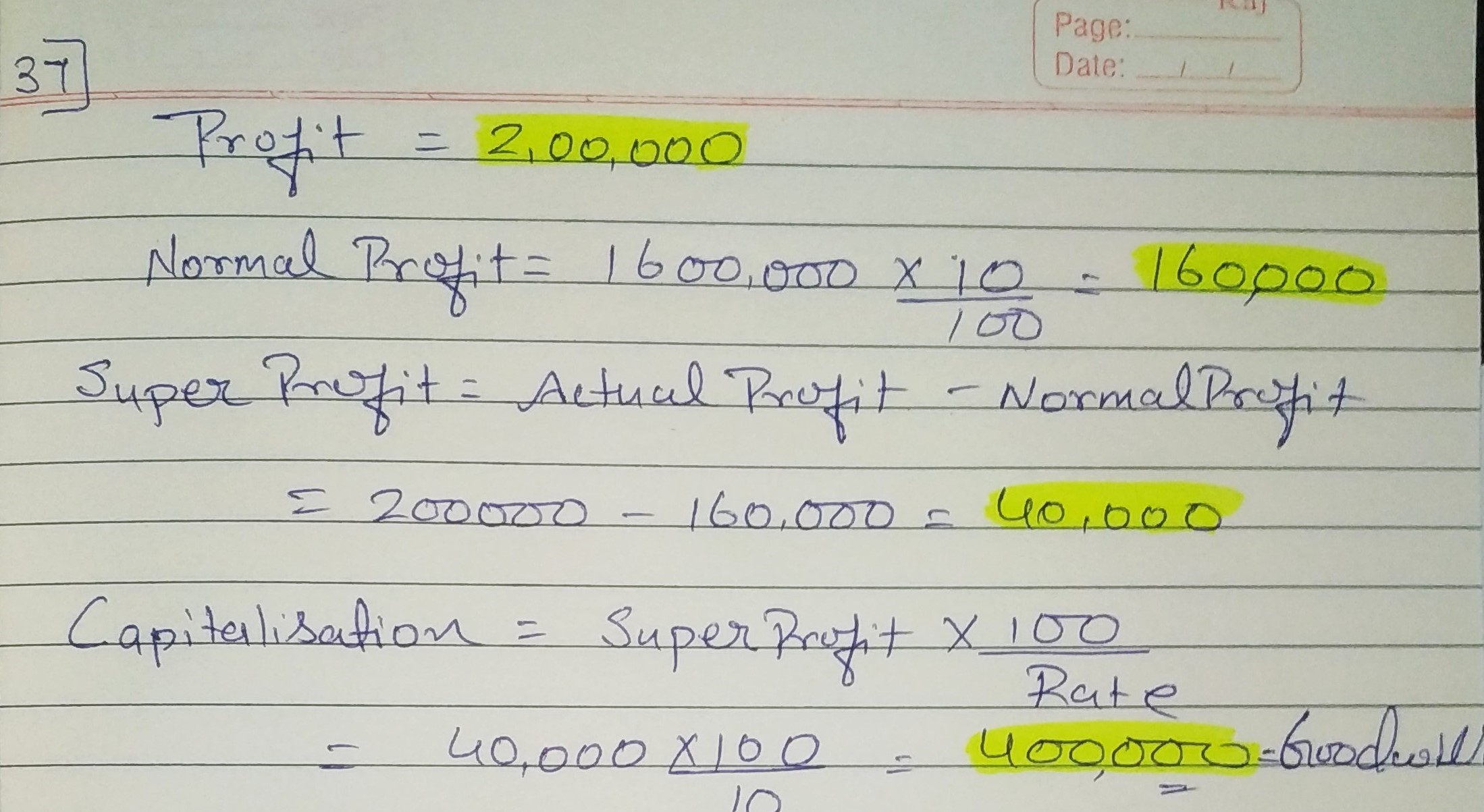

Question 37:

From the following information, calculate value of goodwill of the firm by applying Capitalisation Method: Total Capital of the firm ₹ 16,00,000.

Normal rate of return 10%. Profit for the year ₹ 2,00,000.

ANSWER:

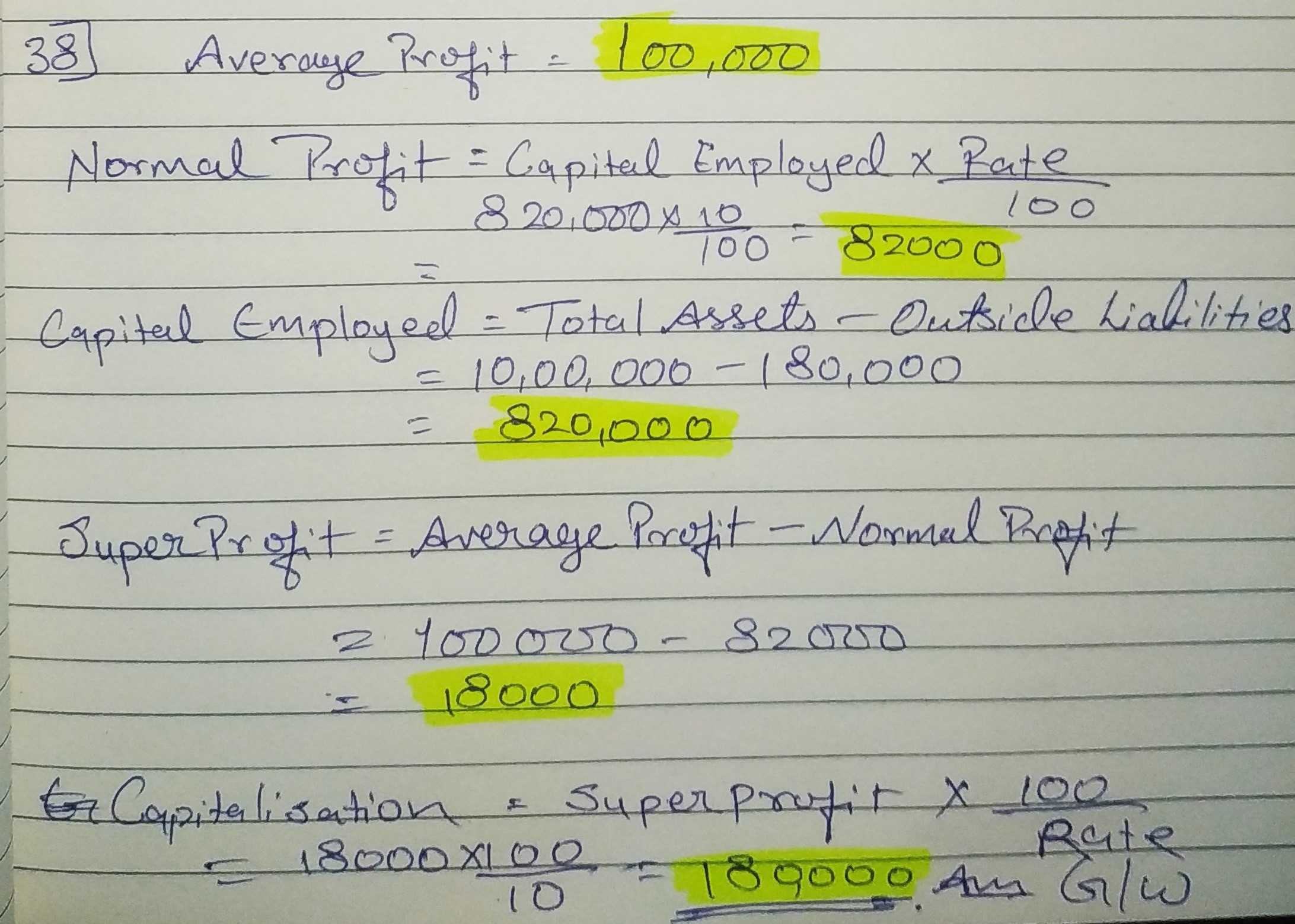

Question 38:

A business has earned average profit of ₹ 1,00,000 during the last few years. Find out the value of goodwill by capitalisation method, given that the assets of the business are ₹ 10,00,000 and its external liabilities are ₹ 1,80,000. The normal rate of return is 10%.

ANSWER:

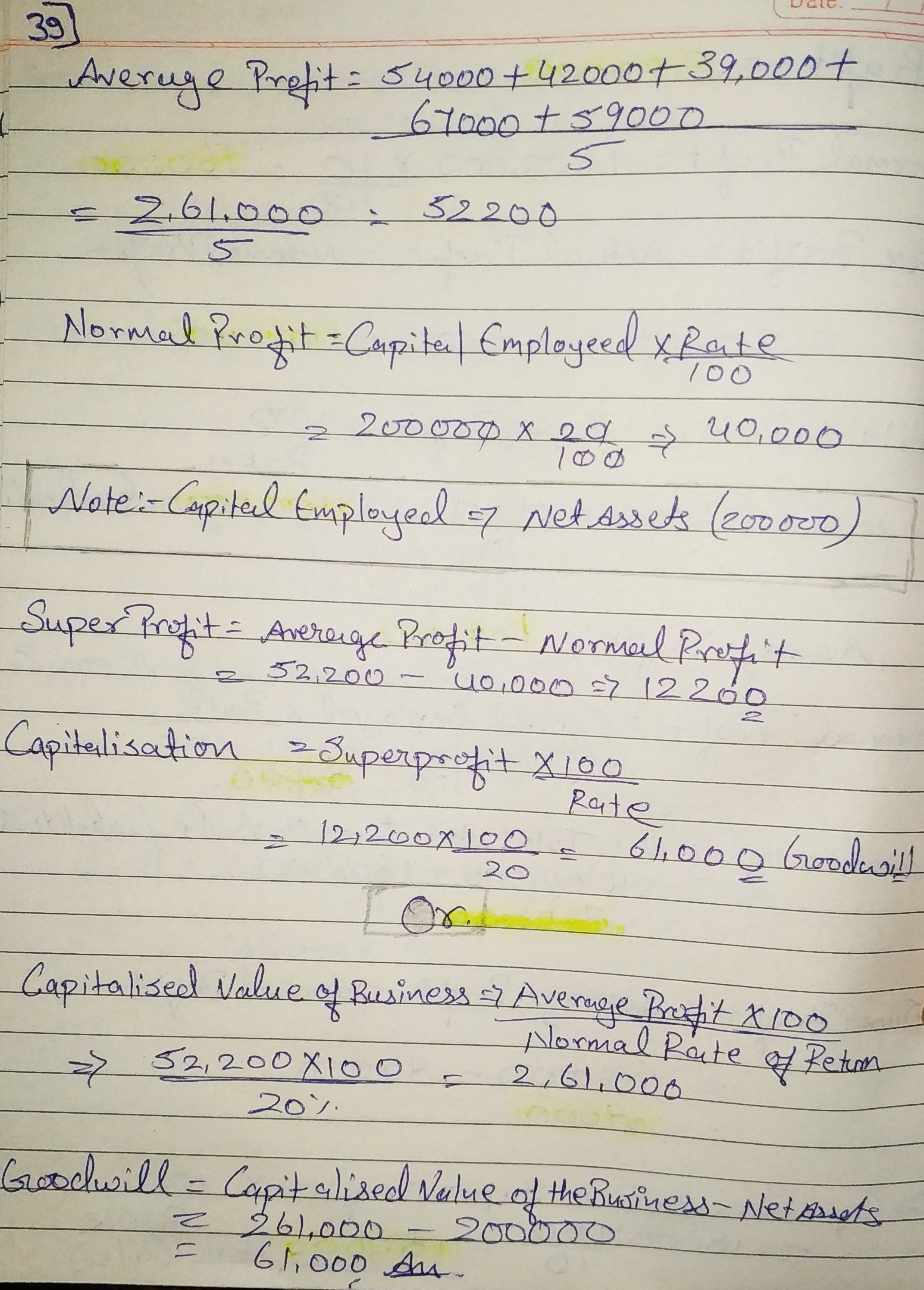

Question 39:

Form the following particulars, calculate value of goodwill of a firm by applying Capitalisation of Average Profit Method:

(i) Profits of last five consecutive years ending 31st March are: 2019 − ₹ 54,000; 2018 − ₹ 42,000; 2017 − ₹ 39,000; 2016 − ₹ 67,000 and 2015 − ₹ 59,000.

(ii) Capitalisation rate 20%.

(iii) Net assets of the firm ₹ 2,00,000.

ANSWER:

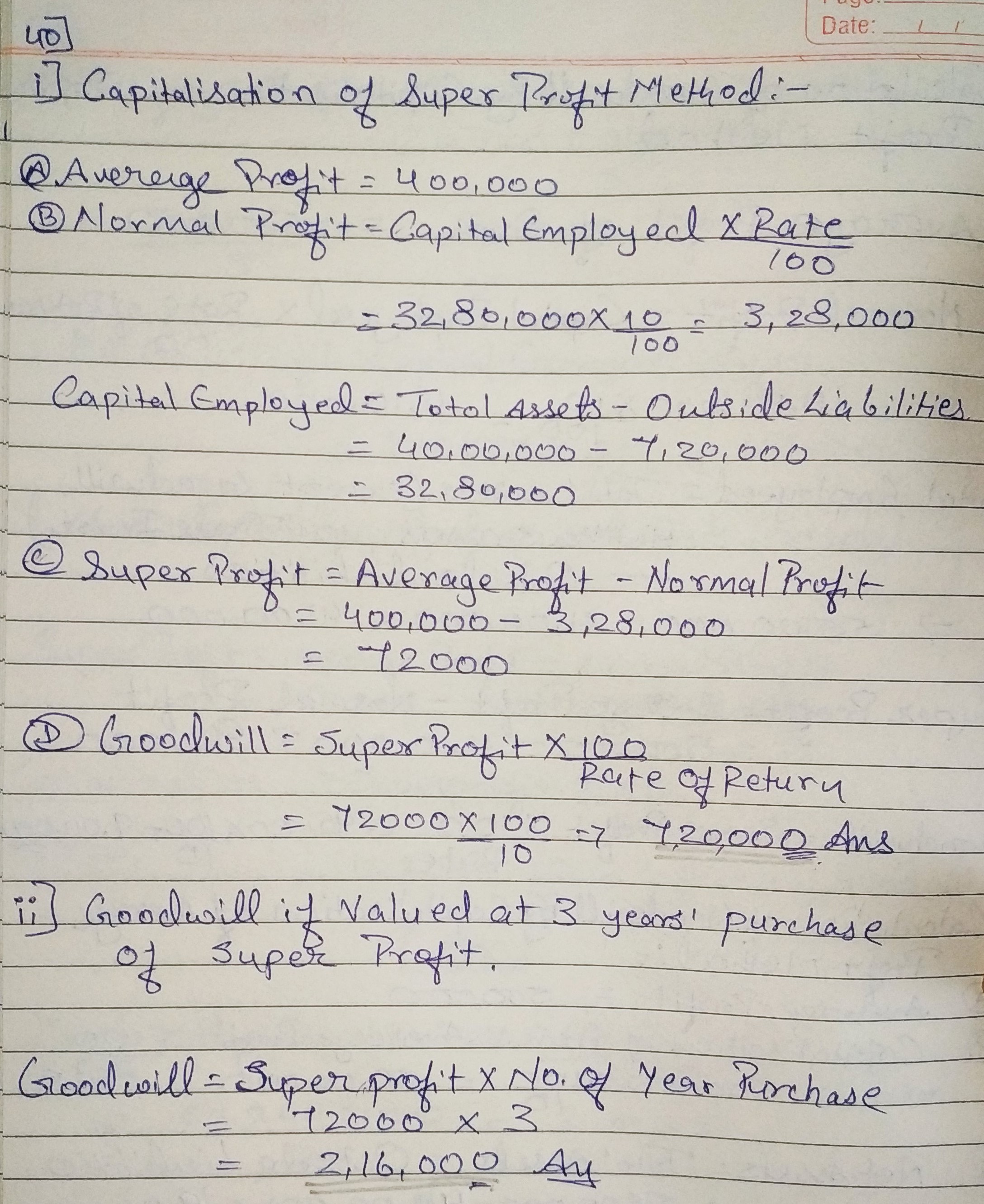

Question 40:

A business has earned average profit of ₹ 4,00,000 during the last few years and the normal rate of return in similar business is 10%. Find value of goodwill by:

(i) Capitalisation of Super Profit Method, and

(ii) Super Profit Method if the goodwill is valued at 3 years’ purchase of super profits.

Assets of the business were ₹ 40,00,000 and its external liabilities ₹ 7,20,000.

ANSWER:

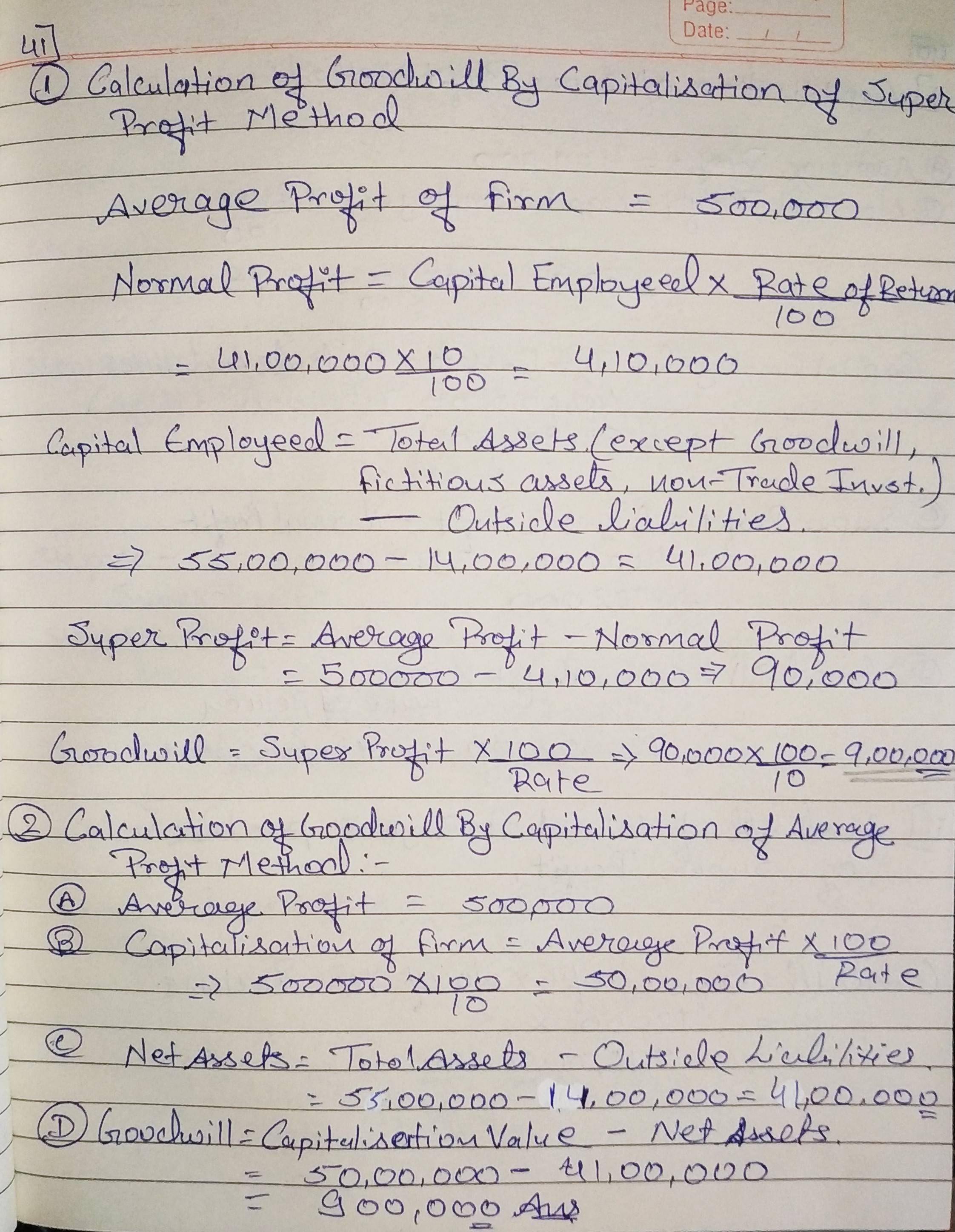

Question 41:

A firm earns profit of ₹ 5,00,000. Normal Rate of Return in a similar type of business is 10%. The value of total assets (excluding goodwill) and total outsiders’ liabilities as on the date of goodwill are ₹ 55,00,000 and ₹ 14,00,000 respectively. Calculate value of goodwill according to Capitalisation of Super Profit Method as well as Capitalisation of Average Profit Method.

ANSWER:

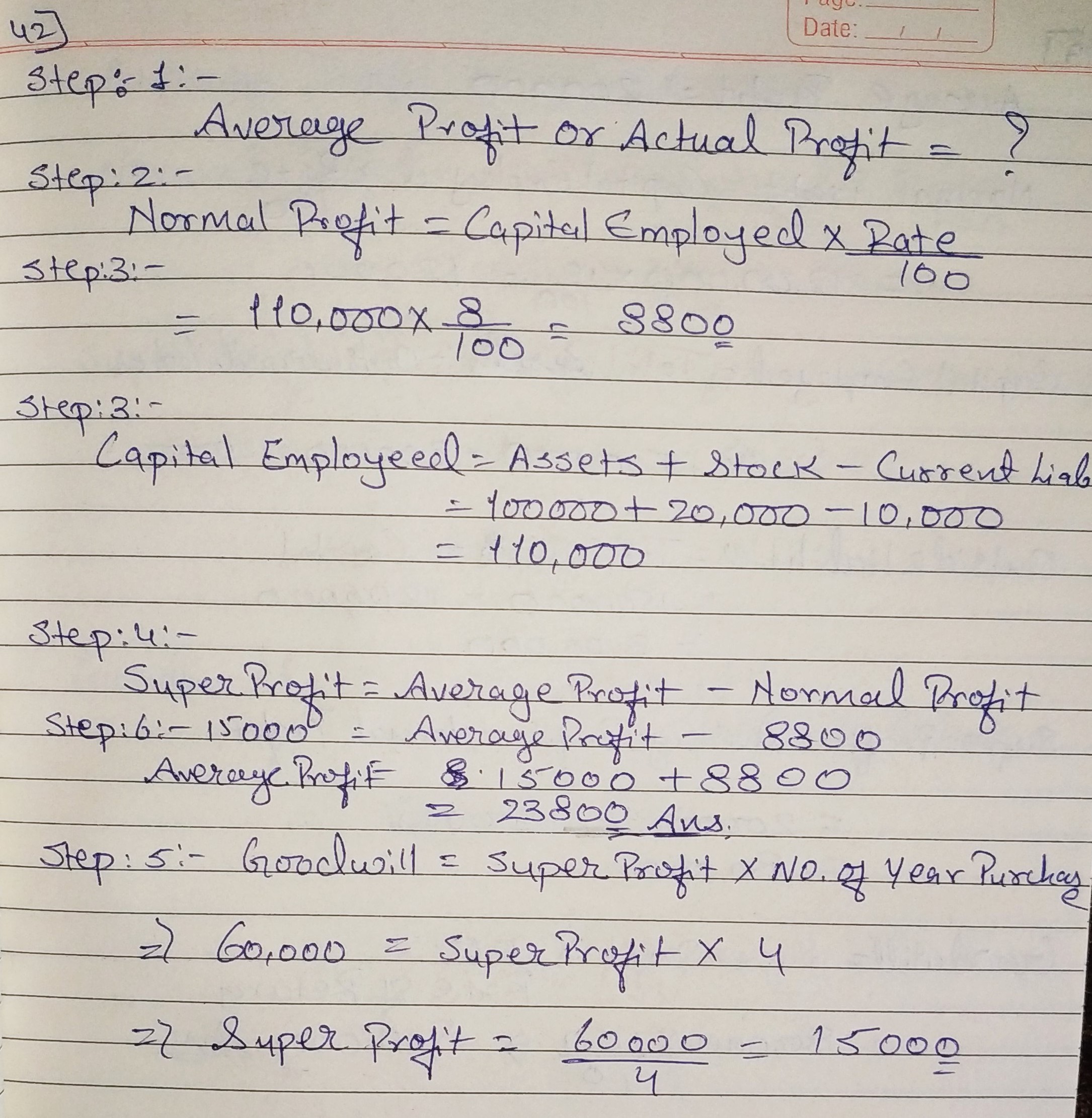

Question 42:

On 1st April, 2018, a firm had assets of ₹ 1,00,000 excluding stock of ₹ 20,000. The current liabilities were ₹ 10,000 and the balance constituted Partners’ Capital Accounts. If the normal rate of return is 8%, the Goodwill of the firm is valued of ₹ 60,000 at four years’ purchase of super profit, find the actual profits of the firm.

ANSWER:

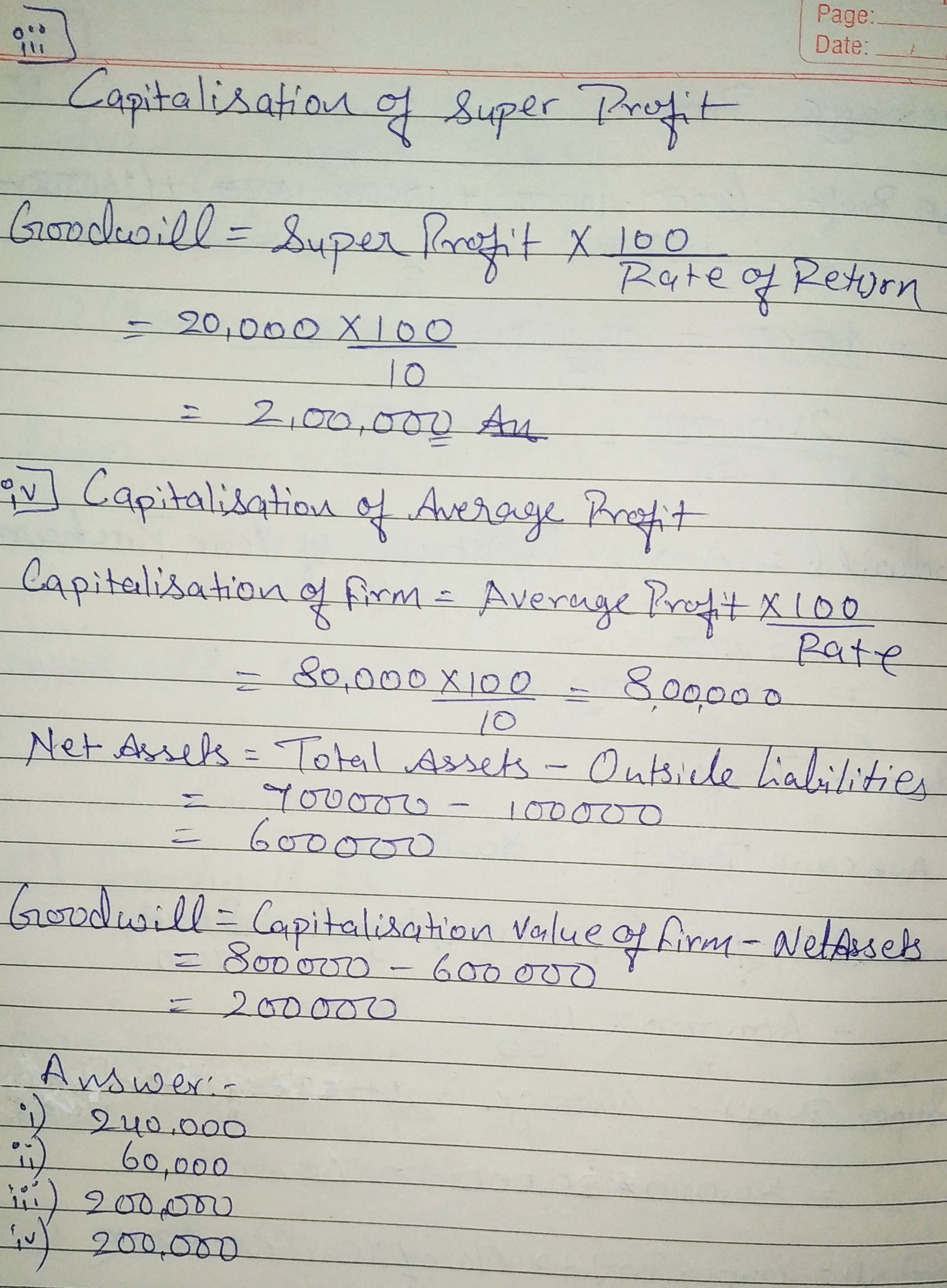

Capitalisation of Super Profit

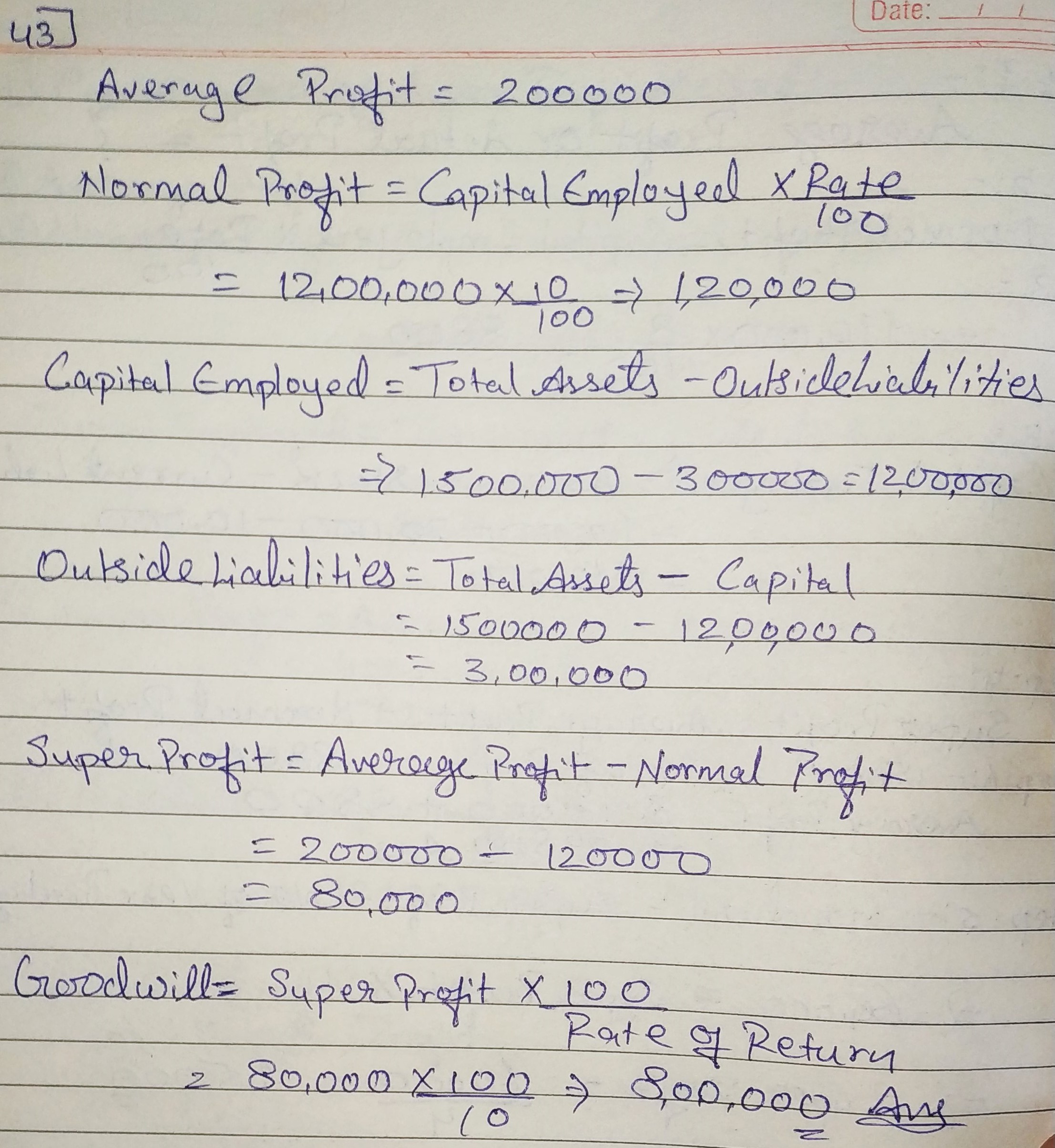

Question 43:

Average profit of the firm is ₹ 2,00,000. Total assets of the firm are₹ 15,00,000 whereas Partners’ Capital is ₹ 12,00,000. If normal rate of return in a similar business is 10% of the capital employed, what is the value of goodwill by Capitalisation of Super Profit?

ANSWER:

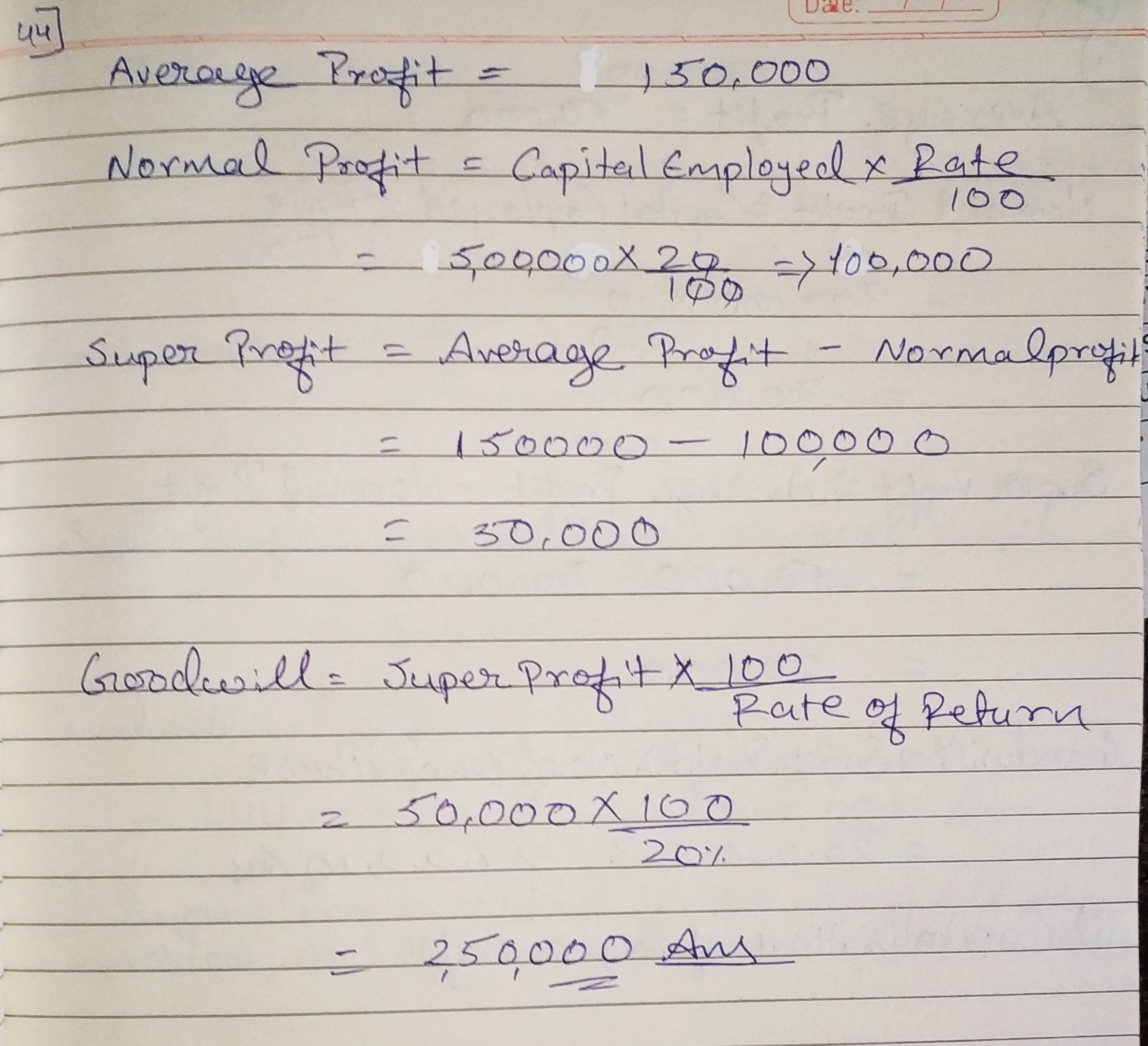

Question 44:

Rajan and Rajani are partners in a firm. Their capitals were Rajan ₹ 3,00,000; Rajani ₹ 2,00,000. During the year 2018−19, the firm earned a profit of ₹ 1,50,000. Calculate the value of goodwill of the firm by capitalisation of super profit assuming that the normal rate of return is 20%.

ANSWER:

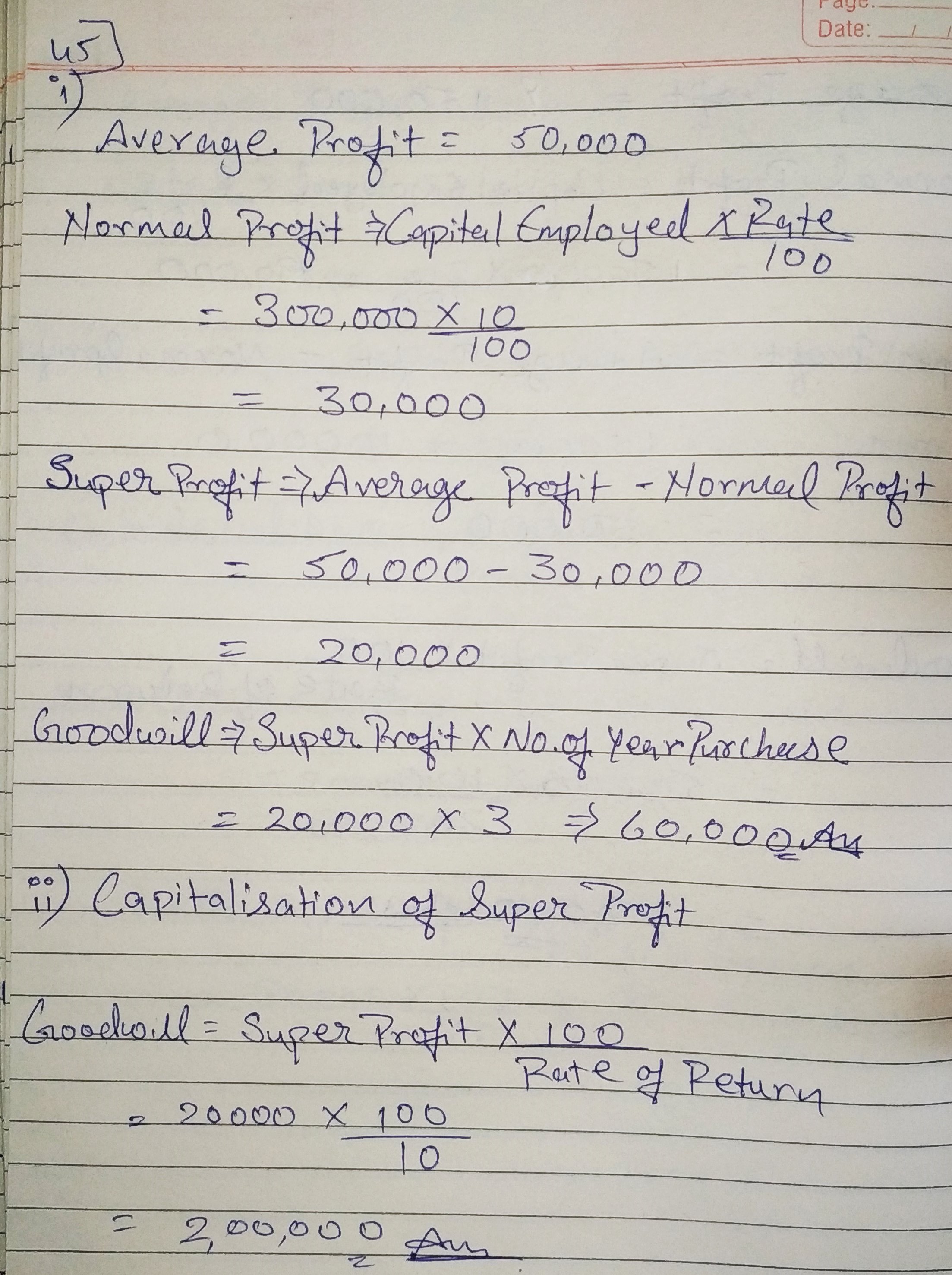

Question 45:

Average profit of GS & Co. is ₹ 50,000 per year. Average capital employed in the business is ₹ 3,00,000. If the normal rate of return on capital employed is 10%, calculate goodwill of the firm by:

(i) Super Profit Method at three years’ purchase; and

(ii) Capitalisation of Super Profit Method.

ANSWER:

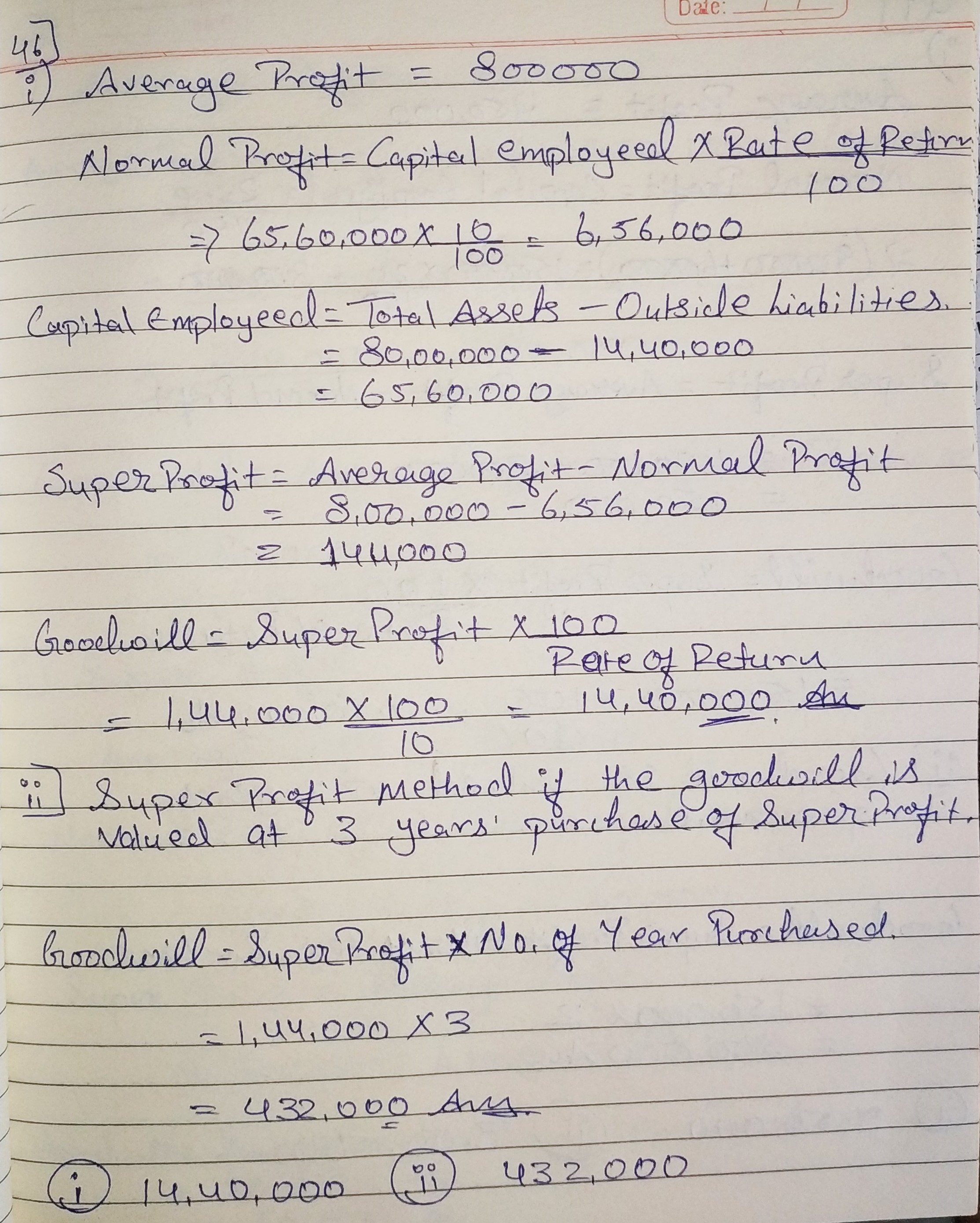

Question 46:

A business has earned average profit of ₹ 8,00,000 during the last few years and the normal rate of return in similar business is 10%. Find value of goodwill by:

(i) Capitalisation of Super Profit Method; and

(ii) Super Profit Method if the goodwill is valued at 3 years’ purchase of super profit.

Assets of the business were ₹ 80,00,000 and its external liabilities ₹ 14,40,000.

ANSWER:

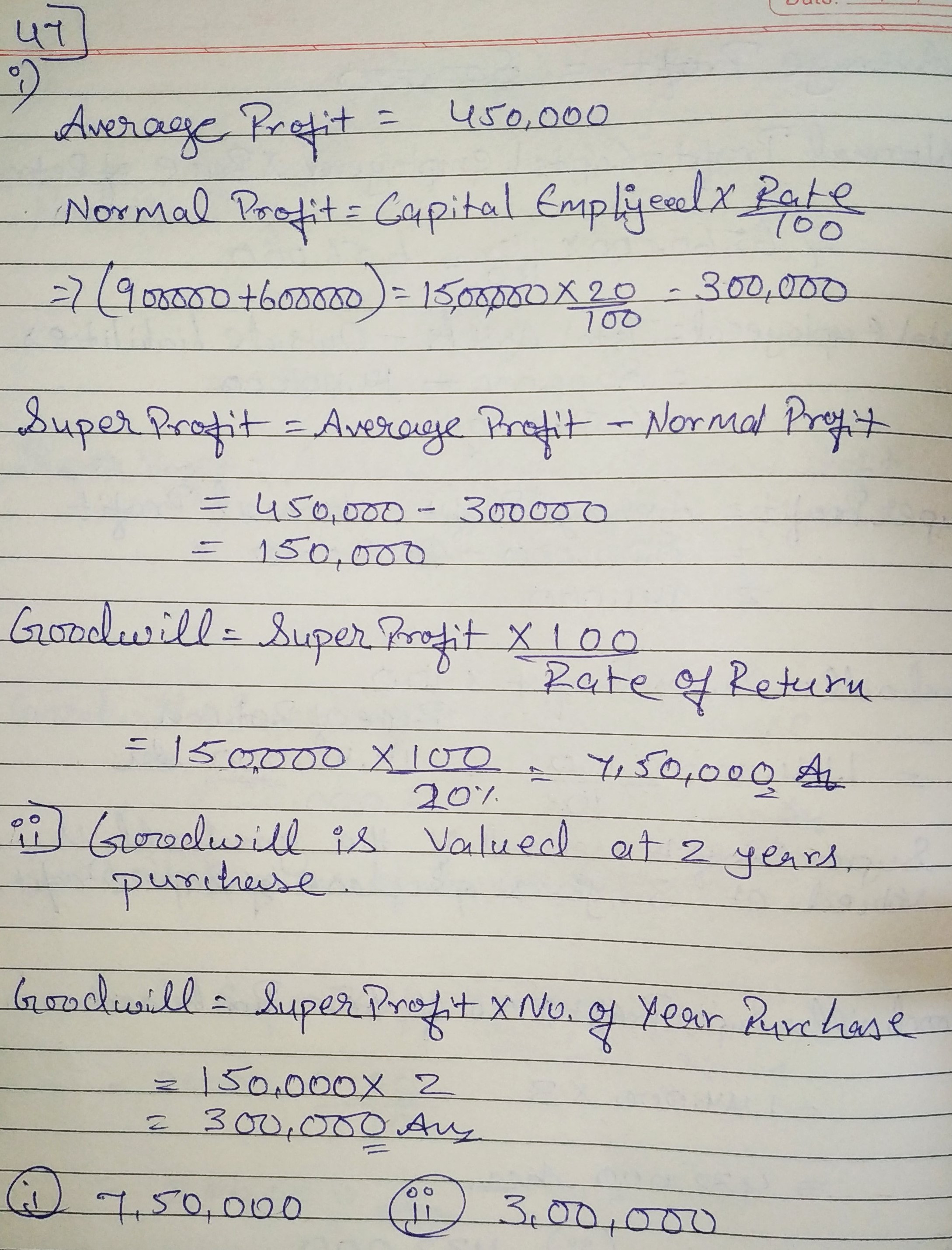

Question 47:

Ajeet and Baljeet are partners in a firm. Their capitals are ₹ 9,00,000 and ₹ 6,00,000 respectively. During the year ended 31st March, 2019 the firm earned a profit of ₹ 4,50,000. Assuming that the normal rate of return is 20%, calculate value of goodwill of the firm:

(i) By Capitalisation Method; and

(ii) By Super Profit Method if the goodwill is valued at 2 years’ purchase of super profit.

ANSWER:

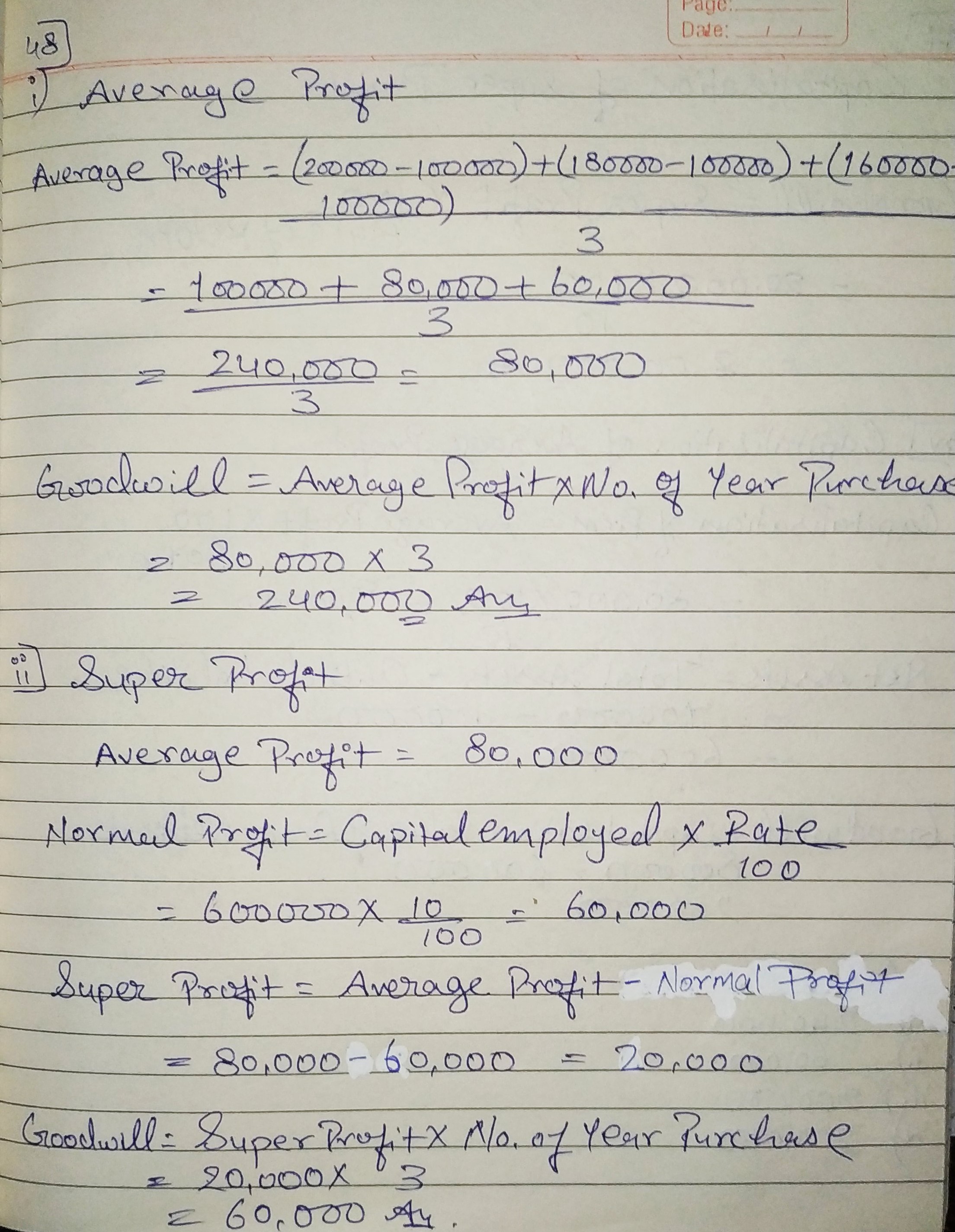

Question 48:

From the following information, calculate value of goodwill of the firm:

(i) At three years’ purchase of Average Profit.

(ii) At three years’ purchase of Super Profit.

(iii) On the basis of Capitalisation of Super Profit.

(iv) On the basis of Capitalisation of Average profit.

Information:

(a) Average Capital Employed is ₹ 6,00,000.

(b) Net Profit/(Loss) of the firm for the last three years ended are:

31st March, 2018 − ₹ 2,00,000, 31st March, 2017 − ₹ 1,80,000, and 31st March, 2016 − ₹ 1,60,000.

(c) Normal Rate of Return in similar business is 10%.

(d) Remuneration of ₹ 1,00,000 to partners is to be taken as charge against profit.

(e) Assets of the firm (excluding goodwill, fictitious assets and non-trade investments) is ₹ 7,00,000 whereas Partners’ Capital is ₹ 6,00,000 and Outside Liabilities ₹ 1,00,000.

ANSWER:

THE END

You can Comment down below if you have Trouble/Problems with any Solutions.

IF YOU HAVE ANY QUERY

COMMENT

DOWN

BELOW

!!!