Here we have given TS Grewal Accountancy Class 12 Solutions Chapter 4 – Change In Profit-Sharing Ratio Among the Existing Partners are part of TS Grewal Accountancy Class 12 Solutions.

Below answer provide for simple understanding (How to Solve that question) for students.

Table of Contents

Note for Students: Before going down please doing by yourselves if you have any trouble with any questions then you can see them on this page.

Keep Practice |Practice | Practice !!!

You can go Now⬇⬇⬇

| Board | CBSE |

| Textbook | NCERT |

| Book | Accounting for Partnership Firms |

| Volume | I |

| Class | 12th |

| Subject | Accountancy |

| Chapter | 4 |

| Chapter Name | Change In Profit-Sharing Ratio Among the Existing Partners |

| Number of Questions (Solved) | 32 |

| Category | TS Grewal’s Solutions |

TS Grewal Accountancy Class 12 Solutions – Chapter 4th – Change in Profit-Sharing Ratio Among the Existing Partners – Edition 2019

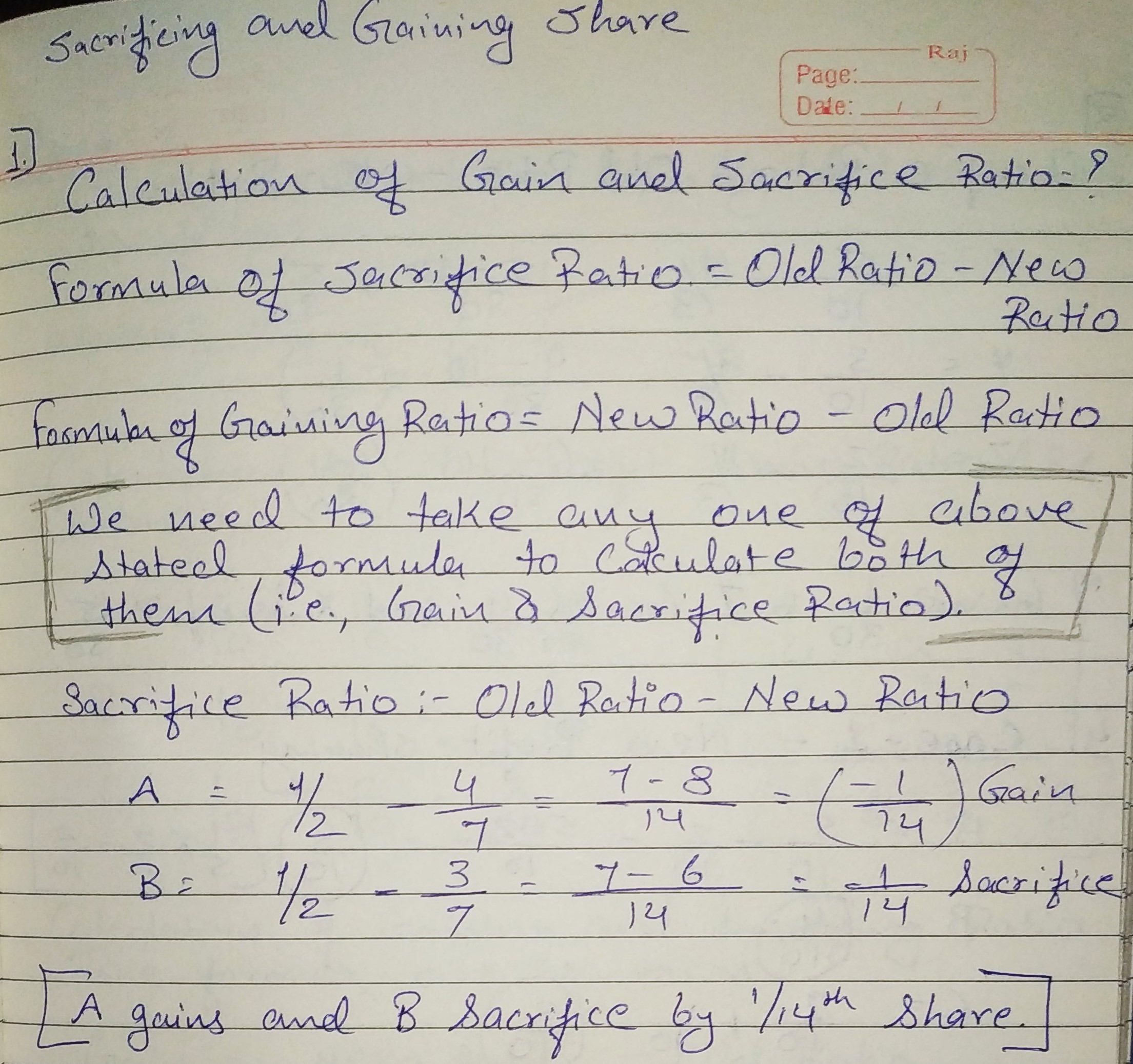

Sacrificing and Gaining Ratio

Question 1:

A and B are sharing profits and losses equally. With effect from 1st April, 2019, they agree to share profits in the ratio of 4 : 3. Calculate individual partner’s gain or sacrifice due to the change in ratio.

ANSWER:

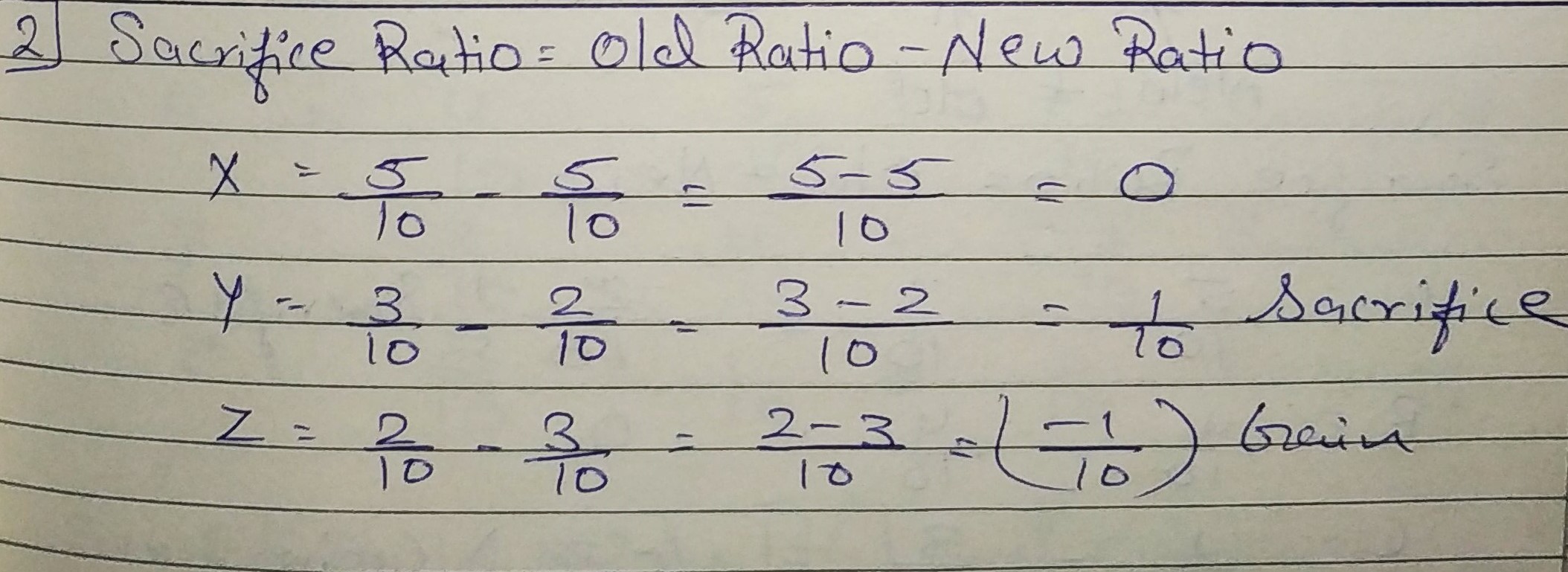

Question 2:

X, Y and Z are sharing profits and losses in the ratio of 5 : 3 : 2. With effect from 1st April, 2019, they decide to share profits and losses in the ratio of 5 : 2 : 3. Calculate each partner’s gain or sacrifice due to the change in ratio.

ANSWER:

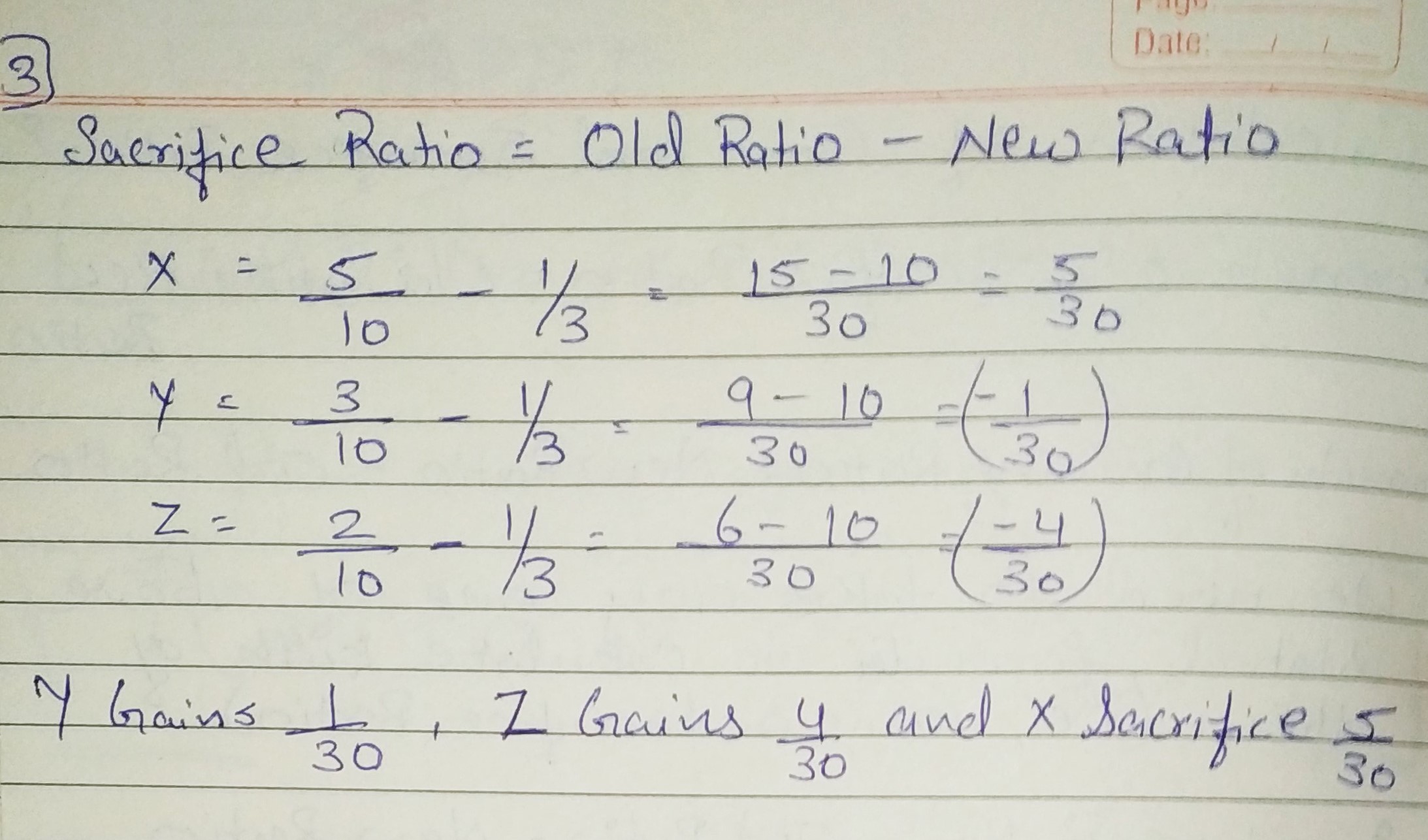

Question 3:

X, Y and Z are sharing profits and losses in the ratio of 5 : 3 : 2. With effect from 1st April, 2019, they decide to share profits and losses equally. Calculate each partner’s gain or sacrifice due to the change in ratio.

ANSWER:

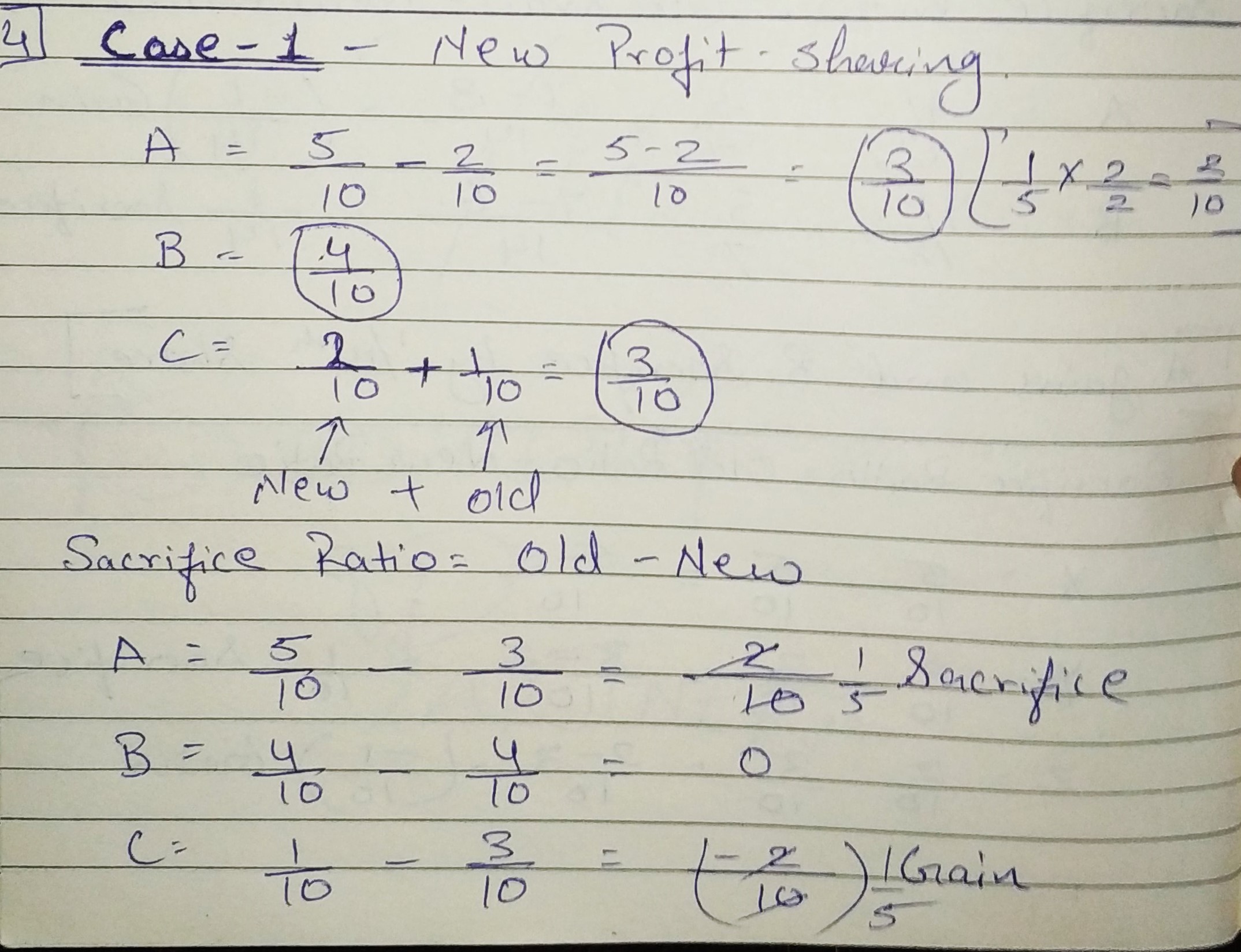

Question 4:

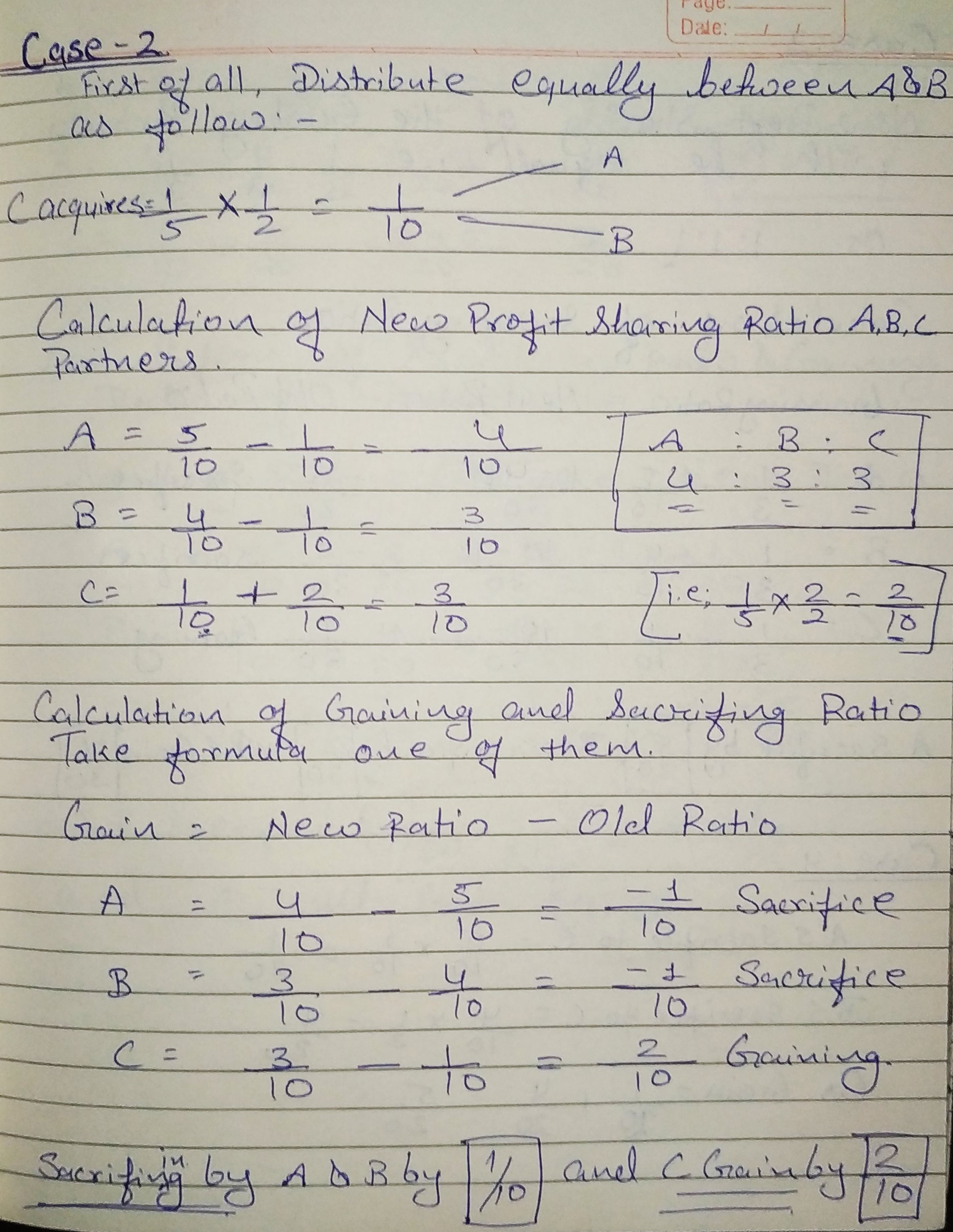

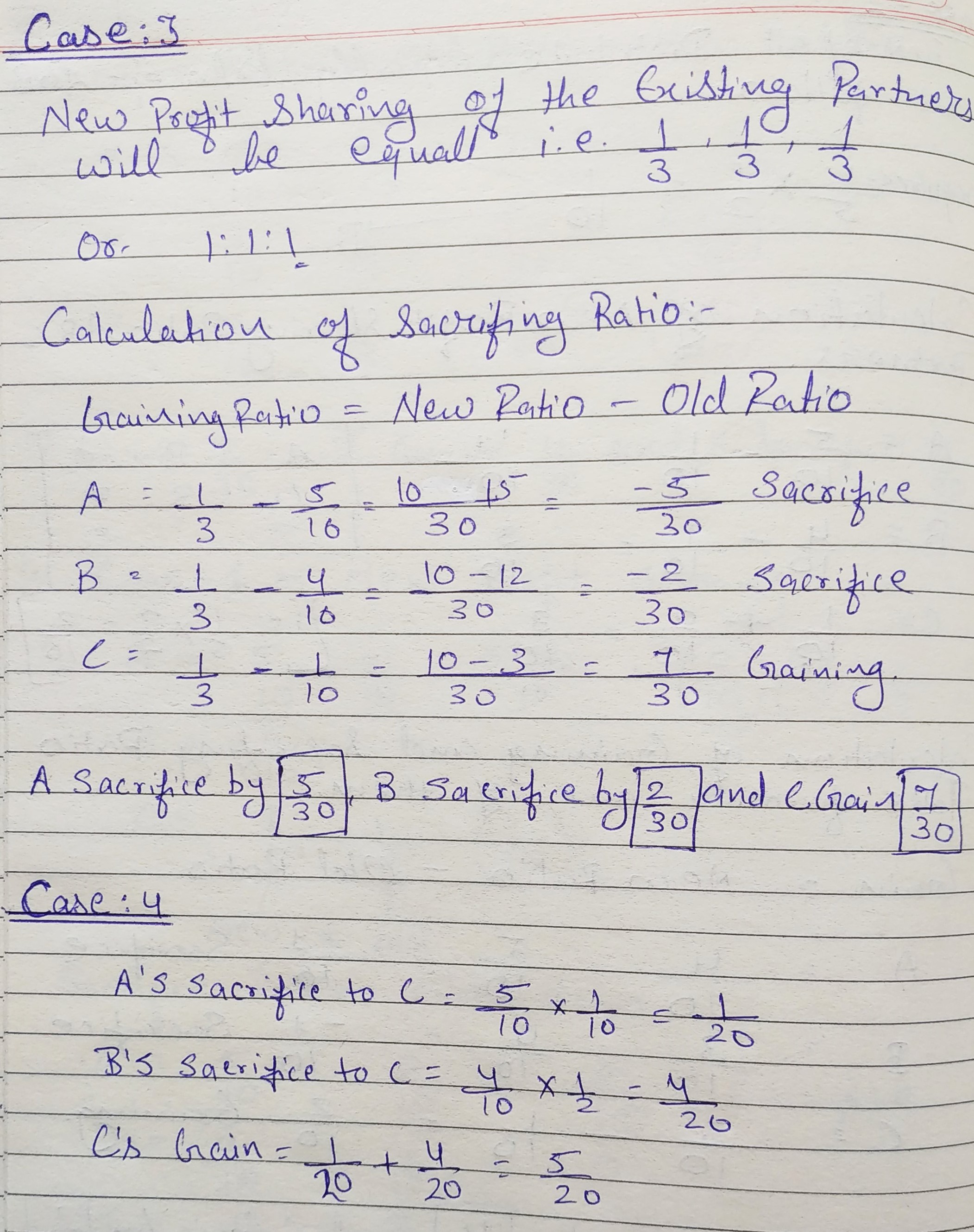

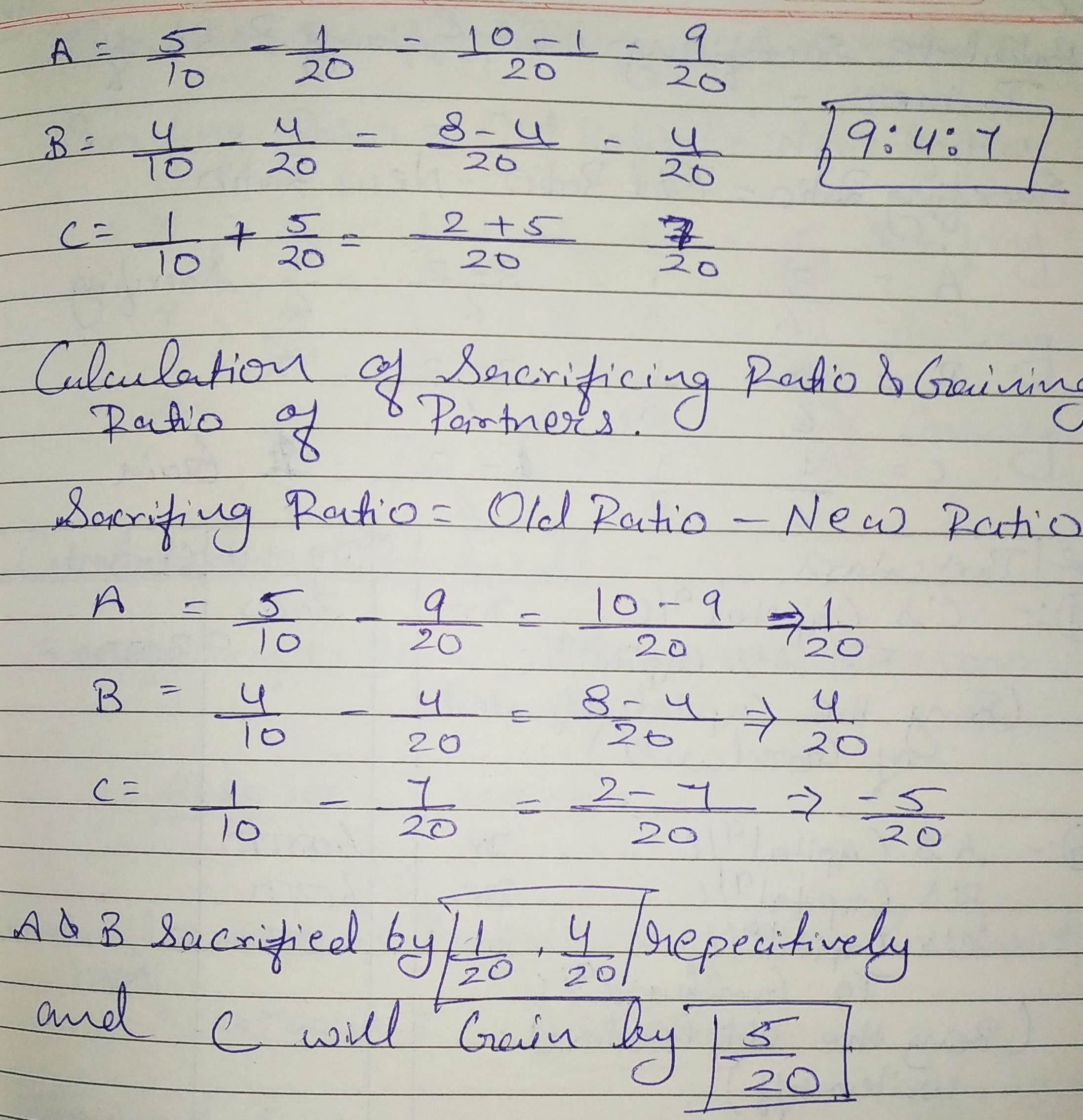

A, B and C are partners sharing profits and losses in the ratio of 5 : 4 : 1. Calculate new profit-sharing ratio, sacrificing ratio and gaining ratio in each of the following cases:

Case 1. C acquires 1/5th share from A.

Case 2. C acquires 1/5th share equally form A and B.

Case 3. A, B and C will share future profits and losses equally.

Case 4. C acquires 1/10th share of A and 1/2 share of B.

ANSWER:

Accounting Treatment of Goodwill

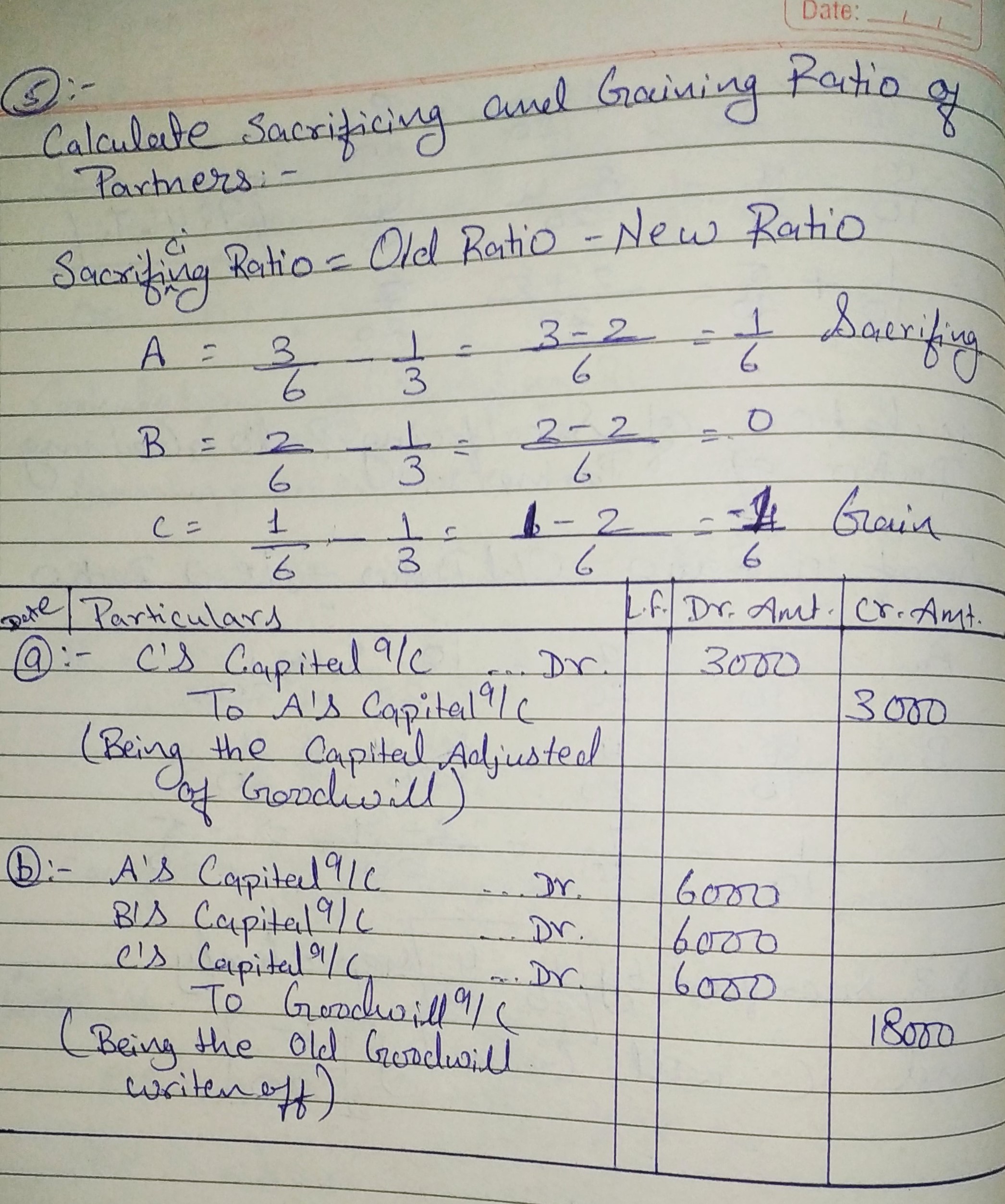

Question 5:

A, B and C shared profits and losses in the ratio of 3 : 2 : 1 respectively. With effect from 1st April, 2019, they agreed to share profits equally. The goodwill of the firm was valued at ₹ 18,000. Pass necessary Journal entries when: (a) Goodwill is adjusted through Partners’ Capital Accounts; and (b) Goodwill is raised and written off.

ANSWER:

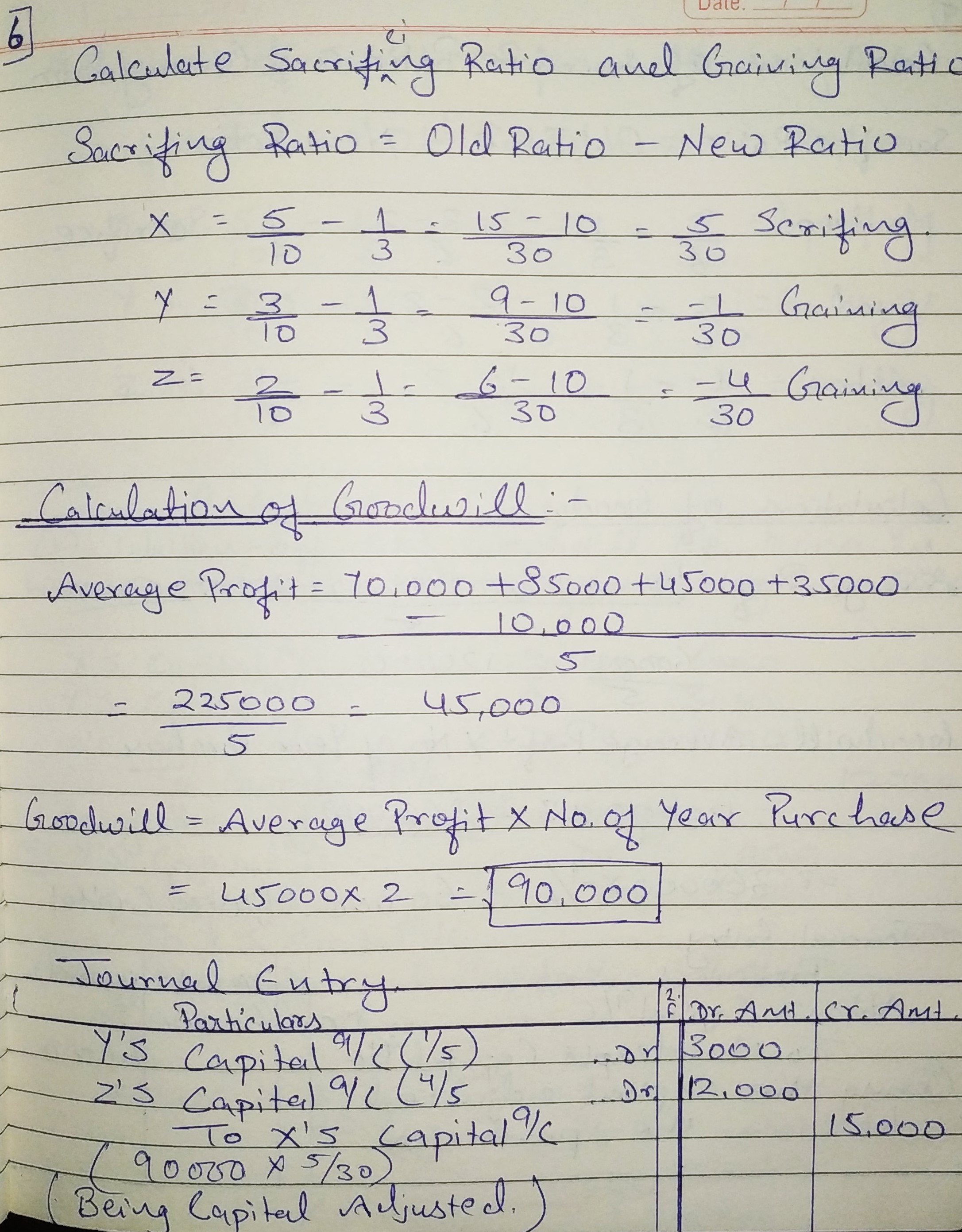

Question 6:

X, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2. From 1st April, 2018, they decided to share profits and losses equally. The Partnership Deed provides that in the event of any change in the profit-sharing ratio, the goodwill should be valued at two years’ purchase of the average profit of the preceding five years. The profits and losses of the preceding years ended 31st March, are:

| Year | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

| Profits (₹) | 70,000 | 85,000 | 45,000 | 35,000 | 10,000 (Loss) |

You are required to calculate goodwill and pass journal entry.

ANSWER:

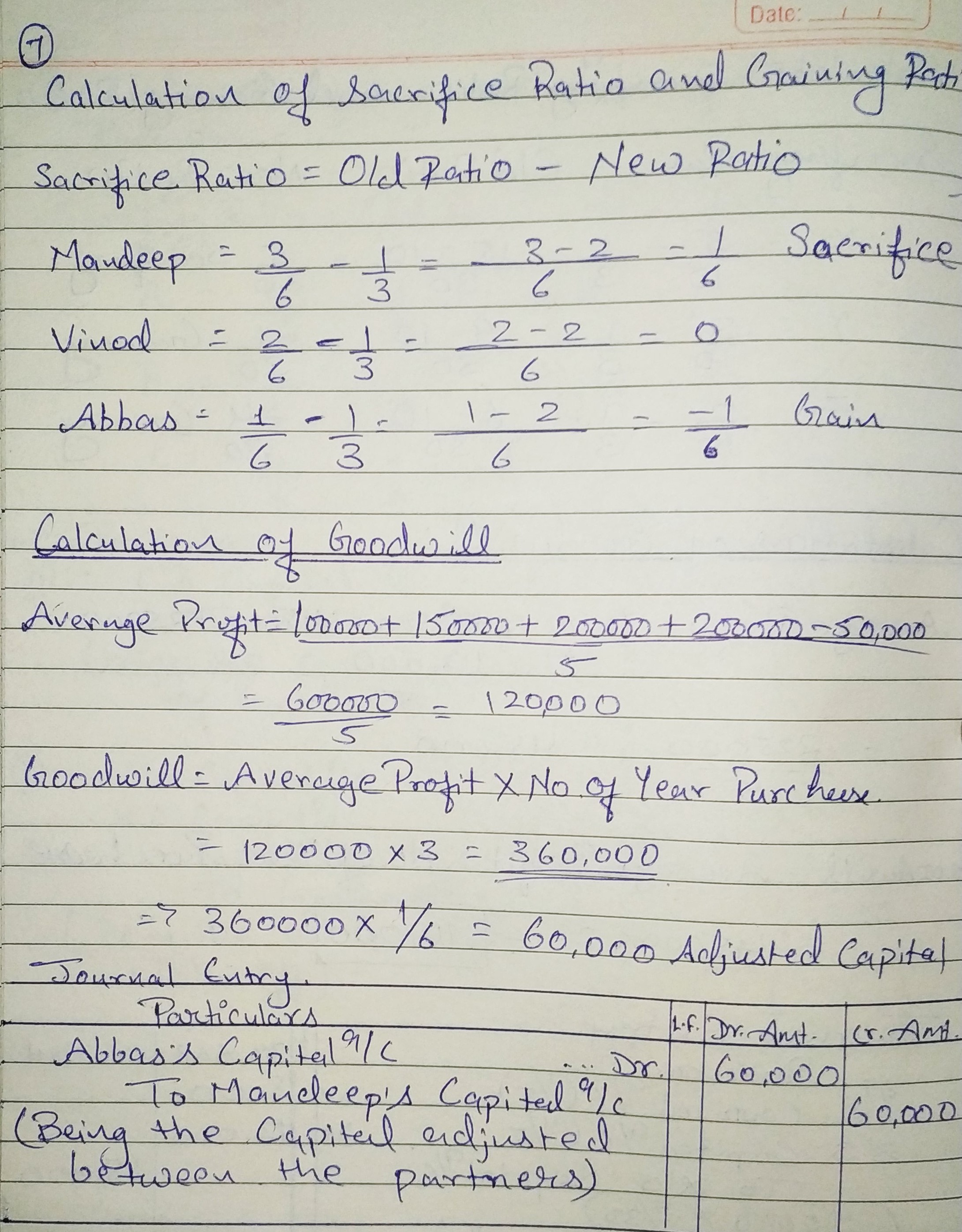

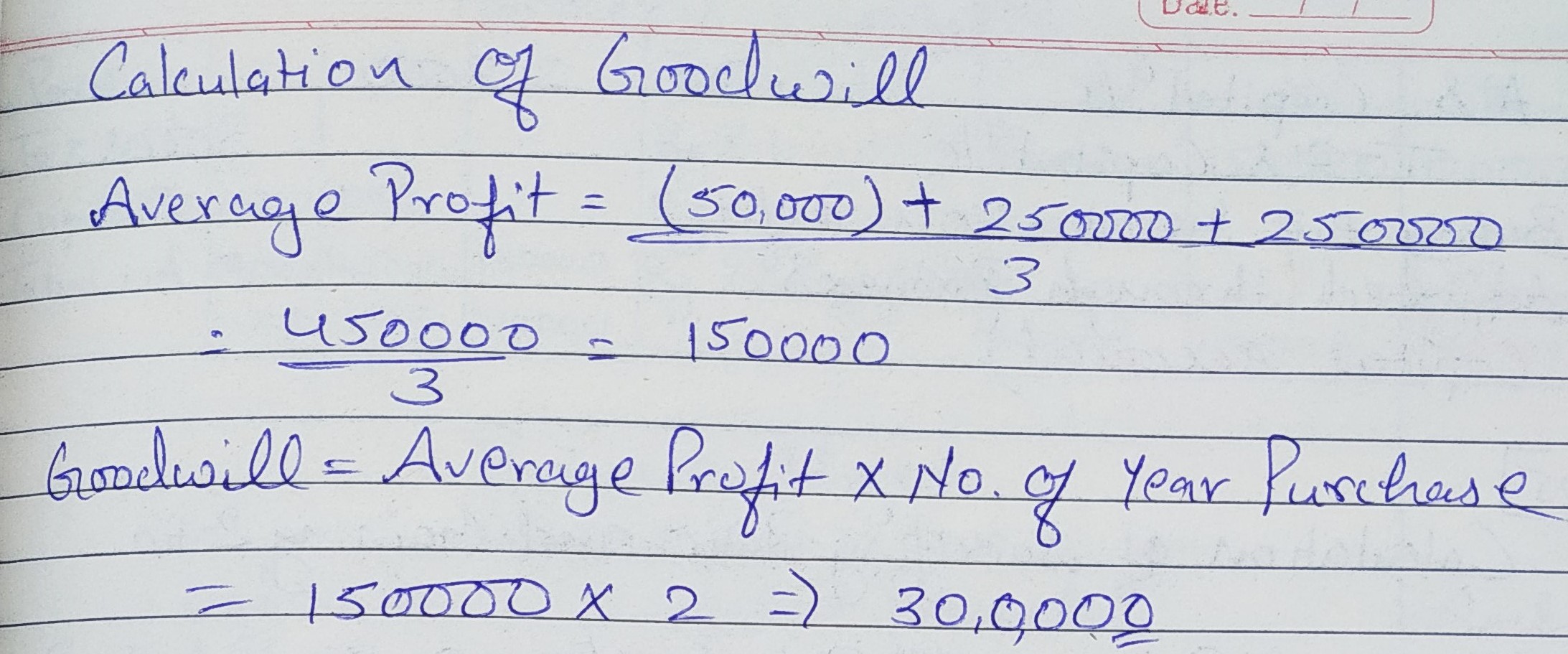

Question 7:

Mandeep, Vinod and Abbas are partners sharing profits and losses in the ratio of 3 : 2 : 1. From 1st April, 2019 they decided to share profits equally. The Partnership Deed provides that in the event of any change in profit-sharing ratio, goodwill shall be valued at three years’ purchase of average profit of last five years. The profits and losses of past five years are:

Profit − Year ended 31st March, 2015 − ₹ 1,00,000; 2016 − ₹ 1,50,000; 2018 − ₹ 2,00,000; 2019 − ₹ 2,00,000.

Loss − Year ended 31st March, 2017 − ₹ 50,000.

Pass the Journal entry showing the working.

ANSWER:

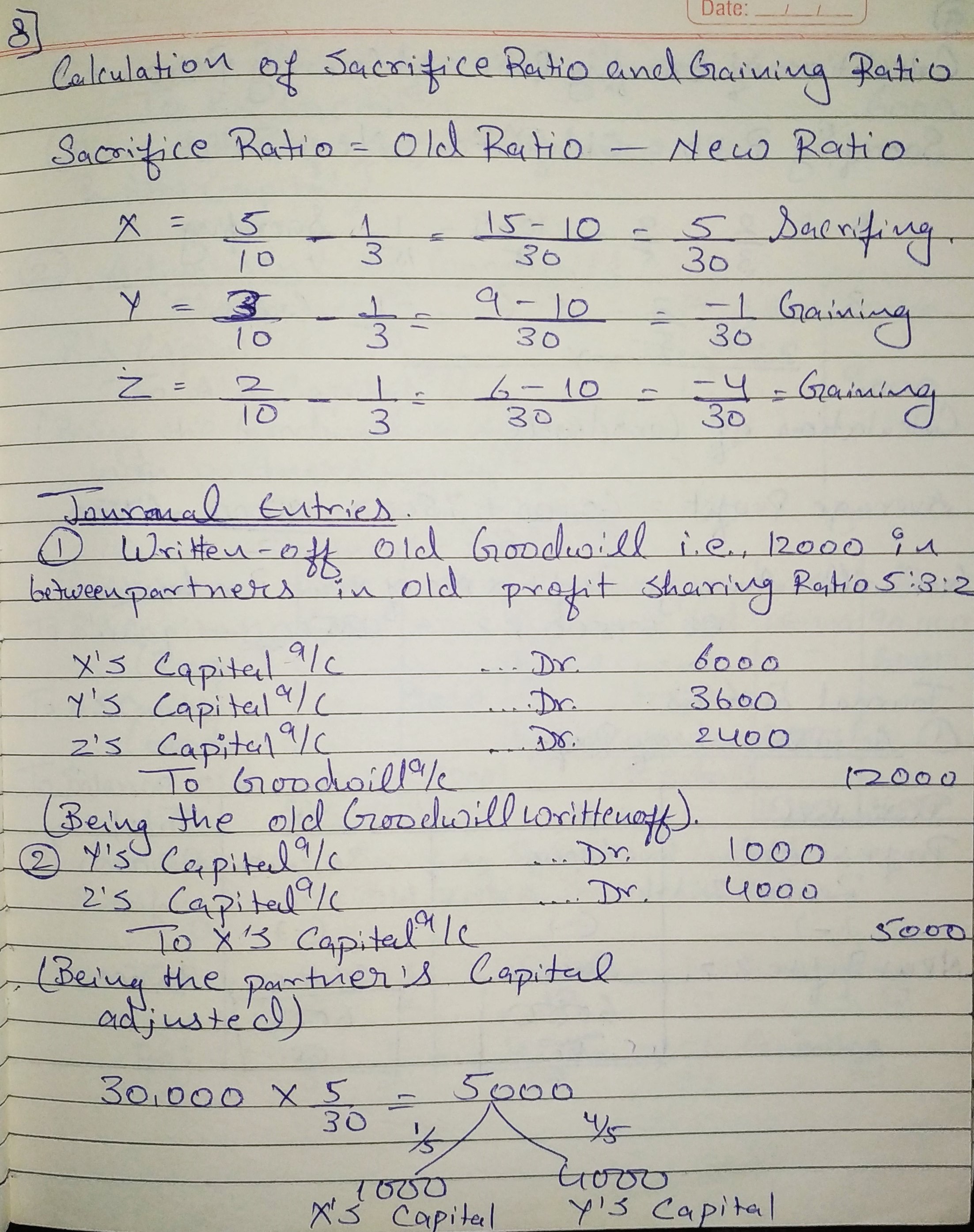

Question 8:

X, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2, decided to share future profits and losses equally with effect from 1st April, 2019. On that date, the goodwill appeared in the books at ₹ 12,000. But it was revalued at ₹ 30,000. Pass Journal entries assuming that goodwill will not appear in the books of account.

ANSWER:

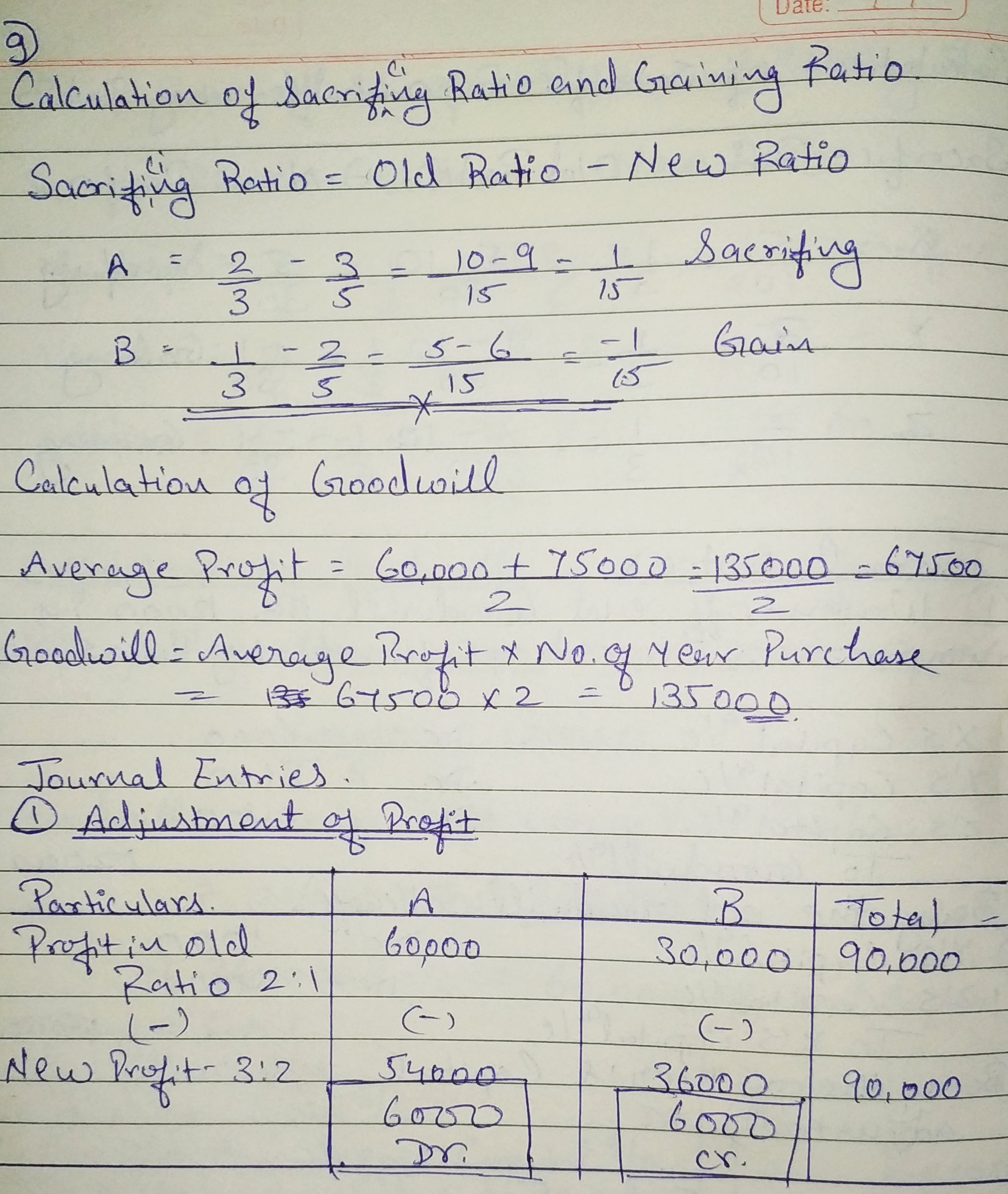

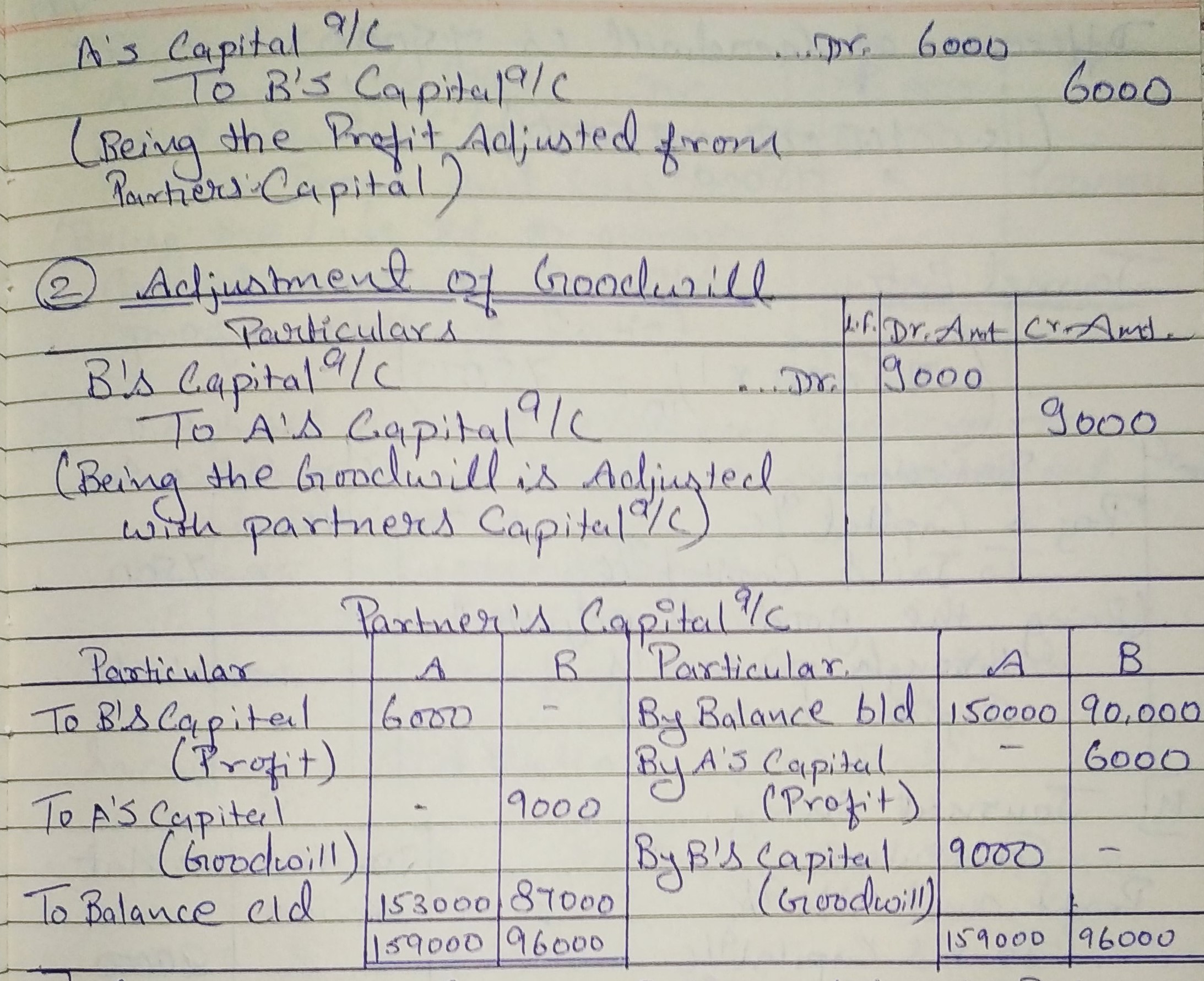

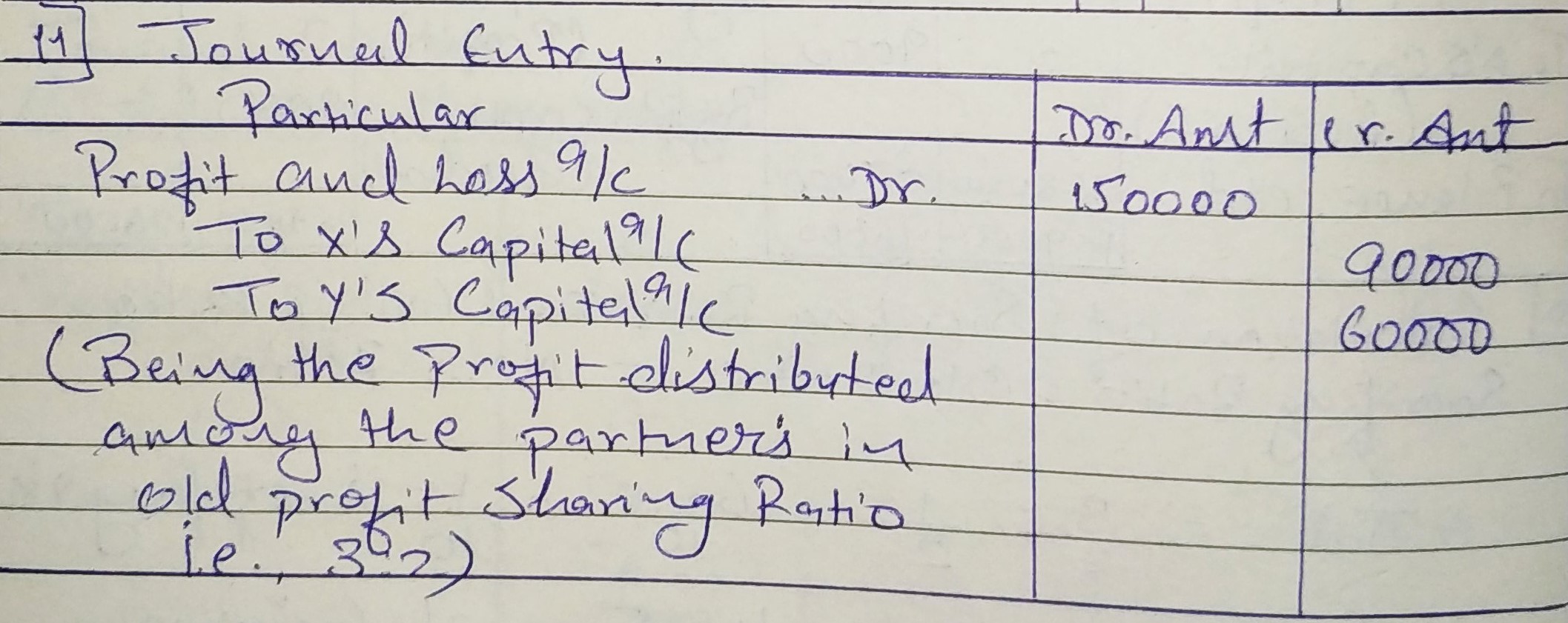

Question 9:

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They decided with effect from 1st April, 2018, that they would share profits in the ratio of 3 : 2. But, this decision was taken after the profit for the year ended 31st March, 2019 of ₹ 90,000 was distributed in the old ratio.

The profits for the year ended 31st March, 2017 and 2018 were ₹ 60,000 and ₹ 75,000 respectively. It was decided that Goodwill Account will not be opened in the books of the firm and necessary adjustment be made through Capital Accounts which on 31st March, 2019 stood at ₹ 1,50,000 for A and ₹ 90,000 for B.

Pass necessary Journal entries and prepare Capital Accounts.

ANSWER:

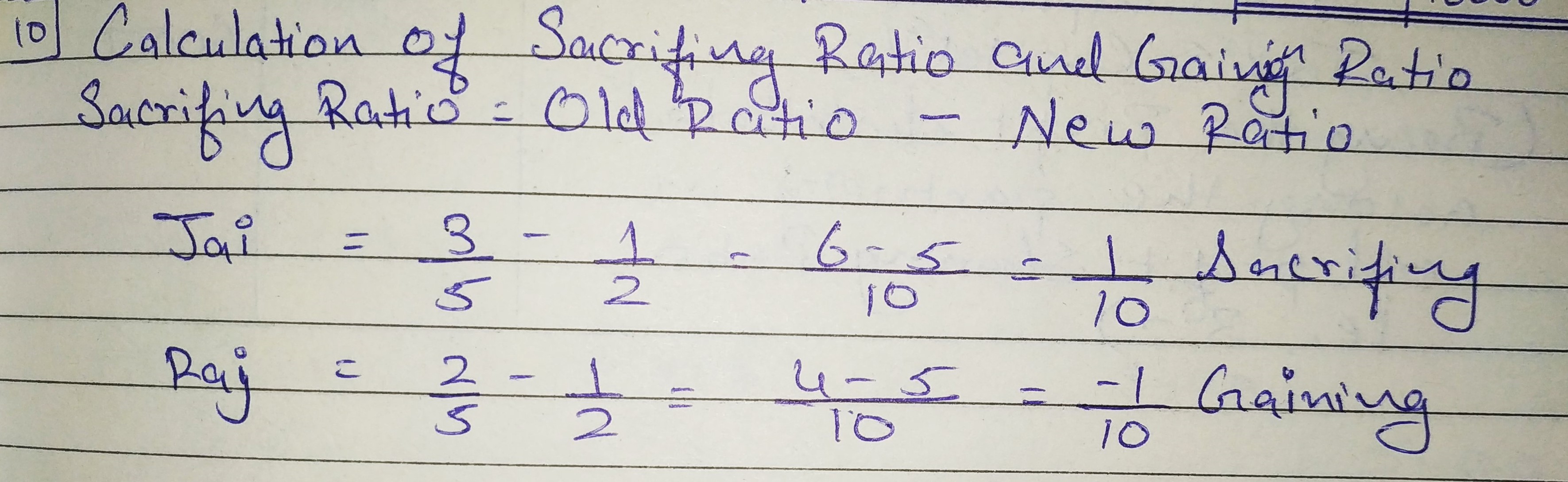

Question 10:

Jai and Raj are partners sharing profits in the ratio of 3 : 2. With effect from 1st April, 2019, they decided to share profits equally. Goodwill appeared in the books at ₹ 25,000. As on 1st April, 2019, it was valued at ₹ 1,00,000. They decided to carry goodwill in the books of the firm.

Pass the Journal entry giving effect to the above.

ANSWER:

Accounting Treatment of Reserve and Accumulated Profit

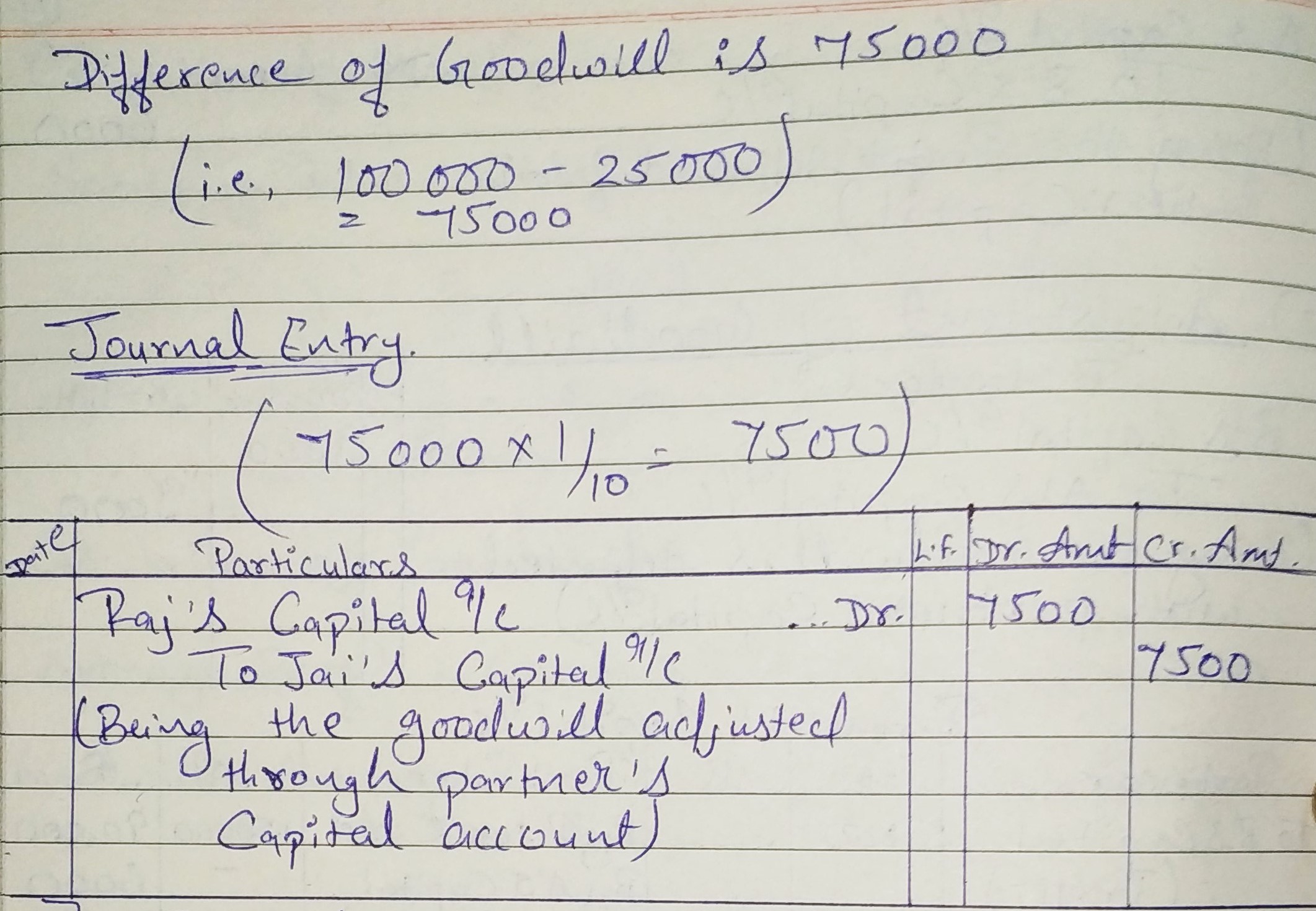

Question 11:

X and Y are partners in a firm sharing profits and losses in the ratio of 3 : 2. With effect from 1st April, 2019, they decided to share future profits equally. On the date of change in the profit-sharing ratio, the Profit and Loss Account showed a credit balance of ₹ 1,50,000. Record the necessary Journal entry for the distribution of the balance in the Profit and Loss Account immediately before the change in the profit-sharing ratio.

ANSWER:

Question 12:

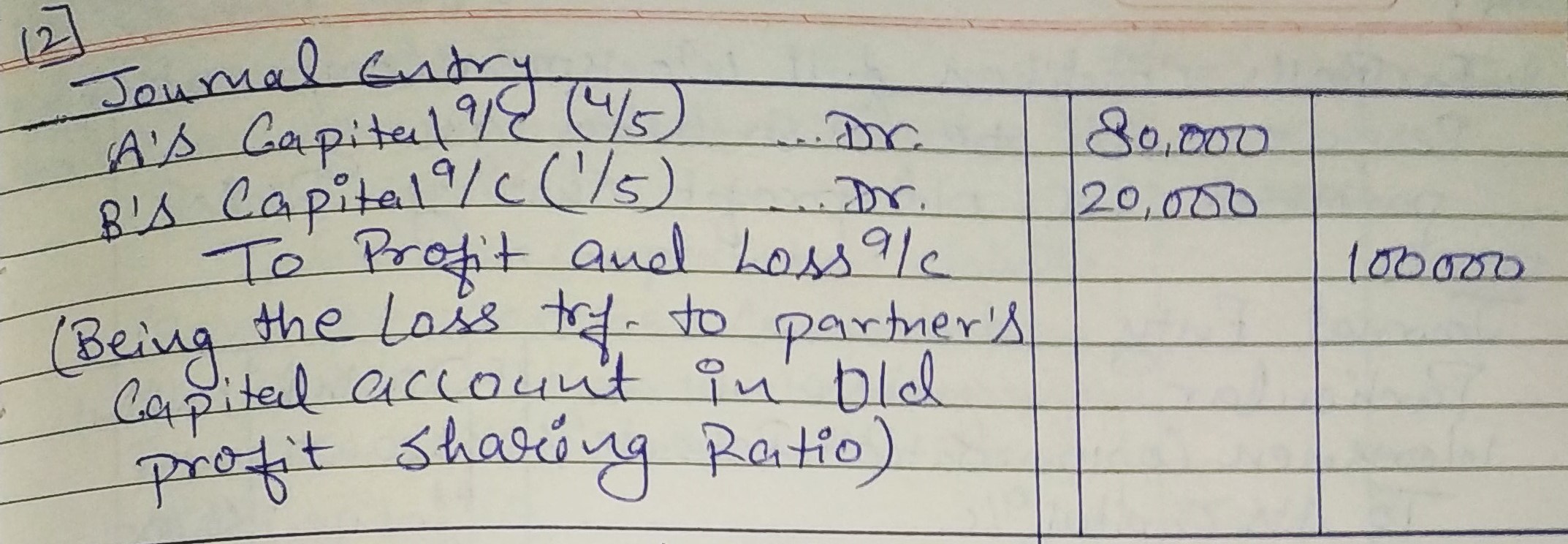

A and B are partners in a firm sharing profits in the ratio of 4 : 1. They decided to share future profits in the ratio of 3 : 2 w.e.f. 1st April, 2019. On that day, Profit and Loss Account showed a debit balance of ₹ 1,00,000. Pass Journal entry to give effect to the above.

ANSWER:

Question 13:

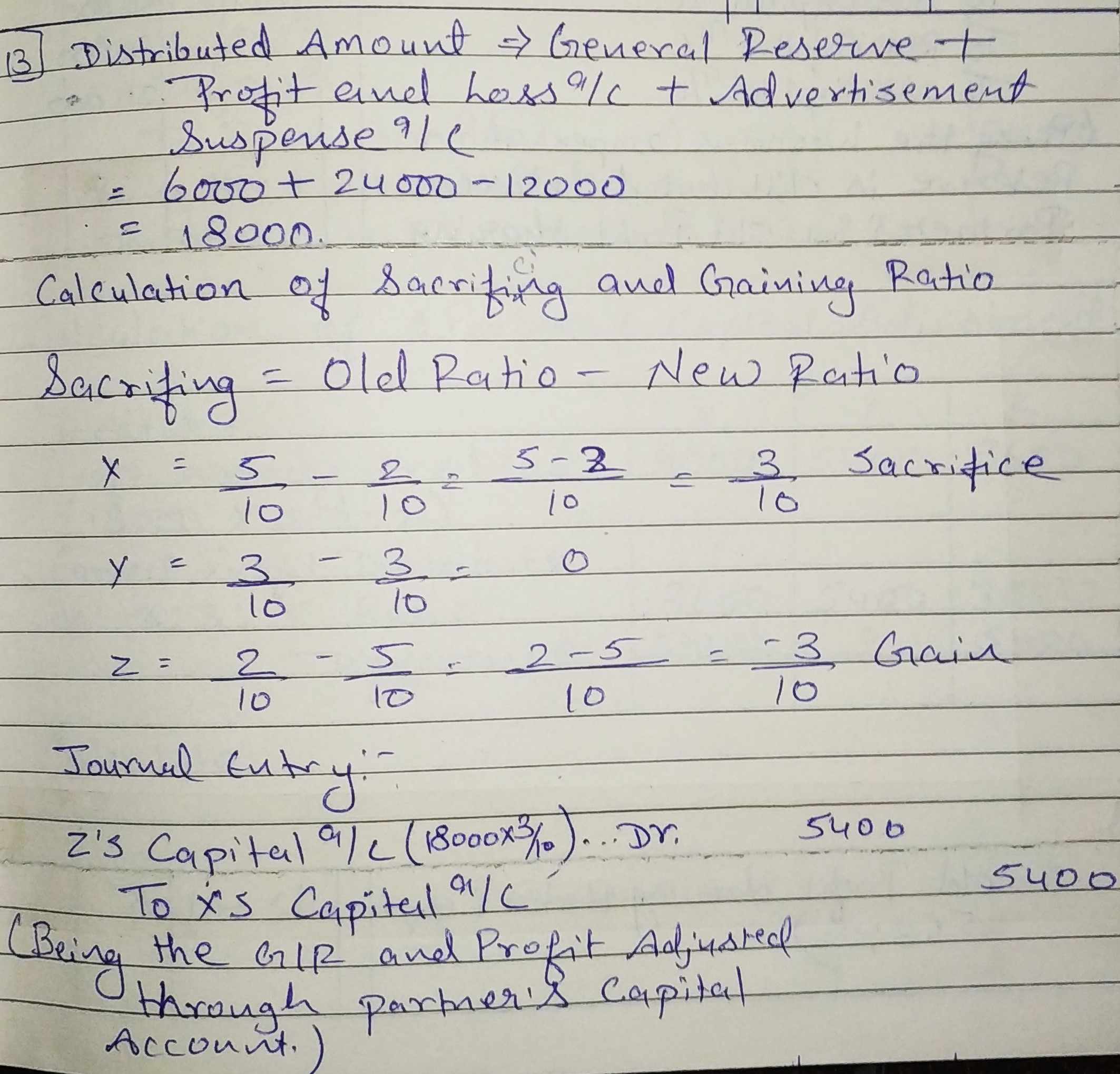

X, Y and Z are sharing profits and losses in the ratio of 5 : 3 : 2. They decide to share future profits and losses in the ratio of 2 : 3 : 5 with effect from 1st April, 2019. They also decide to record the effect of the following accumulated profits, losses and reserves without affecting their book values by passing a single entry .

| Book Values (₹) | |

| General Reserve | 6,000 |

| Profit and Loss A/c (Credit) | 24,000 |

| Advertisement Suspense A/c | 12,000 |

Pass an Adjustment Entry.

ANSWER:

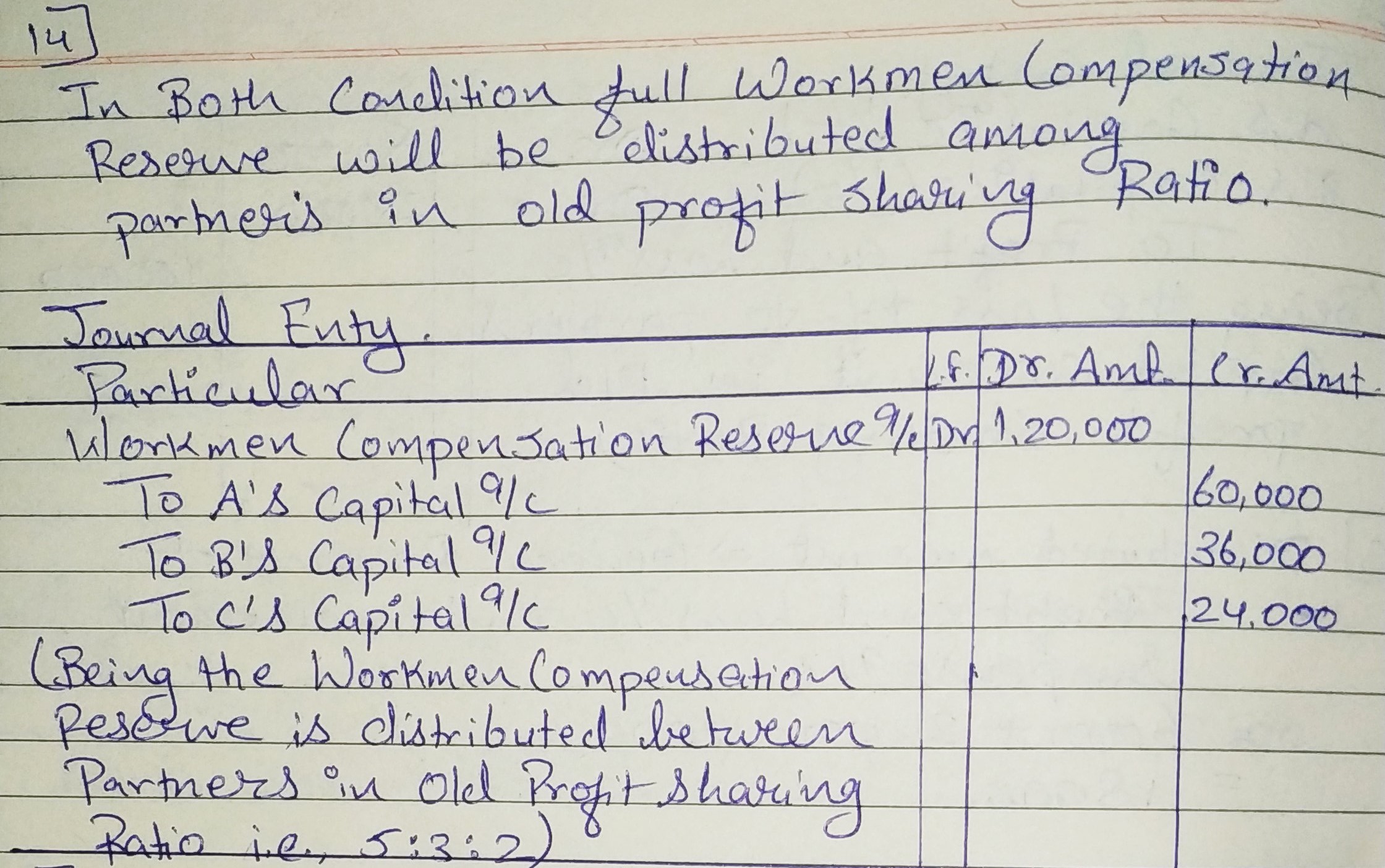

Question 14:

A, B and C who are presently sharing profits and losses in the ratio of 5 : 3 : 2 decide to share future profits and losses in the ratio of 2 : 3 : 5. Give the Journal entry to distribute ‘Workmen Compensation Reserve’ of ₹ 1,20,000 at the time of change in profit-sharing ratio, when:

(i) no information is given; (ii) there is no claim against it.

ANSWER:

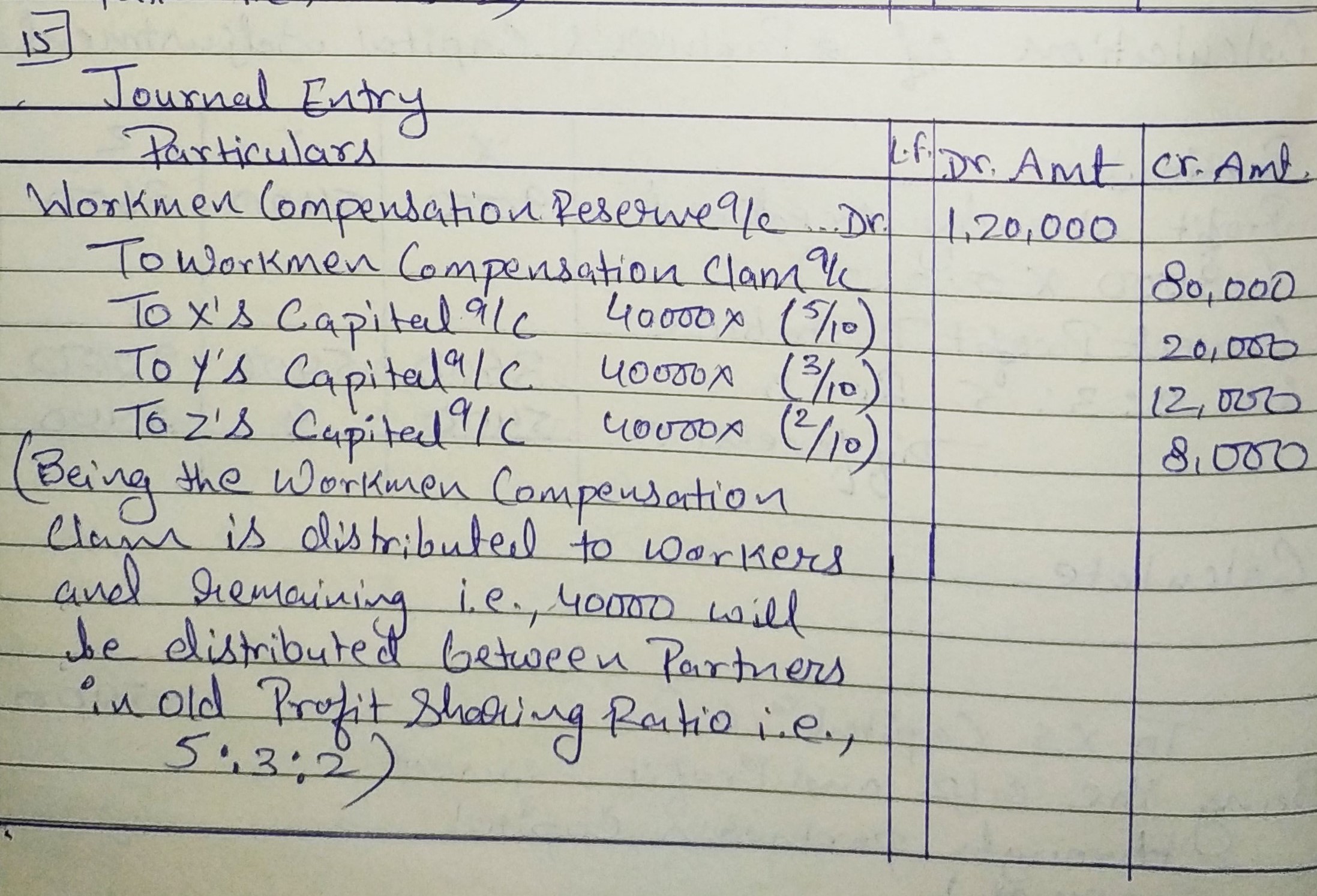

Question 15:

X, Y and Z who are presently sharing profits and losses in the ratio of 5 : 3 : 2 decide to share future profits and losses in the ratio of 2 : 3 : 5. Give the journal entry to distribute ‘Workmen Compensation Reserve’ of ₹ 1,20,000 at the time of change in profit-sharing ratio, when there is a claim of ₹ 80,000 against it.

ANSWER:

Question 16:

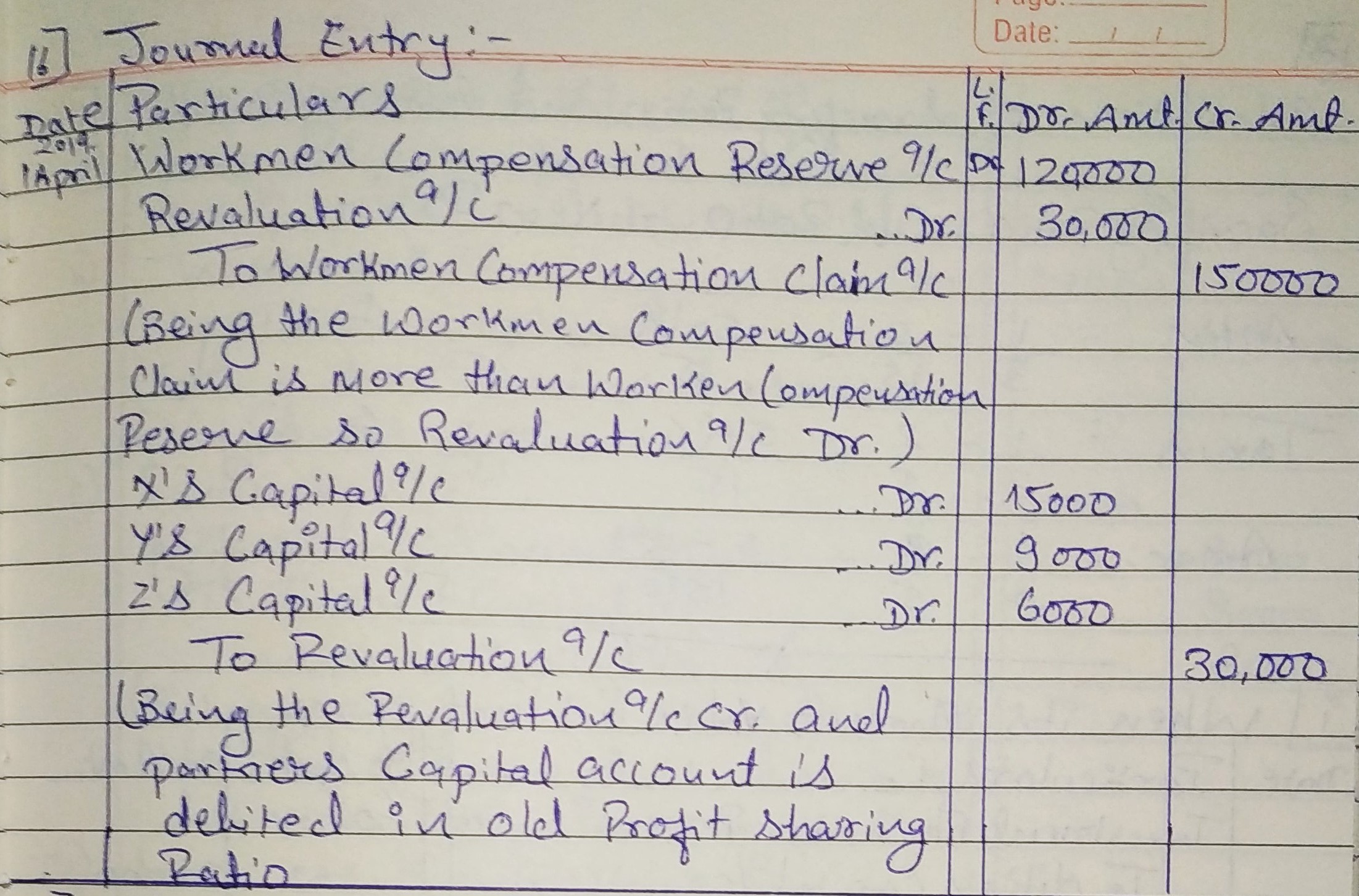

X, Y and Z who are sharing profits in the ratio of 5 : 3 : 2, decide to share profits in the ratio of 2 : 3 : 5 with effect from 1st April, 2019. Workmen Compensation Reserve appears at ₹ 1,20,000 in the Balance Sheet as at 31st March, 2019 and Workmen Compensation Claim is estimated at ₹ 1,50,000. Pass Journal entries for the accounting treatment of Workmen Compensation Reserve.

ANSWER:

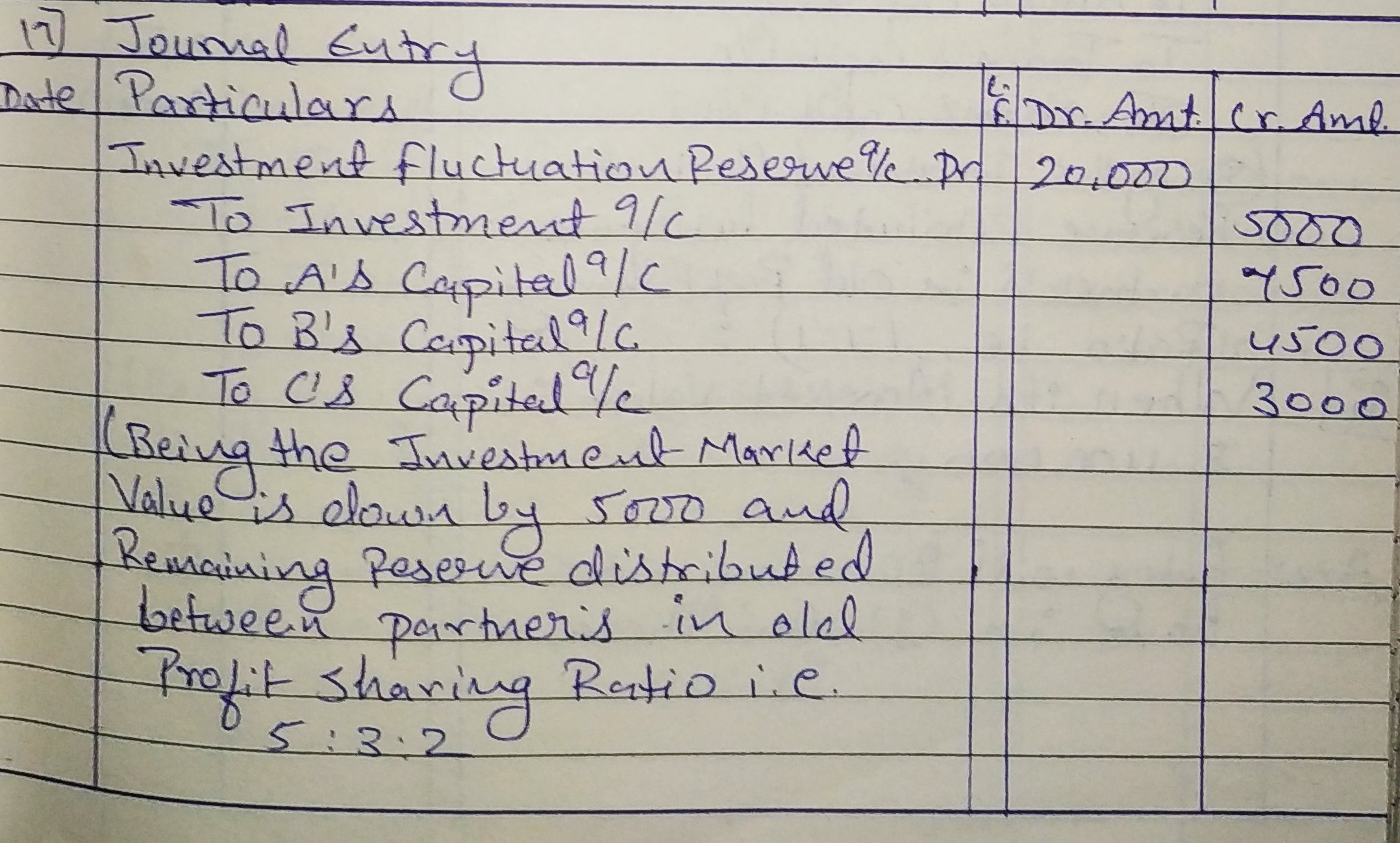

Question 17:

A, B and C who are presently sharing profits and losses in the ratio of 5 : 3 : 2 decide to share future profits and losses in the ratio of 2 : 3 : 5. Give the journal entry to distribute ‘Investments Fluctuation Reserve’ of ₹ 20,000 at the time of change in profit-sharing ratio, when investment (market value ₹ 95,000) appears in the books at ₹ 1,00,000.

ANSWER:

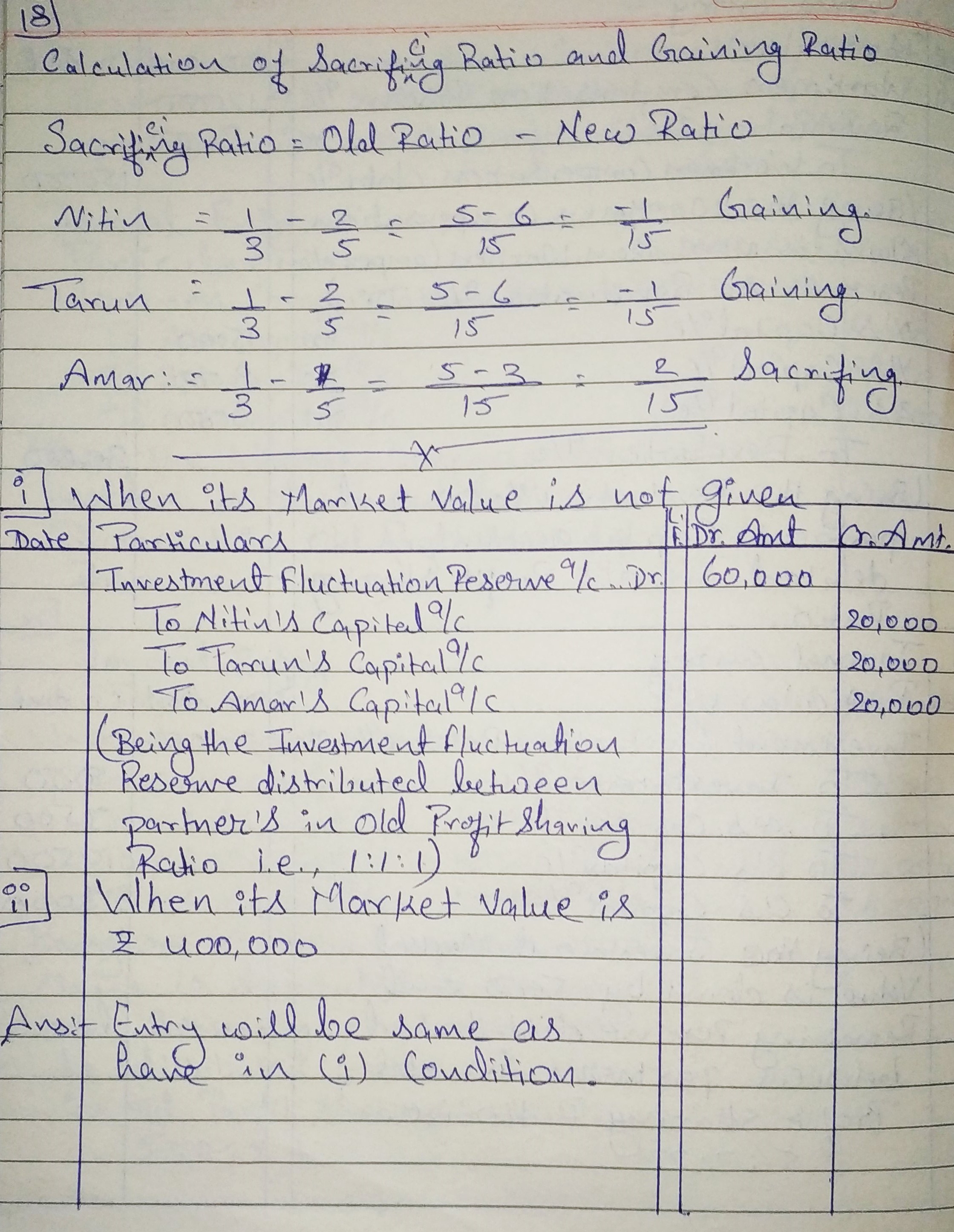

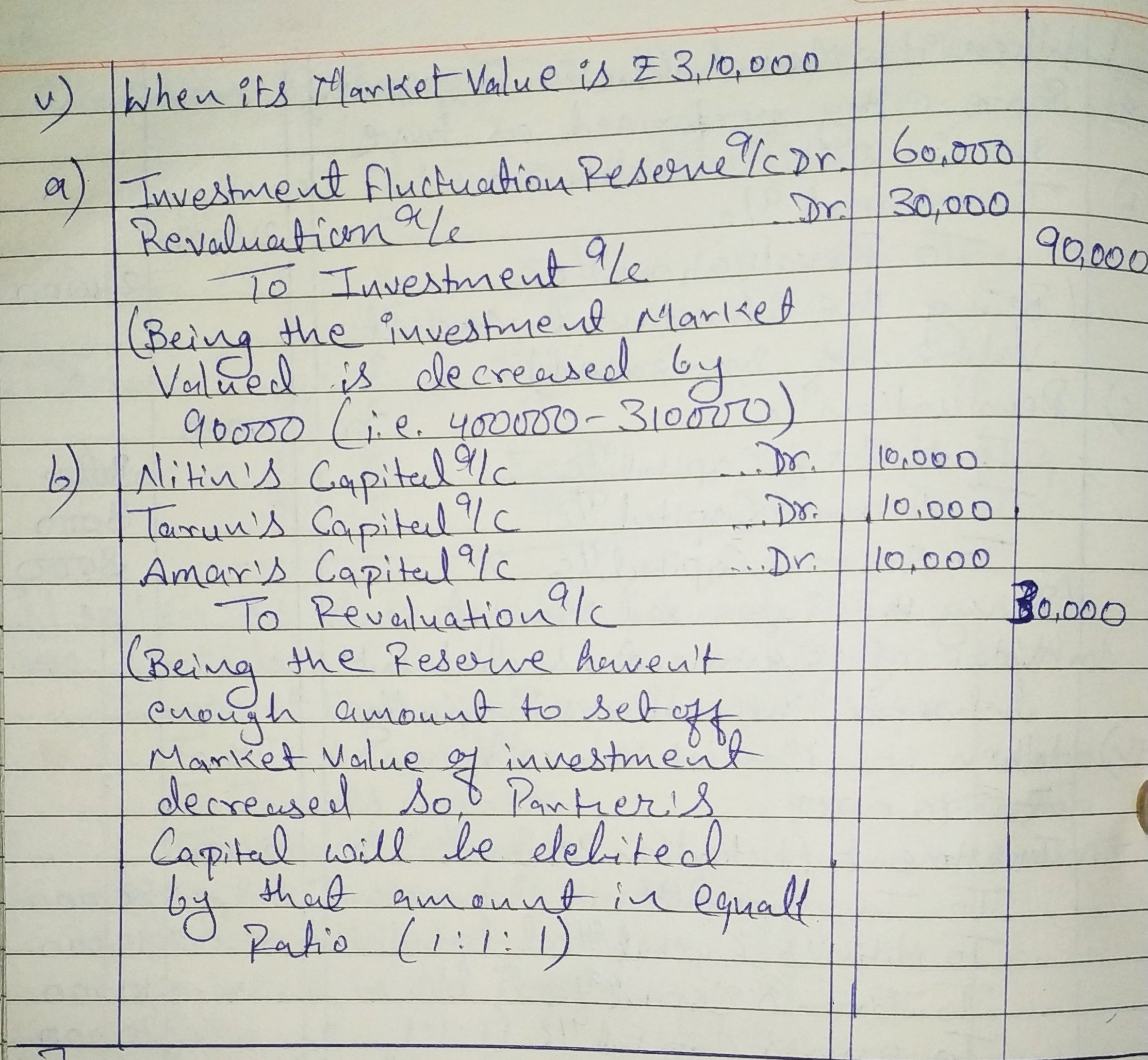

Question 18:

Nitin, Tarun and Amar are partners sharing profits equally and decide to share profits in the ratio of 2 : 2 : 1 w.e.f. 1st April, 2019. The extract of their Balance Sheet as at 31st March, 2019 is as follows:

| Liabilities | ₹ | Assets | ₹ |

| Investments Fluctuation Reserve | 60,000 | Investments (At Cost) | 4,00,000 |

Pass the Journal entries in each of the following situations:

(i) When its Market Value is not given;

(ii) When its Market Value is ₹ 4,00,000;

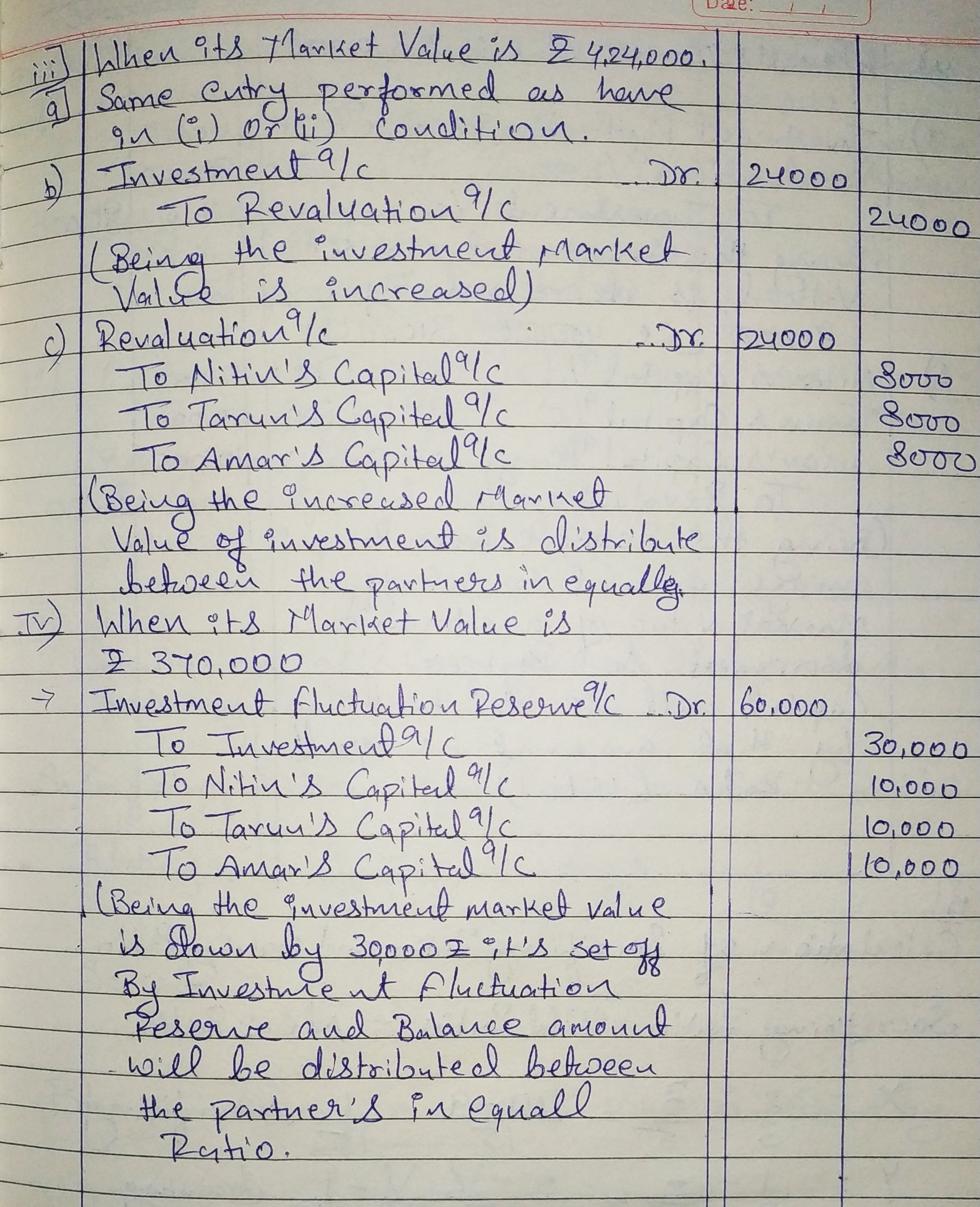

(iii) When its Market Value is ₹ 4,24,000;

(iv) When its Market Value is ₹ 3,70,000;

(v) When its Market Value is ₹ 3,10,000.

ANSWER:

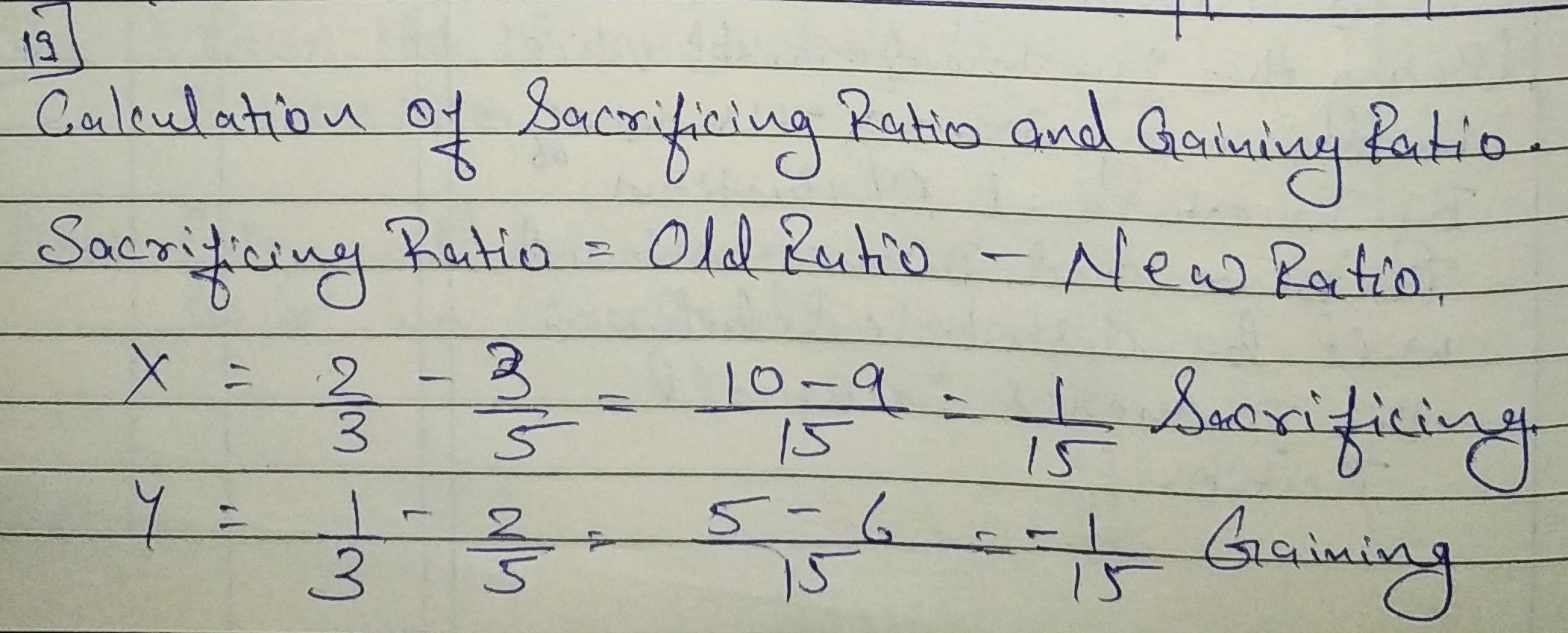

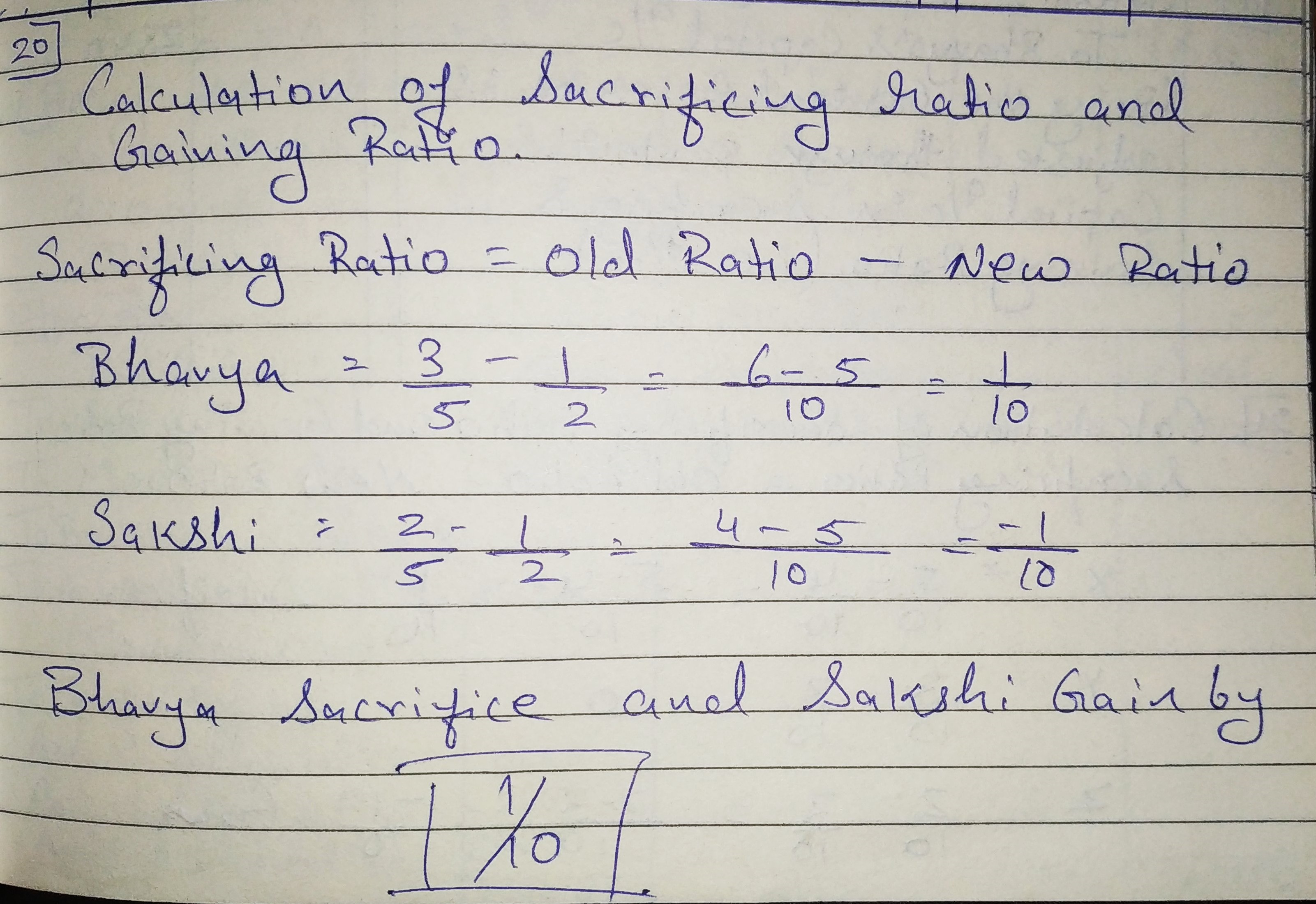

Question 19:

X and Y are partners sharing profits in the ratio of 2 : 1. On 31st March, 2019, their Balance Sheet showed General Reserve of ₹ 60,000. It was decided that in future they will share profits and losses in the ratio of 3 : 2. Pass necessary Journal entry in each of the following alternative cases:

(i) When General Reserve is not to be shown in the new Balance Sheet.

(ii) When General Reserve is to be shown in the new Balance Sheet.

ANSWER:

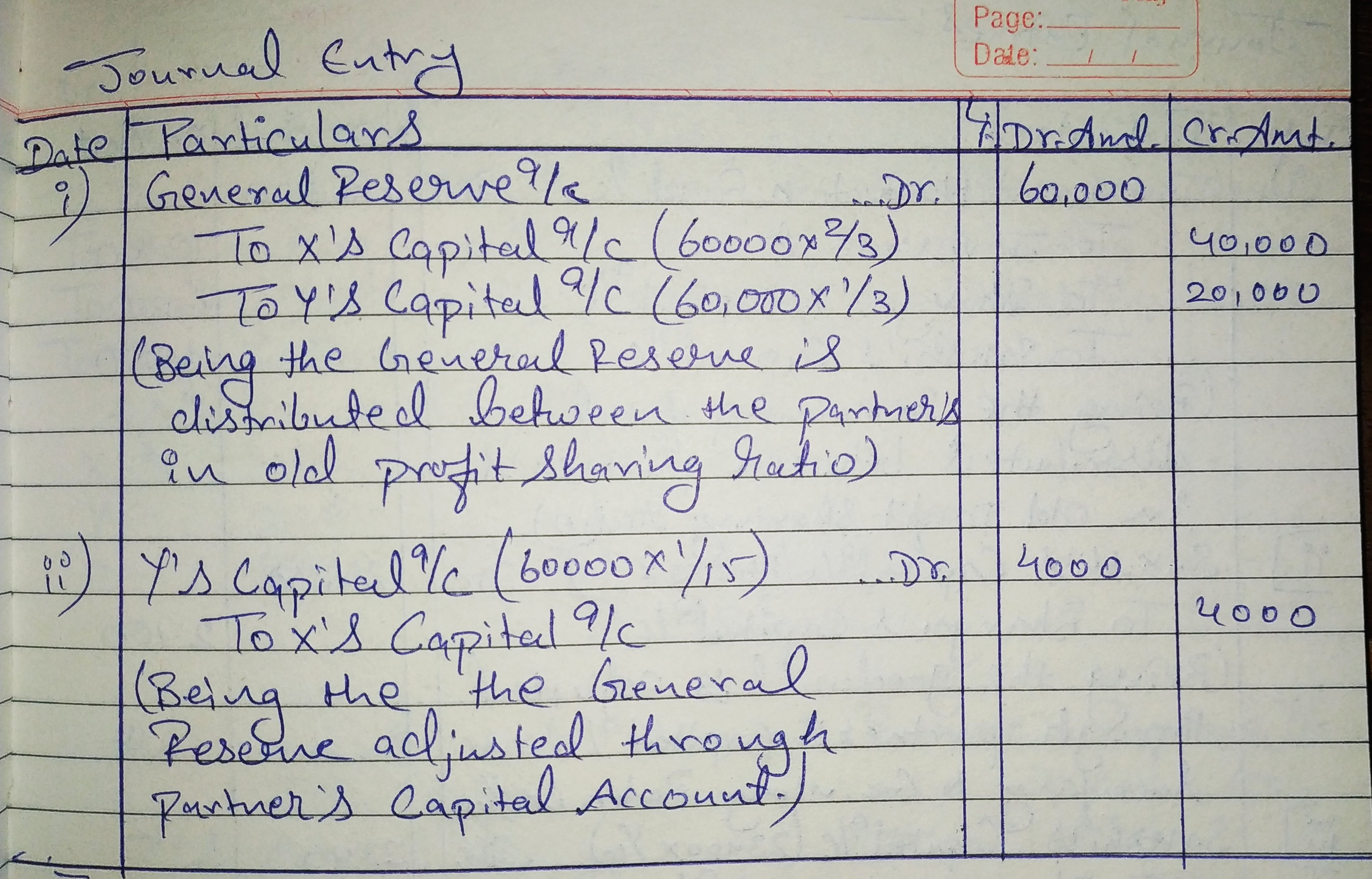

Question 20:

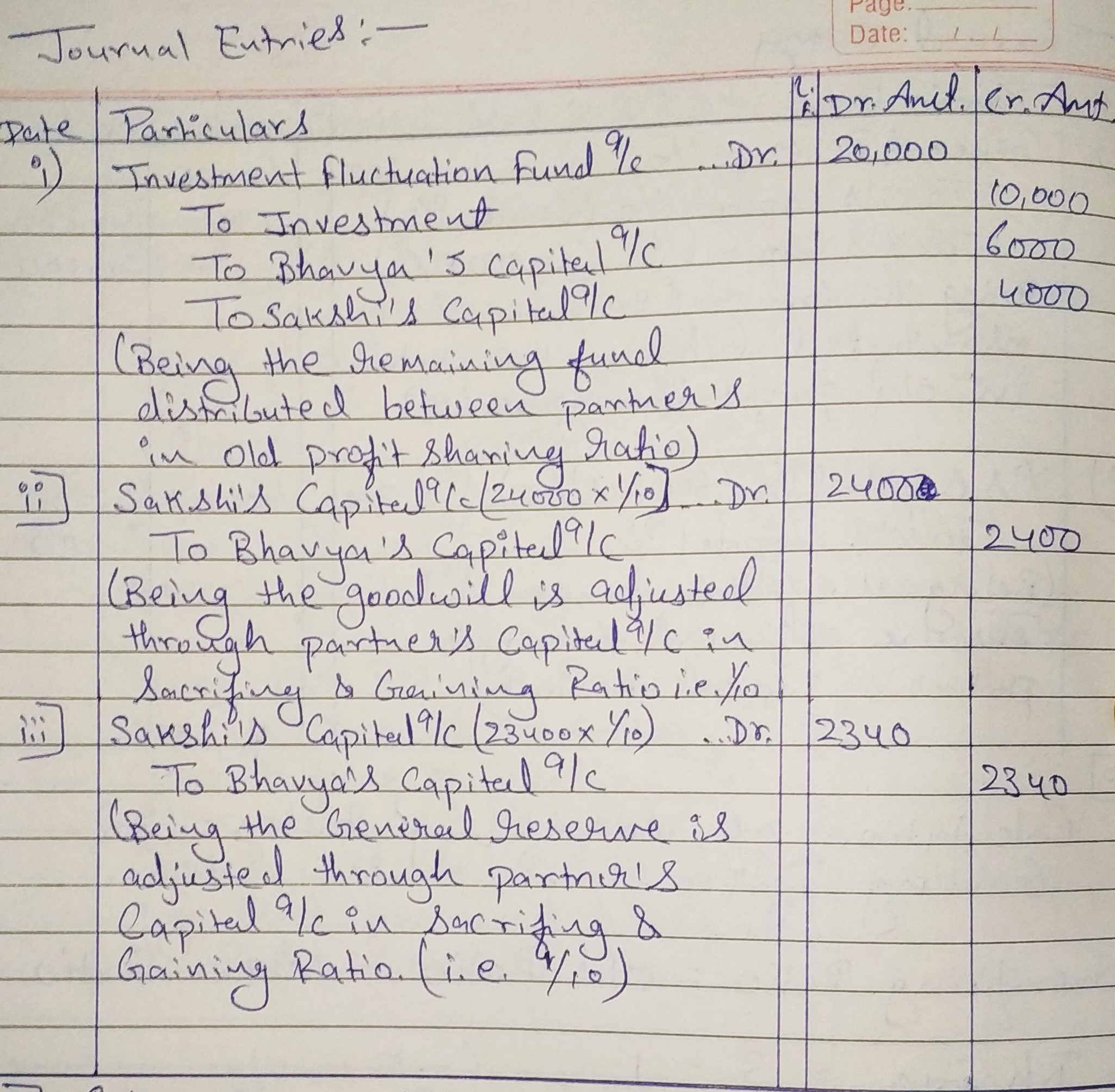

Bhavya and Sakshi are partners in a firm, sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 their Balance Sheet was as under:

| Liabilities | Amount (₹) | Assets | Amount (₹) | ||

| Sundry Creditors | 13,800 | Furniture | 16,000 | ||

| General Reserve | 23,400 | Land and Building | 56,000 | ||

| Investment Fluctuation Fund | 20,000 | Investments | 30,000 | ||

| Bhavya’s Capital | 50,000 | Trade Receivables | 18,500 | ||

| Sakshi’s Capital | 40,000 | Cash in Hand | 26,700 | ||

| 1,47,200 | 1,47,200 | ||||

The partners have decided to change their profit sharing ratio to 1 : 1 with immediate effect. For the purpose, they decided that:

(i) Investments to be valued at ₹ 20,000.

(ii) Goodwill of the firm be valued at ₹ 24,000.

(iii) General Reserve not to be distributed between the partners.

You are required to pass necessary Journal entries in the books of the firm. Show workings.

ANSWER:

Revaluation of Assets and Reassessment of Liabilities

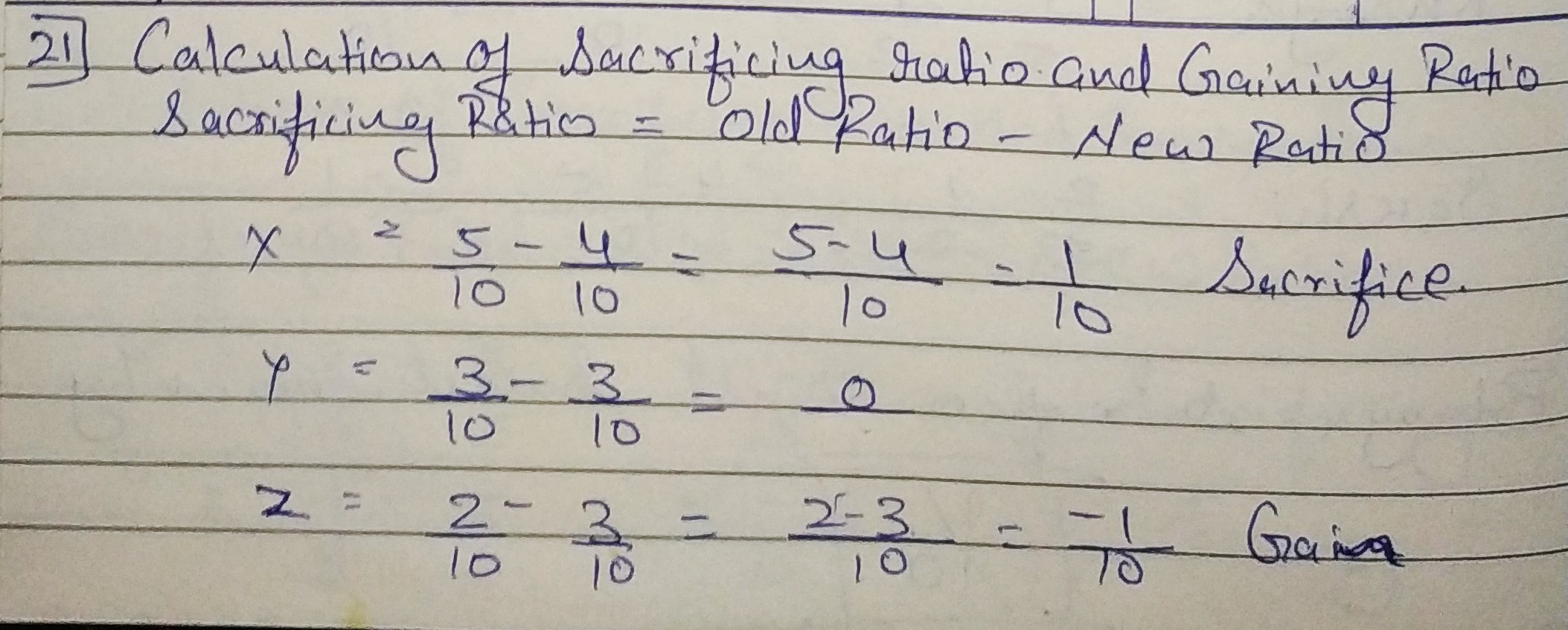

Question 21:

X, Y and Z share profits as 5 : 3 : 2. They decide to share their future profits as 4 : 3 : 3 with effect from 1st April, 2019. On this date the following revaluations have taken place:

| Book Values (₹) | Revised Values (₹) | |

| Investments | 22,000 | 25,000 |

| Plant and Machinery | 25,000 | 20,000 |

| Land and Building | 40,000 | 50,000 |

| Outstanding Expenses | 5,600 | 6,000 |

| Sundry Debtors | 60,000 | 50,000 |

| Trade Creditors | 70,000 | 60,000 |

Pass necessary adjustment entry to be made because of the above changes in the values of assets and liabilities. However, old values will continue in the books .

ANSWER:

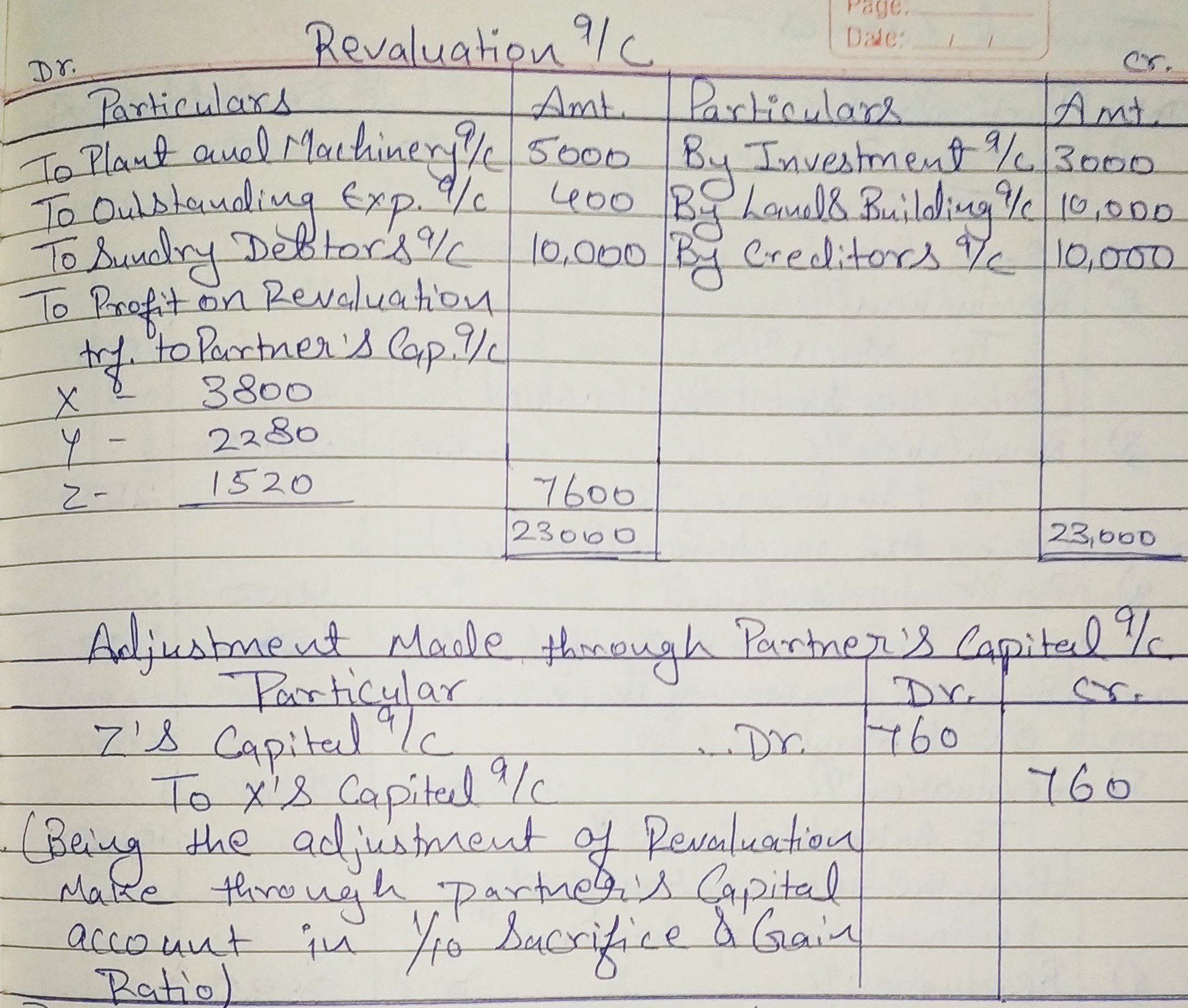

Question 22:

Ashish, Aakash and Amit are partners sharing profits and losses equally. The Balance Sheet as at 31st March, 2019 was as follows:

| ||||

Liabilities | Amount | Assets | Amount | |

| Sundry Creditors | 75,000 | Cash in Hand | 24,000 | |

| General Reserve | 90,000 | Cash at Bank | 1,40,000 | |

| Capital A/cs: | Sundry Debtors | 80,000 | ||

| Ashish | 3,00,000 | Stock | 1,40,000 | |

| Aakash | 3,00,000 | Land and Building | 4,00,000 | |

| Amit | 2,75,000 | 8,75,000 | Machinery | 2,50,000 |

| Advertisement Suspense | 6,000 | |||

| 10,40,000 | 10,40,000 | |||

|

| |||

The partners decided to share profits in the ratio of 2 : 2 : 1 w.e.f. 1st April, 2019. They also decided that:

(i) Value of stock to be reduced to ₹ 1,25,000.

(ii) Value of machinery to be decreased by 10%.

(iii) Land and Building to be appreciated by ₹ 62,000.

(iv) Provision for Doubtful Debts to be made @ 5% on Sundry Debtors.

(v) Aakash was to carry out reconstitution of the firm at a remuneration of ₹ 10,000.

Pass necessary Journal entries to give effect to the above.

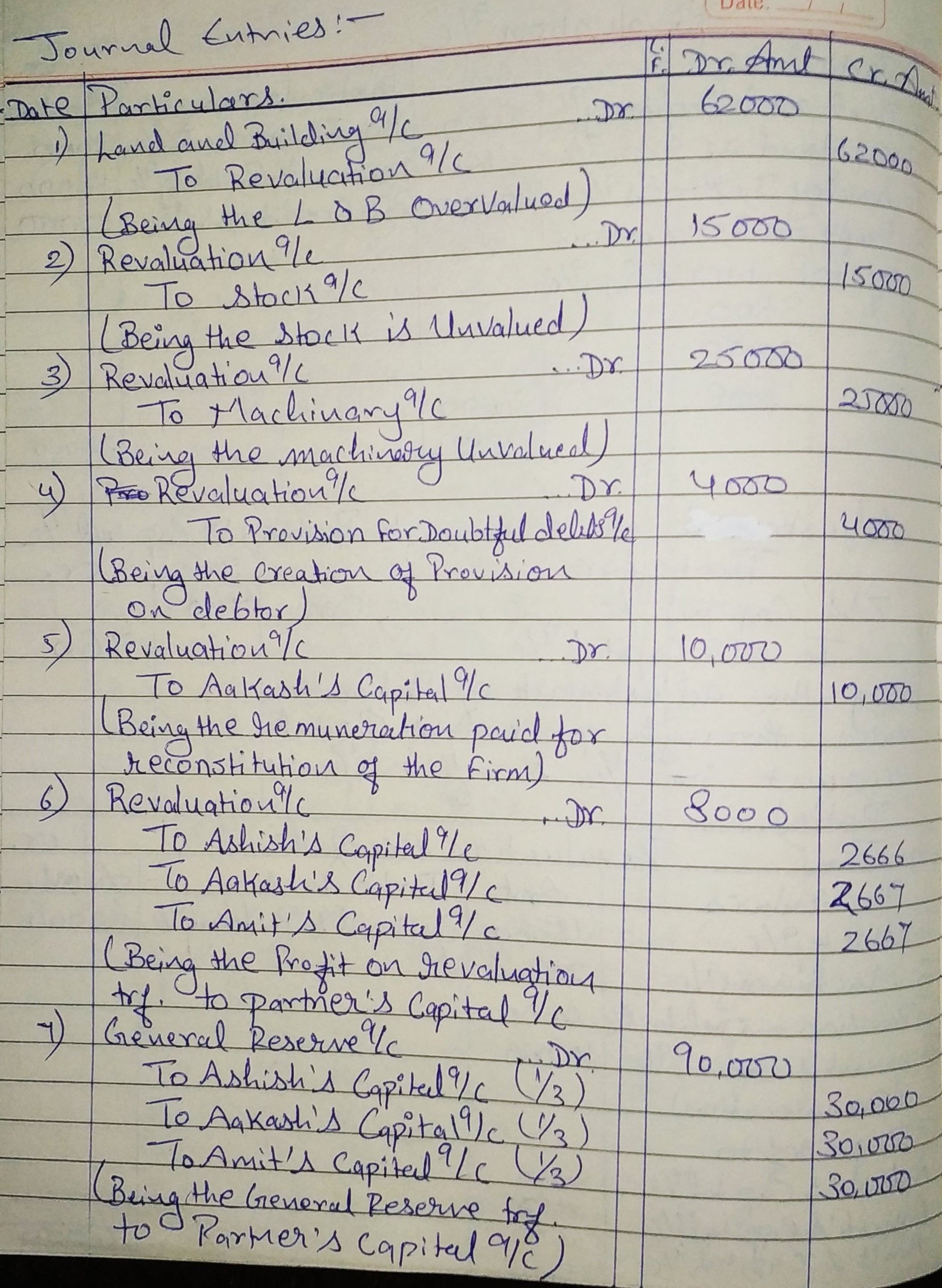

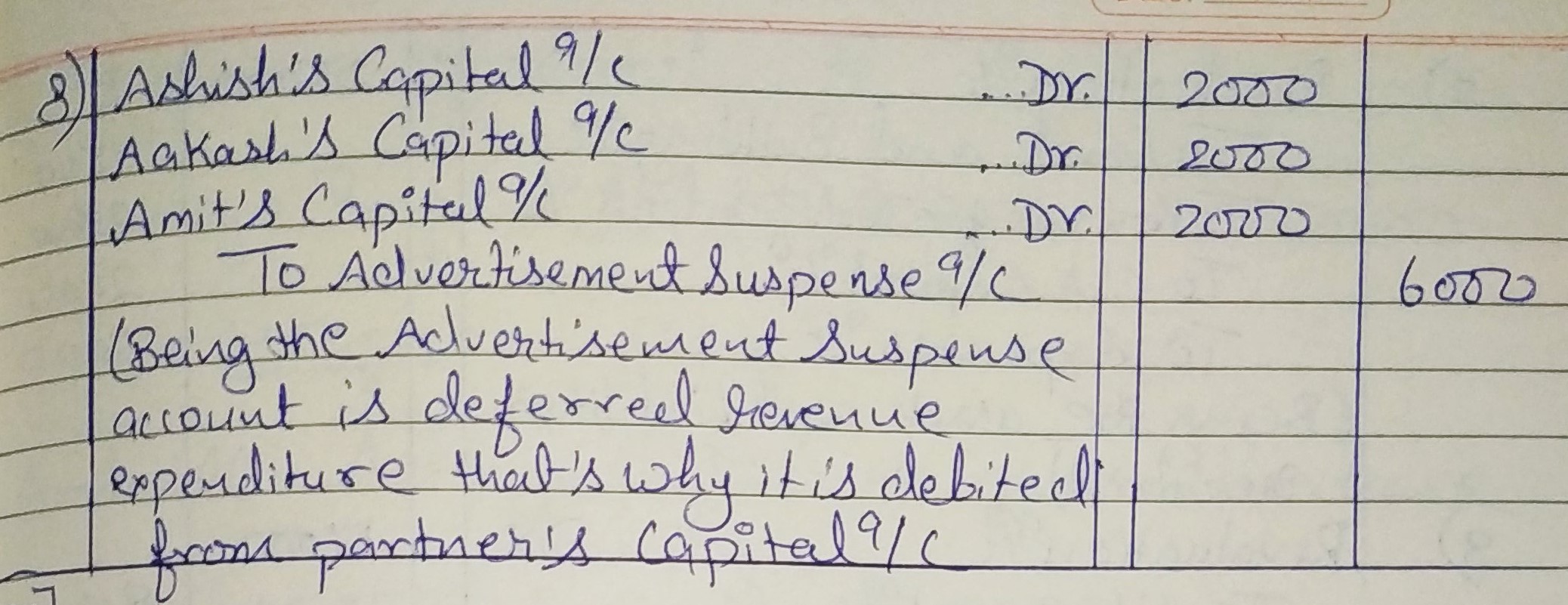

ANSWER:

Question 23:

A, B and C are partners sharing profits and losses in the ratio of 5 : 3 : 2. Their Balance Sheet as at 31st March, 2019 stood as follows:

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Capital A/cs: | Land and Building | 3,50,000 | ||

| A | 2,50,000 | Machinery | 2,40,000 | |

| B | 2,50,000 | Computers | 70,000 | |

| C | 2,00,000 | 7,00,000 | Investments (Market value ₹ 90,000) | 1,00,000 |

| General Reserve | 60,000 | Sundry Debtors | 50,000 | |

| Investments Fluctuation Reserve | 30,000 | Cash in Hand | 10,000 | |

| Sundry Creditors | 90,000 | Cash at Bank | 55,000 | |

| Advertisement Suspense | 5,000 | |||

| 8,80,000 | 8,80,000 | |||

They decided to share profits equally w.e.f. 1st April, 2019. They also agreed that:

(i) Value of Land and Building be decreased by 5%.

(ii) Value of Machinery be increased by 5%.

(iii) A Provision for Doubtful Debts be created @ 5% on Sundry Debtors.

(iv) A Motor Cycle valued at ₹ 20,000 was unrecorded and is now to be recorded in the books.

(v) Out of Sundry Creditors, ₹ 10,000 is not payable.

(vi) Goodwill is to be valued at 2 years’ purchase of last 3 years profits. Profits being for 2018-19 − ₹ 50,000 (Loss); 2017-18 − ₹ 2,50,000 and 2016-17 − ₹ 2,50,000.

(vii) C was to carry out the work for reconstituting the firm at a remuneration (including expenses) of ₹ 5,000. Expenses came to ₹ 3,000.

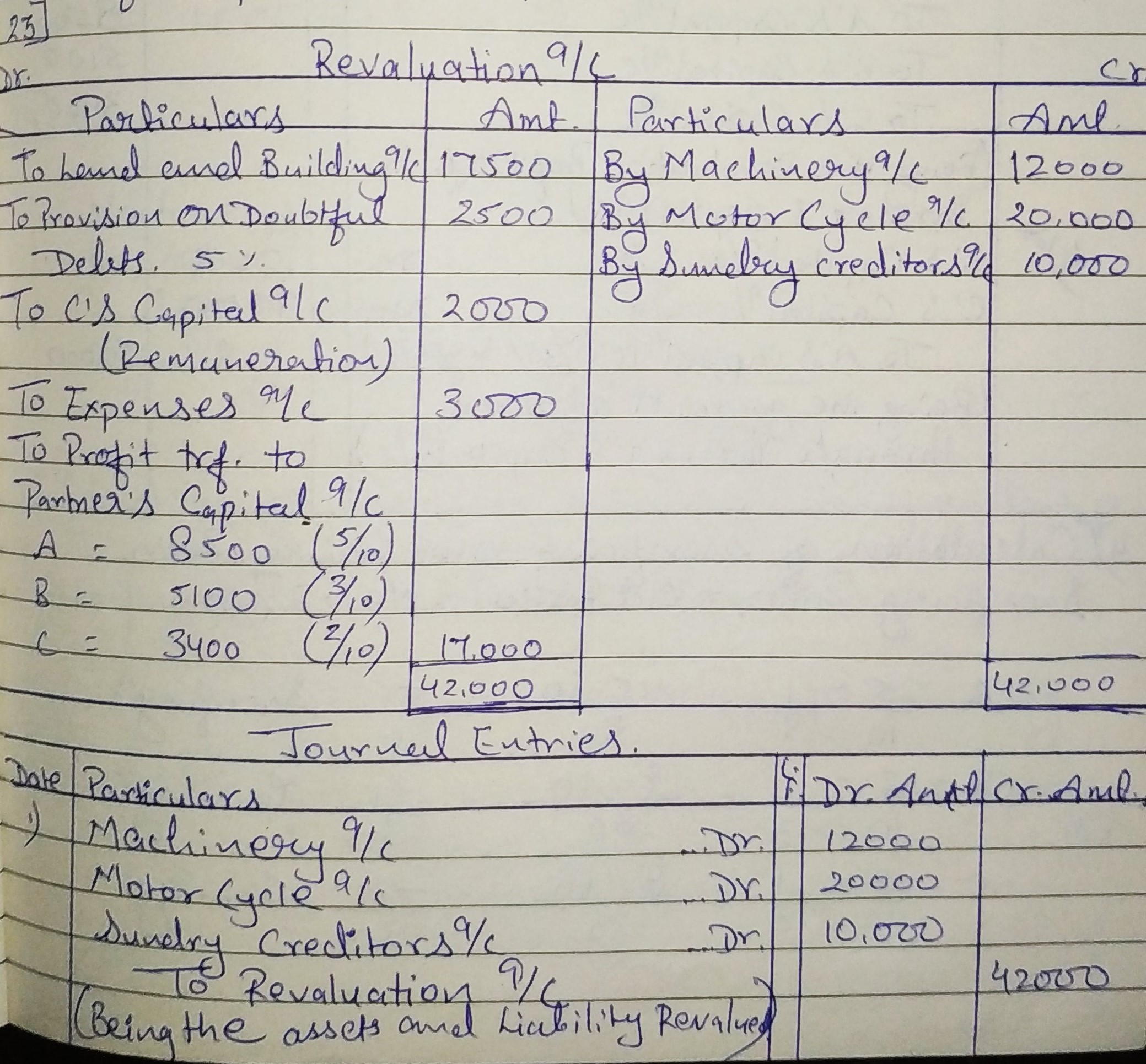

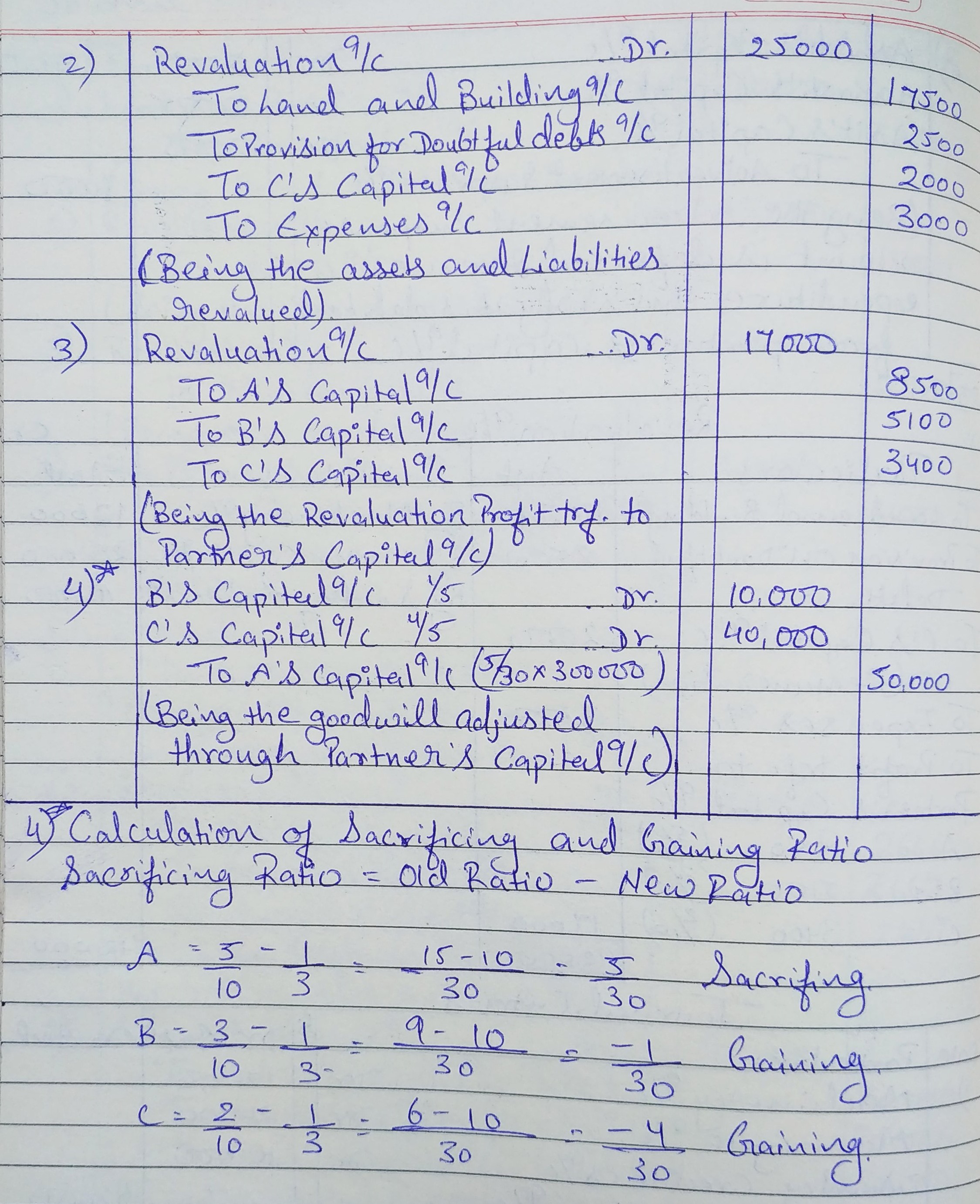

Pass Journal entries and prepare Revaluation Account.

ANSWER:

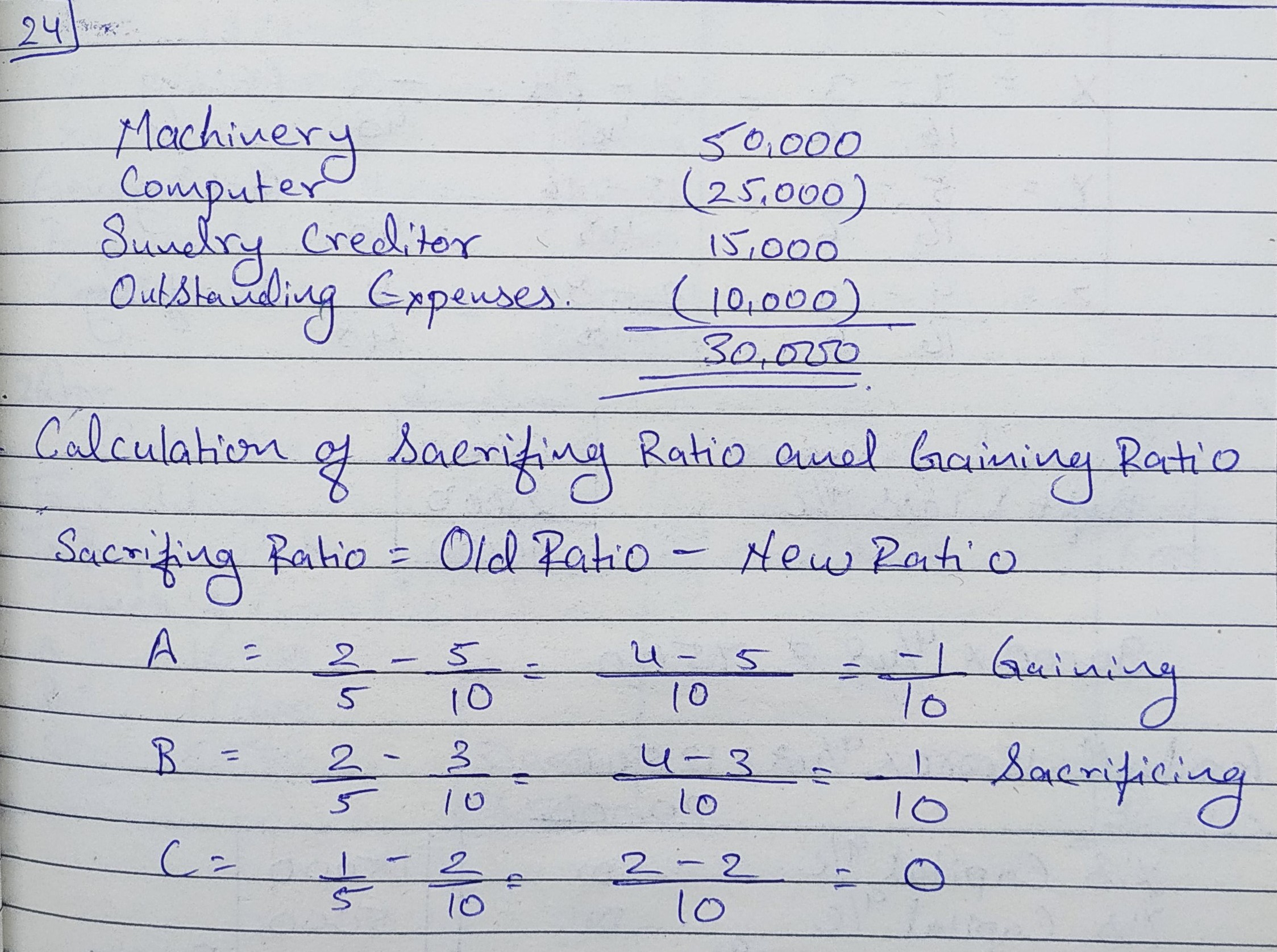

Question 24:

A, B and C are sharing profits and losses in the ratio of 2 : 2 : 1. They decided to share profit w.e.f. 1st April, 2019 in the ratio of 5 : 3 : 2. They also decided not to change the values of assets and liabilities in the books of account. The book values and revised values of assets and liabilities as on the date of change were as follows:

| Book values (₹) | Revised values (₹) | |

| Machinery | 2,50,000 | 3,00,000 |

| Computers | 2,00,000 | 1,75,000 |

| Sundry Creditors | 90,000 | 75,000 |

| Outstanding Expenses | 15,000 | 25,000 |

Pass an adjustment entry.

ANSWER:

Preparation of Balance Sheet

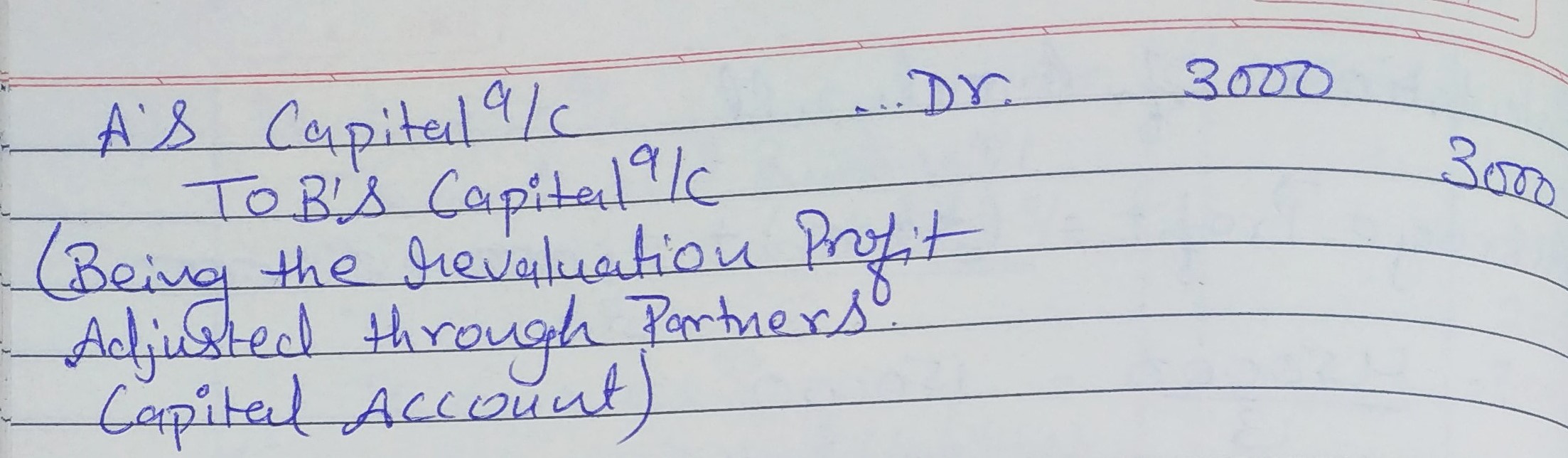

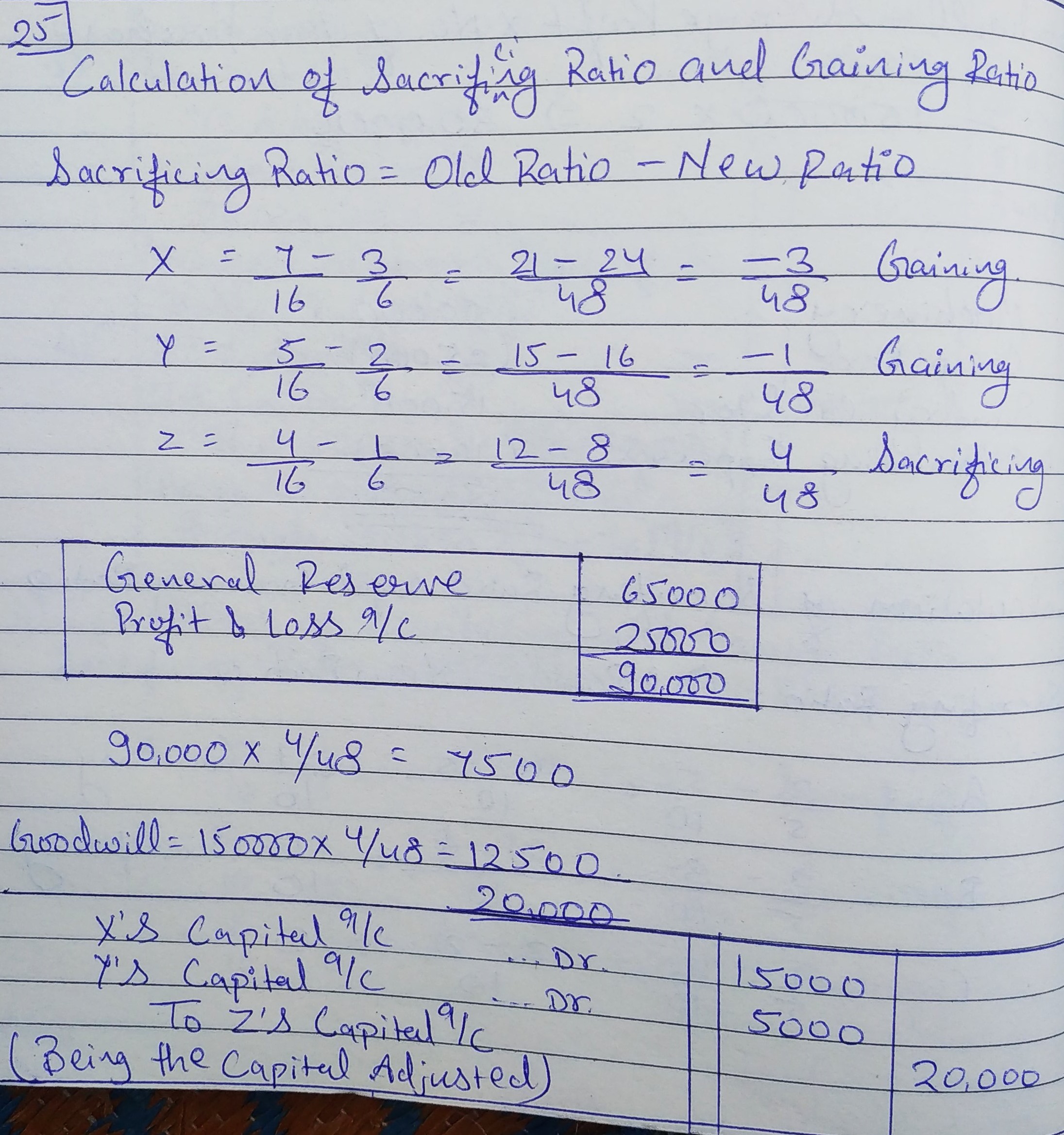

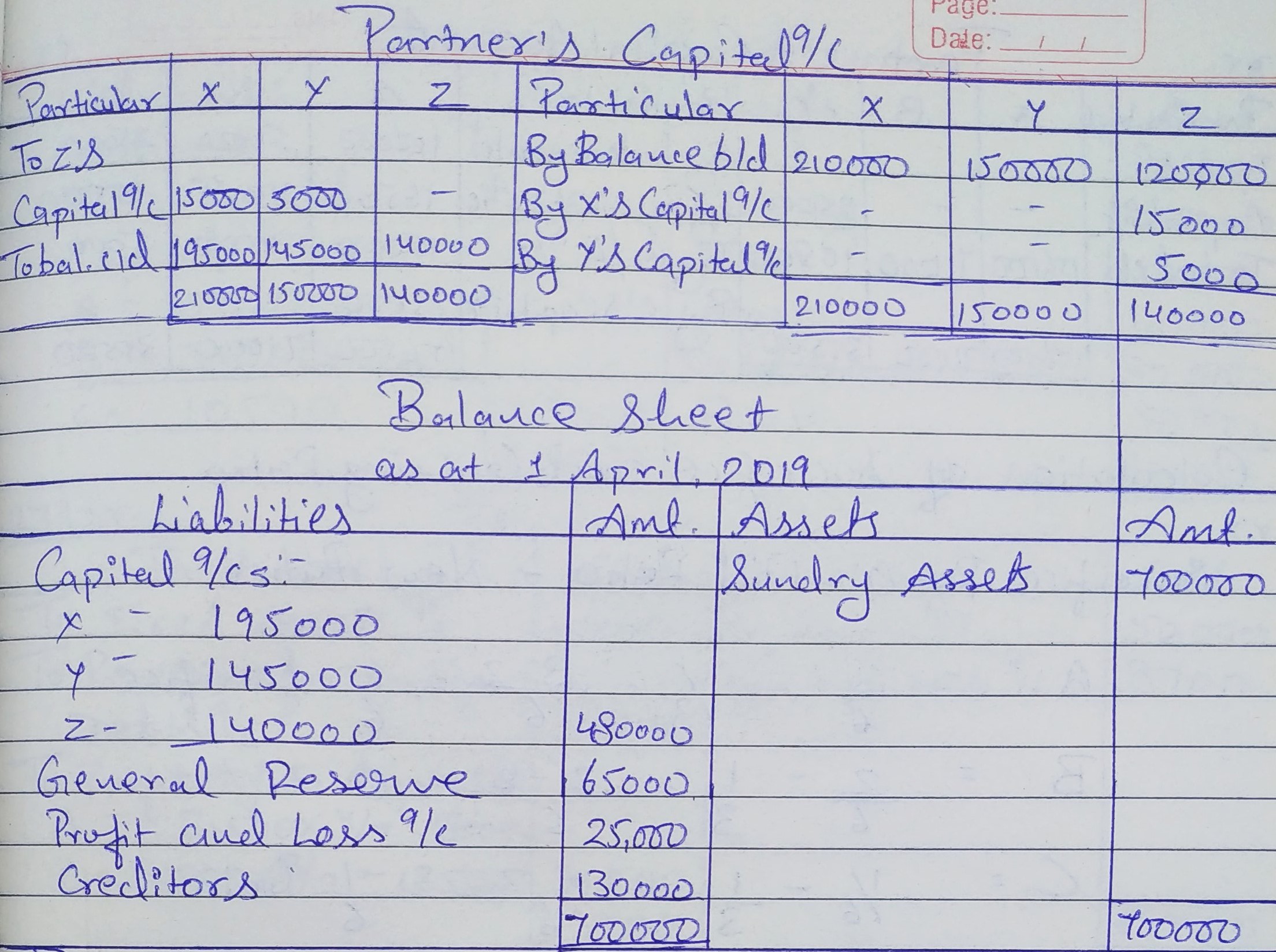

Question 25:

X, Y and Z are partners sharing profits and losses in the ratio of 7 : 5 : 4. Their Balance Sheet as at 31st March, 2019 stood as:

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Capital A/cs: | Sundry Assets | 7,00,000 | ||

| X | 2,10,000 | |||

| Y | 1,50,000 | |||

| Z | 1,20,000 | 4,80,000 | ||

| General Reserve | 65,000 | |||

| Profit and Loss A/c | 25,000 | |||

| Creditors | 1,30,000 | |||

| 7,00,000 | 7,00,000 | |||

Partners decided that with effect from 1st April, 2019, they will share profits and losses in the ratio of 3 : 2 : 1. For this purpose, goodwill of the firm was valued at ₹ 1,50,000. The partners neither want to record the goodwill nor want to distribute the General Reserve and profits.

Pass a Journal entry to record the change and prepare Balance Sheet of the constituted firm.

ANSWER:

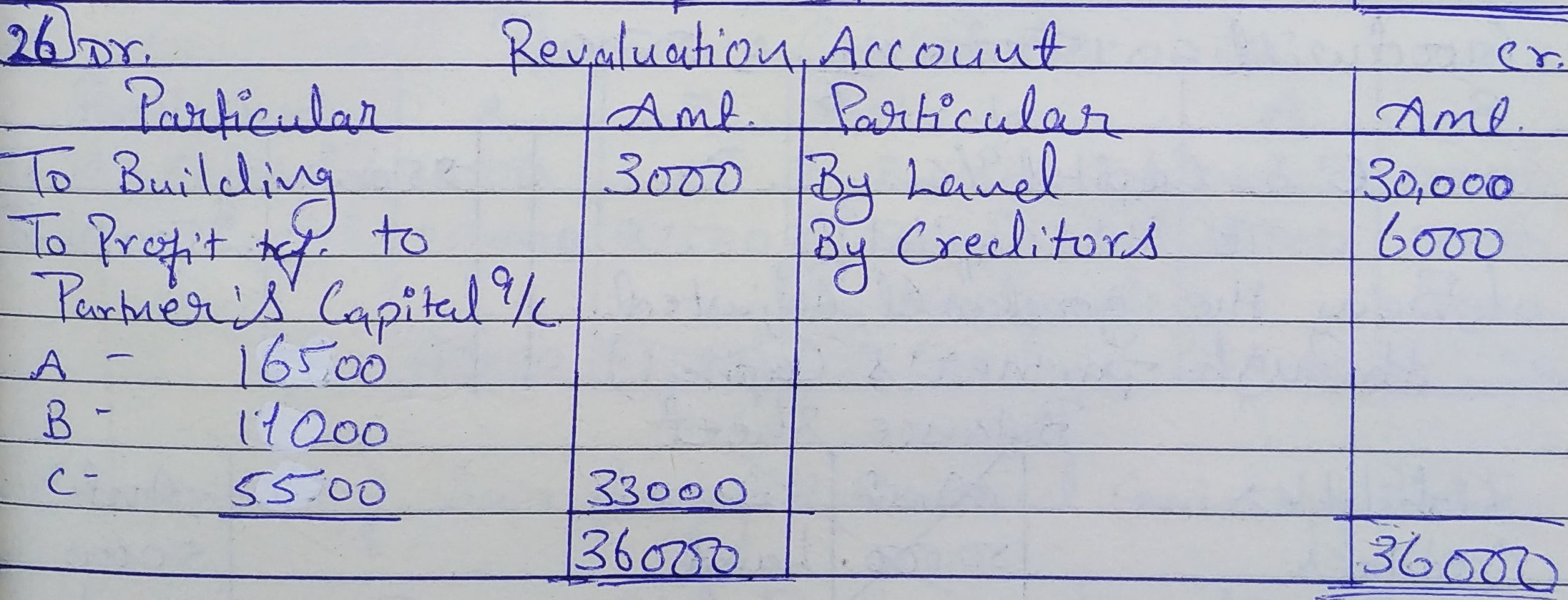

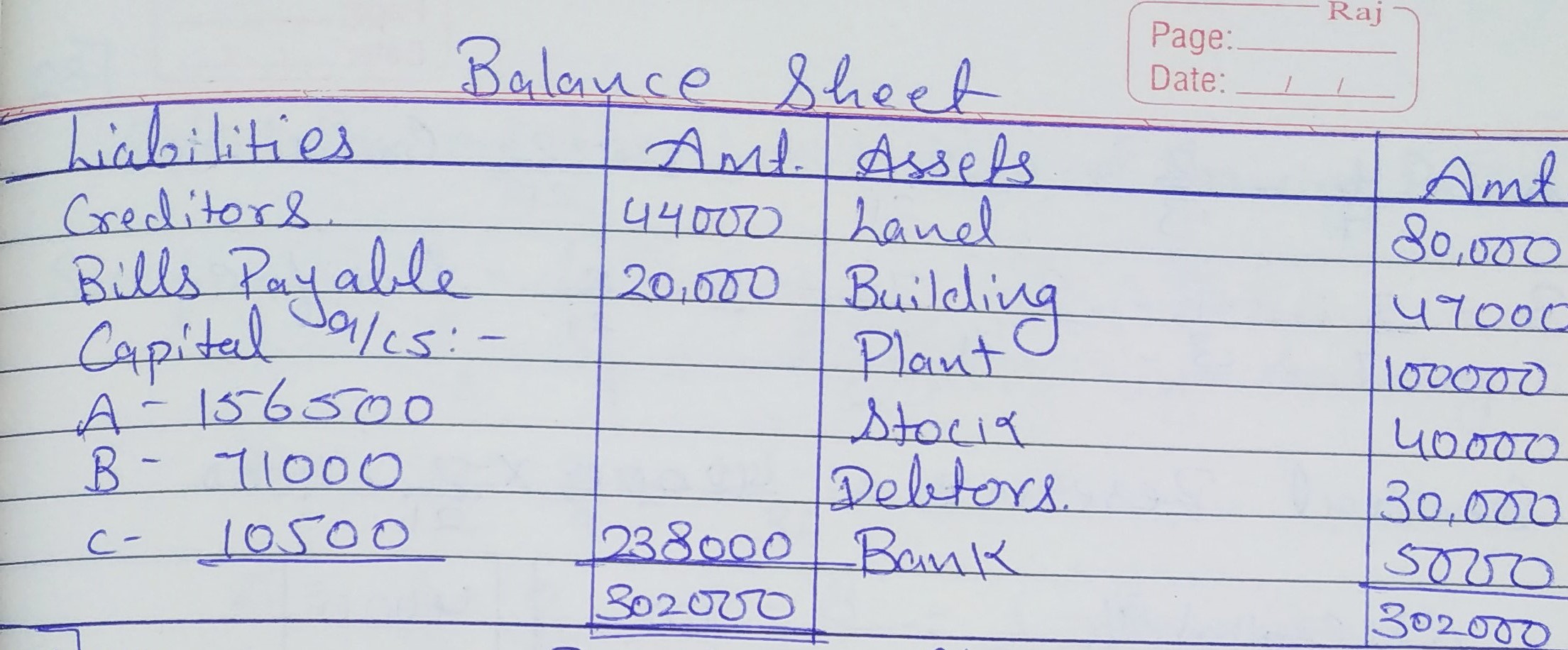

Question 26:

A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet as on 31st March, 2015 was as follows:

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Creditors | 50,000 | Land | 50,000 | |

| Bills Payable | 20,000 | Building | 50,000 | |

| General Reserve | 30,000 | Plant | 1,00,000 | |

| Capital A/cs: | Stock | 40,000 | ||

| A | 1,00,000 | Debtors | 30,000 | |

| B | 50,000 | Bank | 5,000 | |

| C | 25,000 | 1,75,000 | ||

| 2,75,000 | 2,75,000 | |||

From 1st April, 2015, A, B and C decided to share profits equally. For this it was agreed that:

(i) Goodwill of the firm will be valued at ₹ 1,50,000.

(ii) Land will be revalued at ₹ 80,000 and building be depreciated by 6%.

(iii) Creditors of ₹ 6,000 were not likely to be claimed and hence should be written off.

Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet of the reconstituted firm.

ANSWER:

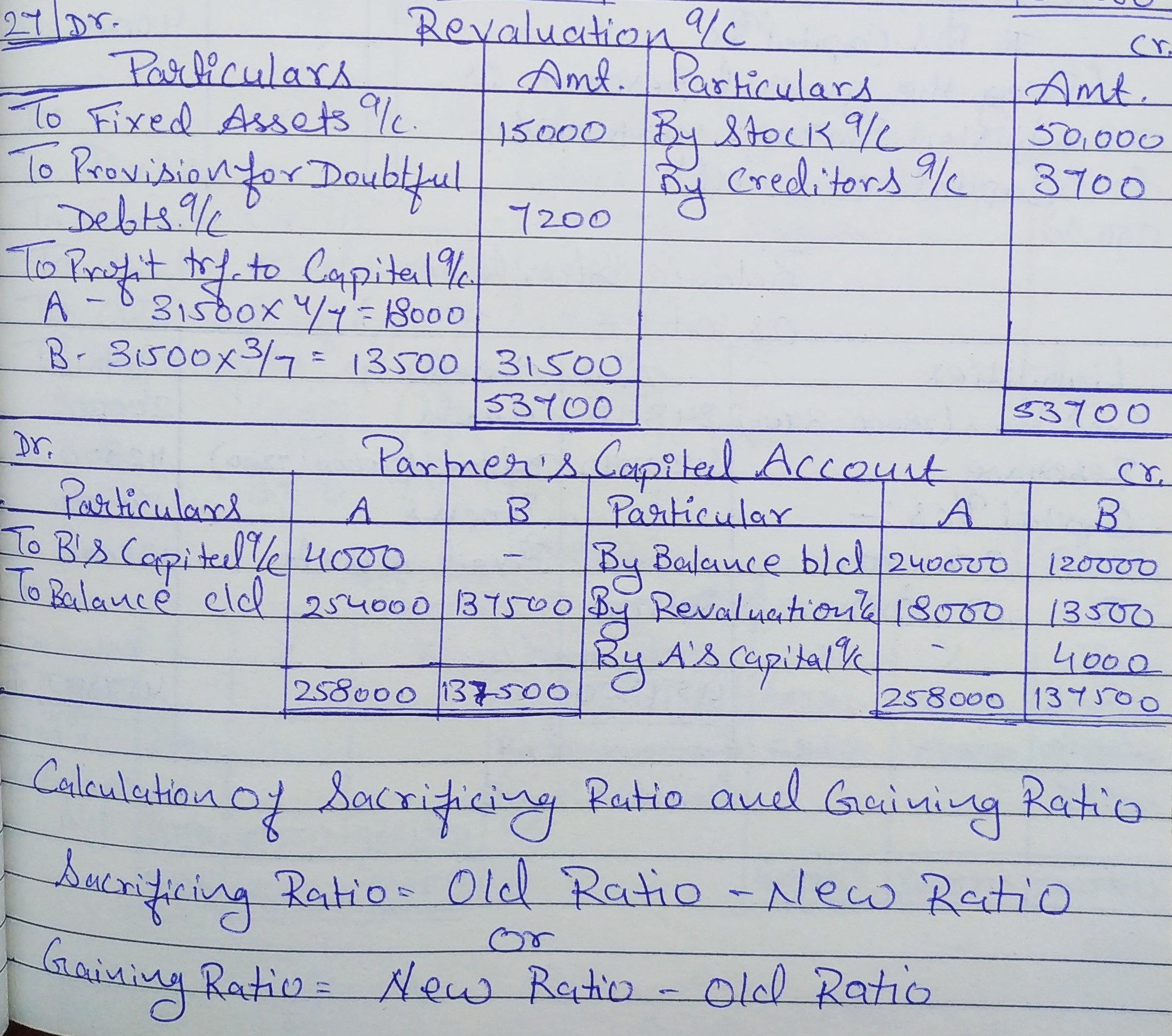

Question 27:

A and B are partners sharing profits in the ratio of 4 : 3. Their Balance Sheet as at 31st March, 2019 stood as:

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Sundry Creditors | 28,000 | Cash | 20,000 | |

| Reserve | 42,000 | Sundry Debtors | 1,20,000 | |

| Capital A/cs: | Stock | 1,40,000 | ||

| A | 2,40,000 | Fixed Assets | 1,50,000 | |

| B | 1,20,000 | 3,60,000 | ||

| 4,30,000 | 4,30,000 | |||

They decided that with effect from 1st April, 2019, they will share profits and losses in the ratio of 2 : 1. For this purpose they decided that:

(i) Fixed Assets are to be reduced by 10%.

(ii) A Provision for Doubtful Debts of 6% be made on Sundry Debtors.

(iii) Stock be valued at ₹ 1,90,000.

(iv) An amount of ₹ 3,700 included in Creditors is not likely to be claimed .

Partners decided to record the revised values in the books. However, they do not want to disturb the Reserve. You are required to pass Journal entries, prepare Capital Accounts of Partners and the revised Balance Sheet.

ANSWER:

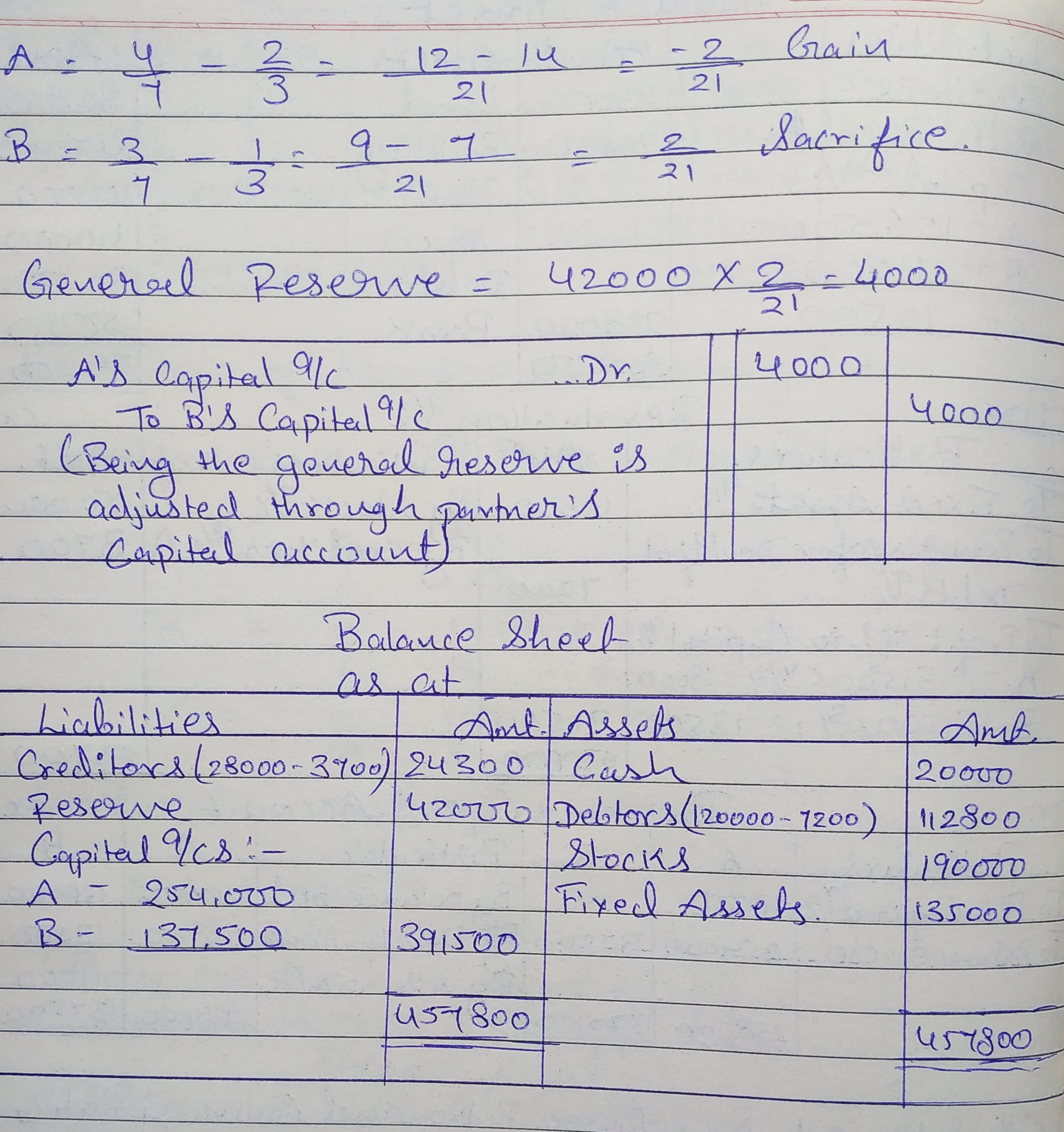

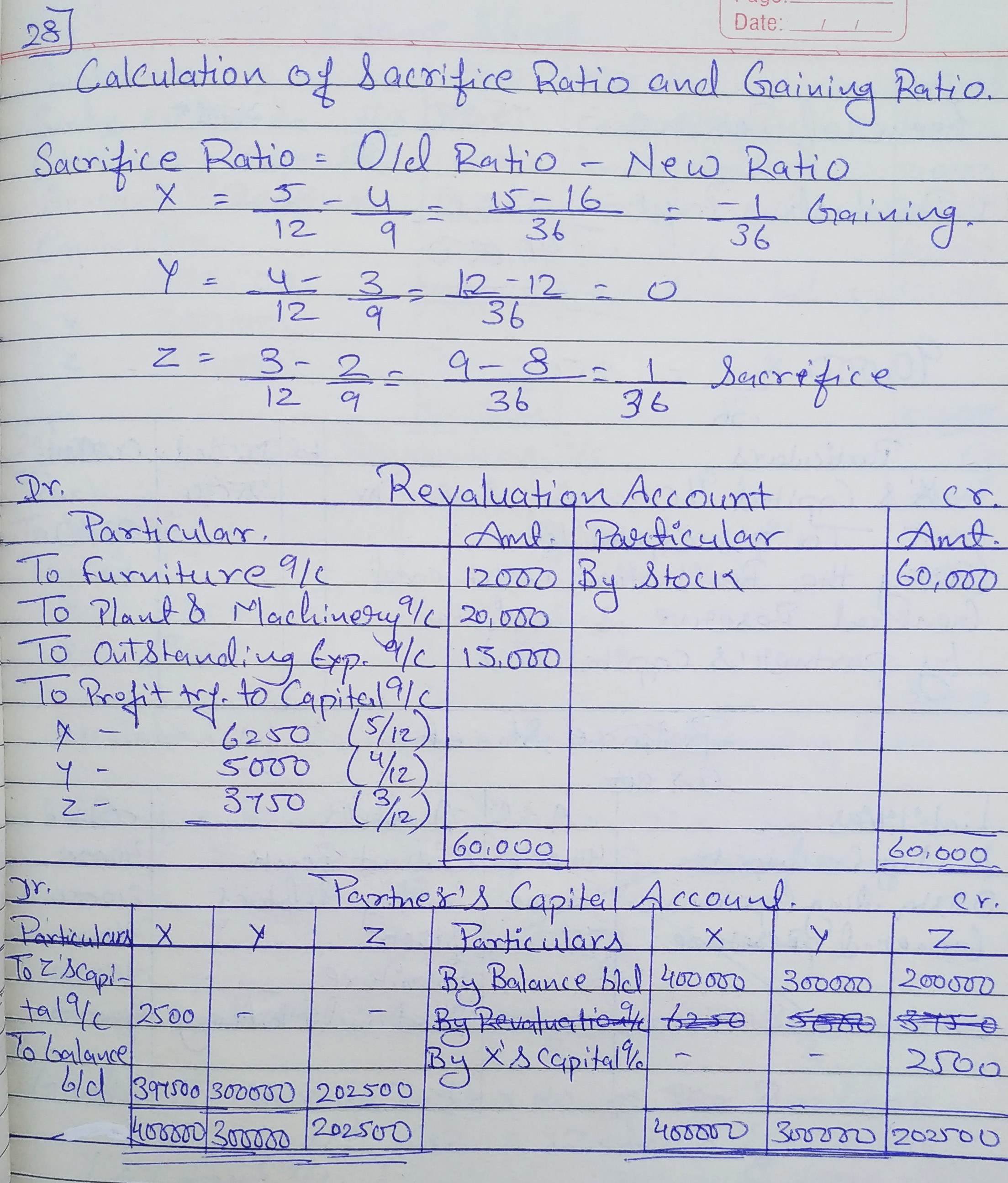

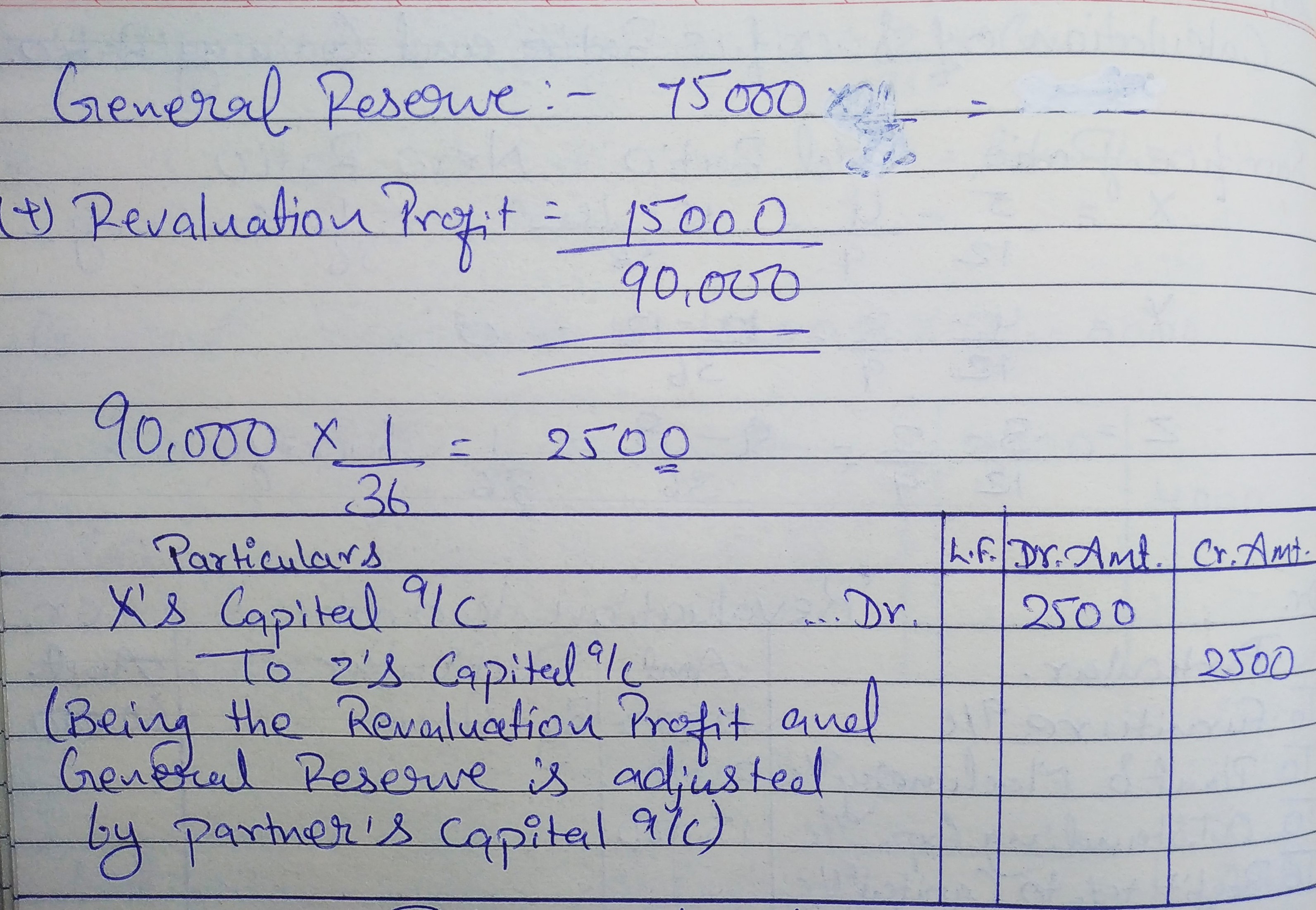

Question 28:

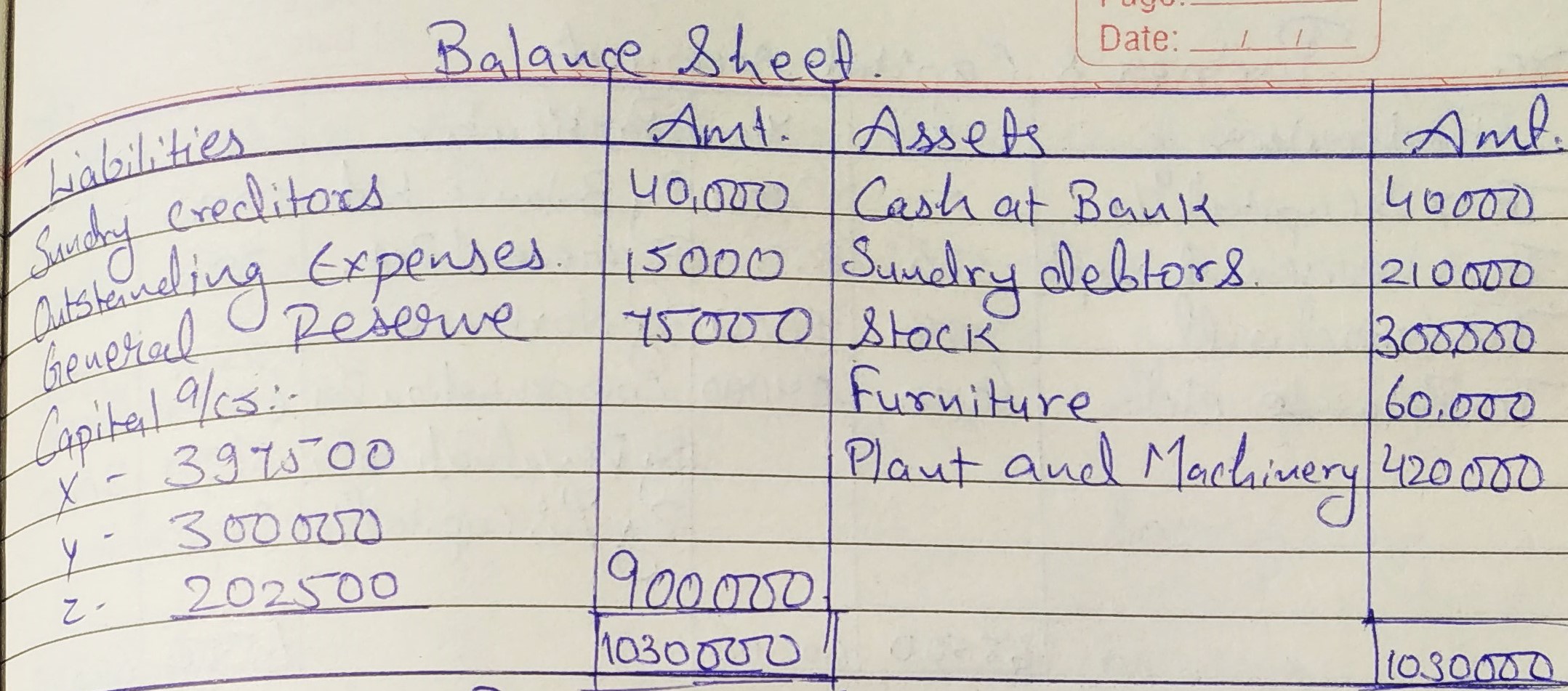

X, Y and Z are partners in a firm sharing profits and losses as 5 : 4 : 3. Their Balance Sheet as at 31st March, 2019 was:

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Sundry Creditors | 40,000 | Cash at Bank | 40,000 | |

| Outstanding Expenses | 15,000 | Sundry Debtors | 2,10,000 | |

| General Reserve | 75,000 | Stock | 3,00,000 | |

| Capital A/cs: | Furniture | 60,000 | ||

| X | 4,00,000 | Plant and Machinery | 4,20,000 | |

| Y | 3,00,000 | |||

| Z | 2,00,000 | 9,00,000 | ||

| 10,30,000 | 10,30,000 | |||

From 1st April, 2019, they agree to alter their profit-sharing ratio as 4 : 3 : 2. It is also decided that:

(a) Furniture be taken at 80% of its value.

(b) Stock be appreciated by 20%.

(c) Plant and Machinery be valued at ₹ 4,00,000.

(d) Outstanding Expenses be increased by ₹ 13,000.

Partners agreed that altered values are not to be recorded in the books and they also do not want to distribute the General Reserve.

You are required to pass a single Journal entry to give effect to the above. Also, prepare Balance Sheet of the new firm.

ANSWER:

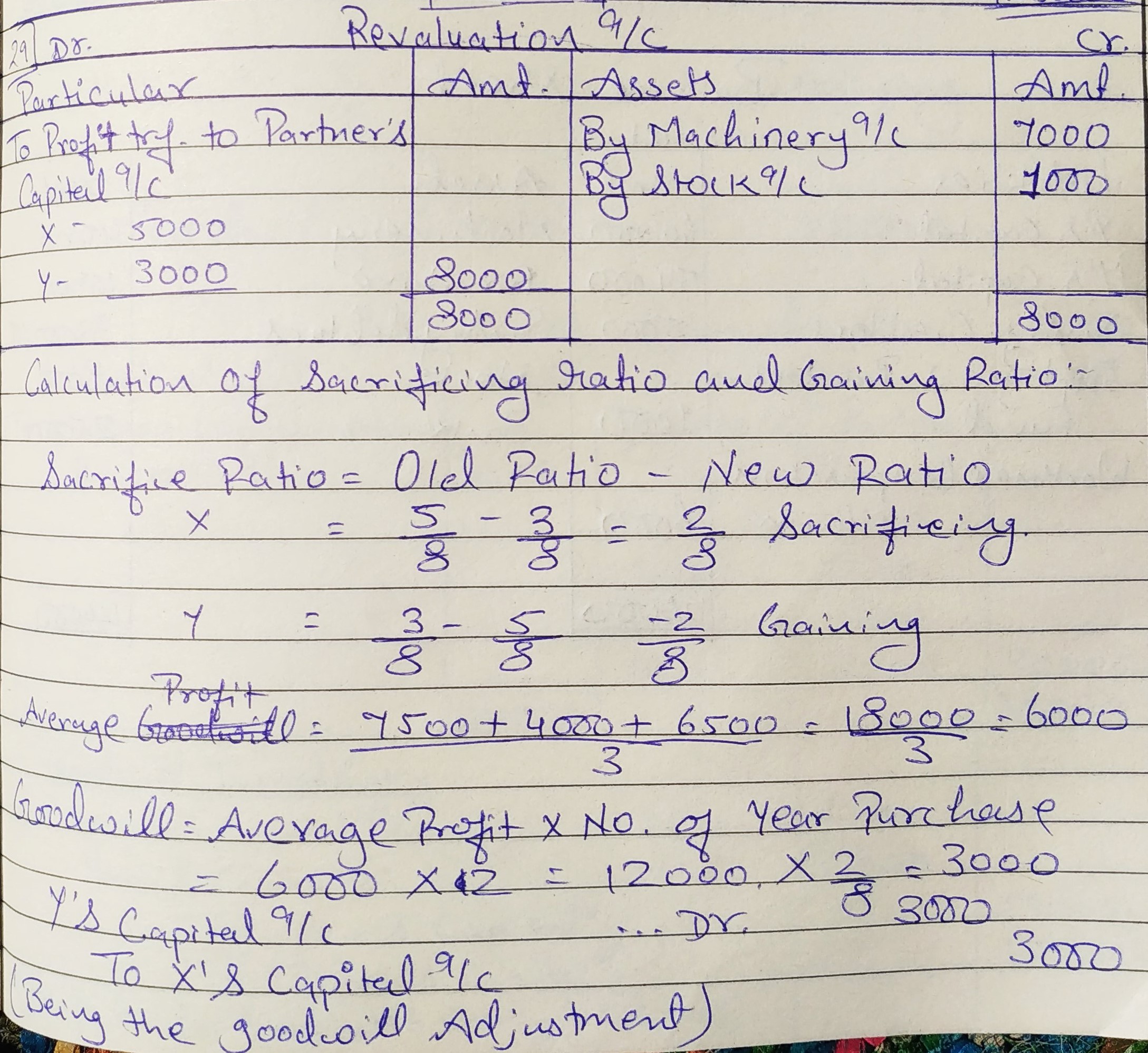

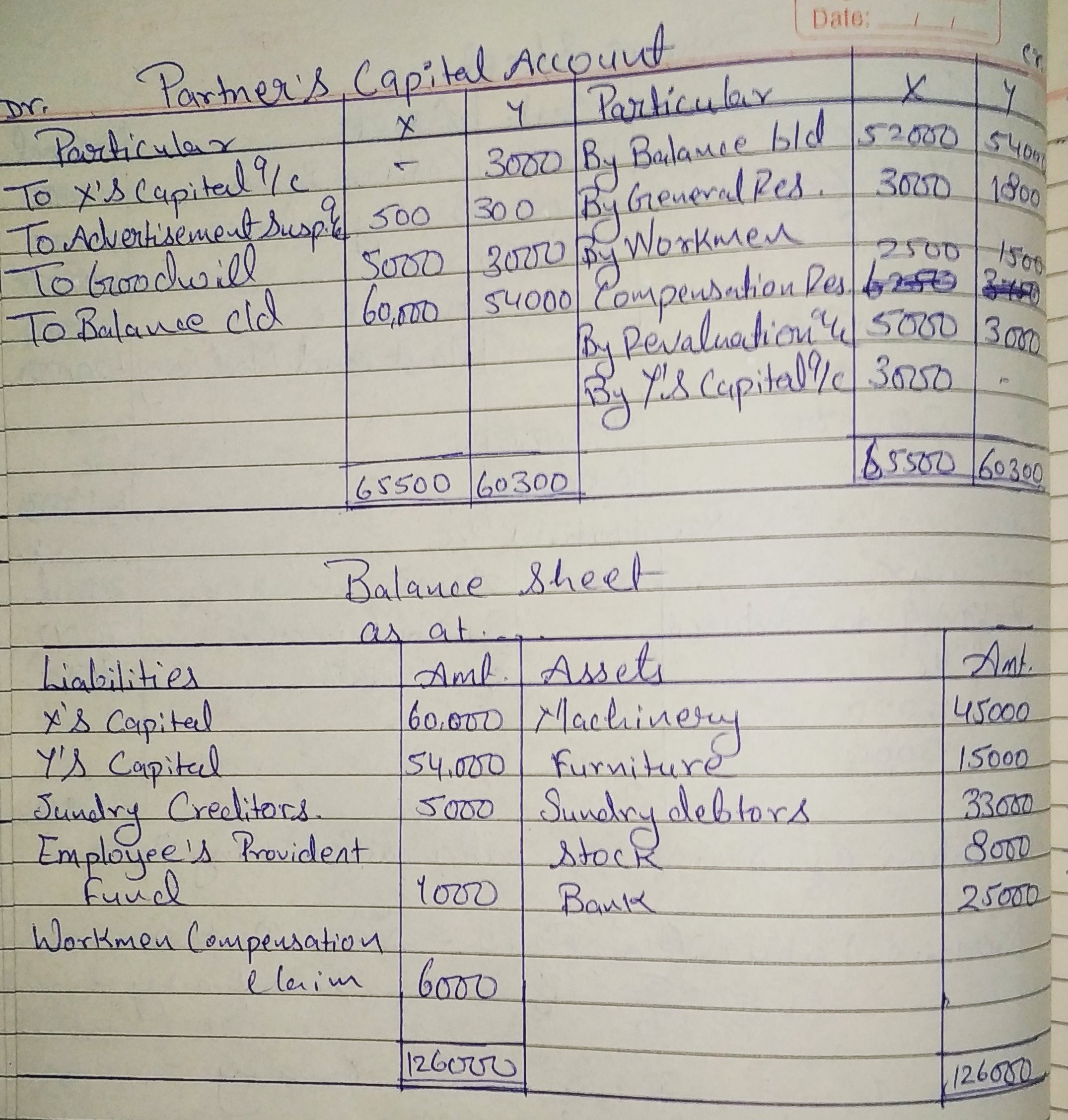

Question 29:

Balance Sheet of X and Y, who share profits and losses as 5 : 3, as at 1st April, 2019 is:

| Liabilities | Amount (₹) | Assets | Amount (₹) |

| X’s Capital | 52,000 | Goodwill | 8,000 |

| Y’s Capital | 54,000 | Machinery | 38,000 |

| General Reserve | 4,800 | Furniture | 15,000 |

| Sundry Creditors | 5,000 | Sundry Debtors | 33,000 |

| Employees’ Provident Fund | 1,000 | Stock | 7,000 |

| Workmen Compensation Reserve | 10,000 | Bank | 25,000 |

| Advertisement Suspense A/c | 800 | ||

| 1,26,800 | 1,26,800 | ||

On the above date, they decided to change their profit-sharing ratio to 3 : 5 and agreed upon the following:

(a) Goodwill be valued on the basis of two years’ purchase of the average profit of the last three years. Profits for the years ended 31st March, are: 2016-17 − ₹ 7,500; 2017-18 − ₹ 4,000; 2018-19 − ₹ 6,500.

(b) Machinery and Stock be revalued at ₹ 45,000 and ₹ 8,000 respectively.

(c) Claim on account of workmen compensation is ₹ 6,000.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the new firm.

ANSWER:

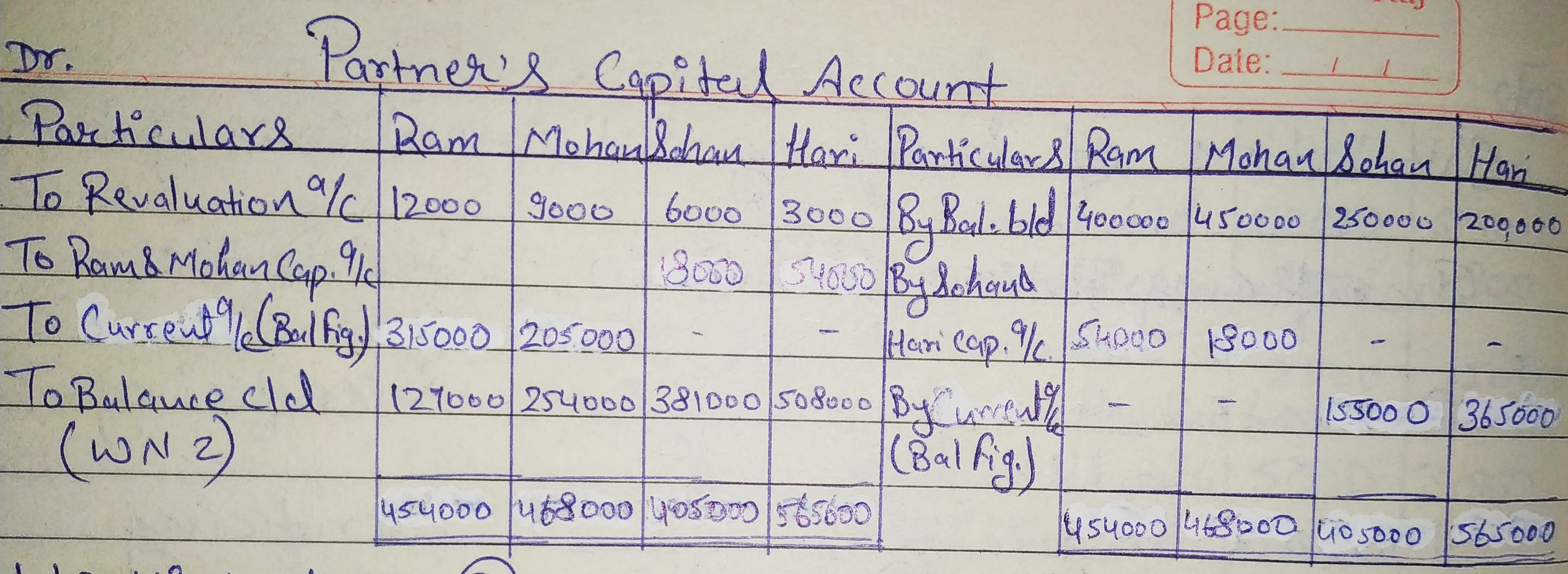

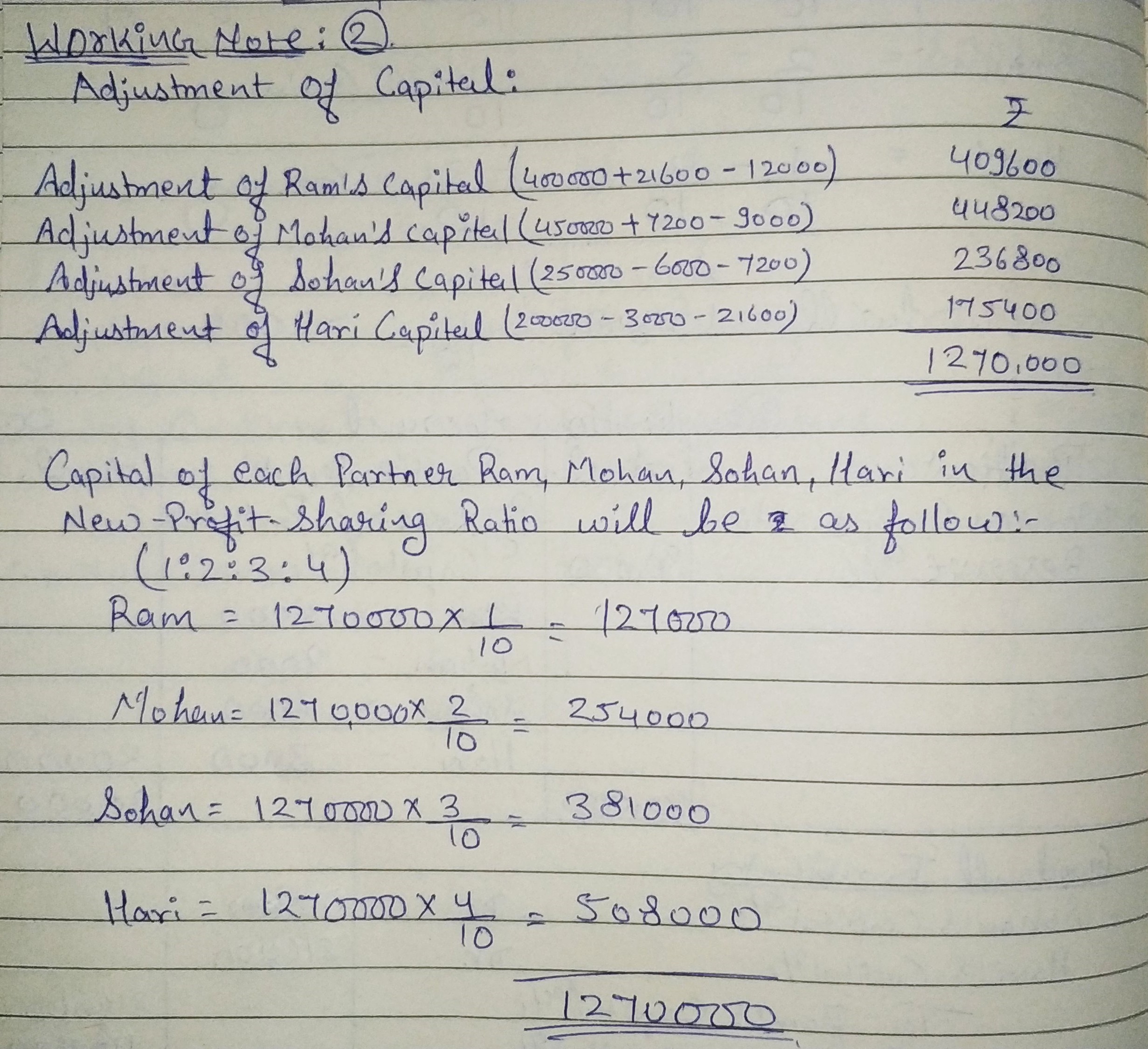

Adjustment of Capital

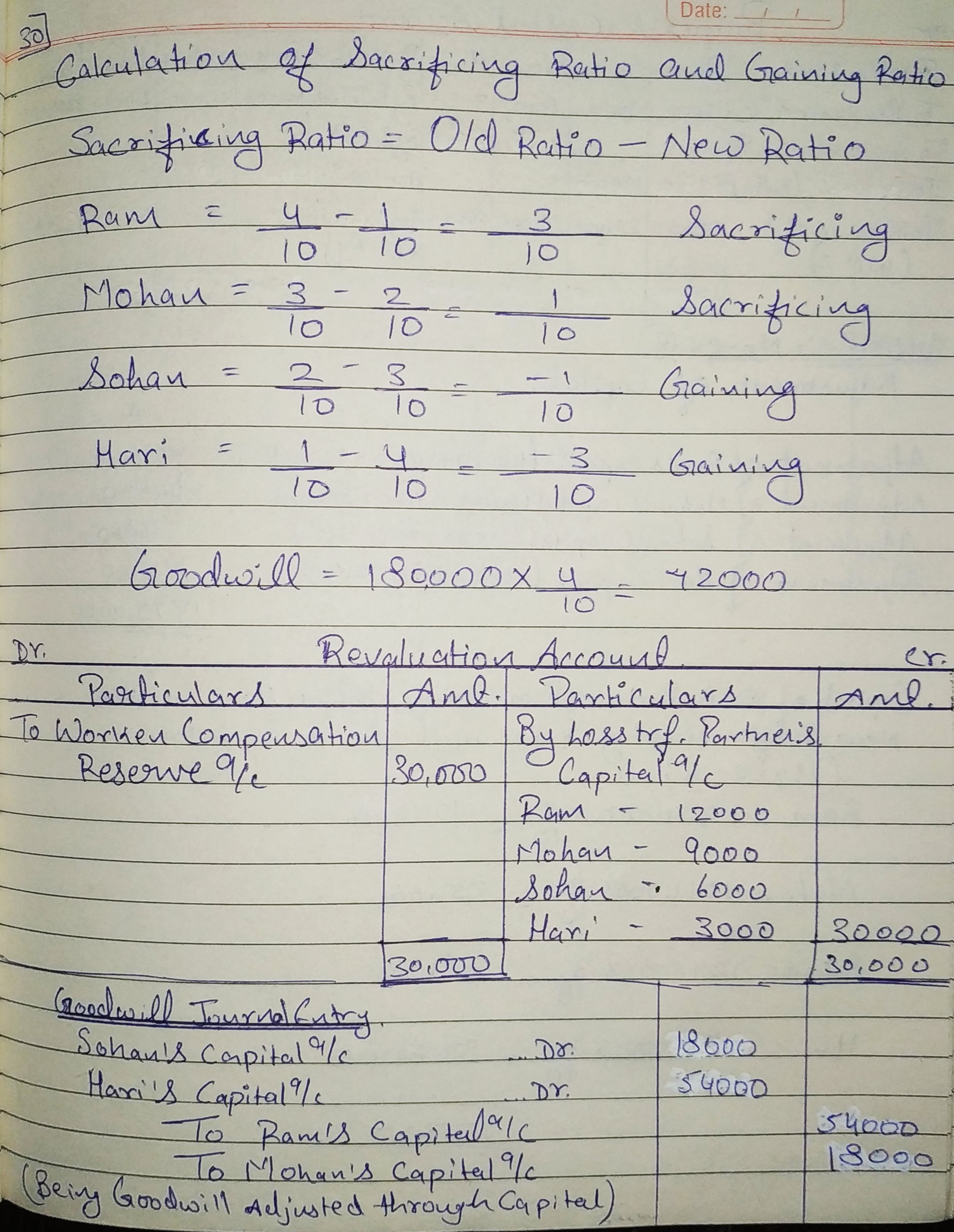

Question 30:

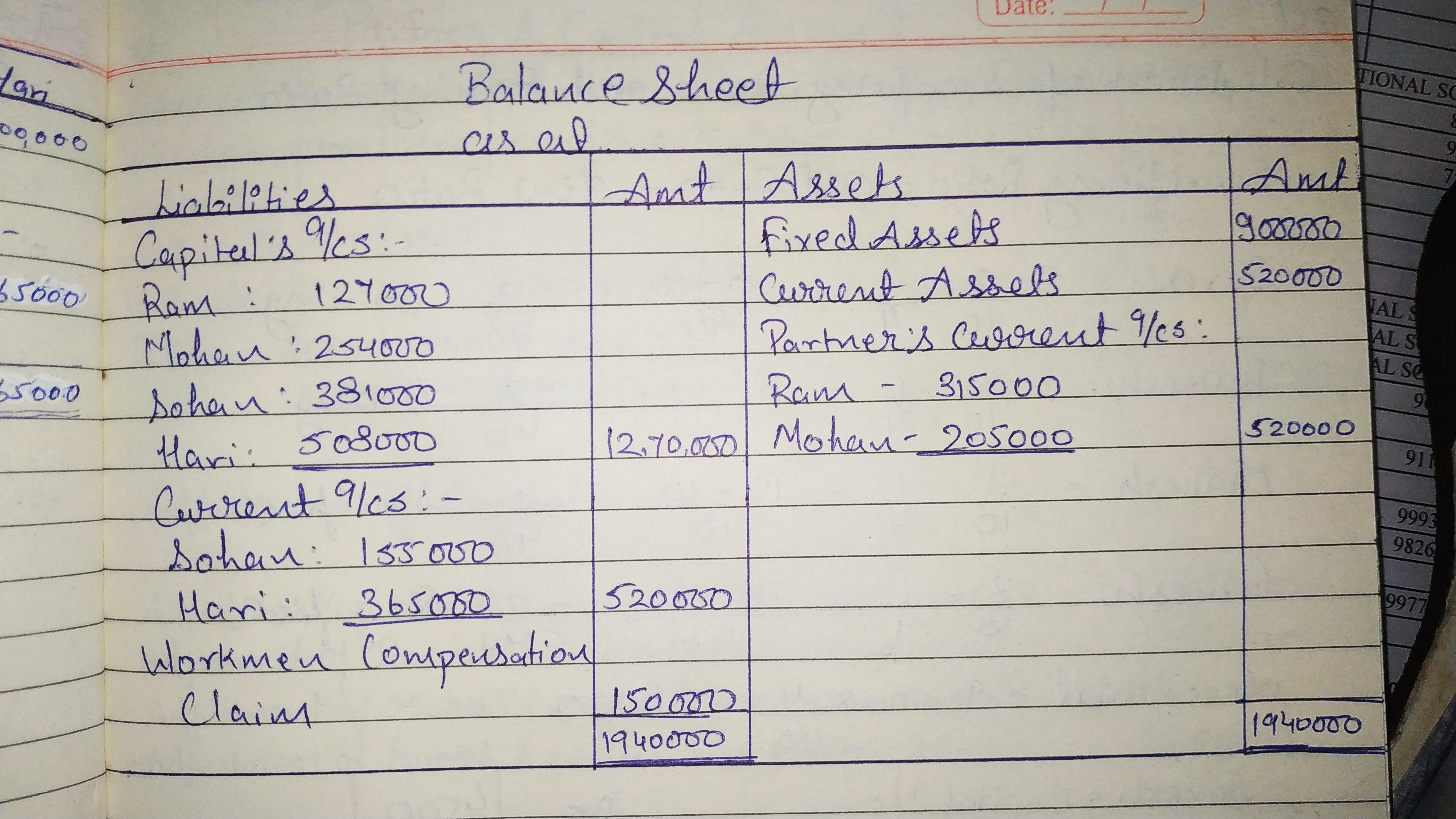

Ram, Mohan, Sohan and Hari were partners in a firm sharing profits in the ratio of 4 : 3 : 2 : 1. On 1st April, 2016, their Balance Sheet was as follows:

BALANCE SHEET OF RAM, MOHAN, SOHAN AND HARI as on 1st April, 2016 | ||||

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs: | Fixed Assets | 9,00,000 | ||

| Ram | 4,00,000 | Current Assets | 5,20,000 | |

| Mohan | 4,50,000 | |||

| Sohan | 2,50,000 | |||

| Hari | 2,00,000 | 13,00,000 | ||

| Workmen Compensation Reserve | 1,20,000 | |||

| 14,20,000 | 14,20,000 | |||

From the above date, the partners decided to share the future profits in the ratio of 1 : 2 : 3 : 4. For this purpose the goodwill of the firm was valued at ₹ 1,80,000. The partners also agreed for the following:(a) The Claim for workmen compensation has been estimated at ₹ 1,50,000.

(b) Adjust the capitals of the partners according to the new profit-sharing ratio by opening Partners’ Current Accounts.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the reconstituted firm.

ANSWER:

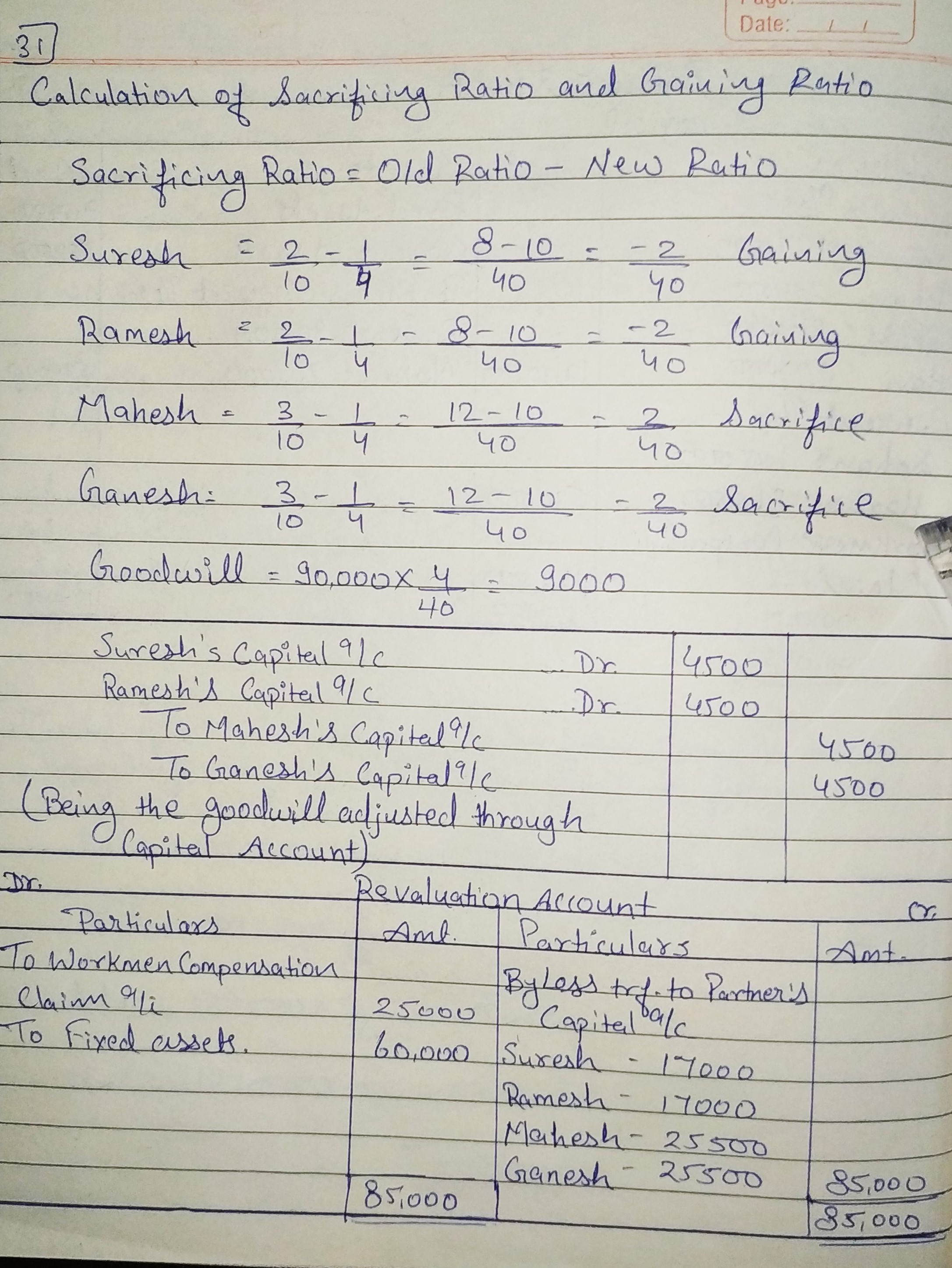

Question 31:

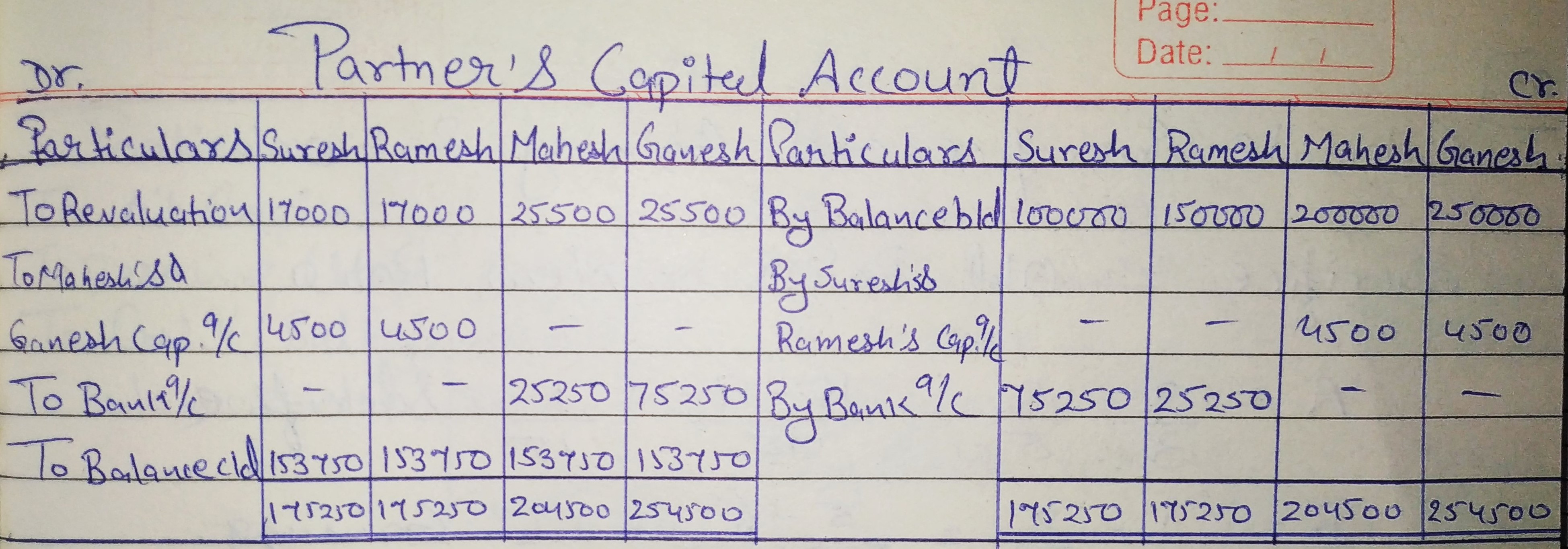

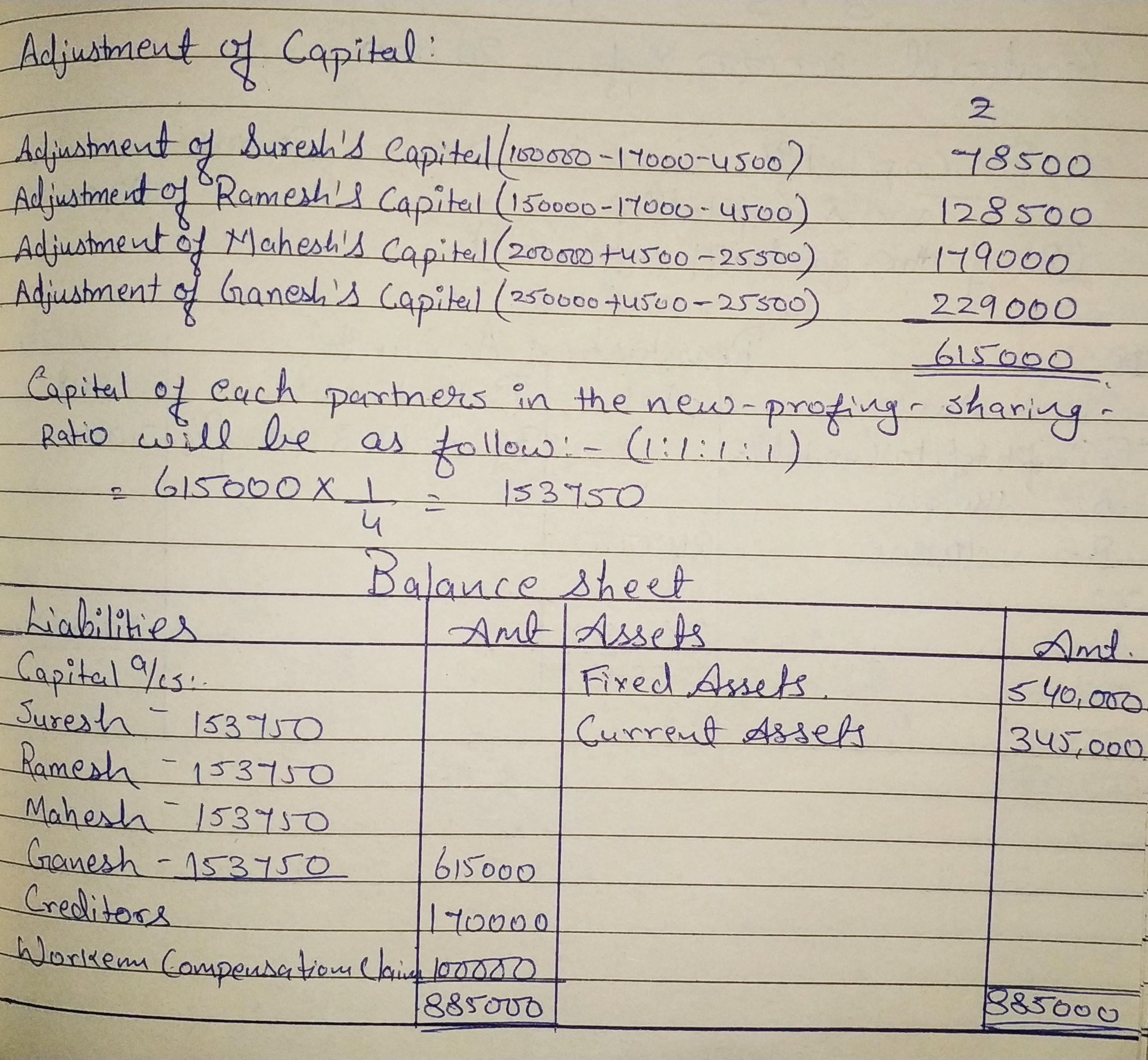

Suresh, Ramesh, Mahesh and Ganesh were partners in a firm sharing profits in the ratio of 2 : 2 : 3 : 3. On 1st April, 2016, their Balance Sheet was as follows:

BALANCE SHEET OF SURESH, RAMESH, MAHESH AND Ganesh as on 1st April, 2016 | ||||

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Capital A/cs: | Fixed Assets | 6,00,000 | ||

| Suresh | 1,00,000 | Current Assets | 3,45,000 | |

| Ramesh | 1,50,000 | |||

| Mahesh | 2,00,000 | |||

| Ganesh | 2,50,000 | 7,00,000 | ||

| Sundry Creditors | 1,70,000 | |||

| Workmen Compensation Reserve | 75,000 | |||

| 9,45,000 | 9,45,000 | |||

From the above date, the partners decided to share the future profits equally. For this purpose the goodwill of the firm was valued at ₹ 90,000. It was also agreed that:

(a) Claim against Workmen Compensation Reserve will be estimated at ₹ 1,00,000 and fixed assets will be depreciated by 10%.

(b) The Capitals of the partners will be adjusted according to the new profit-sharing ratio. For this, necessary cash will be brought or paid by the partners as the case may be.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the reconstituted firm.

ANSWER:

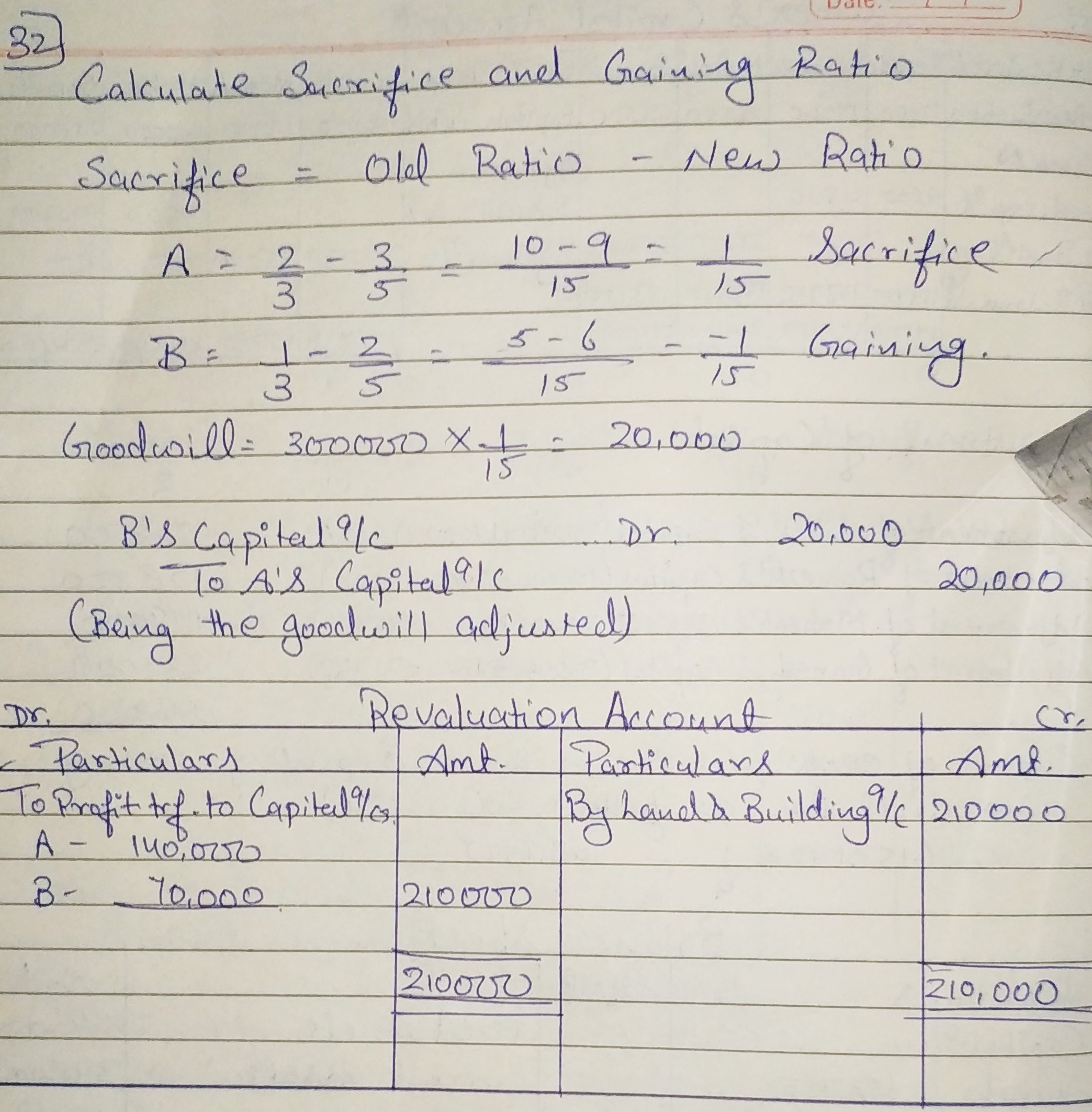

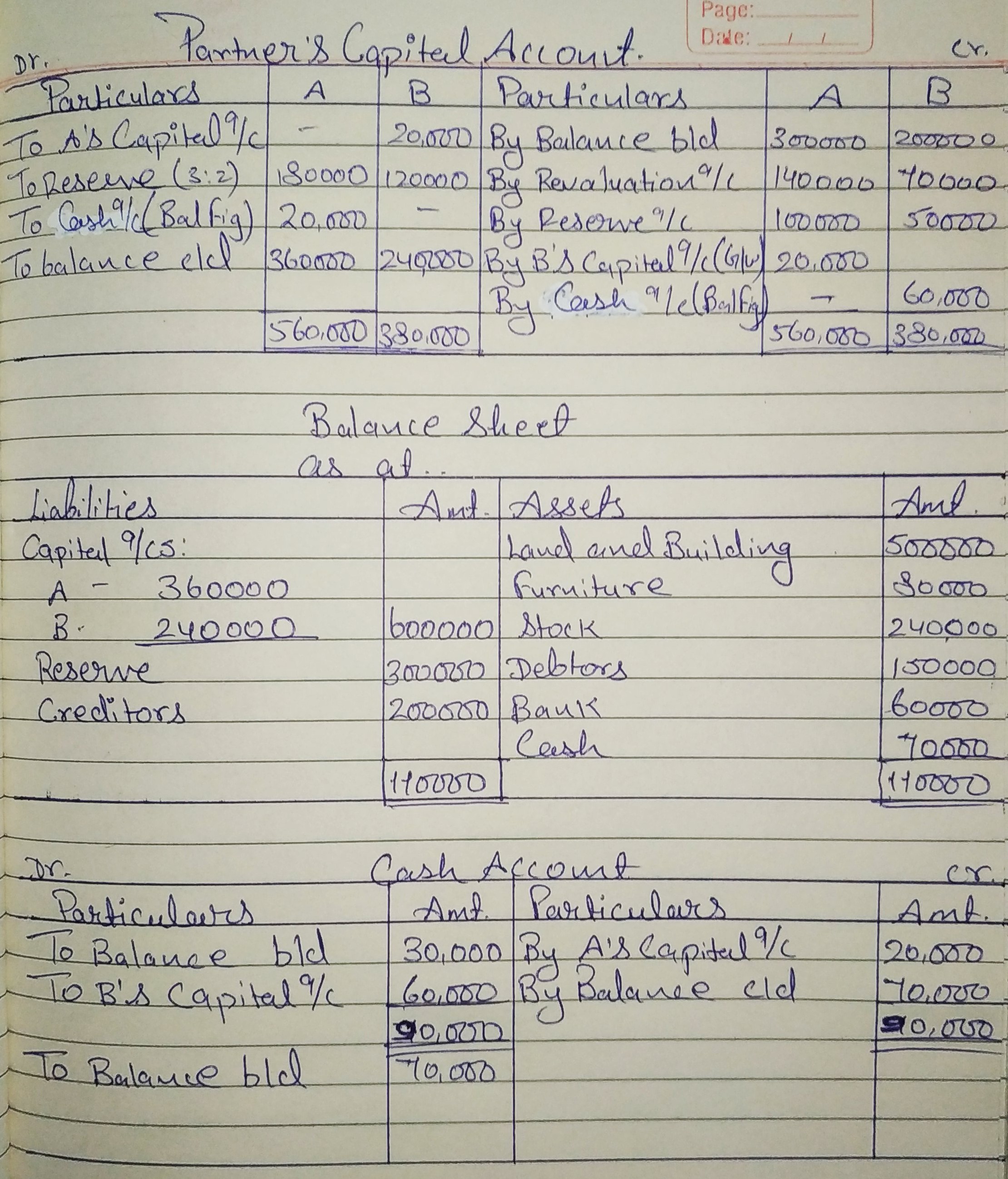

Question 32:

Following is the Balance Sheet of A and B, who shared Profits and Losses in the ratio of 2 : 1, as at 1st April, 2019:

BALANCE SHEET OF A AND B as on 1st April, 2019 | ||||

| Liabilities | Amount (₹) | Assets | Amount (₹) | |

| Capital A/cs: | Land ad Building | 2,90,000 | ||

| A | 3,00,000 | Furniture | 80,000 | |

| B | 2,00,000 | 5,00,000 | Stock | 2,40,000 |

| Reserve | 1,50,000 | Debtors | 1,50,000 | |

| Creditors | 2,00,000 | Bank | 60,000 | |

| Cash | 30,000 | |||

| 8,50,000 | 8,50,000 | |||

On the above date, the partners changed their profit-sharing ratio to 3 : 2. For this purpose, the goodwill of the firm was valued at ₹ 3,00,000. The partners also agreed for the following:

(a) The value of Land and Building will be ₹ 5,00,000;

(b) Reserve is to be maintained at ₹ 3,00,000.

(c) The total capital of the partners in the new firm will be ₹ 6,00,000, which will be shared by the partners in their new profit-sharing ratio.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the reconstituted firm.

ANSWER: