TS Grewal Double Entry Book Keeping Class 12 Solutions of Analysis of Financial Statement Book.

TS Grewal Accountancy Class 12 Solutions Chapter 5th Cash Flow Statement are part of TS Grewal Accountancy Class 12 Solutions.

Here we have given TS Grewal Accountancy Class 12 Solutions Chapter 5th Cash Flow Statement edition – 2019

| Board | CBSE |

| Textbook | NCERT |

| Book | Analysis of Financial Statements |

| Volume | III |

| Class | 12th |

| Subject | Accountancy |

| Chapter | 5TH |

| Chapter Name | Cash Flow Statement |

| Number of Questions (Solved) | 60 |

| Category | TS Grewal’s Solutions |

TS Grewal Accountancy Class 12 Solutions – Chapter 5th Cash Flow Statement

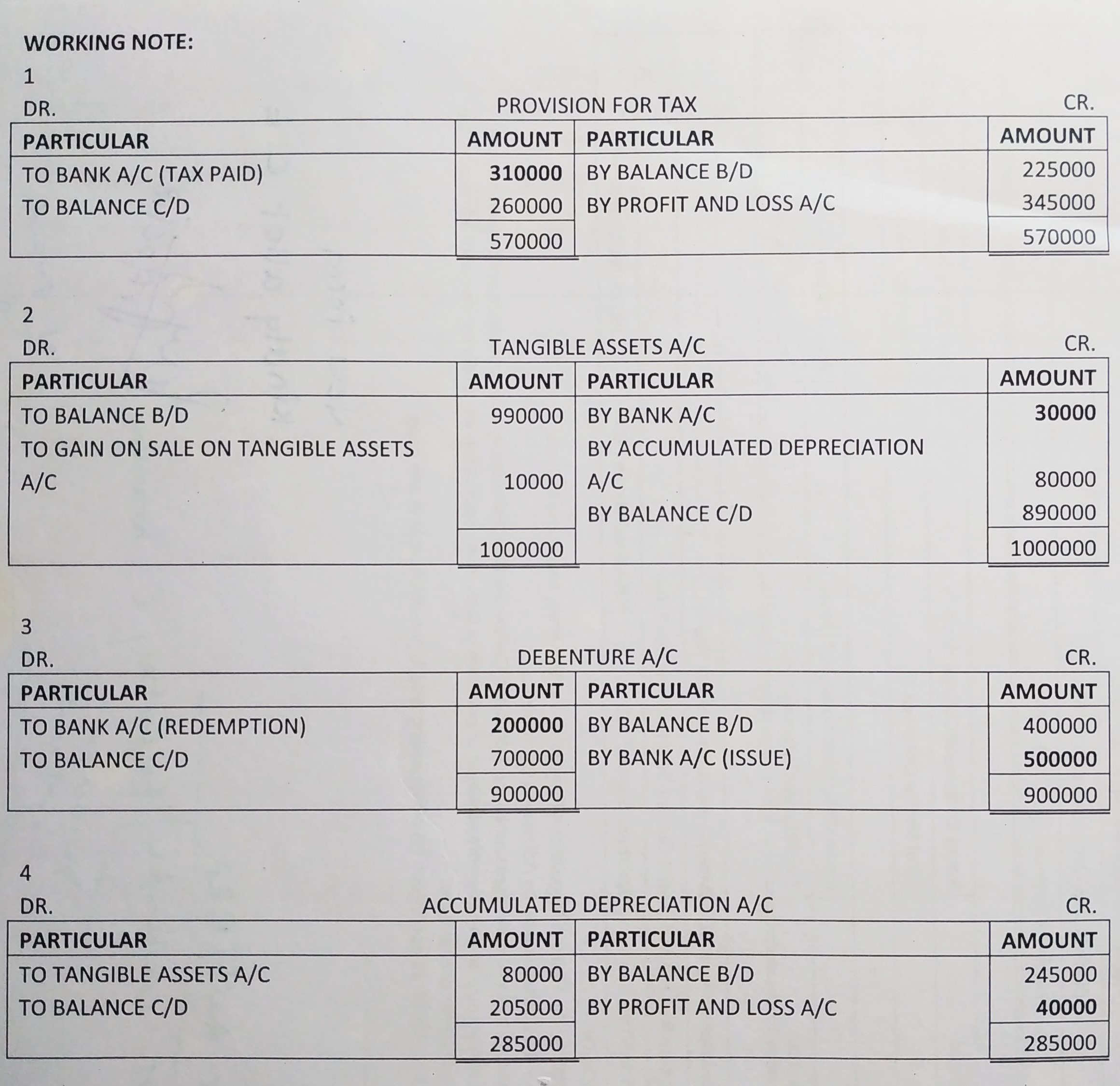

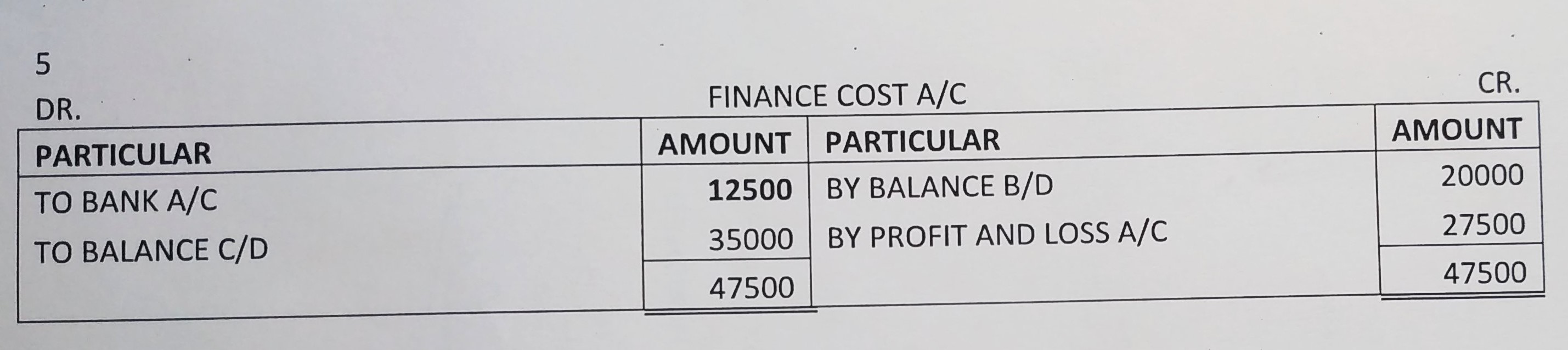

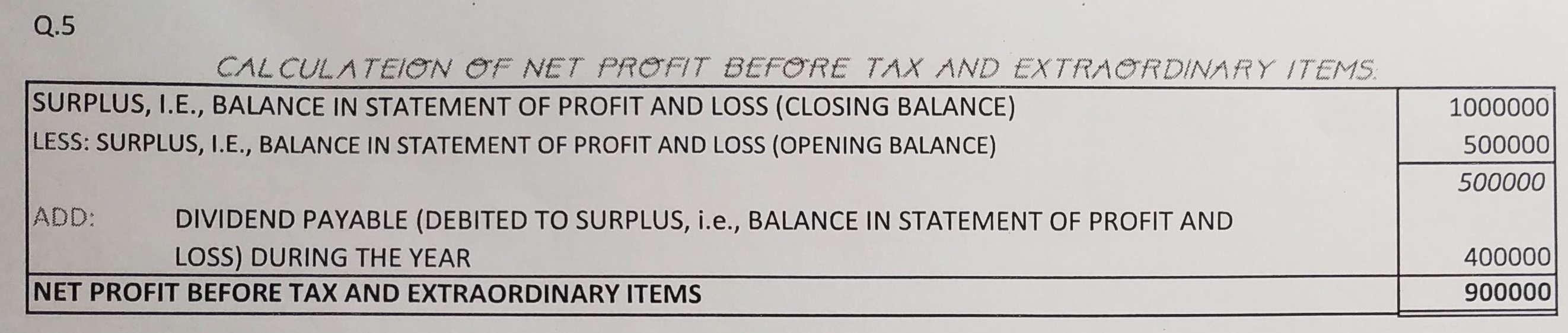

Question 5:

Following are the extracts from the Balance Sheet of MAH Ltd. as at 31st March, 2019:

Particular | 31st March 2019 (₹) | 31st March 2018 (₹) |

| Surplus, i.e., Balance in Statement of Profit and Loss | 10,00,000 | 5,00,000 |

| Dividend Payable | 50,000 | – |

Additional Information: Proposed Dividend for the years ended 31st March, 2018 and 2019 are ₹ 4,00,000 and ₹ 5,00,000 respectively.

Prepare the Note to show Net Profit before Tax and Extraordinary Items.

ANSWER:

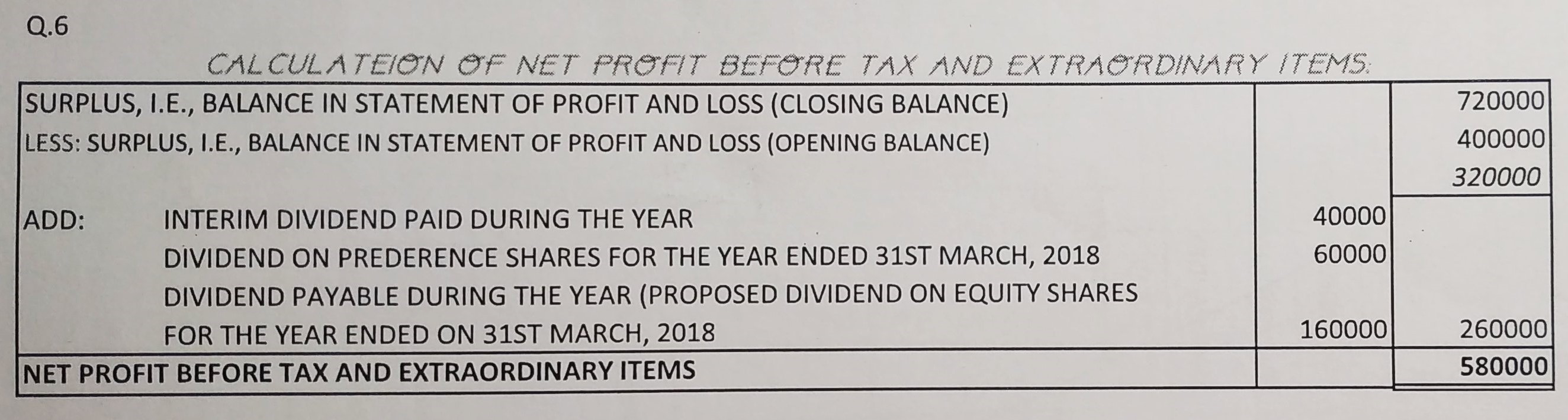

Question 6:

Following is the extract from the Balance Sheet of Zee Ltd.:

Particular | 31st March 2019 (₹) | 31st March 2018 (₹) |

| Equity Share Capital | 8,00,000 | 8,00,000 |

| 10% Preference Share Capital | 6,00,000 | 6,00,000 |

| Surplus i.e., Balance in Statement of Profit and Loss | 7,20,000 | 4,00,000 |

| Unpaid Dividend | 20,000 | – |

Additional Information:

(i) Proposed dividend on equity shares for the year 2017-18 and 2018-19 are ₹ 1,60,000 and ₹ 2,00,000 respectively.

(ii) An Interim Dividend of ₹ 40,000 on Equity Shares was paid.

Calculate Net Profit before Tax and Extraordinary Items.

ANSWER:

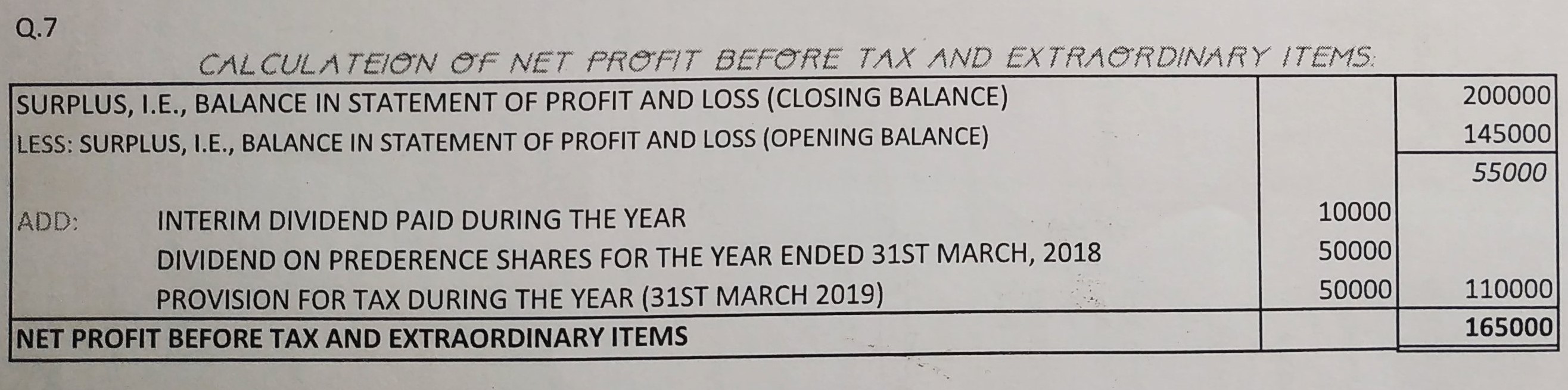

Question 7:

Calculate Net Profit before Tax and Extraordinary Items of Premier Sales Ltd. from its Balance Sheet as at 31st March, 2019:

Particulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital |

| 5,00,000 | 5,00,000 |

(b) Reserves and Surplus (Surplus, i.e., Balance in Statement of Profit and Loss) | 2,00,000 | 1,45,000 | |

2. Current Liabilities | |||

(a) Trade Payables | 90,000 | 50,000 | |

(b) Other Current Liabilities | 20,000 | 10,000 | |

(c) Short-term Provisions | 1 | 50,000 | 30,000 |

Total | 8,60,000 | 7,35,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets | 4,50,000 | 4,00,000 | |

(b) Non-Current Investments | 50,000 | 1,50,000 | |

2. Current Assets | 2,60,000 | 1,85,000 | |

Total | 8,60,000 | 7,35,000 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. Short-term Provisions | ||

Provision for Tax | 50,000 | 30,000 |

Additional Information:(i) Proposed Dividend for the years ended 31st March, 2018 and 2019 are ₹ 50,000 and ₹ 75,000 respectively.

(ii) Interim Dividend paid during the year was ₹ 10,000.

ANSWER:

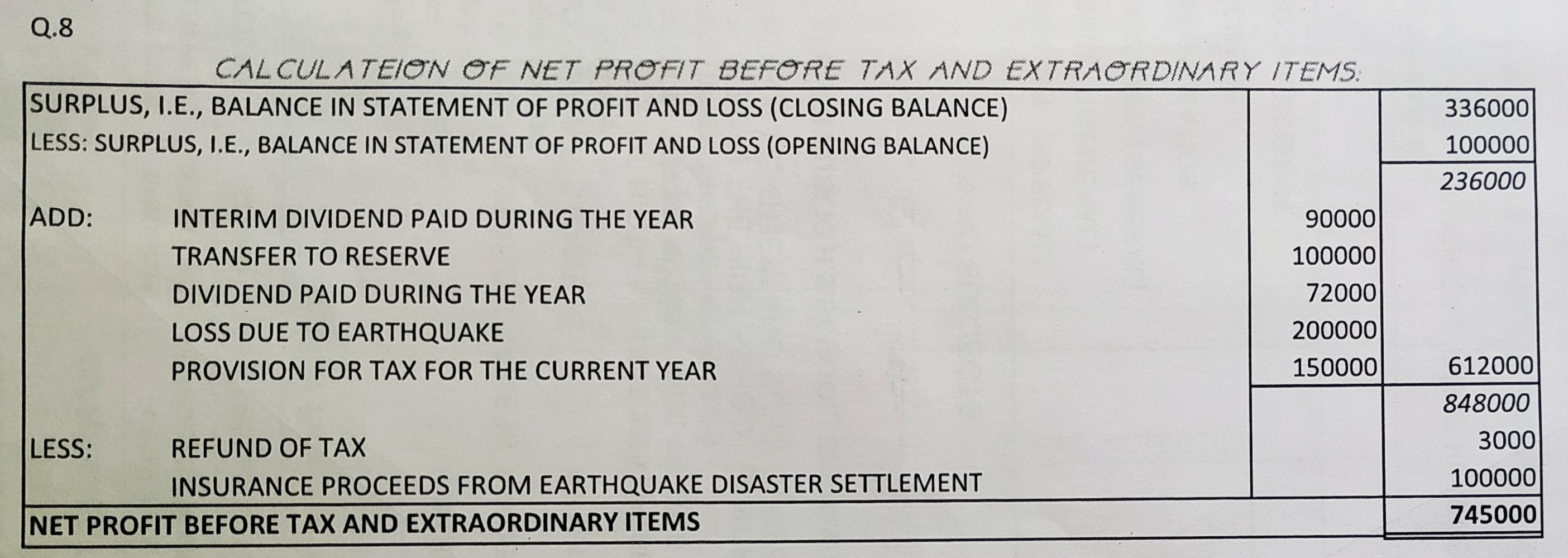

Question 8:

From the following information, calculate Net Profit before Tax and Extraordinary Items:

| ₹ | |

| Surplus, i.e., Balance in Statement of Profit and Loss (Opening) | 1,00,000 |

| Surplus, i.e., Balance in Statement of Profit and Loss (Closing) | 3,36,000 |

| Dividend paid in the current year | 72,000 |

| Interim Dividend Paid during the year | 90,000 |

| Transfer to Reserve | 1,00,000 |

| Provision for Tax for the current year | 1,50,000 |

| Refund of Tax | 3,000 |

| Loss due to Earthquake | 2,00,000 |

| Insurance Proceeds from Earthquake disaster settlement | 1,00,000 |

ANSWER:

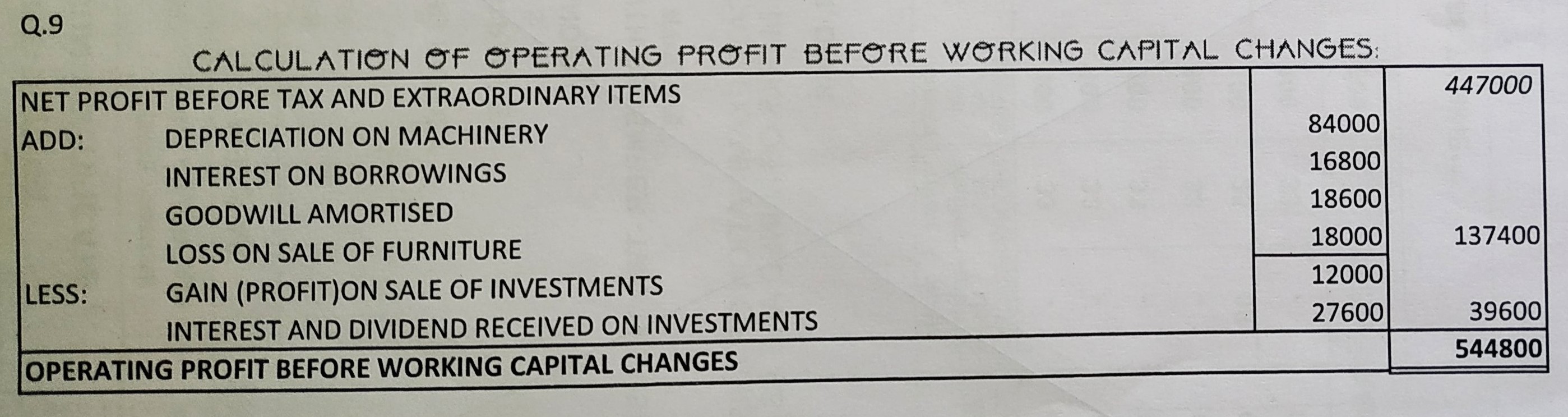

Question 9:

From the following information, calculate Operating Profit before Working Capital Changes:

| ₹ | |

| Net Profit before Tax and Extraordinary Items | 4,47,000 |

| Depreciation on Machinery | 84,000 |

| Interest on Borrowings | 16,800 |

| Goodwill Amortised | 18,600 |

| Loss on Sale of Furniture | 18,000 |

| Premium on Redemption of Preference Shares | 6,000 |

| Gain (Profit) on Sale of Investments | 12,000 |

| Interest and Dividend Received on Investments | 27,600 |

ANSWER:

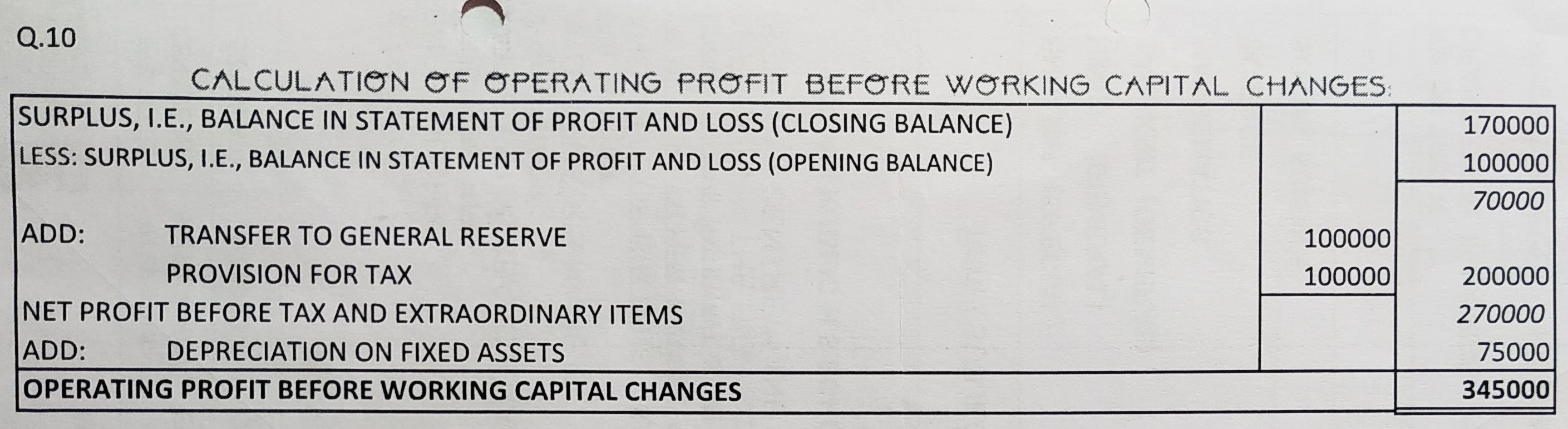

Question 10:

From the following Balance Sheet of Double Tree Ltd. as at 31st March, 2019 and additional information, calculate Operating Profit before Working Capital Changes:

Particulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital |

| 5,00,000 | 5,00,000 |

(b) Reserves and Surplus | 1 | 6,70,000 | 5,00,000 |

2. Current Liabilities | |||

(a) Trade Payables | 60,000 | 50,000 | |

(b) Other Current Liabilities (Outstanding Expenses) | 20,000 | 15,000 | |

(c) Short-term Provisions (Provision for Tax) |

| 1,00,000 | 90,000 |

Total | 13,50,000 | 11,55,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets (Tangible) | 7,50,000 | 7,30,000 | |

(b) Non-Current Investments | 2,50,000 | 3,00,000 | |

2. Current Assets | 3,50,000 | 1,25,000 | |

Total | 13,50,000 | 11,55,000 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. Reserve and Surplus | ||

General Reserve | 5,00,000 | 4,00,000 |

Surplus, i.e., Balance in Statement of Profit and Loss | 1,70,000 | 1,00,000 |

| 6,70,000 | 5,00,000 | |

Additional Information: Depreciation for the year was ₹75,000.

ANSWER:

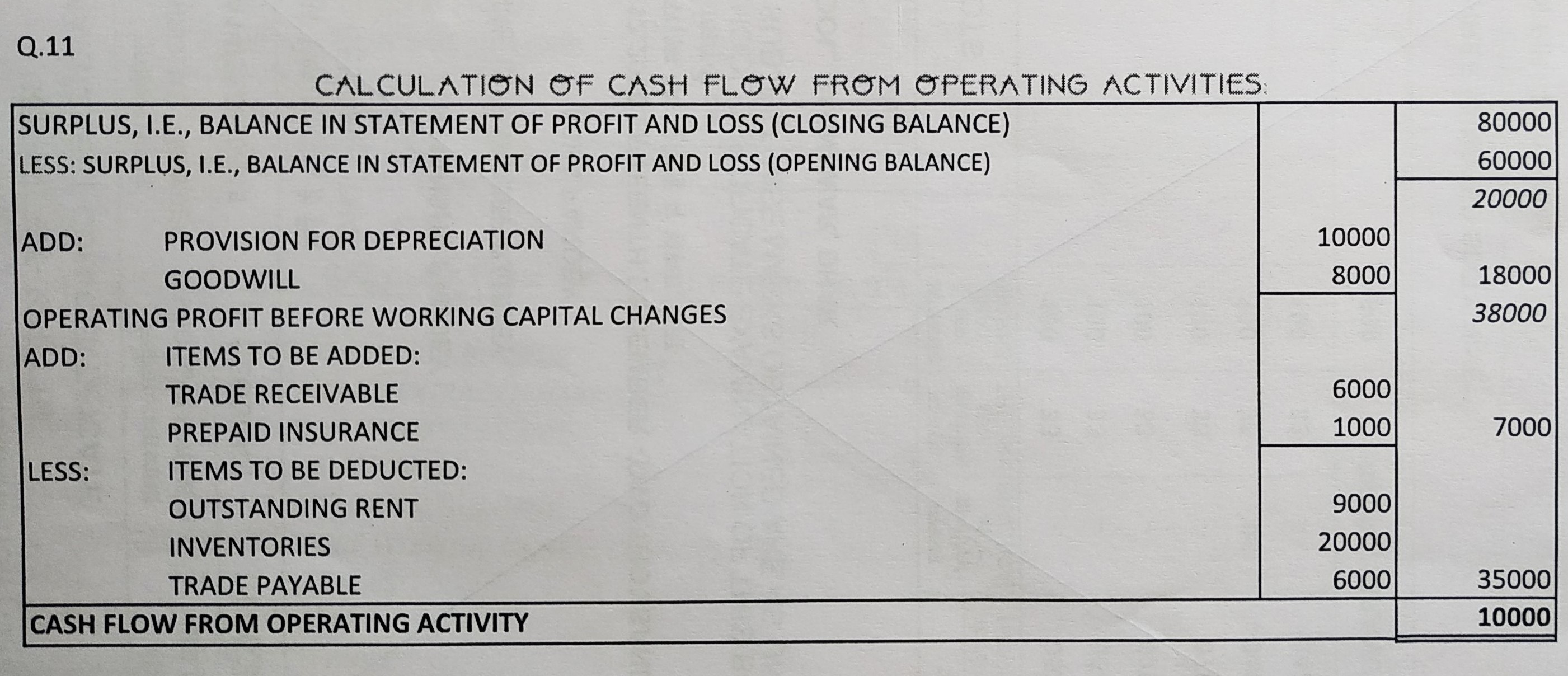

Question 11:

Calculate Cash Flow from Operating Activities from the following details:

| Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| Surplus, i.e., Balance in Statement of Profit and Loss | 80,000 | 60,000 |

| Trade Receivables | 25,000 | 31,000 |

| Provision for Depreciation | 40,000 | 30,000 |

| Inventories | 80,000 | 60,000 |

| Outstanding Rent | 12,000 | 21,000 |

| Goodwill | 30,000 | 38,000 |

| Prepaid Insurance | 1,000 | 2,000 |

| Trade Payables (Creditors) | 13,000 | 19,000 |

ANSWER:

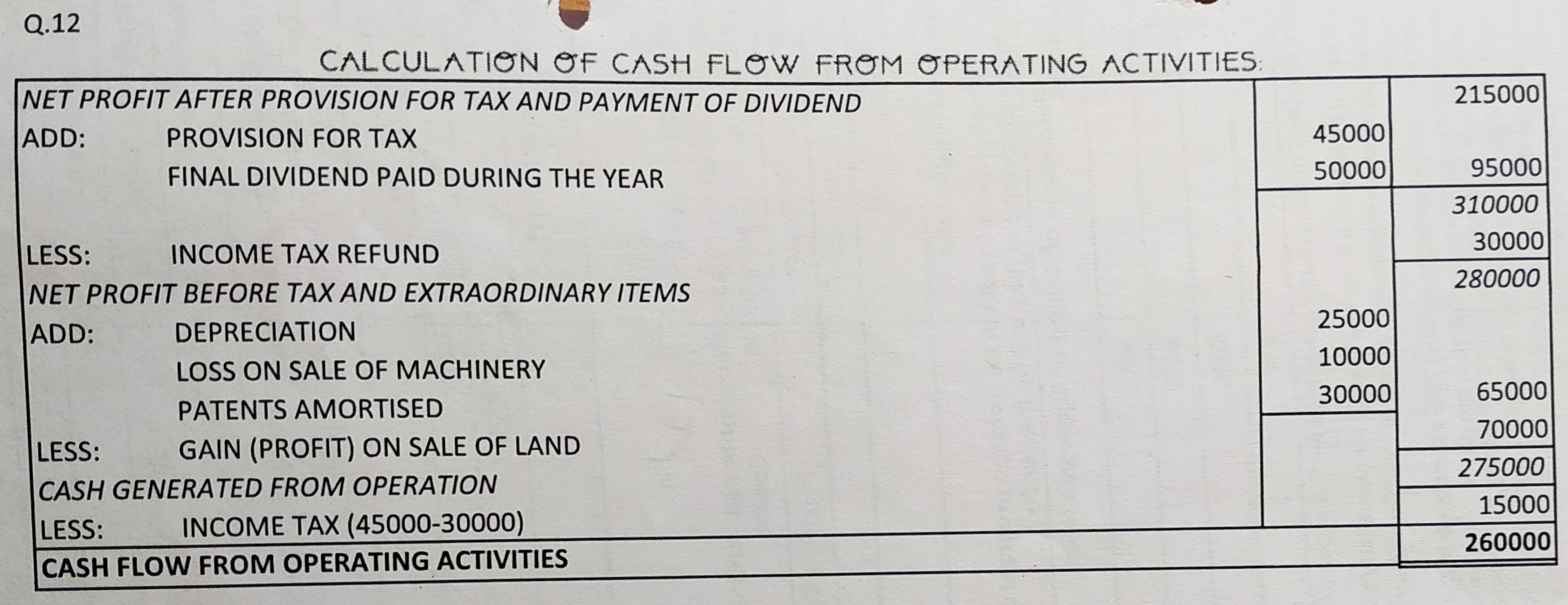

Question 12:

Compute Cash Flow from Operating Activities from the following information:

| |

Particulars | ₹ |

| Net Profit after Provision for Tax and Payment of Dividend | 2,15,000 |

| Provision for Tax | 45,000 |

| Final Dividend paid during the year | 50,000 |

| Depreciation | 25,000 |

| Loss on Sale of Machinery | 10,000 |

| Patents Amortised | 30,000 |

| Gain on Sale of Land | 70,000 |

| Income Tax Refund | 30,000 |

| |

ANSWER:

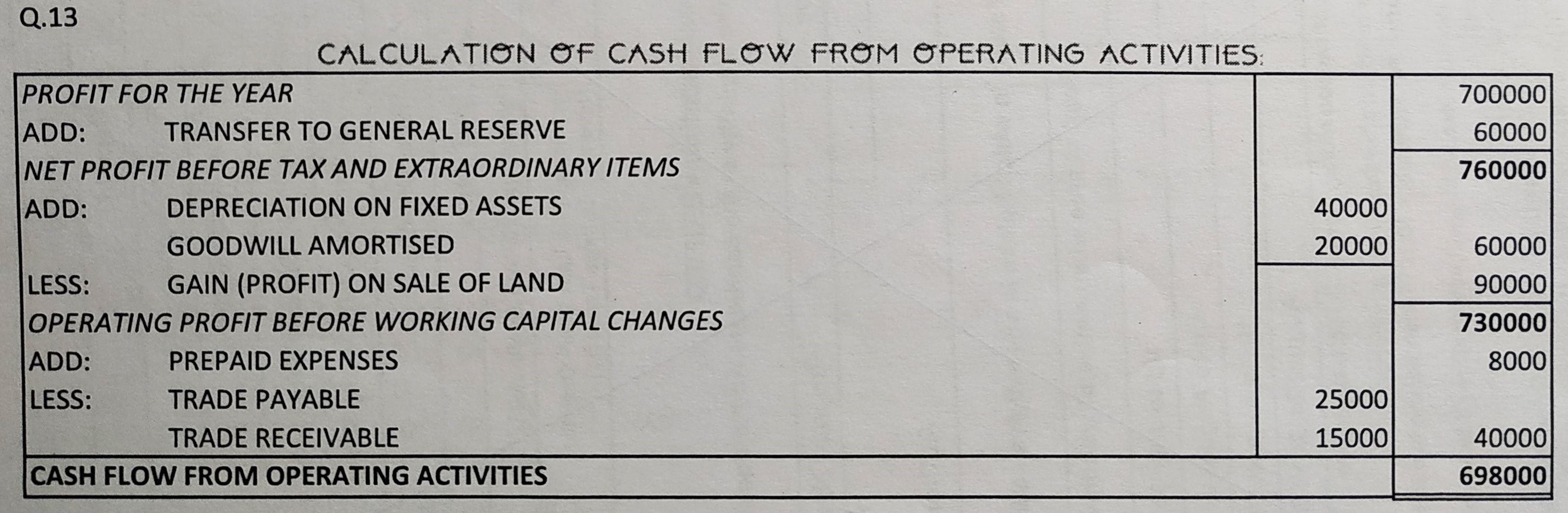

Question 13:

Calculate Cash Flow from Operating Activities from the following:

(i) Profit form the year is ₹ 7,00,000 after considering the following items:

| |

Particulars | (₹) |

| Depreciation on Fixed Assets | 40,000 |

| Goodwill Amortised | 20,000 |

| Gain on Sale of Land | 90,000 |

| Appropriation of Profit towards General Reserve | 60,000 |

| |

(ii) Following is the position of Current Assets and Current Liabiliites

|

| |

Particulars | Closing Balance (₹) | Opening Balance (₹) |

| Trade Payables | 50,000 | 75,000 |

| Trade Receivables | 75,000 | 60,000 |

| Prepaid Expenses | 10,000 | 18,000 |

|

| |

ANSWER:

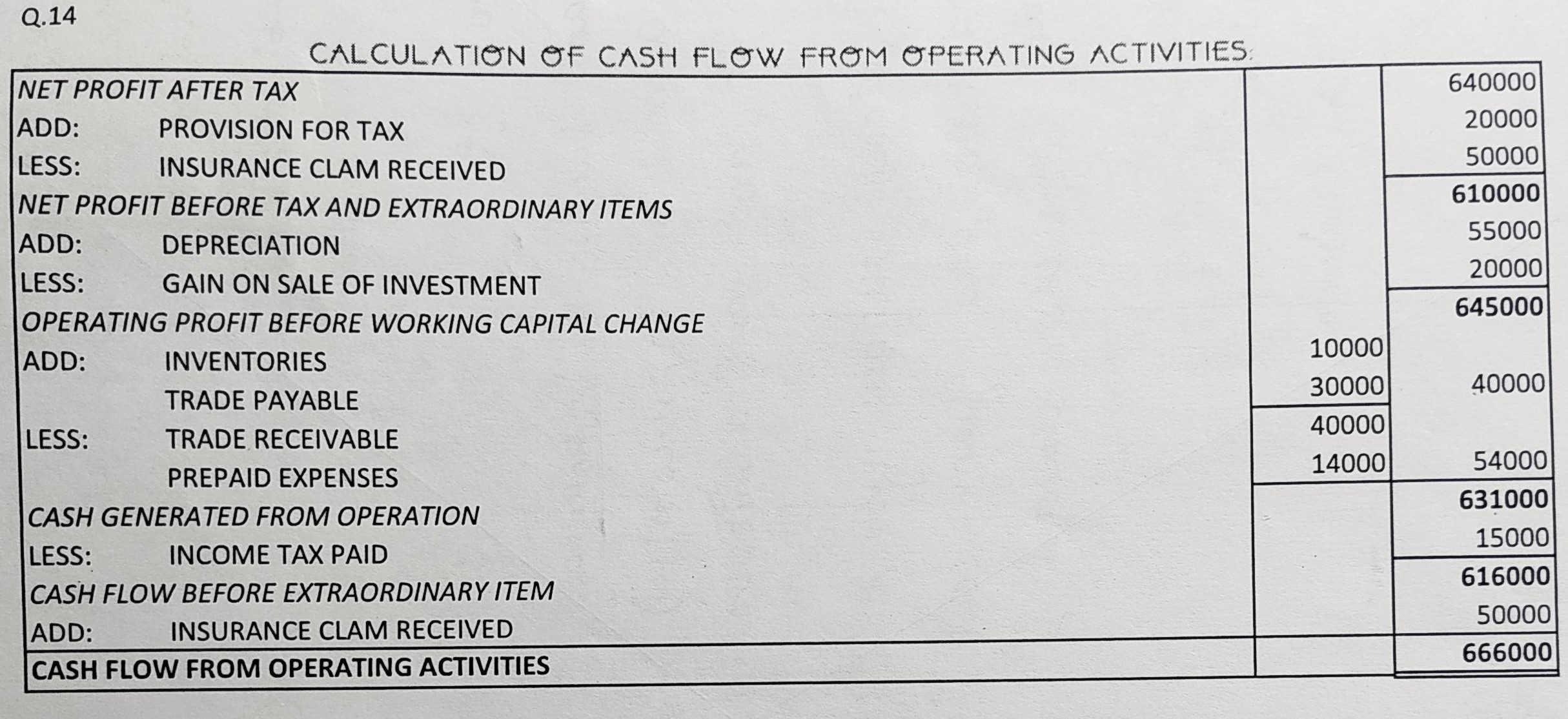

Question 14:

Grand Hospitality Ltd., reported Net Profit after Tax of ₹ 6,40,000 for the year ended 31st March, 2019. The relevant extract from Balance Sheet as at 31st March, 2019 is:

|

| |

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| Inventories | 1,15,000 | 1,25,000 |

| Trade Receivables | 1,50,000 | 1,10,000 |

| Prepaid Expenses | 20,000 | 6,000 |

| Trade Payables | 1,10,000 | 80,000 |

| Provision for Tax | 20,000 | 15,000 |

|

|

Depreciation charged on Plant and Machinery ₹ 55,000, insurance claim received ₹ 50,000, gain (profit) on sale of investment ₹ 20,000 appeared in the Statement of Profit and Loss for the year ended 31st March, 2019. Calculate Cash Flow from Operating Activities.

ANSWER:

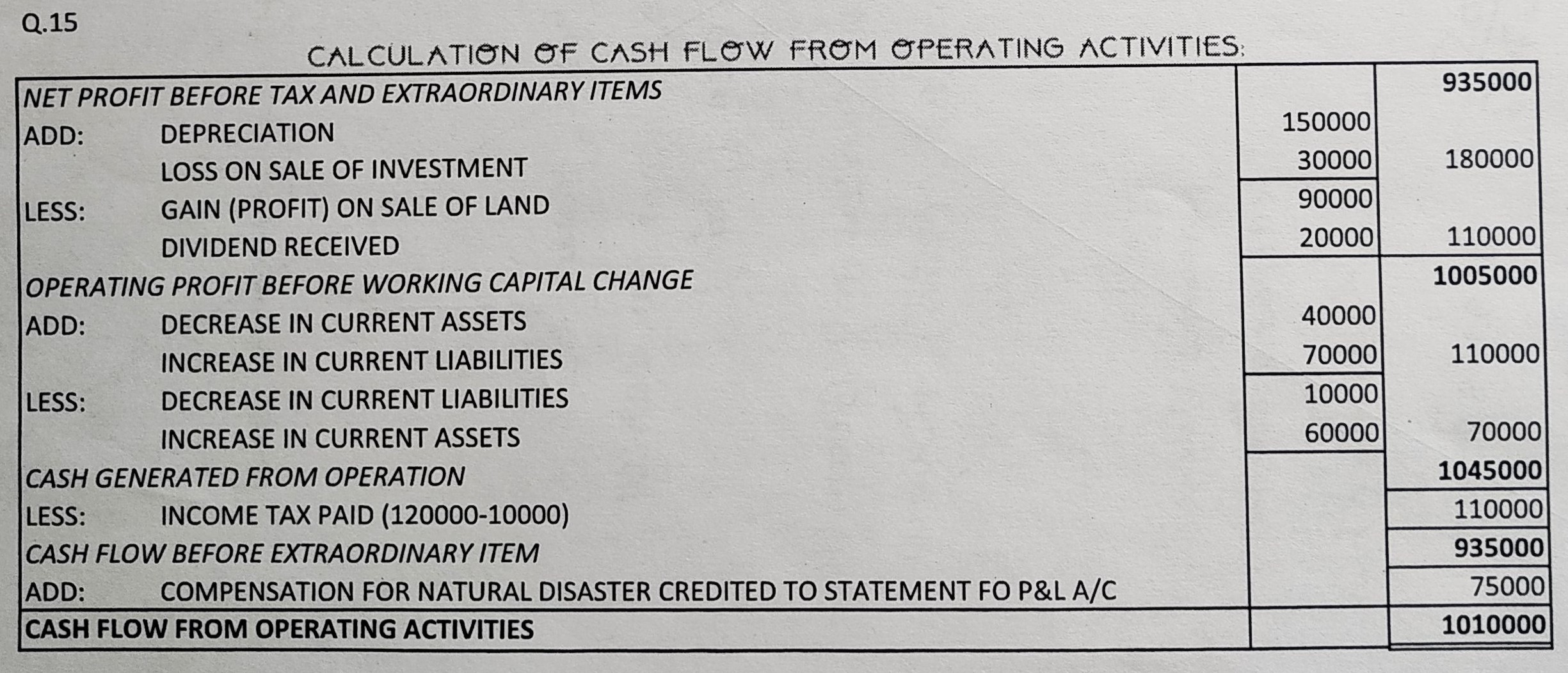

Question 15:

Calculate Cash Flow from Operating Activities from the following information.

Particular | 31st March 2017 (Rs) |

| Net Profit (Difference between Closing and Opening Balance of Surplus, i.e., Balance in Statement of Profit and Loss) | 8,00,000 |

| Final Dividend paid in the year | 1,10,000 |

| Compensation for Natural Disaster credited to Statement of Profit and Loss | 75,000 |

| Depreciation | 1,50,000 |

| Loss on Sale of Investment | 30,000 |

| Gain (Profit) on Sale of Land | 90,000 |

| Provision for Tax | 1,10,000 |

| Dividend Received | 20,000 |

| Decrease in Current Assets (Other than Cash and Cash Equivalents) | 40,000 |

| Increase in Current Liablilities | 70,000 |

| Decrease in Current Liabilities | 10,000 |

| Increase in Current Assets (Other than Cash and Cash Equivalents) | 60,000 |

| Income Tax Refund | 10,000 |

| Income Tax Paid | 1,20,000 |

ANSWER:

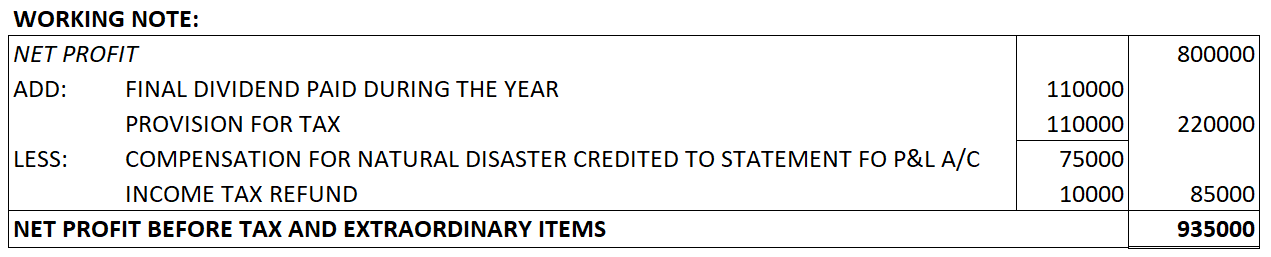

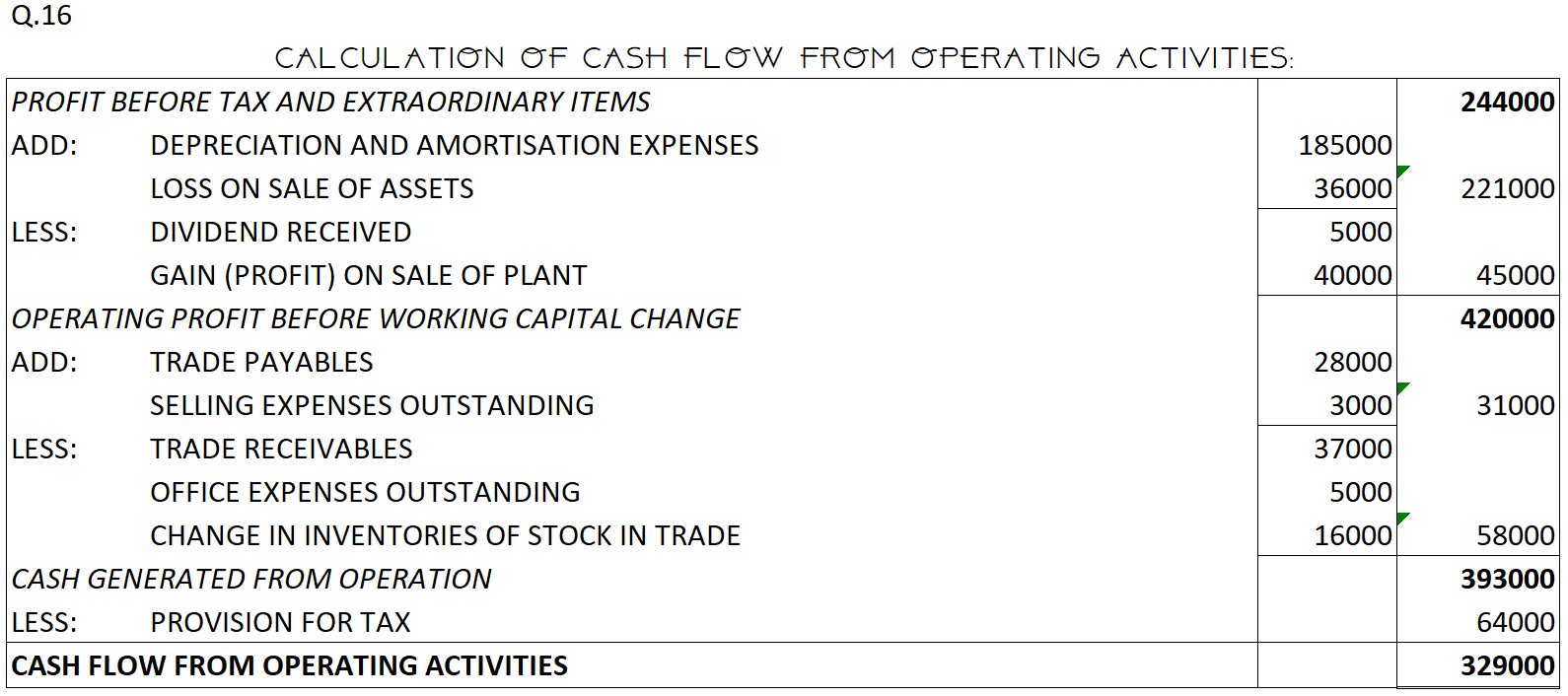

Question 16:

Following information is related to ABC Ltd.:

Particulars | Note No. | (₹) |

I. Revenue from Operations (Net Sales) | 30,00,000 | |

| II. Other Income | 1 | 45,000 |

III. Total Revenue (I + II) | 30,45,000 | |

| IV. Expenses; | ||

(a) Purchases of Stock-in-Trade | 23,03,000 | |

(b) Change in Inventories of Stock-in-Trade | 2 | (16,000) |

(c) Depreciation and Amortisation Expenses | 1,85,000 | |

(d) Other Expenses | 3 | 3,29,000 |

Total Expenses | 28,01,000 | |

| V. Profit before Tax (III − IV) | 2,44,000 | |

VI. Less: Provision for Tax | 64,000 | |

VII. Profit after Tax (V – VI) | 1,80,000 | |

Notes to Accounts

Particulars | ₹ |

| 1. Other Income | |

| (a) Dividend Received | 5,000 |

| (b) Gain (Profit) on Sale of Plant | 40,000 |

45,000 | |

| 2. Change in Inventories of Stock-in-Trade | |

| Opening Inventories | 2,84,000 |

| Less: Closing Inventories | 3,00,000 |

(16,000) | |

| 3. Other Expenses | |

| (a) Office Expenses | 58,000 |

| (b) Selling Expenses | 2,35,000 |

| (c) Loss on Sale of Assets | 36,000 |

3,29,000 | |

| Other Information: | Balance as on 31st March, 2019 (₹) | Balance as on 31st March, 2018 (₹) |

| Trade Payables | 2,78,000 | 2,50,000 |

| Trade Receivables | 4,52,000 | 4,15,000 |

| Inventories | 3,00,000 | 2,84,000 |

| Office Expenses Outstanding | … | 5,000 |

| Selling Expenses Outstanding | 25,000 | 22,000 |

Calculate Cash Flow from Operating Activities.

ANSWER:

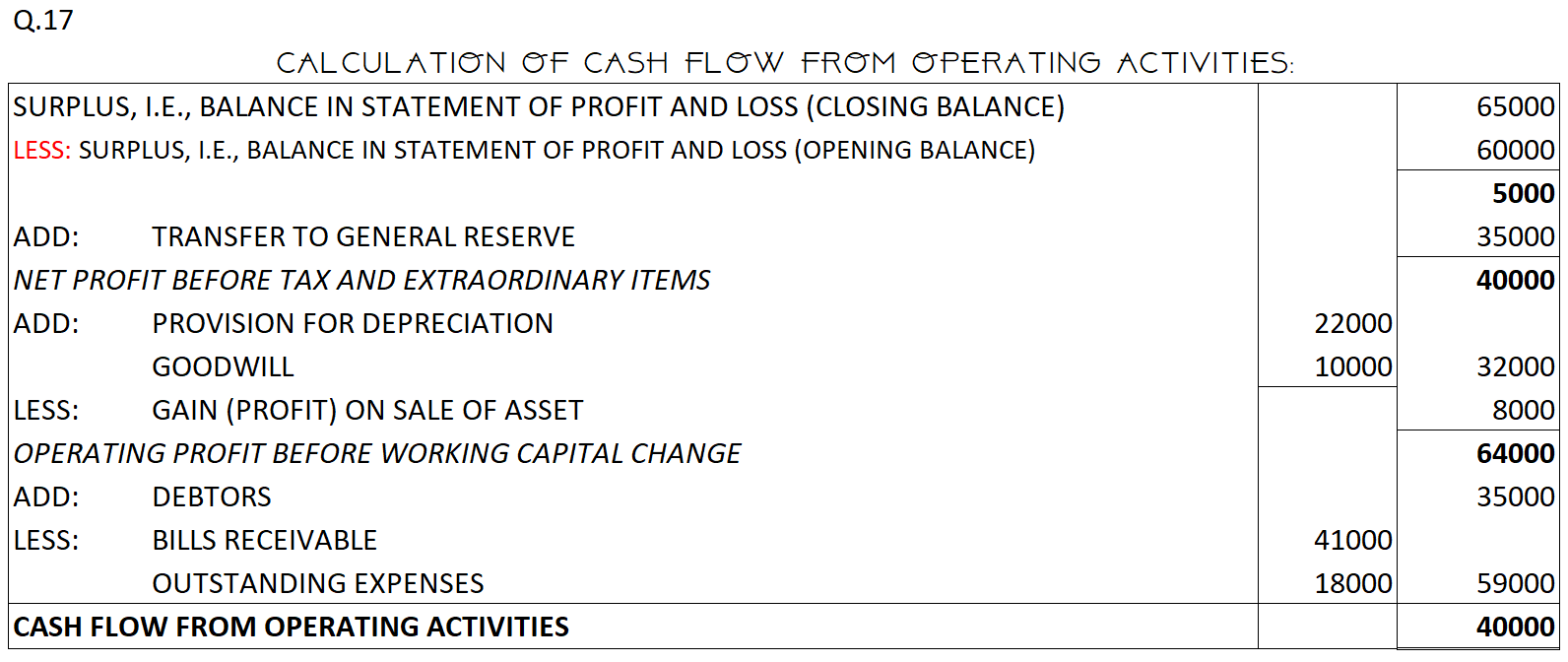

Question 17:

Compute Cash Flow from Operating Activities from the following:

|

| |

Particulars | Closing Balances (₹) | Opening Balances (₹) |

| Surplus, i.e., Balance in Statement of Profit and Loss | 65,000 | 60,000 |

| Trade Receivables: | ||

Debtors | 67,000 | 1,02,000 |

Bills Receivable | 1,03,000 | 62,000 |

| General Reserve | 2,37,000 | 2,02,000 |

| Provision for Depreciation | 30,000 | 20,000 |

| Outstanding Expenses | 12,000 | 30,000 |

| Goodwill | 70,000 | 80,000 |

|

| |

An asset costing ₹ 40,000 having book value of ₹ 28,000 was sold for ₹ 36,000.

ANSWER:

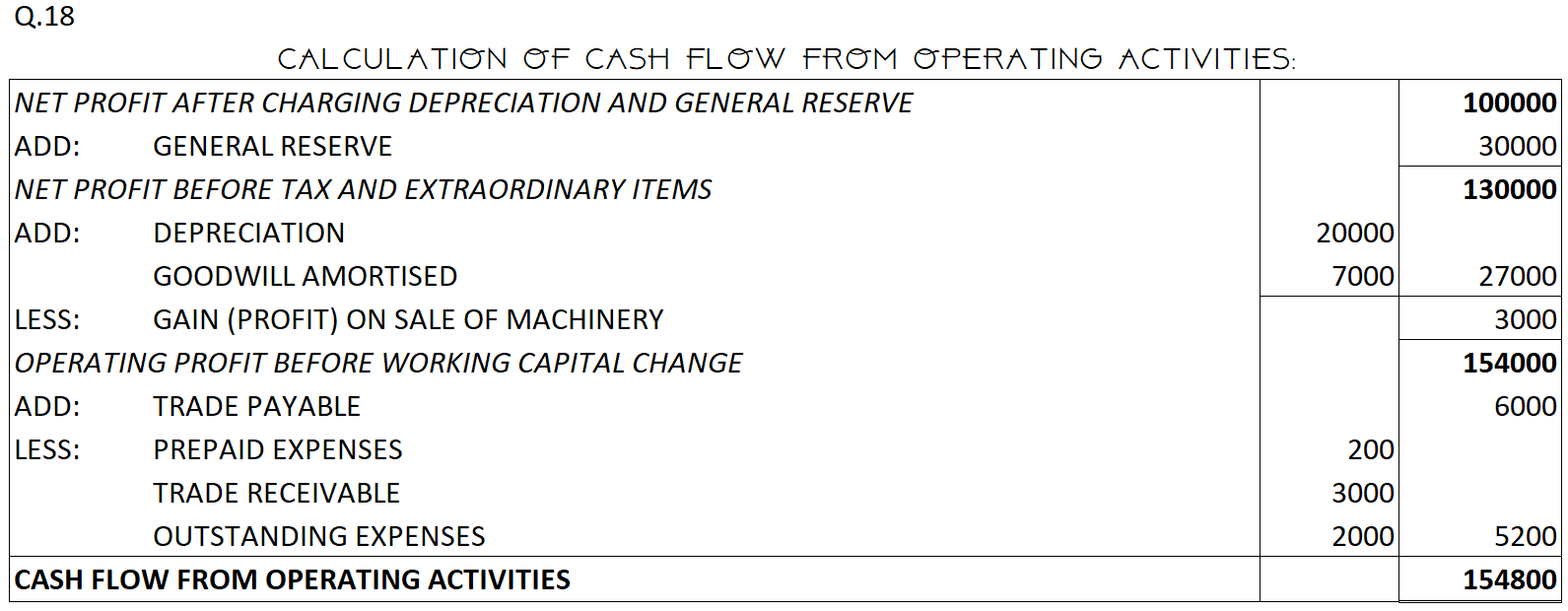

Question 18:

Charles Ltd. earned a profit of ₹ 1,00,000 after charging depreciation of 20,000 on assets and a transfer to General Reserve of ₹ 30,000. Goodwill amortised was ₹ 7,000, and gain on sale of machinery was ₹ 3,000. Other information available is (changes in the value of Current Assets and Current Liabilities): trade receivables showed an increase of ₹ 3,000; trade payables an increase of ₹ 6,000; Prepaid expenses an increase of ₹ 200; and outstanding expenses a decrease of ₹ 2,000.

Ascertain Cash Flow from Operating Activities.

ANSWER:

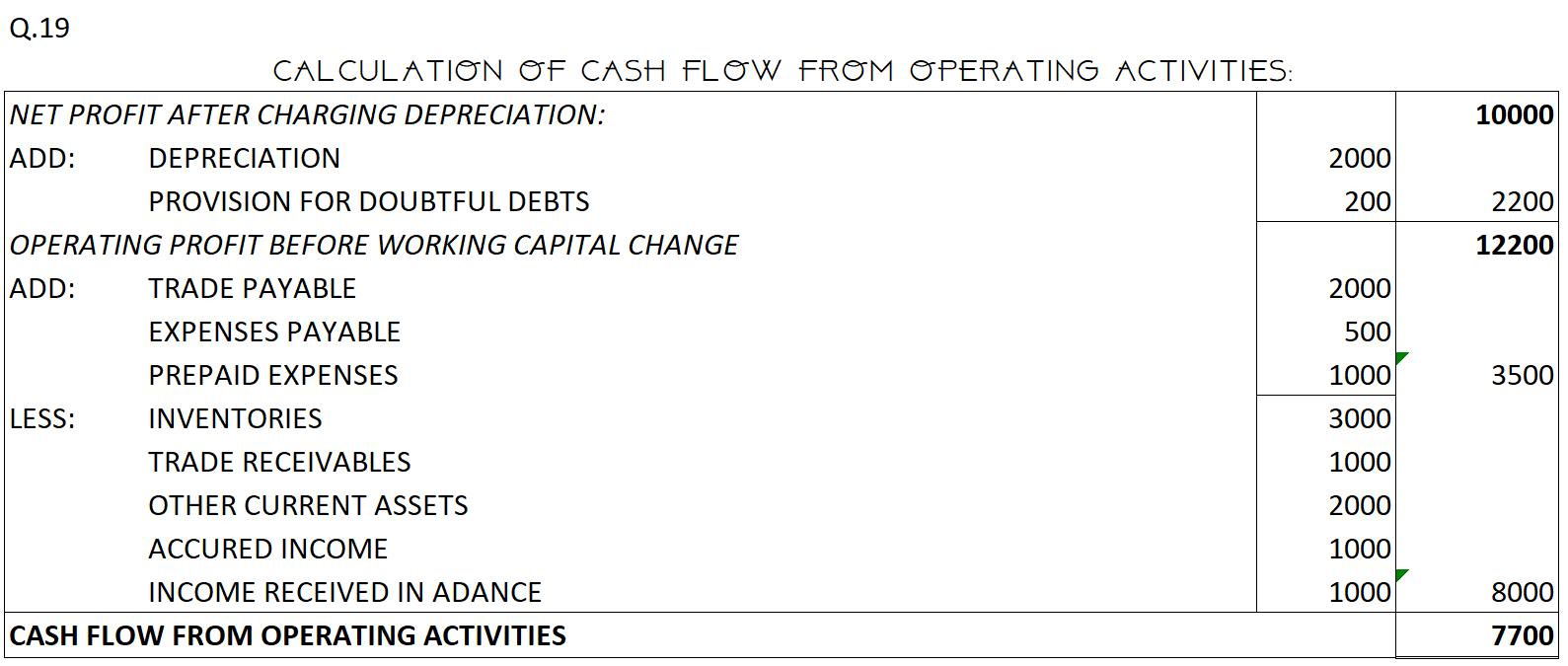

Question 19:

Compute Cash Flow from Operating Activities from the following:

(i) Profit for the year ended 31st March, 2019 is ₹ 10,000 after providing for depreciation of ₹ 2,000.

(ii) Current Assets and Current Liabilities of the business for the year ended 31st March, 2018 and 2019 are as follows:

Particular | 31st March (₹) | 31st March |

| Trade Receivables | 14,000 | 15,000 |

Provision for Doubtful Debts | 1,000 | 1,200 |

Trade Payables | 13,000 | 15,000 |

| Inventories | 5,000 | 8,000 |

| Other Current Assets | 10,000 | 12,000 |

| Expenses Payables | 1,000 | 1,500 |

| Prepaid Expenses | 2,000 | 1,000 |

| Accrued Income | 3,000 | 4,000 |

| Income Received in Advance | 2,000 | 1,000 |

ANSWER:

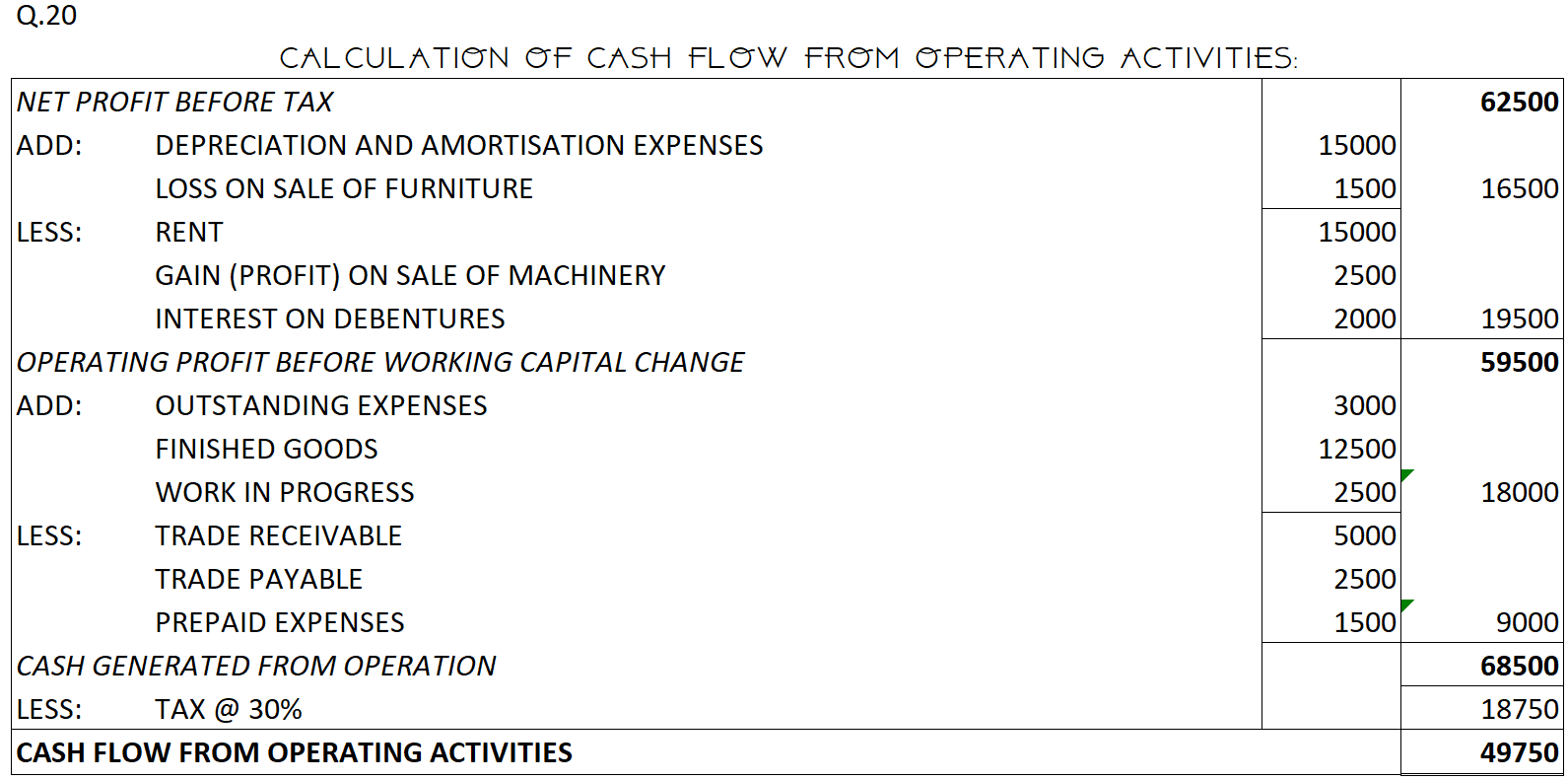

Question 20:

Calculate Cash Flow from Operating Activities from the following information:

Particulars | Note No. | (₹) |

| I. Revenue from Operations (Sales) | 5,98,000 | |

| II. Other Income | 1 | 19,500 |

| III. Total Revnue (I + II) | 6,17,500 | |

| IV. Expenses; | ||

Cost of Materials Consumed | 4,00,000 | |

Change in Inventories of Finished Goods and Work-in-Progress | 2 | 15,000 |

Employee Benefit Expenses | 1,05,000 | |

Depreciation and Amortisation Expenses |

| 15,000 |

Other Expenses | 3 | 20,000 |

Total Expenses | 5,55,000 | |

| V. Profit before Tax (III − IV) | 62,500 | |

| VI. Tax @ 30% | 18,750 | |

| VII. Profit after Tax (V − VI) | 43,750 | |

Notes to Accounts

Particulars | ₹ |

| 1. Other Income | |

Rent | 15,000 |

Gain (Profit) on Sale of Machinery | 2,500 |

Interest on Debentures held as Investments | 2,000 |

19,500 | |

| Changes in Inventories of Finished Goods and Work-in-Progress | |

| (a) Finished Goods | nbsp; |

Opening Inventories | 37,500 |

Less: Closing Inventories | 25,000 |

Sub-Total | 12,500 |

| (b) Work-in-Progress | |

Opening Inventories | 22,500 |

Less: Closing Inventories | 20,000 |

Sub-Total | 2,500 |

Total (a + b) | 15,000 |

| 2. Other Expenses | |

Office Expenses | 12,500 |

Selling Expenses | 6,000 |

Loss on Sale of Furniture | 1,500 |

20,000 | |

| Current Assets and Current Liabilities | As on 31st March, 2019 (₹) | As on 1st April, 2018 (₹) |

| Trade Receivables | 25,000 | 20,000 |

| Trade Payables | 32,500 | 35,000 |

| Outstanding Expenses | 8,000 | 5,000 |

| Prepaid Expenses | 5,000 | 3,500 |

ANSWER:

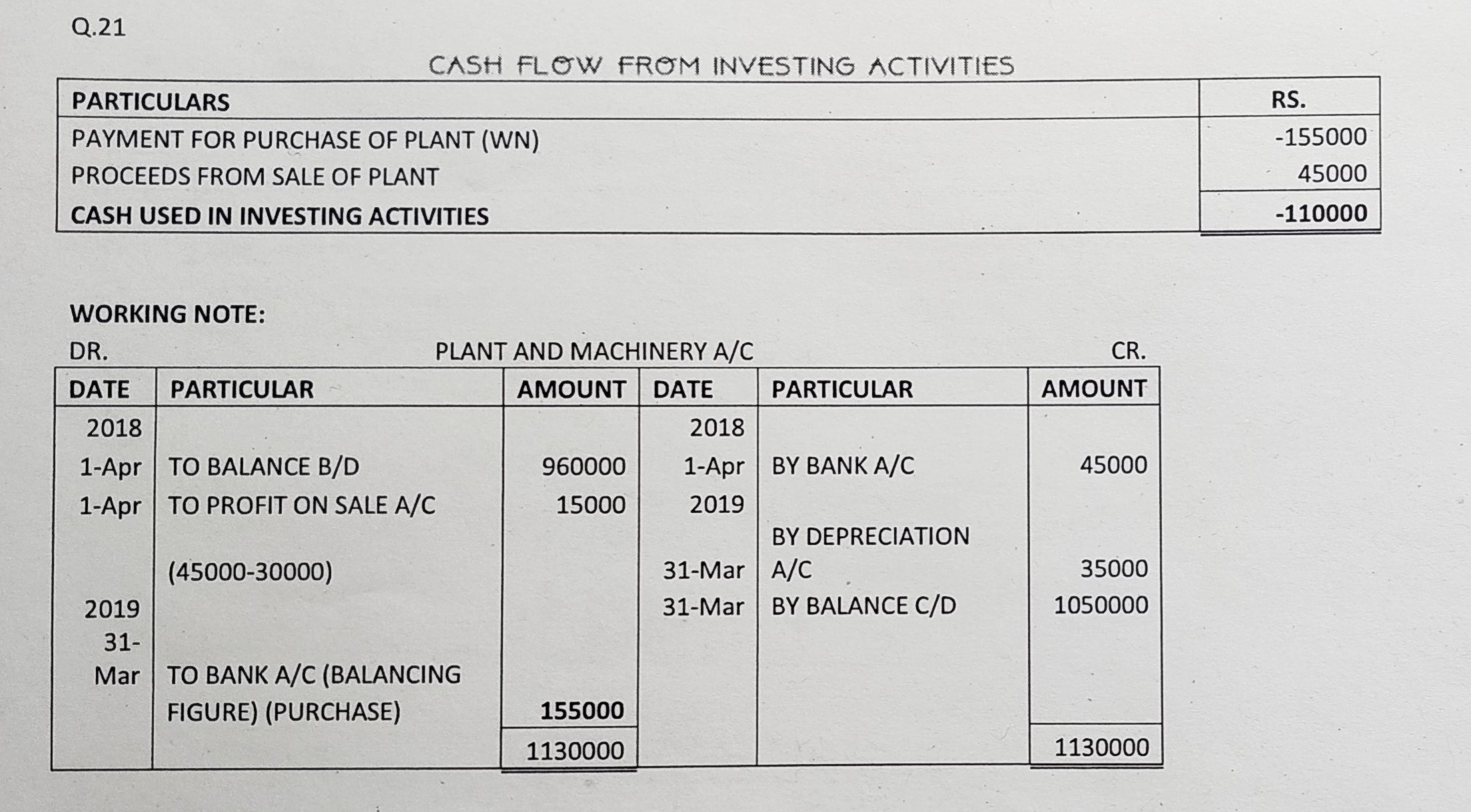

Question 21:

Mars Ltd. has Plant and Machinery whose written down value on 1st April, 2017 was ₹9,60,000 and on 31st March, 2018 was ₹10,50,000. Depreciation for the year was ₹35,000. In the beginning of the year, a part of plant was sold for ₹45,000 which had a written down value of ₹30,000.

Calculate Cash Flow from Investing Activities

ANSWER:

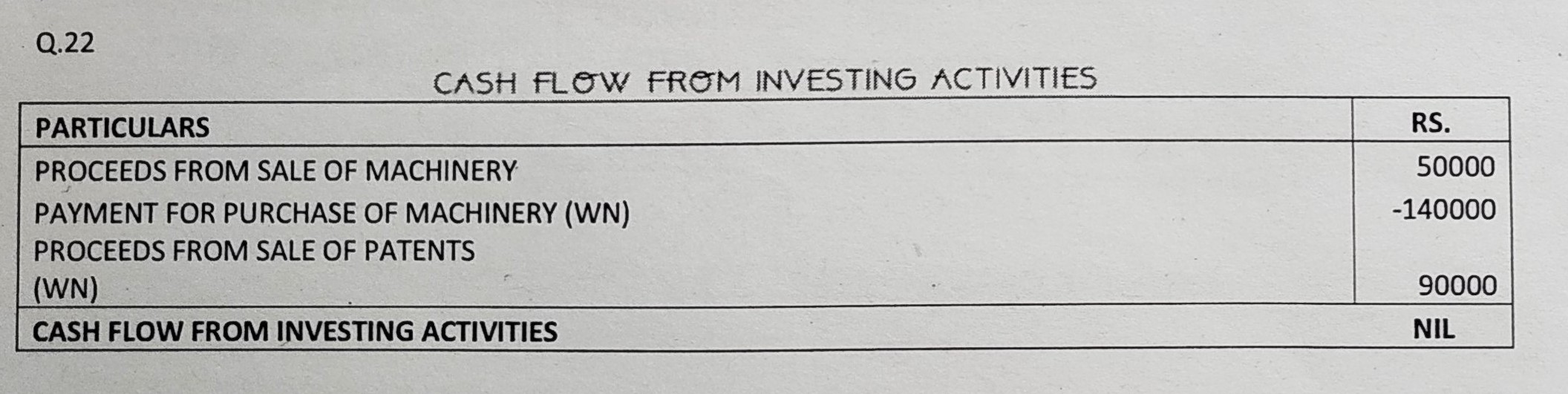

Question 22:

From the following details. calculate Cash Flow from Investing Activities

|

| |

Particulars | Closing (₹) | Opening (₹) |

| Machinery (At Cost) | 10,00,000 | 9,50,000 |

| Accumulated Depreciation | 1,50,000 | 1,10,000 |

| Patents | 2,00,000 | 3,00,000 |

|

| |

Additional Information:

- During the year, machine costing ₹ 90,000 with accumulated depreciation of ₹ 60,000 was sold for ₹ 50,000.

- Patents written off were ₹ 50,000 while a part of patents were sold at a profit of ₹ 40,000.

ANSWER:

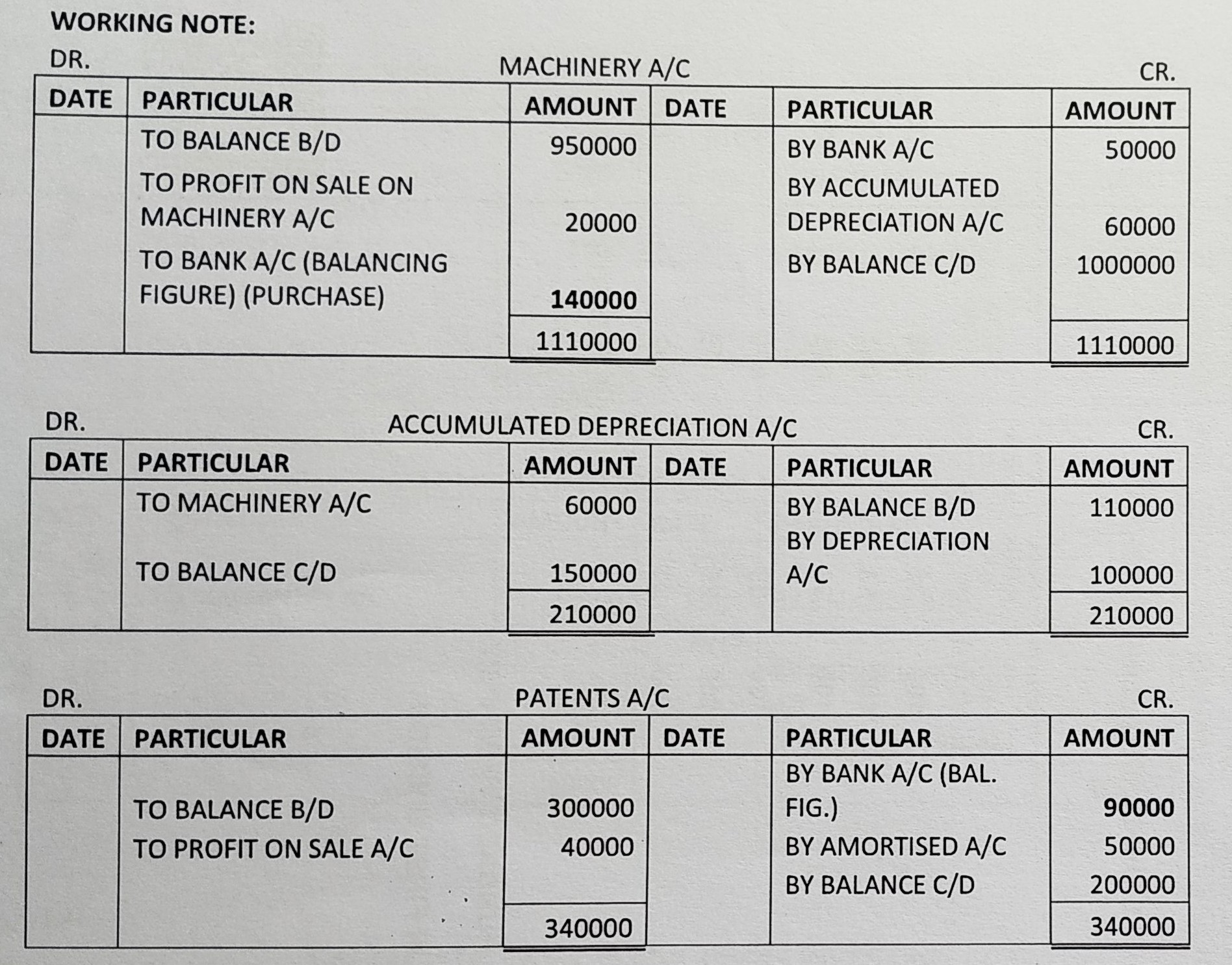

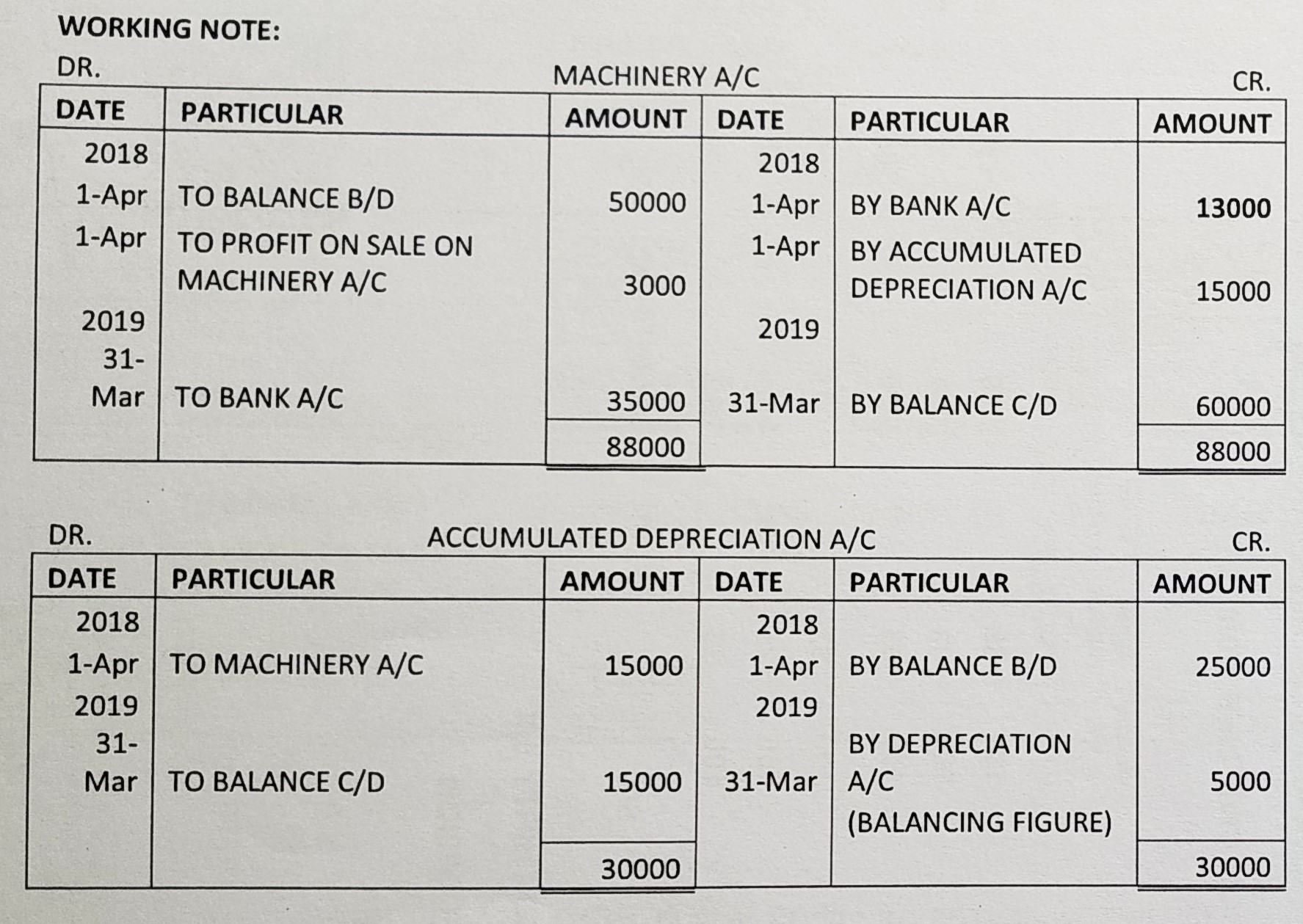

Question 23:

| Welprint Ltd. has given the following information: | ₹ |

| Machinery as on 1st April, 2018 | 50,000 |

| Machinery as on 31st March, 2019 | 60,000 |

| Accumulated Depreciation on 1st April, 2018 | 25,000 |

| Accumulated Depreciation on 31st march, 2019 | 15,000 |

During the year, a machine costing ₹ 25,000 (accumulated depreciation thereon ₹ 15,000) was sold for ₹ 13,000.

Calculate Cash Flow from Investing Activities on the basis of the above information.

ANSWER:

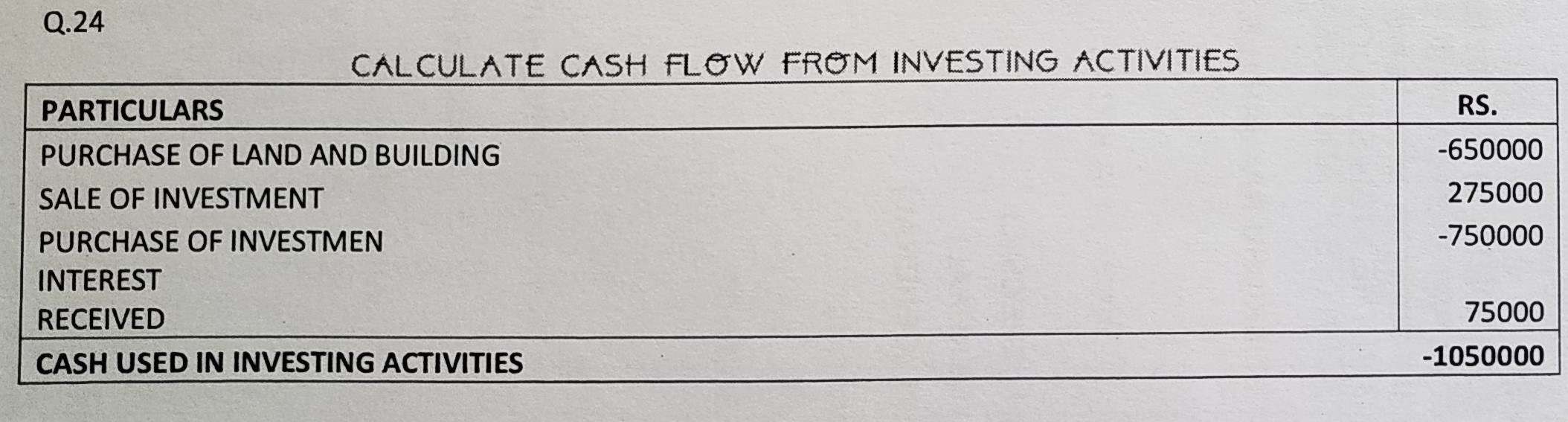

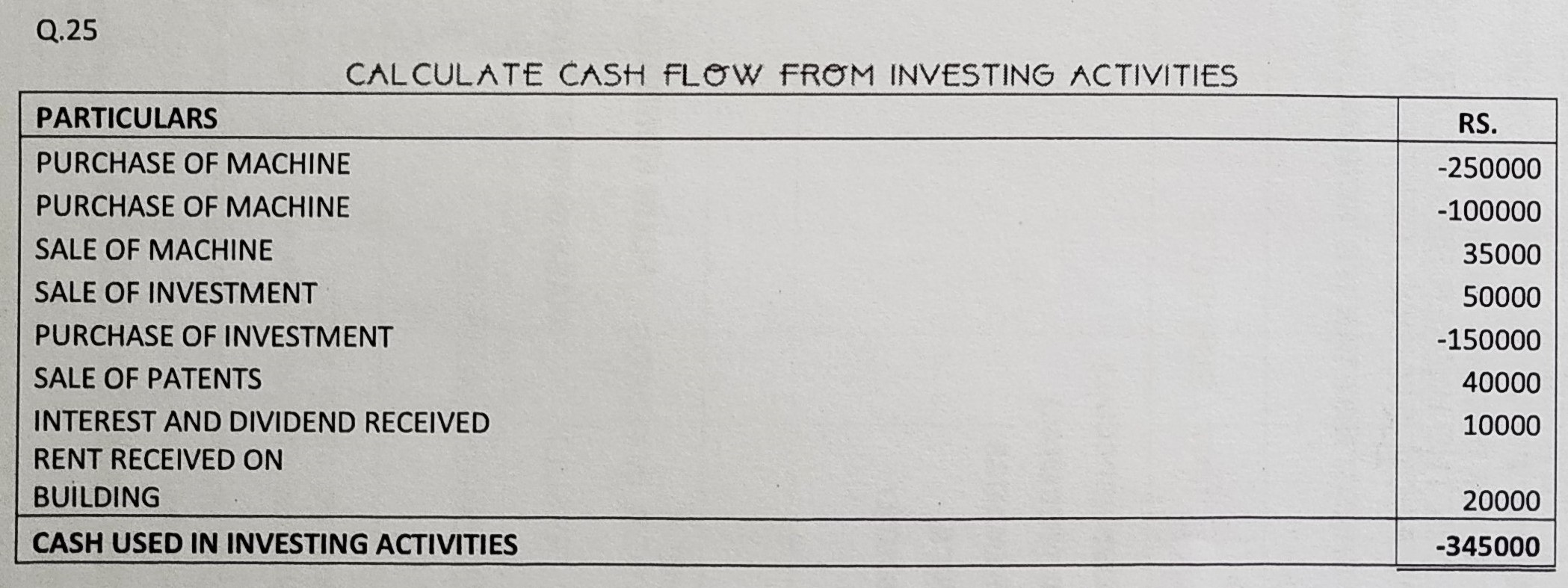

Question 24:

From the following details. Calculate Cash Flow from Investing Activities

| Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| Investment in 10% Debentures | 10,00,000 | 5,00,000 |

| Land and Building | 15,00,000 | 9,00,000 |

Additional Information:

1. Half of the investment held in the beginning of the year were sold at 10% profit.

2. Depreciation on Land and Building was ₹ 50,000 for the year.

3. Interest received on investments ₹ 75,000.

ANSWER:

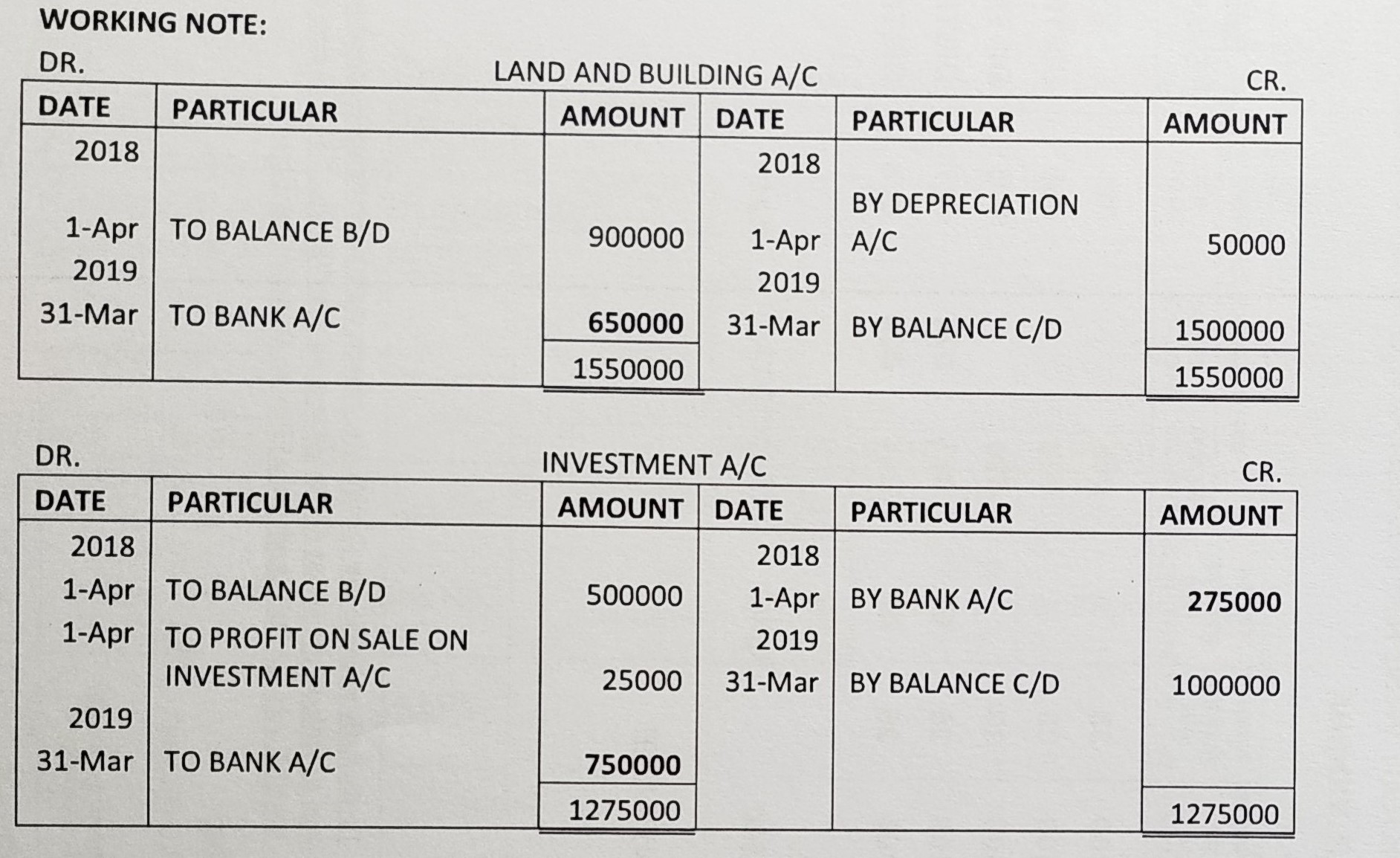

Question 25:

From the following information, calculate Cash Flow from Investing Activities:

| ₹ | ₹ | |||

| Purchase of Machine | 2,50,000 | Purchase of Investments | 1,60,000 | |

| Purchase of Goodwill | 1,00,000 | Sale of Patents | 40,000 | |

| Sale of Machine | 35,000 | Interest and Dividend Received | 10,000 | |

| Sale of Investment | 50,000 |

A building was purchased as investment out of surplus which was let out for commercial purposes.

Rent Received ₹20,000.

ANSWER:

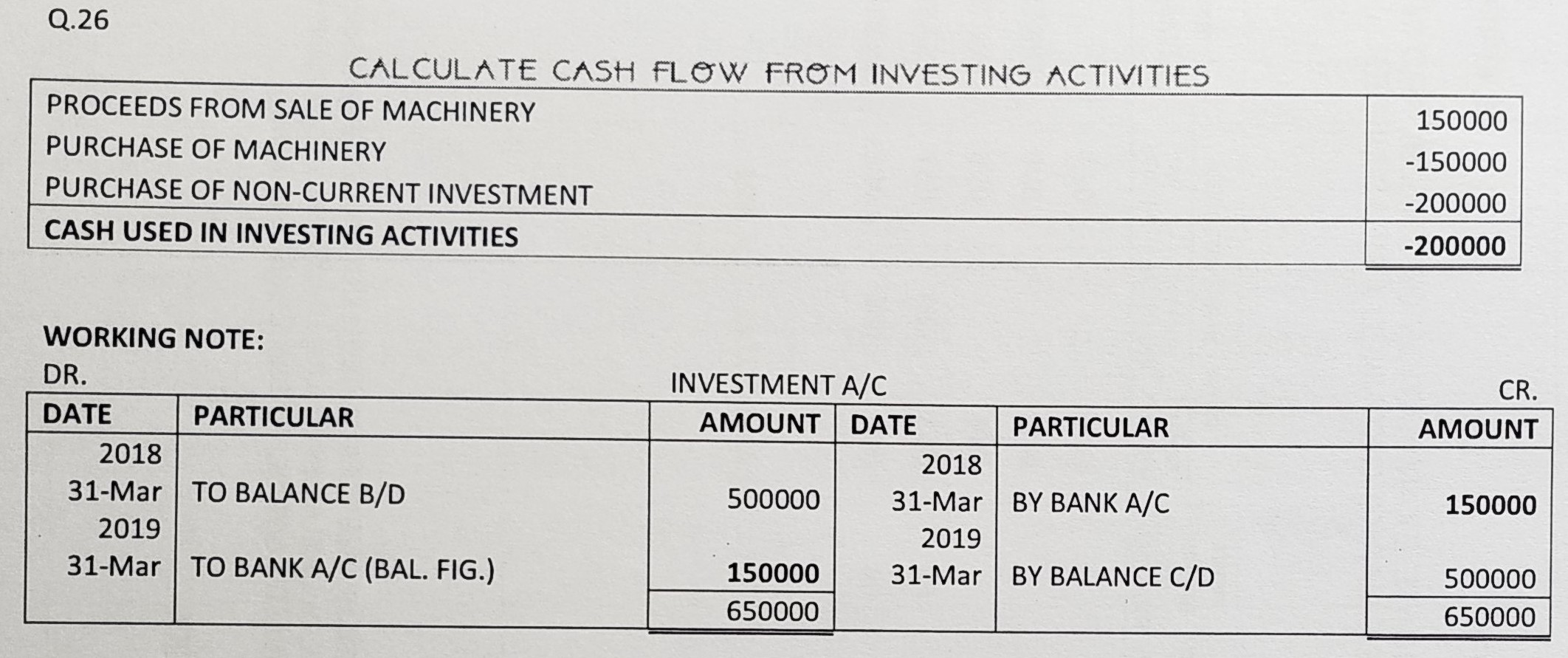

Question 26:

From the following Balance Sheet of Combiplast Ltd. for the year ended 31st March, 2019 and additional information, calculate Cash Flow from Investing Activities:

Particulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds |

| ||

(a) Share Capital | 7,50,000 | 5,00,000 | |

(b) Reserves and Surplus | 10,00,000 | 8,50,000 | |

2. Current Liabilities |

| 4,50,000 | 3,50,000 |

Total | 22,00,000 | 17,00,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets−Tangible Assets | 1 | 12,00,000 | 12,00,000 |

(b) Non-Current Investments | 5,00,000 | 3,00,000 | |

2. Current Assets | |||

(a) Trade Receivables | 3,00,000 | 1,10,000 | |

(b) Cash and Cash Equivalents | 2,00,000 | 90,000 | |

Total | 22,00,000 | 17,00,000 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. Tangible Assets | ||

Land | 3,00,000 | 3,00,000 |

Building | 4,00,000 | 4,00,000 |

Plant and Machinery | 5,00,000 | 5,00,000 |

| 12,00,000 | 12,00,000 | |

Additional Information: During the year the company sold machinery at Book Value of ₹ 1,50,000.

ANSWER:

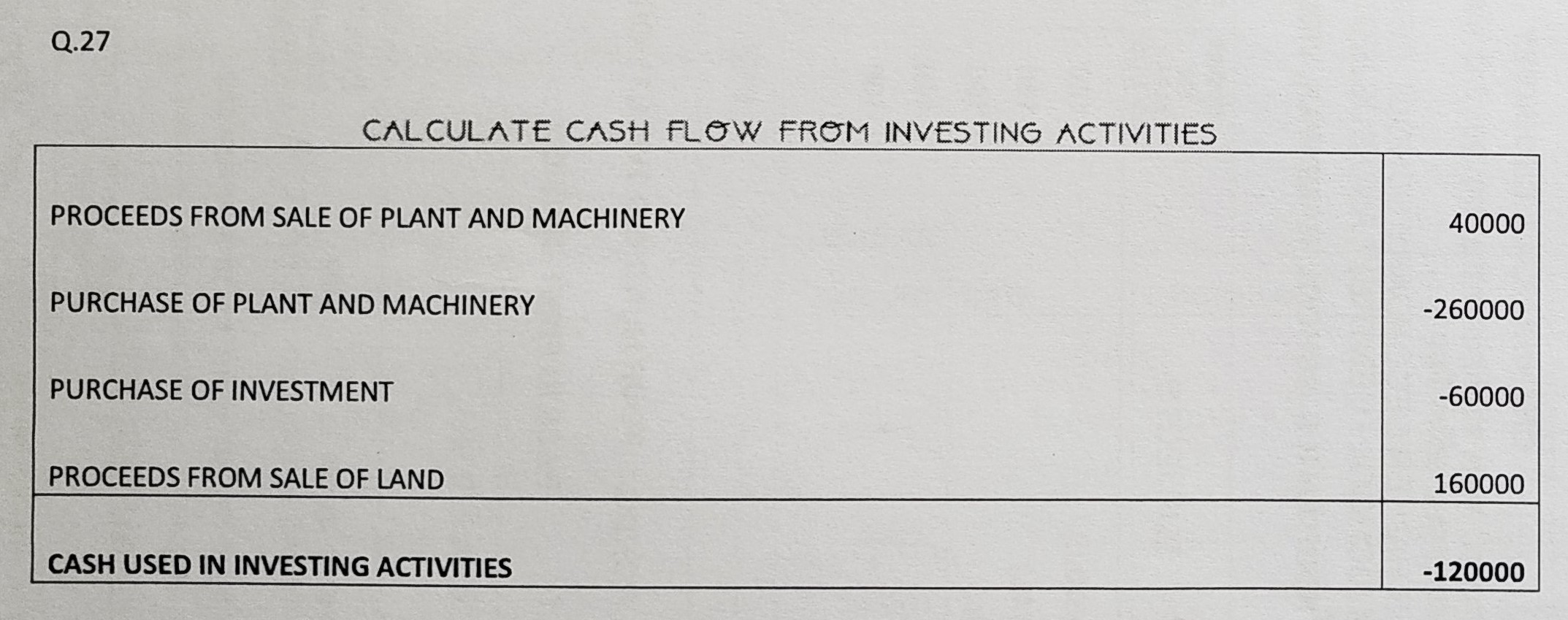

Question 27:

From the following information, calculate Cash Flow from Investing Activities

| Particular | 31st March, 2019(₹) | 31st March, 2018(₹) |

| Plant and Machinery | 10,00,000 | 8,50,000 |

| Investment (Long-term) | 1,00,000 | 40,000 |

| Land (At Cost) | 1,00,000 | 2,00,000 |

Additional Information:

1. Depreciation charged on Plant and Machinery ₹ 50,000.

2. Plant and Machinery with a Book Value of ₹ 60,000 was sold for ₹ 40,000.

3. Land was sold at a profit of ₹ 60,000.

4. No investment was sold during the year.

ANSWER:

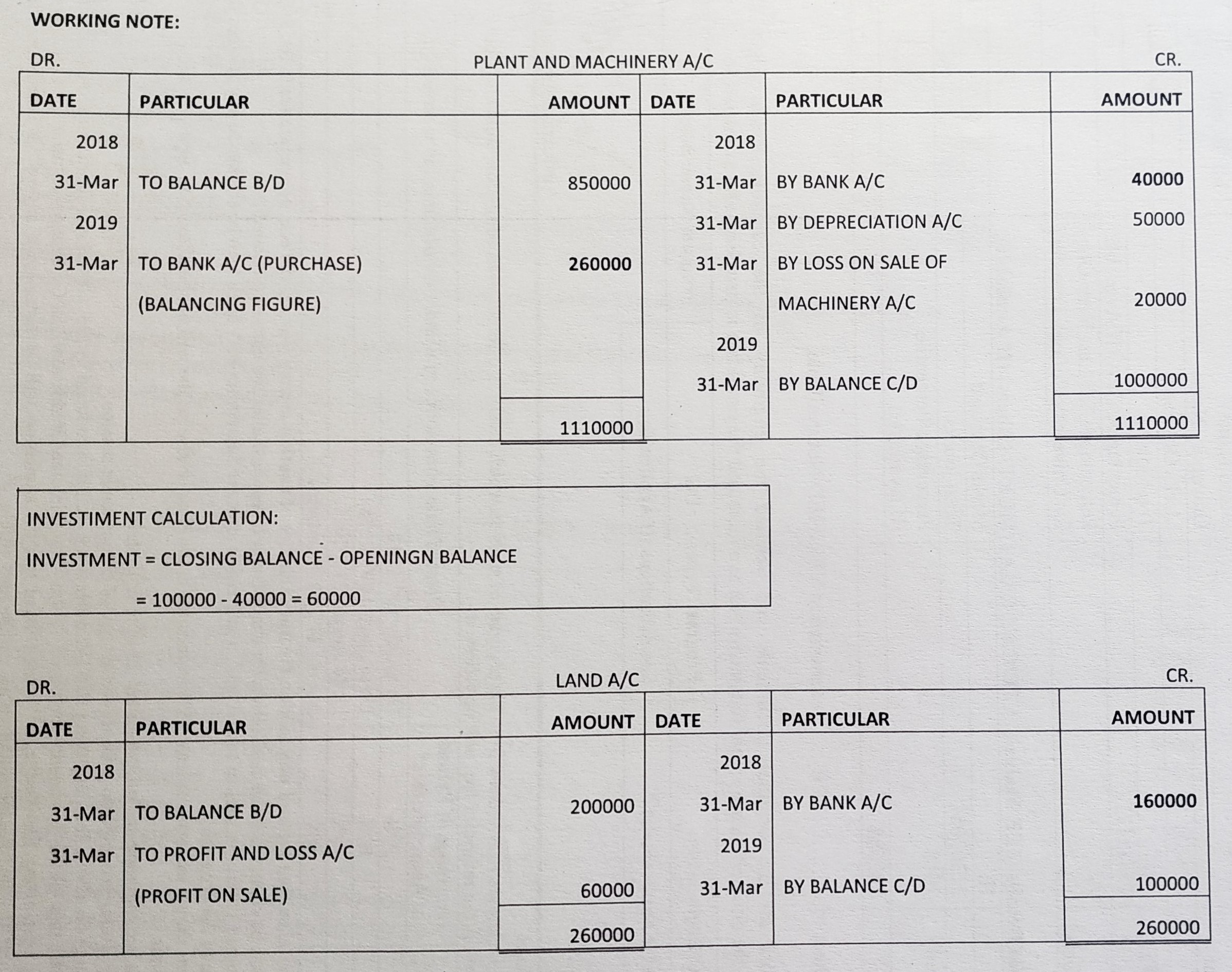

Question 28:

From the following extracts of a company, calculate Cash Flow from Investing Activities:

| Particular | 31st March,2019(₹) | 31st March,2018(₹) |

| Goodwill | 75,000 | 1,00,000 |

| Patents | 1,00,000 | 75,000 |

| Land | 90,000 | 1,00,000 |

| Furniture | 2,46,000 | 21,000 |

| Plant and Machinery (Net) | 2,00,000 | 2,00,000 |

| 10% Investments | 1,80,000 | 2,00,000 |

| Accrued Interest on Investments | 6,000 | … |

ANSWER:

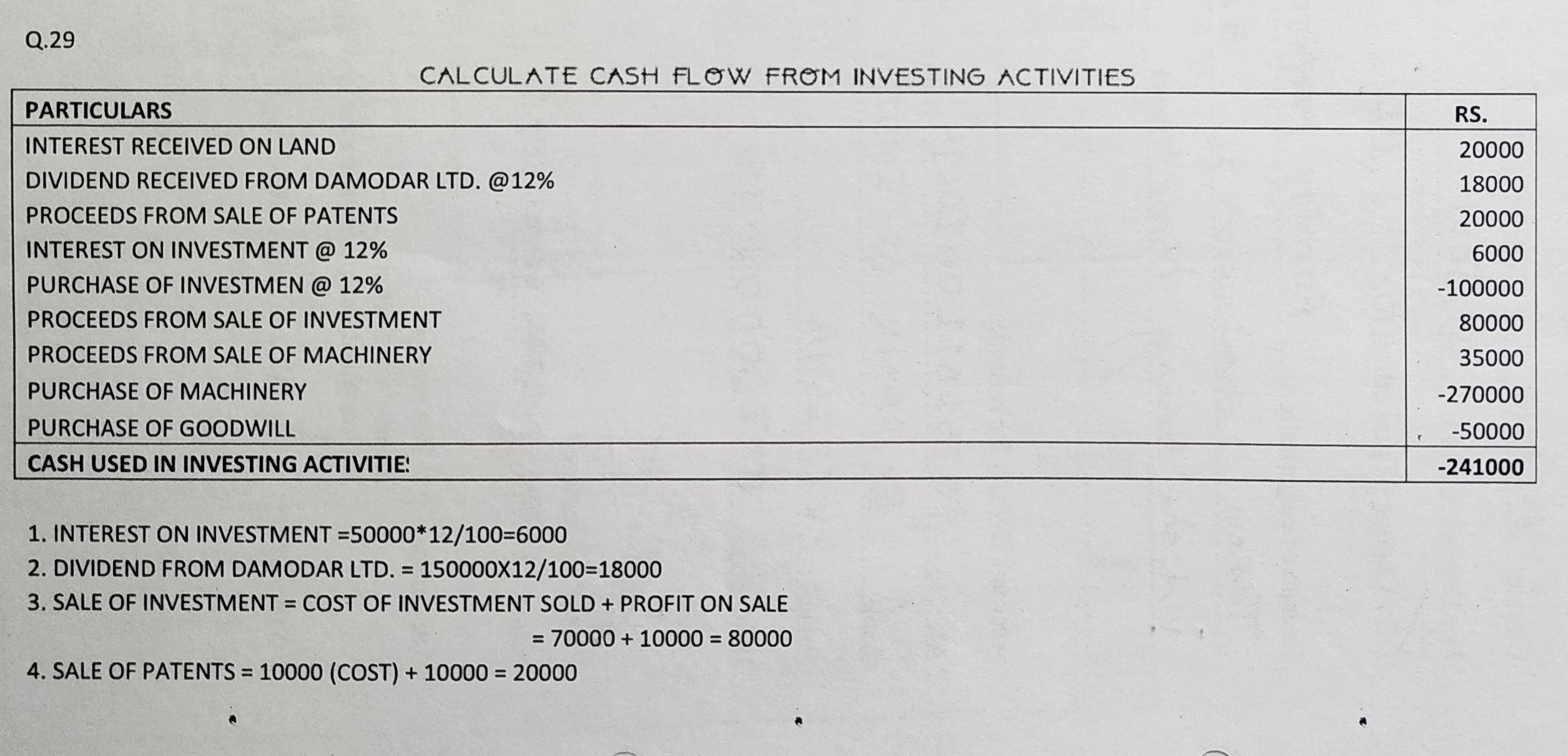

Question 29:

Calculate Cash Flow from Investing Activities from the following information:

| Particular | 31st March, 2019(₹) | 31st March, 2018(₹) |

| Investment in Land | 3,00,000 | 3,00,000 |

| Shares in Damodar Ltd. | 1,50,000 | 1,50,000 |

| 12% Long-term Investments | 80,000 | 50,000 |

| Plant and Machinery | 7,50,000 | 6,00,000 |

| Patents | 70,000 | 1,00,000 |

| Goodwill | 1,50,000 | 1,00,000 |

Additional Information:

1. A piece of land was purchased as an investment out of surplus. It was let out for commercial purpose and the rent received was ₹ 20,000.

2. Dividend received from Damodar Ltd. @ 12%.

3. Patents written off to the extent of ₹ 20,000. Some patents were sold at a profit of ₹ 10,000.

4. A machine costing ₹ 80,000 (depreciation provided thereon ₹ 30,000) was sold for ₹ 35,000. Depreciation charged during the year was ₹ 70,000.

5. During the year 12% investments were purchased for ₹ 1,00,000 and some investments were sold at a profit of ₹ 10,000. Interest on investments for the year was duly received.

ANSWER:

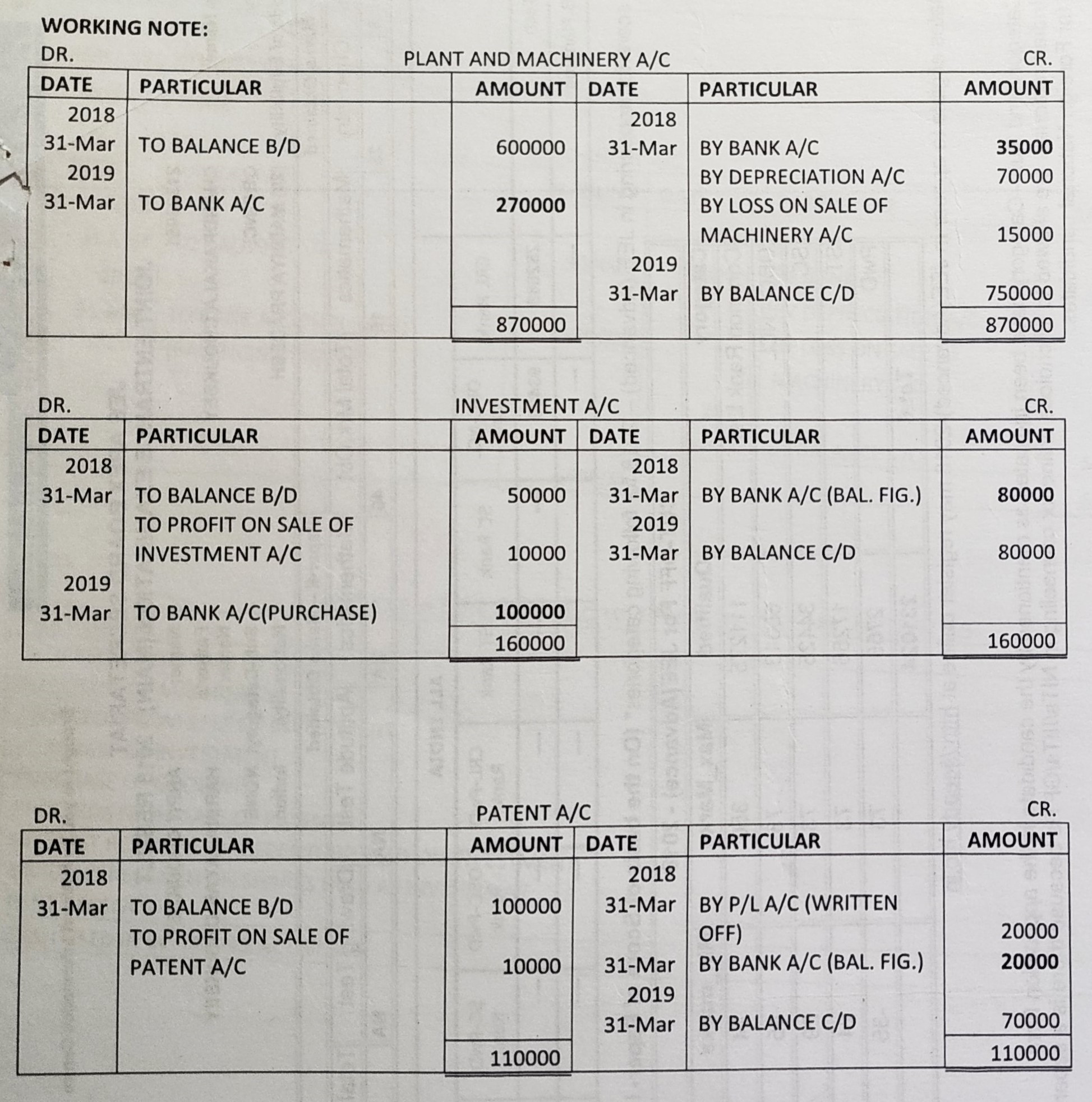

Question 30:

From the following information, calculate Cash Flow from Investing Activities:

| Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| Machinery (At cost) | 5,50,000 | 5,00,000 |

| Accumulated Depreciation | 1,70,000 | 1,00,000 |

During the year, a machinery costing ₹ 50,000 (accumulated depreciation provided thereon ₹ 20,000) was sold for ₹ 26,000.

ANSWER:

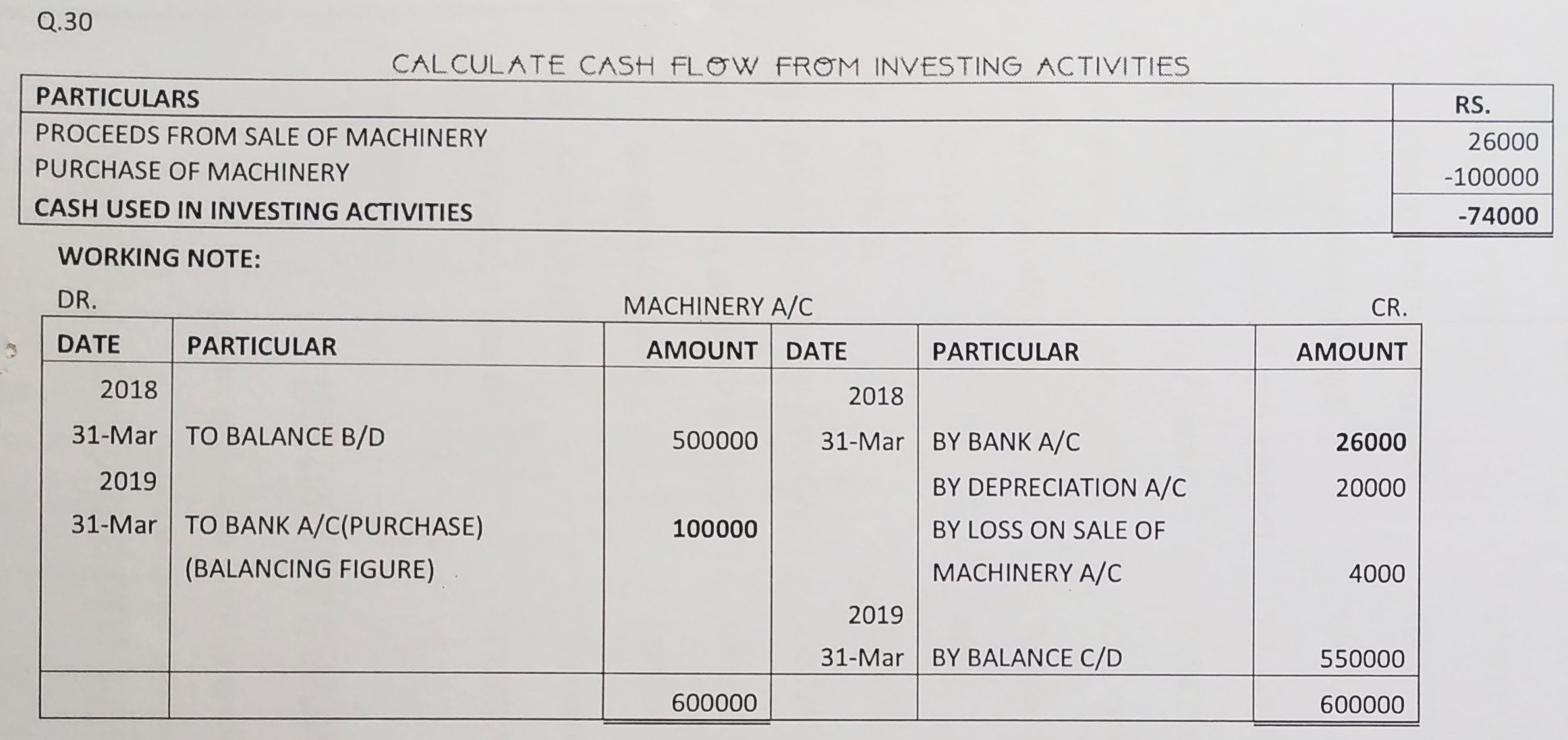

Question 31:

From the following particulars, calculate Cash Flow from Investing Activities

| Particulars | Purchased (₹) | Sold (₹) |

| Machinery | 6,20,000 | 2,00,000 |

| Investments | 2,40,000 | 80,000 |

| Goodwill | 1,00,000 | … |

| Patents | … | 1,50,000 |

Additional Information:

1. Interest received on debentures held as investment ₹ 8,000.

2. Interest paid on debentures issued ₹ 20,000.

3. Dividend received on shares held as investment ₹ 20,000.

4. Dividend paid on Equity Share Capital ₹ 30,000.

5. A plot of land was purchased out of the surplus funds for investment purposes and was let out for commercial use. Rent received ₹ 50,000 during the year.

ANSWER:

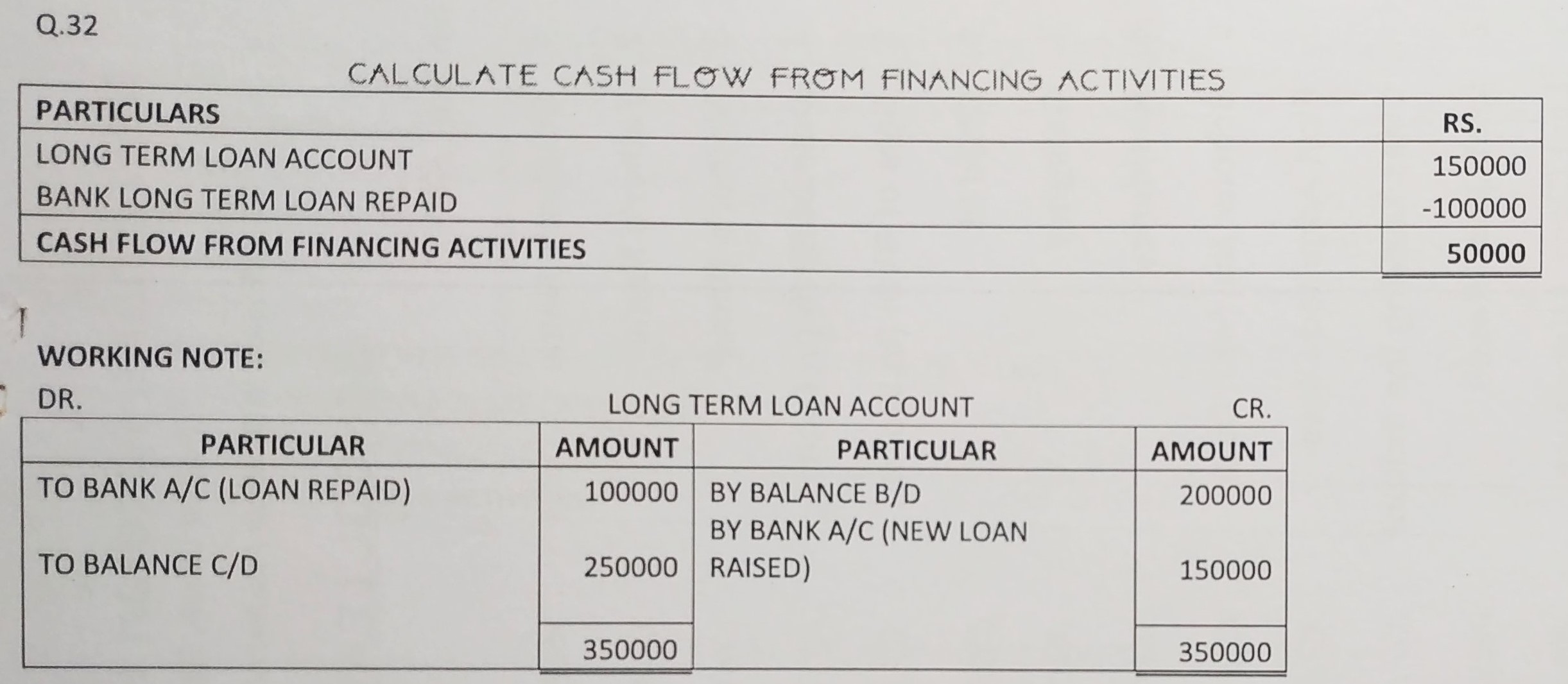

Question 32:

From the following information, calculate Cash Flow from Financing Activities:

| 1st April, 2018 (₹) | 31st March, 2019 (₹) | |

| Long-term Loan | 2,00,000 | 2,50,000 |

During the year, the company repaid a loan of ₹1,00,000.

ANSWER:

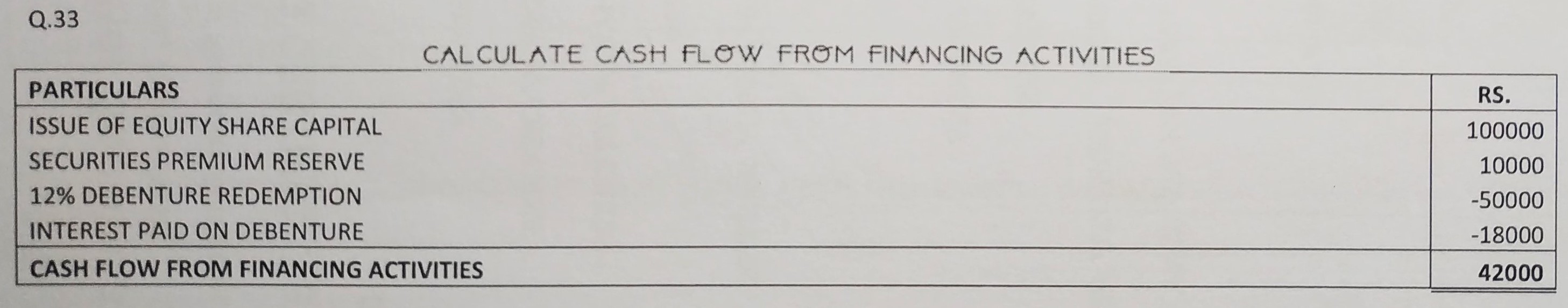

Question 33:

From the following information, calculate Cash Flow from Financing Activities:

| Particulars | 31st March, 2019(₹) | 31st March, 2018(₹) |

| Equity Share Capital | 10,00,000 | 9,00,000 |

| Securities Premium Reserve | 2,60,000 | 2,50,000 |

| 12% Debentures | 1,00,000 | 1,50,000 |

Additional Information: Interest paid on debentures ₹ 18,000.

ANSWER:

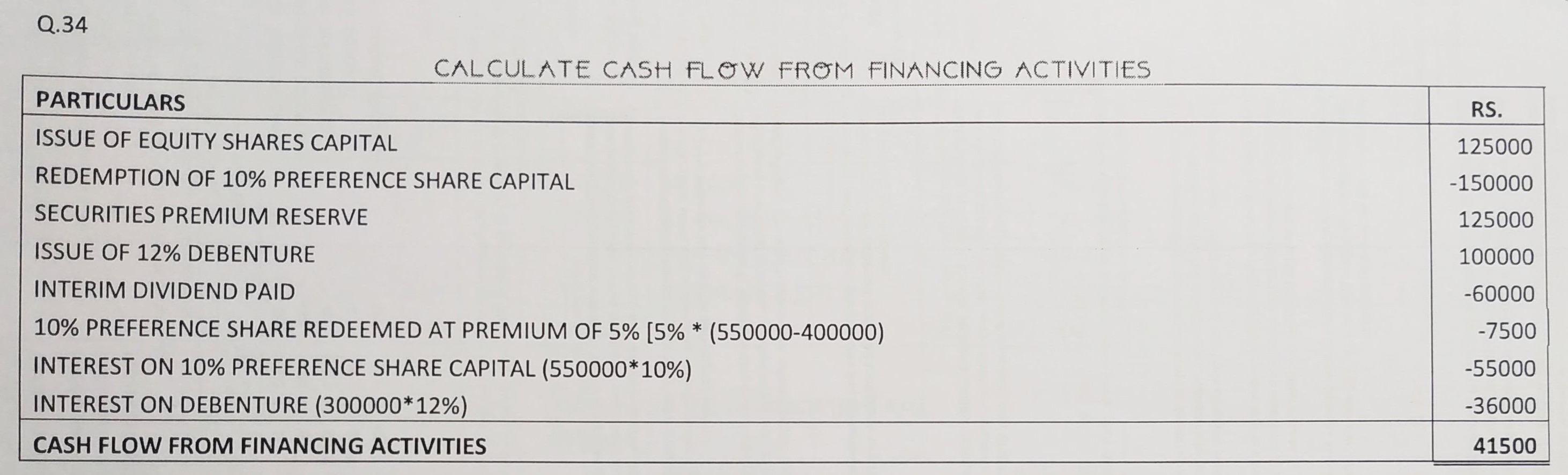

Question 34:

From the following extracts of Balance Sheet of Exe Ltd., calculate Cash Flow from Financing Activities:

| Particulars | 31st March,2019(₹) | 31st March,2018(₹) |

| Equity Share Capital | 5,25,000 | 4,00,000 |

| 10% Preference Share Capital | 4,00,000 | 5,50,000 |

| Securities Premium Reserve | 2,25,000 | 1,00,000 |

| 12% Debentures | 4,00,000 | 3,00,000 |

Additional Information:

1. Equity Shares were issued on 31st March, 2019.

2. Interim dividend on Equity Shares was paid @ 15%.

3. Preference Shares were redeemed on 31st March, 2019 at a premium of 5%. Premium paid was debited to Statement of Profit and Loss.

4. 12% Debentures of face value ₹ 1,00,000 were issued on 31st March, 2019.

ANSWER:

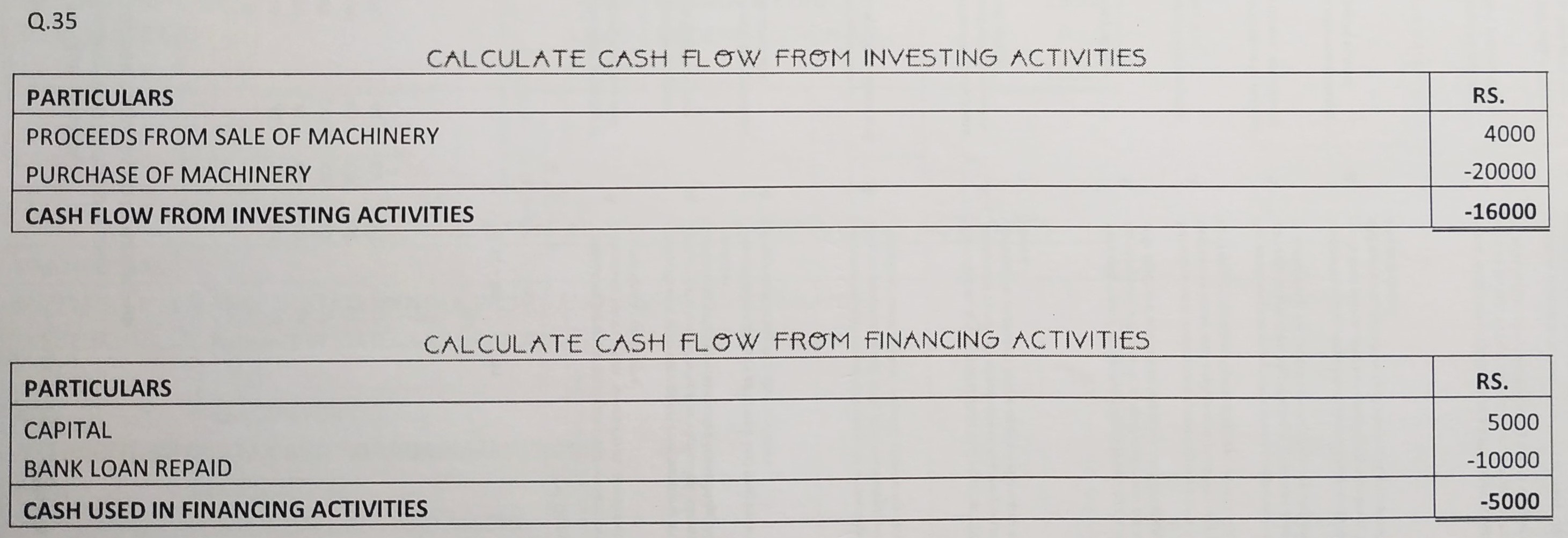

Question 35:

From the following information, calculate Cash Flow from Investing and Financing Activities:

| Particulars | 31stMarch2019(₹) | 31stMarch2018(₹) |

| Machinery (At cost) | 50,000 | 40,000 |

| Accumulated Depreciation | 12,000 | 10,000 |

| Capital | 35,000 | 30,000 |

| Bank Loan | … | 10,000 |

During the year, a machine costing ₹ 10,000 was sold at a loss of ₹ 2,000. Depreciation on machinery charged during the year amounted to ₹ 6,000.

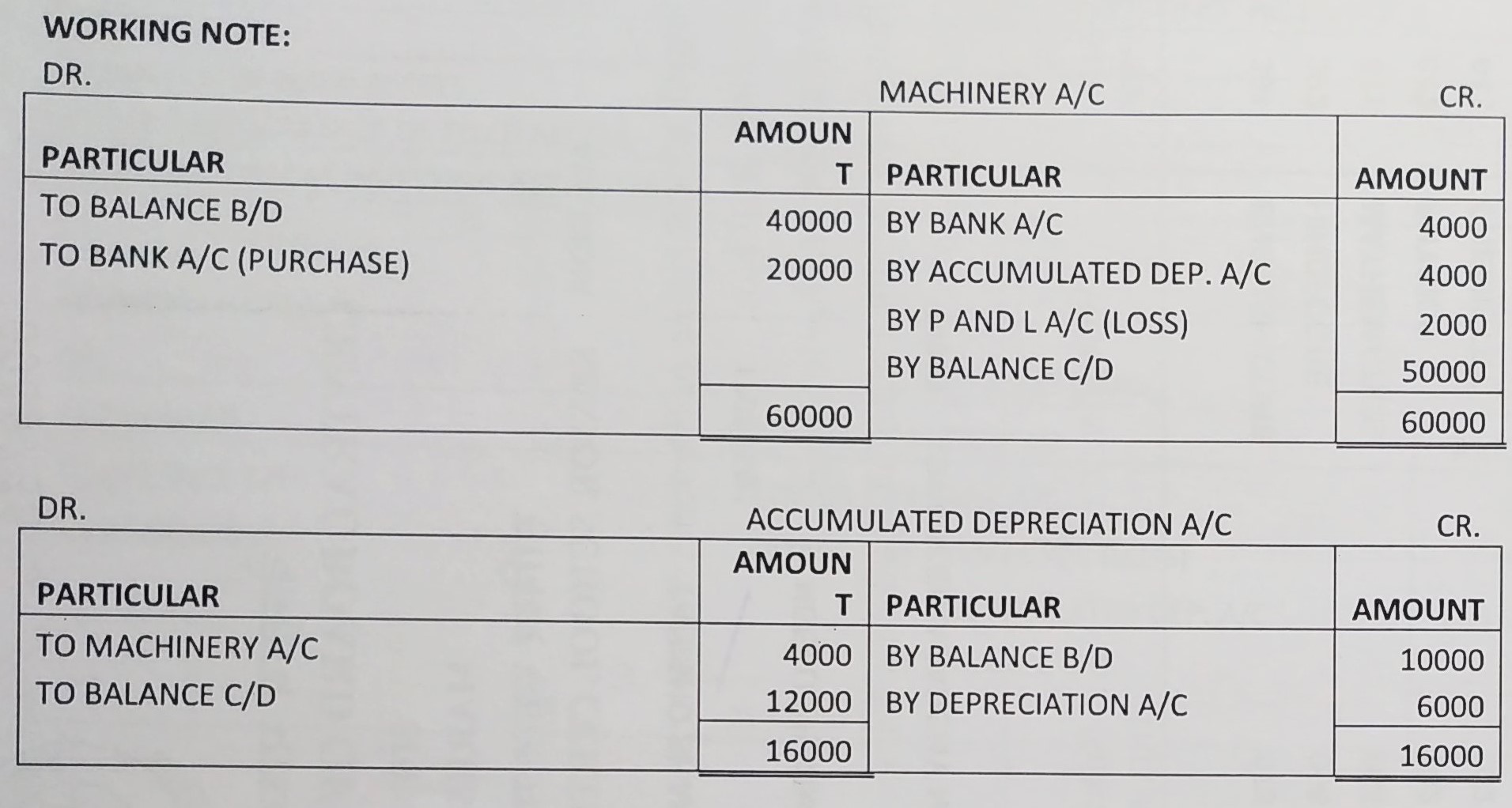

ANSWER:

Question 36:

From the following information, calculation Cash Flow from Operating Activities and Investing Activities:

| Particular | 31st, March,2018, (₹) | 31st, March,2019, (₹) |

| Surplus, i.e., Balance in Statement of Profit and Loss | 2,50,000 | 10,00,000 |

| Provision for Tax | 75,000 | 75,000 |

| Trade Payables | 1,00,000 | 3,75,000 |

| Current Assets (Trade Receivables and Inventories) | 11,50,000 | 13,00,000 |

| Fixed Assets (Tangible) | 21,25,000 | 23,30,000 |

| Accumulated Depreciation | 10,62,500 | 11,00,000 |

Additional Information:

1. A machine having book value of ₹ 1,00,000 (Depreciation provided thereon ₹ 1,62,500) was sold at a loss of ₹ 20,000.

2. Tax paid during the year ₹ 75,000.

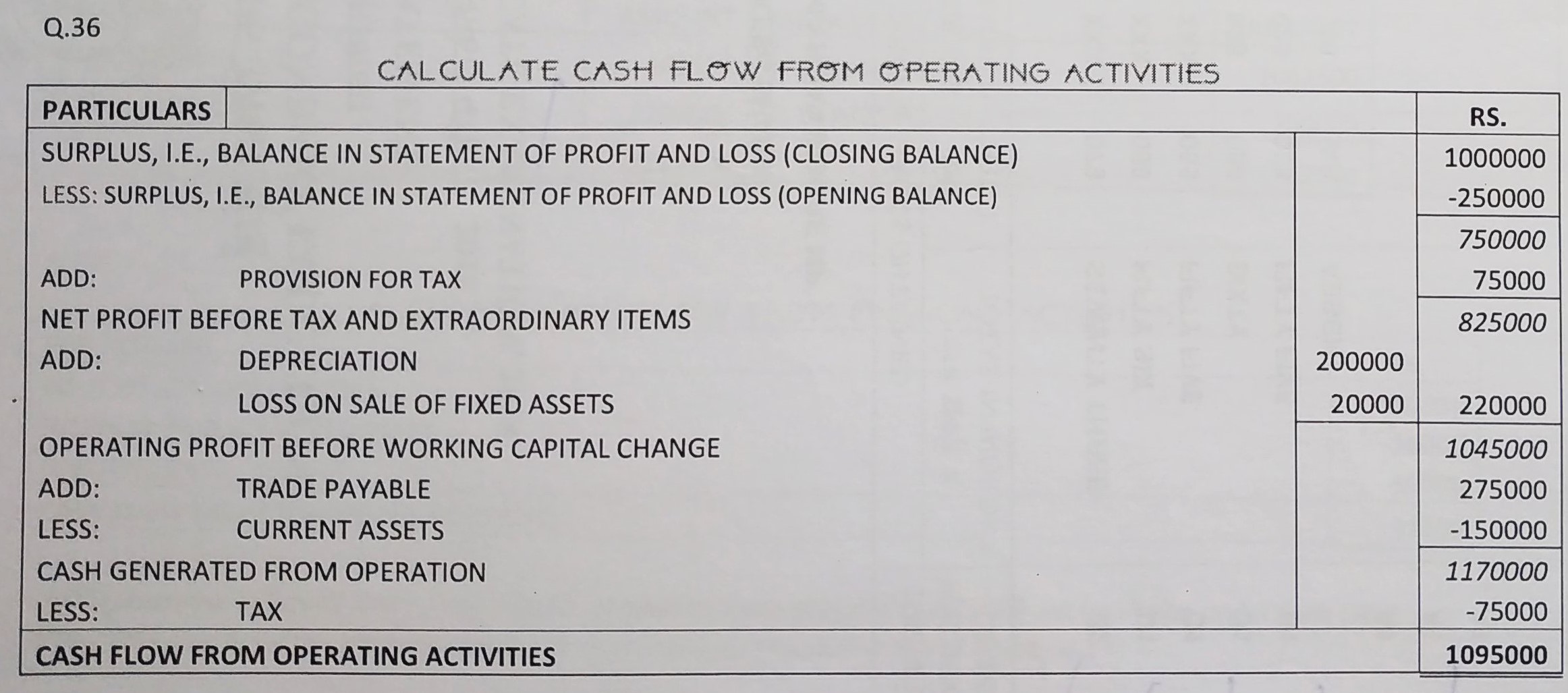

ANSWER:

Question 37:

XYZ. Ltd. provided the following information, calculate Net Cash Flow from Financing Activities:

| Particular | 31st March,2019 (₹) | 31st March,2018 (₹) |

| Equity Share Capital | 12,00,000 | 10,00,000 |

| 12% Debentures | 2,00,000 | 1,00,000 |

Additional Information:

1. Interest paid on debentures ₹ 19,000.

2. Dividend paid in the year ₹ 50,000.

3. During the year, XYZ Ltd. issued bonus shares in the ratio of 5 : 1 by captialising reserve.

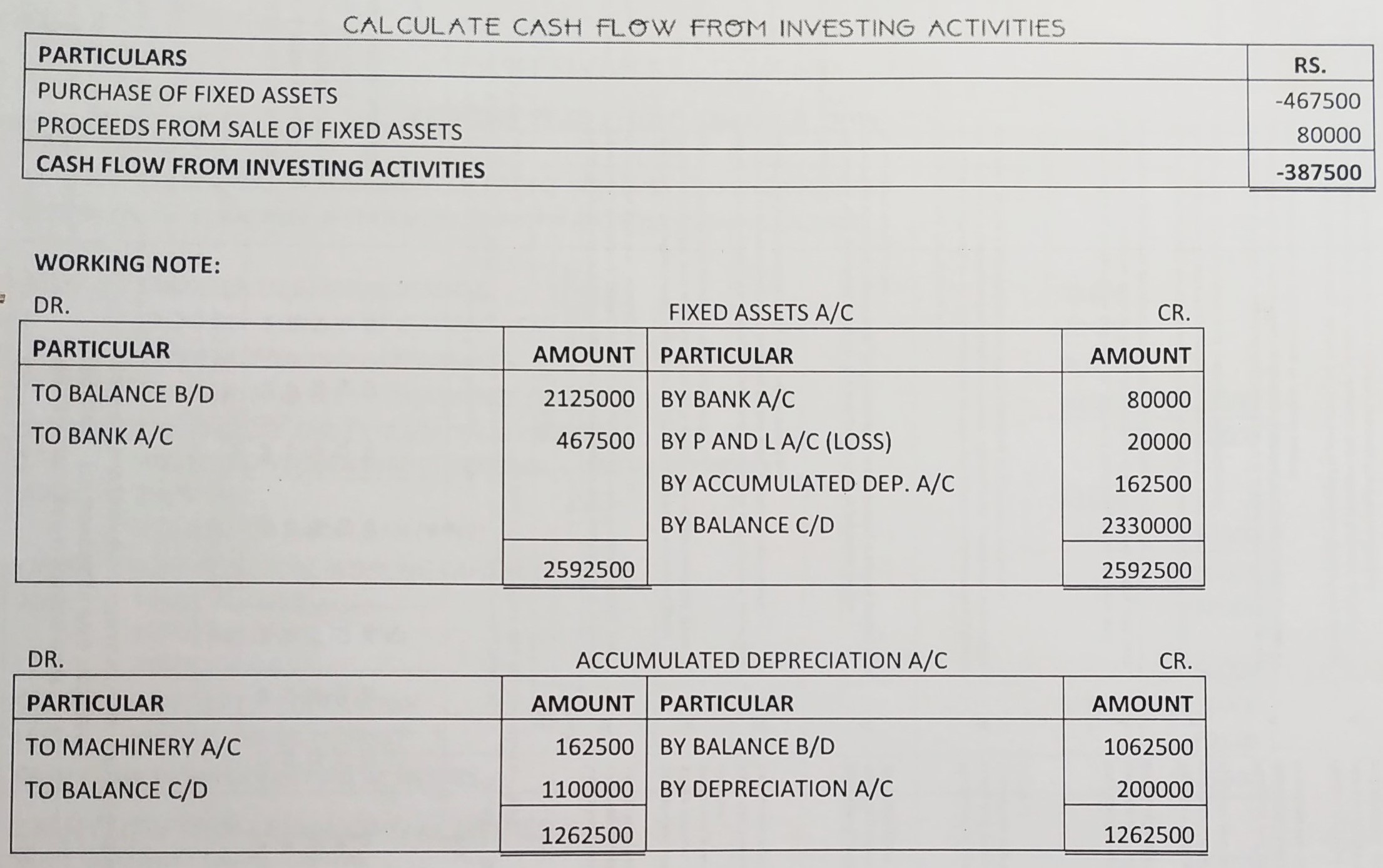

ANSWER:

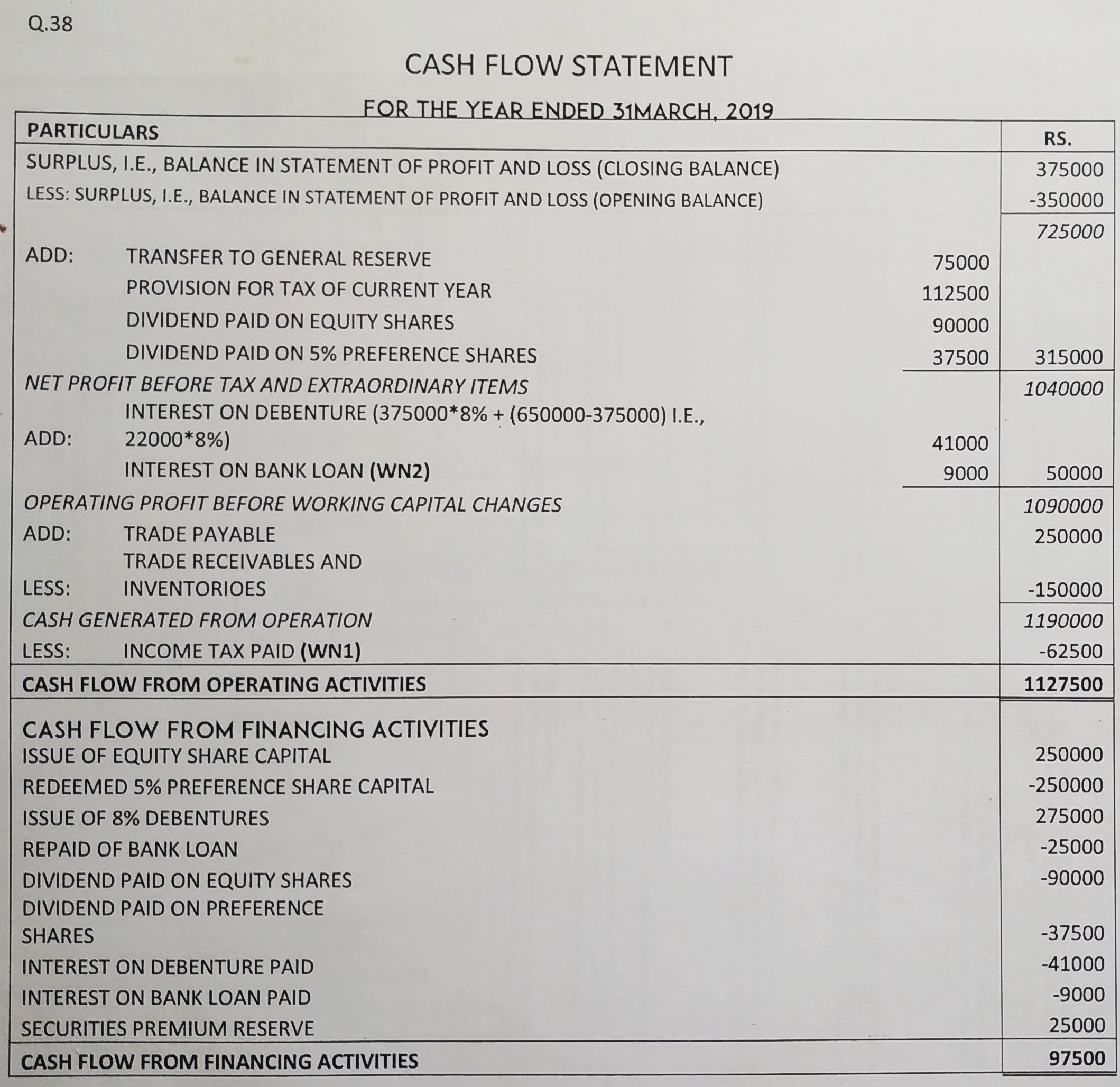

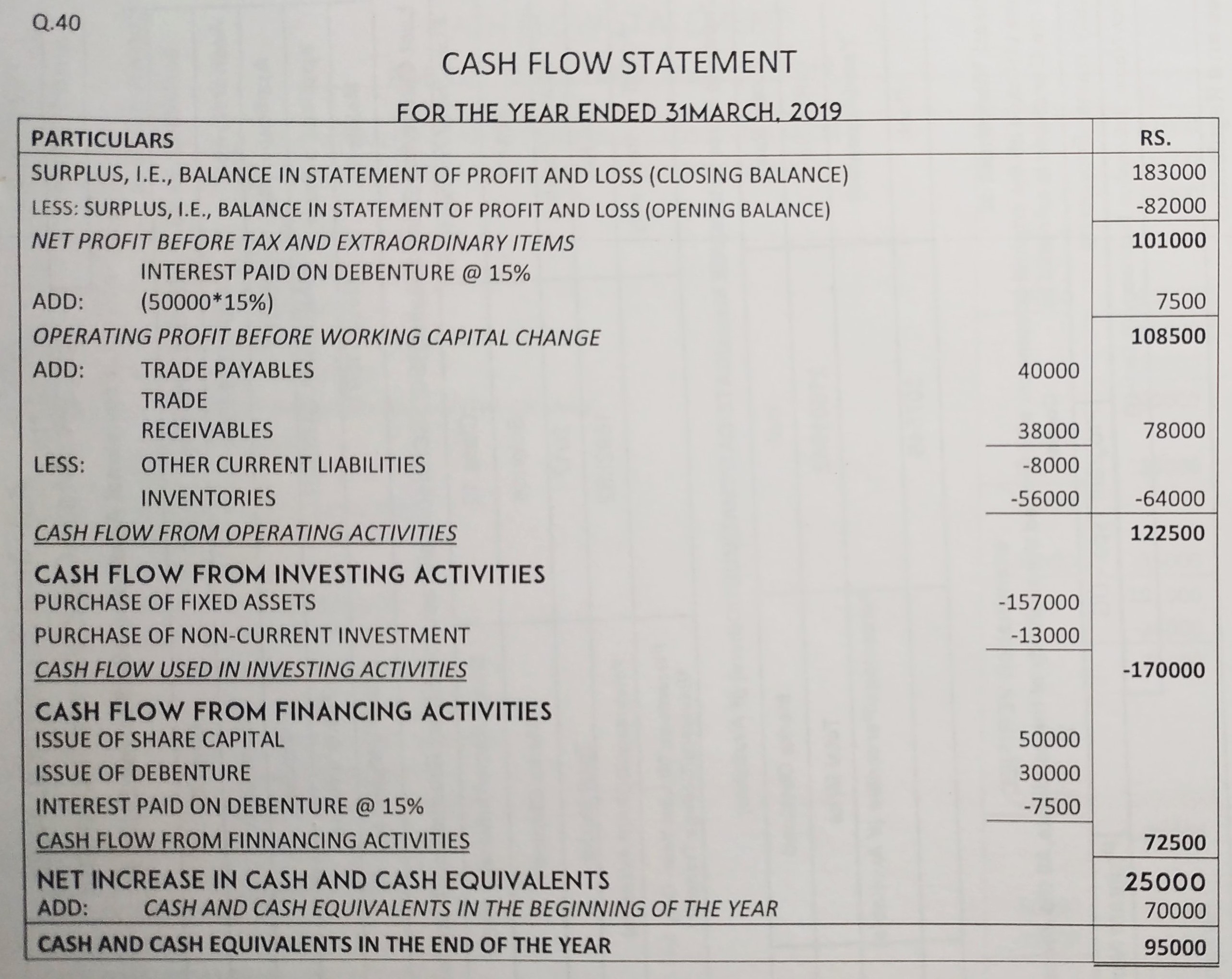

Question 38:

From the following information, calculate Net Cash Flow from Operating Activities and Financing Activities:

| Particular | 31stMarch2019(₹) | 31stMarch2018(₹) |

| Equity Share Capital | 13,75,000 | 11,25,000 |

| 5% Preference Share Capital | 5,00,000 | 7,50,000 |

| General Reserve | 3,75,000 | 3,00,000 |

| Surplus i.e., Balance in Statement of Profit and Loss | 3,75,000 | (3,50,000) |

| Securities Premium Reserve | 25,000 | … |

| Provision for Tax | 1,00,000 | 50,000 |

| Non-current Liabilities (8% Debentures) | 6,50,000 | 3,75,000 |

| Short-term Borrowings (8% Bank Loan) | 1,00,000 | 1,25,000 |

| Trade Payables | 5,00,000 | 2,50,000 |

| Trade Receivables and Inventories | 13,00,000 | 11,50,000 |

Additional Information:

(i) During the year additional debentures were issued at par on 1st October and Bank Loan was repaid on the same date.

(ii) Dividend on Equity Shares @ 8% was paid on Opening Balance.

(iii) Income tax ₹ 1,12,500 has been provided during the year.

(iv) Preference shares were redeemed at par at the end of the year.

ANSWER:

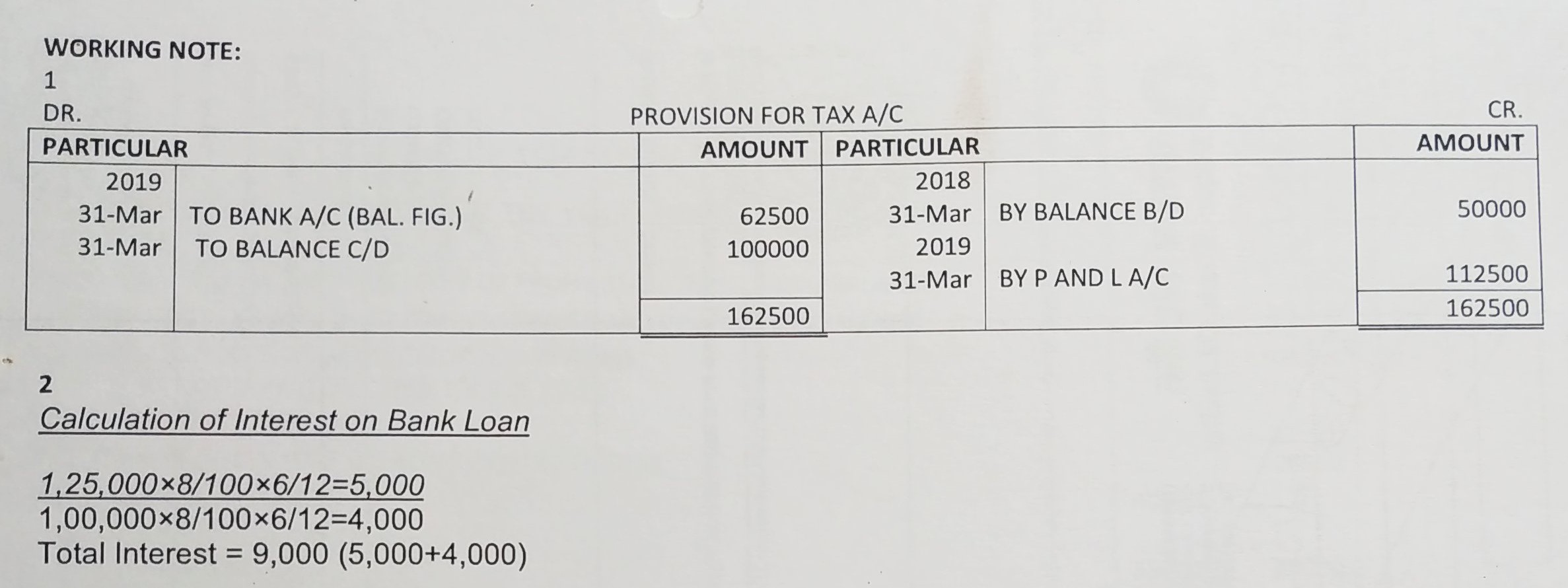

Question 39:

From the following information, prepare Cash Flow Statement:

| Particulars | (₹) |

| Opening Cash and Bank Balances | 1,50,000 |

| Closing Cash and Bank Balances | 1,70,000 |

| Decrease in Stock | 80,000 |

| Increase in Bills Payable | 1,20,000 |

| Sale of Fixed Assets | 3,00,000 |

| Repayment of Long-term Loan | 5,00,000 |

| Net Profit for the Year | 20,000 |

ANSWER:

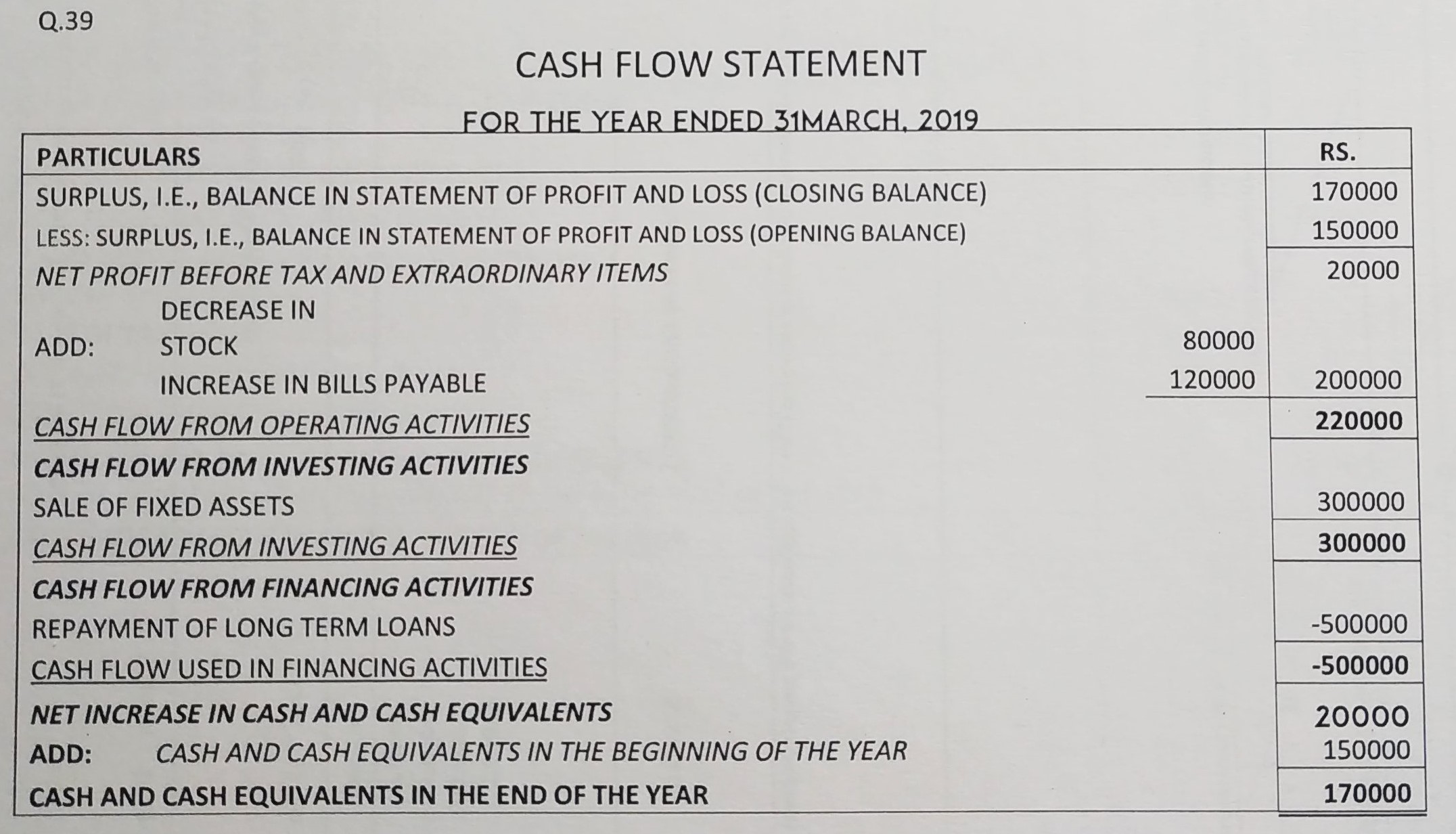

Question 40:

From the following Balance Sheet of Young India Ltd., prepare Cash Flow Statement:

Particular | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital |

| 2,50,000 | 2,00,000 |

(b) Reserves and Surplus: Surplus, i.e., Balance in Statement of Profit and Loss |

| 1,83,000 | 82,000 |

2. Non-Current Liabilities |

| ||

Long-term Borrowings: |

| ||

15% Debentures |

| 80,000 | 50,000 |

3. Current Liabilities |

| ||

(a) Trade Payables |

| 1,50,000 | 1,10,000 |

(b) Other Current Liabilities |

| 12,000 | 20,000 |

Total |

| 6,75,000 | 4,62,000 |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets (Tangible) |

| 2,74,000 | 1,17,000 |

(b) Non-Current Investments |

| 68,000 | 55,000 |

2. Current Assets |

| ||

(a) Inventories |

| 2,06,000 | 1,50,000 |

(b) Trade Receivables |

| 32,000 | 70,000 |

(c) Cash and Cash Equivalents |

| 95,000 | 70,000 |

Total |

| 6,75,000 | 4,62,000 |

ANSWER:

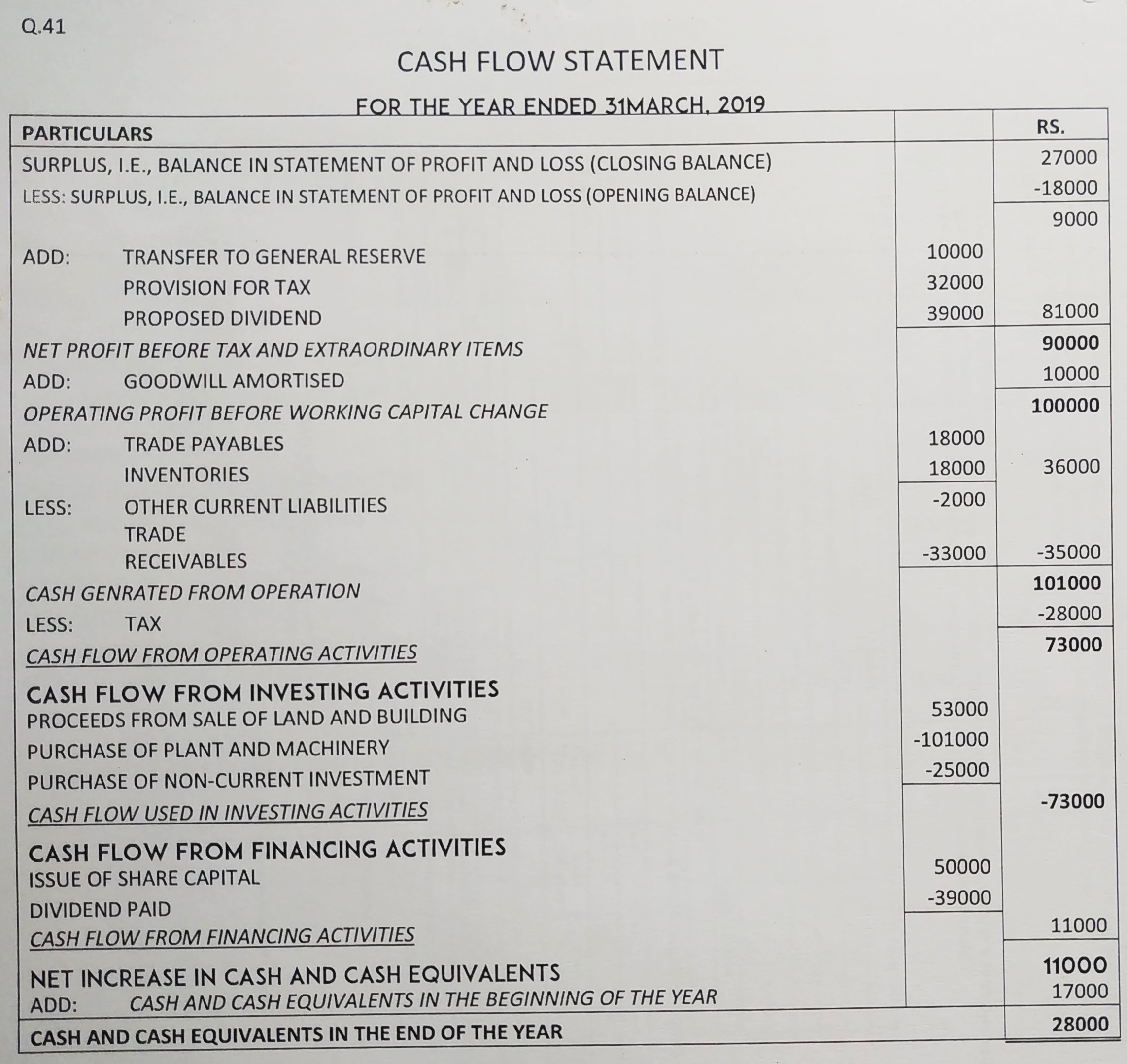

Question 41:

Following is the Balance Sheet of Fine Products Ltd.as at 31st March, 2019:

Particulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital: Equity Share Capital | 3,50,000 | 3,00,000 | |

(b) Reserves and Surplus | 1 | 57,000 | 38,000 |

2. Current Liabilities | |||

(a) Trade Payables | 53,000 | 35,000 | |

(b) Other Current Liabilities | 6,000 | 8,000 | |

(c) Short-term Provisions | 2 | 32,000 | 28,000 |

| Total | 4,98,000 | 4,09,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets: | |||

(i) Tangible Assets | 3 | 2,48,000 | 2,00,000 |

(ii) Intangible Assets (Goodwill) | 40,000 | 50,000 | |

(b) Non-Current Investments | 35,000 | 10,000 | |

2. Current Assets | |||

(a) Inventories | 39,000 | 57,000 | |

(b) Trade Receivables | 1,08,000 | 75,000 | |

(c) Cash and Bank Balance | 28,000 | 17,000 | |

| Total | 4,98,000 | 4,09,000 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| 1. Reserves and Surplus | ||

General Reserve | 30,000 | 20,000 |

Surplus, i.e., Balance in Statement of Profit and Loss | 27,000 | 18,000 |

57,000 | 38,000 | |

| 2. Short-term Provisions | ||

Provision for Tax | 32,000 | 28,000 |

| 3. Tangible Fixed Assets | ||

Land and Building | 57,000 | 1,10,000 |

Plant and Machinery | 1,91,000 | 90,000 |

2,48,000 | 2,00,000 | |

Note: Proposed dividends on equity for the years ended 31st March, 2018 and 2019 are ₹ 39,000 and ₹ 45,000 respectively.

You are required to prepare Cash Flow Statement for the year ended 31st March, 2019.

ANSWER:

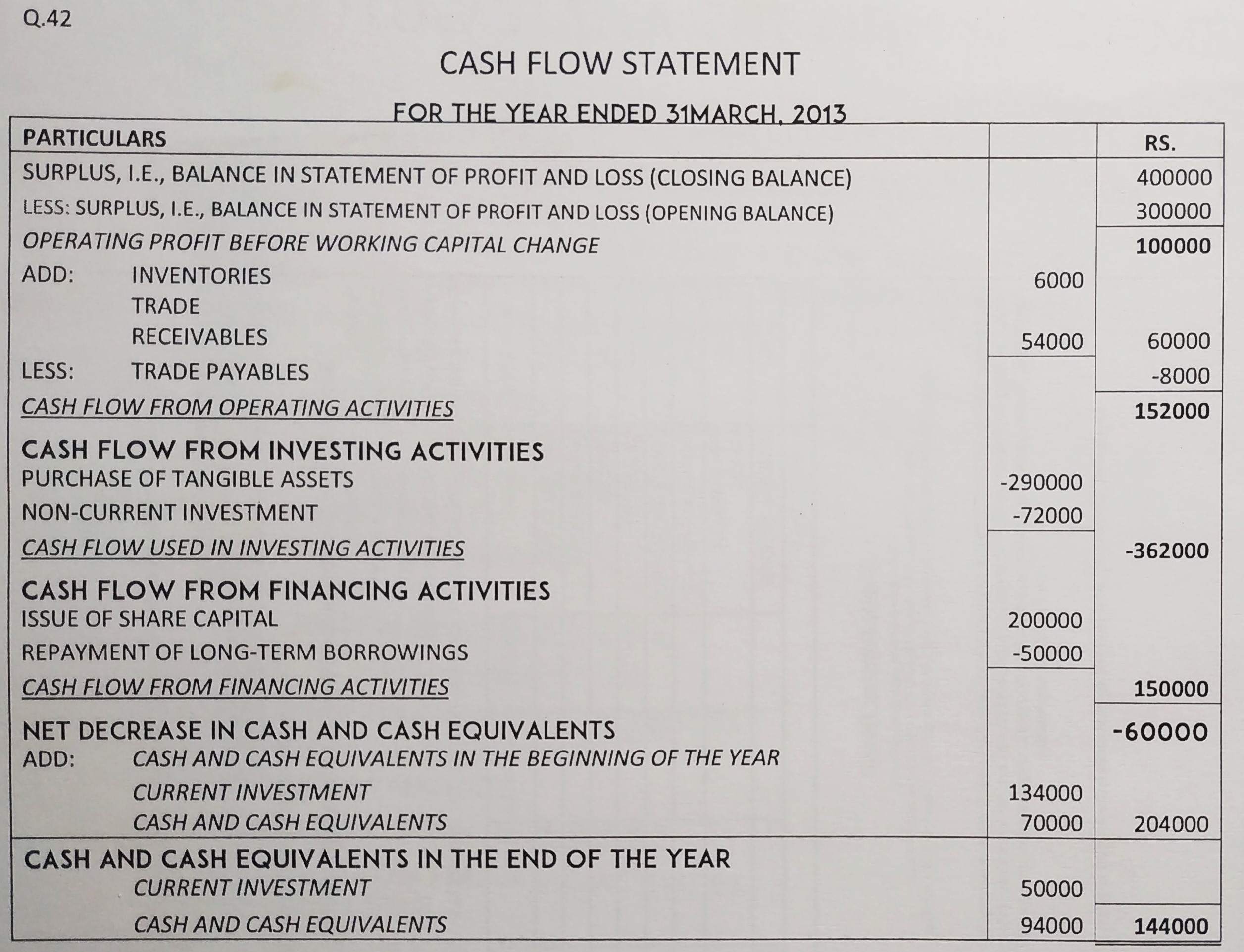

Question 42:

Prepare a Cash Flow Statement on the basis of the information given in the Balance Sheet of Libra Ltd. as at 31st March, 2013 and 31st March 2012:

Particulars | Note No. | 31st March, 2013 (₹) | 31st March, 2012 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 8,00,000 | 6,00,000 | |

(b) Reserves and Surplus | 1 | 4,00,000 | 3,00,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings | 1,00,000 | 1,50,000 | |

3. Current Liabilities | |||

(a) Trade Payables | 40,000 | 48,000 | |

Total | 13,40,000 | 10,98,000 | |

| II. ASSETS | |||

1, Non-Current Assets | |||

(a) Fixed Assets: | |||

Tangible Assets | 8,50,000 | 5,60,000 | |

(b) Non-Current Investments | 2,32,000 | 1,60,000 | |

2. Current Assets | |||

(a) Current Investments | 50,000 | 1,34,000 | |

(b) Inventories | 76,000 | 82,000 | |

(c) Trade Receivables | 38,000 | 92,000 | |

(d) Cash and Cash Equivalents | 94,000 | 70,000 | |

Total | 13,40,000 | 10,98,000 | |

Notes to Accounts

Particulars | 31st March, 2013 (₹) | 31st March, 2012 (₹) |

| I. Reserves and Surplus | ||

Surplus, i.e., Balance in Statement of Profit and Loss | 4,00,000 | 3,00,000 |

CASH FLOW STATEMENT WITH ADJUSTMENTS

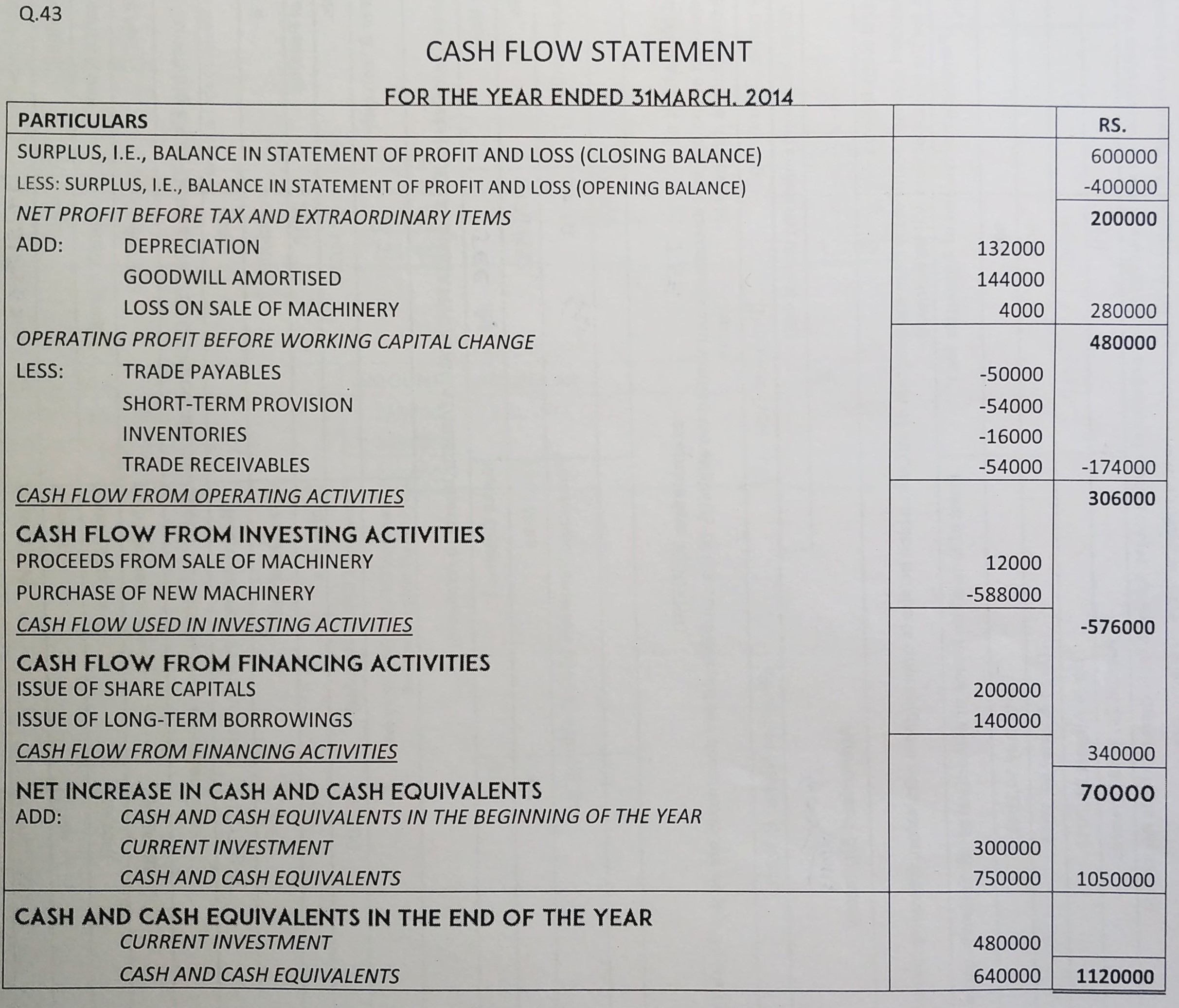

Question 43:

Following are the Balance Sheets of Solar Power Ltd. as at 31st March, 2014 and 2013:

| Solar Power Ltd. |

| BALANCE SHEET |

Particulars | Note No. | 31st March, 2014 (₹) | 31st March, 2013 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital |

| 24,00,000 | 22,00,000 |

(b) Reserves and Surplus | 1 | 6,00,000 | 4,00,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings | 4,80,000 | 3,40,000 | |

| 3. Current Liabilities | |||

(a) Trade Payables | 3,58,000 | 4,08,000 | |

(b) Short-term Provisions |

| 1,00,000 | 1,54,000 |

Total | 39,38,000 | 35,02,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

Fixed Assets: | |||

(i) Tangible Assets | 2 | 21,40,000 | 17,00,000 |

(ii) Intangible Assets | 3 | 80,000 | 2,24,000 |

2. Current Assets | |||

(a) Current Investments | 4,80,000 | 3,00,000 | |

(b) Inventories | 2,58,000 | 2,42,000 | |

(c) Trade Receivables | 3,40,000 | 2,86,000 | |

(d) Cash and Cash Equivalents | 6,40,000 | 7,50,000 | |

Total | 39,38,000 | 35,02,000 | |

Notes to Accounts

Particulars | 31st March, 2014 (₹) | 31st March, 2013 (₹) |

| 1. Revenue and Surplus Surplus, i.e., Balance in Statement of Profit and Loss | 6,00,000 | 4,00,000 |

| 2. Tangible Assets | ||

Machinery | 25,40,000 | 20,00,000 |

Less: Accumulated Deprciation | (4,00,000) | (3,00,000) |

| 21,40,000 | 17,00,000 | |

| 3. Intangible Assets | ||

Goodwill | 80,000 | 2,24,000 |

Additional Iformation:

Druing the year, a piece of machinery costing ₹48,000 on which accumulated deprciation was ₹ 32,000. was sold for ₹ 12,000.

Prepare Cash Flow Statement.

ANSWER:

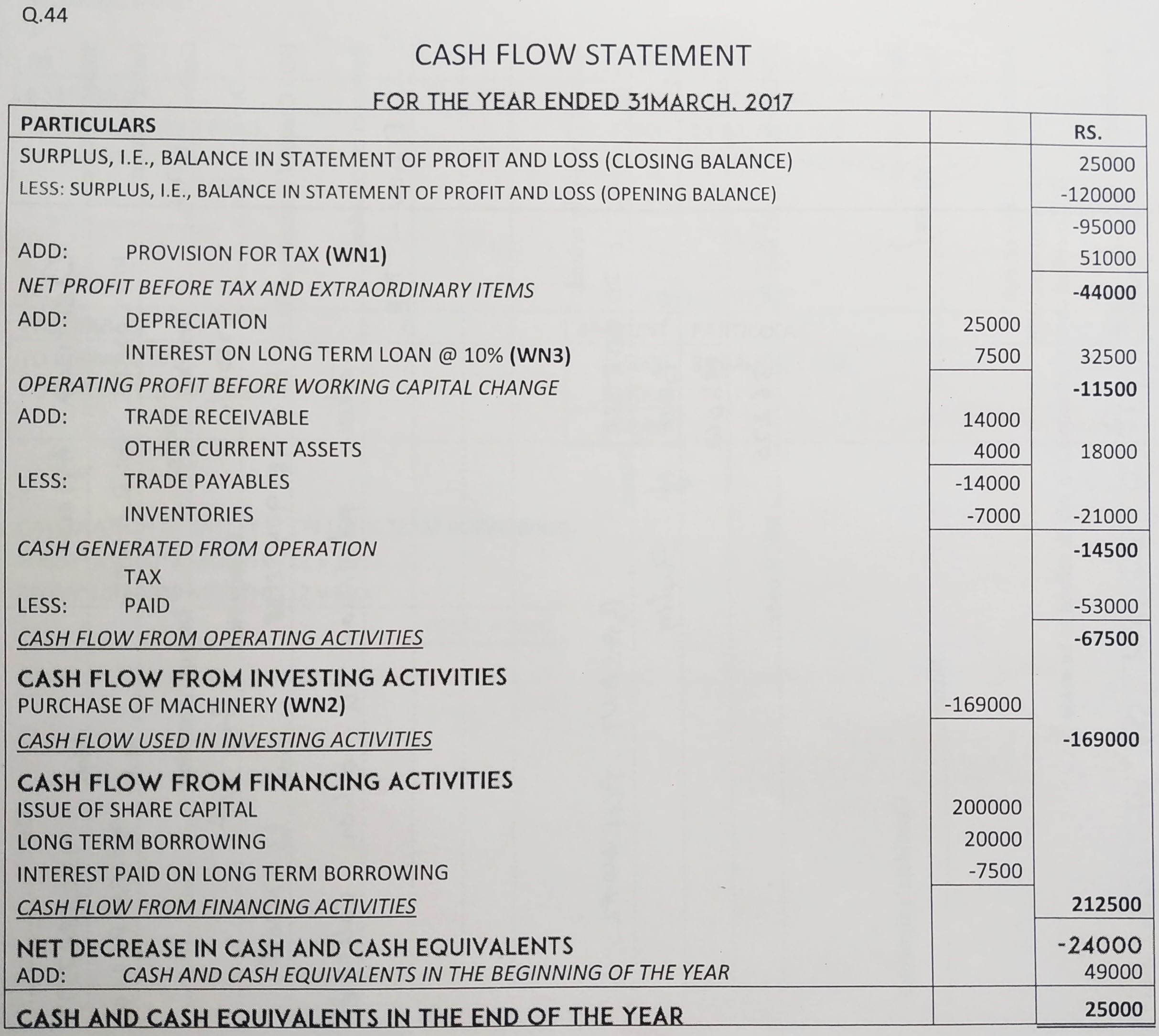

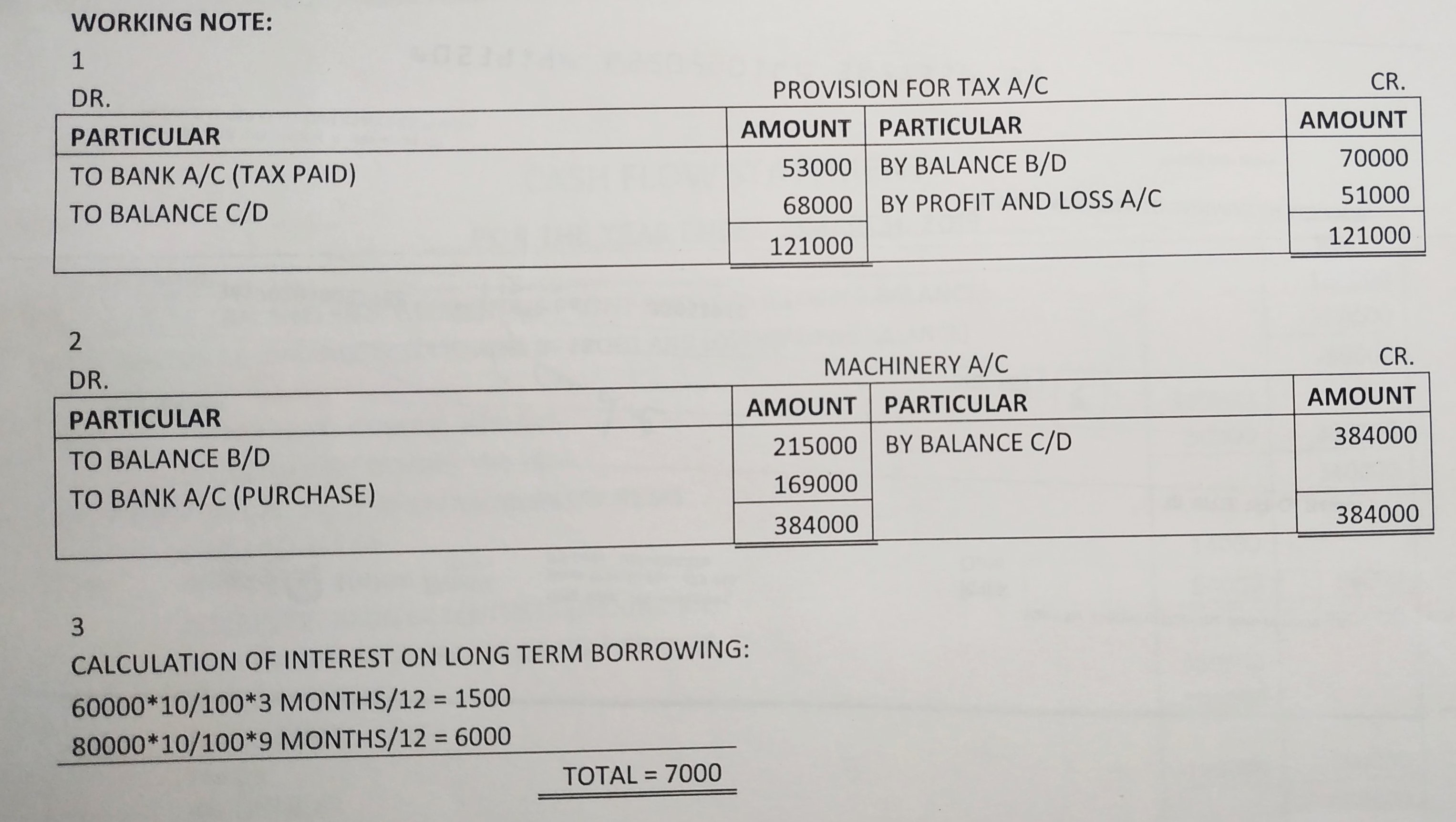

Question 44:

Following is the Balance Sheet of Mevanca Limitedas at 31st March, 2017:

Particulars | Note No. | 31st March, 2017 (₹) | 31st March, 2016 (₹) |

I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 3,00,000 | 1,00,000 | |

(b) Reserves and Surplus | 1 | 25,000 | 1,20,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings | 2 | 80,000 | 60,000 |

3. Current Liabilities | |||

(a) Trade Payables | 6,000 | 20,000 | |

(b) Short-term Provisions | 3 | 68,000 | 70,000 |

Total | 4,79,000 | 3,70,000 | |

II. ASSETS | |||

1. Non-Current Assets | |||

Fixed Assets | 4 | 3,36,000 | 1,92,000 |

2. Current Assets | |||

(a) Inventories | 67,000 | 60,000 | |

(b) Trade Receivables | 51,000 | 65,000 | |

(c) Cash and Cash Equivalents | 25,000 | 49,000 | |

(d) Other Current Assets | … | 4,000 | |

Total | 4,79,000 | 3,70,000 | |

Notes to Accounts

Particulars | 31st March, 2017 (₹) | 31st March, 2016 (₹) |

1. Reserves and Surplus | ||

Surplus, i.e., Balance in Statement of Profit and Loss | 25,000 | 1,20,000 |

25,000 | 1,20,000 | |

2. Long-term Borrowings | ||

10% Long-term Loan | 80,000 | 60,000 |

80,000 | 60,000 | |

3. Short-term Provisions | ||

Provision for Tax | 68,000 | 70,000 |

68,000 | 70,000 | |

4. Fixed Assets | ||

Machinery | 3,84,000 | 2,15,000 |

Accumulated Depreciation | (48,000) | (23,000) |

3,36,000 | 1,92,000 | |

Additional Information:

(i) Additional loan was taken on 1st July, 2016.

(ii) Tax of ₹ 53,000 was paid during the year.

Prepare Cash Flow Statement.

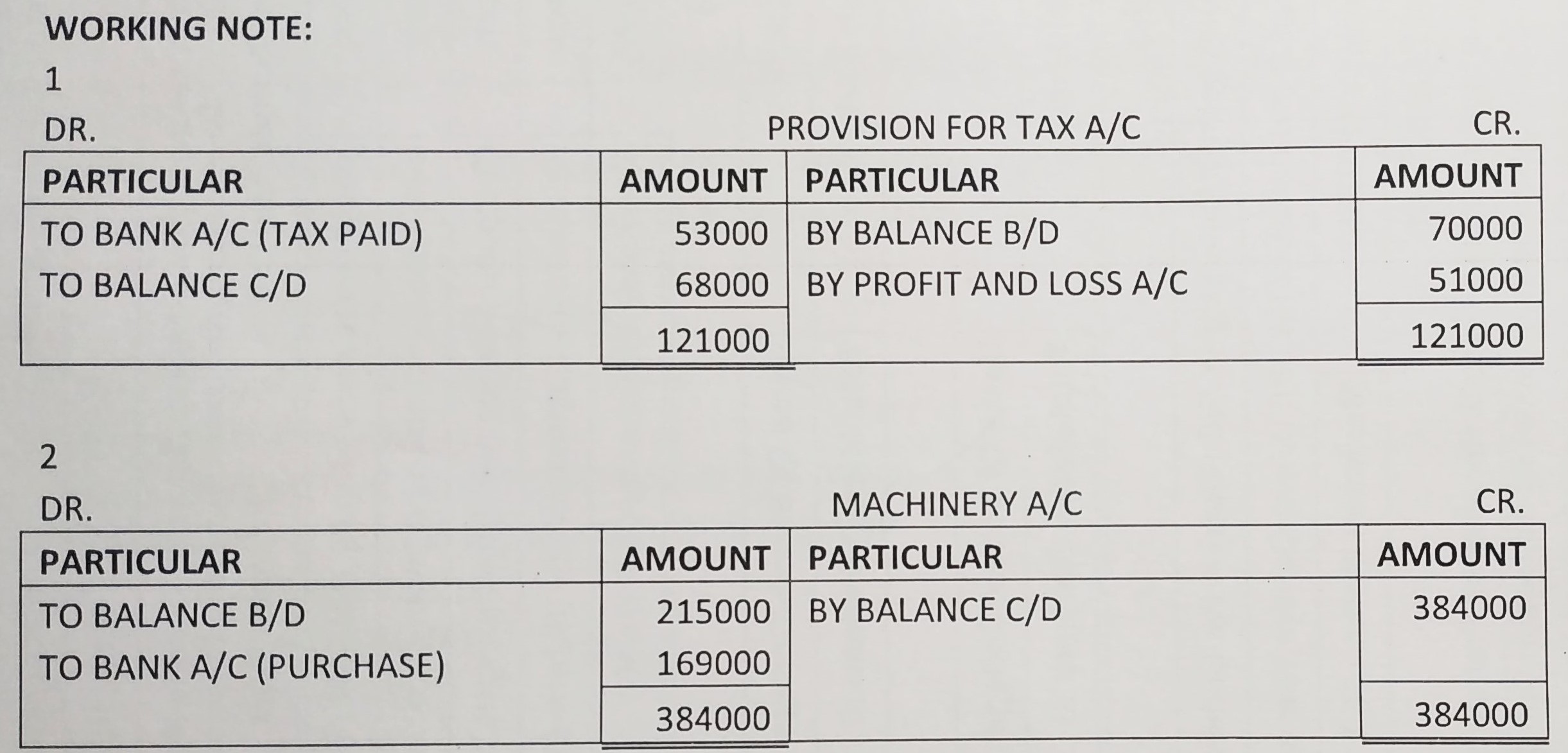

ANSWER:

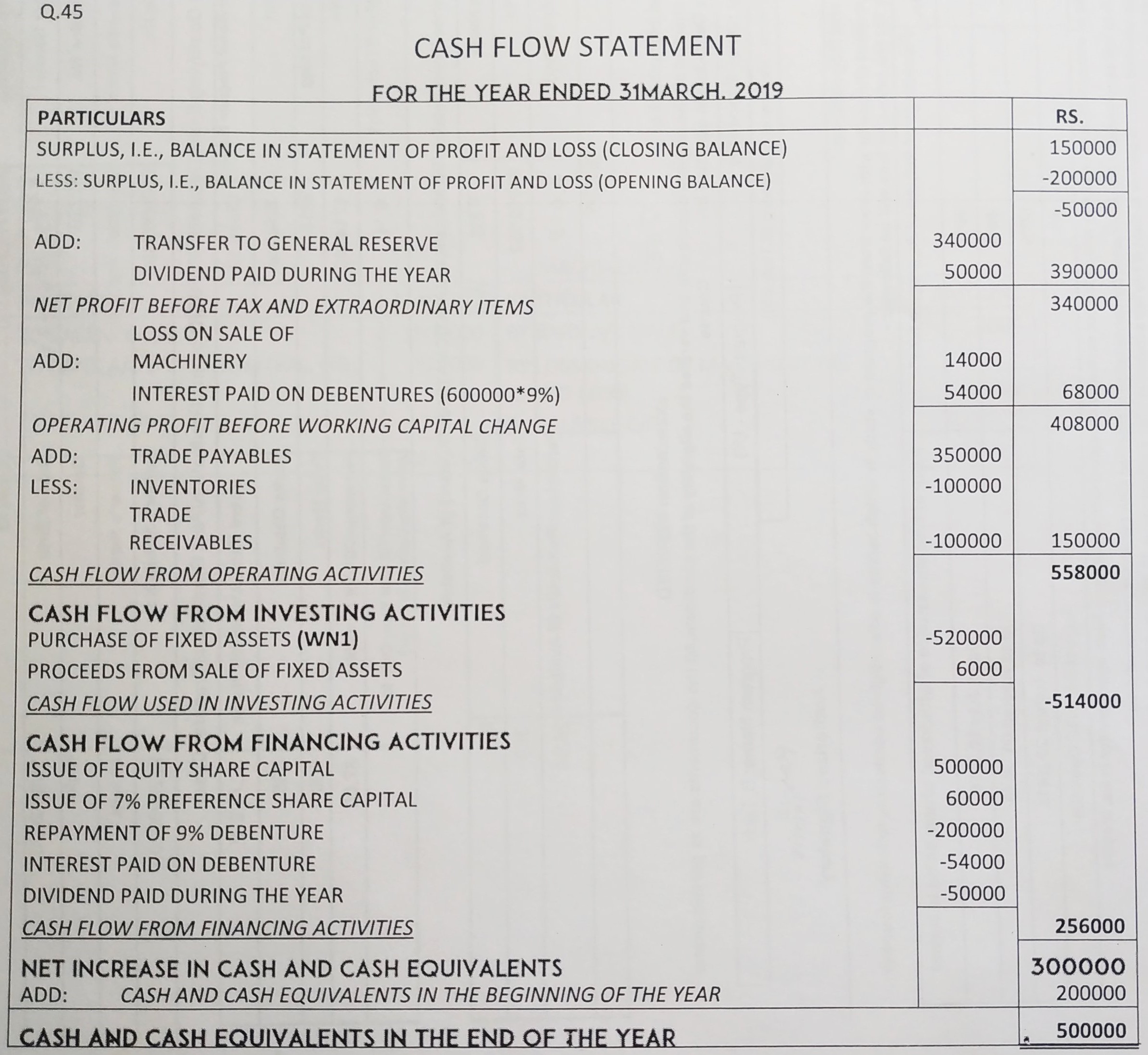

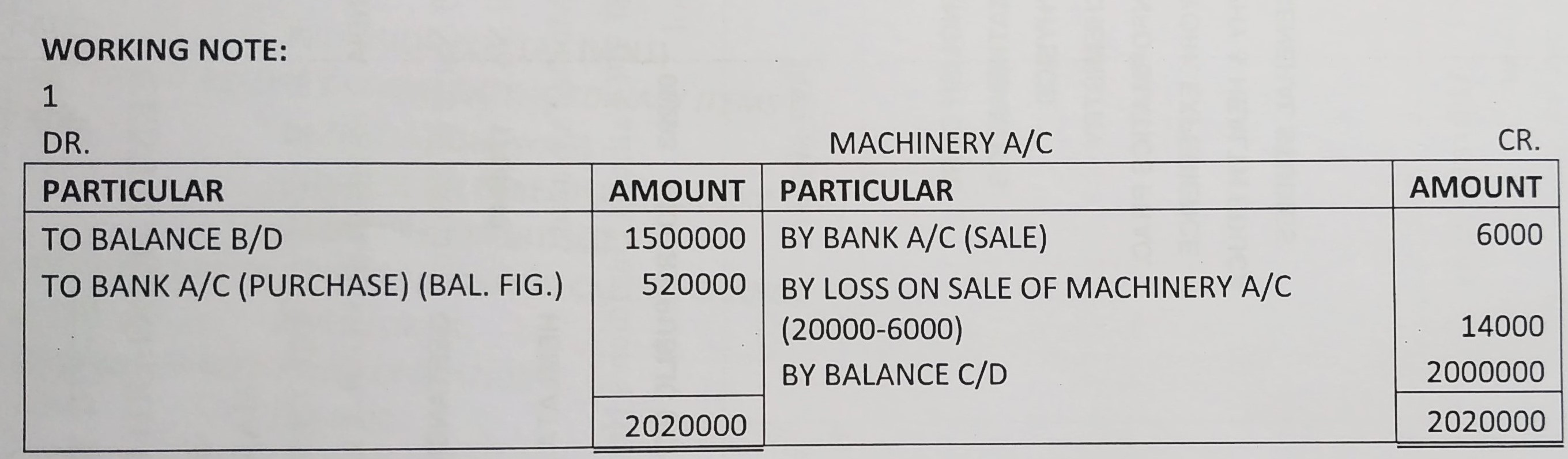

Question 45:

From the following Balance Sheet of Kumar Ltd. as at 31st March, 2019, prepare Cash Flow Statement:

Particulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 1 | 16,00,000 | 10,40,000 |

(b) Reserves and Surplus, | 2 | 5,50,000 | 2,60,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings: | |||

9% Debentures | 4,00,000 | 6,00,000 | |

3. Current Liabilities | |||

Trade Payables | 4,50,000 | 1,00,000 | |

Total | 30,00,000 | 20,00,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

Fixed Assets | 20,00,000 | 15,00,000 | |

2. Current Assets | |||

(a) Inventories | 3,00,000 | 2,00,000 | |

(b) Trade Receivables | 2,00,000 | 1,00,000 | |

(c) Cash and Cash Equivalents | 5,00,000 | 2,00,000 | |

Total | 30,00,000 | 20,00,000 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| 1. Share Capital | ||

Equity Share Capital | 15,00,000 | 10,00,000 |

7% Preference Share Capital | 1,00,000 | 40,000 |

| 16,00,000 | 10,40,000 | |

| 2. Reserves and Surplus | ||

General Reserve | 4,00,000 | 60,000 |

Surplus, i.e., Balance in Statement of Profit and Loss | 1,50,000 | 2,00,000 |

| 5,50,000 | 2,60,000 | |

Additional Information:

1. During a year, a machinery costing ₹ 20,000 was sold for ₹ 6,000.

2. Dividend paid during the year ₹ 50,000.

ANSWER:

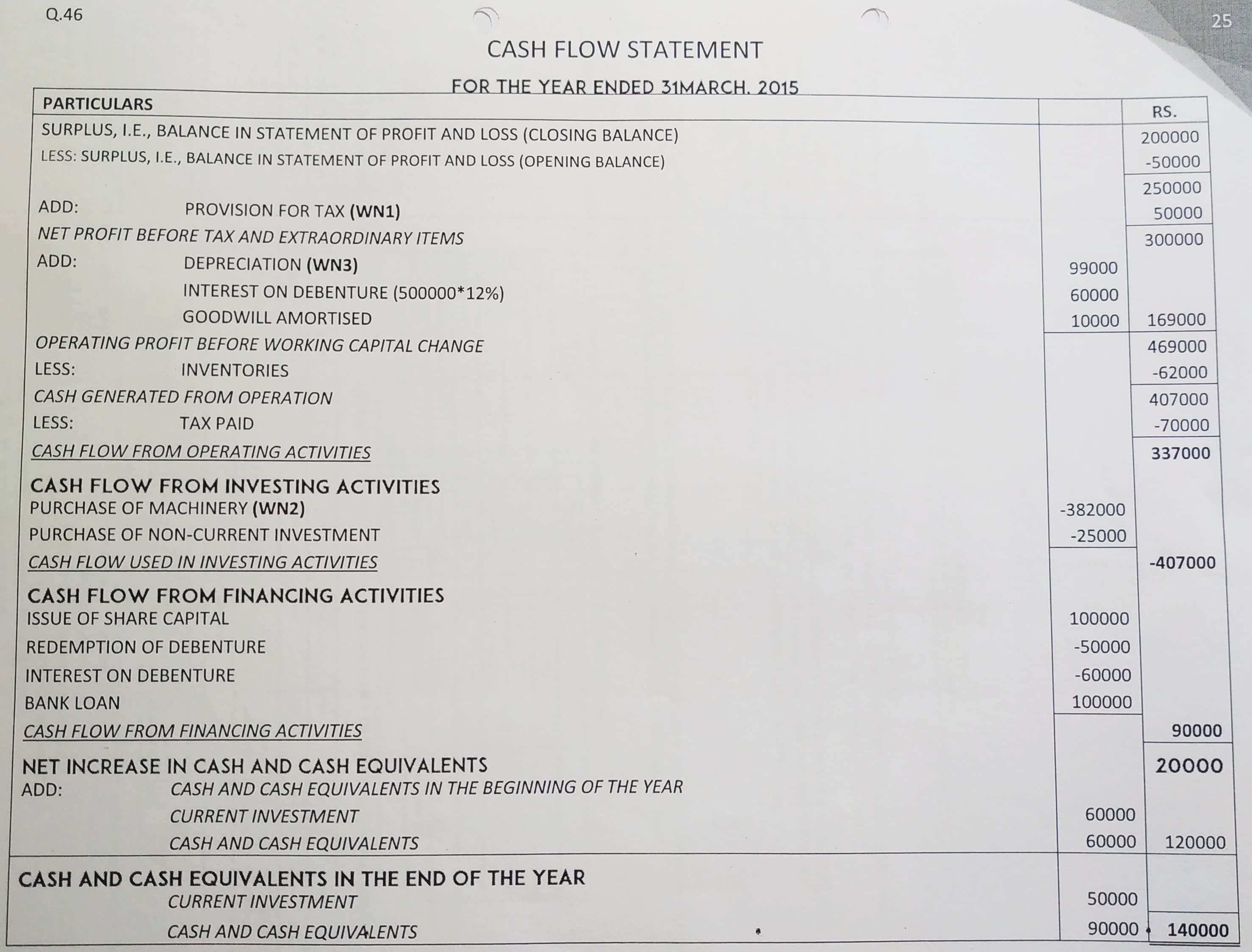

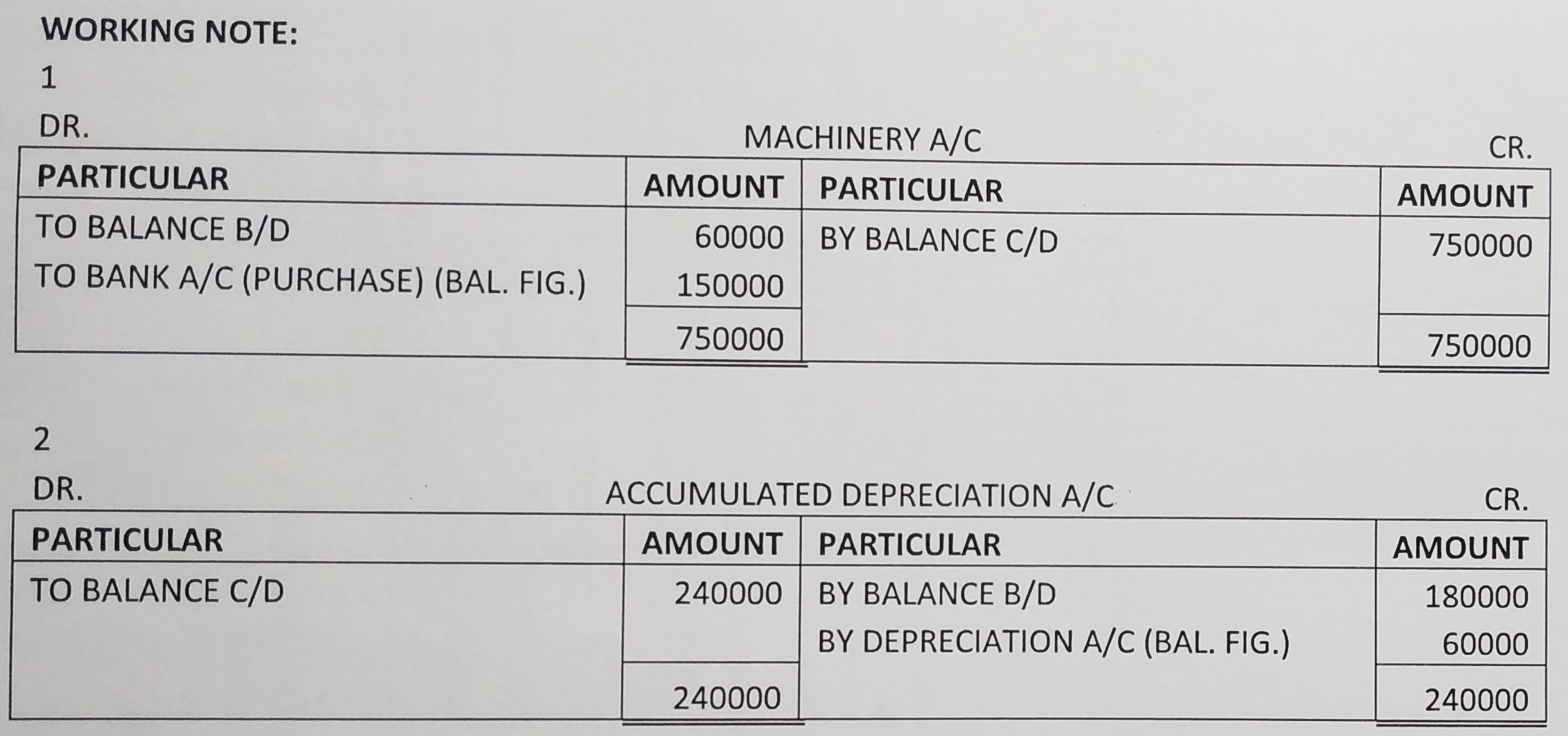

Question 46:

Following was the Balance Sheet of M.M. Ltd. as at 31st March, 2015:

| Particulars | Note No. | (₹) | (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 5,00,000 | 4,00,000 | |

(b) Reserves and Surplus | 1 | 2,00,000 | (50,000) |

2. Non-Current Liabilities | |||

Long-term Borrowings | 2 | 4,50,000 | 5,00,000 |

3. Current Liabilities | |||

(a) Short-term Borrowings | 3 | 1,50,000 | 50,000 |

(b) Short-term Provisions | 4 | 70,000 | 90,000 |

Total Total Expenses | 13,70,000 | 9,90,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets: | |||

(i) Tangible Assets | 5 | 10,03,000 | 7,20,000 |

(ii) Intangible Assets | 6 | 20,000 | 30,000 |

(b) Non-Current Investments | 1,00,000 | 75,000 | |

2. Current Assets | |||

(a) Current Investments | 50,000 | 60,000 | |

(b) Inventories | 7 | 1,07,000 | 45,000 |

(c) Cash and Cash Equivalents | 90,000 | 60,000 | |

Total | 13,70,000 | 9,90,000 | |

Notes to Accounts

Particular | 31st March 2015 (₹) | 31st March 2014 (₹) | |

1. | Reserves and Surplus | ||

| Surplus, i.e., Balance in Statement of Profit and Loss | 2,00,000 | (50,000) |

| 2,00,000 | (50,000) | |

2. | Long-term Borrowings |

|

|

| 12% Debentures | 4,50,000 | 5,00,000 |

| 4,50,000 | 5,00,000 | |

3. | Short-term Borrowings |

|

|

| Bank Overdraft | 1,50,000 | 50,000 |

| 1,50,000 | 50,000 | |

4. | Short-term Provisions |

|

|

| Provision for Tax | 70,000 | 90,000 |

| 70,000 | 90,000 | |

5. | Tangible Assets |

|

|

| Machinery | 12,03,000 | 8,21,000 |

| Less: Accumulated Depreciation | (2,00,000) | (1,01,000) |

| 10,03,000 | 7,20,000 | |

6. | Intangible Assets |

|

|

| Goodwill | 20,000 | 30,000 |

| 20,000 | 30,000 | |

7. | Inventories |

|

|

| Stock-in-Trade | 1,07,000 | 45,000 |

| 1,07,000 | 45,000 | |

|

|

| |

Additional Information:

1. 12% Debentures were redeemed on 31st March, 2015.

2. Tax ₹ 70,000 was paid during the year.

Prepare Cash Flow Statement.

ANSWER:

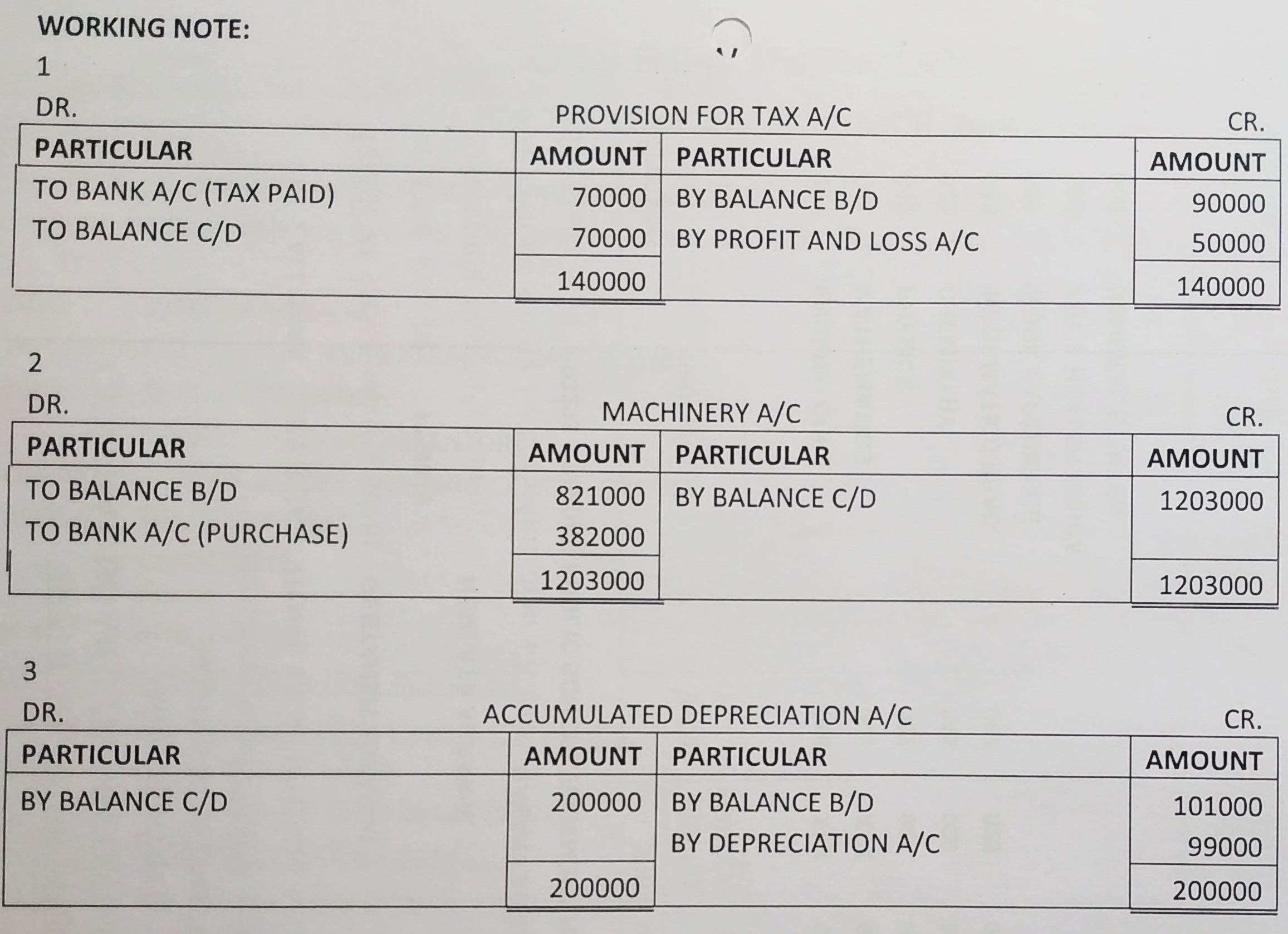

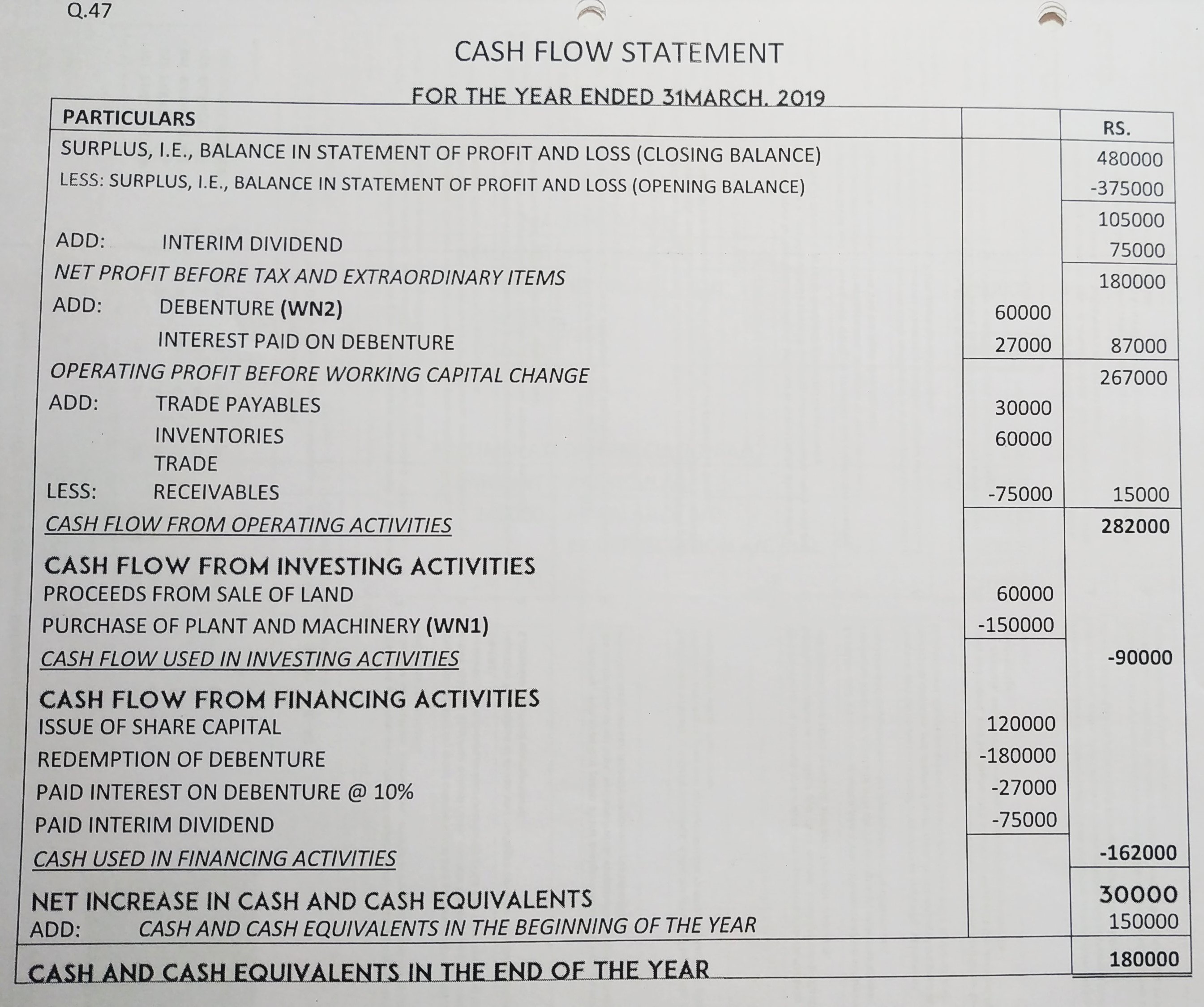

Question 47:

The Balance Sheet of Virendra Paper Ltd. as at 31st March, 2019 is given below:

Particulars ulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 7,20,000 | 6,00,000 | |

(b) Reserves and Surplus: | |||

Surplus i.e., Balance in Statement of Profit and Loss | 4,80,000 | 3,75,000 | |

2. Non-Current Liabilities | |||

Long-term Borrowings: | |||

10% Debentures | 2,70,000 | 4,50,000 | |

3. Current Liabilities | |||

Trade Payables | 1,20,000 | 90,000 | |

Total | 15,90,000 | 15,15,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

Fixed Assets (Tangible) | 1 | 7,50,000 | 7,20,000 |

2. Current Assets | |||

(a) Inventories | 3,60,000 | 4,20,000 | |

(b) Trade Receivables | 3,00,000 | 2,25,000 | |

(c) Cash and Cash Equivalents | 1,80,000 | 1,50,000 | |

Total | 15,90,000 | 15,15,000 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) | |||

1. Fixed Assets (Tangible) | |||||

Land | 2,40,000 | 3,00,000 | |||

31st March, | 31st March, | ||||

2019 (₹) | 2018 (₹) | ||||

Plant and Machinery | 7,50,000 | 6,00,000 | |||

Less: Accumulated Depreciation | 2,40,000 | 1,80,000 | |||

5,10,000 | 4,20,000 | 5,10,000 | 4,20,000 | ||

7,50,000 | 7,20,000 | ||||

Additional Information:

1. Interim Dividend of ₹75,000 has been paid during the year.

2. Debenture Interest paid during the year ₹ 27,000.

You are required to prepare Cash Flow Statement.

ANSWER:

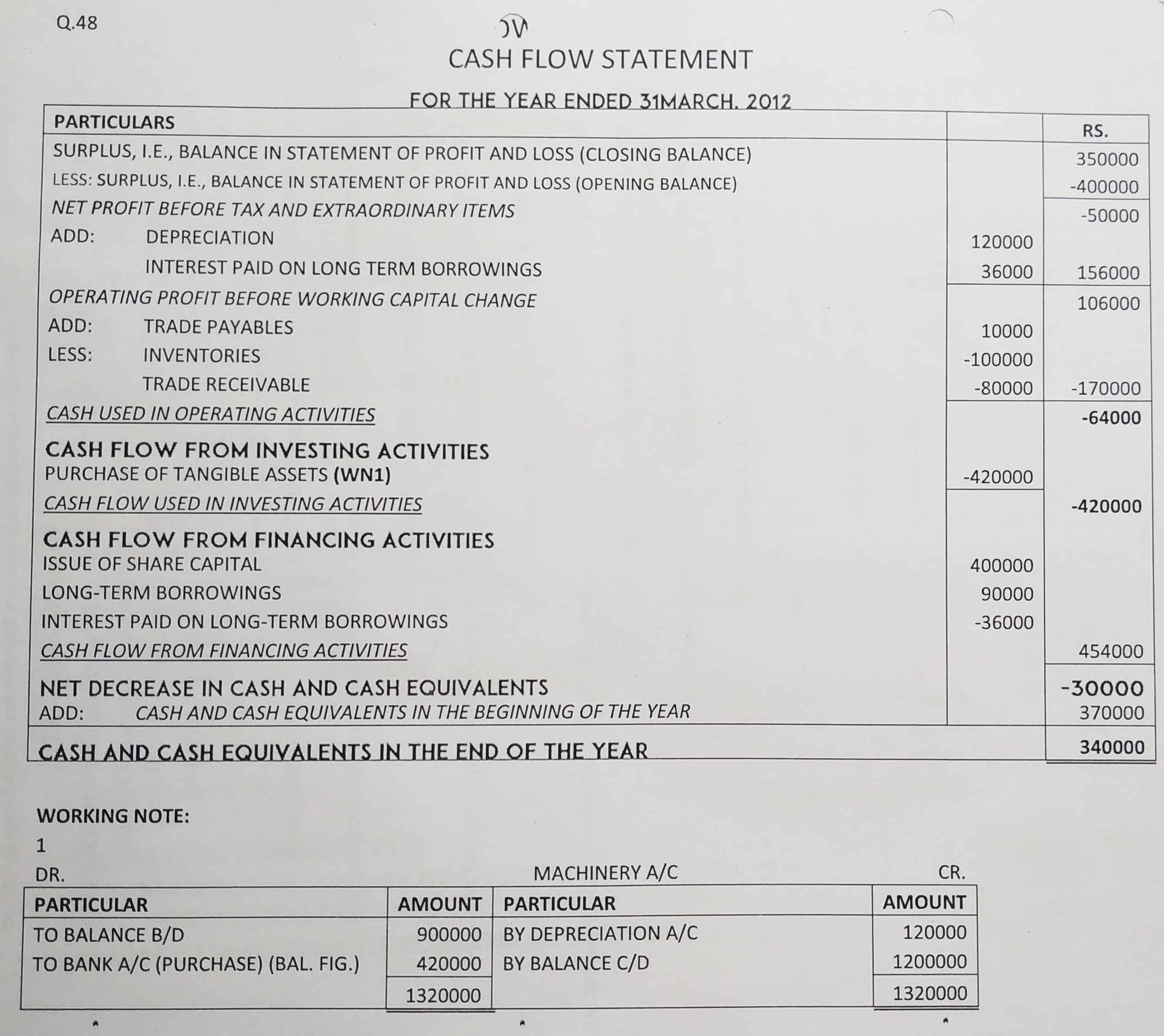

Question 48:

Following are the Balance Sheets of Krishtec Ltd. for the years ended 31st March 2012 and 2011:

Particulars | Note No. | 31st March, 2012 (₹) | 31st March, 2011 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 12,00,000 | 8,00,000 | |

(b) Reserves and Surplus (Surplus, i.e., Balance in Statement of Profit and Loss) | 3,50,000 | 4,00,000 | |

2. Non-Current Liabilities | |||

Long-term Borrowings | 4,40,000 | 3,50,000 | |

3. Current Liabilities | |||

(a) Trade Payables | 60,000 | 50,000 | |

Total | 20,50,000 | 16,00,000 | |

| II. ASSETS | |||

1, Non-Current Assets | |||

Fixed Assets: | |||

Tangible Assets | 12,00,000 | 9,00,000 | |

2. Current Assets | |||

(a) Inventories | 2,00,000 | 1,00,000 | |

(b) Trade Receivables | 3,10,000 | 2,30,000 | |

(c) Cash and Cash Equivalents | 3,40,000 | 3,70,000 | |

Total | 20,50,000 | 16,00,000 | |

Prepare a Cash Flow Statement after taking into account the following adjustments:

(a) The company paid Interest ₹36,000 on its long-term borrowings.

(b) Depreciation charged on tangible fixed assets was ₹1,20,000.

ANSWER:

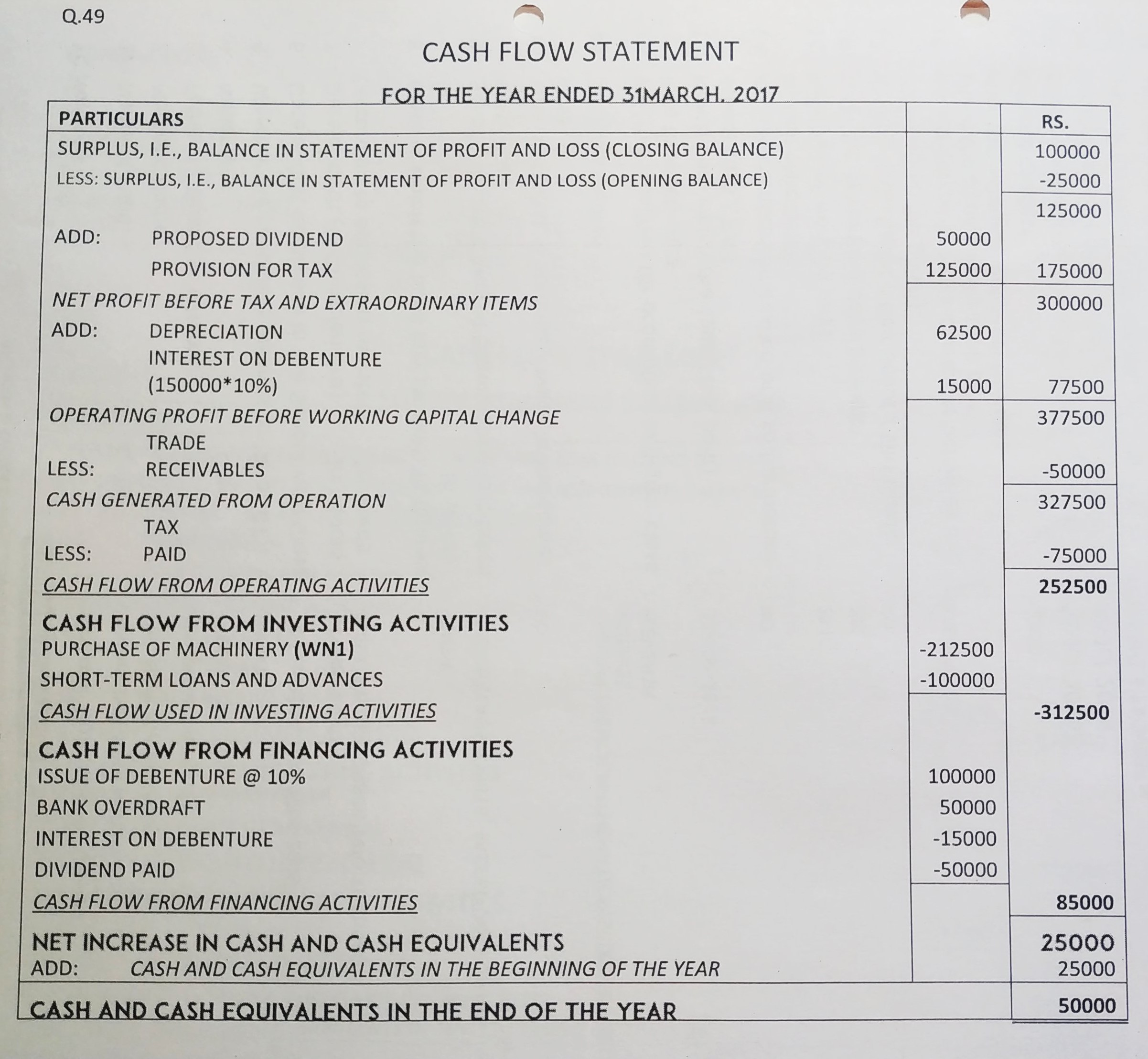

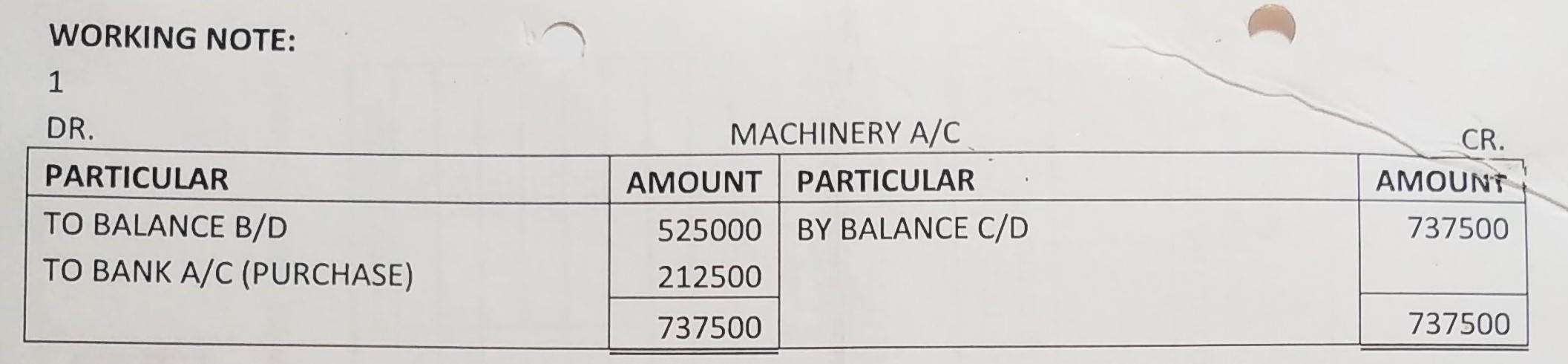

Question 49:

From the following Balance Sheet of JY Ltd. as at 31st March 2017, prepare a Cash Flow Statement:

Particular | Note No. | 31st March, 2017 (₹) | 31st March, 2016 (₹) |

I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 5,00,000 | 5,00,000 | |

(b) Reserves and Surplus | 1 | 1,00,000 | (25,000) |

2. Non-Current Liabilities | |||

Long-term Borrowings | 2 | 2,50,000 | 1,50,000 |

3. Current Liabilities | |||

(a) Short-term Borrowings | 3 | 1,50,000 | 1,10,000 |

(b) Short-term Provisions | 4 | 1,25,000 | 75,000 |

Total | 11,25,000 | 8,00,000 | |

II. ASSETS | |||

1. Non-Current Assets | |||

Fixed Assets–Tangible | 5 | 6,00,000 | 4,50,000 |

2. Current Assets | |||

(a) Trade Receivables | 2,75,000 | 2,25,000 | |

(b) Cash and Cash Equivalents | 50,000 | 25,000 | |

(c) Short-term Loans and Advances | 2,00,000 | 1,00,000 | |

Total | 11,25,000 | 8,00,000 | |

Notes to Accounts

Particular | 31st March, 2017 (₹) | 31st March, 2016 (₹) | |

1. | Reserves and Surplus | ||

Surplus, i.e., Balance in Statement of Profit and Loss | 1,00,000 | (25,000) | |

1,00,000 | (25,000) | ||

2. | Long-term Borrowings | ||

10% Debentures | 2,50,000 | 1,50,000 | |

2,50,000 | 1,50,000 | ||

3. | Short-term Borrowings | ||

Bank Overdraft | 1,50,000 | 1,00,000 | |

1,50,000 | 1,00,000 | ||

4. | Short-term Provisions | ||

Provision for Tax | 1,25,000 | 75,000 | |

1,25,000 | 75,000 | ||

5. | Tangible Assets | ||

Machinery | 7,37,500 | 5,25,000 | |

Accumulated Depreciation | (1,37,500) | (75,000) | |

6,00,000 | 4,50,000 | ||

Note: Proposed Dividend for the years ended 31st March, 2016 and 2017 are ₹ 50,000 and ₹ 75,000 respectively.

Additional Information: ₹ 1,00,000, 10% Debentures were issued on 31st March, 2017.

ANSWER:

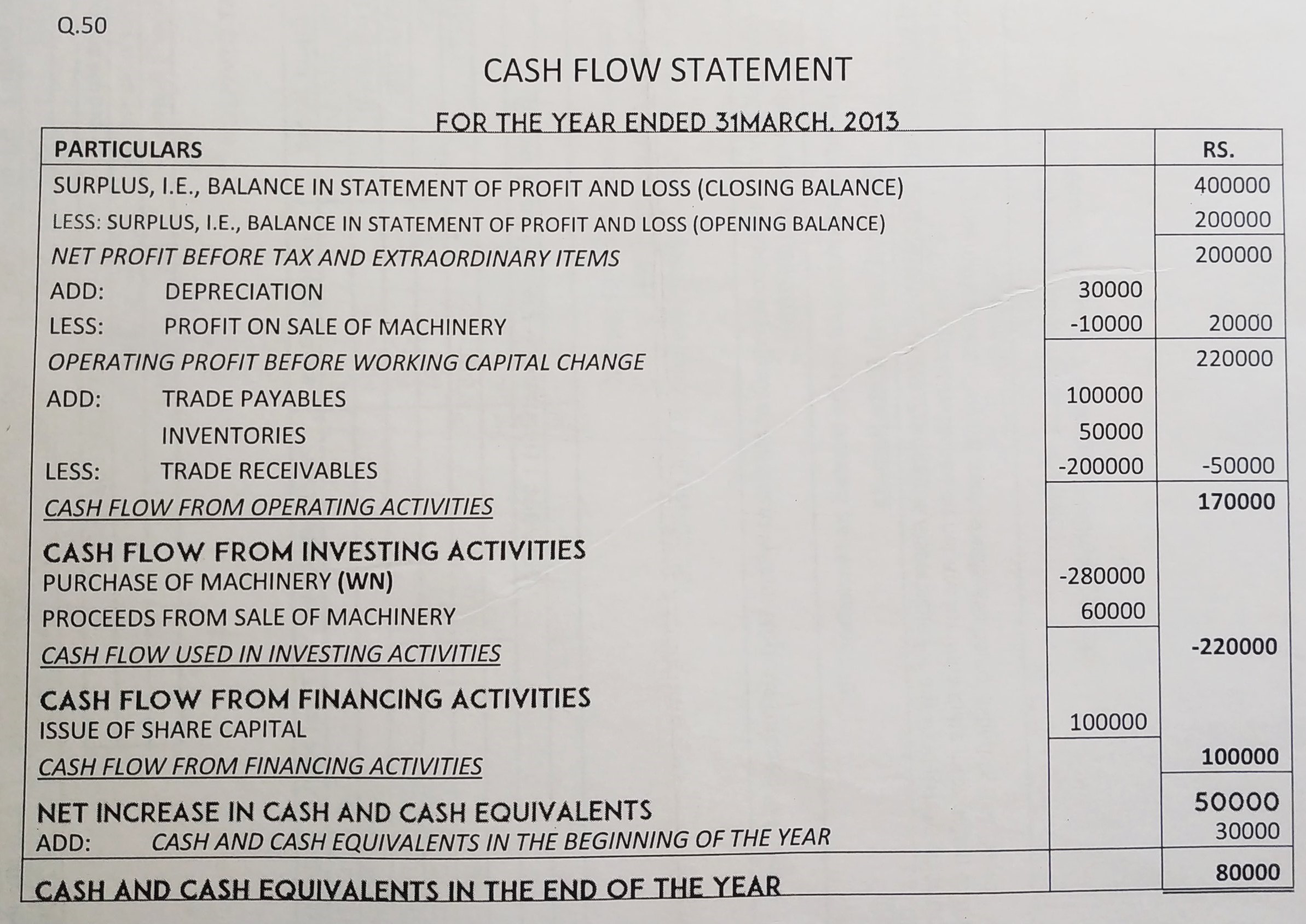

Question 50:

Prepare Cash Flow Statement from the following Balance Sheet:

Particulars | Note No. | 31st March, 2013 (₹) | 31st March, 2012 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 6,00,000 | 5,00,000 | |

(b) Reserves and Surplus | 1 | 4,00,000 | 2,00,000 |

2. Current Liabilities | |||

(a) Trade Payables | 2,80,000 | 1,80,000 | |

Total | 12,80,000 | 8,80,000 | |

| II. ASSETS | |||

1, Non-Current Assets | |||

(a) Fixed Assets: | |||

Plant and Machinery | 5,00,000 | 3,00,000 | |

2. Current Assets | |||

(a) Inventories | 1,00,000 | 1,50,000 | |

(b) Trade Receivables | 6,00,000 | 4,00,000 | |

(c) Cash and Cash Equivalents | 80,000 | 30,000 | |

Total | 12,80,000 | 8,80,000 | |

Notes to Accounts

Particulars | 31st March, 2013 (₹) | 31st March, 2012 (₹) |

| I. Reserves and Surplus | ||

Surplus, i.e., Balance in Statement of Profit and Loss | 4,00,000 | 2,00,000 |

Additional Information:

(i) An old machinery having book value of ₹50,000 was sold for ₹60,000.

(ii) Depreciation provided on Machinery during the year was ₹30,000.

ANSWER:

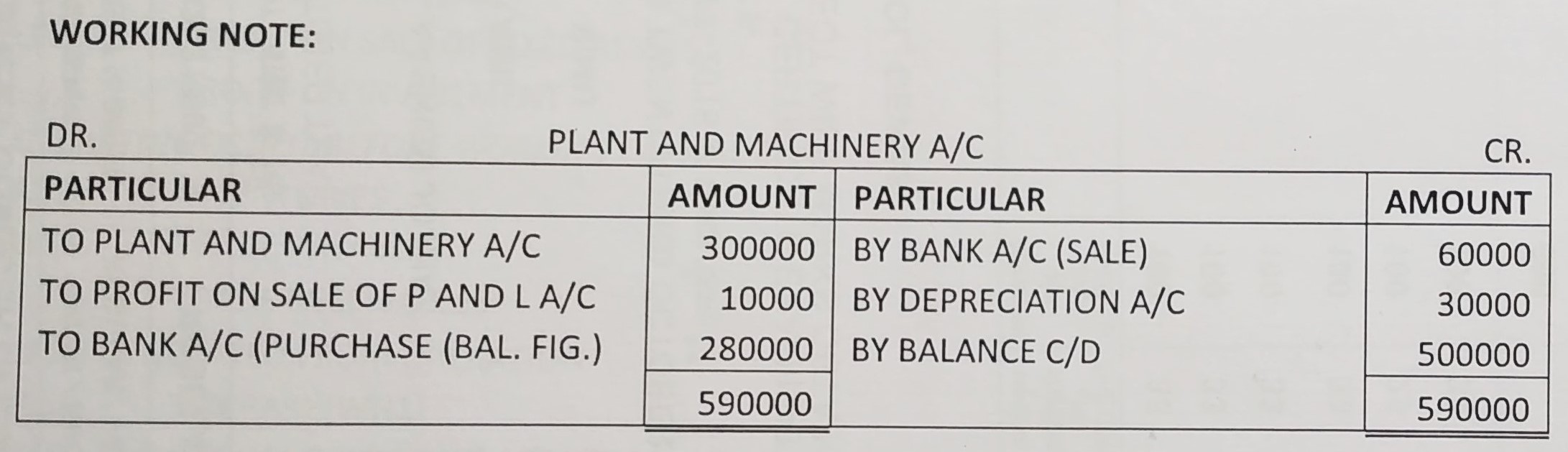

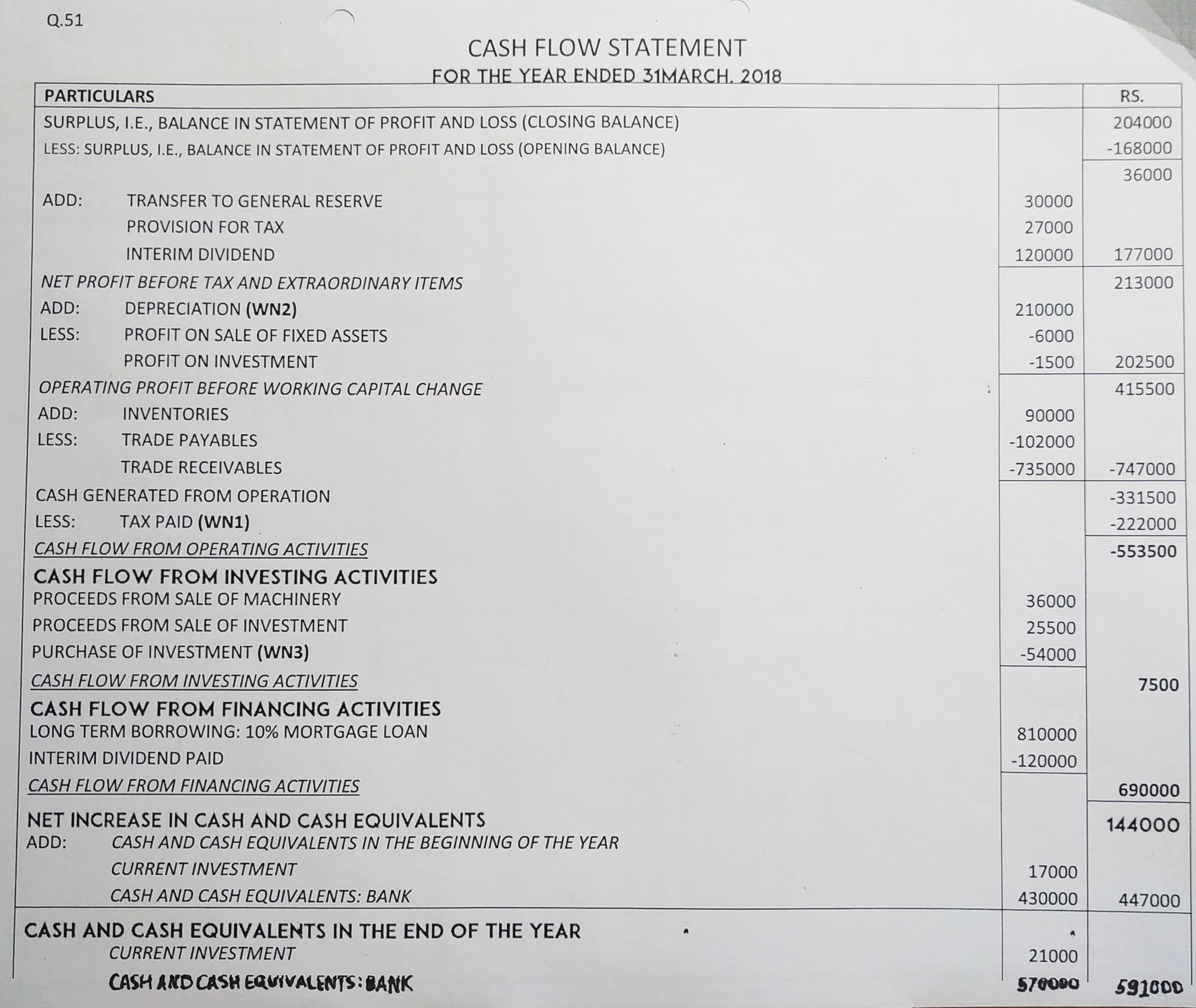

Question 51:

Following is the summarised Balance Sheet of Philips India Ltd. as at 31st March 2018:

Particulars | Note No. | 31st March, 2018 (₹) | 31st March, 2017 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 13,50,000 | 13,50,000 | |

(b) Reserves and Surplus | 1 | 11,34,000 | 10,68,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings: 10% Mortgage Loan | 8,10,000 | … | |

3. Current Liabilities | |||

(a) Trade Payables (Creditors) | 4,20,000 | 5,04,000 | |

(b) Short-term Provisions: | |||

Provision for Tax | 30,000 | 2,25,000 | |

Total | 37,26,000 | 31,47,000 | |

| II. ASSETS | |||

1, Non-Current Assets | |||

(a) Fixed Assets (Tangible) | 9,60,000 | 12,00,000 | |

(b) Non-Current Investments | 1,80,000 | 1,50,000 | |

2. Current Assets | |||

(a) Current Investments | 21,000 | 17,000 | |

(b) Inventories | 63,30,000 | 7,82,000 | |

(c) Trade Receivables | 13,65,000 | 6,30,000 | |

(c) Cash and Cash Equivalents | 5,70,00 | 4,30,000 | |

Total | 37,26,000 | 31,47,000 | |

Notes to Accounts

Particulars | 31st March, 2018 (₹) | 31st March, 2017 (₹) |

| I. Reserves and Surplus | ||

General Reserve | 9,30,000 | 9,00,000 |

Surplus, i.e., Balance in Statement of Profit and Loss | 2,04,000 | 1,68,000 |

| 11,34,000 | 10,68,000 | |

Additional Information:

1. Investments costing ₹ 24,000 were sold during the year for ₹ 25,5000.

2. Provistion for Tax made during the year was ₹ 27,000.

3. During the year, a part of the Fixed Assets costing ₹ 30,000 was sold for ₹ 36,000. The rofits were included in the Statement of Profit and Loss.

4. The Interim Dividend paid during the year amounted to ₹ 1,20,000.

You are required to prepare Cash Flow Statement.

ANSWER:

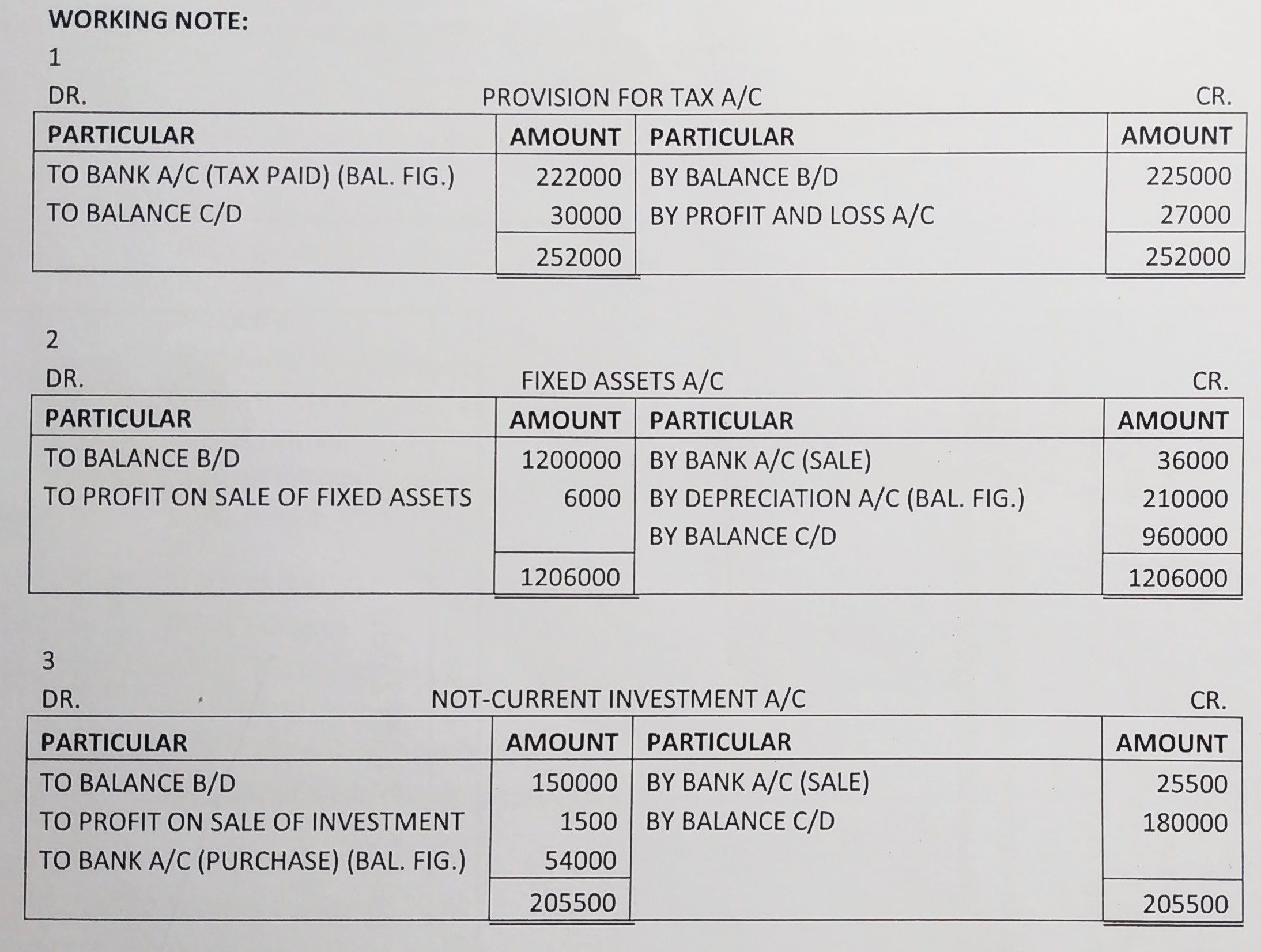

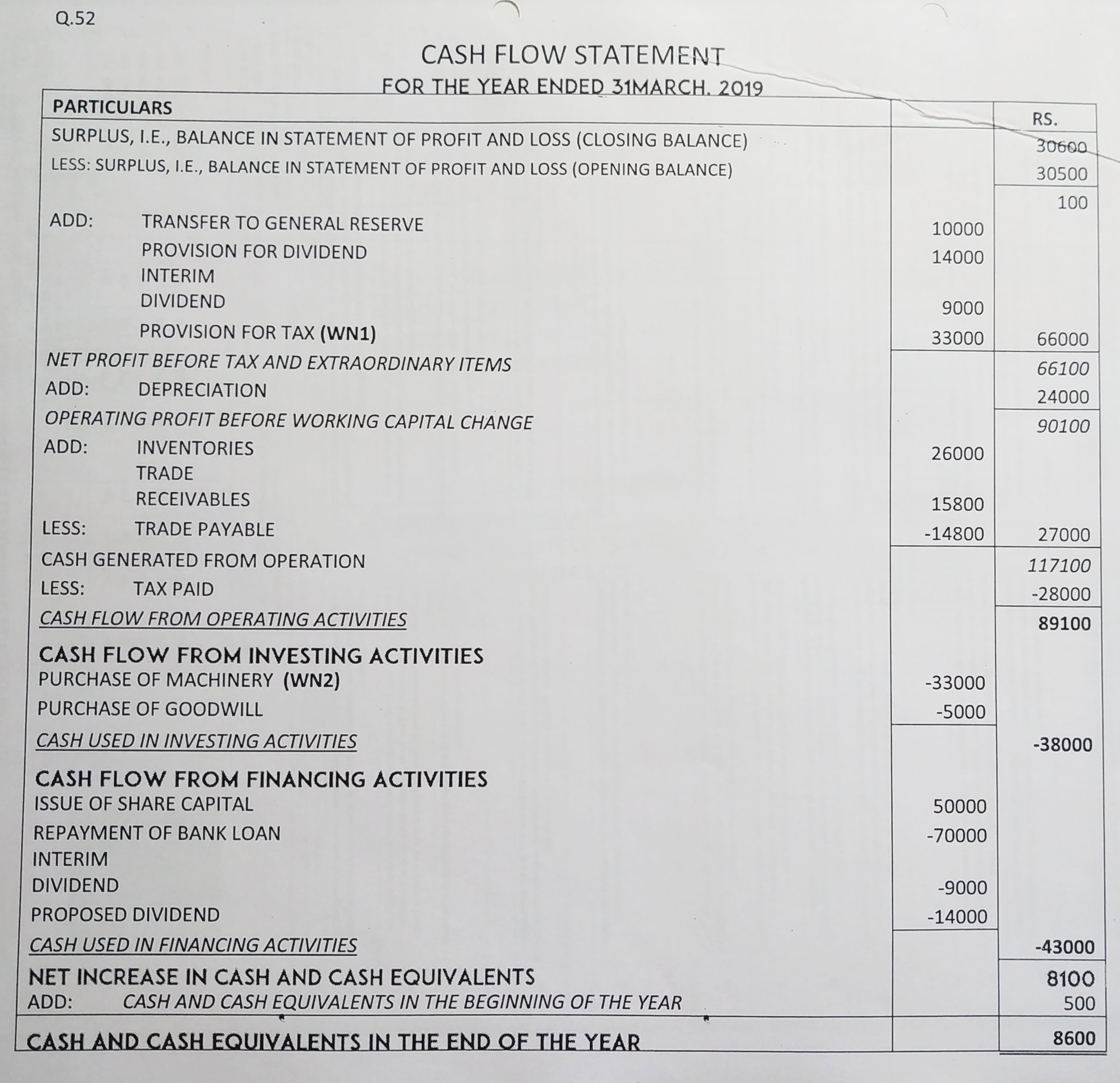

Question 52:

From the following Balance Sheet, prepare Cash Flow Statement:

Particulars ulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 2,50,000 | 2,00,000 | |

(b) Reserves and Surplus, | 1 | 90,600 | 80,500 |

2. Current Liabilities | |||

(a) Short-term Borrowings: Bank Loan | … | 70,000 | |

(b) Trade Payables | 1,35,200 | 1,50,000 | |

(c) Short-term Provisions: Provision for Tax | 35,000 | 30,000 | |

Total Total Expenses | 5,10,800 | 5,30,500 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

Fixed Assets: | |||

(i) Tangible Assets | 2 | 3,59,000 | 3,50,000 |

(ii) Intangible Assets: Goodwill | 5,000 | … | |

2. Current Assets | |||

(a) Inventories | 74,000 | 1,00,000 | |

(b) Trade Receivables | 64,200 | 80,000 | |

(c) Cash and Cash Equivalents | 8,600 | 500 | |

Total | 5,10,800 | 5,30,500 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. Reserves and Surplus | ||

General Reserve | 60,000 | 50,000 |

Surplus, i.e., Balance in Statement of Profit and Loss | 30,600 | 30,500 |

| 90,600 | 80,500 | |

| 2. Tangible Assets | ||

Land and Building | 1,90,000 | 2,00,000 |

Plant and Machinery | 1,69,000 | 1,50,000 |

| 3,59,000 | 3,50,000 | |

Additional Information:

1. Proposed Dividend for the year ended 31st March, 2019 was ₹ 25,000 and for the year ended 31st March, 2018 was ₹ 14,000.

2. Interim Dividend paid during the year was ₹ 9,000.

3. Income Tax paid during the year was ₹ 28,000.

4. Machinery was purchased during the year ₹ 33,000.

5. Depreciation to be charged on machinery ₹ 14,000 and building ₹ 10,000.

ANSWER:

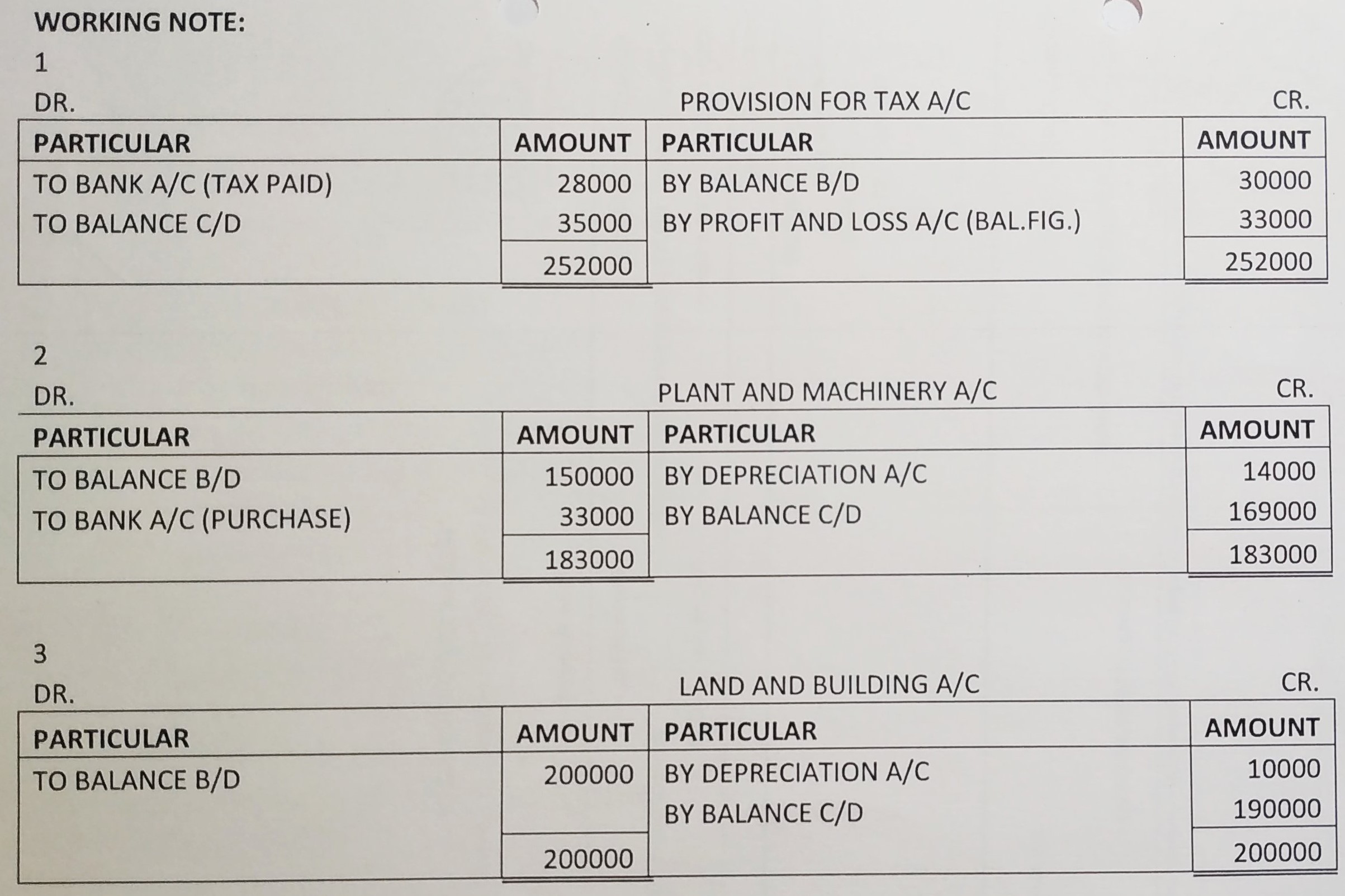

Question 53:

From the following Balance Sheet of Akash Ltd. as at 31st March 2014:

| |||

Particulars | Note No. | 31st March, 2014 (₹) | 31 March, 2013 (₹) |

I. EQUITY AND LIABILITES 1. Shareholders’ Funds | |||

(a) Share Capital | 15,00,000 | 14,00,000 | |

(b) Reserves and Surplus | 1 | 2,50,000 | 1,10,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings |

| 2,00,000 | 1,25,000 |

3. Current Liabilities | |||

(a) Short-term Borrowings | 2 | 12,000 | 10,000 |

(b) Trade Payables | 15,000 | 83,000 | |

(c) Short-term Provisions | 3 | 18,000 | 11,000 |

Total | 19,95,000 | 17,39,000 | |

II. ASSETS | |||

1. Non-Current Assets | |||

Fixed Assets: | |||

(i) Tangible Assets | 4 | 18,60,000 | 16,10,000 |

(ii) Intangible Assets | 5 | 50,000 | 30,000 |

2. Current Assets | |||

(a) Current Investments |

| 8,000 | 5,000 |

(b) Inventories | 37,000 | 59,000 | |

(c) Trade Receivables | 26,000 | 23,000 | |

(d) Cash and Cash Equivalents | 14,000 | 12,000 | |

Total | 19,95,000 | 17,39,000 | |

| Notes to Accounts : | ||

| Particulars | 31st March, 2014 (₹) | 31st March, 2013 (₹) |

| 1. Reserves and Surplus | ||

Surplus, i.e., Balance in Statement of Profit and Loss | 2,50,000 | 1,10,000 |

| 2. Short-term Borrowings : | ||

Bank Overdraft | 12,000 | 10,000 |

| 3. Short-term Provisions | ||

Provision for Tax | 18,000 | 11,000 |

| 4. Tangible Assets : | ||

Machinery | 20,00,000 | 17,00,000 |

Less: Accumulated Depreciation | (1,40,000) | (90,000) |

| 18,60,000 | 16,10,000 | |

| 5. Intangible Assets | ||

Patents | 50,000 | 30,000 |

Additional Information :

(i) Tax paid during the year amounted to ₹ 16,000.

(ii) machine with a net book value of ₹ 10,000 (Accumulated Depreciation ₹ 40,000) was sold for ₹ 2,000.Prepare Cash Flow Statement.

ANSWER:

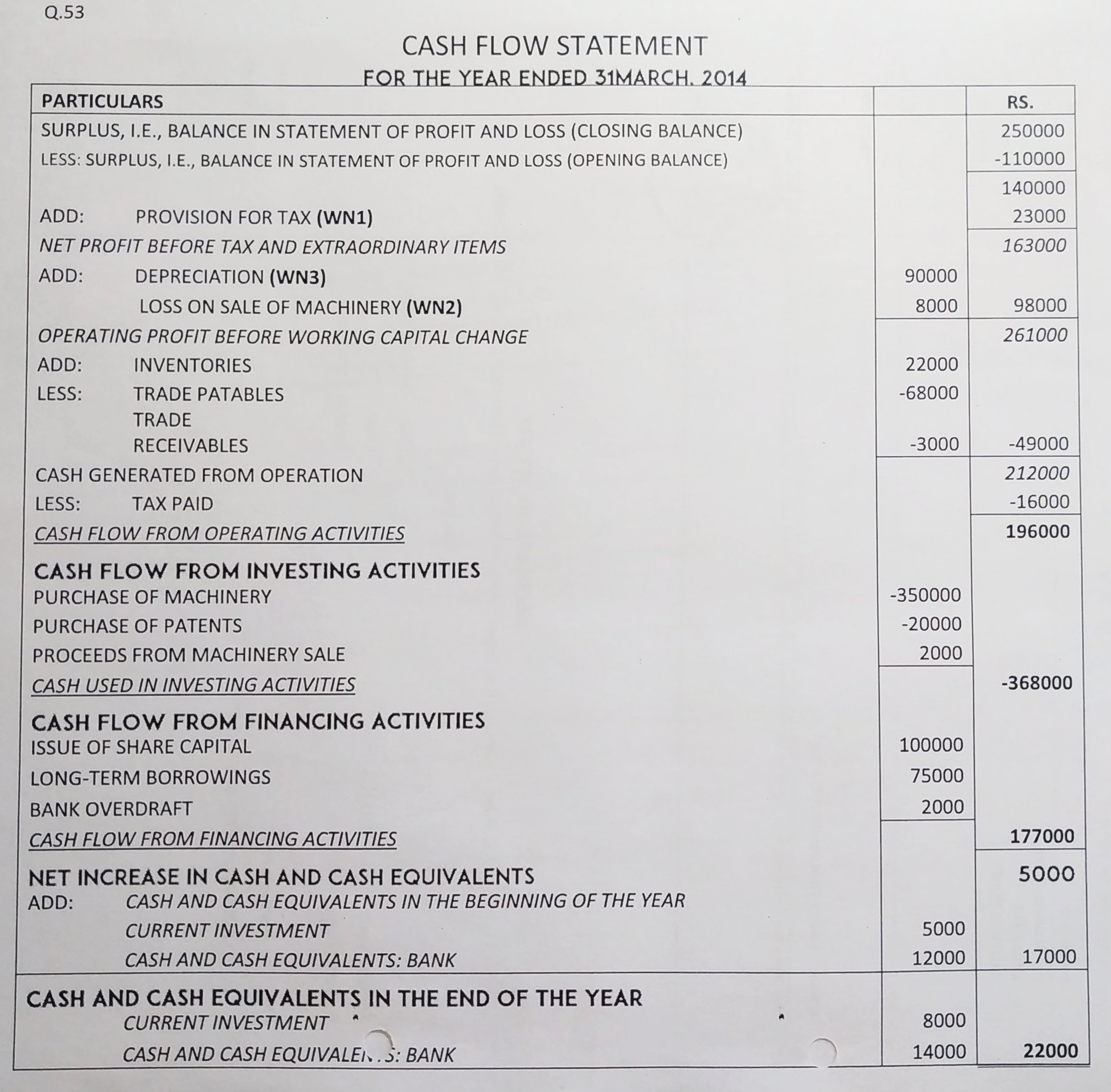

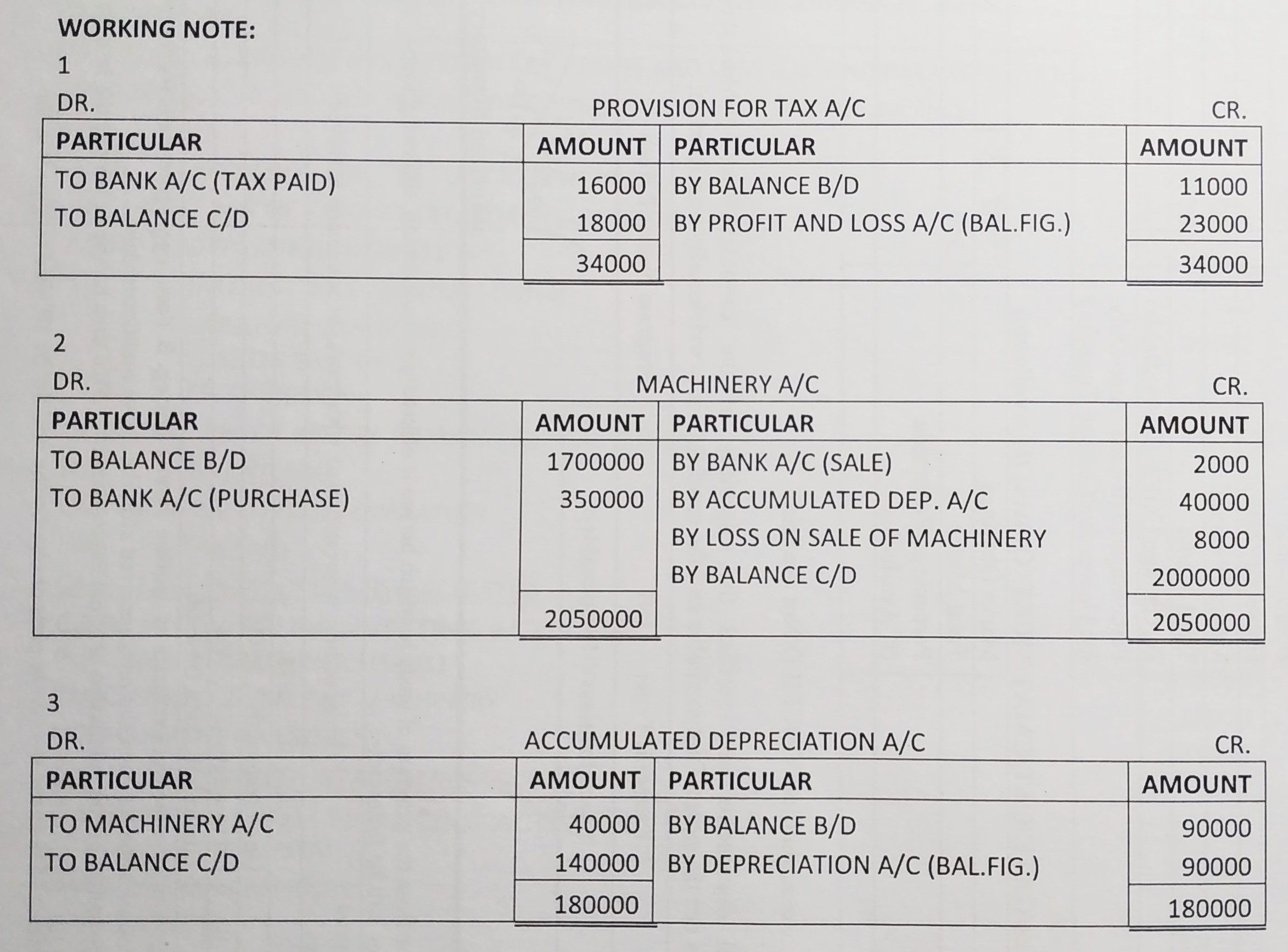

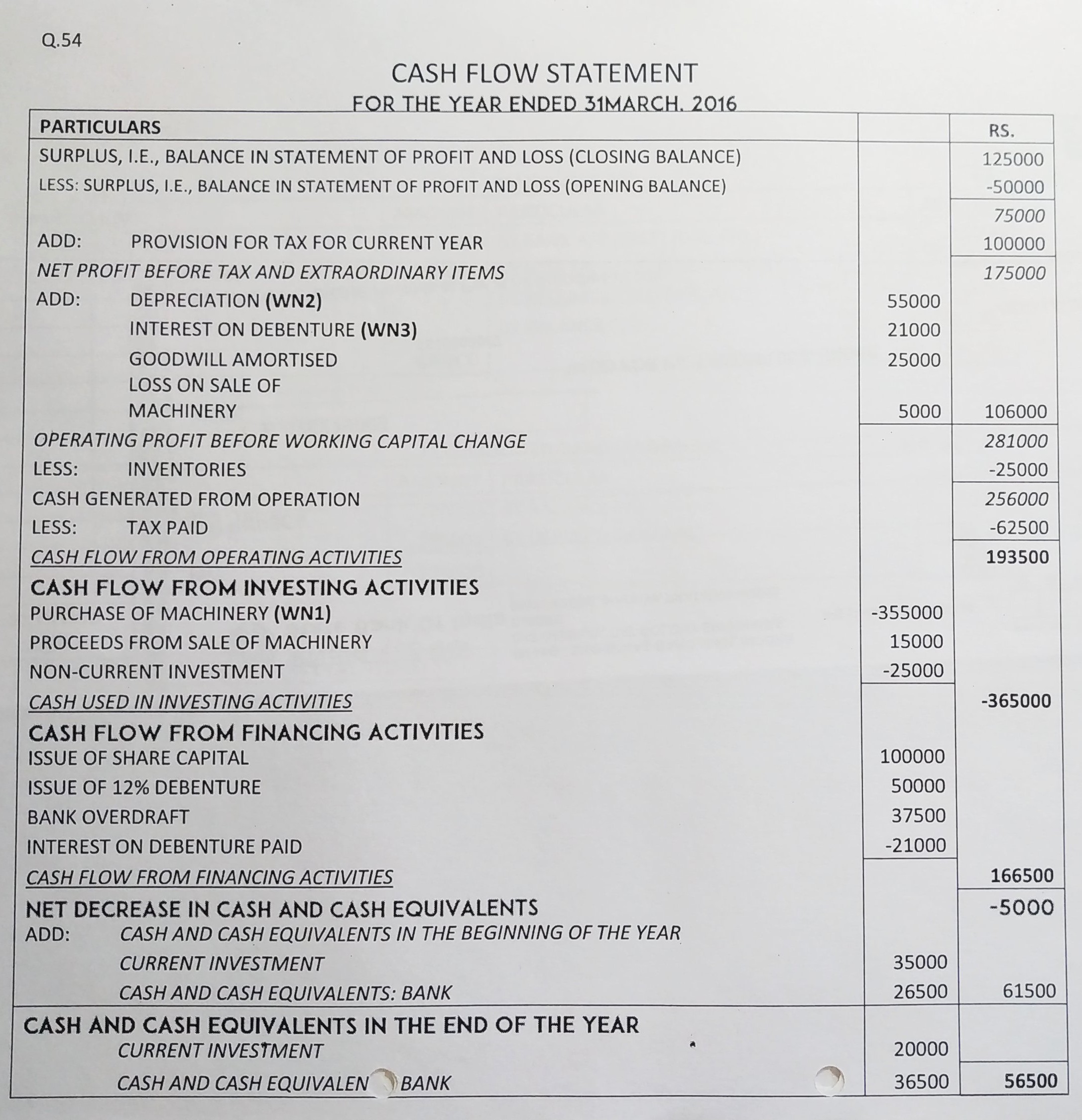

Question 54:

From the following Balance Sheet of SRS Ltd. and the additional information as on 31st March, 2016, prepare a Cash Flow Statement:

SRS Ltd. |

| BALANCE SHEET as on 31st March, 2016 |

Particulars | Note No. | 31st March, 2016 (₹) | 31st March, 2015 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 4,50,000 | 3,50,000 | |

(b) Reserves and Surplus | 1 | 1,25,000 | 50,000 |

| 2. Non-Current Liabilities | |||

Long-term Borrowings | 2 | 2,25,000 | 1,75,000 |

3. Current Liabilities | |||

(a) Short-term Borrowingst | 3 | 75,000 | 37,500 |

(b) Shrot-term Provisions | 4 | 1,00,000 | 62,500 |

Total | 9,75,000 | 6,75,000 | |

| II. ASSETS | |||

1, Non-Current Assets | |||

(a) Fixed Assets: | |||

(i) Tangible | 5 | 7,32,500 | 4,52,500 |

(ii) Intangible | 6 | 50,000 | 75,000 |

(b) Non-current Investments | 75,000 | 50,000 | |

2. Current Assets | |||

(a) Current Investments | 20,000 | 35,000 | |

(b) Inventories | 7 | 61,000 | 36,000 |

(c) Cash and Cash Equivalents | 36,500 | 26,500 | |

Total | 9,75,000 | 6,75,000 | |

Notes to Accounts

Particular | 31st March 2016 (₹) | 31st March 2015 (₹) | |

1. | Reserves and Surplus | ||

| Surplus, i.e., Balance in Statement of Profit and Loss | 1,25,000 | 50,000 |

2. | Long-term Borrowings |

|

|

| 12% Debentures | 2,25,000 | 1,75,000 |

3. | Short-term Borrowings |

|

|

| Bank Overdraft | 75,000 | 37,500 |

4. | Short-term Provisions |

|

|

| Provision for Tax | 1,00,000 | 62,500 |

5. | Tangible Assets |

|

|

| Machinery | 8,37,500 | 5,22,500 |

| Accumulated Depreciation | (1,05,000) | (70,000) |

| 7,32,500 | 4,52,500 | |

6. | Intangible Assets |

|

|

| Goodwill | 50,000 | 75,000 |

7. | Inventories |

|

|

| Stock-in-Trade | 61,000 | 36,000 |

|

|

| |

Additional Information:

(i) ₹50,000, 12% Debentures were issued on 31st March, 2016.

(ii) During the year, a piece of machinery costing ₹40,000, on which accumulated depreciation was ₹20,000, was sold at a loss of ₹5,000.

ANSWER:

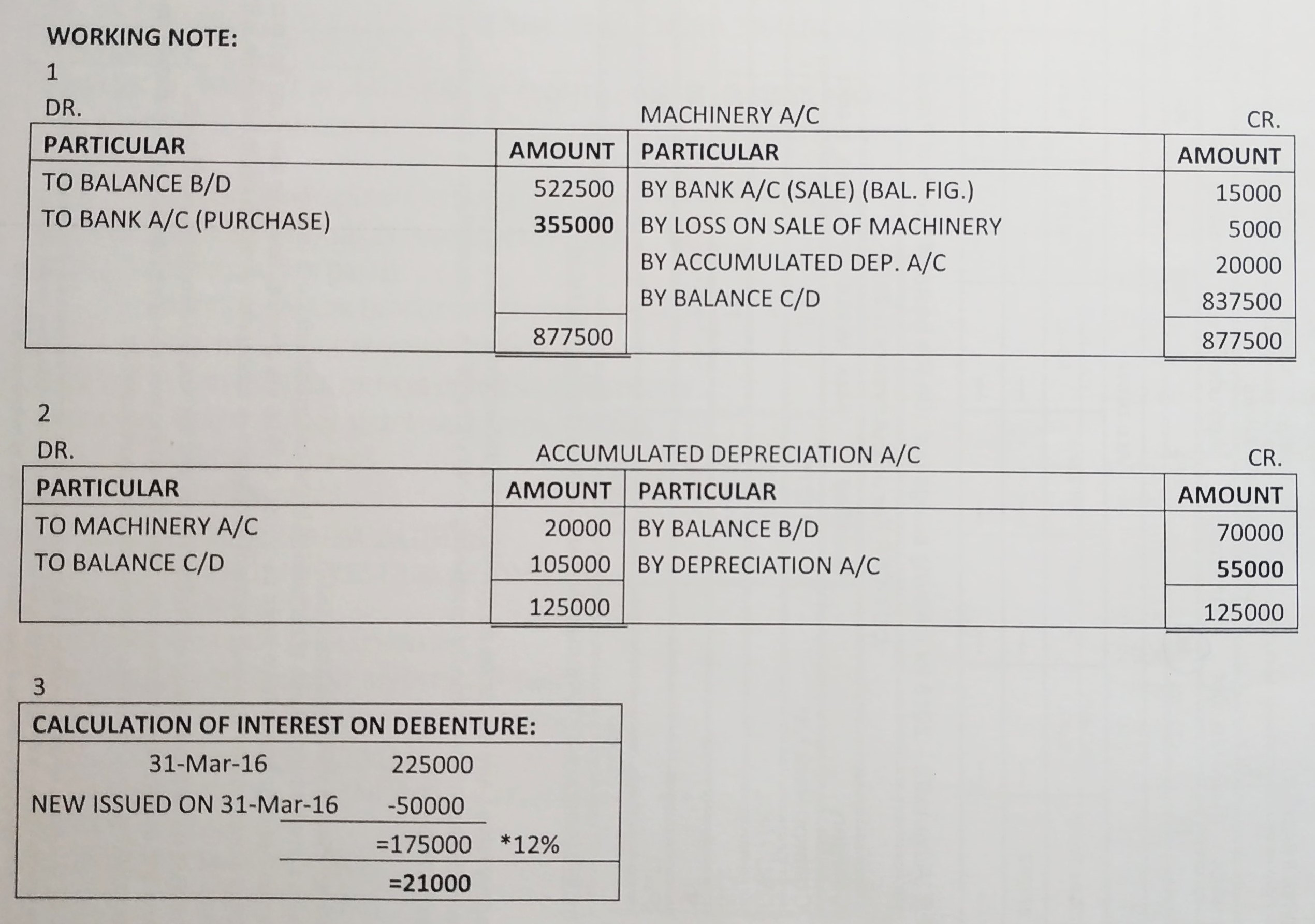

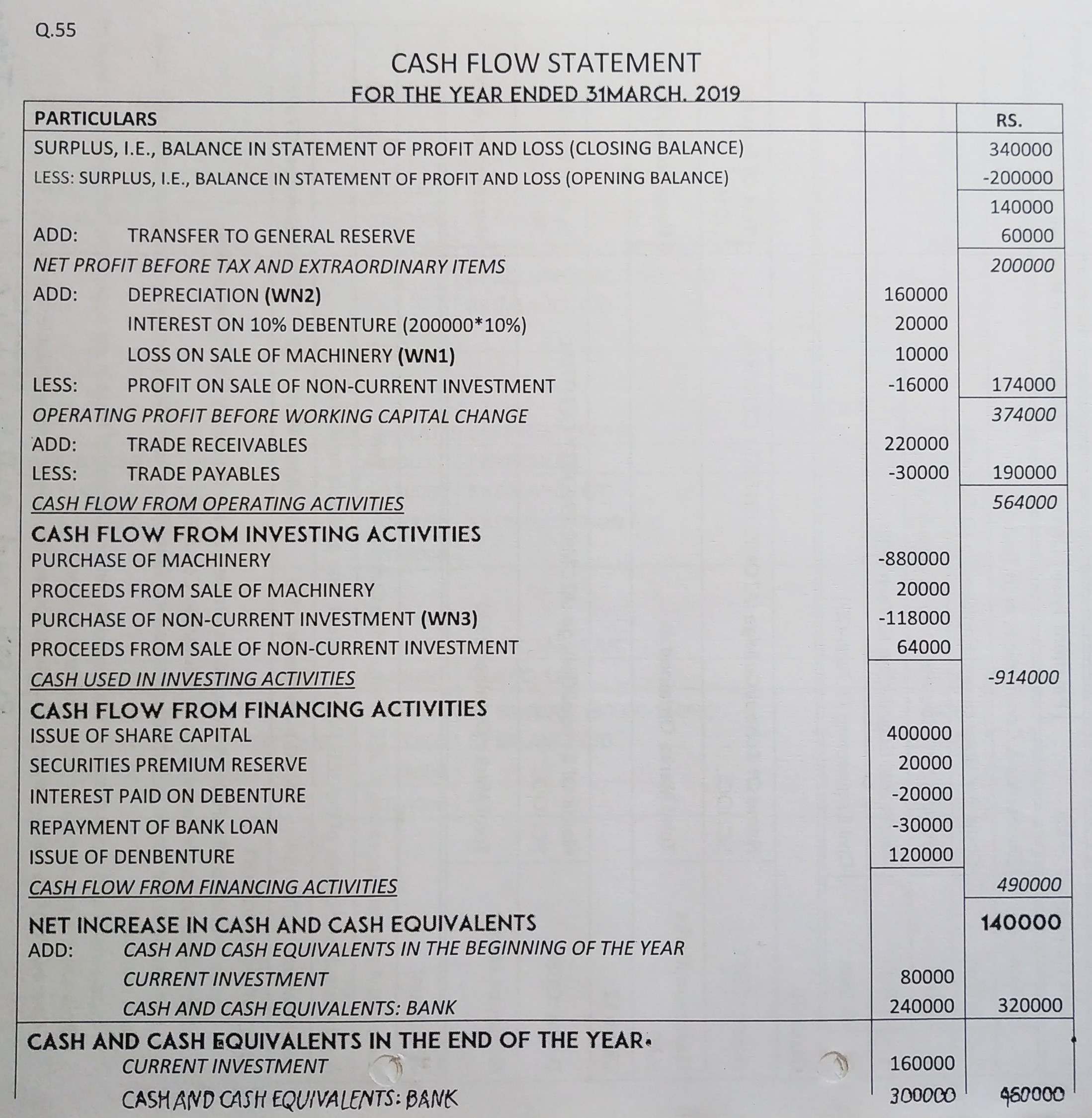

Question 55:

From the following Balance Sheet of Mishi Ltd. as at 31st March, 2019, prepare Cash Flow Statement:

Particulars ulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 16,00,000 | 12,00,000 | |

(b) Reserves and Surplus | 1 | 6,60,000 | 4,40,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings (10% Debentures) | 3,20,000 | 2,00,000 | |

3. Current Liabilities | |||

(a) Short-term Borrowing (Bank Loan) | 80,000 | 1,10,000 | |

(b) Trade Payables | 1,50,000 | 1,80,000 | |

Total Total Expenses | 28,10,000 | 21,30,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets−Tangible | 2 | 19,00,000 | 12,10,000 |

(b) Non-Current Investments | 2,70,000 | 2,00,000 | |

2. Current Assets | |||

(a) Current Investments | 1,60,000 | 80,000 | |

(b) Trade Receivables | 1,80,000 | 4,00,000 | |

(c) Cash and Cash Equivalents | 3 | 3,00,000 | 2,40,000 |

Total | 28,10,000 | 21,30,000 | |

Notes to Accounts : | ||

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

1. Reserves and Surplus : | ||

Securities Premium Reserve | 20,000 | … |

General Reserve | 3,00,000 | 2,40,000 |

Surplus i.e., Balance in the Statement of Profit and Loss | 3,40,000 | 2,00,000 |

6,60,000 | 4,40,000 | |

2. Fixed Assets−Tangible | ||

Machinery (Cost) | 21,40,000 | 14,00,000 |

Less: Accumulated Depreciation | 2,40,000 | 1,90,000 |

19,00,000 | 12,10,000 | |

3. Cash and Cash Equivalents | ||

Cash in Hand | 1,40,000 | 1,10,000 |

Bank Balance | 1,60,000 | 1,30,000 |

3,00,000 | 2,40,000 | |

Additional Information :

(i) During the year, Machinery costing ₹ 1,40,000 (accumulated depreciation provided thereon ₹ 1,10,000) was sold for ₹ 20,000.

(ii) During the year, Non-current Investments costing ₹ 80,000 were sold at a profit of ₹ 16,000.

ANSWER:

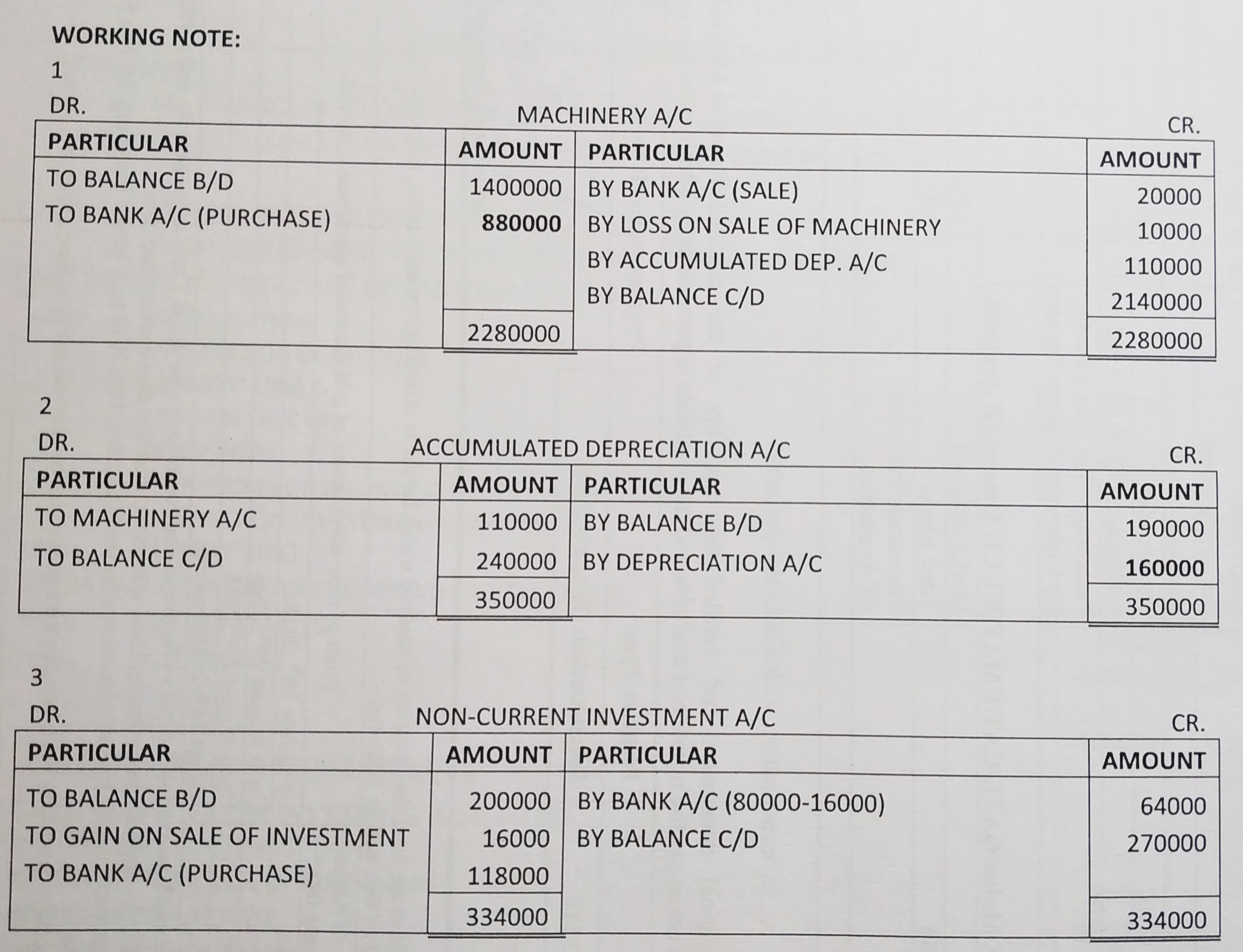

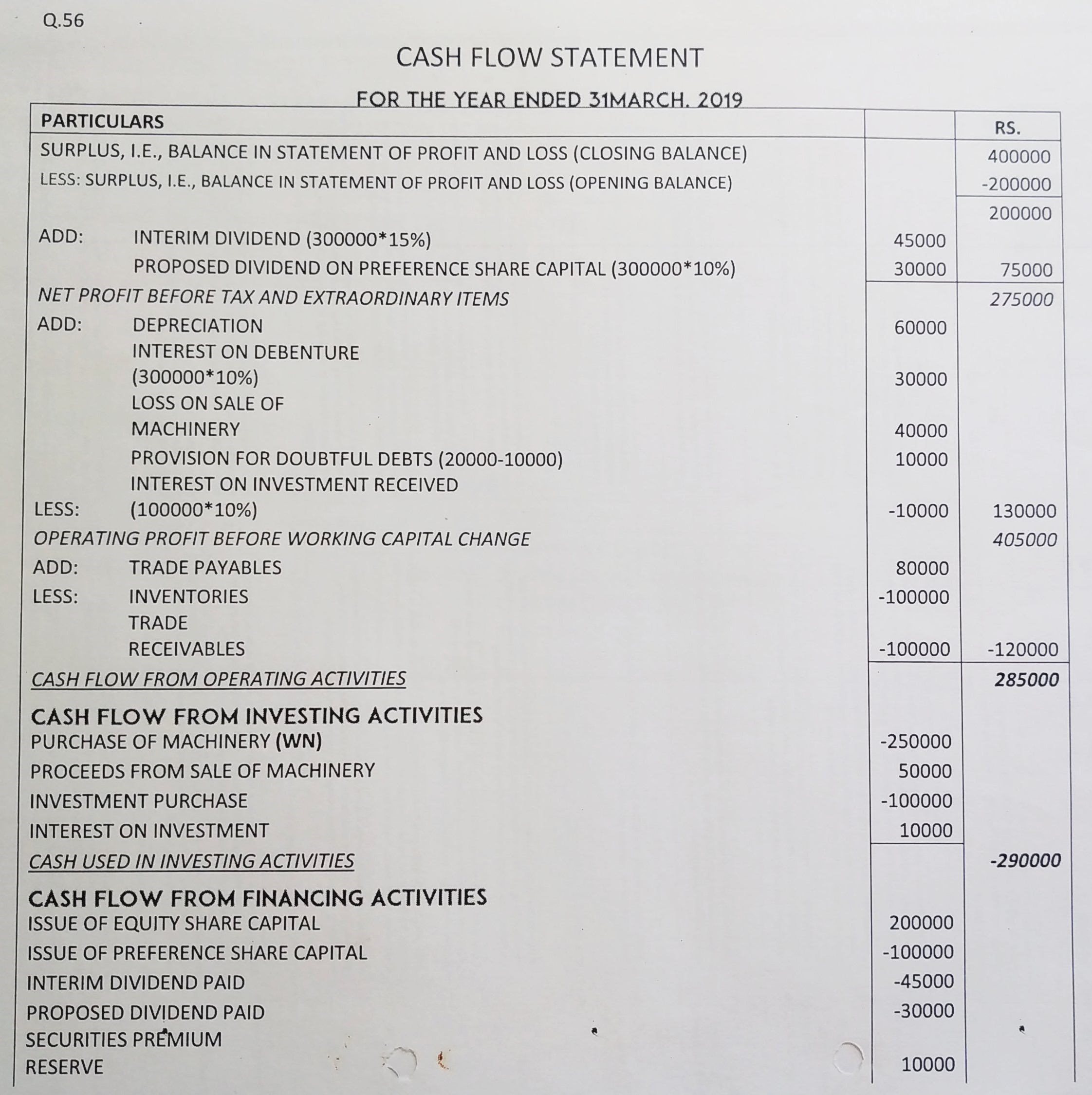

Question 56:

From the following Balance Sheet and information of Sun Ltd., prepare Cash Flow Statement:

Particulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 1 | 7,00,000 | 6,00,000 |

(b) Reserves and Surplus | 2 | 4,10,000 | 2,00,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings: 10% Debentures | 3,00,000 | 2,00,000 | |

3. Current Liabilities | |||

(a) Trade Payables | 1,40,000 | 60,000 | |

Total | 15,50,000 | 10,60,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets−Tangible | 7,00,000 | 6,00,000 | |

(b) 10% Investments | 2,00,000 | 1,00,000 | |

2. Current Assets | |||

(a) Current Investments | 90,000 | 50,000 | |

(b) Inventories | 2,00,000 | 1,00,000 | |

(c) Trade Receivables | 3 | 2,80,000 | 1,90,000 |

(d) Cash and Cash Equivalents | 80,000 | 20,000 | |

Total | 15,50,000 | 10,60,000 | |

Notes to Accounts : | ||

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

1. Share Capital | ||

Equity Share Capital | 5,00,000 | 3,00,000 |

10% Preference Share Capital | 2,00,000 | 3,00,000 |

7,00,000 | 6,00,000 | |

2. Reserves and Surplus | ||

Securities Premium Reserve | 10,000 | … |

Surplus i.e., Balance in Statement of Profit and Loss | 4,00,000 | 2,00,000 |

4,10,000 | 2,00,000 | |

3. Trade Receivables | ||

Sundry Debtors | 3,00,000 | 2,00,000 |

Less: Provision for Doubtful Debts | 20,000 | 10,000 |

2,80,000 | 1,90,000 | |

You are informed that during the year:

| (i) | Proposed Dividend: | 31st March, 2019 | 31st March, 2018 |

| Equity Share Capital | Nil | Nil | |

| Preference Share Capital | 10% | 10% |

(ii) A machine with a book value of ₹ 90,000 was sold for ₹ 50,000;

(iii) Depreciation charged during the year ₹ 60,000;

(iv) Debentures were issued on 1st April, 2018;

(v) Investments were purchased on 31st March, 2019;

(vi) Preference shares were redeemed on 31st December,2018;

(vii) An interim dividend @ 15% was paid on equity shares on 31st December, 2018;

(viii) Fresh equity shares were issued at a premium of 5% on 31st March, 2019.

ANSWER:

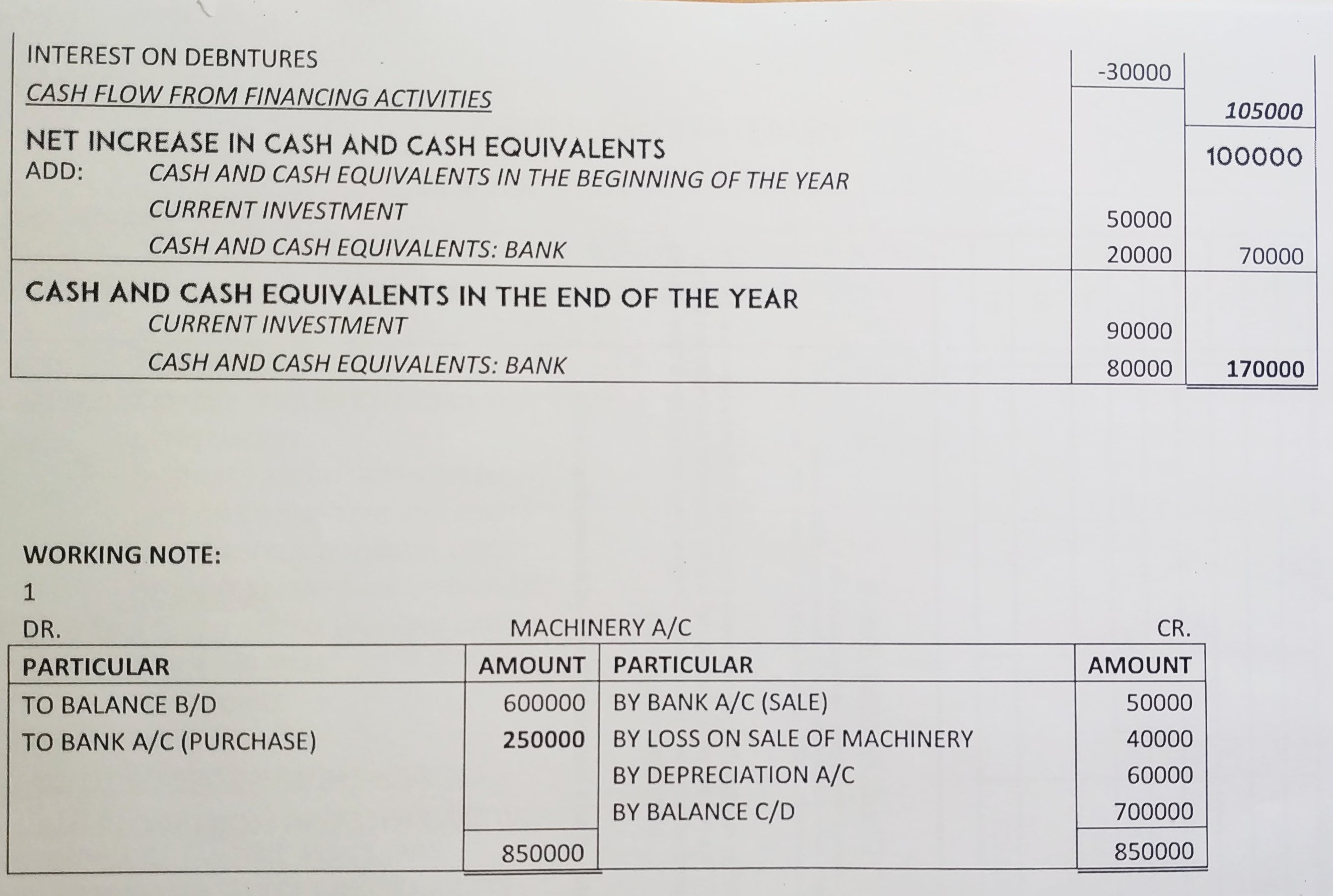

Question 57:

From the following Balance Sheet and information of Volvo Ltd., prepare Cash Flow Statement:

Particulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 1 | 2,25,000 | 2,50,000 |

(b) Reserves and Surplus | 2 | 1,27,500 | 50,000 |

2. Non-Current Liabilities | |||

Long-term Borrowings: 10% Debentures | 1,00,000 | 50,000 | |

3. Current Liabilities | |||

(a) Trade Payables | 72,500 | 35,000 | |

(b) Other Current Liabilities−Premium on Redemption of Preference Shares | 2,500 | 5,000 | |

Total | 5,27,500 | 3,90,000 | |

| II. ASSETS | |||

1, Non-Current Assets | |||

(a) Fixed Assets−Tangible | 3,10,000 | 2,55,000 | |

(b) Non-Current Investments (10% Investments) | 40,000 | 15,000 | |

2. Current Assets | |||

(a) Current Investments | 5,000 | 4,000 | |

(b) Inventories | 45,000 | 50,000 | |

(c) Trade Receivables | 3 | 92,500 | 45,000 |

(d) Cash and Cash Equivalents | 4 | 35,000 | 21,000 |

Total | 5,27,500 | 3,90,000 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

1. Share Capital | ||

Equity Share Capital | 1,75,000 | 1,50,000 |

12% Preference Share Capital | 50,000 | 1,00,000 |

2,25,000 | 2,50,000 | |

2. Reserves and Surplus | ||

General Reserve | 10,000 | 15,000 |

Surplus, i.e., Balance in Statement of Profit and Loss | 1,17,500 | 35,000 |

1,27,500 | 50,000 | |

3. Trade Receivables | ||

Sundry Debtors | 1,00,000 | 50,000 |

Less: Provision for Doubtful Debts | 7,500 | 5,000 |

92,500 | 45,000 | |

4. Cash and Cash Equivalents | ||

Cash in Hand | 12,500 | 6,000 |

Cash in Bank | 22,500 | 15,000 |

35,000 | 21,000 | |

Additional Information :

(i) You are informed during the year:

| Proposed Dividend | 31st March, 2019(₹) | 31st March, 2018(₹) |

| Equity Share Capital | NIL | NIL |

| Preference Share Capital | 12% | 12% |

(ii) A machine with a book value of ₹20,000 was sold for ₹12,500;

(iii) Depreciation charged during the year was ₹35,000;

(iv) Preference shares were redeemed on 31st March, 2018 at a premium of 5%;

(v) An Interim dividend of ₹5,000 was paid on equity shares on 31st March, 2019 out of General Reserve;

(vi) Fresh equity shares were Issued on 31st March, 2019; and

(vii) Additional Investments were purchased on 31st March, 2019.

ANSWER:

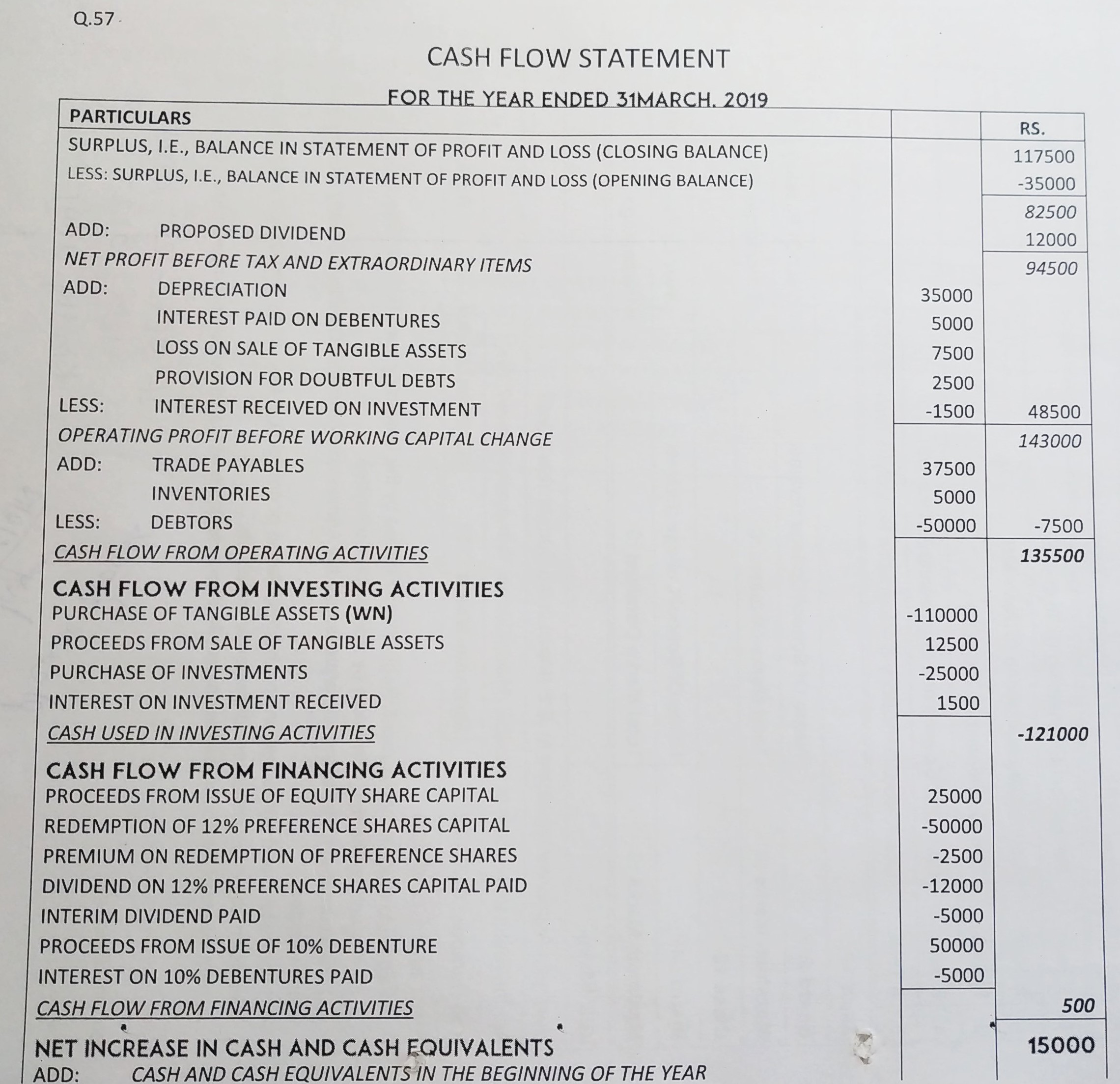

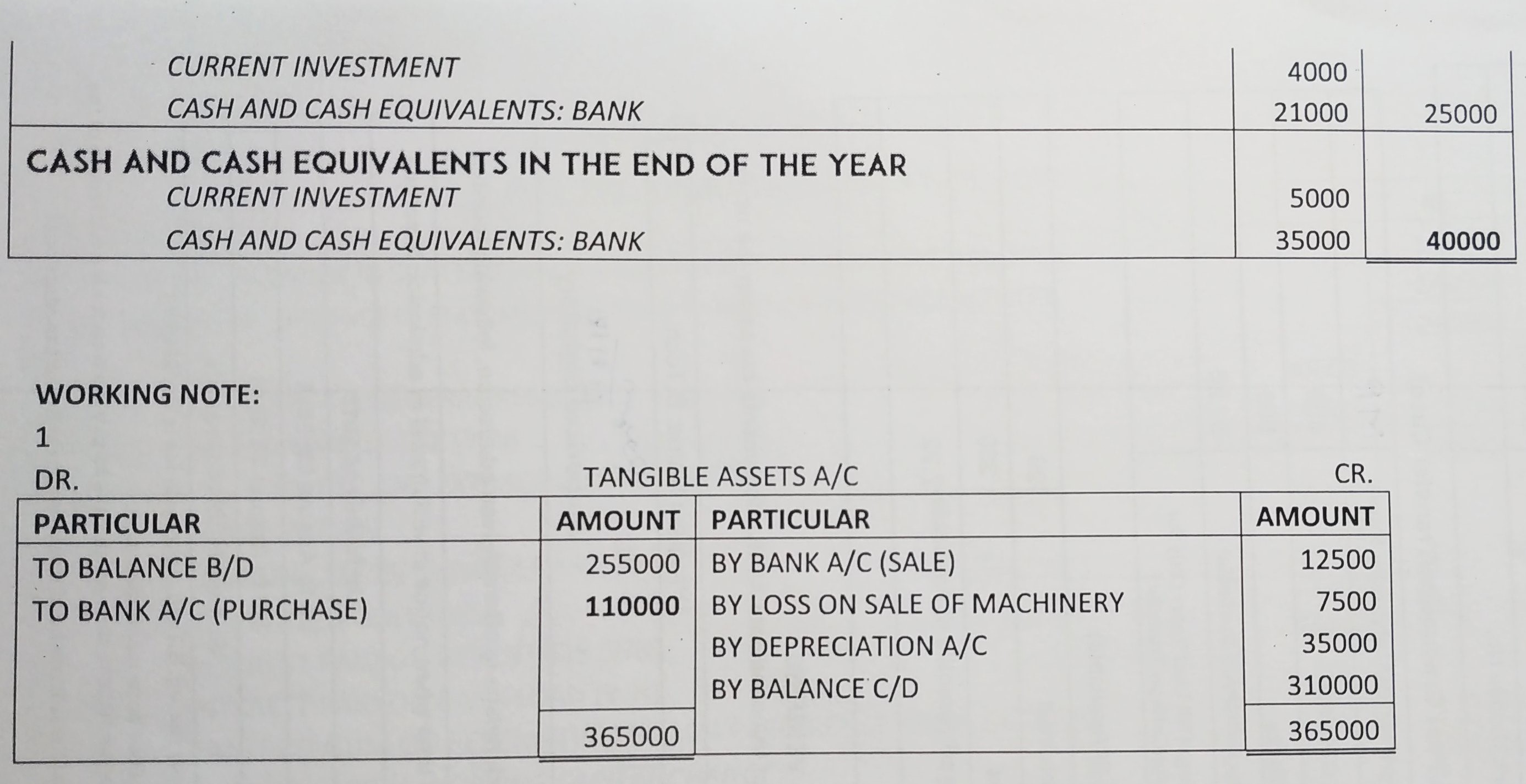

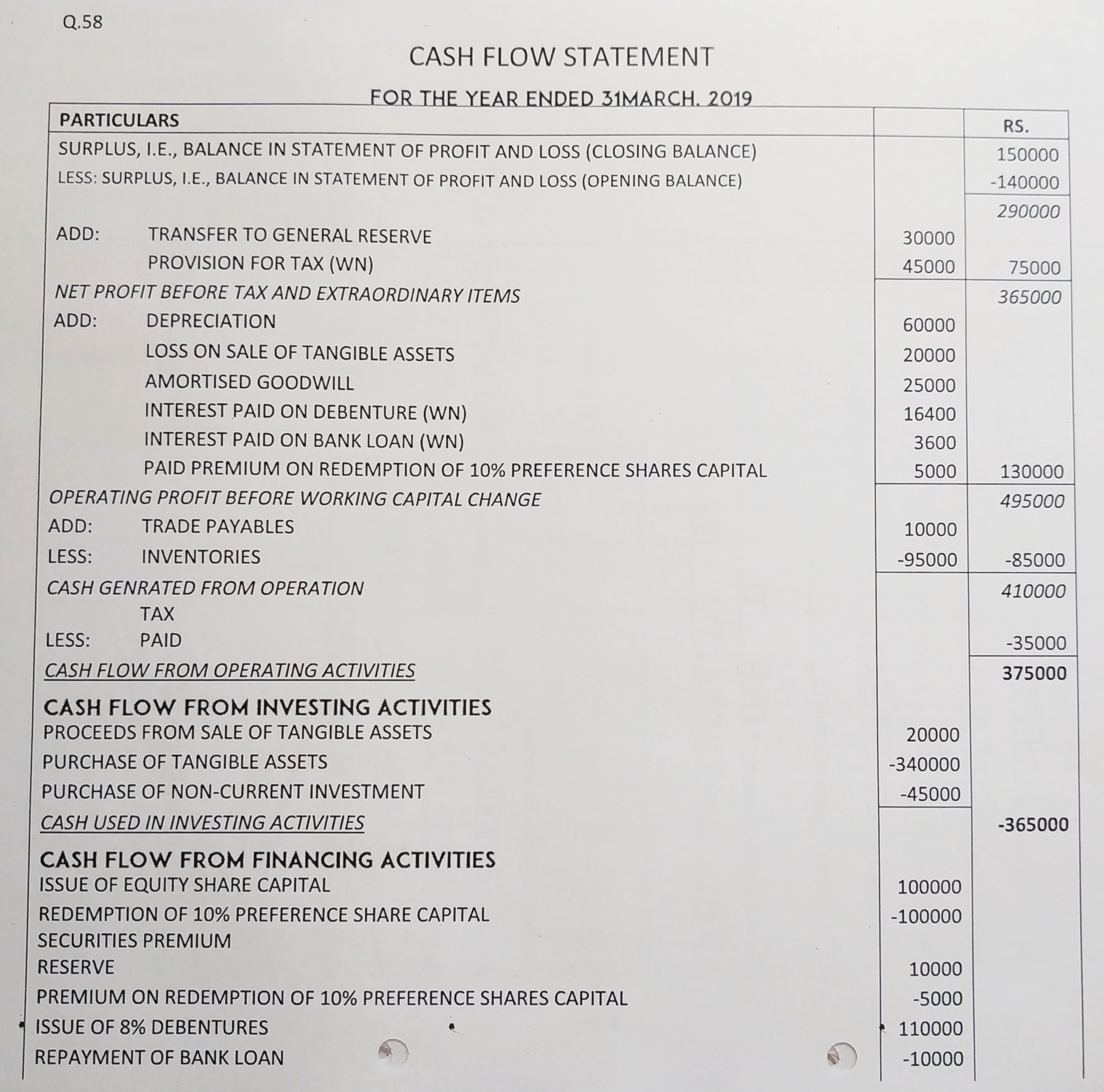

Question 58:

From the following Balance Sheet of Samta Ltd., as at 31st March, 2019, prepare Cash Flow Statement:

Particulars | Note No. | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| I. EQUITY AND LIABILITIES | |||

1. Shareholders’ Funds | |||

(a) Share Capital | 1 | 7,50,000 | 7,50,000 |

(b) Reserves and Surplus | 2 | 3,10,000 | (20,000) |

2. Non-Current Liabilities | |||

Long-term Borrowings (8% Debentures) | 2,60,000 | 1,50,000 | |

3. Current Liabilities | |||

(a) Short-term Borrowings (8% Bank Loan) | 40,000 | 50,000 | |

(b) Trade Payables | 1,20,000 | 1,10,000 | |

(c) Short-term Provisions | 3 | 50,000 | 40,000 |

Total | 15,30,000 | 10,80,000 | |

| II. ASSETS | |||

1. Non-Current Assets | |||

(a) Fixed Assets: | |||

(i) Tangible Assets (Net) | 8,60,000 | 6,20,000 | |

(ii) Intangible Assets (Goodwill) | 15,000 | 40,000 | |

(b) Non-Current Investments | 1,25,000 | 80,000 | |

2. Current Assets | |||

(a) Current Investments | 5,000 | 15,000 | |

(b) Inventories | 1,95,000 | 1,00,000 | |

(c) Trade Receivables | 2,00,000 | 2,00,000 | |

(d) Cash and Cash Equivalents | 1,30,000 | 25,000 | |

Total | 15,30,000 | 10,80,000 | |

Notes to Accounts

Particulars | 31st March, 2019 (₹) | 31st March, 2018 (₹) |

| 1. Share Capital | ||

| Equity Share Capital | 5,50,000 | 4,50,000 |

| 12% Preference Share Capital | 2,00,000 | 3,00,000 |

7,50,000 | 7,50,000 | |

| 2. Reserves and Surplus | ||

| Securities Premium Reserve | 10,000 | … |

| General Reserve | 1,50,000 | 1,20,000 |

| Surplus, i.e., Balance in Statement of Profit and Loss | 1,50,000 | (1,40,000) |

3,10,000 | (20,000) | |

| 4. Short-term Provisions | ||

| Provision for Tax | 50,000 | 40,000 |

Additional Information :

(i) During the year a piece of machinery costing ₹ 60,000 on which depreciation charged was ₹ 20,000 was sold at 50% of its book value. Depreciation provided on tangible Assets ₹ 60,000;

(ii) Income tax ₹ 45,000 was provided;

(iii) Additional Debentures were issued at par on 1st October, 2018 and Bank Loan was repaid on the same date;

(iv) At the end of the year Preference Shares were redeemed at a premium of 5%.

ANSWER:

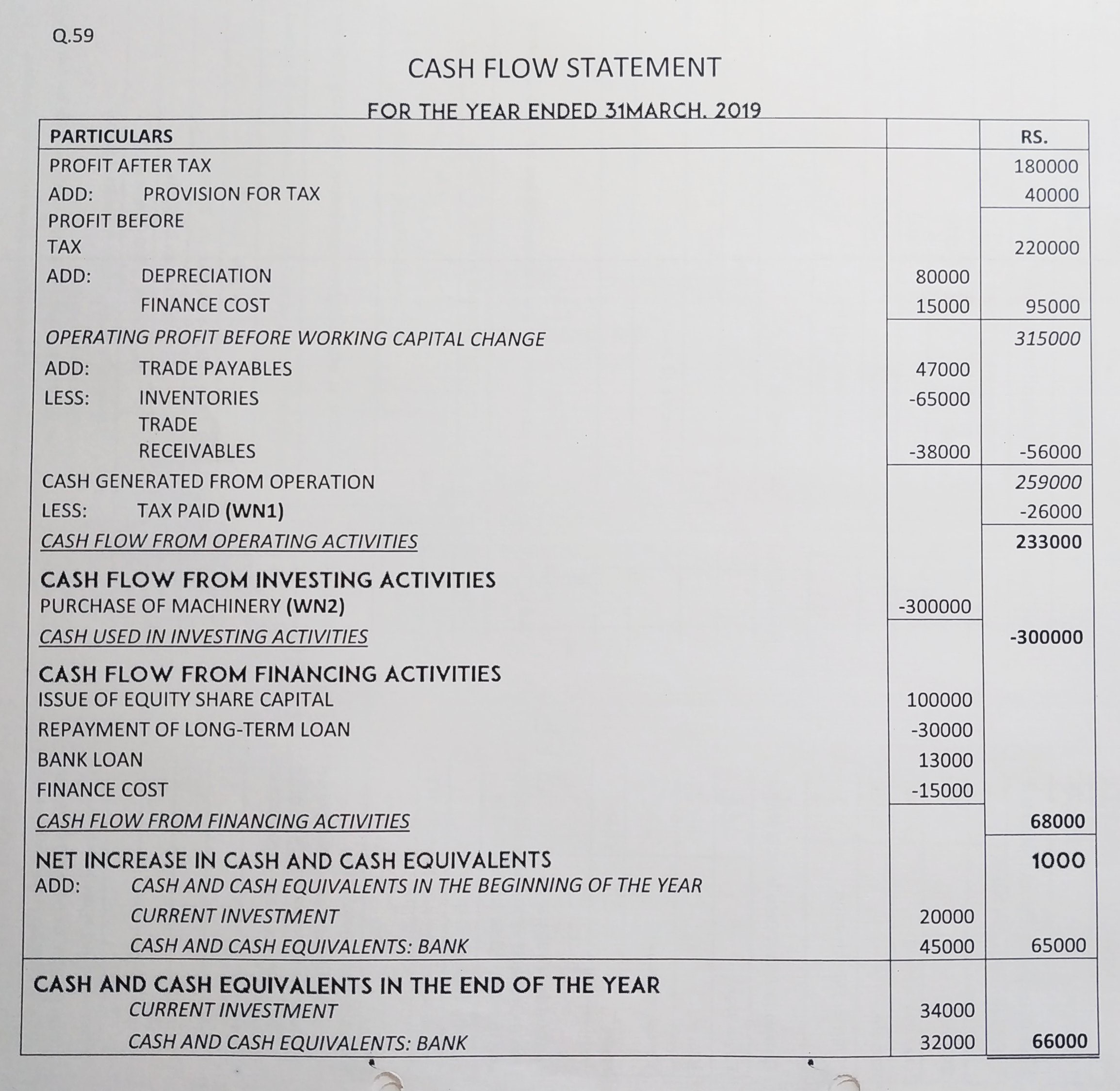

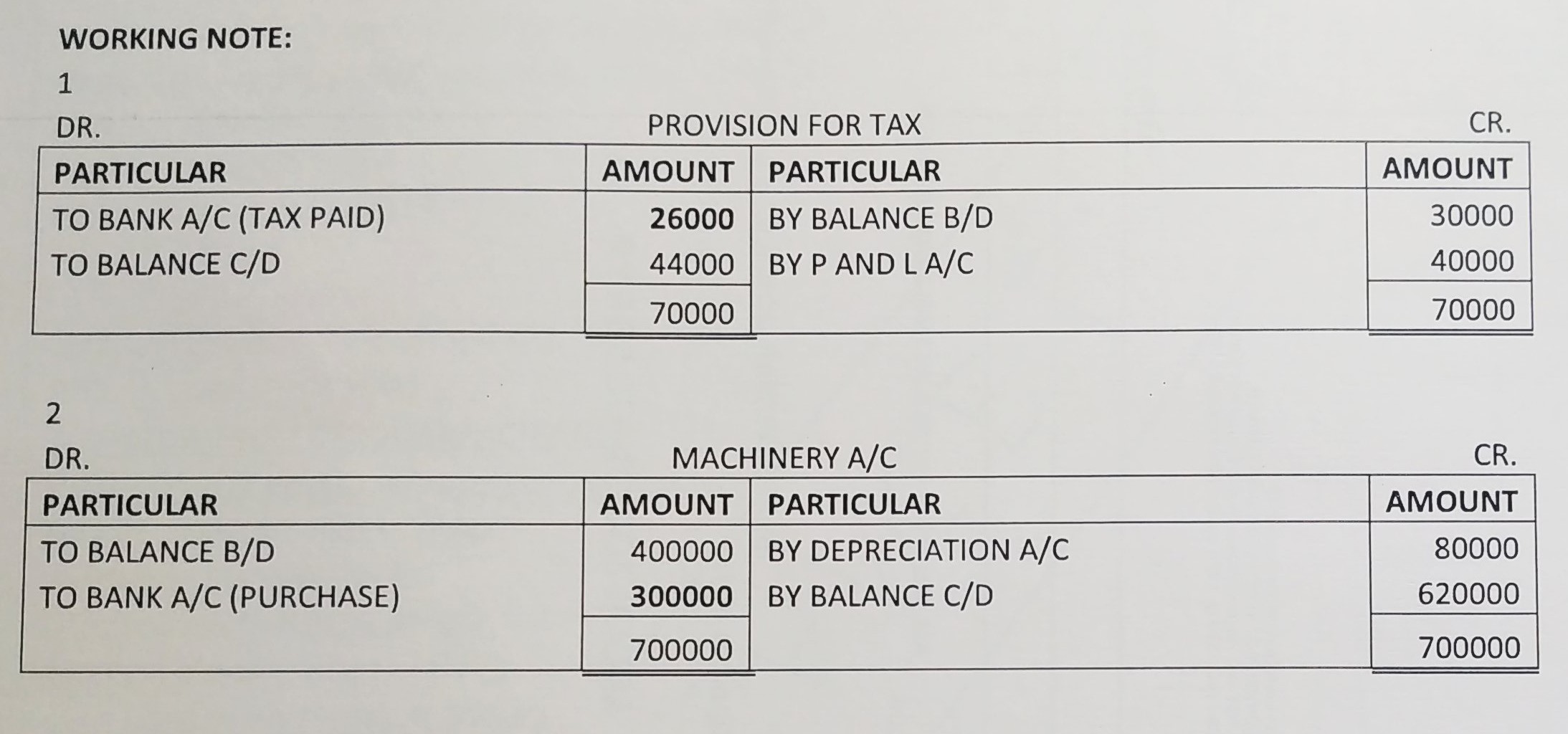

Question 59:

Prepare Cash Flow Statement from the following:

| STATEMENT OF PROFIT AND LOSS for the year ended 31st March, 2019 |