Page 44 - DEBK12

P. 44

Chapter 9 . Company Accounts—Issue of Debentures 9.3

• Issue of Debentures: Debentures like shares, can be issued for: (i) cash and (ii) consideration other than cash.

These debentures can be issued at: (a) par or (b) premium or (c) discount.

Accounting for issue of debentures for cash is the same as the accounting for issue of shares with one

change, i.e., the word ‘Share’ shall be replaced by ‘Debentures’ and ‘Share Capital’ by ‘Debentures’. The

terms used for the issue of shares will be changed at the time of issue of debentures.

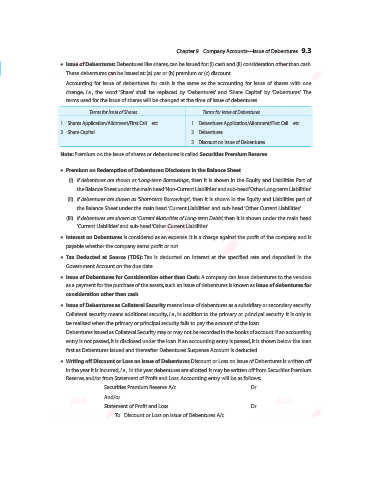

Terms for Issue of Shares Terms for Issue of Debentures

1. Shares Application/Allotment/First Call ... etc. 1. Debentures Application/Allotment/First Call ... etc.

2. Share Capital 2. Debentures

3. Discount on Issue of Debentures

Note: Premium on the issue of shares or debentures is called Securities Premium Reserve.

• Premium on Redemption of Debentures: Disclosure in the Balance Sheet

(i) If debentures are shown as ‘Long-term Borrowings‘, then it is shown in the Equity and Liabilities Part of

the Balance Sheet under the main head ‘Non-Current Liabilities’ and sub-head ‘Other Long-term Liabilities’.

(ii) If debentures are shown as ‘Short-term Borrowings’, then it is shown in the Equity and Liabilities part of

the Balance Sheet under the main head ‘Current Liabilities’ and sub-head ‘Other Current Liabilities’.

(iii) If debentures are shown as ‘Current Maturities of Long-term Debts’, then it is shown under the main head

’Current Liabilities’ and sub-head ‘Other Current Liabilities’.

• Interest on Debentures is considered as an expense. It is a charge against the profit of the company and is

payable whether the company earns profit or not.

• Tax Deducted at Source (TDS): Tax is deducted on interest at the specified rate and deposited in the

Government Account on the due date.

• Issue of Debentures for Consideration other than Cash: A company can issue debentures to the vendors

as a payment for the purchase of the assets, such an issue of debentures is known as issue of debentures for

consideration other than cash.

• Issue of Debentures as Collateral Security means issue of debentures as a subsidiary or secondary security.

Collateral security means additional security, i.e., in addition to the primary or principal security. It is only to

be realised when the primary or principal security fails to pay the amount of the loan.

Debentures issued as Collateral Security may or may not be recorded in the books of account. If an accounting

entry is not passed, it is disclosed under the loan. If an accounting entry is passed, it is shown below the loan

first as Debentures Issued and thereafter Debentures Suspense Account is deducted.

• Writing off Discount or Loss on Issue of Debentures Discount or Loss on Issue of Debentures is written off

in the year it is incurred, i.e., in the year debentures are allotted. It may be written off from Securities Premium

Reserve, and/or from Statement of Profit and Loss. Accounting entry will be as follows:

Securities Premium Reserve A/c ...Dr.

And/or

Statement of Profit and Loss ...Dr.

To Discount or Loss on Issue of Debentures A/c