Page 49 - DEBK12

P. 49

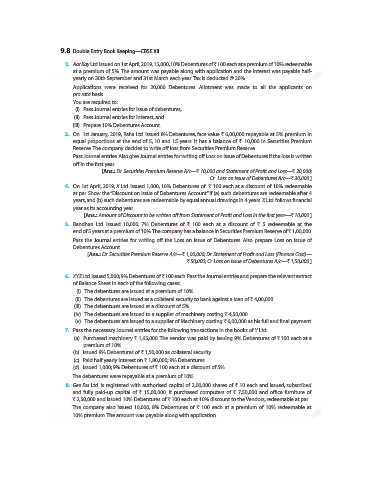

9.8 Double Entry Book Keeping—CBSE XII

2. Aar Kay Ltd. issued on 1st April, 2019, 15,000, 10% Debentures of ` 100 each at a premium of 10% redeemable

at a premium of 5%. The amount was payable along with application and the interest was payable half-

yearly on 30th September and 31st March each year. Tax is deducted @ 20%.

Applications were received for 20,000 Debentures. Allotment was made to all the applicants on

pro rata basis.

You are required to:

(i) Pass Journal entries for issue of debentures,

(ii) Pass Journal entries for interest, and

(iii) Prepare 10% Debentures Account.

3. On 1st January, 2019, Raha Ltd. issued 8% Debentures, face value ` 6,00,000 repayable at 5% premium in

equal proportions at the end of 5, 10 and 15 years. It has a balance of ` 10,000 in Securities Premium

Reserve. The company decides to write off loss from Securities Premium Reserve.

Pass Journal entries. Also give Journal entries for writing off Loss on Issue of Debentures if the loss is written

off in the first year.

[Ans.: Dr. Securities Premium Reserve A/c—` 10,000 and Statement of Profit and Loss—` 20,000;

Cr. Loss on Issue of Debentures A/c—` 30,000.]

4. On 1st April, 2019, X Ltd. issued 1,000, 10% Debentures of ` 100 each at a discount of 10% redeemable

at par. Show the “Discount on Issue of Debentures Account” if (a) such debentures are redeemable after 4

years, and (b) such debentures are redeemable by equal annual drawings in 4 years. X Ltd. follows financial

year as its accounting year.

[Ans.: Amount of Discount to be written off from Statement of Profit and Loss in the first year—` 10,000.]

5. Bandhan Ltd. issued 10,000, 7% Debentures of ` 100 each at a discount of ` 5 redeemable at the

end of 5 years at a premium of 10%. The company has a balance in Securities Premium Reserve of ` 1,00,000.

Pass the Journal entries for writing off the Loss on Issue of Debentures. Also prepare Loss on Issue of

Debentures Account.

[Ans.: Dr. Securities Premium Reserve A/c—` 1,00,000; Dr. Statement of Profit and Loss (Finance Cost)—

` 50,000; Cr. Loss on Issue of Debentures A/c—` 1,50,000.]

6. XYZ Ltd. issued 5,000; 9% Debentures of ` 100 each. Pass the Journal entries and prepare the relevant extract

of Balance Sheet in each of the following cases:

(i) The debentures are issued at a premium of 10%.

(ii) The debentures are issued as a collateral security to bank against a loan of ` 4,00,000.

(iii) The debentures are issued at a discount of 5%.

(iv) The debentures are issued to a supplier of machinery costing ` 4,50,000.

(v) The debentures are issued to a supplier of Machinery costing ` 6,00,000 as his full and final payment.

7. Pass the necessary Journal entries for the following transactions in the books of Y Ltd:

(a) Purchased machinery ` 1,65,000. The vendor was paid by issuing 9% Debentures of ` 100 each at a

premium of 10%.

(b) Issued 9% Debentures of ` 1,50,000 as collateral security.

(c) Paid half yearly interest on ` 1,80,000; 9% Debentures.

(d) Issued 1,000; 9% Debentures of ` 100 each at a discount of 5%.

The debentures were repayable at a premium of 10%.

8. Gee Ess Ltd. is registered with authorised capital of 2,00,000 shares of ` 10 each and issued, subscribed

and fully paid-up capital of ` 15,00,000. It purchased computers of ` 7,50,000 and office furniture of

` 2,50,000 and issued 10% Debentures of ` 100 each at 10% discount to the Vendors, redeemable at par.

The company also issued 10,000, 8% Debentures of ` 100 each at a premium of 10% redeemable at

10% premium. The amount was payable along with application.