Page 29 - DEBK12

P. 29

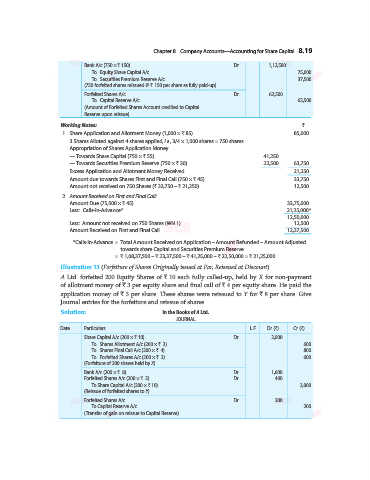

Chapter 8 . Company Accounts—Accounting for Share Capital 8.19

Bank A/c (750 × ` 150) ...Dr. 1,12,500

To Equity Share Capital A/c 75,000

To Securities Premium Reserve A/c 37,500

(750 forfeited shares reissued @ ` 150 per share as fully paid-up)

Forfeited Shares A/c ...Dr. 62,500

To Capital Reserve A/c 62,500

(Amount of Forfeited Shares Account credited to Capital

Reserve upon reissue)

Working Notes: `

1. Share Application and Allotment Money (1,000 × ` 85) 85,000

3 Shares Alloted against 4 shares applied, i.e., 3/4 × 1,000 shares = 750 shares

Appropriation of Shares Application Money

— Towards Share Capital (750 × ` 55) 41,250

— Towards Securities Premium Reserve (750 × ` 30) 22,500 63,750

Excess Application and Allotment Money Received 21,250

Amount due towards Shares First and Final Call (750 × ` 45) 33,750

Amount not received on 750 Shares (` 33,750 – ` 21,250) 12,500

2. Amount Received on First and Final Call:

Amount Due (75,000 × ` 45) 33,75,000

Less: Calls-in-Advance* 21,25,000*

12,50,000

Less: Amount not received on 750 Shares (WN 1) 12,500

Amount Received on First and Final Call 12,37,500

*Calls-in-Advance = Total Amount Received on Application – Amount Refunded – Amount Adjusted

towards share Capital and Securities Premium Reserve

= ` 1,08,37,500 – ` 23,37,500 – ` 41,25,000 – ` 22,50,000 = ` 21,25,000.

Illustration 13 (Forfeiture of Shares Originally issued at Par, Reissued at Discount).

A Ltd. forfeited 200 Equity Shares of ` 10 each fully called-up, held by X for non-payment

of allotment money of ` 3 per equity share and final call of ` 4 per equity share. He paid the

application money of ` 3 per share. These shares were reissued to Y for ` 8 per share. Give

Journal entries for the forfeiture and reissue of shares.

Solution: In the Books of A Ltd.

JOURNAL

Date Particulars L.F. Dr. (`) Cr. (`)

Share Capital A/c (200 × ` 10) ...Dr. 2,000

To Shares Allotment A/c (200 × ` 3) 600

To Shares Final Call A/c (200 × ` 4) 800

To Forfeited Shares A/c (200 × ` 3) 600

(Forfeiture of 200 shares held by X)

Bank A/c (200 × ` 8) ...Dr. 1,600

Forfeited Shares A/c (200 × ` 2) ...Dr. 400

To Share Capital A/c (200 × ` 10) 2,000

(Reissue of forfeited shares to Y)

Forfeited Shares A/c ...Dr. 200

To Capital Reserve A/c 200

(Transfer of gain on reissue to Capital Reserve)