Page 25 - DEBK12

P. 25

Chapter 8 . Company Accounts—Accounting for Share Capital 8.15

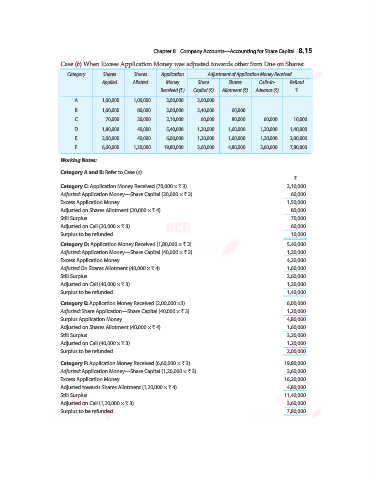

Case (b) When Excess Application Money was adjusted towards other Sum Due on Shares:

Category Shares Shares Application Adjustment of Application Money Received

Applied Allotted Money Share Shares Calls-in- Refund

Received (`) Capital (`) Allotment (`) Advance (`) `

A 1,00,000 1,00,000 3,00,000 3,00,000 ... ... ...

B 1,00,000 80,000 3,00,000 2,40,000 60,000 ... ...

C 70,000 20,000 2,10,000 60,000 80,000 60,000 10,000

D 1,80,000 40,000 5,40,000 1,20,000 1,60,000 1,20,000 1,40,000

E 2,00,000 40,000 6,00,000 1,20,000 1,60,000 1,20,000 2,00,000

F 6,60,000 1,20,000 19,80,000 3,60,000 4,80,000 3,60,000 7,80,000

Working Notes:

Category A and B: Refer to Case (a)

`

Category C: Application Money Received (70,000 × ` 3) 2,10,000

Adjusted: Application Money—Share Capital (20,000 × ` 3) 60,000

Excess Application Money 1,50,000

Adjusted on Shares Allotment (20,000 × ` 4) 80,000

Still Surplus 70,000

Adjusted on Call (20,000 × ` 3) 60,000

Surplus to be refunded 10,000

Category D: Application Money Received (1,80,000 × ` 3) 5,40,000

Adjusted: Application Money—Share Capital (40,000 × ` 3) 1,20,000

Excess Application Money 4,20,000

Adjusted On Shares Allotment (40,000 × ` 4) 1,60,000

Still Surplus 2,60,000

Adjusted on Call (40,000 × ` 3) 1,20,000

Surplus to be refunded 1,40,000

Category E: Application Money Received (2,00,000 ×3) 6,00,000

Adjusted: Share Application—Share Capital (40,000 × ` 3) 1,20,000

Surplus Application Money 4,80,000

Adjusted on Shares Allotment (40,000 × ` 4) 1,60,000

Still Surplus 3,20,000

Adjusted on Call (40,000 × ` 3) 1,20,000

Surplus to be refunded 2,00,000

Category F: Application Money Received (6,60,000 × ` 3) 19,80,000

Adjusted: Application Money—Share Capital (1,20,000 × ` 3) 3,60,000

Excess Application Money 16,20,000

Adjusted towards Shares Allotment (1,20,000 × ` 4) 4,80,000

Still Surplus 11,40,000

Adjusted on Call (1,20,000 × ` 3) 3,60,000

Surplus to be refunded 7,80,000