Page 31 - DEBK12

P. 31

Chapter 8 . Company Accounts—Accounting for Share Capital 8.21

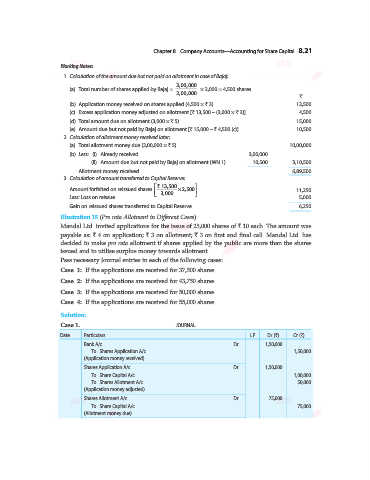

Working Notes:

1. Calculation of the amount due but not paid on allotment in case of Bajaj:

3,00,000

(a) Total number of shares applied by Bajaj = 2,00,000 × 3,000 = 4,500 shares.

`

(b) Application money received on shares applied (4,500 × ` 3) 13,500

(c) Excess application money adjusted on allotment [` 13,500 – (3,000 × ` 3)] 4,500

(d) Total amount due on allotment (3,000 × ` 5) 15,000

(e) Amount due but not paid by Bajaj on allotment [` 15,000 – ` 4,500 (c)] 10,500

2. Calculation of allotment money received later:

(a) Total allotment money due (2,00,000 × ` 5) 10,00,000

(b) Less: (i) Already received 3,00,000

(ii) Amount due but not paid by Bajaj on allotment (WN 1) 10,500 3,10,500

Allotment money received 6,89,500

3. Calculation of amount transferred to Capital Reserve:

È 13,500` ˘

Amount forfeited on reissued shares Í ¥2,500 ˙ 11,250

Less: Loss on reissue Î 3,000 ˚ 5,000

Gain on reissued shares transferred to Capital Reserve 6,250

Illustration 15 (Pro rata Allotment in Different Cases).

Mandal Ltd. invited applications for the issue of 25,000 shares of ` 10 each. The amount was

payable as: ` 4 on application; ` 3 on allotment; ` 3 on first and final call. Mandal Ltd. has

decided to make pro rata allotment if shares applied by the public are more than the shares

issued and to utilise surplus money towards allotment.

Pass necessary Journal entries in each of the following cases:

Case 1: If the applications are received for 37,500 shares.

Case 2: If the applications are received for 43,750 shares.

Case 3: If the applications are received for 50,000 shares.

Case 4: If the applications are received for 55,000 shares.

Solution:

Case 1. JOURNAL

Date Particulars L.F. Dr. (`) Cr. (`)

Bank A/c ...Dr. 1,50,000

To Shares Application A/c 1,50,000

(Application money received)

Shares Application A/c ...Dr. 1,50,000

To Share Capital A/c 1,00,000

To Shares Allotment A/c 50,000

(Application money adjusted)

Shares Allotment A/c ...Dr. 75,000

To Share Capital A/c 75,000

(Allotment money due)