Page 33 - DEBK12

P. 33

Chapter 8 . Company Accounts—Accounting for Share Capital 8.23

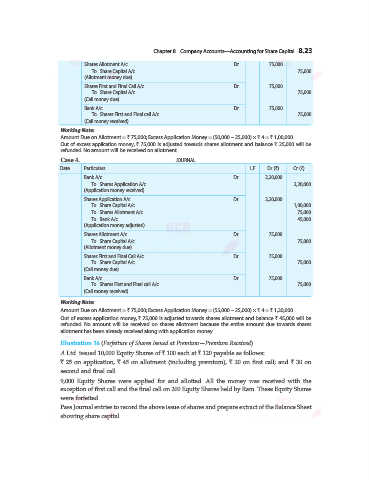

Shares Allotment A/c ...Dr. 75,000

To Share Capital A/c 75,000

(Allotment money due)

Shares First and Final Call A/c ...Dr. 75,000

To Share Capital A/c 75,000

(Call money due)

Bank A/c ...Dr. 75,000

To Shares First and Final call A/c 75,000

(Call money received)

Working Note:

Amount Due on Allotment = ` 75,000; Excess Application Money = (50,000 – 25,000) × ` 4 = ` 1,00,000.

Out of excess application money, ` 75,000 is adjusted towards shares allotment and balance ` 25,000 will be

refunded. No amount will be received on allotment.

Case 4. JOURNAL

Date Particulars L.F. Dr. (`) Cr. (`)

Bank A/c ...Dr. 2,20,000

To Shares Application A/c 2,20,000

(Application money received)

Shares Application A/c ...Dr. 2,20,000

To Share Capital A/c 1,00,000

To Shares Allotment A/c 75,000

To Bank A/c 45,000

(Application money adjusted)

Shares Allotment A/c ...Dr. 75,000

To Share Capital A/c 75,000

(Allotment money due)

Shares First and Final Call A/c ...Dr. 75,000

To Share Capital A/c 75,000

(Call money due)

Bank A/c ...Dr. 75,000

To Shares First and Final call A/c 75,000

(Call money received)

Working Note:

Amount Due on Allotment = ` 75,000; Excess Application Money = (55,000 – 25,000) × ` 4 = ` 1,20,000.

Out of excess application money, ` 75,000 is adjusted towards shares allotment and balance ` 45,000 will be

refunded. No amount will be received on shares allotment because the entire amount due towards shares

allotment has been already received along with application money.

Illustration 16 (Forfeiture of Shares Issued at Premium—Premium Received).

A Ltd. issued 10,000 Equity Shares of ` 100 each at ` 120 payable as follows:

` 25 on application, ` 45 on allotment (including premium), ` 20 on first call; and ` 30 on

second and final call.

9,000 Equity Shares were applied for and allotted. All the money was received with the

exception of first call and the final call on 200 Equity Shares held by Ram. These Equity Shares

were forfeited.

Pass Journal entries to record the above issue of shares and prepare extract of the Balance Sheet

showing share capital.