Page 152 - DEBK-XI(2020)

P. 152

19.4 Double Entry Book Keeping—CBSE XI

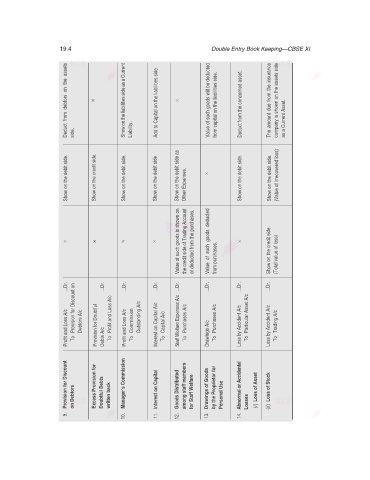

Deduct from debtors on the assets side. × Show on the liabilities side as a Current Liability. Add to Capital on the liabilities side. × Value of such goods will be deducted from capital on the liabilities side. Deduct from the concerned asset. The amount due from the insurance company is shown on the assets side as a Current Asset.

Show on the debit side. Show on the credit side. Show on the debit side. Show on the debit side Show on the debit side as Other Expenses. × Show on the debit side. Show on the debit side. (Value of irrecovered loss)

Value of such goods is shown on the credit side of Trading Account Value of such goods deducted

× × × × or deducted from the purchases. from purchases. × Show on the credit side. (Total value of loss)

...Dr. ...Dr. ...Dr. ...Dr. ...Dr. ...Dr. ...Dr. ...Dr.

Profit and Loss A/c Provision for Discount on To Debtors A/c Provision for Doubtful Debts A/c Profit and Loss A/c To Profit and Loss A/c Commission To Outstanding A/c Interest on Capital A/c Capital A/c To Staff Welfare Expenses A/c Purchases A/c To Drawings A/c Purchases A/c To Loss by Accident A/c Particular Asset A/c To Loss by Accident A/c Trading A/c To

Provision for Discount on Debtors Excess Provision for Doubtful Debts written back Manager’s Commission Interest on Capital Goods Distributed among staff members for Staff Welfare Drawings of Goods by the Proprietor for Personal Use Abnormal or Accidental (i) Loss of Asset (ii) Loss of Stock

9. 10. 11. 12. 13. 14. Losses