Page 151 - DEBK-XI(2020)

P. 151

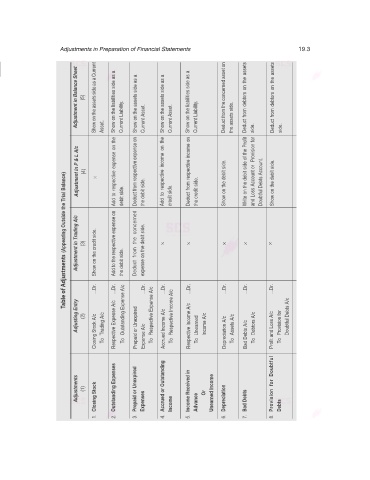

Adjustments in Preparation of Financial Statements 19.3

Adjustment in Balance Sheet (5) Show on the assets side as a Current Asset. Show on the liabilities side as a Current Liability. Show on the assets side as a Current Asset. Show on the assets side as a Current Asset. Show on the liabilities side as a Current Liability. Deduct from the concerned asset on the assets side. Deduct from debtors on the assets side. Deduct from debtors on the assets side.

Adjustment in P & L A/c (4) × Add to respective expense on the debit side. Deduct from respective expense on the debit side. Add to respective income on the credit side. Deduct from respective income on the credit side. Show on the debit side. Write on the debit side of the Profit sion for and Loss Account or Provi Doubtful Debts Account. Show on the debit side.

Table of Adjustments (Appearing Outside the Trial Balance)

Adjustment in Trading A/c (3) Show on the credit side. Add to the respective expense on the debit side. Deduct from the concerned expense on the debit side. × × × × ×

...Dr. ...Dr. ...Dr. ...Dr. ...Dr. ...Dr. ...Dr. ...Dr.

Adjusting Entry (2) Closing Stock A/c Trading A/c Respective Expense A/c Outstanding Expense A/c Prepaid or Unexpired Expense A/c Respective Expense A/c Accrued Income A/c Respective Income A/c Respective Income A/c Unearned Income A/c Depreciation A/c Assets A/c Bad Debts A/c Debtors A/c Profit and Loss A/c Provision for Doubtful Debts A/c

To

To

To

To To To To To

Adjustments (1) Closing Stock Outstanding Expenses Prepaid or Unexpired Expenses Accrued or Outstanding Income Received in Or Unearned Income Depreciation Bad Debts Provision for Doubtful

1. 2. 3. 4. Income 5. Advance 6. 7. 8. Debts