Page 149 - DEBK-XI(2020)

P. 149

19

C H A P T E R

Adjustments in Preparation of

Financial Statements

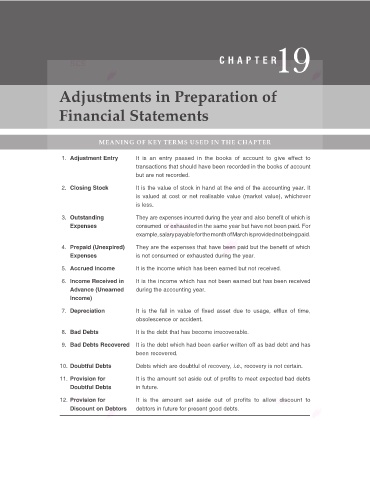

MEANING OF KEY TERMS USED IN THE CHAPTER

1. Adjustment Entry It is an entry passed in the books of account to give effect to

transactions that should have been recorded in the books of account

but are not recorded.

2. Closing Stock It is the value of stock in hand at the end of the accounting year. It

is valued at cost or net realisable value (market value), whichever

is less.

3. Outstanding They are expenses incurred during the year and also benefit of which is

Expenses consumed or exhausted in the same year but have not been paid. For

example, salary payable for the month of March is provided not being paid.

4. Prepaid (Unexpired) They are the expenses that have been paid but the benefit of which

Expenses is not consumed or exhausted during the year.

5. Accrued Income It is the income which has been earned but not received.

6. Income Received in It is the income which has not been earned but has been received

Advance (Unearned during the accounting year.

Income)

7. Depreciation It is the fall in value of fixed asset due to usage, efflux of time,

obsolescence or accident.

8. Bad Debts It is the debt that has become irrecoverable.

9. Bad Debts Recovered It is the debt which had been earlier written off as bad debt and has

been recovered.

10. Doubtful Debts Debts which are doubtful of recovery, i.e., recovery is not certain.

11. Provision for It is the amount set aside out of profits to meet expected bad debts

Doubtful Debts in future.

12. Provision for It is the amount set aside out of profits to allow discount to

Discount on Debtors debtors in future for present good debts.