Page 40 - DEBK-XI(2020)

P. 40

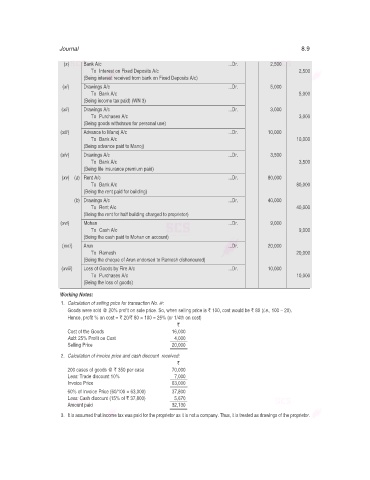

Journal 8.9

(x) Bank A/c ...Dr. 2,500

To Interest on Fixed Deposits A/c 2,500

(Being interest received from bank on Fixed Deposits A/c)

(xi) Drawings A/c ...Dr. 5,000

To Bank A/c 5,000

(Being income tax paid) (WN 3)

(xii) Drawings A/c ...Dr. 3,000

To Purchases A/c 3,000

(Being goods withdrawn for personal use)

(xiii) Advance to Manoj A/c ...Dr. 10,000

To Bank A/c 10,000

(Being advance paid to Manoj)

(xiv) Drawings A/c ...Dr. 3,500

To Bank A/c 3,500

(Being life insurance premium paid)

(xv) (a) Rent A/c ...Dr. 80,000

To Bank A/c 80,000

(Being the rent paid for building)

(b) Drawings A/c ...Dr. 40,000

To Rent A/c 40,000

(Being the rent for half building charged to proprietor)

(xvi) Mohan ...Dr. 9,000

To Cash A/c 9,000

(Being the cash paid to Mohan on account)

(xvii) Arun ...Dr. 20,000

To Ramesh 20,000

(Being the cheque of Arun endorsed to Ramesh dishonoured)

(xviii) Loss of Goods by Fire A/c ...Dr. 10,000

To Purchases A/c 10,000

(Being the loss of goods)

Working Notes:

1. Calculation of selling price for transaction No. iii:

Goods were sold @ 20% profit on sale price. So, when selling price is ` 100, cost would be ` 80 (i.e., 100 – 20).

Hence, profit % on cost = ` 20/` 80 × 100 = 25% (or 1/4th on cost)

`

Cost of the Goods 16,000

Add: 25% Profit on Cost 4,000

Selling Price 20,000

2. Calculation of invoice price and cash discount received:

`

200 cases of goods @ ` 350 per case 70,000

Less: Trade discount 10% 7,000

Invoice Price 63,000

60% of Invoice Price (60/100 × 63,000) 37,800

Less: Cash discount (15% of ` 37,800) 5,670

Amount paid 32,130

3. It is assumed that income tax was paid for the proprietor as it is not a company. Thus, it is treated as drawings of the proprietor.