Page 39 - DEBK-XI(2020)

P. 39

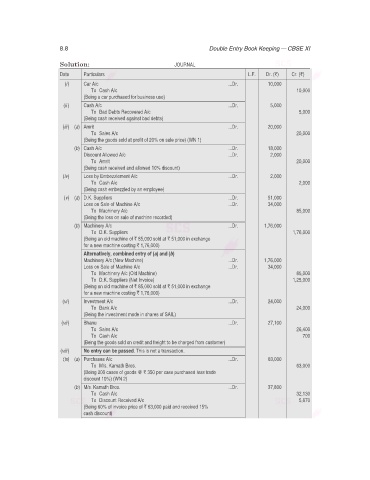

8.8 Double Entry Book Keeping — CBSE XI

Solution: JOURNAL

Date Particulars L.F. Dr. (`) Cr. (`)

(i) Car A/c ...Dr. 10,000

To Cash A/c 10,000

(Being a car purchased for business use)

(ii ) Cash A/c ...Dr. 5,000

To Bad Debts Recovered A/c 5,000

(Being cash received against bad debts)

(iii) (a) Amrit ...Dr. 20,000

To Sales A/c 20,000

(Being the goods sold at profit of 20% on sale price) (WN 1)

(b) Cash A/c ...Dr. 18,000

Discount Allowed A/c ...Dr. 2,000

To Amrit 20,000

(Being cash received and allowed 10% discount)

(iv) Loss by Embezzlement A/c ...Dr. 2,000

To Cash A/c 2,000

(Being cash embezzled by an employee)

(v) (a) D.K. Suppliers ...Dr. 51,000

Loss on Sale of Machine A/c ...Dr. 34,000

To Machinery A/c 85,000

(Being the loss on sale of machine recorded)

(b) Machinery A/c ...Dr. 1,76,000

To D.K. Suppliers 1,76,000

(Being an old machine of ` 85,000 sold at ` 51,000 in exchange

for a new machine costing ` 1,76,000)

Alternatively, combined entry of (a) and (b)

Machinery A/c (New Machine) ...Dr. 1,76,000

Loss on Sale of Machine A/c ...Dr. 34,000

To Machinery A/c (Old Machine) 85,000

To D.K. Suppliers (Net Invoice) 1,25,000

(Being an old machine of ` 85,000 sold at ` 51,000 in exchange

for a new machine costing ` 1,76,000)

(vi) Investment A/c ...Dr. 24,000

To Bank A/c 24,000

(Being the investment made in shares of SAIL)

(vii) Bhanu ...Dr. 27,100

To Sales A/c 26,400

To Cash A/c 700

(Being the goods sold on credit and freight to be charged from customer)

(viii) No entry can be passed. This is not a transaction.

(ix) (a) Purchases A/c ...Dr. 63,000

To M/s. Kamath Bros. 63,000

(Being 200 cases of goods @ ` 350 per case purchased less trade

discount 10%) (WN 2)

(b) M/s. Kamath Bros. ...Dr. 37,800

To Cash A/c 32,130

To Discount Received A/c 5,670

(Being 60% of invoice price of ` 63,000 paid and received 15%

cash discount)