Page 45 - DEBK-XI(2020)

P. 45

8.14 Double Entry Book Keeping — CBSE XI

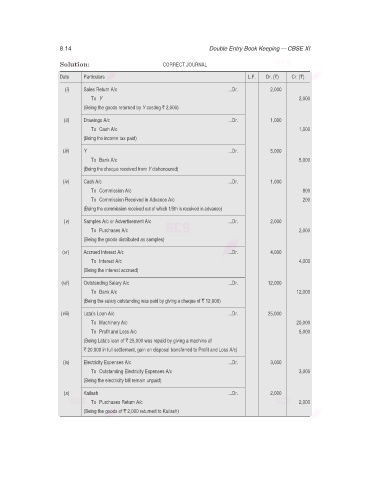

Solution: CORRECT JOURNAL

Date Particulars L.F. Dr. (`) Cr. (`)

(i) Sales Return A/c ...Dr. 2,000

To Y 2,000

(Being the goods returned by Y costing ` 2,000)

(ii) Drawings A/c ...Dr. 1,000

To Cash A/c 1,000

(Being the income tax paid)

(iii) Y ...Dr. 5,000

To Bank A/c 5,000

(Being the cheque received from Y dishonoured)

(iv) Cash A/c ...Dr. 1,000

To Commission A/c 800

To Commission Received in Advance A/c 200

(Being the commission received out of which 1/5th is received in advance)

(v) Samples A/c or Advertisement A/c ...Dr. 2,000

To Purchases A/c 2,000

(Being the goods distributed as samples)

(vi ) Accrued Interest A/c ...Dr. 4,000

To Interest A/c 4,000

(Being the interest accrued)

(vii) Outstanding Salary A/c ...Dr. 12,000

To Bank A/c 12,000

(Being the salary outstanding was paid by giving a cheque of ` 12,000)

(viii) Lata’s Loan A/c ...Dr. 25,000

To Machinery A/c 20,000

To Profit and Loss A/c 5,000

(Being Lata’s loan of ` 25,000 was repaid by giving a machine of

` 20,000 in full settlement, gain on disposal transferred to Profit and Loss A/c)

(ix) Electricity Expenses A/c ...Dr. 3,000

To Outstanding Electricity Expenses A/c 3,000

(Being the electricity bill remain unpaid)

(x) Kailash ...Dr. 2,000

To Purchases Return A/c 2,000

(Being the goods of ` 2,000 returned to Kailash)