Page 58 - DEBK12

P. 58

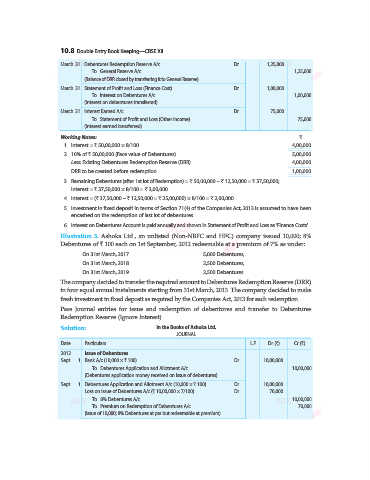

10.8 Double Entry Book Keeping—CBSE XII

March 31 Debentures Redemption Reserve A/c ...Dr. 1,25,000

To General Reserve A/c 1,25,000

(Balance of DRR closed by transferring it to General Reserve)

March 31 Statement of Profit and Loss (Finance Cost) ...Dr. 1,00,000

To Interest on Debentures A/c 1,00,000

(Interest on debentures transferred)

March 31 Interest Earned A/c ...Dr. 75,000

To Statement of Profit and Loss (Other Income) 75,000

(Interest earned transferred)

Working Notes: `

1. Interest = ` 50,00,000 × 8/100 4,00,000

2. 10% of ` 50,00,000 (Face value of Debentures) 5,00,000

Less: Existing Debentures Redemption Reserve (DRR) 4,00,000

DRR to be created before redemption 1,00,000

3. Remaining Debentures (after 1st lot of Redemption) = ` 50,00,000 – ` 12,50,000 = ` 37,50,000;

Interest = ` 37,50,000 × 8/100 = ` 3,00,000.

4. Interest = (` 37,50,000 – ` 12,50,000 = ` 25,00,000) × 8/100 = ` 2,00,000.

5. Investment in fixed deposit in terms of Section 71(4) of the Companies Act, 2013 is assumed to have been

encashed on the redemption of last lot of debentures.

6. Interest on Debentures Account is paid annually and shown in Statement of Profit and Loss as ‘Finance Costs’.

Illustration 3. Ashoka Ltd., an unlisted (Non-NBFC and HFC) company issued 10,000; 8%

Debentures of ` 100 each on 1st September, 2012 redeemable at a premium of 7% as under:

On 31st March, 2017 5,000 Debentures,

On 31st March, 2018 2,500 Debentures,

On 31st March, 2019 2,500 Debentures.

The company decided to transfer the required amount to Debentures Redemption Reserve (DRR)

in four equal annual instalments starting from 31st March, 2013. The company decided to make

fresh investment in fixed deposit as required by the Companies Act, 2013 for each redemption.

Pass Journal entries for issue and redemp tion of debentures and transfer to Debentures

Redemption Reserve (Ignore Interest)

Solution: In the Books of Ashoka Ltd.

JOURNAL

Date Particulars L.F. Dr. (`) Cr. (`)

2012 Issue of Debentures

Sept. 1 Bank A/c (10,000 × ` 100) ...Dr. 10,00,000

To Debentures Application and Allotment A/c 10,00,000

(Debentures application money received on issue of debentures)

Sept. 1 Debentures Application and Allotment A/c (10,000 × ` 100) ...Dr. 10,00,000

Loss on Issue of Debentures A/c (` 10,00,000 × 7/100) ...Dr. 70,000

To 8% Debentures A/c 10,00,000

To Premium on Redemption of Debentures A/c 70,000

(Issue of 10,000; 8% Debentures at par but redeemable at premium)