Page 57 - DEBK12

P. 57

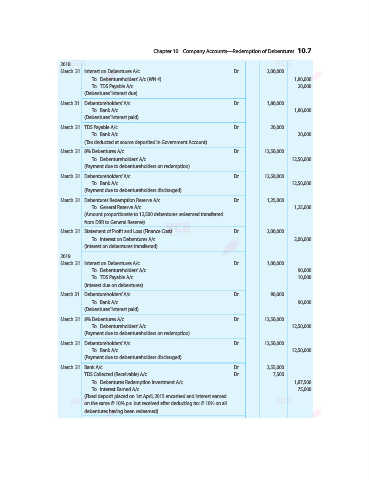

Chapter 10 . Company Accounts—Redemption of Debentures 10.7

2018

March 31 Interest on Debentures A/c ...Dr. 2,00,000

To Debentureholders’ A/c (WN 4) 1,80,000

To TDS Payable A/c 20,000

(Debentures’ interest due)

March 31 Debentureholders’ A/c ...Dr. 1,80,000

To Bank A/c 1,80,000

(Debentures’ interest paid)

March 31 TDS Payable A/c ...Dr. 20,000

To Bank A/c 20,000

(Tax deducted at source deposited in Government Account)

March 31 8% Debentures A/c ...Dr. 12,50,000

To Debentureholders’ A/c 12,50,000

(Payment due to debentureholders on redemption)

March 31 Debentureholders’ A/c ...Dr. 12,50,000

To Bank A/c 12,50,000

(Payment due to debentureholders discharged)

March 31 Debentures Redemption Reserve A/c ...Dr. 1,25,000

To General Reserve A/c 1,25,000

(Amount proportionate to 12,500 debentures redeemed transferred

from DRR to General Reserve)

March 31 Statement of Profit and Loss (Finance Cost) ...Dr. 2,00,000

To Interest on Debentures A/c 2,00,000

(Interest on debentures transferred)

2019

March 31 Interest on Debentures A/c ...Dr. 1,00,000

To Debentureholders’ A/c 90,000

To TDS Payable A/c 10,000

(Interest due on debentures)

March 31 Debentureholders’ A/c ...Dr. 90,000

To Bank A/c 90,000

(Debentures’ interest paid)

March 31 8% Debentures A/c ...Dr. 12,50,000

To Debentureholders’ A/c 12,50,000

(Payment due to debentureholders on redemption)

March 31 Debentureholders’ A/c ...Dr. 12,50,000

To Bank A/c 12,50,000

(Payment due to debentureholders discharged)

March 31 Bank A/c ...Dr. 2,55,000

TDS Collected (Receivable) A/c ...Dr. 7,500

To Debentures Redemption Investment A/c 1,87,500

To Interest Earned A/c 75,000

(Fixed deposit placed on 1st April, 2015 encashed and interest earned

on the same @ 10% p.a. but received after deducting tax @ 10% on all

debentures having been redeemed)