Page 129 - DEBK-XI(2020)

P. 129

16.10 Double Entry Book Keeping—CBSE XI

A did. The following day B met his obligation with a bill at 2 months for the amount

together with interest at 6% p.a. and paid cash for noting charges. When the bill

became due, B paid ` 10,000 and accepted a fresh bill at 3 months for ` 10,500.

B became insolvent before this last bill became due and a first and final dividend

of 25 paise in the rupee was realised from his estate on 1st December, 2017.

Pass Journal entries in the books of A to record the above transactions.

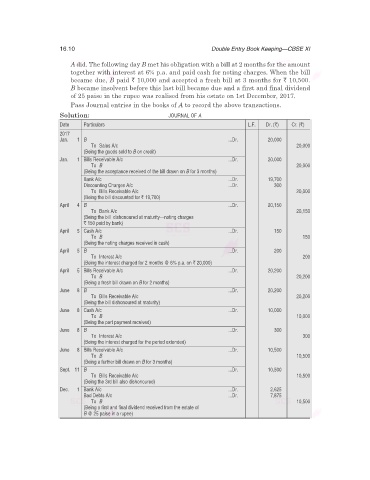

Solution: JOURNAL OF A

Date Particulars L.F. Dr. (`) Cr. (`)

2017

Jan. 1 B ...Dr. 20,000

To Sales A/c 20,000

(Being the goods sold to B on credit)

Jan. 1 Bills Receivable A/c ...Dr. 20,000

To B 20,000

(Being the acceptance received of the bill drawn on B for 3 months)

Bank A/c ...Dr. 19,700

Discounting Charges A/c ...Dr. 300

To Bills Receivable A/c 20,000

(Being the bill discounted for ` 19,700)

April 4 B ...Dr. 20,150

To Bank A/c 20,150

(Being the bill dishonoured at maturity—noting charges

` 150 paid by bank)

April 5 Cash A/c ...Dr. 150

To B 150

(Being the noting charges received in cash)

April 5 B ...Dr. 200

To Interest A/c 200

(Being the interest charged for 2 months @ 6% p.a. on ` 20,000)

April 5 Bills Receivable A/c ...Dr. 20,200

To B 20,200

(Being a fresh bill drawn on B for 2 months)

June 8 B ...Dr. 20,200

To Bills Receivable A/c 20,200

(Being the bill dishonoured at maturity)

June 8 Cash A/c ...Dr. 10,000

To B 10,000

(Being the part payment received)

June 8 B ...Dr. 300

To Interest A/c 300

(Being the interest charged for the period extended)

June 8 Bills Receivable A/c ...Dr. 10,500

To B 10,500

(Being a further bill drawn on B for 3 months)

Sept. 11 B ...Dr. 10,500

To Bills Receivable A/c 10,500

(Being the 3rd bill also dishonoured)

Dec. 1 Bank A/c ...Dr. 2,625

Bad Debts A/c ...Dr. 7,875

To B 10,500

(Being a first and final dividend received from the estate of

B @ 25 paise in a rupee)