Page 142 - DEBK-XI(2020)

P. 142

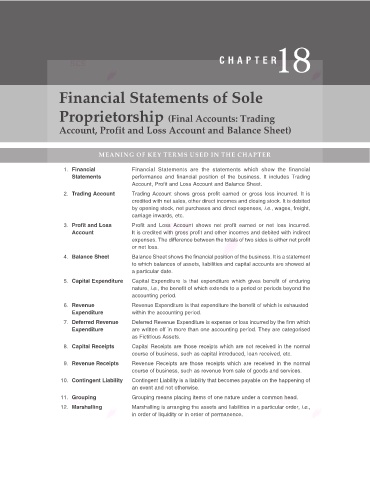

18

C H A P T E R

Financial Statements of Sole

Proprietorship (Final Accounts: Trading

Account, Profit and Loss Account and Balance Sheet)

MEANING OF KEY TERMS USED IN THE CHAPTER

1. Financial Financial Statements are the statements which show the financial

Statements performance and financial position of the business. It includes Trading

Account, Profit and Loss Account and Balance Sheet.

2. Trading Account Trading Account shows gross profit earned or gross loss incurred. It is

credited with net sales, other direct incomes and closing stock. It is debited

by opening stock, net purchases and direct expenses, i.e., wages, freight,

carriage inwards, etc.

3. Profit and Loss Profit and Loss Account shows net profit earned or net loss incurred.

Account It is credited with gross profit and other incomes and debited with indirect

expenses. The difference between the totals of two sides is either net profit

or net loss.

4. Balance Sheet Balance Sheet shows the financial position of the business. It is a statement

to which balances of assets, liabilities and capital accounts are showed at

a particular date.

5. Capital Expenditure Capital Expenditure is that expenditure which gives benefit of enduring

nature, i.e., the benefit of which extends to a period or periods beyond the

accounting period.

6. Revenue Revenue Expenditure is that expenditure the benefit of which is exhausted

Expenditure within the accounting period.

7. Deferred Revenue Deferred Revenue Expenditure is expense or loss incurred by the firm which

Expenditure are written off in more than one accounting period. They are categorised

as Fictitious Assets.

8. Capital Receipts Capital Receipts are those receipts which are not received in the normal

course of business, such as capital introduced, loan received, etc.

9. Revenue Receipts Revenue Receipts are those receipts which are received in the normal

course of business, such as revenue from sale of goods and services.

10. Contingent Liability Contingent Liability is a liability that becomes payable on the happening of

an event and not otherwise.

11. Grouping Grouping means placing items of one nature under a common head.

12. Marshalling Marshalling is arranging the assets and liabilities in a particular order, i.e.,

in order of liquidity or in order of permanence.